Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Triangle Petroleum Corp | v325694_8k.htm |

CORPORATE PRESENTATION October 2012

FORWARD LOOKING STATEMENT Certain statements in this presentation regarding strategic plans, expectations and objectives for future operations or results are "forward - looking statements" as defined by the Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward - looking statements. These forward - looking statements are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from the results contemplated by the forward - looking statements, including the risks discussed in the Company's annual report on Form 10 - K for the fiscal year ended January 31, 2012 and the Company's other filings with the Securities and Exchange Commission. Factors that could cause differences include, but are not limited to , history of losses; speculative nature of oil and natural gas exploration, particularly in the Bakken Shale and Three Forks formations on which the Company is focused; substantial capital requirements and ability to access additional capital; ability to meet the drilling schedule ; timing of operations; changes in tax regulations applicable to the oil and natural gas industry; results of acquisitions; relationships with partners and service providers ; funding commitments and intentions of our partners; ability to acquire additional leasehold interests or other oil and natural gas properties; defects in title to the Company's oil and natural gas interests; ability to manage growth in the Company's businesses , including the business of RockPile Energy Services, LLC and Caliber Midstream Partners, LP ; ability to obtain third party work for our subsidiaries; ability to control properties that the Company does not operate; lack of diversification; competition in the oil and natural gas industry; global financial conditions; oil and natural gas realized prices; ability to market and distribute oil and natural gas produced ; ability to obtain rights - of - way and other easements for infrastructure development; seasonal weather conditions; government regulation of the oil and natural gas industry, including potential regulations affecting hydraulic fracturing and environmental regulations such as climate change regulations; aboriginal claims; uninsured or underinsured risks; and material weakness in internal accounting controls. The forward - looking statements in this presentation are made as of the date of this presentation, even if subsequently made available by the Company on its website or otherwise . The Company does not undertake any obligation to update the forward - looking statements as a result of new information, future events or otherwise .

T ABLE OF C ONTENTS Triangle Highlights Operated Program Vertical Integration Financial Overview Investment Highlights 4 9 12 16 20

TRIANGLE HIGHLIGHTS

P URE - P LAY W ILLISTON B ASIN O PERATOR ~86,000 net acres, ~60% operated Single basin strategy ~85% oil weighted I NTEGRATED AND E FFICIENT D EVELOPMENT M ODEL Core strategy to increase returns through ownership of value chain, thus improving implied cost structure Vertical integration into Oilfield Services and Midstream M ulti - well pad drilling + zipper - frac’ing , improving costs, completion time G ROWING R ESOURCE B ASE Over 180 operated drilling locations in the core area of the play Potential for down - spacing in the Bakken and deeper benches of the Three Forks Continued operated acreage leasing program E XPERIENCED O PERATIONS T EAM Unconventional resource play development experience Capable of operating a larger asset base and drilling program Team assembled from leading independent oil companies S TRONG F INANCIAL P OSITION $116mm cash on the balance sheet (period end Q2 FY’13) $ 52mm undrawn revolver (10/13), initiated hedging program Top - tier private equity partners T RIANGLE H IGHLIGHTS TRIANGLE PETROLEUM – COMPANY OVERVIEW 5

76 74 450 616 696 1,120 750 2,600 1,500 3,200 0 500 1,000 1,500 2,000 2,500 3,000 3,500 Q1 FY'12 Q2 FY'12 Q3 FY'12 Q4 FY'12 Q1 FY'13 Q2 FY'13 Q3 FY'13 Q4 FY'13 T RIANGLE H IGHLIGHTS PRODUCTION AND DRILLING INVENTORY 6 FY’13 exit rate guidance of 2,600 – 3,200 Boepd represents approximately 5x annual growth 180 operated drilling locations in C ore A rea, providing 9 years of inventory Additional potential locations from Bakken downspacing and deeper benches of the Three Forks Station Prospect could potentially add approximately 350 locations to operated inventory A VERAGE D AILY P RODUCTION ( B OEPD ) Actual Production Guidance Low Case Guidance High Case ▪ Funded RockPile in September 2012 ▪ Spud first operated well in October 2012 Funded Caliber in September 2012 S UBSTANTIAL P RODUCTION G ROWTH FROM O PERATED P ROGRAM D RILLING I NVENTORY ▪ Completed first operated well in May 2012 ▪ RockPile completed first Triangle - operated well in July 2012 Second rig came online in April 2012 120 60 Bakken 4 Locations per DSU Three Forks 2 Locations per DSU

