Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US BANCORP \DE\ | d424566d8k.htm |

| EX-99.1 - PRESS RELEASE ISSUED BY U.S. BANCORP - US BANCORP \DE\ | d424566dex991.htm |

U.S.

Bancorp 3Q12 Earnings

Conference Call

U.S. Bancorp

3Q12 Earnings

Conference Call

October 17, 2012

Richard K. Davis

Chairman, President and CEO

Andy Cecere

Vice Chairman and CFO

Exhibit 99.2 |

2

Forward-looking Statements and Additional Information

The

following

information

appears

in

accordance

with

the

Private

Securities

Litigation

Reform

Act

of

1995:

This presentation contains forward-looking statements about U.S. Bancorp.

Statements that are not historical or current facts, including statements

about beliefs and expectations, are forward-looking statements and are based on

the information available to, and assumptions and estimates made

by,

management

as

of

the

date

made.

These

forward-looking

statements

cover,

among

other

things,

anticipated

future

revenue

and

expenses

and

the

future

plans

and

prospects

of

U.S.

Bancorp.

Forward-looking

statements

involve

inherent

risks

and

uncertainties,

and

important

factors could cause actual results to differ materially from those

anticipated. Global and domestic economies could fail to recover from the recent

economic downturn or could experience another severe contraction, which could

adversely affect U.S. Bancorp’s revenues and the values of its assets

and liabilities. Global financial markets could experience a recurrence of significant turbulence, which could reduce the availability of

funding to certain financial institutions and lead to a tightening of credit, a

reduction of business activity, and increased market volatility. Continued

stress

in

the

commercial

real

estate

markets,

as

well

as

a

delay

or

failure

of

recovery

in

the

residential

real

estate

markets,

could

cause

additional

credit losses and deterioration in asset values. In addition, U.S.

Bancorp’s business and financial performance is likely to be negatively impacted

by effects of recently enacted and future legislation and regulation. U.S.

Bancorp’s results could also be adversely affected by continued

deterioration

in

general

business

and

economic

conditions;

changes

in

interest

rates;

deterioration

in

the

credit

quality

of

its

loan

portfolios

or

in

the

value of the collateral securing those loans; deterioration in the value of

securities held in its investment securities portfolio; legal and regulatory

developments; increased competition from both banks and non-banks; changes in

customer behavior and preferences; effects of mergers and acquisitions and

related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit

risk, residual value risk, market risk, operational risk, interest rate risk and

liquidity risk. For discussion of these and other risks that may cause actual

results to differ from expectations, refer to U.S. Bancorp’s Annual Report on

Form 10-K for the year ended December 31, 2011, on file with the Securities and

Exchange Commission, including the sections entitled “Risk

Factors”

and “Corporate Risk Profile”

contained in Exhibit 13, and all subsequent filings with the Securities and

Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the

Securities Exchange Act of 1934. Forward-looking statements speak only as of the date they are made,

and U.S. Bancorp undertakes no obligation to update them in light of new

information or future events. This

presentation

includes

non-GAAP

financial

measures

to

describe

U.S.

Bancorp’s

performance.

The

reconciliations

of

those

measures

to

GAAP

measures

are

provided

within

or

in

the

appendix

of

the

presentation.

These

disclosures

should

not

be

viewed

as

a

substitute

for

operating

results

determined in accordance with GAAP, nor are they necessarily comparable to

non-GAAP performance measures that may be presented by other

companies. |

3

3Q12 Earnings

Conference Call

3Q12 Highlights

Record net income of $1.5 billion; $0.74 per diluted common share

Record total net revenue of $5.2 billion, up 8.0% vs. 3Q11

•

Net interest income growth of 6.1% vs. 3Q11; noninterest income growth of 10.4%

vs. 3Q11 Positive operating leverage on both a year-over-year and a

linked quarter basis Average loan growth of 7.3% vs. 3Q11 and average loan

growth of 1.3% vs. 2Q12 (1.6% excluding the impact of a credit card

portfolio sale) Strong average deposit growth of 11.1% vs. 3Q11 and 3.5% vs.

