UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2012

|

Eagle Bulk Shipping Inc.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Republic of the Marshall Islands

|

001-33831

|

98-0453513

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(IRS employer identification no.)

|

|

477 Madison Avenue

New York, New York

|

10022

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(Registrant's telephone number, including area code): (212) 785-2500

(Former Name or Former Address, if Changed Since Last Report): None

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[_] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

[_]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[_]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02. Results of Operations and Financial Condition

On November 8, 2012, Eagle Bulk Shipping Inc. (the "Company") issued a press release (the "Press Release") relating to its financial results for the third quarter ended September 30, 2012.

In accordance with General Instruction B.2 to the Form 8-K, the information under this Item 2.02 and the Press Release, attached hereto as Exhibit 99.1, shall be deemed to be "furnished" to the Securities and Exchange Commission (the "SEC") and not be deemed to be "filed" with the SEC for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section.

Item 8.01. Other Events

On November 9, 2012, the Company posted on its website, www.eagleships.com, under the section entitled "Investors - Webcasts & Presentations" a presentation dated November 9, 2012 of its financial results for the third quarter ended September 30, 2012. A copy of the presentation is hereby furnished to the SEC and is attached as Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

|

Exhibit Number

|

Description

|

|

99.1

|

Press Release dated November 8, 2012.

|

|

99.2

|

Financial Presentation dated November 9, 2012

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

EAGLE BULK SHIPPING INC.

|

||

|

(registrant)

|

||

|

Dated: November 13, 2012

|

By:

|

/s/ Adir Katzav

|

|

Name:

|

Adir Katzav

|

|

|

Title:

|

Chief Financial Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

99.1

|

Press Release dated November 8, 2012.

|

|

99.2

|

Financial Presentation dated November 9, 2012

|

Exhibit 99.1

Eagle Bulk Shipping Inc. Reports Third Quarter 2012 Results

NEW YORK, NY, November8, 2012-- Eagle Bulk Shipping Inc. (Nasdaq: EGLE) today announced its results for the third quarter ended September 30, 2012.

For the Third Quarter:

|

|

·

|

Net reported loss of $29.8 million or $1.77 per share (based on a weighted average of 16,821,024diluted shares outstanding for the quarter), compared to net loss of $5.9 million, or $0.37 per share, for the comparable quarter in 2011.

|

|

|

·

|

Net revenues of $46.9 million, compared to $80.3 million for the comparable quarter in 2011. Gross time charter and freight revenues of $48.9 million, compared to $84.0 million for the comparable quarter in 2011.

|

|

|

·

|

EBITDA, as adjusted for exceptional items under the terms of the Company's credit agreement, was $12.5 million for the third quarter of 2012, compared with $25.9 million for the third quarter of 2011.

|

|

|

·

|

Fleet utilization rate of 99.4%.

|

Sophocles N. Zoullas, Chairman and CEO, commented, "The dry bulk market remains in a cyclical trough characterized by supply growth and an inconsistent demand profile. While this environment continues to weigh on our financial results, Eagle Bulk's young and agile fleet of Supramax vessels and dynamic chartering strategy should enhance our competitiveness when the market improves."

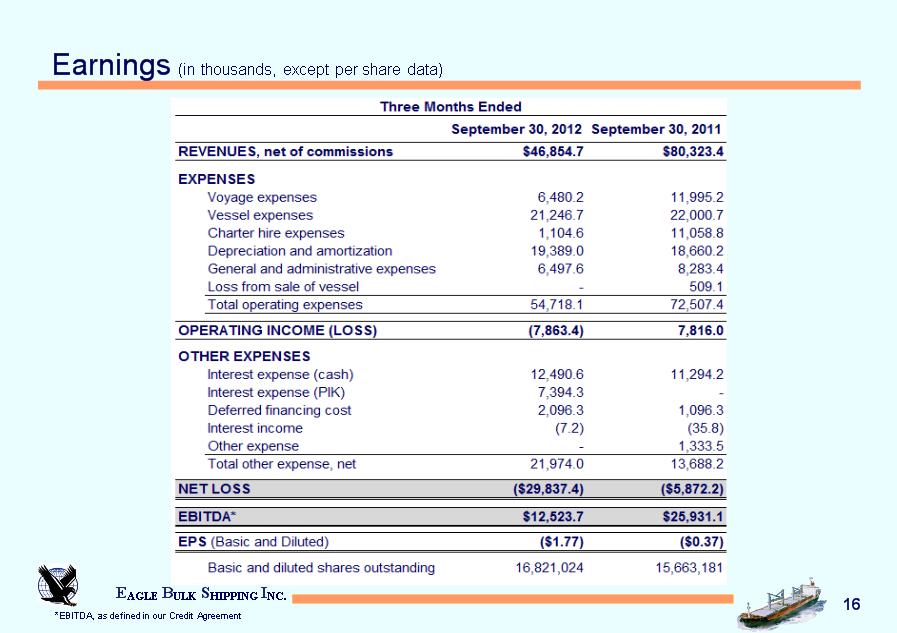

Results of Operations for the three-month period ended September 30, 2012 and 2011

For the third quarter of 2012, the Company reported a net loss of $29,837,360 or $1.77 per share, based on a weighted average of 16,821,024 diluted shares outstanding. In the comparable third quarter of 2011, the Company reported net loss of $5,872,211 or $0.37 per share, based on a weighted average of 15,663,181diluted shares outstanding.

The Company's revenues were earned from time and voyage charters. Gross time and voyage charter revenues in the quarter ended September 30, 2012 were $48,895,357 compared with $83,987,828 recorded in the comparable quarter in 2011. The decrease in gross revenues is attributable primarily to lower charter rates and a decrease in voyage charter revenues in the quarter ended September 30, 2012. Gross revenues recorded in the quarter ended September 30, 2012 and 2011, include an amount of $1,139,972 and $1,267,242, respectively, relating to the non-cash amortization of fair value below contract value of time charters acquired. Brokerage commissions incurred on revenues earned in the quarter ended September 30, 2012 and 2011 were $2,040,686 and $3,664,459, respectively. Net revenues during the quarter ended September 30, 2012 and 2011, were $46,854,671 and $80,323,369, respectively.

Total operating expenses for the quarter ended September 30, 2012were $54,718,097 compared with $72,507,439 recorded in the third quarter of 2011. The Company operated 45 vessels in the third quarter of 2012 compared with 44 vessels in the corresponding quarter in 2011. The decrease in operating expenses was primarily due to a reduction in chartered-in days, and lower voyage expenses offset by the increase in operating a larger fleet size which includes increases in vessels crew cost, insurances and vessel depreciation expense. The decrease in General and Administrative expenses is primarily attributable to a reduction in professional fees.

EBITDA, adjusted for exceptional items under the terms of the Company's credit agreement, decreased by 52% to $12,523,686for the third quarter of 2012, compared with $25,931,089 for the third quarter of 2011. (Please see below for a reconciliation of EBITDA to net loss).

Results of Operations for the nine-month period ended September 30, 2012 and 2011

For the nine months ended September 30, 2012, the Company reported net loss of $70,377,128or $4.36per share, based on a weighted average of 16,153,184 diluted shares outstanding. In the comparable period of 2011, the Company reported net loss of $13,120,770or $0.84 per share, based on a weighted average of 15,648,791diluted shares outstanding.

The Company's revenues were earned from time and voyage charters. Gross revenues for the nine-month period ended September 30, 2012were $154,255,768 compared with $255,505,905 recorded in the comparable period in 2011. The decrease in gross revenues is attributable to lower time charter rates and a decrease in voyage revenues in the period, offset marginally by operating a larger fleet. Gross revenues recorded in the nine-month period ended September 30, 2012and 2011, include an amount of $3,574,012 and $3,833,571, respectively, relating to the non-cash amortization of fair value below contract value of time charters acquired. Brokerage commissions incurred on revenues earned in the nine-month periods ended September 30, 2012 and 2011 were $6,247,464 and $12,084,373, respectively. Net revenues during the nine-month period ended September 30, 2012, decreased 39% to $148,008,304 from $243,421,532 in the comparable period in 2011.

Total operating expenses were $174,441,812 in the nine-month period ended September 30, 2012 compared to $220,906,297 recorded in the same period of 2011. The decrease in operating expenses was primarily due to a reduction in chartered-in days and lower voyage expenses offset by the increase in operating a larger fleet size which includes increases in vessels crew cost, insurances and vessel depreciation expense. The decrease in General and Administrative expenses is primarily attributable to a reduction in professional fees and to lower allowance for bad debts being booked in the nine-month period ended September 30, 2012 compared with 2011.

