Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NTELOS HOLDINGS CORP. | d423633d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - NTELOS HOLDINGS CORP. | d423633dex991.htm |

NASDAQ: NTLS

Company Overview

NASDAQ: NTLS

EXHIBIT 99.2 |

Presentation of Financial and Other Important Information

2

NASDAQ: NTLS

USE OF NON-GAAP FINANCIAL MEASURES

Included in this presentation are certain non-GAAP financial measures that are not determined in

accordance with US generally accepted accounting principles (“GAAP”). These financial

performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating,

capital and financing costs and may differ from comparable information provided by other companies,

and they should not be considered in isolation, as an alternative to, or more meaningful than

measures of financial performance determined in accordance with US generally accepted accounting principles. These

financial performance measures are commonly used in the industry and are presented because NTELOS

believes they provide relevant and useful information to investors. NTELOS utilizes these

financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur

indebtedness if necessary, and to fund continued growth. NTELOS also uses these financial

performance measures to evaluate the performance of its business, for budget planning purposes

and as factors in its employee compensation programs. Adjusted EBITDA is defined as net income attributable to NTELOS Holdings

Corp. before interest, income taxes, depreciation and amortization, accretion of asset retirement

obligations, gain/loss on derivatives, net income attributable to non-controlling

interests, other expenses/income, equity based compensation charges, acquisition related charges, net loss from discontinued operations and

costs related to the separation of the wireless and wireline companies. Please review the

reconciliations and other definitions of non-GAAP financial measures contained in the press

releases filed by the Company with the SEC, including those filed on Form 8-K on February 29, 2012, April 30, 2012 and August 1, 2012.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Any statements contained in this presentation that are not statements of historical fact, including

statements about our beliefs and expectations, are forward- looking statements and should be

evaluated as such. The words “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,” “targets,” “projects,” “should,”

“may,” “will” and similar words and expressions are intended to identify

forward-looking statements. Such forward-looking statements reflect, among other things,

our current expectations, plans and strategies, and anticipated financial results, all of which are

subject to known and unknown risks, uncertainties and factors that may cause our actual results

to differ materially from those expressed or implied by these forward-looking statements. Many of these risks are beyond our ability to

control or predict. Because of these risks, uncertainties and assumptions, you should not place undue

reliance on these forward-looking statements. Furthermore, forward-looking statements

speak only as of the date they are made. We do not undertake any obligation to update or review any forward-looking information,

whether as a result of new information, future events or otherwise. Important factors with

respect to any such forward-looking statements, including certain risks and uncertainties

that could cause actual results to differ from those contained in the forward-looking statements, include, but are not limited to: our ability to

attract and retain retail subscribers to our services; our dependence on our strategic relationship

and the potential outcome of any disputes with Sprint Nextel (“Sprint”); a potential

increase in roaming rates and wireless handset subsidy costs; rapid development and intense competition in the telecommunications

industry; our ability to finance, design, construct and realize the benefits of any planned network

technology upgrade; the potential to experience a high rate of customer turnover; the potential

for Sprint and others to build networks in our markets; cash and capital requirements; operating and financial restrictions imposed

by our senior credit facility; adverse economic conditions; federal and state regulatory fees,

requirements and developments; loss of ability to use our current cell sites; our ability to

realize the benefits anticipated following the spinoff of our wireline business; our continued reliance on indirect channels of retail distribution; our

reliance on certain suppliers and vendors; and other unforeseen difficulties that may occur. These

risks and uncertainties are not intended to represent a complete list of all risks and

uncertainties inherent in our business, and should be read in conjunction with the more detailed cautionary statements and risk factors included

in our SEC filings, including our most recent Annual Report filed on Form 10-K.

|

NASDAQ:

