Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HARDINGE INC | a12-26374_18k.htm |

| EX-99.1 - EX-99.1 - HARDINGE INC | a12-26374_1ex99d1.htm |

Exhibit 99.2

|

|

Third Quarter 2012 Financial Results Conference Call November 8, 2012 NASDAQ: HDNG www.hardinge.com Edward J. Gaio Vice President and Chief Financial Officer Richard L. Simons Chairman, President and Chief Executive Officer |

|

|

Safe Harbor Statement This presentation may contain forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended). Any such statements are based upon management’s current expectations that involve risks and uncertainties. Any statements that are not statements of historical fact or that are about future events may be deemed to be forward-looking statements. For example, words such as “may”, “will”, “should”, “estimates”, “predicts”, “potential”, “continue”, “strategy”, “believes”, “anticipates”, “plans”, “expects”, “intends” and similar expressions are intended to identify forward-looking statements. The Company’s actual results or outcomes and the timing of certain events may differ significantly from those discussed in any forward-looking statements. The following factors are among those that could cause actual results to differ materially from the forward-looking statements, which involve risks and uncertainties, and that should be considered in evaluating any such statement: fluctuations in the machine tool business cycles, changes in general economic conditions in the U.S. or internationally, the mix of products sold and the profit margins thereon, the relative success of the Company’s entry into new product and geographic markets, the Company’s ability to manage its operating costs, actions taken by customers such as order cancellations or reduced bookings by customers or distributors, competitor’s actions such as price discounting or new product introductions, governmental regulations and environmental matters, changes in the availability of cost of materials and supplies, the implementation of new technologies and currency fluctuations. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. 2 |

|

|

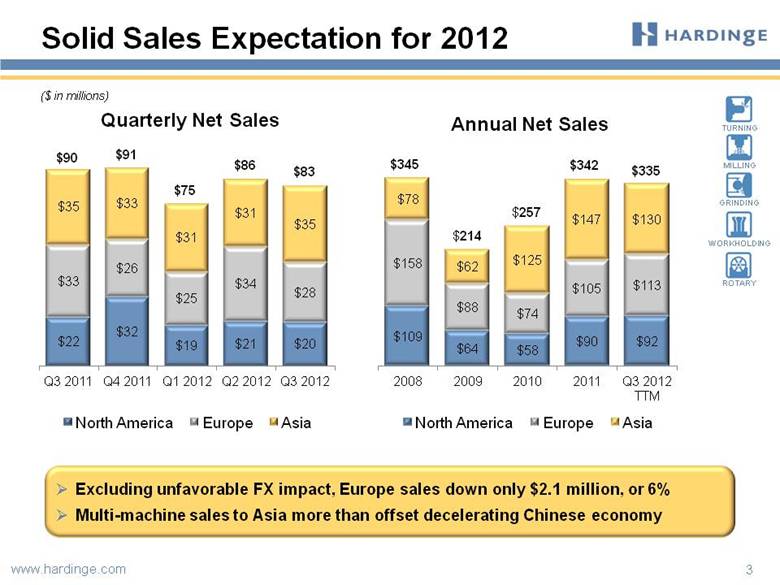

Solid Sales Expectation for 2012 3 ($ in millions) $345 $214 $257 $342 $335 $75 $90 $91 Quarterly Net Sales Annual Net Sales $86 $83 Excluding unfavorable FX impact, Europe sales down only $2.1 million, or 6% Multi-machine sales to Asia more than offset decelerating Chinese economy North America Europe Asia North America Europe Asia |

|

|

Strong Gross Margin Performance 4 Quarterly Sales and Gross Margin Annual Sales and Gross Margin Net Sales (in millions) Improved Q3 2012 gross margin Favorable pricing and product mix drove improved gross margin when compared with last year’s third quarter and the trailing second quarter of 2012 Sales ($ in millions) * Gross Profit and Gross Margin for 2008 and 2009 were adjusted to exclude unusual items. See supplemental slides for Adjusted Gross Profit and Gross Margin reconciliation and other important disclaimers regarding Adjusted Gross Profit and Gross Margin |

