Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHOICE HOTELS INTERNATIONAL INC /DE | d421974d8k.htm |

Deutsche Bank 2012 Leveraged

Finance Conference

Exhibit 99.1 |

2

Disclaimer

Investor Presentation

Certain matters discussed throughout all of this presentation constitute forward-looking

statements within the meaning of the federal securities laws. Generally, our use of words such

as “expect,” “estimate,” “believe,” “anticipate,” “will,”

“forecast,” “plan,” “project,” “assume” or similar words of

futurity identify statements that are forward-looking and that we intend to be included

within the Safe Harbor protections provided by Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking

statements are based on management’s current beliefs, assumptions and expectations

regarding future events, which in turn are based on information currently available to

management. Such statements may relate to, among other things, market trends, the

Company’s financial position, business strategy, projected plans and objectives of management for future

operations. We caution you not to place undue reliance on any forward-looking statements, which

are made as of the date of this presentation. Forward-looking statements do not guarantee

future performance and involve known and unknown risks, uncertainties and other factors. Several factors could cause

actual results, performance or achievements of the company to differ materially from those

expressed in or contemplated by the forward-looking statements. Such risks include, but are not limited to,

changes to general, domestic and foreign economic conditions; operating risks common in the lodging

and franchising industries; risks associated with acquisitions and development of new brands;

changes to the desirability of our brands as viewed by hotel operators and customers; changes to

the terms or termination of our contracts with franchisees; deterioration in the financial

condition of franchisees; our ability to keep pace with improvements in technology utilized for

reservations systems and other operating systems; decrease in brand loyalty due to increasing use of internet

reservation channels; fluctuations in the supply and demand for hotel rooms; and our ability to

effectively manage our indebtedness. These and other risk factors are discussed in detail in

the Risk Factors section of the company’s Form 10-K for the year ended December 31,

2011, filed with the Securities and Exchange Commission on February 29, 2012. We

undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of

new information, future events or

otherwise. |

3

Investor Presentation

Company overview |

4

Investor Presentation

Choice Hotels overview

Growing US hotel market share*

–

9.6% share of branded US hotels (+60 basis points over

trailing 5 years)*

–

2

largest

U.S.

hotelier

Well-known, diversified brands

Global pipeline of 453 hotels

Stable, profitable, long-term growth throughout economic cycles

Cumulative free cash flows of ~$1.4 billion since 1997

–

100% returned to shareholders through share repurchases and

dividends

Capital “light”

model generates strong after-tax returns on invested

capital

Strong, growing, global hotel franchising

business

Highly attractive business model with strong

financial returns

Chain scale mix by rooms (Domestic Q2 2012)

Geographic property distribution by rooms (Q2 2012)

Source: Choice Internal Data as of June 30, 2012

* Based on number of hotels as June 30, 2012 (Smith Travel Research)

Upper

midscale

43%

Midscale

29%

Economy

24%

Extended Upscale

Stay

2%

2%

United States

& Caribbean

79.0%

Europe

8.8%

Canada

5.1%

Asia Pacific

4.8%

South

America

1.5%

Mexico

0.5%

Central

America

0.3%

nd |

5

Investor Presentation

Diversified global footprint*

Source: Choice internal data

*As of June 30, 2012. The Company includes its Caribbean properties within domestic

operating statistics. Canada

Hotels open

308

Hotels under development

37

Rooms open & under dev.

28,407

United

States

&

Caribbean

Hotels

open

Hotels

under

development

Rooms

open

&

under

dev.

Mexico

Hotels

open

Hotels

under

development

Rooms

open

&

under

dev.

Central America

Hotels open

Hotels under development

Rooms open & under dev.

Middle

East

Hotels

open

Hotels

under

development

Rooms

open

&

under

dev.

South America

Hotels open

Hotels under development

Rooms open & under dev.

Europe

Hotels open

Hotels under development

Rooms open & under dev.

Asia Pacific

Hotels open

Hotels under development

Rooms open & under dev.

