Attached files

| file | filename |

|---|---|

| 8-K - ROCK-TENN COMPANY 8-K - Rock-Tenn CO | a50463713.htm |

Exhibit 99.1

Fiscal 2012 4th

Quarter Earnings Conference Call Presentation November 2, 2012 Jim

Rubright – Chairman and Chief Executive Officer Steve Voorhees – Chief

Financial Officer and Chief Administrative Officer

Fiscal 2012 4th

Quarter Earnings Conference Call Presentation November 2, 2012 Jim

Rubright – Chairman and Chief Executive Officer Steve Voorhees – Chief

Financial Officer and Chief Administrative Officer

Cautionary Statement Regarding Forward-Looking Information Statements in this presentation that do not relate strictly to historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including the slide entitled “Key Financial Statistics – FY13 Outlook” that gives guidance for future periods in 2013. Forward-looking statements are based on our current expectations, beliefs, plans or forecasts and use words in this presentation such as will, estimate, trending, or refer to future time periods. You should not place undue reliance on any forward-looking statements as such statements involve risks, uncertainties, assumptions and other factors that could cause actual results to differ materially, including the following: our belief that the Corrugated industry fundamentals are improving, our ability to integrate Smurfit-Stone or to achieve benefits from the Smurfit-Stone Acquisition, including, without limitation, synergies, performance improvements and successful implementation of capital projects; expected levels of depreciation and amortization, corporate expenses, interest expense, income tax rates, federal NOLs, Black Liquor and AMT tax credits, pension expense and contributions, capital expenditures, commodity costs, maintenance outages, containerboard inventory builds; the level of demand for our products; economic downtime; our ability to successfully identify and make performance improvements; anticipated returns on our capital investments; possible increases in energy, raw materials, shipping and capital equipment costs; any reduction in the supply of raw materials; fluctuations in selling prices and volumes; intense competition; the potential loss of certain customers; adverse changes in general market and industry conditions and other risks, uncertainties and factors discussed in Item 1A "Risk Factors" and under the caption "Business — Forward-Looking Information" in our 2011 Annual Report on Form 10-K and by similar disclosures in any of our subsequent SEC filings. The information contained herein speaks as of the date hereof and we do not have or undertake any obligation to update such information as future events unfold.

Disclaimer and Use of Non-GAAP Financial Measures and Reconciliations We may from time to time be in possession of certain information regarding RockTenn that applicable law would not require us to disclose to the public in the ordinary course of business, but would require us to disclose if we were engaged in the purchase or sale of our securities. This presentation shall not be considered to be part of any solicitation of an offer to buy or sell RockTenn securities. This presentation also may not include all of the information regarding RockTenn that you may need to make an investment decision regarding RockTenn securities. Any such investment decision should be made on the basis of the overall mix of information regarding RockTenn that is publicly available as of the date of such decision. We have included financial measures that are not prepared in accordance with accounting principles generally accepted in the United States ("GAAP"). The non-GAAP financial measures presented are not intended to be a substitute for GAAP financial measures, and any analysis of non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP and the reconciliations of non-GAAP financial measures to GAAP financial measures included in the Appendix to this presentation.

RockTenn Q4’12 – Summary Adjusted earnings up 46% to $1.39(1) per share over Q3’12 EBITDA margins of 13.7%, up from 11.7% in Q3’12 (2)$128 million available for dividends, pension contributions in excess of expense and acquisitions and investments, net of debt increase Continued growth in Smurfit-Stone acquisition synergies - Q4’12 end run rate in excess of $250 million July leadership changes driving improved operating performance Implementing price increase on containerboard and boxes Increased annual dividend 12.5% to $0.90 per share Hodge Mill’s income was $0.15 below our expectations at the beginning of the quarter Growth in sequential U.S. Corrugated Packaging volumes in Q4’12 of 1.3% compared to industry decline of 0.3% (1) On a GAAP basis, EPS was $1.14 in 4Q’12 and $0.81 in 3Q’12. See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix. (2) See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix

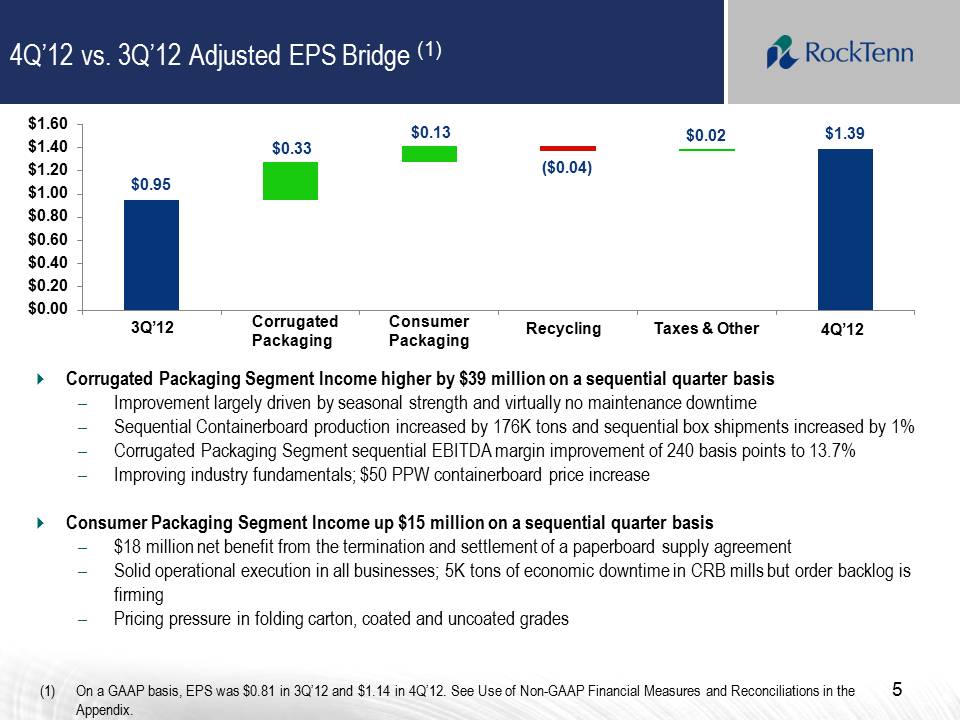

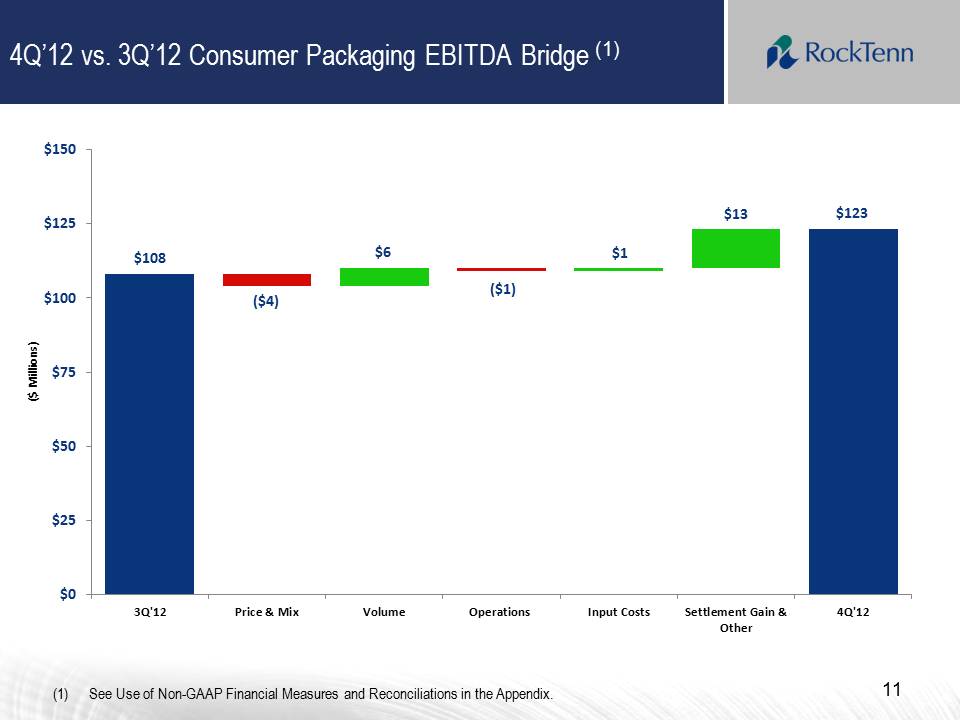

4Q’12 vs. 3Q’12 Adjusted EPS Bridge (1) Corrugated Packaging Segment Income higher by $39 million on a sequential quarter basis Improvement largely driven by seasonal strength and virtually no maintenance downtime Sequential Containerboard production increased by 176K tons and sequential box shipments increased by 1% Corrugated Packaging Segment sequential EBITDA margin improvement of 240 basis points to 13.7% Improving industry fundamentals; $50 PPW containerboard price increase Consumer Packaging Segment Income up $15 million on a sequential quarter basis $18 million net benefit from the termination and settlement of a paperboard supply agreement Solid operational execution in all businesses; 5K tons of economic downtime in CRB mills but order backlog is firming Pricing pressure in folding carton, coated and uncoated grades (1) On a GAAP basis, EPS was $0.81 in 3Q’12 and $1.14 in 4Q’12. See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix. $1.60 $1.40 $1.20 $1.00 $0.80 $0.60 $0.40 $0.20 $0.00 3Q’12 Corrugated Packaging Consumer Packaging Recycling Taxes & Other 4Q’12 $0.95 $0.33 $0.13 ($0.04) $0.02 $1.39

