Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d421418d8k.htm |

| EX-99.1 - TRANSCRIPT OF CONFERENCE CALL - MOSAIC CO | d421418dex991.htm |

The Mosaic Company

Earnings Conference Call –

1st Quarter Fiscal 2013

October 2, 2012

Jim Prokopanko, President and Chief Executive Officer

Larry

Stranghoener,

Executive

Vice

President

and

Chief

Financial

Officer

Laura Gagnon, Vice President Investor Relations

Exhibit 99.2 |

2

Safe Harbor Statement

This presentation contains forward-looking statements within the meaning of

the Private Securities Litigation Reform

Act

of

1995.

Such

statements

include,

but

are

not

limited

to,

statements

about

future

financial

and

operating results. Such statements are based upon the current beliefs and

expectations of The Mosaic Company’s management and are subject to

significant risks and uncertainties. These risks and uncertainties include but are

not limited to the predictability and volatility of, and customer expectations

about, agriculture, fertilizer, raw material, energy and transportation

markets that are subject to competitive and other pressures and economic and

credit market conditions; the level of inventories in the distribution channels

for crop nutrients; changes in foreign currency and exchange rates;

international trade risks; changes in government policy; changes in environmental

and other governmental regulation, including greenhouse gas regulation,

implementation of the U.S. Environmental

Protection

Agency’s

numeric

water

quality

standards

for

the

discharge

of

nutrients

into

Florida

lakes and streams or possible efforts to reduce the flow of excess nutrients into

the Gulf of Mexico; further developments in judicial or administrative

proceedings; difficulties or delays in receiving, increased costs of or

challenges to necessary governmental permits or approvals or increased financial

assurance requirements; resolution of global tax audit activity; the

effectiveness of the Company’s processes for managing its strategic

priorities; adverse weather conditions affecting operations in Central Florida or

the Gulf Coast of the United States, including potential hurricanes or

excess rainfall; actual costs of various items differing from management’s current

estimates, including, among others, asset retirement, environmental remediation,

reclamation or other environmental regulation, or Canadian resources taxes

and royalties; accidents and other disruptions involving Mosaic’s

operations, including brine inflows at its Esterhazy, Saskatchewan potash mine and other potential mine

