Attached files

As filed with the Securities and Exchange Commission on October 16, 2012

Registration No. __________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Coil Tubing Technology, Inc.

(Name of registrant in its charter)

|

Nevada

|

3533

|

76-0625217

|

|

(State or jurisdiction

of incorporation or organization)

|

(Primary Standard

Industrial Classification Code Number)

|

(IRS Employer Identification

No.)

|

19511 Wied Rd. Suite E

Spring, Texas 77388

281-651-0200

(Address and telephone number of principal executive offices and principal place

of business or intended principal place of business)

Jason Swinford, Chief Executive Officer

19511 Wied Rd. Suite E

Spring, Texas 77388

281-651-0200

(Name, address and telephone number of agent for service)

Copies to:

|

David M. Loev

|

John S. Gillies

|

|

|

The Loev Law Firm, PC

|

The Loev Law Firm, PC

|

|

|

6300 West Loop South, Suite 280

|

&

|

6300 West Loop South, Suite 280

|

|

Bellaire, Texas 77401

|

Bellaire, Texas 77401

|

|

|

Phone: (713) 524-4110

|

Phone: (713) 524-4110

|

|

|

Fax: (713) 524-4122

|

Fax: (713) 456-7908

|

Approximate date of proposed sale to the public:

as soon as practicable after the effective date of this Registration Statement.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of earlier effective Registration Statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities To be Registered

|

Amount Being

Registered (1)

|

Proposed Maximum Price Per Share(2)

|

Proposed Maximum Aggregate Price(1)

|

Amount of Registration Fee

|

|

Common Stock,

par value $0.001

per share

|

887,501 (3)

|

$2.30

|

$2,041,252

|

$278.43

|

|

Total

|

887,501 (3)

|

$2.30

|

$2,041,252

|

$278.43

|

(1) In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended and based on the average of the high and low sales prices of our common stock reported on the OTC Pink Market on October 15, 2012, the last day that the Company’s common stock traded on the OTC Pink Market prior to the date of this filing. This amount has been calculated only for purposes of determining the registration fee, the actual amount received by the Selling Stockholders will be based upon fluctuating market prices on the OTC Pink Market or in the event our securities are quoted on the Over-The-Counter Bulletin Board (“OTCBB”) in the future, as it is our intention, on the OTCBB.

(3) Includes 562,501 shares of outstanding common stock; 220,000 shares of common stock issuable upon exercise of warrants to purchase 220,000 shares of common stock of the Company which expire on August 28, 2013, with an exercise price of $1.00 per share; and 105,000 shares of common stock issuable upon exercise of warrants to purchase 105,000 shares of common stock of the Company with a term expiring on January 5, 2017 and an exercise price of $1.00 per share, which are being offered by the Selling Stockholders described in the Prospectus below.

The Registrant hereby amends its Registration Statement, on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 16, 2012

PROSPECTUS

Relating to the Resale of 887,501 Shares of Common Stock

The Selling Stockholders named in this Prospectus are offering 887,501 shares of common stock offered through this Prospectus for their own account, which includes 562,501 shares of outstanding common stock; 220,000 shares of common stock issuable upon exercise of warrants to purchase 220,000 shares of common stock of the Company which expire on August 28, 2013, with an exercise price of $1.00 per share; and 105,000 shares of common stock issuable upon exercise of warrants to purchase 105,000 shares of common stock of the Company with a term expiring on January 5, 2017 and an exercise price of $1.00 per share.

We will not receive any proceeds from this Offering (provided that we may receive up to $325,000 in connection with the exercise of the warrants, which shares of common stock issuable upon exercise thereof are being registered herein) and have not made any arrangements for the sale of these securities.

Our common stock is presently traded on the OTC Pink Sheet market under the symbol “CTBG”; however, our securities are currently highly illiquid, and subject to large swings in trading price, and are only traded on a sporadic and limited basis. The Selling Stockholders will sell at prevailing market prices or privately negotiated prices on the OTC Pink Sheet Market, or on the OTC Bulletin Board, where we hope to quote our shares subsequent to this filing.

A current Prospectus must be in effect at the time of the sale of the shares of common stock discussed above. The Selling Stockholders will be responsible for any commissions or discounts due to brokers or dealers. We will pay all of the other Offering expenses.

Each Selling Stockholder or dealer selling the common stock is required to deliver a current Prospectus upon the sale. In addition, for the purposes of the Securities Act of 1933, as amended, the Selling Stockholders may be deemed to be underwriters.

Our common stock will be considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under the Securities Exchange Act of 1934, as amended. “Penny stock” is generally defined as any equity security not traded on an exchange or quoted on NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser's consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection with any trades involving a stock defined as a penny stock.

The required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions on transferring "penny stocks" and as a result, investors in the common stock may have their ability to sell their shares of the common stock impaired.

The purchase of the securities offered through this Prospectus involves a high degree of risk. See the section entitled “Risk Factors” starting on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this Prospectus. Any representation to the contrary is a criminal offense.

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. The Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

THE DATE OF THIS PROSPECTUS IS ________________ , 2012

TABLE OF CONTENTS

|

Page

|

|

|

Prospectus Summary

|

1 |

|

Summary of the Offering

|

6 |

|

Summary Financial Data

|

8 |

|

Forward-Looking Statements

|

11 |

|

Risk Factors

|

12 |

|

Use of Proceeds

|

28 |

|

Legal Proceedings

|

28 |

|

Directors, Executive Officers and Corporate Governance

|

28 |

|

Executive and Director Compensation

|

35 |

|

Security Ownership Of Certain Beneficial Owners And Management

|

39 |

|

Interest of Named Experts and Counsel

|

40 |

|

Experts

|

40 |

|

Indemnification of Directors and Officers

|

41 |

|

Description of Business

|

42 |

|

Description of Property

|

57 |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

58 |

|

Certain Relationships and Related Transactions

|

69 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

73 |

|

Descriptions of Capital Stock

|

74 |

|

Market for Common Equity and Related Stockholder Matters

|

76 |

|

Selling Stockholders

|

77 |

|

Shares Available For Future Sale

|

78 |

|

Plan of Distribution

|

79 |

|

Where You Can Find More Information

|

82 |

|

Legal Matters

|

82 |

|

Financial Statements

|

F-1 |

You should rely only on the information contained in this Prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. No offers are being made hereby in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this Prospectus is accurate only as of the date on the cover. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless otherwise indicated, information contained in this Prospectus concerning our industry, including our market opportunity, is based on information from independent industry analysts, third-party sources and management estimates. Management estimates are derived from publicly-available information released by independent industry analysts and third party sources, as well as data from our internal research, and are based on assumptions made by us using data and our knowledge of such industry and market, which we believe to be reasonable. In addition, while we believe the market opportunity information included in this Prospectus is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the heading “Risk Factors.”

For investors outside the United States: we have not taken any action to permit a public offering of the shares of our common stock or the possession or distribution of this Prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to this Offering and the distribution of this Prospectus.

