Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ATLANTIC CITY ELECTRIC CO | t74959_8k.htm |

EXHIBIT 99

|

47th EEI Financial Conference

NOVEMBER 11 – 13 • PHOENIX, AZ

|

|

Safe Harbor Statement/Regulation G Information

Some of the statements contained in today’s presentation with respect to Pepco Holdings, Pepco, Delmarva Power and Atlantic City Electric, including each of their respective subsidiaries, are forward-looking statements within the meaning of the U.S. federal securities laws and are subject to the safe harbor created thereby and by the Private Securities Litigation Reform Act of 1995. These statements include declarations regarding the intents, beliefs and current expectations of one or more of PHI, Pepco, DPL or ACE (each a Reporting Company) or their subsidiaries. In some cases you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “could,” “expects,” “intends,” “assumes,” “seeks to,” “plans,” “anticipates,” “believes,” “projects,” “estimates,” “predicts,” “potential,” “future,” “goal,” “objective,” or “continue”, the negative or other variations of such terms, or comparable terminology, or by discussions of strategy that involve risks and uncertainties. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause one or more Reporting Companies’ or their subsidiaries’ actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Therefore, forward-looking statements are not guarantees or assurances of future performance, and actual results could differ materially from those indicated by the forward-looking statements. These forward-looking statements are qualified in their entirety by, and should be read together with, the risk factors included in the “Risk Factors” section and other statements in each Reporting Company’s annual report on Form 10-K for the year ended December 31, 2011 (as amended) and other SEC filings, including each Reporting Company’s Form 10-Q for the quarter ended September 30, 2012, and investors should refer to these risk factor sections and such other statements. All such factors are difficult to predict, contain uncertainties, are beyond each Reporting Company’s or its subsidiaries’ control and may cause actual results to differ materially from those contained in the forward-looking statements. Any forward-looking statements speak only as to the date of this presentation and none of the Reporting Companies undertakes an obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for a Reporting Company to predict all such factors, nor can the impact of any such factor be assessed on such Reporting Company’s or its subsidiaries’ business (viewed independently or together with the business or businesses of some or all of the other Reporting Companies or their subsidiaries) or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive. PHI routinely makes available important information with respect to each Reporting Company, including copies of each Reporting Company’s annual, periodic and current reports filed or furnished with the Securities and Exchange Commission under the Securities Exchange Act of 1934, on PHI’s website at http://www.pepcoholdings.com/investors. PHI recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with each Reporting Company’s disclosure obligations under SEC Regulation FD. Information contained on PHI’s website shall not be deemed incorporated into, or to be part of, this presentation, and any website references are not intended to be made through active hyperlinks.

PHI discloses net income from continuing operations and related per share data (both as historical information and earnings guidance) excluding certain items (non-GAAP financial information) because management believes that these items are not representative of PHI’s ongoing business operations. Management uses this information, and believes that such information is useful to investors, in evaluating PHI’s period-over-period performance. The inclusion of this disclosure is intended to complement, and should not be considered as an alternative to, PHI’s reported net income from continuing operations and related per share data in accordance with accounting principles generally accepted in the United States (GAAP).

1

|

|

PHI’s Strategic Focus

Power Delivery

• Invest in T&D infrastructure

• Focus on reliability and operational excellence

• Implement Blueprint for the Future – AMI, energy efficiency, demand response, decoupling

• Achieve reasonable regulatory outcomes and reduce regulatory lag

• Maintain minimal exposure to generation and commodity markets

Pepco Energy Services

• Manage through the challenging energy services market, adjust cost structure, increase earnings contribution from energy services over time

Note: See Safe Harbor Statement at the beginning of today’s presentation. 2

|

|

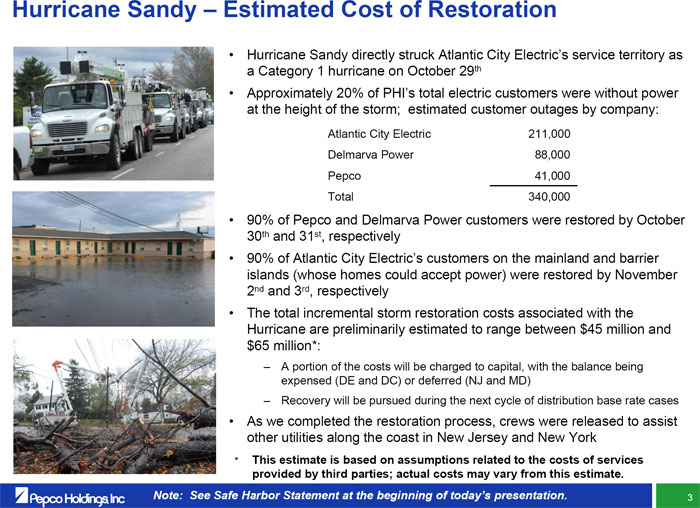

Hurricane Sandy – Estimated Cost of Restoration

• Hurricane Sandy directly struck Atlantic City Electric’s service territory as a Category 1 hurricane on October 29th

• Approximately 20% of PHI’s total electric customers were without power at the height of the storm; estimated customer outages by company:

Atlantic City Electric 211,000 Delmarva Power 88,000 Pepco 41,000 Total 340,000

• 90% of Pepco and Delmarva Power customers were restored by October 30th and 31st, respectively

• 90% of Atlantic City Electric’s customers on the mainland and barrier islands (whose homes could accept power) were restored by November 2nd and 3rd, respectively

• The total incremental storm restoration costs associated with the Hurricane are preliminarily estimated to range between $45 million and $65 million*:

– A portion of the costs will be charged to capital, with the balance being expensed (DE and DC) or deferred (NJ and MD)

– Recovery will be pursued during the next cycle of distribution base rate cases

• As we completed the restoration process, crews were released to assist other utilities along the coast in New Jersey and New York

* This estimate is based on assumptions related to the costs of services provided by third parties; actual costs may vary from this estimate.

Note: See Safe Harbor Statement at the beginning of today’s presentation. 3

|

|

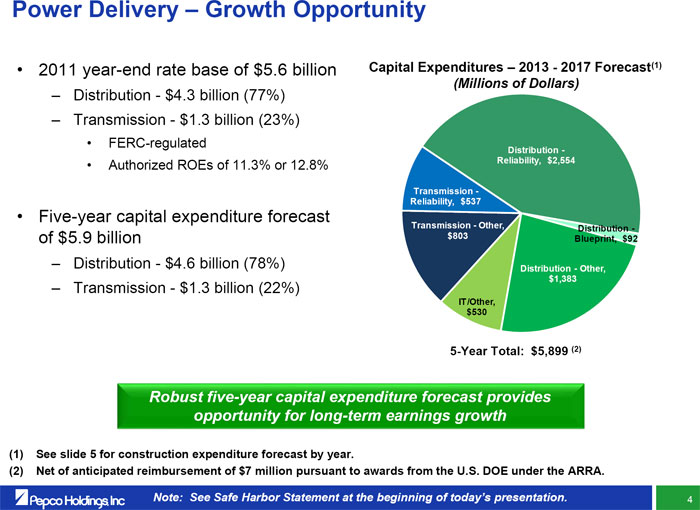

Power Delivery – Growth Opportunity

• 2011 year-end rate base of $5.6 billion Capital Expenditures – 2013 - 2017 Forecast(1)

(Millions of Dollars)

– Distribution - $4.3 billion (77%)

– Transmission - $1.3 billion (23%)

• FERC-regulated

Distribution -

• Authorized ROEs of 11.3% or 12.8% Reliability, $2,554

Transmission -Reliability, $537

• Five-year capital expenditure forecast

Transmission - Other, Distribution -of $5.9 billion $803 Blueprint, $92

– Distribution - $4.6 billion (78%) Distribution - Other,

$1,383

– Transmission - $1.3 billion (22%)

IT/Other, $530

5-Year Total: $5,899 (2)

Robust five-year capital expenditure forecast provides opportunity for long-term earnings growth

(1) See slide 5 for construction expenditure forecast by year.

