Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-kppt18october2012.htm |

1 8-K Filed October 18, 2012

2 Introduction This slide presentation contains forward-looking statements which are subject to change based on various important factors, including without limitation, competitive actions in the marketplace and adverse actions of governmental and other third-party payors. Actual results could differ materially from those suggested by these forward-looking statements. Further information on potential factors that could affect the Company’s financial results is included in the Company’s Form 10-K for the year ended December 31, 2011, and subsequent SEC filings. The Company has no obligation to provide any updates to these forward-looking statements even if its expectations change.

3 Third Quarter Results (In millions, except per share data) 2012 2011 +/(-) Revenue 1,419.4$ 1,404.5$ 1.1% Adjusted Operating Income (1) 258.9$ 263.5$ -1.7% Adjusted Operating Income Margin (1) 18.2% 18.8% (60) bp Adjusted EPS Excluding Amortization (1) 1.76$ 1.61$ 9.3% Operating Cash Flow (2) 203.8$ 176.8$ 15.3% Less: Capital Expenditures (44.1)$ (40.4)$ 9.2% Free Cash Flow 159.7$ 136.4$ 17.1% Three Months Ended Sep 30, (1) See Reconciliation of non-GAAP Financial Measures (included herein) (2) 2011 Operating Cash Flow was reduced by $49.5 million as a result of the Hunter Labs settlement

4 Cash Flow Trends Note: 2011 Free Cash Flow calculation above does not include the $49.5 million Hunter Labs settlement Free Cash Flow is a non-GAAP metric (see reconciliation of non-GAAP Financial Measures included herein) Free Cash Flow CAGR calculation uses 2001 data (2001 Free Cash Flow was $228 million) 12.8% FCF CAGR from 2001-2011 $445 $564 $538 $574 $632 $710 $781 $862 $884 $905 $371 $481 $443 $481 $516 $567 $624 $748 $758 $759 0 20 40 60 80 100 120 140 160 180 $- $200 $400 $600 $800 $1,000 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Num ber of Sha res (Mill ion s) $ Millio ns Operating Cash Flow Free Cash Flow Weighted Avg Diluted Shares Weighted Average Diluted Shares (millions) 154.2 154.7 150.7 144.9 134.7 121.3 111.8 109.1 105.4 101.8

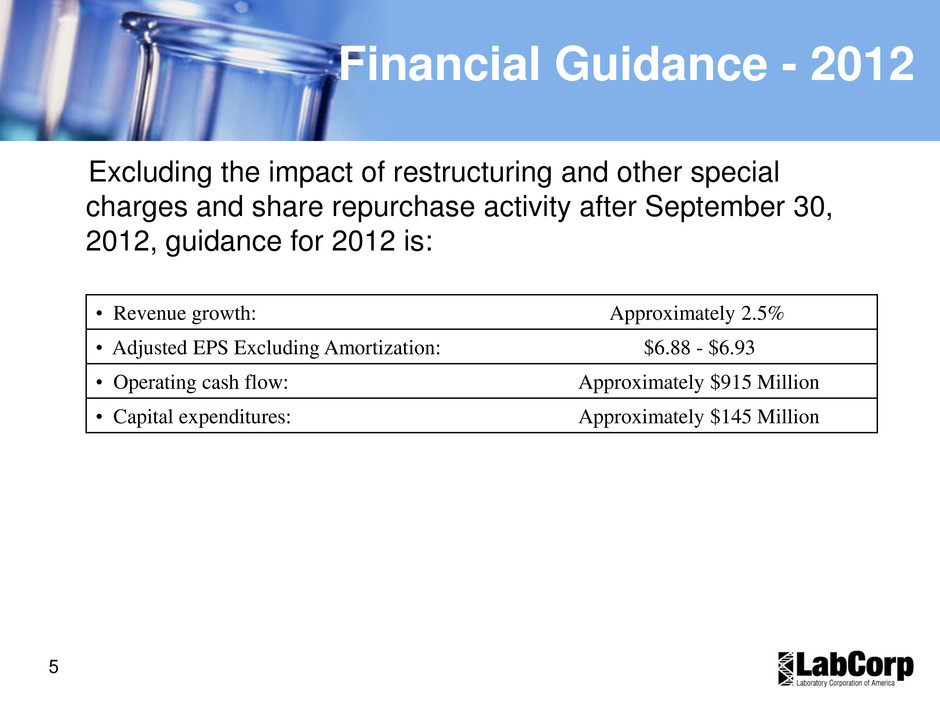

5 Financial Guidance - 2012 Excluding the impact of restructuring and other special charges and share repurchase activity after September 30, 2012, guidance for 2012 is: • Revenue growth: Approximately 2.5% • Adjusted EPS Excluding Amortization: $6.88 - $6.93 • Operating cash flow: Approximately $915 Million • Capital expenditures: Approximately $145 Million

