Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VECTREN CORP | analystreleaseshell.htm |

| EX-99.2 - EXHIBIT 99.2 - VECTREN CORP | a930128kexhibit992vuhi.htm |

ex991eeifinancialconffin

EEI Financial Conference Phoenix, AZ November 11-14, 2012

Management Representatives Carl Chapman – Chairman, President and CEO Jerry Benkert – Executive Vice President and CFO Robert Goocher – Treasurer & Vice President - Investor Relations Aaron Musgrave – Manager - Investor Relations 2

Forward-Looking Statements All statements other than statements of historical fact are forward-looking statements made in good faith by the company and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Such statements are based on management’s beliefs, as well as assumptions made by and information currently available to management and include such words as “believe”, “anticipate”, ”endeavor”, “estimate”, “expect”, “objective”, “projection”, “forecast”, “goal”, “likely”, and similar expressions intended to identify forward-looking statements. Vectren cautions readers that the assumptions forming the basis for forward-looking statements include many factors that are beyond Vectren’s ability to control or estimate precisely and actual results could differ materially from those contained in this document. Forward-looking statements speak only as of the date on which our statement is made, and we assume no duty to update them. More detailed information about these factors is set forth in Vectren’s filings with the Securities and Exchange Commission, including Vectren’s 2011 annual report on Form 10-K filed on February 16, 2012. Robert L. Goocher, Treasurer and VP – Investor Relations rgoocher@vectren.com 812-491-4080 3

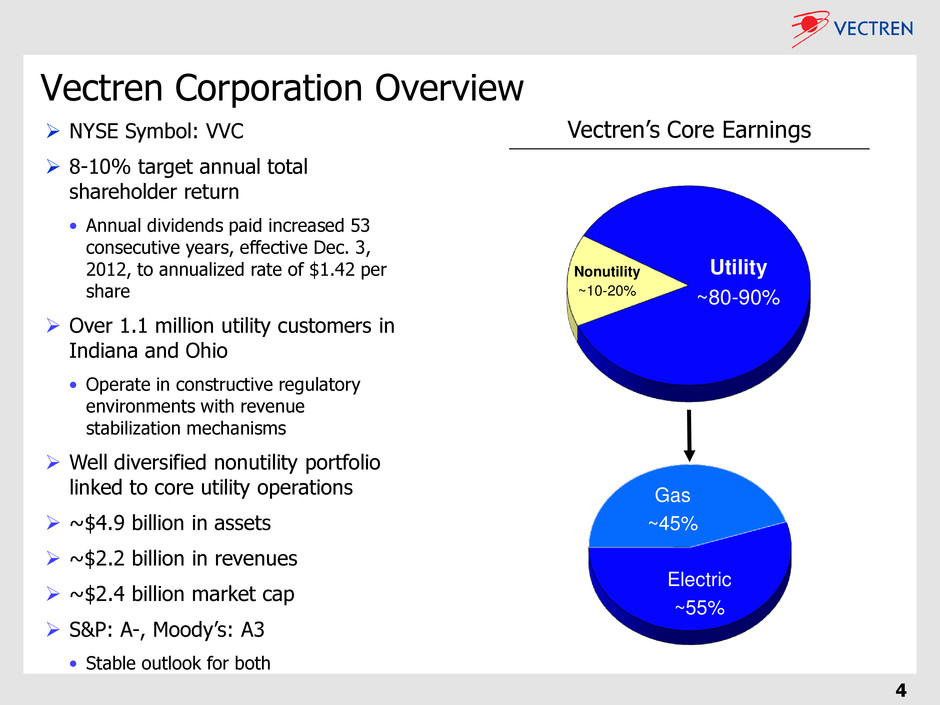

NYSE Symbol: VVC 8-10% target annual total shareholder return • Annual dividends paid increased 53 consecutive years, effective Dec. 3, 2012, to annualized rate of $1.42 per share Over 1.1 million utility customers in Indiana and Ohio • Operate in constructive regulatory environments with revenue stabilization mechanisms Well diversified nonutility portfolio linked to core utility operations ~$4.9 billion in assets ~$2.2 billion in revenues ~$2.4 billion market cap S&P: A-, Moody’s: A3 • Stable outlook for both Vectren Corporation Overview Vectren’s Core Earnings Utility 84% Electric 53% 4 Electric ~55% Gas ~45% Utility ~80-90% Nonutility ~10-20%

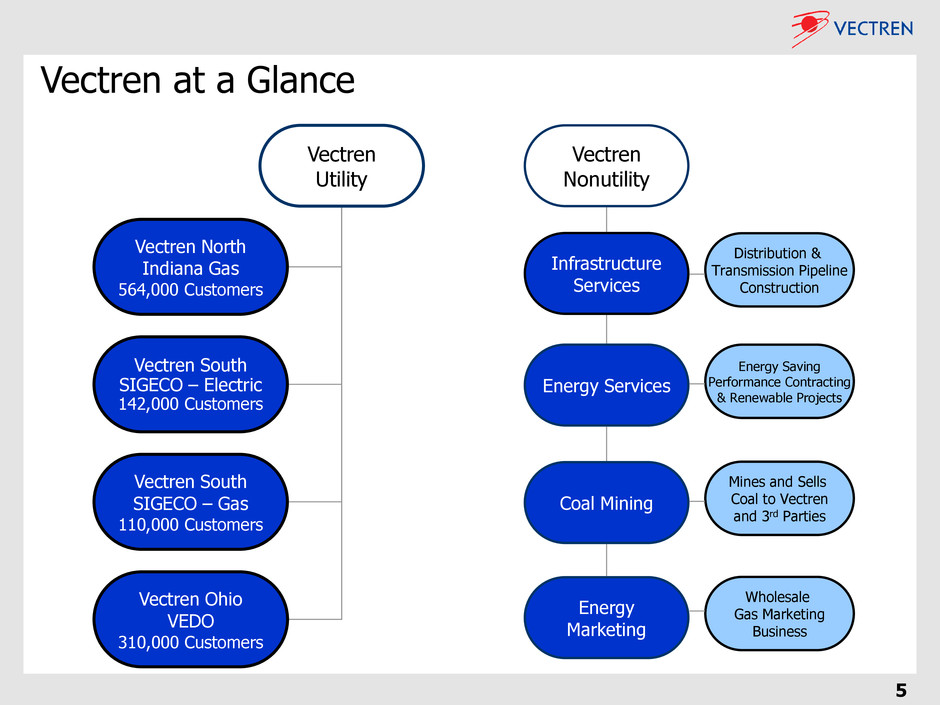

5 Vectren at a Glance Vectren Nonutility Infrastructure Services Energy Services Coal Mining Energy Marketing Distribution & Transmission Pipeline Construction Energy Saving Performance Contracting & Renewable Projects Mines and Sells Coal to Vectren and 3rd Parties Wholesale Gas Marketing Business Vectren Utility Vectren North Indiana Gas 564,000 Customers Vectren South SIGECO – Electric 142,000 Customers Vectren South SIGECO – Gas 110,000 Customers Vectren Ohio VEDO 310,000 Customers

