Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Wendy's Co | d433700d8k.htm |

Third Quarter

2012 Earnings

Conference Call

November 8, 2012

©2012 Oldemark LLC

1

Exhibit 99.1 |

JOHN

BARKER

CHIEF COMMUNICATIONS OFFICER

2 |

The Wendy’s Company

Today’s Agenda

The Wendy’s Company

Opening Comments

Emil Brolick

Financial Update

Steve Hare

CEO Overview

Emil Brolick

Q&A

3 |

Forward-Looking Statements and

Non-GAAP Financial Measures

4

The Wendy’s Company

This presentation, and certain information that management may discuss in connection

with this presentation, contains certain statements that are not

historical facts, including information concerning possible or assumed future

results of our operations. Those statements constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform

Act of 1995 (The “Reform Act”). For all forward-looking statements, we claim the protection of the safe harbor for forward-looking

statements contained in the Reform Act.

Many important factors could affect our future results and could cause those results to

differ materially from those expressed in or implied by our forward-looking

statements. Such factors, all of which are difficult or impossible to predict accurately, and many of which are beyond our

control, include but are not limited to those identified under the caption

“Forward-Looking Statements” in our news release issued on

November 8, 2012 and in the “Special Note Regarding Forward-Looking Statements

and Projections” and “Risk Factors” sections of our most recent

Form 10-K / Form 10-Qs. In addition, this presentation and certain

information management may discuss in connection with this presentation reference non-GAAP financial

measures, such as adjusted earnings before interest, taxes, depreciation and

amortization, or adjusted EBITDA, and adjusted earnings per share. Adjusted

EBITDA and adjusted earnings per share exclude certain expenses, net of certain benefits. Reconciliations of non-GAAP financial

measures to the most directly comparable GAAP financial measures are provided in the

Appendix to this presentation, and are included in our news release issued on

November 8, 2012 and posted on www.aboutwendys.com. |

EMIL

BROLICK

PRESIDENT & CHIEF EXECUTIVE OFFICER

5 |

The Wendy’s Company

6

Core Organic

Growth

Strategies

Shareholder

Value-Enhancing

Initiatives

North America Same-Store Sales Growth

North America Same-Store Sales Growth

Image / Experience Activation

Image / Experience Activation

New Restaurant Development

Restaurant Utilization

& Daypart Expansion

Global Growth

Global Growth

Financial Management

Financial Management

Restaurant Ownership

Restaurant Ownership

Optimization

Optimization |

The Wendy’s Company

Recipe to Win Working!

Reaffirming 2012 Outlook …

Solid Growth Expected in 2013 |

The Wendy’s Company

Making Significant Progress

on Image Activation |

The Wendy’s Company

Sixth Consecutive

Quarter of Positive SSS |

The Wendy’s Company

RECIPE TO WIN

PEOPLE

PEOPLE

5-Star Athletes

5-Star Athletes

PRICE

PRICE

New QSR Quality at QSR Price

New QSR Quality at QSR Price

PRODUCT

PRODUCT

Play a different game. Superior

Play a different game. Superior

perceived quality, competitive price.

perceived quality, competitive price.

PROMOTION

PROMOTION

Strategically driven, tactically brilliant

Strategically driven, tactically brilliant

PLACE

PLACE

The complete brand experience

The complete brand experience

PERFORMANCE

PERFORMANCE

Keeping the brand promise

Keeping the brand promise

The Wendy’s Company

10 |

The Wendy’s Company

Long-Term Adjusted EBITDA and

Adjusted EPS Growth:

High Single-Digit to Low Double-Digit Range

|

The Wendy’s Company

Free Cash Flow &

Flexibility of Our Balance Sheet |

The Wendy’s Company

100% increase in dividend

$100 million share

repurchase program |

STEVE

HARE

CHIEF FINANCIAL OFFICER

14 |

Q3 2012 Financial Highlights

Company

Restaurant Margin

Q3 2012 13.9%

Q3 2011 13.7%

+20 bps

15

North America

Same-Store Sales

Company-Operated +2.7%

Franchise

+2.9%

Systemwide

+2.8% August –

September

July –

August |

Q3 2012 Financial Summary

Q3 2012

Q3 2011

Better/

(Worse)

