Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNEDISON, INC. | memcform8-k9302012pressrel.htm |

| EX-99.1 - 11.7.2012 PRESS RELEASE - SUNEDISON, INC. | exhibit991-9302012pressrel.htm |

MEMC Electronic Materials Third Quarter 2012 Earnings Conference Call November 7, 2012 1 | Confidential

Agenda Safe Harbor 3Q12 Results Review 3Q12 Segment Performance SunEdison Pipeline & Installations Cash Flow Balance Sheet & Liquidity Outlook Appendix Forward-Looking Statements 2

With the exception of historical information, the matters disclosed in this presentation are forward-looking statements. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties are described in the Company’s filings with the Securities and Exchange Commission (SEC), including its 2011 Form 10-K, and Q1 2012 and Q2 2012 Form 10-Qs, in addition to the risks and uncertainties described on page 16 of this presentation. These forward-looking statements represent the Company’s judgment as of the date of this presentation. The Company disclaims, however, any intent or obligation to update these forward-looking statements. This presentation also includes non-GAAP financial measures. You can find a reconciliation of each of these non-GAAP measures to the most directly comparable GAAP financial measure in our earnings press release filed on Form 8-K today with the SEC and posted in the Investor Relations portion of our web site at www.memc.com. Safe Harbor 3

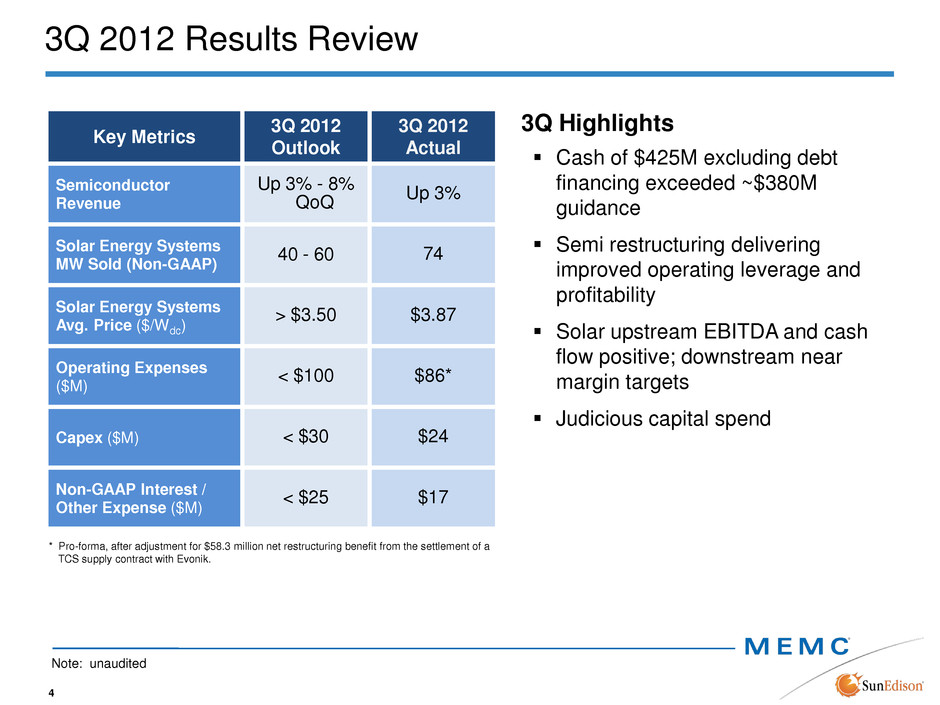

3Q 2012 Results Review 4 3Q Highlights Cash of $425M excluding debt financing exceeded ~$380M guidance Semi restructuring delivering improved operating leverage and profitability Solar upstream EBITDA and cash flow positive; downstream near margin targets Judicious capital spend Key Metrics 3Q 2012 Outlook 3Q 2012 Actual Semiconductor Revenue Up 3% - 8% QoQ Up 3% Solar Energy Systems MW Sold (Non-GAAP) 40 - 60 74 Solar Energy Systems Avg. Price ($/Wdc) > $3.50 $3.87 Operating Expenses ($M) < $100 $86* Capex ($M) < $30 $24 Non-GAAP Interest / Other Expense ($M) < $25 $17 * Pro-forma, after adjustment for $58.3 million net restructuring benefit from the settlement of a TCS supply contract with Evonik. Note: unaudited

