Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Solaris Power Cells, Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - Solaris Power Cells, Inc. | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Solaris Power Cells, Inc. | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - Solaris Power Cells, Inc. | ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended July 31, 2012 | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _________ to ________ | |

| Commission file number: 000-53982 |

| Rolling Technologies, Inc. | |

| (Exact name of registrant as specified in its charter) | |

| Nevada | TBD |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| Penthouse, Menara Antara No. 11, Jalan Bukit Ceylong, Kuala Lumpur |

50200 |

| (Address of principal executive offices) | (Zip Code) |

|

Registrant’s telephone number: 012-377-0130 |

|

|

Securities registered under Section 12(b) of the Exchange Act:

| |

| Title of each class | Name of each exchange on which registered |

| none | not applicable |

|

Securities registered under Section 12(g) of the Exchange Act:

| |

| Title of class | |

| Common stock, par value $0.001 | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| [ ] Large accelerated filer | [ ] Accelerated filer |

| [ ] Non-accelerated filer | [X] Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Not available

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 2,150,000 as of October 24, 2012.

| 1 |

| 2 |

PART I

Company Overview

We were formed as a Nevada corporation, “Rolling Technologies Inc.,” on July 27, 2007. Our principal executive offices are located at 50 West Liberty Street, Suite 880, Reno, NV 89501. Our phone number is (012) 377-0130. Our operations office in Malaysia is located at Penthouse, Menara Antara, No. 11, Jalan Bukit Ceylong, Kuala Lumpur 50200, Malaysia.

We are a development stage company and have not generated any sales to date. We are in the business of developing, producing, and marketing a strong, portable, and affordable car top carrier. Our Product is still in the development stage and is not yet ready for commercial sale.

Industry Background in Asia

As automobile ownership has become more commonplace in many Asian countries, an ever-increasing number of families and individuals utilize their vehicles for travel, particularly for recreational trips. In recent years, automobile manufacturers serving Asian markets have increased the interior space of automobiles to meet consumer demand for spacious, comfortable cabins and increased passenger capacity. This transformation has cut down on the amount of space reserved for non-passenger use, specifically for storage of luggage and other parcels. Some automakers have been inventive, creating usable space in hidden compartments in floorboards, while others have merely compromised storage or trunk space for extra passenger room.

Consumer demand for extra space for non-passenger storage has led to the popularization of car-top luggage carriers in Asian countries. When car-top carriers were initially developed, they were large, plastic boxes that affixed to the roof of most vehicles by installation on the vehicle’s roof rack. Carriers have improved over the years as they have become increasingly aerodynamic, more aesthetically pleasing, and made of stronger, more durable material. More recently, United States patents have been issued for variants on the original carriers: car-top carriers that affix to car tops without roof racks, carriers that attach to the rear of certain types of vehicles, and carriers that lack a box-like structure or support frame.

A distinct disadvantage of the traditional car-top carrier is the difficulty in installing and uninstalling the carrier because of their size, weight, and shape. Consumers experience similar challenges in transporting and storing such carriers when not in use. Because most car-top carriers still sport the hard plastic shell exterior, they do not collapse when not in use and are cumbersome to handle and store. Also, once a consumer has installed a traditional car-top carrier on their vehicle, their ability to access the contents of the carrier is severely limited.

| 3 |

Car Top Carrier Products

The four most popular and widely used automobile storage products are as follows:

| 1. | Car Top Boxes. The most traditional roof top storage device, car top boxes are easy to pack and offer the most protection from wind, rain, and other adverse conditions. They also offer the most durability and longest lifespan of all the car top carrier options. A car top box requires a luggage rack with crossbars or a sport bar system on the vehicle in order to be properly installed. They must be packed full or used with a net inside to hold the contents in place during travel. Also, the contents of the box carrier are limited to the interior height of the box or consumers will not be able to latch the box shut. They are generally the most expensive car top carrier option, generally retailing for between $250 and $750. |

| 2. | Car Top Carrier Bags. Departing from traditional hard shell box exteriors, car-top carrier bags are made of a soft, pliable material (usually nylon or polyester) and attach to the top of a vehicle using straps affixed to the roof rack. An advantage to the carrier bag is that they fold up to a very manageable size when not in use, making them portable and space efficient. A disadvantage is that the bag must be packed full so that the cloth material doesn't flap in the wind while traveling and create additional drag. Also, depending upon the material used in the manufacture of the bag, carrier bags can break down or fade with prolonged exposure to the sun, wind, and rain. Car top carrier bags come with zippers which allow easy access to contents, but which can malfunction or break, rendering the entire carrier useless. High-quality car top bags offer urethane coated zippers for increased durability and liner systems as an additional measure to keep water away from the contents of the bag. Car top carrier bags generally retail for between $100 and $200. |

| 3. | CarTop Baskets. These roof-top storage accessories offer a sturdy structure to lift luggage contents off of a vehicle’s rooftop. They are often used in combination with a car top carrier bag to add structure and support to the contents of the bag and decrease the amount of wind resistance encountered when the bag flaps in the wind while traveling. An advantage of car top baskets is that they are easy to strap cargo bags and nets to, and they offer a rigid base with sidewalls. A disadvantage is that they provide no additional protection from the elements and do not easily break down for transportation or storage. Car top baskets generally retail for between $100 and $200. |

| 4. | Car Back Carrier. The newest product in auxiliary storage solutions, the car back carrier is a large cargo bag that hangs from the luggage rack or steel car hooks on the back of wagons, sport utility vehicles, and vans. When properly installed, they hang under the rear window so the driver’s view is not obstructed. Car back carriers are very easy to load and access during travel, and they do not cause any loss of aerodynamics due to drag. Also, because they ride behind the vehicle, they don't experience the full detrimental effect of sun, wind, and rain, as rooftop carriers do. A distinct disadvantage of car back carriers is that they cannot be adapted for use with traditional sedans or vehicles with trunks. Also, they can restrict access to luggage inside the car by preventing rear doors from opening. Car back carriers generally retail for between $100 and $200. |