6 Supplemental Financial Information Q1 12 Q2 12 Q3 12 YTD Depreciation 34.7$ 33.2$ 34.0$ 101.9$ Amortization 21.4$ 20.5$ 20.9$ 62.8$ Capital expenditures 34.2$ 34.1$ 44.1$ 112.4$ Cash flows from operations 197.1$ 186.3$ 203.8$ 587.2$ Bad debt as a percentage of sales 4.4% 4.4% 4.3% 4.4% Effective interest rate on debt: Zero coupon-subordinated notes 2.00% 2.00% 2.00% 2.00% 3 1/8% Senior Notes 3.27% 3.27% 3.27% 3.27% 4 5/8% Senior Notes 4.74% 4.74% 4.74% 4.74% 5 1/2% Senior Notes 5.38% 5.38% 5.38% 5.38% 5 5/8% Senior Notes 5.75% 5.75% 5.75% 5.75% 2 1/5% Senior Notes - - 2.24% 2.24% 3 3/4% Senior Notes - - 3.76% 3.76% Revolving credit facility (weighted average) 1.22% 1.22% 1.19% 1.19% Days sales outstanding 48 47 48* 48* *Excludes the impact of the MEDTOX Acquisition Laboratory Corporation of America Other Financial Information September 30, 2012 ($ in millions)

7 Reconciliation of non-GAAP Financial Measures Adjusted Operating Income 2012 2011 Operating income 245.1$ 239.4$ Restructuring and other special charges (1) (2) 4.8 24.1 Acquisition fees and expenses (1) 9.0 - Adjusted operating income 258.9$ 263.5$ Adjusted EPS Excluding Amortization Diluted earnings per common share 1.53$ 1.31$ Impact of restructuring and other special charges (1) (2) 0.10 0.17 Amortization expense 0.13 0.13 Adjusted EPS Excluding Amortization (3) 1.76$ 1.61$ Reconciliation of non-GAAP Financial Measures (In millions, except per share data) Three Months Ended Sep 30, Note: Please see footnotes for this reconciliation on slide 9

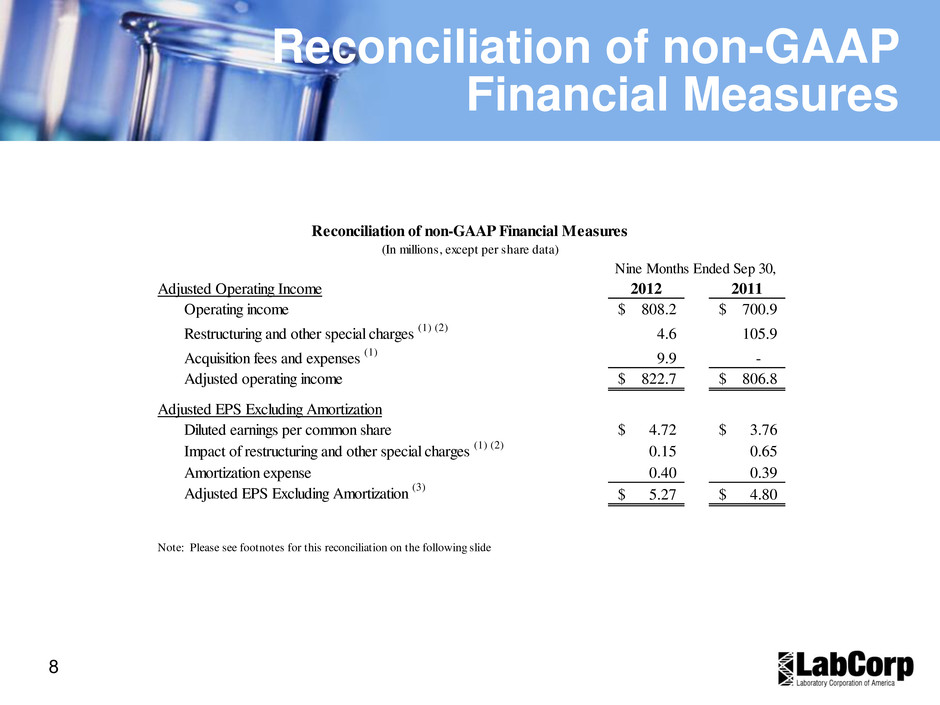

8 Reconciliation of non-GAAP Financial Measures Adjusted Operating Income 2012 2011 Operating income 808.2$ 700.9$ Restructuring and other special charges (1) (2) 4.6 105.9 Acquisition fees and expenses (1) 9.9 - Adjusted operating income 822.7$ 806.8$ Adjusted EPS Excluding Amortization Diluted earnings per common share 4.72$ 3.76$ Impact of restructuring and other special charges (1) (2) 0.15 0.65 Amortization expense 0.40 0.39 Adjusted EPS Excluding Amortization (3) 5.27$ 4.80$ Reconciliation of non-GAAP Financial Measures (In millions, except per share data) Nine Months Ended Sep 30, Note: Please see footnotes for this reconciliation on the following slide

