UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

(Amendment No. 2)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 29, 2012

DIONICS, INC.

(Exact name of registrant as specified in its charter)

Commission file number 000-08161

|

Delaware

|

11-2166744

|

|

(State or other jurisdiction

|

(I.R.S. Employer

|

|

of incorporation)

|

Identification No.)

|

|

No.8 Ji Yang Road, Xinzhou District Shangrao City, Jiangxi Province, China

|

334000

|

|

(Address of principal executive offices)

|

(Zip Code)

|

86 793 8070319 / 86 793 8070676

Registrant's telephone number, including area code:

65 Rushmore Street, Westbury, New York 11590

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory Note

This amendment is being filed to amend certain portions of the disclosure under Items 2.01 of the Current Report on Form 8-K we filed on September 10, 2012, in response to a letter of comment we received from the Staff of the Division of Corporation Finance, Securities and Exchange Commission.

Special Note Regarding Forward Looking Statements

This report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on forward-looking statements. Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

|

·

|

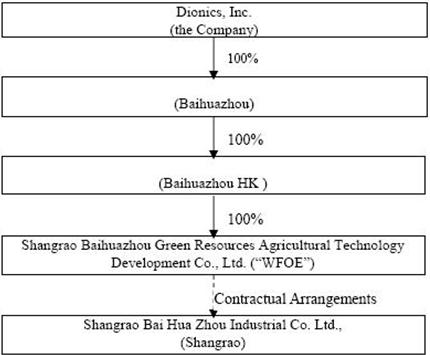

the “Company,” “we,” “us,” and “our” refer to the combined business of Dionics, Inc., a Delaware corporation, and its subsidiaries, Bai Hua Zhou Green Resources (China) Investment Group Limited, a British Virgin Islands company (“Baihuazhou”), Green Resources (China) Investment Group Limited, (“Baihuazhou HK”), a Hong Kong company, Baihuazhou Green Resources (Shangrao) Agriculture Technology Development Ltd., (“WFOE”) a PRC company, and our variable interest entity, Shangrao Bai Hua Zhou Industrial Co., Ltd (“Shangrao”), a PRC company which we control through a series of contractual arrangements among WFOE, Shangrao and its shareholder;

|

|

|

·

|

“Chinese Mu” refers to a Chinese acre, which is equivalent to approximately 0.1647 U.S. acres, with one U.S. acre equivalent to 6.07 Chinese Mu;

|

|

|

·

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

|

·

|

“VIE Agreements” refers to the contractual arrangements among WFOE, Shangrao and the shareholder of Shangrao whereby WFOE controls the operations of Shangrao and is entitled to the benefit of its operations;

|

|

|

·

|

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People's Republic of China;

|

|

|

·

|

“PRC,” “China,” and “Chinese,” refer to the People's Republic of China;

|

|

|

·

|

“Renminbi” and “RMB” refer to the legal currency of China;

|

|

·

|

“SEC” refers to the Securities and Exchange Commission;

|

|

|

·

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

|

·

|

“U.S. dollars,” “dollars”, “USD” and “$” refer to the legal currency of the United States.

|

In China it is customary to refer to a person's name with the family name first and the given name second. We have followed this convention with respect to certain Chinese individuals named in this report.

Item 1.01 Entry Into a Material Definitive Agreement

On January 30, 2012, we entered into a share exchange agreement (the “Original Exchange Agreement”) with Shangrao Bai Hua Zhou Industrial Co., Ltd., a company incorporated in the People’s Republic of China (“Shangrao”) and Li Xiaoling, the sole shareholder of Shangrao, pursuant to which we were to acquire 100% of the issued and outstanding shares of Shangrao in exchange for the issuance of an aggregate of 20,000,000 shares of the common stock (the “Common Shares”) and 50,000 shares of preferred stock convertible into such number of shares of common stock that together with the Common Shares would represent 95.0% of the total shares of common stock to be outstanding upon closing of the transactions contemplated by the Original Exchange Agreement (the “Closing”).

As contemplated by the Original Exchange Agreement, Shangrao loaned the Company $200,000 (the “Loan”) pursuant to a non-recourse promissory note which was due January 30, 2013 (the “Note”). The Original Exchange Agreement also provided that at the Closing we would transfer and assign to an entity (the “Acquisition Entity”) created by Bernard Kravitz, our then President, all of our current assets and that the Acquisition Entity would assume all of our liabilities, including but not limited to the Note. The Exchange Agreement also contemplated that at the Closing, Bernard Kravitz would convert his demand notes payable to us (which as of the date of the Exchange Agreement were in the aggregate principal amount of $104,000) into 2,000,000 shares of common stock and terminate the Put Agreement entered into on October 30, 2009 and release us from any obligations thereunder. Under the Put Agreement, Kravitz had been given an option to put a maximum of 1,000,000 shares at a price equal to the then current market price multiplied by .80, with a minimum purchase price per share of $0.30 and a maximum purchase price per share of $0.80.

On June 29, 2012, we entered into an amendment to the Original Exchange Agreement (the Original Exchange Agreement, as amended is referred to in this report as the “Exchange Agreement”) pursuant to which we agreed to acquire all of the outstanding shares of Bai Hua Zhou Green Resources (China) Investment Group Limited, a company incorporated under the laws of the British Virgin Islands (“Baihuazhou”), from Martian Investment Limited, of which Ms. Li was the director and sole owner, instead of the shares of Shangrao, on the same terms and conditions set forth in the Exchange Agreement. Baihuazhou was formed by Li Xiaoling on March 13, 2012 as a holding company to manage and control the operations of Shangrao through a series of variable interest entity contractual agreements among a company incorporated under the laws of the PRC as a wholly-owned foreign enterprise (“WFOE”), indirectly owned by Baihuazhou through a wholly-owned subsidiary of Baihuazhou incorporated under the laws of the Hong Kong Special Administrative Region of the PRC, due to restrictions on the ownership of businesses with operations in the PRC by foreign entities.

On June 29, 2012, the Acquisition Entity and Shangrao entered into an agreement to extend the maturity date of the Note until January 30, 2014.

The foregoing description of the terms of the Exchange Agreement is qualified in its entirety by reference to the provisions of the agreement, together with the amendments thereto, filed as Exhibits 2.1, 2.2 and 2.3, respectively, to this report, which are incorporated by reference herein.

1

Item 2.01 Completion of Acquisition or Disposition of Assets

On June 29, 2012, we acquired all of the issued and outstanding capital stock of Bai Hua Zhou Green Resources (China) Investment Group Limited (“Baihuazhou”) pursuant to the Exchange Agreement in exchange for an aggregate of 20,000,000 shares of common stock and 50,000 shares of Series A Preferred Stock convertible into 509,800,000 additional shares of common stock (the “Acquisition”).

As a result of the Acquisition, Baihuazhou became our wholly-owned subsidiary and Martian Investment limited, of which Ms. Li is the director and sole owner, as the former shareholder of Baihuazhou, became our controlling stockholder. Baihuazhou, in turn owns all of the issued and outstanding capital stock of Green Resources (China) Investment Group Limited (“Baihuazhou HK”), an entity formed under the laws of Hong Kong, which in turn owns all of the issued and outstanding capital stock of Baihuazhou Green Resources (Shangrao) Agriculture Technology Development Ltd. (“WFOE”). In addition, we effectively and substantially control Shangrao Bai Hua Zhou Industrial Co., Ltd. (“Shangrao”) through a series of agreements among WFOE, Shangrao Bai Hua Zhou Industrial Co., Ltd. and Li Xiaoling, the sole shareholder of Shangrao Bai Hua Zhou Industrial Co., Ltd.

