UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 27, 2012

Wonhe High-Tech International, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Nevada

(State or Other Jurisdiction of Incorporation)

|

333-150835

|

26-0775642

|

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

Rm1001, 10th Floor, Resource Hi-Tech Building South Tower

No.1 Songpingshan Road, North Central Avenue North High-Tech Zone

Nanshan District Shenzhen, Guangdong Province, China

(Address of Principal Executive Offices)

852-2815-0191

(Registrant's Telephone Number, Including Area Code)

Unit E8, 3/F, Tat Comm. Bldg. 97

Bonham Strand East, Sheng Wan, Hong Kong

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

This document contains forward-looking statements which reflect our views with respect to future events and financial performance. These forward-looking statements are subject to uncertainties and other factors that could cause actual results to differ materially from the views expressed in these statements. Forward-looking statements are sometimes identified by, among other things, the words "anticipates", "believes", "estimates", "expects", "plans", "projects", "targets" and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. Except to the extent required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements include, among other things, statements relating to:

|

●

|

our ability to increase our sales and revenue;

|

|

●

|

our ability to contain sourcing and labor costs;

|

|

●

|

our ability to attract and retain key technology and management personnel;

|

|

●

|

our ability to improve our existing technology and remain competitive in the electronics industry;

|

|

●

|

our ability to obtain additional capital in future years to fund our planned expansion; and

|

|

●

|

economic, political, regulatory, legal and foreign exchange risks associated with our operations.

|

USE OF DEFINED TERMS; CONVENTIONS

Except where the context otherwise requires and for the purposes of this report only:

|

●

|

"we," "us," "our company," "our" “Company” and "Wonhe" refer to the combined business of Wonhe High-Tech International, Inc. its consolidated subsidiaries and its consolidated affiliate, as the case may be;

|

|

●

|

"World Win" refers to World Win International Holding Ltd. (BVI), our direct, wholly-owned subsidiary, a BVI corporation;

|

|

●

|

"Kuayu" refers to Kuayu International Holdings Group Limited (Hong Kong), our indirect, wholly-owned subsidiary, a Hong Kong corporation;

|

|

●

|

"Shengshihe Consulting" refers to Shengshihe Management Consulting (Shenzhen) Co., Ltd., our indirect, wholly-owned subsidiary, a Chinese corporation;

|

|

●

|

“Shenzhen Wonhe” refers to Shenzhen Wonhe Technology Co., Ltd., our indirect, consolidated affiliate, a Chinese corporation;

|

|

●

|

"SEC" refers to the United States Securities and Exchange Commission;

|

|

●

|

"China," "Chinese" and "PRC," refer to the People's Republic of China, excluding Hong Kong, Macao and Taiwan;

|

|

●

|

"Renminbi" and "RMB" and “Yuan” refer to the legal currency of China;

|

|

●

|

"U.S. dollars," "dollars" and "$" refer to the legal currency of the United States;

|

|

●

|

"Securities Act" refers to the United States Securities Act of 1933, as amended; and

|

|

●

|

"Exchange Act" refers to the United States Securities Exchange Act of 1934, as amended.

|

Solely for the convenience of the reader, this report contains conversions of certain Renminbi amounts into U.S. dollars at specified rates. Except as otherwise indicated, all conversions from Renminbi to U.S. dollars were made based on the Exchange Rate on March 31, 2012 which was RMB6.29597 to $1.00. No representation is made that the Renminbi or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. See “Risk Factors—Risks Related to Our Business— Fluctuations in exchange rates could adversely affect our business and the value of our securities” for a discussion of the effects on the Company of fluctuating exchange rates.

In this report we refer to information and statistics regarding our industry and the overall economy in China that we obtained from various government and institute research publications. Much of this information is publicly available and has not been specifically prepared for our use or incorporation in this current report on Form 8-K. We have no reason to believe that the information and statistics that we refer to from such reports is not accurate.

1

On June 27, 2012, we entered into and closed an exchange agreement with World Win International Holding Ltd. (BVI), or “World Win”, all of the shareholders of World Win, and Super-stable Group Holdings Limited, or “Super-stable”, the majority shareholder of the Company (the "Exchange Agreement"), pursuant to which all of the shareholders of World Win transferred all of the issued and outstanding stock of World Win to us, and Super-stable transferred to such shareholders all of its 19,128,130 shares of our common stock (the “Share Exchange”). We currently have 23,900,130 shares of common stock issued and outstanding. The funds used by Super-stable to purchase its 19,128,130 shares of our common stock were loaned to it by Shenzhen Wonhe Technology Co., Ltd., or “Shenzhen Wonhe”, our indirect, consolidated affiliate.

Wei Wang was a director and the sole owner of Super-stable. Ms. Wang served as our sole director until the completion of the Share Exchange.

Nanfang Tong is the president and treasurer of Super-stable. Mr. Tong served as our President, Secretary and Treasurer until completion of the Share Exchange, at which point he became our Chief Executive Officer and a Director. Mr. Tong is also a 10% owner of Shenzhen Wonhe. He was also a 3.0% owner of World Win prior to the Share Exchange.

The foregoing description of the terms of the Exchange Agreement is qualified in its entirety by reference to the provisions of those documents filed as Exhibit 2.1, to this report, which are incorporated by reference herein.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On June 27, 2012 (the "Closing Date"), we completed an acquisition of World Win pursuant to the Exchange Agreement. The acquisition was accounted for as a "reverse acquisition" effected as a recapitalization effected by a share exchange, wherein World Win is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

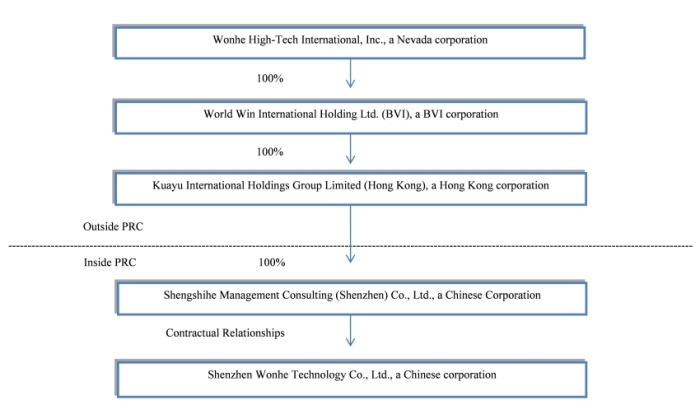

As a result of the acquisition, our consolidated subsidiaries include World Win, our wholly-owned subsidiary which is incorporated under the laws of the British Virgin Islands, Kuayu International Holdings Group Limited (Hong Kong) or “Kuayu,” a wholly-owned subsidiary of World Win which is incorporated under the laws of Hong Kong, Shengshihe Management Consulting (Shenzhen) Co., Ltd., or “Shengshihe Consulting”, a wholly-owned subsidiary of Kuayu which is incorporated under the laws of the PRC, and Shenzhen Wonhe Technology Co., Ltd., or “Shenzhen Wonhe”, a limited liability company incorporated under the laws of the PRC which is effectively and substantially controlled by Shengshihe Consulting through a series of captive agreements.