6 Looking Ahead – Strategies for 2012 and Beyond Utility Execute strategies to consistently achieve annual utility earnings growth target of 3% • Earn allowed returns in gas and electric utilities – Earn current returns on infrastructure investments as provided for in IN & OH legislation – Aggressively manage costs through performance management & strategic sourcing • Disciplined allocation of capital – no new equity issuances expected – Reinvest earnings to support necessary rate base growth – Focus capital expenditures on natural gas infrastructure improvements Nonutility Continued growth and profitability of existing portfolio of nonutility businesses and reduce the reliance on earnings growth from our commodity-sensitive businesses • Continue to invest in Infrastructure Services and Energy Services businesses to drive long- term earnings growth • Continue to nurture investments already made in the Coal Mining business • Continue the focus on improving ProLiance’s profitability prospects through further reductions in fixed cost structure and customer growth

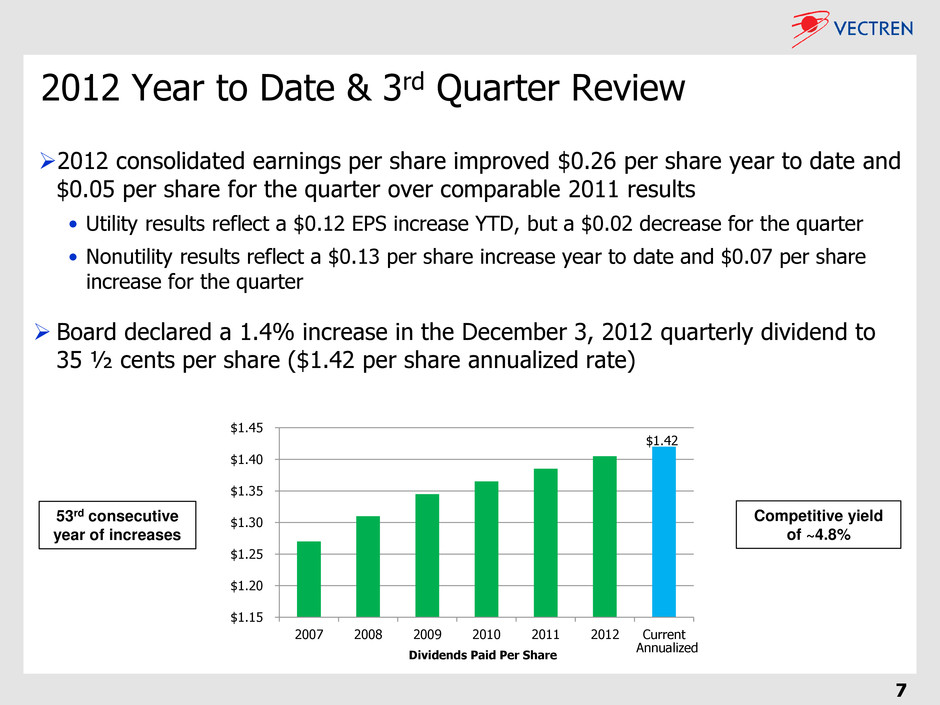

2012 Year to Date & 3rd Quarter Review 2012 consolidated earnings per share improved $0.26 per share year to date and $0.05 per share for the quarter over comparable 2011 results • Utility results reflect a $0.12 EPS increase YTD, but a $0.02 decrease for the quarter • Nonutility results reflect a $0.13 per share increase year to date and $0.07 per share increase for the quarter Board declared a 1.4% increase in the December 3, 2012 quarterly dividend to 35 ½ cents per share ($1.42 per share annualized rate) 7 53rd consecutive year of increases Competitive yield of ~4.8% $1.42 $1.15 $1.20 $1.25 $1.30 $1.35 $1.40 $1.45 2007 2008 2009 2010 2011 2012 Current Dividends Paid Per Share Annualized

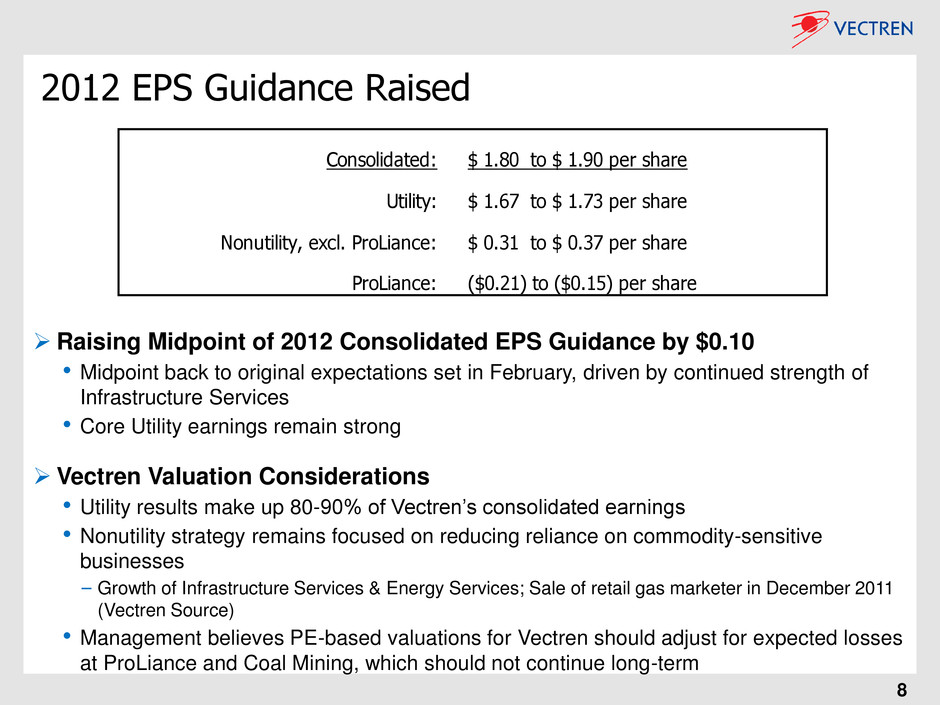

Consolidated: $ 1.80 to $ 1.90 per share Utility: $ 1.67 to $ 1.73 per share Nonutility, excl. ProLiance: $ 0.31 to $ 0.37 per share ProLiance: ($0.21) to ($0.15) per share 2012 EPS Guidance Raised Raising Midpoint of 2012 Consolidated EPS Guidance by $0.10 • Midpoint back to original expectations set in February, driven by continued strength of Infrastructure Services • Core Utility earnings remain strong Vectren Valuation Considerations • Utility results make up 80-90% of Vectren’s consolidated earnings • Nonutility strategy remains focused on reducing reliance on commodity-sensitive businesses − Growth of Infrastructure Services & Energy Services; Sale of retail gas marketer in December 2011 (Vectren Source) • Management believes PE-based valuations for Vectren should adjust for expected losses at ProLiance and Coal Mining, which should not continue long-term 8

