Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SunCoke Energy, Inc. | d426588d8k.htm |

| EX-99.1 - PRESS RELEASE - SunCoke Energy, Inc. | d426588dex991.htm |

Q3 2012

Earnings Conference Call

October 24, 2012

Exhibit 99.2 |

Safe Harbor

Statement Safe Harbor Statement

This slide presentation should be reviewed in conjunction with SunCoke’s Third

Quarter 2012 earnings release and conference call held on October 24, 2012

at 10:00 a.m. ET. Some

of

the

information

included

in

this

presentation

contains

“forward-looking

statements”

(as

defined

in

Section

27A

of

the Securities Act of 1933, as amended and Section 21E of the Securities Exchange

Act of 1934, as amended). Such forward-looking statements are based on

management’s beliefs and assumptions and on information currently available.

Forward-looking statements include the information concerning SunCoke’s

possible or assumed future results of operations, the planned Master Limited

Partnership, business strategies, financing plans, competitive position, potential

growth opportunities, potential operating performance improvements, the effects of

competition and the effects of future legislation or regulations.

Forward-looking statements include all statements that are not historical facts and may be

identified

by

the

use

of

forward-looking

terminology

such

as

the

words

“believe,”

“expect,”

“plan,”

“intend,”

“anticipate,”

“estimate,”

“predict,”

“potential,”

“continue,”

“may,”

“will,”

“should”

or the negative of these terms or similar expressions.

Forward-looking

statements

involve

risks,

uncertainties

and

assumptions.

Actual

results

may

differ

materially

from

those

expressed in these forward-looking statements. You should not put undue

reliance on any forward-looking statements. In accordance with the safe

harbor provisions of the Private Securities Litigation Reform Act of 1995, SunCoke has

included in its filings with the Securities and Exchange Commission cautionary

language identifying important factors (but not necessarily all the

important factors) that could cause actual results to differ materially from those expressed in any

forward-looking statement made by SunCoke. For more information concerning

these factors, see SunCoke's Securities and

Exchange

Commission

filings.

All

forward-looking

statements

included

in

this

presentation

are

expressly

qualified

in

their entirety by such cautionary statements. SunCoke does not have any intention

or obligation to update publicly any forward-looking statement (or its

associated cautionary language) whether as a result of new information or future events

or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to

supplement, not substitute for, comparable GAAP measures. Reconciliations of

non-GAAP financial measures to GAAP financial measures are provided in the

Appendix at the end of the presentation. Investors are urged to consider carefully

