Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PATHEON INC | d430517d8k.htm |

| EX-2.1 - STOCK PURCHASE AGREEMENT BY AND AMONG SOBEL BEST N.V., VION HOLDING N.V. AND PAT - PATHEON INC | d430517dex21.htm |

| EX-10.1 - COMMITMENT LETTER - PATHEON INC | d430517dex101.htm |

| EX-99.1 - ACQUISITION PRESS RELEASE - PATHEON INC | d430517dex991.htm |

| EX-10.2 - EQUITY COMMITMENT LETTER BETWEEN JLL PARTNERS V, L.P. AND PATHEON INC. - PATHEON INC | d430517dex102.htm |

| EX-99.2 - REFINANCING PRESS RELEASE - PATHEON INC | d430517dex992.htm |

Patheon’s

Acquisition of Banner Pharmacaps October 29, 2012

Building the Pharmaceutical Industry’s

Leading Contract Development & Manufacturing Organization

Exhibit 99.3 |

1

Forward-Looking Statements

This presentation contains forward-looking statements or information which reflect our

expectations regarding possible events, conditions, our future growth, results of

operations, performance, and business prospects and opportunities. All statements, other

than statements of historical fact, are forward-looking statements. Forward-looking

statements necessarily involve significant known and unknown risks, assumptions and

uncertainties that may cause our actual results in future periods to differ materially

from those expressed or implied by such forward-looking statements, including risks related

to our ability to complete the proposed acquisition of Banner and the related equity and

debt financings; integration of and achievement of our intended objectives with respect

to our acquisition of Banner; and compliance with our debt covenants and our debt service obligations. For additional

information regarding risks and uncertainties that could affect our business, please see our

2011 Form 10-K and our subsequent filings with the U.S. Securities and Exchange

Commission and the Canadian Securities Administrators. Accordingly, you are

cautioned not to place undue reliance on forward-looking statements. These

forward-looking statements are made as of the date hereof, and except as required by

law, we assume no obligation to update or revise them to reflect new events or circumstances.

Use of Non-GAAP Financial Measures References in

these slides to "Adjusted EBITDA" are to income (loss) before discontinued operations before repositioning

expenses, interest expense, net, foreign exchange losses reclassified from other comprehensive

income, refinancing expenses, gains and losses on sale of fixed assets, gain on

extinguishment of debt, income taxes, asset impairment charge, depreciation and

amortization and other income and expenses. References in these slides to

"EBITDA per the Debt Commitment Letter" are to Adjusted EBITDA adjusted for

certain non-cash or other costs, including stock-based compensation expenses, consulting fees and

executive severance, cost savings, on a pro forma basis, from transformational initiatives

implemented by management and the estimated annualized cost savings from the

acquisition.

Since Adjusted EBITDA and EBITDA per the Debt Commitment Letter are non-GAAP measures that

do not have a standardized meaning, they may not be comparable to similar measures

presented by other issuers. You are cautioned that these non-GAAP measures are

not based on any comprehensive set of accounting rules or principles and should be considered only in conjunction

with, and not as a substitute for, or superior to, income (loss) before discontinued operations

determined in accordance with GAAP as indicators of performance, and EBITDA per the Debt

Commitment Letter should be considered only in conjunction with, and not as a substitute

for, or superior to, operating cash flow as an indicator of liquidity. Reconciliations of these non-GAAP measures to

their closest U.S. GAAP measures are included in the Appendix to this presentation. |

2

Transaction Overview

Transaction

Consideration

Valuation and

Financial

Impact

Timeline

•

Patheon to acquire Banner Pharmacaps, a specialty pharmaceutical

company

dedicated

to

the

research,

development

and

manufacturing

of

unique gelatin-based dosage forms

•

Total consideration to amount to USD 255 million, subject to

adjustments

•

Committed financing for 100% of transaction value

•

Expected to close by end of calendar year 2012

•

Subject to applicable regulatory approvals and other customary terms

and conditions

•

Expected EBITDA per the Debt Commitment Letter to be approx. USD

140 million for combined enterprise

•

Expected to be accretive within two years |

3

Strategic Rationale

•

Banner is the world’s second largest pharmaceutical business in manufacturing

softgels for OTC, prescription and nutritional consumer products

•

Leader in fast-growing complementary technology with a broad product

and intellectual property portfolio

•

Owns state-of-the-art facilities and expands Patheon’s

geographical presence,

notably

in

emerging

markets

•

Creates platform to grow Patheon’s contract manufacturing

operations (CMO) and pharmaceutical development services (PDS)