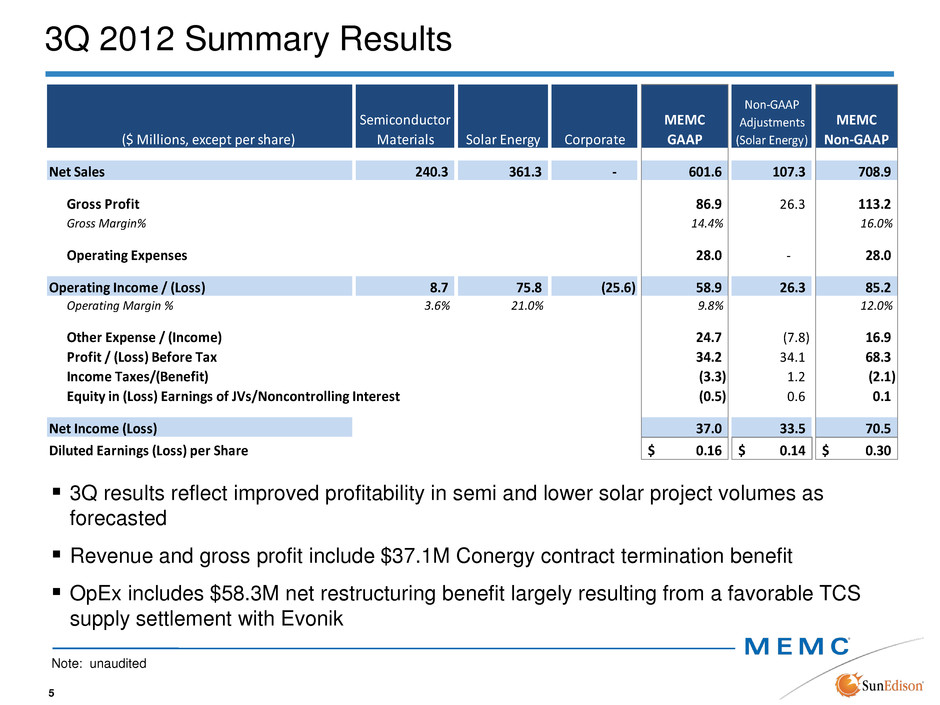

3Q 2012 Summary Results Note: unaudited 5 3Q results reflect improved profitability in semi and lower solar project volumes as forecasted Revenue and gross profit include $37.1M Conergy contract termination benefit OpEx includes $58.3M net restructuring benefit largely resulting from a favorable TCS supply settlement with Evonik ($ Millions, except per share) Semiconductor Materials Solar Energy Corporate MEMC GAAP Non-GAAP Adjustments (Solar Energy) MEMC Non-GAAP Net Sales 240.3 361.3 - 601.6 107.3 708.9 Gross Profit 86.9 26.3 113.2 Gross Margin% 14.4% 16.0% Operating Expenses 28.0 - 28.0 Operating Income / (Loss) 8.7 75.8 (25.6) 58.9 26.3 85.2 Operating Margin % 3.6% 21.0% 9.8% 12.0% Other Expense / (Income) 24.7 (7.8) 16.9 Profit / (Loss) Before Tax 34.2 34.1 68.3 Income Taxes/(Benefit) (3.3) 1.2 (2.1) Equity in (Loss) Earnings of JVs/Noncontrolling Interest (0.5) 0.6 0.1 Net Income (Loss) 37.0 33.5 70.5 Diluted Earnings (Loss) per Share 0.16$ 0.14$ 0.30$

