Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PUBLIC SERVICE ELECTRIC & GAS CO | d432025d8k.htm |

| EX-99 - EX-99 - PUBLIC SERVICE ELECTRIC & GAS CO | d432025dex99.htm |

Public Service Enterprise Group

PSEG Earnings Conference Call

3rd Quarter 2012

November 1, 2012

Exhibit 99.1 |

| 1

Forward-Looking Statement

Readers are cautioned that statements contained in this presentation about our

future performance, including future revenues, earnings, strategies, prospects,

consequences and all other statements that are not purely historical, are

forward-looking statements for purposes of the safe harbor provisions under The Private

Securities

Litigation

Reform

Act

of

1995.

When

used

herein,

the

words

“anticipate”,

“intend”,

“estimate”,

“believe”,

“expect”,

“plan”,

“should”,

“hypothetical”,

“potential”,

“forecast”, “project”, variations of such words and similar

expressions are intended to identify forward-looking statements. Although we believe that our expectations are

based

on

reasonable

assumptions,

they

are

subject

to

risks

and

uncertainties

and

we

can

give

no

assurance

they

will

be

achieved.

The

results

or

developments

projected

or

predicted

in

these

statements

may

differ

materially

from

what

may

actually

occur.

Factors

which

could

cause

results

or

events

to

differ

from

current

expectations include, but are not limited to:

•

adverse changes in the demand for or price of the capacity and energy that we sell

into wholesale electricity markets, •

adverse changes in energy industry law, policies and regulation, including market

structures and a potential shift away from competitive markets toward subsidized market

mechanisms, transmission planning and cost allocation rules, including rules

regarding how transmission is planned and who is permitted to build transmission in the future,

and reliability standards,

•

any inability of our transmission and distribution businesses to obtain adequate

and timely rate relief and regulatory approvals from federal and state regulators,

•

changes in federal and state environmental regulations that could increase our

costs or limit our operations, •

changes in nuclear regulation and/or general developments in the nuclear power

industry, including various impacts from any accidents or incidents experienced at our

facilities or by others in the industry, that could limit operations of our

nuclear generating units, •

actions

or

activities

at

one

of

our

nuclear

units

located

on

a

multi-unit

site

that

might

adversely

affect

our

ability

to

continue

to

operate

that

unit

or

other

units

located

at

the

same site,

•

any inability to balance our energy obligations, available supply and trading

risks, •

any deterioration in our credit quality, or the credit quality of our

counterparties, including in our leveraged leases, •

availability of capital and credit at commercially reasonable terms and conditions

and our ability to meet cash needs, •

any

inability

to

realize

anticipated

tax

benefits

or

retain

tax

credits,

•

changes in the cost of, or interruption in the supply of, fuel and other

commodities necessary to the operation of our generating units, •

delays in receipt of necessary permits and approvals for our construction and

development activities, •

delays or unforeseen cost escalations in our construction and development

activities, •

any inability to achieve or continue to sustain, our expected levels of operating

performance, •

increase in competition in energy supply markets as well as competition for certain

rate-based transmission projects, •

any

inability

to

realize

anticipated

tax

benefits

or

retain

tax

credits,

•

challenges associated with recruitment and/or retention of a qualified

workforce, •

adverse performance of our decommissioning and defined benefit plan trust fund

investments and changes in discount rates and funding requirements, and

•

changes in technology and customer usage patterns.

For further information, please refer to our Annual Report on Form 10-K,

including Item 1A. Risk Factors, and subsequent reports on Form 10-Q and Form 8-K filed

with

the

Securities

and

Exchange

Commission.

These

documents

address

in

further

detail

our

business,

industry

issues

and

other

factors

that

could

cause

actual

results

to differ

materially

from

those

indicated

in

this

presentation.