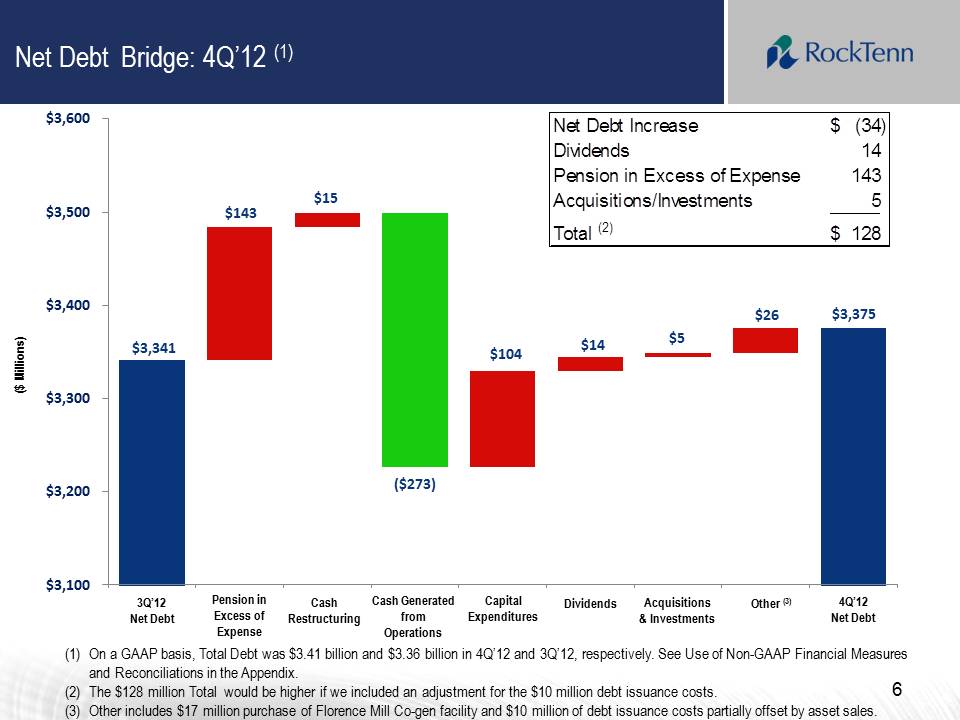

(1) On a GAAP basis, Total Debt was $3.41 billion and $3.36 billion in 4Q’12 and 3Q’12, respectively. See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix. (2) The $128 million Total would be higher if we included an adjustment for the $10 million debt issuance costs. (3) Other includes $17 million purchase of Florence Mill Co-gen facility and $10 million of debt issuance costs partially offset by asset sales. Net Debt Bridge: 4Q’12(1) Net Debt Increase $(34) Dividends 14 Pension in Excess of Expense 143 Acquisitions/Investments 5 Total (2) $128 $3,600 $3,500 $3,400 $3,300 $3,200 $3,100 3Q’12 Net Debt Pension in Excess of Expense Cash Restructuring Cash Generated from Operations Capital Expenditures Dividends Acquisitions & Investments Other (3) 4Q’12 Net Debt $3,341 $143 $15 ($273) $104 $14 $5 $26 $3,375

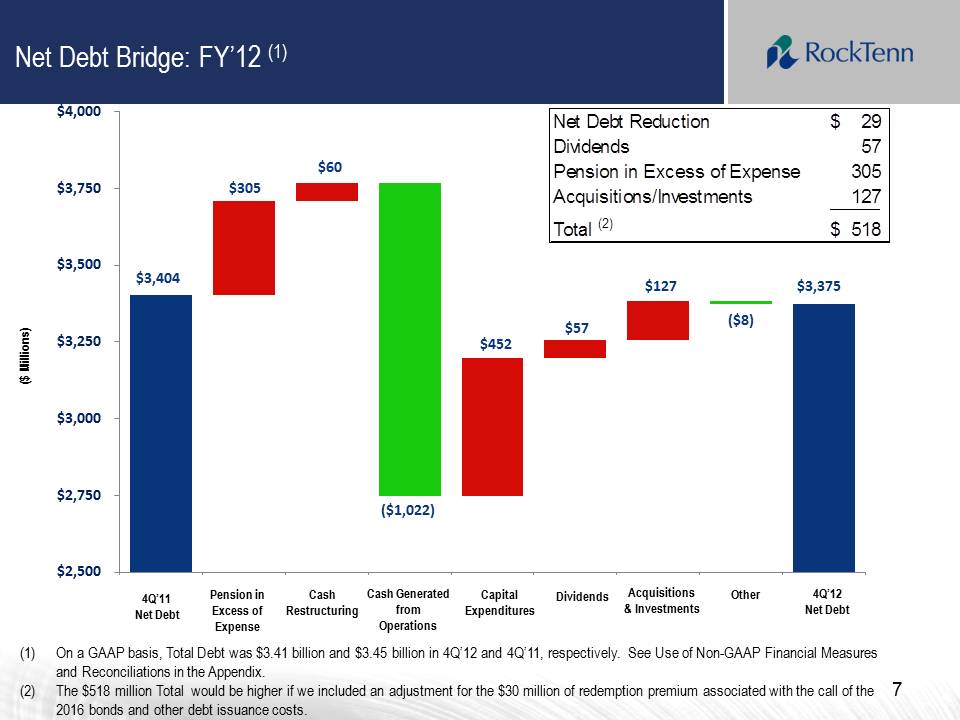

Net Debt Bridge: FY’12 (1)Nebt Bridge: FY’12 (1 (1) On a GAAP basis, Total Debt was $3.41 billion and $3.45 billion in 4Q’12 and 4Q’11, respectively. See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix. (2) The $518 million Total would be higher if we included an adjustment for the $30 million of redemption premium associated with the call of the 2016 bonds and other debt issuance costs. $4,000 $3,750 $3,500 $3,250 $3,000 $2,750 $2,500 4Q’11 Net Debt Pension in Excess of Expense Cash Restructuring Cash Generated from Operations Capital Expenditures Dividends Acquisitions & Investments Other 4Q’12 Net DebtNet Debt Reduction $29 Dividends 57 Pension in Excess of Expense 305 Acquisitions/Investments 127 Total (2) $518 $3,404 $305 $60 ($1,022) $452 $57 $127 ($8) $3,375