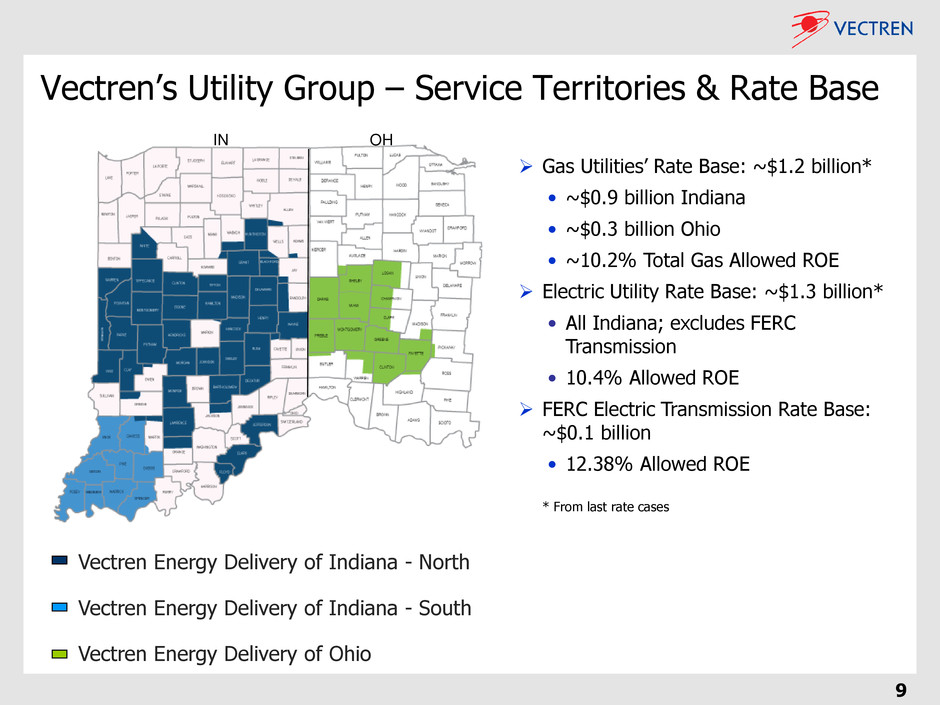

9 Vectren Energy Delivery of Indiana - North Vectren Energy Delivery of Indiana - South Vectren Energy Delivery of Ohio Vectren’s Utility Group – Service Territories & Rate Base OH IN Gas Utilities’ Rate Base: ~$1.2 billion* • ~$0.9 billion Indiana • ~$0.3 billion Ohio • ~10.2% Total Gas Allowed ROE Electric Utility Rate Base: ~$1.3 billion* • All Indiana; excludes FERC Transmission • 10.4% Allowed ROE FERC Electric Transmission Rate Base: ~$0.1 billion • 12.38% Allowed ROE * From last rate cases

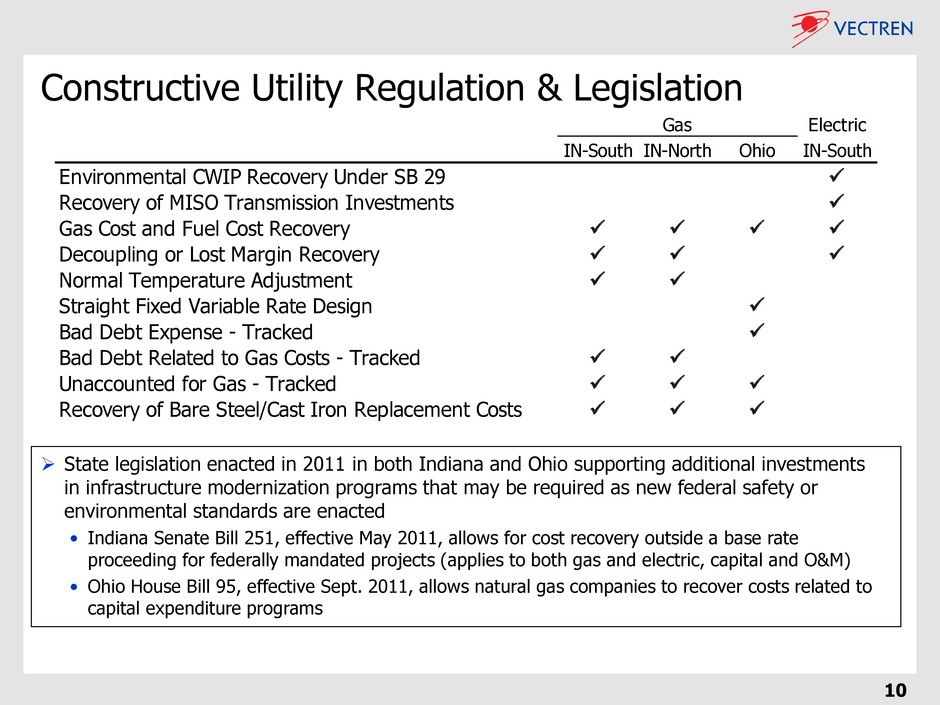

10 Constructive Utility Regulation & Legislation Electric IN-South IN-North Ohio IN-South Environmental CWIP Recovery Under SB 29 Recovery of MISO Transmission Investments Gas Cost and Fuel Cost Recovery Decoupling or Lost Margin Recovery Normal Temperature Adjustment Straight Fixed Variable Rate Design Bad Debt Expense - Tracked Bad Debt Related to Gas Costs - Tracked Unaccounted for Gas - Tracked Recovery of Bare Steel/Cast Iron Replacement Costs Gas State legislation enacted in 2011 in both Indiana and Ohio supporting additional investments in infrastructure modernization programs that may be required as new federal safety or environmental standards are enacted • Indiana Senate Bill 251, effective May 2011, allows for cost recovery outside a base rate proceeding for federally mandated projects (applies to both gas and electric, capital and O&M) • Ohio House Bill 95, effective Sept. 2011, allows natural gas companies to recover costs related to capital expenditure programs

