Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MICHAEL BAKER CORP | d436289d8k.htm |

| EX-99.1 - EX-99.1 - MICHAEL BAKER CORP | d436289dex991.htm |

| EX-10.1 - EX-10.1 - MICHAEL BAKER CORP | d436289dex101.htm |

Creating Value …

…

Delivering Solutions

Michael Baker Corporation

Third Quarter 2012 Earnings Call

November 9, 2012

Exhibit 99.2 |

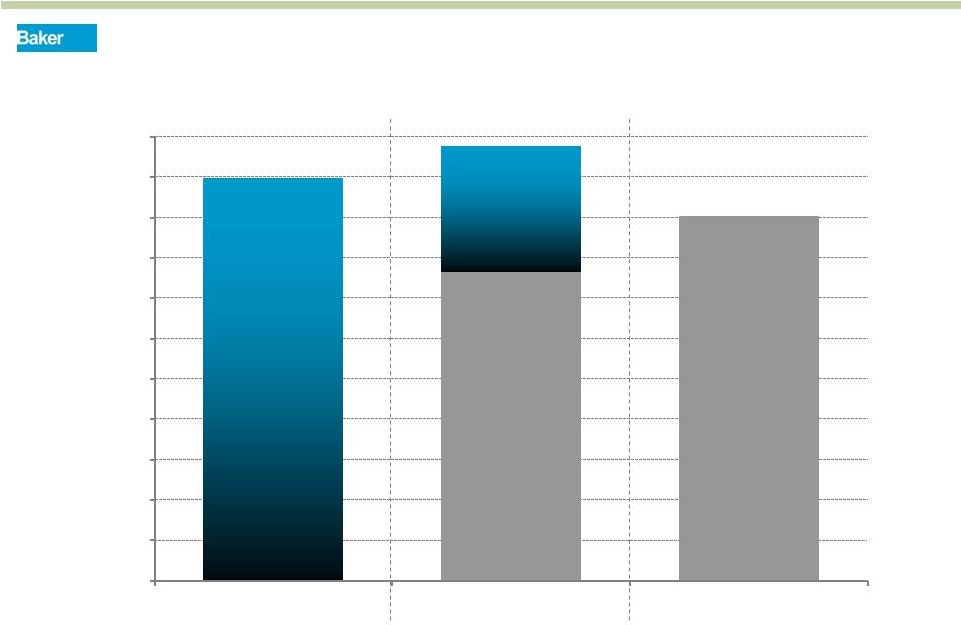

2

Revenue From Continuing Operations

(in millions)

$382.2

$452.2

$499.4

$538.4

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

$550

2010

2011

2012 First 9 Mos. |

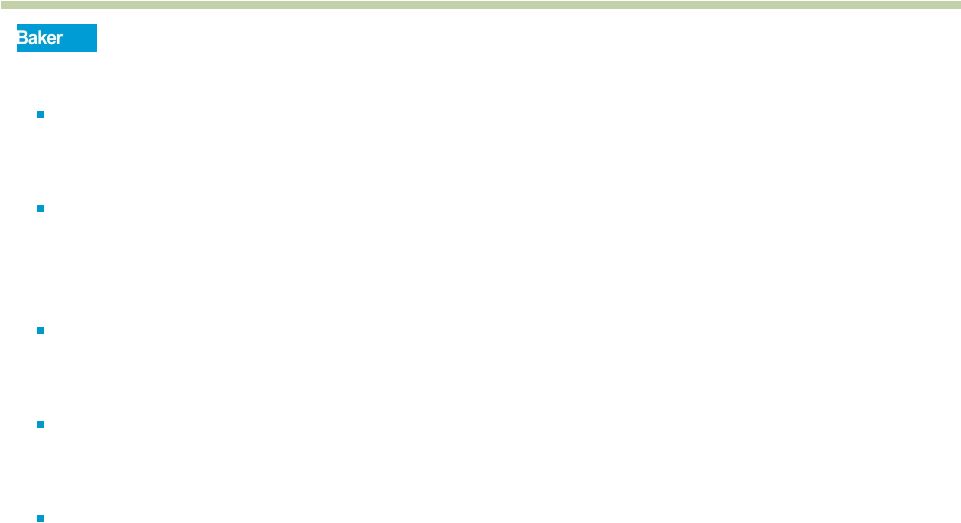

3

Operating

Income

-

Continuing

Operations

(in millions)

