Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDEAVOUR INTERNATIONAL CORP | d420995d8k.htm |

Credit Suisse

High Yield Conference

October 4 -

5, 2012

Exhibit 99.1 |

2

This is an oral presentation which is accompanied by slides. Investors are urged

to review our SEC filings. This presentation contains certain

forward-looking statements regarding various oil and gas

discoveries,

oil

and

gas

exploration,

development

and

production

activities,

anticipated

and

potential

production

and

flow

rates;

anticipated

revenues;

the

economic

potential

of

properties

and

estimated

exploration costs. Accuracy of the projections depends on assumptions about events

that change over time and is thus susceptible to periodic change based on

actual experience and new developments. Endeavour cautions readers that it

assumes no obligation to update or publicly release any revisions to the

projections in this presentation and, except to the extent required by applicable law, does not intend to

update or otherwise revise the projections. Important factors that might cause

future results to differ from these projections include: variations in the

market prices of oil and natural gas; drilling results; access to equipment

and oilfield services; unanticipated fluctuations in flow rates of producing wells related to

mechanical,

reservoir

or

facilities

performance;

oil

and

natural

gas

reserves

expectations;

the

ability

to

satisfy future cash obligations and environmental costs; and general exploration

and development risks and hazards.

The Securities and Exchange Commission permits oil and gas companies in their

filings with the SEC to disclose

only

proved

reserves

that

a

company

has

demonstrated

by

actual

production

or

conclusive

formation tests to be economically and legally producible under existing economic

and operating conditions.

SEC

guidelines

prohibit

the

use

in

filings

of

terms

such

as

“probable,”

“possible,”

P2

or

P3

and

“non-proved”

reserves,

reserves

“potential”

or

“upside”

or

other

descriptions

of

volumes

of

reserves

potentially

recoverable

through

additional

drilling

or

recovery

techniques.

These

estimates

are

by

their

nature more speculative than estimates of proved reserves and accordingly are

subject to greater risk of being actually realized by the company. Certain

statements should be regarded as “forward-looking” statements

within the meaning of the securities laws. These statements speak only as of the date made.

Such statements are subject to assumptions, risk and uncertainty. Actual results

or events may vary materially.

The

estimates

of

recoverable

resources

per

well

and

completed

well

costs

included

herein

are

based upon other typical results in these shale plays and may not be indicative of

actual results. |

3

Endeavour At A Glance

Near-term growth through lower risk development activities

•

Growing cash flow from U.K. development projects

•

Exposure to Brent crude oil and European gas

•

Increasing liquids production near-term

Balanced Strategy

•

Oil and Gas

•

U.K. and U.S.

•

Conventional and unconventional

•

Short and long-term production opportunities

Near-Term Potential Catalysts

•

Acquisition

of

MacCulloch

and

Nicol

from

ConocoPhillips

–

U.K.

•

Rochelle

field

development

in

execution

phase

–

U.K.

•

Heath

Oil

Shale

proof

of

concept

–

U.S.

* Market capitalization as of 10/1/12 with common shares outstanding and those

securities in the money. ** Reserves are pro forma for the acquisition of

MacCulloch and Nicol. Stock Symbol

New York Stock Exchange

END

London Stock Exchange

ENDV

Market Capitalization*

$498.4 million

Diluted Shares Outstanding

50.8 million

Proved & Probable Reserves **

76.0 MMBOE

Key Figures |

Significant Production Growth –

Acquisition and Near-Term Projects

10,000 –

11,000 boepd

14,000 –

18,000 boepd

Current Production

Pro forma Production and

MacCulloch & Nicol Fields

UK Oil

US Gas

UK Gas

Pro forma Production -

Rochelle

20,000 –

25,000 boepd

4

57%

30%

13%

(1)

(2)

(3)

71%

29%

86%

14%

(1)

As of March 31, 2012, pro forma for additional Alba interests acquired on May 31,

2012 and two producing wells from Bacchus. (2)

Assumes the closing of acquisition of MacCulloch and Nicol fields expected in early

4Q 2012. (3)

Rochelle

production

expected

in

4Q

2012

and

3

Bacchus

well

expected

in

2013.