2Q12 Net charge-offs increased 3.5% vs. 2Q12 (decreased 6.9% excluding

$54 million of incremental charge-offs due to a regulatory

clarification) Nonperforming assets (excluding covered assets) declined 3.0%

vs. 2Q12 (7.8% excluding $109 million of incremental nonperforming assets

due to a regulatory clarification) Capital generation continues to fortify

capital position •

Tier 1 common equity ratio of approximately 8.2% using proposed rules for Basel

III standardized approach released June 2012

•

Tier 1 common equity ratio of 9.0%; Tier 1 capital ratio of 10.9%

•

Repurchased 17 million shares of common stock during 3Q12

•

Returned 67% of our earnings in 3Q12 to shareholders

|

4

3Q12 Earnings

Conference Call

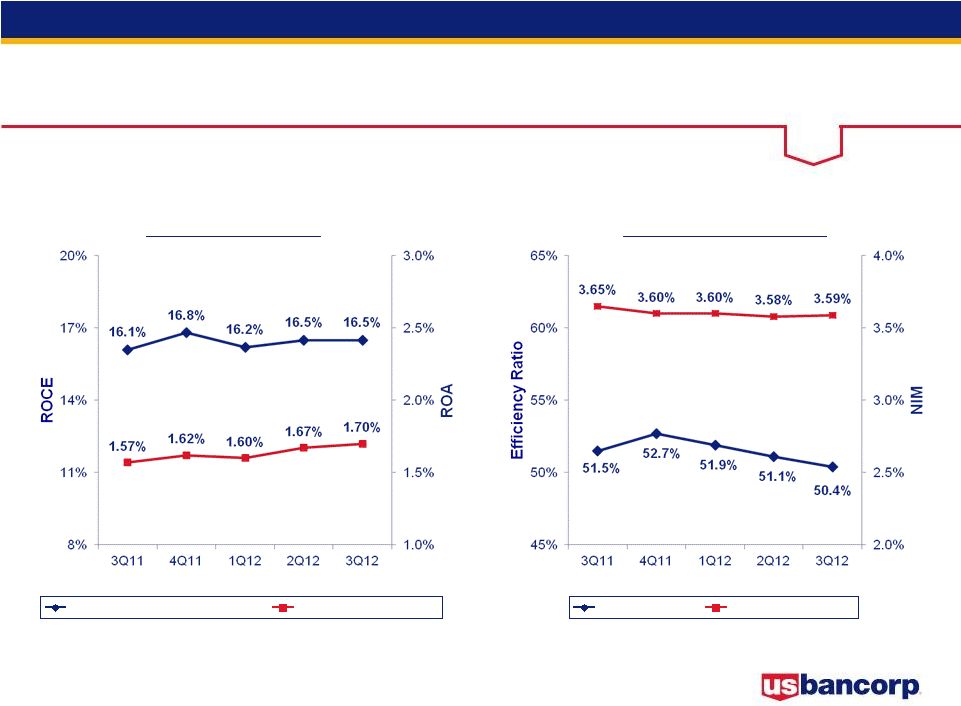

Performance Ratios

ROCE and ROA

Efficiency Ratio and

Net Interest Margin

Return on Avg Common Equity

Return on Avg Assets

Efficiency Ratio

Net Interest Margin

Efficiency ratio computed as noninterest expense divided by the sum of net interest

income on a taxable-equivalent basis

and

noninterest

income

excluding

securities

gains

(losses)

net |

5

3Q12 Earnings

Conference Call

* Gain on merchant processing agreement settlement

Taxable-equivalent basis

Revenue Growth

Year-Over-Year Growth

4.5%

8.1%

9.1%

8.1%

8.0%

$ in millions |

6

3Q12 Earnings

Conference Call

Loan and Deposit Growth

Average Balances

Year-Over-Year Growth

$ in billions

7.7%

$214.1

7.3%

$216.9

5.0%

$202.2

5.9%

$207.0

6.4%

$210.2

10.5%

$231.3

11.1%

$239.3

17.9%

$215.4

17.3%

$223.3

11.7%

$228.3 |

7

3Q12 Earnings

Conference Call

Credit Quality

* Excluding Covered Assets (assets subject to loss sharing agreements with

FDIC) ** Related to a regulatory clarification in the treatment of residential mortgage and other consumer

loans to borrowers who have exited bankruptcy but continue to make payments on

their loans *** Excluding $54 million of incremental charge-offs

Net Charge-offs

Nonperforming Assets*

$ in millions

Net Charge-offs (Left Scale)

NCOs to Avg Loans (Right Scale)

Nonperforming Assets (Left Scale)

NPAs to Loans plus ORE (Right Scale) |

8

3Q12 Earnings

Conference Call

YTD

YTD

3Q12

2Q12

3Q11

vs 2Q12

vs 3Q11

3Q12

3Q11

% B/(W)