EBITDA, adjusted for exceptional items under the terms of the Company's credit agreement, decreased by 54% to $36,307,368 for the nine months ended September 30, 2012 from $78,863,461 for the same period in 2011. (Please see below for a reconciliation of EBITDA to net loss).

Liquidity and Capital Resources

Net cash provided by operating activities during the nine-month period ended September 30, 2012, was $2,644,520, compared with net cash provided by operating activities of $37,107,799 during the corresponding nine-month period ended September 30, 2011. The decrease was primarily due to lower rates on charter renewals.

Net cash provided by investing activities during the nine-month period ended 2012, was $287,344, compared with net cash used in investing activities of $134,649,768 during the corresponding nine-month period ended September 30, 2011. Investing activities during the nine-month period ended September 30, 2011, related primarily to making progress payments and incurring related vessel construction expenses for the newbuilding vessels.

Net cash used in financing activities during the nine-month period ended September 30, 2012 and 2011 was $9,447,930 and $4,305,717, respectively. Financing activities during the nine-month period ended September 30, 2012, related primarily to expenses incurred for the Company's amendment credit agreement.

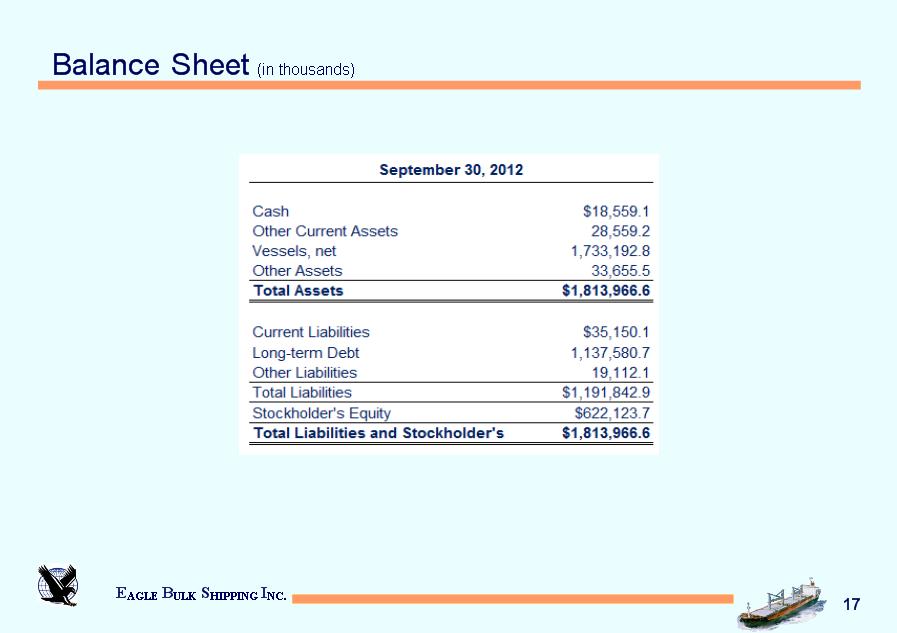

As of September 30, 2012, our cash balance was $18,559,137, compared to a cash balance of $25,075,203 at December 31, 2011. Also recorded in Restricted Cash is an amount of $276,056 which collateralizes letters of credit relating to our office leases.

Debt consists of the following:

|

September 30, 2012

|

December 31, 2011

|

|||||||

|

Credit Facility

|

$ | -- | $ | 1,129,478,741 | ||||

|

Term loan

|

1,129,478,741 | |||||||

|

Payment-in-kind loan

|

8,101,953 | |||||||

|

Less: Current portion

|

-- | (32,094,006 | ) | |||||

|

Long-term debt

|

$ | 1,137,580,694 | $ | 1,097,384,735 | ||||

Disclosure of Non-GAAP Financial Measures

EBITDA represents operating earnings before extraordinary items, depreciation and amortization, interest expense, and income taxes, if any. EBITDA is included because it is used by certain investors to measure a company's financial performance. EBITDA is not an item recognized by U.S. GAAP and should not be considered a substitute for net income, cash flow from operating activities and other operations or cash flow statement data prepared in accordance with accounting principles generally accepted in the United States or as a measure of profitability or liquidity. EBITDA is presented to provide additional information with respect to the Company's ability to satisfy its obligations including debt service, capital expenditures, and working capital requirements. While EBITDA is frequently used as a measure of operating results and the ability to meet debt service requirements, the definition of EBITDA used herein may not be comparable to that used by other companies due to differences in methods of calculation.

Our term loan agreement require us to comply with financial covenants based on debt and interest ratio with extraordinary or exceptional items, interest, taxes, non-cash compensation, depreciation and amortization (Credit Agreement EBITDA). Therefore, we believe that this non-U.S. GAAP measure is important for our investors as it reflects our ability to meet our covenants. The following table is a reconciliation of net loss, as reflected in the consolidated statements of operations, to the Credit Agreement EBITDA:

|

Three Months Ended

|

Nine Months Ended

|

|

||||||||||||||

|

|

September 30, 2012

|

September 30, 2011

|

September 30, 2012

|

September 30, 2011

|

||||||||||||

|

Net loss

|

$ | (29,837,360 | ) | $ | (5,872,211 | ) | $ | (70,377,128 | ) | $ | (13,120,770 | ) | ||||

|

Interest Expense

|

21,981,186 | 12,390,455 | 44,995,438 | 35,399,362 | ||||||||||||

|

Depreciation and Amortization

|

19,389,042 | 18,660,293 | 58,250,356 | 53,459,509 | ||||||||||||

|

Amortization of fair value below contract value of time charter acquired

|

(1,139,972 | ) | (1,267,242 | ) | (3,574,012 | ) | (3,833,571 | ) | ||||||||

|

EBITDA

|

10,392,896 | 23,911,295 | 29,294,654 | 71,904,530 | ||||||||||||

|

Adjustments for Exceptional Items:

|

||||||||||||||||

|

Non-cash Compensation Expense (1)

|

2,130,790 | 2,019,794 | 7,012,714 | 6,958,931 | ||||||||||||

|

Credit Agreement EBITDA

|

$ | 12,523,686 | $ | 25,931,089 | $ | 36,307,368 | $ | 78,863,461 | ||||||||

(1) Stock based compensation related to stock options and restricted stock units.

Capital Expenditures and Drydocking

Our capital expenditures relate to the purchase of vessels and capital improvements to our vessels which are expected to enhance the revenue earning capabilities and safety of these vessels.

In addition to acquisitions that we may undertake in future periods, the Company's other major capital expenditures include funding the Company's maintenance program of regularly scheduled drydocking necessary to preserve the quality of our vessels as well as to comply with international shipping standards and environmental laws and regulations. Although the Company has some flexibility regarding the timing of its drydocking, the costs are relatively predictable. Management anticipates that vessels are to be drydocked every two and a half years. Funding of these requirements is anticipated to be met with cash from operations. We anticipate that this process of recertification will require us to reposition these vessels from a discharge port to shipyard facilities, which will reduce our available days and operating days during that period.

Drydocking costs incurred are amortized to expense on a straight-line basis over the period through the date the next drydocking for those vessels are scheduled to occur. No vessel drydocked in the three months ended September 30, 2012. The following table represents certain information about the estimated costs for anticipated vessel drydockings in the next four quarters, along with the anticipated off-hire days:

|

Quarter Ending

|

Off-hire Days(1)

|

Projected Costs(2)

|

||||||

|

December 31, 2012

|

- | - | ||||||

|

March 31, 2013

|

22 |

$0.60 million

|

||||||

|

June 30, 2013

|

44 |

$1.20 million

|

||||||

|

September 30, 2013

|

22 |

$0.60 million

|

||||||

|

(1)Actual duration of drydocking will vary based on the condition of the vessel, yard schedules and other factors.

(2)Actual costs will vary based on various factors, including where the drydockings are actually performed.

|

||||||||

Summary Consolidated Financial and Other Data:

The following table summarizes the Company's selected consolidated financial and other data for the periods indicated below.

