Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Apollo Global Management, Inc. | d424828d8k.htm |

Apollo Global Management, LLC -

Investor Overview

October 2012

Exhibit 99.1 |

1

1

1

1

Forward Looking Statements and Other Important Disclosures

It should not be assumed that investments made in the future will be

profitable or will equal the performance of investments in this document.

This presentation may contain forward looking statements that are

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. These statements include, but

are not limited to, discussions related to Apollo Global Management LLC’s and its

subsidiaries’ (collectively “Apollo”) expectations

regarding the performance of its business, its liquidity and capital resources and the other non-historical

statements. These forward-looking statements are based on

management’s beliefs, as well as assumptions made by, and information currently available to,

management. When used in this presentation, the words

“believe,” “anticipate,” “estimate,” “expect,” “intend” and similar expressions are intended to

identify forward-looking statements. Although management believes

that the expectations reflected in these forward-looking statements are reasonable, it can

give no assurance that these expectations will prove to have been

correct. These statements are subject to certain risks, uncertainties and assumptions. We

believe these factors include but are not limited to those described

under the section entitled “Risk Factors” in the Company’s prospectus filed in accordance

with Rule 424(b) of the Securities Act with the Securities and

Exchange Commission (“SEC”) on March 30, 2011, as such factors may be updated from time to

time in our periodic filings with the SEC, which are accessible on

the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and

should be read in conjunction with the other cautionary statements

that are included in this presentation in other SEC filings. We undertake no obligation to

publicly update or review any forward-looking statements, whether

as a result of new information, future developments or otherwise.

“Gross IRR” of a fund represents the cumulative

investment-related cash flows for all of the investors in the fund on the basis of the actual timing of

investment inflows and outflows (for unrealized investment assuming

disposition of the respective “as of” dates referenced) aggregated on a gross basis

quarterly, and the return is annualized and compounded before

management fees, carried interest and certain other fund expenses (including interest incurred

by the fund itself) and measures the returns on the fund’s

investments as a whole without regard to whether all of the returns would, if distributed, be payable

to the fund’s investors. “Net IRR” of a fund

means the gross IRR applicable to all investors, including related parties which may not pay fees, net of

management fees, organizational expenses, transaction costs, and

certain other fund expenses (including interest incurred by the fund itself) and realized

carried interest all offset to the extent of interest income, and

measures returns based on amounts that, if distributed, would be paid to investors of the fund; to

the extent that an Apollo private equity fund exceeds all

requirements detailed within the applicable fund agreement, the estimated unrealized value is adjusted

such that a percentage of up to 20.0% of the unrealized gain is

allocated to the general partner, thereby reducing the balance attributable to fund investors.

This presentation includes non-GAAP financial measures. A

reconciliation of these non-GAAP financial measures to the most directly comparable financial

measures calculated and presented in accordance with GAAP is included

on slide 26 of the presentation, as well as within our most recent earnings release filed

with the SEC on August 2, 2012 and included on our website at

www.agm.com. These non-GAAP financial measures should be considered in addition to and

not as a substitute for, or superior to, financial measures presented

in accordance with GAAP. This presentation is for

informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service

of Apollo as well as any Apollo sponsored investment fund, whether an

existing or contemplated fund (“Apollo Fund”), for which an offer can be made only by

such fund's Confidential Private Placement Memorandum and in

compliance with applicable law. |

2

Apollo Global Management, LLC

Ticker:

APO

Exchange:

New York Stock Exchange

Trading Price (October 12, 2012):

$14.48

Market Capitalization

$5.6 billion

L12M Dividend Yield

7.9%

Total Shares / Public Float

(1)

387 million / 60 million

% Insider Ownership

(1)

~70%

L12M Distribution

$1.15 per share

1.

As of June 30, 2012.

Apollo Global Management is a leading

global alternative investment manager in

private equity, credit-oriented capital

markets and real estate |

3

Agenda

1.

Overview of Apollo

2.

Secular Opportunity

3.

Business Segments

4.