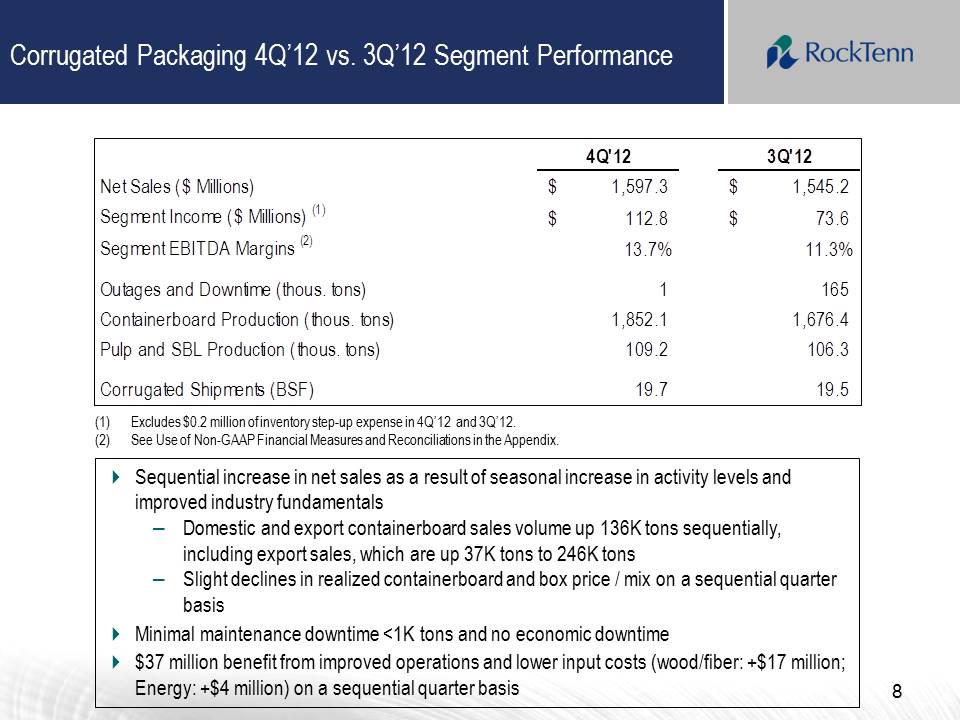

Corrugated Packaging 4Q’12 vs. 3Q’12 Segment Performance 4Q'12 3Q'12Net Sales ($ Millions) $ 1,597.3 $ 1,545.2Segment Income ($ Millions) (1) $ 112.8 $ 73.6 Segment EBITDA Margins (2) 13.7% 11.3% Outages and Downtime (thous. tons) 1 165 Containerboard Production (thous. tons) 1 ,852.1 1,676.4 Pulp and SBL Production (thous. tons) 1 09.2 106.3 Corrugated Shipments (BSF) 19.7 19.5 Sequential increase in net sales as a result of seasonal increase in activity levels and improved industry fundamentals Domestic and export containerboard sales volume up 136K tons sequentially, including export sales, which are up 37K tons to 246K tons Slight declines in realized containerboard and box price / mix on a sequential quarter basis Minimal maintenance downtime <1K tons and no economic downtime $37 million benefit from improved operations and lower input costs (wood/fiber: +$17 million; Energy: +$4 million) on a sequential quarter basis(1) Excludes $0.2 million of inventory step-up expense in 4Q’12 and 3Q’12. (2) See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix.

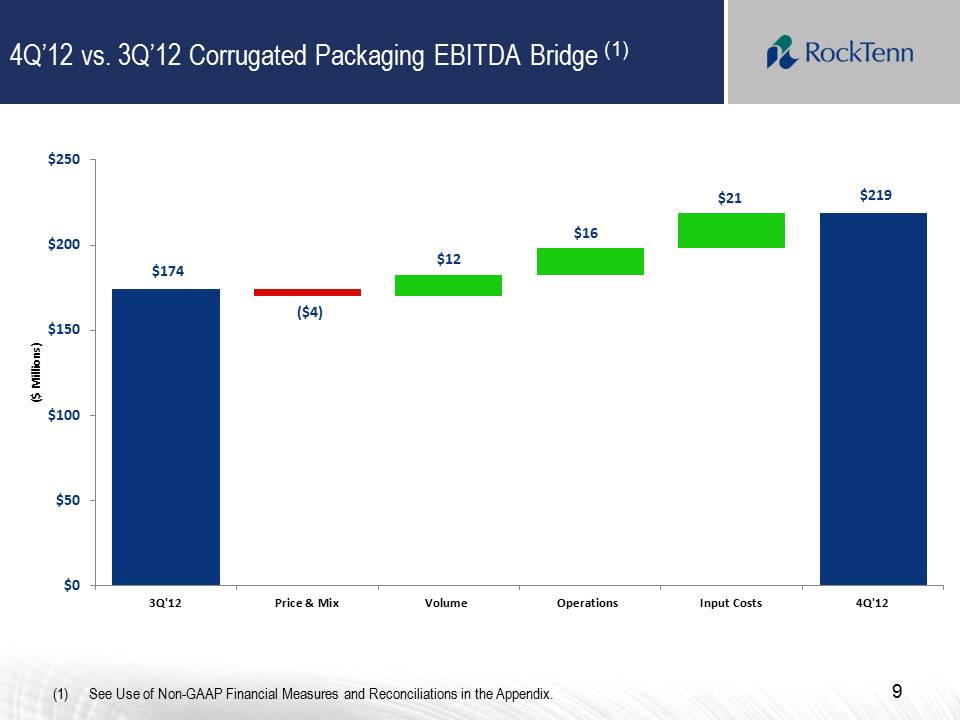

4Q’12 vs. 3Q’12 Corrugated Packaging EBITDA Bridge (1) (1) See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix. $250 $200 $150 $100 $50 $0 3Q’12 Price & Mix Volume Operations Input Costs 4Q’12 $174 ($4) $12 $16 $21 $219

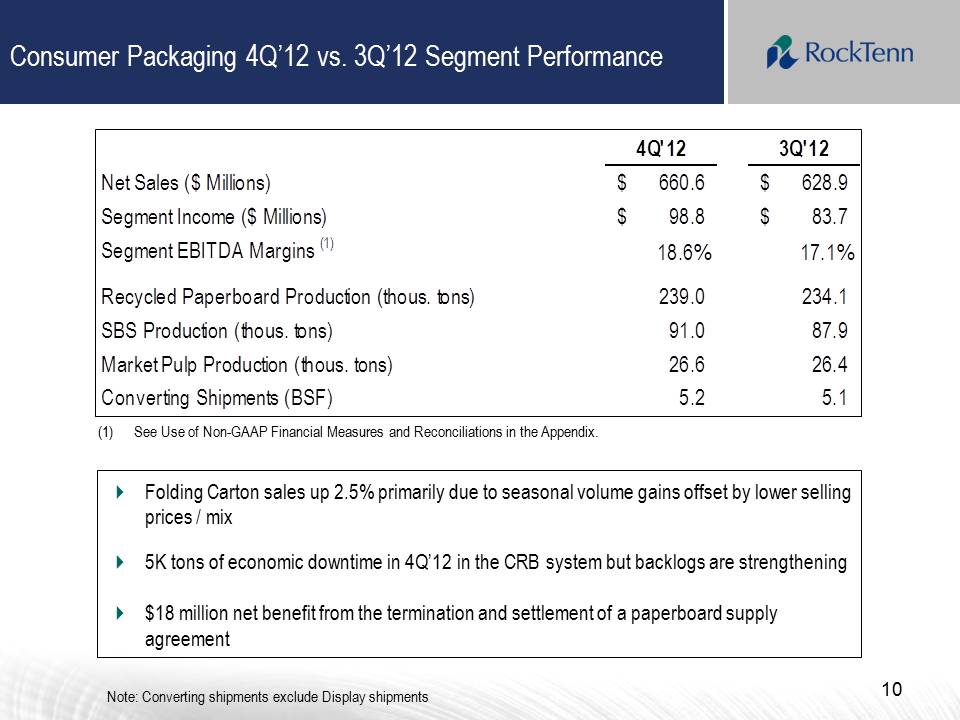

4Q'12 3Q'12 Net Sales ($ Millions) $660.6 $628.9 Segment Income ($ Millions) $98.8 $83.7 Segment EBITDA Margins (1) 18.6% 17.1% Recycled Paperboard Production (thous. tons) 239.0 234.1 SBS Production (thous. tons) 91.0 87.9 Market Pulp Production (thous. tons) 26.6 26.4 (1) Converting Shipments (BSF) 5.2 5.1 (1) See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix. (2) Folding Carton sales up 2.5% primarily due to seasonal volume gains offset by lower selling prices / mix (3) 5K tons of economic downtime in 4Q’12 in the CRB system but backlogs are strengthening $18 million net benefit from the termination and settlement of a paperboard supply agreement Note: Converting shipments exclude Display shipments