CONSOLIDATED STATEMENT OF OPERATIONS

|

Three Months Ended

|

Nine Months Ended

|

|||||||||||||||

|

September 30, 2012

|

September30, 2011

|

September30, 2012

|

September 30, 2011

|

|||||||||||||

|

Revenues, net of commissions

|

$ | 46,854,671 | $ | 80,323,369 | $ | 148,008,304 | $ | 243,421,532 | ||||||||

|

Voyage expenses

|

6,480,233 | 11,995,164 | 20,370,857 | 35,941,960 | ||||||||||||

|

Vessel expenses

|

21,246,653 | 22,000,678 | 67,557,977 | 62,763,849 | ||||||||||||

|

Charter hire expenses

|

1,104,571 | 11,058,796 | 1,711,144 | 38,013,289 | ||||||||||||

|

Depreciation and amortization

|

19,389,042 | 18,660,293 | 58,250,356 | 53,459,509 | ||||||||||||

|

General and administrative expenses

|

6,497,598 | 8,283,432 | 26,551,478 | 30,218,614 | ||||||||||||

|

Loss (gain) from sale of vessel

|

— | 509,076 | — | 509,076 | ||||||||||||

|

Total operating expenses

|

54,718,097 | 72,507,439 | 174,441,812 | 220,906,297 | ||||||||||||

|

Operating income (loss)

|

(7,863,426 | ) | 7,815,930 | (26,433,508 | ) | 22,515,235 | ||||||||||

|

Interest expense

|

21,981,186 | 12,390,455 | 44,995,438 | 35,399,362 | ||||||||||||

|

Interest income

|

(7,252 | ) | (35,796 | ) | (23,443 | ) | (122,930 | ) | ||||||||

|

Other (Income) expense

|

— | 1,333,482 | (1,028,375 | ) | 359,573 | |||||||||||

|

Total other expense, net

|

21,973,934 | 13,688,141 | 43,943,620 | 35,636,005 | ||||||||||||

|

Net loss

|

$ | (29,837,360 | ) | $ | (5,872,211 | ) | $ | (70,377,128 | ) | $ | (13,120,770 | ) | ||||

|

Weighted average shares outstanding*:

|

||||||||||||||||

|

Basic

|

16,821,024 | 15,663,181 | 16,153,184 | 15,648,791 | ||||||||||||

|

Diluted

|

16,821,024 | 15,663,181 | 16,153,184 | 15,648,791 | ||||||||||||

|

Per share amounts:

|

||||||||||||||||

|

Basic net loss

|

$ | (1.77 | ) | $ | (0.37 | ) | $ | (4.36 | ) | $ | (0.84 | ) | ||||

|

Diluted net loss

|

$ | (1.77 | ) | $ | (0.37 | ) | $ | (4.36 | ) | $ | (0.84 | ) | ||||

* Adjusted to give effect to the 1 for 4 reverse stock split that became effective on May 22, 2012.

Fleet Operating Data

|

Three Months Ended

|

Nine Months Ended

|

|||

|

September 30, 2012

|

September 30, 2011

|

September 30, 2012

|

September 30, 2011

|

|

|

Ownership Days

|

4,140

|

3,938

|

12,330

|

11,168

|

|

Chartered-in under operating lease Days

|

58

|

582

|

90

|

2,240

|

|

Available Days

|

4,198

|

4,489

|

12,372

|

13,336

|

|

Operating Days

|

4,172

|

4,464

|

12,275

|

13,243

|

|

Fleet Utilization

|

99.4%

|

99.4%

|

99.2%

|

99.3%

|

CONSOLIDATED BALANCE SHEETS

|

September 30, 2012 (unaudited)

|

December 31, 2011

|

|||||||

|

ASSETS:

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 18,559,137 | $ | 25,075,203 | ||||

|

Accounts receivable, net

|

13,794,508 | 13,960,777 | ||||||

|

Prepaid expenses

|

3,261,234 | 3,969,905 | ||||||

|

Inventories

|

10,813,659 | 11,083,331 | ||||||

|

Investment

|

135,886 | 988,196 | ||||||

|

Fair value above contract value of time charters acquired

|

553,894 | 567,315 | ||||||

|

Fair value of derivative instruments

|

- | 246,110 | ||||||

|

Total current assets

|

47,118,318 | 55,890,837 | ||||||

|

Noncurrent assets:

|

||||||||

|

Vessels and vessel improvements, at cost, net of accumulated

depreciation of $295,815,545 and $239,568,767, respectively

|

1,733,192,789 | 1,789,381,046 | ||||||

|

Other fixed assets, net of accumulated amortization of $466,074 and $324,691,respectively

|

512,633 | 605,519 | ||||||

|

Restricted cash

|

276,056 | 670,418 | ||||||

|

Deferred drydock costs

|

2,526,709 | 3,303,363 | ||||||

|

Deferred financing costs

|

27,204,280 | 11,766,779 | ||||||

|

Fair value above contract value of time charters acquired

|

2,628,175 | 3,041,496 | ||||||

|

Other assets

|

507,637 | 2,597,270 | ||||||

|

Total noncurrent assets

|

1,766,848,279 | 1,811,365,891 | ||||||

|

Total assets

|

$ | 1,813,966,597 | $ | 1,867,256,728 | ||||

|

LIABILITIES & STOCKHOLDERS' EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 9,473,153 | $ | 10,642,831 | ||||

|

Accrued interest

|

1,953,730 | 2,815,665 | ||||||

|

Other accrued liabilities

|

15,570,073 | 11,822,582 | ||||||

|

Current portion of long-term debt

|

— | 32,094,006 | ||||||

|

Deferred revenue and fair value below contract value of time charters acquired

|

3,969,335 | 5,966,698 | ||||||

|

Unearned charter hire revenue

|

4,183,856 | 5,779,928 | ||||||

|

Total current liabilities

|

35,150,147 | 69,121,710 | ||||||

|

Noncurrent liabilities:

|

||||||||

|

Long-term debt

|

1,137,580,694 | 1,097,384,735 | ||||||

|

Deferred revenue and fair value below contract value of time charters acquired

|

14,614,056 | 17,088,464 | ||||||

|

Fair value of derivative instruments

|

4,498,027 | 9,486,116 | ||||||

|

Total noncurrent liabilities

|

1,156,692,777 | 1,123,959,315 | ||||||

|

Total liabilities

|

1,191,842,924 | 1,193,081,025 | ||||||

|

Commitment and contingencies

|

||||||||

|

Stockholders' equity:

|

||||||||

|

Preferred stock, $.01 par value, 25,000,000 shares authorized, none issued

|

— | — | ||||||

|

Common stock, $.01 par value, 100,000,000 shares authorized, 15,771,496*shares issued and outstanding

|

157,715 | 157,508 | ||||||

|

Additional paid-in capital

|

760,134,806 | 745,945,694 | ||||||

|

Retained earnings (net of dividends declared of $262,118,388 as of September 30, 2012 and December 31,

2011, respectively)

|

(132,851,614 | ) | (62,474,486 | ) | ||||

|

Accumulated other comprehensive loss

|

(5,317,234 | ) | (9,453,013 | ) | ||||

|

Total stockholders' equity

|

622,123,673 | 674,175,703 | ||||||

|

Total liabilities and stockholders' equity

|

$ | 1,813,966,597 | $ | 1,867,256,728 | ||||

* Adjusted to give effect to the 1 for 4 reverse stock split that became effective on May 22, 2012.

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

Nine Months Ended

|

||||||||

|

September 30, 2012

|

September 30, 2011

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net loss

|

$ | (70,377,128 | ) | $ | (13,120,770 | ) | ||

|

Adjustments to reconcile net loss to net cash provided by operating activities:

|

||||||||

|

Items included in net loss not affecting cash flows:

|

||||||||

|

Depreciation

|

56,388,161 | 51,014,334 | ||||||

|

Amortization of deferred drydocking costs

|

1,862,195 | 2,445,175 | ||||||

|

Amortization of deferred financing costs

|

4,428,572 | 3,014,720 | ||||||

|

Amortization of fair value below contract value of time charter acquired

|

(3,574,012 | ) | (3,833,571 | ) | ||||

|

Loss from sale of vessel

|

— | 509,076 | ||||||

|

Payment-in-kind interest on debt

|

8,101,953 | — | ||||||

|

Unrealized gain from forward freight agreements, net

|

246,110 | 377,889 | ||||||

|

Allowance for accounts receivable

|

5,351,609 | 6,586,900 | ||||||

|

Non-cash compensation expense

|

7,012,714 | 6,958,931 | ||||||

|

Drydocking expenditures

|

(1,085,541 | ) | (2,074,115 | ) | ||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