fires, floods, explosions, seismic events or releases of hazardous or volatile

chemicals, as well as other risks and uncertainties reported from time to

time in The Mosaic Company’s reports filed with the Securities and Exchange

Commission. Actual results may differ from those set forth in the

forward-looking statements. |

|

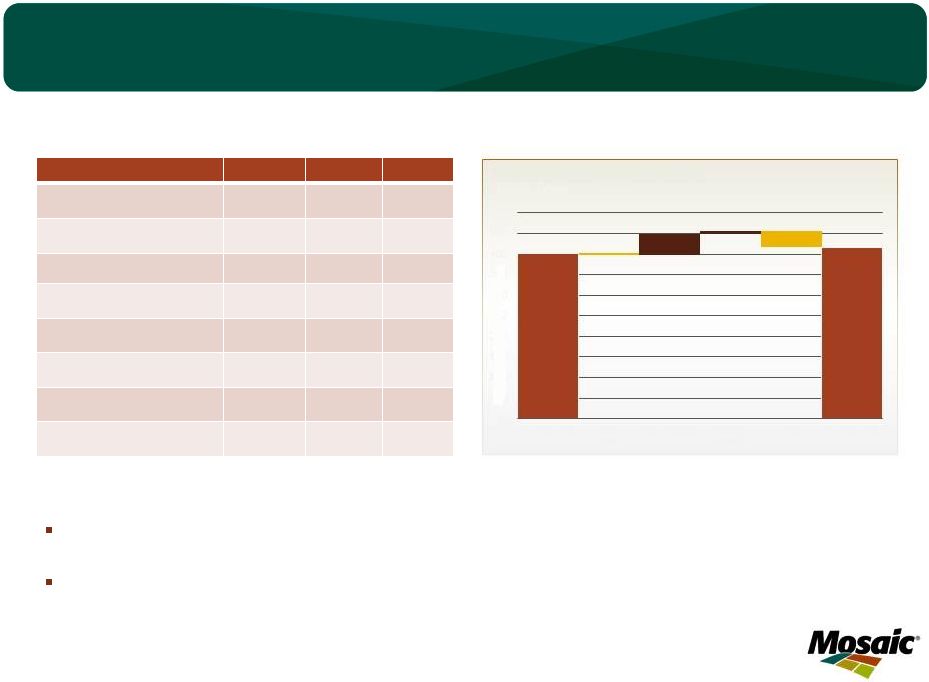

4

First Quarter Financial Highlights

$1.01 in Earning per Share

$0.02 loss from notable items

$2.5 billion

$610 million

Revenue

Phosphates

Potash

$1,561

$960

$208

$416

Operating Earnings |

5

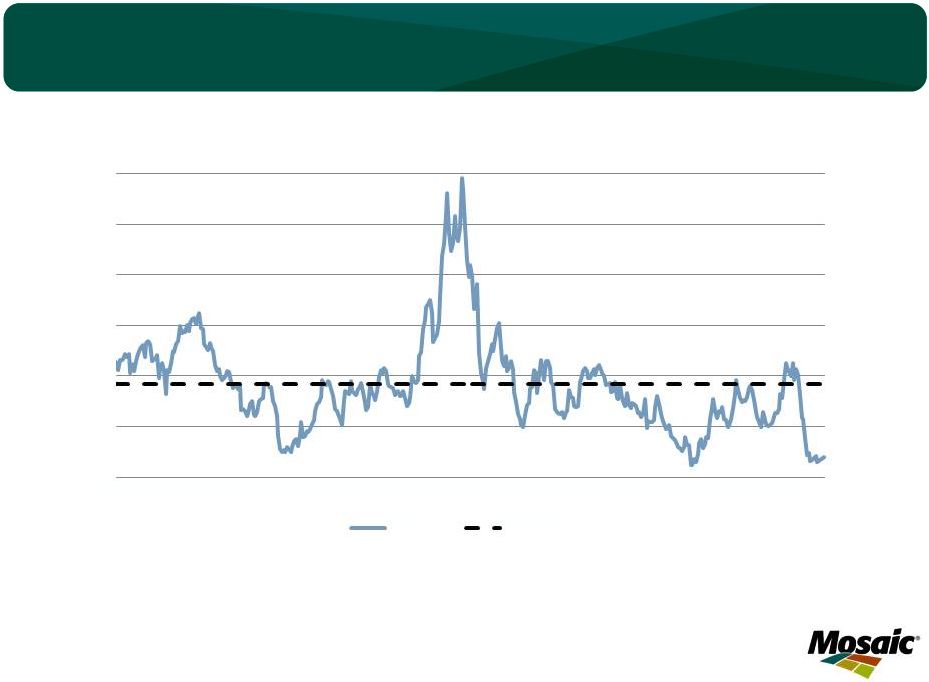

Grain and Oilseed Stocks at Critical Levels

70

72

74

76

78

80

82

84

86

88

90

92

94

96

98

00

02

04

06

08

10

12F

Actual

Average

Crop Year

14%

16%

18%

20%

22%

24%

26%

28%

30%

32%

34%

Source: USDA

Global

Grain

and

Oilseed

Stocks-To-Use