T RIANGLE H IGHLIGHTS ACREAGE POSITION 7 Source: Triangle Petroleum Corporation and North Dakota Industrial Commission, 2012. (1) Operated assumes 30% or greater working interest. (2) Based on 4 Bakken/2Three Forks wells per unit. (3) Station Prospect is an exploratory area. D ETAILS M C K ENZIE C OUNTY W ILLIAMS C OUNTY /S TATE L INE S TATION P ROSPECT (3) N ET A CREAGE ~21,000 ~15,000 ~50,000 P ERCENT O PERATED (%) (1) 50% 67% 75% B AKKEN D RILLING L OCATIONS (2) 64 56 232 T HREE F ORKS D RILLING L OCATIONS (2) 32 28 116 Core Operating Area Nesson Anticline

OPERATED PROGRAM

O PERATED P ROGRAM MCKENZIE COUNTY – CORE AREA 9 Source: Triangle Petroleum Corporation and North Dakota Industrial Commission, 2012. 16 D ETAILS 21,000 net acres; 50% operated Completion : Plug and perf , 100% ceramic Drilling Inventory : 96 operated locations Currently operating 3 drilling rigs 44 permits approved or submitted K EY H IGHLIGHTS 7 gross operated wells producing and 2 gross operated wells waiting on completion Recently completed first Three Forks well McKenzie AFEsMin $8.7 Max $11.2 Average $9.8

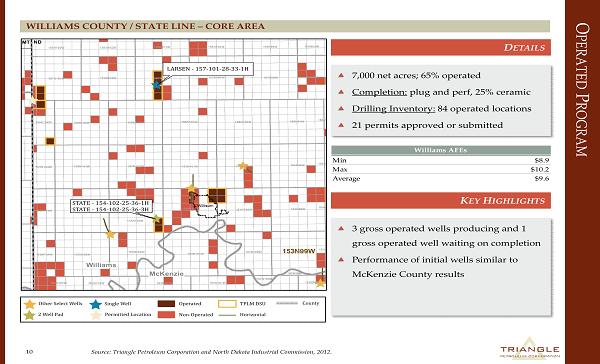

O PERATED P ROGRAM WILLIAMS COUNTY / STATE LINE – CORE AREA 10 Source: Triangle Petroleum Corporation and North Dakota Industrial Commission, 2012. 16 D ETAILS 7,000 net acres; 65% operated Completion : plug and perf , 25% ceramic Drilling Inventory : 84 operated locations 21 permits approved or submitted K EY H IGHLIGHTS 3 gross operated wells producing and 1 gross operated well waiting on completion Performance of initial wells similar to McKenzie County results Williams AFEs Min $8.9 Max $10.2 Average $9.6

O PERATED P ROGRAM MONTANA – STATION PROSPECT 11 Source: Triangle Petroleum Corporation and North Dakota Industrial Commission, 2012. 16 D ETAILS 50,000 net acres; 75% operated Potential Drilling Inventory : 350 operated locations K EY H IGHLIGHTS Industry activity continues to escalate in offsetting townships Exploration programs by Apache and Southwestern Energy Long - term leasehold allows a “wait - and - see” approach Asset provides substantial exploration upside

