Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRINITY INDUSTRIES INC | trn8kinvestorpresentationq.htm |

Trinity Industries, Inc. November 2012 Exhibit 99.1

2 Forward Looking Statements This presentation contains “forward looking statements” as defined by the Private Securities Litigation Reform Act of 1995 and includes statements as to expectations, beliefs and future financial performance, or assumptions underlying or concerning matters herein. These statements that are not historical facts are forward looking. Readers are directed to Trinity’s Form 10-K and other SEC filings for a description of certain of the business issues and risks, a change in any of which could cause actual results or outcomes to differ materially from those expressed in the forward looking statements. Any forward looking statement speaks only as of the date on which such statement is made. Trinity undertakes no obligation to update any forward looking statement or statements to reflect events or circumstances after the date on which such statement is made.

3 Agenda I. Overview II. Key Investment Considerations III. Strategy and Vision IV. Financial Highlights V. Appendix

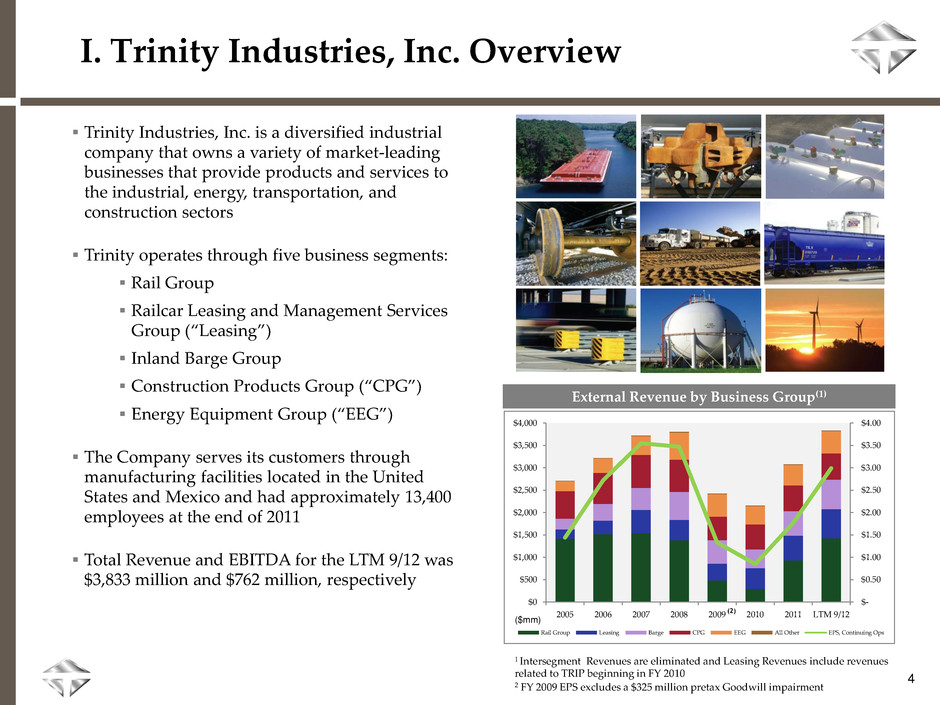

$- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2005 2006 2007 2008 2009 2010 2011 LTM 9/12 Rail Group Leasing Barge CPG EEG All Other EPS, Continuing Ops I. Trinity Industries, Inc. Overview 4 Trinity Industries, Inc. is a diversified industrial company that owns a variety of market-leading businesses that provide products and services to the industrial, energy, transportation, and construction sectors Trinity operates through five business segments: Rail Group Railcar Leasing and Management Services Group (“Leasing”) Inland Barge Group Construction Products Group (“CPG”) Energy Equipment Group (“EEG”) The Company serves its customers through manufacturing facilities located in the United States and Mexico and had approximately 13,400 employees at the end of 2011 Total Revenue and EBITDA for the LTM 9/12 was $3,833 million and $762 million, respectively External Revenue by Business Group(1) 1 Intersegment Revenues are eliminated and Leasing Revenues include revenues related to TRIP beginning in FY 2010 2 FY 2009 EPS excludes a $325 million pretax Goodwill impairment ($mm) (2)

II. Key Investment Considerations 5 Leading Market Positions Diversified Portfolio of Businesses Flexible and Cost-Effective Manufacturing Seasoned Performers Enrichment Value Focused

Leading Market Positions 6 Rail Group Leading manufacturer of railcars in North America Leading manufacturer of railcar axles in North America Leading manufacturer of railcar coupling devices in North America Railcar Leasing and Management Services Group Leading provider of railcar leasing and management services Inland Barge Group Leading manufacturer of inland barges in the United States Largest manufacturer of fiberglass covers for barges in the United States Construction Products Group Leading full-line manufacturer of highway guardrail and crash cushions in the United States Leading supplier of concrete and aggregates in certain regions of Texas Energy Equipment Group Leading manufacturer of structural wind towers in North America Leading producer of propane tanks, tank containers, and tank heads for pressure and non-pressure vessels in North America

