Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Energy Future Holdings Corp /TX/ | d434384d8k.htm |

EFH

Corp. 2012 EEI Financial Conference

Discussion Deck

November

11

th

–

14

th

Exhibit 99.1 |

1

Safe Harbor Statement

This presentation contains forward-looking statements, which are subject to

various risks and uncertainties. All statements, other than statements of

historical facts, that are included in this presentation, in response to

questions or otherwise, that address activities, events, or developments that

we expect or anticipate to occur in the future, including such matters as

financial or operational projections, capital allocation, future capital

expenditures, business strategy, competitive strengths, goals, future

acquisitions or dispositions, development or operation of power generation

assets, market and industry developments and the growth of our businesses and

operations (often, but not always, through the use of words or phrases

such

as

“intends,”

“plans,”

“will

likely,”

“expected,”

“anticipated,”

“estimated,”

“should,”

“projection,”

“target,”

“goal,”

“objective”

and “outlook”),

are forward looking statements. A discussion of the risks and uncertainties that

could cause actual results to differ materially from management's current

projections, forecasts, estimates and expectations is contained in EFH Corp.'s

filings with the Securities and Exchange Commission (SEC).

Regulation G

This presentation includes certain non-GAAP financial measures. A reconciliation

of these measures to the most directly comparable GAAP measures is included in

the appendix to this presentation. |

Table

of Contents 2

I.

Five

Year

Review………………………………………………

.

3 –

8

II.

Luminant………………………………………………………...

9 –

12

III.

TXU

Energy……………………………………………………..

13 –

18

IV.

Oncor…………………………………………………………….

19 –

21

V.

EFH

Corp………………………………………………………..

22 –

26

VI.

Appendix………………………………………………………...

27 –

40

VII.

Regulation

G……………………………………………………

41 –

46 |

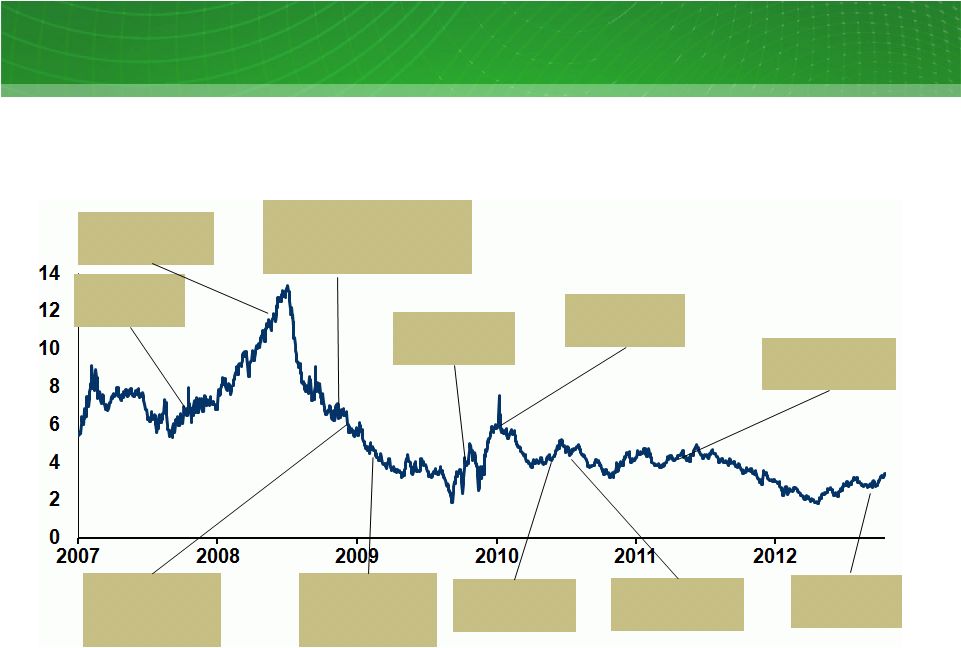

EFH

Has Made Significant Accomplishments Despite Lower Commodity Prices

3

Historical NYMEX spot natural gas prices

2007-2012

;

$/MMBtu

1

As of 10/15/2012

1

TXU Energy begins

customer care system

implementation

Sandow 5

complete

Oak Grove

1 complete

TCEH Amend

and Extend

EFH sells

~20% interest

in Oncor

Oncor

awarded

CREZ project

Oak Grove 2

complete

Debt

Exchanges

CSAPR

vacated

Oncor begins

AMS rollout

Merger

closes |

EFH

Has Invested Over $10 Billion And Added Nearly 1,900 Positions

Capital Investment

Amount

TCEH and Corporate

>$5

Oncor

>$5

Grand Total

>$10

Jobs

New employee positions added

~1,900

4

Capital investment and jobs

2008-2012

1

; $ billions, positions added

Luminant invested $3.25 billion to build 2,200 MWs of new units

TXU Energy has invested nearly $100 million in new tools and products for

customers to manage their own electricity usage

Oncor is expected to invest about $1.5 billion on CREZ and nearly $700 million

on AMS through 2012

1

2012E based on latest projections. Job positions 2012YTD as of

10/15/2012 Source: EFH 2011 and 2009 10K, Oncor 2Q 2012 earnings

presentation, 2012E based on latest projections |

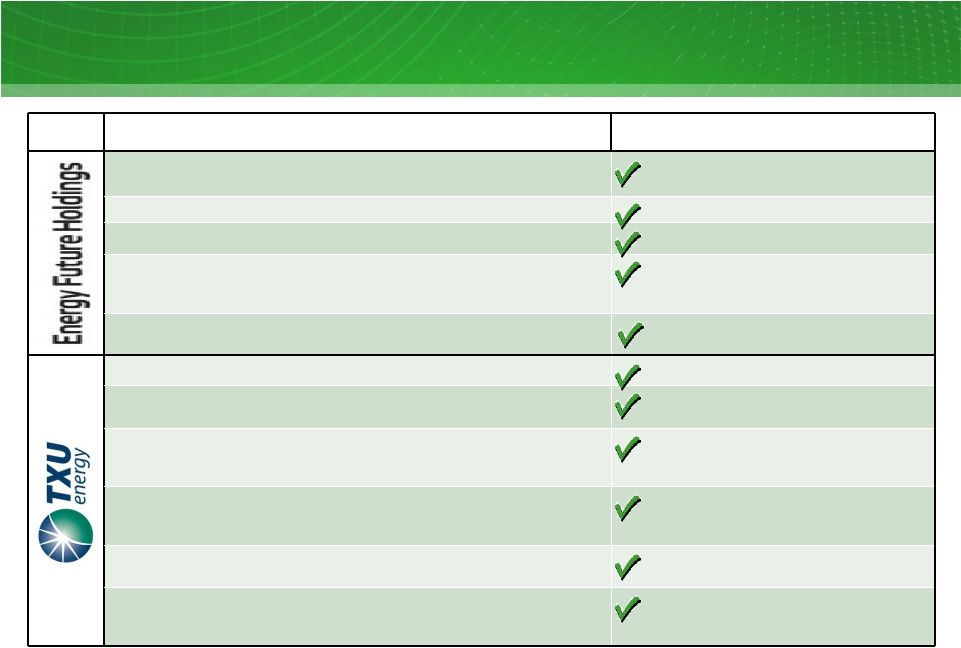

5

Commitment

Results

Reorganize

the

company

into

three

separate

and

distinct

business

units

with

separate boards, management teams and headquarters

Done

Maintain headquarters for each business in the DFW area

Done

Hold

majority

ownership

in

EFH

Corp.

and

Oncor

for

at

least

five

years

Done

Create a Sustainable Energy Advisory Board (SEAB) to provide input from

environmental, economic, customer, reliability and technology viewpoints

Done

Ensure employee compensation, health benefits and

retirement programs

Done

Deliver a 15% residential price cut to legacy PTB customers

Done

Guarantee price protection against changing market conditions through

December 2008 for legacy PTB customers

Done

Provide $150 million in low-income customer assistance over five years,

through 2012 ($125 million, ~10% discount for qualifying customers and $25

million in bill payment assistance)

Ongoing: On track to fulfill the $150 million

commitment by EOY 2012

Waive deposits for certain residential customers

Done: Implemented for eligible low-income

elderly customers and those with good

payment history

Form a new Low Income Advisory Committee (LIAC) comprising leaders in

the social service delivery sector

Done

Invest $100 million over five years through 2012 in new tools for customers

to manage their own electricity usage through innovative energy efficiency

and conservation approaches

Ongoing: On track to fulfill the $100 million

investment by EOY 2012

Completing Merger Commitments |

Commitment

Results

Terminate eight planned coal units

Done

Provide increased investment in alternative energy

Ongoing

Start planning process for two IGCC commercial demonstration plants to

be located in Texas

Done: IGCC RFP issued 12/07; suspended 8/09

due to market conditions

Offset 100% of key emissions from new coal-fueled power plants and

reduce nitrogen oxide, sulfur dioxide and mercury emissions by 20% from

2005 total levels from coal-fueled power plants through nation’s largest

voluntary emissions reduction program

Ongoing

Double wind energy purchases to 1500 MW, maintaining status as the

largest buyer of wind power in Texas

Ongoing: More than 900 MW of wind energy

purchased

Join the FutureGen Alliance

Joined the FutureGen Alliance 12/07

1

Join USCAP

Applied for membership to USCAP 11/07

Expedite voluntarily the company’s 14.101 filing

Done

Make minimum capital spend of $3.6 billion for five years, through 2012

Done

Implement aggressive demand reduction program including an additional

five-year, $100 million investment in conservation and energy efficiency

Ongoing: On track to fulfill the $100 million

investment by EOY 2012

Implement no rate increases as a result of the transaction

Ongoing: Transaction has not resulted in any

rate increases for customers

File no system-wide rate case until 2008.

Done

Generate no new debt as a result of the transaction.

Ongoing: Transaction has not generated any

new debt for customers.

Limit debt so that Oncor’s debt-to-equity ratio is at or below the

assumed debt-to-equity ratio established by the PUC.

Ongoing: Ratio has not exceeded the ratio

established by the PUC of 60% debt, 40% equity

Agree to resolve all outstanding 14.101 issues.

Done

Issue one-time, $72 million retail customer credit.

Done

Provide annual reports to the PUC regarding commitments.