Sales

558.3

$

534.5

$

23.8

$

Franchise revenues

78.0

76.9

1.1

Total revenues

636.3

$

611.4

$

24.9

$

Adjusted EBITDA from continuing operations*

84.5

$

87.0

$

(2.5)

$

(Unaudited)

($ in millions)

16

*See reconciliation of Adjusted EBITDA from continuing operations in the

appendix. |

Impact of Image Activation on Q3

and Q4 2012 Adjusted EBITDA

Q3

$4 million negative impact from

temporary closure of restaurants and

other costs related to

Image Activation

Q4

Expect positive impact from 47

reimaged restaurants that

re-opened late in Q3 and early in Q4

17 |

Income from Continuing Operations and Special Items

18

(Unaudited)

($ in thousands except per share amounts)

After tax

Per share (b)

After tax

Per share

Adjusted income and adjusted earnings per share from continuing operations (a)

11,300

$

0.03

$

17,563

$

0.05

$

(Less):

Loss on early extinguishment of debt

(30,926)

(0.08)

-

-

Facilities relocation and other transition costs

(6,977)

(0.02)

-

-

Transaction related costs

(89)

(0.00)

(15,019)

(0.04)

Total adjustments

(37,992)

(0.10)

(15,019)

(0.04)

(Loss) income and earnings per share from continuing operations

(26,692)

$

(0.07)

$

2,544

$

0.01

$

Third Quarter

2012

2011

(a)

See reconciliation of Adjusted Income and Adjusted Earnings per Share from

Continuing Operations in the appendix. (b)

Adjusted earnings per share amounts for the third quarter include the dilutive

effect of stock options and restricted shares. The effect of stock options and restricted

shares was excluded from the reported number of shares used to calculate basic

and diluted loss per share, as the impact would have been anti-dilutive. Included in

the

appendix

is

a

reconciliation

of

the

number

of

shares

used

to

calculate

adjusted

earnings

per

share

amounts. |

Financial Management

Financial Management

Global Growth

Global Growth

Restaurant Utilization

& Daypart Expansion

Restaurant Ownership

Restaurant Ownership

Optimization

Optimization

New Restaurant Development

Image / Experience Activation

Image / Experience Activation

North America Same-Store Sales Growth

North America Same-Store Sales Growth

19

Core Organic

Growth

Strategies

Shareholder

Value-Enhancing

Initiatives

The Wendy’s Company |

Free Cash Flow Highlights & Projections

20

(Unaudited)

($ in millions)

3 YearE

2011

2012E

2013E

(Cumulative)

Adjusted EBITDA*

331

$

328

$

355

$

1,014

$

Cash Interest & Taxes

(126)

(121)

(86)

(333)

Operating Cash Flow

205

207

269

681

Base Capital Spending

(96)

(125)

(100)

(321)

Free Cash Flow

109

$

82

$

169

$

360

$

*See reconciliation of Adjusted EBITDA from continuing operations in the

appendix; represents midpoint of current outlook. Because certain income statement items needed to calculate income from

continuing operations vary from quarter to quarter, the Company is unable to

provide projections of income from continuing operations or a reconciliation of projected Adjusted EBITDA from continuing

operations to projected income from continuing operations. |

Capital Allocation to Support Organic

Growth and Returns to Stockholders

Strong cash position

$454 million of cash

Consistent free cash flow generation in excess of base capital

expenditures Expected high return on investment from Image

Activation Flexibility to fund both growth and returns to

stockholders Up to $500 million of capital expenditures committed

to Image Activation through 2015

Increased dividend in Q4 and stock repurchases authorized

21 |

Initiatives to Increase

Stockholder Returns

100 percent increase in quarterly dividend

Q4 increase from $0.02 to $0.04 per share

Payable on Dec. 17 to stockholders of record on Dec. 3

$100 million share repurchase program

22 |

Selected Balance Sheet Highlights

($ in Millions)

