Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SPRINT Corp | d424757d8k.htm |

| EX-99.1 - EX-99.1 - SPRINT Corp | d424757dex991.htm |

Sprint / SoftBank

Investor Call

October 15, 2012

Exhibit 99.2 |

Cautionary Statement

2

This presentation includes “forward-looking statements” within the meaning of

the securities laws. The words “may,” “could,”

“should,” “estimate,” “project,” “forecast,” intend,” “expect,” “anticipate,”

“believe,” “target,” “plan,” “providing guidance,”

and similar expressions are intended to identify information that is not historical

in nature. All statements that address operating performance, events or developments

that we expect or anticipate will occur in the future — including statements

relating to network performance, subscriber growth, and liquidity, and statements expressing

general views about future operating results — are forward-looking

statements. Forward-looking statements are estimates and projections reflecting

management’s judgment based on currently available information and involve a

number of risks and uncertainties that could cause actual results to differ

materially from those suggested by the forward-looking statements. With respect to

these forward-looking statements, management has made assumptions regarding, among other

things, development and deployment of new technologies; efficiencies and cost savings

of multimode technologies; customer and network usage; customer growth and retention;

service, coverage and quality; availability of devices; the timing of various events

and the economic environment. Sprint Nextel believes these forward-looking

statements are reasonable; however, you should not place undue reliance on

forward-looking statements, which are based on current expectations and speak

only as of the date when made. Sprint Nextel undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. In addition, forward-looking

statements are subject to certain risks and uncertainties that could cause actual

results to differ materially from our company's historical experience and our present

expectations or projections. Factors that might cause such differences include, but

are not limited to, those discussed in the company’s Annual Report on Form

10-K for the year ended December 31, 2011 filed with the U.S. Securities and

Exchange Commission, which are incorporated herein by reference and when filed, Part II,

Item 1A, “Risk Factors,” of our Form 10-Q for the quarter ended June

30, 2012. You should understand that it is not possible to predict or identify all

such factors. Consequently, you should not consider any such list to be a complete

set of all potential risks or uncertainties. |

Soliciting Material Pursuant to14a-12

3

Cautionary Statement Regarding Forward Looking Statements

This document includes "forward-looking statements" within the meaning of the securities

laws. The words "may," "could," "should," "estimate," "project," "forecast," intend," "expect," "anticipate," "believe,"

"target," "plan," "providing guidance" and similar expressions are intended to

identify information that is not historical in nature. This document contains forward-looking statements relating to the proposed transaction between

Sprint Nextel Corporation ("Sprint") and SOFTBANK CORP. ("Softbank") and its group companies,

including Starburst II, Inc. ("Starburst II") pursuant to a merger agreement and bond purchase

agreement. All statements, other than historical facts, including statements regarding the expected timing of the

closing of the transaction; the ability of the parties to complete the transaction considering the

various closing conditions; the expected benefits of the transaction such as improved operations, enhanced

revenues and cash flow, growth potential, market profile and financial strength; the competitive

ability and position of Softbank or Sprint; and any assumptions underlying any of the foregoing, are forward-

looking statements. Such statements are based upon current plans, estimates and expectations that

are subject to risks, uncertainties and assumptions. The inclusion of such statements should not be

regarded as a representation that such plans, estimates or expectations will be achieved. You

should not place undue reliance on such statements. Important factors that could cause actual results to differ

materially from such plans, estimates or expectations include, among others, that (1) one or more

closing conditions to the transaction may not be satisfied or waived, on a timely basis or otherwise, including

that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the

transaction or that the required approval by Sprint’s stockholders may not be obtained; (2) there may be a

material adverse change of Softbank or Sprint or the respective businesses of Softbank or Sprint may

suffer as a result of uncertainty surrounding the transaction; (3) the transaction may involve unexpected

costs, liabilities or delays; (4) legal proceedings may be initiated related to the transaction; and

(5) other risk factors as detailed from time to time in Sprint's and Starburst II's reports filed with the Securities and

Exchange Commission ("SEC"), including Sprint's Annual Report on Form 10-K for the year

ended December 31, 2011 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2012 and the proxy

statement/prospectus to be contained in Starburst II's Registration Statement on Form S-4, which

are (or will be, when filed) available on the SEC's web site (www.sec.gov). There can be no assurance that the

merger will be completed, or if it is completed, that it will close within the anticipated time period

or that the expected benefits of the merger will be realized. None of Sprint, Softbank or Starburst II undertakes any obligation to update any forward-looking

statement to reflect events or circumstances after the date on which the statement is made or to reflect

the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on any

of these forward-looking statements. Additional Information and Where to Find It

In connection with the proposed strategic combination, Starburst II plans to file with the SEC a