Our Product

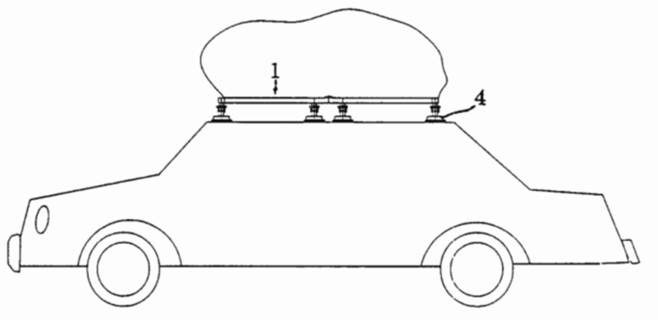

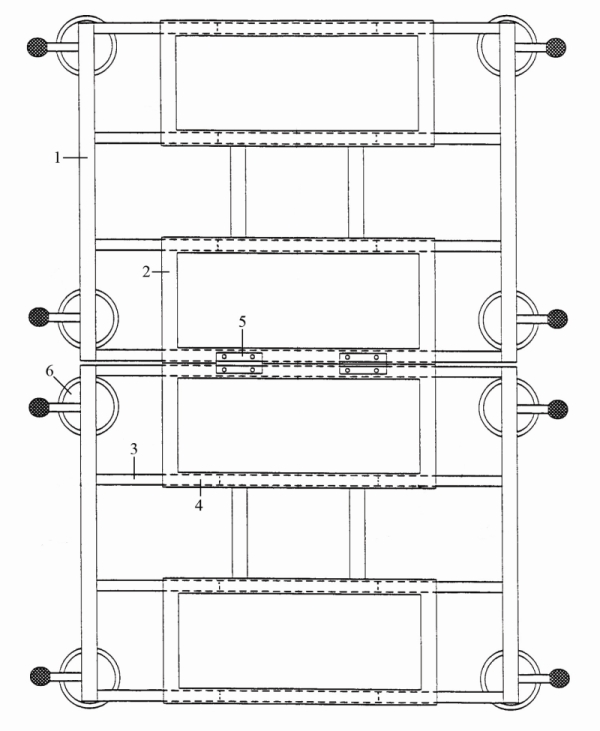

We are in the process of developing a portable, light-weight car-top carrier that combines the strength of a box carrier with the convenience of a bag carrier (See Figure 1) for a retail price of under $50. Our current Product has two support frames (See Figure 2), an outer (1) and an inner frame (2), to provide the structure and strength of a traditional box carrier. The outer frame has several cross-bars (3) and the inner frame has several bushings (4), which fit together upon assembly and installation. This combines the structural support of the inner and outer frames to provide for maximum strength and weight-bearing ability. The entire unit is attached to the car top by strong magnets (6), which are connected to the outer frame. Ease of storage is enhanced by hinges in the middle of the frame (5), allowing users to fold the entire unit in half lengthwise in lieu of, or in addition to, removing the outer frame cross-bars from the inner frame bushings. Upon disassembly, which we anticipate will be quick, easy, and require no technical or mechanical sophistication, the Product can then be transported or stored in the accompanying luggage bag, requiring very little space.

| 4 |

Our Product is being designed specifically for the Asian market. One of the variables influential in the development of our Product is the fact that very few cars in Asia are equipped with roof racks by the manufacturer, so we needed to design our Product for easily installation in the absence of a roof rack. Thus, our Product can be attached to a vehicle using strong magnets, so no roof rack is necessary. We have not yet determined whether we will use permanent magnets or electromagnets for this purpose, nor have we determined the magnetic field strength required to safely and securely keep our Product attached to a car top while experiencing the drag associated with speeds up to 200 kph. These variables are being addressed as we continue to develop the final model of our Product.

Also, because our Product doesn’t rest directly on the roof of the vehicle and the weight is distributed across several contact points, it can withstand a greater amount of weight than traditional carriers that apply the force of their weight to the luggage rack, which determines the maximum load. Our current research and development efforts include maximizing the carrying load of our Product. Another factor in the weight load is the material used for the inner and outer frames. We are experimenting with different alloys and plastics to find the best combination of strength and cost-effectiveness for our Product. Final Product weight will also be a factor in determining the material we use for the Product frame.

Figure 1

| 5 |

Figure 2

| 6 |

Strategy

Our company’s long-term business strategy is designed to capitalize on the current lack of a strong, portable, and affordable car top carrier that we perceive within the Asian marketplace. Our goal is to grow our company by expanding the reach of our product sales channels, by forming relationships with companies who supply products that fit our business model, and by making our product available directly to consumers.