In connection with the consummation of the Acquisition, all of the assets related to the semiconductor business we previously conducted were transferred to a newly formed entity controlled by Mr. Bernard Kravitz (“Acquisition Entity”). In consideration of such transfer, the Acquisition Entity assumed all of our liabilities as of the time immediately prior to the consummation of the Acquisition, including the payment of the Note. Payment of the Note is secured by a pledge of 2,000,000 shares of common stock issued to Bernard Kravitz in exchange for the cancellation of certain of our demand notes in the aggregate principal amount of $104,000. In connection with the execution of the Original Share Exchange Agreement, Mr. Kravitz also agreed to terminate the Put Agreement entered into on October 30, 2009 and release us from any obligations thereunder. Under the Put Agreement, Mr. Kravitz had been given an option to put to us a maximum of 1,000,000 shares of common stock at a price equal to the then current market price multiplied by .80, with a minimum purchase price per share of $0.30 and a maximum purchase price per share of $0.80.

Reasons for Entering into the Variable Interest Entity Agreements with Shangrao

Ms. Li, the sole shareholder of Shangrao, desires to access the US capital markets to obtain funds to expand the operations of Shangrao and, potentially, to acquire other business in China. Because Shangrao controls natural forest resources containing rare plant species, if it is to be acquired by non-Chinese citizens, the acquirer must submit a report to the Ministry of Commerce which, if it determined that the transaction may have a serious impact on the security of China’s economy, could prohibit the transaction or amend the terms on which it occurred to eliminate the perceived threat. Although she believes there is no basis for such action, Ms. Li, the sole shareholder of Shangrao was concerned that the Ministry of Commerce would not permit the forest resources or Shangrao to be acquired by foreigners or would simply fail to take any action. Rather than seek the consent of the Chinese authorities, Ms. Li determined to cause Shangrao to enter into the VIE agreements with WFOE. The VIE structure has been used by other Chinese companies that have accessed the US capital markets and Ms. Li believes that it will enable Shangrao to obtain the capital necessary to achieve her goals. There is no assurance that the use of the VIE structure will insulate us from action by the Ministry of Commerce should it determine it is appropriate to do so. The material terms of the VIE Agreements are summarized below under the caption “Business – The VIE Agreements.”

Inasmuch as the business of Shangrao represents all of our operations after giving effect to the Exchange Agreement and the management of Shangrao will represent a majority of our Board of Directors and all of our officers, to provide the reader with information regarding our business we are providing below substantially all of the information that would be required if we were to file a registration statement on Form 10.

2

The Acquisition was accounted for as a recapitalization effected by a share exchange, whereby Baihouzhou is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

Business Overview

We operate our business in China through Shangrao Bai Hua Zhou Industrial Co., Ltd., which was founded by Ms. Li Xiaoling in November 2002. With over ten years’ growth, we have become a leading landscaping company in East China. In addition to providing complete landscaping services we maintain leased properties on which we grow trees, shrubs and flowers for sale to third parties or installation in our projects which we believe adds to our profit margin. We have six production facilities covering a total area of more than 660 hectares on which we cultivate a large quantity of tree species, landscape plants, shrubs, flowers and high-grade seedlings. We believe that by growing our own trees, plants and shrubs, we can generate this inventory at a cost below that which it could be acquired from third party vendors, particularly in light of the ongoing inflation in China. Our resource costs as a percentage of our overall costs have dropped significantly as a result of steady appreciation in value of the resources we acquired in the past. According to statistics provided by www.yuanlin.com, while the price of seedlings has increased by 5-10 times, the price for precious tree species soared by 10-1000 times between 2005 and 2010.

In addition to providing clients with nursery stock grown by us or acquired from third parties, we provide full-scale landscaping services ranging from landscape design and engineering, construction and landscape conservation, to planning and maintenance of trees, shrubs and flowers. While our main focus is on providing services in Jiangxi Province, we have extended our sales network to other provinces and regions in China including Fujian, Zhejiang, Hunan, Guangdong and Hubei.

During 2011 we made an effort to shift the focus of our business from lower margin nursery stock to higher margin products such as rare bonsai and stump products. More recently, we have expanded our operations into the production, supply and sale of organic agricultural products, valuable seedlings, stump carvings and high-grade bonsai and flowers. Because the sale of most of our agricultural and forestry products and services is tax-exempt, we enjoy an overall profit margin that has risen steadily from 48.5% in 2010 to 62.8 % in 2011 and to 76.7% in the first quarter of 2012.

The revenues of Shangrao were $14,056,779 and $18,900,616 in the years ended December 31, 2010 and 2011, respectively, and $7,213,929 for the first quarter ended March 31, 2012.

Our principal executive office is located at No.8 Ji Yang Road, Xinzhou District Shangrao City, Jiangxi Province, People's Republic of China. The telephone number at our principal executive office is 86 793 8070319.

Corporate History and Background

Dionics, Inc., which was incorporated in the State of Delaware in 1968, designed, manufactured and marketed semiconductor electronic products. Dionics, which operated at a loss in 2009 and 2010, had net sales of $628,000, $705,100 and $492,200 in 2009, 2010 and 2011, respectively, and $107,400 for the first quarter ended March 31, 2012, as compared to $116,000 for the first quarter ended March 31, 2011. In October, 2009, Dionics consummated a Stock Purchase Agreement whereby Central Mega Limited, a British Virgin Islands corporation (“CML”), acquired 13,000,000 shares of our common stock at a price of $0.04 per share, consisting of 11,000,000 newly issued shares acquired from us and 2,000,000 previously issued shares acquired from Bernard Kravitz.

3

On January 30, 2012, Dionics entered into the Original Exchange Agreement with Shangrao and Li Xiaoling, its sole shareholder. Shangrao was established in November 2002 in Shangrao City in Jiangxi Province, China. In anticipation of the consummation of the Original Exchange Agreement, Ms. Li caused Baihuazhou to be established in the British Virgin Islands on March 13, 2012; Baihuazhou HK to be established in Hong Kong on March 21, 2012; and WFOE to be established in the PRC on March 2, 2012. On February 22, 2012, the local government of the PRC issued a certificate of approval regarding the foreign ownership of WFOE by Baihuazhou HK.

On June 29, 2012, we entered into an amendment to the Original Exchange Agreement pursuant to which we agreed to acquire all of the outstanding shares of Baihuazhou from the former shareholder of Baihuazhou, instead of the shares of Shangrao, on the same terms and conditions set forth in the Original Exchange Agreement. Baihuazhou was formed by Li Xiaoling to manage and control the operations of Shangrao through a series of variable interest entity contractual agreements among Shangrao, the shareholder of Shangrao and WFOE, a wholly-owned foreign enterprise owned by Baihuazhou HK, due to restrictions on the ownership of businesses with operations in the PRC by foreign entities. Thus, upon consummation of the Acquisition, Baihuazhou became our wholly-owned subsidiary and the former shareholder of Baihuazhou became our controlling stockholder and, as a result of the actions taken in anticipation of the consummation of the Acquisition, Baihuazhou, in turn owns all of the issued and outstanding capital stock of Baihuazhou HK, which in turn owns all of the issued and outstanding capital stock of WFOE which effectively and substantially controls Shangrao through the VIE Agreements.