|

|

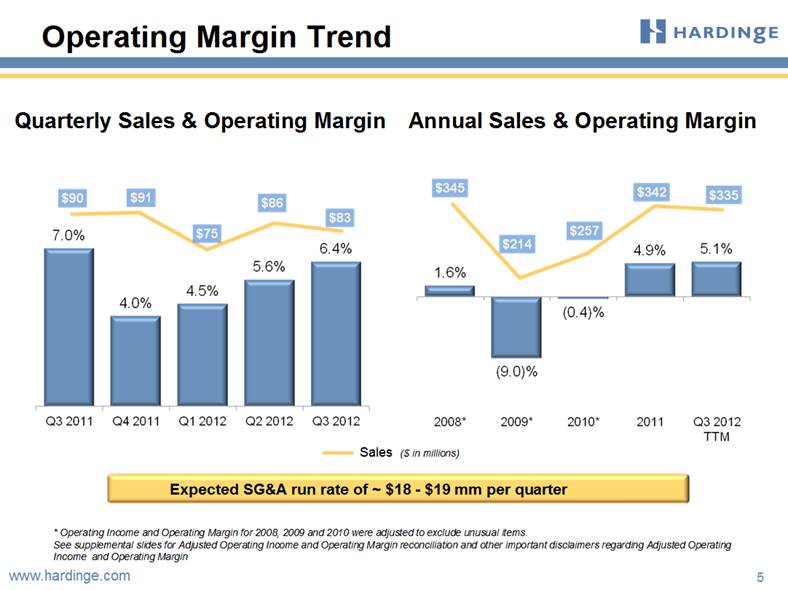

Operating Margin Trend 5 Quarterly Sales & Operating Margin Annual Sales & Operating Margin Expected SG&A run rate of ~ $18 - $19 mm per quarter Sales ($ in millions) * Operating Income and Operating Margin for 2008, 2009 and 2010 were adjusted to exclude unusual items. See supplemental slides for Adjusted Operating Income and Operating Margin reconciliation and other important disclaimers regarding Adjusted Operating Income and Operating Margin |

|

|

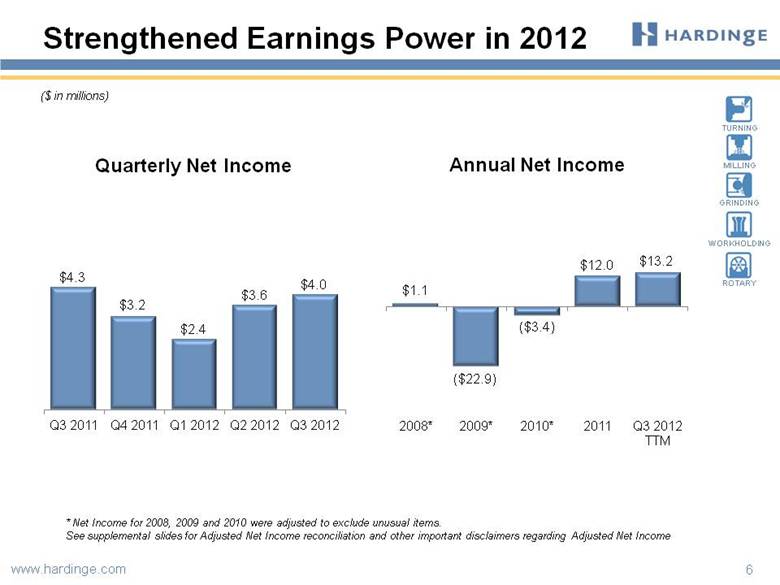

Quarterly Net Income Annual Net Income Strengthened Earnings Power in 2012 6 ($ in millions) * Net Income for 2008, 2009 and 2010 were adjusted to exclude unusual items. See supplemental slides for Adjusted Net Income reconciliation and other important disclaimers regarding Adjusted Net Income |