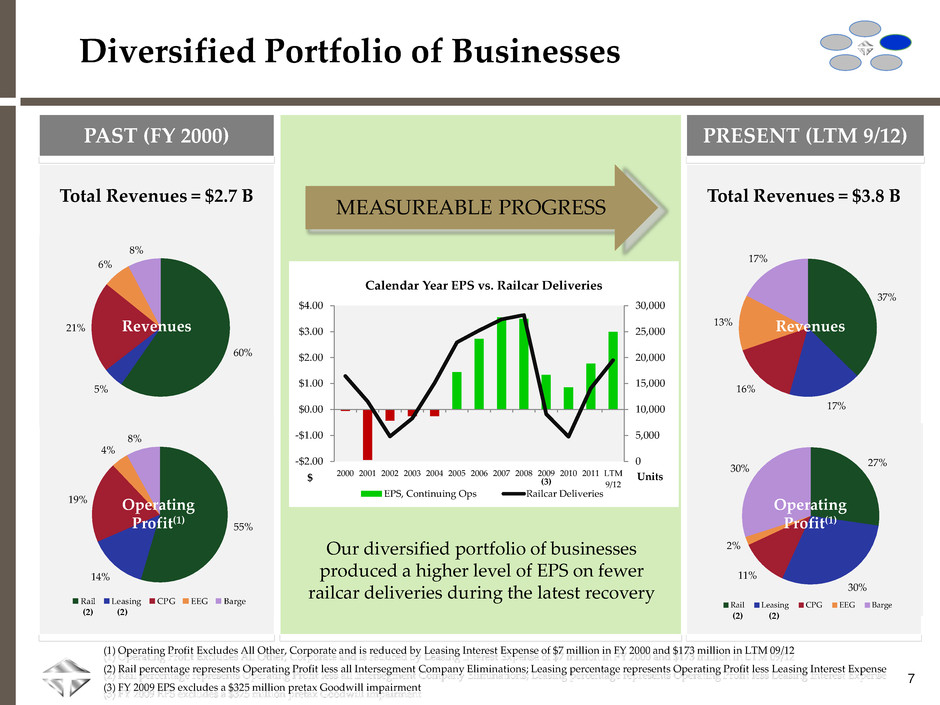

27% 30% 11% 2% 30% Rail Leasing CPG EEG Barge Diversified Portfolio of Businesses 7 PAST (FY 2000) PRESENT (LTM 9/12) MEASUREABLE PROGRESS Total Revenues = $2.7 B Total Revenues = $3.8 B 60% 5% 21% 6% 8% 55% 14% 19% 4% 8% Rail Leasing CPG EEG Barge Revenues Operating Profit(1) Operating Profit(1) Our diversified portfolio of businesses produced a higher level of EPS on fewer railcar deliveries during the latest recovery (1) Operating Profit Excludes All Other, Corporate and is reduced by Leasing Interest Expense of $7 million in FY 2000 and $173 million in LTM 09/12 (2) Rail percentage represents Operating Profit less all Intersegment Company Eliminations; Leasing percentage represents Operating Profit less Leasing Interest Expense (3) FY 2009 EPS excludes a $325 million pretax Goodwill impairment (2) (2) (2) (2) 37% 17% 16% 13% 17% 0 5,000 10,000 15,000 20,000 25,000 30,000 -$2.00 -$1.00 $0.00 $1.00 $2.00 $3.00 $4.00 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 LTM 9/12 Calendar Year EPS vs. Railcar Deliveries EPS, Continuing Ops Railcar Deliveries Revenues $ Units (3)

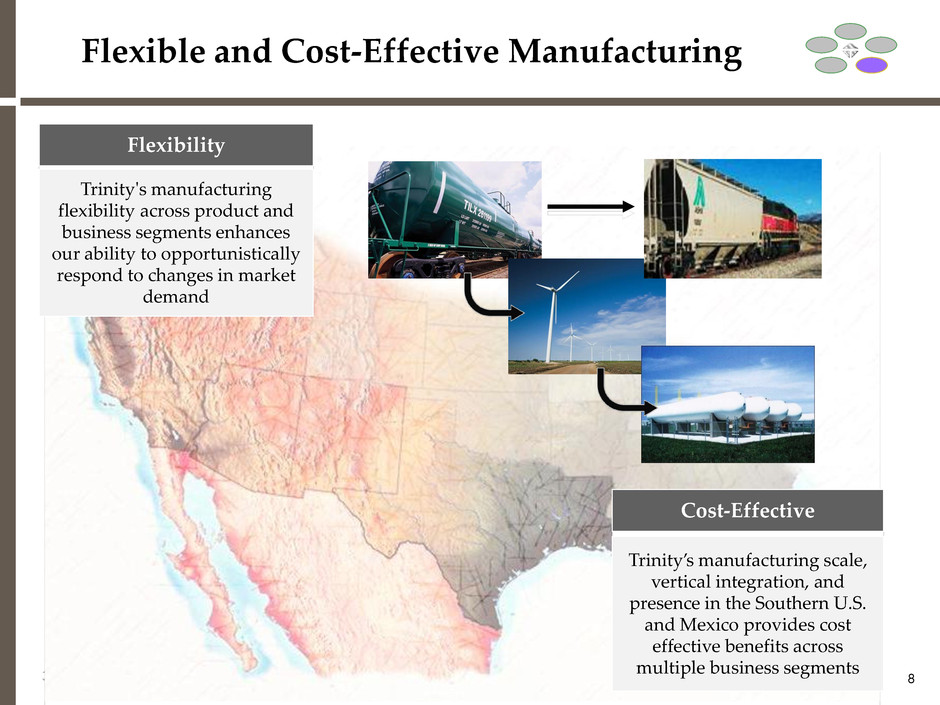

Flexible and Cost-Effective Manufacturing 8 Flexibility Cost-Effective Trinity's manufacturing flexibility across product and business segments enhances our ability to opportunistically respond to changes in market demand Trinity’s manufacturing scale, vertical integration, and presence in the Southern U.S. and Mexico provides cost effective benefits across multiple business segments