Ongoing

1

Did not renew membership for 2009 following DOE’s funding withdrawal

6

Completing Merger Commitments (continued) |

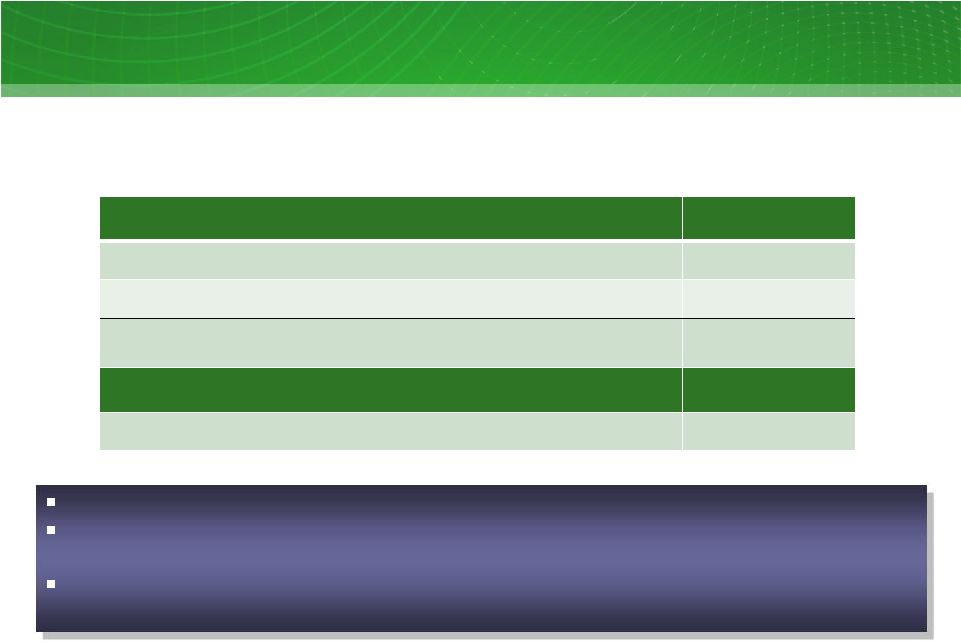

We

Continue To Focus On Operational Excellence 7

Sustainable, Flexible, Dynamic Organization

Operational Excellence

Financial Optimization

Strategic Growth

Prudent financial

management

Optimize balance sheet

Optimize hedge platform

Identify and execute

internal / organic

opportunities

Seek external

opportunities

Maintain competitive

intelligence

Engage in key public

and governmental

affairs issues

Execute an aggressive

operational plan

Deliver top decile

results

Maintain a competitive

position in marketplace

Build infrastructure

Maintain and enhance

TXU brand

Identify and mitigate

operational risks |

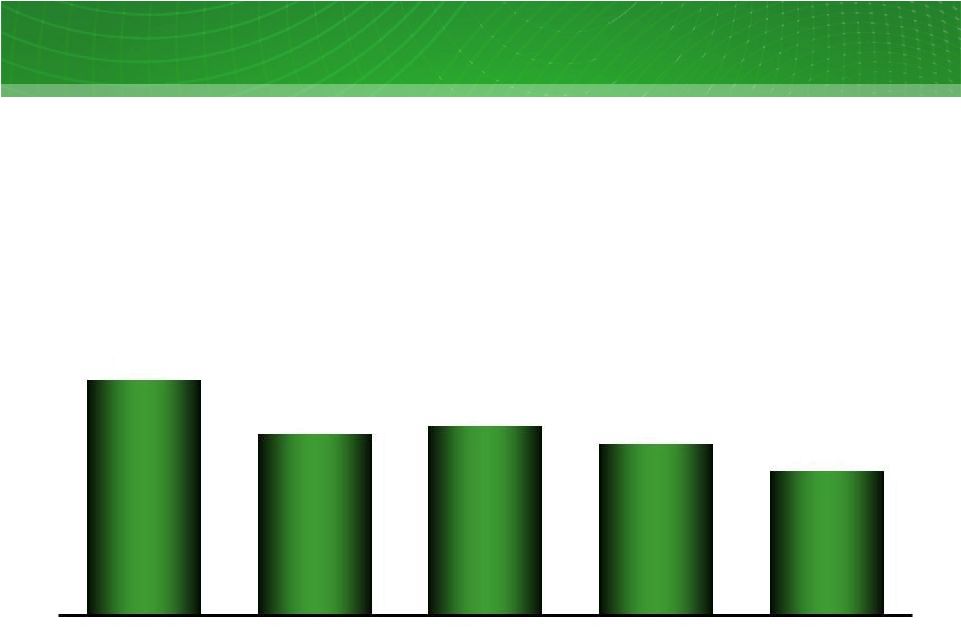

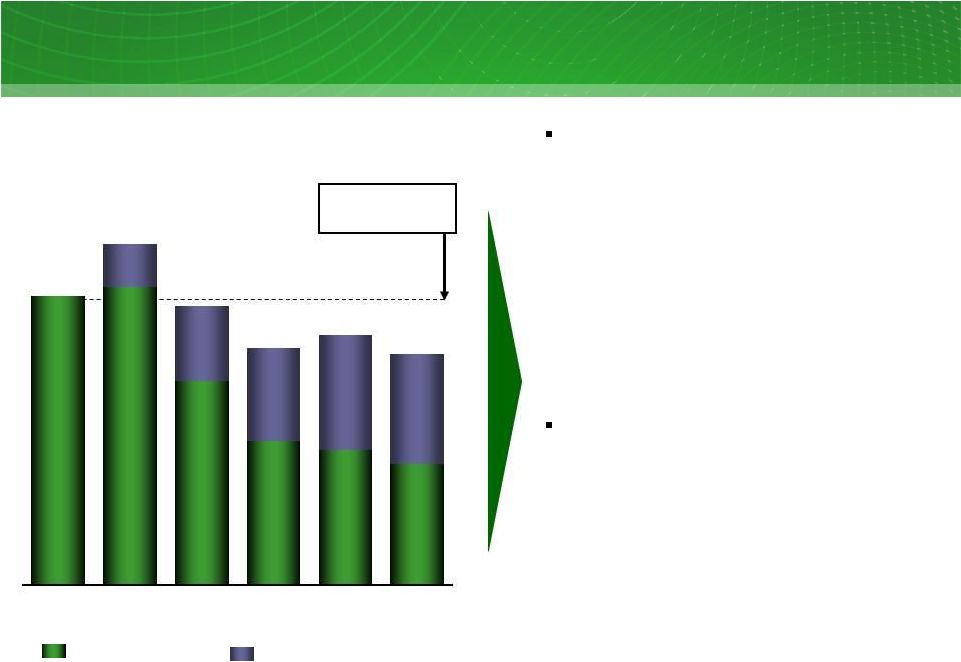

Which

Has Generated Strong Corporate Earnings EFH Adjusted EBITDA

1

2008-YTD Sept. 2012; $ millions

8

1

See Appendix for Regulation G reconciliations and definition

4,845

3,734

3,886

3,513

2,968

2008

2009

2010

2011

YTD 9/30/12 |

9 |

1

Includes four mothballed units (1,655 MW) not currently available for

dispatch 2

Nine months ended September 30, 2012 (excludes purchased power)