rd |

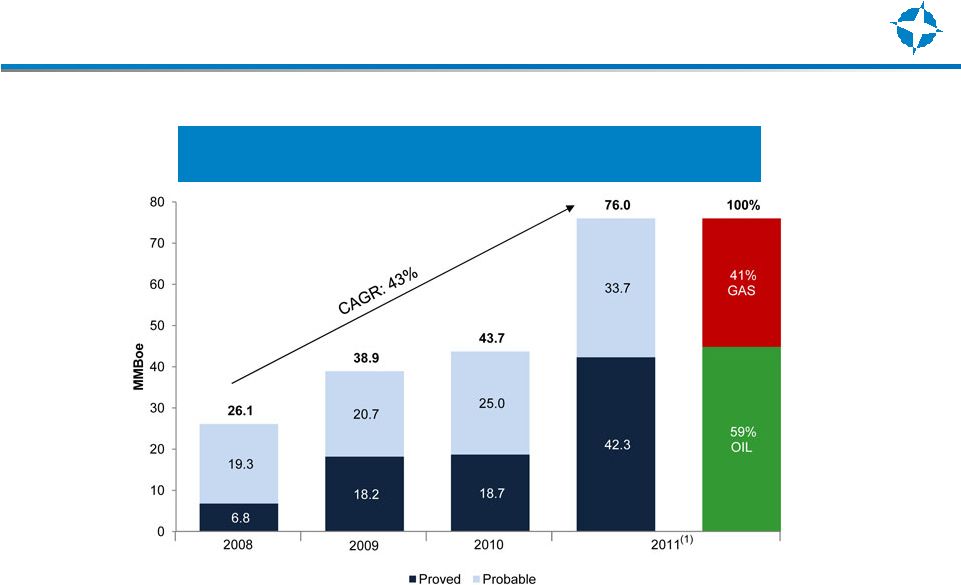

Our

Growing Resource Base (1)

Pro forma for reserves of assets acquired and to be acquired in the North Sea

Acquisition. Reserve Growth

5 |

$2,467

$1,288

$810

$715

$0

$500

$1,000

$1,500

$2,000

$2,500

2P PV-10

1P PV-10

Total Debt

Net Debt

6

Reserve Valuation

Net Asset Valuation

(1) Pre-tax PV-10 as of December 31, 2011 pro forma for the acquisition of

assets in the North Sea per NSAI audited reserve reports for respective assets.

(1)

(1) |

Reserves Value Make-Up and Migration

Reserves

Migrate

from

Probable

to

Proved

from

Known

Fields,

with

Little

Capital

Investment

7

$0

$500

$1,000

$1,500

$2,000

$2,500

1P PV-10

1P PV-10

Over Time = 2P

Rochelle

Bacchus

Alba

Other |

Overview of Endeavour’s U.K. Assets

8

* On 12/27/11, END announced the acquisition of three ConocoPhillips assets

in the North Sea,

including

an

increased

working

interest

in

Alba

and

two

new

assets

–

MacCulloch

and

Nicol. Alba acquisition closed on May 31, 2012. MacCulloch and Nicol expected to

close in early 4Q 2012.

Current Production

Development Projects

Bacchus

Enoch

Columbus

Bittern

Alba

MacCulloch

Nicol

Renee

Rubie

Ivanhoe /

RobRoy

Rochelle |

Expected 2012 Exit Position of Endeavour

9

GDF Suez

Premier

EnQuest

DONG Energy

Hess Corporation

OMV

RWE Dea

Dyas

Canadian Natural Resources

E.ON Ruhrgas

Marathon

ATP Oil & Gas

Perenco

Ithaca Energy

Wintershall

Nautical Petroleum

Fairfield Energy

Sterling Resources

Itochu

BHP Billiton

Murphy Oil

JX Nippon Oil & Energy

Corp

Xcite Energy

Tullow Oil

EnCore Oil

Marubeni

Noble Energy

Bayerngas

EOG Resources

Valiant Petroleum

Chrysaor

Agora Oil & Gas

First Oil

Bridge Energy

DEO Petroleum

KNOC

Endeavour UK

Endeavour UK +

Bacchus/Rochelle

and Acquisition

0

20

40

60

80

100

0

5

10

15

20

25

30

35

40

Production (kboe/d)

Source: Woodmac |

Bacchus -

Block 22/06a Central North Sea

10

First two wells on production, initial rate

~13,000 boepd gross

Reservoir is formed by shallow marine

Fulmar sandstones of Upper Jurassic age

Oil exported to Forties Pipeline System

END WI:

30%

Operator:

Apache (50% WI)

Partner:

First Oil (20% WI)

Bacchus

Forties

B3Y

B2 |

Project in execution phase

•

The first of two planned development wells spud on

August 1, 2012

•

Installation of the pipe and manifolds commenced

•

Pipe laying operations underway

•

Modifications at Scott platform substantially

completed

Off-take capacity at the Scott Platform is 100

mmcf/d in year one ramping up to 120 mmcf/d in

the second year

Reservoir Development

•

2 x 500m horizontal development wells

•

High potential wells at 100 mmcf/d per well

•

Gravel pack with pre-drilled liner

•

5 ½”

completion with permanent downhole

pressure/temperature gauges

Rochelle -

Blocks 15/26b, 15/26c and 15/27

11

Operator:

Endeavour (44% WI)

Partners:

Nexen (41% WI), Premier Oil (15% WI)

FDP Approved:

February 2011

Online:

Q4 2012

Rochelle

Renee

Rubie

Ivanhoe /

RobRoy

Goldeneye |

Rochelle Field -

Development Status

12

•

Pipeline

section

fabrication

completed

2012

Achievements

•

Commenced

full

pipeline

completed

•

Deliveries

on

target

•

Beds

on

the

platform

allocated

•

Regulatory

consents

in

place

•

Drilling

commenced

on

August

1,

2012

•

Pipe

laying

operations

underway

•

Rochelle

first

gas

in

4Q |

Alba

Field Overview - Block 16/26a

450ft water depth

Late Eocene reservoir at ~6,200ft depth

•

Massive homogeneous unconsolidated

sands with excellent quality

35 Platform and subsea wells

Three well infill drilling program planned

for 2012

Oil exported by tanker

13

END WI:

25.68%

Operator:

Chevron (23.37% WI)

Partners:

Statoil (17% WI)

BP (13% WI)

Total (12.65% WI)

CIECO/Itochu (8% WI)

Discovered/1st

Production

1984/1994

Alba

MacCulloch

Nicol

Britannia |

Alba

Field - Future Development

Sustain current production and increase reserves

through continued development drilling

Cumulative production to date

•

~373 MMbbls gross

Infill drilling since 2009 has largely sustained

Continuation of infill drilling program

•

2012 campaign extended from 6 to 9 months

•

Continuation of drilling included in operator’s business

plan

•

Large basket of further drilling opportunities identified

•

Addition to current reserves

•

Low economic threshold

•

Short payback time

14

production |

MacCulloch Field Overview -

Block 15/24b

490ft water depth

Paleocene reservoir at ~6,200ft depth

•

Large and extensive natural aquifer pressure

support

5 active wells

FPSO off-take solution

Currently operated by ConocoPhillips.

15

END WI:

40% WI*

Partners:

ENI(40% WI)

Noble Energy (14% WI)

Talisman (6% WI)

Discovered/1st

Production

1990/1997

Alba

MacCulloch

Nicol

Britannia

* On 12/27/11, END announced the acquisition of three ConocoPhillips assets

in the North Sea. MacCulloch is expected to close in early Q4 2012.

|

MacCulloch Field -

Details

Cumulative production to date

•

114 MMbbl gross

Plan to assume operatorship from

ConocoPhillips on completion of

acquisition

•

Plans to perform a detailed asset performance

review:

•

Evaluation of infill / near field potential

•

Opportunity to return shut-in wells to production

•

Optimization of gas lift rates and distribution

•

Debottlenecking, improvement to compressor

performance and availability

•

Improve operational efficiency

•

Manage offshore duty holder (NSPC) to

implement operational improvements

•

Subject to partner and DECC approval

16 |

17

Overview of Endeavour’s US Assets

Heath Shale Oil Play -

MT

Marcellus Play -

PA

Haynesville Play –

LA/ E. TX

Cretaceous Plays -

CO

US Q2 2012

542,000 gross / 146,000 net acres

15.4 MMCFe/D net production |

Heath

Shale ‘Tight Oil’ Play in Central Montana

25% joint venture with two independent

Montana producers

430,000+ gross acres primarily in Garfield and

Rosebud Counties (94,000 net to END)

Re-entry

of

1

vertical

planned

in

the

coming

months. Currently in process of securing a rig

to drill the Zeus 1H-13 in Rosebud country

Robust activity with more than 20 drilling

permits around Endeavour’s acreage

‘Bakken-like’

play, but shallower

(4000-

5500 ft. depth)

A proven petroleum system ~ 137 MMBO

cumulative production (Heath Shale is the

primary source rock)

Rich, oil-prone source rock, up to 20%

total organic carbon content, light oil

Heath Play Attributes

Heath Play, END Activity

18

END

CMR

Cirque

Cabot

Fidelity Heath sourced oil fields

Schmidt

44-27h

IP

248

boepd

Rock Happy 33-3H

IP 271 boepd

END/CMR

Zeus1H-13

st |

The

Haynesville and Marcellus Plays 19

Low cost entry with limited drilling

requirements

Endeavour’s Marcellus and Haynesville

acreage largely held by production

•

No wells currently drilling

Future capex is at Endeavour’s discretion,

enabling the Company to wait for a gas

price recovery prior to development

Haynesville Shale Play

Marcellus play developing around

Endeavour’s core HBP acreage

•

14,900 gross acres (6,750 net to END)