The VIE Agreements

On May 1, 2012, WFOE, Shangrao and Li Xiaoling, Shangrao’s sole shareholder, entered into a series of agreements known as variable interest entity agreements (the “VIE Agreements”), pursuant to which Shangrao became contractually controlled by WFOE. The VIE Agreements included:

|

(1)

|

Exclusive Business Cooperation Agreement: Pursuant to this Agreement, WFOE will be the exclusive provider of management consultation, staff training, business support, financing and related services to Shangrao. In consideration of its services, WFOE shall be paid an amount equal to the pre-tax profits of Shangrao and upon request WFOE shall be required to pay to Shangrao the amount of any loss incurred by Shangrao. The term of the Exclusive Business Cooperation Agreement will continue for a term of thirty years, or until May 1, 2042, and will be extended automatically for successive ten year periods thereafter, except that the agreement will terminate (i) at the expiration of the initial thirty-year term, or any ten-year renewal term, if WFOE notifies Shangrao not less than 30 days prior to the applicable expiration date that it does not want to extend the term, (ii) upon prior written notice from WFOE, or (iii) upon the date WFOE acquires all of the assets or equity interests of Shangrao.

|

|

(2)

|

Exclusive Option Agreement: Pursuant to this Agreement, Li Xiaoling, the sole shareholder of Shangrao, granted to WFOE an exclusive option to purchase all of the assets or outstanding shares of Shangrao. Unless an appraisal is required by the laws of China, the purchase price of the assets or outstanding equity shall be equal to the lower of (i) the actual registered capital of Shangrao and (ii) RMB 500,000. The term of the Exclusive Option Agreement is thirty years, or until May 1, 2042, unless extended by WFOE.

|

|

(3)

|

Power of Attorney: Li Xiaoling, the sole shareholder of Shangrao, has granted WFOE a Power of Attorney irrevocably authorizing WFOE to exercise all of its rights as a shareholder of Shangrao. The rights granted include, without limitation, the right to: (i) attend the shareholders’ meetings of Shangrao; (ii) exercise all of holder’s rights as a shareholder under the laws of the PRC and the Articles of Association of Shangrao, including but not limited to the right to transfer or pledge or disposition of the grantor’s shares in Shangrao; (iii) designate and appoint the legal representatives, Chair of the board of directors and other members of the senior management of Shangrao; and (iv) to execute the relevant share and/or asset purchase agreements contemplated in the Exclusive Option Agreement, and to effect the terms of the Share Pledge Agreement and Exclusive Option Agreement.

|

4

|

(4)

|

Loan Agreement: Pursuant to a Loan Agreement, Li Xiaoling, the sole shareholder of Shangrao has borrowed RMB 10,000,000 from WFOE on an interest-free basis for use in the business of Shangrao. The term of the loan is 30 years from the date of the loan, except that WFOE may require repayment of the loan upon thirty days notice.

|

|

(5)

|

Share Pledge Agreement: Pursuant to a Share Pledge Agreement, Li Xiaoling, the sole shareholder of Shangrao, has pledged all of her shares in Shangrao as security for the performance by Shangrao and Li Xiaoling, as the sole shareholder of Shangrao, of their obligations under the VIE Agreements. The Share Pledge Agreement was registered with the local office of the State Administration for Industry & Commerce, or SAIC, in April 2012.

|

The foregoing description of the terms of the Exclusive Business Cooperation Agreement, the Exclusive Option Agreement, the Power of Attorney, the Loan Agreement and the Share Pledge Agreement is qualified in its entirety by reference to the provisions of the agreements filed as exhibits to this report.

The chart below presents our corporate structure:

5

The following table lists the directors and officers of the foregoing entities:

|

Corporate Name

|

Director

|

Officer

|

|

Baihuazhou

(BVI)

|

Li Xiaoling

Liu Shuzhong,

Lu Jun

|

Chairperson: Li Xiaoling

CEO: Liu Shuzhong

CFO: Zhu Xiuzhi

|

|

Baihuazhou HK

|

Li Xiaoling,

Liu Shuzhong,

Lu Jun

|

Chairperson: Li Xiaoling

CEO: Liu Shuzhong

CFO: Zhu Xiuzhi

|

|

WFOE

|

Li Xiaoling,

Liu Shuzhong,

Lu Jun

|

Chairperson: Li Xiaoling

CEO: Liu Shuzhong

CFO: Zhu Xiuzhi

|

|

Shangrao

|

Li Xiaoling,

Liu Shuzhong,

Lu Jun

|

Chairperson: Li Xiaoling

CEO: Liu Shuzhong

CFO: Zhu Xiuzhi

|

Description of Business

The industry

Starting in 2001, China experienced rapid growth in the landscaping and forestation industry. The dramatic change was largely driven by the rapid urbanization of China and government support. According to the National Bureau of Statistics of China, the urban area within China has increased by an average of 5% per year from 19,000 square kilometers in 1995 to 40,000 square kilometers in 2009. The urbanization ratio grew from 35% in 2001 to 53% in 2009 and was estimated to reach 55-60% by 2015. Based on the information provided by the Chinese Society of Landscape Architecture (CHSLA), the total urban green spaces in China grew from 400,000 hectares in 2001 to 2 million hectares in 2010. By 2010, the green coverage ratio had exceeded 40% and per capita public green space was more than 10 square meters per person. With the rapid increase of urbanization, the landscaping and forestation industry in China has become a market with an estimated demand totaling over 200 billion RMB.

Within China, central and local governments have encouraged and supported the growth of the landscaping and forestation industry. For example, on May 31, 2001, the State Council promulgated the “Circular on Strengthening the Development of Urban Forestation”, opening up the landscaping industry to private investors. The industry in all aspects including landscape planning, landscape engineering, and landscape conservation and seedling cultivation has since experienced rapid growth. In March 2011, in its Five-Year Plan the Chinese Government set the goal of raising the urbanization ration to 55-60% by 2015 and enhancing the scale of urban landscaping. In addition to policy supports, governments at all levels have increased their investment in urban landscaping from 16.3 billion RMB in 2001 to 70 billion RMB in 2009.

For most landscaping companies, the cost of raw materials such as seedlings, building stones, timber and shrubs, and labor account for a high portion of their expenses and, in turn represent more than half of the cost to the customer. The rapid growth in demand for raw materials can cause temporary scarcities and has resulted in substantial price increases for many products. Consequently, the ability to obtain sufficient raw materials at competitive costs can give a company a competitive edge when bidding for larger projects.

Our Products

Shangrao was organized for the express purpose of providing landscape services and nursery stock sales to residential, industrial, and commercial customers in Jiangxi and surrounding provinces, with an emphasis on providing landscape services to larger industrial, commercial and government projects. Our services include all aspects of landscape design, construction and maintenance. Our services are principally offered to and our customers include larger real estate developers and urban planning departments. Our principal products include the trees, shrubs and flowers, necessary for large scale landscaping projects and our services include providing the engineering and horticultural skills necessary to complete such projects. Part of our strategy has been to seek to ensure that we have access to the necessary raw materials at reasonable cost by obtaining land use rights or leases to agricultural properties when possible or entering into agreements which grant us exclusive access to government controlled properties. We currently lease or have land use rights to six separate parcels, all of which are described below, and have been granted an Exclusive Operating License (30 Years) by Jiangxi Provincial Government to develop, harvest, process, and sell, in the protective manner, seedlings in the primeval forests in an area of 460 square kilometers over Mount Wufu (part of Wuyi Mountains). We are also the only firm in Jiangxi with a Business Permit issued by the Forestry Administration of China allowing us to utilize National Key Protected Wild Plants & Products in our projects.