the comparable GAAP measures and the reconciliations to those measures

provided in the Appendix, or on our website at www.suncoke.com. SunCoke

Energy Q3 2012 Earnings Conference Call 1 |

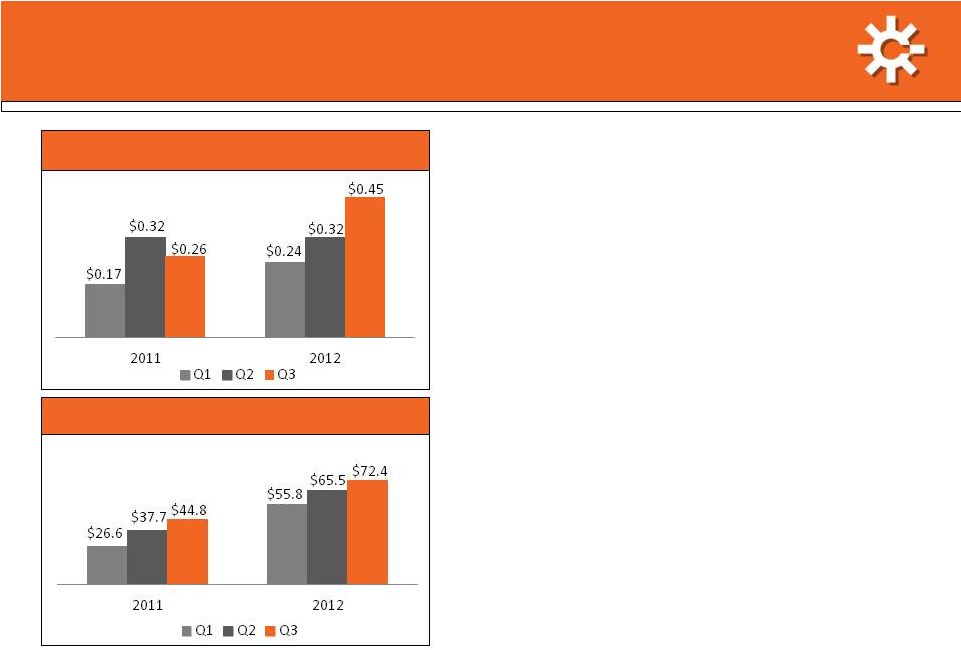

Q3 2012 Earnings

Overview SunCoke Energy Q3 2012 Earnings Conference Call

2

Q3 2012 EPS up 73% to $0.45 per share •

Middletown continues to perform at high level •

All U.S. coke facilities built on solid prior year

performance

Coal delivered slightly favorable results •

Benefited from higher YoY price/volume and

contingent consideration adjustment •

Production costs and reject rates increased Strong

liquidity position

•

Cash balance of nearly $160 million and virtually

undrawn revolver of $150 million •

FY 2012 free cash flow

expected to be in

excess of $100 million costs, with $60+ million

expected in Q4

2012

Refining range of expected 2012 Adjusted

EBITDA to $255 million to $270 million •

Implies expected Q4 2012 Adjusted EBITDA of

$61 million to $76 million Earnings

Per Share (diluted)

Adjusted EBITDA

(1)

(in millions)

(1)

For a definition and reconciliation of Adjusted EBITDA, please see appendix. (2)

For a definition and reconciliation of free cash flow, please see appendix

(1)

(2) |

Revenue up

19% Adjusted EBITDA

(3)

increased 62%

Earnings Per Share of $0.45

Q3 2012 Financial Results

Q3 2012 Financial Results

Middletown added nearly $77 million on

volume of 156 thousand tons

Middletown contributed almost

$17 million

Domestic Coke Adjusted EBITDA

(3)

per

ton up $11 per ton to $61

Coal benefited from higher mid-vol.

price/volumes and $3.2 million

contingent consideration adjustment

Corporate costs lower due to 2011

headquarter relocation

Reflects strong U.S. cokemaking business

performance and lower corporate costs

SunCoke Energy Q3 2012 Earnings Conference Call

3

(1) Coke Adjusted EBITDA includes Jewell Coke, Other Domestic Coke and International

segments. (2) Coal Adjusted EBITDA includes Coal Mining segment. In Q1 ’12,

internal coal transfer price mechanism changed to reflect Jewell Coke contract price;

prior year periods adjusted to reflect this change. (3) For a definition and

reconciliation of Adjusted EBITDA and Adjusted EBITDA per ton, please see

appendix.

($ in millions)

Q3'12

Q3'11

Change

Domestic Coke Sales Volumes

1,116

968

148

Coal Sales Volumes

392

371

21

Revenue

$480.5

$403.5

$77.0

Operating Income

$52.7

$30.0

$22.7

Net Income Attributable to

Shareholders

$31.6

$18.2

$13.4

Earnings Per Share

$0.45

$0.26

$0.19

Coke Adjusted EBITDA

(1)

$69.4

$49.9

$19.5

Coal Adjusted EBITDA

(2)

$10.7

$9.2

$1.5

Corporate/Other

($7.7)

($14.3)

$6.6

Adjusted EBITDA

(3)

$72.4

$44.8

$27.6 |

$44.8

$72.4

$16.9

$2.6

$1.5

$6.6

Q3 2011

Adjusted

EBITDA (1)

Middletown

Coke Business

(excluding Middletown)

Coal Mining

Corporate

Q3 2012

Adjusted

EBITDA (1)

Adjusted EBITDA

Adjusted EBITDA

(1)

(1)

Bridge–Q3 2011 to Q3 2012

Bridge–Q3 2011 to Q3 2012

SunCoke Energy Q3 2012 Earnings Conference Call

4

Middletown was the primary driver of the quarter’s performance

(1)

($ in millions)

For a definition and reconciliation of Adjusted EBITDA, please see the appendix.

|

EPS Bridge

– EPS Bridge –

Q3 2011 to Q3 2012

Q3 2011 to Q3 2012

SunCoke Energy Q3 2012 Earnings Conference Call

5

EPS benefited from strong coke business results and lower corporate costs

offset by financing costs for standalone capital structure

$0.26

$0.45

$0.28

$0.10

$0.02

($0.06)

($0.12)

($0.03 )

Q3 2011 EPS

(Diluted)

Adjusted

EBITDA(1)

Coke Business

Adjusted

EBITDA(1)

Corporate

Adjusted

EBITDA(1)

Coal Mining

Depreciation,

Depletion

& Amortization

Financing Costs

Taxes

Q3 2012 EPS

(Diluted)

(1)

For a definition and reconciliation of Adjusted EBITDA, please see the appendix. |

Q3 2012 Sources

& Uses of Cash Q3 2012 Sources & Uses of Cash

SunCoke Energy Q3 2012 Earnings Conference Call

6

Ended quarter with solid cash position, virtually undrawn revolver

and improving credit metrics

($ in millions)

Primary Changes vs. Q2 2012:

Accounts receivables: ($37.6m)*

Accounts payable: ($28.6m)

Interest: ($8.3m)

Inventory: +$17.3m

* Due to timing of payment on $23.7 million receivable on Monday, October 1, 2012 instead of

Sunday, September 30.