In

addition,

any

forward-looking

statements

included herein

represent our

estimates only

as

of

today and should not be relied upon as representing our estimates as of any

subsequent date. While we may elect to update forward-looking statements from time to

time, we specifically disclaim any obligation to do so, even if our internal

estimates change, unless otherwise required by applicable securities laws. |

| 2

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Net Income reported in

accordance with accounting principles generally accepted in the United

States (GAAP). Operating Earnings is a non-GAAP financial measure that

differs from Net Income because it excludes gains or losses associated with

Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM)

accounting, and other material one-time items. PSEG presents

Operating Earnings because management believes that it is appropriate for

investors to

consider results excluding these items in addition to the results reported in

accordance with GAAP. PSEG believes that the non-GAAP financial

measure of Operating Earnings provides a consistent and comparable

measure of performance of its businesses to help shareholders understand

performance

trends.

This

information

is

not

intended

to

be

viewed

as

an

alternative to GAAP information. The last slide in this presentation includes

a list of items excluded from Income from Continuing Operations to

reconcile to Operating Earnings, with a reference to that slide included on

each of the slides where the non-GAAP information appears.

|

PSEG

2012 Q3 Review

Caroline Dorsa

EVP and Chief Financial Officer |

4

Q3 Earnings Summary

$ millions (except EPS)

2012

2011

Operating Earnings

$ 382

$ 420

Reconciling Items, Net of Tax

(35)

(155)

Income from Continuing Operations

$ 347

$ 265

Discontinued Operations, Net of Tax

-

29

Net Income

$ 347

$ 294

EPS from Operating Earnings*

$ 0.75

$ 0.83

Quarter ended September 30

* See Page A for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

5

Year to Date 2012 Earnings Summary

$ millions (except EPS)

2012

2011

Operating Earnings

$ 1,029

$ 1,152

Reconciling Items, Net of Tax

22

(105)

Income from Continuing Operations

$ 1,051

$ 1,047

Discontinued Operations

-

96

Net Income

$ 1,051

$ 1,143

EPS from Operating Earnings*

$ 2.03

$ 2.27

Nine months ended September 30

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. |

6

PSEG –

Q3 2012 Highlights

Solid financial results --

Operating Earnings of $0.75 vs. $0.83 per share

in Q3 2011

Executing on operational goals

Record output from CCGTs, strong production from Nuclear, and Power’s

control of O&M supported results

Transmission becoming a significant contributor to earnings

Executing on capital program

Key regulatory approvals received for Susquehanna-Roseland transmission

line Decisions expected in Q1 2013 on extensions to Solar 4 All and Solar

Loan investment programs

Power added 400 MW of new peakers on time to respond to summer demand

Holdings’

Queen Creek solar farm in AZ achieved commercial operation in

October; announced a new $47 million, Delaware solar investment with

completion target by January 2013

Competitive market issues under review

US District Court will proceed to hearings on LCAPP litigation

PJM MOPR settlement to be filed with FERC that establishes revised price

bidding rules for new generation supply beginning with the May 2013 auction

|

PSEG

– Subsequent Events

7

In late October 2012, Hurricane Sandy’s high winds, heavy rainfall and related

flooding caused severe damage to our transmission and distribution system

throughout our service territory as well as to some of our generation

infrastructure in the northern part of New Jersey. Walls

of

water

created

by

the

storm

surge

flooded

a

large

number

of

substations

along

the

Passaic,

Raritan

and

Hudson

rivers.

The

magnitude

of

the

flooding

in

contiguous

areas

is

unprecedented.

At the peak of the outages, approximately 1.5 million of our customers were without

power due to the storm;

the

most

in

PSE&G’s

history

--

surpassing

both

Tropical

Storm

Irene

and

the

October

2011

snowstorm.

With the assistance of mutual aid crews from other utilities, our associates are

working to minimize the length of time our customers are without electric or

gas service. PSE&G and Power are unable to estimate the possible

loss or range of loss related to Hurricane Sandy, however, such costs could

be material. On

October

26,

2012,

PSE&G

filed

a

petition

with

the

BPU

seeking

authorization

to

defer

on

our

books

actually incurred, uninsured, incremental storm restoration costs associated with

our gas and electric distribution systems.