Registration Statement on Form S-4 that will include a proxy statement of Sprint, and that also will

constitute a prospectus of Starburst II. Sprint will mail the proxy statement/prospectus to its

stockholders. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES

AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. The proxy statement/prospectus, as well as other filings containing information about Sprint, Softbank and Starburst II,

will be available, free of charge, from the SEC's web site (www.sec.gov). Sprint's SEC filings in

connection with the transaction also may be obtained, free of charge, from Sprint's web site (www.sprint.com)

under the tab "About Us – Investors" and then under the heading "Documents and Filings

– SEC Filings," or by directing a request to Sprint, 6200 Sprint Parkway, Overland Park, Kansas 66251, Attention:

Shareholder Relations or (913) 794-1091. Starburst II's SEC filings in connection with the

transaction (when filed) also may be obtained, free of charge, by directing a request to Softbank, 1-9-1 Higashi-

Shimbashi, Minato-ku, Tokyo 105-7303, Japan; telephone: +81.3.6889.2290; e-mail:

ir@softbank.co.jp. Participants in the Merger Solicitation

The respective directors, executive officers and employees of Sprint, Softbank, Starburst II and other

persons may be deemed to be participants in the solicitation of proxies in respect of the

transaction. Information regarding Sprint's directors and executive officers is available in its

Annual Report on Form 10-K for the year ended December 31, 2011. Other information regarding the interests of

such individuals as well as information regarding Softbank's and Starburst II's directors and executive

officers will be available in the proxy statement/prospectus when it becomes available. These documents

can be obtained free of charge from the sources indicated above. This communication shall not

constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer

of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended. |

*Non-GAAP Financial Measures

Sprint Nextel provides financial measures determined in accordance with accounting

principles generally accepted in the United States (GAAP) and adjusted GAAP

(non-GAAP). The non-GAAP financial measures reflect industry conventions, or standard measures of liquidity, profitability or

performance commonly used by the investment community for comparability purposes. These

measurements should be considered in addition to, but not as a substitute for,

financial information prepared in accordance with GAAP. We have defined below each of the non-GAAP measures we use, but

these measures may not be synonymous to similar measurement terms used by other

companies. Sprint Nextel provides reconciliations of these non-GAAP measures in

its financial reporting. Because Sprint Nextel does not predict special items that

might occur in the future, and our forecasts are developed at a level of detail different

than that used to prepare GAAP-based financial measures, Sprint Nextel does not

provide reconciliations to GAAP of its forward-looking financial measures. The

measures used in this release include the following: OIBDA

is

operating

income/(loss)

before

depreciation

and

amortization.

Adjusted

OIBDA

is

OIBDA

excluding

severance,

exit

costs,

and

other

special

items. Adjusted

OIBDA Margin represents Adjusted OIBDA divided by non-equipment

net operating revenues for Wireless and Adjusted OIBDA divided by net operating

revenues for Wireline. We believe that Adjusted OIBDA and Adjusted OIBDA Margin provide useful information to investors

because

they

are

an

indicator

of

the

strength

and

performance

of

our

ongoing

business

operations,

including

our

ability

to

fund

discretionary

spending

such as capital expenditures, spectrum acquisitions and other investments and our ability to

incur and service debt. While depreciation and amortization are considered operating

costs under GAAP, these expenses primarily represent non-cash current period costs associated with the use of long-lived

tangible and definite-lived intangible assets. Adjusted OIBDA and Adjusted OIBDA Margin

are calculations commonly used as a basis for investors, analysts

and

credit

rating

agencies

to

evaluate

and

compare

the

periodic

and

future

operating

performance

and

value

of

companies

within

the

telecommunications industry.

4 |

Sprint CEO

Dan Hesse

5 |

Sprint

Turnaround Phases of the Sprint Turnaround

I. Recovery

II. Investment

III. Margin Expansion

2008 -

2011

2012 -

2013

2014+

6

•

Improve the Brand

•

Reverse subscriber

trends

•

Begin growing Revenue

•

Eliminate costs

•

Conserve Capital in

preparation for

investment phase

•

Build world-class network

platform

•

Eliminate duplicative

network cost structure

•

Focus on growth of core

Sprint Platform business

•

Expect strong margin

improvement from

Network Vision and

continued revenue

growth |

Expected Transaction Benefits

•

Build shareholder value

-

Premium to current holders

-

Ownership in stronger, better capitalized Sprint

•

SoftBank expertise

-

Proven track record of challenging incumbent carriers

-

Leader in advanced technology

•

Financial strength and flexibility

-

Opportunities to invest, internally and externally,

to grow our business

•

Enables a stronger, more competitive #3 player in the

US market

-

Innovation and competition benefit US consumers

7 |

SoftBank CEO

Masayoshi Son

8 |

9

Cautionary Statement

This document includes “forward-looking statements” within the meaning of the

securities laws. The words “may,” “could,” “should,” “estimate,” “project,” “forecast,” intend,” “expect,”