9 Reconciliation of non-GAAP Financial Measures - Footnotes Note: GENZYME GENETICS and its logo are trademarks of Genzyme Corporation and used by Esoterix Genetic Laboratories, LLC, a wholly-owned subsidiary of LabCorp, under license. Esoterix Genetic Laboratories and LabCorp are operated independently from Genzyme Corporation. 1) During the third quarter of 2012, the Company recorded net restructuring and other special charges of $4.8 million. The charges consisted of $5.2 million in severance related liabilities and $1.2 million in net facility-related costs primarily associated with ongoing consolidation of recent acquisitions and other operations; partially offset by the reversal of previously established reserves of $0.9 million in unused severance and $0.7 million in unused facility-related costs. The Company also recorded $9.0 million in fees associated with the successful completion of its acquisition of MEDTOX Scientific, Inc. (“MEDTOX”) on July 31, 2012. The after tax impact of these charges decreased net earnings for the three months ended September 30, 2012, by $9.5 million and diluted earnings per share by $0.10 ($9.5 million divided by 96.8 million shares). During the first two quarters of 2012, the Company recorded a net credit of $0.2 million in restructuring and other special charges. The restructuring charges included $6.2 million in severance and other personnel costs along with $1.3 million in facility-related costs primarily associated with the ongoing integration of the Clearstone Central Laboratories (“Clearstone”) acquisition and the termination of an executive vice-president. These charges were offset by the reversal of previously established restructuring reserves of $4.8 million in unused severance and $2.9 million in unused facility-related costs. The Company recorded $0.9 million in acquisition fees and expenses relating to its acquisition of MEDTOX. As part of the Clearstone integration, the Company recorded a $6.9 million loss on the disposal of one of its European subsidiaries. In addition, in conjunction with the liquidation of one of its joint ventures, the Company recorded a one- time increase of $2.9 million in equity method income. For the nine months ended September 30, 2011, the after tax impact of these combined net charges decreased net earnings by $15.1 million and diluted earnings per share by $0.15 ($15.1 million divided by 98.1 million shares). 2) During the third quarter of 2011, the Company recorded net restructuring and other special charges of $24.1 million, consisting of $7.9 million in severance related liabilities and $16.2 million in net facility-related costs primarily associated with ongoing integration of the Clearstone, Genzyme Genetics and Westcliff acquisitions. The after tax impact of these charges decreased net earnings for the three months ended September 30, 2011, by $16.9 million and diluted earnings per share by $0.17 ($16.9 million divided by 102.2 million shares). During the first two quarters of 2011, the Company recorded restructuring and other special charges of $81.8 million. The restructuring charges included $10.9 million in net severance and other personnel costs along with $20.5 million in net facility-related costs primarily associated with the ongoing integration of the Genzyme Genetics and Westcliff acquisitions. The special charges also include $34.5 million ($49.5 million, net of previously recorded reserves of $15.0 million) relating to the settlement of the Hunter Labs litigation in California, along with $1.1 million for legal costs associated with the planned acquisition of Orchid Cellmark incurred during the second quarter of 2011, both of which were recorded in Selling, General and Administrative Expenses in the Company’s Statement of Operations. The charges also included a $14.8 million write-off of an investment made in a prior year. For the nine months ended September 30, 2011, the after tax impact of these combined charges decreased net earnings by $66.3 million and diluted earnings per share by $0.65 ($66.3 million divided by 102.3 million shares). 3) The Company continues to grow its business through acquisitions and uses Adjusted EPS Excluding Amortization as a measure of operational performance, growth and shareholder returns. The Company believes adjusting EPS for amortization will provide investors with better insight into the operating performance of the business. For the quarters ended September 30, 2012 and 2011, intangible amortization was $21.1 million and $21.2 million, respectively ($13.0 million and $13.0 million net of tax, respectively) and decreased EPS by $0.13 ($13.0 million divided by 96.8 million shares) and $0.13 ($13.0 million divided by 102.2 million shares), respectively. For the nine months ended September 30, 2012 and 2011, intangible amortization was $63.1 million and $64.6 million respectively ($38.9 million and $39.5 million net of tax, respectively) and decreased EPS by $0.39 ($38.9 million divided by 98.1 million shares) and $0.40 ($39.5 million divided by 102.3 million shares), respectively.

10 Reconciliation of Free Cash Flow (1) 2011 cash flows from operations excludes the $49.5 million Hunter Labs settlement payment (2) Free cash flow represents cash flows from operations less capital expenditures 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 Cash flows from operations1 905.1$ 883.6$ 862.4$ 780.9$ 709.7$ 632.3$ 574.2$ 538.1$ 564.3$ 444.9$ Capital expenditures (145.7) (126.1) (114.7) (156.7) (142.6) (115.9) (93.6) (95.0) (83.6) (74.3) Free cash flow2 759.4 757.5 747.7 624.2 567.1 516.4 480.6 443.1 480.7 370.6 Weighted average diluted shares outstanding 101.8 105.4 109.1 111.8 121.3 134.7 144.9 150.7 154.7 154.2 Reconciliation of non-GAAP Financial Measures (In millions, except per share data)

11