Net Interest Income

2,783

$

2,713

$

2,624

$

2.6

6.1

8,186

$

7,675

$

6.7

Noninterest Income

2,396

2,355

2,171

1.7

10.4

6,990

6,329

10.4

Total Revenue

5,179

5,068

4,795

2.2

8.0

15,176

14,004

8.4

Noninterest Expense

2,609

2,601

2,476

(0.3)

(5.4)

7,770

7,215

(7.7)

Operating Income

2,570

2,467

2,319

4.2

10.8

7,406

6,789

9.1

Net Charge-offs

538

520

669

(3.5)

19.6

1,629

2,221

26.7

Excess Provision

(50)

(50)

(150)

--

--

(190)

(375)

--

Income before Taxes

2,082

1,997

1,800

4.3

15.7

5,967

4,943

20.7

Applicable Income Taxes

650

619

548

(5.0)

(18.6)

1,852

1,483

(24.9)

Noncontrolling Interests

42

37

21

13.5

100.0

112

62

80.6

Net Income

1,474

1,415

1,273

4.2

15.8

4,227

3,522

20.0

Preferred Dividends/Other

70

70

36

-

(94.4)

193

115

(67.8)

NI to Common

1,404

$

1,345

$

1,237

$

4.4

13.5

4,034

$

3,407

$

18.4

Diluted EPS

0.74

$

0.71

$

0.64

$

4.2

15.6

2.12

$

1.77

$

19.8

Average Diluted Shares

1,897

1,898

1,922

0.1

1.3

1,901

1,926

1.3

% B/(W)

Earnings Summary

$ in millions, except per-share data

Taxable-equivalent basis |

9

3Q12 Earnings

Conference Call

3Q12 Results -

Key Drivers

vs. 3Q11

Net Revenue growth of 8.0%

•

Net

interest

income

growth

of

6.1%;

net

interest

margin

of

3.59%

vs.

3.65%

•

Noninterest income growth of 10.4%

Noninterest expense growth of 5.4%

Provision for credit losses lower by $31 million

•

Net charge-offs lower by $131 million

•

Provision lower than NCOs by $50 million vs. $150 million in 3Q11

vs. 2Q12

Net Revenue growth of 2.2%

•

Net

interest

income

growth

of

2.6%;

net

interest

margin

of

3.59%

vs.

3.58%

•

Noninterest income growth of 1.7%

Noninterest expense growth of 0.3%

Provision for credit losses higher by $18 million

•

Net charge-offs higher by $18 million

•

Provision lower than NCOs by $50 million vs. $50 million in 2Q12

|

10

3Q12 Earnings

Conference Call

Capital Position

$ in billions

RWA = risk-weighted assets

3Q12

2Q12

1Q12

4Q11

3Q11

Shareholders' equity

38.7

$

37.8

$

35.9

$

34.0

$

33.2

$

Tier 1 capital

30.8

30.0

30.0

29.2

28.1

Total risk-based capital

37.6

36.4

36.4

36.1

35.4

Tier 1 common equity ratio

9.0%

8.8%

8.7%

8.6%

8.5%

Tier 1 capital ratio

10.9%

10.7%

10.9%

10.8%

10.8%

Total risk-based capital ratio

13.3%

13.0%

13.3%

13.3%

13.5%

Leverage ratio

9.2%

9.1%

9.2%

9.1%

9.0%

Tangible common equity ratio

7.2%

6.9%

6.9%

6.6%

6.6%

Tangible common equity as a % of RWA

8.8%

8.5%

8.3%

8.1%

8.1%

Basel

III

Tier 1 common equity ratio using Basel III

proposals published prior to June 2012

-

-

8.4%

8.2%

8.2%

Tier 1 common equity ratio approximated

using proposed rules for the Basel III

standardized approach released June 2012

8.2%

7.9%

-

-

- |

11

3Q12 Earnings

Conference Call

Mortgage Repurchase

Mortgages Repurchased and Make-whole Payments

Mortgage Representation and Warranties Reserve

$ in millions

3Q12

2Q12

1Q12

4Q11

3Q11

Beginning Reserve

$216

$202

$160

$162

$173

Net Realized Losses

(32)

(31)

(25)

(31)

(31)

Additions to Reserve

36

45

67

29

20

Ending Reserve

$220

$216

$202

$160

$162

Mortgages

repurchased

and make-whole

payments

$58

$58

$55

$61

$57

Repurchase activity lower than

peers due to:

•

Conservative credit and

underwriting culture

•

Disciplined origination process -

primarily conforming

loans

(

95% sold to GSEs)

Do not participate in private

placement securitization market

Outstanding repurchase and

make-whole requests balance

= $118 million

Repurchase requests expected to

remain relatively stable over next

few quarters |

continues

continues

Momentum

Momentum |

13

3Q12 Earnings

Conference Call

Appendix |

14

3Q12 Earnings

Conference Call

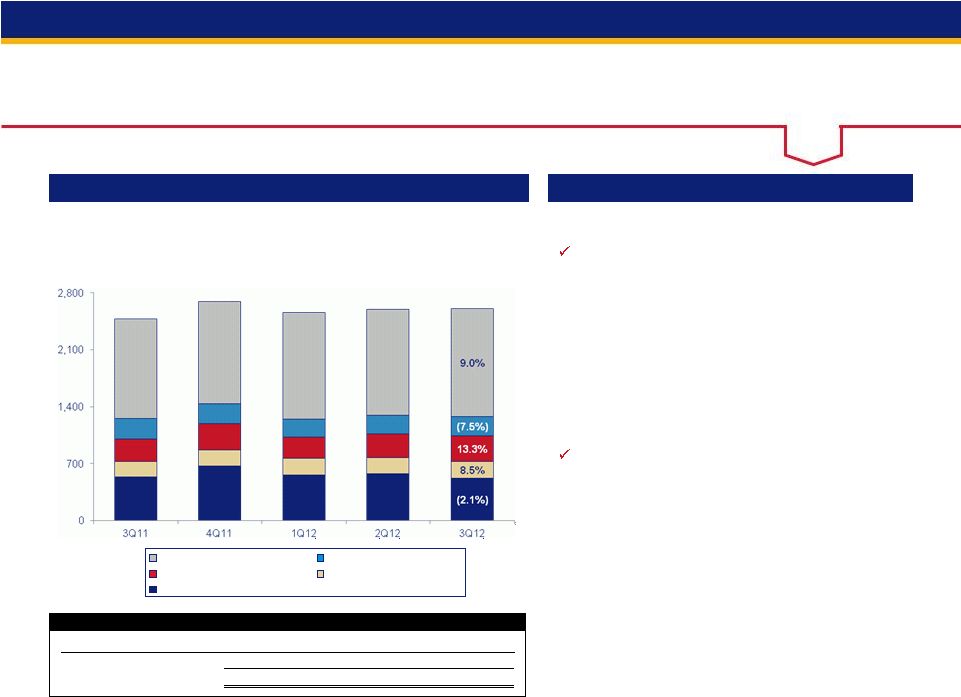

Commercial

CRE

Res Mtg

Credit

Card

Retail

Average Loans

Average Loans

Key Points

$ in billions

vs. 3Q11

Average total loans grew by $14.7 billion, or 7.3%

Average total loans, excluding covered loans,

were higher by 9.6%

Average total commercial loans increased $9.8

billion, or 18.8%; average residential mortgage

loans increased $6.9 billion, or 20.4%

vs. 2Q12

Average total loans grew by $2.8 billion, or 1.3%

(1.6% excluding the impact of a credit card

portfolio sale)

Average total loans, excluding covered loans,

were higher by 2.0%

Average total commercial loans increased $2.2

billion, or 3.6%; average residential mortgage

loans increased $1.8 billion, or 4.6%

Year-Over-Year Growth

5.0%

5.9%

6.4%

7.7%

7.3%

Covered

Commercial

CRE

Res Mtg

Retail

Credit Card

$202.2

$207.0

$210.2

$214.1

$216.9

Covered |

15

3Q12 Earnings

Conference Call

Time

Money

Market

Checking

& Savings

Noninterest

-bearing

Average Deposits

Average Deposits

Key Points

$ in billions

vs. 3Q11

Average total deposits increased by $23.9

billion, or 11.1%

Average low cost deposits (NIB, interest

checking, money market and savings)

increased by $17.3 billion, or 10.1%

vs. 2Q12

Average total deposits increased by $8.0

billion, or 3.5%

Average low cost deposits increased by $4.1

billion, or 2.2%

Year-Over-Year Growth

17.9%

17.3%

11.7%

10.5%

11.1%

Time

Money Market

Checking and Savings

Noninterest-bearing

$215.4

$223.3

$228.3

$231.3

$239.3 |

16

3Q12 Earnings

Conference Call

Net Interest Income

Net Interest Income

Key Points

$ in millions

Taxable-equivalent basis

vs. 3Q11

Average earning assets grew by $22.7 billion, or

7.9%

Net interest margin lower by 6 bp (3.59% vs.