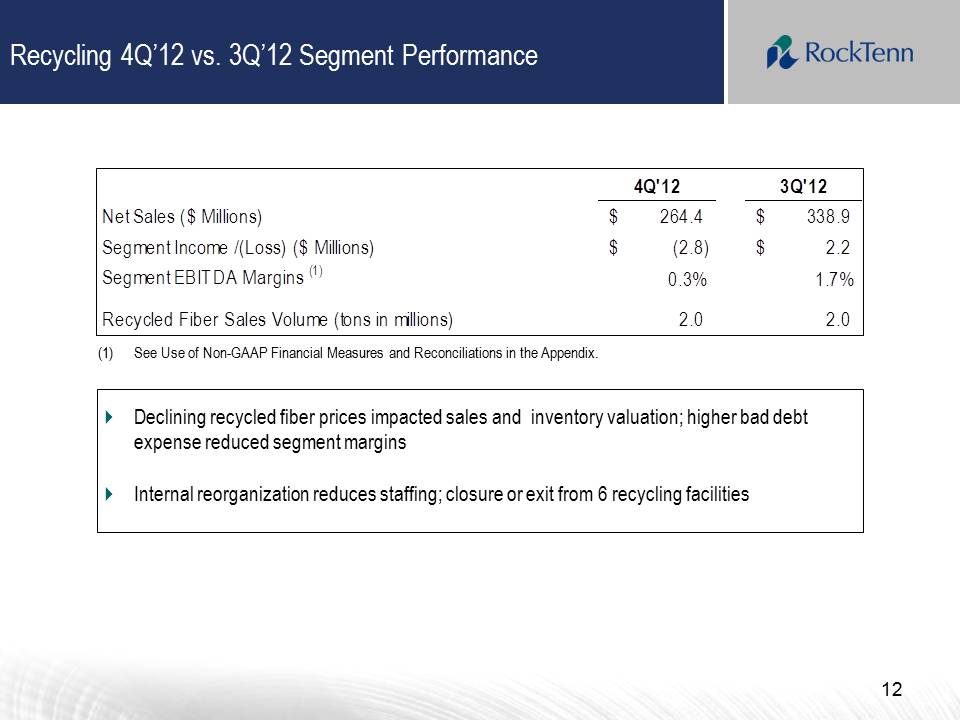

Recycling 4Q’12 vs. 3Q’12 Segment Performance 4Q'12 3Q'12 Net Sales ($ Millions) $264.4 $338.9 Segment Income /(Loss) ($ Millions) $(2.8) $2.2 Segment EBITDA Margins (1) 0.3% 1.7% Recycled Fiber Sales Volume (tons in millions) 2.0 2.0 (1) See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix. Declining recycled fiber prices impacted sales and inventory valuation; higher bad debt expense reduced segment margins Internal reorganization reduces staffing; closure or exit from 6 recycling facilities

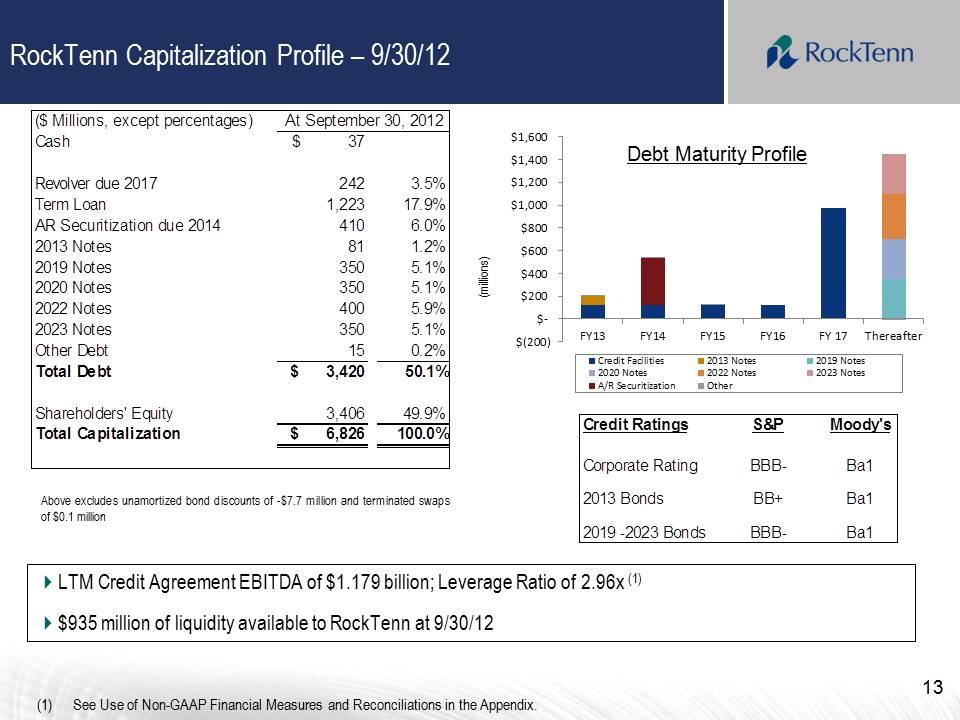

RockTenn Capitalization Profile – 9/30/12 ($ Millions, except percentages) At September 30, 2012 Cash $37 Revolver due 2017 242 3.5% Term Loan 1,223 17.9% AR Securitization due 2014 410 6.0% 2013 Notes 81 1.2% 2019 Notes 350 5.1% 2020 Notes 350 5.1% 2022 Notes 400 5.9% 2023 Notes 350 5.1% Other Debt15 0.2% Total Debt $3,420 50.1% Shareholders' Equity 3,406 49.9% Total Capitalization $6,826 100.0% Above excludes unamortized bond discounts of -$7.7 million and terminated swaps of $0.1 million Credit Ratings S&P Moody's Corporate Rating BBB- Ba1 2013 Bonds BB+ Ba1 2019 -2023 Bonds BBB- Ba1 LTM Credit Agreement EBITDA of $1.179 billion; Leverage Ratio of 2.96x (1) $935 million of liquidity available to RockTenn at 9/30/12 (1) See Use of Non-GAAP Financial Measures and Reconciliations in the Appendix. $1,600 FY13 FY14 FY15 FY16 FY 17 Thereafter $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $- $9200) FY13 FY14 FY15 FY16 FY17

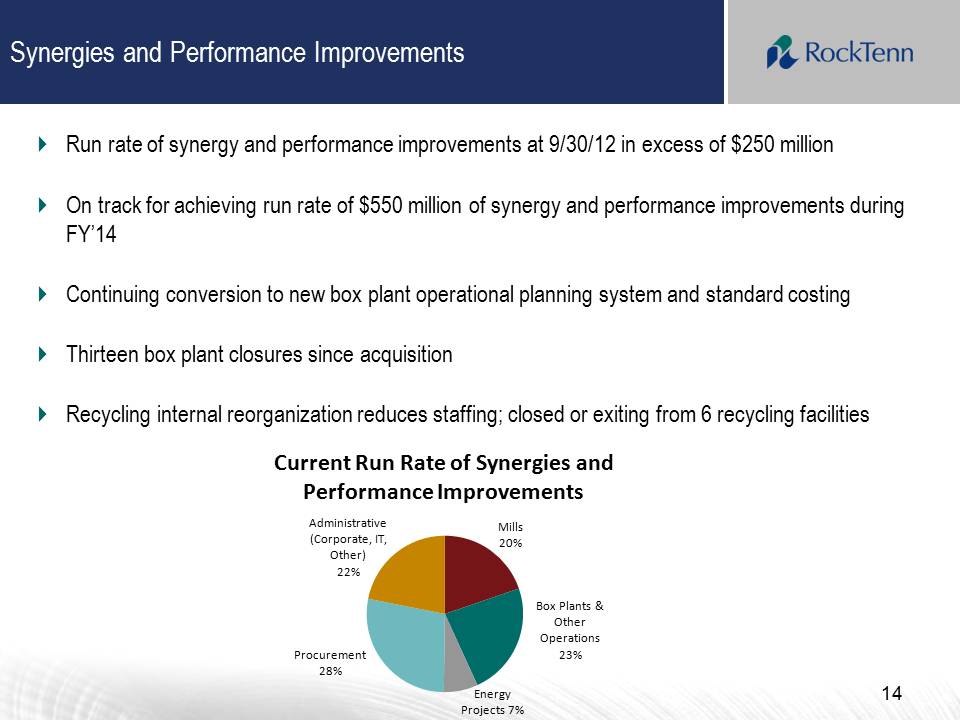

Synergies and Performance Improvements Run rate of synergy and performance improvements at 9/30/12 in excess of $250 million On track for achieving run rate of $550 million of synergy and performance improvements during FY’14 Continuing conversion to new box plant operational planning system and standard costing Thirteen box plant closures since acquisition Recycling internal reorganization reduces staffing; closed or exiting from 6 recycling facilities Current Run Rate of Synergies and Performance Improvements Mills 20% Box Plants & Other Operations 23% Energy Projects 7% Procurement 28% Administrative (Corporate, IT, Other) 22%