businesses

Building a USD 1 billion enterprise in a highly fragmented industry segment

|

4

Banner Acquisition is Consistent with our Strategy

•

Increases capability and scale in

complex solid dosage formats

•

Higher margins from proprietary

technologies and products

•

Provides immediate access to

Latin America market with Mexico

facility and direct to market

business

•

Emerging market presence

•

Offers proprietary technology

portfolio in softgels as well as

product ownership

•

Second largest pharmaceutical

business focused on delivering

proprietary softgel formulations

for OTC, prescription and

nutritional consumer products

STRENGTHEN CORE

OPERATIONS

SELL BUSINESS

DIFFERENTLY

ENTER LOGICAL

ADJACENCIES

DRIVE INDUSTRY

CONSOLIDATION |

5

•

Improving growth rates

•

Majority of players are private

$1.4 B

(+7.5%)

PharmSource data included for PDS services where Patheon participates

(preformulation; formulation; analytical; CTM).

Does not include packaging.

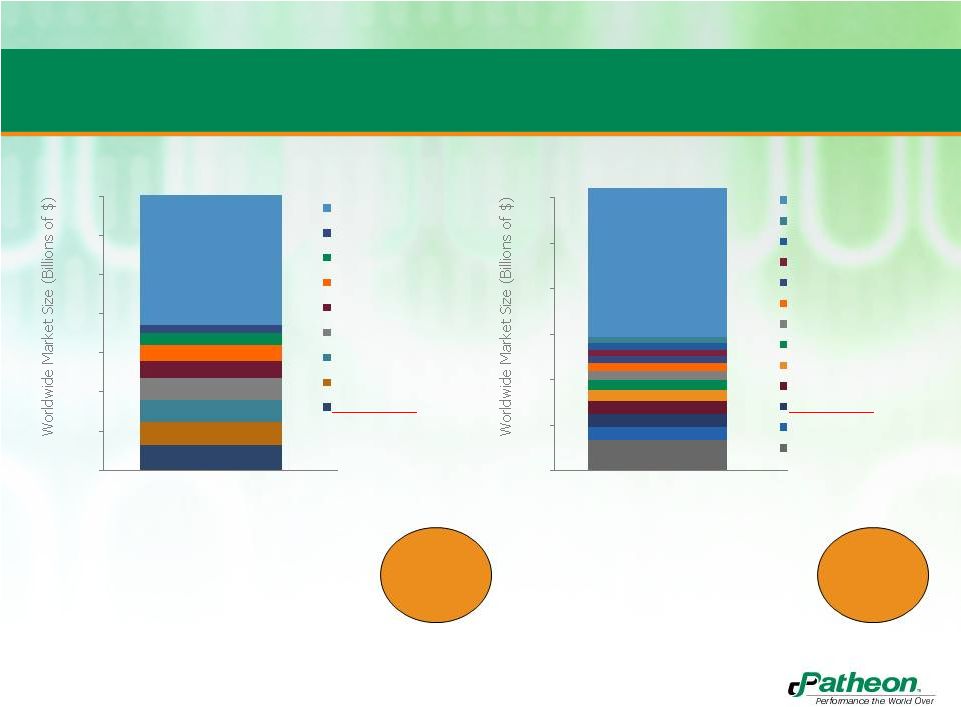

Growing Market Share in a Highly Fragmented

Marketplace

$12.3 B

(+5%)

•

Historical growth (5% CAGR)

•

Modest growth projections

(3% to 5% from “organic

growth”, higher in steriles)

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0

2011

12

10

8

6

4

2

0

2011

PDS MARKET CHARACTERISTICS

CMO MARKET CHARACTERISTICS

100+ Others (47%)

Catalent (3%)

AAIPharma (4%)

Aptuit (6%)

PPD (6%)

SGS (8%)

Lancaster Labs (8%)

Almac (9%)

Patheon (9%)

All Other (52%)

LTS (2%)

Corden Pharma (2%)

Hospira (2%)

Recipharm (2%)

Aenova (3%)

Haupt (3%)

Vetter (4%)

FAREVA Holdings (4%)

Famar (5%)

Patheon (5%)

Baxter (5%)

Catalent (11%)