PSE&G requested similar relief in August 2011 as Tropical Storm Irene

approached. Both requests are currently pending before the BPU.

We maintain property insurance for both nuclear and non-nuclear property. We

intend to seek recovery from our insurers for any property damage above our

self-insured retentions, however, no assurances can be given relative to

the timing or amount of such recovery. |

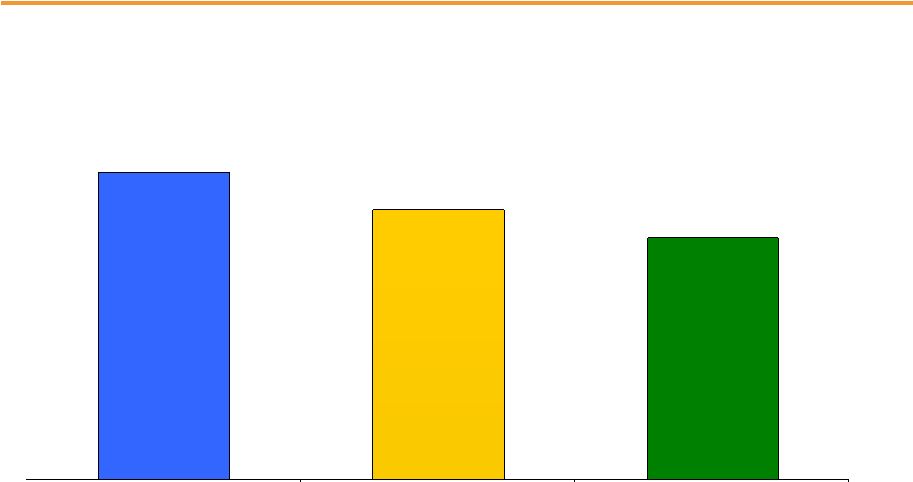

2010 Operating

Earnings* 2011 Operating Earnings*

2012 Guidance

8

$2.25 -

$2.50E

PSEG –

Maintaining 2012 Guidance

$3.12

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings.

$2.74

YTD

9/30/12

EPS $2.03 |

PSEG

2012 Q3 Operating Company Review |

10

Q3 Operating Earnings by Subsidiary

Operating Earnings

Earnings per Share

$ millions (except EPS)

2012

2011

2012

2011

PSEG Power

$ 217

$ 258

$ 0.43

$ 0.51

PSE&G

155

154

0.30

0.30

PSEG Energy Holdings/

Enterprise

10

8

0.02

0.02

Operating Earnings*

$ 382

$ 420

$ 0.75

$ 0.83

Quarter ended September 30

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. |

11

$0.83

$0.75

(.08)

0.00

0.25

0.50

0.75

1.00

PSEG EPS Reconciliation –

Q3 2012 versus Q3 2011

Lower Pricing (.15)

Higher Volume .01

Capacity .05

O&M .01

Transmission .03

Weather (.01)

O&M (.02)

D&A (.01)

Other .01

Q3 2012

Operating

Earnings*

Q3 2011

Operating

Earnings*

PSEG Power

PSE&G

Energy

Holdings/

Enterprise

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. |

12

Year to Date Operating Earnings by Subsidiary

Operating Earnings

Earnings per Share

$ millions (except EPS)

2012

2011

2012

2011

PSEG Power

$ 523

$ 710

$ 1.03

$ 1.40

PSE&G

453

422

0.89

0.83

PSEG Energy Holdings/

Enterprise

53

20

0.11

0.04

Operating Earnings*

$ 1,029

$ 1,152

$ 2.03

$ 2.27

Nine months ended September 30

•See Page A for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

13

PSEG EPS Reconciliation –

YTD 2012 versus YTD 2011

YTD 2012

Operating

Earnings*

YTD 2011

Operating

Earnings*

Lower Pricing (.32)

Lower Volume (.02)

Lower Capacity (.06)

Financing Costs .03

O&M .03

Lower

Coal Sales

& Other (.03)