Marketing

We intend to market our product to large automobile companies, automobile retailers, automobile accessory retailers, and general retailers.

Intellectual Property

Our business depends, in part, on the protection of our intellectual property, including our business name, logo, and distinctive branding. We have not taken any measures to protect our intellectual property to this point, so there are no legal barriers to prevent others from using what we regard as our intellectual property. In the future we may decide to file a trademark application to protect our brand, but we cannot guarantee the success of this application. In addition, the laws of some foreign countries do not protect intellectual property to the same extent as the laws of the United States, which could increase the likelihood of misappropriation. Furthermore, other companies could develop similar or superior trademarks without violating our intellectual property rights. If we resort to legal proceedings to enforce our intellectual property rights, the proceedings could be burdensome, disruptive and expensive, and distract the attention of management, and there can be no assurance that we would prevail.

We are in the process of researching patent rights, and at present we are not aware of anyone in Malaysia or China having any patents, trademarks and/or copyright protection for this or any similar product. Upon successful completion of the development of our Product, we plan to apply for patent protection and/or copyright protection in Malaysia, and other jurisdictions in which we conduct business and distribute our Product.

We have selected the name of our company in an attempt to establish our brand name. Although our company name and logo is not trademarked at this time, we anticipate the necessity of a trademark upon successful commercialization of our product in order to protect our brand integrity.

| 7 |

Competition

The automobile accessories industry can be categorized as highly competitive. There are a large number of established firms that currently sell products similar to ours, aimed at a target market similar to ours. Many of these established distributors have representatives in the field who have established relationships within the industry. In some cases, competitors have exclusivity agreements to supply certain automobile manufacturers. A number of manufacturers for the types of products we offer already sell their products directly to the consumer. These highly competitive market conditions may make it difficult for us to succeed in this market. Our most significant competitors include:

| · | Yakima – This industry leader offers the widest selection of products directly to consumers, but their prices are also the highest. While they have negotiated deals with major automobile manufacturers to provide their products on new cars in North America and Europe, their presence in Malaysia, China, and other Asian countries is limited to consumer retail outlets and consumer-direct internet sales. |

| · | Lakeland Vacation Gear – Lakeland competes much more effectively on price than other manufacturers and is often considered the low price leader in luggage racks and bags. While consumers can also purchase their products directly through their web site or at automobile accessory retail stores, they have not negotiated large wholesale deals with automobile manufacturers or retailers. In spite of their reputation, their products are priced at nearly twice our target retail price. |

| · | Automobile Manufacturers – Perhaps our greatest competition comes from large automobile manufacturers themselves. Many produce luggage carriers and offer them as upgrades or incentives to consumers when they purchase automobiles. They are also able to offer luggage carriers as after-market items through their retail locations and online. We will need to be able to offer a significant cost-savings to consumers to compete with the automobile manufacturers, who can afford to take a loss on the manufacture and sale of a car top carrier in order to sell an automobile. We will need to be able to offer an even more significant cost savings if we hope to engage automobile manufacturers as customers to replace their in-house manufacturing of similar products. |

Government Regulation

Government regulation and compliance with environmental laws do not have a material effect on our business. We are subject to the laws and regulations of those jurisdictions in which we plan to sell our product, which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the sale of our product in Malaysia and China is not subject to special regulatory and/or supervisory requirements.

Employees

We have no employees other than our officer and directors as of the date of this report. As needed from time to time, we may pay for the services of independent contractors such as web designers and commissioned sales people.

We do not lease or own any real property. We maintain our corporate office at 50 West Liberty Street, Suite 880, Reno, NV 89501 and our operations office in Malaysia is located at Penthouse, Menara Antara, No. 11, Jalan Bukit Ceylong, Kuala Lumpur 50200, Malaysia. This office space is being provided free of charge by our officer and director, Tee Kai Shen.

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

| 8 |

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is quoted under the symbol “ROTE” on the OTCBB operated by the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the OTCQB operated by OTC Markets Group, Inc. Few market makers continue to participate in the OTCBB system because of high fees charged by FINRA. Consequently, market makers that once quoted our shares on the OTCBB system may no longer be posting a quotation for our shares. As of the date of this report, however, our shares are quoted by several market makers on the OTCQB. The criteria for listing on either the OTCBB or OTCQB are similar and include that we remain current in our SEC reporting. Our reporting is presently current and, since inception, we have filed our SEC reports on time.

Only a limited market exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell his securities in our company.

The following tables set forth the range of high and low prices for our common stock for the each of the periods indicated as reported by the OTCQB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year Ending July 31, 2012 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| July 31, 2012 | N/A | N/A | ||||||||

| March 31, 2012 | N/A | N/A | ||||||||

| December 31, 2011 | N/A | N/A | ||||||||

| September 30, 2011 | N/A | N/A | ||||||||

| Fiscal Year Ending July 31, 2011 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| July 31, 2011 | N/A | N/A | ||||||||

| March 31, 2011 | N/A | N/A | ||||||||

| December 31, 2010 | N/A | N/A | ||||||||

| September 30, 2010 | N/A | N/A | ||||||||

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

| 9 |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of July 31, 2012, we had 2,150,000 shares of our common stock issued and outstanding, held by forty (40) shareholders of record.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

1. we would not be able to pay our debts as they become due in the usual course of business, or;

2. our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

| 10 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

Results of Operations for the Years Ended July 31, 2012 and 2011 and for the period from inception (July 27, 2007) to July 31, 2012

We have not earned any revenues since our inception. We are presently in the development stage of our business and we can provide no assurance that we will develop a viable product, or if such product is developed, that we will be able to generate sufficient sales and enter into commercial production.