Business Profile

Generation

Largest coal & nuclear generation fleet in ERCOT

Top decile nuclear plant production and cost performance

Top quartile coal fleet production and cost performance

Largest mine-mouth coal operator in Texas

Gas

plant

operations

-

high

availability

to

meet

peak

demand

Active asset management and hedging program to maintain

value in volatile commodity market

Coal

Gas

Nuclear

Generating

Capacity

as

of

9/30/12

Total Net Generation for the nine months ended

September 30, 2012

15,427 MW

52,818 GWh

Safety

Wholesale power prices

Natural gas hedge program

Coal / Nuclear plant reliability

Mining operations / lignite cost

Fuel / O&M / SG&A costs

Peaking gas assets

Operational excellence / continuous improvement

Competitive market

Value Drivers

Luminant Is The Largest Power Generator In Texas

10

2%

2

1 |

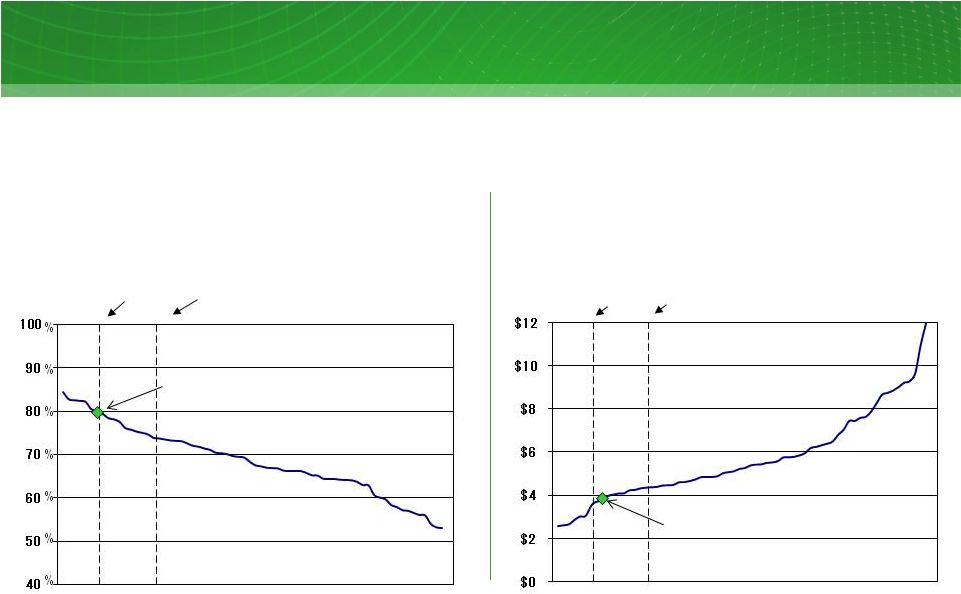

1

Benchmarking net capacity factors based on GADS. Luminant is legacy lignite/coal

fleet only and based on net GADS capacity Source: GKS

Top decile

79.7%

Top quartile

73.8%

Top decile

$3.63

Top quartile

$4.36

Luminant vs. US coal fleet net capacity factors

Percent

Luminant vs. US coal fleet O&M

$/MWh

Luminant Is A High-Performing Coal Operator

11

Luminant 09–11 fleet avg. = 79.9%

Luminant 09–11 fleet avg. = $3.87

1 |

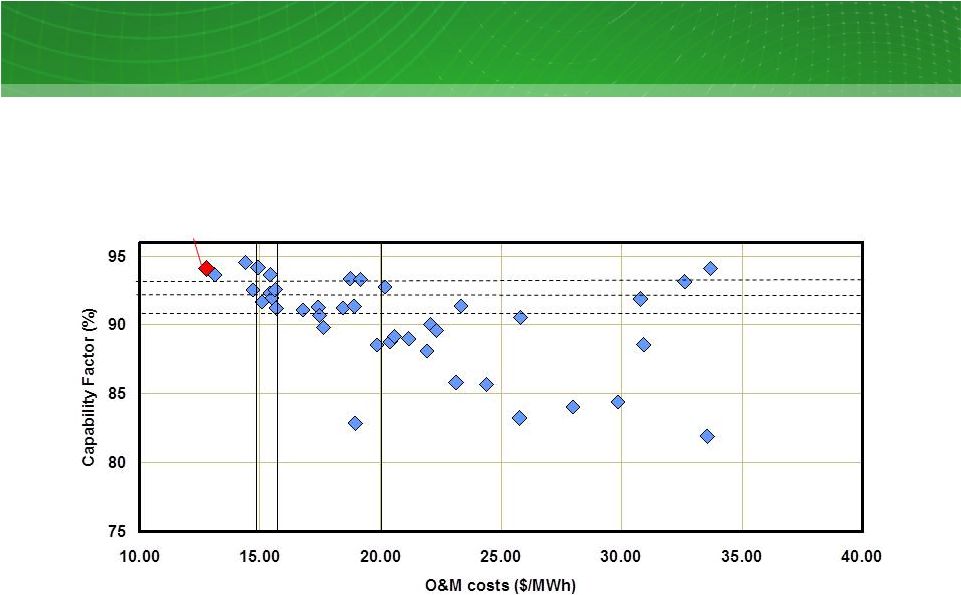

Comanche Peak Plant Is One Of Highest-Performing

Nuclear Plants In The Country

09-11 Capability Factor / O&M

$/MWh

Benchmarking peer set defined as 18 month fuel cycle U.S. nuclear plants

Source: EUCG May, 2012 Comprehensive Data Release for Cost and WANO for Capability

Factors CPNPP

Decile

Quartile

Median

Decile

Quartile

Median

12 |

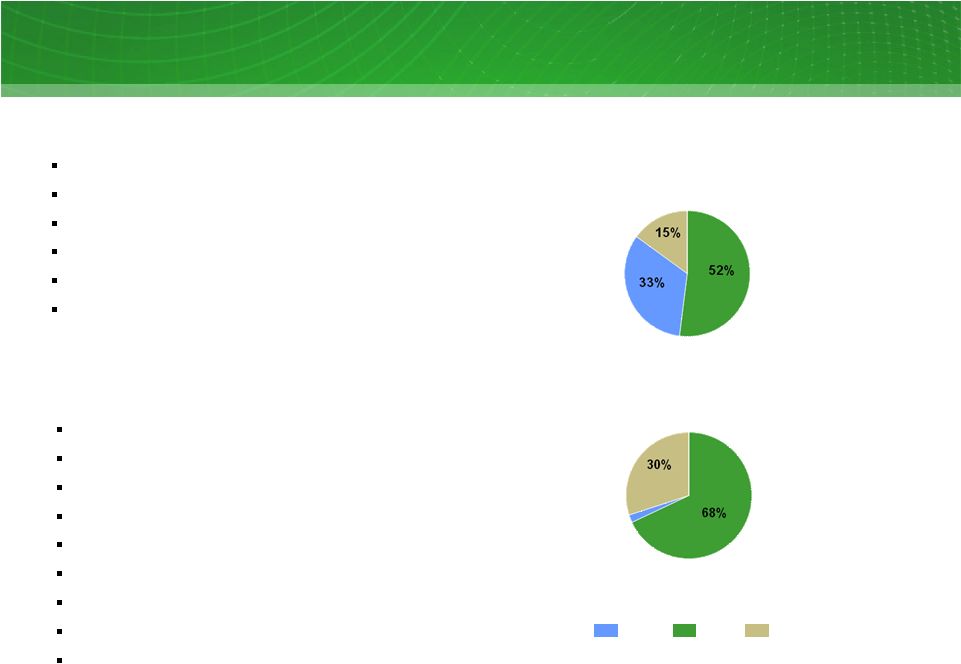

13 |

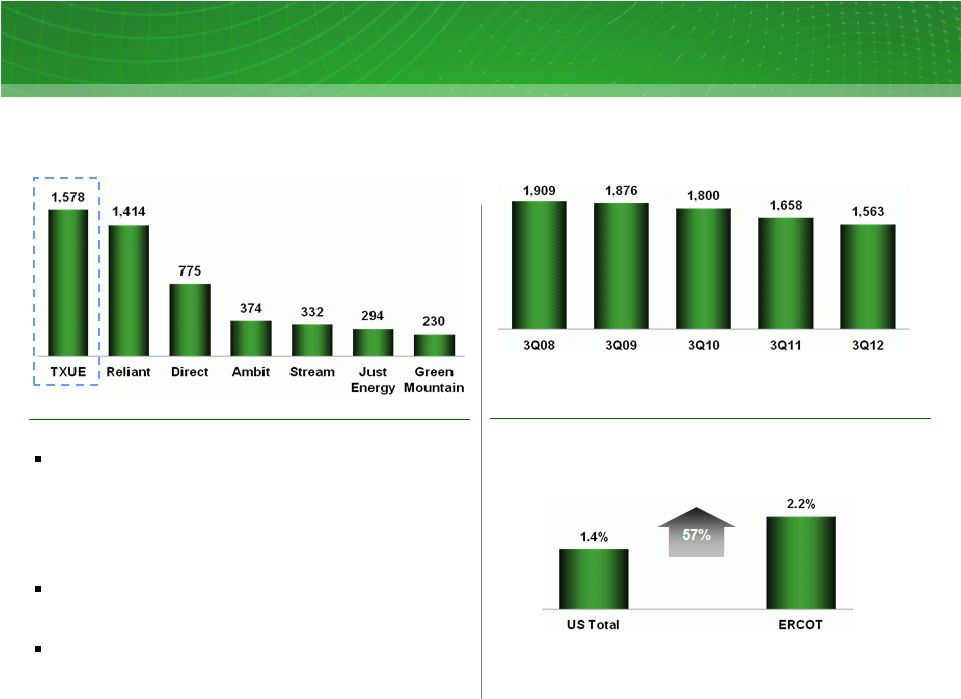

TXU

Energy Is The Largest Retail Electricity Provider In Texas

Strong customer value proposition

•

High brand recognition in Texas competitive areas

•

Competitive retail prices

•

Innovative products and services

•

Committed to low-income customer assistance

•

Improved customer care delivery capabilities

Balance Sheet

•

Combined TCEH risk management and liquidity efficient capital

structure

Expected margins (5–10% net)

Source:

KEMA

Retailer

Landscape

Report

dated

9/28/12;

As

of

June

2012

Source:

Residential Customers / Meters

(in thousands)

Residential Customers

(in thousands)

Projected Annual Demand Growth

CAGR (2010A-2020E; percent)

Value Drivers

14

Q2-Q3 Customer Attrition

1.5%

(1.8)%

(1.6)%

(2.8)%

(1.0)%

NERC 2011 Long-Term Reliability Assessment (Summer Demand)