5,024

378

423,968

22

2

2,522

15

5

1,945

1

0

70

59

3

7,917

416

15

45,374

354

13

25,014 |

6

Investor Presentation

Investor Presentation

Brand

Number of properties

Number of rooms

Occupancy (%)

Average daily room

rate (ADR)

RevPAR

Upscale

52

4,652

61.5%

$113.84

$70.03

19

2,221

NA

NA

NA

Upper

Midscale

1,379

107,895

58.7%

80.36

47.20

608

46,903

60.6%

84.30

51.08

189

27,534

48.1%

74.30

35.71

Midscale

391

28,327

55.3%

70.89

39.17

1,082

93,655

51.0%

68.47

34.89

Extended Stay

40

3,083

70.4%

67.47

47.50

62

7,260

68.5%

40.58

27.80

Economy

801

49,114

48.2%

55.03

26.52

401

22,671

50.1%

52.38

26.22

Total / Average

5,024

393,315

54.8%

$72.58

$39.73

International

1,175

104,522

Total

6,199

497,837

Portfolio overview

Note: Number of properties and rooms as of June 30, 2012, all other statistics are

LTM as of 6/30/2012 Source: Company’s public filings, management

data |

7

Investor Presentation

Investor Presentation

Franchise portfolio growth

Worldwide hotels*

Domestic pipeline*

Worldwide unit growth has increased at a CAGR of

1% since Q2 2010

Executed a total of 170 new domestic hotel

franchise contracts in Q1 & Q2 2012

Current domestic pipeline consists of 378 hotels

representing 30,653 rooms

235 hotels under construction or awaiting

development

143 hotels awaiting conversion

* As of June 30, 2012

Source: Company’s public filings

6,074

6,091

6,142

6,128

6,117

6,138

6,178

6,174

6,199

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

26

13

84

65

41

42

15

23

16

21

32

New Construction

Conversion

Midscale

Extended Stay

Economy

Upscale |

Investor Presentation

8

Investor Presentation

Strategy for Choice’s brands, growth and shareholders

Improve and Grow Brands

–

Increase portfolio profitability of the Comfort brand family

–

Refresh Sleep Inn to improve long-term brand growth potential

–

Capture Greater Share of Reservations Via Central Channels

–

–

Continue to enhance ChoiceHotels.com to increase traffic and conversion

–

Continue balanced debt and shareholder capital allocation policies

–

Leverage financial capacity/strength to support expansion of emerging brands

–

Evaluate opportunities to enter new segments

–

Invest in IT infrastructure to shore up value proposition for international

properties Invest

in

and

expand

emerging

brands/segments

–

Cambria,

Ascend,

International

Grow

Choice

Privileges

loyalty

program

–

target

2.0

million

new

members

in

2012

Allocate

Free

Cash

Flows

To

“Best

And

Highest”

Use |

9

Investor Presentation

Investment highlights |

10

Investor Presentation

Investor Presentation

Investment highlights

Asset light franchising

model with strong

returns on investment

Strong and growing

brand awareness

Established hotel

franchising platform

with global scale

Resilient fee-for service

business model with

stable cash flows

Strong, growing loyalty

program

Effective central

reservation system

Strong pipeline

expected to continue to

grow as global

economy improves |

11

Investor Presentation

Investor Presentation

Established hotel franchising platform with global

scale

One of the largest hoteliers…

…

with a significant number of rooms in the portfolio

7,170

6,199

4,542

4,426

3,800

3,748

1,319

1,112

492

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

WYN

CHH

IHG

ACC

Hilton

MAR

Carlson

HOT

H

666,873

646,110

630,000

608,300

531,714

497,837

327,813

208,500

135,327

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

IHG

MAR

Hilton

WYN

ACC

CHH

HOT

Carlson

H

Source: Various public companies’ filings as of June 30, 2012, except for ACC and Carlson,

which are as of December 31, 2011 |

12

Investor Presentation

Resilient fee-for-service business model with stable

cash flows

($ in millions)

Source: Smith Travel Research, Management data, December 2011

$0

$50

$100

$150

$200

$250

$300

$350

(20.0%)

(15.0%)

(10.0%)

(5.0%)

0.0%

5.0%

10.0%

15.0%

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

CHH RevPAR

STR Chain Scale (Supply Weighted)