$190.0

$32.9

$18.9

$5.3

$157.8

($57.0)

($9.0)

($19.9)

($3.4)

Q2 2012

Cash

Balance

Q3 2012

Net Income

Depreciation,

Depletion &

Amortization

Deferred

Taxes &

Taxes Payable

Changes in

Working

Capital

(excl. Taxes Payable)

Other

Capital

Expenditures

Cash Used

In Financing

Activities

Q3 2012

Cash

Balance |

Domestic Coke Business Summary

Domestic Coke Business Summary

(Jewell Coke & Other Domestic Coke)

(Jewell Coke & Other Domestic Coke)

SunCoke Energy Q3 2012 Earnings Conference Call

7

($ in millions, except per ton amounts)

Sustained strong coke operations drove

Adjusted

EBITDA

(1)

per

ton

above

$60

per

ton

179

176

174

176

177

314

309

291

299

291

293

289

286

291

297

178

172

175

177

178

68

142

153

154

964

1,014

1,068

1,097

1,095

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Q3 '12

Jewell

Indiana Harbor

Haverhill

Granite City

Middletown

Domestic Coke Production

(Tons in thousands)

$14

$11

$15

$13

$14

$34

$21

$40

$49

$55

$48

$32

$55

$62

$69

$ 50

$ 34

$ 51

$ 57

$ 61

/ton

(2)

/ton

/ton

(3)

/ton

/ton

Domestic Coke Adjusted EBITDA

(1)

Per Ton

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Q3 '12

Jewell Coke Segment

Other Domestic Coke Segment

Adjusted EBITDA/ton

(1)

For a definition of Adjusted EBITDA and Adjusted EBITDA/Ton and reconciliations,

see appendix.

(2) Includes Indiana Harbor contract billing adjustment of $6.0

million, net of NCI, and inventory adjustment of $6.2 million, net of NCI, of which

$3.1 million is attributable to Q3 2011. (3) Includes a $2.4 million, net of NCI, charge related to coke

inventory reduction and a $1.3 million, net of NCI, lower cost or market

adjustment on pad coal inventory and lower coal-to-coke yields related

to the startup at Middletown.

|

SunCoke Energy Q3 2012 Earnings Conference Call

8

Pretax Return on Invested Capital (ROIC)

Pretax Return on Invested Capital (ROIC)

1)

For a definition of Pretax ROIC and reconciliations, please see the appendix.

Pretax ROIC is calculated as Adjusted Pretax Operating Income divided by average invested capital

(stockholders’

equity

plus

total

debt

net

of

cash

and

cash

equivalents);

for

a

reconciliation

of

Adjusted

Pretax

Operating

Income

to

Adjusted

EBITDA,

please

see

appendix

2)

This

table

excludes

Middletown

assets

up

to

and

including

Q4

2011.

At

the

end

of

Q4

2011,

identifiable

assets

included

in

Other

Domestic

Coke

attributable

to

Middletown

were

$402.8m (prior to Q4 2011, Middletown was included in the Corporate and Other

segment); see historical segment detail in public filings for additional detail.

3)

Includes Indiana Harbor contract billing adjustment of $6.0 million, net of NCI,

and inventory adjustment of $6.2 million, net of NCI, of which $3.1 million is attributable to Q3 2011.

4)

Includes a $2.4 million, net of NCI, charge related to a coke inventory reduction

and a $1.3 million, net of NCI, lower cost or market adjustment on pad coal inventory and $4.0 million of

non-recurring costs and lower coal-to-coke yields related to the

startup at Middletown. Pretax ROIC, ex-Middletown prior 2012

(1)(2)

Q1 2011

Q2 2011

Q3 2011

Q4 2011

2011

Q1 2012

Q2 2012

Q3 2012

Total Domestic Coke (Includes Jewell Coke and Other Domestic Coke)

2%

15%

23%

12%

13%

17%

20%

24%

International Coke

10%

7%

20%

120%

36%

0%

7%

11%

Coal Mining

46%

28%

21%

(5%)

23%

11%

17%

22%

Total SunCoke (Including Corp./Other)

4%

11%

16%

8%

10%

13%

17%

20%

2%

15%

23%

12%

17%

20%

24%

13%

Q1 2011

Q2 2011

Q3 2011

Q4 2011

2011

Q1 2012

Q2 2012

Q3 2012

Pretax ROIC

(1)

for Domestic Coke

excluding Middletown prior to 2012

(2) |

Coal Mining

Financial Summary Coal Mining Financial Summary

SunCoke Energy Q3 2012 Earnings Conference Call

9

Q3 2012 segment Adjusted EBITDA

(1)

up

$1.5 million to $10.7 million

Higher mid-vol. price and volumes

benefited results YoY

Contingent consideration fair value

adjustment contributed $1.3 million to

increase

Cash production costs up

Experienced yield and productivity

challenges in quarter

Increased mix of mid-vol. coal production

also pulled average costs up

Represented $3.2 million of segment’s

Q3 2012 Adj. EBITDA

–

Jewell underground cash cost per ton:

$149 in Q3 2012; $143 in Q2 2012; $138 in

Q3 2011

•

•

•

•

•

Coal Mining Adjusted EBITDA

(1)

and Avg. Sales

Price/Ton

(2)

Coal Sales, Production and Purchases

$9

$2

$7

$9

$11

$155

$159

$171

$169

$165

$25

$20

$20

$25

$27

$132

$138

$151

$137

$143

Q3 '11

Q4 '11(3)

Q1 '12

Q2 '12

Q3 '12

Coal Adjusted EBITDA

Average Sales Price

Coal Adj EBITDA / ton

Coal Cash Cost / ton

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Q3 '12

Coal Sales

371

363

373

365

392

Coal Producton

340

349

375

401

349

Purchased Coal

22

20

19

4

10

Reject Rate (%)

64

65

68

66

67

($ in millions, except per ton amounts)

(1) For a definition and a reconciliation of Adjusted EBITDA, please see the

appendix. (2)

Average Sales Price is the weighted average sales price for all coal sales volumes, including

sales to affiliates and sales to Jewell Coke. (3)

Q4 2011 Adjusted EBITDA inclusive of Black Lung Liability charge of $3.4 million and

OPEB expense allocation of $1.8 million. |

SunCoke

Energy Q3 2012 Earnings Conference Call 10

Coal Mining Action Plan

Coal Mining Action Plan

Taking more aggressive action in Q4 2012 to reduce costs and

improve productivity to position coal business for 2013

•

Rationalizing underground mining plan

–

Idling 2 company operated mines (6

4) and 3 contract mines (8

5)

Maintain

idled

operations

on

“stand-by”

for

when

markets

improve

–

Concentrating people and equipment in remaining mines, while leveraging lower

variable costs (such as royalties, transportation, etc.)

•

Implementing improved underground mining practices

–

Relocating two operating sections in largest company mine closer

to portal

–

Implement deep cut plans as MSHA approval received

•

Installing new cyclone & ultra fine circuit in prep plant; expect to complete by

year end

–

Anticipate this will improve yields by at least 2% and achieve payback in 18 months

•

Targeting at least 10% reduction in overall Jewell underground cash costs in

2013 |

Coal Mining

Business Outlook Coal Mining Business Outlook

SunCoke Energy Q3 2012 Earnings Conference Call

11

•

2013 mining plan based on expected flat sales volumes vs. 2012

(approximately 1.5 million tons)

–

Revelation venture and purchased coal expected to represent about ~30% of

volumes in 2013, compared with estimated 15% in 2012

–

Mix change will drive lower average cost per ton

•

2013 pricing/contracting in process

–

Anticipate significant reduction from YTD 2012 average realized price of $168

per ton

–

Will update outlook once pricing finalized in Q4 2012

–

Expect Coal Mining will contribute minimally to 2013 results

•

Despite anticipated underground cash cost reductions and mix

improvement, significant margin compression likely in 2013 |

Full

Year Adjusted EBITDA Full Year Adjusted EBITDA

(1)

(1)

Outlook

Outlook

SunCoke Energy Q3 2012 Earnings Conference Call

12

FY 2012 Adjusted EBITDA

(1)

expected to increase by more than $110 million

vs. FY 2011 driven by strength of coke business

($ in millions)

(1)

$55.8

$255

-

$270

$141

$65.5

$72.4

$61

-

$76

Q1 2012

Adjusted EBITDA

Q2 2012

Adjusted EBITDA

Q3 2012

Adjusted EBITDA

Estimated

Q4 2012

Adjusted EBITDA

Estimated

FY 2012

Adjusted EBITDA

FY 2011

Adjusted

EBITDA

For a definition and reconciliation of Adjusted EBITDA, please see the appendix.

|

Updated 2012

Guidance Updated 2012 Guidance

Metric

Expected 2012 Outlook

Adjusted EBITDA

(1)

$255 million –

$270 million

EPS* (at 22% tax rate)

$1.30 –

$1.40

Capital Expenditures &

Investments

Approximately $75 million

Free Cash Flow

(2)

$100 million +

Cash Tax Rate

10% –

15%

Effective Tax Rate

20% –

24%

Corporate Costs

$29 million –

$32 million

Coke Production

In excess of 4.3 million tons

Coal Production

Approximately 1.4 million tons

SunCoke Energy Q3 2012 Earnings Conference Call

13

(1) For a definition and reconciliation of Adjusted EBITDA, please see the appendix.

(2) For a definition of Free Cash Flow and reconciliation, please see the appendix.