|

|

Emphasis on Productivity and Cash Managed Working Capital* as a Percent of Sales 7 Receivable Days Outstanding (Avg) Inventory Turns (Avg) * Managed Working Capital is defined as: Receivables + Inventory - Payables - Customer Deposits |

|

|

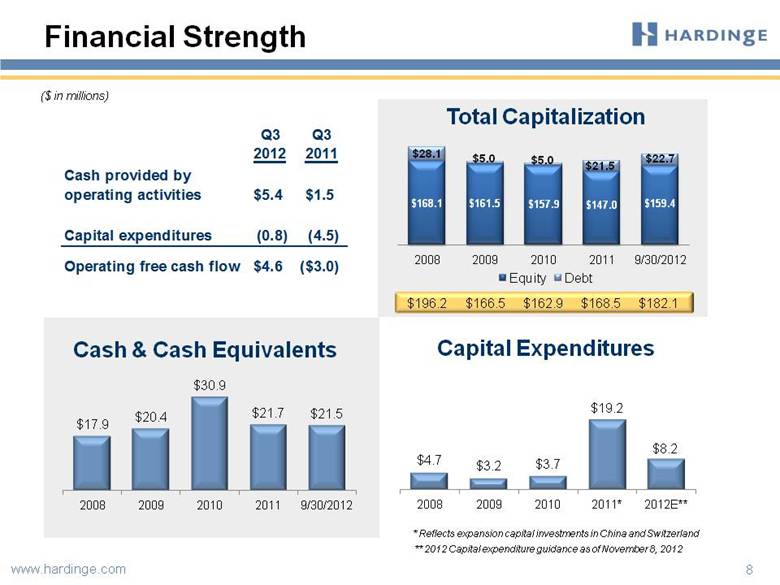

8 Financial Strength Total Capitalization ($ in millions) * Reflects expansion capital investments in China and Switzerland Cash & Cash Equivalents Capital Expenditures ** 2012 Capital expenditure guidance as of November 8, 2012 $196.2 $166.5 $162.9 $168.5 $182.1 Q3 2012 Q3 2011 Cash provided by operating activities $5.4 $1.5 Capital expenditures (0.8) (4.5) Operating free cash flow $4.6 ($3.0) Equity Debt |

|

|

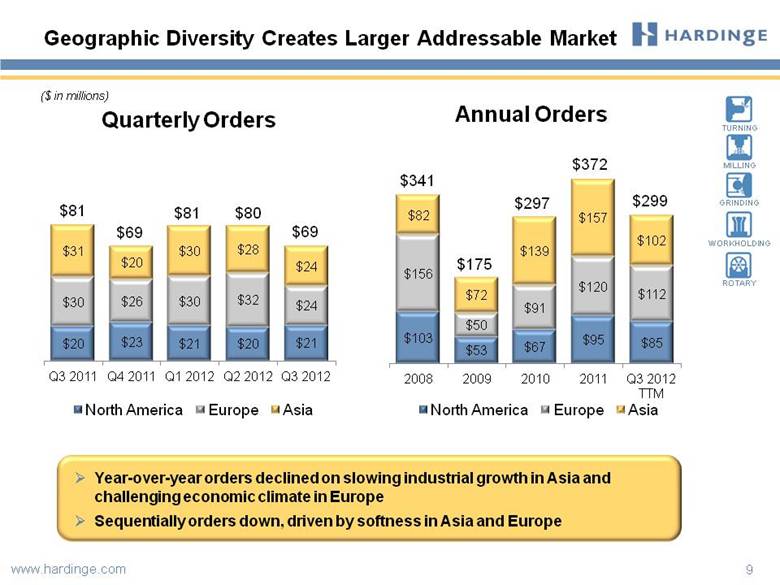

9 Geographic Diversity Creates Larger Addressable Market ($ in millions) Annual Orders $299 $372 $297 $175 $341 Quarterly Orders $80 $81 $69 $81 $69 Year-over-year orders declined on slowing industrial growth in Asia and challenging economic climate in Europe Sequentially orders down, driven by softness in Asia and Europe North America Europe Asia |