PROSPECTUS SUMMARY

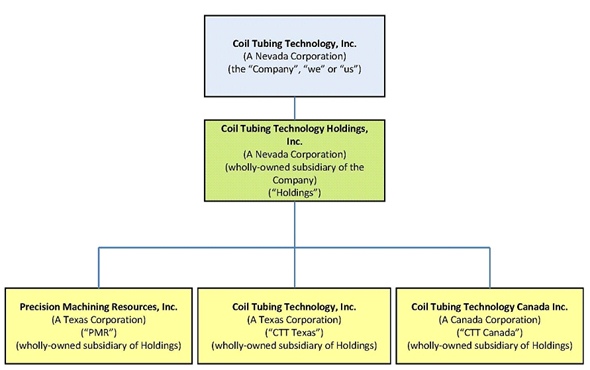

The following summary highlights material information found in more detail elsewhere in the Prospectus. It does not contain all of the information you should consider. As such, before you decide to buy our common stock, in addition to the following summary, we urge you to carefully read the entire Prospectus, especially the risks of investing in our common stock as discussed under "Risk Factors." The Company currently has one wholly-owned subsidiary; Coil Tubing Technology Holdings, Inc., a Nevada corporation, which in turn has three wholly-owned subsidiaries, Precision Machining Resources, Inc. (“PMR”) and Coil Tubing Technology, Inc. (“CTT Texas”), both Texas corporations and Coil Tubing Technology Canada Inc., an Alberta, Canada corporation (“CTT Canada”). In this Prospectus, the terms "we," "us," "our," “Coil Tubing” and "Company," refer to Coil Tubing Technology, Inc., a Nevada corporation and its subsidiaries. "Common Stock" refers to the common stock, par value $0.001 per share, of Coil Tubing Technology, Inc.

Our Company

We specialize in the design and production of proprietary tools for the coil tubing industry. We concentrate on three categories of coil tubing applications: tubing fishing, tubing work over and coil tubing drilling, which categories of applications are described in greater detail below. We currently outsource 95% of our tools and components to be manufactured by outside manufacturers and purchase the remaining 5% of our products off the shelf.

Coiled tubing refers to using a long, thin, continuous string of hollow pipe that is mounted on a truck to workover oil and gas wells. Crews lower this tubing into the well under the careful control of an operator and once in place this pipe allows the usage of specialized tools, and the pumping of fluids such as nitrogen into the well. The tool string at the bottom of the coil is often called the bottom hole assembly (“BHA”). The BHA can range from something as simple as a jetting nozzle, for jobs involving pumping chemicals or cement through the coil, to a larger string of logging tools, depending on the operations. Coiled tubing is used for a wide range of oil field services, including but not limited to drilling, logging, fracturing, cementing, fishing, completion and production.

We focus on the development, marketing and rental of advanced tools and related technical solutions for use with coil tubing and jointed pipe in the BHA for the exploration and production of hydrocarbons (“E&P”). Although various companies in the E&P services industry have realized the importance of coiled tubing, we have focused entirely on the development of dedicated, patented, proprietary downhole tools and related marketing strategies.

The Market for Coiled Tubing

We believe that the United States domestic market and Canada, which we are actively trying to expand our presence in, is by far the largest and the most competitive market for coil tubing technology, due to the older age of wells and the difficulty in keeping them profitable. Moreover, the United States is considered to be the breeding ground for new technology with a consequential large build-up of coiled tubing units and related companies keeping the rates competitive and therefore coiled tubing workovers more viable. We are currently focusing our efforts primarily in the United States, Canada and Latin America; however we are also working to expand our distribution markets to include the North Sea and Middle Eastern markets.

Plan of Operations

We believe that we will be able to continue our business operations for the next twelve months without raising any additional capital. We anticipate the need for approximately $11,000,000 in additional funding to support the planned expansion of our operations and acquisitions over the next twelve months and $11,500,000 in additional funding to support our planned expansion and acquisitions over the next 24 months (See also, “Management's Discussion and Analysis of Financial Condition and Results of Operations” – “Plan of Operation for the Next Twelve Months”, below). We may choose to raise additional funds in the future through sales of debt and/or equity securities to support our ongoing operations and for expansion. Even if we are successful in raising capital in the future, we will likely need to raise additional capital to continue and/or expand our operations and repay our outstanding liabilities. If we do not raise the additional capital, it is likely that we may need to scale back or curtail implementing our business plan.

-1-

We are currently working on a new generation of coil tubing tools to aid in and facilitate well drilling. We expect the market for new applications of coiled tubing to continue to expand our operations throughout fiscal 2012 and 2013, especially in drilling and workover applications, which we are actively pursuing, including working to provide additional sales to Canada and moving into international markets including Indonesia.

Moving forward, we anticipate spending a larger percentage of our working capital on research and development activities, which we believe will be required to provide technological advancement to our coiled tubing technologies and workover product lines. We also hope to undertake acquisitions of related businesses, tool companies and other companies with whom we believe we may have synergistic relationships with in the future, funding permitting; provided that we do not currently have any planned acquisitions, have not entered into any definitive agreements relating to acquisitions and will need to raise additional funding in the future to complete acquisitions, which funding we hope to raise through the sale of debt or equity, which we may not be able to undertake on favorable terms, if at all.

Recent Financial Performance

|

·

|

We had total revenue of $2,080,723 for the three months ended June 30, 2012, compared to total revenue of $1,088,386 for the three months ended June 30, 2011, an increase in total revenue of $992,337 or 91.2% from the prior period.

|

|

·

|

We had cost of products and rental revenues of $682,441 for the three months ended June 30, 2012, compared to cost of products and rental revenues of $333,786 for the three months ended June 30, 2011, an increase in cost of product and rental revenues of $348,655 or 104.5% from the prior period.

|

|

·

|

We had cost of revenue – depreciation of rental tools of $245,235 for the three months ended June 30, 2012, compared to $106,928 for the three months ended June 30, 2011, an increase of $138,307 or 129.3% from the prior period.

|

|

·

|

We had gross profit of $1,153,047 for the three months ended June 30, 2012, compared to gross profit of $647,672 for the three months ended June 30, 2011, an increase in gross profit of $505,375 or 78.0% from the prior period.

|

|

·

|

We had total operating expenses of $948,508 for the three months ended June 30, 2012, compared to total operating expenses of $415,552 for the three months ended June 30, 2011, an increase in total operating expenses of $532,956 or 128.3% from the prior period.

|

|

·

|

We had net income of $199,840 for the three months ended June 30, 2012, compared to net income of $223,717 for the three months ended June 30, 2011, a decrease in net income of $23,877 or 10.7% from the prior period.

|

|

·

|

We had total revenue of $4,345,806 for the six months ended June 30, 2012, compared to total revenue of $1,735,302 for the six months ended June 30, 2011, an increase in total revenue of $2,610,504 or 150.4% from the prior period.

|

-2-

|

·

|

We had cost of products and rental revenues of $1,334,444 for the six months ended June 30, 2012, compared to cost of products and rental revenues of $609,284 for the six months ended June 30, 2011, an increase in cost of product and rental revenues of $725,160 or 119.0% from the prior period.

