Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED AIRLINES, INC. | d421003d8k.htm |

Credit Suisse Global

Credit Products

Conference

United Continental

Holdings, Inc.

October 5, 2012

Exhibit 99.1 |

Ted

North Managing Director –

Corporate Finance |

| Safe

Harbor Statement Certain statements included in this presentation are

forward-looking and thus reflect our current expectations and beliefs with

respect to certain current and future events and financial performance. Such

forward-looking statements are and will be subject to many risks and

uncertainties relating to our operations and business environment that may cause actual results to differ materially

from

any

future

results

expressed

or

implied

in

such

forward-looking

statements.

Words

such

as

“expects,”

“will,”

“plans,”

“anticipates,”

“indicates,”

“believes,”

“forecast,”

“guidance,”

“outlook”

and similar expressions are intended to identify forward-

looking

statements.

Additionally,

forward-looking

statements

include

statements

which

do

not

relate

solely

to

historical

facts,

such as statements which identify uncertainties or trends, discuss the possible

future effects of current known trends or uncertainties, or which indicate

that the future effects of known trends or uncertainties cannot be predicted, guaranteed or

assured. All forward-looking statements in this presentation are based upon

information available to us on the date of this presentation. We undertake no

obligation to publicly update or revise any forward-looking statement, whether as a result of new

information, future events, changed circumstances or otherwise, except as required by

applicable law. Our actual results could differ materially from these

forward-looking statements due to numerous factors including, without limitation, the following: our

ability to comply with the terms of our various financing arrangements; the costs and

availability of financing; our ability to maintain

adequate

liquidity;

our

ability

to

execute

our

operational

plans;

our

ability

to

control

our

costs,

including

realizing

benefits

from our resource optimization efforts, cost reduction initiatives and fleet

replacement programs; our ability to utilize our net operating losses; our

ability to attract and retain customers; demand for transportation in the markets in which we operate; an

outbreak of a disease that affects travel demand or travel behavior; demand for

travel and the impact that global economic conditions have on customer travel

patterns; excessive taxation and the inability to offset future taxable income; general economic

conditions (including interest rates, foreign currency exchange rates, investment or

credit market conditions, crude oil prices, costs of aircraft fuel and energy

refining capacity in relevant markets); our ability to cost-effectively hedge against increases in the

price of aircraft fuel; any potential realized or unrealized gains or losses related

to fuel or currency hedging programs; the effects of any hostilities, act of

war or terrorist attack; the ability of other air carriers with whom we have alliances or partnerships to

provide

the

services

contemplated

by

the

respective

arrangements

with

such

carriers;

the

costs

and

availability

of

aviation

and

other

insurance;

the

costs

associated

with

security

measures

and

practices;

industry

consolidation

or

changes

in

airline

alliances;

competitive pressures on pricing and demand; our capacity decisions and the capacity

decisions of our competitors; U.S. or foreign governmental legislation,

regulation and other actions (including open skies agreements and environmental regulations);

labor

costs;

our

ability

to

maintain

satisfactory

labor

relations

and

the

results

of

the

collective

bargaining

agreement

process

with

our union groups; any disruptions to operations due to any potential actions by our

labor groups; weather conditions; the possibility that expected merger

synergies will not be realized or will not be realized within the expected time period; and other

risks and uncertainties set forth under Item 1A., Risk Factors of the Company’s

Annual Report on Form 10-K, as well as other risks and uncertainties set

forth from time to time in the reports we file with the SEC. Consequently, forward-looking statements should

not

be

regarded

as

representations

or

warranties

by

us

that

such

matters

will

be

realized.