*Diluted |

Questions |

Media releases and SEC filings

are available on

www.suncoke.com

Investor Relations:

630-824-1907 |

Appendix

|

Definitions

•

Adjusted

EBITDA

represents

earnings

before

interest,

taxes,

depreciation,

depletion

and

amortization

(“EBITDA”)

adjusted

for

sales

discounts and the deduction of income attributable to noncontrolling interests in

our Indiana Harbor cokemaking operations. EBITDA reflects

sales

discounts

included

as

a

reduction

in

sales

and

other

operating

revenue.

The

sales

discounts

represent

the

sharing

with

customers

of

a

portion

of

nonconventional

fuel

tax

credits,

which

reduce

our

income

tax

expense.

However,

we

believe

our

Adjusted

EBITDA would be inappropriately penalized if these discounts were treated as a

reduction of EBITDA since they represent sharing of a tax

benefit

that

is

not

included

in

EBITDA.

Accordingly,

in

computing

Adjusted

EBITDA,

we

have

added

back

these

sales

discounts.

Our Adjusted EBITDA also reflects the deduction of income attributable to

noncontrolling interests in our Indiana Harbor cokemaking operations. EBITDA

and Adjusted EBITDA do not represent and should not be considered alternatives to net income or

operating income under GAAP and may not be comparable to other similarly titled

measures in other businesses. Adjusted EBITDA does not represent and should

not be considered as an alternative to net income as determined by GAAP, and calculations thereof

may not be comparable to those reported by other companies. We believe Adjusted

EBITDA is an important measure of operating performance

and

provides

useful

information

to

investors

because

it

highlights

trends

in

our

business

that

may

not

otherwise

be

apparent when relying solely on GAAP measures and because it eliminates items that

have less bearing on our operating performance. Adjusted EBITDA is a measure

of operating performance that is not defined by GAAP and should not be considered a

substitute for net (loss) income as determined in accordance with GAAP.

•

Adjusted

EBITDA/Ton

represents

Adjusted

EBITDA

divided

by

tons

sold.

•

Free Cash Flow

equals cash from operations less cash used in investing activities less cash

distributions to non-controlling interests. Management

believes

Free

Cash

Flow

information

enhances

an

investor’s

understanding

of

a

business’

ability

to

generate

cash.

Free Cash Flow does not represent and should not be considered an alternative to

net income or cash flows from operating activities as determined under GAAP

and may not be comparable to other similarly titled measures of other businesses.

•

Pretax

Return

on

Invested

Capital

(ROIC)

is

defined

as

Adjusted

EBITDA

less

depreciation

expense

plus

net

income

attributable

to

non-controlling

interests

divided

by

average

invested

capital

(stockholders’

equity

plus

total

debt

net

of

cash

and

cash

equivalents).

We use Pretax ROIC as one measure of how effectively we deploy capital and make

multi-year investment decisions. It is also used as a

long-term performance measure under certain of our incentive compensation plans. Pretax ROIC is not a measure of financial

performance under generally accepted accounting principles, and may not be

comparable to other similarly titled measures used by other companies. Pretax

ROIC should not be considered in isolation or as an alternative to net earnings as an indicator of

performance. We define segment level Pretax ROIC as Adjusted EBITDA less

depreciation expense plus net income attributable to non-controlling

interests divided by average allocated invested capital. Average allocated invested capital for each respective

segment is calculated pro-rata based on the segment level identifiable assets

for the period as disclosed in our public filings. SunCoke Energy Q3 2012

Earnings Conference Call 17 |

Reconciliations

SunCoke Energy Q3 2012 Earnings Conference Call

18

$ in millions

Q3 2012

Q2 2012

Q1 2012

FY 2011

Q4 2011

Q3 2011

Q2 2011

Q1 2011

Adjusted Operating Income

54.8

46.6

37.1

80.4

14.9

33.5

24.6

7.4

Net Income (Loss) attributable to Noncontrolling Interest

1.3

1.3

(0.3)

(1.7)

(0.5)

3.4

1.6

(6.2)

Subtract: Depreciation Expense

(18.9)

(20.2)

(18.4)

(58.4)

(16.0)

(14.7)

(14.7)

(13.0)

Adjusted EBITDA

72.4

65.5

55.8

140.5

31.4

44.8

37.7

26.6

Subtract: Depreciation, depletion and amortization

(18.9)

(20.2)

(18.4)

(58.4)

(16.0)

(14.7)

(14.7)

(13.0)

Subtract: Financing expense, net

(12.2)

(11.8)

(12.0)

(1.4)

(7.1)

(3.3)

4.5

4.5

Subtract: Income Tax

(7.6)

(7.0)

(5.3)

(7.2)

2.9

(5.1)

(1.9)

(3.1)

Subtract: Sales Discount

(2.1)

(3.8)

(3.2)

(12.9)

(3.2)

(3.5)

(3.1)

(3.1)

Add: Net Income attributable to NCI

1.3

1.3

(0.3)

(1.7)

(0.5)

3.4

1.6

(6.2)