NTLS 3

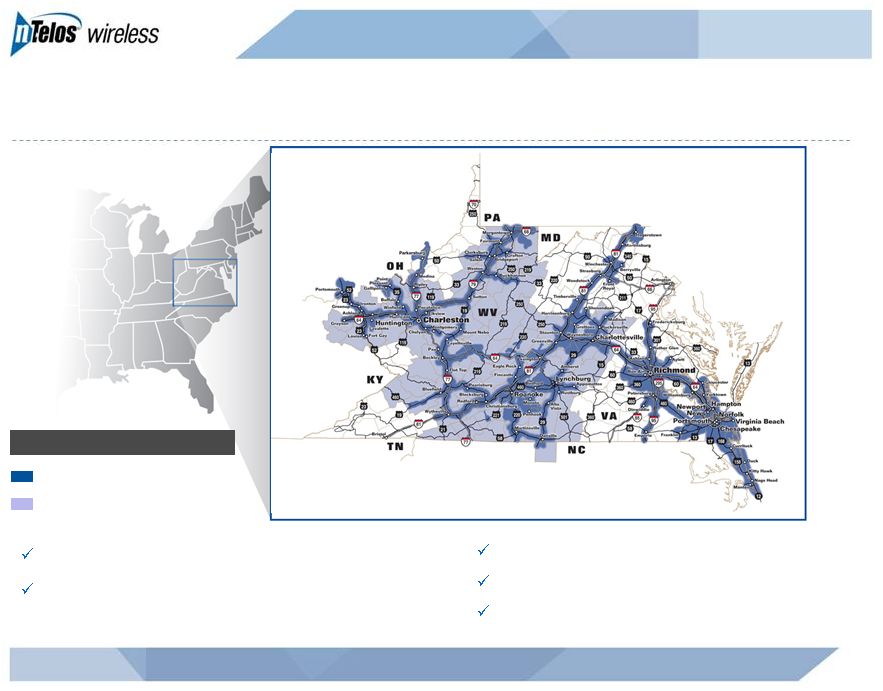

Leading

regional

provider

of

wireless

communications

services

in

the

mid-Atlantic

region,

serving Virginia, West Virginia and parts of Kentucky, North Carolina, Ohio,

Pennsylvania and Maryland

NTELOS-branded retail postpay and prepay subscribers as well as robust

wholesale business Key operating strategies

Elevate brand & best value in wireless position to improve quality of

subscriber base and grow market share

Enhance customer experience at all touch points by focusing on core

differentiators of savings,

simplicity

and

service

to

improve

customer

satisfaction

and

reduce

subscriber

churn

Drive Smartphone and data services penetration to increase ARPU

Leverage disciplined network investments to expand wholesale revenues and

margin Manage cost structure to improve profitability

Exclusive CDMA Network provider for Sprint in WV and Western VA

NTELOS spun off its wireline operations to Lumos Networks (NASDAQ: LMOS) on October

31, 2011, becoming a pure-play wireless operator

Company Overview (NASDAQ: NTLS) |

Regionally Focused Wireless Service Provider

NASDAQ: NTLS

4

LTM

9/30/2012

revenue

of

$443M

(1)

LTM

9/30/12

adjusted

EBITDA

of

$136M

(1)

Diverse spectrum portfolio

6.0 million covered POPs

430K retail subscribers as of 9/30/12

Ntelos Covered Network

Sprint Wholesale Markets

STRATEGIC NETWORK ASSETS

(1)

Denotes preliminary numbers |

Attractive Spectrum Portfolio

5

NASDAQ: NTLS

Average Spectrum Depth in Key Markets

Band

Commentary

PCS

Average depth of 23 MHz

Scarce strategic asset

AWS

Significant spectrum

holdings in top operating

markets of western Virginia

Currently undeployed

MHZ

3,643

2,661

1,775

1,025

Licensed POPs

(000’s)

302

194

211

213

200

273

Source: Map Info: Custom Data, Total Population – Current Year and Five Year USA by Block