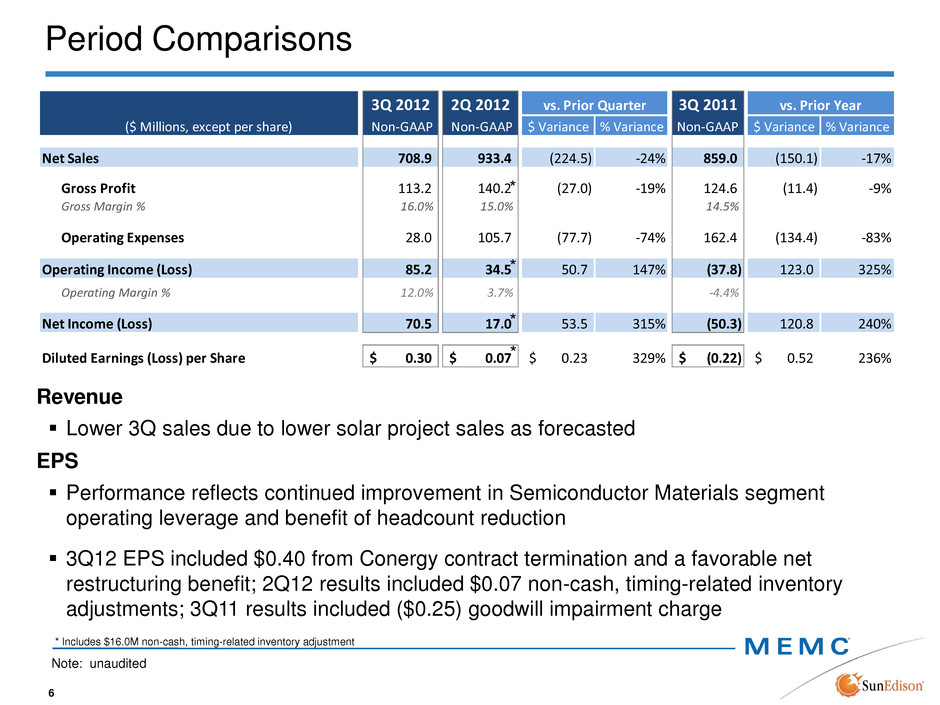

Period Comparisons Note: unaudited 6 Revenue Lower 3Q sales due to lower solar project sales as forecasted EPS Performance reflects continued improvement in Semiconductor Materials segment operating leverage and benefit of headcount reduction 3Q12 EPS included $0.40 from Conergy contract termination and a favorable net restructuring benefit; 2Q12 results included $0.07 non-cash, timing-related inventory adjustments; 3Q11 results included ($0.25) goodwill impairment charge 3Q 2012 2Q 2012 3Q 2011 ($ Millions, except per share) Non-GAAP Non-GAAP $ Variance % Variance Non-GAAP $ Variance % Variance Net Sales 708.9 933.4 (224.5) -24% 859.0 (150.1) -17% Gross Profit 113.2 140.2 (27.0) -19% 124.6 (11.4) -9% Gross Margin % 16.0% 15.0% 14.5% Operating Expenses 28.0 105.7 (77.7) -74% 162.4 (134.4) -83% Operating Income (Loss) 85.2 34.5 50.7 147% (37.8) 123.0 325% Operating Margin % 12.0% 3.7% -4.4% Net Income (Loss) 70.5 17.0 53.5 315% (50.3) 120.8 240% Diluted Earnings (Loss) per Share 0.30$ 0.07$ 0.23$ 329% (0.22)$ 0.52$ 236% vs. Prior Quarter vs. Prior Year * Includes $16.0M non-cash, timing-related inventory adjustment * * * *