Percentage |

6

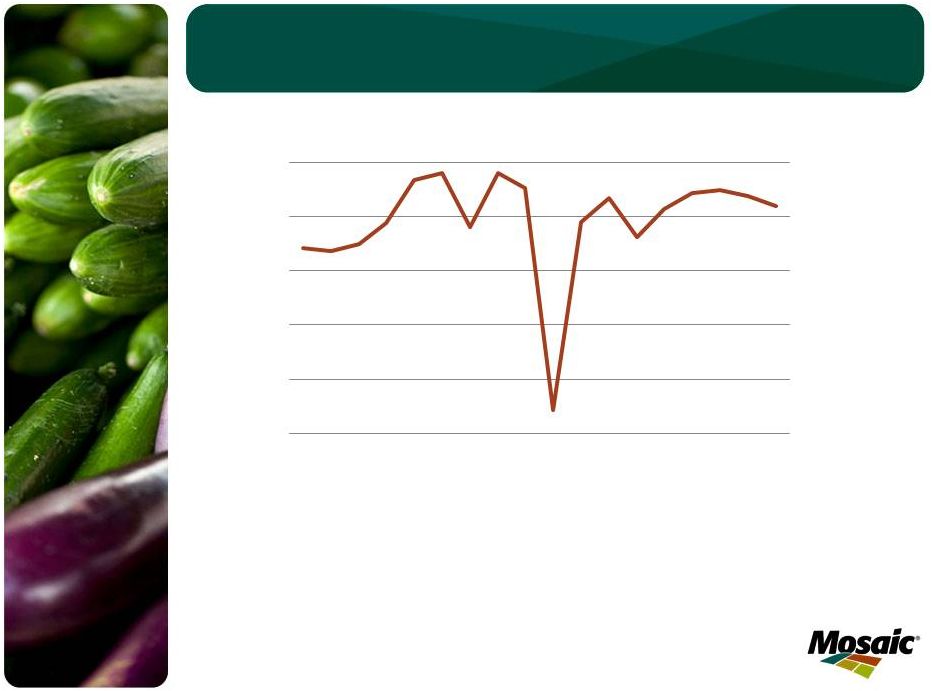

Crop Nutrients are Highly Affordable

0.50

0.70

0.90

1.10

1.30

1.50

1.70

05

06

07

08

09

10

11

12

Crop Nutrient Price Index/Crop Price Index Ratio

Ratio

Average

Our homemade Plant Nutrient Affordability metric is a ratio of a plant nutrient price index and a crop

price index. The plant nutrient price index is a weighted average of indices for urea,

DAP and MOP prices. These indices are calculated using weekly published spot prices at key U.S.

pricing points. Weights are N, P, and K percentages of total U.S. nutrient use from 2005 to

2007. The crop price index is a weighted average of indices for corn, soybeans and

wheat. These indices are calculated using the daily closing price of the front month futures contract. Weights

are the shares of total U.S. production of these three crops from 2005 to 2007. The base year