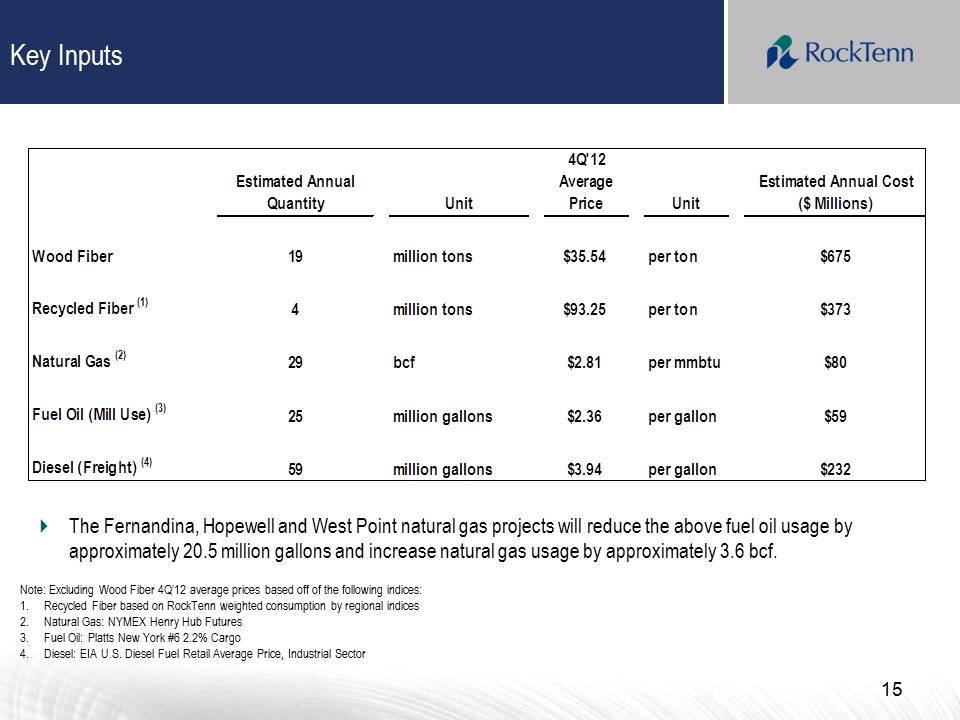

Key Inputs Estimated Annual Quantity Unit 4Q'12 Average Price Unit Estimated Annual Cost ($ Millions) Wood Fiber 19 million tons $35.54 per ton $675 Recycled Fiber (1) 4 million tons $93.25 per ton $373 Natural Gas (2) 29 bcf $2.81 per mmbtu $80 Fuel Oil (Mill Use) (3) 25 million gallons $2.36 per gallon $59 Diesel (Freight) (4) 59 million gallons $3.94 per gallon $232 The Fernandina, Hopewell and West Point natural gas projects will reduce the above fuel oil usage by approximately 20.5 million gallons and increase natural gas usage by approximately 3.6 bcf. Note: Excluding Wood Fiber 4Q’12 average prices based off of the following indices: Recycled Fiber based on RockTenn weighted consumption by regional indices Natural Gas: NYMEX Henry Hub Futures Fuel Oil: Platts New York #6 2.2% Cargo Diesel: EIA U.S. Diesel Fuel Retail Average Price, Industrial Sector

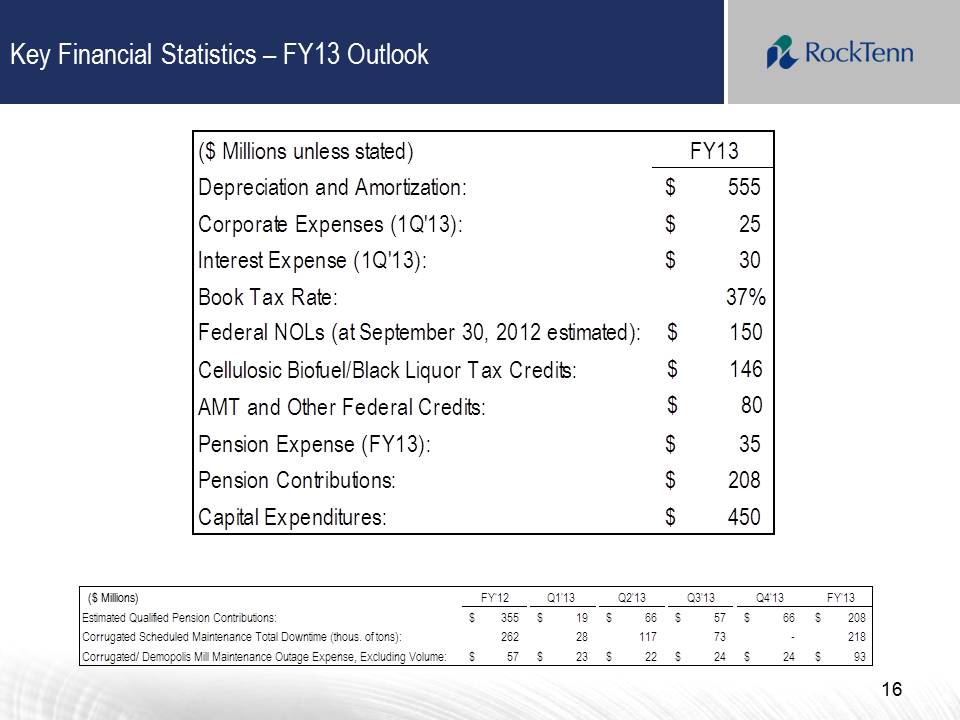

Key Financial Statistics – FY13 Outlook ($ Millions unless stated) FY13 Depreciation and Amortization: $555 Corporate Expenses (1Q'13):$25 Interest Expense (1Q'13): $30 Book Tax Rate: 37% Federal NOLs (at September 30, 2012 estimated): $150 Cellulosic Biofuel/Black Liquor Tax Credits: $146 AMT and Other Federal Credits:$80 Pension Expense (FY13): $35 Pension Contributions: $208 Capital Expenditures: $450 FY'12 Q1'13 Q2'13 Q3'13 Q4'13 FY'13 Estimated Qualified Pension Contributions: $355 $19 $66 $57 $66 $208 Corrugated Scheduled Maintenance Total Downtime (thous. of tons): 262 28 117 73 – 218 Corrugated/ Demopolis Mill Maintenance Outage Expense, Excluding Volume: $57 $23 $22 $24 $24 $93

Appendix

Use of Non-GAAP Financial Measures and Reconciliations Below, we define the non-GAAP financial measures, provide a reconciliation of each non-GAAP financial measure to the most directly comparable financial measure calculated in accordance with GAAP, and discuss the reasons that we believe this information is useful to management and may be useful to investors. These measures may differ from similarly captioned measures of other companies in our industry. Non-GAAP Measures Our definitions of Credit Agreement EBITDA and Segment EBITDA may differ from other similarly titled measures at other companies. Credit Agreement EBITDA (as defined) and Adjusted EBITDA (as defined) are not defined in accordance with GAAP and should not be viewed as alternatives to GAAP measures of operating results or liquidity. RockTenn management believes that net income is the most directly comparable GAAP measure to Credit Agreement EBITDA (as defined) and Segment Income is the most directly comparable GAAP measure to Segment EBITDA.

Non-GAAP Measures: Credit Agreement EBITDA and Total Funded Debt (as defined) “Credit Agreement EBITDA” is calculated in accordance with the definition of “EBITDA” contained in the Company’s Credit Agreement. Credit Agreement EBITDA is generally defined as Consolidated Net Income plus: consolidated interest expense; consolidated tax expenses; depreciation and amortization expenses; charges and expenses for financing fees and expenses and write-offs of deferred financing fees and expenses, remaining portions of OID on prepayment of indebtedness, premiums due in respect of prepayment of indebtedness, and commitment fees in respect of financing commitments; various charges and expenses related to, or incurred in connection with, the Smurfit-Stone acquisition; costs and expenses relating to the integration of Smurfit-Stone and the achievement of synergies relating to the Smurfit-Stone acquisition; certain run-rate synergies expected to be achieved due to the Smurfit-Stone acquisition; all non-cash charges; all cash charges and expenses for plant and other facility closures and other cash restructuring charges; labor disruption charges; officer payments associated with any permitted acquisitions; “black liquor” expenses; cash charges and expenses incurred in respect of the Chapter 11 bankruptcy proceeding and plan of reorganization of Smurfit-Stone; and all non-recurring cash expenses taken in respect of any multi-employer and defined benefit pension plan obligations that are related to plant and other facilities closures. For additional information on the calculation see our Credit Agreement, dated as of May 27, 2011, filed as Exhibit 10.1 to our Form 8-K, dated May 27, 2011. “Total Funded Debt” is calculated in accordance with the definition of “Total Funded Debt” contained in the Company’s Credit Agreement. Total Funded Debt is generally defined as aggregate debt obligations reflected in our balance sheet, less the hedge adjustments resulting from terminated and existing fair value interest rate derivatives or swaps, plus additional outstanding letters of credit not already reflected in debt, plus debt guarantees.