ERCOT May 2012 CDR report |

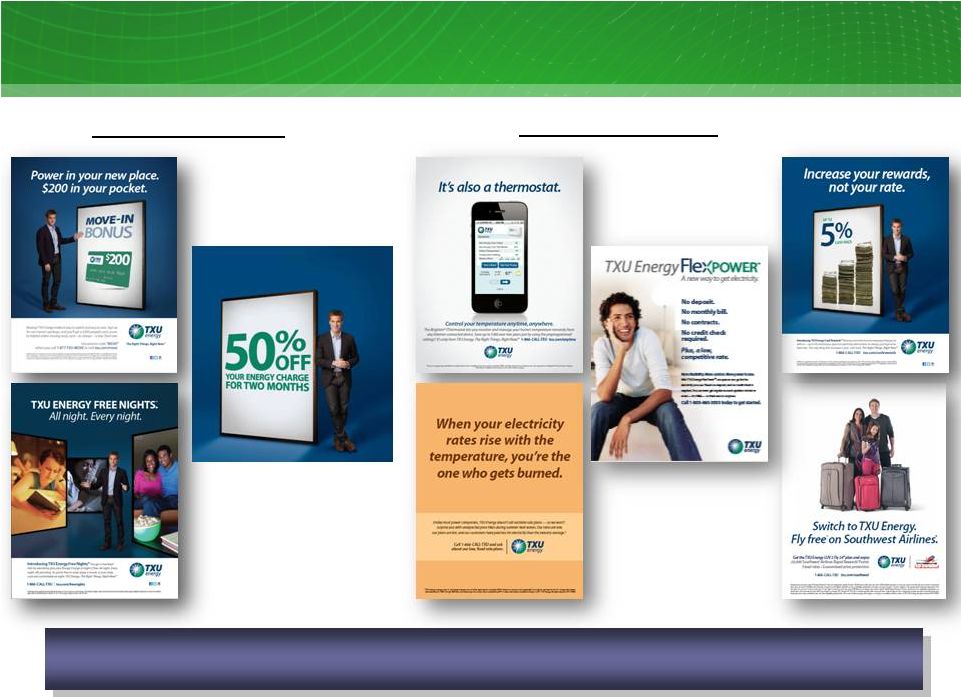

Executing A Marketing Strategy Balancing Value and Price

15

Price Orientation

Value Orientation

New offers are reinforcing TXU Energy’s value proposition

|

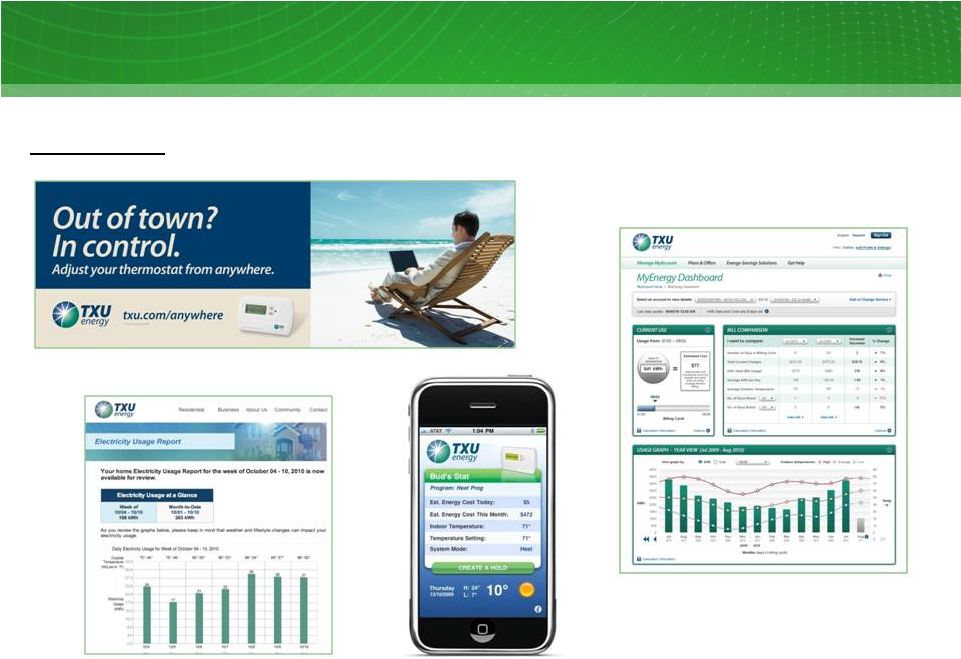

And

Incorporating Technological Solutions Innovations

TXU Energy MyEnergy Dashboard

TXU Energy Electricity Usage Report

TXU Energy’s iPhone and Android Apps

16

Brighten

SM

iThermostat |

17

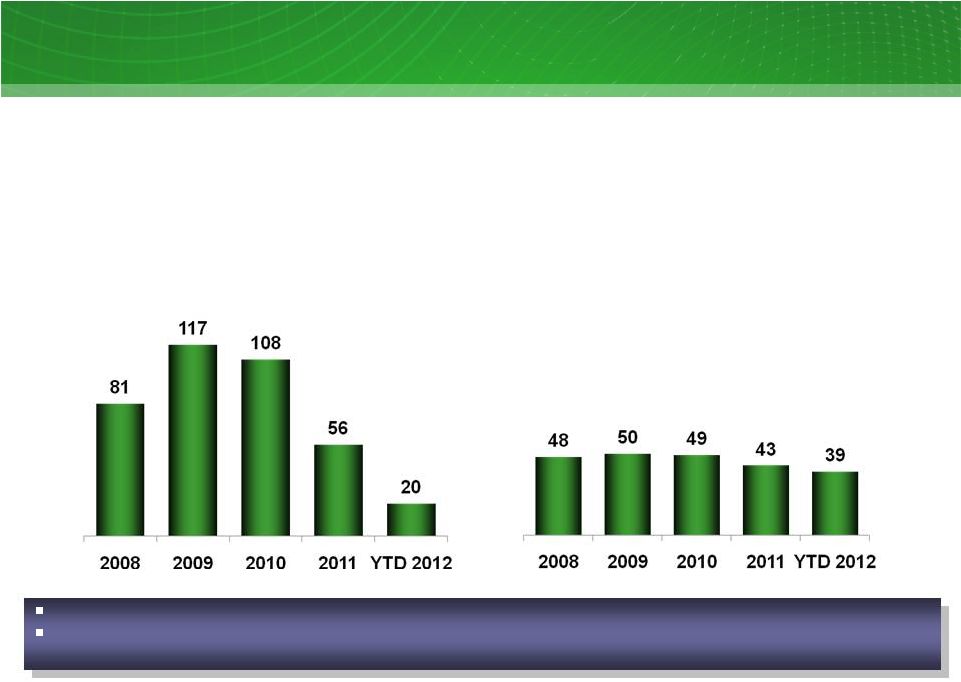

While Managing Expenses And Improving Cash Flow

Bad debt expense

2008 -

YTD Sep 2012; $ millions

Days sales outstanding

2008 –

YTD Sep 2012; Days

TXU Energy lowered bad debt

over time….

…and generated cash flow by

reducing days sales outstanding

YTD Sep 2012 Bad Debt expense was $20 million, on track to be the lowest in TXUE recent history Days Sales Outstanding have improved

significantly due to collection initiatives, customer mix and credit policy improvements |

And

Providing A Strong Customer Experience 18

20%

80%

First Call Resolution

PUC Complaints

Enhanced Customer Experience and Product Innovation:

•

Record performance -

first call resolution, customer satisfaction, PUC complaints

•

Lower operating costs through gains in technology and self service

•

First

to

market

with

innovations

leveraging

Smart

Grid

–

Free

Nights,

iPhone

app,

etc.

•

Reduced customer net attrition in 2012 Q3; approximately two-thirds vs. 2011

Q3 •

Proven risk management strategies delivering more predictable pricing to customers |

19 |

20

New Oncor Infrastructure

Oncor’s investment in CREZ will receive accelerated recovery,

consistent with other transmission investment, mitigating regulatory delay

Oncor has invested $1.36 billion cumulatively

Oncor has invested $1.36 billion cumulatively

on CREZ projects as of September 30, 2012

on CREZ projects as of September 30, 2012

Oncor expects to invest ~$2.0 billion on

CREZ-related transmission lines…

…to support the continued buildout of

…to support the continued buildout of

to support the continued buildout of

wind capacity in Texas

wind capacity in Texas |

21

Oncor Demand-Side Management

Oncor recovers its investment through a

PUC

1

-approved surcharge

Customer monitoring of consumption

“Smart”

appliances

Dynamic pricing

Oncor’s

energy

efficiency

filing

has

been

approved

and

is

reflected

in

rates

…that will enable key DSM

initiatives 1

Public Utility Commission of Texas

Oncor has installed approximately 3.1 million meters as of

September 30, 2012, including 802,000 in the nine months

ending September 30, 2012

Oncor has deployed ~$642 million of

capital for advanced metering

initiatives…

|

Energy Future Holdings Corp.

Energy Future Holdings Corp.

22 |

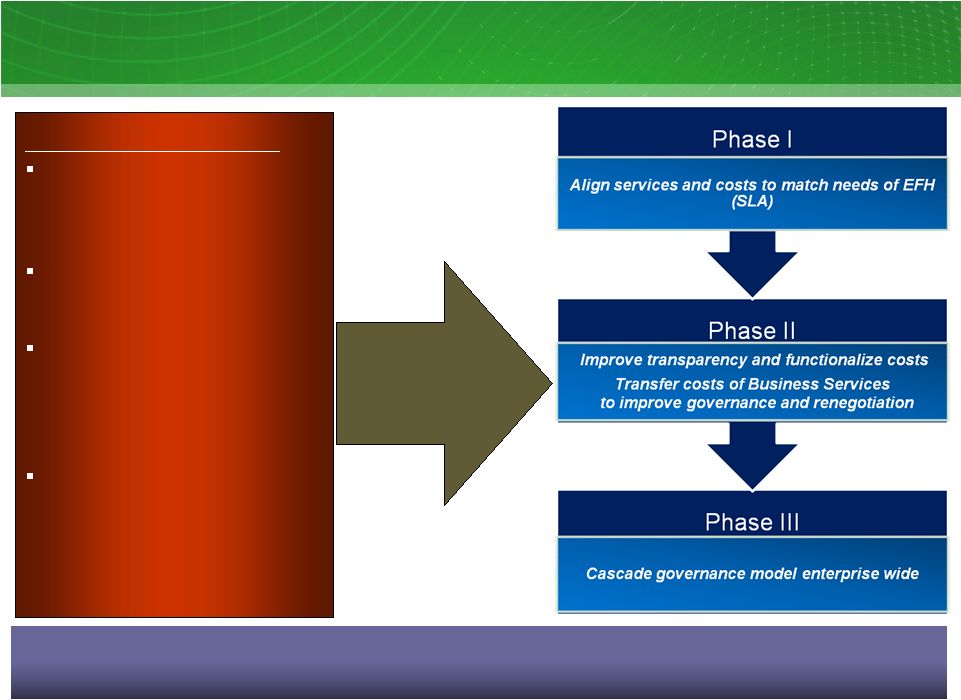

EFH Transformed Business

Services To Focus on Service, Excellence and Governance

23

Before

July

2008

Business Services costs

were not fully categorized

or allocated

Service Level Agreements

(SLA) were not in place

Governance over shared

services and alignment

with businesses needed to

be enhanced

Transparency to Business

Services cost needed to be

improved

Establish

Service,

Excellence &

Governance

Model

The objective was to create a cost-effective shared services group that provided

service levels consistent with a large scale competitive / regulated energy company

|

To

Create Value For The Rest Of The Enterprise 24

Enhanced liquidity through balance sheet and tax initiatives

Implemented cost controls

Enhanced enterprise-wide risk management policies and procedures

Streamlined corporate governance and developed policies and

procedures consistent with strategic goals and objectives

Recruited and retained key leadership talent and created programs to

identify and develop in-house talent

Formed and maintained key stakeholder relationships with industry

participants and other nongovernmental organizations (NGOs)