Group: United States, SO215245 |

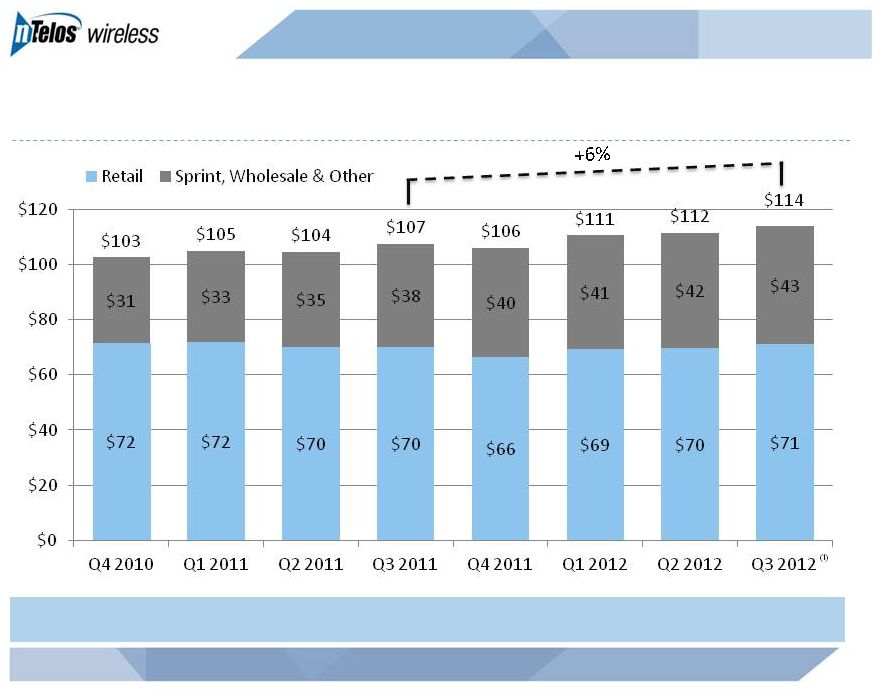

Operating Revenues

6

NASDAQ: NTLS

millions

Year-over-Year Revenue Increases

(1)

Denotes preliminary numbers |

Growth Initiatives

NASDAQ: NTLS

7

NTELOS brand positioned as the best value in wireless: Savings, Simplicity,

Service Gaining subscriber share from competitors

“Brand

Awareness”

and

“Consideration”

scores

have

dramatically

improved

Churn improvement resulting in positive net add trends

Postpay churn decreased 57 bps from 2.56% in Q3 11 to 1.99% in Q3 12

Prepay churn down 178 bps from 6.47% in Q3 11 to 4.69% in Q3 12

Total churn down 81 bps from 3.69% in Q3 11 to 2.88% in Q3 12

Simplification of rate plans and handset pricing to better compete in local

marketplace

Smartphone penetration driving growth and profitability

Postpay Smartphone penetration increased from 28.3% in Q3 11 to 52.7% in Q3

12 Positive impact from iPhone launch in April 2012, followed by iPhone 5

launch in September Retail data ARPU growth of $4.19 from $15.46 in Q2 11 to

$19.65 in Q2 12 Leverage network investments to expand wholesale revenues and

margin beyond Sprint Network Alliance |

NTELOS Branding Resonating With Consumers

8

NASDAQ: NTLS

NTELOS Gaining Market Share

Positive net ports

vs. all other carriers

(1)

Denotes preliminary numbers

(1)

Source: Independent third-party research studies.

(4,000)

(2,000)

0

2,000

4,000

6,000

8,000

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Postpay Number Porting, Net Ports

3Q11

3Q12

Net Promoter

Score

33%

46%

Unaided

Awareness

24%

32%

Unaided Recall

16%

28%

Purchase

Consideration

12%

21% |

Managing Postpaid Churn to Enhance Profitability

9

NASDAQ: NTLS

Churn Improvements Driving Greater Retail Profitability

1.0%

1.5%

2.0%

2.5%

3.0%

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Postpaid Churn

Predictive churn analytics driving

improved results

Brand positioning yielding better

credit quality customers

“CRM”

driving retention costs

down through more targeted

loyalty programs

“Best Value in Wireless”

rate

plans resonating with customers |

Prepaid Churn

Simplified, tax-inclusive rate

plans at competitive prices

Expanded device line-up driving

better credit quality subscribers

Increased smartphone

penetration results in customer

“stickiness”