We have included the information that would be required if the registrant were filing a general form for registration of securities on Form 10, including a complete description of the business and operations of World Win and its operating subsidiaries in Item 5.06 below, which is incorporated herein by reference.

As a result of the closing of the Exchange Agreement, the former shareholders of World Win now own 80.0% of the total outstanding shares of our common stock.

See Item 1.01 above and Item 5.06 below, each of which is incorporated herein by reference.

2

|

ITEM 5.02

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

|

On June 27, 2012, Wei Wang, sole member of our board of directors, submitted a letter of resignation pursuant to which she resigned immediately from her position as our sole director. The resignation of Ms. Wang is not in connection with any known disagreement with us on any matter.

On June 27, 2012, (a) Qing Tong was appointed as Chairman of our board of directors; (b) Nanfang Tong and Jingwu Li were appointed as members of our board of directors; (c) Nanfang Tong was appointed to serve as our Chief Executive Officer, (d) Chahua Yuan was appointed to serve as our Chief Financial Officer, Secretary and Treasurer, and (e) Nanfang Tong ceased to serve as our President, Secretary and Treasurer.

For certain biographical and other information regarding the newly appointed officers and directors, see the disclosure under Item 5.06 of this report, which disclosure is incorporated herein by reference.

|

ITEM 5.03

|

AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR

|

The fiscal year-end for World Win is December 31. On June 27, 2012, the Board of Directors of the Company approved changing the fiscal year-end of the Company from June 30 to December 31 as a result of the reverse acquisition of World Win.

|

ITEM 5.06

|

CHANGE IN SHELL COMPANY STATUS

|

On June 27, 2012, the Company acquired World Win in a reverse acquisition transaction. Prior to the transactions contemplated by the Exchange Agreement the Company was a shell company as defined in Rule 12b-2 under the Exchange Act. As a result of the transactions under the Exchange Agreement, the Company is no longer a shell company. The information with respect to the transactions set forth in Item 2.01 is incorporated herein by reference.

FORM 10 DISCLOSURE

We are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the acquisition of World Win, except that information relating to periods prior to the date of the reverse acquisition only relate to World Win and its subsidiaries and controlled consolidated affiliate unless otherwise specifically indicated.

3

DESCRIPTION OF BUSINESS

We conduct our operations through our consolidated affiliate Shenzhen Wonhe Technology Co., Ltd. (hereinafter referred to as “Shenzhen Wonhe”). Shenzhen Wonhe, founded in November 2010, is a high tech company specializing in research and development, outsourced-manufacturing and marketing of high-end business and personal information technology products. The Company is located in Shenzhen, People’s Republic of China.

OUR CORPORATE HISTORY AND BACKGROUND

Wonhe High-Tech International, Inc. (the “Company”) was incorporated in the State of Nevada on August 13, 2007 under the name “Baby Fox International, Inc.” Until June 30, 2011, the Company was a specialty retailer, developer, and designer of fashionable, value-priced women’s apparel and accessories. On June 30, 2011, the Company entered into and closed a Reorganization Agreement with its former operating subsidiary Shanghai Baby Fox, Baby Fox Limited, Hitoshi Yoshida and BBFX Holding Corp. (“Newco”). Pursuant to the terms of the Reorganization Agreement, the Company transferred all of its ownership interest in Shanghai Baby Fox, its operating subsidiary, to Newco in exchange for all of the capital stock of Newco, and then transferred all of its ownership interest in Newco to Baby Fox Limited, its former majority shareholder, which is wholly owned by Hitoshi Yoshida, and Hitoshi Yoshida, in consideration for Baby Fox Limited and Hitoshi Yoshida agreeing to cancelation of an aggregate of 38,057,487 shares of the Company’s Common Stock previously held by them, which shares constituted approximately 94% of the Company’s outstanding shares of Common Stock. As a result of the disposition of Newco and Shanghai Baby Fox, the Company then had no subsidiaries and had disposed of nearly all of its operating assets.

The reorganization was structured with the intent that the operating company should be transferred from the Company to Baby Fox Limited and Mr. Yoshida in exchange for the cancellation of their shares in the Company while the remaining shareholders in the Company should receive the residual value in the Company as a shell company available to enter into some future transaction with another operating company.

On June 30, 2011, the Company entered into a novation agreement (the “Novation Agreement”) with Jieming Huang and Newco, pursuant to which Newco became the obligor and assumed all of the obligations and rights of the Company (the “Novation”) under that certain Loan Agreement dated February 18, 2008 (the “Original Loan Agreement”), pursuant to which Jieming Huang provided a loan with a principal amount of $810,160 and with a five percent annual interest rate to the Company. As a result of the Novation, the Company is no longer a party to the Original Loan Agreement and is no longer obligated to repay the related loan balance. At the time of entering into the Novation Agreement, Jieming Huang was the Chief Executive Officer and a director of the Company.

Hitoshi Yoshida, the owner of Baby Fox Limited, our majority shareholder prior to the reorganization, was married to Fengling Wang but divorced in October 2008. Fengling Wang is the mother of Jieming Huang and Jieping Huang. Fengling Wang, Jieping Huang and Jieping Huang were the Company’s three directors at the time of the Reorganization, and Jieming Huang was the Company’s Chief Executive Officer, President and Chairman.

On June 30, 2011, the Company entered into a Termination Agreement (the “Termination Agreement”) with Beijing Allstar Business Consulting, Inc. (“Allstar”), pursuant to which the Company terminated its Consulting Agreement with Allstar dated May 18, 2007, as amended and restated on April 28, 2008 (the “Allstar Consulting Agreement”). The parties entered into the Termination Agreement in connection with the Reorganization. As a result of the closing of the reorganization, Baby Fox Limited and its owner Hitoshi Yoshida no longer own any of their previous holdings of 38,057,487 shares of the Company’s Common Stock, which shares previously constituted approximately 94% of the Company’s outstanding shares of Common Stock prior to the Reorganization. The board of directors prior to the Reorganization named Mu Zhang to be the sole officer and director of the Company effective from the time of effectiveness of the reorganization.