3.65%) driven by:

•

Higher balances in lower yielding investment securities

•

Partially offset by lower rates on deposits and long-

term debt and the classification change of credit card

balance transfer fees from noninterest income to

interest income beginning 1Q12

vs. 2Q12

Average earning assets grew by $5.2 billion, or

1.7%

Net interest margin higher by 1 bp (3.59% vs.

3.58%) driven by:

•

Favorable funding costs, primarily lower rates on

wholesale funds

•

Partially offset by a reduction in the yield on the

investment securities portfolio

Year-Over-Year Growth

5.9%

7.0%

7.3%

6.6%

6.1%

$2,624

$2,673

$2,690

$2,713

$2,783

3.65%

3.60%

3.60%

3.58%

3.59%

2.0%

3.0%

4.0%

5.0%

6.0%

1,000

1,500

2,000

2,500

3,000

3Q11

4Q11

1Q12

2Q12

3Q12

Net Interest Income

Net Interest Margin |

17

3Q12 Earnings

Conference Call

Noninterest Income

Noninterest Income

Key Points

$ in millions

Payments = credit and debit card revenue, corporate payment products revenue and

merchant processing; Service charges = deposit service charges, treasury

management fees and ATM processing services vs. 3Q11

Noninterest income grew by $225 million, or 10.4%,

driven by:

•

Mortgage banking revenue increase of $274 million

•

Trust and investment management fees (10.0% growth)

•

Increase in other income (3.8% growth) due to a credit card

portfolio sale gain, partially offset by an equity-method

investment charge and lower retail lease residual revenue

•

Lower credit and debit card revenue (26.3% decline) due to

the impact of legislative changes and a 1Q12 classification

change, partially offset by higher transaction volumes

•

Lower ATM processing services revenue (24.3% decline)

due to a 1Q12 classification change

vs. 2Q12

Noninterest income grew by $41 million, or 1.7%,

driven by:

•

Mortgage banking revenue increase of $29 million

•

Higher deposit service charges (11.5% increase) and

corporate payment products revenue (5.8% increase) due

to seasonally higher sales volume

•

Partially offset by lower credit and debit card revenue (9.4%

decline) primarily due to a benefit from the final expiration of

debit card customer rewards recognized in 2Q12 and

merchant processing (3.9% decline) due to lower volumes

Year-Over-Year Growth

2.9%

9.4%

11.3%

9.7%

10.4%

All Other

Mortgage

Service Charges

Trust and Inv Mgmt

Payments

3Q11

4Q11

1Q12

2Q12

3Q12

Non-operating gains

-

$

263

$

-

$

-

$

-

$

Total

-

$

263

$

-

$

-

$

-

$

Notable Noninterest Income Items

$2,171

$2,431

$2,239

$2,355

$2,396

Trust and

Inv Mgmt

Service

Charges

All Other

Mortgage

Payments |

18

3Q12 Earnings

Conference Call

Noninterest Expense

Noninterest Expense

Key Points

$ in millions

vs. 3Q11

Noninterest expense was higher by $133 million,

or 5.4%, driven by:

•

Increase in professional services (44.0%) principally due

to mortgage servicing review-related projects

•

Increased compensation (8.6%) and employee

benefits (10.8%)

•

Lower net occupancy and equipment (7.5%) principally

reflecting the change in classification of ATM surcharge

revenue passed through to others

vs. 2Q12

Noninterest expense was higher by $8 million, or

0.3%, driven by:

•

Higher compensation expense (3.1%) and professional

services (5.9%)

•

Higher marketing (20.0%) due to the timing of marketing

campaigns

•

Partially offset by a decrease in other expense (9.4%)