Strengthened IT infrastructure

–

Implemented new TXU Energy customer care and billing system

–

Invested in upgrading aging infrastructure |

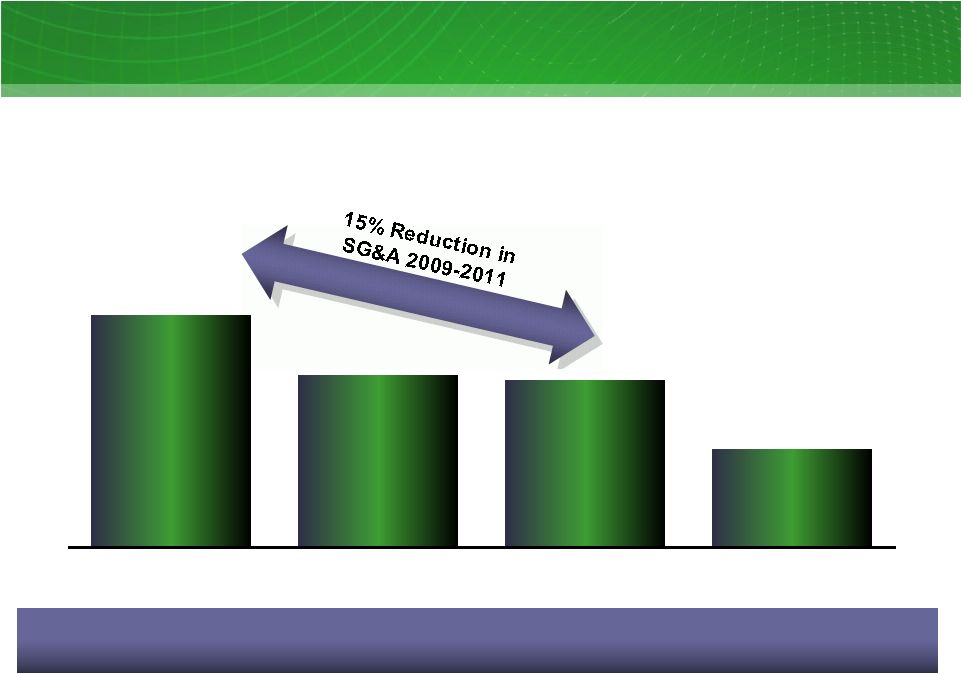

And

Drive Down Consolidated SG&A Over Time 25

Consolidated SG&A

2009-2012; $ millions

SG&A has declined over $130MM from 2009 to 2011

1

Pro-forma for the deconsolidation of Oncor that occurred prospectively in

2010 875

1

751

742

491

2009

2010

2011

YTD 9/30/12 |

Key

Takeaways – Maximizing Enterprise Value

26

Improved the company’s reputation and met merger commitments

–

Engaged company stakeholders including legislators and NGOs

–

Invested in the surrounding communities

Invested in Texas -

$10+ billion in capital and added ~1,900 positions

Maintained focus on Operational Excellence

–

Safe and reliable operating performance at Luminant

–

TXU Energy managing margins and controlling costs amidst increased competition

–

Business Services restructured operations, strengthened infrastructure and

controlled costs

A keen focus on operational excellence has resulted in strong operating and

financial performance amidst depressed commodity prices

|

27

APPENDIX |

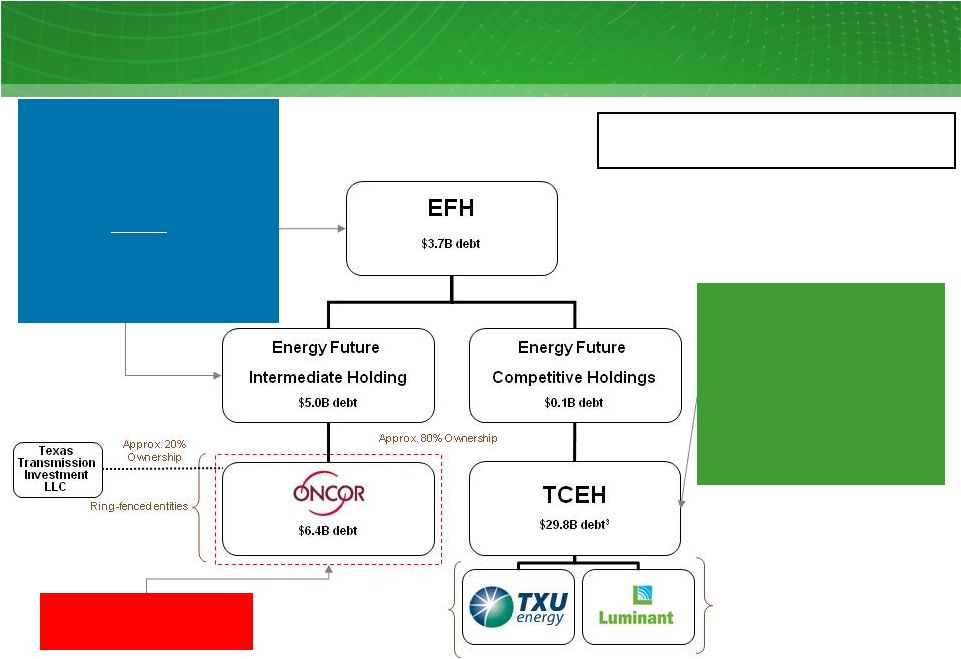

28

Largest competitive electric

generator in Texas

Largest lignite/coal and

nuclear generation fleet in

Texas

Low-cost lignite reserves

Largest T&D utility in

Texas

Leader in smart-grid

development

Constructive regulatory

regime

Largest retail

electricity provider in

Texas

Strong customer value

proposition

The largest power generator, retail electricity provider and transmission &

distribution utility in Texas

Energy Future Holdings Overview |

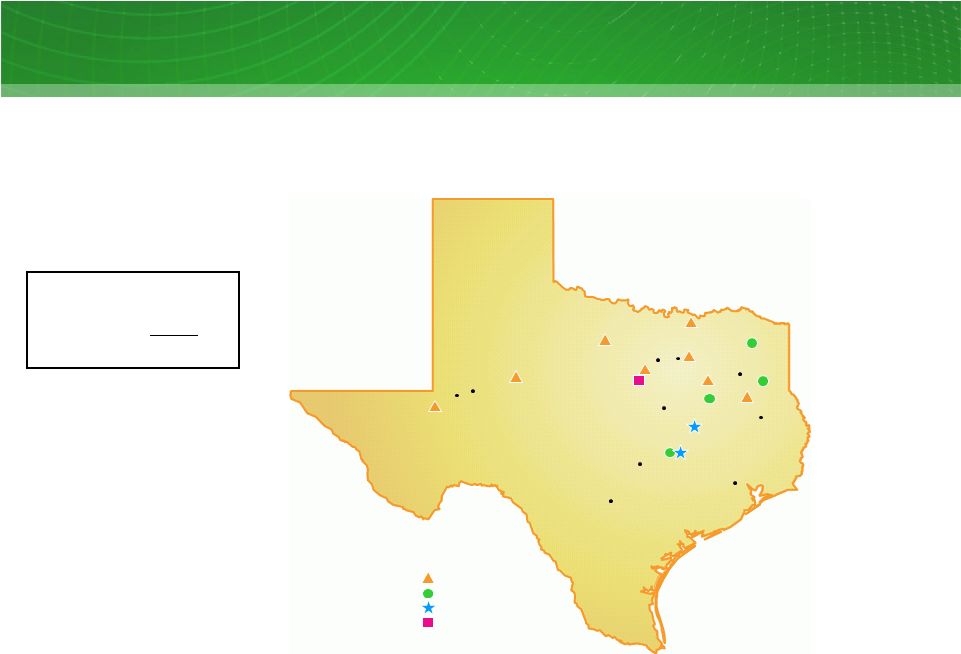

Luminant Generation Facilities

29

Generation capacity in ERCOT

At 9/30/12; MW

Nuclear

2,300 MW

Coal

8,017

Natural gas

1

5,110

Total

15,427 MW

1

Includes four mothballed units (1,655 MW) not currently available for

dispatch HOUSTON

SAN ANTONIO

AUSTIN

WACO

MIDLAND

LUFKIN

ODESSA

DALLAS

FORT

WORTH

Power Plants

Natural gas

Coal

Coal, new build

Nuclear |

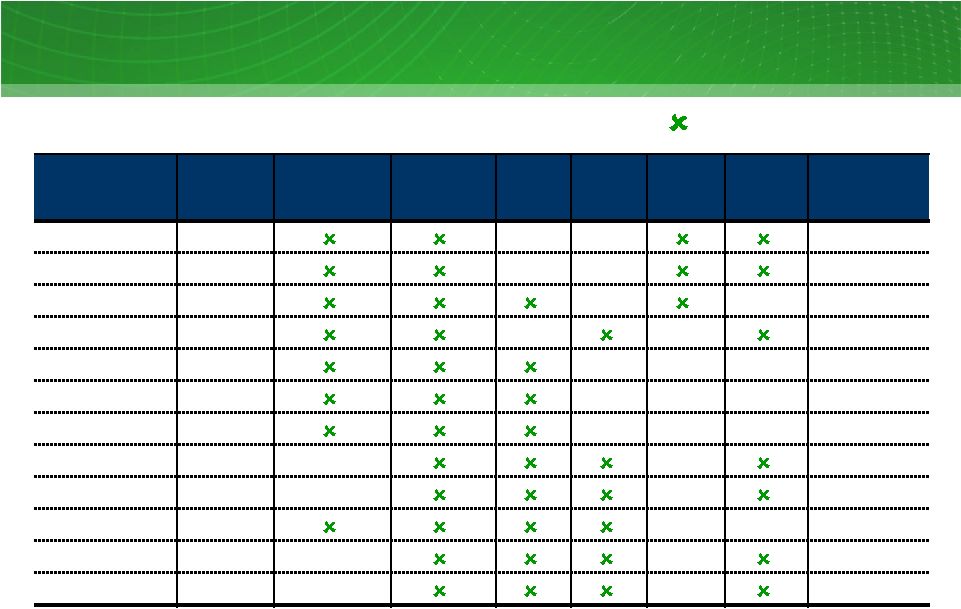

Currently

Installed

1

Environmental

Control

Equipment

At

Luminant Coal Units

Currently installed

1

There is no assurance that the currently installed control equipment will satisfy

the requirements under any change to applicable law or any future Environmental Protection Agency or

Texas Commission on Environmental Quality regulations

2

FGD refers to flue gas desulfurization systems that reduce SO2 emissions with

co-benefits of other emissions reductions 3

Activated carbon injection systems reduce mercury emissions

4

ESP refers to electro-static precipitation systems. ESP and bag-house

systems reduce particulate emissions with co-benefits of other emissions reductions

5

SNCR refers to selective non-catalytic reduction systems. SCR refers to

selective catalytic reduction systems. Both systems reduce NOx emissions

6

PRB refers to Powder River Basin coal transported to plants via railcar

30

Coal Unit

Capacity

(MW)

FGD

(Scrubber)