4

On March 20, 2012, the Company entered into a Stock Purchase Agreement (the “Purchase Agreement”) by and among Mu Zhang, Catalpa Holdings, Inc., First Prestige, Inc., JD Infinity Holdings, Inc. and Favor Jumbo Enterprises Limited (collectively referred to as the “Sellers” or individually as a “Seller”), and Super-stable Group Holdings Limited (“Super-stable”). Pursuant to the terms of the Purchase Agreement, on March 20, 2012 (the “Closing Date”), Super-stable acquired from the Sellers 1,912,813 shares (the “Purchased Stock”), or approximately 80.0%, of the issued and outstanding common stock of the Company. In consideration for the sale of the Purchased Stock, the Buyer paid the Sellers $250,000 (the “Cash Consideration”), which was paid to the Sellers in cash and was funded by a loan from Shenzhen Wonhe. Pursuant to the terms of the Purchase Agreement, Mu Zhang, the then current officer and director of the Company, resigned on the Closing Date and Wei Wang was named sole Director of the Company and Nanfang Tong was named President, Secretary and Treasurer of the Company. Wei Wang is the sole owner and a director of Super-stable and Nanfang Tong is the President and Treasurer of Super-stable. Such resignation and appointments were effective as of the Closing Date with respect to the directors and officers of the Company. Mu Zhang, the former sole director and officer of the Company, was one of the Sellers. Concurrent with this change of management, the Company moved its principal executive offices to Unit E8, 3/F, Tat Comm. Bldg. 97, Bonham Strand East, Sheng Wan, Hong Kong.

On April 20, 2012, the Company amended its articles of incorporation to change its name to “Wonhe High-Tech International, Inc.” (the “Name Change”) and to effect a 10-for-1 forward stock split (the “Forward Split”) of its outstanding shares of common stock. The Forward Split increased the number of issued and outstanding shares of the Company’s common stock from 2,390,013 shares outstanding prior to the split to 23,900,130 shares outstanding after the split. In connection with the Name Change, the Company’s trading symbol changed from “BBFX” to “WHHT” (the “Symbol Change”). The Name Change was legally effective as of April 20, 2012, and the Forward Split became effective on April 30, 2012. The Company received Financial Industry Regulatory Authority’s (“FINRA”) approval of the Name Change and Symbol Change and the Forward Split, effective May 2, 2012 and April 30, 2012, respectively.

Acquisition of World Win

On June 27, 2012, we completed a reverse acquisition transaction through a share exchange with World Win and its shareholders, or the “Shareholders”, whereby we acquired 100% of the issued and outstanding capital stock of World Win in exchange for our majority shareholder Super-stable transferring to the Shareholders all of its 19,128,130 shares of our common stock, which constituted 80.0% of our issued and outstanding capital stock as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, World Win became our wholly-owned subsidiary and the former shareholders of World Win became our controlling stockholders. The amount of consideration received by the shareholders of World Win was determined on the basis of arm’s-length negotiations between World Win, Super-stable and the Shareholders. The share exchange transaction was treated as a reverse acquisition, with World Win as the acquirer and the Company as the acquired party for accounting purposes. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of World Win and its consolidated subsidiaries.

Immediately prior to the Share Exchange, the common stock of World Win was owned by the following persons in the indicated percentages: Youliang Wang (3.4%); Qing Tong (3.0%); Jingwu Li (3.0%); Nanfang Tong (3.0%); Qian Xu (4.3%); Ling Tong (4.3%); Jingbo Xu (4.2%); Jinquan Deng (4.2%); Gaozuo He (4.2%); Hui Tong (4.2%); Chunliang Wang (4.8%); Jieli Chen (4.9%); Zhixiu Yu (4.9%); Huili Chen (4.8%); Minghua Li (4.7%); Zhengyu Li (4.8%); Jinhui Fan (4.7%); Ping Wang (4.7%); Kang Liu (4.8%); Shaoxian Liang (4.7%); Hongmei Liang (4.6%); Yutong Chen (4.8%); and Global Elite Capital Holdings Group Co., Ltd. (5.0%).

The funds used by Super-stable to purchase its 19,128,130 shares of our common stock were loaned to it by Shenzhen Wonhe, our indirect, consolidated affiliate.

Wei Wang was a director and the sole owner of Super-stable. Ms. Wang served as our sole director until the completion of the Share Exchange.

5

Nanfang Tong is the president and treasurer of Super-stable. Mr. Tong served as our President, Secretary and Treasurer until completion of the Share Exchange, at which point he became our Chief Executive Officer and a Director. Mr. Tong is also a 10% owner of Shenzhen Wonhe. He was also a 3.0% owner of World Win prior to the Share Exchange.

Qing Tong and Jingwu Li, our Chairman and a Director, respectively, each owned 3.00% of the outstanding equity of World Win prior to the Share Exchange. In addition, Qing Tong and Jingwu Li each own 25% of the outstanding equity of Shenzhen Wonhe.

On June 27, 2012, Wei Wang, sole member of our Board of Directors, submitted a letter of resignation pursuant to which she resigned immediately from her position as our sole director.

In addition, on June 27, 2012: (a) Qing Tong was appointed as Chairman of our board of directors; (b) Nanfang Tong and Jingwu Li were appointed as members of our board of directors; (c) Nanfang Tong was appointed to serve as our Chief Executive Officer, (d) Chahua Yuan was appointed to serve as our Chief Financial Officer, Secretary and Treasurer, and (e) Nanfang Tong ceased to serve as our President, Secretary and Treasurer.

As a result of our acquisition of World Win, we now own all of the issued and outstanding capital stock of Kuayu, which in turn owns all of the issued and outstanding capital stock Shengshihe Consulting. In addition, we effectively and substantially control Shenzhen Wonhe through a series of captive agreements with Shenzhen Consulting.

World Win was established in the British Virgin Islands on April 5, 2012. Kuayu was established in Hong Kong on January 11, 2012 to serve as an intermediate holding company. Shengshihe Consulting was established in the PRC on April 17, 2012. Shenzhen Wonhe, our operating consolidated affiliate, was established in the PRC on November 16, 2010. On April 6, 2012, the local government of the PRC issued a certificate of approval regarding the foreign ownership of Shengshihe Consulting by Kuayu, a Hong Kong entity.