|

|

·

|

We had cost of revenue – depreciation of rental tools of $469,433 for the six months ended June 30, 2012, compared to $165,439 for the six months ended June 30, 2011, an increase of $303,994 or 183.7% from the prior period.

|

|

·

|

We had gross profit of $2,541,929 for the six months ended June 30, 2012, compared to gross profit of $960,579 for the six months ended June 30, 2011, an increase in gross profit of $1,581,350 or 164.6% from the prior period.

|

|

·

|

We had total operating expenses of $1,832,900 for the six months ended June 30, 2012, compared to total operating expenses of $810,208 for the six months ended June 30, 2011, an increase in total operating expenses of $1,022,692 or 126.2% from the prior period.

|

|

·

|

We had net income of $699,892 for the six months ended June 30, 2012, compared to net income of $126,728 for the six months ended June 30, 2011, an increase net income of $573,164 or 452.3% from the prior period.

|

|

·

|

We had total revenue of $5,541,131 for the year ended December 31, 2011, compared to total revenue of $1,751,850 for the year ended December 31, 2010, an increase in total revenue of $3,789,281 or 216.3% from the prior period.

|

|

·

|

We had cost of revenue products and rental revenues of $1,681,857 for the year ended December 31, 2011, compared to cost of products and rental revenues of $1,291,701 for the year ended December 31, 2010, an increase in cost of product and rental revenues of $390,156 or 30.2% from the prior period.

|

|

·

|

We had cost of revenue – depreciation of rental tools of $544,013 for the year ended December 31, 2011, compared to $140,593 for the year ended December 31, 2010, a decrease of $403,420 or 286.9% from the prior period.

|

|

·

|

We had gross profit of $3,315,261 for the year ended December 31, 2011, compared to gross profit of $319,556 for the year ended December 31, 2010, an increase in gross profit of $2,995,705 or 937.5% from the prior period.

|

|

·

|

We had total operating expenses of $2,555,538 for the year ended December 31, 2011, compared to total operating expenses of $722,578 for the year ended December 31, 2010, an increase in total operating expenses of $1,832,960 or 253.7% from the prior period.

|

|

·

|

We had net income of $729,445 for the year ended December 31, 2011, compared to net loss of $457,590 for the year ended December 31, 2010, an increase in net income of $1,187,035 from the prior period.

|

Penny Stock Rules

Our common stock will be considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under the Securities Exchange Act of 1934, as amended. “Penny stock” is generally defined as any equity security not traded on an exchange or quoted on NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser's consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection with any trades involving a stock defined as a penny stock.

-3-

The required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions on transferring "penny stocks" and as a result, investors in the common stock may have their ability to sell their shares of the common stock impaired.

Emerging Growth Company

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, have elected to comply with certain reduced public company reporting requirements for future filings. See "Description of Business: Government Regulations" contained herein and “Risk Factors” below.

Risks Relating to Our Business and Our Industry

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this Prospectus summary. Some of these risks are:

|

•

|

the need for additional funding;

|

|

|

•

|

our status as a former “shell company”;

|

|

|

•

|

our lack of a significant operating history;

|

|

|

•

|

our preferred stock and related rights;

|

|

|

•

|

the fact that our majority shareholder has control over our voting stock;

|

|

|

•

|

the loss of key personnel or failure to attract, integrate and retain additional personnel;

|

|

|

•

|

corporate governance risks;

|

|

|

•

|

the cost of the production of our products;

|

|

|

•

|

economic downturns;

|

|

|

•

|

our ability to innovate;

|

|

|

•

|

the level of competition in our industry and our ability to compete;

|

|

|

•

|

our ability to respond to changes in our industry;

|

|

|

•

|

our ability to protect our intellectual property and not infringe on others’ intellectual property;

|

|

|

•

|

our ability to scale our business;

|

|

|

•

|

our ability to maintain supplier relationships;

|

|

|

•

|

our ability to obtain and retain customers;

|

|

|

•

|

our ability to produce our products at competitive rates;

|

|

|

•

|

our ability to execute our business strategy in a very competitive environment;

|

|

|

•

|

trends in and the market for and the price of oil and gas and alternative energy sources;

|

|

|

•

|

lack of insurance policies;

|

|

|

•

|

dependence on a small number of customers;

|

|

|

•

|

changes in laws and regulations;

|

|

|

•

|

volatility and/or declines in oil and gas prices;

|

|

|

•

|

the volatile market for our common stock;

|

|

|

•

|

our ability to effectively manage our growth;

|

|

|

•

|

dilution to existing shareholders;

|

|

|

•

|

costs and expenses associated with being a public company;

|

|

|

•

|

economic downturns both in the United States and globally;

|

|

|

•

|

risk of increased regulation of our operations and products; and

|

|

|

•

|

other risk factors included under “Risk Factors” below.

|

-4-

Corporate Information

Our principal executive offices are located at 19511 Wied Rd., Suite E, Spring, Texas 77388, and our telephone number is (281) 651-0200. Our website address is www.coiltubingtechnology.com. The information on, or that may be accessed through, our website is not incorporated by reference into this registration statement and should not be considered a part of this registration statement.

“CTT,” our logo, and other trade names, trademarks, and service marks of the Company appearing in this Prospectus are the property of the Company. Other trade names, trademarks, and service marks appearing in this Prospectus are the property of their respective holders.

-5-

SUMMARY OF THE OFFERING:

|

Common Stock Offered:

|

887,501 shares of common stock

|

|

Common Stock Outstanding Before The Offering:

|

15,651,827 shares

|

-6-

General Information About This Prospectus

Unless otherwise noted, throughout this Prospectus the number of shares of our common stock to be outstanding following this Offering is based on 15,651,827 shares of our common stock outstanding as of October 16, 2012. It does not include:

|

•

|

1,203,334 shares of our common stock issuable upon exercise of outstanding stock options as of October 16, 2012, at a weighted average exercise price of $1.02 per share;

|

|

•

|

warrants to purchase 1,925,000 shares of our common stock at a weighted average exercise price of $1.00 per share, as of October 16, 2012 (of which shares of common stock issuable upon exercise of 325,000 of such warrants are being registered herein);

|

|

•

|

233,333 shares of common stock reserved for future issuance under our 2012 Stock Incentive Plan and 2010 Stock Incentive Plan, as of October 16, 2012; or

|

|

•

|

66,667 shares of common stock issuable upon the conversion of our outstanding Series B Convertible Preferred Stock, as of October 16, 2012.

|

Unless otherwise indicated, all information in this Prospectus reflects and assumes the following:

|

•

|

no exercise of options or warrants outstanding as of October 16, 2012; and

|

|

•

|

no conversion of our outstanding Series B Convertible Preferred Stock.

|

[Remainder of page left intentionally blank.]

