Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Manitex International, Inc. | d434995dex991.htm |

| 8-K - FORM 8-K - Manitex International, Inc. | d434995d8k.htm |

“Focused

manufacturer of

engineered lifting

equipment”

Exhibit 99.2

Manitex International, Inc.

Conference Call

Third Quarter 2012

November 8th, 2012 |

2

Forward Looking Statements &

Non GAAP Measures

“Focused

manufacturer of

engineered lifting

equipment”

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of

1995: This presentation contains statements that are forward-looking in

nature which express the beliefs and expectations of management including

statements regarding the Company’s expected results of operations or liquidity;

statements concerning projections, predictions, expectations, estimates or forecasts

as to our business, financial and operational results and future economic

performance; and statements of management’s goals and objectives and

other similar expressions concerning matters that are not historical facts. In some

cases, you can identify forward-looking statements by terminology such as

“anticipate,” “estimate,”

“plan,”

“project,”

“continuing,”

“ongoing,”

“expect,”

“we believe,”

“we intend,”

“may,”

“will,”

“should,”

“could,”

and similar expressions. Such statements are based on current plans, estimates and

expectations and involve a number of known and unknown risks, uncertainties

and other factors that could cause the Company's future results, performance

or achievements to differ significantly from the results, performance or

achievements expressed or implied by such forward-looking statements. These factors and additional

information are discussed in the Company's filings with the Securities and Exchange

Commission and statements in this presentation should be evaluated in light of

these important factors. Although we believe that these statements are based

upon reasonable assumptions, we cannot guarantee future results.

Forward-looking statements speak only as of the date on which they are made, and

the Company undertakes no obligation to update publicly or revise any

forward-looking statement, whether as a result of new information, future

developments or otherwise. Non-GAAP Measures: Manitex International from

time to time refers to various non-GAAP (generally

accepted accounting principles) financial measures in this presentation.

Manitex believes that this information is useful to understanding its

operating results without the impact of special items. See Manitex’s

Third Quarter 2012 Earnings Release on the Investor Relations section of our website

www.manitexinternational.com

for a description and/or reconciliation of these measures.

|

3

“Focused

manufacturer of

engineered lifting

equipment”

Overview

•

Second consecutive record quarter delivered from benefits of increased

production activities and strong backlog

–

Sales of $53.4 million (44% increase), 2% sequentially

–

Net income of $2.5 million (145% increase)

–

EPS $0.21 (133% increase)

–

EBITDA $5.3 million (70% increase), 10% of sales

•

Our markets remain steady, notwithstanding widespread uncertainty, and we

remain optimistic for growth

–

N.A. energy sector continuing to drive demand for key products, especially

specialized boom trucks and trailers

–

9/30 backlog at $126 million

–

2012 v 2011 ytd investment in R&D increase over 70%.

Continuing to launch new

product to drive future growth

•

On pace to deliver solid increase in sales and profits compared to 2011

–

2012 year to date revenue, net income and EBITDA already exceed 2011 full

year. –

Expectations for full year revenues in excess of $200m, EBITDA growth of

65% |

4

“Focused

manufacturer of

engineered lifting

equipment”

Q3 2012 Business Update

•Market conditions consistent with prior quarter

•Significant degree of uncertainty still exists in N. America, influencing

buying decisions •N. American general construction / housing steady,

but still relatively subdued. Energy still active and positive

outlook •European

markets

continue

to

be

adversely

impacted

from

economic

conditions

and

lack

of

credit

•Selective international markets and sectors remain a positive

opportunity •Product demand profile remains consistent with recent

quarters i.e. still focused on more specialized, higher tonnage units or

industry specific product (e.g. energy). •9/30/12 Backlog $125.8

million •YOY increase 99%, ytd 2012 increase 50%

•Production increases at several facilities have reduced order book as

anticipated, together with some Q3 seasonality impact on order

intake •Broad based order book although boom trucks continue to be

heavily represented •

Strongest

demand

for

our

Manitex

boom

trucks.