for all indices is 2005. Source: Mosaic

|

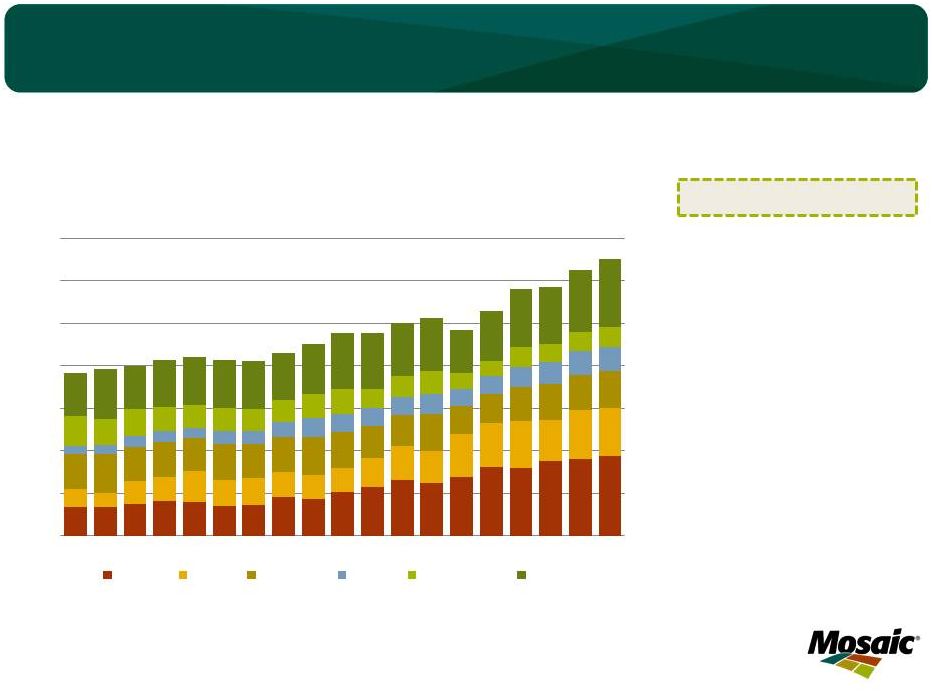

Global Farm Economics at Historical Highs

•

Increases in cash payments

•

Improving farmer returns,

despite higher at the farm

fertilizer costs

North America

India

•

Record farm cash income

•

~$25B in crop insurance

payouts

Brazil

•

Record acreage expected

for beans and corn

0

20

40

60

80

100

120

140

80

82

84

86

88

90

92

94

96

98

00

02

04

06

08

10

12F

$ in billions

U.S. Net Cash Farm Income

From Government Payments

From Farming

Source: USDA

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

2005

2006

2007

2008

2009

2010

2011

2012

INR hectare

Source: Mosaic

Indian Farm Economics

Estimated Revenue after Variable Cost

Rice

Punjab/Haryana

Wheat

Punjab/Haryana

-

- |

8

Grain Rally and Fertilizer Pricing

•

Caution in the value chain

•

India P&K subsidy changes

•

Weaker macro environment

•

Greater supply certainty

Why haven’t fertilizer prices followed the grain

rally, like we saw in 2008? |

9

Sentiment and Fundamentals

•

Declining potash producer inventories

•

Phosphate supply uncertainties

•

Elimination of drought-related

uncertainties

Potential catalysts to changing market

sentiment: |

10

Potash Market Correcting:

Poised for Recovery in 2013

Dynamics

•

China/India delaying

purchasing

•

North American

inventories declined for

3

rd

month in a row

0

10

20

30

40

50

60

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12F

13F

China

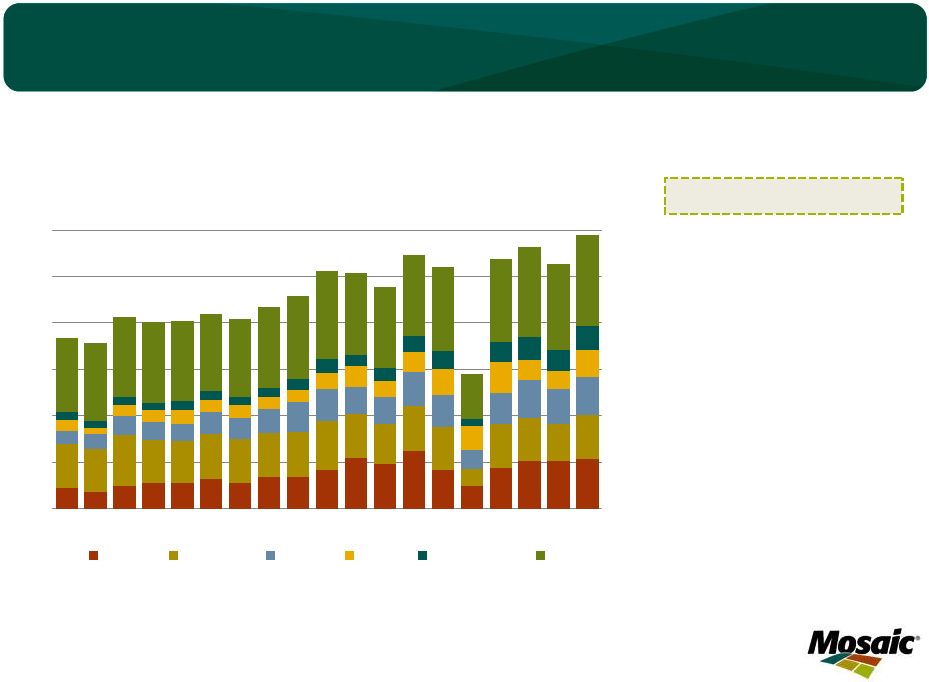

North Am

Brazil

India

Indo/Malay

Other

Source: Fertecon

and Mosaic

World Muriate of Potash Shipments

Million tonnes

KCL |

11

Head Frame at Esterhazy K3 |

Potash Operating Rates

Source: Fertecon demand assumptions, Assumes global MOP demand grows to 69 million

