Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Summit Healthcare REIT, Inc | v325621_8k.htm |

October 11, 2012

Dear Cornerstone Core Properties REIT, Inc. Shareholder:

We write to you today to provide an update on the recent activities of Cornerstone Core Properties REIT, Inc. (the “REIT”). At September 30, 2012, our portfolio consisted of the fourteen properties listed below:

Cornerstone Core Properties REIT, Inc. – Portfolio Summary

| PROPERTY | LOCATION | ACQUISITION DATE | BOOK VALUE | SQUARE FEET | #

OF UNITS | September

30, 2012 Occupancy | ||||||||||||||

| Shoemaker Industrial Building | Santa Fe Springs, CA | Jun-06 | $ | 1,088,104 | 18,921 | 4 | 75.69 | % | ||||||||||||

| 20100 Western Ave | Los Angeles, CA | Dec-06 | $ | 10,902,982 | 116,433 | 5 | 100.0 | % | ||||||||||||

| Marathon Center | Largo, FL | Apr-07 | $ | 2,004,381 | 52,020 | 12 | 37.62 | % | ||||||||||||

| Carter Commerce Center | Winter Garden, FL | Nov-07 | $ | 2,670,414 | 49,125 | 16 | 64.89 | % | ||||||||||||

| Goldenrod Commerce Center | Orlando, FL | Nov-07 | $ | 4,354,426 | 78,646 | 20 | 83.00 | % | ||||||||||||

| Hanging Moss Commerce Center | Orlando, FL | Nov-07 | $ | 5,571,568 | 94,200 | 23 | 82.48 | % | ||||||||||||

| Monroe South Commerce Center | Sanford, FL | Nov-07 | $ | 9,446,522 | 172,500 | 34 | 68.58 | % | ||||||||||||

| Monroe North Commerce Center | Sanford, FL | Apr-08 | $ | 9,096,073 | 181,348 | 15 | 97.33 | % | ||||||||||||

| 1830 Santa Fe | Santa Ana, CA | Aug-10 | $ | 825,448 | 13,200 | 2 | 100.0 | % | ||||||||||||

| Nantucket – Sr Living Community | Nantucket, MA | Dec-09 | $ | 3,760,000 | 96,302 | 60 | 63.2 | % | ||||||||||||

| Total - Legacy Segment | $ | 49,719,918 | 872,695 | 191 | 79.53 | % | ||||||||||||||

| Portland Properties* | ||||||||||||||||||||

| Sheridan Care Center | Sheridan, OR | Aug-12 | $ | 3,952,982 | 13,912 | 51 beds | 100.0 | % | ||||||||||||

| Fern Hill Care Center | Portland, OR | Aug-12 | $ | 4,647,018 | 13,344 | 51 beds | 100.0 | % | ||||||||||||

| Farmington Square Medford | Medford, OR | Sept-12 | $ | 8,500,000 | 32,557 | 71 beds | 100.0 | % | ||||||||||||

| Friendship Haven Healthcare and Rehabilitation Center | Galveston County TX | Sept-12 | $ | 15,000,000 | 56,968 | 150 beds | 100.0 | % | ||||||||||||

| Total - Reposition Segment** | $ | 32,100,000 | 116,781 | 323 beds | 100.0 | % | ||||||||||||||

| Total Portfolio | $ | 81,819,918 | 989,476 | 645 | 81.95 | % | ||||||||||||||

* Portland Properties does not include a 78 bed facility in Tigard, Oregon which is under option by the same joint venture which purchased the Sheridan and Fern Hill facilities. An option deposit of $348,000 was paid. The option purchase price is $8.2 million and must be closed in February 2013.

** Cornerstone Core Properties REIT, Inc. holds a 95% interest on these properties.

Acquisitions

In continuing efforts to reposition the REIT’s property portfolio into higher income-producing properties in recession-resistant sectors of the U.S. economy, on September 14, 2012, the REIT funded an additional $8.0 million investment in the joint venture entity, Cornerstone Healthcare Partners, LLC, to acquire a 95% interest in two additional healthcare facilities.

Cornerstone Core Properties REIT, Inc. • 1920 Main Street, Suite 400 • Irvine, California 92614

Toll-free (877) 805-3333 • Local (949) 852-1007 • www.CREfunds.com

Farmington Square Medford (the “Medford Facility”) is located in Medford, Oregon and was acquired in an $8.5 million transaction. The 71-bed memory care facility has 52 units located within four separate wood-frame, single-story buildings that total 32,557 square feet. The facility was constructed in phases between 1990 and 1997.

The Medford Facility is 100% leased to Radiant Senior Living, the current operator of the facility, pursuant to a ten-year triple net lease. The starting lease rate for the Medford Facility is 9% of the purchase price, and it is estimated the initial cash on cash yield will be approximately 12.0%.

Radiant Senior Living has served as the operator of the Medford Facility since 1991, and has over twenty years of experience operating senior living facilities in the Pacific Northwest. Including the Medford Facility, the operator manages thirteen assisted living facilities in Oregon and Washington.

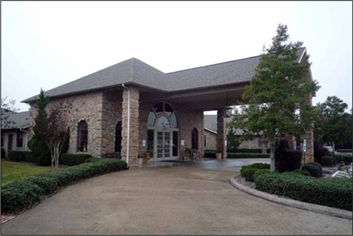

Friendship Haven Healthcare and Rehabilitation Center (the “Galveston Facility”) is located in Galveston County, Texas and was acquired in a $15.0 million transaction. The 56,968 square foot skilled nursing facility operates 150 licensed beds and was constructed in 1997.