|

|

10 Overview and Outlook Continue to have positive long-term outlook on machine tool industry Near-term headwinds from global economic weakness Engineering and development efforts focused on maintaining competitive edge Focus on productivity improvements and cash management Foundational values drive culture: Quality, customer service, continuous process improvement, global cooperation, and employee development |

|

|

Third Quarter 2012 Earnings Conference Call November 8, 2012 NASDAQ: HDNG www.hardinge.com |

|

|

NASDAQ: HDNG SUPPLEMENTAL INFORMATION www.hardinge.com |

|

|

Annual Adjusted Gross Profit Reconciliation 13 ($ in millions) Gross Profit for 2008 and 2009 was adjusted to exclude unusual items. Hardinge believes that when used in conjunction with GAAP measures, Adjusted Gross Profit, which is a non-GAAP measure, assists in the understanding of Hardinge’s operating performance. 2008 2009 2010 2011 Q3 2012 TTM Sales $345.0 $214.1 $257.0 $341.6 $334.9 Cost of sales 252.7 173.3 195.7 250.5 242.5 Gross profit 92.3 40.8 61.3 91.1 92.4 Inventory impairment 7.8 5.0 - - - Adjusted gross profit 100.1 45.8 61.3 91.1 92.4 Adjusted gross margin 29.0% 21.4% 23.9% 26.7% 27.6% |

|

|

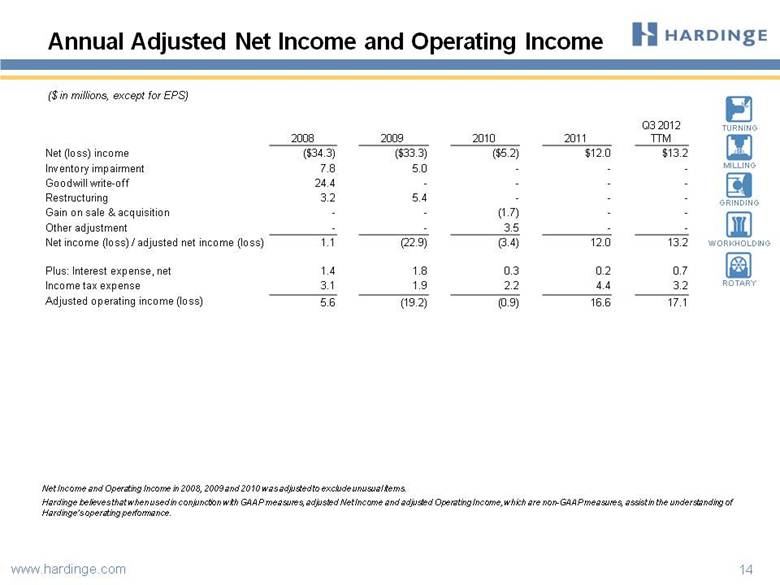

Annual Adjusted Net Income and Operating Income 14 ($ in millions, except for EPS) Net Income and Operating Income in 2008, 2009 and 2010 was adjusted to exclude unusual items. Hardinge believes that when used in conjunction with GAAP measures, adjusted Net Income and adjusted Operating Income, which are non-GAAP measures, assist in the understanding of Hardinge’s operating performance. 2008 2009 2010 2011 Q3 2012 TTM Net (loss) income ($34.3) ($33.3) ($5.2) $12.0 $13.2 Inventory impairment 7.8 5.0 - - - Goodwill write-off 24.4 - - - - Restructuring 3.2 5.4 - - - Gain on sale & acquisition - - (1.7) - - Other adjustment - - 3.5 - - Net income (loss) / adjusted net income (loss) 1.1 (22.9) (3.4) 12.0 13.2 Plus: Interest expense, net 1.4 1.8 0.3 0.2 0.7 Income tax expense 3.1 1.9 2.2 4.4 3.2 Adjusted operating income (loss) 5.6 (19.2) (0.9) 16.6 17.1 |