“anticipate,” “believe,” “target,” “plan,” “providing

guidance” and similar expressions are intended to identify information that is not historical in nature. This document contains forward-

looking statements relating to the proposed transaction between Sprint Nextel Corporation

(“Sprint”) and SOFTBANK CORP. (“SOFTBANK”) and its group companies, including

Starburst II, Inc. (“Starburst II”) pursuant to a merger agreement and bond purchase

agreement. All statements, other than historical facts,including, but not limited to, statements

regarding the expected timing of the closing of the transaction; the ability of the parties to

complete the transaction considering the various closing conditions; the expected benefits of

the transaction such as improved operations, enhanced revenues and cash flow, growth potential, market

profile and financial strength; the competitive ability and position of SOFTBANK or Sprint; and

any assumptions underlying any of the foregoing, are forward-looking statements. Such statements are based upon current plans, estimates and

expectations that are subject to risks, uncertainties and assumptions. The inclusion of such

statements should not be regarded as a representation that such plans, estimates or

expectations will be achieved. You should not place undue reliance on such statements.

Important factors that could cause actual results to differ materially from such plans,

estimates or expectations include, among others, that (1) one or more closing conditions to the

transaction may not be satisfied or waived, on a timely basis or otherwise, including that a

governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction or that the required approval by Sprint stockholders may not be obtained;

(2) there may be a material adverse change of SOFTBANK or Sprint, or the respective businesses of

SOFTBANK or Sprint may suffer as a result of uncertainty surrounding the transaction; (3) the

transaction may involve unexpected costs, liabilities or delays; (4) legal proceedings may be initiated related to the transaction; and (5) other risk factors as detailed

from time to time in Sprint’s and Starburst II’s reports filed with the Securities and

Exchange Commission (“SEC”), including Sprint’s Annual Report on Form 10-K for the year ended

December 31, 2011 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, and the

proxy statement/prospectus to be contained in Starburst II’s Registration Statement on

Form S-4, which are, (or will be, when filed) available on the SEC’s web site (www.sec.gov). There can be no assurance that the merger will be completed, or if it is

completed, that it will close within the anticipated time period or that the expected benefits of the

merger will be realized. None of Sprint, SOFTBANK or Starburst II undertakes any

obligation to update any forward-looking statement to reflect events or circumstances after the

date on which the statement is made or to reflect the occurrence of unanticipated events.

Readers are cautioned not to place undue reliance on any of these forward-looking statements.Additional Information and Where to Find It

In connection with the proposed strategic combination, Starburst II plans to file with the SEC

a Registration Statement on Form S-4 that will include a proxy statement of Sprint, and

that also will constitute a prospectus of Starburst II. Sprint will mail the proxy

statement/prospectus to its stockholders. INVESTORS ARE URGED TO READ THE PROXY

STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION.

The proxy statement/prospectus, as well as other filings containing information about Sprint

and Starburst II will be available, free of charge, from the SEC’s web site (www.sec.gov). Sprint’s SEC filings in

connection with the transaction also may be obtained, free of charge, from Sprint’s web

site (www.sprint.com) under the tab “About Us – Investors” and then under the heading “Documents and Filings –

SEC Filings,” or by directing a request to Sprint, 6200 Sprint Parkway, Overland Park, Kansas

66251, Attention: Shareholder Relations or (913) 794-1091.Starburst II’s SEC filings in

connection with the transaction (when filed) also may be obtained, free of charge, by directing a

request to SOFTBANK, 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo 105-7303, Japan;

telephone: +81.3.6889.2290; e-mail: ir@softbank.co.jpParticipants in the

Merger Solicitation

The respective directors, executive officers and employees of Sprint, SOFTBANK, Starburst II

and other persons may be deemed to be participants in the solicitation of proxies in respect of

the transaction. Information regarding Sprint’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2011. Other

information regarding the interests of such individuals as well as information regarding

SOFTBANK’s and Starburst II’s directors and executive officers will be available in the proxy

statement/prospectus when it becomes available. These documents can be obtained free of charge

from the sources indicated above. This communication shall not constitute an offer to

sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction. No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. |

Soliciting Material Pursuant to14a-12

10

•

Cautionary Statement Regarding Forward Looking Statements

•

This

document

includes

“forward-looking

statements”

within

the

meaning

of

the

securities

laws.

The

words

“may,”

“could,”

“should,”

“estimate,”

“project,”

“forecast,”

intend,”

“expect,”

“anticipate,”

“believe,”

“target,”

“plan,”

“providing

guidance”

and

similar

expressions

are

intended

to

identify

information

that

is

not

historical in nature.

•

This

document

contains

forward-looking

statements

relating

to

the

proposed

transaction

between

Sprint

Nextel

Corporation

(“Sprint”)

and

SOFTBANK

CORP.

(“SoftBank”)

and

its

group

companies,

including

Starburst

II,

Inc.