#1 Market

Share

#2 Market

Share |

6

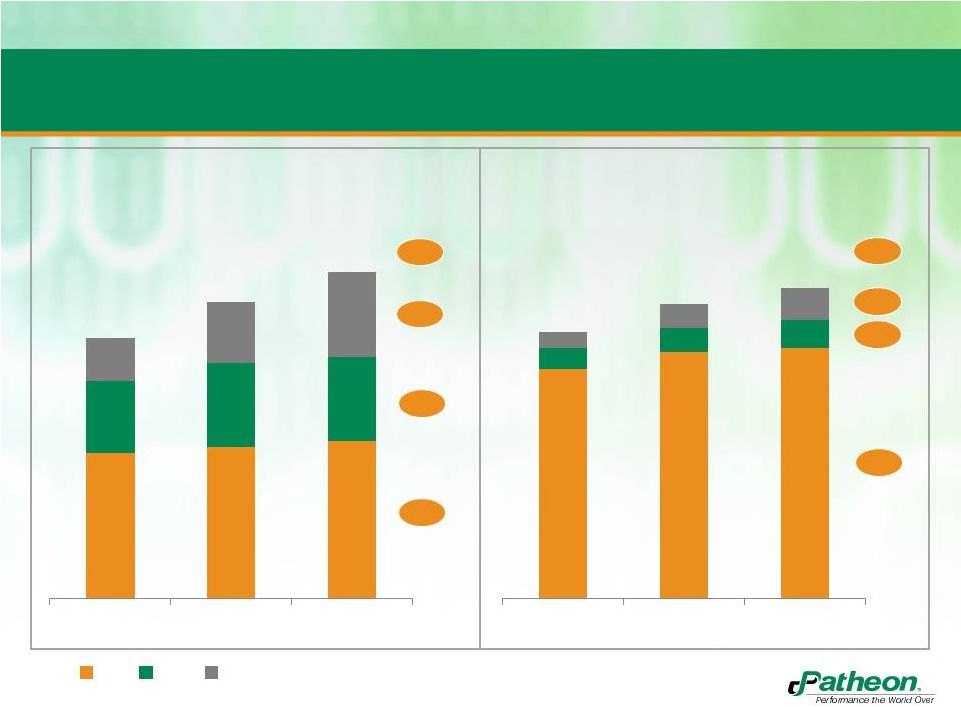

Softgel Market has Experienced Continued Growth

Historically

18%

4%

2%

6%

CAGR

07-11

CAGR

07-11

18%

8%

2%

3%

5.4

4.9

4.3

7.7

7.4

6.7

Source: Commissioned Report

2.4

2.5

2.6

1.2

1.4

1.4

0.7

1.0

1.4

2007

2009

2011

U.S. Softgel Market

Billion units

5.7

6.1

6.2

0.5

0.6

0.7

0.4

0.6

0.8

2007

2009

2011

U.S. Softgel Market

Billion $

Nutritional

OTC

Rx |

7

Type of Technology

Main Features

•

Attractive dosage form for pediatric and geriatric patients

•

Masks tastes and odors

•

Non-animal based gelatin alternative

•

pH and heat tolerant

•

Enteric feature reduces reflux and gastric irritation

•

Enteric

features

lie

within

the

shell

itself

–

therefore

clear

capsules

•

Attractive dosage form for pediatric and geriatric patients

•

Masks tastes and odors

•

Masks tastes and odors

•

Provides a multitude of color combinations; allows surface printing

•

Patented technology is difficult to mimic, providing easy recognition of

tampering or counterfeiting by consumers or pharmacists

•

Provides enhanced bioavailability of the API and lessens biovariability

•

Controlled release suitable for lipophilic and hydrophilic drugs

•

Drug release can be tailored to desired rate and extent

•

Abuse resistance

Banner’s Proprietary Softgel Technologies |

8

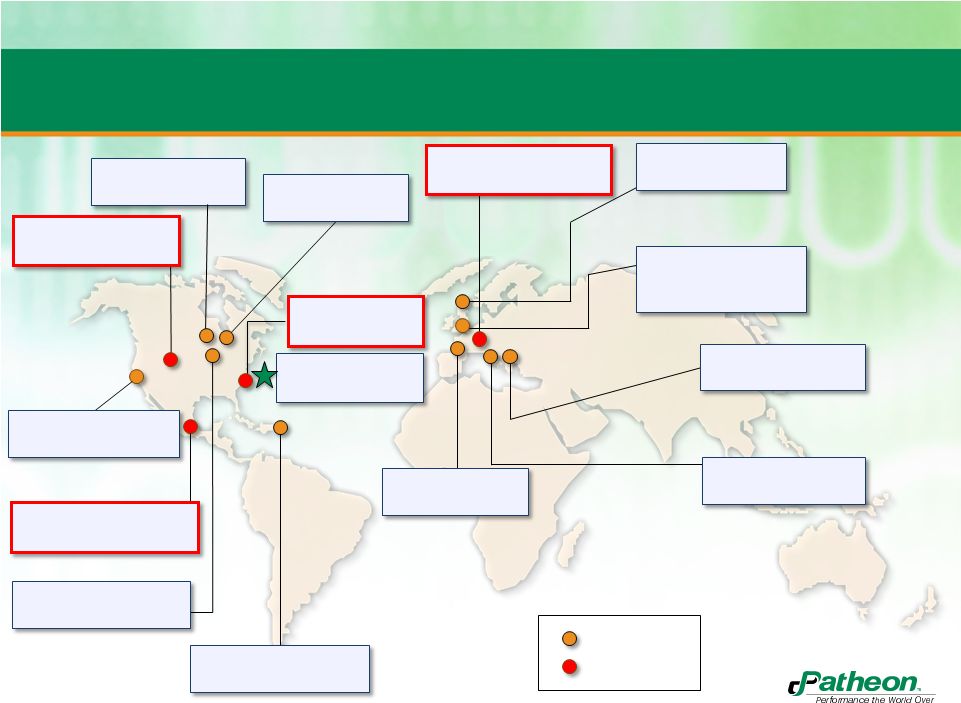

Expanded Global Network

8

Toronto, Canada

(PDS, CMO solids)

Olds, Alberta Canada

(CMO)

San Francisco, USA

(PDS development)

Naucalpan, Edo., Mexico

(CMO/softgel, R&D)

Cincinnati, USA

(PDS, CMO solid)

Manatí, Puerto Rico

(CMO solids)

Whitby, Canada

(PDS, CMO solids)

High Point, USA

(R&D, CMO)

RTP, USA

HQ

Bourgoin, France

(PDS, CMO solids)

Tilburg, The Netherlands

(CMO/softgel)

Swindon, England

(PDS, CMO sterile)

Milton Park, England

(PDS development)

(included in Swindon)

Monza, Italy

(CMO solid/sterile)

Ferentino, Italy

(PDS, CMO sterile)

Patheon