2

Activated

Carbon

Injection

3

ESP

4

SNCR

5

SCR

5

Bag-

house

4

Fuel Source

Oak Grove 1

800

Lignite

Oak Grove 2

800

Lignite

Sandow 4

557

Lignite

Sandow 5

580

Lignite

Martin Lake 1

750

Lignite/PRB

6

Martin Lake 2

750

Lignite/PRB

Martin Lake 3

750

Lignite/PRB

Monticello 1

565

Lignite/PRB

Monticello 2

565

Lignite/PRB

Monticello 3

750

Lignite/PRB

Big Brown 1

575

Lignite/PRB

Big Brown 2

575

Lignite/PRB |

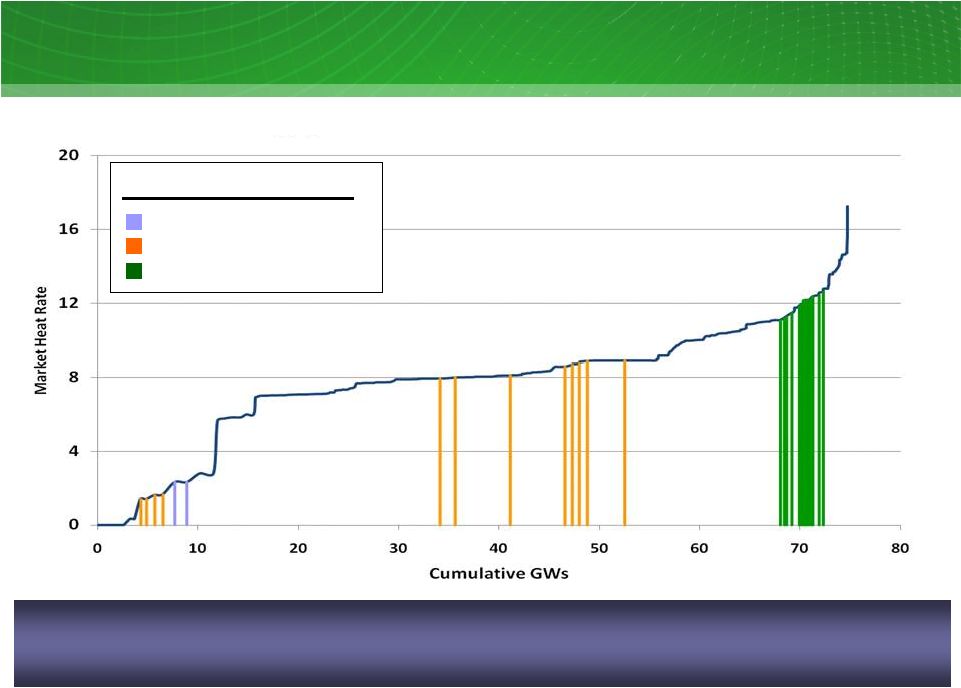

Summer 2012 ERCOT supply stack -

indicative

ERCOT Supply Stack

Sources: ERCOT and Energy Velocity

®, Ventyx Luminant plants are

typically on the “book-ends” of the supply stack; however, the

low natural gas prices of summer 2012 “pushed”

Luminant legacy lignite/coal units up the

supply stack. ERCOT’s

marginal price is set by natural gas in most hours of the year Luminant

nuclear plant Luminant lignite/coal plants

Luminant gas plants

Legend

31 |

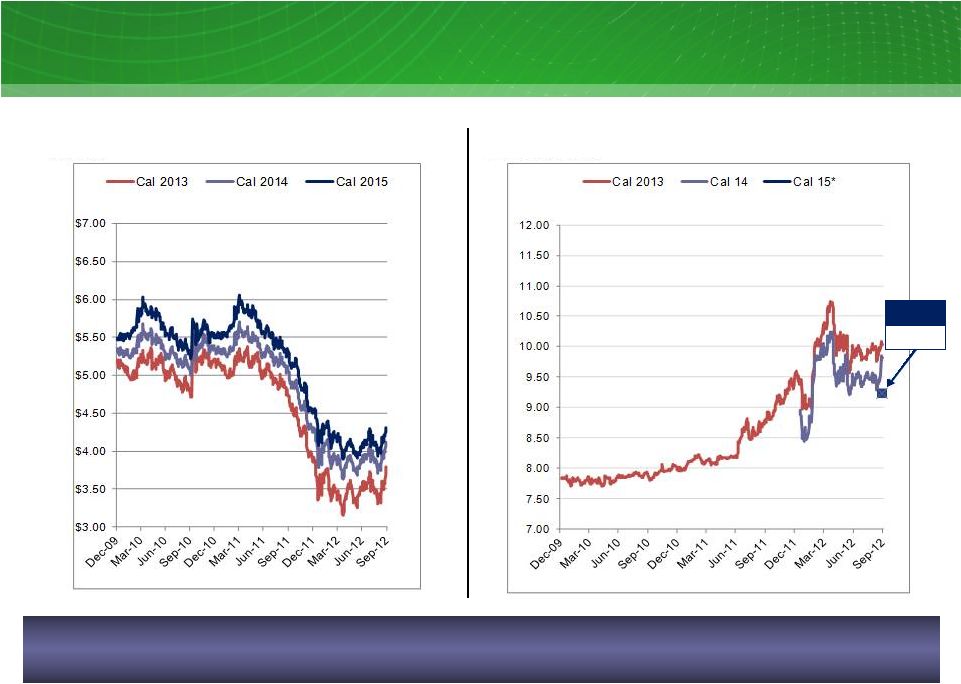

HSC

Natural Gas Futures $/MMBtu

ERCOT NHub ATC (7x24) Heat Rate

MMBtu/MWh

*estimate based on

limited broker quotes

32

Forward Natural Gas Prices and Heat Rates

Forward gas prices have shown some indications of stabilizing.

Near term heat rates continue to show volatility

2015 HR*

9.23 |

33

ERCOT Capacity, Demand and Reserve (CDR) Summary, May 2012. Prior CDR used

for 2012 ERCOT filing on Reserve Margin Analysis, PUCT Project No. 40000,

October 22, 2012 Resource Adequacy in ERCOT

ERCOT reserve margin

2012A-2017E; percent

13.75% target

reserve margin

Drivers of ERCOT October 2012 filing on

Reserve Margin Analysis

–

Reduced load growth rate to Moody’s “Low”

economic growth forecast

•

Lowered 2013 load forecast by ~1,000

MW (~1.5% lower)

•

Approximately 0.5% reduction of 2013-

2018 annual load growth rate

–

Starting in 2014, added pending resources

not included in May 2012 CDR of ~1,000 MW

Recent and pending PUCT/ERCOT actions

and potential deliberations:

–

Increased system-wide offer cap to $5,000

effective June 1, 2013; $7,000 effective June

1, 2014; and $9,000 effective June 1, 2015

–

ERCOT December CDR Report

–

ERCOT review of whether 13.75% is the

appropriate target reserve margin

–

Continued PUCT evaluation of long-term

solution

13.9

16.4

13.4

11.4

12.0

11.1

14.3

9.8

6.9

6.5

5.8

2.1

3.6

4.5

5.5

5.3

'12

'13

'14

'15

'16

'17

1

2

May 2012 CDR

1

Increase from Oct 2012 filing

2 |

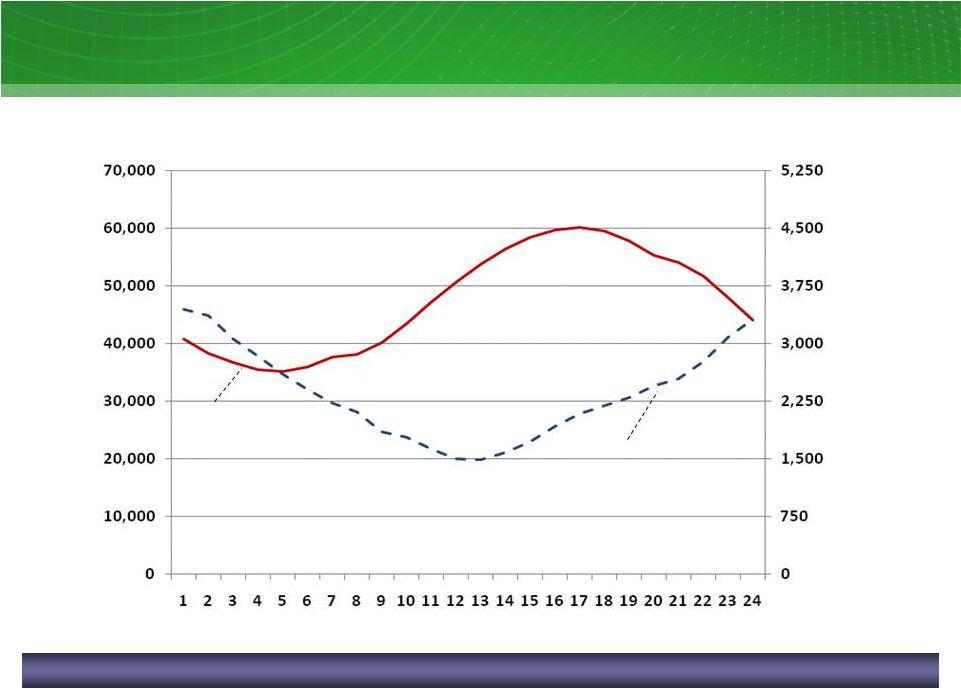

34

ERCOT Average Daily Profile Of Load And Wind

Source: ERCOT

ERCOT average daily profile of load and wind output

August 2012; mixed measures

Average

Load

Average

Wind Output

Load

(aMW)

Wind Output

(MW)

Wind operating characteristics necessitate additional resources for reliability

Hour |

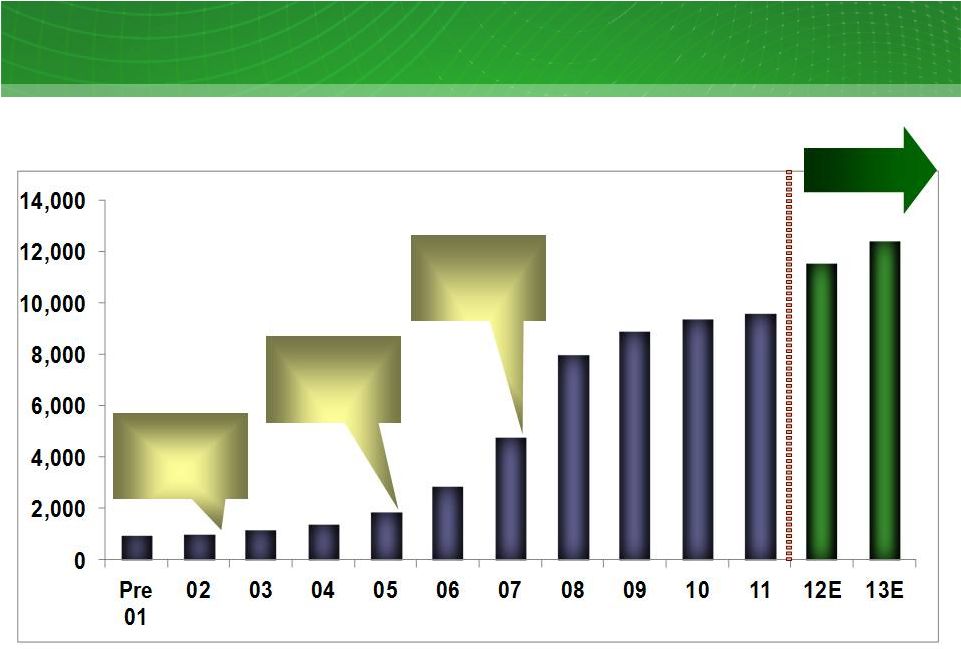

35

ERCOT Wind Additions

RPS¹

Target

of 2,880 MW

by 2009

RPS¹

Target

of 5,880 MW

by 2015

CREZs

Designated

ERCOT SGIA²

Cumulative wind capacity additions in ERCOT

Pre 01 -

11; 12E -

13E; MW

Renewable Portfolio Standard

Signed Generation Interconnect Agreement

Source: ERCOT –

September 2012 System Planning Report to the Reliability and Operations

Subcommittee 1

2 |

$45.0B total gross debt

$41.9B total net debt

1

Gross debt excludes unamortized debt discounts and premiums, fair value discounts