Our operating expenses for the year ended July 31, 2012 consisted of professional fees in the amount of $17,199 and filing fees in the amount of $1,373, while our operating expenses for the year ended July 31, 2011 consisted of professional fees in the amount of $14,158 and filing fees in the amount of $955. Our operating expenses for the period from inception (July 27, 2008) through July 31, 2012 consisted of professional fees in the amount of $110,357 and filing fees in the amount of $7,328.

We had a net loss of $18,572 for the year ended July 31, 2012, compared with a net loss of $15,113 for the year ended July 31, 2011, and a net loss of $117,685 for the period from inception (July 27, 2007) to July 31, 2012.

Liquidity and Capital Resources

As of July 31, 2012, we had total current assets of $0. Our total current liabilities as of July 31, 2012 were $74,685. Thus, we have a working capital deficit of $74,685 as of July 31, 2012.

Operating activities used $12,558 in cash for the year ended July 31, 2012. Our net loss of $18,572 was the primary negative component of our operating cash flow. Cash flows provided by financing activities during year ended July 31, 2012 consisted of $12,558 as loans from our officer and director.

The success of our business plan beyond the next 12 months is contingent upon us obtaining additional financing. We intend to fund operations through debt and/or equity financing arrangements, which may be insufficient to fund our capital expenditures, working capital, or other cash requirements. We do not have any formal commitments or arrangements for the sales of stock or the advancement or loan of funds at this time. There can be no assurance that such additional financing will be available to us on acceptable terms, or at all.

| 11 |

Going Concern

We have incurred losses since inception, have negative working capital, and have not yet received revenues from sales of products or services. These factors create substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustment that might be necessary if we are unable to continue as a going concern.

Our ability to continue as a going concern is dependent on generating cash from the sale of our common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plans include selling our equity securities and obtaining debt financing to fund our capital requirement and ongoing operations; however, there can be no assurance we will be successful in these efforts.

Purchase or Sale of Equipment

We do not expect to purchase or sell any plant or significant equipment.

Personnel

Tee Kai Shen, our President and Director is currently working approximately 10 to 20 hours per week to meet our needs. As demand requires, Tee Kai Shen will devote additional time. Tam Siew Suan is our Secretary and Director, and devotes enough time to meet our needs. We currently have no other employees. We do not expect to increase our number of employees during the next twelve months.

Off Balance Sheet Arrangements

As of July 31, 2012, there were no off balance sheet arrangements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

Audited Financial Statements:

| 12 |

Silberstein Ungar, PLLC CPAs and Business Advisors

Phone (248) 203-0080

Fax (248) 281-0940

30600 Telegraph Road, Suite 2175

Bingham Farms, MI 48025-4586

www.sucpas.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Boards of Directors

Rolling Technologies, Inc.

Las Vegas, Nevada

We have audited the accompanying balance sheets of Rolling Technologies, Inc., as of July 31, 2012 and 2011, and the related statements of operations, stockholders’ deficit, and cash flows for the years then ended and the period from July 27, 2007 (date of inception) to July 31, 2012. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company has determined that it is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Rolling Technologies, Inc., as of July 31, 2012 and 2011 and the results of its operations and cash flows for the years then ended and the period from July 27, 2007 (date of inception) to July 31, 2012, in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements have been prepared assuming that Rolling Technologies, Inc. will continue as a going concern. As discussed in Note 8 to the financial statements, the Company has incurred losses from operations, has negative working capital and is in need of additional capital to grow its operations so that it can become profitable. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans with regard to these matters are described in Note 8. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Silberstein Ungar, PLLC

Silberstein Ungar, PLLC

Bingham Farms, Michigan

October 24, 2012

| F-1 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

AS OF JULY 31, 2012 AND 2011

| 2012 | 2011 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and equivalents | $ | 0 | $ | 0 | ||||

| Prepaid expenses | 0 | 3,000 | ||||||

| TOTAL ASSETS | $ | 0 | $ | 3,000 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Liabilities | ||||||||

| Current Liabilities | ||||||||

| Accrued expenses | $ | 4,394 | $ | 1,380 | ||||

| Loan payable - related party | 70,291 | 57,733 | ||||||

| Total Liabilities | 74,685 | 59,113 | ||||||

| Stockholders’ Deficit | ||||||||

| Common Stock, $.001 par value, 100,000,000 shares authorized, 2,150,000 shares issued and outstanding | 2,150 | 2,150 | ||||||

| Additional paid-in capital | 40,850 | 40,850 | ||||||

| Deficit accumulated during the development stage | (117,685 | ) | (99,113 | ) | ||||

| Total Stockholders’ Deficit | (74,685 | ) | (56,113 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 0 | $ | 3,000 | ||||

See accompanying notes to financial statements.