Cash

454

$

Senior Debt

1,424

$

Capital Leases and Other Debt

33

Total Debt

1,457

$

TTM Adjusted EBITDA*

318

$

Total Debt / TTM Adjusted EBITDA*

4.6x

Net Debt / TTM Adjusted EBITDA*

3.2x

September 30, 2012

23

*See reconciliation of Adjusted EBITDA from continuing operations in the

appendix. |

2012, 2013 and Long-Term Earnings Outlook

2012

24

Reaffirming

Adjusted EBITDA

from continuing

operations

in a range of

$320 to $335

million

Adjusted EBITDA

from continuing

operations in a

range of

$350 to $360

million

Average annual

Adjusted EBITDA

and Adjusted EPS

growth rates in

high-single-digit

to low-double-

digit range

2013

Long-Term |

EMIL

BROLICK

25 |

Financial Management

Financial Management

Global Growth

Global Growth

Restaurant Utilization

& Daypart Expansion

Restaurant Ownership

Restaurant Ownership

Optimization

Optimization

New Restaurant Development

Image / Experience Activation

Image / Experience Activation

North America Same-Store Sales Growth

North America Same-Store Sales Growth

26

Core Organic

Growth

Strategies

Shareholder

Value-Enhancing

Initiatives

The Wendy’s Company |

27

Delivers “A Cut Above”

brand positioning

•

Creates a great work environment for our restaurant teams

•

Distinguishes Wendy’s from other traditional QSRs

•

Customers tell us they love the restaurants

|

The Wendy’s Company

28

10 Reimages

Average Annualized

Sales +25% |

The Wendy’s Company

Salt Lake City, UT |

30

The Wendy’s Company

Raleigh, NC |

IMAGE

ACTIVATION

BRAND

IMAGE

PEOPLE &

SERVICE

CUSTOMER

EXPERIENCE

FOOD

EXPERIENCE

31 |

Wendy's Brand Transformation

32

Restaurant Signage,

Merchandising,

& Uniforms

Advertising, PR,

Websites, Social Media

& Packaging |

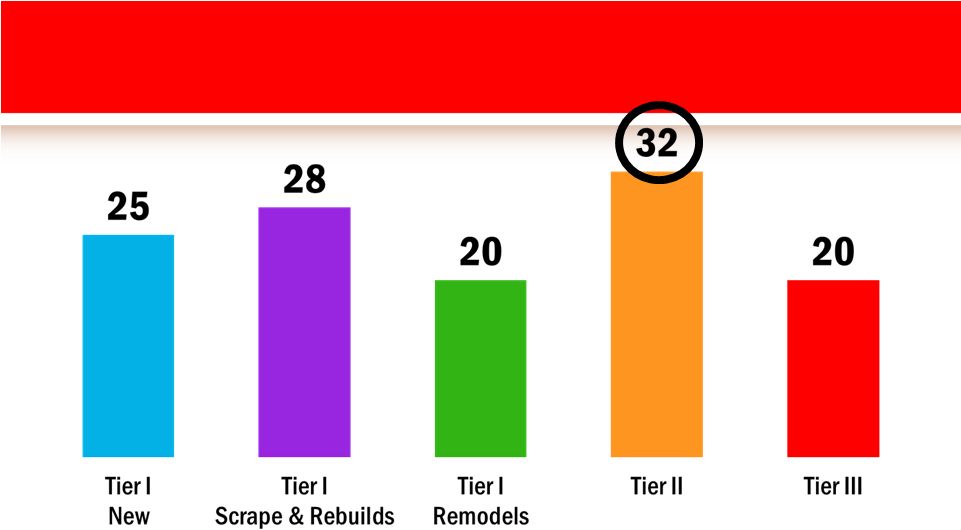

TIER I

TIER II

TIER III

2013: Tiered Design Strategy to Optimize Returns

The Wendy’s Company

Targeted

Investment*

$650 to $750K

$510 to 550K

$375K

Sales Lift

> 25%

20%

7.5%

*Estimates based on Company’s current outlook; excludes maintenance cap ex

and other costs 33 |

The Wendy’s Company

34

Company

100

Reimages

All Tiers

25

New Restaurants

Franchise

Expect

100

Reimages

Majority Tier I

Introduce Tier II and

Tier III Designs

50

New Restaurants

Estimates based on Company’s current outlook

|

Company Image Activation Plan For 2013

100 Reimages and 25 New Restaurants

35 |

The Wendy’s Company

36

Franchise Interest is Growing

Offering incentive for Tier 1 |

The Wendy’s Company

37

Image Activation Expansion

Estimates based on Company’s current outlook

2011

2015

750

50%

of company restaurants

Image Activated

by end of 2015

50%

of company restaurants

Image Activated

by end of 2015

approx.