$18.7

$6.0

$22.3

$24.2

$0

$5

$10

$15

$20

$25

$30

2010

2011

2012 First 9 Mos. |

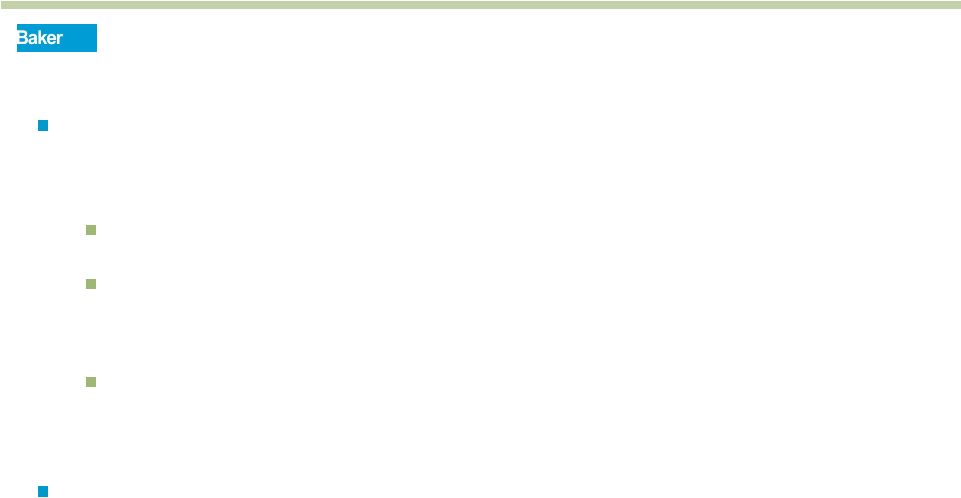

4

Diluted EPS From Continuing Operations

$1.38

$0.45

$1.60

$1.80

$0.00

$0.50

$1.00

$1.50

$2.00

2010

2011

2012 First 9 Mos. |

We need to…

Improve Performance Dramatically and

Immediately

Deliver Value to Shareholders

5 |

Focus on Improving Business Results

We completed a realignment of our operations to increase work sharing,

enhance cross-selling and improve our utilization rate.

Management believes that the Company has addressed its strategic

expansion needs with its acquisition of LPA in the Southeast and

RBF in

the West and Southwest.

The Company is focusing squarely on improving its operating results and

management will not pursue additional major acquisitions at this

time.

This will enable the Company’s management to solely concentrate all of

its efforts on improving internal operations for the next 12 to 18 months.

Management will consult with the Board in the event that a potentially

attractive acquisition opportunity is presented prior to expending

significant resources on it.

6 |

Alternative

Delivery Construction Management

Oil & Gas

Private Sector Work

Organic Growth Strategy

7 |

Performance Improvement Plan (“PIP”)

Approximately $18-$20 Million in Cost Savings

Reductions in Force / Retirements

Overhead Reductions

Reduce Occupancy Costs

Reduce Travel Expenses

Reduce Other Miscellaneous SG&A Expenses

One-time cash costs in Q4 estimated at $1.0M

To be monitored by Board Committee

8 |

Dividend

$0.14 Quarterly Dividend

A

$0.14

quarterly

cash

dividend

would

represent

an

approximately

2.5%

dividend

yield.

9

9.7M

Total Shares Outstanding

x

$0.14

Quarterly Cash Dividend

$1.36M

Quarterly Dividend to be paid in Cash

x

4

$5.44M

Annual Cash Dividend |

Share Repurchase Authorization

Board has authorized the repurchase of up to

$10.0M of the Company’s shares from time to time

in the open market or otherwise.

Parameters for repurchases to be set in

consultation with the Performance Improvement

Committee, but initially expect to repurchase shares

on an opportunistic basis if circumstances warrant

so doing.

10 |

Stock Ownership Guidelines

The Board adopts the following stock ownership

guidelines:

CEO –

5x Base Salary

CFO, CLO, COO, CPO, Transportation Market Leader

& Former RBF Co-CEOs –

3x Base Salary

Board of Directors –

4x Cash Retainer

Guidelines are to be met within five years

11 |

Summary

Redoubling our focus on improving business results

Not pursuing more major acquisitions at this time

Focusing squarely on organic growth opportunities

Cutting between $18-$20 million in costs in 2013

Initiating a quarterly dividend of $0.14/share

Authorizing a potential share repurchase of up to $10M

of our shares

Implementing stock ownership guidelines for Board and

top management

12 |

All in Order To ….

Improve

Performance

Dramatically

…

and

Immediately

Deliver Value to Shareholders

13 |

Michael Baker

Corporation Third Quarter 2012 Earnings Call

November 9, 2012

Creating Value …

…

Delivering Solutions |