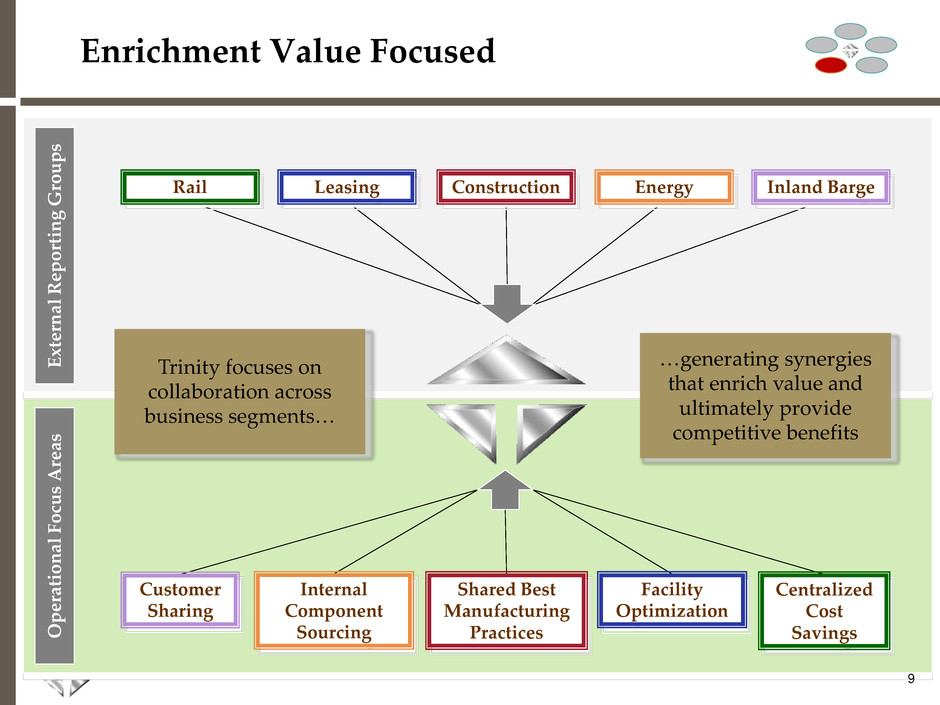

Enrichment Value Focused 9 E x te rn a l R e p o rti n g G ro u p s O p e ra tio n a l Foc u s A re a s Rail Leasing Construction Energy Inland Barge Customer Sharing Internal Component Sourcing Shared Best Manufacturing Practices Facility Optimization Centralized Cost Savings Trinity focuses on collaboration across business segments… …generating synergies that enrich value and ultimately provide competitive benefits

10 Seasoned Performer Across Economic Cycles Trinity is uniquely positioned to emerge from a severe down cycle with more opportunity for growth to generate significant profits during an up cycle Seasoned management team knows how to assess the market, proactively plan for cycles and address changes in economic conditions Manufacturing flexibility is a core competency, and when combined with our broad product offering allows us to pursue a wide range of orders Cost-effective manufacturing footprint in the Southern United States and Mexico is a competitive advantage for many of our product lines Shared synergies across business lines provide unique opportunities Trinity’s lease fleet of 71,255 railcars (including TRIP) provides a strong strategic connection to our customers, as well as a consistent long-term stream of profit and cash flow Strong liquidity position of approximately $758 million and solid balance sheet

III. Strategy and Vision: Operational 11 Strategically Grow the Lease Fleet Maximize Manufacturing Efficiency Selectively Build our Backlogs Diversify Through Organic Growth Acquire Complementary Product Portfolios Be a premier, diversified industrial company that generates superior earnings and returns for shareholders

Liquidity (at 9/30/12): ~ $758 mm Strategy and Vision: Financial 12 Maintain a conservative and liquid balance sheet to be attractively positioned to capitalize on opportunities Working Capital Capital Expenditures Acquisitions Shareholder Distributions Corporate Debt(1) - Convertible Subordinated Notes - $450 mm Other Debt - $5 mm Leasing Debt(2) – Recourse Debt: Capital lease obligations/Term loan - $98 mm Non-recourse Debt: TILC Warehouse borrowings - $386 mm TILC Long-term financings - $1,261 mm TRIP Long-term financings - $869 mm (1) Excludes $90.7 mm of unamortized discount related to Company’s convertible debt (2) Total leasing financings of $2.6 billion, including TRIP; Leasing assets have a net book value of $4.3 billion, including TRIP, which leaves a significant amount of unencumbered assets available for financing Cash and Cash Equivalents - $312 mm Corporate Revolver Availability - $356 mm TILC Warehouse Availability - $89 mm Balance Sheet Debt (at 9/30/12): ~ $3,069 mm(1) Equity (at 9/30/12): ~ $2,087 mm