(5,185,340 | ) | (16,264,471 | ) | ||||

|

Other assets

|

2,089,633 | (2,528,419 | ) | |||||

|

Prepaid expenses

|

708,671 | (198,860 | ) | |||||

|

Inventories

|

269,672 | (5,087,644 | ) | |||||

|

Accounts payable

|

(1,169,678 | ) | 3,309,380 | |||||

|

Accrued interest

|

(861,935 | ) | (2,495,987 | ) | ||||

|

Accrued expenses

|

505,953 | 8,709,633 | ||||||

|

Deferred revenue

|

(471,017 | ) | 19,244 | |||||

|

Unearned revenue

|

(1,596,072 | ) | (233,646 | ) | ||||

|

Net cash provided by operating activities

|

2,644,520 | 37,107,799 | ||||||

|

Cash flows from investing activities:

|

||||||||

|

Vessels and vessel improvements and advances for vessel construction

|

(58,521 | ) | (155,686,543 | ) | ||||

|

Purchase of other fixed assets

|

(48,497 | ) | (342,932 | ) | ||||

|

Proceeds from sale of vessel

|

— | 22,511,226 | ||||||

|

Changes in restricted cash

|

394,362 | (1,131,519 | ) | |||||

|

Net cash provided by (used in) investing activities

|

287,344 | (134,649,768 | ) | |||||

|

Cash flows from financing activities:

|

||||||||

|

Repayment of bank debt

|

— | (21,875,735 | ) | |||||

|

Changes in restricted cash

|

— | 19,000,000 | ||||||

|

Deferred financing costs

|

(9,382,792 | ) | — | |||||

|

Cash used to settle net share equity awards

|

(65,138 | ) | (1,429,982 | ) | ||||

|

Net cash used in financing activities

|

(9,447,930 | ) | (4,305,717 | ) | ||||

|

Net decrease in cash

|

(6,516,066 | ) | (101,847,686 | ) | ||||

|

Cash at beginning of period

|

25,075,203 | 129,121,680 | ||||||

|

Cash at end of period

|

$ | 18,559,137 | $ | 27,273,994 | ||||

The following table represents certain information about our revenue earning charters on our operating fleet as of September 30, 2012:

|

Vessel

|

Year

Built

|

|

Dwt

|

|

Charter Expiration (1)

|

Daily

Charter Hire Rate

|

||

|

|

|

|

|

|

|

|

||

|

Avocet (2)

|

2010

|

|

|

53,462

|

|

Oct2012

|

$

|

9,000

|

|

|

|

|

|

|

|

|

|

|

|

Bittern (2)

|

2009

|

|

|

57,809

|

|

Oct 2012

|

$

|

7,800

|

|

|

|

|

|

|

|

|

|

|

|

Canary (2)

|

2009

|

|

|

57,809

|

|

Oct 2012

|

$

|

11,000

|

|

|

|

|

|

|

|

|

|

|

|

Cardinal

|

2004

|

|

|

55,362

|

|

Nov 2012 to Feb 2013

|

|

Index(4)

|

|

|

|

|

|

|

|

|

|

|

|

Condor

|

2001

|

|

|

50,296

|

|

Nov 2012 to Jan 2013

|

$

|

11,000

|

|

|

|

|

|

|

|

|

|

|

|

Crane (2)

|

2010

|

|

|

57,809

|

|

Oct 2012

|

$

|

11,500

|

|

|

|

|

|

|

|

|

|

|

|

Crested Eagle

|

2009

|

|

|

55,989

|

|

Oct 2012

|

$

|

10,500

|

|

|

|

|

|

|

|

|

|

|

|

Crowned Eagle

|

2008

|

|

|

55,940

|

|

Oct 2012

|

Voyage(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

Egret Bulker

|

2010

|

|

|

57,809

|

|

Oct 2012 to Feb 2013

|

|

$17,650(5) (with 50%

profit share over $20,000)

|

|

|

|

|

|

|

|

|

|

|

|

Falcon

|

2001

|

|

|

50,296

|

|

Dec 2012 to Feb 2013

|

$

|

8,000

|

|

|

|

|

|

|

|

|

|

|

|

Gannet Bulker

|

2010

|

|

|

57,809

|

|

Jan 2013 to May 2013

|

|

$17,650(5) (with 50%

profit share over $20,000)

|

|

|

|

|

|

|

|

|

|

|

|

Golden Eagle

|

2010

|

|

|

55,989

|

|

Oct 2012 to Dec 2012

|

$

|

10,500

|

|

|

|

|

|

|

|

|

|

|

|

Goldeneye

|

2002

|

|

|

52,421

|

|

Oct 2012 to Jan 2013

|

|

Index(4)

|

|

|

|

|

|

|

|

|

|

|

|

Grebe Bulker

|

2010

|

|

|

57,809

|

|

Feb 2013 to Jun 2013

|

|

$17,650(5) (with 50%

profit share over $20,000)

|

|

|

|

|

|

|

|

|

|

|

|

Harrier

|

2001

|

|

|

50,296

|

|

Oct 2012 to Nov 2012

|

$

|

5,000

|

|

|

|

|

|

|

|

|

|

|

|

Hawk I

|

2001

|

|

|

50,296

|

|

Nov 2012

|

$

|

7,250

|

|

|

|

|

|

|

|

|

|

|

|

Ibis Bulker

|

2010

|

|

|

57,775

|

|

Mar 2013 to Jul 2013

|

|

$17,650(5) (with 50%

profit share over $20,000)

|

|

|

|

|

|

|

|

|

|

|

|

Imperial Eagle

|

2010

|

|

|

55,989

|

|

Nov 2012 to Feb 2013

|

|

Index(4)

|

|

|

|

|

|

|

|

|

|

|

|

Jaeger

|

2004

|

|

|

52,248

|

|

Nov 2012 to Jan 2013

|

|

Index(4)

|

|

|

|

|

|

|

|

|

|

|

|

Jay(2)

|

2010

|

|

|

57,802

|

|

-

|

|

Spot

|

|

|

|

|

|

|

|

|

|

|

|

Kestrel I

|

2004

|

|

|

50,326

|

|

Mar 2013 to May 2013

|

$

|

9,500

|

|

|

|

|

|

|

|

|

|

|

|

Kingfisher (2)

|

2010

|

|

|

57,776

|

|

Nov 2012 to Feb 2013

|

$

|

8,900

|

|

|

|

|

|

|

|

|

|

|

|

Kite

|

1997

|

|

|

47,195

|

|

Oct 2012 to Nov 2012

|

$

|

7,250

|

|

|

|

|

|

|

|

|

|

|

|

Kittiwake

|

2002

|

|

|

53,146

|

|

Oct 2012 to Jan 2013

|

$

|

10,500

|

|

|

|

|

|

|

|

|

|

|

|

Martin(2)

|

2010

|

|

|

57,809

|

|

Nov 2012 to Feb 2013

|

$

|

8,300

|

|

|

|

|

|

|

|

|

|

|

|

Merlin

|

2001

|

|

|

50,296

|

|

Nov 2012

|

|

Voyage(3)

|

|

|

|

|

|

|

|

|

|

|

|

Nighthawk(2)

|

2011

|

|

|

57,809

|

|

Nov 2012

|

$

|

12,500

|

|

|

|

|

|

|

|

|

|

|

|

Oriole(2)

|

2011

|

|

|

57,809

|

|

Oct 2012

|

$

|

8,400

|

|

|

|

|

|

|

|

|

|

|

|

Osprey I

|

2002

|

|

|

50,206

|

|

Oct 2012

|

Voyage(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

Owl(2)

|

2011

|

|

|

57,809

|

|

Oct 2012

|

$

|

8,500

|

|

|

|

|

|

|

|

|

|

|

|

Peregrine

|

2001

|

|

|

50,913

|

|

Dec 2012 to Mar 2013

|

$

|

8,250

|

|

Petrel Bulker

|

2011

|

|

|

57,809

|

|

May 2014 to Sep 2014

|

|

$17,650(5) (with 50%

profit share over $20,000)

|

|

|

|

|

|

|

|

|

|

|

|

Puffin Bulker

|

2011

|

|

|

57,809

|

|

May 2014 to Sep 2014

|

|

$17,650(5) (with 50%

profit share over $20,000)

|

|

|

|

|

|

|

|

|

|

|

|

Redwing

|

2007

|

|

|

53,411

|

|

Oct 2012

|

$

|

10,000

|

|

|

|

|

|

|

|

|

|

|

|

Roadrunner Bulker

|

2011

|

|

|

57,809

|

|

Aug 2014 to Dec 2014

|

|

$17,650(5) (with 50%

profit share over $20,000)

|

|

|

|

|

|

|

|

|

|

|

|

Sandpiper Bulker

|

2011

|

|

|

57,809

|

|

Aug 2014 to Dec 2014

|

|

$17,650(5) (with 50%

profit share over $20,000)