Subsequent to the closing of the Exchange Agreement, we conduct our operations through our controlled consolidated affiliate Shenzhen Wonhe. Shenzhen Wonhe is a high-tech company specializing in research and development, outsourced manufacturing and marketing of high-end business and personal information technology products. The Company is located in Room 1001, 10th Floor, Resource Hi-Tech Building South Tower, No.1 Songpingshan Road, North Central Avenue, North High-Tech Zone, Nanshan District, Shenzhen, Guangdong Province, People’s Republic of China.

Contractual Arrangements with our Controlled Consolidated Affiliate and its Shareholders

On May 30, 2012, prior to the reverse acquisition transaction, Shengshihe Consulting and Shenzhen Wonhe and its shareholders Youliang Wang, Qing Tong, Jingwu Li and Nanfang Tong entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Shenzhen Wonhe became Shengshihe Consulting’s contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. The VIE Agreements included:

|

(1)

|

an Exclusive Technical Service and Business Consulting Agreement between Shengshihe Consulting and Shenzhen Wonhe pursuant to which Shengshihe Consulting is to provide technical support and consulting services to Shenzhen Wonhe in exchange for (i) 95% the total annual net profit of Shenzhen Wonhe and (ii) RMB50,000 per month (U.S.$7,942).

|

|

|

(2)

|

a Call Option Agreement among Youliang Wang, Qing Tong, Jingwu Li and Nanfang Tong, and Shengshihe Consulting under which the shareholders of Shenzhen Wonhe have granted to Shengshihe Consulting the irrevocable right and option to acquire all of the equity interests in Shenzhen Wonhe to the extent permitted by PRC law. If PRC law limits the percentage of Shenzhen Wonhe that Shengshihe Consulting may purchase at any time, then Shengshihe Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB1.00($0.16) or any lower price permitted by PRC law. The Shenzhen Wonhe shareholders agreed to refrain from taking certain actions which might harm the value of Shenzhen Wonhe or Shengshihe Consulting’s option;

|

6

|

(3)

|

a Proxy Agreement by Youliang Wang, Qing Tong, Jingwu Li and Nanfang Tong pursuant to which they each authorize Shengshihe Consulting to designate someone to exercise all of his shareholder decision rights with respect to Shenzhen Wonhe; and

|

|

|

(4)

|

A Share Pledge Agreement among Youliang Wang, Qing Tong, Jingwu Li and Nanfang Tong (together referred to as “Shenzhen Wonhe Shareholders”), Shenzhen Wonhe, and Shengshihe Consulting under which the Shenzhen Wonhe Shareholders agree to pledged all of their equity in Shenzhen Wonhe to Shengshihe Consulting to guarantee Shenzhen Wonhe’s and Shenzhen Wonhe’s shareholders’ performance of their obligations under the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement and the Proxy Agreement. The VIE entity, Shenzhen Wonhe, has received approval of equity pledge by Shenzhen Wonhe Shareholders to Sehngshihe Consulting issued by Shenzhen Market Supervision and Management Authority on August 20, 2012.

|

The VIE Agreements with our Chinese affiliate and its shareholders, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. See “Risk Factors - Risks Relating to the VIE Agreements.”

The foregoing description of the terms of the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement, the Proxy Agreement and the Share Pledge Agreement is qualified in its entirety by reference to the provisions of the agreements filed as Exhibits 10.5, 10.6, 10.7 and 10.8 to this report, respectively, which are incorporated by reference herein.

See “Related Party Transactions” for further information on our contractual arrangements with these parties.

7

After the exchange, our current organizational structure is as follows:

OVERVIEW

Shenzhen Wonhe is a high-tech enterprise which specializes in research and development (R&D), and marketing of high-end business and personal IT products providing various application services. We currently have eight lines of hardware products that are in various stages of research and development, including a computer set-top-box (“PC-STB”), a triple play set-top-box, a domestic mini-terminal server, a minicomputer, an All-In-One PC, an ARM panel personal computer and an Android smartphone, as well as a Wonhe applications platform and a metropolis business information operating website. Our major product under development is a PC-STB which combines the system architecture of a multimedia computer with that of a digital set-top box, and features wireless remote control, fully integrating a family’s multimedia application requirements into a single device.

Most of our revenues to date have been derived from sales of our Home Media Center 660 (“HMC660”). Our HMC660 is a data storage, management and control center for household equipment, and a central processing center which uses remote wireless technology to allow a user to control various devices while at home or remotely when away from home.. HMC660 provides a software platform that has the functional characteristics of a family security device, direct tv receiver, with the ability to access TV and video on demand, game console and storage facility for family and urban business information.

HMC 660 can be used to watch ground satellite programs, read CD-ROMs and video files , support Wifi function, share broadband access, support 3G module functions, and can be adapted to includeother applications. We believe our HMC 660 has the following favorable traits and advantages compared to other similar products currently available in the marketplace:

(1) Excellent performance: good audio and video decoding capability equipped with high-performance CPU and AV chips, supporting 1080P high definition play and 7.1 sound track HIFI effect.

(2) Ultralow power: the incorporation of the series of INTEL ATOM ultralow power master chip and highly advanced inner thermal designreduces power consumption to only one-tenth of a typical desktop computer to levels below those of comparable products. In addition, the fine heat dissipation and structural design ensure the surface temperature remains below 35℃ even while working for a long time. Avoidance of extreme temperatures contributes to the chip’s performance and minimizes disruptions.

8

(3) Complete functions: our HMC^^) combines a PC set top box (“STB”), DVD, multimedia computer, security monitor HZJTHY and visual telephone into one comprehensive digital home furnishing solution with a fashionable appearance and compact size.

(4) Abundant applications: the application software combines telecommunication, radio and television and the internet, provides abundant video content themed by television, movies and information programs, households themed by family security, smart home, motion sports and videophone; and value-added services themed by telemedicine, online instruction, auto repair and E-shopping.

OUR INDUSTRY

In the description below we rely on certain information and statistics regarding our industry and the economy in China from the 2011 Statistical Report of Electronic and Information Industry published by the Ministry of Industry and Information Technology of the People’s Republic of China. We have no reason to believe that the information and statistics we cite are not accurate.

Current Status of IT industry in the PRC

(1) The electronic information products industry is growing at a rate in excess of that of the economy generally

In recent years the electronic information products industry has achieved growth rates above that of the overall Chinese economy. In 2010, domestic the PRC electronic information products industry achieved 7.8 trillion Yuan in sales revenue and year-over-year earnings growth was 29.5%, while the PRC domestic GDP grew 10.3% during the corresponding period. With the anticipated continuation of the growth of the PRC national economy and the transformation of the Chinese society to a more western styled information economy,, market demand for electronic information products is expected to continue to experience significant rates of growth above that of the economy generally.