3

3 |

United

is transforming Broad,

business-centric

network

Capacity

discipline &

business

flexibility

Strengthening

the balance

sheet

Investing in

our people,

customers,

products &

technology

Growing

high-margin

businesses

4

We are building a new airline |

The

world’s best network Serving the most destinations of any global

carrier Hubs in the four largest U.S. cities

50 of Fortune 100 companies headquartered in hubs

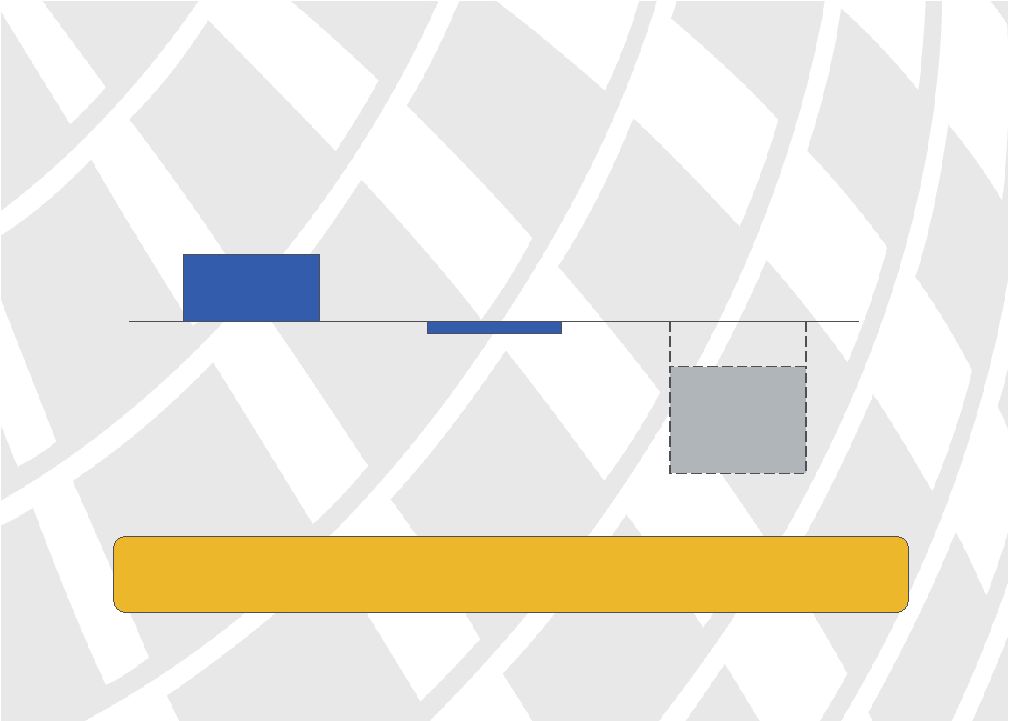

Rankings for US carriers by TME 2Q 2012 scheduled ASMs

Source: OAG

5

Best Network for Business Customers |

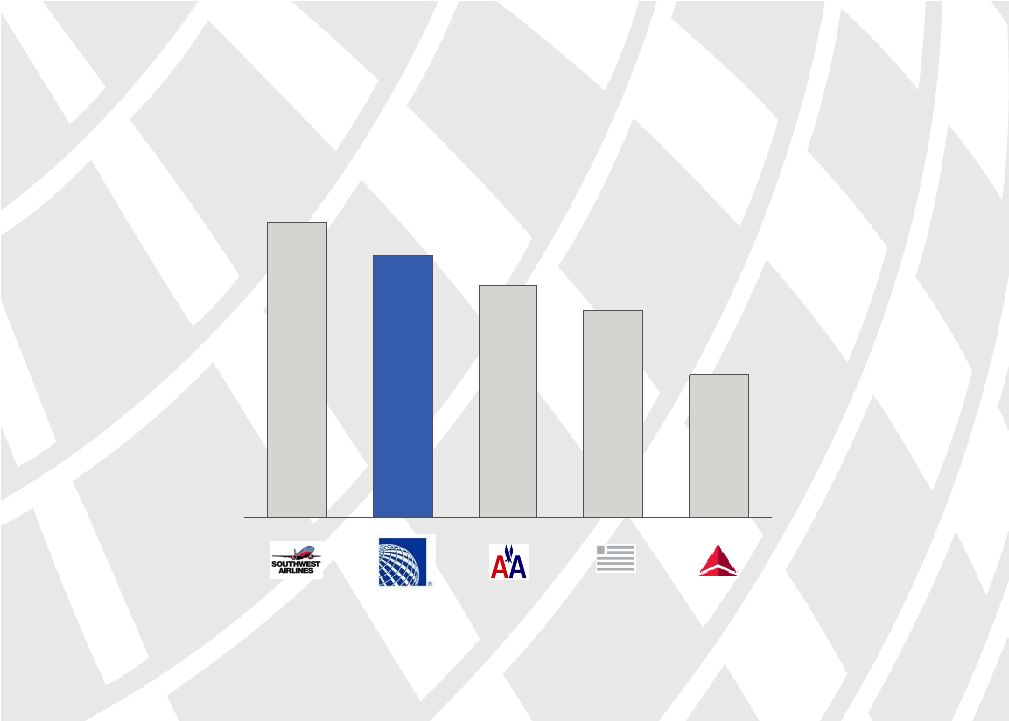

Industry-leading unit revenue

1. Consolidated PRASM numbers for carriers other than UAL adjusted for length of haul

versus UAL’s length of haul Source: Earnings releases and SEC

filings 6

TME 2Q 2012 PRASM

1

(in cents)