| F-2 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

FOR THE YEARS ENDED JULY 31, 2012 AND 2011

FOR THE PERIOD FROM JULY 27, 2007 (INCEPTION) TO JULY 31, 2012

| Year ended July 31, 2012 | Year ended July 31, 2011 | Period from July 27, 2007 (Inception) to July 31, 2012 | ||||||||||

| REVENUES | $ | 0 | $ | 0 | $ | 0 | ||||||

| EXPENSES | ||||||||||||

| Professional fees | 17,199 | 14,158 | 110,357 | |||||||||

| Filing fees | 1,373 | 955 | 7,328 | |||||||||

| TOTAL EXPENSES | 18,572 | 15,113 | 117,685 | |||||||||

| LOSS FROM OPERATIONS | (18,572 | ) | (15,113 | ) | (117,685 | ) | ||||||

| PROVISION FOR INCOME TAXES | 0 | 0 | 0 | |||||||||

| NET LOSS | $ | (18,572 | ) | $ | (15,113 | ) | $ | (117,685 | ) | |||

| NET LOSS PER SHARE: BASIC AND DILUTED | $ | (0.01 | ) | $ | (0.01 | ) | ||||||

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING: BASIC AND DILUTED | 2,150,000 | 2,150,000 | ||||||||||

See accompanying notes to financial statements.

| F-3 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF STOCKHOLDERS’ DEFICIT

FOR THE PERIOD FROM JULY 27, 2007 (INCEPTION) TO JULY 31, 2012

| Common Stock | Additional paid-in | Deficit accumulated during the development | ||||||||||||||||||

| Shares | Amount | Capital | Stage | Total | ||||||||||||||||

| Inception, July 27, 2007 | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||||

| Issuance of common stock for cash @ $0.001 per share | 2,150,000 | 2,150 | 40,850 | — | 43,000 | |||||||||||||||

| Net loss for the period ended July 31, 2007 | — | — | — | (4,000 | ) | (4,000 | ) | |||||||||||||

| Balance, July 31, 2007 | 2,150,000 | 2,150 | 40,850 | (4,000 | ) | 39,000 | ||||||||||||||

| Net loss for the year ended July 31, 2008 | — | — | — | (45,000 | ) | (45,000 | ) | |||||||||||||

| Balance, July 31, 2008 | 2,150,000 | 2,150 | 40,850 | (49,000 | ) | (6,000 | ) | |||||||||||||

| Net loss for the year ended July 31, 2009 | — | — | — | (9,500 | ) | (9,500 | ) | |||||||||||||

| Balance, July 31, 2009 | 2,150,000 | 2,150 | 40,850 | (58,500 | ) | (15,500 | ) | |||||||||||||

| Net loss for the year ended July 31, 2010 | — | — | — | (25,500 | ) | (25,500 | ) | |||||||||||||

| Balance, July 31, 2010 | 2,150,000 | 2,150 | 40,850 | (84,000 | ) | (41,000 | ) | |||||||||||||

| Net loss for the year ended July 31, 2011 | — | — | — | (15,113 | ) | (15,113 | ) | |||||||||||||

| Balance, July 31, 2011 | 2,150,000 | 2,150 | 40,850 | (99,113 | ) | (56,113 | ) | |||||||||||||

| Net loss for the year ended July 31, 2012 | — | — | — | (18,572 | ) | (18,572 | ) | |||||||||||||

| Balance, July 31, 2012 | 2,150,000 | $ | 2,150 | $ | 40,850 | $ | (117,685 | ) | $ | (74,685 | ) | |||||||||

See accompanying notes to financial statements.

| F-4 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

FOR THE YEARS ENDED JULY 31, 2012 AND 2011

FOR THE PERIOD FROM JULY 27, 2007 (INCEPTION) TO JULY 31, 2012

| Year ended July 31, 2012 | Year ended July 31, 2011 | Period from July 27, 2007 (Inception) to July 31, 2012 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

| Net loss for the period | $ | (18,572 | ) | $ | (15,113 | ) | $ | (117,685 | ) | |||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||

| Changes in assets and liabilities: | ||||||||||||

| (Increase) decrease in prepaid expenses | 3,000 | (1,000 | ) | 0 | ||||||||

| Increase (decrease) in accrued expenses | 3,014 | (462 | ) | 4,394 | ||||||||

| Net Cash Used by Operating Activities | (12,558 | ) | (16,575 | ) | (113,291 | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

| Proceeds from issuance of common stock | 0 | 0 | 43,000 | |||||||||

| Loan received from related party | 12,558 | 16,575 | 70,291 | |||||||||

| Net Cash Provided by Financing Activities | 12,558 | 16,575 | 113,291 | |||||||||

| NET INCREASE (DECREASE) IN CASH | 0 | 0 | 0 | |||||||||

| Cash, beginning of period | 0 | 0 | 0 | |||||||||

| Cash, end of period | $ | 0 | $ | 0 | $ | 0 | ||||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | ||||||||||||

| Interest paid | $ | 0 | $ | 0 | $ | 0 | ||||||

| Income taxes paid | $ | 0 | $ | 0 | $ | 0 | ||||||

See accompanying notes to financial statements.

| F-5 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

JULY 31, 2012

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Rolling Technologies, Inc. (“Rolling” and the “Company”) was incorporated in Nevada on July 27, 2007. The Company is in the process of developing a portable, light-weight car-top carrier that combines the strength of a box carrier with the convenience of a bag carrier for a retail price of under $50.

Development Stage Company

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles related to development-stage companies. A development-stage company is one in which planned principal operations have not commenced or if its operations have commenced, there has been no significant revenues there from.