Lower churn in prepay base

improves ARPU and customer

profitability

Consistently Improving Prepaid Churn Metrics

10

NASDAQ: NTLS

Churn Improvements Driving Greater Retail Profitability

2%

4%

6%

8%

10%

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012 |

Subscribers and ARPU –

Return to Growth

11

NASDAQ: NTLS

Q1

Q2

Q3

Q4

Q1

Q2

2011

2011

2011

2011

2012

2012

Postpay net additions comparison

Prepay net additions comparison

(8,000)

(4,000)

0

4,000

8,000

Q1

Q2

Q3

Q4

2011

2012

$0

$10

$20

$30

$40

$50

$60

Prepay Data ARPU

Prepay Voice ARPU

Postpay Data ARPU

Postpay Voice ARPU

(8,000)

(4,000)

0

4,000

8,000

12,000

16,000

Q1

Q2

Q3

Q4

2011

2012 |

Closing the Device Gap on Competition

12

NASDAQ: NTLS

Best

Q4 2009

Q4 2010

Q4 2012

Better

Good

LG Optimus

Plus

Motorola

Defy XT

Alcatel One

Touch Ultra

Motorola

Milestone 3

HTC One V

Samsung Galaxy S II

Motorola

RAZR MAXX

Motorola

Milestone PLUS

iPhone 4

iPhone 4S

iPhone 5

BlackBerry

Curve 8330

BlackBerry

Pearl Flip

8230

HTC Hero

Android

BlackBerry

Pearl

8130

HTC 6800

HTC Touch

Diamond

BlackBerry

Curve 8330

BlackBerry

Pearl Flip

8230

HTC Snap

HTC Hero

Android

BlackBerry

Tour 9630

Evolution of Handsets to More Data-Centric Devices |

iPhone Data –

Q2 2012 Snapshot (Launch Date April 20, 2012)

NASDAQ: NTLS

13

9,500 iPhones sold

26% of gross adds

56% of postpaid adds

54% of iPhones sold to new subscribers

6% penetration in postpaid subscriber base as of June 30, 2012

30% of iPhone upgrades paid early upgrade fee |

Network Evolution

NASDAQ: NTLS

14

6.0mm covered POPs; 8.1mm licensed POPs

90% of covered POPs are served with 3G EV-DO

Rev. A

Primarily Alcatel Lucent equipment

1,396 cell sites deployed

Market level spectrum holdings ranging from 10

MHz to 50 MHz

PCS average depth of 23 MHz

AWS average depth of 20 MHz

Additional spectrum includes

Small amount of WCS, BRS and LMDS

Opportunities for additional spectrum and

spectrum sharing being evaluated

Upgrade history

1xRTT launched in 2002

EV-DO Rev A launched in 2008

LTE Drivers

Serve the needs of our retail subscribers

Maintain competitive position in

marketplace

Optimize long-term network operating cost

with new technology

Serve the needs of our largest wholesale

customer, Sprint

Deployment Plan

Launch first LTE markets in 2H 2013

Complete initial build-out by year-end 2014;

70% of covered POPs

Devices supporting Band Classes 2, 4 and

25

Estimated CapEx of approximately $60mm

to $65mm

Current network

4G LTE upgrade plans |

Sprint Strategic Network Alliance Evolution

15

NASDAQ: NTLS

NTELOS is a Key Partner to Sprint

8/1999:

Agreement

with Horizon PCS

(Sprint affiliate)

8/2004:

Horizon

bankruptcy; Sprint

agreement signed

10/2006:

Sprint

launches EV-DO

Rev A in San Diego

10/2010:

Sprint

announces

Network Vision

9/2012:

Sprint has

19 metropolitan areas

with 4G LTE

8/2007:

Amends

agreement with Sprint

3/2008:

Launch

of EV-DO

11/2008:

Completes

EV-DO build |

Sprint Strategic Network Alliance Service

16

NASDAQ: NTLS

Exclusively provides 3G services to large number of Sprint home and travel

subscribers

Encompasses approximately:

2.0mm covered POPs in WV and Western VA

823 cell sites

36,800 square miles

Provides ~$40mm in quarterly revenues

Sprint relationship update

Continuing dialogue

Rate dispute previously outlined remains outstanding; estimated range

now ($8.0mm) to $8.0mm

Q3 $4.2mm dispute, isolated to historical billing issues only

|

Sprint Strategic Network Alliance Leverages NTELOS’s Network

17

NASDAQ: NTLS

Strategic

Network

Alliance

revenues

(1)

Attractive Revenue Stream

(1)

Excludes roaming

(2)

Denotes preliminary numbers

Sprint Nextel Strategic Network Alliance

through at least July 2015

$9 million monthly minimum revenue

guarantee

Attractive contribution to margin

Growing Usage

Significant growth in data usage

since EV-DO launched

Voice continues to grow

Calculated revenues exceeded

the $9 million monthly minimum in

all quarters of 2011 and 2012 YTD

millions

(2)

$21

$22

$23

$23

$24

$24

$25

$10

$11

$13

$15

$16

$17

$17

$0

$5

$10

$15

$20

$25

Total Voice

Total Data

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012 |

Strategic Network Alliance with Sprint

18

NASDAQ: NTLS

EV-DO amended agreement signed in August 2007

EV-DO network upgrade was catalyst for new agreement

Covers portions of WV and Western Virginia territories

Exclusive provider of wholesale CDMA network services

Separate rate structures for data and voice for home and roamer subscribers

Agreement through July 2015, with renewal options

Sprint

prohibited

from

beginning

“over-build”

until

January

1,

2014

(18

months prior) |

Financial Overview

NASDAQ: NTLS |

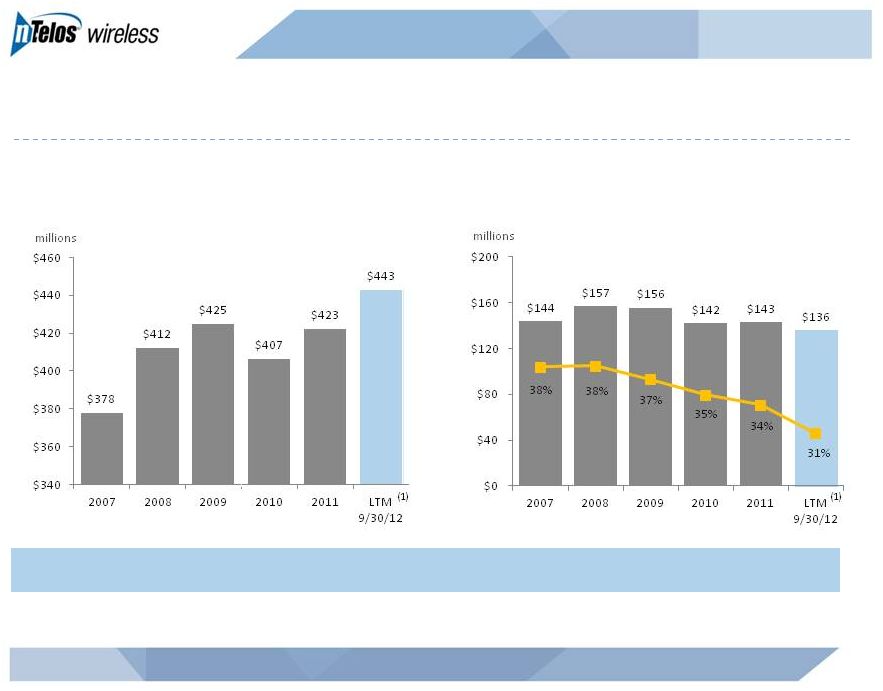

Strong Historical Financial Performance

20

NASDAQ: NTLS

Total Revenue

Total Adjusted EBITDA/Margin %

Driving Positive Results

Note: Historical operating results throughout this presentation exclude NTELOS’s former

wireline results which were spun off to Lumos Networks on 10/31/11 (1)