VERTICAL INTEGRATION

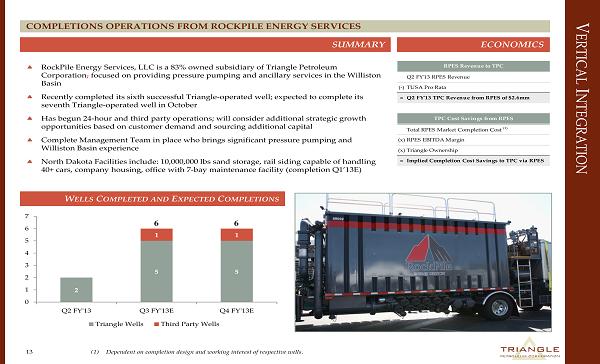

V ERTICAL I NTEGRATION 13 COMPLETIONS OPERATIONS FROM ROCKPILE ENERGY SERVICES RockPile Energy Services, LLC is a 83% owned subsidiary of Triangle Petroleum Corporation , focused on providing pressure pumping and ancillary services in the Williston Basin Recently completed its sixth successful Triangle - operated well; expected to complete its seventh Triangle - operated well in October Has begun 24 - hour and third party operations; will consider additional strategic growth opportunities based on customer demand and sourcing additional capital Complete Management Team in place who brings significant pressure pumping and Williston Basin experience North Dakota Facilities include: 10,000,000 lbs sand storage, rail siding capable of handling 40+ cars, company housing, office with 7 - bay maintenance facility (completion Q1’13E ) SUMMARY ECONOMICS W ELLS C OMPLETED AND E XPECTED C OMPLETIONS 2 5 5 1 1 0 1 2 3 4 5 6 7 Q2 FY'13 Q3 FY'13E Q4 FY'13E Triangle Wells Third Party Wells 6 6 (1) Dependent on completion design and working interest of respective wells. RPES Revenue to TPC Q2 FY'13 RPES Revenue (-)TUSA Pro Rata = Q2 FY'13 TPC Revenue from RPES of $2.6mm TPC Cost Savings from RPES Total RPES Market Completion Cost (1) (x)RPES EBITDA Margin (x)Triangle Ownership = Implied Completion Cost Savings to TPC via RPES

V ERTICAL I NTEGRATION 14 TRIANGLE INFRASTRUCTURE VIA CALIBER MIDSTREAM Source: Triangle Petroleum Corporation and North Dakota Industrial Commission, 2012. ▪ M ULTIPLE OPTIONS FOR OIL , INCLUDING PIPE AND RAIL ▪ G AS GOES TO M IDWEST M ARKETS , INCLUDING C HICAGO M ULTIPLE D ELIVERY AND R ECEIPT P OINTS F OCUS A REA T IMING D ISCOUNT TO T RIANGLE S TRATEGIC O BJECTIVE Get pipe into the ground and trucks off pads Be able to offer Triangle and other Bakken players gathering & processing capabilities at market or better rates Producers will recognize operational efficiencies and cost savings Producers will recognize earlier gas and NGL monetization Centralized oil gathering with varying options for delivery points Dry gas under negotiation (Northern Border Pipeline and vicinity) Produced water is disposed of in Caliber - owned saltwater disposal wells Freshwater purchased by Triangle is delivered to the wellhead from the Western Area Water Supply Pipeline The majority of Triangle’s McKenzie County acreage Operations expected to begin in November 2012 , with an in - service date by August 2013 Caliber Cost % of Trucking Cost Min Max Trucking Oil 15.0% 37.5% Trucking SWD 71.6% 88.8% Trucking Freshwater 62.7% 69.0%

On October 1, 2012, Triangle announced the formation of Caliber Midstream Partners, LP (“Caliber”), a joint venture with First Reserve Corporation’s Energy Infrastructure Fund (“FREIF”). First Reserve Corporation is a Greenwich - based private equity and infrastructure investment firm V ERTICAL I NTEGRATION 15 CALIBER TRANSACTION SUMMARY OVERVIEW T RIANGLE FREIF C APITAL I NVESTMENT Triangle agreed to contribute to Caliber $30mm in cash less capital expended to date FREIF agreed to contribute to Caliber $ 70mm in cash FREIF has indicated that it intends to contribute an additional $80 million O WNERSHIP 3,000,000 limited partner Class A Units of Caliber (“Class A Units”); right of first refusal to contribute additional capital 500 Units of the General Partner (“LLC Units”), which owns and controls Caliber 7,000,000 Class A Units; once FREIF has contributed $150mm, it will hold 15,000,000 Class A Units 500 LLC Units T RIGGER U NITS Triangle will receive 4,000,000 of Class A Trigger Units that vest subject to certain business performance metrics W ARRANTS Triangle owns 4,000,000 Class A Warrants Series 1 with a unit price of $10.00 and an exercise price of $14.69 Triangle owns 2,400,00 Class A Warrants Series 2 with an exercise price of $24.00 and feature the same provisions as the Class A Warrants Series 1 1,600,000 Class A Trigger Warrants with an exercise price of $14.69 will be granted to Triangle in conjunction with the granting of Class A Trigger Units T RIANGLE U PSIDE Subject to business performance, Triangle shareholders can own up to 15,000,000 Class A Units, giving it a total ownership stake of 50% with no required capital contributions beyond the initial $30mm No impact to Triangle budget for FY2013