|

|

|

|

|

|

|

|

|

|

|

|

Shrike

|

2003

|

|

|

53,343

|

|

Dec 2012 to Mar 2013

|

$

|

11,300

|

|

|

|

|

|

|

|

|

|

|

|

Skua

|

2003

|

|

|

53,350

|

|

Oct 2012

|

$

|

8,250

|

|

|

|

|

|

|

|

|

|

|

|

Sparrow

|

2000

|

|

|

48,225

|

|

Oct 2012

|

$

|

8,500

|

|

|

|

|

|

|

|

|

|

|

|

Stellar Eagle

|

2009

|

|

|

55,989

|

|

Mar 2013 to Jun 2013

|

Index(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

Tern

|

2003

|

|

|

50,200

|

|

Oct 2012

|

$

|

5,750(3)

|

|

|

|

|

|

|

|

|

|

|

|

Thrasher (2)

|

2010

|

|

|

53,360

|

|

Oct 2012

|

$

|

10,000(3)

|

|

|

|

|

|

|

|

|

|

|

|

Thrush

|

2011

|

|

|

53,297

|

|

Oct 2012

|

$

|

9,000(3)

|

|

|

|

|

|

|

|

|

|

|

|

Woodstar (2)

|

2008

|

|

|

53,390

|

|

Nov 2012

|

$

|

7,200

|

|

|

|

|

|

|

|

|

|

|

|

Wren (2)

|

2008

|

|

|

53,349

|

|

Oct 2012 to Nov 2012

|

$

|

13,000

|

|

(1)

|

|

The date range provided represents the earliest and latest date on which the charterer may redeliver the vessel to the Company upon the termination of the charter. The time charter hire rates presented are gross daily charter rates before brokerage commissions, ranging from 0.625% to 5.00%, to third party ship brokers.

|

|

|

(2)

|

|

The charter rate does not include any shortfall between the vessels' actual daily earnings and the $17,000 per day for which KLC is responsible. Revenue from KLC will be recognized when collectability is assured. In addition, through December 2015, we are entitled to100% of the profits on earnings between $17,000 to $21,000 per day and a 50% profit share on earnings above $17,000 per day from January 2016 to December 2018.

|

|

|

(3

|

)

|

Upon conclusion of the previous charter, the vessel will commence a short-term charter for up to six months.

|

|

|

(4

|

)

|

Index, an average of the trailing Baltic Supramax Index.

|

|

| (5 | ) |

The charterer has an option to extend the charter by two periods of 11 to 13 months each.

|

Glossary of Terms:

Ownership days: The Company defines ownership days as the aggregate number of days in a period during which each vessel in its fleet has been owned. Ownership days are an indicator of the size of the fleet over a period and affect both the amount of revenues and the amount of expenses that is recorded during a period.

Chartered-in under operating lease days: The Company defines chartered-in under operating lease days as the aggregate number of days in a period during which the Company chartered-in vessels.

Available days: The Company defines available days as the number of ownership days less the aggregate number of days that its vessels are off-hire due to vessel familiarization upon acquisition, scheduled repairs or repairs under guarantee, vessel upgrades or special surveys and the aggregate amount of time that we spend positioning our vessels. The shipping industry uses available days to measure the number of days in a period during which vessels should be capable of generating revenues.

Operating days: The Company defines operating days as the number of its available days in a period less the aggregate number of days that the vessels are off-hire due to any reason, including unforeseen circumstances. The shipping industry uses operating days to measure the aggregate number of days in a period during which vessels actually generate revenues.

Fleet utilization: The Company calculates fleet utilization by dividing the number of our operating days during a period by the number of our available days during the period. The shipping industry uses fleet utilization to measure a company's efficiency in finding suitable employment for its vessels and minimizing the amount of days that its vessels are off-hire for reasons other than scheduled repairs or repairs under guarantee, vessel upgrades, special surveys or vessel positioning. Our fleet continues to perform at very high utilization rates.

Conference Call Information

As previously announced, members of Eagle Bulk's senior management team will host a teleconference and webcast at 8:30 a.m. ET on Friday, November 9th to discuss the results.

To participate in the teleconference, investors and analysts are invited to call 800-561-2693 in the U.S., or 617-614-3523 outside of the U.S., and reference participant code 99522816. A simultaneous webcast of the call, including a slide presentation for interested investors and others, may be accessed by visiting http://www.eagleships.com.

A replay will be available following the call until 11:59 PM ET on November 15, 2012. To access the replay, call 888-286-8010 in the U.S., or 617-801-6888 outside of the U.S., and reference passcode 94614983.

About Eagle Bulk Shipping Inc.

Eagle Bulk Shipping Inc. is a Marshall Islands corporation headquartered in New York. The Company is a leading global owner of Supramax dry bulk vessels that range in size from 50,000 to 60,000 deadweight tons and transport a broad range of major and minor bulk cargoes, including iron ore, coal, grain, cement and fertilizer, along worldwide shipping routes.

Forward-Looking Statements

Matters discussed in this release may constitute forward-looking statements. Forward-looking statements reflect our current views with respect to future events and financial performance and may include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management's examination of historical operating trends, data contained in our records and other data available from third parties. Although Eagle Bulk Shipping Inc. believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, Eagle Bulk Shipping Inc. cannot assure you that it will achieve or accomplish these expectations, beliefs or projections.

Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include the strength of world economies and currencies, general market conditions, including changes in charter hire rates and vessel values, changes in demand that may affect attitudes of time charterers to scheduled and unscheduled drydocking, changes in our vessel operating expenses, including dry-docking and insurance costs, or actions taken by regulatory authorities, potential liability from future litigation, domestic and international political conditions, potential disruption of shipping routes due to accidents and political events or acts by terrorists.

Risks and uncertainties are further described in reports filed by Eagle Bulk Shipping Inc. with the US Securities and Exchange Commission.

Visit our website at www.eagleships.com

Contact:

Company Contact:

Adir Katzav

Chief Financial Officer

Eagle Bulk Shipping Inc.

Tel. +1 212-785-2500

Investor Relations / Media:

Jonathan Morgan

Perry Street Communications, New York

Tel. +1 212-741-0014

--------------------------------------------------------------------------------

Source: Eagle Bulk Shipping Inc.

Exhibit 99.2

EAGLE BULK SHIPPING INC. 3Q 2012 Results Presentation 9 November 2012

EAGLE BULK SHIPPING INC. 3Q 2012 Results Presentation 9 November 2012

* Forward Looking Statements This presentation contains certain statements that may be deemed to be “forward-looking statements” within the meaning of the Securities Acts. Forward-looking statements reflect management’s current views with respect to future events and financial performance and may include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts. The forward-looking statements in this presentation are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management's examination of historical operating trends, data contained in our records and other data available from third parties. Although Eagle Bulk Shipping Inc. believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, Eagle Bulk Shipping Inc. cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include the strength of world economies and currencies, general market conditions, including changes in charter hire rates and vessel values, changes in demand that may affect attitudes of time charterers to scheduled and unscheduled drydocking, changes in our vessel operating expenses, including dry-docking and insurance costs, or actions taken by regulatory authorities, ability of our counterparties to perform their obligations under sales agreements, charter contracts, and other agreements on a timely basis, potential liability from future litigation, domestic and international political conditions, potential disruption of shipping routes due to accidents and political events or acts by terrorists. Risks and uncertainties are further described in reports filed by Eagle Bulk Shipping Inc. with the US Securities and Exchange Commission. EAGLE BULK SHIPPING INC.

* Results and Highlights Commercial Industry Financials Q&A Appendix Agenda EAGLE BULK SHIPPING INC.

EAGLE BULK SHIPPING INC. Results and Highlights

3Q 2012 Results and Highlights * * Net reported loss of $29.8 million or $1.77 per share (based on a weighted average of 16,821,024 diluted shares outstanding for the quarter), compared to net loss of $5.9 million, or $0.37 per share, for the comparable quarter in 2011 Net revenues of $46.9 million, compared to $80.3 million for the comparable quarter in 2011. Gross time charter and freight revenues of $48.9 million, compared to $84.0 million for the comparable quarter in 2011 EBITDA, as adjusted for exceptional items under the terms of the Company's credit agreement, was $12.5 million for the third quarter of 2012, compared with $25.9 million for the third quarter of 2011 Fleet utilization rate of 99.4% EAGLE BULK SHIPPING INC.

