Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FNB CORP/PA/ | d427352dex991.htm |

| 8-K - 8-K - FNB CORP/PA/ | d427352d8k.htm |

F.N.B. Corporation

Announces Agreement to Acquire

Annapolis Bancorp, Inc.

October 22, 2012

Exhibit 99.2 |

Cautionary Statement Regarding Forward-Looking Information

and Non-GAAP Financial Information

2

F.N.B.

Corporation

and

Annapolis

Bancorp,

Inc.

will

file

a

proxy

statement/prospectus

and

other

relevant

documents

with

the

SEC

in

connection

with

the

merger.

SHAREHOLDERS OF ANNAPOLIS BANCORP, INC. ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS

WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL

AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. The proxy statement/prospectus and other relevant materials

(when they become available), and any other documents F.N.B. Corporation has filed with

the

SEC,

may

be

obtained

free

of

charge

at

the

SEC's

website

at

www.sec.gov.

In

addition,

investors

and

security

holders

may

obtain

free

copies

of

the documents F.N.B. Corporation has filed with the SEC by contacting James Orie, Chief Legal

Officer, F.N.B. Corporation, One F.N.B. Boulevard, Hermitage, PA 16148,

telephone: (724) 983-3317; and free copies of the documents Annapolis Bancorp, Inc. has filed with the SEC by contacting Edward

Schneider, Treasurer and CFO, Annapolis Bancorp, Inc., 1000 Bestgate Road, Suite 400,

Annapolis, MD 21401, telephone: (410) 224-4455. F.N.B.

Corporation

and

Annapolis

Bancorp,

Inc.

and

certain

of

their

directors

and

executive

officers

may

be

deemed

to

be

participants

in the solicitation of proxies from its shareholders in connection with the proposed merger.

Information concerning such participants' ownership of Annapolis

Bancorp,

Inc.

common

stock

will

be

set

forth

in

the

proxy

statement/prospectus

relating

to

the

merger

when

it

becomes

available.

This

communication

does

not

constitute

an

offer

of

any

securities

for

sale.

This presentation contains "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act, relating to present or future trends or

factors affecting the banking industry and, specifically, the financial operations, markets and products of F.N.B. Corporation. Forward-looking

statements are typically identified by words such as “believe”, “plan”,

“expect”, “anticipate”, “intend”, “outlook”, “estimate”, “forecast”, “will”, “should”,

“project”, “goal”, and other similar words and expressions. These

forward-looking statements involve certain risks and uncertainties. In addition to factors

previously disclosed in F.N.B. Corporation’s reports filed with the SEC and those

identified elsewhere in this presentation, the following factors among others, could

cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals and meet

other closing conditions to the Merger, including approval by Annapolis Bancorp, Inc.

shareholders, on the expected terms and schedule; delay in closing the Merger;

difficulties experienced by F.N.B. Corporation in expanding into a new market area, including retention of customers and key personnel of Annapolis

Bancorp, Inc. and its subsidiary BankAnnapolis; difficulties and delays in integrating the

F.N.B. Corporation and Annapolis Bancorp, Inc. businesses or fully realizing cost

savings and other benefits; business disruption following the Merger; changes in asset quality and credit risk; the inability to sustain revenue

and earnings growth; changes in interest rates and capital markets; inflation; customer

acceptance of F.N.B. Corporation’s products and services; customer borrowing,

repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business

initiatives; competitive conditions; the inability to realize cost savings or revenues or to

implement integration plans and other consequences associated with mergers,

acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management

activities, and other actions of the Federal Reserve Board and legislative and regulatory

actions and reforms. F.N.B. Corporation undertakes no obligation to revise

these forward-looking statements or to reflect events or circumstances after the date of this presentation.