Financial Overview |

4

Investment Highlights

Leading global alternative investment manager with a diversified

and integrated

platform and highly scalable business model

22 year history of industry-leading returns, especially during

periods of market turbulence

Well positioned to capitalize on secular growth dynamics in

alternative asset management sector with established brand

name Proven success growing assets under management and building

new businesses Attractive financial characteristics with solid

track record of cash distributions to shareholders

Strong management and investment teams aligned with shareholders

and clients |

5

Apollo Global Management Overview

Private Equity

$38bn

AUM

Capital Markets

(3)

$56bn

AUM

Principal Investment Businesses

(1)

Natural Resources

(2)

~$1bn

AUM

Real Estate

$8bn

AUM

Los Angeles

New York

London

Singapore

Frankfurt

Luxembourg

Mumbai

Hong Kong

Houston

Firm Profile

(1)

Founded:

1990

AUM:

$105 bn

Employees:

616

Inv. Prof.:

237

Global Footprint

Investment Approach

Value-oriented

Contrarian

Opportunistic across

market cycles

Integrated platform across

asset classes and

geographies

Deep industry knowledge

Invest across the capital

structure

1.

As of June 30, 2012. (2) Approximate total commitments as of June

30, 2012. There can be no assurance as to the final committed capital. (3) Includes three funds that are denominated in Euros and translated into U.S.

dollars at an exchange rate of €1.00 to $1.27 as of June 30,

2012. |

6

Apollo’s Fully Integrated Business Model

Industry Insights

Management Relationships

Investment Opportunities

Capital

Markets

Investment Opportunities

Market Insights

Market Relationships

Private

Equity

Development of industry insight through :

–

Over 300 current and former portfolio

companies

–

Exclusive strategic relationships

with industry executives

–

Significant relationships at CEO,

CFO and board level

Real

Estate

Natural

Resources

Note: The listed companies are a sample of Apollo private equity

and capital markets investments. The list was compiled based on non-performance criteria and are not representative of all transactions of a given type or

investment of any Apollo fund generally, and are solely intended to be

illustrative of the type of investments across certain core industries that may be made by the Apollo funds. There can be no guarantees that any similar

investment opportunities will be available or pursued by Apollo in the

future. It contains companies which are not currently held in any Apollo portfolio. |

7

Apollo’s Expertise –

Nine Core Industries

Chemicals

Consumer

& Retail

Distribution &

Transportation

Financial &

Business

Services

Manufacturing

& Industrial

Media, Cable &

Leisure

Packaging &

Materials

Satellite &

Wireless

Commodities

ATHLON ENERGY

Note: The listed companies are a sample of Apollo private equity

and capital markets investments. The list was compiled based on non-performance criteria and are not representative of all transactions of a given

type or investment of any Apollo fund generally, and are solely intended

to be illustrative of the type of investments across certain core industries that may be made by the Apollo funds. There can be no guarantees

that any similar investment opportunities will be available or pursued

by Apollo in the future. It contains companies which are not currently held in any Apollo portfolio. |