tonnes in 2017 and effective capacity increases to 75 million tonnes

in 2017. •

Better than expected balance during the next five years

•

More capacity later in decade

•

Some projects more likely than others

50%

60%

70%

80%

90%

100%

00

02

04

06

08

10

12F

14F

16F

Global MOP Operating Rates

Source: Mosaic

12 |

Phosphates is a Tight Market

•

Very low North

American producer

inventories

•

Drought-related, low

river levels impacting

timing of North

American shipping

•

Global supply

uncertainty

0

10

20

30

40

50

60

70

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12F

13F

Million tonnes

DAP/MAP/TSP

World Processed Phosphate Shipments

China

India

North Am

Brazil

Europe/FSU

Other

Dynamics

13

Source:

Fertecon

and

Mosaic |

Phosphate Operating Rates in the

Short and Near Term

Source: Fertecon demand assumptions, Mosaic estimates of capacity additions of 11

million tonnes expansion plans, including: Ma’aden on line in 2011,

doubling in 2017. •

Expected new capacity just keeps pace with projected

demand growth

•

Supply uncertainties

•

Growing demand

65%

68%

70%

73%

75%

78%

80%

83%

00

01

02

03

04

05

06

07

08

09

10

11

12F

13F

14F

15F

16F

17F

Global Phosphoric Acid Operating Rates

Source: Mosaic

14

of phosphoric acid in Middle East, North Africa, China and Latin America based on announced |