ADDITIONAL

INFORMATION

ABOUT

THE

MERGER |

Natural

progression Consistent with stated expansion strategy

Market opportunity

Attractive demographics

Significant commercial banking opportunities

Excellent retail and wealth opportunities

Access to greater Baltimore and Washington

D.C. markets

Execute FNB’s scalable, proven business

model and strong sales management culture

Establishes a 5

th

FNB region (refer to page 5)

Attractive partner

ANNB is a relationship-focused bank with

strong community ties and presence

Opportunity Overview

3

Source:

Deposit

and

demographic

data

per

SNL

Financial;

deposits

as

of

June

30,

2012

(1) Includes branch opened October, 2012 in Waugh Chapel

County

Branches

Deposits in

Market ($000)

HH Income

($ -

2011)

Anne Arundel, MD

(1)

7

298,251

79,692

Queen Anne’s, MD

1

45,107

72,774

FNB Current Wtd Avg. by County

42,332

Attractive Market Entry Opportunity

Markets conducive to FNB’s model

Annapolis Bancorp (ANNB) (8 branches)

(1)

F.N.B. (FNB) (266 branches) |

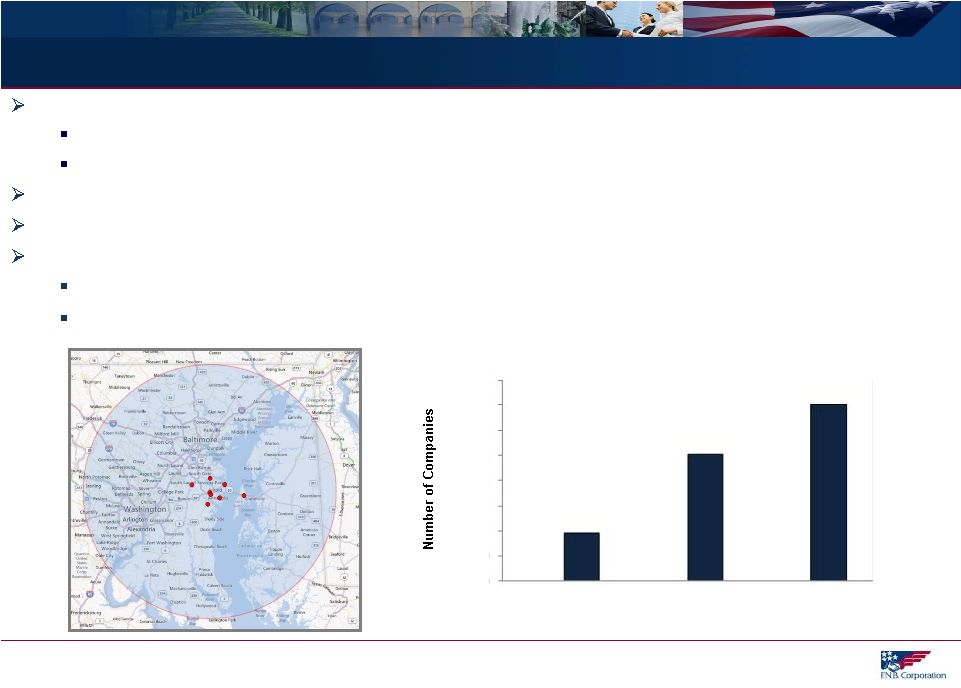

Market Opportunity

4

9,693

25,379

35,072

10,000

15,000

20,000

25,000

30,000

35,000

40,000

>$5 million

$1

$5 million

Total

Revenue

0

5,000

-

Number

of

Commercial

Companies

Within

50-Mile

Radius

of

ANNB

(2)

Leverage FNB’s core competencies and proven business model in a high growth market

Execute FNB’s scalable, cross-functional sales management process

Regional model with local decision making, market leaders, credit authority and functional

support Competitive environment : Similar to FNB’s larger markets

Future

opportunity

for

expansion:

25

identified

banks

in

close

proximity

(1)

Attractive markets present commercial and retail opportunities

Strong demographics present retail, wealth management, private banking and insurance

opportunities Strong commercial opportunities with access to more than 35,000 companies

within 50-mile radius (1)

Source: SNL Financial; Includes banks with assets between $200 million and $5 billion with

NPA’s/assets<4%; Excludes MHC’s, merger targets and banks with 5 or fewer

branches (2)