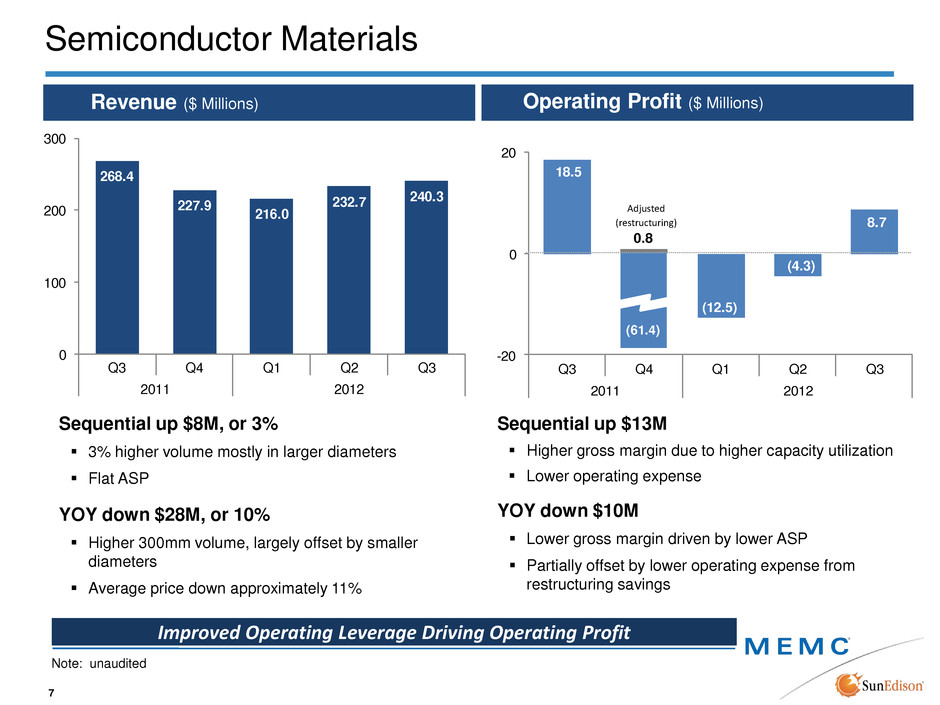

Revenue ($ Millions) Operating Profit ($ Millions) Sequential up $8M, or 3% 3% higher volume mostly in larger diameters Flat ASP YOY down $28M, or 10% Higher 300mm volume, largely offset by smaller diameters Average price down approximately 11% Sequential up $13M Higher gross margin due to higher capacity utilization Lower operating expense YOY down $10M Lower gross margin driven by lower ASP Partially offset by lower operating expense from restructuring savings 18.5 0.8 (12.5) (4.3) 8.7 -20 0 20 Q3 Q4 Q1 Q2 Q3 2011 2012(61.4) Note: unaudited Semiconductor Materials 7 Adjusted (restructuring) 268.4 227.9 216.0 232.7 240.3 0 100 200 300 Q3 Q4 Q1 Q2 Q3 2011 2012 Improved Operating Leverage Driving Operating Profit

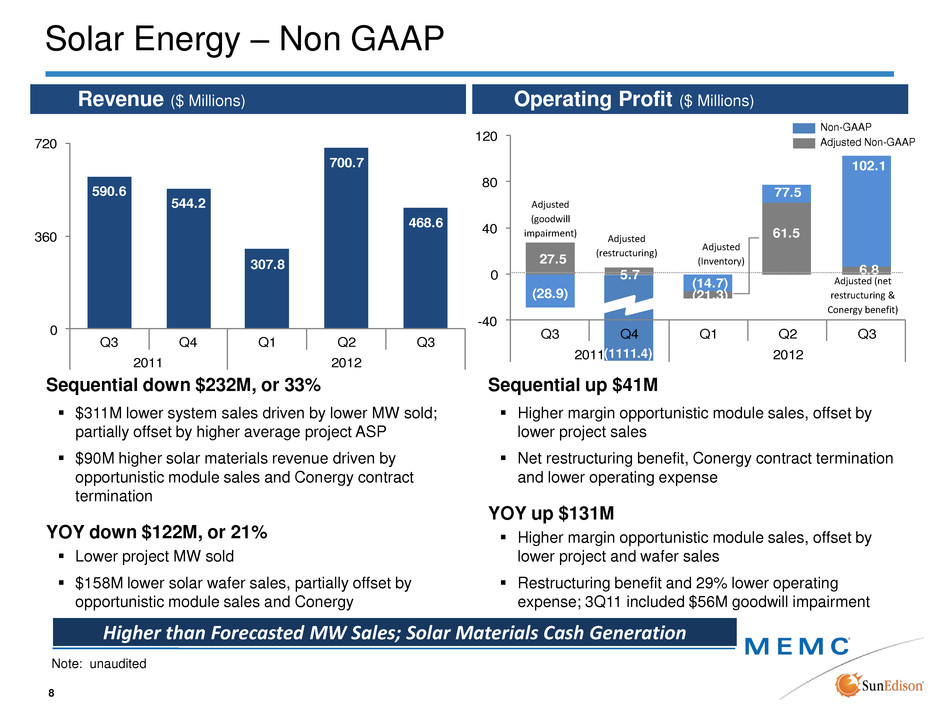

Revenue ($ Millions) Operating Profit ($ Millions) Sequential down $232M, or 33% $311M lower system sales driven by lower MW sold; partially offset by higher average project ASP $90M higher solar materials revenue driven by opportunistic module sales and Conergy contract termination YOY down $122M, or 21% Lower project MW sold $158M lower solar wafer sales, partially offset by opportunistic module sales and Conergy Sequential up $41M Higher margin opportunistic module sales, offset by lower project sales Net restructuring benefit, Conergy contract termination and lower operating expense YOY up $131M Higher margin opportunistic module sales, offset by lower project and wafer sales Restructuring benefit and 29% lower operating expense; 3Q11 included $56M goodwill impairment (1111.4) 27.5 5.7 (14.7) 61.5 6.8 (28.9) (21.3) 77.5 102.1 -40 0 40 80 120 Q3 Q4 Q1 Q2 Q3 2011 2012 Solar Energy – Non GAAP Note: unaudited 8 Adjusted (restructuring) Adjusted (goodwill impairment) Non-GAAP Adjusted Non-GAAP 590.6 544.2 307.8 700.7 468.6 0 360 720 Q3 Q4 Q1 Q2 Q3 2011 2012 Adjusted (net restructuring & Conergy benefit) Higher than Forecasted MW Sales; Solar Materials Cash Generation Adjusted (Inventory)