Net Income

32.9

24.0

16.6

58.9

7.5

21.6

24.1

5.7

Reconciliations from Adjusted Operating Income and Adjusted EBITDA to Net Income

|

Reconciliations

SunCoke Energy Q3 2012 Earnings Conference Call

19

$ in millions, except per ton data

Jewell

Coke

Other

Domestic

Coke

International

Coke

Jewell

Coal

Corporate

Combined

Domestic

Coke

Q3 2012

Adjusted EBITDA

13.6

54.9

0.9

10.7

(7.7)

72.4

68.5

Subtract: Depreciation, depletion and amortization

(1.4)

(12.7)

-

(4.2)

(0.6)

(18.9)

(14.1)

to noncontrolling interests

1.3

1.3

1.3

Adjusted Pre-Tax Operating Income

12.2

43.5

0.9

6.5

(8.3)

54.8

55.7

Adjusted EBITDA

13.6

54.9

0.9

10.7

(7.7)

72.4

68.5

Sales Volume (thousands of tons)

183

933

310

392

1,116

Adjusted EBITDA per Ton

74.3

58.8

2.9

27.3

61.4

Average Allocated Invested Capital

(1)

51.2

889.0

32.6

117.2

NMF

1,090.1

940.3

Annualized Quarterly Pretax ROIC

95%

20%

11%

22%

NMF

20%

24%

Q2 2012

Adjusted EBITDA

12.5

48.6

0.7

9.3

(5.6)

65.5

61.1

Subtract: Depreciation, depletion and amortization

(1.3)

(13.7)

(0.1)

(4.3)

(0.8)

(20.2)

(15.0)

to noncontrolling interests

1.3

1.3

1.3

Adjusted Pre-Tax Operating Income

11.2

36.2

0.6

5.0

(6.4)

46.6

47.4

Adjusted EBITDA

12.5

48.6

0.7

9.3

(5.6)

65.5

61.1

Sales Volume (thousands of tons)

170

892

358

373

1,062

Adjusted EBITDA per Ton

73.5

54.5

2.0

24.9

57.5

Average Allocated Invested Capital

(1)

50.9

892.7

36.6

117.7

NMF

1,097.9

943.6

Annualized Quarterly Pretax ROIC

88%

16%

7%

17%

NMF

17%

20%

Q1 2012

Adjusted EBITDA

15.0

40.1

0.1

7.4

(6.8)

55.8

55.1

Subtract: Depreciation, depletion and amortization

(1.3)

(12.6)

(0.1)

(4.1)

(0.3)

(18.4)

(13.9)

to noncontrolling interests

(0.3)

(0.3)

(0.3)

Adjusted Pre-Tax Operating Income

13.7

27.2

-

3.3

(7.1)

37.1

40.9

Adjusted EBITDA

15.0

40.1

0.1

7.4

(6.8)

55.8

55.1

Sales Volume (thousands of tons)

186

892

358

373

1,078

Adjusted EBITDA per Ton

80.6

45.0

0.3

19.8

51.1

Average Allocated Invested Capital

(1)

53.3

928.2

41.0

119.6

NMF

1,142.1

981.5

Annualized Quarterly Pretax ROIC

103%

12%

0%

11%

NMF

13%

17%

Reconciliations from Adjusted EBITDA to Adjusted Pre-Tax Operating Income

|

Reconciliations

SunCoke Energy Q3 2012 Earnings Conference Call

20

$ in millions, except per ton data

Jewell

Coke

Other

Domestic

Coke

International

Coke

Jewell

Coal

Corporate

Combined

Domestic

Coke

FY 2011

Adjusted EBITDA

46.1

89.4

13.7

35.5

(44.2)

140.5

135.5

Subtract: Depreciation, depletion and amortization

(4.9)

(38.7)

(0.2)

(12.9)

(1.7)

(58.4)

(43.6)

to noncontrolling interests

(1.7)

(1.7)

(1.7)

Adjusted Pre-Tax Operating Income

41.2

49.0

13.5

22.6

(45.9)

80.4

90.2

Adjusted EBITDA

46.1

89.4

13.7

35.5

(44.2)

140.5

135.5

Sales Volume (thousands of tons)

702

3,068

1,442

1,454

3,770

Adjusted EBITDA per Ton

65.7

29.1

9.5

24.4

35.9

Average Allocated Invested Capital

52.8

627.8

37.4

99.8

NMF

817.8

680.6

Pretax ROIC

78%

8%

36%

23%

NMF

10%

13%

Q4 2011

Adjusted EBITDA

10.6

21.3

10.2

2.5

(13.2)

31.4

31.9

Subtract: Depreciation, depletion and amortization

(1.2)

(10.6)

(0.1)

(3.7)

(0.4)

(16.0)

(11.8)

to noncontrolling interests

(0.5)

(0.5)

(0.5)

Adjusted Pre-Tax Operating Income

9.4

10.2

10.1

(1.2)