Industry RevPAR

CHH Franchising Revenue |

13

Investor Presentation

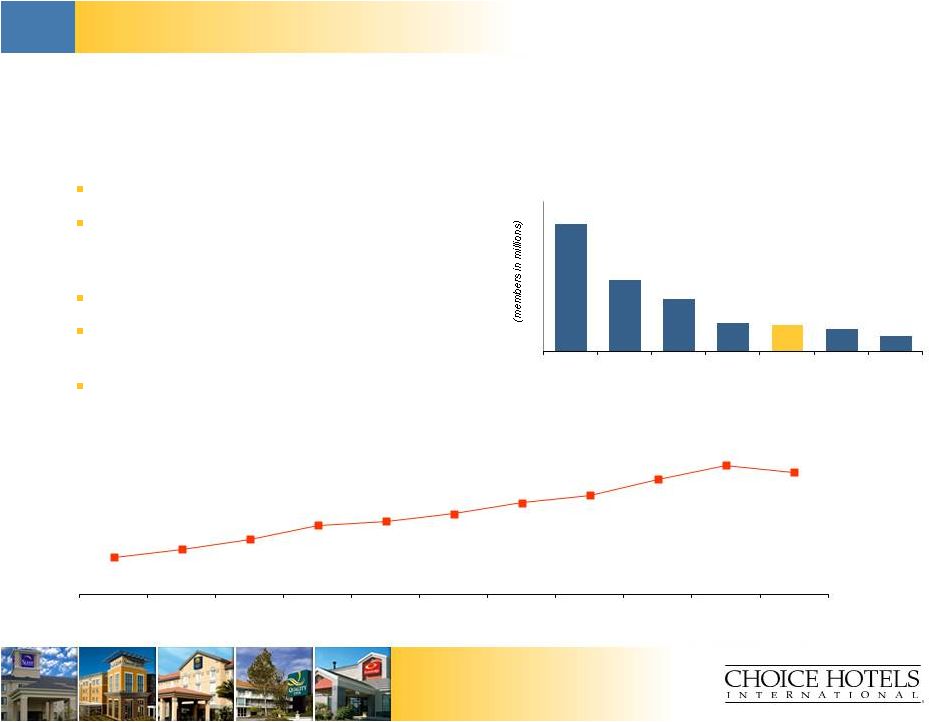

Strong, growing loyalty program

Choice Privileges revenue as percent

of domestic gross room revenues*

Source: Management Data, December 31, 2011, Company’s public filings

* 2001-2008 Data Excludes Econo Lodge and Rodeway Inn brands

Comprehensive loyalty rewards program

14 million members worldwide –

contribute over ¼

of domestic

gross room revenues

2.1 million new members added in 2011

Delivers incremental business to all Choice

brand hotels

Important selling point for franchise sales

Loyalty program

68

38

28

15

14

12

8

IHG

MAR

WYN

HOT

CHH

H

ACC

8.3%

10.0%

12.2%

15.3%

16.2%

17.9%

20.3%

22.0%

25.6%

28.7%

27.1%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011 |

14

Investor Presentation

Investor Presentation

Effective marketing and central reservation system

Consists of the telephone reservation system,

proprietary internet site, mobile phone applications,

global distribution systems and other internet

reservation sites

Central Reservation System (“CRS”) provides a data

link to the Company’s franchised properties and to

airline reservation systems

Offers rooms for sale on the Company’s own internet

site, as well as other travel companies

Expertise and innovation in on-line, targeted interactive

marketing to influence guest hotel stay decisions

Powerful advertising campaigns

Focus on driving guests to Choice central channels

Facilitate “one-stop”

shopping

Reservation agents can match each caller with a

Choice-branded hotel

$300-plus million in annual marketing and reservation

spending

Description

Size, scale and distribution

Domestic franchise system

gross room revenue source

Domestic Choice CRS

net room revenue

Source: Company’s public filings as of December 31, 2011, Management

data Travel agent

(GDS)

4%

Voice (call

centers)

7%

Internet

22%

Direct

Reservation

67%

$1,161

$1,342

$1,596

$1,638

$1,410

$1,501

$1,660

2005

2006

2007

2008

2009

2010

2011 |

15

Investor Presentation

Investor Presentation

Strong pipeline expected to continue to grow as the

global economy improves

Historical international pipeline

Source: Company’s public filings, Management data

Historical domestic pipeline

0

100

200

300

400

500

600

700

800

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

2005

2006

2007

2008

2009

2010

2011

Comfort Inn

Comfort Suites

Sleep

Quality

Clarion

Econo Lodge

Rodeway

MainStay

Suburban

Ascend Collection

Cambria Suites

190

413

258

602

276

264

194

136

728

723

533

380

131

277

0

10

20

30

40

50

60

70

80

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

Conv.