6

Our reserves include trees protected by the Central Government such as natural Chinese yews and ginkgo, wild plants (e.g., torreys, citrons, and Cinnamomum hupehanums), representing approximately 37% of our stock, and wild trees (e.g., the osmanthus, redflowered loropetalum, Phyllostachys pubescens, Chinese chestnut, Ilex cornuta, and camellia) protected by the Provincial Government of Jiangxi, representing approximately 24% of our stock.

Our resource reserves have enabled us to keep the rate at which our costs have increased below the rates incurred by many of our competitors. The forest land, trees and land resources we acquired have steadily appreciated in value. According to www.yuanlin.com, while seedling prices increased by 5-10 times, the prices for precious tree species had soured by 10-1000 times between 2005 and 2010. For example, 20-year-old Chinese yew costs RMB 3,000-100,000 Yuan per tree.

Property

We currently have the rights to use the parcels of land located on our six bases for nursery and cultivation purposes, subject to different terms and conditions:

Mount Wufu Base: We entered into a lease agreement with the local government of Wufu Mountains on November 16, 2002. We have the right under the lease to use a parcel of 1070 Chinese Mu for 30 years for a total rent of 16,050,000 RMB (approximately $1.9 million).

Zao Tou Base: We entered into a lease agreement with the local government of Zaotou Town on October 20, 2002. We have the right under the lease to use a parcel of 730 Chinese Mu for 30 years for a total rent of 13,140,000 RMB (approximately $1.6 million).

Shishi Base: We entered into two lease agreements with the local government of Shishi Town respectively on April 1, 2006 and January 1, 2007. We have the right under the two leases to use two parcels totaling 1,500 Chinese Mu respectively for 50 years. The first lease provides for a total rent of 19,500,000 RMB (approximately $2.4 million) and the second one for a total rent of 5,000,000 RMB (approximately $600,000).

Company Base: We entered into a lease agreement with Jiangxi Jiahe Electronics Co., Ltd. on November 1, 2006. We have the right under the lease to use a parcel of 50 mu for 6 years for a total rent of 60,000 RMB (approximately $9,600).

Feng Ling Tou Base: We entered into a seedling purchase agreement with Jiangxi Yiqing Industrial Co., Ltd. on May 6, 2008. We agreed to use a parcel of 1,000 Chinese Mu free of charge and purchase all its production for a price totaling 26 million RMB. The right to use the parcel of land was valued at 730,000 RMB (approximately $100,000).

Long Hu Base: We entered into a seedling purchase agreement with Jiangxi Red Rose Agricultural Development Co., Ltd. on November 15, 2008. We can use a parcel of 5,570 Chinese Mu free of charge and purchase all its production for a price totaling 44 million RMB. The right to use the parcel of land was valued at 458,000 RMB (approximately $60,000).

Our Technology

We are an industry leader in tree grafting and tissue culture techniques in China. Part of our business strategy is to protect and propagate rare tree species. The application of our grafting techniques serves to preserve and rejuvenate old trees while creating unique features and increasing market values. Our tissue culture techniques are used for the reproduction and multiplication of endangered tree species.

7

Our Growth Strategy

For the foreseeable future the principle focus of our efforts will be to expand and improve our capacity to generate high margins along the value chain of the landscaping industry. Our high value-added nursery products include eco-green agricultural products, high-grade flowers, high-grade bonsai, valuable seedlings and trees, and high-grade wood carvings.

In addition to expanding our core business, we intend to seek to grow our business by leveraging our strength in resource reserves and continuing our efforts to develop unique high value-added products. For the immediate future we will seek to acquire additional resources including forest lands, precious tree species and forest trees. In addition, in our forest laboratories we will seek to develop new uses for our natural resources. For example, we are currently developing high-grade camellia oil for use as a green edible oil and skin care product to take advantage of our natural camellia forests. We also are working to develop herbal products as we have a long history of planting kudzu vine root which is used as food ingredient and Chinese Traditional Medicine herb. In addition, we routinely explore whether there are specialty green and organic foods we can profitably grow and distribute. Except as stated above, the Company does not have any plans to develop specific products at this time. Some of the products that the Company may decide to produce may be subject to regulations other than those discussed below under the caption “Government Regulations.” Any determination by the Company to produce a particular product will only be made after an examination of applicable regulations and an assessment of the impact of such regulations on cost and feasibility.

Customers

Our primary customers include real estate developers, landscaping companies, gardening companies and urban planners in Jiangxi Province and the adjacent provinces. Our sales to date have been concentrated among buyers in and around Shangrao due to their proximity to our facilities. Due to the size of some of the projects that we undertake, one or a few customers generally represent a large portion of our revenues each year. However, as we undertake new products, the identities of these customers will vary from period to period. Our five largest customers, accounted for 41%, 45% and 78% of our total sales for the years ended December 31, 2011 and 2010, and the three months ended March 31, 2012, respectively. During the year ended December 31, 2011, we had a major sales contract with Changshao Luchuan Seedling Cooperation that represented 11% of our total sales for that year and during the fiscal year ended December 31, 2010, we had a major greening work service contract with Shangrao Economic House Development Department that represented 18% of our total sales for that year. Sales to no other customer accounted for 10% or more of our total sales for each of the years ended December 31, 2011 and 2010.

Despite the concentration of our sales to date, we believe there are numerous prospective buyers for our products.

We seek to reach our customers through various means. Larger real estate developers, government agencies and commercial enterprises are directly contacted by members of our management. For smaller customers, we have experienced sales personnel and maintain a website to provide round the clock information on items in stock and prices.

Raw Materials

The materials used in landscaping projects generally represent a high portion of the cost to the customer. Moreover, the ability to deliver rare or more desirable species often may influence a customer when deciding to award a project. We have made an effort to obtain direct access to a large volume and a diverse nursery stock. This stock includes not only more common plants, shrubs, trees and flowers, but also includes a large variety of rare species and high margin products such as bonsai and tree stumps used to produce high value wood carvings. Because of the emphasis we place on having direct access to nursery stock more than half of the nursery plants we sell are collected from Mount Wufu or cultivated on our facilities. Asian stumps used for bonsai are collected by employees from the mountains located on our bases. We replant cuttings to reproduce precious tree species, practicing ecologically sound resource recovery methods such as monitoring the number of cuttings planted to avoid overgrowth.

The extinction of plant species may be due to several factors, for instance, destruction, pollution, and deforestation. Mount Wufu has a large area of dense seedlings. In order to improve the absorption of light and fertility of the seedlings to ensure survival, many of them should be cleared. Instead of simply cutting and disposing of the excess seedlings, transplanting is an ecologically sound method to foster greater growth. With approval from local forestry department, we transplant seedlings from Mount Wufu to our base for cultivation. In this way, rare species are well kept. Well grown seedlings are used as the parent tissue culture to generate more seedlings. Well grown trees are sold to beautify the city's ecological environment.