Basis of Presentation

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America and are presented in US dollars.

Accounting Basis

The Company uses the accrual basis of accounting and accounting principles generally accepted in the United States of America (“GAAP” accounting). The Company has adopted a July 31 fiscal year end.

Cash and Cash Equivalents

Rolling considers all highly liquid investments with maturities of six months or less to be cash equivalents. At July 31, 2012 and 2011, the Company had $0 of cash.

Fair Value of Financial Instruments

The Company’s financial instruments consist of cash and cash equivalents, prepaid expenses, accrued expenses and loans payable to a related party. The carrying amount of these financial instruments approximates fair value due either to length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in these financial statements.

Income Taxes

Income taxes are computed using the asset and liability method. Under the asset and liability method, deferred income tax assets and liabilities are determined based on the differences between the financial reporting and tax bases of assets and liabilities and are measured using the currently enacted tax rates and laws. A valuation allowance is provided for the amount of deferred tax assets that, based on available evidence, are not expected to be realized.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition

The Company recognizes revenue when products are fully delivered or services have been provided and collection is reasonably assured.

| F-6 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

JULY 31, 2012

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Basic Income (Loss) Per Share

Basic income (loss) per share is calculated by dividing the Company’s net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing the Company’s net income available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. There are no such common stock equivalents outstanding as of July 31, 2012.

Stock-Based Compensation

Stock-based compensation is accounted for at fair value in accordance with ASC 718. To date, the Company has not adopted a stock option plan and has not granted any stock options. As of July 31, 2012, the Company has not issued any stock-based payments to its employees.

Recent Accounting Pronouncements

Rolling does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position or cash flow.

NOTE 2 – PREPAID EXPENSES

Prepaid expenses at July 31, 2011 consisted of amounts prepaid for legal services used during the year ended July 31, 2012. Prepaid expenses totaled $0 and $3,000 as of July 31, 2012 and 2011, respectively.

NOTE 3 – ACCRUED EXPENSES

Accrued expenses at July 31, 2012 consisted of amounts owed to the Company’s attorneys and stock transfer agent. Accrued expenses totaled $4,394 and $1,380 as of July 31, 2012 and 2011, respectively.

NOTE 4 – LOAN PAYABLE – RELATED PARTY

The Company has received loans from a related party to be used for working capital. The loans are unsecured, non-interest bearing, and due on demand. The balance due to the shareholder was $70,291 and $57,733 as of July 31, 2012 and 2011, respectively.

NOTE 5 – STOCKHOLDERS’ DEFICIT

The Company has 100,000,000 shares of $0.001 par value common stock authorized. There were no shares of common stock issued during the years ended July 31, 2012 and 2011. As of July 31, 2012, Rolling had 2,150,000 shares of common stock issued and outstanding.

NOTE 6 – COMMITMENTS AND CONTINGENCIES

Rolling neither owns nor leases any real or personal property. An office has provided office services without charge. There is no obligation for this arrangement to continue. Such costs are immaterial to the financial statements and accordingly are not reflected herein. The officers and directors are involved in other business activities and most likely will become involved in other business activities in the future.

| F-7 |

ROLLING TECHNOLOGIES, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

JULY 31, 2012

NOTE 7 – INCOME TAXES

As of July 31, 2012, the Company had net operating loss carry forwards of approximately $118,000 that may be available to reduce future years’ taxable income through 2031. Future tax benefits which may arise as a result of these losses have not been recognized in these financial statements, as their realization is determined not likely to occur and accordingly, the Company has recorded a valuation allowance for the deferred tax asset relating to these tax loss carry-forwards.

The provision for Federal income tax consists of the following for the years ended July 31, 2012 and 2011:

| 2012 | 2011 | |||||||

| Federal income tax benefit attributable to: | ||||||||

| Current Operations | $ | 6,314 | $ | 5,138 | ||||

| Less: valuation allowance | (6,314 | ) | (5,138 | ) | ||||

| Net provision for Federal income taxes | $ | 0 | $ | 0 | ||||

The cumulative tax effect at the expected rate of 34% of significant items comprising our net deferred tax amount is as follows as of July 31, 2012 and 2011:

| 2012 | 2011 | |||||||

| Deferred tax asset attributable to: | ||||||||

| Net operating loss carryover | $ | 40,012 | $ | 33,698 | ||||

| Less: valuation allowance | (40,012 | ) | (33,698 | ) | ||||

| Net deferred tax asset | $ | 0 | $ | 0 | ||||

Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry forwards of $117,685 for Federal income tax reporting purposes are subject to annual limitations. Should a change in ownership occur net operating loss carry forwards may be limited as to use in future years.

NOTE 8 – LIQUIDITY AND GOING CONCERN

Rolling has negative working capital, has incurred losses since inception, and has not yet received revenues from sales of products or services. These factors create substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustment that might be necessary if the Company is unable to continue as a going concern.

The ability of Rolling to continue as a going concern is dependent on the Company generating cash from the sale of its common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plans include selling its equity securities and obtaining debt financing to fund its capital requirement and ongoing operations; however, there can be no assurance the Company will be successful in these efforts.

NOTE 9 – SUBSEQUENT EVENTS

In accordance with ASC 855-10, the Company has analyzed its operations subsequent to July 31, 2012 to the date these financial statements were issued, and has determined that it does not have any material subsequent events to disclose in these financial statements.

| F-8 |

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

There were no events requiring disclosure under Item 304 of Regulation S-K during the fiscal year ending July 31, 2012.