-7-

SUMMARY FINANCIAL DATA

You should read the summary consolidated financial information presented on the following pages as of June 30, 2012 and December 31, 2011 and for the three and six months ended June 30, 2012 and 2011. We derived the summary financial information from our unaudited consolidated financial statements for the three and six months ended June 30, 2012 and 2011 and our audited consolidated financial statements for the years ended December 31, 2011 and 2010, appearing elsewhere in this Prospectus. You should read this summary financial information in conjunction with our plan of operation, financial statements and related notes to the financial statements, each appearing elsewhere in this Prospectus.

[Remainder of page left intentionally blank.]

-8-

SUMMARY CONSOLIDATED BALANCE SHEETS INFORMATION

JUNE 30, 2012 AND DECEMBER 31, 2011

|

June 30,

|

December 31,

|

|||||||

|

2012

|

2011

|

|||||||

|

Assets

|

(unaudited)

|

|||||||

|

Current Assets:

|

||||||||

|

Cash

|

$ | 637,592 | $ | 225,750 | ||||

|

Accounts receivable, net

|

1,844,974 | 1,580,901 | ||||||

|

Other current assets

|

76,644 | 54,490 | ||||||

|

Total Current Assets

|

2,559,210 | 1,861,141 | ||||||

|

Rental tools, net

|

3,930,585 | 3,566,766 | ||||||

|

Property and equipment, net

|

537,862 | 500,696 | ||||||

|

Intangible assets, net

|

1,073,331 | 1,113,333 | ||||||

|

Total Assets

|

$ | 8,100,988 | $ | 7,041,936 | ||||

|

Liabilities and Stockholders' Equity

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

$ | 802,588 | $ | 1,146,736 | ||||

|

Accrued liabilities

|

461,202 | 276,820 | ||||||

|

Related party notes payable - current

|

155,556 | 155,556 | ||||||

|

Notes payable - current

|

61,617 | 73,818 | ||||||

|

Total Current Liabilities

|

1,480,963 | 1,652,930 | ||||||

|

Long Term Liabilities:

|

||||||||

|

Related party notes payable, net of current portion

|

324,073 | 401,851 | ||||||

|

Notes payable, net of current portion

|

159,998 | 203,593 | ||||||

|

Total Liabilities

|

1,965,034 | 2,258,374 | ||||||

|

Commitments and contingencies

|

||||||||

|

Stockholders' Equity:

|

||||||||

|

Preferred Stock, $.001 par value, 5,000,000 shares authorized

|

||||||||

|

Series A Preferred Stock, $.001 par value, 1,000,000 shares authorized;

|

||||||||

|

0 shares issued and outstanding

|

- | - | ||||||

|

Series B Convertible Preferred Stock, $.001 par value, 1,000,000 shares

|

||||||||

|

authorized; 1,000,000 shares issued and outstanding

|

1,000 | 1,000 | ||||||

|

Common Stock, $.001 par value, 200,000,000 shares authorized;

|

||||||||

|

15,651,827 and 15,599,327 shares issued and outstanding, respectively

|

15,652 | 15,599 | ||||||

|

Subscription receivable

|

(800,000 | ) | (1,400,000 | ) | ||||

|

Additional paid-in capital

|

9,165,535 | 9,113,088 | ||||||

|

Accumulated deficit

|

(2,246,233 | ) | (2,946,125 | ) | ||||

|

Total Stockholders' Equity

|

6,135,954 | 4,783,562 | ||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 8,100,988 | $ | 7,041,936 | ||||

-9-

SUMMARY CONSOLIDATED STATEMENTS OF OPERATIONS INFORMATION

THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011

|

Three Months Ended

|

Six Months Ended

|

|||||||||||||||

|

June 30,

|

June 30,

|

|||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

|||||||||||||

|

Revenue:

|

|

|||||||||||||||

|

Product revenue

|

$ | 51,973 | $ | 234,914 | $ | 102,411 | $ | 437,238 | ||||||||

|

Rental revenue

|

2,028,750 | 853,472 | 4,243,395 | 1,298,064 | ||||||||||||

|

Total revenue

|

2,080,723 | 1,088,386 | 4,345,806 | 1,735,302 | ||||||||||||

|

Cost of revenue:

|

||||||||||||||||

|

Cost of products and rental revenue

|

682,441 | 333,786 | 1,334,444 | 609,284 | ||||||||||||

|

Cost of revenue - depreciation of rental tools

|

245,235 | 106,928 | 469,433 | 165,439 | ||||||||||||

|

Total cost of revenue

|

927,676 | 440,714 | 1,803,877 | 774,723 | ||||||||||||

|

Gross profit

|

1,153,047 | 647,672 | 2,541,929 | 960,579 | ||||||||||||

|

Operating Expenses:

|

||||||||||||||||

|

Selling and marketing

|

514,634 | 248,835 | 1,033,763 | 421,092 | ||||||||||||

|

General and administrative

|

373,609 | 127,355 | 680,950 | 312,271 | ||||||||||||

|

Depreciation and amortization

|

60,265 | 39,362 | 118,187 | 76,845 | ||||||||||||

|

Total operating expenses

|

948,508 | 415,552 | 1,832,900 | 810,208 | ||||||||||||

|

Income from operations

|

204,539 | 232,120 | 709,029 | 150,371 | ||||||||||||

|

Other expense:

|

||||||||||||||||

|

Interest expense

|

(4,699 | ) | (8,403 | ) | (9,137 | ) | (23,643 | ) | ||||||||

|

Total other expense

|

(4,699 | ) | (8,403 | ) | (9,137 | ) | (23,643 | ) | ||||||||

|

Net income

|

$ | 199,840 | $ | 223,717 | $ | 699,892 | $ | 126,728 | ||||||||

|

Net income per share :

|

||||||||||||||||

|

Basic

|

$ | 0.01 | $ | 0.04 | $ | 0.04 | $ | 0.03 | ||||||||

|

Diluted

|

$ | 0.01 | $ | 0.03 | $ | 0.04 | $ | 0.03 | ||||||||

|

Weighted average common shares outstanding:

|

||||||||||||||||

|

Basic

|

16,411,333 | 6,040,131 | 16,409,314 | 3,904,915 | ||||||||||||

|

Diluted

|

18,732,517 | 7,013,346 | 18,730,498 | 4,878,130 | ||||||||||||

-10-

FORWARD-LOOKING STATEMENTS

Portions of this Prospectus, including disclosure under “Management’s Discussion and Analysis or Plan of Operation,” contain forward-looking statements. These forward-looking statements which include words such as "anticipates", "believes", "expects", "intends", "forecasts", "plans", "future", "strategy" or words of similar meaning, are subject to risks and uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results, performance or achievements expressed or implied by the forward-looking statements. You should not unduly rely on these statements. Forward-looking statements involve assumptions and describe our plans, strategies, and expectations. You can generally identify a forward-looking statement by words such as may, will, should, expect, anticipate, estimate, believe, intend, contemplate or project. Factors, risks, and uncertainties that could cause actual results to differ materially from those in the forward-looking statements include among others set forth under “Risk Factors”:

|

•

|

the need for additional funding;