restaurants |

The Wendy’s Company

38

System Optimization to Yield Multiple

Benefits; Strengthen Overall System

Strong

Franchise

Base

New

Franchisees

Optimal

System

In-market concentration

Restaurant performance

Optimal franchise mix

to maximize value

High-quality operators

Strong, more concentrated

franchise platforms

Ability to image activate

Existing

Company-

Owned

Footprint

The Wendy’s Company |

Financial Management

Global Growth

Restaurant Utilization

& Daypart Expansion

Restaurant Ownership

Optimization

New Restaurant Development

Image / Experience Activation

North America Same-Store Sales Growth

Core Organic

Growth

Strategies

Shareholder

Value-Enhancing

Initiatives

39

The Wendy’s Company |

SOMETHING

TO BUY

SOMETHING

TO BUY INTO

40

MARKETING: DUAL CAMPAIGN LEGS |

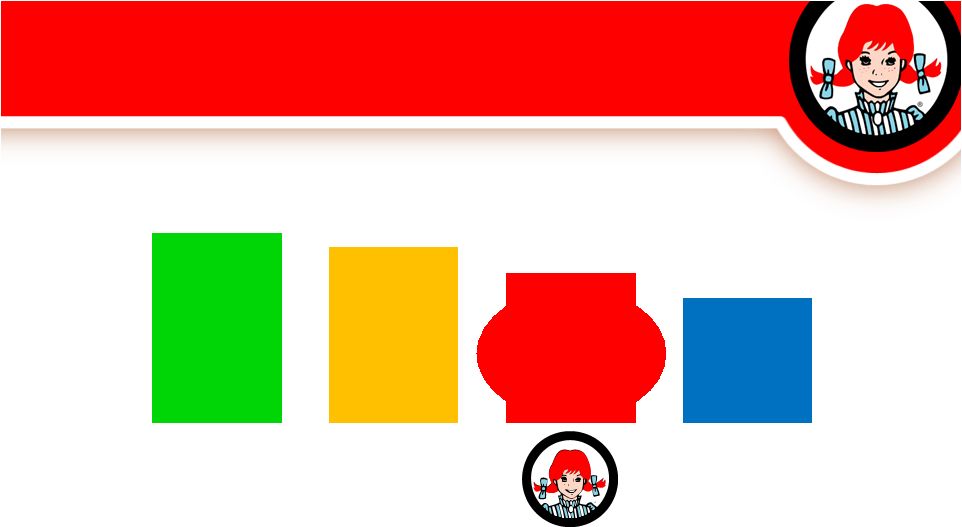

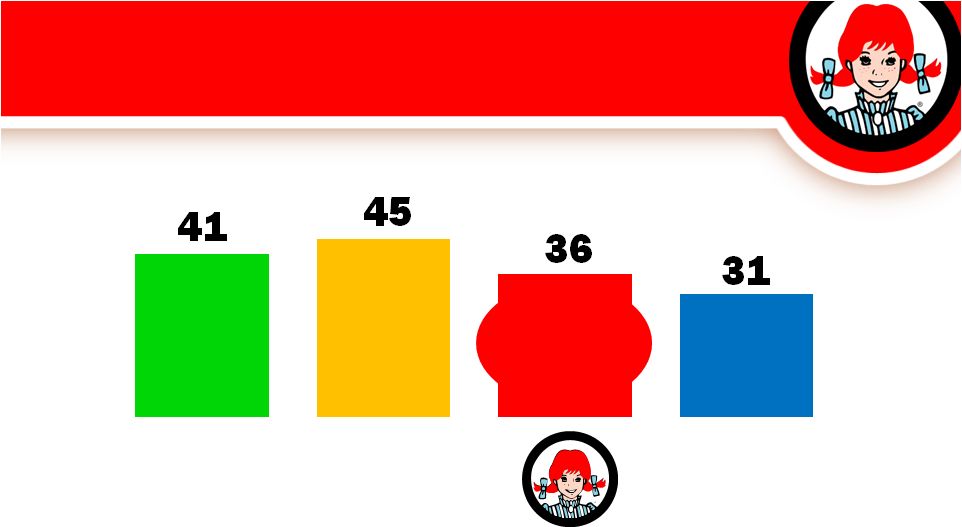

Consumers Remember It!

41

53

49

42

35

AD AWARENESS

+12%