PSEG Power

Transmission .08

Renewables

and Other

Investments .01

O&M (.06)

Weather (.02)

D&A (.03)

Tax

Settlement .06

Other .02

PSE&G

PSEG Energy

Holdings/

Enterprise

Tax

Settlement

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. $2.27

.06

.07

$2.03

(.37)

0.00

0.50

1.00

1.50

2.00

2.50 |

PSEG

Power 2012 Q3 Review |

15

PSEG Power –

Q3 2012 EPS Summary

$ millions (except EPS)

Q3 2012

Q3 2011

Variance

Operating Revenues

$ 1,038

$ 1,398

$ (360)

Operating Earnings

$ 217

$ 258

$ (41)

NDT Funds Related

Activity,

Net of Tax

40

7

33

Mark-to-Market, Net of Tax**

(76)

8

(84)

Income from Continuing Operations

181

273

(92)

Discontinued Operations, Net of Tax

-

29

(29)

Net Income

$ 181

$ 302

(121)

EPS from Operating Earnings*

$ 0.43

$ 0.51

$ (0.08)

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. **Includes the financial impact from positions with

forward delivery months. |

16

Lower Pricing (.15)

Volume .01

Capacity .05

PSEG Power EPS Reconciliation –

Q3 2012 versus Q3 2011

Q3 2012

Operating

Earnings*

Q3 2011

Operating

Earnings*

O&M .01

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. $0.51

.01

$0.43

(0.09)

0.00

0.10

0.20

0.30

0.40

0.50 |

17

PSEG Power –

Generation Measures

Quarter

ended

September

30

Total Nuclear

Total Coal*

Oil & Natural Gas

* Includes figures for Pumped Storage. Includes Hudson and Mercer with Gas.

PSEG Power –

Generation (GWh)

14,426

14,919

Quarter

ended

September

30

PSEG Power –

Capacity Factors (%)

2011

2012

Nuclear

90.6

92.0

Coal*

NJ (Coal/Gas)

33.9

26.6

PA

83.2

79.0

CT

25.5

3.8

Combined

Cycle

PJM and NY

57.5

67.1

15,000

7,500

0

2011

2012

4,473

5,289

2,536

2,071

7,417

7,559 |

18

PSEG Power –

Generation Measures

Nine

Months

ended

September

30

Total Nuclear

Total Coal*

Oil & Natural Gas

* Includes figures for Pumped Storage. Includes Hudson and Mercer with Gas.

PSEG Power –

Generation (GWh)

41,779

40,769

Nine

Months

ended

September

30

PSEG Power –

Capacity Factors (%)

2011

2012

Nuclear

93.3

92.5

Coal*

NJ (Coal/Gas)

32.7

14.2

PA

80.9

68.7

CT

18.7

2.9

Combined

Cycle

PJM and NY

54.2

60.3

40,000

30,000

20,000

10,000

0

12,088

13,509

7,039

4,656

22,652

22,604

2011

2012 |

19

PSEG Power –

Fuel Costs

Quarter ended September 30

($ millions)

2011

2012

Coal

98.4

64.9

Oil & Gas

184.8

166.7

Total Fossil

283.2

231.6

Nuclear

45.3

52.7

Total Fuel Cost

328.5

284.3

Total Generation

(GWh)

14,426

14,919

$ / MWh

22.77

19.05

PSEG Power –

Fuel Costs*

* Based on Operating Earnings.