FINANCIAL OVERVIEW

F INANCIAL O VERVIEW 17 Note: Dollars in U.S. millions, except per share data. CURRENT POSITION C URRENT P OSITION L IQUIDITY P ROFILE F ULLY D ILUTED O WNERSHIP Heavily aligned Officers and Directors Share Price (as of October 12, 2012) $7.30 90-day % Change 38.4% Shares Outstanding 44.3 Market Capitalization $323.1 Total Debt $120.0 Total Cash (period ended Q2 FY '13) $116.4 Total Enterprise Value $326.8 Total Acreage 86,000 TEV / Acres $3,800 Current Commitments: - RockPile contractural obligations - Caliber contractual obligations - Two full-time rigs (Extreme and Precision) 5.1% 94.9% Officers & Directors Public Total Cash (period ended Q2 FY'13) $ 116 .4 Revolver Availability (as of October 15, 2012) $52.5 Total Liquidity $168.9

0 500 1,000 1,500 2,000 2,500 3,000 3,500 Q1'13E Q2'13E Q3'13E Q4'13E F INANCIAL O VERVIEW 18 FY’13 CAPITAL BUDGET AND PRODUCTION FORECAST Note: Budget Detail and Budget Allocation based on Management estimates and assumptions as of August 1, 2012. Production Fore cas t based on Management estimates and assumptions as of February 1, 2012. All forward looking information subject to a number of assumptions and uncertainties. They are not a guarantee of future performance. B UDGET D ETAIL B UDGET A LLOCATION P RODUCTION F ORECAST 60% 9% 16% 15% 2-Rig Operated Drilling Program Non-Operated Drilling Program Land Spend Infrastructure Exit Rate ~2,600 – ~3,200 Boe/d April 2012 July 2012 October 2012 January 2013 Capital Expenses Capex Budget ($mm) 2-Rig Operated Drilling Program $98.0 Non-Operated Drilling Program $15.0 Land Spend $25.0 Infrastructure $25.0 Total $163.0

F INANCIAL O VERVIEW 19 RISK MANAGEMENT T RIANGLE S TANDARD H EDGING P ROGRAM Expected to grow as PDP reserves and production grows; quarterly redeterminations Growing production outpaces lagging hedges T RIANGLE - C ALIBER P UT H EDGING P ROGRAM Caliber volume commitment liability greatest in early development years Growing production decreases the decreasing liability Hedge Expiry Date Approx. Days Remain Volume StrikeOutright bullet puts 6/17/2013 250 400,000 $75.00 Outright bullet puts 12/16/2013 431 500,000 $75.00 Total: 900,000 Hedge Period Volume (Bopd) Days Total Volumes Floor Avg. CeilingCalendar-month-average swap zero cost Sep-Dec12 1,000 122 122,000 $87.00 $103.70 Calendar-month-average swap zero cost Cal13 500 365 182,500 $85.00 $104.30 Calendar-month-average swap zero cost Cal14 500 365 182,500 $80.00 $101.20 Total 487,000

INVESTMENT HIGHLIGHTS

I NVESTMENT H IGHLIGHTS TRIANGLE PETROLEUM – INVESTMENT HIGHLIGHTS 21 Single - basin strategy with a scalable position Balanced portfolio of low - risk development opportunities and exploration upside Vertical integration facilitating low - cost strategy Experienced operations team assembled from leading independent oil companies Strong balance sheet and risk management program Substantial production and reserve growth in the near - term