Banner |

9

•

Total consideration is USD 255 million, subject to adjustments

•

Committed financing for transaction value, associated expenses and

repayment of existing debt, and for general corporate purposes

•

We expect that Patheon’s Adjusted EBITDA margin will benefit from

the integration of Banner’s operations and expected synergies

–

Expected EBITDA per the Debt Commitment Letter to be approx. USD

140

million for the combined enterprise

–

Expected to be accretive within two years

–

Expected to realize about USD 12.5 million/year in SG&A synergies

Financial Impact |

10

Quarterly Adjusted EBITDA and EBITDA per Debt

Commitment Letter

U.S.D., in millions

Actual results

Estimated results

Q1'12

Q2'12

Q3'12

Q4'12

FYE'12

Adjusted EBITDA

(9.2)

9.7

34.6

33.9

69.0

Non-cash items

0.7

1.3

0.4

0.9

3.3

Consulting fees

6.3

6.0

1.0

0.0

13.3

Other items

0.4

2.4

0.0

0.0

2.8

Pro forma cost savings

7.8

5.2

0.6

0.2

13.8

Patheon EBITDA per the Debt Commitment letter

$6.0

$24.6

$36.6

$35.0

$102.2

Estimated Banner pro forma adjusted EBITDA

25.0

Estimated cost savings from combination

12.5

EBITDA per the Debt Commitment Letter

$139.7

Patheon (loss) income before discontinued operations

(19.3)

(79.6)

15.5

(19.2)

(102.6)

Patheon operating cash flow

9.9

(32.8)

29.7

16.8

23.6

Patheon investing cash flow

(6.5)

(11.0)

(15.2)

(16.6)

(49.3)

Patheon financing cash flow

(2.9)

30.6

2.6

(4.3)

26.0 |

11

Q&A |

12

Building the Pharmaceutical Industry’s Leading

Contract Development & Manufacturing Organization

Combination

Timeline

Valuation and

Financial

Impact

•

Adds well-balanced product and intellectual property portfolio with

complementary technology platforms

•

Builds scale, expands capacity and broadens footprint in emerging

markets

•

Expected to close by end of calendar 2012

•

Subject to applicable regulatory approvals and other customary terms

and conditions

•

Expected

EBITDA

per

the

Debt

Commitment

Letter

to

be

approx.