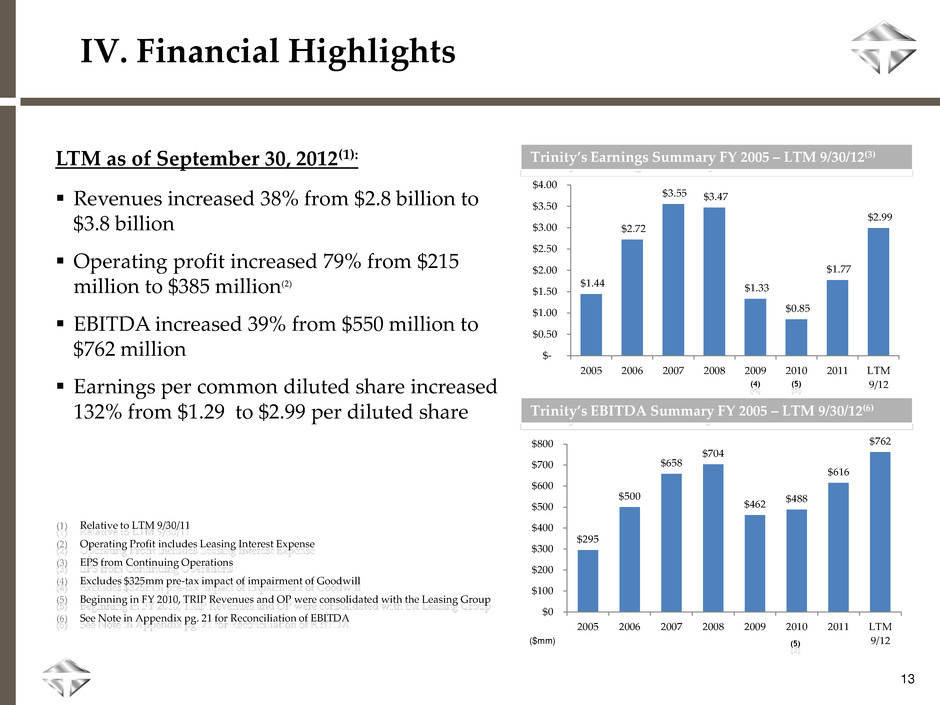

$295 $500 $658 $704 $462 $488 $616 $762 $0 $100 $200 $300 $400 $500 $600 $700 $800 2005 2006 2007 2008 2009 2010 2011 LTM 9/12 $1.44 $2.72 $3.55 $3.47 $1.33 $0.85 $1.77 $2.99 $- $0.50 $1. 0 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 005 2006 2007 2008 2009 2010 2011 LTM 9/12 13 IV. Financial Highlights Trinity’s Earnings Summary FY 2005 – LTM 9/30/12(3) LTM as of September 30, 2012(1): Revenues increased 38% from $2.8 billion to $3.8 billion Operating profit increased 79% from $215 million to $385 million(2) EBITDA increased 39% from $550 million to $762 million Earnings per common diluted share increased 132% from $1.29 to $2.99 per diluted share Trinity’s EBITDA Summary FY 2005 – LTM 9/30/12(6) ($mm) (1) Relative to LTM 9/30/11 (2) Operating Profit includes Leasing Interest Expense (3) EPS from Continuing Operations (4) Excludes $325mm pre-tax impact of impairment of Goodwill (5) Beginning in FY 2010, TRIP Revenues and OP were consolidated with the Leasing Group (6) See Note in Appendix pg. 21 for Reconciliation of EBITDA (5) (5) (4)