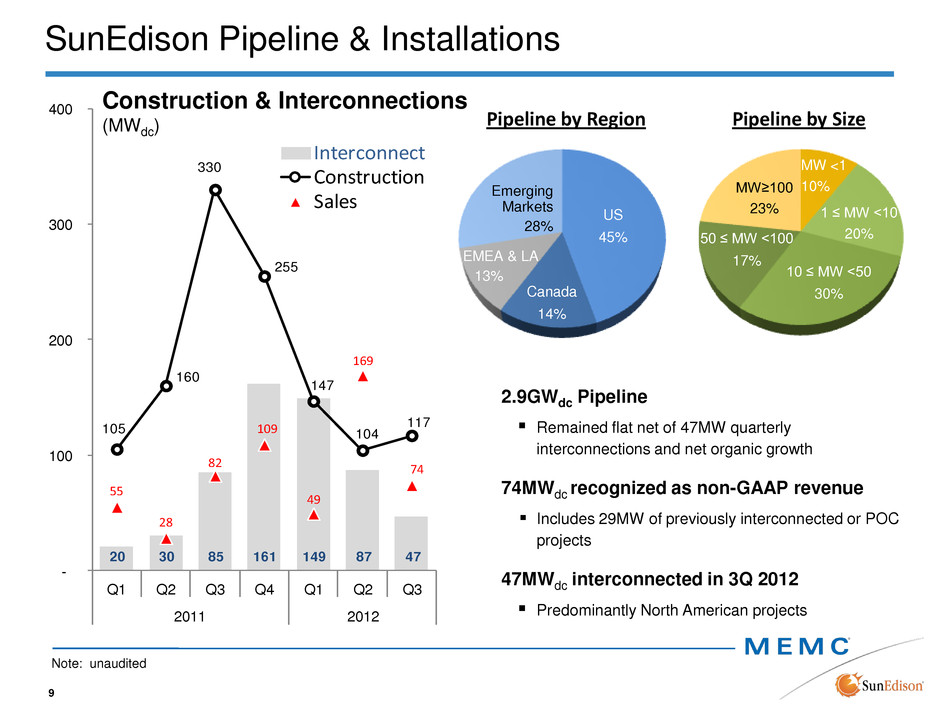

20 30 85 161 149 87 47 105 160 330 255 147 104 117 55 28 82 109 49 169 74 - 100 200 300 400 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2011 2012 Interconnect Construction Sales SunEdison Pipeline & Installations Note: unaudited 9 Pipeline by Region Pipeline by Size 2.9GWdc Pipeline Remained flat net of 47MW quarterly interconnections and net organic growth 74MWdc recognized as non-GAAP revenue Includes 29MW of previously interconnected or POC projects 47MWdc interconnected in 3Q 2012 Predominantly North American projects Construction & Interconnections (MWdc) 10 ≤ MW <50 30% 1 ≤ MW <10 20% MW≥100 23% MW <1 10% US 45% EMEA & LA 13% Emerging Markets 28% Canada 14% 50 ≤ MW <100 17%