Denotes preliminary results |

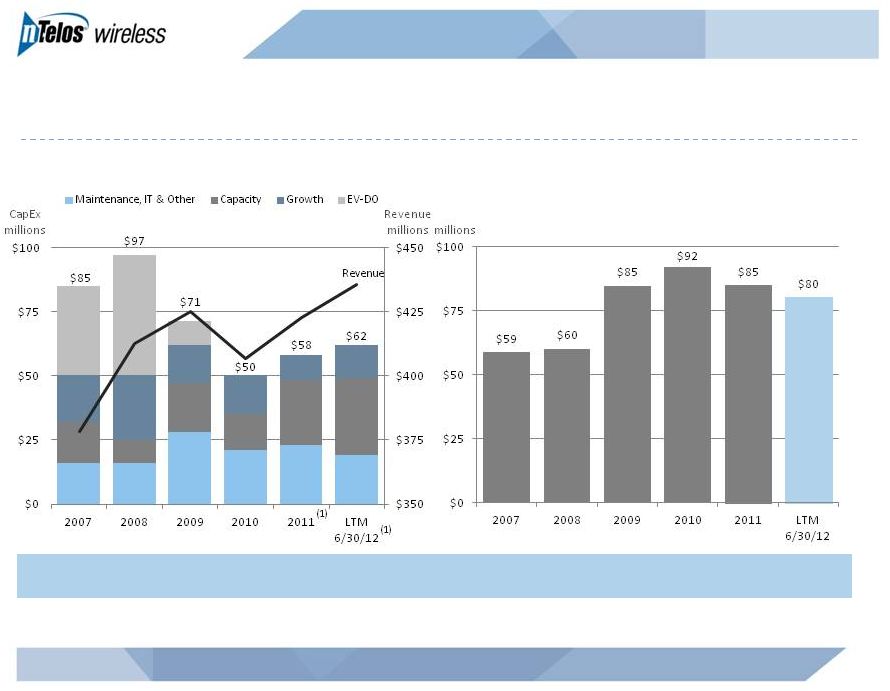

Managing Free Cash Flow with Disciplined Capital Investment

21

NASDAQ: NTLS

CapEx

EBITDA less CapEx

Note: Excludes wireline capex incurred prior to business separation

(1)

Includes $5mm of capex related to business separation

Network Upgrade to EV-DO Still Driving Revenue Growth |

Summary

22

NASDAQ: NTLS

Competitive and diversified business model

Strategic asset set

Numerous catalysts for sustainable topline and adjusted EBITDA growth

High-margin wholesale revenue

Increased smartphone penetration

Improved distribution

Operational improvements

Focus on profitability and free cash flow growth

Experienced management team |

Appendix

NASDAQ: NTLS |

Adjusted EBITDA Reconciliation

24

NASDAQ: NTLS

Consolidated

2007

2008

2009

2010

2011

LTM 6/30/12

Net income Attributable to NTELOS Holdings Corp.

32,453

$

44,829

$

63,285

$

44,808

$

(23,715)

$

(33,814)

$

Net income attributable to noncontrolling interests

-

-

(851)

(1,417)

(1,769)

(1,600)

Net Income

32,453

$

44,829

$

64,136

$

46,225

$

(21,946)

$

(31,876)

$

Discontinued operations, net

12,638

16,002

18,054

16,882

(45,386)

(57,999)

Income from continuing operations

19,815

$

28,827

$

46,082

$

29,343

$

23,440

$

26,123

$

Interest expense

24,520

17,024

15,922

24,728

23,380

21,832

Loss (gain) on interest rate derivatives

3,527

9,531

(2,100)