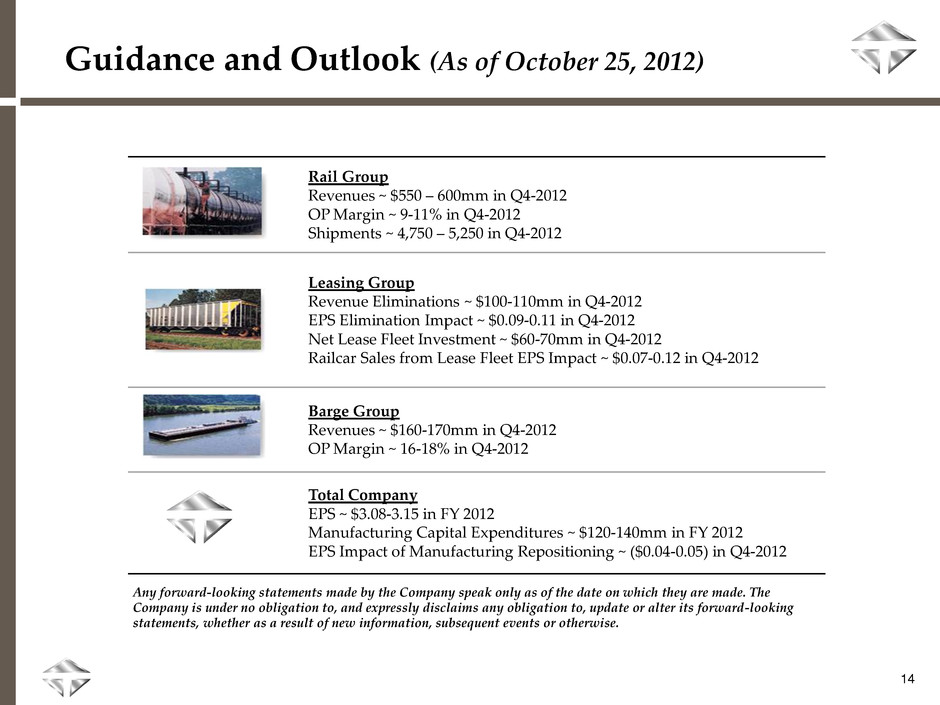

Guidance and Outlook (As of October 25, 2012) 14 Any forward-looking statements made by the Company speak only as of the date on which they are made. The Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise. Rail Group Revenues ~ $550 – 600mm in Q4-2012 OP Margin ~ 9-11% in Q4-2012 Shipments ~ 4,750 – 5,250 in Q4-2012 Leasing Group Revenue Eliminations ~ $100-110mm in Q4-2012 EPS Elimination Impact ~ $0.09-0.11 in Q4-2012 Net Lease Fleet Investment ~ $60-70mm in Q4-2012 Railcar Sales from Lease Fleet EPS Impact ~ $0.07-0.12 in Q4-2012 Barge Group Revenues ~ $160-170mm in Q4-2012 OP Margin ~ 16-18% in Q4-2012 Total Company EPS ~ $3.08-3.15 in FY 2012 Manufacturing Capital Expenditures ~ $120-140mm in FY 2012 EPS Impact of Manufacturing Repositioning ~ ($0.04-0.05) in Q4-2012

Appendix: Operating Business Summaries

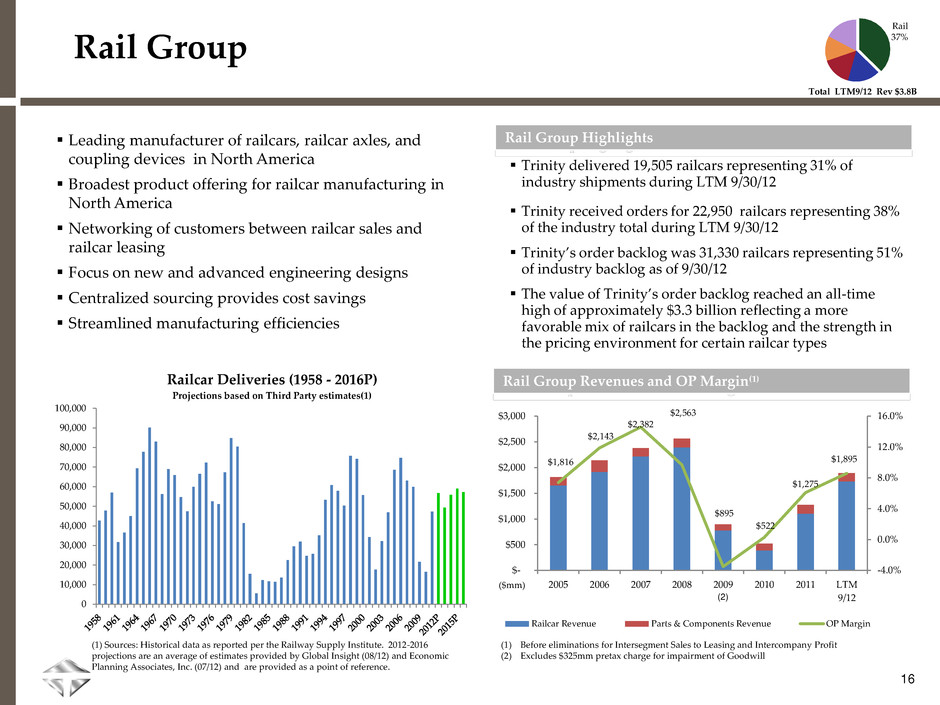

$1,816 $2,143 $2,382 $2,563 $895 $522 $1,275 $1,895 -4.0% 0.0% 4.0% 8.0% 12.0% 16.0% $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 2005 2006 2007 2008 2009 2010 2011 LTM 9/12 Railcar Revenue Parts & Components Revenue OP Margin 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Railcar Deliveries (1958 - 2016P) Projections based on Third Party estimates(1) 16 Trinity delivered 19,505 railcars representing 31% of industry shipments during LTM 9/30/12 Trinity received orders for 22,950 railcars representing 38% of the industry total during LTM 9/30/12 Trinity’s order backlog was 31,330 railcars representing 51% of industry backlog as of 9/30/12 The value of Trinity’s order backlog reached an all-time high of approximately $3.3 billion reflecting a more favorable mix of railcars in the backlog and the strength in the pricing environment for certain railcar types Rail Group Leading manufacturer of railcars, railcar axles, and coupling devices in North America Broadest product offering for railcar manufacturing in North America Networking of customers between railcar sales and railcar leasing Focus on new and advanced engineering designs Centralized sourcing provides cost savings Streamlined manufacturing efficiencies Rail Group Highlights Rail Group Revenues and OP Margin(1) (1) Before eliminations for Intersegment Sales to Leasing and Intercompany Profit (2) Excludes $325mm pretax charge for impairment of Goodwill ($mm) (2) (1) Sources: Historical data as reported per the Railway Supply Institute. 2012-2016 projections are an average of estimates provided by Global Insight (08/12) and Economic Planning Associates, Inc. (07/12) and are provided as a point of reference. Rail 37% Total LTM9/12 Rev $3.8B