|

|

|

•

|

our status as a former “shell company”;

|

|

|

•

|

our lack of a significant operating history;

|

|

|

•

|

our preferred stock and related rights;

|

|

|

•

|

the fact that our majority shareholder has control over our voting stock;

|

|

|

•

|

the loss of key personnel or failure to attract, integrate and retain additional personnel;

|

|

|

•

|

corporate governance risks;

|

|

|

•

|

the cost of the production of our products;

|

|

|

•

|

economic downturns;

|

|

|

•

|

our ability to innovate;

|

|

|

•

|

the level of competition in our industry and our ability to compete;

|

|

|

•

|

our ability to respond to changes in our industry;

|

|

|

•

|

our ability to protect our intellectual property and not infringe on others’ intellectual property;

|

|

|

•

|

our ability to scale our business;

|

|

|

•

|

our ability to maintain supplier relationships;

|

|

|

•

|

our ability to obtain and retain customers;

|

|

|

•

|

our ability to produce our products at competitive rates;

|

|

|

•

|

our ability to execute our business strategy in a very competitive environment;

|

|

|

•

|

trends in and the market for and the price of oil and gas and alternative energy sources;

|

|

|

•

|

lack of insurance policies;

|

|

|

•

|

dependence on a small number of customers;

|

|

|

•

|

changes in laws and regulations;

|

|

|

•

|

volatility and/or declines in oil and gas prices;

|

|

|

•

|

the volatile market for our common stock;

|

|

|

•

|

our ability to effectively manage our growth;

|

|

|

•

|

dilution to existing shareholders;

|

|

|

•

|

costs and expenses associated with being a public company;

|

|

|

•

|

economic downturns both in the United States and globally;

|

|

|

•

|

risk of increased regulation of our operations and products; and

|

|

|

•

|

other risk factors included under “Risk Factors” below.

|

With respect to any forward-looking statement that includes a statement of its underlying assumptions or basis, we caution that, while we believe such assumptions or basis to be reasonable and have formed them in good faith, assumed facts or basis almost always vary from actual results, and the differences between assumed facts or basis and actual results can be material depending on the circumstances. When, in any forward-looking statement, we or our management express an expectation or belief as to future results, that expectation or belief is expressed in good faith and is believed to have a reasonable basis, but there can be no assurance that the stated expectation or belief will result or be achieved or accomplished. All subsequent written and oral forward-looking statements attributable to us, or anyone acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by applicable law, including the securities laws of the United States and/or if the existing disclosure fundamentally or materially changes, we do not undertake any obligation to publicly release any revisions to any forward-looking statements to reflect events or circumstances after the date of this Prospectus or to reflect unanticipated events that may occur.

-11-

RISK FACTORS

The securities offered herein are highly speculative and should only be purchased by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this Prospectus before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent. The below risk factors include a discussion of all material risks which we believe are applicable to the Company, its operations and its securities.

We May Require Additional Financing To Implement Our Business Plan And Continue Developing And Marketing Our Products.

The revenues we have generated since our incorporation have not been sufficient to support our operations, which have principally been funded through sales of common stock to date. We currently believe that we will be able to continue our business operations for approximately the next twelve months with our current cash on hand and from our expected revenues. Historically we have received funds from our largest shareholder and Director, Herbert C. Pohlmann, through private placements of our common stock, which we have used to fund our operations. We anticipate the need for approximately $10,000,000 in additional funding to support the planned expansion of our operations over the next approximately twelve months. Additional available capital may not be available on favorable terms, if at all. We anticipate the need for approximately $11,500,000 in additional funding to support our plans for expansion of our operations over the next approximately 24 months. We may choose to raise additional funds in the future through sales of debt and/or equity securities to support our ongoing operations and for expansion.

Even if we are successful in raising capital in the future, we will likely need to raise additional capital to continue and/or expand our operations and repay our outstanding liabilities. If we do not raise the additional capital, it is likely that we may need to scale back or curtail implementing our business plan.

We May Have Difficulty Obtaining Future Funding Sources, If Needed, And We May Have To Accept Terms That Would Adversely Affect Shareholders

We will need to raise funds from additional financing. We have no commitments for any financing and any financing commitments may result in dilution to our existing stockholders. We may have difficulty obtaining additional funding, and we may have to accept terms that would adversely affect our stockholders. For example, the terms of any future financings may impose restrictions on our right to declare dividends or on the manner in which we conduct our business. Additionally, we may raise funding by issuing convertible notes, which if converted into shares of our common stock would dilute our then shareholders’ interests. Lending institutions or private investors may impose restrictions on a future decision by us to make capital expenditures, acquisitions or significant asset sales. If we are unable to raise additional funds, we may be forced to curtail or even abandon our business plan.

Our Ability To Grow And Compete In The Future Will Be Adversely Affected If Adequate Capital Is Not Available.

The ability of our business to grow and compete depends on the availability of adequate capital, which in turn depends in large part on our cash flow from operations and the availability of equity and debt financing. Our cash flow from operations may not be sufficient or we may not be able to obtain equity or debt financing on acceptable terms or at all to implement our growth strategy. As a result, adequate capital may not be available to finance our current growth plans, take advantage of business opportunities or respond to competitive pressures, any of which could harm our business.

-12-

Shareholders Who Hold Unregistered Shares Of Our Common Stock Will Be Subject To Resale Restrictions Pursuant To Rule 144, Due To The Fact That We Are Deemed To Be A Former “Shell Company.”

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. While we do not believe that we are currently a “shell company”, we were previously a “shell company” and as such are deemed to be a former “shell company” pursuant to Rule 144, and as such, sales of our securities pursuant to Rule 144 may not be able to be made until we are subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, and have filed all of our required periodic reports for at least the previous one year period prior to any sale pursuant to Rule 144; and a period of at least twelve months has elapsed from the date “Form 10 information” has been filed with the Commission reflecting the Company’s status as a non-“shell company.” Because we are deemed to be a former “shell company”, none of our non-registered securities will be eligible to be sold pursuant to Rule 144, until at least a year after the Registration Statement of which this Prospectus is a part is declared effective by the Commission (assuming we continue to file the reports required under the Exchange Act), any non-registered securities we sell in the future or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until a year after we have complied with the requirements of Rule 144. As a result, it may be harder for us to fund our operations and pay our consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our status as a former “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions (although none are currently planned).

We Lack A Significant Operating History Focusing On Our Current Business Strategy Which You Can Use To Evaluate Us, Making Share Ownership In Our Company Risky

Our Company lacks a long standing operating history focusing on our current business strategy which investors can use to evaluate our Company’s previous earnings. Therefore, ownership in our Company is risky because we have no significant business history and it is hard to predict what the outcome of our business operations will be in the future.

We Have Established Preferred Stock Which Can Be Designated By The Company's Board Of Directors Without Shareholder Approval And The Board Established Series A Preferred Stock, Which Gives The Holders Majority Voting Power Over The Company.