Our principal vendors include Shangsha Luchuan Nursery Cooperation Co., Ltd. and Shangrao Jiyang Chinese Herbs Co., Ltd. Although our purchases of raw materials to date have been concentrated among a small number of buyers, we believe there are alternate sources of supply available to fill our needs at prices comparable to those we currently pay for supplies.

During 2011, approximately 55% of our raw materials were obtained from lands we lease on Mount Wufu, approximately 16% was self-cultivated at our other bases, and approximately 29% was obtained from vendors. During 2010, approximately 56% of our raw materials were obtained from lands we lease on Mount Wufu, approximately24% was self-cultivated, and approximately 20% was obtained from vendors.

The cost of raw materials obtained from Mount Wufu consists primarily of our labor costs, machinery rental fees, transportation fees and cultivation costs incurred to plant new specimens. The cost of raw materials cultivated on our other bases consists primarily of our labor costs, the cost of the facilities, and cultivation costs to plant new specimens as specimens are harvested. The cost of raw material obtained from vendors consists primarily of the price paid to the vendor. We believe that the costs of raw materials obtained from Mount Wufu or cultivated on our other bases are generally less than those obtained from third party vendors due to our ability to control our costs and the fact that third parties include a profit margin in the price of materials they sell to us where we can choose to minimize the profit from raw materials we produce in order to achieve a profit on other aspects of our business.

Employees

We currently employ 47 full time people consisting of 7 technicians, 8 management level personnel and 32 base laborers. We require our employees to have appropriate education, training or work experience in their respective fields. We believe that our management team possesses in-depth knowledge critical to our Company’s success and is capable of identifying and seizing market opportunities, and implementing our business plans. We also employ part time laborers, ranging from 100 during the fourth quarter when nursery cultivation operations are least active, to 300 during the first three quarters of the year when nursery cultivation operations are more active. We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC.

8

Seasonality

Although nursery sales and greening operations are not seasonal, nursery cultivation operations are more active during the first three quarters of the year than during the fourth quarter. Consequently, we tend to decrease the number of part-time personnel engaged during the fourth quarter and our revenues and expenses may be reduced accordingly.

Competition

There are currently no dominant companies in the national Chinese landscaping industry. Most of the industry participants are relatively small companies which operate in a specific territory. We are currently the largest landscaping company measured by dollar volume in Jiangxi Province although we face competition from numerous smaller companies. There is vigorous competition with respect to the design and construction of landscaping projects. We seek to differentiate ourselves from competitors by emphasizing our ability to provide rare species and our ability to provide full-scale services and operate across a wider geographic region than most of our competitors. These competitive strengths enable us to lower and spread operating costs and capture higher profit margins.

Our competitors in China are mainly Orient Landscape Inc., Guangdong Palm Landscape Architecture Co., Ltd. and Lingnan Landscape Co., Ltd. In Jiangxi Province we compete principally with Jiu Jiu Landscape Development Co., Ltd. and Yuan Quan Industrial Group Co., Ltd. Most of our competitors purchase from other bases and individuals large-size, valuable and modeling seedlings used in seedling sale and construction, which increases their sales cost and greatly reduces their profit margin. We possess the following strengths in resource reserves, valuable seedling stocks, cost advantage and talent reserves:

|

●

|

We hold an Exclusive Operating License to develop, harvest, process, and sell seedlings from the primeval forests located on an area of 460 square kilometers on Mount Wufu. Mount Wufu is known as a Valuable Plant Specimen Bank of China. The operating license is valid until May 2032. We engage in an ongoing dialogue with the local forestry department regarding the condition of the forests on Mount Wufu and our plans for developing the forests and harvesting products from the forests. Before harvesting any products from Mount Wufu, however, we must provide the local forestry department with our plans identifying the quantity of each species to be harvested and if the forestry department were to object, we would have to revise our plans. Collection has to be from the permitted 460 square kilometers of Mount Wufu. Our ability to collect plants is unlimited except for those plants protected as key national plants. We have an ongoing dialogue with the department, so we know what will happen to the species to be harvested.

|

|

●

|

We are one of a few firms in China with a Business Permit for National Key Protected Wild Plants & Products (GFWO E2011 No.021) issued by the Forestry Administration of China. This Permit allows us to harvest, process and sell certain classified wild plants. This Permit is a one-time perpetual grant, subject to a routine inspection conducted once every three years. Our next inspection is scheduled for June 2014. We will pass the inspection if there we have not violated any laws with respect to the harvesting of wild plants.

|

|

●

|

As part of our growth plan, we have cultivated in large areas such high-grade plants as Chinese yews, podocarpus and ancient tree stump bonsai to increase our market share in valuable plants. During our growth, we have also sought to strengthen the professionalism of our mid-to-high management, and have hired sufficient management to support our growth for the immediate future.

|

Government Regulations

We believe that we have obtained all regulatory approvals and permits required for the conduct of our business and have obtained an opinion from our counsel, the DeHeng Law Offices, as to the compliance of our corporate structure with applicable PRC regulations which has been filed as an exhibit to this report.

Regulations on Harvesting and Dealing of Wild Plant

Wild plants in China are subject to strict regulation. The major wild plant regulations applicable to us include the Law of the People’s Republic of China on Forests, the Law of the People’s Republic of China on Grassland, the Regulations of the People’s Republic of China on Wild Plant Protection (the “Wild Plant Regulations”), and relevant regulations promulgated by authorities at the provincial and regional levels.

China generally bans harvesting for economic purposes, sale and purchase of certain protected wild plants. The Wild Plant Regulations require a permit to harvest key wild plants subject to protection. Harvesting of key protected wild plants must conform to the category, quantity, site, time and methods set forth by the permit.

We currently hold a Business Permit for Key Protected Wild Plants of Jiangxi and Products issued by the Forestry Administration of Jiangxi Province on June 7, 2011. We also hold a Business Permit and a Production Permit for Forest Trees and Seeds respectively issued by the Forestry Administration of Shangrao on March 25, 2010.

9

Regulations on Urban Landscaping and Afforestation

The State Council promulgated the Regulations of the People’s Republic of China on Urban Afforestation (the “Afforestation Regulations”) on June 22, 1992. The Afforestation Regulations require landscaping companies to obtain qualifications in order to undertake landscaping and afforestation projects.

We currently hold a Certificate of Class 2 Qualifications for Urban Landscaping and Afforestation Enterprises issued by the Department Housing and Urban-Rural Development of Jiangxi Province in April 2012. This certificate permits us to undertake greening work services, including greening field work throughout the PRC and to provide construction and subsequent maintenance service.