Financial Results Review |

16

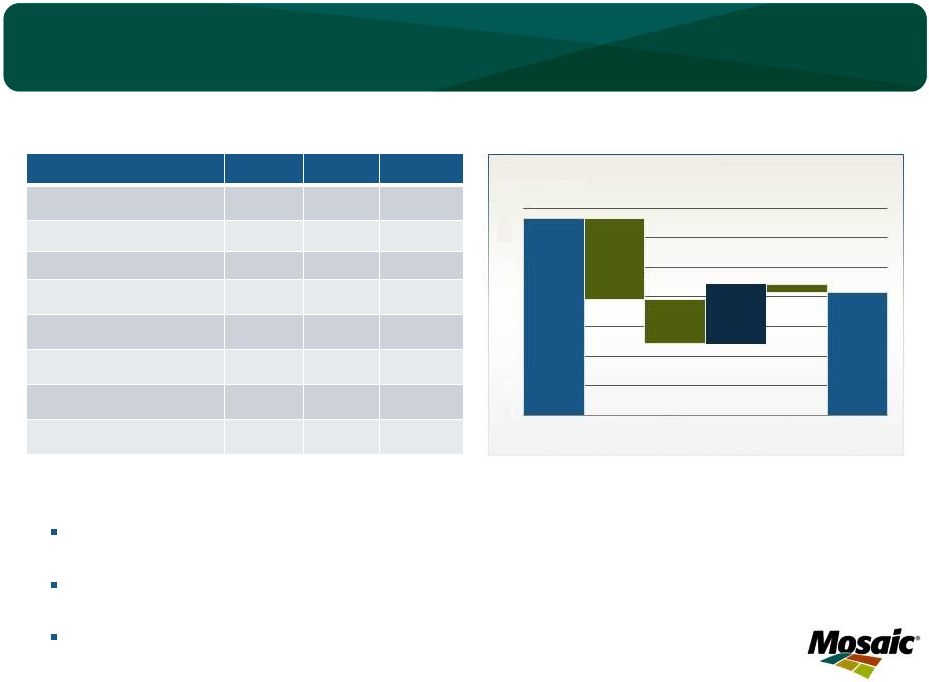

First Quarter Financial Performance

In millions, except per share amounts

Three Months Ended

August 31,

2012

2011

Net Sales

$2,505

$3,083

Gross Margin

$747

$848

% of net sales

30%

28%

Net Earnings

$429

$526

% of net sales

17%

17%

Diluted EPS

$1.01

$1.17

Effective Tax Rate

28%

28%

Cash Flow Provided by Operations

$339

$554

Cash and Cash Equivalents

$3,595

$4,038 |

17

Potash Segment Highlights

In millions, except MOP price

Q1 FY13

Q4 FY12

Q1 FY12

Net sales

$960

$1,037

$873

Gross Margin

$459

$514

$444

Percent of net sales

48%

50%

51%

Operating earnings

$416

$464

$402

Sales volumes

1.9

2.0

1.8

Production volume

1.5

1.9

1.9

Production operating rate

65%

85%

81%

Avg MOP selling price

$444

$455

$446

First quarter highlights:

Gross margins were impacted by increased brine

management expenses, longer shut-downs and higher depreciation,

partially offset by mark-to-market gains on derivatives.

Brine management costs were $28M higher than last year’s quarter, reflecting

higher expenses related to advanced technologies, such as horizontal

drilling. 0

50

100

150

200

250

300

350

400

450

500

Q1 FY12 OE

Sales Sales volumes

price

Resource

taxes

Other

Q1 FY13 OE

OPERATING EARNINGS BRIDGE

$ IN MILLIONS |

18

Tolling Agreement and Canpotex

Allocation Process

Tolling Agreement Impact on P&L

•

Effective January 1, 2013

•

Canpotex allocation change: from 37% to 43% *

Canpotex Allocation Process

•

Current rules based on peaking capacities in effect at that time

•

Adjusted based on proving runs

•

Entitlements reviewed twice a year (January/July)

* Excluding any expansions |

19

Phosphates Segment Highlights

In millions, except DAP price

Q1 FY13

Q4 FY12

Q1 FY12

Net sales

$1,561

$1,789

$2,220

Gross Margin

$288

$322

$410

Percent of net sales

18%

18%

18%

Operating earnings

$208

$224

$333

Sales volumes

2.7

2.9

3.2

NA production volume

(a)

2.0

2.1

2.2

Finished product operating rate

81%

86%

89%

Avg DAP selling price

$529

$494

$576

(a)

Includes crop nutrient dry concentrates and animal feed ingredients

First quarter highlights:

Sales volumes impacted by limited inventory availability and transportation

logistics related to Mississippi river water levels.

Margins reflect lower rock costs due to startup of South Fort Meade, lower ammonia

costs; offset by lower concentrate operating rates and a higher mix of lower

margin blend products. South Fort Meade is fully operational; expect to start

shipping rock across the Gulf to our Louisiana facilities.