The Company has 5,000,000 shares of preferred stock authorized. The shares of preferred stock of the Company may be issued from time to time in one or more series, each of which shall have a distinctive designation or title as shall be determined by the Board of Directors of the Company ("Board of Directors") prior to the issuance of any shares thereof. The preferred stock shall have such voting powers, full or limited, or no voting powers, and such preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof as adopted by the Board of Directors. In May 2007, we designated 1,000,000 shares of Series A Preferred Stock, $0.001 par value per share (the "Series A Preferred Stock"). The Series A Preferred Stock have no dividend rights, no liquidation preference, no redemption rights and no conversion rights. Shortly after being designated, we granted all 1,000,000 shares of such Series A Preferred Stock to our Executive Vice President and Chairman, Jerry Swinford, who held such shares until his entry into the Executive Employment Agreement in November 2010, described below under “Employment Agreements” pursuant to which such Series A Preferred Stock were cancelled. The Series A Preferred Stock have the right, voting in aggregate, to vote on all shareholder matters equal to fifty-one percent (51%) of the total vote (the “Super Majority Voting Rights”). In June 2007, we designated 1,000,000 shares of Series B Preferred Stock and subsequently issued such Series B Preferred Stock to Grifco. The Series B Preferred Stock have no voting rights, but are convertible into 66,667 shares of our common stock (0.0667 of one share for each share of Series B Preferred Stock outstanding), if Grifco exercises its option to purchase the Series A Preferred Stock of the Company for aggregate consideration of $100, which option is exercisable for two (2) years from the date that Mr. Swinford no longer desired to hold such Series A Preferred Stock (which date was November 30, 2010 and which option expires on November 30, 2012). We believe that Grifco is no longer an operating entity and we further believe that the likelihood of Grifco exercising its rights under the Series B Preferred Stock is minimal at this time.

-13-

Because the Board of Directors is able to designate the powers and preferences of the preferred stock without the vote of a majority of the Company's shareholders, shareholders of the Company will have no control over what designations and preferences the Company's preferred stock will have.

Herbert C. Pohlmann, Our Majority Shareholder and Director, Can Vote A Majority Of Our Common Stock And Can Exercise Control Over Corporate Decisions.

Herbert C. Pohlmann, our majority shareholder and Director beneficially owns 16,001,095 shares of our common stock, representing 92.8% of our outstanding common stock giving him the right to exercise control in determining the outcome of all corporate transactions or other matters, including the election of directors, mergers, consolidations, the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of Mr. Pohlmann may differ from the interests of the other stockholders and thus result in corporate decisions that are adverse to other shareholders. Additionally, as described below under “Certain Relationships and Related Transactions” Mr. Pohlmann has made an approximate $3.75 million provision for our Executive Vice President and Chairman, Jerry Swinford in the event Mr. Pohlmann dies, which could cause conflicts of interest between Mr. Pohlmann, Mr. Swinford as our Executive Vice President and Chairman, and our minority shareholders. Mr. Pohlmann has also entered into a voting agreement with Mr. Swinford, described in greater detail below under the risk factor entitled “Jerry Swinford, Our Executive Vice President, Chief Financial Officer And Director Is Party To A Voting Agreement With Our Majority Shareholder”.

Jerry Swinford, Our Executive Vice President and Chairman, Can Vote A Majority Of The Outstanding Voting Shares Of Our Wholly-Owned Subsidiary, Coil Tubing Technology Holdings, Inc. ("Holdings").

Jerry Swinford, our Executive Vice President and Chairman, holds 1,000,000 shares of the Series A Preferred Stock of Holdings, which owns and controls substantially all of our assets and operations, which preferred stock gives him the right to vote in aggregate, 51% of the outstanding voting shares of Holdings on all shareholder matters. Accordingly, Mr. Swinford will exercise control in determining the outcome of all corporate transactions or other matters concerning Holdings, including the election of Directors, mergers, consolidations, the sale of all or substantially all of Holdings’ assets, and also the power to prevent or cause a change in control. The interests of Mr. Swinford may differ from the interests of the Company and the Company’s other stockholders and thus result in corporate decisions relating to Holdings that are adverse to the Company or other shareholders.

Jerry Swinford, Our Executive Vice President, Chief Financial Officer And Director Is Party To A Voting Agreement With Our Majority Shareholder.

In January 2011, the Company’s majority shareholder and current Director, Herbert C. Pohlmann, and the Company’s Executive Vice President, Chief Executive Officer and Director, Jerry Swinford, entered into a Voting Agreement, pursuant to which Mr. Pohlmann agreed to vote the shares of the Company which he owns as directed by Mr. Swinford from time to time, to appoint at least 40% of the Company’s Board of Directors, rounded up to the nearest whole number of Directors. As such, Mr. Swinford has the right to direct Mr. Pohlmann to appoint two (2) out of every five (5) Directors of the Company (currently two (2) of the Company’s three (3) Directors), as determined by Mr. Swinford in his sole discretion, pursuant to the Voting Agreement, which remains in effect until December 31, 2015. Pursuant to the Voting Agreement, Mr. Swinford has the power to appoint two (2) of the Company’s three (3) Directors, and moving forward will have the power to appoint 40% of the Company’s Directors in the event the number of Directors of the Company is increased in the future. Accordingly, Mr. Swinford will exercise significant control in determining the appointment of Directors and subsequently, the outcome of corporate transactions or other matters concerning the Company, including the appointment of officers. The interests of Mr. Swinford may differ from the interests of the Company and the Company’s other stockholders. The voting rights provided to Mr. Swinford pursuant to the Voting Agreement may be viewed negatively by investors and the marketplace and may cause the value of our shares to decline in value and/or be worth less than similarly situated companies which do not have similar voting arrangements in place.

-14-

We Rely On Our Executive Vice President And Chairman, Jerry Swinford, And If He Were To Leave Our Company Our Business Plan Could Be Adversely Effected

We rely on Jerry Swinford, our Executive Vice President and Chairman for the success of our Company. Mr. Swinford has an employment agreement with us, currently effective until November 2015, which employment agreement is described in greater detail below under “Directors, Executive Officers And Corporate Governance”, “Employment Agreements”. Mr. Swinford’s experience and input creates the foundation for our business and he is responsible for the direction and control over the Company’s development activities. Moving forward, should he be lost for any reason, the Company will incur costs associated with recruiting a replacement and any potential delays in operations which this may cause. If we are unable to replace Mr. Swinford with another individual suitably trained in coil tubing technology we may be forced to scale back or curtail our business plan.

Our Officers Receive Discretionary Bonuses From Time To Time In the Sole Discretion of The Board of Directors, And Have The Ability To Approve Their Own Bonuses.