New

Const.

2005

2006

2007

2008

2009

2010

2011

Comfort Inn

Comfort Suites

Sleep

Quality

Clarion

Econo Lodge

Rodeway

MainStay

Suburban

Ascend Collection

Cambria Suites

36

48

31

39

33

47

58

54

56

74

58

51

42

40 |

16

Investor Presentation

Investor Presentation

Asset light franchising model with strong returns on

investment

Capital light model generates strong after-tax returns on invested capital

Virtually 100% of the properties are franchised*

* The Company owns three MainStay Suites hotels that it holds for strategic

purposes. Source: Company’s public filings, Management data 0%

20%

40%

60%

80%

100%

100%

94%

86%

67%

46%

25%

38%

6%

14%

31%

48%

56%

15%

1%

5%

19%

47%

CHH

WYN

IHG

MAR

HOT

H

ACC

Franchised

Managed

Owned / Leased

15.2%

16.1%

14.7%

19.5%

27.6%

36.7%

49.7%

62.9%

78.5%

68.8%

59.5%

48.1%

48.0%

47.2%

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011 |

17

Investor Presentation

Strong and growing brand awareness

Source: Percentage of survey respondents. Millward Brown, December 2011.

* Econo Lodge, Rodeway Inn and Suburban Extended Stay measured among economy hotel

users. 98%

77%

43%

87%

72%

NA

NA

14%

NA

NA

22%

98%

89%

53%

87%

81%

93%

56%

24%

14%

18%

50%

2001

2011 |

18

Investor Presentation

Financial overview |

19

Investor Presentation

Investor Presentation

Choice’s franchise business model provides stable, growing cash flows, driven

primarily through unit expansion and RevPAR growth

Recent performance

LTM Revenue

LTM Adjusted EBITDA

Choice has experienced consistent revenue growth

over the past eight quarters

Revenues have increased by 17.2% since Q2 2010

EBITDA margins have increased by 156 bps since

Q2 2010

Domestic and international unit growth and

improvement in operating performance continues

to drive profitability

($ in millions)

Source: Company’s public filings

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

$563.9

$581.8

$596.1

$603.9

$619.4

$627.9

$638.8

$652.7

$661.0

$163.5

$169.1

$170.9

$172.3

$173.9

$181.5

$184.3

$189.6

$195.9 |

20

Investor Presentation

Investor Presentation

Historical operating metrics

RevPAR & occupancy

Total worldwide rooms

Source: Company’s public filings

$41.75

$40.98

$35.18

$36.18

$38.44

$39.73

57.9%

55.3%

49.4%

51.3%

53.5%

54.8%

44.0%

46.0%

48.0%

50.0%

52.0%

54.0%

56.0%

58.0%

60.0%

$-

$10

$20

$30

$40

$50

$60

2007

2008

2009

2010

2011

LTM Q2

2012

RevPAR (domestic)

Occupancy (domestic)

452,027

472,526

487,410

495,145

497,205

497,837

420,000

440,000

460,000

480,000

500,000

2007

2008

2009

2010

2011

LTM Q2

2012 |

21

Investor Presentation

Investor Presentation

Historical financial overview

Revenue*

Adjusted EBITDA

*Excludes marketing and reservation revenues

($ in millions)

$299

$305

$259

$267

$290

$300

$220

$240

$260

$280

$300

$320

2007

2008

2009

2010

2011

LTM Q2

2012

$198

$200

$164

$171

$184

$196

$100

$125

$150

$175

$200

$225

2007

2008

2009

2010

2011

LTM Q2

2012

Source: Company’s public filings |

22

Investor Presentation

Investor Presentation

Historical capital expenditure overview

($ in millions)

$12

$13

$11

$24

$11

$12

$0

$5

$10

$15

$20

$25

$30

2007

2008

2009

2010*

2011

LTM Q2 2012

*The spike in 2010 was due to the Company leasing extra space for a new technology

center in Phoenix, AZ. Source: Company’s public filings

|

Investor Presentation

23

Investor Presentation

Pro

forma

capitalization

–

$600

million

Special

Cash

Dividend

($ in millions)

Pro forma capitalization

As of

Mult LTM

Pro forma

Mult LTM

6/30/2012

Adjusted EBITDA

Adjustments

6/30/2012

Adjusted EBITDA

Total cash and equivalents

$485.4

($396.1)