primarily due to the 2Q12 accrual related to

indemnification obligations associated with Visa and

lower FDIC insurance costs, partially offset by higher

costs related to investments in affordable housing and

other tax-advantaged projects

All Other

Tech and Communications

Prof Svcs, Marketing and PPS

Occupancy and Equipment

Compensation and Benefits

3Q11

4Q11

1Q12

2Q12

3Q12

Mortgage servicing matters

-

$

130

$

-

$

-

$

-

$

Total

-

$

130

$

-

$

-

$

-

$

Notable Noninterest Expense Items

Year-Over-Year Growth

3.8%

8.5%

10.6%

7.3%

5.4%

$2,476

$2,696

$2,560

$2,601

$2,609

Occupancy

and Equipment

Prof Services,

Marketing

and PPS

Tech and Comm

Compensation

and Benefits

All Other |

19

3Q12 Earnings

Conference Call

Credit Quality

-

Commercial Loans

Average Loans and Net Charge-offs Ratios

Key Statistics

Comments

Nonperforming loans continue to improve year-over-year and on a linked

quarter basis Net charge-offs and delinquencies were relatively stable

and remain at levels below last year Strong new lending activity of both

loans and commitments resulted in 4% linked quarter loan growth and 22%

growth year-over-year

Utilization rates remain historically low

3Q11

2Q12

3Q12

Average Loans

$46,484

$54,362

$56,655

30-89 Delinquencies

0.34%

0.26%

0.29%

90+ Delinquencies

0.09%

0.07%

0.07%

Nonperforming Loans

0.71%

0.31%

0.23%

$ in millions |

20

3Q12 Earnings

Conference Call

Credit Quality

-

Commercial Leases

Average Loans and Net Charge-offs Ratios

Key Statistics

Comments

Net charge-offs improved linked quarter and year-over-year

Nonperforming loans declined on a linked quarter and year-over-year

basis 3Q11

2Q12

3Q12

Average Loans

$5,860

$5,658

$5,537

30-89 Delinquencies

0.93%

0.83%

0.93%

90+ Delinquencies

0.02%

0.00%

0.02%

Nonperforming Loans

0.68%

0.40%

0.35%

$ in millions

$5,860

$5,834

$5,822

$5,658

$5,537

0.61%

1.43%

0.55%

1.07%

0.50%

0.0%

1.5%

3.0%

4.5%

6.0%

0

2,000

4,000

6,000

8,000

3Q11

4Q11

1Q12

2Q12

3Q12

Average Loans

Net Charge

-

offs Ratio

Small Ticket

$3,260

Equipment

Finance

$2,277

Commercial Leases |

21

3Q12 Earnings

Conference Call

Credit Quality

-

Commercial Real Estate

Average Loans and Net Charge-offs Ratios

Key Statistics

Comments

Average loans increased $1.1B, or 3.0%, on a year-over-year basis

Net charge-off ratio of 0.27%, down from 0.58% on a linked quarter basis and

from the 2Q10 peak of 2.67% The linked quarter decline was driven by a 57%

reduction in net charge-offs in the mortgage portfolio Delinquencies

continue to decline on a linked quarter and year-over-year basis

3Q11

2Q12

3Q12

Average Loans

$35,569

$36,549

$36,630

30-89 Delinquencies

0.44%

0.24%

0.18%

90+ Delinquencies

0.08%

0.03%

0.03%

Nonperforming Loans

3.43%

1.89%

1.71%

Performing TDRs*

459

596

583

$ in millions

* TDR = troubled debt restructuring, new accounting guidance adopted 3Q11 (FASB

Accounting Standards Update No. 2011-02) Investor

$19,400

Owner

Occupied

$11,286

Multi-family

$1,812

Retail

$599

Residential

Construction

$976

Condo

Construction

$168

A&D

Construction

$751

Office

$742

Other

$896

CRE Mortgage

CRE Construction |

22

3Q12 Earnings

Conference Call

Credit Quality

-

Residential Mortgage

Average Loans and Net Charge-offs Ratios

Key Statistics

Comments

Strong growth in high quality originations (weighted average FICO 763, weighted

average LTV 67%) as average loans increased 4.6% over 2Q12, driven by demand

for refinancing Increase in net charge-offs ($22 million), nonperforming

loans ($85 million) and performing TDRs ($129 million) primarily due to a

regulatory clarification in the treatment of loans to borrowers who have exited bankruptcy but

continue to make payments on their loans

3Q11

2Q12

3Q12

Average Loans

$34,026

$39,166

$40,969

30-89 Delinquencies

1.09%

0.86%

0.93%

90+ Delinquencies

1.03%

0.80%

0.72%

Nonperforming Loans

1.85%

1.65%

1.81%

$ in millions

** Excludes GNMA loans, whose repayments are insured by the FHA or guaranteed by

the Department of VA ($1,631 million 3Q12) $34,026

$36,256

$37,831

$39,166

$40,969

1.42%

1.30%

1.19%

1.12%

1.17%

%*

0.0%

1.5%

3.0%

4.5%

6.0%

0

12,000

24,000

36,000

48,000

3Q11

4Q11

1Q12

2Q12

3Q12

Average Loans

Adjusted NCO Ratio

0.96

$1,938

$2,002

$2,017

$2,011

$2,076

0

1,000

2,000

3,000

4,000

3Q11

4Q11

1Q12

2Q12

3Q12

Residential Mortgage Performing TDRs**

Net

Charge-offs

Ratio

* Excluding $22 million related to a regulatory clarification in the treatment of loans to borrowers