Item 9A(T). Controls and Procedures

As required by Rule 13a-15 under the Securities Exchange Act of 1934, we have carried out an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this annual report, being July 31, 2012. This evaluation was carried out under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Securities Exchange Act of 1934 is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Based upon that evaluation, including our Chief Executive Officer and Chief Financial Officer, we have concluded that our disclosure controls and procedures were ineffective as of the end of the period covered by this annual report.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934). Management has assessed the effectiveness of our internal control over financial reporting as of July 31, 2012 based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of this assessment, management concluded that, as of July 31, 2012, our internal control over financial reporting was not effective. Our management identified the following material weaknesses in our internal control over financial reporting, which are indicative of many small companies with small staff: (i) inadequate segregation of duties and effective risk assessment; and (ii) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and SEC guidelines.

We plan to take steps to enhance and improve the design of our internal control over financial reporting. During the period covered by this annual report on Form 10-K, we have not been able to remediate the material weaknesses identified above. To remediate such weaknesses, we hope to implement the following changes during our fiscal year ending July 31, 2013: (i) appoint additional qualified personnel to address inadequate segregation of duties and ineffective risk management; and (ii) adopt sufficient written policies and procedures for accounting and financial reporting. The remediation efforts set out in (i) and (ii) are largely dependent upon our securing additional financing to cover the costs of implementing the changes required. If we are unsuccessful in securing such funds, remediation efforts may be adversely affected in a material manner.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to an exemption for non-accelerated filers set forth in Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

None

| 13 |

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The following information sets forth the names, ages, and positions of our current directors and executive officers as of July 31, 2012.

| Name | Age | Position Held with the Company |

|

Tee Kai Shen Penthouse, Menara Antara, No. 11, Jalan Bukit Ceylong, Kuala Lumpur 50200 Kuala Lumpur, Malaysia |

26 | President, CEO, and Director |

|

Tam Siew Suan 94, Jalan Metro Perdana Barat 12 Taman Usahawan Kepong Kuala Lumpur, Malaysia |

50 | Secretary and Director |

Set forth below is a brief description of the background and business experience of each of our current executive officers and directors.

Tee Kai Shen is our President, CEO, and director. Tee Kai Shen was a university student from 2000 through 2005. Tee Kai Shen obtained a Management Diploma from the University of Abertay Dundee in December of 2005. Since graduation, Tee Kai Shen has worked as a manager at Galaxy Properties Corporation in Kuala Lumpur, Malaysia. Tee Kai Shen’s duties in this position include general management tasks, oversight of employees, and management level decision-making.

Tam Siew Suan is our Secretary and one of our directors. Tam Siew Suan obtained a Bachelor of Science from University Lampung in 2002. Since that time, Tam Siew Suan has worked as a Senior Engineer at Vintage Manufacturing Co. In this position, Tam Siew Suan has gained experience in design and manufacturing, which have been extremely beneficial in the design and development of our current Product.

Term of Office

Our Directors are appointed for a one year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Family Relationships

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

| 14 |

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past ten years, none of the following occurred with respect to a present or former director, executive officer, or employee: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently reversed, suspended vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Committees of the Board

Our company currently does not have nominating, compensation or audit committees or committees performing similar functions nor does our company have a written nominating, compensation or audit committee charter. Our directors believe that it is not necessary to have such committees, at this time, because the functions of such committees can be adequately performed by the board of directors.

Our company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for directors. The board of directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our company does not currently have any specific or minimum criteria for the election of nominees to the board of directors and we do not have any specific process or procedure for evaluating such nominees. The board of directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our board of directors may do so by directing a written request addressed to our CEO, Tee Kai Shen, at the address appearing on the first page of this annual report.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers and persons who beneficially own more than ten percent of a registered class of the Company’s equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent beneficial shareholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To the best of our knowledge based solely on a review of Forms 3, 4, and 5 (and any amendments thereof) received by us during or with respect to the year ended July 31, 2010, the following persons have failed to file, on a timely basis, the identified reports required by Section 16(a) of the Exchange Act during fiscal year ended July 31, 2012:

| Name and principal position |

Number of late reports |

Transactions not timely reported |

Known failures to file a required form |

| Tee Kai Shen, President, CEO and Director | 0 | 0 | 0 |

| Tam Siew Suan, Secretary and Director | 0 | 0 | 0 |

Code of Ethics

As of July 31, 2012, we had not adopted a Code of Ethics for Financial Executives, which would include our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

| 15 |

Item 11. Executive Compensation

Summary Compensation Table

The table below summarizes all compensation awarded to, earned by, or paid to our former or current executive officers for the fiscal years ended July 31, 2012 and 2011.

| SUMMARY COMPENSATION TABLE | |||||||||

|

Name and principal position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|

Tee Kai Shen President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director |

2012 2011

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

|

Tam Siew Suan Secretary and Director |

2012 2011

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

Narrative Disclosure to the Summary Compensation Table

We have not entered into any employment agreement or consulting agreement with our executive officers. There are no arrangements or plans in which we provide pension, retirement or similar benefits for executive officers.

Although we do not currently compensate our officers, we reserve the right to provide compensation at some time in the future. Our decision to compensate officers depends on the availability of our cash resources with respect to the need for cash to further our business purposes.