Non-GAAP Measures: Credit Agreement EBITDA and Total Funded Debt Our management uses Credit Agreement EBITDA and Total Funded Debt to evaluate compliance with RockTenn’s debt covenants and borrowing capacity available under its Credit Agreement. Management also uses Credit Agreement EBITDA as a measure of our Company’s core operating performance. Management believes that investors also use these measures to evaluate the Company’s compliance with its debt covenants and available borrowing capacity. Management also believes that investors use Credit Agreement EBITDA as a measure of our Company’s core operating performance. Borrowing capacity is dependent upon, in addition to other measures, the “Total Funded Debt/EBITDA ratio” or the “Leverage Ratio,” which is defined as Total Funded Debt divided by Credit Agreement EBITDA.

Non-GAAP Measures: Net Debt We have defined the non-GAAP measure “Net Debt” to include the aggregate debt obligations reflected in our balance sheet, less the hedge adjustments resulting from terminated and existing fair value interest rate derivatives or swaps, the balance of our cash and cash equivalents, restricted cash (which includes the balance sheet line items restricted cash and restricted cash and marketable debt securities) and certain other investments that we consider to be readily available to satisfy such debt obligations. Our management uses Net Debt, along with other factors, to evaluate our financial condition. We believe that Net Debt is an appropriate supplemental measure of financial condition and may be useful to investors because it provides a more complete understanding of our financial condition before the impact of our decisions regarding the appropriate use of cash and liquid investments.

Non-GAAP Measures: Adjusted Net Income and Adjusted Earnings Per Diluted Share We also use the non-GAAP measures “adjusted net income” and “adjusted earnings per diluted share”. Management believes these non-GAAP financial measures provide our board of directors, investors, potential investors, securities analysts and others with useful information to evaluate the performance of the Company because it excludes restructuring and other costs, net, the alternative fuel mixture credit and cellulosic biofuel producer credit and other specific items that management believes are not indicative of the ongoing operating results of the business. The Company and the board of directors use this information to evaluate the Company’s performance relative to other periods.

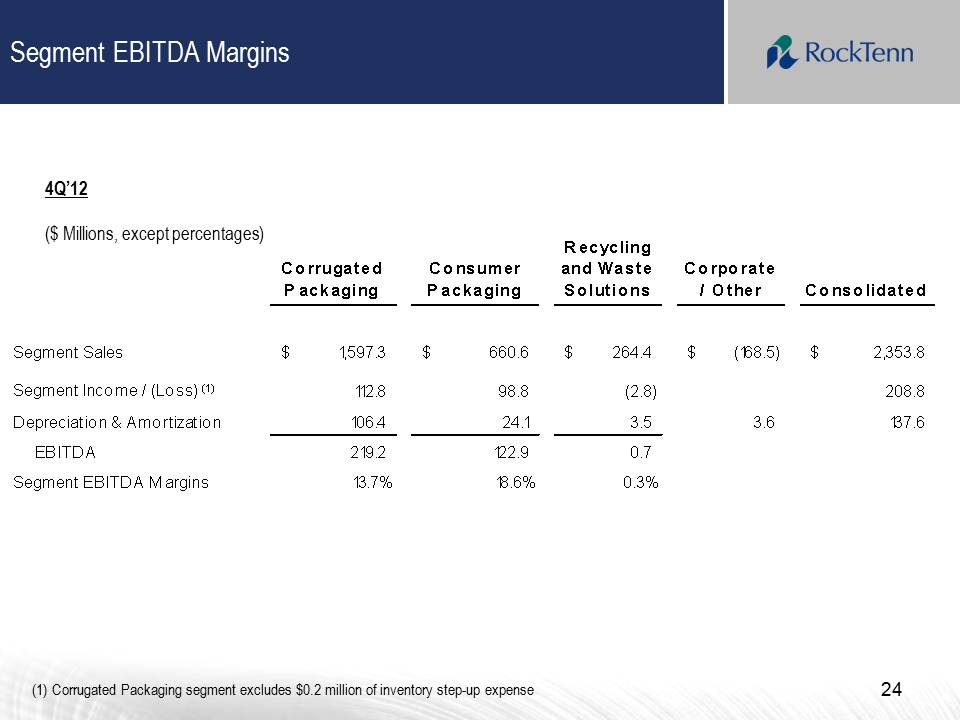

Segment EBITDA Margins 4Q’12 ($ Millions, except percentages) Corrugated Packaging Consumer Packaging Recycling and Waste Solutions Corporate / Other Consolidated Segment Sales $1,597.3 $660.6 $264.4 $(168.5) $2,353.8 Segment Income / (Loss) (1) 112.8 98.8 (2.8) 208.8 Depreciation & Amortization 106.4 24.1 3.5 3.6 137.6 EBITDA 219.2 122.9 0.7 Segment EBITDA Margins 13.7% 18.6% 0.3% Corrugated Packaging segment excludes $0.2 million of inventory step-up expense

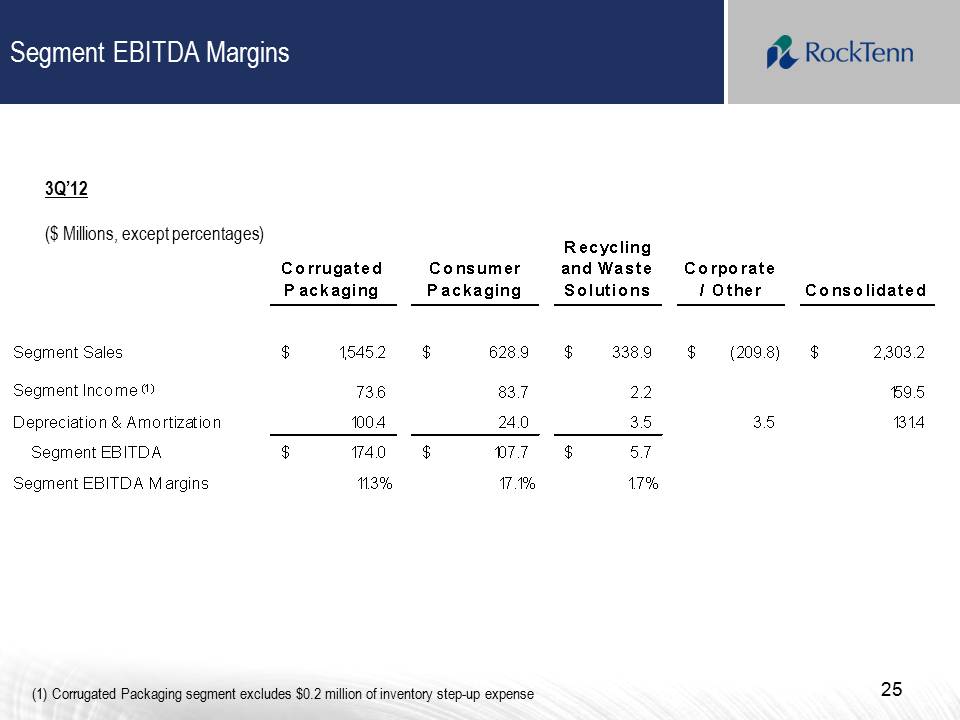

Segment EBITDA Margins 3Q’12 ($ Millions, except percentages)Corrugated Packaging Consumer Packaging Recycling and Waste Solutions Corporate / Other Consolidated Segment Sales $1,545.2 $628.9 $338.9 $(209.8) $2,303.2 Segment Income (1) 73.6 83.7 2.2 159.5 Depreciation & Amortization 100.4 24.0 3.5 3.5 131.4 Segment EBITDA $174.0 $107.7 $5.7 Segment EBITDA Margins 11.3% 17.1% 1.7%