Source: Millward Brown/Brand Health Tracking Study (August 2012 vs. April

2012) QSR HAMBURGER

COMPETITOR A

QSR HAMBURGER

COMPETITOR B

QSR SANDWICH

COMPETITOR A

The Wendy’s Company |

Consumers Respond To It!

42

BRAND CONSIDERATION

+9%

Source: Millward Brown/Brand Health Tracking Study (August 2012 vs. April

2012) QSR HAMBURGER

COMPETITOR A

QSR HAMBURGER

COMPETITOR B

QSR SANDWICH

COMPETITOR A

The Wendy’s Company |

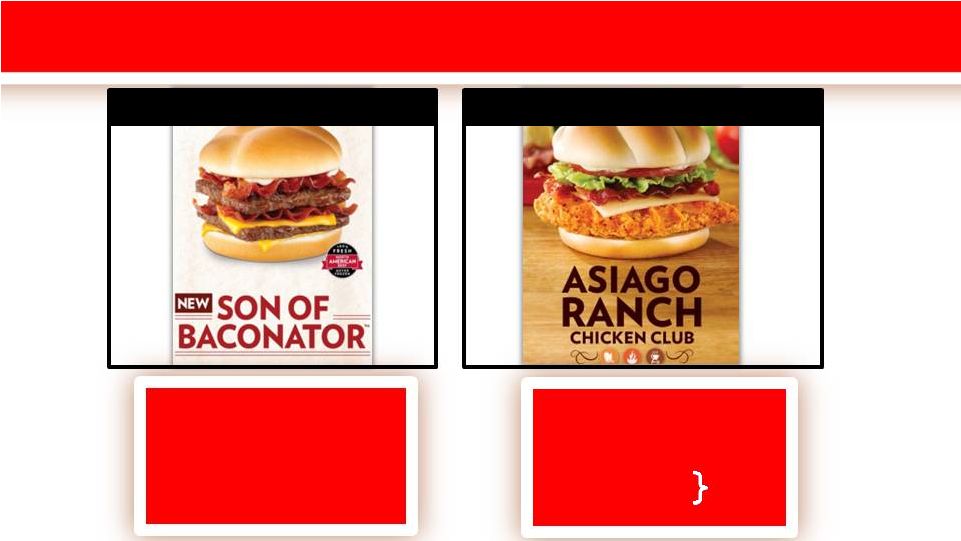

Successful Premium Product Launches

43

Asiago Ranch Chicken Club |

Growing Share in Premium Segments

44

HAMBURGER

CHICKEN

SALADS

JJA’11

SON’11

DJF’12

MAM’12

JJA’12

JJA’12

Source: The NPD Group / CREST

®

NEW QSR

COMPETITOR Y

QSR HAMBURGER

COMPETITOR X |

Recent Awards and Recognition

ZAGAT: #1 Overall Mega Chain

ACSI: #1 in Hamburger Category

You Gov Social Media: #2 Buzz Index

QSR Magazine: Fastest Drive-Thru

Food Network: Chef’s Choice

Trademarks are the property of their respective owners.

