Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Global Eagle Entertainment Inc. | v327811_ex99-2.htm |

| 8-K - FORM 8-K - Global Eagle Entertainment Inc. | v327811_8k.htm |

November 8 th , 2012 Investor Call: Global Eagle Entertainment

1 ADDITIONAL INFORMATION ABOUT THE BUSINESS COMBINATION AND WHERE TO FIND IT Global Eagle intends to file with the Securities and Exchange Commission (SEC) a preliminary proxy statement of Global Eagle in connection with the proposed business combination and will mail a definitive proxy statement and other relevant documents to its stockholders. Global Eagle stockh old ers and other interested persons are advised to read, when available, the preliminary proxy statement, and amendments thereto, and the definitive proxy statement in conne cti on with Global Eagle’s solicitation of proxies for the stockholder meeting to be held to approve the business combination because the proxy statement will contain important in formation about AIA, Row 44, Global Eagle and the proposed business combination. The definitive proxy statement will be mailed to stockholders of Global Eagle as of a rec ord date to be established for voting on the business combination. Stockholders will also be able to obtain copies of the Registration Statement and the proxy statement, wit hout charge, once available, at the SEC's Internet site at http://www.sec.gov or by directing a request to: Global Eagle Acquisition Corp., 10900 Wilshire Blvd., Suite 15 00, Los Angeles, CA 90024 Attn.: James A. Graf, Chief Financial Officer. PARTICIPANTS IN THE SOLICITATION Global Eagle and its directors and officers may be deemed participants in the solicitation of proxies to Global Eagle’s stock hol ders with respect to the transaction. A list of the names of those directors and officers and a description of their interests in Global Eagle is contained in Global Eagle’s ann ual report on Form 10 - K for the fiscal year ended December 31, 2011, which was filed with the SEC, and will also be contained in the proxy statement for the proposed business com bination when available. FORWARD LOOKING STATEMENTS This press release may include "forward looking statements" within the meaning of the "safe harbor" provisions of the United Sta ted Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as "anticipate", "believe", "expect", "estimate", "p lan", "outlook", and "project" and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward l ook ing statements with respect to the timing of the proposed business combination with Row 44 and AIA, as well as the expected performance, strategies, prospects and other aspec ts of the businesses of Global Eagle, AIA, Row 44 and the combined company after completion of the proposed business combination, are based on current expectations that ar e subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking sta tements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Row 44 Merger Agreement or the AIA Stock Purchase Agreement (the "Business Combination Agreements"), (2) the outcome of any legal proceedings that may be instituted against Gl oba l Eagle, AIA, Row 44 or others following announcement of the Business Combination Agreements and transactions contemplated therein; (3) the inability to complete the tra nsactions contemplated by the Business Combination Agreements due to the failure to obtain approval of the stockholders of the Global Eagle or other conditions to c los ing in the Business Combination Agreement, (4) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or comple te regulatory reviews required to complete the transactions contemplated by the Business Combination Agreements; (5) the risk that the proposed transaction disrupts current pl ans and operations as a result of the announcement and consummation of the transactions described herein; (6) the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maint ain relationships with suppliers and obtain adequate supply of products and retain its key employees; (7) costs related to the proposed business combination; (8) changes in applicable laws or regulations; (9) the possibility that AIA and Row 44 may be adversely affected by other economic, business, and/or competitive factors; and (10) o the r risks and uncertainties indicated from time to time in the proxy statement to be filed by Global Eagle with the SEC, including those under “Risk Factors” therein, and ot her filings with the SEC by Global Eagle. Readers are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made, and Global Eagle, AIA and Row 44 undertake no obligation to update or revise the forward - looking statements, whether as a result of new information, future events or other wise.

2 Executive Summary This transaction creates the largest entertainment and connectivity platform for the worldwide airline industry combining: – AIA (listed on the Frankfurt Stock Exchange; Xetra: DVN1) is a leading supplier of games, movies, general entertainment and applications to more than 130 airlines worldwide – Row 44 is a leading satellite - based broadband service provider to the global airline industry, with its inflight entertainment connectivity system currently installed on more than 400 aircraft that operate over land and sea worldwide The combined company will gain access to 100% of the airline passenger experience through AIA's penetration of the installed inflight entertainment (“IFE”) market and Row 44's wi - fi to mobile capability Marriage of content and connectivity technology will create a superior platform to exploit the global airline industry’s expanding focus on in - cabin entertainment and other ancillary revenues Global Eagle Acquisition raised the largest U.S. SPAC in the last 5 years ($190 million) and the proceeds remaining following the closing will be used to fund growth and industry consolidation initiatives Global Eagle Acquisition will acquire Row 44, Inc. (“Row 44”) and 86% of Advanced Inflight Alliance AG (“AIA”) and will be called Global Eagle Entertainment Inc.