$89.3

New revolver

--

0.0x

$53.9

$53.9

0.3x

Term Loan A

--

0.0x

150.0

150.0

0.8x

Total secured debt

--

0.0x

$200.0

1.1x

Existing revolver

$ --

$ --

Existing senior notes

250.0

1.3x

250.0

1.3x

New senior unsecured notes

400.0

2.0x

400.0

2.0x

Other debt

2.4

0.0x

2.6

0.0x

Total debt

$652.4

3.3x

$852.6

4.4x

LTM Adjusted EBITDA

$195.9

--

$195.9

Interest expense

13.1

$32.5

45.6

Capital expenditures

12.1

--

12.1

Credit metrics

Total debt / Adjusted EBITDA

3.3x

4.4x

Net debt / Adjusted EBITDA

0.9x

3.9x

Adjusted EBITDA / int. exp.

15.0x

4.3x

(Adjusted

EBITDA

-

capex)

/

int.

exp

14.0x

4.0x |

24

Investor Presentation

Questions and answers |

25

Investor Presentation

DISCLAIMER

Adjusted earnings before interest, taxes depreciation and amortization (EBITDA),

return on average invested capital (ROIC) and free cash flows are

non-GAAP financial measurements. These financial measurements are

presented as supplemental disclosures because they are used by management in

reviewing and analyzing the company’s performance. This information

should not be considered as an alternative to any measure of performance as

promulgated under accounting principles generally accepted in the United

States (GAAP), such as operating income, net income, diluted earnings per

share, total revenues or net cash provided by operating activities.

The calculation of these non-GAAP

measures may be different from the calculation by other companies and therefore

comparability may be limited. The company has included the following

appendix which reconcile these measures to the comparable GAAP

measurement. |

Investor

Presentation 26

FRANCHISING REVENUES

Source: Choice Internal Data, December 2011

($ amounts in thousands)

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

2011

2010

2009

2008

2007

2006

2005

Total Revenues

638,793

$

596,076

$

564,178

$

641,680

$

615,494

$

539,903

$

472,098

$

Adjustments:

Marketing and Reservation

(349,036)

(329,246)

(305,379)

(336,477)

(316,827)

(273,267)

(237,822)

Product Sales

-

-

-

-

-

-

-

Hotel Operations

(4,356)

(4,031)

(4,140)

(4,936)

(4,692)

(4,505)

(4,293)

Franchising Revenues

285,401

$

262,799

$

254,659

$

300,267

$

293,975

$

262,131

$

229,983

$ |

27

Investor Presentation

FRANCHISING REVENUES (Continued)

Source: Choice Internal Data, December 2011

($ amounts in thousands)

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

2004

2003

2002

2001

2000

1999

1998

Total Revenues

428,208

$

385,866

$

365,562

$

341,428

$

352,841

$

324,203

$

165,474

$

Adjustments:

Marketing and Reservation

(220,732)

(195,219)

(190,145)

(168,170)

(185,367)

(162,603)

-

Product Sales

-

-

-

-

-

(3,871)

(20,748)

Hotel Operations

(3,729)

(3,565)

(3,331)

(3,215)

(1,249)

-

(1,098)

Franchising Revenues

203,747

$

187,082

$

172,086

$

170,043

$

166,225

$

157,729

$

143,628

$ |

28

Investor Presentation

RETURN ON INVESTED CAPITAL

(a) Operating income and tax rate for the year ended December 31, 2001 have been

adjusted to exclude the effect of a $22.7 million impairment charge related

to the write-off of the company’s investment in Friendly Hotels.

Source: Choice Internal Data, December 2011

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

($ in thousands)

2011

2010

2009

2008

2007

2006

2005

Operating Income (a)

$171.9

$160.8

$148.1

$174.6

$185.2

$166.6

$143.8

Tax Rate(a)

30.1%

32.1%

34.8%

36.3%

36.0%

27.4%

33.0%

After-Tax Operating Income

120.2

109.2

96.6

111.2

118.5

121.0

96.3

+ Depreciation & Amortization

8.0

8.3

8.3

8.2

8.6

9.7

9.1

- Maintenance CAPEX

8.0

8.3

8.3

8.2

8.6

9.7

9.1

Net Op. Profit After-tax (NOPAT)