YTD ended September 30

($ millions)

2011

2012

Coal

271.2

142.4

Oil & Gas

530.3

407.8

Total Fossil

801.5

550.2

Nuclear

135.4

150.7

Total Fuel Cost

936.9

700.9

Total Generation

(GWh)

41,779

40,769

$ / MWh

22.43

17.19 |

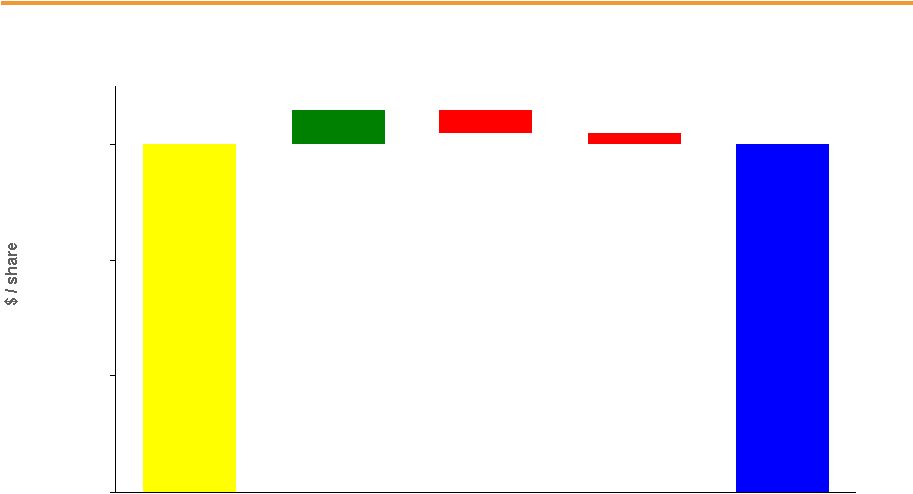

20

$57

$54

$47

PSEG Power –

Gross Margin Performance

Highest ever combined cycle output

Margins aided by increased reliance on low-cost, efficient CCGT fleet

Migration volumes slightly lower than Q2, in line with full-year estimate of

36%-40%

Regional Performance

Region

Q3 2012

Gross

Margin* ($M)

2012 Performance

PJM

$652

Decline in energy prices partially

offset by strong performance of

nuclear fleet and CCGT production

New

England

$19

Hurt by lower dark spreads and

lower coal sales

New York

$26

Margin improved over the year

earlier on strong CCGT production

PSEG Power Gross Margin* ($/MWh)

Quarter ended

September 30

* Based on Operating Earnings.

$0

$25

$50

$75

2010

2011

2012 |

21

Hedging Update…

Contracted Energy*

* Hedge

percentages

and

prices

as

of

September

28,

2012.

Revenues

of

full

requirement

load

deals

based

on

contract

price,

including

renewable

energy

credits,

ancillary,

and

transmission

components

but

excluding

capacity.

Hedges

include

positions

with

MTM

accounting

treatment

and

options.

Volume TWh

12

35

35

Base Load

% Hedged

100%

90-95%

50-55%

(Nuclear and Base Load Coal)

Price $/MWh

$54

$51

$49

Volume TWh

4

18

18

Intermediate Coal, Combined

% Hedged

35-40%

0%

0%

Cycle, Peaking

Price $/MWh

$54

$51

$49

Volume TWh

13

52-54

53-55

Total

% Hedged

80-85%

60-65%

30-35%

Price $/MWh

$54

$51

$49

Oct -Dec

2012

2013

2014 |

22

PSEG Power –

Q3 2012 Operating Highlights

Q3 output increased 3% from the Q3 2011 level

Combined-cycle production represented 32% of generation for Q3 and was the

highest ever Summer output achieved by the CCGT fleet

Strong nuclear performance has resulted in a YTD nuclear capacity factor of

92.5% Planned Salem 2 refueling outage began in mid-October

Operations

Regulatory and Market

Environment

Financial

MOPR reform discussions ongoing at PJM

Federal Court update on November 13

Average energy only hedge price for 2012 is $60/MWh

Customer migration held at approximately 37% for the quarter

Power’s total debt as a percentage of capital at September 30 was 33%

Power’s next maturity is a $300 million, 2.50% Senior Note due April

2013 |

MOPR

Reform – Comparison of Features

23

Design Feature

Existing MOPR

Proposed MOPR

Resource Type

All new generating resources (except

nuclear, coal, IGCC, hydro, wind,

solar, have zero minimum price

threshold).