0

50

100

150

200

250

300

350

Q1 FY12

OE

Sales

price

Sales

volumes

Raw

materials

Other

Q1 FY13

OE

OPERATING EARNINGS BRIDGE

$ IN MILLIONS |

20

Financial Guidance Summary

Category

Guidance

–

Fiscal

2013

Potash

Q2

Sales

volume

1.6

-

1.9

million

tonnes

Q2

MOP

selling

price

$420

-

$450

per

tonne

Q2 Operating rate above 70 percent

Phosphates

Q2

Sales

volume

3.0

-

3.4

million

tonnes

Q2

DAP

selling

price

$520

-

$550

per

tonne

Q2 Operating rate above 80 percent

Capital Expenditures

$1.5

-

$1.8

billion

Canadian Resource Taxes

and Royalties

$320

-

$380

million

SG&A

$420

-

$445

million

Effective Tax Rate

Upper 20 percent range |

21

Fiscal Year 2013 Outlook

Post drought demand

River levels

India and China

Record farmer

economics

Tight grain & oilseed

stocks-to-use

Capital deployment |

22

Progress Towards Fiscal Year 2013 Goals

Safety Performance

ROIC/Momentum

Sustainability

Premium Products

Sustainability

On Time, on Budget

Capacity Timing

Ammonia Investment

TSR focus

Potash Expansion

Innovation

Operational Excellence

Capital |

|

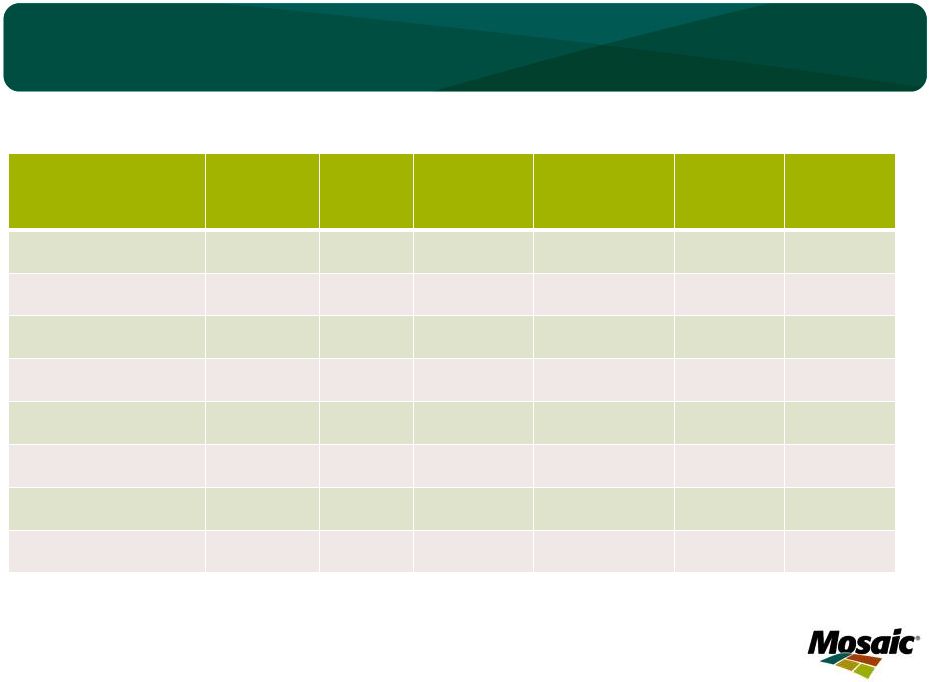

24

FY13 Q1

Actual

Change

FY13 Q1

Margin %

Actual

% Impact on

Segment

Margin

Pre-Tax

Impact

EPS

Impact

Marketing

MOP Price ($/tonne)

$444

$50

47.9%

9.2%

$88

$0.15

Potash Volume

(million tonnes)

1.9

0.5

47.9%

16.9%

$162

$0.27

DAP Price ($/tonne)

$529

$50

18.4%

6.3%

$98

$0.17

Phosphate Volume

(million tonnes)

2.7

0.5

18.4%

5.8%

$90

$0.15

Raw Materials

Sulfur ($/lt)

$196

$50

18.4%

2.6%

$40

$0.07

Ammonia ($/tonne)

$449

$50

18.4%

1.4%

$22

$0.04

(a)

These factors do not change in isolation; actual results could vary from the above

estimates (b)

Assumes no change to KMAG pricing

(b)

Earnings

Sensitivity

to

Key

Drivers

(a) |

25

Raw Material Cost Detail

The company is currently implementing a new inventory valuation system. After

implementation, the company expects to include this information in its

performance data disclosures. Q1 FY2013

%

Ammonia

Realized in COGS

$ 449

Average Purchase Price

$ 664

Sulfur

Realized in COGS

$ 196

Average Purchase Price

$ 189

Phosphate rock (used in production)

('000 metric tonnes)

US mined rock

2,895

88%

Purchased Miski Mayo rock

150

5%

Other purchased rock

251

8%

Total

3,296

100%

Average cost / tonne consumed rock

$ 64

|