(13.6)

14.9

19.6

Adjusted EBITDA

10.6

21.3

10.2

2.5

(13.2)

31.4

31.9

Sales Volume (thousands of tons)

166

837

295

363

1,003

Adjusted EBITDA per Ton

63.9

25.4

34.6

6.9

31.8

Average Allocated Invested Capital

46.7

594.0

33.7

105.6

NMF

779.9

640.6

Annualized Quarterly Pretax ROIC

81%

7%

120%

-5%

NMF

8%

12%

Q3 2011

Adjusted EBITDA

13.9

34.3

1.7

9.2

(14.3)

44.8

48.2

Subtract: Depreciation, depletion and amortization

(1.2)

(9.9)

-

(3.3)

(0.3)

(14.7)

(11.1)

to noncontrolling interests

3.4

3.4

3.4

Adjusted Pre-Tax Operating Income

12.7

27.8

1.7

5.9

(14.6)

33.5

40.5

Adjusted EBITDA

13.9

34.3

1.7

9.2

(14.3)

44.8

48.2

Sales Volume (thousands of tons)

191

777

373

371

968

Adjusted EBITDA per Ton

72.8

44.1

4.6

24.8

49.8

Average Allocated Invested Capital

53.5

636.2

34.8

115.1

NMF

839.6

689.7

Annualized Quarterly Pretax ROIC

95%

17%

20%

21%

NMF

16%

23%

Reconciliations from Adjusted EBITDA to Adjusted Pre-Tax Operating Income

|

Reconciliations

Reconciliations

SunCoke Energy Q3 2012 Earnings Conference Call

21

$ in millions, except per ton data

Jewell

Coke

Other

Domestic

Coke

International

Coke

Jewell

Coal

Corporate

Combined

Domestic

Coke

Q2 2011

Adjusted EBITDA

10.6

25.3

0.8

11.5

(10.5)

37.7

35.9

Subtract: Depreciation, depletion and amortization

(1.4)

(9.6)

(0.1)

(3.2)

(0.4)

(14.7)

(11.0)

to noncontrolling interests

1.6

1.6

1.6

Adjusted Pre-Tax Operating Income

9.2

17.3

0.7

8.3

(10.9)

24.6

26.5

Adjusted EBITDA

10.6

25.3

0.8

11.5

(10.5)

37.7

35.9

Sales Volume (thousands of tons)

170

757

412

334

927

Adjusted EBITDA per Ton

62.4

33.4

1.9

34.4

38.7

Average Allocated Invested Capital

57.9

648.2

39.7

117.7

NMF

863.4

706.1

Annualized Quarterly Pretax ROIC

64%

11%

7%

28%

NMF

11%

15%

Q1 2011

Adjusted EBITDA

11.0

8.5

1.0

12.3

(6.2)

26.6

19.5

Subtract: Depreciation, depletion and amortization

(1.1)

(8.6)

-

(2.7)

(0.6)

(13.0)

(9.7)

to noncontrolling interests

(6.2)

(6.2)

(6.2)

Adjusted Pre-Tax Operating Income

9.9

(6.3)

1.0

9.6

(6.8)

7.4

3.6

Adjusted EBITDA

11.0

8.5

1.0

12.3

(6.2)

26.6

19.5

Sales Volume (thousands of tons)

175

697

362

386

872

Adjusted EBITDA per Ton

62.9

12.2

2.8

31.9

22.4

Average Allocated Invested Capital

56.0

645.6

41.4

83.8

NMF

826.9

701.7

Annualized Quarterly Pretax ROIC

71%

-4%

10%

46%

NMF

4%

2%

Reconciliations from Adjusted EBITDA to Adjusted Pre-Tax Operating Income

|

SunCoke Energy Q3 2012 Earnings Conference Call

22

Pretax Return on Invested Capital Reconciliation

(1)

(2)

Q1 2012 Average Invested Capital includes Middletown in both the beginning and ending of

quarter average (Q1 2012 and Q4 2011) See Adjusted EBITDA and Pretax ROIC Reconciliation

for respective periods, 2010 uses Adjusted Pro Forma Operating Income Consolidated Sun

Coke Energy Q3 2012

Q2 2012

Q1 2012

2011

Q4 2011

Q3 2011

Q2 2011

Q1 2011

2010

Adjusted Pre-Tax Operating Income

(1)

54.8

46.6

37.1

80.4

14.9

33.5

24.6

7.4

151.5

Invested Capital ($ in millions)

Q3 2012

Q2 2012

Q1 2012

(2)

2011

Q4 2011

Q3 2011

Q2 2011

Q1 2011

2010

Debt

$724.1

$724.9

$725.7

$726.4

$726.4

$697.8

$794.7

$715.7

$655.3

Equity

543.6

535.4

513.3

559.9

559.9

604.5

457.3

433.4

429.3

Cash

(157.8)