8

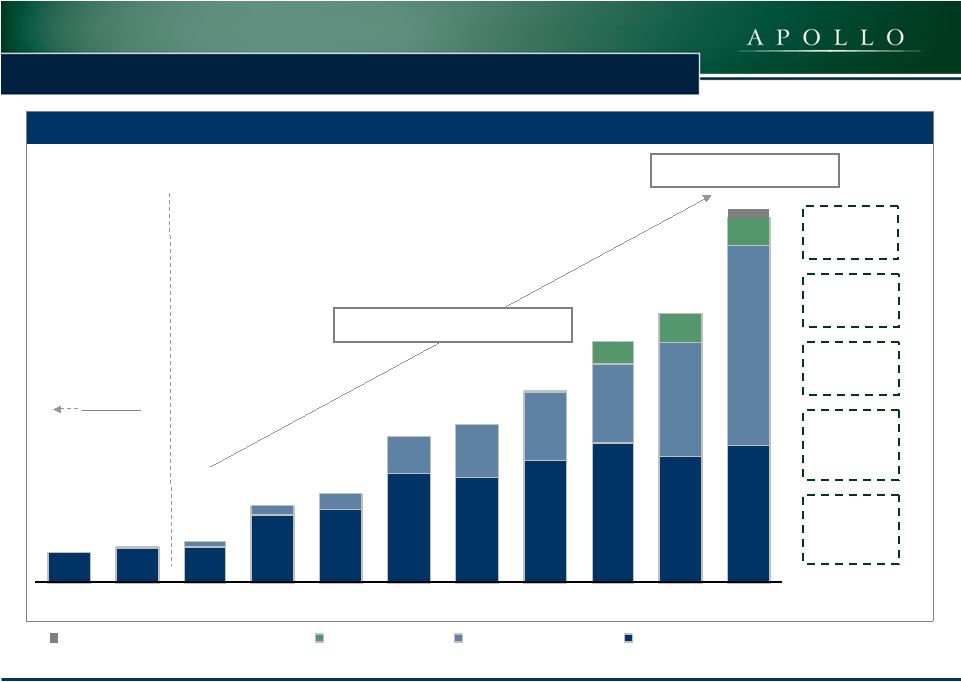

Apollo’s Total AUM Has Grown By More Than 10x Over the Last

Decade $8,163

$9,200

$9,765

$18,734

$20,186

$30,237

$29,094

$34,002

$38,799

$35,384

$38,228

$529

$1,557

$2,463

$4,392

$10,533

$15,108

$19,112

$22,283

$31,867

$56,108

$495

$6,469

$7,971

$7,861

$2,696

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

June 2012

Unallocated Strategic Account AUM

Real Estate AUM

Capital Markets AUM

Private Equity AUM

1990-2002:

PE Only

Significant Growth and Diversification

Strategic

Acquisitions

& Alliances

Geographic

Expansion

New Product

Development

Scale Existing

Businesses

2013 and

Beyond

New

Distribution

Channels

($ in millions)

Apollo AUM CAGR: 35%

Total AUM: $105 bn |

9

Growing Global Base of Loyal Long-Term Investors

Long-Lived

Asset

Base

1

Recent Mandates for Large Strategic Partnerships

Total AUM: $68 billion

Approximately 92% of AUM was in funds with a contractual

life at inception of seven years or more

Customized

strategic

partnerships

enable

Apollo’s

institutional investors to be more opportunistic and

well-positioned to capture value in today’s market

1.

As of June 30, 2012. Duration of AUM based on contractual life at

inception. 9

Large State

Pension Plan

$3 billion

Large State

Pension Plan

$1.5 billion

Large

Sovereign

Wealth Fund

$500 million

Large

U.S. City

Pension Plan

$600 million

Large

Sovereign

Wealth Fund

€200 million

Select Apollo Strategic Partnerships:

7 or More Years

(excl. Perm. Capital)

85%

Permanent Capital

7%

Fewer than 7 Years

8% |

10

Significant Progress Since Our IPO

10

10

Increased

total AUM by 50%

from $70 billion to $105 billion

Raised

$9.6 billion

of third party capital across the Apollo platform

Deployed

$5.2 billion

of private equity capital

Distributed $1.61 per share

of cash to our shareholders over the last six quarters

Acquired two alternative credit managers

(Stone Tower, Gulf Stream) with

approximately $21 billion of assets under management

Since its IPO in March, 2011, Apollo has continued to execute against

its growth plan |

11

Agenda

1.

Background & Business Model

2.

Secular Opportunity

3.

Business Segments

4.

Financial Overview |

12

Current Pension Allocation Plans are Broken

Real Assets

8%

Equities

41%

Cash, Other; 6%

Alternatives

12%

Fixed Income

33%

20 Year

10 Year

5 year

Projected

(2)

7.8%

2.9%

(0.3%)

3-5%

6.5%

5.8%

6.5%

2-4%

13.5%

12.0%

7.2%

15+%

8.1%

8.1%

3.1%

9-12%

Typical

Pension

Allocation

(1)

Historical Asset Class Returns

(1)

(1)

(1)

(1)

1. Source: Russell Investments 2012

Global Survey on Alternative Investing. Sources: Equities – PerTrac for S&P 500 Total Return as of December 31, 2011; Fixed Income – PerTrac for Barclay’s Aggregate Bond

Index as of December 31, 2011; Alternatives - Cambridge Associates

LLC U.S. Private Equity Index and Benchmark Statistics, December 31, 2011; returns represent End-to-End Pooled Mean Net to Limited

Partners for all U.S. Private Equity; Real Assets – PerTrac for

NCREIF National Index as of December 31, 2011.

2 Represents Apollo estimates for returns over next 3-5 years based on current market trading levels, interest rates and potential interest rate changes over time, inflation and expected inflation, third

party

research, comparable analysis, precedent transactions and current and

expected underwriting levels. No assurances can be made that these projections will be met. |

13

Alternatives are Growing as Investors Search for Yield

13

1.

Source: Towers Watson Global Pension Assets Study 2012.