EAGLE BULK SHIPPING INC. Commercial

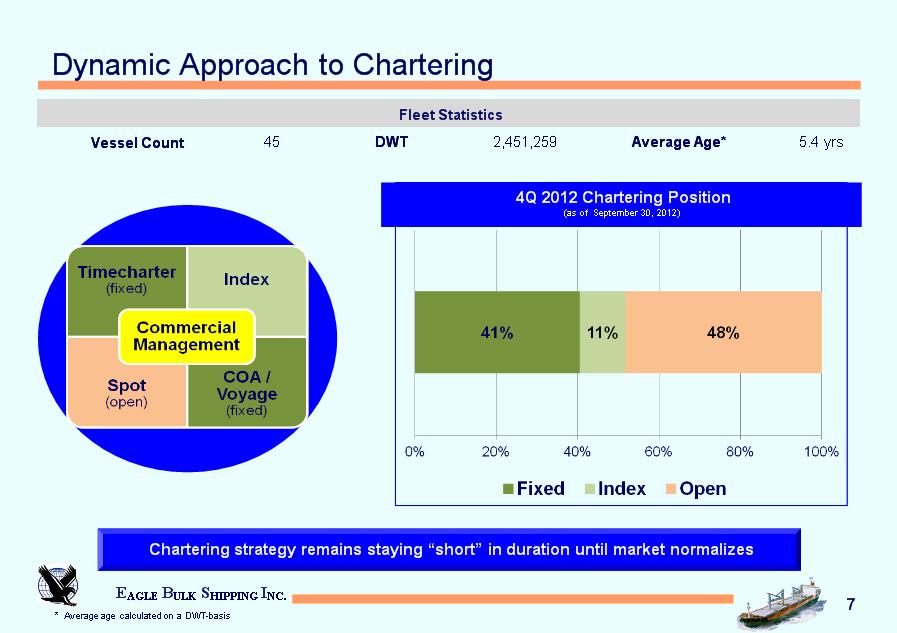

* Dynamic Approach to Chartering Chartering strategy remains staying “short” in duration until market normalizes 4Q 2012 Chartering Position (as of September 30, 2012) Fleet Statistics Fleet Statistics Fleet Statistics Fleet Statistics Fleet Statistics Fleet Statistics Vessel Count 45 DWT 2,451,259 Average Age* 5.4 yrs * Average age calculated on a DWT-basis EAGLE BULK SHIPPING INC.

* Cargoes Carried During the Third Quarter 2012 Diversified Cargo Mix Cargo Cargo Type MT as a % of Total 1 Coal Major 1,785,024 34.4% 2 Grains / Agricultural Major 599,359 11.6% 3 Cement Minor 420,659 8.1% 4 Iron Ore Major 396,212 7.6% 5 Steels / Pig Iron / Scrap Minor 324,740 6.3% 6 Potash / Fertilizer Minor 278,405 5.4% 7 Limestone Minor 239,036 4.6% 8 Sand Minor 199,971 3.9% 9 Miscellaneous Minor 188,829 3.6% 10 Other Ores Minor 180,090 3.5% 11 Coke Minor 145,295 2.8% 12 Sugar Minor 139,259 2.7% 13 Forest Products Minor 119,876 2.3% 14 Alumina/Bauxite Minor 89,662 1.7% 15 Copper Minor 79,314 1.5% Total Cargoes Carried Total Cargoes Carried Total Cargoes Carried 5,185,731 100.0% Cargo Mix by Type EAGLE BULK SHIPPING INC.

EAGLE BULK SHIPPING INC. Industry

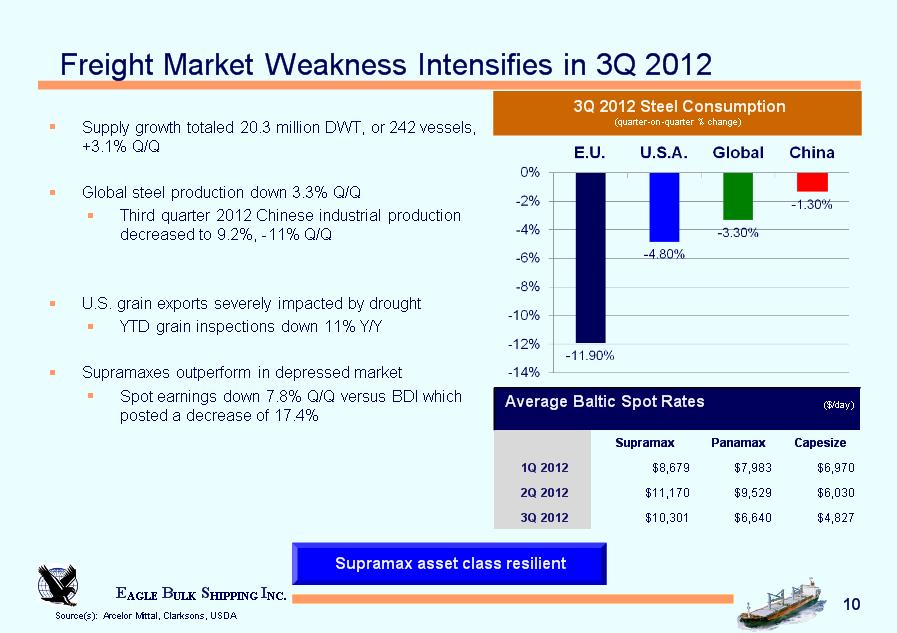

* Source(s): Arcelor Mittal, Clarksons, USDA Supply growth totaled 20.3 million DWT, or 242 vessels, +3.1% Q/Q Global steel production down 3.3% Q/Q Third quarter 2012 Chinese industrial production decreased to 9.2%, -11% Q/Q U.S. grain exports severely impacted by drought YTD grain inspections down 11% Y/Y Supramaxes outperform in depressed market Spot earnings down 7.8% Q/Q versus BDI which posted a decrease of 17.4% Freight Market Weakness Intensifies in 3Q 2012 Average Baltic Spot Rates ($/day) Average Baltic Spot Rates ($/day) Average Baltic Spot Rates ($/day) Average Baltic Spot Rates ($/day) Supramax Panamax Capesize 1Q 2012 $8,679 $7,983 $6,970 2Q 2012 $11,170 $9,529 $6,030 3Q 2012 $10,301 $6,640 $4,827 Supramax asset class resilient 3Q 2012 Steel Consumption (quarter-on-quarter % change) EAGLE BULK SHIPPING INC.

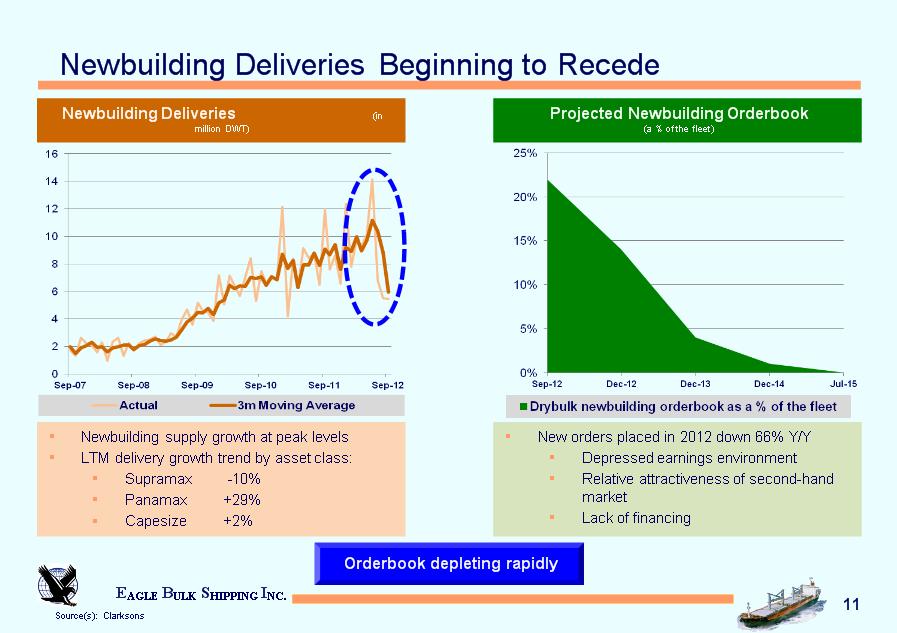

* Source(s): Clarksons Newbuilding Deliveries Beginning to Recede Orderbook depleting rapidly Projected Newbuilding Orderbook (a % of the fleet) Newbuilding Deliveries (in million DWT) New orders placed in 2012 down 66% Y/Y Depressed earnings environment Relative attractiveness of second-hand market Lack of financing Newbuilding supply growth at peak levels LTM delivery growth trend by asset class: Supramax -10% Panamax +29% Capesize +2% EAGLE BULK SHIPPING INC.