Large

tonnage

unit

shipments

up

over

1

20% compared to Q3-2011

•

Specialized trailer demand continues to strengthen in response to continued

product developments and international demand

•

Product development initiatives continuing: Successful October launch event

for Badger 15 ton pick and carry crane targeted for industrial / energy

sector |

5

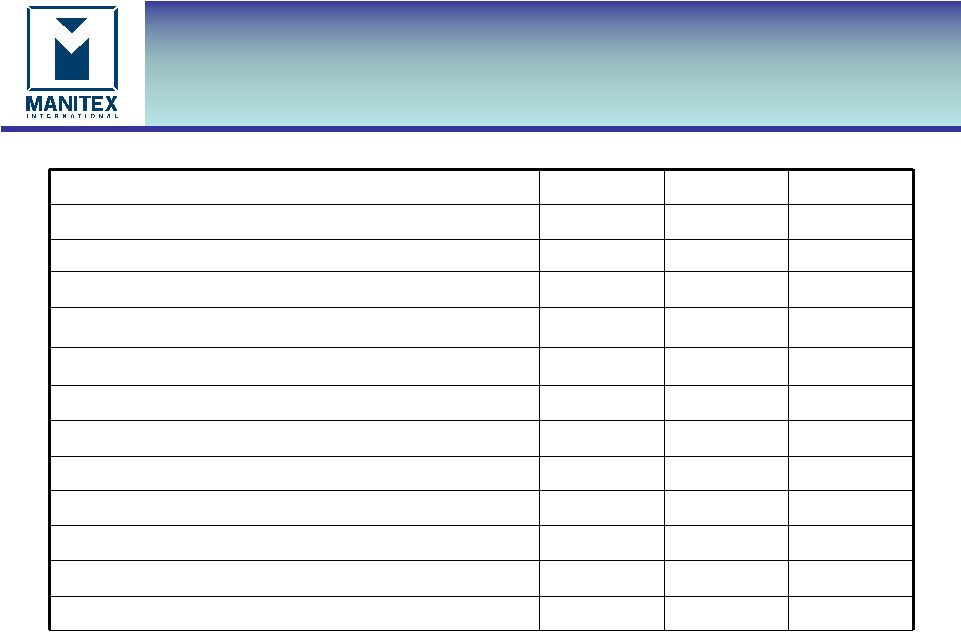

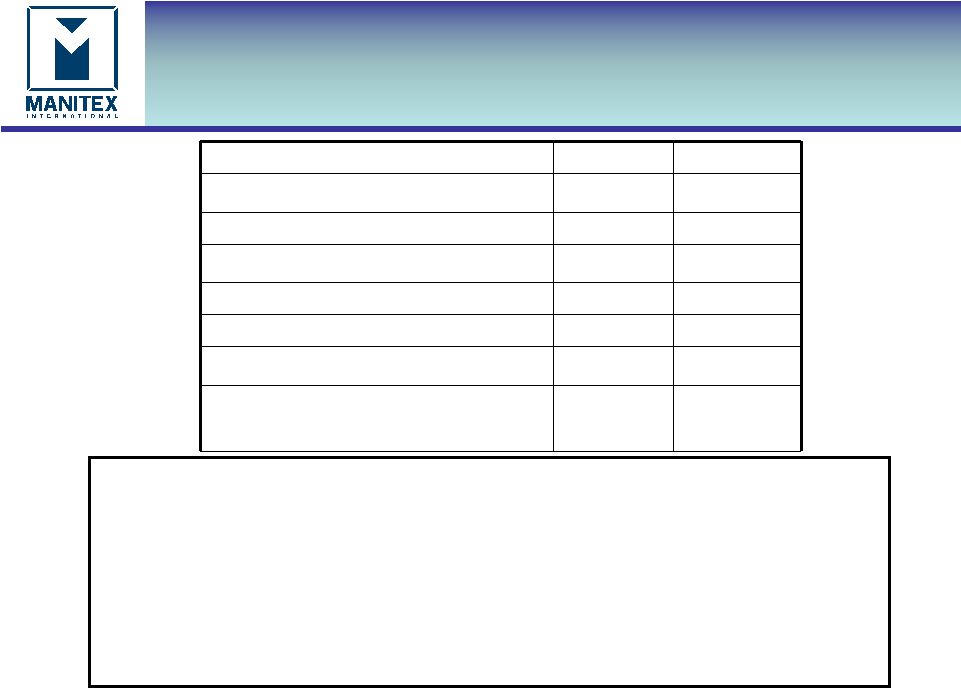

Key Figures -

Quarterly

“Focused

manufacturer of

engineered lifting

equipment”

USD thousands

Q3-2012

Q3-2011

Q2-2012

Net sales

$53,380

$36,942

$52,496

% change in Q3-2012 to prior period

-

44.5%

1.7%

Gross profit

10,810

7,824

10,756

Gross margin %

20.3%

21.2%

20.5%

Operating expenses

6,343

5,591

6,560

Net Income

2,504

1,020

2,308

EBITDA

5,349

3,147

5,116

EBITDA % of Sales

10.0%

8.5%

9.7%

Working Capital

58,795

39,145

52,303

Current Ratio

2.3

2.4

2.2

Backlog

125,785

63,105

149,564

% change in Q3-2012 to prior period

-

99.3%

(15.9%) |

6

“Focused

manufacturer of

engineered lifting

equipment”

Q3-2012 Operating Performance

$m

$m

Q3-2011 Net income

1.0

Gross profit impact of increased sales of $16.4 million

(Q3-2012

sales less Q3-2011 sales at 2011 gross profit % ).