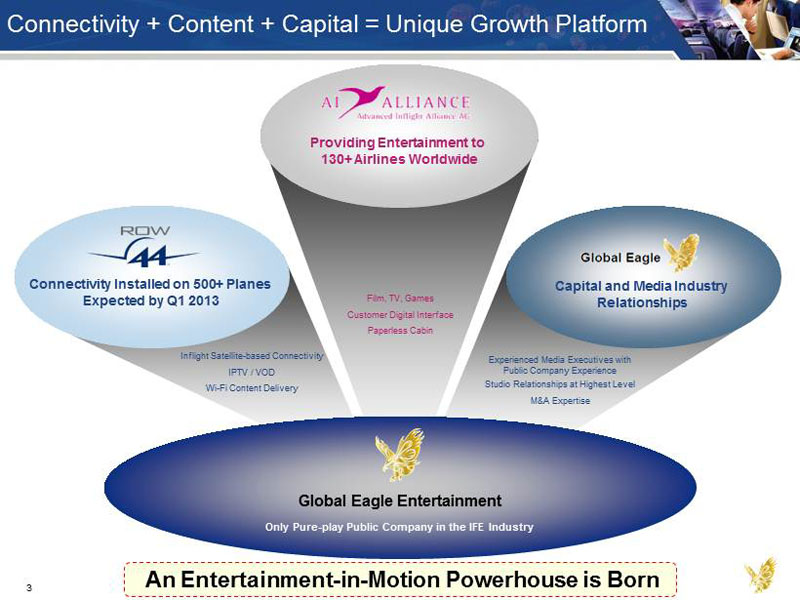

3 Connectivity + Content + Capital = Unique Growth Platform Connectivity Installed on 500+ Planes Expected by Q1 2013 Providing Entertainment to 130+ Airlines Worldwide Global Eagle Entertainment Only Pure - play Public Company in the IFE Industry Inflight Satellite - based Connectivity IPTV / VOD Wi - Fi Content Delivery Experienced Media Executives with Public Company Experience Studio Relationships at Highest Level M&A Expertise Film, TV, Games Customer Digital Interface Paperless Cabin Capital and Media Industry Relationships An Entertainment - in - Motion Powerhouse is Born