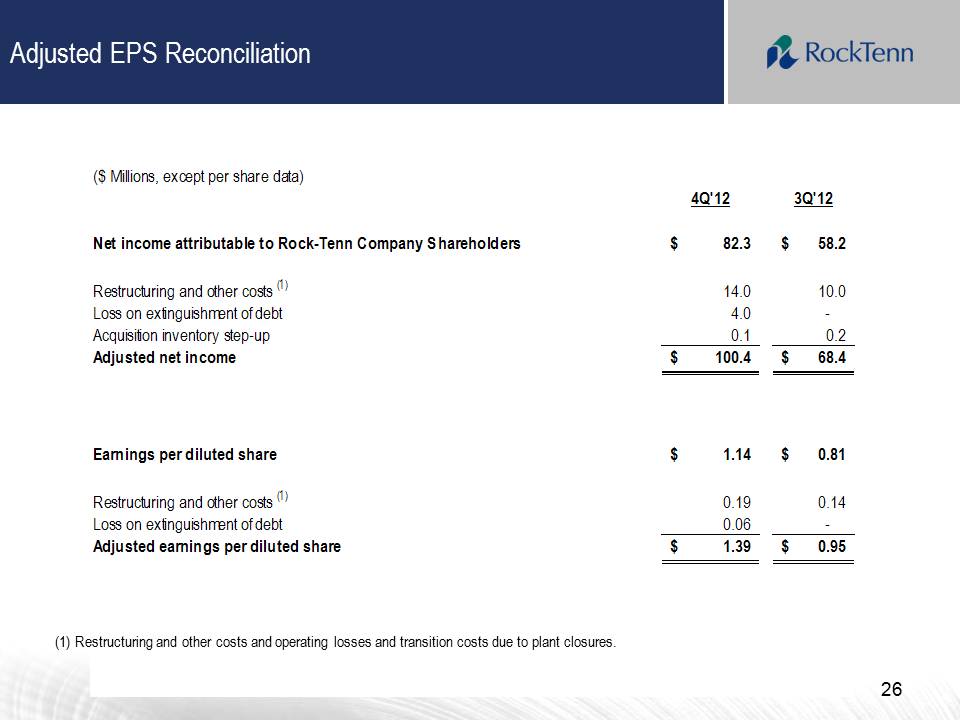

Adjusted EPS Reconciliation ($ Millions, except per share data) 4Q'12 3Q'12 Net income attributable to Rock-Tenn Company Shareholders $82.3 $58.2 Restructuring and other costs (1) 14.0 10.0 Loss on extinguishment of debt 4.0 - Acquisition inventory step-up 0.1 0.2 Adjusted net income $100.4 $68.4 Earnings per diluted share $1.14 $0.81 Restructuring and other costs (1) 0.19 0.14 Loss on extinguishment of debt 0.06 - Adjusted earnings per diluted share $1.39 $0.95 Restructuring and other costs and operating losses and transition costs due to plant closures.

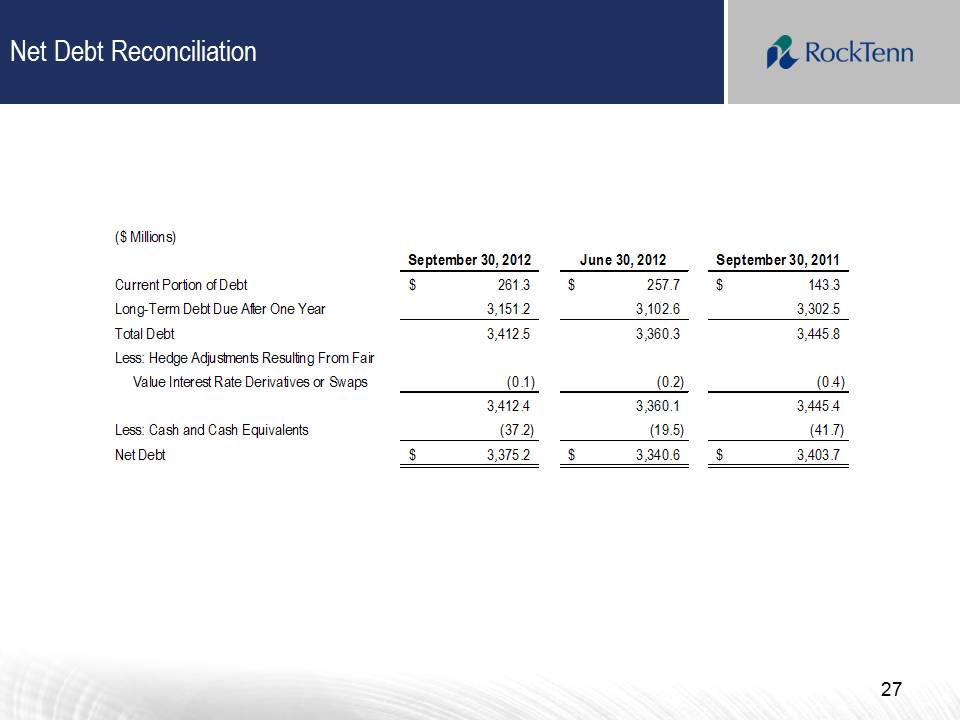

Net Debt Reconciliation ($ Millions) September 30, 2012 June 30, 2012 September 30, 2011 Current Portion of Debt $261.3 $257.7 $143.3 Long-Term Debt Due After One Year 3,151.2 3,102.6 3,302.5 Total Debt 3,412.5 3,360.3 3,445.8 Less: Hedge Adjustments Resulting From Fair Value Interest Rate Derivatives or Swaps (0.1) (0.2) (0.4) 3,412.4 3,360.1 3,445.4 Less: Cash and Cash Equivalents (37.2) (19.5) (41.7) Net Debt $3,375.2 $3,340.6 $3,403.7

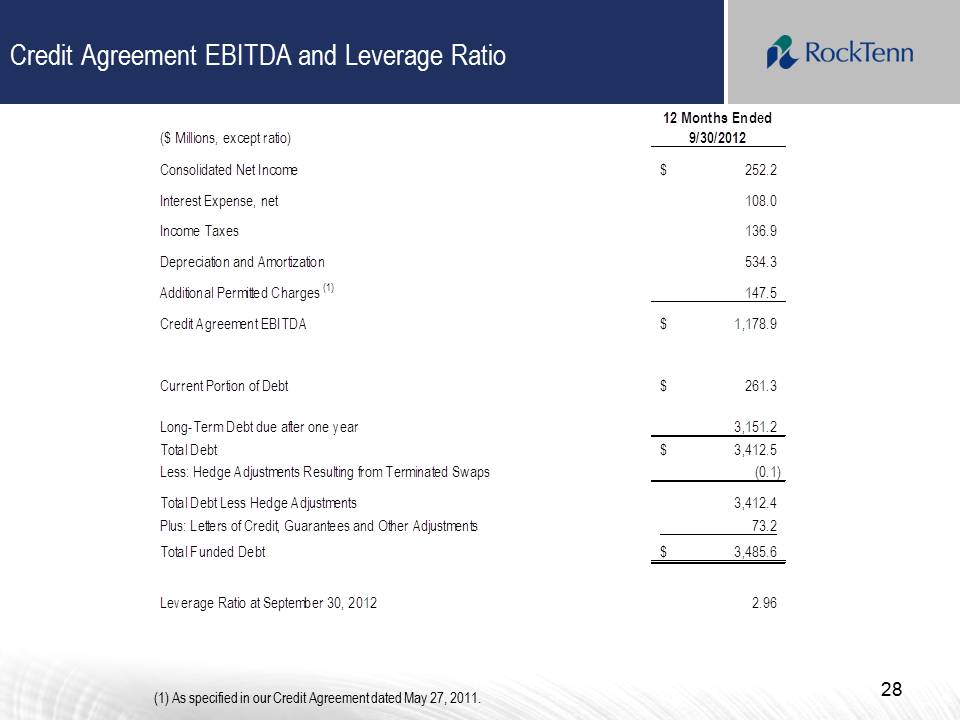

Credit Agreement EBITDA and Leverage Ratio ($ Millions, except ratio) 12 Months Ended 9/30/2012 Consolidated Net Income $252.2 Interest Expense, net 108.0 Income Taxes 136.9 Depreciation and Amortization 534.3 Additional Permitted Charges (1) 147.5 Credit Agreement EBITDA $1,178.9 Current Portion of Debt $261.3 Long-Term Debt due after one year 3,151.2 Total Debt $3,412.5 Less: Hedge Adjustments Resulting from Terminated Swaps (0.1) Total Debt Less Hedge Adjustments 3,412.4 Plus: Letters of Credit, Guarantees and Other Adjustments 73.2 Total Funded Debt $3,485.6 Leverage Ratio at September 30, 2012 2.96