Stock Option Grants

We have not granted any stock options to the executive officers or directors since our inception.

| 16 |

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of July 31, 2012.

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | |||||||||

| OPTION AWARDS | STOCK AWARDS | ||||||||

|

Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units of Stock That Have Not Vested ($) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value

of Unearned Shares, Units or Other Rights That Have Not Vested

(#) |

| Tee Kai Shen | - | - | - | - | - | - | - | - | - |

| Tam Siew Suan | - | - | - | - | - | - | - | - | - |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth certain information known to us with respect to the beneficial ownership of our Common Stock as of July 31, 2012, by (1) all persons who are beneficial owners of 5% or more of our voting securities, (2) each director, (3) each executive officer, and (4) all directors and executive officers as a group. The information regarding beneficial ownership of our common stock has been presented in accordance with the rules of the Securities and Exchange Commission. Under these rules, a person may be deemed to beneficially own any shares of capital stock as to which such person, directly or indirectly, has or shares voting power or investment power, and to beneficially own any shares of our capital stock as to which such person has the right to acquire voting or investment power within 60 days through the exercise of any stock option or other right. The percentage of beneficial ownership as to any person as of a particular date is calculated by dividing (a) (i) the number of shares beneficially owned by such person plus (ii) the number of shares as to which such person has the right to acquire voting or investment power within 60 days by (b) the total number of shares outstanding as of such date, plus any shares that such person has the right to acquire from us within 60 days. Including those shares in the tables does not, however, constitute an admission that the named stockholder is a direct or indirect beneficial owner of those shares. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares that power with that person’s spouse) with respect to all shares of capital stock listed as owned by that person or entity.

| 17 |

Except as otherwise indicated, all Shares are owned directly and the percentage shown is based on 2,150,000 Shares of Common Stock issued and outstanding as of July 31, 2012.

| Name and Address of Beneficial Owners of Common Stock1 | Title of Class | Amount and Nature of Beneficial Ownership | % of Common Stock2 |

|

Tee Kai Shen Penthouse, Menara Antara, No. 11, Jalan Bukit Ceylong, Kuala Lumpur 50200 Kuala Lumpur, Malaysia |

Common Stock |

600,000 | 27.9% |

|

Tam Siew Suan 94, Jalan Metro Perdana Barat 12 Taman Usahawan Kepong Kuala Lumpur, Malaysia |

Common Stock | 600,000 | 27.9% |

| DIRECTORS AND OFFICERS – TOTAL | 1,200,000 | 55.8% | |

| 5% SHAREHOLDERS | |||

| NONE | Common Stock | NONE | NONE |

Other than the shareholders listed above, we know of no other person who is the beneficial owner of more than five percent (5%) of our common stock.

Item 13. Certain Relationships and Related Transactions, and Director Independence

Except as follows, none of our directors or executive officers, nor any proposed nominee for election as a director, nor any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to all of our outstanding shares, nor any members of the immediate family (including spouse, parents, children, siblings, and in-laws) of any of the foregoing persons has any material interest, direct or indirect, in any transaction over the last two years or in any presently proposed transaction which, in either case, has or will materially affect us.

We have received loans from Tee Kai Shen, our officer and director, for working capital. The loans are due upon demand, non-interest bearing, and unsecured. The balances due on the loan were $70,291 and $57,733 as of July 31, 2012 and 2011, respectively.

As of the date of this annual report, our common stock is traded on the OTC Bulletin Board (the “Bulletin Board”). The Bulletin Board does not impose on us standards relating to director independence or the makeup of committees with independent directors, or provide definitions of independence.

Item 14. Principal Accounting Fees and Services

Below is the table of Audit Fees (amounts in US$) billed by our auditor in connection with the audit of the Company’s annual financial statements for the years ended:

| Financial Statements for the Year Ended July 31 | Audit Services | Audit Related Fees | Tax Fees | Other Fees |

| 2012 | $8,000 | $0 | $0 | $0 |

| 2011 | $8,000 | $0 | $0 | $0 |

| 18 |

PART IV

Item 15. Exhibits, Financial Statements Schedules

| (a) | Financial Statements and Schedules |

The following financial statements and schedules listed below are included in this Form 10-K.

Financial Statements (See Item 8)

| (b) | Exhibits |

| Exhibit Number | Description |

| 3.1 | Articles of Incorporation (1) |

| 3.2 | Bylaws(1) |

| 31.1 | Certification of Chief Executive Officer pursuant to Securities Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2 | Certification of Chief Financial Officer pursuant to Securities Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101** | The following materials from the Company’s Annual Report on Form 10-K for the year ended July 31, 2012 formatted in Extensible Business Reporting Language (XBRL). |

| (1) | Incorporated by reference to the Registration Statement on Form SB-2 filed on September 18, 2007. |

| 19 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Rolling Technologies, Inc.

| By: | /s/ Tee Kai Shen |

|

Tee Kai Shen President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director

| |

| October 29, 2012 |

| By: | /s/ Tam Siew Suan |

|

Tam Siew Suan Secretary and Director

| |

| October 29, 2012 |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Tee Kai Shen |

|

Tee Kai Shen President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director

| |

| October 29, 2012 |

| By: | /s/ Tam Siew Suan |

|

Tam Siew Suan Secretary and Director

| |

| October 29, 2012 |

| 20 |