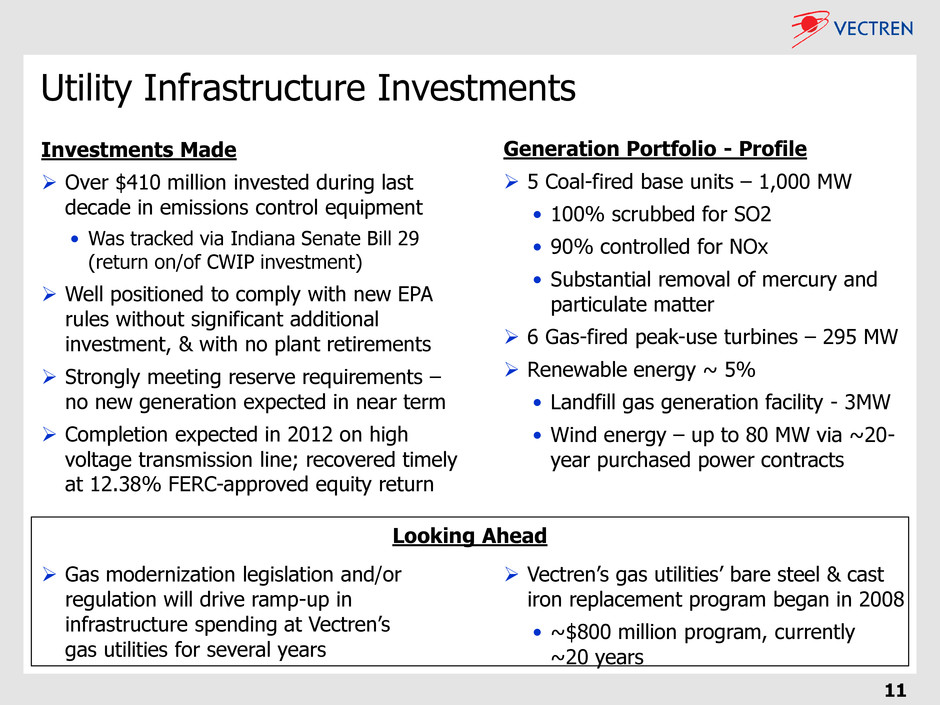

11 Generation Portfolio - Profile 5 Coal-fired base units – 1,000 MW • 100% scrubbed for SO2 • 90% controlled for NOx • Substantial removal of mercury and particulate matter 6 Gas-fired peak-use turbines – 295 MW Renewable energy ~ 5% • Landfill gas generation facility - 3MW • Wind energy – up to 80 MW via ~20- year purchased power contracts Utility Infrastructure Investments Investments Made Over $410 million invested during last decade in emissions control equipment • Was tracked via Indiana Senate Bill 29 (return on/of CWIP investment) Well positioned to comply with new EPA rules without significant additional investment, & with no plant retirements Strongly meeting reserve requirements – no new generation expected in near term Completion expected in 2012 on high voltage transmission line; recovered timely at 12.38% FERC-approved equity return Gas modernization legislation and/or regulation will drive ramp-up in infrastructure spending at Vectren’s gas utilities for several years Vectren’s gas utilities’ bare steel & cast iron replacement program began in 2008 • ~$800 million program, currently ~20 years Looking Ahead

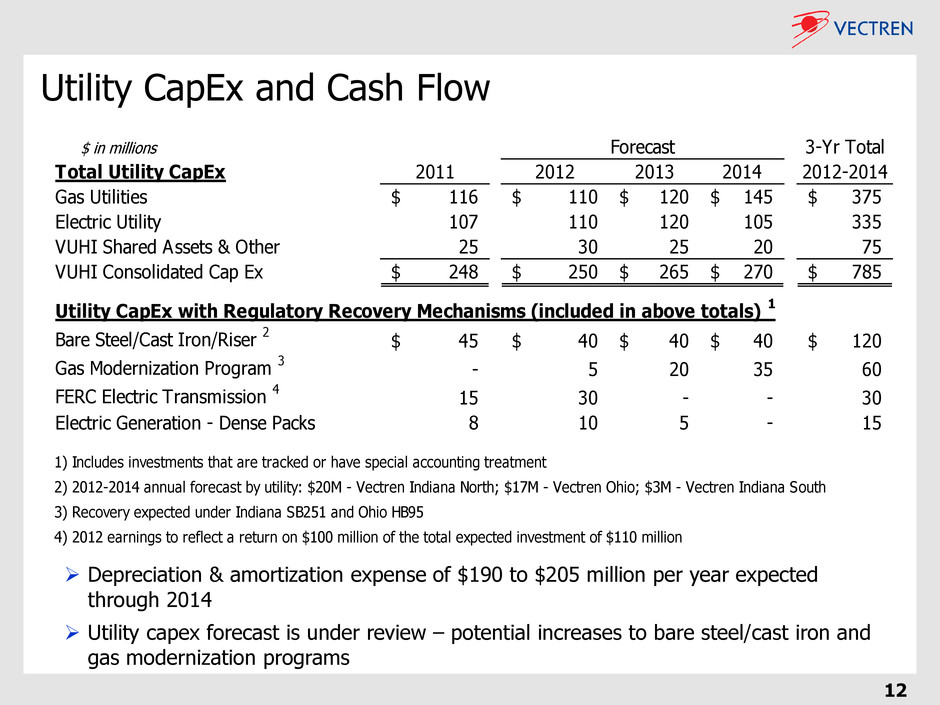

12 Utility CapEx and Cash Flow $ in millions 3-Yr Total Total Utility CapEx 2011 2012 2013 2014 2012-2014 Gas Utilities 116$ 110$ 120$ 145$ 375$ Electric Utility 107 110 120 105 335 VUHI Shared Assets & Other 25 30 25 20 75 VUHI Consolidated Cap Ex 248$ 250$ 265$ 270$ 785$ Utility CapEx with Regulatory Recovery Mechanisms (included in above totals) 1 Bare Steel/Cast Iron/Riser 2 45$ 40$ 40$ 40$ 120$ Gas Modernization Program 3 - 5 20 35 60 FERC Electric Transmission 4 15 30 - - 30 Electric Generation - Dense Packs 8 10 5 - 15 1) Includes investments that are tracked or have special accounting treatment 2) 2012-2014 annual forecast by utility: $20M - Vectren Indiana North; $17M - Vectren Ohio; $3M - Vectren Indiana South 3) Recovery expected under Indiana SB251 and Ohio HB95 4) 2012 earnings to reflect a return on $100 million of the total expected investment of $110 million Forecast Depreciation & amortization expense of $190 to $205 million per year expected through 2014 Utility capex forecast is under review – potential increases to bare steel/cast iron and gas modernization programs

Vectren’s Gas & Electric Industrial Volumes – Both Above Pre-Recession Levels 13 Economic recovery in Indiana & Ohio evidenced by volumes at pre-recession levels by 2010 September 2012 YTD industrial gas volumes up more than 9% and electric volumes up 2.5% 2007 2008 2009 2010 2011 Gas (MMDth) 86,200 91,522 77,944 90,786 97,026 Electric (GWh) 2,539 2,409 2,259 2,630 2,745 - 500 1,000 1,500 2,000 2,500 3,000 - 20,000 40,000 60,000 80,000 100,000 120,000 2007 - 2011 Industrial Volumes Gas (MMDth) Electric (GWh)