(2) Net of anticipated reimbursement of $7 million pursuant to awards from the U.S. DOE under the ARRA.

Note: See Safe Harbor Statement at the beginning of today’s presentation.

4

|

|

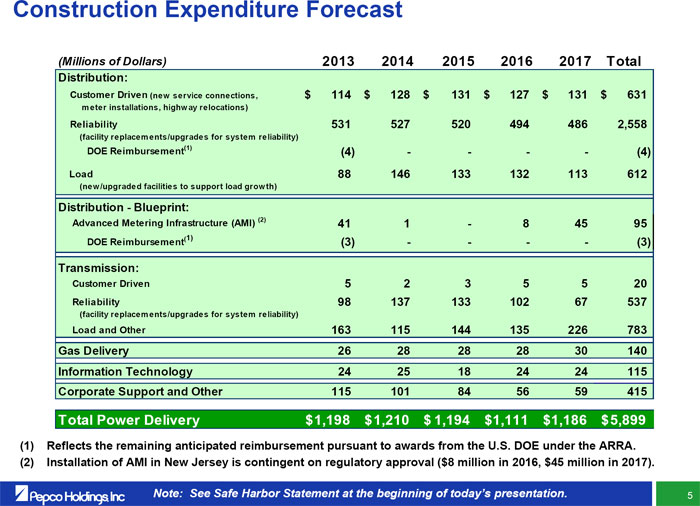

Construction Expenditure Forecast

(Millions of Dollars) 2013 2014 2015 2016 2017 Total

Distribution:

Customer Driven (new service connections, $ 114 $ 128 $ 131 $ 127 $ 131 $ 631

meter installations, highway relocations)

Reliability 531 527 520 494 486 2,558

(facility replacements/upgrades for system reliability)

DOE Reimbursement(1) (4) - - - - (4) Load 88 146 133 132 113 612

(new/upgraded facilities to support load growth)

Distribution - Blueprint:

Advanced Metering Infrastructure (AMI) (2) 41 1 - 8 45 95 DOE Reimbursement(1) (3) - - - - (3)

Transmission:

Customer Driven 5 2 3 5 5 20 Reliability 98 137 133 102 67 537

(facility replacements/upgrades for system reliability)

Load and Other 163 115 144 135 226 783 Gas Delivery 26 28 28 28 30 140 Information Technology

24 25 18 24 24 115 Corporate Support and Other 115 101 84 56 59 415

Total Power Delivery $ 1,198 $ 1,210 $ 1,194 $ 1,111 $1,186 $ 5,899

(1) Reflects the remaining anticipated reimbursement pursuant to awards from the U.S. DOE under the ARRA. (2) Installation of AMI in New Jersey is contingent on regulatory approval ($8 million in 2016, $45 million in 2017).

Note: See Safe Harbor Statement at the beginning of today’s presentation.

5

|

|

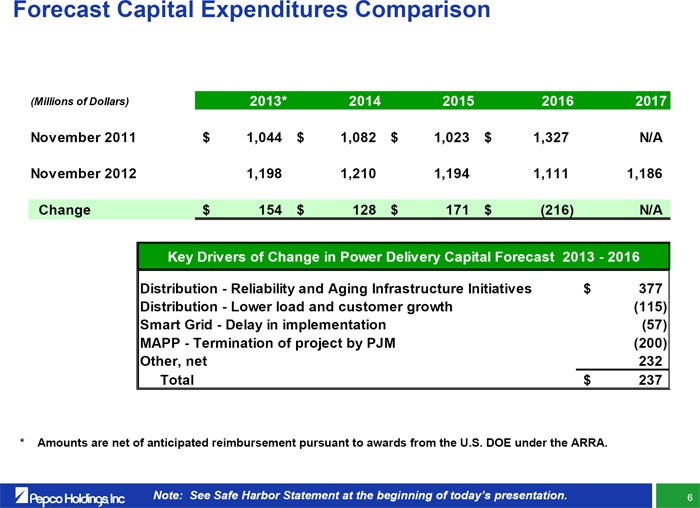

Forecast Capital Expenditures Comparison

(Millions of Dollars) 2013* 2014 2015 2016 2017 November 2011 $ 1,044 $ 1,082 $ 1,023 $ 1,327N/A November 2012 1,198 1,210 1,194 1,111 1,186 Change$ 154 $ 128 $ 171 $ (216)N/A

Key Drivers of Change in Power Delivery Capital Forecast 2013 - 2016

Distribution - Reliability and Aging Infrastructure Initiatives $ 377 Distribution - Lower load and customer growth (115) Smart Grid - Delay in implementation (57) MAPP - Termination of project by PJM (200) Other, net 232 Total$ 237

* Amounts are net of anticipated reimbursement pursuant to awards from the U.S. DOE under the ARRA.

Note: See Safe Harbor Statement at the beginning of today’s presentation.

6

|

|

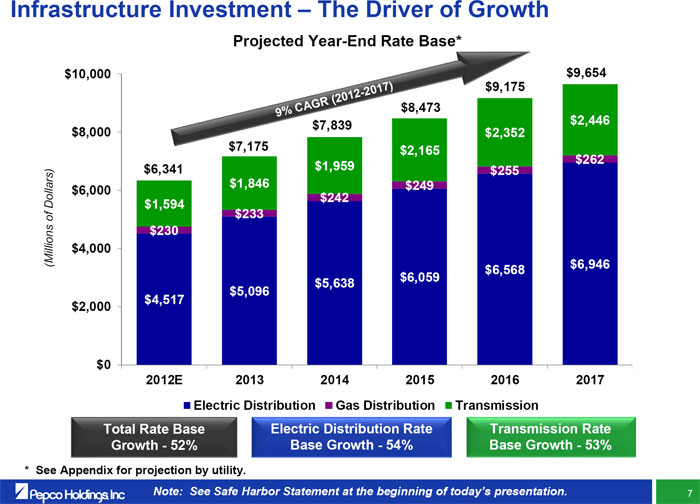

Infrastructure Investment – The Driver of Growth

Projected Year-End Rate Base*

$10,000 $9,654 017 ) $9,175

12-2 (20

AGR $8,473

9 % C $7,839 $2,446 $8,000 $2,352 $7,175 $2,165 $262 $6,341 $1,959 $255 $1,846$249 $6,000 $242 $1,594 $233 $230

(Millions of Dollars) $4,000 $6,568 $6,946 $6,059 $5,638 $5,096 $4,517 $2,000

$0

2012E 2013 2014 2015 2016 2017 Electric Distribution Gas Distribution Transmission

Total Rate Base Electric Distribution Rate Transmission Rate Growth - 52% Base Growth - 54%Base Growth - 53%

* See Appendix for projection by utility.