(“Starburst

II”)

pursuant

to

a

merger

agreement

and

bond

purchase

agreement.

All

statements,

other

than

historical

facts,

including,

but

not

limited

to,

statements

regarding

the

expected

timing

of

the

closing

of

the

transaction;

the

ability

of

the

parties

to

complete

the

transaction

considering

the

various

closing

conditions;

the

expected

benefits

of

the

transaction

such

as

improved

operations,

enhanced

revenues

and

cash

flow,

growth

potential,

market

profile

and

financial

strength;

the

competitive

ability

and

position

of

or

Sprint;

and

any

assumptions

underlying

any

of

the

foregoing,

are

forward-looking

statements.

Such

statements

are

based

upon

current

plans,

estimates

and

expectations

that

are

subject

to

risks,

uncertainties

and

assumptions.

The

inclusion

of

such

statements

should

not

be

regarded

as

a

representation

that

such

plans,

estimates

or

expectations

will

be

achieved.

You

should

not

place

undue

reliance

on

such

statements.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

such

plans,

estimates

or

expectations

include,

among

others,

that

(1)

one

or

more

closing

conditions

to

the

transaction

may

not

be

satisfied

or

waived,

on

a

timely

basis

or

otherwise,

including

that

a

governmental

entity

may

prohibit,

delay

or

refuse

to

grant

approval

for

the

consummation

of

the

transaction

or

that

the

required

approval

by

Sprint

stockholders

may

not

be

obtained;

(2)

there

may

be

a

material

adverse

change

of

SOFTBANK

or

Sprint,

or

the

respective

businesses

of

SoftBank

or

Sprint

may

suffer

as

a

result

of

uncertainty

surrounding

the

transaction;

(3)

the

transaction

may

involve

unexpected

costs,

liabilities

or

delays;

(4)

legal

proceedings

may

be

initiated

related

to

the

transaction;

and

(5)

other

risk

factors

as

detailed

from

time

to

time

in

Sprint’s

and

Starburst

II’s

reports

filed

with

the

Securities

and

Exchange

Commission

(“SEC”),

including

Sprint’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011

and

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

June

30,

2012,

and

the

proxy

statement/prospectus

to

be

contained

in

Starburst

II’s

Registration

Statement

on

Form

S-4,

which

are,

(or

will

be,

when

filed)

available

on

the

SEC’s

web

site

(www.sec.gov).

There

can

be

no

assurance

that

the

merger

will

be

completed,

or

if

it

is

completed,

that

it

will

close

within

the

anticipated

time

period

or

that

the

expected

benefits

of

the

merger

will

be

realized.

•

None of Sprint, SoftBank or Starburst II undertakes any obligation to update any

forward-looking statement to reflect events or circumstances after the date on which

the statement is made or to reflect the occurrence of unanticipated events.

Readers are cautioned not to place undue reliance on any of these forward-looking

statements.

•

Additional Information and Where to Find It

•

In connection with the proposed strategic combination, Starburst II plans to file

with the SEC a Registration Statement on Form S-4 that will include a proxy

statement of Sprint, and that also will constitute a prospectus of Starburst

II. Sprint will mail the proxy statement/prospectus to its stockholders. INVESTORS ARE

URGED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE BECAUSE IT

WILL CONTAIN IMPORTANT INFORMATION. The

proxy

statement/prospectus,

as

well

as

other

filings

containing

information

about

Sprint

and

Starburst

II

will

be

available,

free

of

charge,

from

the

SEC’s

web

site

(www.sec.gov).

Sprint’s

SEC

filings

in

connection

with

the transaction

also

may

be

obtained,

free

of

charge,

from

Sprint’s

web

site

(www.Sprint.com)

under

the

tab

“About

Us

–

Investors”

and

then

under

the

heading

“Documents

and

Filings –

SEC Filings,”

or by directing a request to Sprint, 6200 Sprint Parkway,

Overland Park, Kansas 66251, Attention: Shareholder Relations or

(913) 794-1091. Starburst II’s SEC filings in connection with the

transaction (when filed) also may be obtained, free of charge, by directing

a request to SoftBank, 1-9-1 Higashi-Shimbashi, Minato-ku, Tokyo 105-7303, Japan; telephone: +81.3.6889.2290;

e-mail: ir@softbank.co.jp

•

Participants in the Merger Solicitation

•

The

respective

directors,

executive

officers

and

employees

of

Sprint,

SoftBank,

Starburst

II

and

other

persons

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

in

respect

of

the

transaction.

Information

regarding

Sprint’s

directors

and

executive

officers

is

available

in

its

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011.

Other

information

regarding

the

interests

of

such

individuals

as

well

as

information

regarding

SoftBank’s

and

Starburst

II’s

directors

and

executive

officers

will

be

available

in

the

proxy

statement/prospectus

when

it

becomes

available.