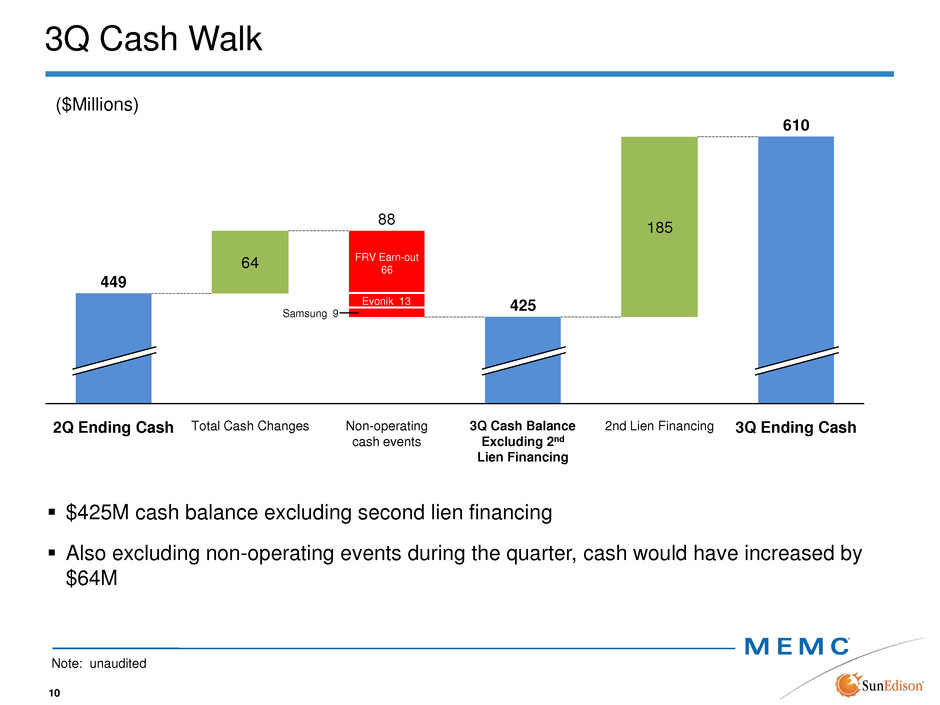

3Q Cash Walk Note: unaudited 185 64 3Q Ending Cash 610 2nd Lien Financing 3Q Cash Balance Excluding 2nd Lien Financing 425 Non-operating cash events 88 FRV Earn-out 66 Total Cash Changes 2Q Ending Cash 449 ($Millions) 10 $425M cash balance excluding second lien financing Also excluding non-operating events during the quarter, cash would have increased by $64M Evonik 13 Samsung 9

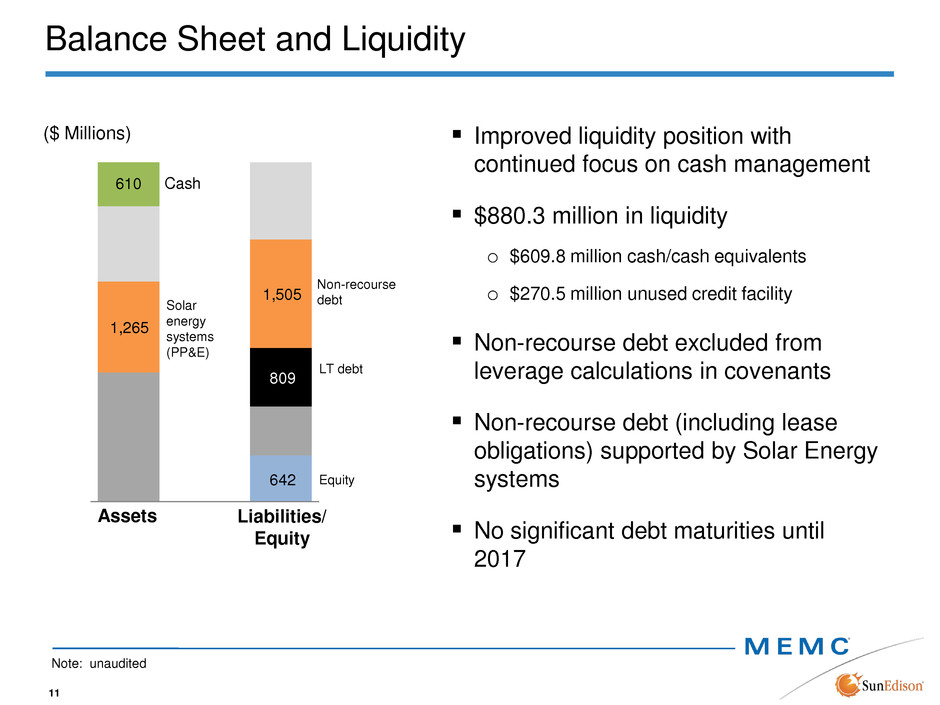

642 1,265 809 610 1,505 Balance Sheet and Liquidity ($ Millions) Assets Liabilities/ Equity Cash Non-recourse debt LT debt Equity Solar energy systems (PP&E) Note: unaudited Improved liquidity position with continued focus on cash management $880.3 million in liquidity o $609.8 million cash/cash equivalents o $270.5 million unused credit facility Non-recourse debt excluded from leverage calculations in covenants Non-recourse debt (including lease obligations) supported by Solar Energy systems No significant debt maturities until 2017 11 2016

Q4 & FY 2012 Outlook 12 Semiconductor Materials: Softer 4Q ASP and volume due to weaker 2H demand, especially in 4Q, and exacerbated seasonality effects Solar Energy: Mostly North American projects in 4Q Cash: Expecting to generate cash Key Metrics Prior FY12 Guidance YTD Actual 4Q12 Outlook YTD Actual + Q4 Outlook Comments Semiconductor Revenue Y/Y (2%) to (5%) (13%) Q/Q (4%) to (11%) Y/Y (10%) to (12%) Weaker 2H industry demand and seasonality Solar Energy Systems MW Sold (non- GAAP) > 400 292 90 – 120 382 - 412 Includes Totana Solar Energy Systems Avg. Price ($/Wdc) > $3.50 $3.75 > $3.50 > $3.50 Operating Expenses ($M) ~ $385 $296 < $90 < $386 In line with 3Q 2012 Capex ($M) < $150 $100 <$35 <$135 Continue to focus on Semi Non-GAAP Interest Expense ($M) < $100 $75 ~ $25 ~ $100 Note: unaudited