and premiums, and A/R securitization 2

Total net debt equals total gross debt less total cash & cash equivalents and

restricted cash of ~$3.1 billion 3

Excludes $184 million from A/R securitization

4

Excludes intercompany note balances

EFH Capital Structure Overview

36

$4.0B

EFIH 6.875% 1

Lien due 2017

EFH 9.75% 1

Lien due 2019

EFIH 9.75% 1 Lien due 2019

EFH 10.00% 1 Lien due 2020

EFIH 10.00% 1 Lien due 2020

$0.4B

EFIH 11.00% 2

Lien due 2021

$1.7B

EFIH 11.75% 2 Lien due 2022

$0.7B

Unsecured

$1.8B

EFH 5.55% Series P due 2014

EFH 6.50% Series Q due 2024

EFH 6.55% Series R due 2034

$0.1B

Unsecured Other

$16.4B

1 Lien TLB / Deposit LC due 2017

$3.85B

1

Lien TLB / Deposit LC due 2014

$0.2B

Revolver due 2016

$0.1B

Revolver due 2013

$1.75B

11.5% 1 Lien Notes due 2020

$1.6B

15.0% 2 Lien Notes due 2021

$4.8B

10.25% LBO due in 2015

10.50% LBO due in 2016

$1.1B

Unsecured PCRBs/Other

$0.8B

Revolver @ L+125 bps due 2016

$5.1B

Long Term Debt @ avg. 6.1%

$0.5B

Securitization Debt @ avg. 5.3%

Balances as of 9/30/2012 Pro Forma

for

October

2012

Issuance

4

st

st

st

st

st

nd

nd

st

st

st

nd

1

2

EFH 10.875% LBO due 2017

EFH 11.25% LBO due 2017 |

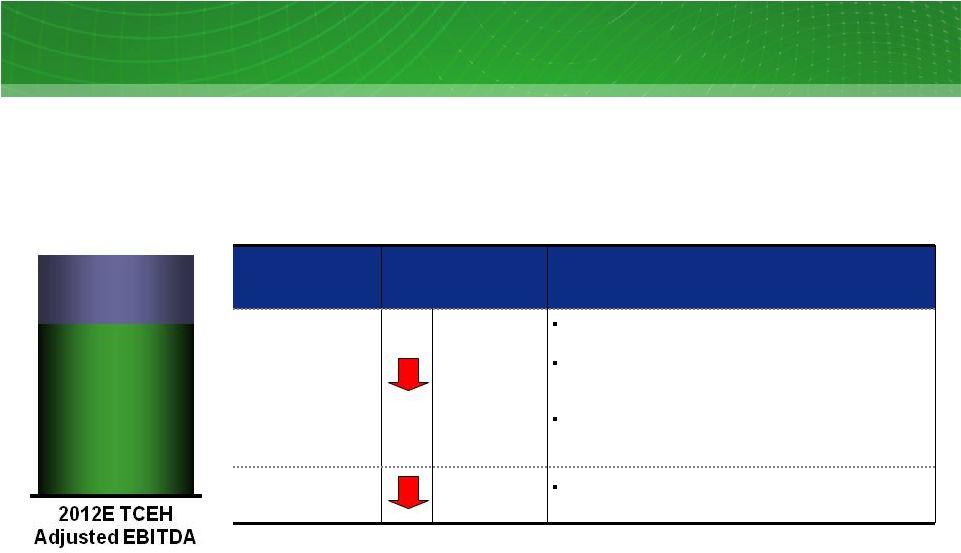

Key

Drivers 2013 Est. Impact vs.

2012 (millions)

Assumptions

Commodity

$600 -

$700

Smaller hedge position: ~115M mmbtu position @

~$3.05 lower price¹

Change in average hedge price: $0.47/mmbtu

lower average price¹

in 2013 vs 2012 on ~500M

mmbtu

New

2013

power

sales

at

higher

expected

heat

rate

net of lower implied market gas prices on ~68-70

TWh²

Retail

$60 -

$120

Lower volumes, weather, and continued

competitive pricing environment in 2013

37

2013 TCEH Adjusted EBITDA (non-GAAP) Key Drivers

$?

Q4

1

Weighted average prices are based on NYMEX Henry Hub prices of forward natural gas

sales positions in the long-term hedging program (excluding the impact of

offsetting purchases for rebalancing and pricing point basis transactions)

2

Excludes volume committed under a long term purchase contract

3

See Appendix for Regulation G reconciliations and definition

$2,854

YTD

9/30/12

3 |

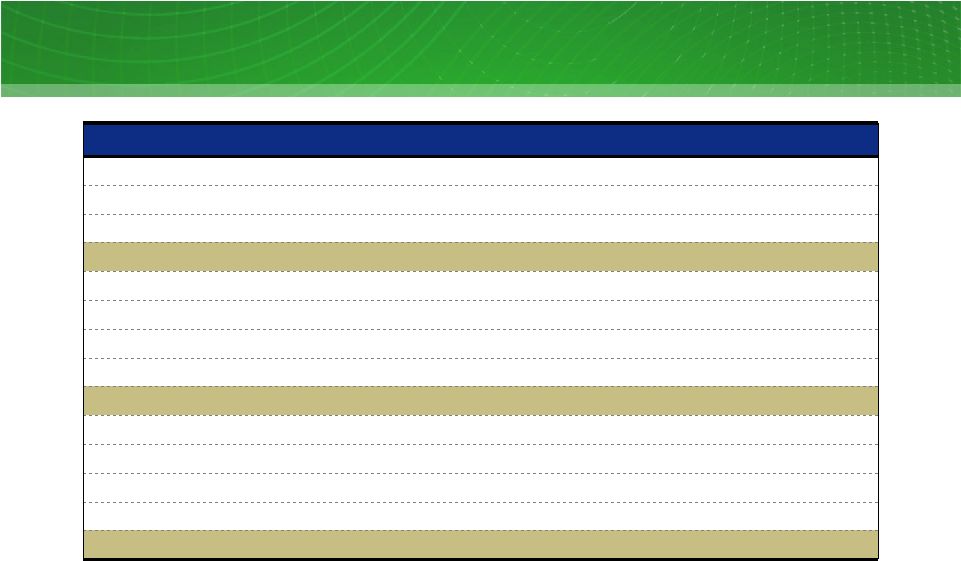

38

TCEH Open EBITDA (non-GAAP) Estimate

Assumptions

Units

2013E

Wholesale

Total coal and nuclear generation

TWh

72 –

74

Estimated power price²

$/MWh

$37 -

$39

Average coal and nuclear cost³

$/MWh

$30 -

$32

Retail

Revenues

$

$4.0 -

$5.0

Profitability percentage (after tax)

%

5 -

10%

TCEH Open EBITDA (non-GAAP)¹

Estimate

13E: $ millions

1

Open EBITDA is intended to provide a view of our projected earnings for the fiscal

year ended December 31, 2013, assuming that (1) our expected coal and nuclear

generation for 2013 is sold at market observed forward power prices as of 7/31/2012

less our expected costs to produce the power, including expected fuel expense,

O&M and SG&A expenses, (2) our retail revenues are derived from market

observed retail rates, and (3) we do not engage in any natural gas and power hedging

activities. This is not intended to serve as an indication of what we expect

our earnings to be for the fiscal year ended December 31, 2013, or how we intend to

operate the business. EFH Corp. does not provide projected EBITDA for future

periods and, as a result, there is no comparable GAAP financial measure to which we

can reconcile Open EBITDA

2

Estimated wholesale power prices for 2013 are based on average ERCOT North Hub

prices as of 7/31/2012 3

Includes fuel, O&M and SG&A expenses

4

Based on average residential pricing and ~$1.5 billion of small and large business

revenue based on trailing 12 months (Q4 2011 and Q1-Q3 2012). For residential

new offer pricing please go to

www.powertochoose.org 5

Calculation assumes a 35% overall tax rate

5

4 |

ELA

and DIG 39

ELA and DIG.

o

EFH

has

a

$19

billion

excess

loss

account

(ELA)

and

a

$4

billion

deferred

intercompany

gain

(DIG),

both

of

which

are reflected in the tax basis of the stock of EFCH held by EFH.

o

The DIG was created in connection with internal reorganizations and the ELA was

created in connection with financing

transactions

that

involved

TCEH

and

its

assets

but

not

EFIH

or

Oncor

Holdings.

We have no plans to trigger the ELA or the DIG, and we are working to eliminate the

ELA and DIG to provide additional structuring flexibility.

o

An ELA and a DIG are generally included in taxable income only if a transaction

occurs that triggers such items.

We have no plans to implement a transaction that would trigger the ELA or the

DIG. o

As we are evaluating strategies to simplify our tax structure and eliminate the

ELA and the DIG, we included the tax-related

disclosure

in

our

Form

10-Q.

We

filed

a

Form

8-K

on

November

6,

2012

in

response

to

questions

from investors about our Form 10-Q disclosure. |

ELA

and DIG (continued) 40

Tax Sharing Among the EFH Tax Group if the ELA and/or DIG were Triggered:

o

Pursuant to applicable Treasury regulations and published guidance of the Internal

Revenue Service, corporations that are members of a consolidated group have

joint and several liability for the taxes of such group. TCEH’s

subsidiaries include both regarded corporations and entities that are disregarded

for federal income tax purposes. o

While disregarded entities are not corporate members of the consolidated tax group

within the meaning of the Internal Revenue Code, the Internal Revenue

Service has issued guidance stating its informal position that a

disregarded

entity

may

be

liable

for

taxes

on

income

that

it

is

responsible

for

generating.