These

documents

can

be

obtained

free

of

charge

from

the

sources

indicated

above.

This

communication

shall

not

constitute

an

offer

to

sell

or

the

solicitation

of

an

offer

to

sell

or

the

solicitation

of

an

offer

to

buy

any

securities,

nor

shall

there

be

any

sale

of

securities

in

any

jurisdiction

in

which

such

offer,

solicitation

or

sale

would

be

unlawful

prior

to

registration

or

qualification

under

the

securities

laws

of

any

such

jurisdiction.

No

offer

of

securities

shall

be

made

except

by

means

of

a

prospectus

meeting

the

requirements

of

Section

10

of

the Securities Act of 1933, as amended. |

*Non-GAAP Financial Measures

11

•

Sprint Nextel provides financial measures determined in accordance with accounting principles

generally accepted in the United States (GAAP) and adjusted GAAP (non-GAAP). The

non-GAAP financial measures reflect industry conventions, or standard measures of

liquidity, profitability or performance commonly used by the investment community for

comparability purposes. These measurements should be considered in addition to, but not as a

substitute for, financial information prepared in accordance with GAAP. We have defined below

each of the non-GAAP measures we use, but these measures may not be synonymous to similar

measurement terms used by other companies.

•

•

Sprint Nextel provides reconciliations of these non-GAAP measures in its financial reporting.

Because Sprint Nextel does not predict special items that might occur in the future, and our

forecasts are developed at a level of detail different than that used to prepare GAAP-based

financial measures, Sprint Nextel does not provide reconciliations to GAAP of its

forward-looking financial measures.

•

•

•

The measures used in this presentation include the following: •

•

OIBDA is operating income/(loss) before depreciation and amortization. Adjusted OIBDA is OIBDA

excluding severance, exit costs, and other special items. Adjusted OIBDA Margin represents

Adjusted OIBDA divided by non-equipment net operating revenues for Wireless and Adjusted

OIBDA divided by net operating revenues for Wireline. We believe that Adjusted OIBDA and

Adjusted OIBDA Margin provide useful information to investors because they are an indicator of the

strength and performance of our ongoing business operations, including our ability to fund

discretionary spending such as capital expenditures, spectrum acquisitions and other investments

and our ability to incur and service debt. While depreciation and amortization are considered

operating costs under GAAP, these expenses primarily represent non-cash current period

costs associated with the use of long-lived tangible and definite-lived intangible assets. Adjusted OIBDA

and Adjusted OIBDA Margin are calculations commonly used as a basis for investors, analysts and credit

rating agencies to evaluate and compare the periodic and future operating performance and value

of companies within the telecommunications industry. •

This presentation may contain certain “non-GAAP” financial measures. SOFTBANK CORP.

(“SoftBank”) uses certain non- GAAP performance measures and ratios in managing

its business. Non-GAAP financial information should be viewed in addition to, and not as an

alternative for, the reported operating results or cash flow from operations or any other measures of

performance prepared in accordance with generally accepted accounting principles in Japan. In

addition, the presentation of these measures may not be comparable to similarly titled measures

other companies may use. |

SOFTBANK Consolidated Revenue

12

FY2011

FY1981

$80bn

SOFTBANK

data

includes

WILLCOM

and

EMOBILE

data.

SOFTBANK

is

WILLCOM's

sponsor

in

connection

with

WILLCOM's

rehabilitation

under

Japan's

Corporate

Rehabilitation

Act,

and

holds

a

100%

economic

interest

in

WILLCOM.

eAccess

Ltd.,

provider

of

the

EMOBILE

service,

is

the

subject

of

a

proposed

share

exchange

transaction

with

SOFTBANK,

whereby

eAccess

Ltd.

is

tentatively

scheduled

to

become

a

wholly-owned

subsidiary

of

SOFTBANK

in

February

2013,

subject

to

certain

shareholder

and

regulatory

approvals

and

procedures.

* ProForma |

SOFTBANK Consolidated EBITDA

13

$18bn

FY1981

FY2011

SOFTBANK

data

includes

WILLCOM

and

EMOBILE

data.

SOFTBANK

is

WILLCOM's

sponsor

in

connection

with

WILLCOM's

rehabilitation

under

Japan's

Corporate

Rehabilitation

Act,

and

holds

a

100%

economic

interest

in

WILLCOM.

eAccess

Ltd.,

provider

of

the

EMOBILE

service,

is

the

subject

of

a

proposed

share

exchange

transaction

with

SOFTBANK,

whereby

eAccess

Ltd.

is

tentatively

scheduled

to

become

a

wholly-owned

subsidiary of SOFTBANK in February 2013, subject to certain shareholder and

regulatory approvals and procedures. *Non GAAP. Refer to disclaimer.

|

SOFTBANK EBIT

14

$2.5bn

KDDI

Disrupted

Duopoly

$1.2bn

SOFTBANK

Q1

Q1

Q1

Q1

Q1

Q1

Q1

Q1

(FY)

NTT DOCOMO

$3.4bn

(USD bn)

0

2005

’06

’07

’08

’09

’10

’11

’12

*Created by SOFTBANK CORP. based on respective companies’ publicly available information. |

960

Mobile Internet Companies 15

Mobile Internet Platform

Mobile Internet Platform |

US

Mobile Market 16

Compelling Market Opportunity

Compelling Market Opportunity

1.