Portfolio Allocations to Alternatives Have

Quadrupled

Since

1995

(1)

49%

51%

41%

46%

37%

39%

5%

12%

20%

0%

10%

20%

30%

40%

50%

60%

1995

2003

2011E

Equities

Alternatives

Fixed Income / Cash

“Cash-strapped US Pension Funds Ditch

Stocks For Alternatives”

—

Reuters (8/18/12)

“Alternatives Becoming Mainstream”

—

Asset Allocation News (7/27/12)

“In Search of Diversification and Alpha,

Investors Seek Alts…”

—

Asset International (6/19/12)

“Alts Poised to Gain Significant Market

Share…”

—

Fundfire (5/7/12)

“Alternatives Growing in Portfolios as

Markets Stumble”

—

AdvisorOne (6/4/12) |

14

Agenda

1.

Background & Business Model

2.

Secular Opportunity

3.

Business Segments

4.

Financial Overview |

15

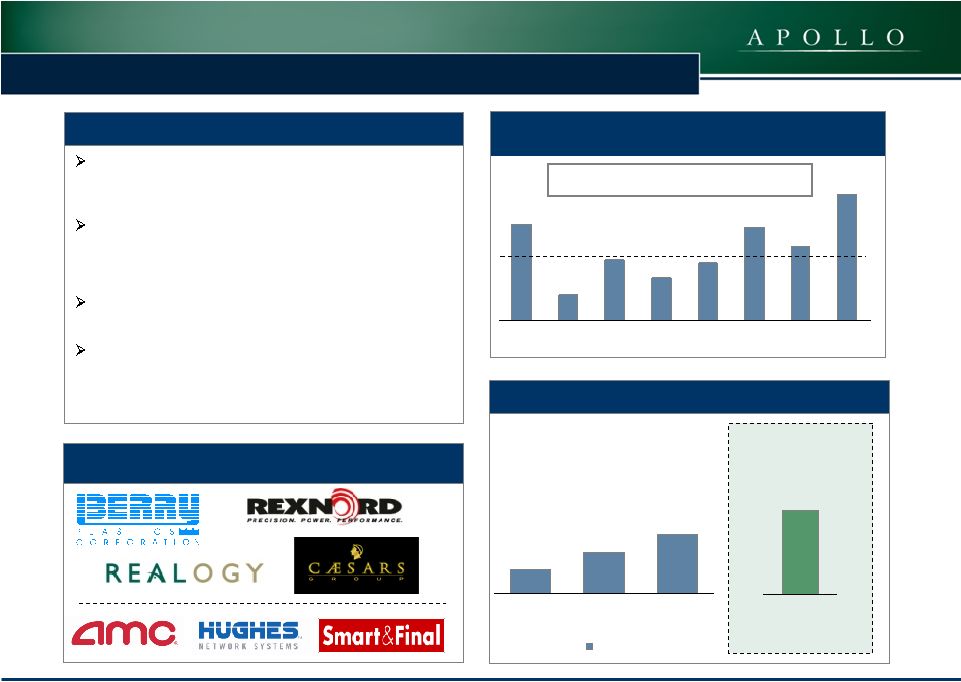

Private Equity Business Overview

15

Highlights

(1)

$38.2bn in AUM ($27.8bn in fee generating)

–

16% CAGR (12/31/07-

6/30/12) fee generating

$6.6bn of “dry powder”

–

Latest fund (Fund VII) total value 1.5x total

invested capital

Value orientation: Buyouts completed at lower

EBITDA multiples than industry averages

Significant

focus

on

distressed

since

inception

(2)

–

$11.1 billion in 247 distressed investments

–

Generated MOIC of 1.9x and 49% gross IRR

Steady Pace of Capital Deployment

Remaining Capital

Invested

$9,238

($mm)

Recent Portfolio Company IPOs & Sales

$1,266

$334

$802

$565

$757

$1,226

$984

$1,657

Q3'10

Q4'10

Q1'11

Q2'11

Q3'11

Q4'11

Q1'12

Q2'12

$950mm average per quarter

Historical Returns for Selected Asset Classes

(3)

14%

20%

8%

S&P 500

Index

All Private

Equity

Estimated Top

Quartile PE

20 Year

25%

Apollo PE Net

IRR

(4)

1.