who have exited bankruptcy but continue to make payments on their loans |

23

3Q12 Earnings

Conference Call

3Q11

2Q12

3Q12

Average Loans

$16,057

$16,696

$16,551

30-89 Delinquencies

1.38%

1.20%

1.41%

90+ Delinquencies

1.28%

1.17%

1.18%

Nonperforming Loans

1.53%

1.12%

0.99%

Credit Quality -

Credit Card

Average Loans and Net Charge-offs Ratios

Key Statistics

Comments

Net charge-offs continue to remain low

Average loans are down slightly, however during 3Q12, the Company sold a branded

consumer and business credit card portfolio

Early stage delinquencies increased primarily due to seasonal patterns

$ in millions

* Excluding portfolio purchases where the acquired loans were recorded at fair

value at the purchase date Average Loans

Net Charge-offs Ratio

Net Charge-offs Ratio Excluding Acquired Portfolios*

$16,057

$16,271

$16,778

$16,696

$16,551

4.40%

4.71%

4.05%

4.10%

4.01%

4.54%

4.88%

4.21%

4.25%

4.17%

0.0%

3.0%

6.0%

9.0%

12.0%

0

5,000

10,000

15,000

20,000

3Q11

4Q11

1Q12

2Q12

3Q12

Core

Portfolio

$15,936

Portfolios

Acquired at

Fair Value

$615

Credit Card |

24

3Q12 Earnings

Conference Call

Credit Quality -

Home Equity

Average Loans and Net Charge-offs Ratios

Key Statistics

Comments

High-quality originations (weighted average FICO 771, weighted average CLTV

70%) originated primarily through the retail branch network to existing bank

customers on their primary residence Increase in net charge-offs ($26

million) and nonperforming loans ($13 million) primarily due to a regulatory

clarification in the treatment of loans to borrowers who have exited bankruptcy but

continue to make payments on their

loans 3Q11

2Q12

3Q12

Average Loans

$18,510

$17,598

$17,329

30-89 Delinquencies

0.83%

0.71%

0.81%

90+ Delinquencies

0.67%

0.30%

0.32%

Nonperforming Loans

0.19%

0.91%

1.05%

Consumer Finance: 13%

Wtd Avg LTV**: 82%

NCO: 5.48%

$ in millions

Traditional: 87%

Wtd Avg LTV**: 71%

NCO: 1.53%

** LTV at origination

* Excluding $26 million related to a regulatory clarification in the treatment of loans to borrowers

who have exited bankruptcy but continue to make payments on their loans |

25

3Q12 Earnings

Conference Call

Credit Quality -

Retail Leasing

Average Loans and Net Charge-offs Ratios

Key Statistics

Comments

High-quality originations (weighted average FICO 772)

Retail leasing delinquencies have stabilized at very low levels

Strong used auto values continued to contribute to historically low net

charge-offs 3Q11

2Q12

3Q12

Average Loans

$5,097

$5,151

$5,256

30-89 Delinquencies

0.19%

0.13%

0.17%

90+ Delinquencies

0.02%

0.00%

0.02%

Nonperforming Loans

0.00%

0.00%

0.02%

$ in millions

* Manheim Used Vehicle Value Index source: www.manheimconsulting.com, January 1995 = 100,

quarter value = average monthly ending value |

26

3Q12 Earnings

Conference Call

Credit Quality -

Other Retail

Average Loans and Net Charge-offs Ratios

Key Statistics

Comments

Average balances grew modestly during the quarter as auto loan demand remained

strong Increase in net charge-offs ($5 million) and nonperforming loans

($10 million) primarily due to a regulatory clarification in the treatment

of loans to borrowers who have exited bankruptcy but continue to make

payments on their loans 3Q11

2Q12

3Q12

Average Loans

$24,773

$25,151

$25,406

30-89 Delinquencies

0.67%

0.51%

0.59%

90+ Delinquencies

0.20%

0.16%

0.16%

Nonperforming Loans

0.12%

0.09%

0.12%

Installment

$5,480

Auto Loans

$12,211

Revolving

Credit

$3,322

Student

Lending

$4,393

$ in millions

* Excluding $5 million related to a regulatory clarification in the treatment of

loans to borrowers who have exited bankruptcy but continue to make payments on their loans