Large market with rapid smartphone growth

2.

High ARPU, mainly postpaid

3.

Slow network speeds

4.

Duopolistic market |

Complementary Partners

•

Strong Brand

•

Shared Vision

•

Smartphone and LTE Strategy

•

Strong US Management

17 |

Sprint Turnaround Began in 2008

18

Phases of the Sprint Turnaround

I. Recovery

•

•

•

•

•

II. Investment

•

•

•

III. Margin Expansion

•

2008 -

2011

2012 -

2013

2014+

Improve the brand

Reverse subscriber

trends

Begin growing revenue

Eliminate costs

Conserve capital in

preparation for

investment phase

Build world-class network

platform

Eliminate duplicative

network cost structure

Focus on growth of core

Sprint Platform business

Expect strong margin

improvement from

Network Vision and

continued revenue

growth |

SoftBank’s Contribution (Capital)

19

-

Strengthen Balance Sheet

-

Strategic Investment

-

Network Enhancement

a

New Capital: $8bn

* Expected uses for New Capital |

SoftBank’s Contribution (Strategy)

20

Group Synergy

-

Smartphone Strategy

-

LTE Strategy

-

Proven Track Record of

Turnarounds |

(FY)

*Source: Created based on Sprint’s publicly available information

*Non GAAP. Refer to disclaimer.

Accelerated Growth

with SoftBank

2011Q2

’11Q3

’11Q4

’12Q1

’12Q2

($)

1.31bn

1.40bn

0.84bn

1.21bn

1.45bn

Sprint Adjusted OIBDA

21 |

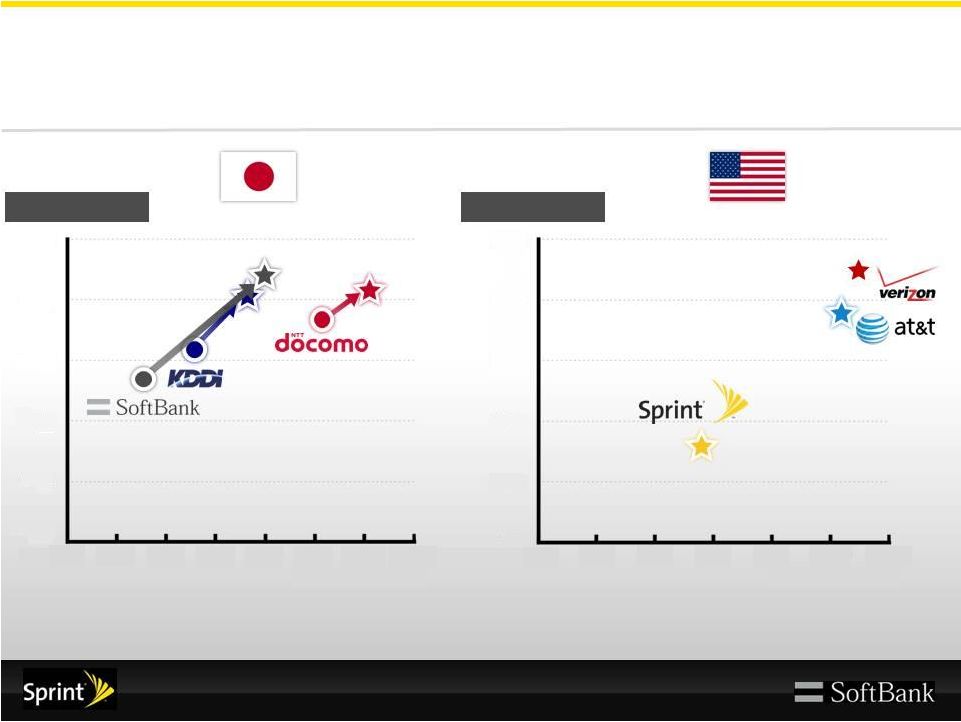

(FY2005 to FY2011)

(FY2011)

10

20

30

40

50

60

70

20

40

60

80

100

120

Subscribers(millions)

Subscribers(millions)

Mobile EBITDA

Margin

FY2005:

EBITDA

Margin:

April

2005

-

March

2006.

Subscribers

as

of

March

31,

2006.

FY2011: EBITDA Margin: April 2011 -March, 2012. Subscribers as of September 30,

2012. SOFTBANK includes WILLCOM and EMOBILE.

*Non GAAP. Refer to disclaimer.