147

264

18

Income taxes

17,161

20,787

26,526

20,251

16,363

17,030

Other expense (income), net

2,953

1,402

971

413

2,807

1,285

Operating income

67,976

$

77,571

$

87,401

$

74,882

$

66,254

$

66,288

$

Depreciation and amortization

70,102

75,982

63,015

58,016

63,083

63,695

Accretion of asset retirement obligations

746

914

695

770

658

631

Equity-based compensation

4,328

2,729

3,227

5,270

6,072

6,041

Acquisition related charges

570

-

1,477

2,815

-

-

Business separation charges

-

-

-

352

6,988

5,895

Adjusted EBITDA

143,721

$

157,196

$

155,815

$

142,105

$

143,054

$

142,549

$

(1)

Charges for legal and consulting services in connection with the separation of the

Company’s wireless and wireline operations

(1) |

ARPU Reconciliation

25

NASDAQ: NTLS

Average Monthly Revenue per User (ARPU) ¹

2009

2010

2011

2012

2011

(In thousands, except for subscribers and ARPU)

Operating Revenues

425,057

$

406,793

$

422,629

$

222,125

$

209,229

$

Less: Equipment revenue from sales to new customers

(6,379)

(8,233)

(9,091)

(7,900)

(3,930)

Less: Equipment revenue from

sales to existing customers (18,453)

(14,893)

(17,793)

(8,306)

(9,292)

Less: Wholesale, other and

adjustments (119,219)

(116,575)

(143,477)

(81,897)

(66,436)

Gross subscriber revenue

281,006

267,092

252,268

$

124,022

129,571

Less: prepay subscriber revenue

(67,974)

(58,918)

(48,758)

(27,404)

(25,224)

Less: adjustments to prepay

subscriber revenue (483)

(276)

(1,175)

(1,035)

(636)

Gross

postpay subscriber revenue 212,549

$

207,898

$

202,335

$

95,583

$

103,711

$

Prepay subscriber revenue

67,974

58,918

48,758

27,404

25,224

Plus: adjustments to prepay

subscriber revenue 483

276

1,175

1,035

636

Gross prepay subscriber revenue

68,457

$

59,194

$

49,933

$

28,439

$

25,860

$

Average number of subscribers

440,207

437,735

422,256

419,721

428,624

Total ARPU

53.20

$

50.85

$

49.79

$

49.25

$

50.38

$

Average number of postpay

subscribers 310,852

303,986

298,992

286,940

302,403

Postpay ARPU

56.98

$

56.99

$

56.39

$

55.52

$

57.16

$

Average number of prepay

subscribers 129,356

133,750

123,264

132,781

126,222

Prepay ARPU

44.10

$

36.88

$

33.76

$

35.70

$

34.15

$

Gross subscriber revenue

281,006

267,092

252,268

124,022

129,571

Less: voice and other feature revenue

(232,271)

(203,657)

(171,882)

(75,287)

(91,015)

Data revenue

48,735

$

63,435

$

80,386

$

48,735

$

38,556

$

Average number of subscribers

440,207

437,735

422,256

419,721

428,624

Total Data ARPU

9.23

$

12.08

$

15.86

$

19.35

$

14.99

$

Gross postpay subscriber

revenue 212,549

207,898

202,335

95,583

103,711

Less: postpay voice and other feature

revenue (175,031)

(158,890)

(144,114)

(62,922)

(74,862)

Postpay data revenue

37,518

$

49,008

$

58,221

$

32,661

$

28,849

$

Gross prepay subscriber revenue

67,974

$

59,195

$

49,933

$

28,439

25,860

Less: prepay voice and other

feature revenue 56,756

(44,768)

(27,767)

(12,365)

(16,153)

Prepay data revenue

11,218

$

14,427

$

22,166

$

16,074

$

9,707

$

Average number of postpay

subscribers 310,852

303,986

298,992

286,940

302,403

Postpay data ARPU

10.06

$

13.43

$

16.23

$

18.97

$

15.90

$

Average number of prepay

subscribers 129,356

133,750

123,264

132,781

126,222

Prepay data ARPU

7.23

$

8.99

$

14.99

$

20.18

$

12.82

$

6 Months Ended June 30,

Year Ended December 31, |