Note: See Safe Harbor Statement at the beginning of today’s presentation.

7

|

|

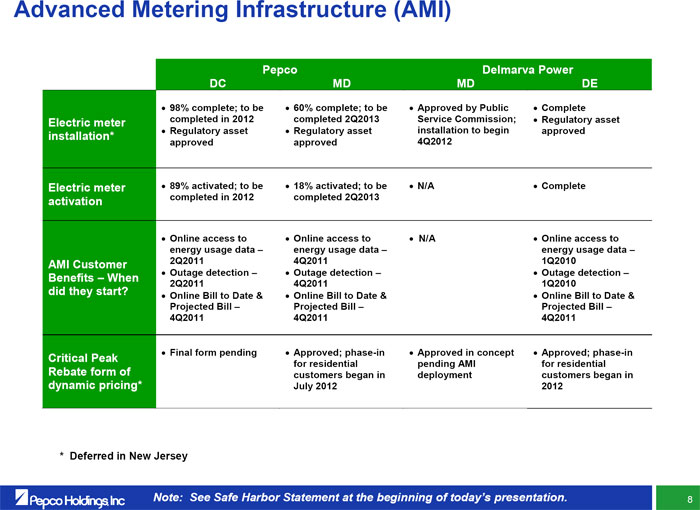

Advanced Metering Infrastructure (AMI)

Pepco Delmarva Power DC MD MD DE

98% complete; to be 60% complete; to be Approved by Public Complete Electric metercompleted in 2012completed 2Q2013Service Commission; Regulatory asset

Regulatory asset Regulatory asset installation to begin approved

installation*

approved approved 4Q2012

Electric meter 89% activated; to be 18% activated; to be N/A Complete activationcompleted in 2012completed 2Q2013

Online access to Online access to N/A Online access to energy usage data – energy usage data –energy usage data – AMI Customer2Q20114Q20111Q2010 Benefits – When Outage detection – Outage detection – Outage detection – 2Q20114Q20111Q2010 did they start? Online Bill to Date & Online Bill to Date & Online Bill to Date & Projected Bill – Projected Bill – Projected Bill – 4Q2011 4Q2011 4Q2011

Final form pending Approved; phase-in Approved in concept Approved; phase-in

Critical Peak

for residential pending AMI for residential Rebate form of customers began in deploymentcustomers began in

dynamic pricing* July 2012 2012

* Deferred in New Jersey

Note: See Safe Harbor Statement at the beginning of today’s presentation.

8

|

|

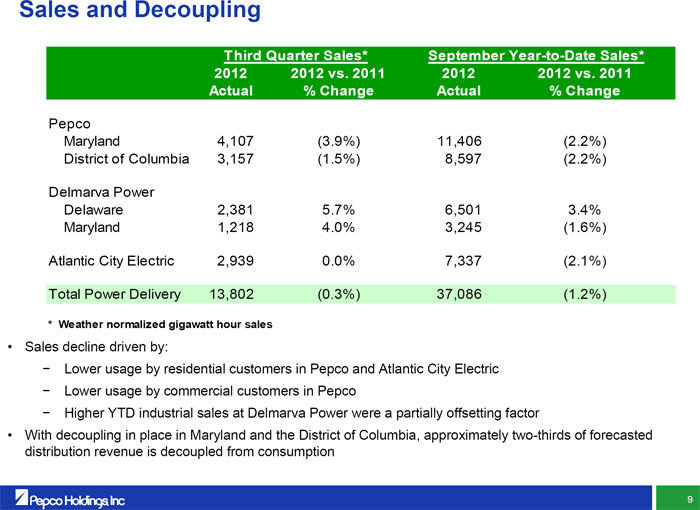

Sales and Decoupling

Third Quarter Sales* September Year-to-Date Sales* 2012 2012 vs. 2011 2012 2012 vs. 2011 Actual% ChangeActual% Change

Pepco

Maryland 4,107 (3.9%) 11,406 (2.2%) District of Columbia 3,157 (1.5%) 8,597(2.2%)

Delmarva Power

Delaware 2,381 5.7% 6,501 3.4% Maryland 1,218 4.0% 3,245 (1.6%)

Atlantic City Electric 2,939 0.0% 7,337 (2.1%)

Total Power Delivery 13,802 (0.3%) 37,086 (1.2%)

* Weather normalized gigawatt hour sales

• Sales decline driven by:

Lower usage by residential customers in Pepco and Atlantic City Electric

Lower usage by commercial customers in Pepco

Higher YTD industrial sales at Delmarva Power were a partially offsetting factor

• With decoupling in place in Maryland and the District of Columbia, approximately two-thirds of forecasted distribution revenue is decoupled from consumption

9

|

|

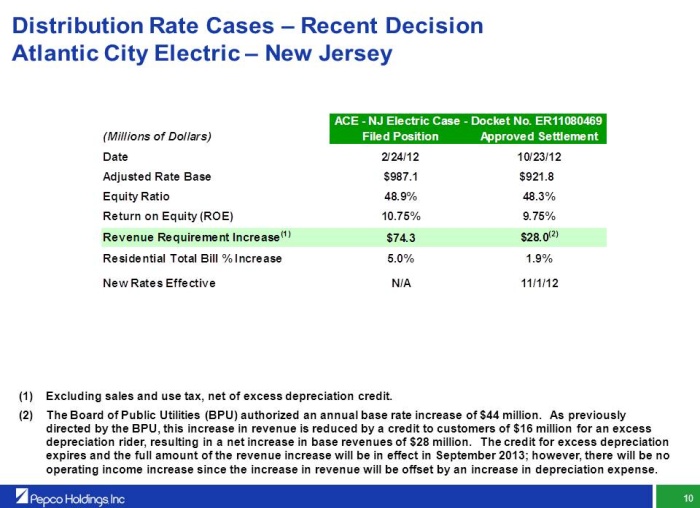

Distribution Rate Cases – Recent Decision Atlantic City Electric – New Jersey

ACE - NJ Electric Case - Docket No. ER11080469 (Millions of Dollars) Filed Position Approved Settlement Date2/24/1210/23/12 Adjusted Rate Base$987.1$921.8 Equity Ratio48.9%48.3% Return on Equity (ROE)10.75%9.75% Revenue Requirement Increase(1) $74.3$28.0(2) Residential Total Bill % Increase5.0%1.9%

New Rates Effective N/A 11/1/12

(1) Excluding sales and use tax, net of excess depreciation credit.

(2) The Board of Public Utilities (BPU) authorized an annual base rate increase of $44 million. As previously directed by the BPU, this increase in revenue is reduced by a credit to customers of $16 million for an excess depreciation rider, resulting in a net increase in base revenues of $28 million. The credit for excess depreciation expires and the full amount of the revenue increase will be in effect in September 2013; however, there will be no operating income increase since the increase in revenue will be offset by an increase in depreciation expense.