FY2011:

EBITDA

Margin:

April

2011

-

March,

2012.

Subscribers

as

of

June

30,

2012.

Source : Japan: Created by SOFTBANKCORP. based on data from Bloomberg and

TCA. US:

Respective

companies’

publicly

available

information

ad

Wireless

Intelligence.

*Non GAAP. Refer to disclaimer.

Mobile EBITDA

Margin

Mobile EBITDA Margin

22

0

0%

10%

20%

30%

40%

50%

0%

10%

20%

30%

40%

50%

0 |

$5.5bn

(USD bn)

1.0

(FY)

Turnaround

Mobile EBIT (Operating Income)

23 |

Full Loan

Repayment

$1.7bn

FY2007

Original Repayment Plan

FY2008

FY2009

FY2010

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

FY2017

FY2018

FY2006

Repayment

Ahead of

Schedule

Vodafone K.K. Acquisition Financing

Balance of SBM loan only

24 |

SoftBank

+ Sprint*

+

+

+

China

Mobile

Verizon

AT&T

Vodafone

NTT

DOCOMO

KDDI

*Revenue from January to June 30, 2012

Created by SOFTBANK CORP. based on

respective

companies’

publicly

available

information.

$43bn

$27bn

$31bn

$18bn

Sprint

$32bn

$32bn

$37bn

$25bn

Deutsche

Telekom

Mobile Revenue

25

SOFTBANK data includes WILLCOM and EMOBILE data. SOFTBANK is WILLCOM's sponsor in connection with

WILLCOM's rehabilitation under Japan's Corporate Rehabilitation Act, and holds a 100% economic

interest in WILLCOM. eAccess Ltd., provider of the EMOBILE service, is the subject of a proposed share exchange transaction with

SOFTBANK, whereby eAccess Ltd. is tentatively scheduled to

become a wholly-owned subsidiary of SOFTBANK in February 2013, subject to certain shareholder and regulatory approvals and procedures.

*Pro forma

SOFTBANK

Group |

Subscribers

26

Verizon

AT&T

T-Mobile

33m

NTT DOCOMO

61m

au

36m

SoftBank

+ Sprint*

96m

105m

111m

*Subscribers as of

June 30, 2012 US;

September 30, 2012 Japan

*Source:

Created

by

SOFTBANK

CORP.

based

on

data

from

Wireless

Intelligence,

TCA

and

respective

companies’

publicly

available

information.

SOFTBANK

data

includes

WILLCOM

and

EMOBILE

data.

SOFTBANK

is

WILLCOM's

sponsor

in

connection

with

WILLCOM's

rehabilitation

under

Japan's

Corporate

Rehabilitation

Act,

and

holds

a

100%

economic

interest

in

WILLCOM.

eAccess

Ltd.,

provider

of

the

EMOBILE

service,

is

the

subject

of

a

proposed

share

exchange

transaction

with

SOFTBANK,

whereby

eAccess

Ltd.

is

tentatively

scheduled

to

become

a

wholly-owned

subsidiary

of

SOFTBANK

in

February

2013,

subject

to

certain

shareholder

and

regulatory

approvals

and

procedures.

*Pro forma |

Summary

1.

SoftBank is the Global No.3 Mobile Operator

2.

Compelling U.S. Market Opportunity

3.

Complementary Smartphone and LTE Strategies

4.

Enhanced Sprint Financial Strength and Competitiveness

5.

SoftBank's Proven Turnaround & Debt Repayment

Track

Record

6.

Attractive Value to Both Companies’

Shareholders

27 |

Sprint CFO

Joe Euteneuer

28 |

Legacy

Sprint Shareholders SoftBank Ownership

New Sprint

($8 billion cash infusion)

30%

ownership

70%

ownership

•

55% of Sprint shares receive $7.30 cash / share ($12.14 billion)

•

45% of Sprint shares convert into 30% of the newly capitalized New Sprint

(with $8 billion cash infusion)

Attractive Shareholder Return

29 |

Expected

Financial Benefits 30

•

Attractive consideration to Sprint shareholders

-

$7.30 represents significant premium to unaffected share price

•

Oct. 10 Spot:

45%

•

30 day

(1)

:

39%

•

60 day

(1)

:

42%

•

90 day

(1)

:

54%

•

Strengthens Sprint’s Balance Sheet

-

The first investment by SoftBank, a $3.1 billion Sprint convertible

bond, is expected to occur following this announcement

-

$8 billion total cash contribution enhances liquidity

•

Capital investment improves financial and operational

flexibility

(1) Based on volume-weighted average closing prices |

Transaction Overview

Currently

3.0B Sprint

shares

outstanding

SoftBank

invests $3.1

billion in

convertible

debt @

$5.25/share

†

SoftBank

invests $4.9

billion in

newly issued

shares @

$5.25/share

†

†

Shares

O/S*

3.0B

4.6B

3.6B

70% SoftBank

(3.2B shares)