(See

IRS

CCA

199930013, 7/30/1999; CCA 200235023, 6/20/2002).

o

EFH and certain of its subsidiaries (including EFCH, EFIH, and TCEH, but not

including Oncor Holdings and Oncor) are bound by a tax sharing agreement,

which provides for the allocation of income tax liabilities among the

parties thereto. EFH, Oncor Holdings and Oncor are parties to a separate tax

sharing agreement, which governs the computation of federal income tax

liability between EFH, on one hand, and Oncor Holdings, Oncor and the other

ring-fenced entities, on the other hand. –

The tax sharing agreements provide, among other things, that a disregarded entity

is required to make payments to EFH in an amount calculated to approximate

the amount of tax liability such entity would have owed if it filed a

separate corporate tax return. |

Appendix –

Regulation G Reconciliation

41 |

Financial Definitions

Measure

Definition

Adjusted (non-GAAP)

Operating Results

Net income (loss) adjusted for items representing income or losses that are not

reflective of underlying operating results. These items include

unrealized mark-to-market gains and losses, noncash impairment charges and other charges, credits or gains that

are unusual or nonrecurring. EFH Corp. uses adjusted (non-GAAP) operating

results as a measure of performance and believes that analysis of its business

by external users is enhanced by visibility to both net income (loss) prepared in accordance with

GAAP and adjusted (non-GAAP) operating earnings (losses).

Adjusted EBITDA

(non-GAAP)

Competitive Business

Results

Refers to the combined results of the Competitive Electric segment and

Corporate & Other. Competitive Electric segment refers to the EFH

Corp. business segment that consists principally of TCEH. Contribution Margin

(non- GAAP)

Operating revenues less fuel, purchased power costs, and delivery fees, plus or

minus net gain (loss) from commodity hedging and trading activities, which on

an adjusted (non-GAAP) basis, exclude unrealized gains and losses.

EBITDA

(non-GAAP)

Net income (loss) before interest expense and related charges, income tax expense

(benefit) and depreciation and amortization. GAAP

Generally accepted accounting principles.

Purchase Accounting

Regulated Business

Refers to the results of the Regulated Delivery segment, which consists largely of

EFH Corp.’s investment in Oncor. 42

EBITDA adjusted to exclude interest income, noncash items, unusual items, results of discontinued

operations and other adjustments allowable under the EFH Corp. senior secured notes

indentures. Adjusted EBITDA plays an important role in respect of certain covenants

contained in these indentures. Adjusted EBITDA is not intended to be an alternative to GAAP results as a

measure of operating performance or an alternative to cash flows from operating activities as a measure

of liquidity or an alternative to any other measure of financial performance presented in

accordance with GAAP, nor is it intended to be used as a measure of free cash flow available for

EFH Corp.’s discretionary use, as the measure excludes certain cash requirements such as

interest payments, tax payments and other debt service requirements. Because not all companies use identical calculations,

Adjusted EBITDA may not be comparable to similarly titled measures of other companies. See EFH

Corp.’s filings with the SEC for a detailed reconciliation of EFH Corp.’s net income

prepared in accordance with GAAP to Adjusted EBITDA.

The purchase method of accounting for a business combination as prescribed by GAAP, whereby the

purchase price of a business combination is allocated to identifiable assets and liabilities

(including intangible assets) based upon their fair values. The excess of the purchase

price over the fair values of assets and liabilities is recorded as goodwill. Depreciation and amortization due to purchase

accounting represents the net increase in such noncash expenses due to recording the fair market values

of property, plant and equipment, debt and other assets and liabilities, including intangible

assets such as emission allowances, customer relationships and sales and purchase contracts with

pricing favorable to market prices at the date of the Merger. Amortization is reflected in revenues,

fuel, purchased power costs and delivery fees, depreciation and amortization and interest expense in

the income statement. |

43

Table

1:

EFH

Corp.

Net

Debt

Reconciliation

1

As of September 30, 2012

$ millions

Description

9/30/12

Short-term borrowings

469

Long-term debt due currently

104

Long-term debt, less amounts due currently

37,428

Total debt (GAAP) as of September 30, 2012

38,001

Add principal amount of long-term debt issuance in October 2012

253

Less:

Short-term borrowings related to accounts receivable securitization

program (184)

Net unamortized discount, fair value discount and premiums

515

Total debt

38,585

Less:

Cash and cash equivalents

(1,112)

Net proceeds (cash) from October 12 long-term debt issuance

(259)

Restricted cash

(1,644)

Net debt

35,570

1

GAAP basis which reflects deconsolidation of Oncor. Oncor’s total debt

is ~$6.4 billion, added to EFH Corp.’s debt equals ~$45.0 billion. |

44

Table 2: Oncor Net Debt Reconciliation

As of September 30, 2012

$ millions

Description

9/30/12

Short-term borrowings

784

Long-term debt due currently

123

Long-term debt, less amounts due currently

5,440

Total debt (GAAP)

6,347

Less unamortized discounts

37

Total debt

6,384

Less:

Cash and cash equivalents

(9)

Restricted cash

(80)

Net debt

6,295 |

45

Table 3: EFH Corp. Adjusted EBITDA Reconciliation

Year Ended December 31, 2008 -

2011 and Nine Months Ended September 30, 2012

$ millions

1

2

3

4

5

Factor

2008

2009

2010

2011

YTD 12

Net income (loss) attributable to EFH Corp.

(9,838)

344

(2,812)

(1,913)

(1,408)

Income tax expense (benefit)

(471)

367

389

(1,134)

(879)

Interest expense and related charges

4,935

2,912

3,554

4,294

2,746

Depreciation and amortization

1,610

1,754

1,407

1,499

1,015

EBITDA

(3,764)

5,377

2,538

2,746

1,474

Oncor EBITDA

(496)

(1,354)

-

-

-

Oncor

distributions/dividends

(2008

includes

$1.253

billion

sale

of

Oncor

equity)

1,582

216

169

116

100

Interest income

(27)

(45)

(10)

(2)

(2)

Amortization of nuclear fuel

76

101

140

142

124

Purchase accounting adjustments

460

340

210

204

74

Impairment of goodwill

8,000

90

4,100

-

-

Impairment and write-down of other assets

1,221

42

15

433

9

Debt extinguishment gains

-

(87)

(1,814)

(51)

-

Net income (loss) attributable to noncontrolling interests

(160)

64

-

-

-

Equity in earnings of unconsolidated subsidiary

-

-

(277)

(286)

(249)

Unrealized net (gain) loss resulting from hedging transactions

(2,329)

(1,225)

(1,221)

(58)

1,290

Amortization of “day one”

net loss on Sandow power purchase agreement

-

(10)

(22)

-

-

Noncash compensation expense

27

11

18

13

11

Severance expense

3

10

4

7

1

Transition and business optimization costs

45

22

4

39

31

Transaction and merger expenses

64

81

48

37

29

Restructuring and other

43

1

(116)

73

7

Expenses incurred to upgrade or expand a generation station

100

100

100

100

69

EFH Corp. Adjusted EBITDA per Incurrence Covenant

4,845

3,734

3,886

3,513

2,968

Add Oncor Adjusted EBITDA (reduced by Oncor distributions/dividends above)

(267)

1,123

1,354

1,523

1,254

EFH Corp. Adjusted EBITDA per Restricted Payments Covenant

4,578

4,857

5,240

5,036

4,222

3

4

5

2

1

2008 includes litigation accrual, charge related to a counterparty bankruptcy and losses on sale of

receivables, net of insurance settlement proceeds. 2009 includes reversal of certain liabilities accrued in purchase

accounting, partially offset by restructuring and nonrecurring activities and losses on sale of

receivables. 2010 includes a gain on termination of a long-term power sales contract. 2011 includes settlement of amounts

due from counterparty bankruptcy, fees related to the amendment and extension of the TCEH Senior

Secured Facilities and reversal of certain liabilities accrued in purchase accounting. See Form 10-Ks for more detail

Includes amortization of the intangible net asset value of retail and wholesale power sales agreements,

environmental credits, coal purchase contracts, nuclear fuel contracts and power purchase agreements

and the stepped-up value of nuclear fuel. Also includes certain credits and gains on asset

sales not recognized in net income due to purchase accounting

2008 and 2011 include impairment of emission allowances. 2008 also includes impairment of trade name

intangible assets, land, and the natural gas-fueled generation fleet and charges related to cancelled

development of coal-fueled generation facilities

Includes professional fees and other costs related to retail billing and customer care systems,

generation plant reliability and supply chain efficiency initiatives as well as incentive compensation expenses

Includes costs related to the Merger, abandoned strategic transactions, certain growth initiatives and

Oncor’s sale of noncontrolling interests, outsourcing transition costs and Sponsor Group management fee |

46

Table 4: TCEH Adjusted EBITDA Reconciliation

Nine Months Ended September 30, 2012

$ millions

1

Includes amortization of the intangible net asset value of retail and wholesale

power sales agreements, environmental credits, coal purchase contracts, nuclear fuel contracts and power

purchase agreements and the stepped-up value of nuclear fuel. Also

includes certain credits and gains on asset sales not recognized in net income due to purchase accounting

2

Represents

amounts

recorded

under

stock-based

compensation

accounting

standards

and

excludes

capitalized

amounts

3

Includes

incentive

compensation

expenses

as

well

as

professional

fees

and

other

costs

related

to

generation

plant

reliability

and

supply

chain

efficiency

initiatives

4

Primarily represents Sponsor Group management fees

5

Reflects noncapital outage costs

Factor

YTD 12

Net loss

(1,252)

Income tax benefit

(670)

Interest expense and related charges

2,200

Depreciation and amortization

992

EBITDA

1,270

Adjustments to EBITDA (pre-tax):

Interest income

(36)

Amortization of nuclear fuel

124

Purchase

accounting

adjustments

54

Impairment of assets and inventory write down

1

Unrealized net (gain) loss resulting from hedging transactions

1,290

Net loss attributable to noncontrolling interests

1

EBITDA amount attributable to consolidated unrestricted subsidiaries

(6)

Corp. depreciation, interest and income tax expense included in SG&A

13

Noncash

compensation

expense

8

Severance expense

1

Transition

and

business

optimization

costs

30

Transaction and merger expenses

4

29

Restructuring and other

6

Expenses incurred to upgrade or expand a generation station

5

69

TCEH Adjusted EBITDA per Incurrence Covenant

2,854

Expenses related to unplanned generation station outages

64

TCEH Adjusted EBITDA per Maintenance Covenant

2,918

3

2

1 |

47

EFH Corp. Investor Relations Contacts

Molly Sorg

Director, Investor Relations

214-812-8868

Molly.Sorg@energyfutureholdings.com

Blake Holcomb

Investor Relations

214-812-8005

Blake.Holcomb@energyfutureholdings.com

|