As of June 30, 2012. 2. Please refer to the Endnotes at the

end of this presentation. 3. Please refer to the Endnotes at the end of this presentation. 4. Smart & Final sale transaction is pending. |

16

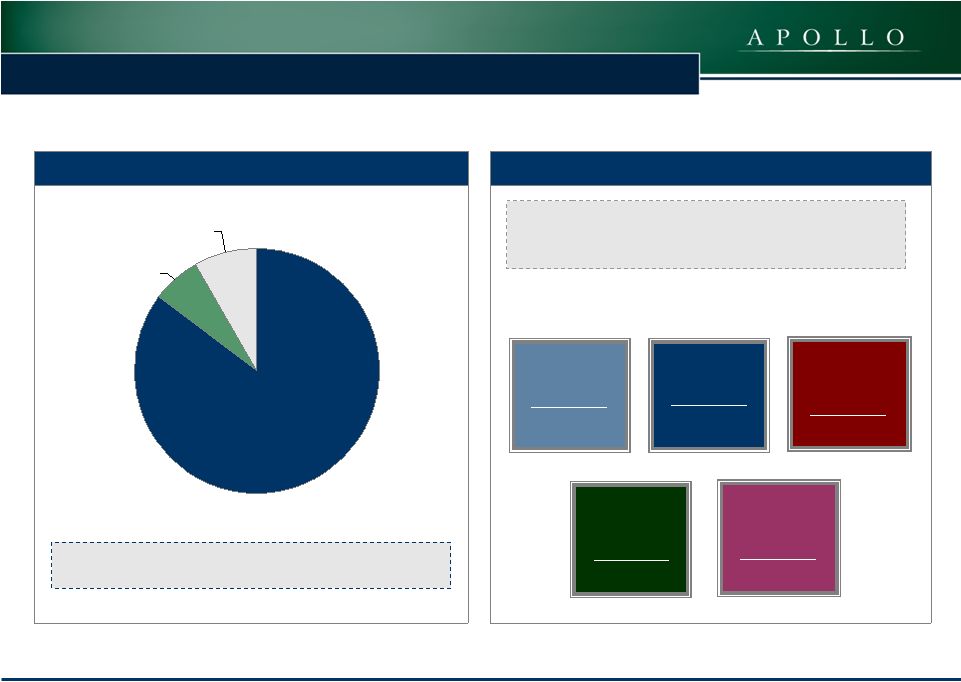

Capital Markets Business Overview

(1)

16

Diversified Mix of AUM

Highlights

$1.6

$56.1

2004

30-Jun-12

Other including

Strategic

Accounts and

Athene Life Re

$29.1bn

52%

Senior Credit

Funds

$16.9

30%

Non-Performing

Loan Funds

$4.1bn

7%

Mezzanine Funds

$4.0bn

7%

Distressed &

Event Driven

Hedge Funds

$2.0bn

4%

Established in 2003

$56.1 billion AUM ($45.5 billion in fee-generating)

Same value-oriented approach as private equity

Leverage core industry expertise of global Apollo

franchise and benefit from integrated platform

Activities span broad range of credit spectrum

Attractive relative returns with downside protected

strategies

Consists of private locked funds, public permanent

capital vehicles, and more liquid funds

Significant Growth

1.

All figures as of June 30, 2012.

Apollo Captive Investment Vehicles (AUM)