Forestry Law of the People's Republic of China

On September 20, 1984, the Standing Committee of the Sixth National People's Congress promulgated Forestry Law of the People’ Republic of China, which was amended by the Second Meeting of the Standing Committee of the Ninth National People's Congress on April 29, 1998. According to the relevant provisions, forest resources belong to the state, excluding those specified under law belonging to collective ownership. State-owned and collective-owned forests, woods and forest lands, individual-owned woods and individual-used forest lands shall be registered by the local people's governments at or above the county level and rosters compiled and certificates issued confirming the ownership or right to use. The State Council may authorize the competent department of forestry under the State Council to register and compile rosters of forests, woods and forest lands of the key state-owned forest regions determined by the State Council, issue certificates and notify the local people's governments concerned. Legitimate rights and interests of owners and users of forests, woods and forest lands are protected by law upon which no unit or individual shall infringe. The State strictly controls the annual rate of forest felling in accordance with the principle that the rate of consumption is lower than the rate of growth. Annual quotas for felling shall be worked out by state-owned forestry enterprises and institutions, farms, factories and mines as units with respect to the state-owned forests and woods and by counties as units with respect to collective-owned forests and woods and individually-owned woods which shall be collected and consolidated by the competent departments of forestry of the provinces, autonomous regions and municipalities directly under the Central Government and submitted to the State Council for approval upon examination and verification by people's governments at the corresponding level.

As of May 25, 2012, the forestry bureau of Shangrao County issued proof certifying that since Shangrao was established, it has been in compliance with the relevant provisions of state and local forestry regulation.

Law of the People's Republic of China on Land Contract in Rural Areas

The Law of the People's Republic of China on Land Contract in Rural Areas, was adopted at the 29th Meeting of the Standing Committee of the Ninth National People's Congress of the People's Republic of China on August 29, 2002, which was promulgated and in effect as of March 1, 2003.

According to this law, land in rural areas, which includes the arable land, forestlands and grasslands, are owned collectively by the peasants and by the State and used collectively by the peasants. The collective economic organization of the village or the villagers committee is entitled to contract the land owned collectively by the peasants to others. However, when the party giving out contracts gives out the contracts for rural land to units or individuals other than the ones of the collective economic organization concerned, the matter shall first be subject to consent by not less than two-thirds of the members of the villagers assembly, or of the villagers' representatives, of the collective economic organization concerned and it shall be submitted to the township (town) people's government for approval. Where units or individuals other than the ones of the collective economic organization concerned undertake contracts, the contracts shall be concluded only after examination of the credit position and management capability of the contractors.

Shangrao has signed several Rural Land Lease Agreements with local villagers committees, directly and indirectly. However, such agreements did not receive the requisite approvals from the competent peasants subject to the above laws. Since as a practical matter it is difficult for each of the relevant peasants involved with the rural land to agree with the signed agreements in a timely manner, the local villager committee usually represents the relevant peasants to sign such agreements with third parties without approval from the competent peasants. Each of the villagers committees concerned has agreed to bear the liability if there is any conflict the outcome of which is unfavorable to Shangrao. Although to our knowledge, no proceedings and/or claims have been asserted against us relating to our rights to the land, we cannot provide any assurance that such proceedings or claims may not arise in the future. In the event such proceedings and/or claims are brought against us, our business operations and financial performance may be adversely affected.

10

Regulations on Annual Inspection

In accordance with relevant PRC laws, all types of enterprises incorporated under the PRC laws are required to conduct annual inspections with the State Administration for Industry and Commerce of the PRC or its local branches. In addition, foreign-invested enterprises are subject to annual inspections conducted by other applicable PRC governmental authorities. In order to reduce enterprises’ burden of submitting inspection documentation to different governmental authorities, the Measures on Implementing Joint Annual Inspection on Foreign-invested Enterprises issued in 1998 by SAFE, together with six other ministries, stipulated that foreign-invested enterprises must participate in an annual inspection jointly conducted by all relevant PRC governmental authorities.

The annual inspection normally would involve the review by the authorities of the following matters:

|

|

·

|

Any change of recorded information (such as the company name, business address, legal representative, shareholders, directors, supervisors, manager, registered capital, paid-in capital);

|

|

|

·

|

Business performance for the past year;

|

|

|

·

|

Outside investments;

|

|

|

·

|

Branches and subsidiaries; and

|

|

|

·

|

Whether shareholders have performed their capital contribution obligations.

|

Under relevant regulations, only a company which has passed an annual inspection is permitted to conduct business. A company which fails to participate in or pass an annual inspection, is subject to a fine, and if such failure continues, its business license may be cancelled.

Regulations on Work Safety

The Work Safety Law of PRC (the “Work Safety Law”) was promulgated as of June 29, 2002. It regulates the work safety of those entities that engage in production and business operation activities within the territory of the PRC (hereinafter referred to as “production and business operation entities”). All production and business operation entities must observe the Work Safety Law and any other relevant laws or regulations concerning work safety, strengthen the administration of work safety, establish and perfect the system of responsibility for work safety, perfect the conditions for safe production, and ensure safety during production. The production and business operation entities must provide conditions for safe production as provided in the Work Safety Law and other relevant laws, administrative regulations, national standards and industrial standards.

Any entity that does not maintain the conditions for safe production may not engage in production and business operation activities.

The Department of the State Council in charge of the supervision and administration of work safety is required to implement comprehensive supervision and administration of work safety in the PRC. The relevant governmental authorities superior to the county level and in charge of the supervision and administration of work safety are required to implement comprehensive supervision and administration of work safety within their respective administrative jurisdictions according to the Work Safety Law.

In case of a violation of the Work Safety Law, the relevant authorities can order the decision-making department or key person-in-charge of any production and business operation entity to correct the violation, suspend production or business and can take other administrative measures. If a work safety accident has resulted and a crime has been committed, the key person-in-charge may incur criminal liabilities according to the relevant provisions of the Criminal Law.

Regulations on Foreign Currency Exchange

Pursuant to the Foreign Currency Administration Rules promulgated in 1996 and amended in 2008 and various regulations issued by the State Administration of Industry and Commerce and the State Administration of Foreign Exchange (“SAFE”) and other relevant PRC governmental authorities, Renminbi are freely convertible only to the extent of current account items, such as trade related receipts and payments, interest and dividends. Capital account items, such as direct equity investments, loans and repatriation of investment, require prior approval from SAFE or its local counterpart for conversion of Renminbi into a foreign currency, such as U.S. dollars, and remittance of the foreign currency outside the PRC.

Payments for transactions that take place within the PRC must be made in Renminbi. Unless otherwise approved, PRC companies must repatriate foreign currency payments received from abroad. Foreign-invested enterprises may retain foreign exchange in accounts with designated foreign exchange banks subject to a cap set by SAFE or its local counterpart. Unless otherwise approved, domestic enterprises must convert all of their foreign currency receipts into Renminbi.

11

On August 29, 2008, SAFE promulgated a circular regulating the conversion by a foreign-invested company of its registered capital in foreign currency into Renminbi by restricting how the converted Renminbi may be used. This circular stipulates that the registered capital of a foreign-invested company settled in Renminbi converted from foreign currencies may only be used for purposes within the business scope approved by the applicable governmental authority and may not be used for equity investments within China. Violations of this circular can result in severe penalties, including monetary fines.

In addition, any foreign loans to an operating subsidiary in China that is a foreign invested enterprise, cannot, in the aggregate, exceed the difference between its respective approved total investment amount and its respective approved registered capital amount.