45 |

JOHN

BARKER

CHIEF COMMUNICATIONS OFFICER

46 |

The Wendy’s Company

2013 Events

January 16-17:

ICR Conference in Miami, FL

February 28:

Q4 and 2012 Earnings Release

Upcoming Investor Calendar

47 |

Q&A

48 |

49

The Wendy’s Company |

Appendix

50 |

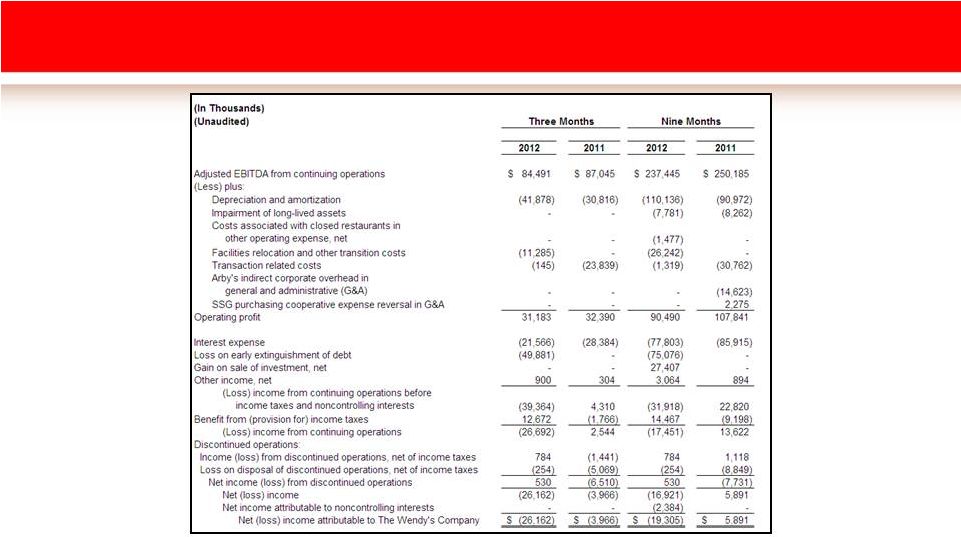

Reconciliation

of

Adjusted

EBITDA

from

Continuing

Operations

to Net (Loss) Income Attributable to The Wendy’s Company

51 |

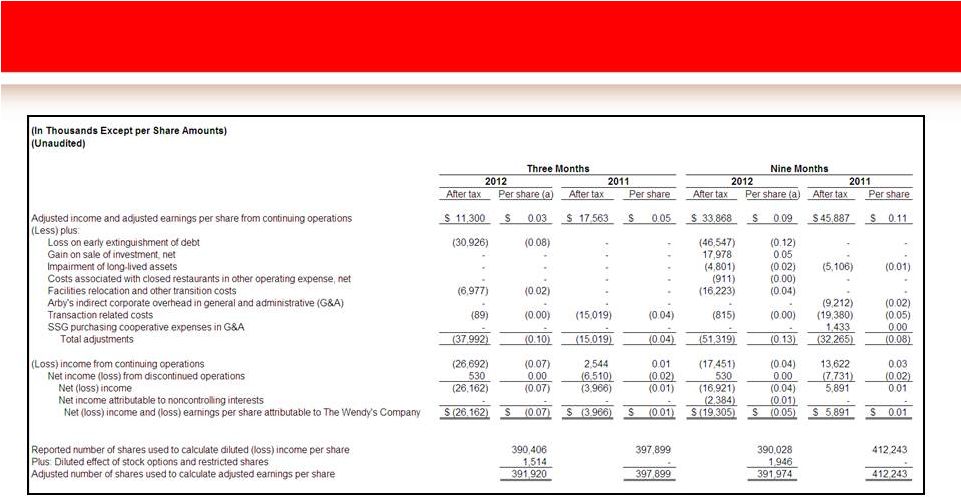

Reconciliation of Adjusted Income and Adjusted Earnings per Share from

Continuing Operations to Net (Loss) Income and Earnings per Share

Attributable to The Wendy’s Company

52

(a)

Adjusted earnings per share amounts for the three and nine months ended

September 30, 2012, include the dilutive effect of stock options and

restricted shares. The effect of stock options and restricted

shares was excluded from the reported number of shares used to calculate basic and diluted loss per share, as

the impact would have been anti-dilutive. Included above is a

reconciliation of the number of shares used to calculate adjusted earnings per share amounts. |