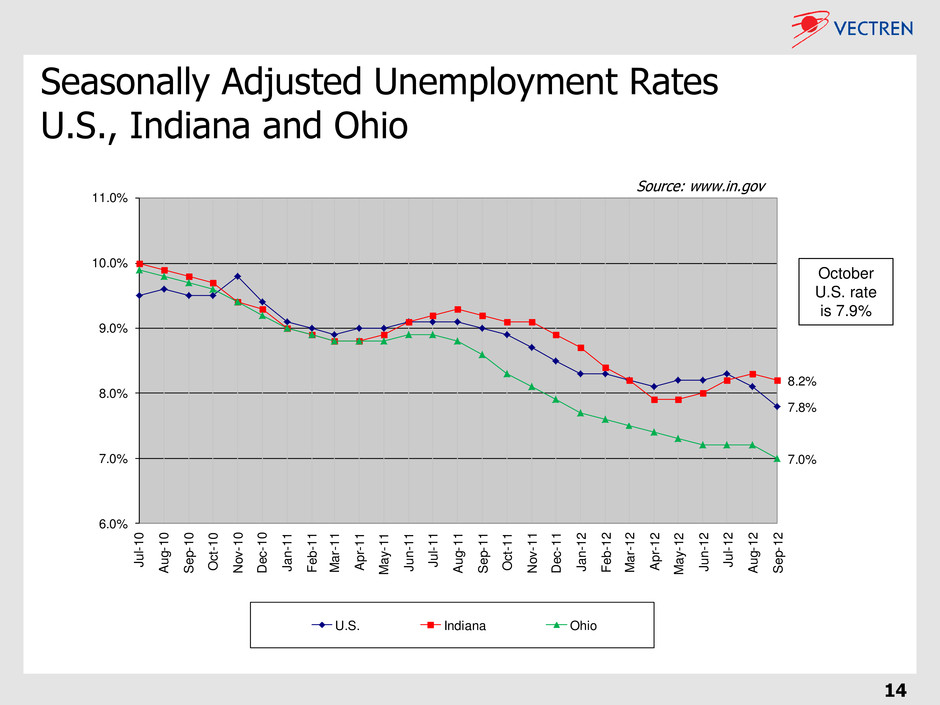

Seasonally Adjusted Unemployment Rates U.S., Indiana and Ohio 7.8% 8.2% 7.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% Ju l-1 0 Au g- 10 Se p- 10 O ct -1 0 N ov -1 0 D ec -1 0 Ja n- 11 Fe b- 11 M ar -1 1 Ap r-1 1 M ay -1 1 Ju n- 11 Ju l-1 1 Au g- 11 Se p- 11 O ct -1 1 N ov -1 1 D ec -1 1 Ja n- 12 Fe b- 12 M ar -1 2 Ap r-1 2 M ay -1 2 Ju n- 12 Ju l-1 2 Au g- 12 Se p- 12 U.S. Indiana Ohio 14 Source: www.in.gov October U.S. rate is 7.9%

Infrastructure Services - Miller Pipeline & Minnesota Limited Distribution Business Provides underground pipeline construction and repair services for natural gas, water and wastewater companies Major customers are regional utilities, such as Vectren, NiSource, Duke, LG&E, Alagasco and Citizens Transmission Business Provides underground pipeline construction and repair services for natural gas and petroleum transmission companies Major customers include Northern Natural, Consumers Energy, Enbridge Energy and Minnesota Pipe Line 15 Strategy: Drive business growth through sustainable, long-term customer relationships built upon high quality construction and customer service, and strategic acquisitions Section of 16-inch pipeline on a 35-mile project in Minnesota Strong demand for repair & replacement due to safety concerns with aging natural gas & oil pipelines Additional opportunities driven by development of oil and natural gas in shale formations $32M of earnings expected in 2012 (midpoint of range); Earnings of ~$15M in 2011 and ~$3M in 2010 $197 $371 $495 $- $100 $200 $300 $400 $500 $600 2010 2011* 2012E Infrastructure Services Net Revenue In millions Midpoint of expected results range *Acquired Minnesota Limited on 3/31/11 Employees at 9/30 1,600 2,600 3,100 Geography: Operates in ~25 states, primarily in the Upper Midwest, Midwest, Mid-Atlantic and South

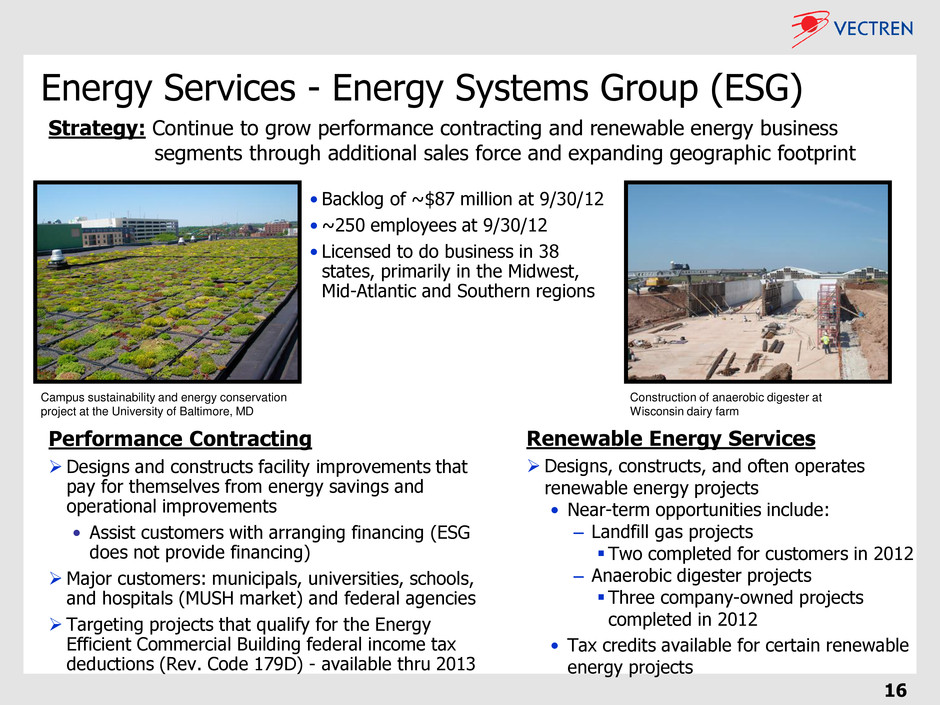

16 Energy Services - Energy Systems Group (ESG) Performance Contracting Designs and constructs facility improvements that pay for themselves from energy savings and operational improvements • Assist customers with arranging financing (ESG does not provide financing) Major customers: municipals, universities, schools, and hospitals (MUSH market) and federal agencies Targeting projects that qualify for the Energy Efficient Commercial Building federal income tax deductions (Rev. Code 179D) - available thru 2013 Renewable Energy Services Designs, constructs, and often operates renewable energy projects • Near-term opportunities include: – Landfill gas projects Two completed for customers in 2012 – Anaerobic digester projects Three company-owned projects completed in 2012 • Tax credits available for certain renewable energy projects • Backlog of ~$87 million at 9/30/12 •~250 employees at 9/30/12 • Licensed to do business in 38 states, primarily in the Midwest, Mid-Atlantic and Southern regions Strategy: Continue to grow performance contracting and renewable energy business segments through additional sales force and expanding geographic footprint Construction of anaerobic digester at Wisconsin dairy farm Campus sustainability and energy conservation project at the University of Baltimore, MD