Regulation on Foreign Exchange in Certain Onshore and Offshore Transactions

In October 2005, SAFE issued Circular 75, which regulates foreign exchange matters in relation to the use of a “special purpose vehicle” by PRC residents to seek offshore equity financing and conduct “return investment” in China. Under Circular 75, a “special purpose vehicle” refers to an offshore entity established or controlled, directly or indirectly, by PRC citizens or PRC entities (collectively, as PRC residents) for the purpose of seeking offshore equity financing using assets or interests owned by such PRC residents or PRC entities in onshore companies, while “round trip investment” refers to the direct investment in China by PRC residents through the use of “special purpose vehicles,” including without limitation, establishing foreign invested enterprises and using such foreign invested enterprises to purchase or control (by way of contractual arrangements) onshore assets. Circular 75 requires that, before establishing or controlling a “special purpose vehicle,” PRC residents are required to complete foreign exchange registration with the competent local counterparts of SAFE for their overseas investments. In addition, such PRC resident is required to amend his or her SAFE registration or to file with SAFE or its competent local branch, with respect to that offshore special purpose vehicle in connection with any increase or decrease of capital, transfer of shares, merger, division, equity investment or creation of any security interest over any assets located in China by the offshore special purpose vehicle. To further clarify the implementation of such amendment or filing procedure, SAFE requires domestic enterprises under Circular 75 to coordinate and supervise such amendment or filings with SAFE or its local counterparts by such PRC residents. If PRC residents fail to comply, the domestic enterprises are required to report to the local SAFE authorities.

Failure to comply with the registration procedures set forth in Circular 75 may result in restrictions being imposed on the foreign exchange activities of the relevant onshore company, including being prohibited from distributing its profits and proceeds from any reduction in capital, share transfer or liquidation to its offshore parent or affiliate, and restrictions on the ability to contribute additional capital from the offshore entity to the PRC entities, and may also subject relevant PRC residents to penalties under PRC foreign exchange administration regulations.

Regulation on Overseas Listings

On August 8, 2006, MOFCOM, the CSRC, the State-owned Assets Supervision and Administration Commission, the SAT, the State Administration of Industry and Commerce and SAFE jointly promulgated the “Rules on the Mergers and Acquisition of Domestic Enterprises by Foreign Investors,” which became effective on September 8, 2006, and was further amended on June 22, 2009, or the M&A Rules.

Among other things, the M&A Rules include new provisions that purport to require that an offshore special purpose vehicle, or SPV, formed for listing purposes and controlled directly or indirectly by PRC companies or individuals must obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website procedures specifying documents and materials required to be submitted to it by SPVs seeking CSRC approval of their overseas listings. However, the application of this PRC regulation remains unclear with no consensus currently existing among the leading PRC law firms regarding the scope and applicability of the CSRC approval requirement.

12

Regulations on Dividend Distribution

The principal regulations governing dividend distributions by wholly foreign-owned enterprises include: Wholly Foreign-Owned Enterprise Law (1986), as amended in 2000 and Wholly Foreign-Owned Enterprise Law Implementing Rules (1990), as amended in 2001. Under these regulations, wholly foreign-owned enterprises in the PRC may pay dividends only out of their accumulated profits, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, these foreign-invested enterprises are required to set aside 10% of their after-tax profits based on the PRC accounting standards each year, if any, to fund their general reserve fund, until the accumulative amount of such reserves reaches 50% of their registered capital. These reserves are not distributable as cash dividends. Besides the compulsory reserve fund, wholly foreign-owned enterprises may also set aside any funds from their after-tax profits, at the discretion of their shareholders. In addition, dividends we pay to our non-PRC shareholders may be subject to a 10% withholding tax, unless otherwise set forth in the tax treaties between China and other countries or areas.

Regulations Relating to Taxation

The PRC Enterprise Income Tax Law (the “EIT Law”) applies a uniform 25% enterprise income tax rate to both foreign-invested enterprises and domestic enterprises, unless where the enterprise is involved in an industry or engaged in a special project that has been granted an exemption. Article 27(1) of the Enterprise Income Tax Law (the “EIT Law”) of the People’s Republic of China (PRC) states that income derived from agricultural, nursery planting and cultivation, forestry collection, or nursery related services is exempt from the EIT tax. In addition, Article 86 of the Implementing Regulations of the EIT Law (the “Implementing Regulations”) contains an exemption for income derived from such projects as cultivation and planting trees, harvesting of forest products, and primary processing of agricultural products. Our business satisfies the requirements for these exemptions. Thus, the Company is currently exempt from the EIT tax on all of its current activities.

Under the PRC EIT Law and its implementation regulations, dividends generated from the business of a PRC subsidiary after January 1, 2008 and payable to its foreign investor may be subject to a withholding tax rate of 10% if the PRC tax authorities determine that the foreign investor is a non-resident enterprise, unless there is a tax treaty with China that provides for a preferential withholding tax rate. Distributions of earnings generated before January 1, 2008 are exempt from PRC withholding tax.

Under the PRC Enterprise Income Tax Law, an enterprise established outside China with “de facto management bodies” within China is considered a “resident enterprise” for PRC enterprise income tax purposes and is generally subject to a uniform 25% enterprise income tax rate on its worldwide income. A circular issued by the State Administration of Taxation in April 2009 regarding the standards used to classify certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese enterprise groups and established outside of China as “resident enterprises” clarified that dividends and other income paid by such PRC “resident enterprises” will be considered PRC-source income and subject to PRC withholding tax, currently at a rate of 10%, when paid to non-PRC enterprise shareholders. This circular also subjects such PRC “resident enterprises” to various reporting requirements with the PRC tax authorities.

Under the implementation regulations to the PRC Enterprise Income Tax Law, a “de facto management body” is defined as a body that has material and overall management and control over the manufacturing and business operations, personnel and human resources, finances and properties of an enterprise. In addition, the tax circular mentioned above specifies that certain PRC-invested overseas enterprises controlled by a Chinese enterprise or a Chinese enterprise group in the PRC will be classified as PRC resident enterprises if the following are located or resident in the PRC: senior management personnel and departments that are responsible for daily production, operation and management; financial and personnel decision making bodies; key properties, accounting books, the company seal, and minutes of board meetings and shareholders’ meetings; and 50% or more of the senior management or directors having voting rights.

13

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Notes Regarding Forward-Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

Risks Related to Our Business

We are dependent on a limited number of customers.

Our five largest customers accounted for 41%, 45% and 78% of our total sales for the year ended December 31, 2011 and 2010 and the three months ended March 31, 2012, respectively. Our revenue increased substantially in the first quarter of 2012 due to contracts entered into with three customers which represented approximately 57% of our revenue for the quarter as a result of the Key Greening Project announced in 2011. During the year ended December 31, 2011, we had a major sales contract with Changshao Luchuan Seedling Cooperation that represented 11% of our total sales for that year and during the fiscal year ended December 31, 2010, we had a major greening work service contract with Shangrao Economic House Development Department that represented 18% of our total sales for that year. Sales to no other customer accounted for 10% or more of our total sales for each of the years ended December 31, 2011 and 2010. We cannot assure you that similar projects will be announced by the government or that we will be awarded substantial contracts in connection with future projects.

We may have difficulty in managing our future growth and any associated increased scale of our operations.

We expect to expand through both organic growth and acquisitions. We plan to expand our primeval forest bases, acquire additional resources including old stumps, precious seedlings and trees, and forest trees with economic values, reform our natural camellia forests, build laboratories and processing factories, and extend our trading platforms to other major cities. Our future expansion may place a significant strain on our managerial, operational, technical and financial resources. In order to better allocate our resources to manage our growth, we must hire, recruit and manage our workforce effectively and implement adequate internal controls in a timely manner. If we are unable to effectively manage our growth and the associated increased scale of our operations, our business, financial condition and results of operations could be materially and adversely affected.