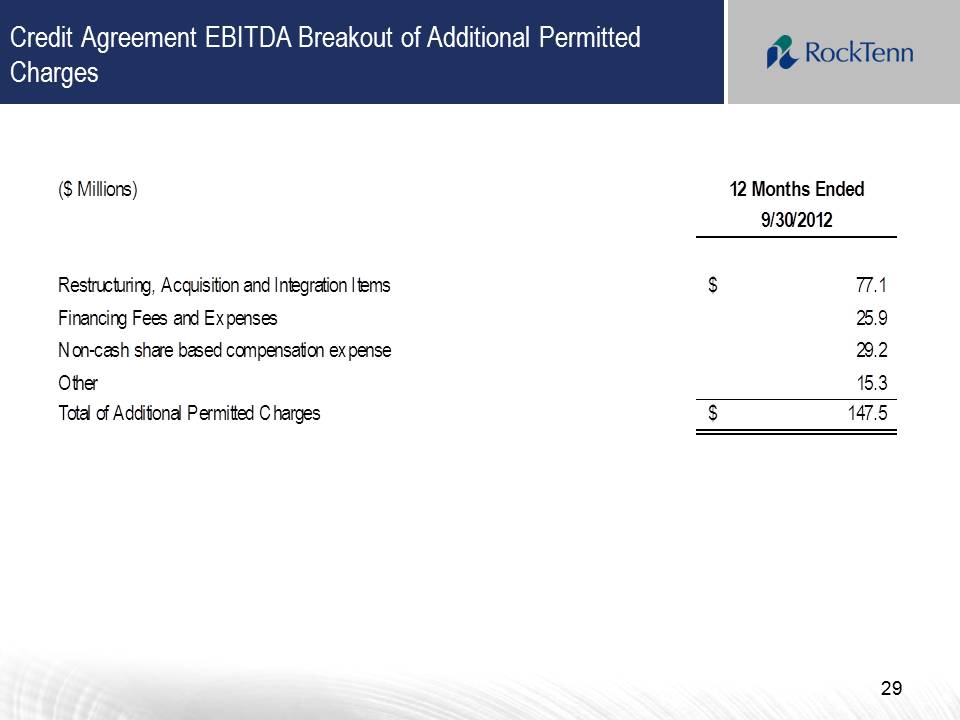

Credit Agreement EBITDA Breakout of Additional Permitted Charges ($ Millions) 12 Months Ended 9/30/2012 Restructuring, Acquisition and Integration Items $77.1 Financing Fees and Expenses 25.9 Non-cash share based compensation expense 29.2 Other 15.3 Total of Additional Permitted Charges $147.5

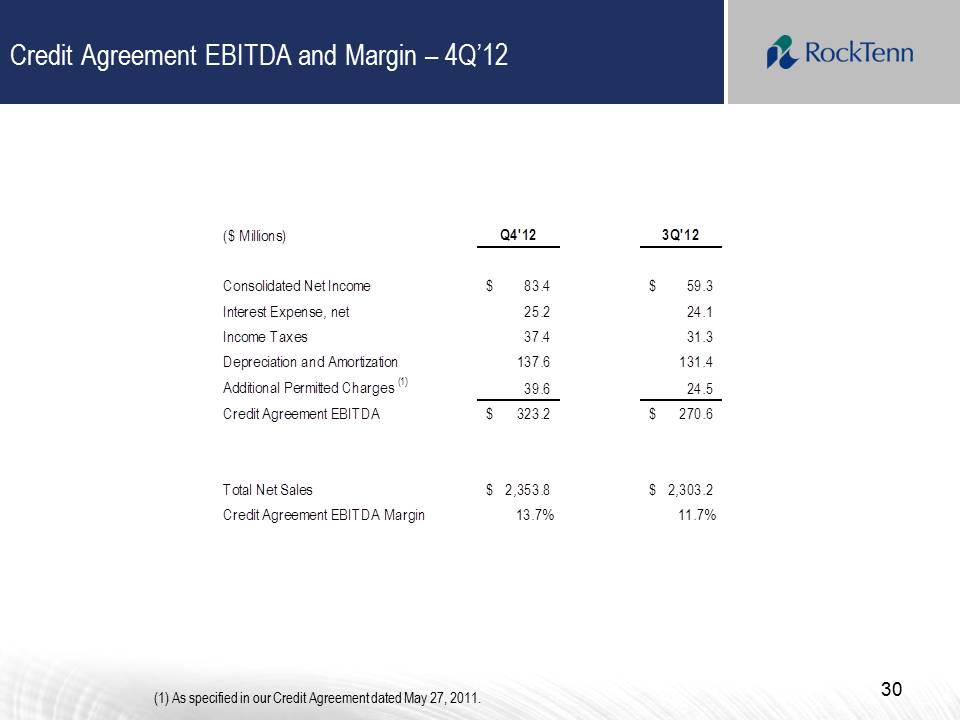

Credit Agreement EBITDA and Margin – 4Q’12 ($ Millions) Q4'12 3Q'12 Consolidated Net Income $83.4 $59.3 Interest Expense, net 25.2 24.1 Income Taxes 37.4 31.3 Depreciation and Amortization 137.6 131.4 Additional Permitted Charges (1) 39.6 24.5 Credit Agreement EBITDA $323.2 $270.6 Total Net Sales $2,353.8 $2,303.2 Credit Agreement EBITDA Margin 13.7% 11.7%

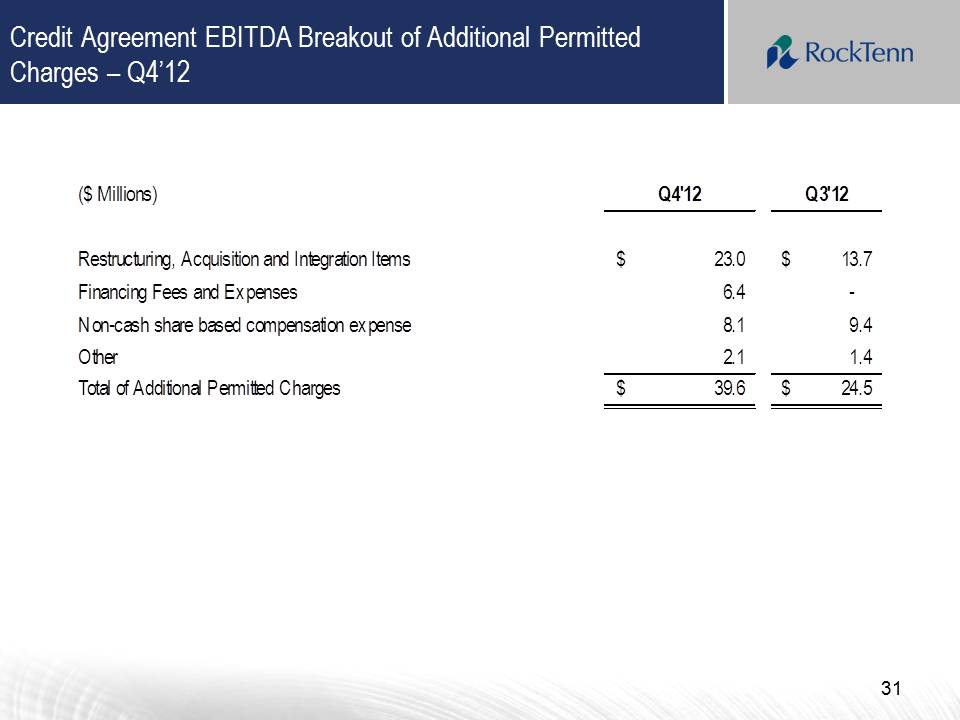

Credit Agreement EBITDA Breakout of Additional Permitted Charges – Q4’12 ($ Millions) Q4'12 Q3'12 Restructuring, Acquisition and Integration Items $23.0 $13.7 Financing Fees and Expenses 6.4 - Non-cash share based compensation expense 8.1 9.4 Other 2.1 1.4 Total of Additional Permitted Charges $39.6 $24.5