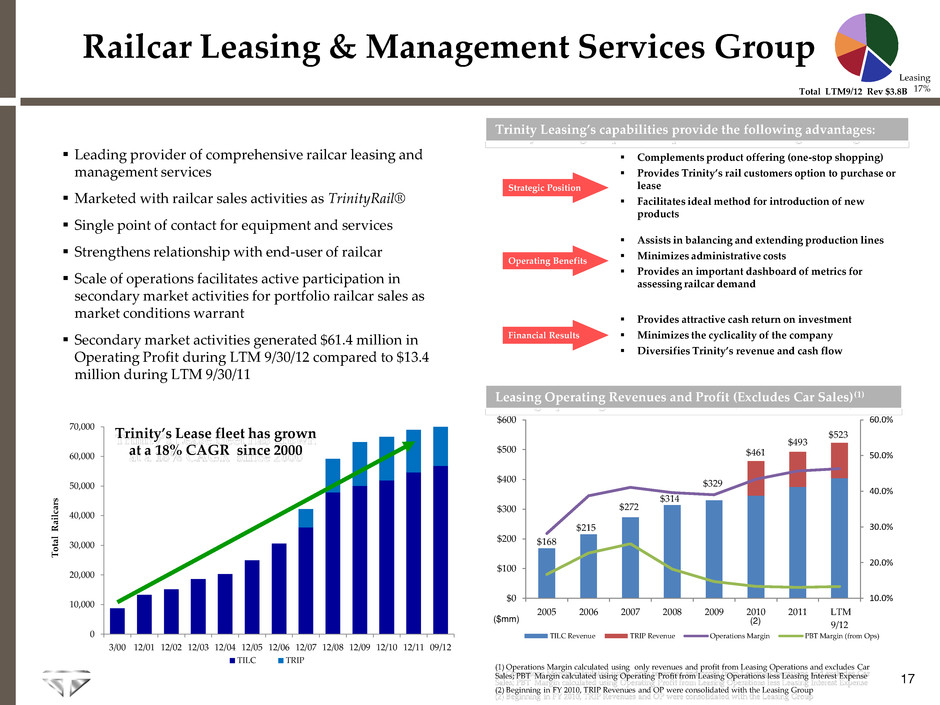

$168 $215 $272 $314 $329 $461 $493 $523 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% $0 $100 $200 $300 $400 $500 $600 2005 2006 2007 2008 2009 2010 2011 LTM 9/12 TILC Revenue TRIP Revenue Operations Margin PBT Margin (from Ops) 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 3/00 12/ 1 12/ 2 1 /03 12/04 2/05 2/06 12/07 12/08 12/09 12/10 12/11 09/12 TILC TRIP Tot al Ra ilc ar s 17 Railcar Leasing & Management Services Group Leading provider of comprehensive railcar leasing and management services Marketed with railcar sales activities as TrinityRail® Single point of contact for equipment and services Strengthens relationship with end-user of railcar Scale of operations facilitates active participation in secondary market activities for portfolio railcar sales as market conditions warrant Secondary market activities generated $61.4 million in Operating Profit during LTM 9/30/12 compared to $13.4 million during LTM 9/30/11 Trinity Leasing’s capabilities provide the following advantages: Strategic Position Operating Benefits Financial Results Complements product offering (one-stop shopping) Provides Trinity’s rail customers option to purchase or lease Facilitates ideal method for introduction of new products Assists in balancing and extending production lines Minimizes administrative costs Provides an important dashboard of metrics for assessing railcar demand Provides attractive cash return on investment Minimizes the cyclicality of the company Diversifies Trinity’s revenue and cash flow Leasing Operating Revenues and Profit (Excludes Car Sales)(1) ($mm) (1) Operations Margin calculated using only revenues and profit from Leasing Operations and excludes Car Sales; PBT Margin calculated using Operating Profit from Leasing Operations less Leasing Interest Expense (2) Beginning in FY 2010, TRIP Revenues and OP were consolidated with the Leasing Group Trinity’s Lease fleet has grown at a 18% CAGR since 2000 (2) Leasing 17% Total LTM9/12 Rev $3.8B