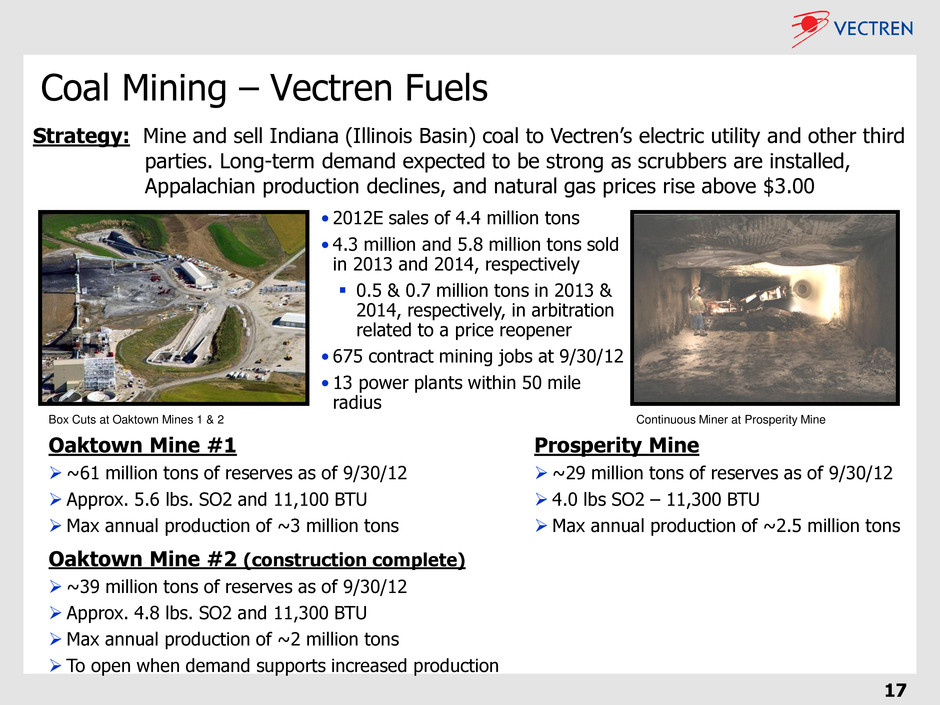

17 Coal Mining – Vectren Fuels • 2012E sales of 4.4 million tons • 4.3 million and 5.8 million tons sold in 2013 and 2014, respectively 0.5 & 0.7 million tons in 2013 & 2014, respectively, in arbitration related to a price reopener • 675 contract mining jobs at 9/30/12 • 13 power plants within 50 mile radius Strategy: Mine and sell Indiana (Illinois Basin) coal to Vectren’s electric utility and other third parties. Long-term demand expected to be strong as scrubbers are installed, Appalachian production declines, and natural gas prices rise above $3.00 Continuous Miner at Prosperity Mine Box Cuts at Oaktown Mines 1 & 2 Prosperity Mine ~29 million tons of reserves as of 9/30/12 4.0 lbs SO2 – 11,300 BTU Max annual production of ~2.5 million tons Oaktown Mine #1 ~61 million tons of reserves as of 9/30/12 Approx. 5.6 lbs. SO2 and 11,100 BTU Max annual production of ~3 million tons Oaktown Mine #2 (construction complete) ~39 million tons of reserves as of 9/30/12 Approx. 4.8 lbs. SO2 and 11,300 BTU Max annual production of ~2 million tons To open when demand supports increased production

18 Energy Marketing – ProLiance Profit Improvement Initiatives Firm transportation and storage demand costs will decline significantly in 2012 (~$55 million of fixed demand costs in 2012, ~$73 million in 2011) ~$45 million of annualized fixed demand costs expected in 2013 ($10 million lower than 2012) ~$12 million of additional fixed demand cost reductions are scheduled to occur in 2014-2015 ProLiance Investment - Recap Founded in 1996 with initial investment of $1 million ($500K from each owner) From inception thru 2010, ProLiance has delivered ~$500 million of pre-tax earnings, over $200 million of savings for owners’ customers, and nearly $50 million of dividends to Vectren (plus div’s for taxes) • At 9/30/12, 38 Bcf of natural gas storage • Balanced book approach – VaR capped at $2.5 million •New standalone credit facility in place through May 2014 Strategy: Execute profit improvement initiatives currently underway, including efforts to lower pipeline and storage demand costs through ongoing renegotiations Gas marketing operations where ProLiance buys, sells and optimizes gas supplies • Operates throughout the Midwest & Southeast • Retail services to ~1,850 commercial and industrial customers •Wholesale services to utilities, municipals, power generators Investment: Wholesale gas marketer owned Vectren (61%; equity acctg.) & Citizens Energy Group (39%)

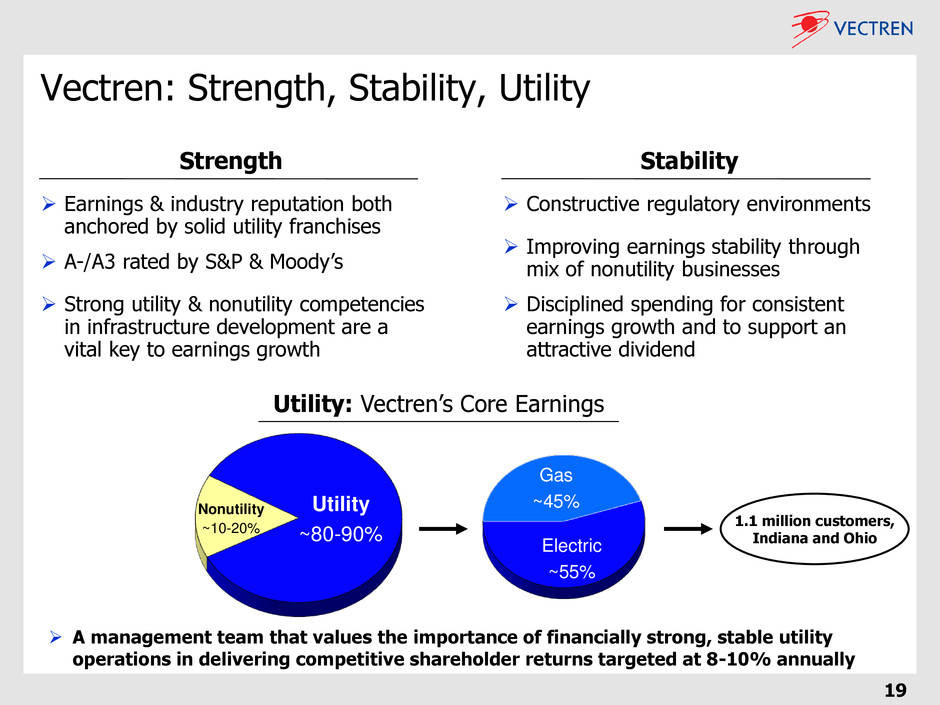

19 Vectren: Strength, Stability, Utility Utility ~80-90% Nonutility ~10-20% Utility: Vectren’s Core Earnings Electric ~55% Gas ~45% Strength Stability Earnings & industry reputation both anchored by solid utility franchises A-/A3 rated by S&P & Moody’s Strong utility & nonutility competencies in infrastructure development are a vital key to earnings growth Constructive regulatory environments Improving earnings stability through mix of nonutility businesses Disciplined spending for consistent earnings growth and to support an attractive dividend 1.1 million customers, Indiana and Ohio A management team that values the importance of financially strong, stable utility operations in delivering competitive shareholder returns targeted at 8-10% annually