(

$3.4 billion

$437 million

$1.4 billion

$10.7 billion

2004 –

6/30/2012 CAGR: 61%

($bn) |

17

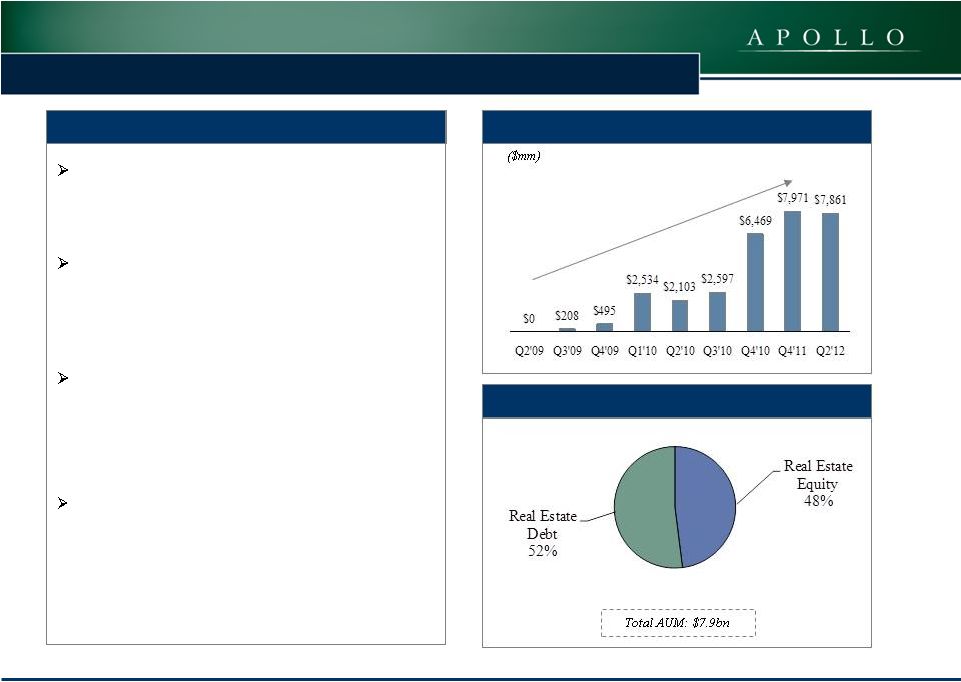

Real Estate Business Overview

Overview

(1)

Apollo Global Real Estate (AGRE) leverages

Apollo’s investment expertise and long history

of investing in real estate-related sectors

AGRE’s investment team has significant

experience in real estate restructuring and

investing in all parts of the capital structure

including both debt and equity

Acquired Citi Property Investors from Citigroup

in November 2010

–

Real estate investment management business

with $3.6 billion in AUM

Recently raised first dedicated U.S. private

equity style fund with total capital of $785

million

1.

All figures as of June 30, 2012.

Real Estate Portfolio Diversification

Growth in Apollo’s Real Estate AUM |

18

Agenda

1.

Background & Business Model

2.

Secular Opportunity

3.

Business Segments

4.

Financial Overview |

19

19

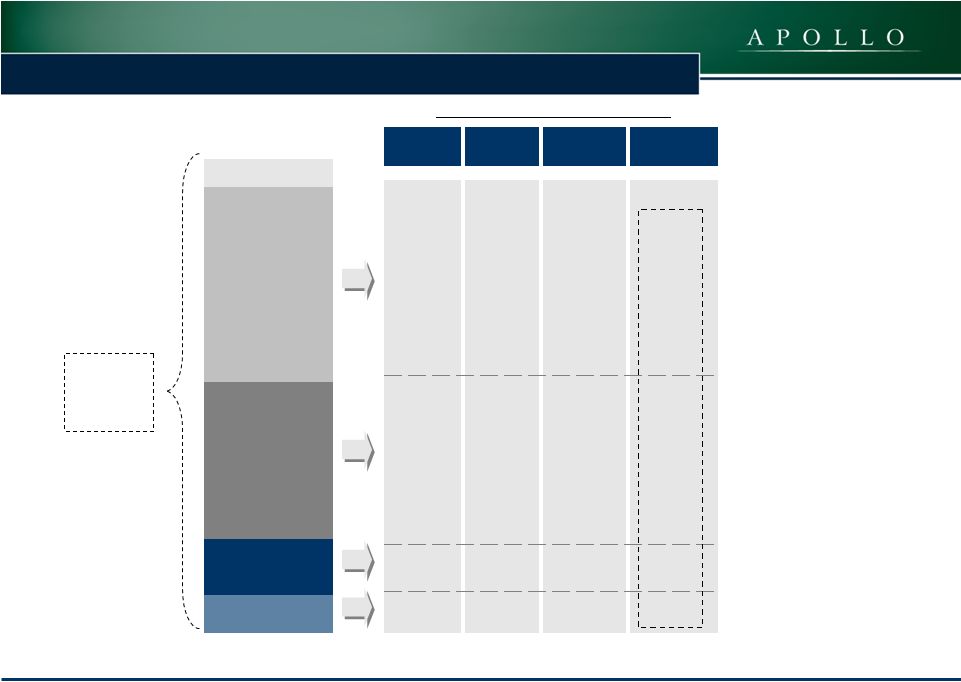

Apollo’s Primary Business Drivers

Management fees are earned

based on a percentage of fee-

generating assets

Transaction fees are generated on

certain completed PE & RE

transactions

Advisory fees are derived

through the ongoing

monitoring of PE portfolio

company operations

Carried interest from our

funds entitles us to as

much as 20% of the income

and gains that are

achieved by the funds net

of fund expenses

Note: Simplified structure for illustrative purposes only.