10

|

|

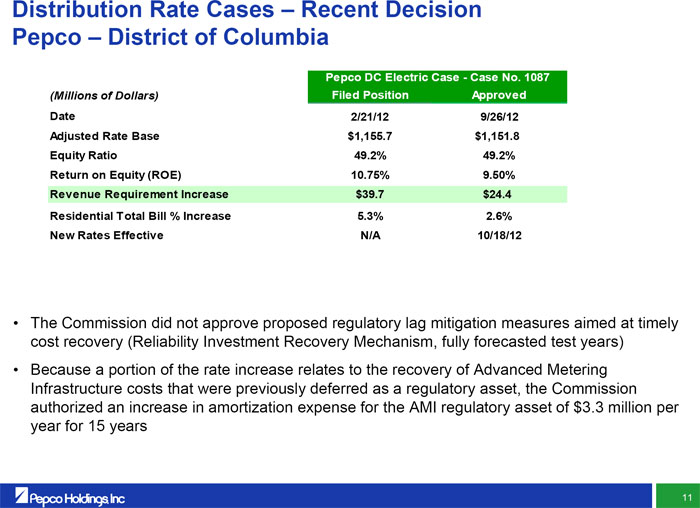

Distribution Rate Cases – Recent Decision Pepco – District of Columbia

Pepco DC Electric Case - Case No. 1087 (Millions of Dollars) Filed Position Approved Date2/21/129/26/12 Adjusted Rate Base$1,155.7$1,151.8 Equity Ratio49.2%49.2% Return on Equity (ROE)10.75%9.50% Revenue Requirement Increase$39.7$24.4 Residential Total Bill % Increase5.3%2.6% New Rates EffectiveN/A10/18/12

• The Commission did not approve proposed regulatory lag mitigation measures aimed at timely cost recovery (Reliability Investment Recovery Mechanism, fully forecasted test years)

• Because a portion of the rate increase relates to the recovery of Advanced Metering Infrastructure costs that were previously deferred as a regulatory asset, the Commission authorized an increase in amortization expense for the AMI regulatory asset of $3.3 million per year for 15 years

11

|

|

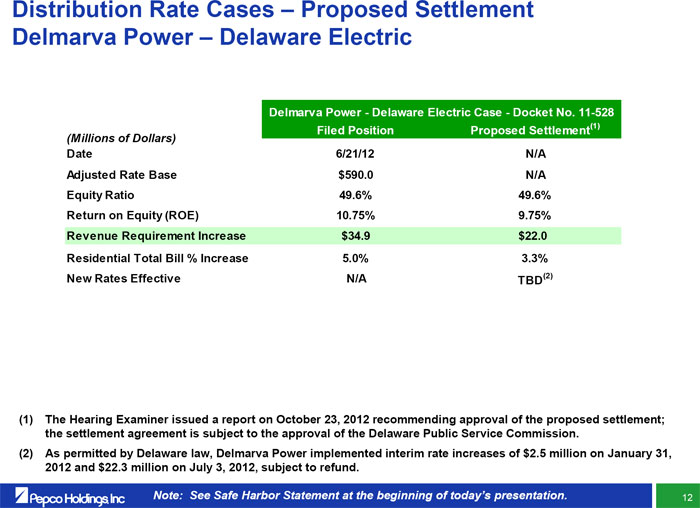

Distribution Rate Cases – Proposed Settlement Delmarva Power – Delaware Electric

Delmarva Power - Delaware Electric Case - Docket No. 11-528 Filed Position Proposed Settlement(1)

(Millions of Dollars)

Date 6/21/12 N/A Adjusted Rate Base $590.0 N/A Equity Ratio 49.6% 49.6% Return on Equity (ROE)10.75%9.75% Revenue Requirement Increase$34.9$22.0 Residential Total Bill % Increase5.0%3.3% New Rates EffectiveN/ATBD(2)

(1) The Hearing Examiner issued a report on October 23, 2012 recommending approval of the proposed settlement; the settlement agreement is subject to the approval of the Delaware Public Service Commission.

(2) As permitted by Delaware law, Delmarva Power implemented interim rate increases of $2.5 million on January 31, 2012 and $22.3 million on July 3, 2012, subject to refund.

Note: See Safe Harbor Statement at the beginning of today’s presentation.

12

|

|

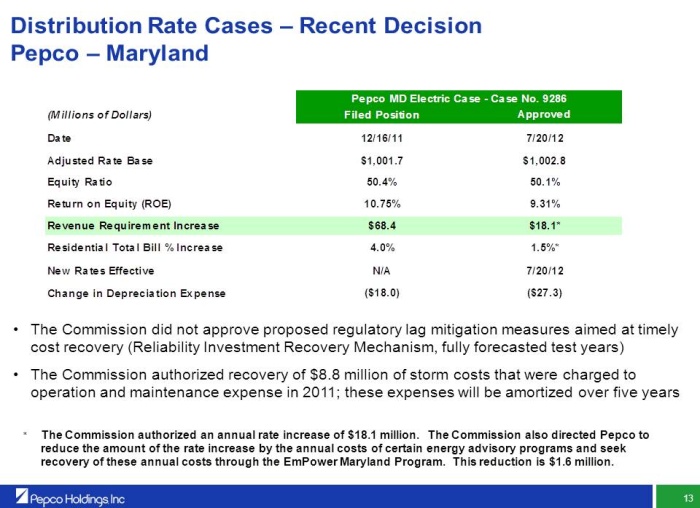

Distribution Rate Cases – Recent Decision Pepco – Maryland

Pepco MD Electric Case - Case No. 9286 (Millions of Dollars) Filed Position Approved

Date 12/16/11 7/20/12

Adjusted Rate Base $1,001.7 $1,002.8 Equity Ratio 50.4% 50.1% Return on Equity (ROE) 10.75%9.31% Revenue Requirement Increase$68.4$18.1*

Residential Total Bill % Increase 4.0% 1.5%*

New Rates Effective N/A 7/20/12 Change in Depreciation Expense ($18.0) ($27.3)

• The Commission did not approve proposed regulatory lag mitigation measures aimed at timely cost recovery (Reliability Investment Recovery Mechanism, fully forecasted test years)

• The Commission authorized recovery of $8.8 million of storm costs that were charged to operation and maintenance expense in 2011; these expenses will be amortized over five years

* The Commission authorized an annual rate increase of $18.1 million. The Commission also directed Pepco to reduce the amount of the rate increase by the annual costs of certain energy advisory programs and seek recovery of these annual costs through the EmPower Maryland Program. This reduction is currently estimated at $1.5 million.