•

Strategic leasehold in HBP status

34,500 gross acres (15,800 net to END)

Solid well results in adjacent areas on trend

with southern McKean and Cameron

counties |

20

Financial Philosophy

Maintain disciplined, conservative approach to capital spending

•

Allocate capital to optimize and grow our asset base, making appropriate

adjustments in sustained periods of lower commodity prices

•

Capital budget is expected to be fully funded from operations

•

Focus on assets that have controllable capex requirements and low cost abandonment

obligations

•

General approach is to protect downside and keep upside potential

Improve credit profile each year

Enter into a bank revolver for working capital and lower cost of

capital

during 2013

Continue non-speculative hedging policy to minimize cash flow volatility

|

$10

$10

$14

$135

$500

$100

$63

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

2012

2013

2014

2015

2016

2017

2018

21

Debt Maturity Profile

($ in millions)

(1)

Subordinated Notes due 2014

Convertible Notes due 2016 ($18.51 per share conversion price)

Convertible Bonds due 2016 ($16.52 per share conversion price)

Senior Notes due 2018

Revolving Credit Facility due 2013 *

* Being replaced by a new bank syndicate in 2013.

$110

$198

$500 |

Capital Structure

22

($ mm)

December 31,

March 31,

June 30,

2011

2012

2012

Cash and Deposits

106.0

$

511.6

$

94.7

$

Senior Term Loan, 12% plus 3% PIK, due 2013

240.3

241.6

Revolving Credit Facility, 13%, due 2013

-

-

100.0

Senior Notes, 12%, due 2018, net

-

480.3

481.1

Convertible Bonds, 11.5%, due 2016 @ $16.52, net

60.0

62.2

63.9

Convertible Senior Notes, 5.5%, due 2016 @ $18.51

135.0

135.0

135.0

Subordinated Notes, 12%, due 2014

32.0

32.2

29.8

Total Net Debt

361.3

$

439.6

$

715.0

$

Series C Preferred Stock, convertible @ $8.75

37.0

37.0

37.0

Stockholders' Equity

154.1

120.0

137.7

Equity Component

191.1

$

157.0

$

174.7

$

Shares Outstanding - assuming all converted

June 30, 2012

Common Stock

46.6

Series C Preferred Stock, convertible @ $8.75

4.2

Convertible Bonds, 11.5%, due 2016 @ $16.52

4.0

Convertible Senior Notes, 5.5%, due 2016 @ $18.51

7.3

Options, warrants and stock-based compensation

2.9

65.1

|

2012

Capital Plan by Project - $175mm to $200mm

2012 is About Turning On and Maintaining North Sea Production

Note: Capital Plan is pro forma for the North Sea Acquisition

23

$0

$20

$40

$60

$80

$100

$120

Rochelle

Bacchus

UK Other

US |

Key

Credit Highlights 24

Balanced business strategy based on the low risk exploitational development of

proven petroleum systems with current technology

North Sea acquisition has significantly increase production and cash flow

Significant production growth expected in 2013 from known developments

Production is primarily exposed to premium Brent crude oil (57%)

and UK natural

gas (30%) commodity pricing

Opportunity in 2013 to improve the credit profile and capital structure

Low cost option on North American portfolio |

Corporate Focus

25

North Sea Asset Acquisition

•

Closed acquisition of Alba interests on May 31, 2012

•

Closing on the acquisition of MacCulloch and Nicol field interests expected

in early 4Q

Bacchus Development On-line

•

First two wells on production with field performance at 13,000 boepd gross and

above expectations

Rochelle in Execution Phase:

•

Drilling by the Diamond Ocean Nomad commenced on August 1, 2012

•

Subsea installation of pipe-in-pipe structure started in September

•

First gas in 4Q 2012

2013 Focus

•

Generate

cash,

improve

cost

of

capital,

pay

down

debt

and

pursue

the

existing

portfolio of assets |

LSE:ENDV

NYSE:END

www.endeavourcorp.com

Mike Kirksey

Chief Financial Officer

713.307.8788 / +44.207.451.2381

mike.kirksey@endeavourcorp.com

Darcey Matthews

Director of Investor Relations

713.307.8711

darcey.matthews@endeavourcorp.com

INVESTOR CONTACTS: |