USD

140

million

for

combined

enterprise

•

Expected

to

be

accretive

within

two

years |

Appendix

|

14

U.S. Non-GAAP Reconciliation

Adjusted EBITDA

(U.S.D., in millions)

(unaudited)

Actuals

Estimate

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Full Year

Adjusted EBITDA

(9.2)

9.7

34.6

33.9

69.0

Depreciation and amortization

(10.6)

(10.8)

(9.3)

(9.9)

(40.6)

Repositioning expenses

(0.8)

(6.0)

(0.1)

1.7

(5.2)

Interest expense, net

(6.5)

(6.5)

(6.8)

(6.6)

(26.4)

Impairment charge

-

(57.9)

-

-

(57.9)

Loss on sale of capital assets

-

-

-

(0.6)

(0.6)

Benefit (provision) for income taxes

7.7

(8.0)

(3.3)

(38.3)

(41.9)

Miscellaneous

0.1

(0.1)

0.4

0.6

1.0

(Loss) income before discontinued operations

(19.3)

(79.6)

15.5

(19.2)

(102.6) |

15

U.S. Non-GAAP Reconciliation

(1) Represents Banner Pharmacaps expected earnings

before interest expense, income tax expense, depreciation

and amortization, foreign exchange gains and losses,

management fees, other income and expense, and $1.7

million in pricing allowances related to prior period sales

recorded in the 12 months ended October 31, 2012.

(2) Represents estimated annual synergies resulting from

Patheon's expected acquisition of Banner Pharmacaps

assuming completion of integration activities.

(3) Represents amortization of stock-based compensation

and non-cash foreign exchange gains and losses.

(4) Represents consulting fees related to Patheon's

operational excellence program recorded in the 12 months

ended October 31, 2012.

(5) Represents expenses related to a 2011 product recall by

one of Patheon's customers for product returns recorded in

the second quarter of fiscal 2012 and executive severance

paid to the company's former CFO in the first quarter of fiscal

2012.

(6) Represents additional estimated savings from operational

excellence projects and Puerto Rico overhead savings that

Patheon expects that it would have recognized in fiscal 2012

had all such projects been completed and fully implemented

as of November 1, 2011.

Actuals

Estimate

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Full Year

EBITDA per the Debt Commitment Letter

139.7

Estimated Banner pro forma adjusted EBITDA (1)

(25.0)

Estimated cost savings from combination (2)

(12.5)

Patheon EBITDA per the Debt Commitment Letter

6.0

24.6

36.6

35.0

102.2

Non-cash items (3)

(0.7)

(1.3)

(0.4)

(0.9)

(3.3)

Consulting fees (4)

(6.3)

(6.0)

(1.0)

-

(13.3)

Other items (5)

(0.4)

(2.4)

-

-

(2.8)

Pro forma cost savings (6)

(7.8)

(5.2)

(0.6)

(0.2)

(13.8)

Depreciation and amortization

(10.6)

(10.8)

(9.3)

(9.9)

(40.6)

Repositioning expenses

(0.8)

(6.0)

(0.1)

1.7

(5.2)

Interest expense, net

(6.5)

(6.5)

(6.8)

(6.6)

(26.4)

Impairment charge

-

(57.9)

-

-

(57.9)

Loss on sale of capital assets

-

-

-

(0.6)

(0.6)

Benefit (provision) for income taxes

7.7

(8.0)

(3.3)

(38.3)

(41.9)

Miscellaneous

0.1

(0.1)

0.4

0.6

1.0

(Loss) income before discontinued operations

(19.3)

(79.6)

15.5

(19.2)

(102.6)

Adjustments for non-cash items

Depreciation and amortization

10.6

10.8

9.3

9.9

40.6

Stock-based compensation expense

1.0

0.8

0.7

0.9

3.4

Impairment charge

-

57.9

-

-

57.9

Loss on sale of capital assets

-

-

-

(0.6)

(0.6)

Deferred revenue amortization

(2.4)

(2.6)

(2.6)

(4.1)

(11.7)

Deferred financing charge amortization

0.3

0.3

0.3

0.2

1.1

Working capital changes

16.1

(27.7)

1.7

(3.1)

(13.0)

Change in other long term assets/liabilities

(1.4)

2.0

(2.6)

29.0

27.0

Change in deferred revenue

5.3

5.3

8.1

4.3

23.0

Miscellaneous

(0.3)

-

(0.7)

(0.5)

(1.5)

Cash flow from operating activities

9.9

(32.8)

29.7

16.8

23.6

Cash flow from investing activities

(6.5)

(11.0)

(15.2)

(16.6)

(49.3)

Cash flow from financing activities

(2.9)

30.6

2.6

(4.3)

26.0

EBITDA per the Debt Commitment Letter

(U.S.D., in millions)

(unaudited) |