13

|

|

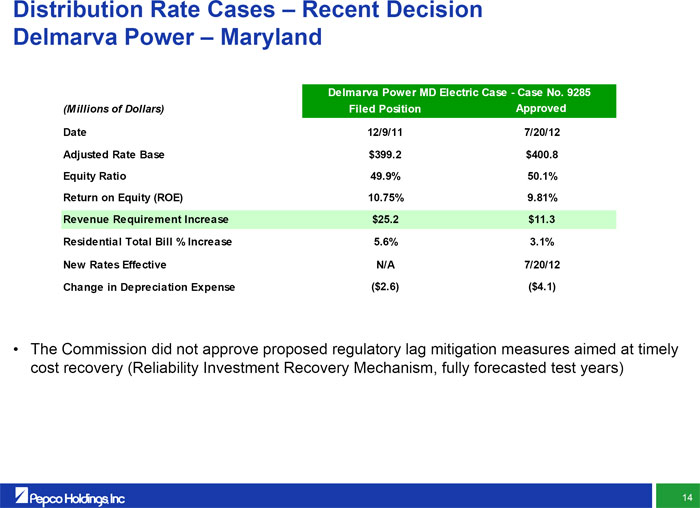

Distribution Rate Cases – Recent Decision Delmarva Power – Maryland

Delmarva Power MD Electric Case - Case No. 9285 (Millions of Dollars) Filed Position Approved

Date 12/9/11 7/20/12

Adjusted Rate Base $399.2 $400.8 Equity Ratio 49.9% 50.1% Return on Equity (ROE) 10.75%9.81% Revenue Requirement Increase$25.2$11.3

Residential Total Bill % Increase 5.6% 3.1%

New Rates Effective N/A 7/20/12 Change in Depreciation Expense ($2.6) ($4.1)

• The Commission did not approve proposed regulatory lag mitigation measures aimed at timely cost recovery (Reliability Investment Recovery Mechanism, fully forecasted test years)

14

|

|

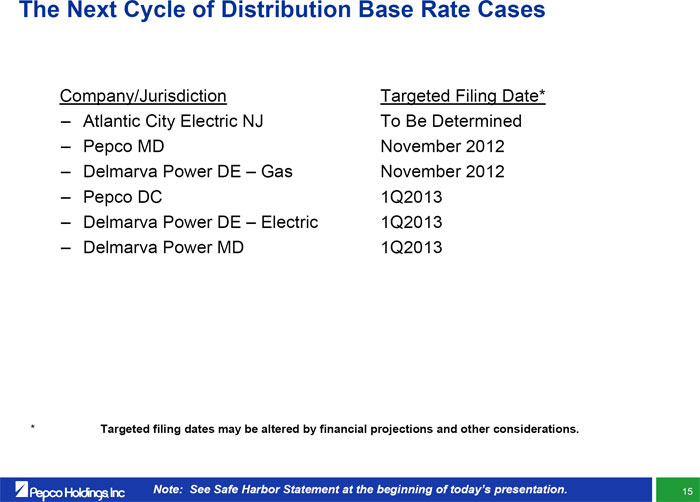

The Next Cycle of Distribution Base Rate Cases

Company/Jurisdiction Targeted Filing Date*

– Atlantic City Electric NJ To Be Determined

– Pepco MD November 2012

– Delmarva Power DE – Gas November 2012

– Pepco DC 1Q2013

– Delmarva Power DE – Electric 1Q2013

– Delmarva Power MD 1Q2013

* Targeted filing dates may be altered by financial projections and other considerations.

Note: See Safe Harbor Statement at the beginning of today’s presentation.

15

|

|

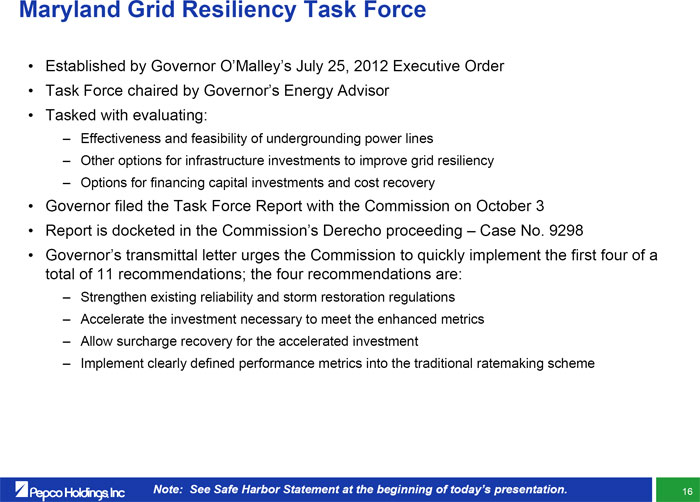

Maryland Grid Resiliency Task Force

• Established by Governor O’Malley’s July 25, 2012 Executive Order

• Task Force chaired by Governor’s Energy Advisor

• Tasked with evaluating:

– Effectiveness and feasibility of undergrounding power lines

– Other options for infrastructure investments to improve grid resiliency

– Options for financing capital investments and cost recovery

• Governor filed the Task Force Report with the Commission on October 3

• Report is docketed in the Commission’s Derecho proceeding – Case No. 9298

• Governor’s transmittal letter urges the Commission to quickly implement the first four of a total of 11 recommendations; the four recommendations are:

– Strengthen existing reliability and storm restoration regulations

– Accelerate the investment necessary to meet the enhanced metrics

– Allow surcharge recovery for the accelerated investment

– Implement clearly defined performance metrics into the traditional ratemaking scheme

Note: See Safe Harbor Statement at the beginning of today’s presentation.

16

|

|

District of Columbia Power Line Undergrounding Task Force

• Established by Mayor Gray’s August 16, 2012 Executive Order

• Task Force co-chaired by PHI’s CEO, Joe Rigby and City Administrator, Allen Lew

• Tasked with evaluating:

– General causes of storm-related power outages

– Actions that may be taken to reduce future storm-related outages

– Issues related to the undergrounding of power lines to improve electric system reliability

• Task force meetings began in August

• Written report is due to Mayor Gray by January 31, 2013

Note: See Safe Harbor Statement at the beginning of today’s presentation.

17

|

|

Pepco Energy Services – Overview

PES provides institutional and government customers with competitive energy efficiency services

•Energy Efficiency

– A leading developer of energy efficiency projects

– Since 1995, completed $1 billion of energy efficiency projects

– Own and operate 12 MW of renewable energy facilities

•Combined Heat and Power (CHP)/Thermal

– Develop, operate, and maintain CHP and thermal energy plants • Energy Supply

– Wind-down to be completed no later than

•W.A. Chester 2014

– Primarily underground high voltage

– Two peaking power plants were successfully transmission construction for utilitiesretired in the second quarter 2012

Note: See Safe Harbor Statement at the beginning of today’s presentation.

18

|

|

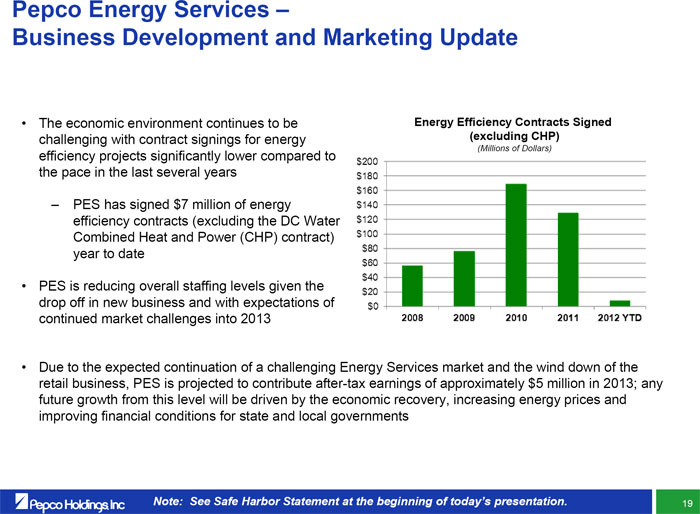

Pepco Energy Services –

Business Development and Marketing Update

• The economic environment continues to be Energy Efficiency Contracts Signed challenging with contract signings for energy(excluding CHP)

(Millions of Dollars)

efficiency projects significantly lower compared to the pace in the last several years

– PES has signed $7 million of energy efficiency contracts (excluding the DC Water Combined Heat and Power (CHP) contract) year to date

• PES is reducing overall staffing levels given the drop off in new business and with expectations of continued market challenges into 2013

• Due to the expected continuation of a challenging Energy Services market and the wind down of the retail business, PES is projected to contribute after-tax earnings of approximately $5 million in 2013; any future growth from this level will be driven by the economic recovery, increasing energy prices and improving financial conditions for state and local governments

Note: See Safe Harbor Statement at the beginning of today’s presentation.