(2) As is evident from the development cycle of the international electronic information industry, traditional electronic products will be replaced by new networked, digitalized products.

The development potential of the Chinese IT industry

Nowadays, the electronic information industry is viewed by many countries as a leading and strategic industry. The rapid promotion of informatization around the globe, the development of transnational investment and transnational transmission of information, have enhanced the value of the electronic information industry. As theChinese electronic information industry has grown, international competition has continued to increase. Despite the growth in the Chinese electronic information industry, some bottle-neck issues have developed, such as the limitations of technology, capital, availability of personnel, as well as increasing costs and a decease in foreign-funded investment in recent years as a result of the macro-environment changes in China and abroad. Despite these problems, we believe the electronics information industry will continue to grow and experience the following trends:

(1) Electronic Information Industry has a solid history of growth.

Since 2000, the Chinese domestic electronic information industry has consistently experienced rapid growth and has always been a leading industry in the whole national economy. By the end of 2010 the total number of patent applications from the PRC nationwide information technology field was over 1.1 million, more than 10% above the number of patents filed by the industry the prior year. Several companies in this field have received Chinese National Prizes for Progress in Science and Technology, and achieved new breakthroughs in servers, carriage communication installation and software, demonstrating a good industry development trend.

9

(2) Technology innovation capabilities improving

Since 2000, the rate of innovation in the electronic information industry has increased. R&D and industrialization of CPU, Chinese Linux, the third generation mobile communication, trunking communication and digital TV, have proven successful in creating technology and products with proprietary intellectual property rights and closing the gap with the advanced world standard. The technology of TD-SCDMA (Time Division-Synchronization Code Division Multiple Access) also made significant progress. Setting its own independent criteria and establishing industry wide standards has made the PRC industry increasingly competitive, especially those domestic PRC companies which are market leaders.

(3) Region characteristic industrial cluster emerging

The potentially huge domestic PRC electronic information products market, abundant low-priced manpower and continuously improving investment environment are key factors attracting foreing companies and investors to set up business bases in China. Foreign capital accelerated the development of the PRC electronic information industry, particularly in the Pearl River Delta, Yangtze River Delta and Bohai Rim. These areas have a good industry foundation, strong ability to provide the auxiliary items necessary for growth, and the strong service consciousness from government, to attract foreign investment to increase investments, and promote the local industries development into a positive cycle. .

COMPETITION

More than 10 year ago, tri-networks integration was proposed by the government and this goal has been listed as a priority in each of the “ninth”, ”tenth” and “eleventh” five-year plans. In the tenth five-year plan, the government emphasized that industry should promote the integration of the telecommunication and broadcast networkswith the capability of the computer. The eleventh five-year plan reiterated this goal and stated that in order to impel tri-network integration, industry should integrate infrastructure resources in the development of technology. At the same time, all of the relative departments in the country are actively implementing the tri-networks integration project.

Business Competition

Our products compete with other manufacturers and providers of electronic furniture and digital/multimedia home entertainment systems, such as Shenzhen Huawei Technology Co., Ltd, Datang Tele-Communication Technology Co., Ltd., Haier Group, TCL Group Co., and Lenovo Group Co., Ltd. In varying degrees, depending on the product category involved, we compete with our competitors on the basis of style, price, quality, comfort and brand name prestige and recognition, among other considerations.

Our home media center (“HMC”) entertainment system product competes with numerous well-known domestic brands such as Huawei, Haier, TCL and Lenovo, as well as well-known foreign brands such as Samsung and Apple IPad. Due to the lower costs and labor expenses in Asia Pacific regions, many international HMC manufacturers are establishing plants in Asia. This allows large manufacturers to compete with local manufacturers in pricing. Many of our competitors are larger in scale, have been in existence for a longer period of time, have achieved greater recognition for their brand names, have captured greater market shares and/or have substantially greater financial, distribution, marketing and other resources than we do. We introduced our HMC 660 products in December 2011. Due to the short period of time this product has been offered, we have not been able to establish a significant market share and strong market competitive strength. There can be no guarantee that we can compete successfully now or in the future, or that competitive pressures will not have a material adverse effect on our business, financial condition and results of operations.

Technology Team

Shenzhen Wonhe possesses a core technology team most of whom have been engaged in the IT industry for more than 10 years, and who specialize in R&D of hardware, system drivers, industrial design, application software system and backstage data service. Meanwhile, in an attempt to keep up with the international digital technology trend, the company has dedicated efforts to create excellent Audio and Video effects; initially connects with broadcast television and telecommunication operators and provides plenty of high-quality video resources; positively cooperates with the third parties application service suppliers and provides convenient and efficient application value-added service.

Research and Development

Shenzhen Wonhe has completed the development of and produced prototypes of domestic media centers, set top boxes, Minicomputers, X86 panel personal computers and ARM panel personal computers, ready for mass production level. The iitial development of our All-in-One computers and domestic smart servers has been completed and these products have entered into the engineering test stage, and we intend to put them into mass production within the next _ months .

We have developed client-side application software equipped with the characteristics of mellow human-computer interface, humanized menu design and handy function switchover. We are simultaneously proceeding with cross-platform transplanting to adapt to Windows, Linux and Android OS; software such as resources search engine, video filtering and processing technology, resource allocation and management, disposition and scheme of backstage application and data server are all completed by the Shenzhen Wonhe Application Center.

10

OUR GROWTH STRATEGY

For the foreseeable future we intend to continue to emphasize the development of multimedia devices fully capable of being integrated into the telecommunication, broadcast and computer (internet) networks. In addition, we intend to focus on the development of panel personal computers or portable pads (“PPC’s”) and smartphones (“PcPhones”). The telecommunications market in China is undergoing rapid development and there is a growing demand for portable media devices to be integrated into GSM and TD-SCDMA networks. If we are successful in developing such products, in addition to offering them directly to the consumer, we will seek to enter into joint marketing or other cooperative agreements with mobile telecom carriers in China.capable of consumers

Business Partnerships

Through taking advantage of all kinds of social resources and tackle key problems, the company intends to positively cooperate with the three biggest operators make efforts to learn about their demand on PPC design and supply panel personal computer or Portable PAD (“PPC”) and Smart Phone (“PcPhone, especially”) to China Mobile. Meanwhile, we intend to positively cooperate with the government-enterprise customer departments of Telecom and Communication Corporation (“China Mobile”), the largest mobile telecom carrier based on GSM and TD-SCDMA network in China. Further, the Company intends to make efforts to establish business partnership with China United Network Communications Group Co, Ltd. (“China Unicom to make every effort to achieve binding sales model with them.”), the largest telecom operator in China, and China Telecommunications Corporation (“China Telecom), a large state-owned telecommunication company, to combine our sales of smart phone products with telecommunication services provided by those operators. Although we intend to make efforts to establish these business relationships, there is no guarantee that we will succeed.