Source: Hoover’s; Includes companies within a 50-mile radius of ANNB headquarters

with revenue >$5 million, between $1 and $5 million and total companies with

revenue >$1 million |

5

FNB’s Regional Model

The ANNB transaction will

create a 5

th

FNB region

Benefits of a regional model

Local established

management team with

strong ties to region

Local decision making

Leverage newly created

regional hub to integrate

future acquisitions

Regional Model

Northwest Region

Pittsburgh Region

Central Region

Capital Region

Newly Created

Maryland Region

FNB Regions |

(1)

Based on FNB stock price as of Friday, October 19, 2012

(2)

Subject to incremental cash pay-out for potential credit-related adjustment

(3)

Dependent upon credit related adjustment

(4)

Excluding one-time costs

Transaction Overview

6

Consideration

$12.09

(1)

per Annapolis Bancorp share

Fixed 1.143x exchange ratio

100% stock

(2)

Credit Related

Adjustment

Maximum additional cash consideration of up to $0.36 per share in cash based

on Annapolis Bancorp’s ability to resolve an agreed upon credit

matter Gross Credit Mark

5% -

6% of loans

(3)

Detailed Due Diligence

Completed

Required Approvals

Customary regulatory and Annapolis Bancorp shareholders

Expected Closing

April 2013

TARP Repayment

Annapolis Bancorp intends to redeem its $4 million of remaining TARP prior to

closing, subject to Treasury approval

Financial Impact

Neutral to tangible book value per share

Highly accretive on a marginal basis to earnings per share

Slightly

accretive

to

total FNB earnings

per

share

in

the

first

full

year

(4) |

7

Appendix |

8

Annapolis Bancorp (8 branches)

$297 Million Loan Portfolio

$343 Million of Deposits

Source: SNL Financial and public filings as of June 30, 2012.

Annapolis Bancorp, Inc. Financial Overview

Consumer

3%

C&D

13%

CRE

41%

C&I

16%

Home Equity

12%

1-4 Family

16%

5.66%

Yield:

Savings

38%

Time

Deposits

21%

NOW

10%

Money

Market

15%

Noninterest

Bearing

16%

0.47%

Cost: |

Annapolis Bancorp, Inc. Financial Highlights

9

Source: SNL Financial and public filings.

($ in millions, except EPS)

Year Ended December 31

Quarter Ended

2008

2009

2010

2011

03/31/12

06/30/12

Balance Sheet

Total Assets

$395

$444

$432

$442

$441

$437

Gross Loans

268

282

280

290

301

297

Total Deposits

301

350

341

350

347

343

Loans / Deposits

89%

80%

82%

83%

87%

87%

Capital

TARP

$0

$8

$8

$8

$8

$4

Common Equity

27

25

27

29

30

31

TCE / TA

6.8%

5.5%

6.2%

6.6%

6.8%

7.0%

Tier 1 Ratio

11.4

12.5

12.8

12.8

12.7

11.8

Total Capital Ratio

12.6

13.7

14.1

14.0

14.0

13.1

Leverage Ratio

8.4

8.6

9.1

9.4

9.6

8.8

Income Statement

Net Income

$1.4

($1.7)

$1.6

$2.2

$0.8

$0.9

ROAA

0.38%

(0.38%)

0.37%

0.50%

0.75%

0.83%

ROAE

5.4

(5.2)

4.7

6.1

8.7

10.4

Net Interest Margin

3.6

3.3

3.7

3.9

3.8

3.9

Efficiency Ratio

70

76

72

69

67

65

Fee Income / Revenue

12

12

11

10

10

10

EPS

$0.35

($0.56)

$0.29

$0.39

$0.18

$0.21

Asset Quality

Reserves / Loans

1.54%

2.81%

2.45%

2.47%

2.25%

2.32%

NPAs / Assets

1.64

4.35

2.35

1.88

1.94

1.97

NCOs / Avg. Loans

0.21

1.00

1.16

0.64

0.79

(0.04) |