19

|

|

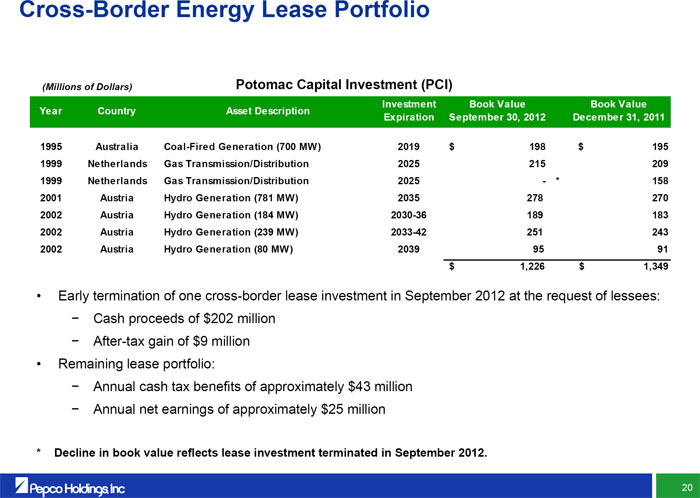

Cross-Border Energy Lease Portfolio

(Millions of Dollars) Potomac Capital Investment (PCI)

Investment Book Value Book Value Year Country Asset Description Expiration September 30, 2012December 31, 2011

1995 Australia Coal-Fired Generation (700 MW) 2019 $ 198 $ 195 1999 Netherlands Gas Transmission/Distribution2025215 209 1999Netherlands Gas Transmission/Distribution2025 - * 158 2001AustriaHydro Generation (781 MW)2035 278 270 2002AustriaHydro Generation (184 MW)2030-36 189 183 2002AustriaHydro Generation (239 MW)2033-42 251 243 2002AustriaHydro Generation (80 MW)2039 95 91

$ 1,226 $ 1,349

• Early termination of one cross-border lease investment in September 2012 at the request of lessees:

Cash proceeds of $202 million

After-tax gain of $9 million

• Remaining lease portfolio:

Annual cash tax benefits of approximately $43 million

Annual net earnings of approximately $25 million

* Decline in book value reflects lease investment terminated in September 2012.

20

|

|

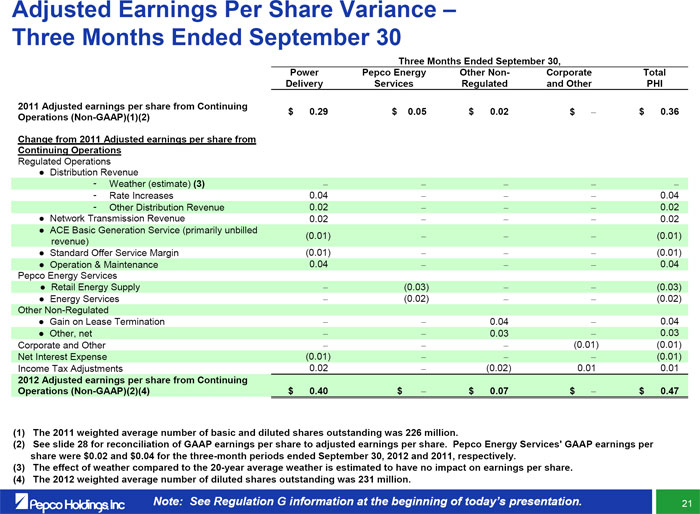

Adjusted Earnings Per Share Variance –Three Months Ended September 30

Three Months Ended September 30,

Power Pepco Energy Other Non- Corporate Total DeliveryServices Regulatedand OtherPHI

2011 Adjusted earnings per share from Continuing

$ 0.29 $ 0.05 $ 0.02 $ $ 0.36 Operations (Non-GAAP)(1)(2)

Change from 2011 Adjusted earnings per share from

Continuing Operations

Regulated Operations

Distribution Revenue

- Weather (estimate) (3)

- Rate Increases 0.04 0.04

- Other Distribution Revenue 0.02 0.02

Network Transmission Revenue 0.02 0.02

● ACE Basic Generation Service (primarily unbilled

(0.01) (0.01) revenue)

Standard Offer Service Margin (0.01) (0.01)

● Operation & Maintenance 0.04 0.04 Pepco Energy Services

Retail Energy Supply (0.03) (0.03)

● Energy Services (0.02) (0.02) Other Non-Regulated

● Gain on Lease Termination 0.04 0.04

● Other, net 0.03 0.03 Corporate and Other (0.01)(0.01) Net Interest Expense(0.01)(0.01) Income Tax Adjustments0.02(0.02)0.010.01

2012 Adjusted earnings per share from Continuing

Operations (Non-GAAP)(2)(4) $ 0.40 $ $ 0.07 $ $ 0.47

(1) The 2011 weighted average number of basic and diluted shares outstanding was 226 million.

(2) See slide 28 for reconciliation of GAAP earnings per share to adjusted earnings per share. Pepco Energy Services’ GAAP earnings per share were $0.02 and $0.04 for the three-month periods ended September 30, 2012 and 2011, respectively.

(3) The effect of weather compared to the 20-year average weather is estimated to have no impact on earnings per share. (4) The 2012 weighted average number of diluted shares outstanding was 231 million.

Note: See Regulation G information at the beginning of today’s presentation.