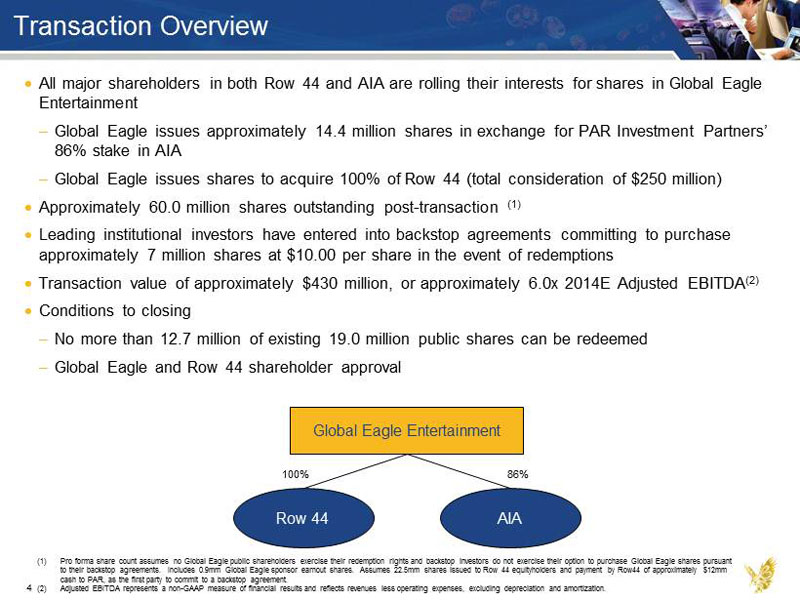

4 Transaction Overview All major shareholders in both Row 44 and AIA are rolling their interests for shares in Global Eagle Entertainment – Global Eagle issues approximately 14.4 million shares in exchange for PAR Investment Partners’ 86% stake in AIA – Global Eagle issues shares to acquire 100% of Row 44 (total consideration of $250 million) Approximately 60.0 million shares outstanding post - transaction (1) Leading institutional investors have entered into backstop agreements committing to purchase approximately 7 million shares at $10.00 per share in the event of redemptions Transaction value of approximately $430 million, or approximately 6.0x 2014E Adjusted EBITDA (2) Conditions to closing – No more than 12.7 million of existing 19.0 million public shares can be redeemed – Global Eagle and Row 44 shareholder approval (1) Pro forma share count assumes no Global Eagle public shareholders exercise their redemption rights and backstop investors do not exercise their option to purchase Global Eagle shares pursuant to their backstop agreements. Includes 0.9mm Global Eagle sponsor earnout shares. Assumes 22.5mm shares issued to Row 44 eq uit yholders and payment by Row44 of approximately $12mm cash to PAR, as the first party to commit to a backstop agreement. (2) Adjusted EBITDA represents a non - GAAP measure of financial results and reflects revenues less operating expenses, excluding depr eciation and amortization. Global Eagle Entertainment Row 44 AIA 100% 86%

5 Total 1,840 2,520 3,090 3,660 4,220 2012E 2013E 2014E 2015E 2016E Global Passengers (in billions) Global Aircraft Fleet Forecast (2) (1) Growth in Passengers & Aircraft Explosion in Availability of Entertainment and Content Aircraft Equipped with Connectivity Aircraft with IFE Installed Source: IMDC; IATA; Wall Street Research. (1) 2011 - 2013 figures from the IATA September 2012 Industry Financial Forecast Report. (2) Data provided by Seabury Group. 2012E Penetration Rate: 13% 2016E Penetration Rate: 22% 2011A Penetration Rate: 79% 2016E Penetration Rate: 93% 10,763 1,660 9,103 5,279 3,209 2,574 1,359 3,933 11,678 6,638 14,382 635 18,315 13,972 2,294 2011 Active Worldwide Fleet Retirements Current Active in 2016E New Deliveries 2016E Active Worldwide Fleet Widebody Narrowbody Passengers 2.83 2.97 3.10 3.25 3.40 3.56 2011 2012E 2013E 2014E 2015E 2016E Total 11,000 12,000 14,000 15,000 16,000 17,000 2011 2012E 2013E 2014E 2015E 2016E Strong Secular Demand For Inflight Services

6 Vertical and Horizontal Consolidation Platform Global Eagle Entertainment: Only Full Service Platform Inflight Connectivity Internet IPTV Email TV / Movies On Demand Games Shopping Audio IFE Magazines / Newspapers SMS Texting Ad Sales Content Mgmt Inflight Content Tapping into the Multi - Billion Dollar Content & Connectivity Market