|

|

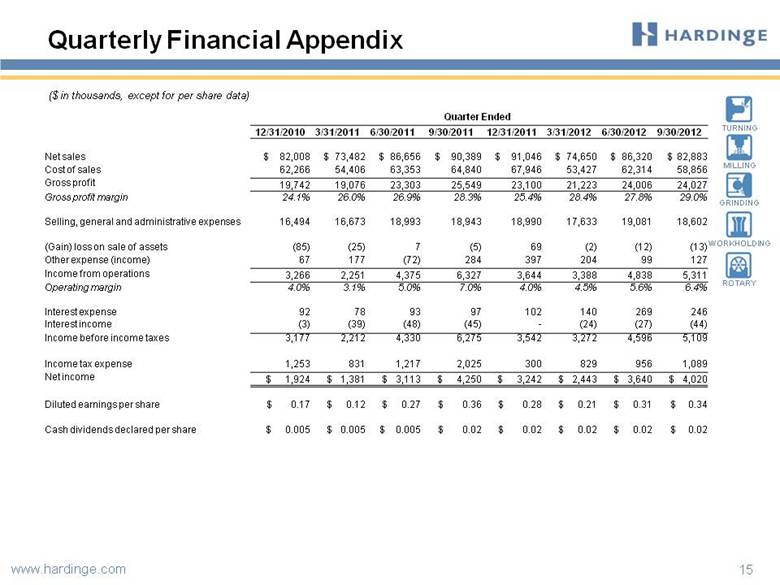

Quarterly Financial Appendix 15 ($ in thousands, except for per share data) Quarter Ended 12/31/2010 3/31/2011 6/30/2011 9/30/2011 12/31/2011 3/31/2012 6/30/2012 9/30/2012 Net sales $ 82,008 $ 73,482 $ 86,656 $ 90,389 $ 91,046 $ 74,650 $ 86,320 $ 82,883 Cost of sales 62,266 54,406 63,353 64,840 67,946 53,427 62,314 58,856 Gross profit 19,742 19,076 23,303 25,549 23,100 21,223 24,006 24,027 Gross profit margin 24.1% 26.0% 26.9% 28.3% 25.4% 28.4% 27.8% 29.0% Selling, general and administrative expenses 16,494 16,673 18,993 18,943 18,990 17,633 19,081 18,602 (Gain) loss on sale of assets (85) (25) 7 (5) 69 (2) (12) (13) Other expense (income) 67 177 (72) 284 397 204 99 127 Income from operations 3,266 2,251 4,375 6,327 3,644 3,388 4,838 5,311 Operating margin 4.0% 3.1% 5.0% 7.0% 4.0% 4.5% 5.6% 6.4% Interest expense 92 78 93 97 102 140 269 246 Interest income (3) (39) (48) (45) - (24) (27) (44) Income before income taxes 3,177 2,212 4,330 6,275 3,542 3,272 4,596 5,109 Income tax expense 1,253 831 1,217 2,025 300 829 956 1,089 Net income $ 1,924 $ 1,381 $ 3,113 $ 4,250 $ 3,242 $ 2,443 $ 3,640 $ 4,020 Diluted earnings per share $ 0.17 $ 0.12 $ 0.27 $ 0.36 $ 0.28 $ 0.21 $ 0.31 $ 0.34 Cash dividends declared per share $ 0.005 $ 0.005 $ 0.005 $ 0.02 $ 0.02 $ 0.02 $ 0.02 $ 0.02 |