$24,773

$24,901

$24,902

$25,151

$25,406

1.11%

1.19%

0.92%

0.86%

1.06%

0.98

0.0%

1.5%

3.0%

4.5%

6.0%

0

7,000

14,000

21,000

28,000

3Q11

4Q11

1Q12

2Q12

3Q12

Average Loans

Net Charge-offs Ratio

Adjusted NCO Ratio

Other Retail |

27

3Q12 Earnings

Conference Call

Non-GAAP Financial Measures

$ in millions

3Q12

2Q12

1Q12

4Q11

3Q11

Total equity

39,825

$

38,874

$

36,914

$

34,971

$

34,210

$

Preferred stock

(4,769)

(4,769)

(3,694)

(2,606)

(2,606)

Noncontrolling interests

(1,164)

(1,082)

(1,014)

(993)

(980)

Goodwill (net of deferred tax liability)

(8,194)

(8,205)

(8,233)

(8,239)

(8,265)

Intangible assets (exclude mortgage servicing rights)

(980)

(1,118)

(1,182)

(1,217)

(1,209)

Tangible common equity (a)

24,718

23,700

22,791

21,916

21,150

Tier 1 Capital, determined in accordance with prescribed regulatory requirements using Basel I

definition 30,766

30,044

29,976

29,173

28,081

Trust preferred securities

-

-

(1,800)

(2,675)

(2,675)

Preferred stock

(4,769)

(4,769)

(3,694)

(2,606)

(2,606)

Noncontrolling interests, less preferred stock not eligible for Tier I capital

(685)

(685)

(686)

(687)

(695)

Tier 1 common equity using Basel I definition (b)

25,312

24,590

23,796

23,205

22,105

Tier 1 capital, determined in accordance with prescribed regulatory requirements using Basel III

proposals published prior to June 2012

27,578

25,636

24,902

Preferred stock

(3,694)

(2,606)

(2,606)

Noncontrolling interests of real estate investment trusts

(659)

(664)

(667)

Tier 1 common equity using Basel III proposals published prior to June 2012 (c)

23,225

22,366

21,629

Tier 1 capital, determined in accordance with prescribed regulatory requirements approximated

using proposed rules for the Basel III standardized approach released June 2012

29,644

28,622

Preferred Stock

(4,769)

(4,769)

Tier 1 common equity approximated using proposed rules for the Basel III standardized approach

released June 2012 (d)

24,875

23,853

Total assets

352,253

353,136

340,762

340,122

330,141

Goodwill (net of deferred tax liability)

(8,194)

(8,205)

(8,233)

(8,239)

(8,265)

Intangible assets (exclude mortgage servicing rights)

(980)

(1,118)

(1,182)

(1,217)

(1,209)

Tangible assets (e)

343,079

343,813

331,347

330,666

320,667

Risk-weighted assets, determined in accordance with prescribed regulatory requirements using Basel

I definition (f) 282,033

279,972

274,847

271,333

261,115

Risk-weighted assets using Basel III proposals published prior to June 2012 (g)

277,856

274,351

264,103

Risk-weighted assets approximated using proposed rules for the Basel III standarized approach

released June 2012 (h) 304,200

303,212

Tangible common equity to tangible assets (a)/(e)

7.2%

6.9%

6.9%

6.6%

6.6%

Tangible common equity to risk-weighted assets using Basel I definition (a)/(f)

8.8%

8.5%

8.3%

8.1%

8.1%

Tier 1 common equity to risk-weighted assets using Basel I definition (b)/(f)

9.0%

8.8%

8.7%

8.6%

8.5%

Tier 1 common equity to risk-weighted assets using Basel III proposals published prior to June 2012

(c)/(g) -

-

8.4%

8.2%

8.2%

Tier 1 common equity to risk-weighted assets approximated using proposed rules for the Basel III

standardized approach released June 2012 (d)/(h)

8.2%

7.9%

-

-

-

3Q12

risk-weighted

assets

are

preliminary

data,

subject

to

change

prior

to

filings

with

applicable

regulatory

agencies

Ratios |

U.S.

Bancorp 3Q12 Earnings

Conference Call

U.S. Bancorp

3Q12 Earnings

Conference Call

October 17, 2012 |