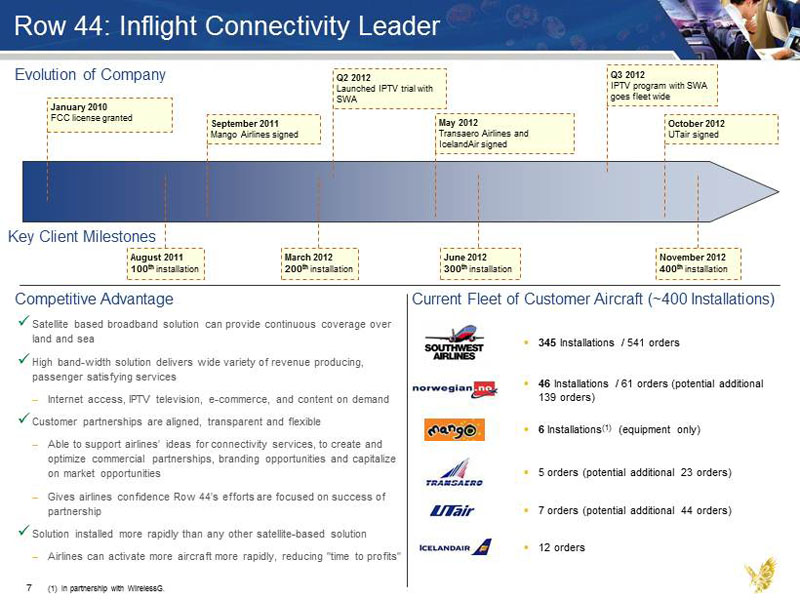

7 Row 44: Inflight Connectivity Leader Competitive Advantage Current Fleet of Customer Aircraft (~400 Installations) x Satellite based broadband solution can provide continuous coverage over land and sea x High band - width solution delivers wide variety of revenue producing, passenger satisfying services – Internet access, IPTV television, e - commerce, and content on demand x Customer partnerships are aligned, transparent and flexible – Able to support airlines’ ideas for connectivity services, to create and optimize commercial partnerships, branding opportunities and capitalize on market opportunities – Gives airlines confidence Row 44’s efforts are focused on success of partnership x Solution installed more rapidly than any other satellite - based solution – Airlines can activate more aircraft more rapidly, reducing "time to profits" 345 Installations / 541 orders 6 Installations (1) (equipment only) 12 orders 46 Installations / 61 orders (potential additional 139 orders) 5 orders (potential additional 23 orders) 7 orders (potential additional 44 orders) (1) In partnership with WirelessG. Evolution of Company October 2012 UTair signed January 2010 FCC license granted Q2 2012 Launched IPTV trial with SWA Q3 2012 IPTV program with SWA goes fleet wide June 2012 300 th installation March 2012 200 th installation August 2011 100 th installation November 2012 400 th installation May 2012 Transaero Airlines and IcelandAir signed Key Client Milestones September 2011 Mango Airlines signed

8 AIA: Inflight Entertainment Content Leader for 15 years Competitive Advantage Global customer base includes the world’s premier airlines x First mover in content provision to airlines for installed inflight entertainment systems x Significant geographic reach (serving over 130 airline companies on all continents) – Global sales team footprint allows company to drive opportunities for Row 44 and others x Platform agnostic – ability to deliver content on any on - board entertainment system (Panasonic, Rockwell Collins, Thales, etc.) x Long term access to unique content and to economies of scale x Full integration of IFE content value chain (professional services, sourcing of content, licensor/distributor, Lab, content s erv ice provider) x Attractive customer demographics – The average demographic profile for a frequent flyer is significantly more attractive versus the national average

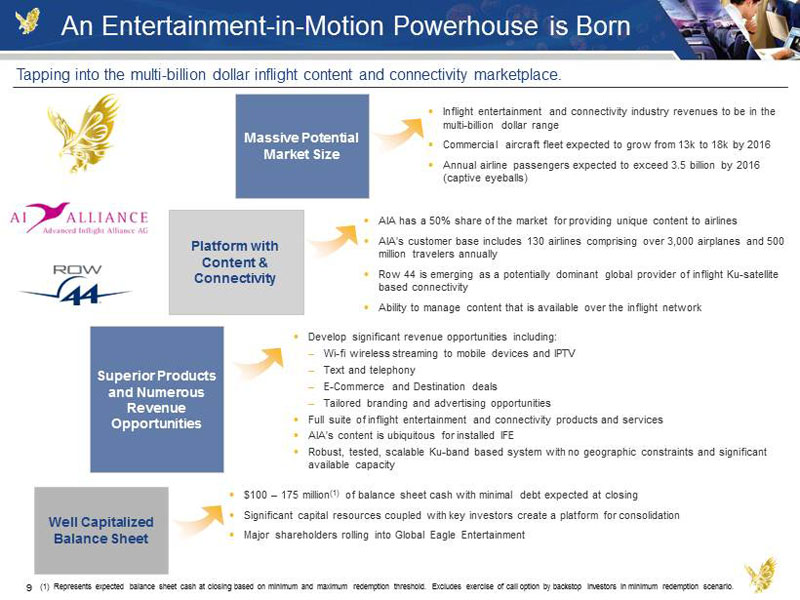

9 Well Capitalized Balance Sheet An Entertainment - in - Motion Powerhouse is Born Superior Products and Numerous Revenue Opportunities Platform with Content & Connectivity Massive Potential Market Size Develop significant revenue opportunities including: – Wi - fi wireless streaming to mobile devices and IPTV – Text and telephony – E - Commerce and Destination deals – Tailored branding and advertising opportunities Full suite of inflight entertainment and connectivity products and services AIA’s content is ubiquitous for installed IFE Robust, tested, scalable Ku - band based system with no geographic constraints and significant available capacity AIA has a 50% share of the market for providing unique content to airlines AIA’s customer base includes 130 airlines comprising over 3,000 airplanes and 500 million travelers annually Row 44 is emerging as a potentially dominant global provider of inflight Ku - satellite based connectivity Ability to manage content that is available over the inflight network Inflight entertainment and connectivity industry revenues to be in the multi - billion dollar range Commercial aircraft fleet expected to grow from 13k to 18k by 2016 Annual airline passengers expected to exceed 3.5 billion by 2016 (captive eyeballs) Tapping into the multi - billion dollar inflight content and connectivity marketplace. $100 – 175 million (1) of balance sheet cash with minimal debt expected at closing Significant capital resources coupled with key investors create a platform for consolidation Major shareholders rolling into Global Eagle Entertainment (1) Represents expected balance sheet cash at closing based on minimum and maximum redemption threshold. Excludes exercise of call option by backstop investors in minimum redemption scenario.