Appendix 13

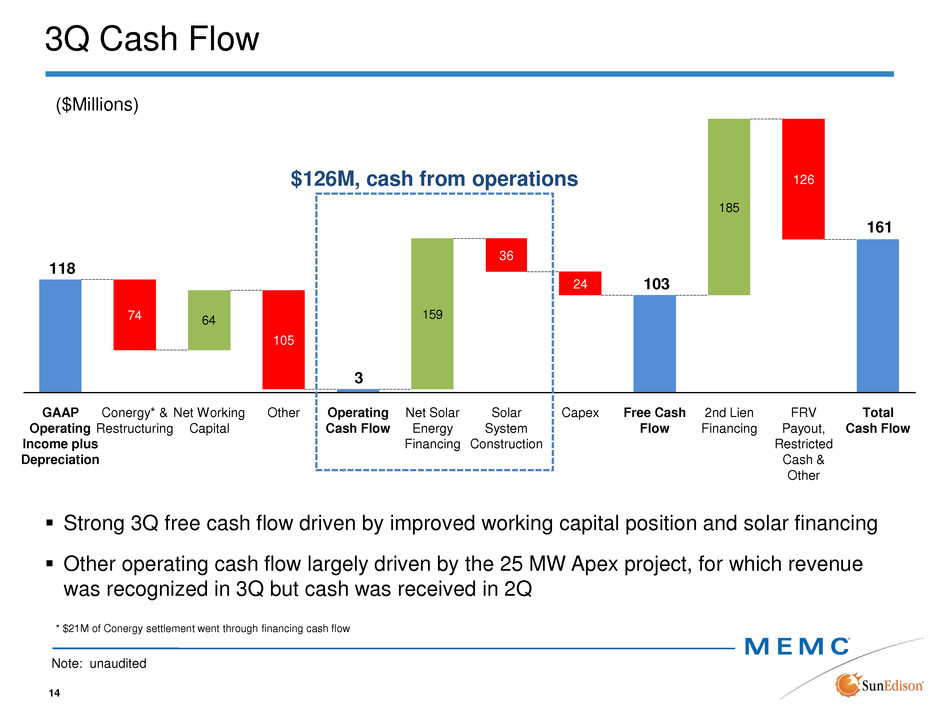

3Q Cash Flow Note: unaudited Strong 3Q free cash flow driven by improved working capital position and solar financing Other operating cash flow largely driven by the 25 MW Apex project, for which revenue was recognized in 3Q but cash was received in 2Q 161 103 3 118 185 15964 Solar System Construction Total Cash Flow FRV Payout, Restricted Cash & Other 126 2nd Lien Financing Free Cash Flow Capex 24 36 Net Solar Energy Financing Operating Cash Flow Other 105 Net Working Capital Conergy* & Restructuring 74 GAAP Operating Income plus Depreciation ($Millions) $126M, cash from operations * $21M of Conergy settlement went through financing cash flow 14