Assets Under

Management

Investment

Performance

Management Fees

Transaction and Advisory Fees

Private Equity & Real

Estate Carry

Capital Markets Incentive

Income

General Partner Investments |

20

Steady Growth of Management Fee Revenue

0.94 %

1.03 %

1.00 %

0.80 %

Private Equity

Capital Markets

Q2 2011

Q2 2012

Management Business Revenues

Management Fee as % of Avg. Fee Generating AUM

$159.6

$313.8

$391.6

$579.3

$512.7

$558.3

$617.0

$402.5

$0

$100

$200

$300

$400

$500

$600

$700

2005

2006

2007

2008

2009

2010

2011

1H

2012

Advisory & Transaction Fees

Net Interest Income

Management Fees

($mm)

Revenue Breakdown by Business Segment

(1)

Private Equity

59%

Real Estate

7%

Capital

Markets

34%

1.

Based on segment revenues for Q2 2012. |

21

21

Overview of Carried Interest

$ in millions

As of 6/30/12

Carried Interest Receivable by Segment:

Private Equity

$990.6

Capital Markets

308.8

Real Estate

3.4

Total Carried Interest Rec.

$1,302.8

Less: Profit Sharing Payable

665.9

Net Carried Interest Receivable

$636.9

% of Portfolio Marks Valued Using Exchange

or Broker Quotes

(1)

as of 6/30/12

87%

59%

72%

47%

Total

Real

Estate

Capital

Markets

Private

Equity

Note: Past performance is not indicative of future results.

1.

Percent of investments valued using listed exchange quotes or broker

quotes. |

22

22

AGM Key Balance Sheet Indicators

AGM Key Balance Sheet Indicators as of June 30, 2012

($ in millions, except per share data)

Cash and Cash Equivalents

$620

G.P and L.P. Investments Held by AGM

404

Carried Interest Receivable

1,302

Profit Sharing Payable

666

Shareholders Equity (excluding consolidated entities)

3,293

Total Debt

738

Q2 2012 Dividend Per Share

$0.24

Net Carry

Receivable

$636

Note: Past performance is not indicative of future results.

1.

Dividend for Q2 2012 declared on August 2, 2012.

(1) |

23

Cash Distributions to Shareholders

Since the beginning of 2011, Apollo has distributed an average

quarterly cash distribution of $0.27 per share

(1)

($ per share)

~$0.07

regular

distribution

~$0.08 from

interest and

dividends

~$0.12 from

one-time

realizations

1.

Past performance is not indicative of future results.

|

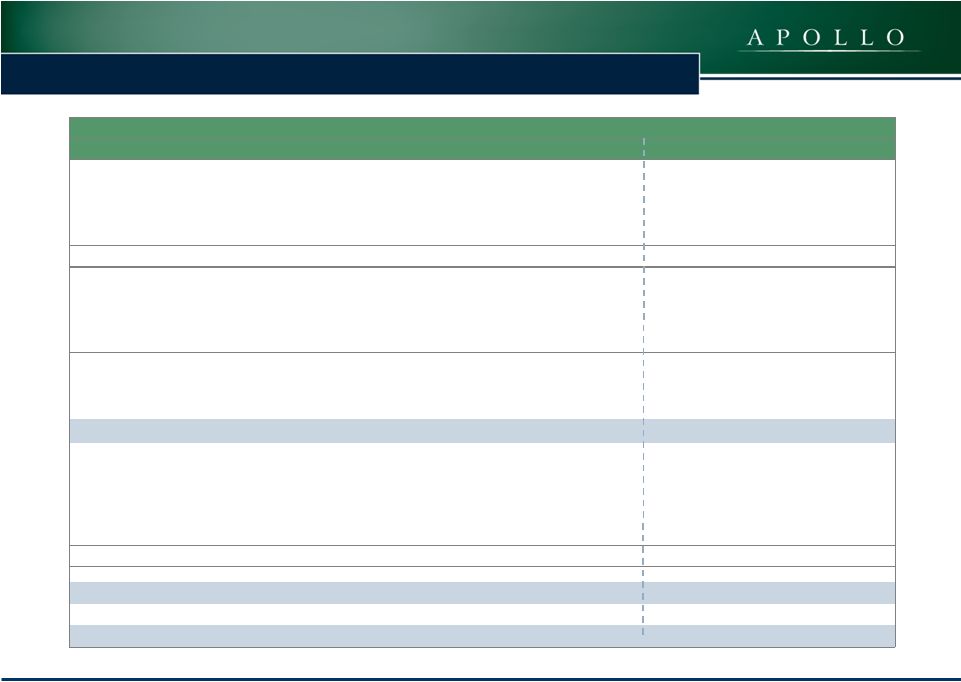

24

24

AGM’s

Financial

Summary

–

Combined

Segments

(1)