20 Appendix

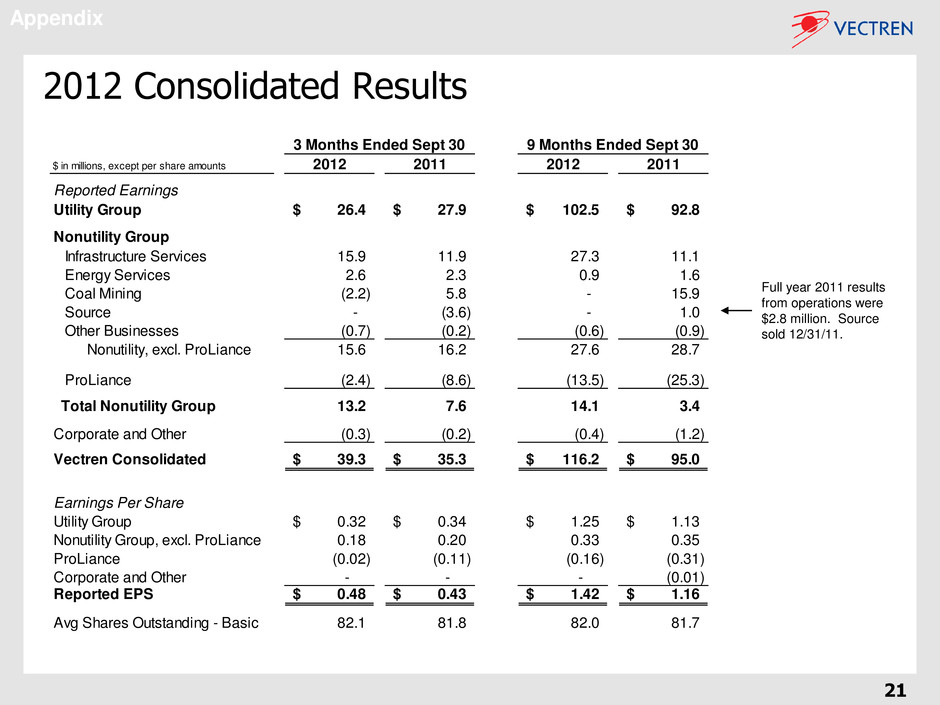

$ in millions, except per share amounts 2012 2011 2012 2011 Reported Earnings Utility Group 26.4$ 27.9$ 102.5$ 92.8$ Nonutility Group Infrastructure Services 15.9 11.9 27.3 11.1 Energy Services 2.6 2.3 0.9 1.6 Coal Mining (2.2) 5.8 - 15.9 Source - (3.6) - 1.0 Other Businesses (0.7) (0.2) (0.6) (0.9) Nonutility, excl. ProLiance 15.6 16.2 27.6 28.7 ProLiance (2.4) (8.6) (13.5) (25.3) Total Nonutility Group 13.2 7.6 14.1 3.4 Corporate and Other (0.3) (0.2) (0.4) (1.2) Vectren Consolidated 39.3$ 35.3$ 116.2$ 95.0$ Earnings Per Share Utility Group 0.32$ 0.34$ 1.25$ 1.13$ Nonutility Group, excl. ProLiance 0.18 0.20 0.33 0.35 ProLiance (0.02) (0.11) (0.16) (0.31) Corporate and Other - - - (0.01) Reported EPS 0.48$ 0.43$ 1.42$ 1.16$ Avg Shares Outstanding - Basic 82.1 81.8 82.0 81.7 3 Months Ended Sept 30 9 Months Ended Sept 30 21 2012 Consolidated Results Full year 2011 results from operations were $2.8 million. Source sold 12/31/11. Appendix

22 Nonutility Metrics – Infrastructure Services $ in millions 2012 2011 2012 2011 Midpoint 2012E 2011 2010 (3) Net Revenue (1) 151.7$ 137.2$ 373.8$ 257.1$ 495.0$ 370.8$ 197.0$ Gross Margin as % of Net Revenue 25% 22% 21% 16% 21% 16% 11% Depreciation and Amortization 5.1$ 4.2$ 14.2$ 10.6$ 19.0$ 14.9$ 8.8$ EBITDA (2) 32.9$ 25.8$ 65.1$ 33.7$ 81.0$ 47.9$ 17.8$ Net Income (2) 15.9$ 11.9$ 27.3$ 11.1$ 32.0$ 14.9$ 3.1$ Footnote: 1) Net of pass-through costs, including material and subcontractor costs 2) After allocations 3) Full-year results prior to acquisition of Minnesota Limited on 3/31/2011 3 Months Ended Sept 30 9 Months Ended Sept 30 12 Months Ended Dec 31 2011 metrics do not include 1st quarter results from Minnesota Limited which was acquired on 3/31/2011 Appendix

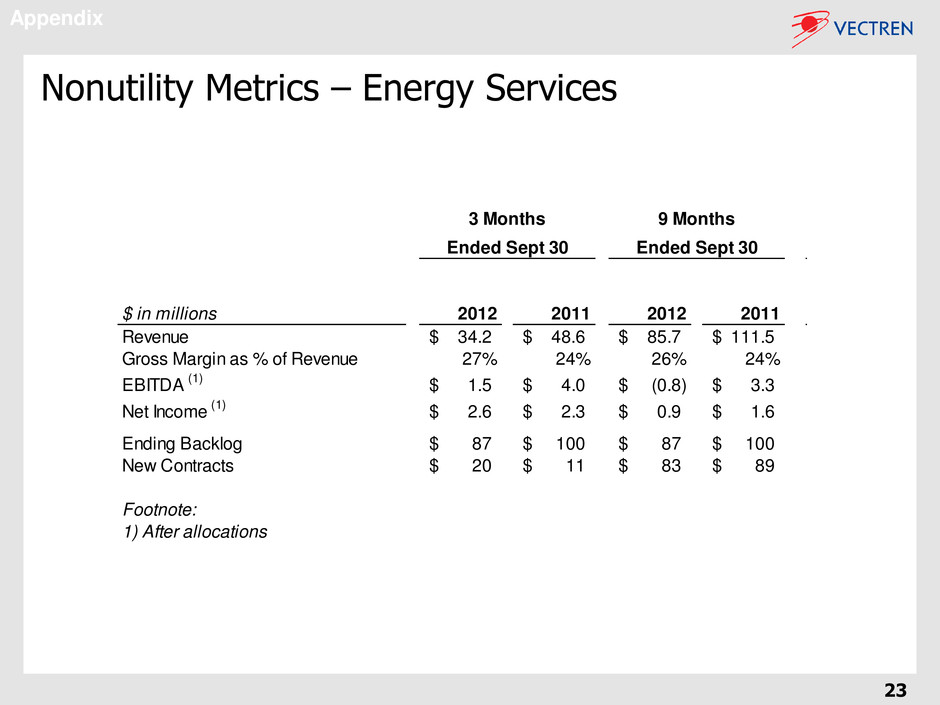

23 Nonutility Metrics – Energy Services $ in millions 2012 2011 2012 2011 Revenue 34.2$ 48.6$ 85.7$ 111.5$ Gross Margin as % of Revenue 27% 24% 26% 24% EBITDA (1) 1.5$ 4.0$ (0.8)$ 3.3$ Net Income (1) 2.6$ 2.3$ 0.9$ 1.6$ Ending Backlog 87$ 100$ 87$ 100$ New Contracts 20$ 11$ 83$ 89$ Footnote: 1) After allocations Ended Sept 30 3 Months 9 Months Ended Sept 30 Appendix