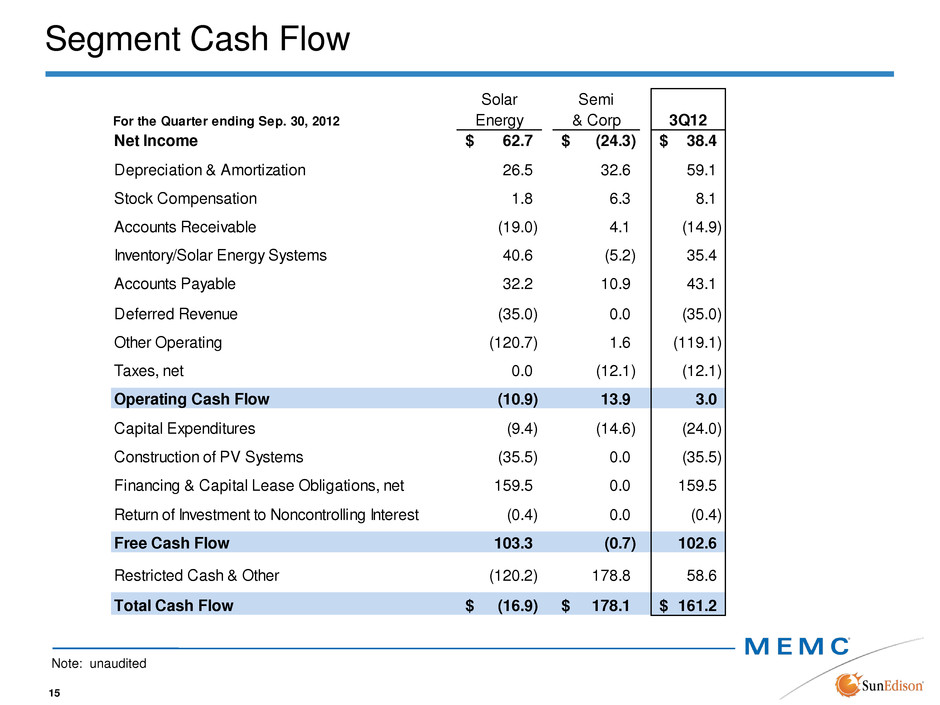

Segment Cash Flow 15 Note: unaudited Solar Semi For the Quarter ending Sep. 30, 2012 Energy & Corp 3Q12 Net Income 62.7$ (24.3)$ 38.4$ Depreciation & Amortization 26.5 32.6 59.1 Stock Compensation 1.8 6.3 8.1 Accounts Receivable (19.0) 4.1 (14.9) Inventory/Solar Energy Systems 40.6 (5.2) 35.4 Accounts Payable 32.2 10.9 43.1 Deferred Revenue (35.0) 0.0 (35.0) Other Operating (120.7) 1.6 (119.1) Taxes, net 0.0 (12.1) (12.1) Operating Cash Flow (10.9) 13.9 3.0 Capital Expenditures (9.4) (14.6) (24.0) Construction of PV Systems (35.5) 0.0 (35.5) Financing & Capital Lease Obligations, net 159.5 0.0 159.5 Return of Investment to Noncontrolling Interest (0.4) 0.0 (0.4) Free Cash Flow 103.3 (0.7) 102.6 Restricted Cash & Other (120.2) 178.8 58.6 Total Cash Flow (16.9)$ 178.1$ 161.2$

Forward-Looking Statements 16 Certain matters discussed in this presentation are forward-looking statements, including that for the 2012 fourth quarter, the company expects Semiconductor Materials revenue to be down 4% to 11% sequentially, Solar Energy systems non-GAAP sales volume in the range of 90 MW to 120 MW, Solar Energy systems average pricing greater than $3.50 per watt, operating expenses less than $90 million and capital spending less than $35 million, non-GAAP interest expense of about $25 million. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties include concentrated project development risks related to large scale solar projects; the availability of attractive project finance and other capital for SunEdison projects; market demand for our products and services; changes to accounting interpretations or accounting rules; changes in the pricing environment for silicon wafers and polysilicon, as well as solar power systems; the availability and size of government and economic incentives to adopt solar power, including tax policy and credits and renewable portfolio standards; the ability to effectuate and realize the savings from the restructuring plan; our ability to maintain adequate liquidity and compliance with our debt covenants; the need to impair long lived assets or other intangible assets due to changes in the carrying value or realizability of such assets; the effect of any antidumping or countervailing duties imposed on photovoltaic cells and/or modules in connection with any trade complaints in the United States, Europe or elsewhere; the result of any Chinese government investigations of unfair trade practices in connection with polysilicon exported from the United States or South Korea into China; existing or new regulations and policies governing the electric utility industry; our ability to convert SunEdison pipeline into completed projects in accordance with our current expectations; dependence on single and limited source suppliers; utilization of our manufacturing volume and capacity, including the successful ramping of production at our Ipoh facility; the terms of any potential future amendments to or terminations of our long-term agreements with our solar wafer customers; general economic conditions, including interest rates; the ability of our customers to pay their debts as they become due; changes in the composition of worldwide taxable income and applicable tax laws and regulations, including our ability to utilize any net operating losses; failure of third-party subcontractors to construct and install our solar energy systems; seasonality or quarterly fluctuations in our SunEdison business; the impact of competitive products and technologies; inventory levels of our customers; supply chain difficulties or problems; interruption of production; outcome of pending and future litigation matters; good working order of our manufacturing facilities; our ability to reduce manufacturing and operating costs; assumptions underlying management's financial estimates; actions by competitors, customers and suppliers; changes in the retail industry; damage to our brand; acquisitions of pipeline in our Solar Energy segment; changes in product specifications and manufacturing processes; changes in financial market conditions; changes in foreign economic and political conditions; changes in technology; changes in currency exchange rates and other risks described in the company’s filings with the Securities and Exchange Commission. These forward-looking statements represent the company’s judgment as of the date of this presentation. The company disclaims, however, any intent or obligation to update these forward-looking statements.