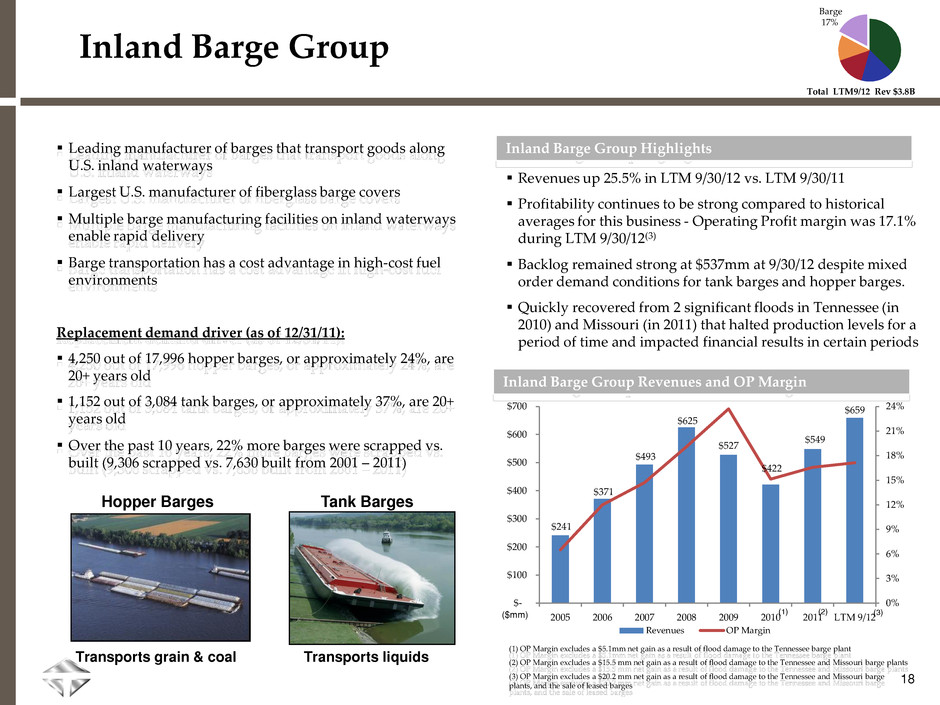

$241 $371 $493 $625 $527 $422 $549 $659 0% 3% 6% 9% 12% 15% 18% 21% 24% $- $100 $200 $300 $400 $500 $600 $700 2005 2006 2007 2008 2009 2010 2011 LTM 9/12 Revenues OP Margin 18 Revenues up 25.5% in LTM 9/30/12 vs. LTM 9/30/11 Profitability continues to be strong compared to historical averages for this business - Operating Profit margin was 17.1% during LTM 9/30/12(3) Backlog remained strong at $537mm at 9/30/12 despite mixed order demand conditions for tank barges and hopper barges. Quickly recovered from 2 significant floods in Tennessee (in 2010) and Missouri (in 2011) that halted production levels for a period of time and impacted financial results in certain periods Inland Barge Group Inland Barge Group Highlights Inland Barge Group Revenues and OP Margin Tank Barges Hopper Barges Transports grain & coal Transports liquids ($mm) Leading manufacturer of barges that transport goods along U.S. inland waterways Largest U.S. manufacturer of fiberglass barge covers Multiple barge manufacturing facilities on inland waterways enable rapid delivery Barge transportation has a cost advantage in high-cost fuel environments Replacement demand driver (as of 12/31/11): 4,250 out of 17,996 hopper barges, or approximately 24%, are 20+ years old 1,152 out of 3,084 tank barges, or approximately 37%, are 20+ years old Over the past 10 years, 22% more barges were scrapped vs. built (9,306 scrapped vs. 7,630 built from 2001 – 2011) (1) (1) OP Margin excludes a $5.1mm net gain as a result of flood damage to the Tennessee barge plant (2) OP Margin excludes a $15.5 mm net gain as a result of flood damage to the Tennessee and Missouri barge plants (3) OP Margin excludes a $20.2 mm net gain as a result of flood damage to the Tennessee and Missouri barge plants, and the sale of leased barges (2) (3) Barge 17% Total LTM9/12 Rev $3.8B