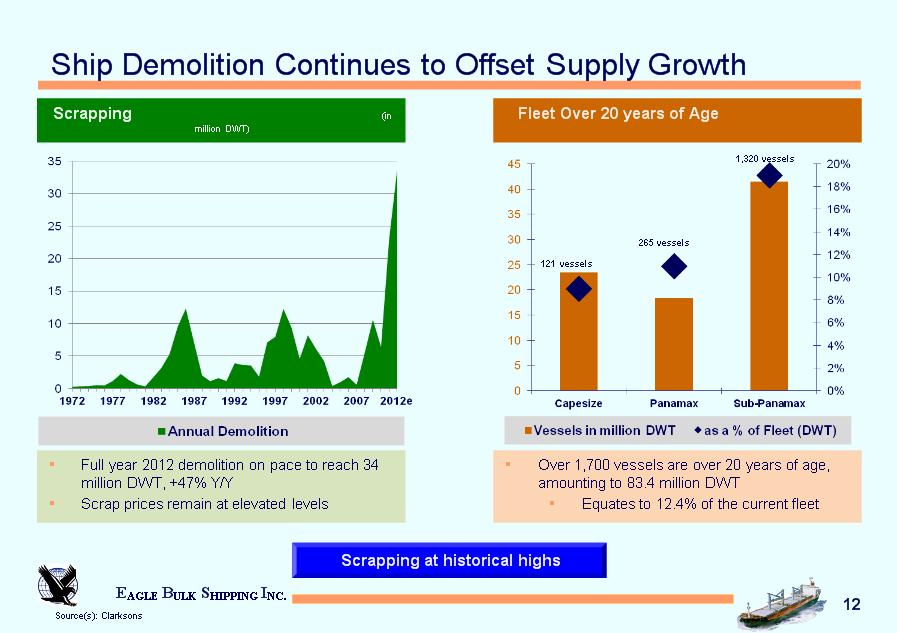

* Source(s): Clarksons Scrapping at historical highs Ship Demolition Continues to Offset Supply Growth Scrapping (in million DWT) Fleet Over 20 years of Age ( 121 vessels 265 vessels 1,320 vessels Full year 2012 demolition on pace to reach 34 million DWT, +47% Y/Y Scrap prices remain at elevated levels Over 1,700 vessels are over 20 years of age, amounting to 83.4 million DWT Equates to 12.4% of the current fleet EAGLE BULK SHIPPING INC.

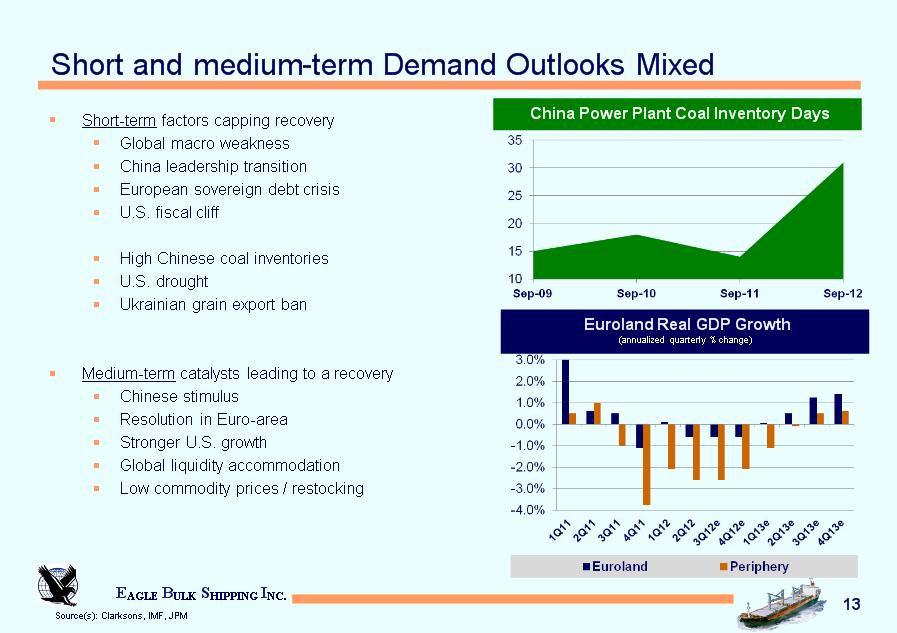

* Source(s): Clarksons, IMF, JPM Short-term factors capping recovery Global macro weakness China leadership transition European sovereign debt crisis U.S. fiscal cliff High Chinese coal inventories U.S. drought Ukrainian grain export ban Medium-term catalysts leading to a recovery Chinese stimulus Resolution in Euro-area Stronger U.S. growth Global liquidity accommodation Low commodity prices / restocking Short and medium-term Demand Outlooks Mixed Euroland Real GDP Growth (annualized quarterly % change) China Power Plant Coal Inventory Days EAGLE BULK SHIPPING INC.

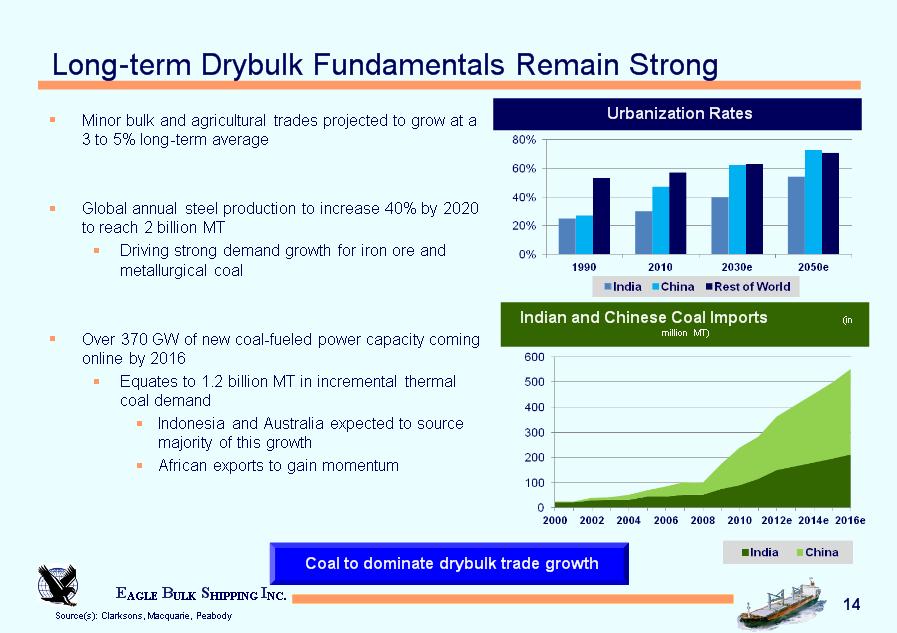

* Source(s): Clarksons, Macquarie, Peabody Minor bulk and agricultural trades projected to grow at a 3 to 5% long-term average Global annual steel production to increase 40% by 2020 to reach 2 billion MT Driving strong demand growth for iron ore and metallurgical coal Over 370 GW of new coal-fueled power capacity coming online by 2016 Equates to 1.2 billion MT in incremental thermal coal demand Indonesia and Australia expected to source majority of this growth African exports to gain momentum Long-term Drybulk Fundamentals Remain Strong Coal to dominate drybulk trade growth Indian and Chinese Coal Imports (in million MT) Urbanization Rates EAGLE BULK SHIPPING INC.

EAGLE BULK SHIPPING INC. Financials

* Earnings (in thousands, except per share data) *EBITDA, as defined in our Credit Agreement EAGLE BULK SHIPPING INC.

* Balance Sheet (in thousands) EAGLE BULK SHIPPING INC.