All new gas-fired resources (CC, CT,

IGCC) over 20 MW (except for landfill

gas and eligible cogeneration)

Locations

Any LDA for which separate VRR

curve is established

Entire PJM market region

Default MOPR

Lower of 90% NET CONE for the

asset type (70% where there is no

applicable asset type CONE ) or unit

specific minimum offer floor

determined by the IMM and PJM

100% of NET CONE for asset type

Exemption

Unit specific alternative minimum offer

established through detailed review of

project cost/revenue

Specific exemptions for the following

categories subject to specific criteria:

•

Self supply (traditional business

models building or contracting for the

capacity needs of their customers and

consistent with specific criteria)

•

Competitive entry

Duration of Mitigation

Until new resource clears in one RPM

auction

Non-exempt units must clear in RPM

auctions for 3 separate delivery years,

or must clear in 1 RPM auction in

certain situations where reliability

could be detrimentally affected

Source:

www.pjm.com

;

Minimum

Offer

Price

Rule

Education

Session

Materials

–

October

4,

2102 |

PSE&G

2012 Q3 Review |

25

PSE&G –

Q3 Earnings Summary

$ millions (except EPS)

Q3 2012

Q3 2011

Variance

Operating Revenues

$ 1,683

$ 1,841

(158)

Operating Expenses

756

943

(187)

366

342

24

216

197

19

24

31

(7)

Total Operating Expenses

1,362

1,513

(151)

Operating Earnings / Net Income

$ 155

$154

$ 1

EPS from Operating Earnings

$ 0.30

$ 0.30

-

Energy Costs

Operation & Maintenance

Depreciation & Amortization

Taxes Other than Income Taxes |

26

$0.30

.03

$0.30

(.02)

(.01)

0.00

0.10

0.20

0.30

PSE&G EPS Reconciliation –

Q3 2012

versus Q3 2011

Q3 2012

Operating

Earnings

Q3 2011

Operating

Earnings

Transmission

O&M (.02)

D&A (.01)

Other .01

Weather |

27

PSE&G –

Monthly Summer Weather Data

6,184

5,308

2,054

7,092

4,730

2,868

4,967

4,489

1,835

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

5,500

6,000

6,500

7,000

July

August

September

2012

2011

Normal

2012

vs.

2011

vs.

Normal

PSE&G

Monthly

Temperature

Humidity

Index

(THI)

-7.8% Q3 2012 vs. Q3 2011

+20% Q3 2012 vs. Normal |

28

PSE&G –

Q3 Operating Highlights

Received key regulatory approvals for the Susquehanna-Roseland transmission

line; construction is underway

PSE&G expects the BPU to decide on two requests to spend up to $883

million to expand the Solar 4 All and Solar Loan programs in early 2013

PSE&G

lowered

its

residential

gas

prices

by

an

additional

3.6%,

the

9

th

price

reduction in a row and a 39% savings in gas supply costs since January 2009

PSE&G earned its authorized return

Issued $350 million of secured medium-term notes at 3.65% due September

2042 Retired $300 million of 5.13% secured medium-term notes at

maturity Operations

Regulatory and Market

Environment

Financial

Weather in Q3 2012 warmer than normal but cooler than Q3 2011

Transmission revenues were $0.03 per share higher over Q3 2011

O&M remains under control |

PSEG

Energy Holdings/Enterprise 2012 Q3 Review |

30

PSEG Energy Holdings/Enterprise –

Q3 2012 Earnings

Summary

$ millions (except EPS)

Q3 2012

Q3 2011

Variance

Operating Earnings

$ 10

$ 8

$ 2

Lease Related Activity

1

(170)

171

Net Income

$ 11

$ (162)