The Employment Agreements of our officers, Jerry Swinford and his son, Jason Swinford, provide for them to receive discretionary bonuses from time to time in the sole discretion of the Board of Directors. To date Jerry Swinford has received a discretionary bonus of $108,000 for both the 2011 and 2012 fiscal years and Jason Swinford has received discretionary bonuses of $144,000 and $200,000, for the 2011 and 2012 fiscal years, respectively; provided that the 2012 bonus has been accrued and has not been paid to date. As Jerry and Jason Swinford represent a majority of our Board of Directors, they have the power, in their sole discretion, to approve discretionary bonuses to themselves from time to time and to further determine the amount of such discretionary bonuses. The approval and payment of discretionary bonuses to Jerry and Jason Swinford at the discretion of the Board of Directors (of which Jerry and Jason Swinford constitute a majority of such Board of Directors) may ultimately not be in the best interests of the Company or its shareholders. Furthermore, the perception from the investing community that such discretionary bonuses are not fair to the shareholders or the Company, may be perceived negatively. The payment of discretionary bonuses may create actual or perceived conflicts of interest between the officers, the Company and the Company’s shareholders. Our results of operations may be adversely affected by discretionary bonuses declared and paid to Jerry and Jason Swinford and the value of our common stock may be adversely effected by such discretionary bonuses and/or negative perceptions from the investing community regarding such bonuses. See also the risk factor below entitled “We Face Corporate Governance Risks And Negative Perceptions Of Investors Associated With The Fact That We Currently Have Only Three Directors, None of Whom Are Independent” and the description of the Employment Agreements below under “Corporate Governance”, “Employment Agreements”.

Our Officers Have The Right To Receive Substantial Bonuses From The Company Pursuant To Their Employment Agreements.

The Employment Agreements of our officers, Jerry Swinford and his son, Jason Swinford, provide them the right to receive discretionary bonuses (as described in the risk factor above), bonuses based on our yearly EBITDA (for each year other than fiscal 2013), bonuses based on our gross profit (for fiscal 2013) and in Jason Swinford’s case, a bonus based on the occurrence of certain fundamental transactions which effect the Company.

-15-

Each of the executives is due a bonus at the end of each calendar year during the term of the agreements (other than 2013) in the event the Company has positive earnings before interest, taxes, depreciation and amortization (minus extraordinary items including stock buybacks, acquisitions and other extraordinary items as determined at the reasonable discretion of the Board of Directors of the Company, and legal fees associated with such items) (“EBITDA”) for the prior calendar year ended December 31 (the “Prior Year”). The bonus is based on a percentage of the officer’s annual base salary for the Prior Year (the “Prior Year’s Salary”) pursuant to a set schedule from between 100% of the Prior Year’s Salary if EBITDA exceeds $7 million to no bonus if EBITDA is less than $2 million.

The officers were also provided the right to earn a profit sharing bonus equal to 2.5% of the Company’s Gross Profit (the “Profit Bonus”) monthly in arrears for each month from January 2013 through December 2013 (each a “Profit Sharing Month”), which Profit Bonus is paid to the officers by the Company based on the applicable Profit Sharing Month’s Gross Profit. “Gross Profit” is defined as the Company’s gross profit (in the event the Company has a gross loss for any period, there shall be no Gross Profit for the applicable period) for each applicable period, calculated by taking the Company’s revenue for the applicable period and subtracting cost of revenues.

In addition to the bonuses described above, Jason Swinford’s Employment Agreement provides for him to receive a bonus (the “Transaction Bonus”) in the event that a (a) Change of Control (as defined in the Employment Agreement) of the Company, Holdings, or CTT Texas; or (b) the sale by the Company of substantially all of the assets of the Company (or controlling interests in the Company’s subsidiaries), each in one or more related transactions (each a “Bonus Transaction”); occurs while Mr. Swinford is employed under the terms of the Employment Agreement or within six (6) months of the termination of such agreement by the Company for any reason other than cause, or by Mr. Swinford for good reason. The Amount of the Transaction Bonus varies based on a set schedule and provides for Mr. Swinford to receive from between $2 million in the event the total consideration received by the Company and its shareholders is more than $75 million to $5 million in the event the total consideration received by the Company and its shareholders is more than $150 million.

The Employment Agreements and the bonuses are described in greater detail below under “Corporate Governance”, “Employment Agreements”. Due to the structure of the bonuses, the officers have an incentive to increase our EBITDA and Gross Profit in the periods covered by the bonuses and Jason Swinford has an incentive to facilitate a Bonus Transaction. Such bonuses may cause actual or perceived conflicts of interest between our officers, the Company and the Company’s shareholders. The payment of the bonuses will likely have a material adverse effect on our results of operations, cash flow and funds available for business operations. The payment of the bonuses may force us to curtail or abandon planned expansion activities. The requirement for the Company to pay the bonuses could prevent a change of control of the Company. Consequently, the bonuses could cause the value of our common stock to decline in value and/or be valued at less than a similarly sized company which does not have a similar bonus structure.

We Will Owe Substantial Consideration To Our Officers In The Event They Are Able to Terminate Their Employment Agreements With Us For “Good Reason”, Including Their Death Or Disability.

We entered into five year Executive Employment Agreements with Jerry Swinford to serve as our Chief Executive Officer and Jason Swinford to serve as our Chief Operating Officer in November 2010. In December 2011, the agreements were amended, Jerry Swinford resigned as Chief Executive Officer of the Company (provided that he still serves as the Treasurer, Chief Financial Officer and Secretary of the Company) and was appointed as Executive Vice President of the Company and Jason Swinford was appointed as the Chief Executive Officer of the Company. The agreements were subsequently amended again in August 2012 and October 2012 (effective August 2012) and the December 2011, August 2012 and October 2012 amendments are reflected in the discussion below. Both agreements are renewable for additional one-year terms as provided in the agreements. Pursuant to Jerry Swinford’s amended employment agreement, he is currently due $120,000 per year for services to the Company. Pursuant to Jason Swinford’s amended employment agreement, he is currently due $200,000 per year for services to the Company. Additionally, each is due Options and Bonuses (as described below under “Directors, Executive Officers And Corporate Governance”, “Employment Agreements”) pursuant to the agreements. If either individual’s employment is terminated by the Company for “cause” as defined in their agreements, the Company is required to pay such individual the compensation earned by him through the date of termination, including any Bonus which is due (which is calculated pro rata through the end of the last full calendar quarter as applicable), within 10 days of such termination date. In the event the Company terminates either individual’s employment for no reason or such individual terminates the agreement for “good reason” as provided for in the agreements, including his death, the Company materially diminishing his responsibilities, his disablement, the Company breaching any term of the employment agreement, or a constructive termination (including such individual being demoted, having his salary decreased or being forced to re-locate), the Company is required pay such individual his salary for the remaining amount of the term of the agreement (at such times as the consideration would be due as if he was still employed by the Company), along with an additional $100,000 lump sum payment, due within 10 days of the termination date of the agreement. As such, in the event that either Jerry or Jason Swinford’s employment agreements are terminated by them for “good reason”, including, but not limited to their death or disablement, we will be forced to continue to pay their salaries, honor their Options and pay them (or their estate) the Bonuses they would have been due as if they were still employed by the Company, as well as paying them a $100,000 lump sum payment. The requirement for the Company to continue to pay the salaries and other compensation to Jerry and Jason Swinford after they are no longer employed by the Company could prevent us from having sufficient available cash to engage new officers or Directors, materially adversely affect our ability to pay our expenses as they become due, negatively affect our results of operations, and/or prevent a change of control of the Company.