3.5

Impact

from

lower

margin

(Q3-2012

gross

profit

%

-

Q3-2011

gross

profit

% multiplied by Q3-2012 sales)

(0.5)

Increase in gross profit

3.0

Increase in R&D expense

Increase in SG&A expenses

(0.2)

(0.6)

Interest

0.1

Other income / (expense)

(0.1)

Increase in tax

(0.7)

Q3-2012 Net income

$ 2.5 |

7

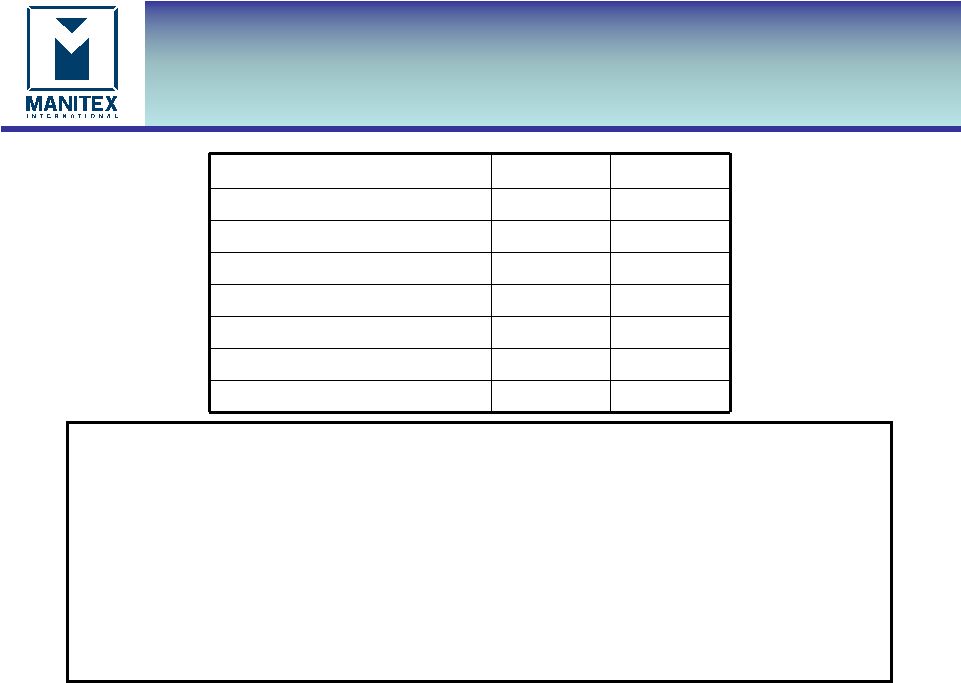

Working Capital

“Focused

manufacturer of

engineered lifting

equipment”

$000

Q3-2012

Q4-2011

Working Capital

$58,795

$41,032

Days sales outstanding (DSO)

57

60

Days payable outstanding (DPO)

65

59

Inventory turns

2.8

2.7

Current ratio

2.3

2.4

Operating working capital

66,556

50,007

Operating working capital % of annualized

LQS

31.2%

34.2%

•Major movements in working capital increase Q3-2012 v Q4 2011 of

$17.8m •Cash ($3.2m), Receivables ($9.2m), inventory ($18.2m) 7

Prepaid ($1.2m), offset by increased accounts payable ($11.3m), and

accrued expenses & other current liabilities ($2.4m)

•Inventory: increases in raw materials ($15.4m) and WIP ($1.5m) to

support growth •Operating working capital % decreased compared to

Q4-2011, as revenue growth was achieved in the quarter as

planned |

8

“Focused

manufacturer of

engineered lifting

equipment”

$000

Q3-2012

Q4-2011

Total Cash

3,305

71

Total Debt

46,304

42,227

Total Equity

57,208

46,794

Net capitalization

100,207

88,950

Net debt / capitalization

42.9%

47.4%

Quarterly EBITDA

5,349

2,876

Quarterly EBITDA % of sales

10.0%

7.9%

•Increase in cash $3.2m

•Increase in debt at 9/30/2012 from 12/31/2011 of $4.1m, ($0.8m net of

cash) •

Increase

in

lines

of

credit,

equipment

finance

and

Italian

working

capital

finance

$10.3m

•

Repayments of $6.4 m on long term debt, including $3.8m paid early during Q2

& Q3- 2012

•N. American revolver facilities, based on available collateral at 9/30/12 was

$38.5m. •N. American revolver availability at 9/30/12 of $6.0m

•July 2012 raised $4.1m (gross) from equity to repay long term debt in

Q3-2012 Debt & Liquidity

•

Net capitalization is the sum of debt plus equity minus cash

•

Net debt is total debt less cash |

9

Summary

“Focused

manufacturer of

engineered lifting

equipment”

•

Niche product and market strategy delivering strong growth

performance

•

Significant production expansion to balance with demand, achieved by

solid execution by team and supply chain.

•

EPS and EBITDA growth continues to outpace revenue growth due to

operating leverage

•

Optimistic outlook.

•

Expect

full

year

2012

to

show

a

solid

increase

compared

to

2011

in

revenue, net income and EBITDA

•

Revenues to exceed $200m in 2012

•

Continued growth and improvements expected in 2013

|