$ 173

EPS from Operating Earnings*

$ 0.02

$ 0.02

-

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. |

31

PSEG Energy Holdings/Enterprise –

Q3 Operating Highlights

Financial

Payments on Holdings’

remaining lease portfolio are current

A new $47 million investment in the Milford Solar Farm in Delaware

with a completion target of January 2013

$75 million investment in Queen Creek Arizona solar farm; achieved

commercial operation in early October |

PSEG |

33

PSEG Financial Highlights

Maintaining

full-year

operating

earnings

guidance

of

$2.25

-

$2.50

per

share

Focused on maintaining operating efficiency and customer reliability

Executing on capital program

Financial position remains strong

Debt as a percentage of capital at 41% at September 30

Proactively and aggressively investing in infrastructure at attractive utility

returns as a means of enhancing reliability, improving the environment and

supporting the NJ economy

In October 2012, S&P published updated credit opinions for Power

and

PSE&G that kept their ratings and outlooks unchanged

|

34

PSEG 2012 Operating Earnings Guidance -

By Subsidiary

$ millions (except EPS)

2012E

2011A

PSEG Power

$575 –

$665

$ 845

PSE&G

$530 –

$560

$ 521

PSEG Energy

Holdings/Enterprise

$35 –

$45

$ 23

Operating Earnings*

$1,140 –

$1,270

$ 1,389

Earnings per Share

$ 2.25 –

$ 2.50

$2.74

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. |

35

PSEG Liquidity as of September 30, 2012

Company

Facility

Date

Facility

Usage

Liquidity

($Millions)

PSE&G

5-year Credit Facility

Apr-16

$600

$1

$599

5-Year Credit Facility (Power)

Mar-17

$1,600

$119

$1,481

5-Year Credit Facility (Power)

Apr-16

$1,000

$0

$1,000

5-Year Bilateral (Power)

Sep-15

$100

$100

$0

5-year Credit Facility (PSEG)

Mar-17

$500

$4

$496

5-year Credit Facility (PSEG)

Apr-16

$500

$0

$500

Total

$4,300

$224

$4,076

$662

PSE&G ST Investment

$48

Total Liquidity Available

$4,786

Total Parent / Power Liquidity

$4,139

PSEG /

Power

PSEG Money Pool ST Investment |

Items

Excluded from Income from Continuing Operations to Reconcile to Operating

Earnings Please see Page 2 for an explanation of PSEG’s use of Operating

Earnings as a non-GAAP financial measure and how it differs from Net

Income. A

(Unaudited)

2012

2011

2012

2011

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

40

$

7

$

49

$

49

$

50

$

46

$

Gain

(Loss)

on

Mark-to-Market

(MTM)

(a)

(PSEG

Power)

(76)

8

(34)

16

107

(1)

Dynegy Related Activity (PSEG Energy Holdings)

1

(170)

7

(170)

-

-

Market Transition Charge Refund (PSE&G)

-

-

-

-

-

(72)

Gain on Sale of Qwest Building (Energy Holdings)

-

-

-

-

34

-

Lease Transaction Loss (Energy Holdings)

-

-

-

-

(173)

-

Total Pro-forma adjustments

(35)

$

(155)

$

22

$

(105)

$

18

$

(27)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

507

507

Per Share Impact (Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.08

$

0.01

$

0.10

$

0.10

$

0.10

$

0.09

$

Gain

(Loss)

on

MTM

(a)

(PSEG

Power)

(0.15)

0.02

(0.07)

0.03

0.21

-

Dynegy Related Activity (PSEG Energy Holdings)

-

(0.34)

0.01

(0.34)

-

-

Market Transition Charge Refund (PSE&G)

-

-

-

-

-

(0.14)

Gain on Sale of Qwest Building (Energy Holdings)

-

-

-

-

0.06

-

Lease Transaction Loss (Energy Holdings)

-

-

-

-

(0.34)

-

Total Pro-forma adjustments

(0.07)

$

(0.31)

$

0.04

$

(0.21)

$

0.03

$

(0.05)

$

(a) Includes the financial impact from positions with forward delivery

months. September 30,

For the Twelve Months Ended

September 30,

Reconciling

Items

Excluded

from

Continuing

Operations

to

Compute

Operating

Earnings

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

For the Three Months Ended

For the Nine Months Ended

December 31,

Pro-forma Adjustments, net of tax

2011

2010 |