The Galveston Facility is 100% leased to Mason Friendswood OP, LLC, the current licensee of the facility, pursuant to a ten-year triple net lease. The starting lease rate fo r the Galveston Facility is 10% of the purchase price, and it is estimated the initial cash on cash yield will be approximately 15.0%.

The Galveston Facility will continue to be operated by the current operator, which has over twenty years of experience operating senior living facilities in Texas and Louisiana and has served as the operator of the Galveston Facility since February 2012. Including the Galveston Facility, the operator manages fifteen skilled nursing facilities in Texas.

GE Loan

The Medford Facility and the Galveston Facility were acquired subject to a loan agreement with General Electric Capital Corporation (the “GE Loan”) in the aggregate amount of approximately $16.5 million. In addition, proceeds from the GE Loan were used to repay the entire principal balance of the loan we obtained in connection to the August 2012 acquisition of the Portland Properties. As a result, the GE Loan is secured by security interests in the Medford Facility, the Galveston Facility and the Portland Properties. The GE Loan has a five-year term and matures on September 12, 2017.

Management Changes

Effective September 18, 2012, Terry Roussel resigned as Chairman, CEO and Secretary of the REIT and from his management and director roles at Cornerstone Realty Advisors, the REIT’s advisor. There are no current plans to name a new Chairman /CEO. Mr. Roussel’s action was voluntary and is supported by the independent directors as appropriate to the REIT’s ongoing strategic repositioning initiative. Mr. Roussel’s resignation was not due to any disagreement with the REIT on any matter relating to the REIT’s operations, policies or practices. Ongoing executive leadership will be provided by Kent Eikanas, the REIT’s President and Chief Operating Officer, who will serve in the interim as the REIT’s principal executive officer. Concurrent with Mr. Roussel’s resignation, Mr. Eikanas has been appointed President, Chief Operating Officer and the sole board member of Cornerstone Realty Advisors.

Expense Reductions/Service Changes

In the effort to reduce expenses and increase shareholder value, effective November 1, 2012, the REIT will utilize the services of a new transfer agent, Xerox, located in Dallas, Texas. Xerox will be responsible for maintaining investor accounts, processing account changes and transfers, paying distributions, disseminating correspondence and responding to investor requests. Without sacrificing the level of quality services our investors have come to expect, the use of Xerox services will result in significant monthly savings.

While our Investor Services phone number will remain (888) 522-1771, we will have a new address for submitting requests. In the coming weeks we will provide the new address to you along with a list of minor service changes that may affect you.

Core REIT Objectives

Both management and the board of directors are focused on the following key objectives for the REIT:

| 1. | Growing revenues and income being generated by the REIT |

| 2. | Growing shareholder value |

| 3. | Growing the overall size of the REIT |

| 4. | Reinstating a cash distribution plan for the benefit of shareholders |

| 5. | Reinstating a stock repurchase program for the benefit of shareholders |

Management and the board of directors are working very hard to evaluate options that would enable the REIT to accomplish the above objectives over time. Management and the board believe that the above objectives can be realized as assets within the REIT are repositioned.

In evaluating strategies to accomplish these objectives, the board of directors is mindful of the desire of many of the REIT’s stockholders to obtain enhanced liquidity for their investment as soon as possible. In particular, the board has carefully considered various plans to enhance the liquidity of its shares in the short-term, including among other ideas, whether to reinstate and modify the stock repurchase program to expand the sources of funding that the REIT can use to redeem shares under the program, and whether to seek stockholder approval to begin an orderly liquidation of the company’s assets. Ultimately, the board concluded on September 21, 2012, that, in view of REIT’s present efforts to reposition its business and investment portfolio into real estate sectors that are more profitable and accretive to long-term share value, it is currently in the best interest of the REIT and its stockholders to defer action to enhance the immediate liquidity of the REIT’s common stock. Notwithstanding this conclusion, the board will continue to revisit this important issue in coming quarters, especially as it relates to the REIT’s ability to support reinstatement of a stock repurchase program.

For more information regarding our recent acquisitions, we invite you to view the complete Form 8-K filing by visiting our website as follows: 1) Go to www.CREfunds.com, 2) Click on “Public Funds,” 3) Select “Cornerstone Core Properties REIT, Inc.,” 4) Click on “SEC Filings,” 5) Select “Cornerstone Core Properties REIT, Inc.,” 6) On the SEC website, click on the “documents” icon next to the 8-K filing you wish to view, and 7) Click on the document file shown in red.

If you have any questions, please contact your financial advisor or Investor Services at (888) 522-1771.

Sincerely,

Timothy C. Collins

Chief Financial Officer

cc: Financial Advisor

This letter contains forward-looking statements relating to the business and financial outlook of Cornerstone Core Properties REIT, Inc. that are based on our current expectations, estimates, forecasts and projections and are not guarantees of future performance. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this release. Such factors include those described in the Risk Factors sections of the Cornerstone Core Properties REIT, Inc.’s annual report on Form 10-K for the year ended December 31, 2011, and quarterly reports for the periods ended March 31, 2012, and June 30, 2012. Forward-looking statements in this document speak only as of the date on which such statements were made, and we undertake no obligation to update any such statements that may become untrue because of subsequent events. We claim the safe harbor protection for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

CL0306 10/12