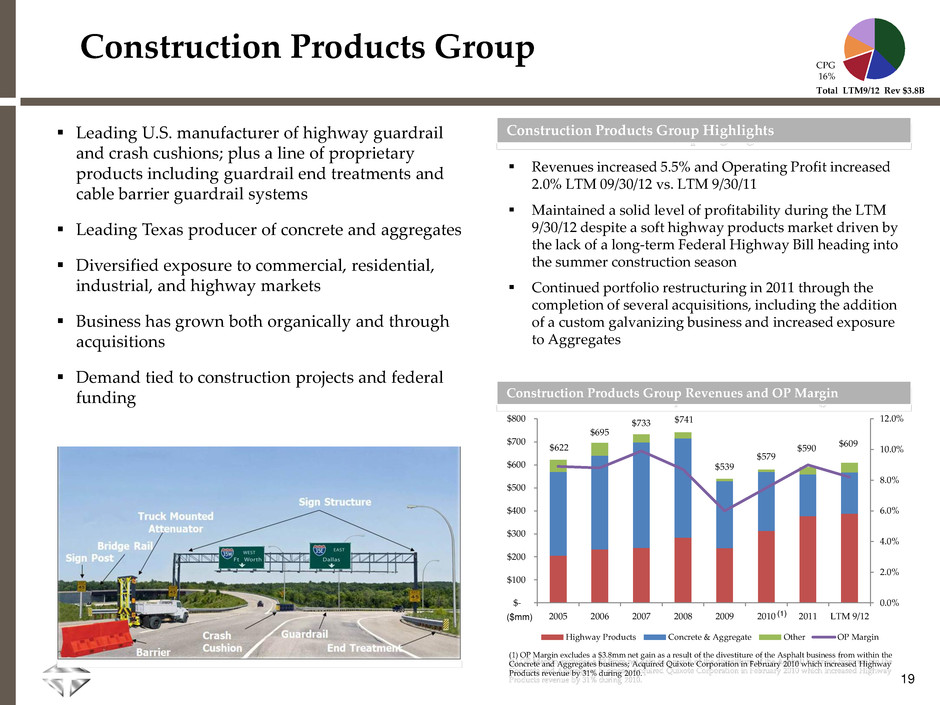

$622 $695 $733 $741 $539 $579 $590 $609 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% $- $100 $200 $300 $400 $500 $600 $700 $800 2005 2006 2007 2008 2009 2010 2011 LTM 9/12 Highway Products Concrete & Aggregate Other OP Margin 19 Revenues increased 5.5% and Operating Profit increased 2.0% LTM 09/30/12 vs. LTM 9/30/11 Maintained a solid level of profitability during the LTM 9/30/12 despite a soft highway products market driven by the lack of a long-term Federal Highway Bill heading into the summer construction season Continued portfolio restructuring in 2011 through the completion of several acquisitions, including the addition of a custom galvanizing business and increased exposure to Aggregates Construction Products Group Leading U.S. manufacturer of highway guardrail and crash cushions; plus a line of proprietary products including guardrail end treatments and cable barrier guardrail systems Leading Texas producer of concrete and aggregates Diversified exposure to commercial, residential, industrial, and highway markets Business has grown both organically and through acquisitions Demand tied to construction projects and federal funding Construction Products Group Highlights Construction Products Group Revenues and OP Margin ($mm) (1) OP Margin excludes a $3.8mm net gain as a result of the divestiture of the Asphalt business from within the Concrete and Aggregates business; Acquired Quixote Corporation in February 2010 which increased Highway Products revenue by 31% during 2010. (1) CPG 16% Total LTM9/12 Rev $3.8B

$235 $337 $434 $633 $510 $ 420 $473 $516 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% $- $100 $200 $300 $400 $500 $600 $700 2005 2006 2007 2008 2009 2010 2011 LTM 9/12 Wind Tower Revenues Other Revenues OP Margin 20 Structural Wind Towers: Revenues of $246 million in LTM 9/30/12 Backlog of $754 million(1) as of 9/30/12 Plants are strategically located along the central corridor where the majority of wind farms are installed Began shifting excess wind tower capacity to support railcar production as part of our flexible manufacturing platform due to the potential expiration of the Production Tax Credit on 12/31/12 Tank Containers: Consistent and mature business Recently launched the frac tank product to support oil & gas exploration industry Energy Equipment Group Leading manufacturer of structural wind towers in North America Leading producer of propane tanks, tank containers, and tank heads for pressure and non- pressure vessels in North America Low-cost manufacturer with primary tank container production in Mexico facilities Synergies among products across multiple Trinity business groups Energy Equipment Group Highlights Energy Equipment Group Revenues & OP Margin ($mm) (1) Approximately $413 million of this backlog is involved in litigation filed by the Company against one of our structural wind tower customers for breach of a long-term supply contract for the manufacture of towers EEG 13% Total LTM9/12 Rev $3.8B

2005 2006 2007 2008 2009 2010 2011 LTM 9/12 Income (loss) from continuing operations $110.5 $212.6 $289.8 $282.4 ($137.7) $75.4 $145.7 $239.8 Add: Interest expense 42.2 68.7 84.5 109.4 123.2 182.1 185.3 192.7 Provision/(Benefit) for income taxes 65.6 131.3 165.1 171.4 (9.4) 40.9 91.8 131.7 Depreciation & amortization expense 76.2 87.6 118.9 140.3 160.8 189.6 192.9 197.4 Goodwill impairment - - - - 325.0 - - - Earnings from continuing before interest expense, income taxes, and depreciation and amortization expense $294.5 $500.2 $658.3 $703.5 $461.9 $488.0 $615.7 $761.6 Reconciliation of EBITDA (in millions) “EBITDA” is defined as income (loss) from continuing operations plus interest expense, income taxes, and depreciation and amortization including goodwill impairment charges. EBITDA is not a calculation based on generally accepted accounting principles. The amounts included in the EBITDA calculation, however, are derived from amounts included in the historical statements of operations data. In addition, EBITDA should not be considered as an alternative to net income or operating income as an indicator of our operating performance, or as an alternative to operating cash flows as a measure of liquidity. We believe EBITDA assists investors in comparing a company’s performance on a consistent basis without regard to depreciation and amortization, which can vary significantly depending upon many factors. However, the EBITDA measure presented in this presentation may not always be comparable to similarly titled measures by other companies due to differences in the components of the calculation. (1) Includes results of operations related to TRIP starting January 1, 2010 21 (1) (1) (1)