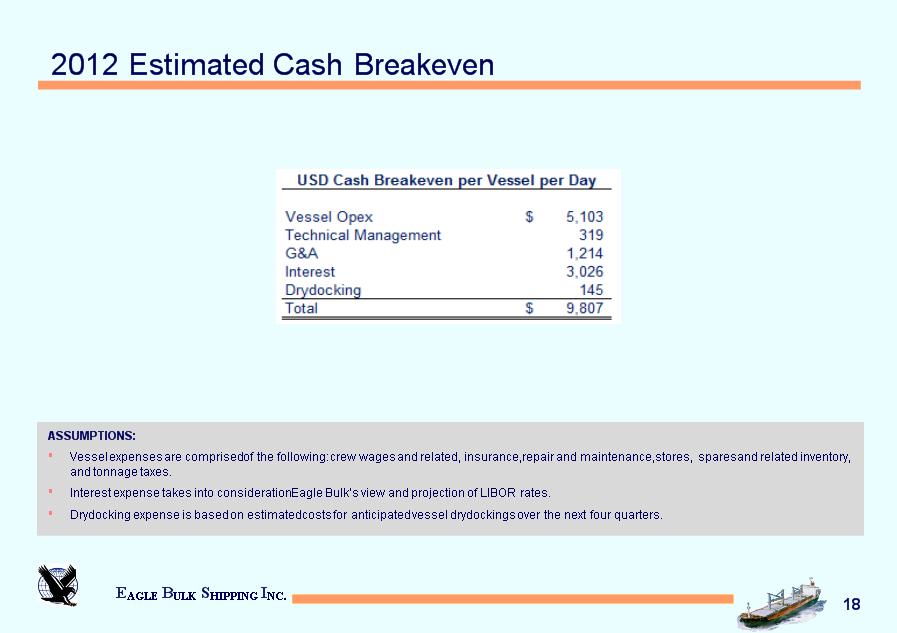

* 2012 Estimated Cash Breakeven ASSUMPTIONS: Vessel expenses are comprised of the following: crew wages and related, insurance, repair and maintenance, stores, spares and related inventory, and tonnage taxes. Interest expense takes into consideration Eagle Bulk’s view and projection of LIBOR rates. Drydocking expense is based on estimated costs for anticipated vessel drydockings over the next four quarters. EAGLE BULK SHIPPING INC.

EAGLE BULK SHIPPING INC. Q&A

EAGLE BULK SHIPPING INC. EAGLE BULK SHIPPING INC.

EAGLE BULK SHIPPING INC. Appendix

* Fleet Vessel DWT Year Built Vessel DWT Year Built Vessel DWT Year Built 1 Sandpiper Bulker 57,809 2011 16 Avocet 53,462 2010 31 Kestrel I 50,326 2004 2 Roadrunner Bulker 57,809 2011 17 Thrasher 53,360 2010 32 Skua 53,350 2003 3 Puffin Bulker 57,809 2011 18 Golden Eagle 55,989 2010 33 Shrike 53,343 2003 4 Petrel Bulker 57,809 2011 19 Egret Bulker 57,809 2010 34 Tern 50,200 2003 5 Owl 57,809 2011 20 Crane 57,809 2010 35 Kittiwake 53,146 2002 6 Oriole 57,809 2011 21 Canary 57,809 2009 36 Goldeneye 52,421 2002 7 Nighthawk 57,809 2011 22 Bittern 57,809 2009 37 Osprey I 50,206 2002 8 Thrush 53,297 2011 23 Stellar Eagle 55,989 2009 38 Falcon 50,296 2001 9 Martin 57,809 2010 24 Crested Eagle 55,989 2009 39 Peregrine 50,913 2001 10 Kingfisher 57,776 2010 25 Crowned Eagle 55,940 2008 40 Condor 50,296 2001 11 Jay 57,802 2010 26 Woodstar 53,390 2008 41 Harrier 50,296 2001 12 Ibis Bulker 57,775 2010 27 Wren 53,349 2008 42 Hawk I 50,296 2001 13 Grebe Bulker 57,809 2010 28 Redwing 53,411 2007 43 Merlin 50,296 2001 14 Gannet Bulker 57,809 2010 29 Cardinal 55,362 2004 44 Sparrow 48,225 2000 15 Imperial Eagle 55,989 2010 30 Jaeger 52,248 2004 45 Kite 47,195 1997 * Average age calculated on a DWT-basis VESSEL COUNT 45 DWT 2,451,259 AVERAGE AGE* 5.4 yrs EAGLE BULK SHIPPING INC.

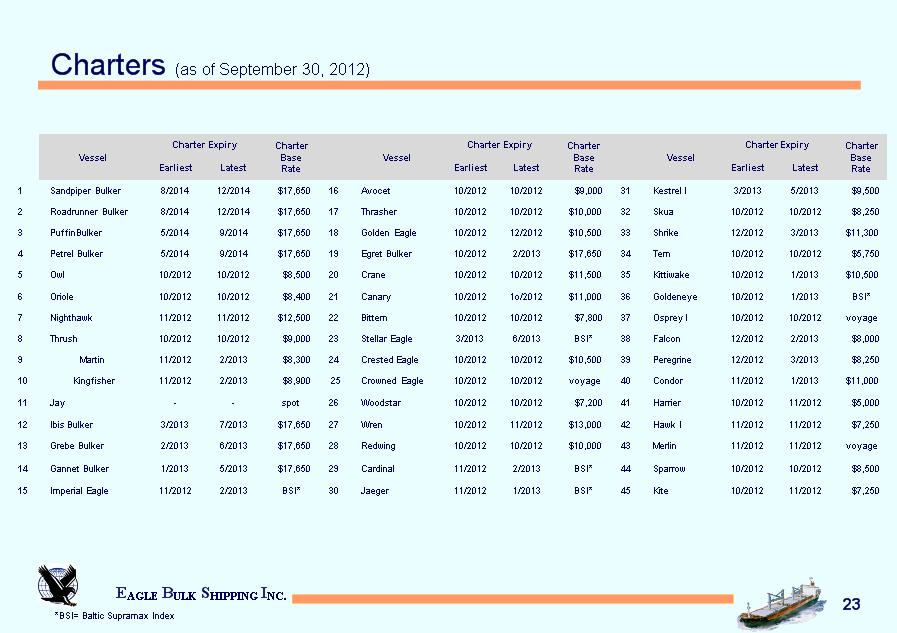

* Charters (as of September 30, 2012) Vessel Charter Expiry Charter Expiry Charter Base Rate Vessel Charter Expiry Charter Expiry Charter Base Rate Vessel Charter Expiry Charter Expiry Charter Base Rate Vessel Earliest Latest Charter Base Rate Vessel Earliest Latest Charter Base Rate Vessel Earliest Latest Charter Base Rate 1 Sandpiper Bulker 8/2014 12/2014 $17,650 16 Avocet 10/2012 10/2012 $9,000 31 Kestrel I 3/2013 5/2013 $9,500 2 Roadrunner Bulker 8/2014 12/2014 $17,650 17 Thrasher 10/2012 10/2012 $10,000 32 Skua 10/2012 10/2012 $8,250 3 Puffin Bulker 5/2014 9/2014 $17,650 18 Golden Eagle 10/2012 12/2012 $10,500 33 Shrike 12/2012 3/2013 $11,300 4 Petrel Bulker 5/2014 9/2014 $17,650 19 Egret Bulker 10/2012 2/2013 $17,650 34 Tern 10/2012 10/2012 $5,750 5 Owl 10/2012 10/2012 $8,500 20 Crane 10/2012 10/2012 $11,500 35 Kittiwake 10/2012 1/2013 $10,500 6 Oriole 10/2012 10/2012 $8,400 21 Canary 10/2012 1o/2012 $11,000 36 Goldeneye 10/2012 1/2013 BSI* 7 Nighthawk 11/2012 11/2012 $12,500 22 Bittern 10/2012 10/2012 $7,800 37 Osprey I 10/2012 10/2012 voyage 8 Thrush 10/2012 10/2012 $9,000 23 Stellar Eagle 3/2013 6/2013 BSI* 38 Falcon 12/2012 2/2013 $8,000 9 Martin 11/2012 2/2013 $8,300 24 Crested Eagle 10/2012 10/2012 $10,500 39 Peregrine 12/2012 3/2013 $8,250 10 Kingfisher 11/2012 2/2013 $8,900 25 Crowned Eagle 10/2012 10/2012 voyage 40 Condor 11/2012 1/2013 $11,000 11 Jay - - spot 26 Woodstar 10/2012 10/2012 $7,200 41 Harrier 10/2012 11/2012 $5,000 12 Ibis Bulker 3/2013 7/2013 $17,650 27 Wren 10/2012 11/2012 $13,000 42 Hawk I 11/2012 11/2012 $7,250 13 Grebe Bulker 2/2013 6/2013 $17,650 28 Redwing 10/2012 10/2012 $10,000 43 Merlin 11/2012 11/2012 voyage 14 Gannet Bulker 1/2013 5/2013 $17,650 29 Cardinal 11/2012 2/2013 BSI* 44 Sparrow 10/2012 10/2012 $8,500 15 Imperial Eagle 11/2012 2/2013 BSI* 30 Jaeger 11/2012 1/2013 BSI* 45 Kite 10/2012 11/2012 $7,250 *BSI= Baltic Supramax Index EAGLE BULK SHIPPING INC.