30% existing

Sprint

shareholders

(1.4B shares)

Step 2a

Step 1

Post-close

ownership

$8B cash infusion into

Sprint

SoftBank

4.6B

Step2b

$12.1B cash

to Sprint

shareholders

Sprint shareholders

Shortly after signing

At close

31

* Fully diluted pro forma shares outstanding; † Converts into equity immediately prior to

closing of Steps 2a and 2b

†† In addition, SoftBank receives five-year warrant to purchase 54.6M shares in

newly recapitalized Sprint at $5.25 per share for total additional consideration of $287M

|

Capital Structure –

as of June 30, 2012

Actual

Illustrative Pro forma

upon close*

Net Debt / Adjusted OIBDA* 2.95

LTM Adj. OIBDA (3Q11-2Q12) $4.9B

Net Debt / Adjusted OIBDA* 1.32

LTM Adj. OIBDA (3Q11-2Q12) $4.9B

$14.8

$21.3

$6.5

$-

$5.0

$10.0

$15.0

$20.0

$25.0

Cash**

Total Debt

Net Debt

$6.8

$21.3

$14.5

$-

$5.0

$10.0

$15.0

$20.0

$25.0

Cash**

Total Debt

Net Debt

32

*Non-GAAP measure. Assumes no debt holder exercises change of control offer clause;

**Cash, cash equivalents & short-term investments

|

Conclusion

33

•

Build shareholder value

-

Premium to current holders

-

Ownership in stronger, better capitalized Sprint

•

SoftBank expertise

-

Proven track record of challenging incumbent carriers

-

Leader in advanced technology

•

Financial strength and flexibility

-

Opportunities to invest, internally and externally,

to grow our business

•

Enables a stronger, more competitive #3 player in the

US market

-

Innovation and competition benefit US consumers |

Q&A

34 |

Appendix

35 |

Share

Calculation 36

@ Announcement

@ Closing

5-Year Warrants

Sprint @

Step 1

Common

Step 2a

(1)

Purchase to

Step 2b

55mm

Step 2c

(2)

($ in billions, shares in millions)

market

Conversion

Sprint

issuance

Sprint

$12.14bn Secondary

Sprint

Warrants

Sprint

Existing common shares

3,004

--

3,004

--

3,004

(1,663)

1,341

--

1,341

Common shares issued to Softbank

--

--

--

933

933

--

933

--

933

Purchase outstanding Sprint shares

--

--

--

--

--

1,663

1,663

--

1,663

Total common shares

3,004

--

3,004

933

3,938

--

3,938

--

3,938

Dilution

(3)

37

--

39

--

39

--

48

--

48

Conversion shares / Warrants

--

590

590

--

590

--

590

55

645

Fully-diluted shares

3,042

590

3,633

933

4,567

--

4,576

55

4,631

Softbank beneficial shares

590

1,524

3,187

3,241

Softbank beneficial ownership %

16.3%

33.4%

69.6%

70.0%

Cumulative

Cumulative investment

$3.1

$8.0

$20.1

$20.4

Price

$5.25

$5.25

$7.30

$5.25

Shares

590

933

1,663

55

(1) Per share amount under Step 2a is implied based on contemplated amount of total equity

contribution. (2) Per share amount under Step 2c is implied based on warrant exercisable for

shares of Parent (Sprint post-merger). (3) Dilution based on treasury stock method. At

market assumes $5.04 10/10/2012 unaffected close, Steps 1 and 2a assume $5.25 price, and Steps 2b and 2c assume $7.30 price. |

Non-GAAP

Reconciliation 37

NON-GAAP RECONCILIATION - NET LOSS TO ADJUSTED OIBDA* (Unaudited)

(Millions, USD)

Quarter To Date

6/30/12

3/31/12

12/31/11

9/30/11

6/30/11

Net Loss

$

(1,374)

$

(863)

$

(1,303)

$

(301)

$

(847)

Income Tax Expense

(26)

(37)

(106)

(12)

(99)

Loss before Income Taxes

(1,348)

(826)

(1,197)

(289)

(748)

Equity in losses of unconsolidated investments and other, net

398

273

472

261

588

Interest Expense

321

298

287

236

239

Operating (Loss) Income

(629)

(255)

(438)

208

79

Depreciation and amortization

1,896

1,666

1,174

1,194

1,235

OIBDA*

1,267

1,411

736

1,402

1,314

Severance and Lease Exit Costs

184

-

28

-

-

Gains from asset dispositions and exchanges

-

(29)

-

-

-

Asset impairments and abandonments

-

18

78

-

-

Spectrum hosting contract termination, net

-

(170)

-

-

-

Access Costs

-

(17)

-

-

-

Adjusted OIBDA*

$

1,451

$

1,213

$

842

$

1,402

$

1,314

|