(190.0)

(113.6)

(127.5)

(127.5)

(110.9)

(30.5)

(11.0)

(40.1)

Middletown

(402.8)

(402.8)

(387.6)

(346.1)

(286.7)

(242.2)

Invested Capital

$1,109.9

$1,070.3

$1,125.4

$756.0

$756.0

$803.8

$875.4

$851.5

$802.4

Average Invested Capital*

$1,090.1

$1,097.9

$1,142.1

$817.8

$779.9

$839.6

$863.4

$826.9

$844.0

Q3 2012

Q2 2012

Q1 2012

2011

Q4 2011

Q3 2011

Q2 2011

Q1 2011

2010

Quarterly ROIC

20%

17%

13%

8%

16%

11%

4%

Last Twelve Months' ROIC

10%

18%

*5 quarter average for 2011, two quarter average for each quarter, year-end average for

2010 |

SunCoke Energy Q3 2012 Earnings Conference Call

23

Pretax Return on Invested Capital Reconciliation

Period ended

Jewell

Coke

Other

Domestic Coke

International

Coke

Coal

Mining

Corporate

and Other

Total

Identifiable Assets for

Allocating Invested Capital

Q3 2012

86.0

1,447.7

52.8

190.1

183.8

1,960.4

Q2 2012

81.4

1,458.4

53.9

193.0

183.5

1,970.2

Q1 2012

83.9

1,440.2

64.6

189.1

141.1

1,918.9

Q4 2011, inc Middletown

81.6

1,440.8

62.7

182.1

174.6

1,941.8

Q4 2011

81.6

1,038.0

62.7

182.1

174.6

1,539.0

Q3 2011

77.7

990.6

52.7

178.3

192.3

1,879.2

Q2 2011

85.1

954.4

53.6

173.5

67.2

1,972.6

Q1 2011

82.6

922.6

61.2

167.3

48.9

1,860.1

2010

80.9

962.6

59.7

76.7

7.3

1,718.5

Percentage of

Invested Capital

Q3 2012

4.8%

81.5%

3.0%

10.7%

NMF

100.0%

Q2 2012

4.6%

81.6%

3.0%

10.8%

NMF

100.0%

Q1 2012

4.7%

81.0%

3.6%

10.6%

NMF

100.0%

Q4 2011, inc Middletown

4.6%

81.5%

3.5%

10.3%

NMF

100.0%

Q4 2011

6.0%

76.1%

4.6%

13.3%

NMF

100.0%

Q3 2011

6.0%

76.2%

4.1%

13.7%

NMF

100.0%

Q2 2011

6.7%

75.4%

4.2%

13.7%

NMF

100.0%

Q1 2011

6.7%

74.8%

5.0%

13.6%

NMF

100.0%

2010

6.9%

81.6%

5.1%

6.5%

NMF

100.0%

Allocated

Invested Capital

Q3 2012

53.7

904.4

33.0

118.8

-

1,109.9

Q2 2012

48.8

873.6

32.3

115.6

-

1,070.3

Q1 2012

53.1

911.7

40.9

119.7

-

1,125.4

Q4 2011, inc Middletown

53.5

944.8

41.1

119.4

-

1,158.8

Q4 2011

45.2

575.1

34.7

100.9

-

756.0

Q3 2011

48.1

612.9

32.6

110.3

-

803.8

Q2 2011

58.8

659.6

37.0

119.9

-

875.4

Q1 2011

57.0

636.7

42.3

115.5

-

851.5

2010

55.0

654.6

40.6

52.1

-

802.4

Note: This table excludes

Middletown assets up to and including Q4 2011. At the end of Q4 2011, identifiable assets included in Other Domestic Coke attributable to Middletown were

$402.8m (prior to Q4 2011, Middletown was included in the Corporate and Other segment); see historical

segment detail in public filings for additional detail. |

(in

millions) 2012E

Low

2012E

High

Net Income

$94

$104

Depreciation, Depletion and Amortization

80

78

Total financing costs, net

48

47

Income tax expense

25

34

EBITDA

$247

$263

Sales discounts

11

12

Noncontrolling interests

(3)

(5)

Adjusted EBITDA

$255

$270

Estimated 2012 EBITDA Reconciliation

2012E Net Income to Adjusted EBITDA Reconciliation

SunCoke Energy Q3 2012 Earnings Conference Call

24 |

Free Cash Flow

Reconciliation Free Cash Flow Reconciliation

SunCoke Energy Q3 2012 Earnings Conference Call

25

(in millions)

Estimated

2012

For nine

months ended

9/30/2012

(Actual)

Cash from operations

In excess of

$ 179

$ 78

Less cash used for investing activities

Approx.

(75)

(41)

Less payments to minority interest

Approx.

(4)

(0)

Free Cash Flow

In excess of

$ 100

$ 36

2012E Estimated Free Cash Flow Reconciliation |