21

|

|

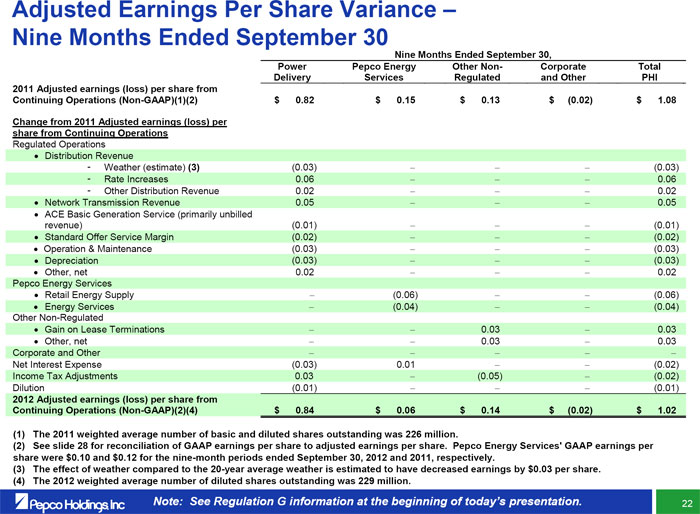

Adjusted Earnings Per Share Variance –Nine Months Ended September 30

Nine Months Ended September 30,

Power Pepco Energy Other Non- Corporate Total Delivery ServicesRegulatedand OtherPHI 2011 Adjusted earnings (loss) per share from Continuing Operations (Non-GAAP)(1)(2)$ 0.82$ 0.15$ 0.13$ (0.02) $ 1.08

Change from 2011 Adjusted earnings (loss) per share from Continuing Operations Regulated Operations

• Distribution Revenue

- Weather (estimate) (3) (0.03) (0.03)

- Rate Increases 0.06 0.06

- Other Distribution Revenue 0.02 0.02

• Network Transmission Revenue 0.05 0.05

ACE Basic Generation Service (primarily unbilled revenue) (0.01) (0.01)

• Standard Offer Service Margin (0.02) (0.02)

• Operation & Maintenance (0.03) (0.03)

• Depreciation (0.03) (0.03)

Other, net 0.02 0.02 Pepco Energy Services

• Retail Energy Supply (0.06) (0.06)

Energy Services (0.04) (0.04) Other Non-Regulated

Gain on Lease Terminations 0.03 0.03

Other, net 0.03 0.03 Corporate and Other Net Interest Expense(0.03)0.01(0.02) Income Tax Adjustments 0.03(0.05)(0.02) Dilution (0.01) (0.01)

2012 Adjusted earnings (loss) per share from

Continuing Operations (Non-GAAP)(2)(4) $ 0.84 $ 0.06 $ 0.14 $ (0.02)$ 1.02

(1) The 2011 weighted average number of basic and diluted shares outstanding was 226 million.

(2) See slide 28 for reconciliation of GAAP earnings per share to adjusted earnings per share. Pepco Energy Services’ GAAP earnings per share were $0.10 and $0.12 for the nine-month periods ended September 30, 2012 and 2011, respectively. (3) The effect of weather compared to the 20-year average weather is estimated to have decreased earnings by $0.03 per share.

(4) The 2012 weighted average number of diluted shares outstanding was 229 million.

Note: See Regulation G information at the beginning of today’s presentation.

22

|

|

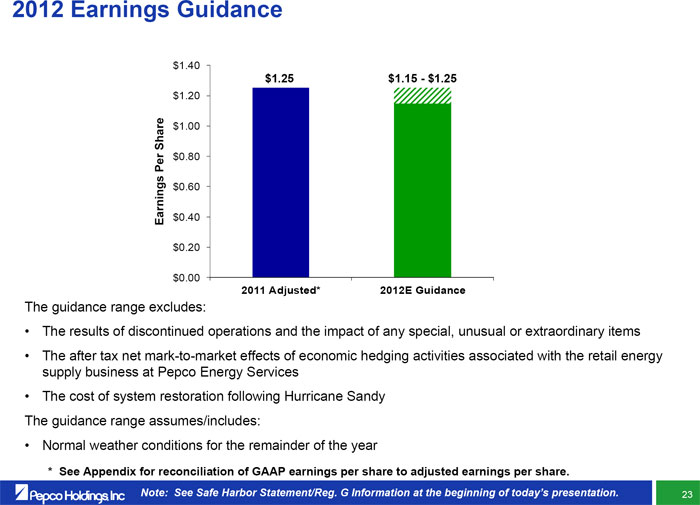

2012 Earnings Guidance

$1.40 $1.25 $1.15 - $1.25 $1.20

$1.00

$0.80

$0.60

Earnings Per Share $0.40 $0.20

$0.00

2011 Adjusted* 2012E Guidance

The guidance range excludes:

• The results of discontinued operations and the impact of any special, unusual or extraordinary items

• The after tax net mark-to-market effects of economic hedging activities associated with the retail energy supply business at Pepco Energy Services

• The cost of system restoration following Hurricane Sandy The guidance range assumes/includes:

• Normal weather conditions for the remainder of the year

* See Appendix for reconciliation of GAAP earnings per share to adjusted earnings per share.

Note: See Safe Harbor Statement/Reg. G Information at the beginning of today’s presentation

23

|

|

Investment Highlights

• Stable Earnings Base – Derived primarily from regulated utility business

• Long-term Earnings Growth – Driven by T&D utility infrastructure investments and reasonable regulatory outcomes

– Power Delivery – 9% CAGR of Rate Base (2012 – 2017)

• Financial Strength – Strong balance sheet, ample liquidity, solid investment grade credit ratings

• Secure Dividend – Attractive current yield

• Experienced Team – Delivering on commitments

PHI – Well Positioned to Deliver Value

Note: See Safe Harbor Statement at the beginning of today’s presentation.

24

|

|

Appendix |

|

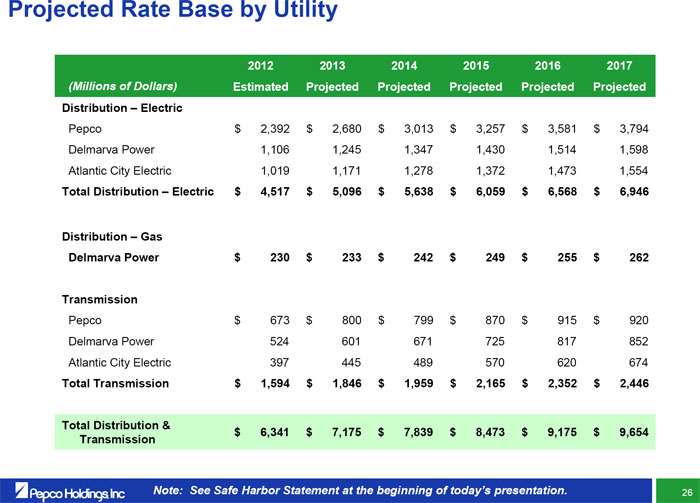

Projected Rate Base by Utility

2012 2013 2014 2015 2016 2017 (Millions of Dollars) Estimated Projected Projected ProjectedProjectedProjected Distribution – Electric

Pepco $ 2,392 $ 2,680 $ 3,013 $ 3,257 $ 3,581 $ 3,794 Delmarva Power 1,106 1,245 1,347 1,430 1,5141,598 Atlantic City Electric1,0191,1711,2781,3721,4731,554

Total Distribution – Electric $ 4,517 $ 5,096 $ 5,638 $ 6,059 $ 6,568 $ 6,946

Distribution – Gas

Delmarva Power $ 230 $ 233 $ 242 $ 249 $ 255 $ 262

Transmission

Pepco $ 673 $ 800 $ 799 $ 870 $ 915 $ 920 Delmarva Power 524 601 671 725 817 852 Atlantic City Electric397445489570620674

Total Transmission $ 1,594 $ 1,846 $ 1,959 $ 2,165 $ 2,352 $ 2,446

Total Distribution &

$ 6,341 $ 7,175 $ 7,839 $ 8,473 $ 9,175 $ 9,654 Transmission

Note: See Safe Harbor Statement at the beginning of today’s presentation.