-16-

We Face Corporate Governance Risks And Negative Perceptions Of Investors Associated With The Fact That We Currently Have Only Three Directors, None of Whom Are Independent.

Currently, our officers are Jerry Swinford and Jason Swinford, his son. As such, Jerry and Jason Swinford have significant control over our business direction. Our Directors include Jerry and Jason Swinford and our majority shareholder, Herbert C. Pohlmann. As such, Jerry and Jason Swinford have majority control of the Board of Directors and can, among other things, declare themselves discretionary bonuses, take actions to maximize the consideration they are due under their Employment Agreements, and determine their own compensation levels. Additionally, there are no independent members of the Board of Directors available to second and/or approve related party transactions involving Jerry or Jason Swinford or Mr. Pohlmann, including the compensation paid to Jerry or Jason Swinford and the employment agreements we enter into with such individuals. Therefore, investors may perceive that because no other Directors are approving related party transactions involving Jerry or Jason Swinford or Mr. Pohlmann, that such transactions are not fair to the Company. The price of our common stock may be adversely affected and/or devalued compared to similarly sized companies with multiple unrelated and independent officers and Directors due to the investing public’s perception of limitations facing our Company due to the above.

We Have Arrangements In Place With Various Manufacturers To Build And Produce Our Products, And If The Demand For Those Manufacturers’ Skills Increases, The Cost Of Producing Our Products May Increase, Causing Our Profits (If Any) To Decrease.

We currently have a number of arrangements with various manufacturing shops which manufacture our Coil Tubing Technology tools and equipment. In the event that the demand for those manufacturers’ time and unique skills increase, we may be forced to pay more money to have our products manufactured. If this were to happen, we may be forced to charge more for our products, which may cause the demand for our products and consequently our sales to decrease, which would likely cause any securities which you hold to decrease as well. Additionally, if the materials which our products are made from, including steel, increase in cost, it could similarly cause increases in the cost of manufacturing our products, which could force us to increase the prices we charge for our products, which could cause the demand for such products to decline.

-17-

Our Future Success And Profitability May Be Adversely Affected If We Fail To Develop And Introduce New And Innovative Products That Appeal To Our Customers.

The oil and gas drilling industry is characterized by continual technological developments that have resulted in, and likely will continue to result in, substantial improvements in the scope and quality of oilfield chemicals, drilling and artificial lift products and services and product function and performance. As a result, our future success depends, in part, upon our continued ability to develop and introduce new and innovative products in order to address the increasingly sophisticated needs of our customers and anticipate and respond to technological and industry advances in the oil and gas drilling industry in a timely manner. If we fail to successfully develop and introduce new and innovative products and services that appeal to our customers, or if new companies or our competitors offer such products, our revenue and profitability may suffer.

If We Are Unable To Adequately Protect Our Intellectual Property Rights Our Business Is Likely To Be Adversely Affected.

We rely on a combination of patents, trademarks, non-disclosure agreements and other security measures to establish and protect our proprietary rights. The measures we have taken or may take in the future may not prevent misappropriation of our proprietary information or prevent others from independently developing similar products or services, designing around our proprietary or patented technology or duplicating our products or services. Furthermore, some of our intellectual property rights are only protected by patent applications and we may choose to not move forward with those patent applications in the future. Finally, our patent applications may not be granted in the future. In the event that we do not move forward with the patent applications and/or do not obtain registration of those patents, we will have a diminished ability to protect our proprietary technology, which could cause us to spend substantial funds in connection with litigation and/or may force us to curtail or abandon our business activities.

Jerry Swinford, Our Executive Vice President And Chairman Has A First Priority Security Interest Over Our Patents.

The Patents (defined below under “Description of Business”, “Patents, Trademarks and Licenses”) which we acquired from Jerry Swinford, our Executive Vice President and Chairman, are significant to our operations and are required for us to operate our business and protect our intellectual property rights. Mr. Swinford currently holds a first priority security interest over the Patents in order to secure the repayment of a note in the original amount of $700,000 which is due September 15, 2015, and is payable in monthly installments of the lesser of $12,963 or the amount outstanding under such note per month, which note was provided to Mr. Swinford by the Company in connection with the IP Purchase Agreement described in greater detail below under “Certain Relationships and Related Transactions and Director Independence”). In the event we default in the repayment of such note and Mr. Swinford enforces his security interest over the Patents we may be forced to curtail or abandon our business operations. The total amount outstanding under the note as of June 30, 2012 was $479,629.

A Significant Amount Of Our Revenues Are Due To Only A Small Number Of Customers, And If We Were To Lose Any Of Those Customers, Our Results Of Operations Would Be Adversely Affected.

The Company had gross sales of $4,345,806 and $1,735,302 during the six months ended June 30, 2012 and 2011, respectively. The Company had two customers representing approximately 15.8% and 16.4% of gross sales during the six months ended June 30, 2012 which were Total Thru Tubing and Weatherford. The Company had three customers representing approximately 12%, 11%, and 10% of gross sales during the six months ended June 30, 2011 which were Dark Light, LLC, Total Thru Tubing, and Quality Energy Services, respectively. The Company had gross sales of $5,541,131 and $1,751,850 for the years ended December 31, 2011 and 2010, respectively. The Company had one customer that represented greater than 10% of gross sales for the year ended December 31, 2011 which was DSI Thru Tubing. The Company had three customers that represented approximately 18%, 14%, and 11% of gross sales for the year ended December 31, 2010 which were Weatherford, Key Energy Services and Dark Light, LLC, respectively. As a result, the majority of our revenues are due to only a small number of customers, and we anticipate this trend continuing moving forward. Additionally, we do not have any contracts in place with the majority of our customers (except as described below under “Description of Business”, “Material Agreements”) and instead operate purchase order to purchase order with such customers. As a result, a termination in relationship or a reduction in orders from these customers could have a materially adverse effect on our results of operations and could force us to curtail or abandon our current business operations.

-18-

A Significant Amount Of Our Revenues Come From Entities Which Are Also Our Competitors, And If We Were To Lose Any Of Those Customers, Or They Were To Create Products To Directly Compete With Ours, Our Results Of Operations Would Be Adversely Affected.

For the year ended December 31, 2011, a significant portion of our revenues, approximately 8.6%, came from Weatherford International and approximately 1.6% came from Thru Tubing Solutions, a Division of Rollins Corporation, which are also competitors of us. While such companies do not currently compete directly for our products, they offer similar products. If either of those entities, or any other entity which is a customer of ours, creates products in the future which directly compete with ours, such entities will likely cease using our services and our revenues could be adversely affected. Similarly, we could lose additional customers to such directly competing competitors, which would further cause a decrease in our results of operations.

Our Revenues Are Subject To Seasonal Rules And Regulations, Such As The Frost Laws Enacted By Several States And Canada, Which Could Cause Our Operations To Be Subject To Wide Seasonal Variations.