The development process and plan of application software follow closely grows with national policies and industry demand to encourage integration of tri-networks integration. On the basis of ensuring basic function of tri-networks integration (film and (TV cable, video communication, and web browser), Shenzhen Wonhe cooperates with a internet). Upon accomplishment of its product R&D, the Company intends to cooperate with third party Application Service Provider (“ASP”), through which the Company will implement software operating system and application software supplier and gradually provides abundant and powerfulfunctions to provide value- added services. to its customers.

Our Marketing Strategy

Shenzhen Wonhe intends to expand its regional sales agencies and distributors from point to dimension to attempt to gain local market share. Shenzhen Wonhe intends to first sell its products to local sales agencies and distributors to introduce its products to the market, and then to establish its own and exclusive distribution and sales channels. We intend to market our products through the following ways:

|

1.

|

Design a “Wonhe Vision Identity”,.;

|

|

2.

|

Build “Wonhe” brand image by unifying the appearance of all regional agents as well as the website of Wonhe;

|

|

3.

|

Try to issue product reviews on influential IT websites, such as PConline, 3G sina, to enhance the brand image and awareness of Wonhe;

|

|

4.

|

Engage film stars and celebrities to be image spokespersons to promote Wonhe branded products;

|

|

5.

|

Seek to publish articles about Shenzhen Wonhe and its products in newspapers and elite fashion magazines (e.g. Modern Weekly, Fashion; Popular Science, etc.) in major cities.

|

Our Challenges

The following events and circumstances may prevent us from achieving our goals:

|

1.

|

A sudden increase of raw materials and processing costs could increase our operating costs and decrease our profit margins or even result in a loss and negatively affect our performance;

|

|

2.

|

Our products are technology-driven. R&D and patented technology is the core of our competitive strength. If our products never achieve or lose their technological advantage, it may prevent us from achieving significant sales or cause us to lose sales to competitors.

|

PRODUCTION

Shenzhen Wonhe outsources the manufacture of its products to only one producer, Shenzhen Tehuilong Electronic R&D Center. Shenzhen Wonhe does not engage in manufacturing, but provides technology and purchase orders to Shenzhen Tehuilong and it manufactures as we may require.

We have a contract with Shenzhen Tehuilong which will expire at the end of 2012.We have placed an order for 50,000 of our HMC660’swhich we believe is sufficient for this year’s sales plan. Shenzhen Tehuilong and its affiliates are independent third parties with no relationship with Shenzhen Wonhe or its owners.

Relying on one manufacturer is a risk to our business. However, in entering into the contract, we considered these factors:

(1) This company’s production capacity and manufacturing strength are sufficient to satisfy our current annual sales plan;

11

(2) Every month we order a sufficient quantity of products from to meet the next month’s demand to ensure the next month’s products to be sold and defend us from the risk if something unexpected were to happen to this company that may lead to the stopped supply of the products;

(3) We are also keeping close relations with other manufacturers who possess good production technology and can enter into cooperation immediately if necessary.

We currently only have this one product supplier, but with the business developing and demand growing, we expect to grow from the one to several suppliers.

Shenzhen Wonhe markets its products through distributors and retailers, and also sells directly to some customers. As of the end of May 2012, two customers accounted for more than 10% of our sales. Beurer Electronic (Shenzhen) Co., Ltd. accounted for 13.27% of our total sales volume and Shenzhen Yanqu Electronic Co., Ltd represented 11.41% of our total sales volume.

Producers of information technology products face strong pressure to respond quickly to industry demands with new designs and product innovations that support rapidly changing technical demand and regulatory requirements. Shenzhen Wonhe spent approximately $409,000 and $135,000 on its research and development efforts for the year ended December 31, 2011 and for the period from November 16, 2010 (inception) to December 31, 2010, respectively.

INTELLECTUAL PROPERTY

We protect our intellectual property primarily by maintaining strict control over the use of production processes. All our employees, including key employees and engineers, have signed our standard form of labor contracts, pursuant to which they are obligated to hold in confidence any of our trade secrets, know-how or other confidential information and not to compete with us. In addition, for each project, only the personnel associated with the project have access to the related intellectual property. Access to proprietary data is limited to authorized personnel to prevent unintended disclosure or otherwise using our intellectual property without proper authorization. We will continue to take steps to protect our intellectual property.

Patent Technology

Shenzhen Wonhe creates a peculiar development mode on customizing a development platform model, researching and developing customized software development platforms with autonomous intellectual property--- Wonhe HMC660 platform, is a control, management and data storage center for family equipment and a central processing center which uses the remote technology to control the family equipment at home or in other cities. HMC660 provides a software platform has the function characteristics of family security, television direct transmission, TV on demand, VOD, life information, urban business information, handy service for the public, medical care and games world.

Since established in 2010, the company has successfully researched and developed ten more new electronic information products, accepting the corresponding approval from clients after promoting to the market, which was a big benefit for the company. The company not only pays attention to the R&D of new products, but also emphasizes intellectual property research. On April 2011, the company submitted two patent applications to SIPO: tri-networks integration equipment (Patent number: ZL 2011 2 0095525.X) and TV system and remote control (Patent number: ZL 2011 2 0130608.8), which have officially received utility model patent certifications from the SIPO on September 21st 2011 and October 19th 2011, respectively.

Shenzhen Wonhe has trademarked the term “Woner” for its HMC860 product.

12

REGULATION

Because our operating affiliate Shenzhen Wonhe is located in the PRC, our business is regulated by the national and local laws of the PRC. We believe our conduct of business complies with existing PRC laws, rules and regulations.

General Regulation of Businesses

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time, for our operations in the PRC.

According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees. We are required to pay no less than local minimum wages to our employees. We are also required to provide employees with labor safety and sanitation conditions meeting PRC government laws and regulations and carry out regular health examinations of our employees engaged in hazardous occupations.