$120.2

$109.2

$96.6

$111.2

$118.5

$121.0

$96.3

Total Assets

$447.7

$411.7

$340.0

$328.2

$328.4

$303.3

$265.3

- Current Liabilities

184.6

165.3

131.8

135.1

147.5

139.8

120.3

Invested Capital

$263.1

$246.4

$208.2

$193.1

$180.9

$163.5

$145.0

Return on Average Invested Capital

47.2%

48.0%

48.1%

59.5%

68.8%

78.5%

62.9% |

29

Investor Presentation

RETURN ON INVESTED CAPITAL (Continued)

(a) Operating income and tax rate for the year ended December 31, 2001 have been

adjusted to exclude the effect of a $22.7 million impairment charge related

to the write-off of the company’s investment in Friendly Hotels.

Source: Choice Internal Data, December 2011

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

($ in thousands)

2004

2003

2002

2001

2000

1999

1998

Operating Income (a)

$125.0

$113.9

$104.7

$96.3

$92.4

$94.2

$85.2

Tax Rate(a)

35.1%

36.1%

36.5%

35.0%

39.0%

39.5%

41.7%

After-Tax Operating Income

81.1

72.8

66.5

62.6

56.4

57.0

49.7

+ Depreciation & Amortization

9.9

11.2

11.3

12.5

11.6

7.7

6.7

- Maintenance CAPEX

9.9

11.2

11.3

12.5

11.6

7.7

6.7

Net Op. Profit After-tax (NOPAT)

$81.1

$72.8

$66.5

$62.6

$56.4

$57.0

$49.7

Total Assets

$263.4

$267.3

$316.8

$321.2

$484.1

$464.7

$398.2

- Current Liabilities

102.1

102.2

84.3

71.2

93.8

88.7

64.7

Invested Capital

$161.3

$165.1

$232.5

$250.0

$390.3

$375.9

$333.6

Return on Average Invested Capital

49.7%

36.7%

27.6%

19.5%

14.7%

16.1%

15.2% |

30

Investor Presentation

FREE CASH FLOWS

Source: Choice Internal Data, June 2012

YTD Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

June 30,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

($ in thousands)

2012

2011

2010

2009

2008

2007

2006

2005

Net Cash Provided by Operating Activities

37,802

$

134,844

$

144,935

$

112,216

$

104,399

$

145,666

$

153,680

$

133,588

$

Net Cash Provided (Used) by Investing Activities

(10,387)

(23,804)

(32,155)

(3,349)

(20,265)

(21,284)

(17,244)

(24,531)

Free Cash Flows

27,415

$

111,040

$

112,780

$

108,867

$

84,134

$

124,382

$

136,436

$

109,057

$ |

31

Investor Presentation

FREE CASH FLOWS (Continued)

Source: Choice Internal Data, June 2012

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

December 31,

($ in thousands)

2004

2003

2002

2001

2000

1999

1998

Net Cash Provided by Operating Activities

108,908

$

115,304

$

99,018

$

101,712

$

53,879

$

65,040

$

38,952

$

Net Cash Provided (Used) by Investing Activities

(14,544)

27,784

(14,683)

87,738

(16,617)

(36,031)

(9,056)

Free Cash Flows

94,364

$

143,088

$

84,335

$

189,450

$

37,262

$

29,009

$

29,896

$ |

32

Investor Presentation

Source: Choice Internal Data, June 2012

ADJUSTED EBITDA

LTM

Year Ended

Year Ended

Year Ended

Year Ended

Year Ended

($ in thousands)

June 30,

December 31,

December 31,

December 31,

December 31,

December 31,

2012

2011

2010

2009

2008

2007

Operating Income

183,717

$

171,863

$

160,762

$

148,073

$

174,596

$

185,199

$

Adjustments

Acceleration of Management Succession Plan

-

-

-

-

6,605

-

Loss on Sublease of Office Space

-

-

-

1,503

-

-

Executive Termination Benefits

4,027

4,444

1,730

4,604

3,537

4,250

Curtailment of SERP

-

-

-

1,209

-

-

Loan Reserves Related to Impaired Notes Receivable

-

-

-

-

7,555

-

Product Sales

-

-

-

-

-

-

Impairment of Friendly investment

-

-

-

-

-

-

Depreciation and Amortization

8,115

8,024

8,342

8,336

8,184

8,637

Adjusted EBITDA

195,859

$

184,331

$

170,834

$

163,725

$

200,477

$

198,086

$ |