For the Three Months Ended June

For the Six Months Ended June

$ in millions

2012

2011

2012

2011

Total

Assets

under

Management

(2)

Private Equity

$38,228

$40,430

$38,228

$40,430

Capital Markets

56,108

23,684

56,108

23,684

Real Estate

7,861

7,600

7,861

7,600

TOTAL AUM

$104,893

(1)

$71,714

$104,893

(1)

$71,714

Management Business Revenues

Management Fees

156.4

121.2

286.4

239.4

Net Advisory & Transaction Fees

70.0

23.6

97.3

43.0

Carried Interest (from AIC)

9.2

11.2

18.8

23.7

Total Management Business Revenues

235.6

156.0

402.5

306.1

Management Business Expenses

158.3

137.6

295.8

277.6

Other Management Business Income / (Loss)

(6.9)

12.1

(1.1)

16.8

Management Business ENI

70.4

30.5

105.5

45.2

Incentive Business

Carried Interest Income

3.2

152.9

627.2

699.2

Carry & Incentive Fee Compensation

19.8

67.1

268.9

294.4

Other Incentive Business Income/(Loss)

(11.8)

9.0

40.2

51.9

Incentive Business ENI

(28.4)

94.8

398.5

456.7

Total ENI (after tax)

18.7

117.5

441.0

468.9

Total ENI per share

$0.05

$0.31

$1.15

$1.29

Distributions per share

$0.24

$0.24

$0.49

$0.46

1.

Totals may not sum due to rounding..

2.

Includes $2.7 billion of commitments that have yet to be deployed to an

Apollo fund within Apollo’s three segments. |

25

25 |

26

26

ENI to GAAP Earnings Reconciliation

($'s in millions)

June 30, 2012

June 30, 2011

June 30, 2012

June 30, 2011

Reconciliation of GAAP Net Income to ENI and Adjusted ENI

Net Income (loss) attributable to Apollo Global Management, LLC

(41.3)

$

(51.0)

$

56.7

$

(12.8)

$

Impact of non-cash charges related to

equity-based compensation 127.8

270.4

257.8

540.8

Income tax provision

10.6

3.6

25.2

12.4

Amortization of intangible assets associated with 2007 Reorganization and acquisition. . . .

. 9.6

4.3

15.7

7.5

Net income (loss) attributable to Non-Controlling Interests in Apollo Operating Group. . .

. . (64.7)

(102.0)

148.6

(46.0)

Economic Net Income.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . .

42.0

$

125.3

$

504.0

$

501.9

$

For the Three Months Ended

For the Six Months Ended

. . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . |

27

27

Endnotes

Footnotes from Page 15:

1.

Data as of June 30, 2012.

2.

Information for Apollo’s

distressed

investment

experience

is

provided

to

illustrate

the

Firm’s

experience

making

distressed

investments

since

the

Firm’s

inception. While

Apollo

believes

the

performance

represents

all

such

distressed

investments,

there

can

be

no

assurance

as

to

the

validity of such

methodology or determination. Gross IRRs and MOIC are computed prior

to management fees, incentive compensation, certain expenses and taxes,

which, if given effect to, would reduce such returns and, in

the aggregate, are expected to be substantial. Gross

IRRs are based on actual cash flows to and from the respective

Apollo fund in accordance with the applicable provisions within the partnership agreement of the relevant Apollo fund, as well

as the valuations for unrealized investments as of June 30, 2012.

3.

(a) S&P

as

of

June

30,

2012.

(b)

All

Private

Equity

per

Cambridge

Associates

LLC

U.S.

Private

Equity

Index

and

Benchmark

Statistics,

March 31,

2012, the most recent data available. Returns represent

End-to-End Pooled Mean Net to Limited Partners (net of fees, expenses and carried interest)

for all U.S. Private Equity. (c) Estimated Top Quartile Private Equity

per Cambridge Associates LLC U.S. Private Equity Index and Benchmark

Statistics, March 31, 2012, the most recent data available. Estimated

Top Quartile PE numbers are calculated by taking 20 year return metrics as

described above and adding the average of the delta between Top

Quartile IRRs and the Pooled Mean Net to Limited Partners for the selected

timeframe. (d) Apollo Private Equity Net IRR represents returns of all

Apollo Private Equity funds since inception in 1990 through June 30, 2012. |