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these Rules, RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a company in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

Regulation of Income Taxes

On March 16, 2007, the National People’s Congress of China passed the Enterprise Income Tax Law, or the EIT Law, and its implementing rules, both of which became effective on January 1, 2008. The EIT Law and its implementing rules impose a unified EIT rate of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions.

13

Under the EIT Law, companies designated as High- and New-Technology Enterprises may enjoy a reduced national EIT rate of 15%. The Administrative Measures for Assessment of High-New Tech Enterprises and Catalogue of High/New Tech Domains Strongly Supported by the State (2008), jointly issued by the Ministry of Science and Technology and the Ministry of Finance and State Administration of Taxation set forth general guidelines regarding criteria as well as application procedures for qualification as a High- and New-Tech Enterprise under the EIT Law.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization’s global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see “Risk Factors – Risks Related to Our Business – Under the EIT Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.”

Our future effective income tax rate depends on various factors, such as tax legislation, the geographic composition of our pre-tax income and non-tax deductible expenses incurred. Our management carefully monitors these legal developments and will timely adjust our effective income tax rate when necessary.

Dividend Distribution

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year to its general reserves until the cumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

The EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises’ shareholder has a tax treaty with China that provides for a different withholding arrangement. Shengshihe Consulting is considered a FIE and is directly held by our subsidiary in Hong Kong, Kuayu. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Kuayu by Shengshihe Consulting, but this treatment will depend on our status as a non-resident enterprise.

PRC M&A Rule, Circular 75 and Circular 638

On August 8, 2006, six Chinese government agencies, namely, the Ministry of Commerce, or MOFCOM, the State Administration for Industry and Commerce, or SAIC, the China Securities Regulatory Commission, or CSRC, the State Administration of Foreign Exchange, or SAFE, the State Assets Supervision and Administration Commission, or SASAC, and the State Administration for Taxation, or SAT, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, referred to as the “New M&A Rules”, which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore “special purpose vehicles,” that are (1) formed for the purpose of overseas listing of the equity interests of Chinese companies via acquisition and (2) are controlled directly or indirectly by Chinese companies and/or Chinese individuals, to obtain the approval of the CSRC prior to the listing and trading of their securities on overseas stock exchanges. Based on our understanding of current Chinese Laws and pursuant to a legal opinion issued by Jinlin Changchun Law Firm dated June 2012, (i) Shengshihe Consulting was incorporated by a foreign investor and therefore has no Chinese shareholders; (ii) the share exchange between World Win and the Company, Wonhe High-Tech International Inc., is between two offshore companies and is not deemed as a transaction to acquire equity or assets of a “Chinese domestic company” as defined under the New M&A Rules and (ii) no provision in the New M&A Rules clearly classifies the contractual arrangements between Shengshihe Consulting and Shenzhen Wonhe as a type of transaction falling within the New M&A Rules.

The SAFE issued a public notice in October 2005, or the Circular 75, requiring Chinese residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of Chinese companies, referred to in the Circular 75 as special purpose vehicles, or SPVs. Chinese residents who are shareholders of SPVs established before November 1, 2005 were required to register with the local SAFE branch before June 30, 2006. Further, Chinese residents are required to file amendments to their registrations with the local SAFE branch if their SPVs undergo a material event involving changes in capital, such as changes in share capital, mergers and acquisitions, share transfers or exchanges, spin-off transactions or long-term equity or debt investments.

Pursuant to the Circular 698, where a foreign investor transfers the equity interests of a Chinese resident enterprise indirectly via disposing of the equity interests of an overseas holding company, which we refer to as an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the foreign investor shall report such Indirect Transfer to the competent tax authority of the Chinese resident enterprise. The Chinese tax authority will examine the true nature of the Indirect Transfer, and if the tax authority considers that the foreign investor has adopted an abusive arrangement in order to avoid Chinese tax, they will disregard the existence of the overseas holding company and re-characterize the Indirect Transfer and as a result, gains derived from such Indirect Transfer may be subject to Chinese withholding tax at the rate of up to 10%. Circular 698 also provides that, where a non-Chinese resident enterprise transfers its equity interests in a Chinese resident enterprise to its related parties at a price lower than the fair market value, the competent tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

ENVIRONMENTAL MATTERS

Our operations are not subject to any environmental regulations.

INSURANCE

Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we could face liability from the interruption of our business as summarized under “Risk Factors – Risks Related to Our Business – We do not carry business interruption insurance so we could incur unrecoverable losses if our business is interrupted.”

OUR EMPLOYEES

As of December 31, 2011, we had a total of 75 full-time employees and no part-time employees.

14

We occupy our principal executive offices in Shenzhen, China, which comprises approximately 1243 square meters, at a current monthly rental of approximately $14,808, for which our lease expires on February 28, 2019. The lease provides for an increase in rent of 5% in March 2013 and every two years thereafter. We believe we can renew this lease on comparable terms to our existing lease.

Shenzhen Wonhe also leases several apartments to house its employees as follows:

|

1.

|

Approximately 113 square meters in Shenzhen at a monthly rental of approximately $762, for which our lease expires in March 2013.

|

|

2.

|

Approximately 79 square meters in Shenzhen at a monthly rental of approximately $632, for which our lease expires in March 2013.

|

|

3.

|

Approximately 68 square meters in Shenzhen at a monthly rental of approximately $429, for which our lease expires in August 2012.

|

|

4.

|

Approximately 83 square meters in Shenzhen at a monthly rental of approximately $556, for which our lease expires in February 2013.

|

|

5.

|

Approximately 85 square meters in Beijing at a monthly rental of approximately $715, for which our lease expires in September 2012.

|

The Company does not believe that any of the apartment leases are material to its operations and does not anticipate any difficulty in renewing or replacing any of these apartment leases when they expire.

15

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled "Special Notes Regarding Forward-Looking Statements" immediately following these risk factors for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

RISKS RELATED TO OUR BUSINESS

In order to grow at the pace expected by management, we will require additional capital to support our long-term growth strategies. If we are unable to obtain additional capital, we may be unable to proceed with our plans and we may be forced to curtail our operations.

We will require additional working capital to support our long-term growth strategies, which includes development of marketing and R&D of new products. Our working capital requirements and the cash flow provided by future operating activities, if any, may vary greatly from quarter to quarter, depending on the volume of business during the period. We may not be able to obtain adequate levels of additional financing, whether through equity financing, debt financing or other sources. Additional financings could result in significant dilution to our earnings per share or the issuance of securities with rights superior to our current outstanding securities. In addition, we may grant registration rights to investors purchasing our equity or debt securities in the future. If we are unable to raise additional financing, we may be unable to implement our long-term growth strategies, develop or enhance our products and services, take advantage of future opportunities or respond to competitive pressures on a timely basis.