26

|

|

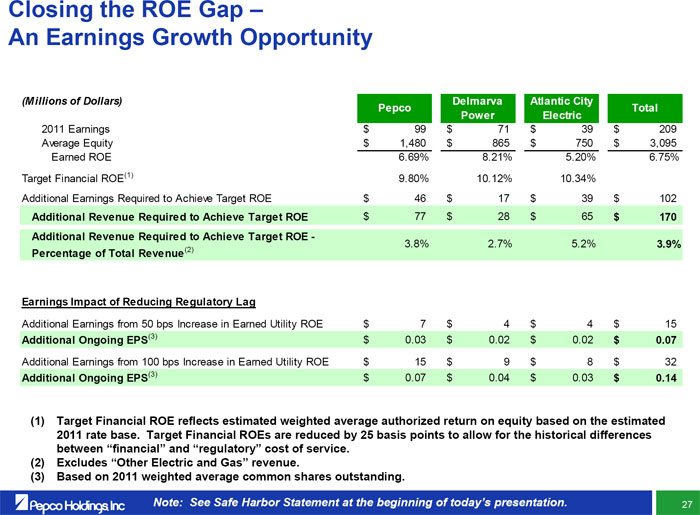

Closing the ROE Gap –

An Earnings Growth Opportunity

(Millions of Dollars) Delmarva Atlantic City

Pepco Total Power Electric

2011 Earnings $ 99 $ 71 $ 39 $ 209 Average Equity $ 1,480 $ 865 $ 750 $ 3,095 Earned ROE6.69%8.21%5.20%6.75% Target Financial ROE(1) 9.80% 10.12% 10.34% Additional Earnings Required to Achieve Target ROE $ 46 $ 17 $ 39 $ 102

Additional Revenue Required to Achieve Target ROE $ 77 $ 28 $ 65 $ 170 Additional Revenue Required to Achieve Target ROE -

3.8% 2.7% 5.2% 3.9% Percentage of Total Revenue(2)

Earnings Impact of Reducing Regulatory Lag

Additional Earnings from 50 bps Increase in Earned Utility ROE $ 7 $ 4 $ 4 $ 15 Additional Ongoing EPS(3) $ 0.03 $ 0.02 $ 0.02 $ 0.07 Additional Earnings from 100 bps Increase in Earned Utility ROE $ 15 $ 9 $ 8 $ 32 Additional Ongoing EPS(3) $ 0.07 $ 0.04 $ 0.03 $ 0.14

(1) Target Financial ROE reflects estimated weighted average authorized return on equity based on the estimated 2011 rate base. Target Financial ROEs are reduced by 25 basis points to allow for the historical differences between “financial” and “regulatory” cost of service.

(2) Excludes “Other Electric and Gas” revenue.

(3) Based on 2011 weighted average common shares outstanding.

Note: See Safe Harbor Statement at the beginning of today’s presentation.

27

|

|

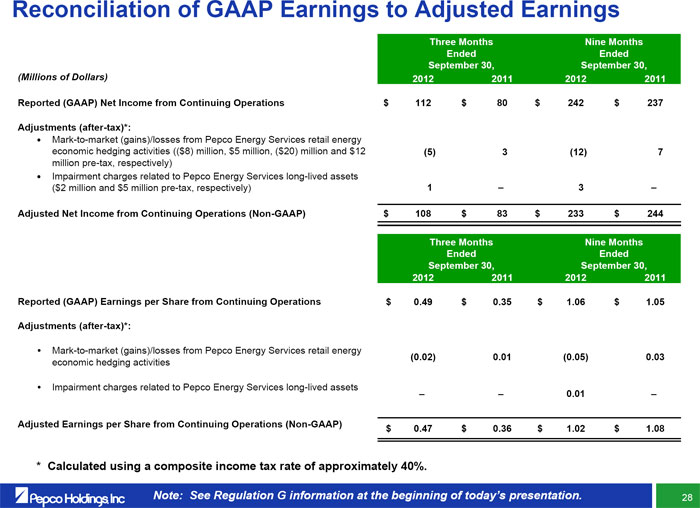

Reconciliation of GAAP Earnings to Adjusted Earnings

Three Months Nine Months Ended Ended September 30, September 30,

(Millions of Dollars) 2012 2011 2012 2011

Reported (GAAP) Net Income from Continuing Operations $ 112 $ 80 $ 242 $237

Adjustments (after-tax)*:

• Mark-to-market (gains)/losses from Pepco Energy Services retail energy economic hedging activities (($8) million, $5 million, ($20) million and $12(5)3(12)7 million pre-tax, respectively)

• Impairment charges related to Pepco Energy Services long-lived assets

($2 million and $5 million pre-tax, respectively) 1 – 3 –

Adjusted Net Income from Continuing Operations (Non-GAAP) $ 108 $ 83 $ 233$244

Three Months Nine Months Ended Ended September 30, September 30, 2012 2011 2012 2011

Reported (GAAP) Earnings per Share from Continuing Operations $ 0.49 $ 0.35 $ 1.06$1.05

Adjustments (after-tax)*:

• Mark-to-market (gains)/losses from Pepco Energy Services retail energy

(0.02) 0.01 (0.05) 0.03 economic hedging activities

• Impairment charges related to Pepco Energy Services long-lived assets

– – 0.01 –

Adjusted Earnings per Share from Continuing Operations (Non-GAAP)

$ 0.47 $ 0.36 $ 1.02 $ 1.08

* Calculated using a composite income tax rate of approximately 40%.

Note: See Regulation G information at the beginning of today’s presentation.

28

|

|

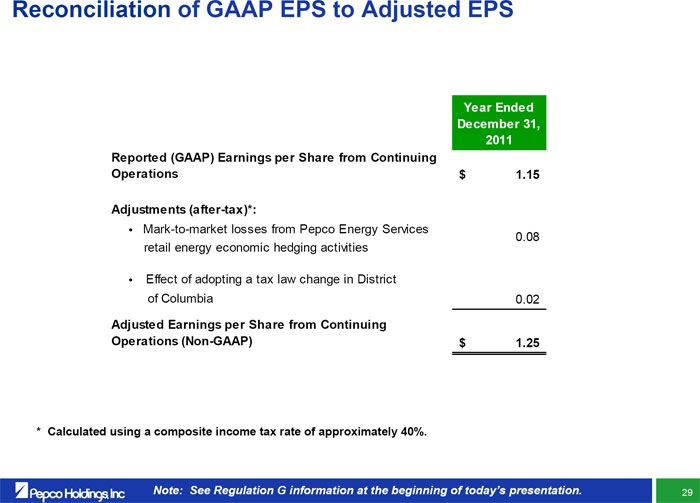

Reconciliation of GAAP EPS to Adjusted EPS

Year Ended December 31, 2011 Reported (GAAP) Earnings per Share from Continuing Operations $ 1.15

Adjustments (after-tax)*:

• Mark-to-market losses from Pepco Energy Services

0.08 retail energy economic hedging activities

• Effect of adopting a tax law change in District of Columbia 0.02

Adjusted Earnings per Share from Continuing

Operations (Non-GAAP) $ 1.25

* Calculated using a composite income tax rate of approximately 40%.

Note: See Regulation G information at the beginning of today’s presentation.

29

|