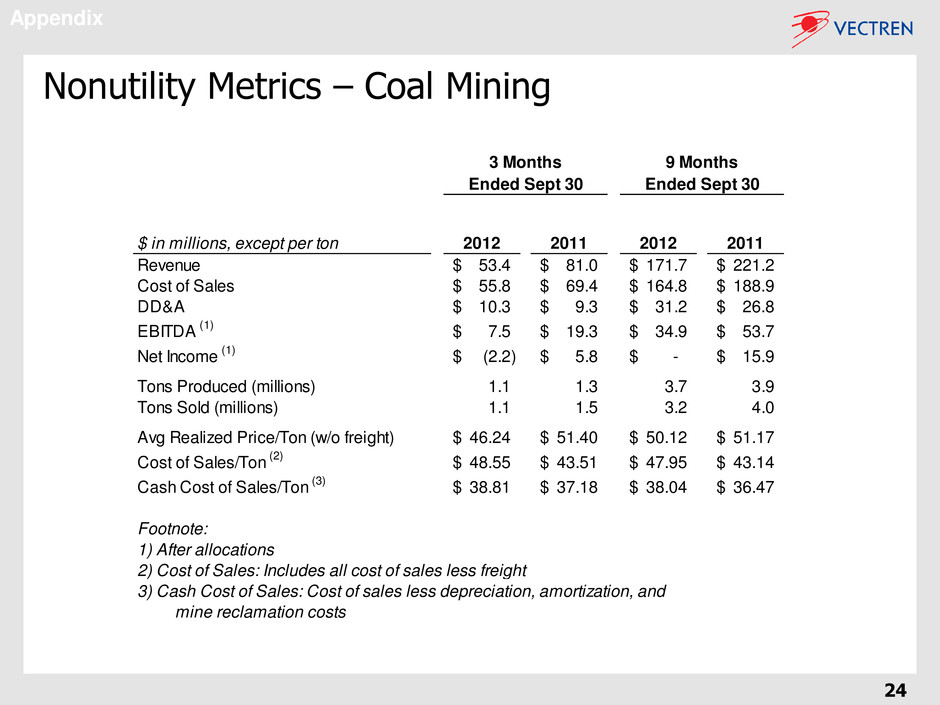

24 Nonutility Metrics – Coal Mining $ in millions, except per ton 2012 2011 2012 2011 Revenue 53.4$ 81.0$ 171.7$ 221.2$ Cost of Sales 55.8$ 69.4$ 164.8$ 188.9$ DD&A 10.3$ 9.3$ 31.2$ 26.8$ EBITDA (1) 7.5$ 19.3$ 34.9$ 53.7$ Net Income (1) (2.2)$ 5.8$ -$ 15.9$ Tons Produced (millions) 1.1 1.3 3.7 3.9 Tons Sold (millions) 1.1 1.5 3.2 4.0 Avg Realized Price/Ton (w/o freight) 46.24$ 51.40$ 50.12$ 51.17$ Cost of Sales/Ton (2) 48.55$ 43.51$ 47.95$ 43.14$ Cash Cost of Sales/Ton (3) 38.81$ 37.18$ 38.04$ 36.47$ Footnote: 1) After allocations 2) Cost of Sales: Includes all cost of sales less freight 3) Cash Cost of Sales: Cost of sales less depreciation, amortization, and mine reclamation costs Ended Sept 30 3 Months 9 Months Ended Sept 30 Appendix

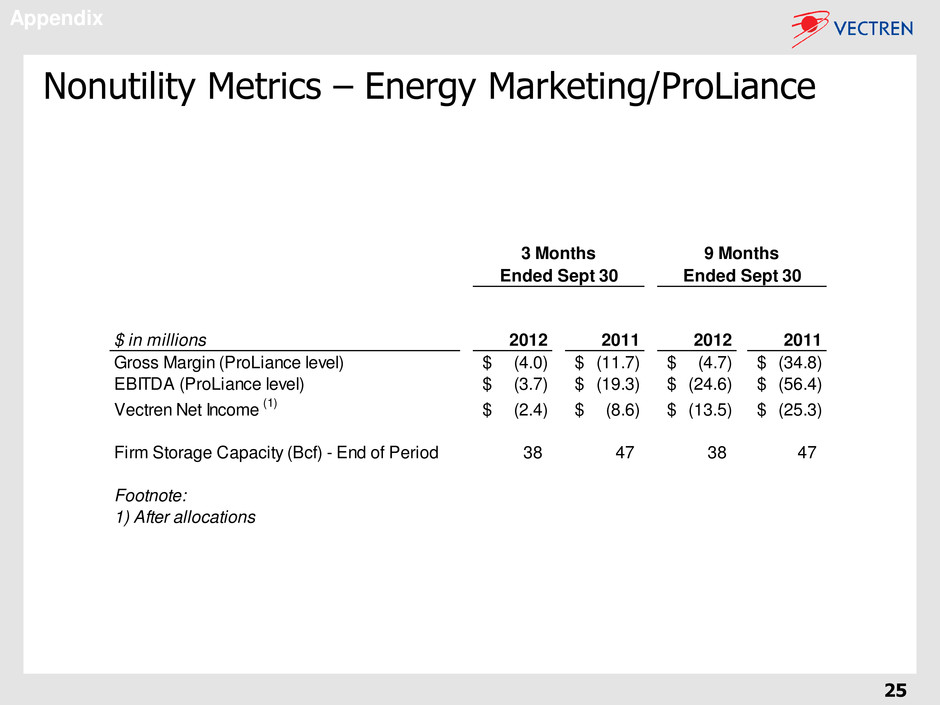

25 Nonutility Metrics – Energy Marketing/ProLiance $ in millions 2012 2011 2012 2011 Gross Margin (ProLiance level) (4.0)$ (11.7)$ (4.7)$ (34.8)$ EBITDA (ProLiance level) (3.7)$ (19.3)$ (24.6)$ (56.4)$ Vectren Net Income (1) (2.4)$ (8.6)$ (13.5)$ (25.3)$ Firm Storage Capacity (Bcf) - End of Period 38 47 38 47 Footnote: 1) After allocations 3 Months Ended Sept 30 9 Months Ended Sept 30 Appendix

26 Use of Non-GAAP Performance Measures and Per Share Measures Per share earnings contributions of the Utility Group, Nonutility Group, and Corporate and Other are presented herein and are non-GAAP measures. Such per share amounts are based on the earnings contribution of each group included in Vectren’s consolidated results divided by Vectren’s basic average shares outstanding during the period. The earnings per share of the groups do not represent a direct legal interest in the assets and liabilities allocated to the groups, but rather represent a direct equity interest in Vectren Corporation's assets and liabilities as a whole. These non-GAAP measures are used by management to evaluate the performance of individual businesses. In addition, other items giving rise to period over period variances, such as weather, are presented on an after tax and per share basis. These amounts are calculated at a statutory tax rate divided by Vectren’s basic average shares outstanding during the period. Accordingly, management believes these measures are useful to investors in understanding each business’ contribution to consolidated earnings per share and in analyzing consolidated period to period changes and the potential for earnings per share contributions in future periods. Reconciliations of the non-GAAP measures to their most closely related GAAP measure of consolidated earnings per share are included throughout the presentation presented. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP. Appendix