Substantially all of our business, assets and operations are located in the PRC.

Substantially all of our business, assets and operations are located in the PRC. The economy of the PRC differs from the economies of most developed countries in many respects. The economy of the PRC has been transitioning from a planned economy to a market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in the PRC are still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry by imposing industrial policies. It also exercises significant control over the PRC’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Some of these measures benefit the overall economy of the PRC, but may have a negative effect on us.

Our management has no experience in managing and operating a public company. Any failure to comply or adequately comply with federal securities laws, rules or regulations could subject us to fines or regulatory actions, which may materially adversely affect our business, results of operations and financial condition.

Our current management has no experience managing and operating a public company and relies in many instances on the professional experience and advice of third parties including our attorneys and accountants. Most of our middle and top management staff are not educated and trained in the Western system, and we may have difficulty hiring new employees in the PRC with such training. As a result, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. Therefore, we may, in turn, experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002, as amended. This may result in significant deficiencies or material weaknesses in our internal controls, which could impact the reliability of our financial statements and prevent us from complying with the U.S. Securities and Exchange Commission ("SEC") rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002, as amended. Failure to comply or adequately comply with any laws, rules, or regulations applicable to our business may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition and could result in delays in developing of an active and liquid trading market for our common stock. To the extent that the market place perceives that we do not have a strong financial staff and financial controls, the market for, and price of, our stock may be impaired.

16

Our planned expansion could be delayed or adversely affected by, among other things, difficulties in obtaining sufficient financing, technical difficulties, or human or other resource constraints.

Our planned expansion could be delayed or adversely affected by, among other things, difficulties in obtaining sufficient financing, technical difficulties, or human or other resource constraints. Moreover, the costs involved in these projects may exceed those originally contemplated. Costs savings and other economic benefits expected from these projects may not materialize as a result of any such project delays, cost overruns or changes in market circumstances. Failure to obtain intended economic benefits from these projects could adversely affect our business, financial condition and operating performances.

We encounter substantial competition in our business and any failure to compete effectively could adversely affect our results of operations.

The electronics and information technology industry is highly competitive, and we may not be able to compete successfully against current or potential competitors. We compete with large PRC electronics companies, such as Shenzhen Huawei Technology Co., Ltd., Datang Telecom Technology Co., Ltd as well as a large number of small firms. Many of our competitors have greater financial resources than we do. We anticipate that our competitors will continue to expand and seek to obtain additional market share with competitive price and performance characteristics. Aggressive expansion by our competitors or the entrance of new competitors into our markets could have a material adverse effect on our business, results of operations and financial condition.

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Our limited operating history may not provide a meaningful basis for evaluating our business. The Company entered into business in 2010. We cannot guarantee that we will achieve profitability or that we will not incur net losses in the future. We will continue to encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

|

●

|

obtain sufficient working capital to support our expansion;

|

|

●

|

expand our product offerings and maintain the high quality of our products;

|

|

●

|

manage our expanding operations and continue to fill customers’ orders on time;

|

|

●

|

maintain adequate control of our expenses allowing us to realize anticipated income growth;

|

|

●

|

implement our product development, sales, and acquisition strategies and adapt and modify them as needed;

|

|

●

|

successfully integrate any future acquisitions; and

|

|

●

|

anticipate and adapt to changing conditions in the electronics and information technology industry resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

|

If we are not successful in addressing any or all of the foregoing risks, our results of operations may be materially and adversely affected.

17

We require highly qualified personnel and if we are unable to hire or retain qualified personnel, we may not be able to grow effectively.

Our future success also depends upon our ability to attract and retain highly qualified personnel. Expansion of our business and the management, and the proposed growth of our business will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. We may not be able to attract or retain highly qualified personnel. Competition for skilled information technology personnel is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

The loss of the services of our key employees, particularly the services rendered by Qing Tong, our chairman, Nanfang Tong, our chief executive officer, and Chahua Yuan, our chief financial officer, could harm our business.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Qing Tong, our chairman, Nanfang Tong, our chief executive officer and Chahua Yuan, our chief financial officer. We currently do not have key employee insurance for our officers and directors. The loss of any these key employees, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

We rely on a single third-party manufacturer to manufacture our products.

We depend on a single contract manufacturer to manufacture the products that we sell. Any significant problems at our third-party manufacturer’s production facility could impact our ability to deliver our products. If this contract manufacturer is unable to maintain adequate manufacturing and shipping capacity, it may be unable to provide us with timely delivery of products of acceptable quality. Our inability to meet our customers’ demand for our products could have a material adverse impact on our business, financial condition and results of operations. In addition, if the prices charged by this contractor increase for reasons such as increases in labor costs or currency fluctuations, our cost of manufacturing would increase, adversely affecting our results of operations. We also depend on third parties to transport and deliver our products. Due to the fact that we do not have any independent transportation or delivery capabilities of our own, if these third parties are unable to transport or deliver our products for any reason, or if they increase the price of their services, including as a result of increases in the cost of fuel, our operations and financial performance may be adversely affected.

We require our contract manufacturer to meet our standards in terms of product quality and other matters. Any failure by our contract manufacturer to meet these standards, to adhere to labor or other laws or to diverge from our mandated practices, and the potential negative publicity relating to any of these events, could harm our business and reputation.

Our agreement with our contract manufacturer is of a short duration. To the extent we are unable to maintain or secure relationships with quality manufacturers, our business could be harmed.

We will incur significant costs to ensure compliance with United States corporate governance and accounting requirements.

We will incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the SEC. Since we had no obligations as a public company prior to the reverse acquisition on June 27, 2012, we did not have any such expenses prior to that date. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

18

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $75 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation if our public float exceeds $75 million.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional financing as needed.

We do not carry business interruption or other insurance, so we have to bear losses ourselves.

We are subject to risk inherent to our business, including equipment failure, theft, natural disasters, industrial accidents, labor disturbances, business interruptions, property damage, product liability, personal injury and death. We do not carry any business interruption insurance or third-party liability insurance or other insurance to cover risks associated with our business. As a result, if we suffer losses, damages or liabilities, including those caused by natural disasters or other events beyond our control and we are unable to make a claim against a third party, we will be required to bear all such losses from our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

We compete in an industry that is brand-conscious, and unless we are able to establish and maintain brand name recognition our sales may be negatively impacted.