Our business requires significant and continuous capital investment.

We will require a high level of capital expenditure in the foreseeable future to fund our future growth. Although the demand for landscaping plants is increasing, plant resources are limited. It is a key factor in maintaining a leading position in competition to have control on resources and acquire or buy more from time to time. We will require significant additional capital to implement our strategy of acquiring additional forest and plant resources, production bases and precious plant species. In addition, the establishment of plant distribution channels and wholesale markets requires adequate funds to build up a proper nursing, processing, production and sales chain. We intend to fund our capital expenditures and future acquisitions out of internal sources and/or through access to additional financing from external sources. Our ability to obtain external financing in the future at a reasonable cost is subject to a variety of uncertainties, including:

|

·

|

our future financial condition, results of operations and cash flows;

|

|

|

·

|

the condition of the global and domestic financial markets; and

|

|

·

|

changes in the monetary policy of the PRC government with respect to bank interest rates and lending practices.

|

If we require additional funds and cannot obtain them on acceptable terms when required or at a reasonable financing cost or at all, we may be unable to fulfill our working capital needs, upgrade our existing facilities or expand our business. These or other factors may also prevent us from entering into transactions that would otherwise benefit our business or implementing our future strategies. Any of these factors may have a material adverse effect on our business, financial condition and results of operations.

14

If we are unable to attract and retain senior management and qualified technical and sales personnel, our operations, financial condition and prospects could be materially adversely affected.

Our future success depends in part on the contributions of our management team and key technical and sales personnel and our ability to attract and retain qualified new personnel. In particular, our success depends on the continuing employment of Ms. Li Xiaoling, our Chairperson of the Board, Mr. Liu Shuzhong, our Chief Executive Officer, and Ms. Kathy Zhu, our Chief Financial Officer. There is significant competition in our industry for qualified managerial, technical and sales personnel and we cannot assure you that we will be able to retain our key senior managerial, technical and sales personnel or that we will be able to attract, integrate and retain other such personnel that we may require in the future. If we are unable to attract and retain key personnel in the future, our business, operations, financial condition, results of operations and prospects could be materially adversely affected.

Our operating costs may increase.

Labor costs and raw material and utilities costs in China are generally expected to increase. If our labor costs or other operating costs increase and we cannot increase our production efficiency to offset any such increase or pass any such increase on to our customers, our business, financial condition and results of operations may be materially and adversely affected.

The landscaping industry is highly competitive.

The landscaping industry is highly competitive and our continued success depends upon our ability to compete effectively in markets that contain numerous competitors across the country, some of which have significantly greater financial, marketing and other resources than we have. With the expansion of our business into other provinces, competition may cause us to lower our prices, which may adversely impact our profits. New or existing competition that uses a business model that is different from our business model may put pressure on us to change so that we can remain competitive.

We may be subject to disputes with employees or other third parties.

The businesses we operate involve dealings with both permanent and temporary employees as well as numerous third parties including land use rights holders, suppliers and customers, and we may be subject to claims or litigation involving such employees or third parties from time to time such as labor disputes and claims under business contracts with suppliers or customers. We may also be subject to labor disputes, labor shortages or other impositions on our business operations, such as supply shortages, if we are unable to amicably resolve disputes with any such parties. Issues with the local communities surrounding the areas where we operate might also arise from the implementation of our business activities, which may result in community protests, blocking of access to our operations and third party claims. Our operations may be affected if we fail to successfully settle any such issues with local communities or groups. We cannot assure you that any such disputes will not arise in the future and that the occurrence of one or multiple disputes will not have a material adverse effect on our business and financial condition.

We face certain risks and uncertainties beyond our control that are associated with our operations.

Our operations are subject to a number of operating risks and hazards, some of which are beyond our control. These operating risks and hazards include sudden outburst of plant diseases and pests, floods, landslides, earthquakes, debris flows, fires, inclement or hazardous weather conditions and natural disasters. Any of these risks and hazards or any combination thereof may disrupt or result in a suspension of our operations, increase production costs, result in property damage, personal injuries and liability to us and harm our reputation. Moreover, natural disasters and industrial accidents may damage or substantially hamper critical ancillary operations such as the growth of plants, transportation of our products to our customers, and the quality and time of the landscaping engineering works. The occurrence of any natural disaster or industrial accident adversely affecting our customers and their ancillary operations may have a material adverse effect on our business, financial condition and results of operations.

15

We do not have any insurance to cover our business risks.

We face various operational risks in connection with our business. However, we do not carry any insurance against these or any other risks related to our business. We cannot assure you that the safety measures we have in place for our operations will be sufficient to prevent industrial accidents or that casualties or accidents will not occur for which we will be liable. In the event that we incur substantial losses or liabilities as a result of industrial accidents or other operational hazards or occurrences, our business, financial condition and results of operations may be materially and adversely affected.

We are dependent on continual use of our bases to conduct our business.

Our business growth requires the continual use of our production bases, including Mount Wu Fu Base, Zao Tou Base, Shishi Base, Feng Ling Tou Base and Long Hu Base, or our obtaining the rights to alternate productive land. The agreements that grant us the right to use the parcels of land on our bases may be terminated by the PRC government if the land were to be requisitioned for other purposes, similar to an exercise of eminent domain, or in the event of a natural disaster, such as an earthquake or flood. The termination of any of these agreements or substantial rent increases under these agreements may have a material adverse effect on our business, financial condition and results of operations, and there is no assurance that if we were to lose the rights to our current bases we could obtain replacement facilities on reasonable terms or at all.

Our business is subject to foreign exchange risks due to fluctuations in the exchange rate between US Dollars and the RMB.

While our reporting currency is the US Dollar, our revenues, costs and expenses are denominated in RMB. All of our assets are denominated in RMB. As a result, we are exposed to foreign exchange risk as our revenues and results of operations may be affected by fluctuations in the exchange rate between US Dollars and RMB. If the RMB depreciates against the US Dollar, the value of our RMB revenues, earnings and assets as expressed in our US Dollar financial statements will decline. A 10% appreciation or depreciation in foreign exchange rates in the years ended December 31, 2011 and 2010 would not have resulted in a material loss or gain. To date, we have not entered into any foreign exchange forward contracts or similar instruments to attempt to mitigate our exposure to change in foreign currency rates.

Risks Related to Doing Business in China

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Our business depends on China’s economic growth.

Our business and prospects depend on the rate of economic growth in the PRC which, in turn, affects demand for plants and landscaping engineering. The PRC economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange, and allocation of resources. The PRC economy has grown significantly in recent years; however, we cannot assure you that such growth will continue. If the PRC’s economic growth slows or if the PRC economy experiences a recession, the demand for our products may decrease and our business, financial condition and results of operations may be materially and adversely affected.

16

Since 2008, the economies of the United States, Europe and certain countries in Asia experienced a severe and prolonged recession and China experienced a slowdown in growth, which led to a reduction in economic activity. Any prolonged slowdown of the PRC economy in the future could have a material adverse effect on our business, financial condition and results of operations.

Our business is subject to extensive regulations and affected by government policies in the PRC landscaping industry.

We are subject to extensive national, provincial and local government regulations, policies and controls in the PRC that govern many aspects of our industry, including, without limitation:

|

·

|