8.86

10.60

11.94

12.06

13.12 |

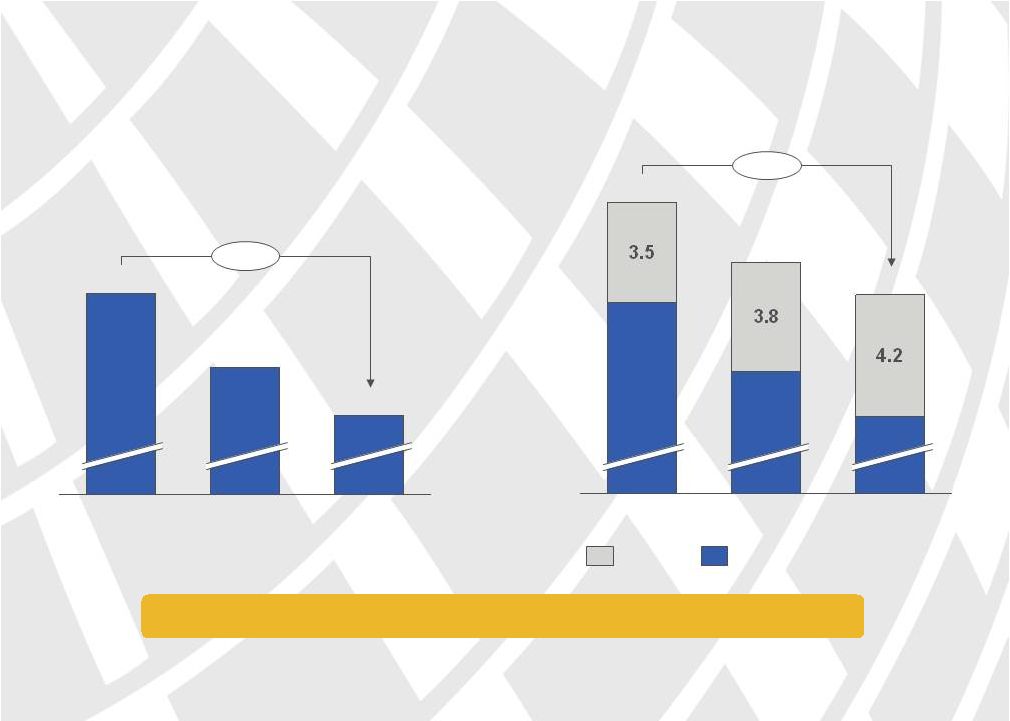

1.

Source: Kiodex – Platts US Gulf Coast Jet

2. Source: Earnings releases and SEC filings; Excludes special, one-time items.

See non-GAAP reconciliation in Appendix B; Results prior to 4Q10 proforma

Pre-tax Earnings/(Loss) ($B)

2

7

$1.1

($2.3)

TME 2Q12

2008

Average Jet A ($/bbl)

1

TME 2Q12

$127.4

2008

$124.7

Generating solid earnings despite elevated fuel prices |

ROIC

goal of 10% over the business cycle Return on Invested Capital

8

Note: Results proforma prior to 4Q 2010; ROIC calculation available in Appendix A and

on our website: http//:ir.united.com Source: SEC filings

1. Source: Kiodex –

Platts US Gulf Coast Jet

10.3%

11.3%

7%

8%

9%

10%

11%

12%

13%

14%

TME 2Q 2012

2010 -

2Q 2012

10%

Threshold

Jet A Price ($/bbl)

1

Achieved 10% ROIC goal in most recent twelve month period despite elevated fuel

prices

70

80

90

100

110

120

130

140

Jan. 2011

Jan. 2010

Sep. 2012

Jan. 2012 |

9

Note: Rolling consolidated capacity for prior twelve months; industry includes AMR,

DAL, LUV and LCC; capacity proforma for merged carriers Source: Earnings

releases and SEC filings (10%)

(5%)

0%

5%

Industry

ex-UAL

4Q08

4Q10

4Q09

2Q12

4Q06

4Q07

4Q11

Maintaining capacity discipline is core to our long-term

success |

Source: SEC filings and investor updates

Consolidated Capacity Trend

(Year-over-Year % Change in ASMs)

2010

1

2011

(0.2%)

(1.75%)

2012E

2

(0.75%)

1.1%

Expect FY 2013 consolidated capacity to decline

approximately 1% year-over-year

10

Reducing capacity in response to economic outlook

Results proforma prior to 4Q 2010

Updated from July 2012 investor Update

1.

2. |

Solid liquidity position

1. Cash,

short-term

investments

and

undrawn

credit

facilities

divided

by

TME

2Q

2012

revenue

Source: SEC filings

11

TME 2Q 2012 Liquidity

(as % of revenue)

14.6%

18.5%

20.0%

21.8%

23.8%

1 |

Note: Results prior to 4Q 2010 pro forma

Source: Earnings releases, SEC filings and July 2012 Investor Update

Net Debt

1

($B)

12

Net Debt

1

incl. Pension

2

($B)

2012 interest expense

3

expected to decline more than 20% vs. 2010

Committed to strengthening the balance sheet

$12.0

2009

$13.5

2010

$15.9

($3.9)

2011

2010

($3.2)

2011

$17.3

$16.2

12.0

15.9

$19.4

2009

13.5

Net Debt

Pension

1. Year end balances; Includes aircraft rent capitalized at 7

times 2. Pension includes the under-funded

portion of pension and post-retirement liabilities

3. 2012 interest expense is midpoint of non-operating

expense guidance from July 2012 Investor Update |

$4B

of non-aircraft debt coming due through 2016 13

Scheduled Debt & Capital Lease Payments ($B)

0.4

1.0

1.2

1.0

2016

$1.1

0.7

0.0

2015

$2.1

0.9

2014

$2.3

1.0

2013

$1.9

0.8

2012

$1.5

0.8

0.4

0.1

0.2

0.1

0.3

Aircraft Amortization

Non-Aircraft

Aircraft Maturities

Note: As of September 26, 2012; Includes 2012-2 EETC financing

|

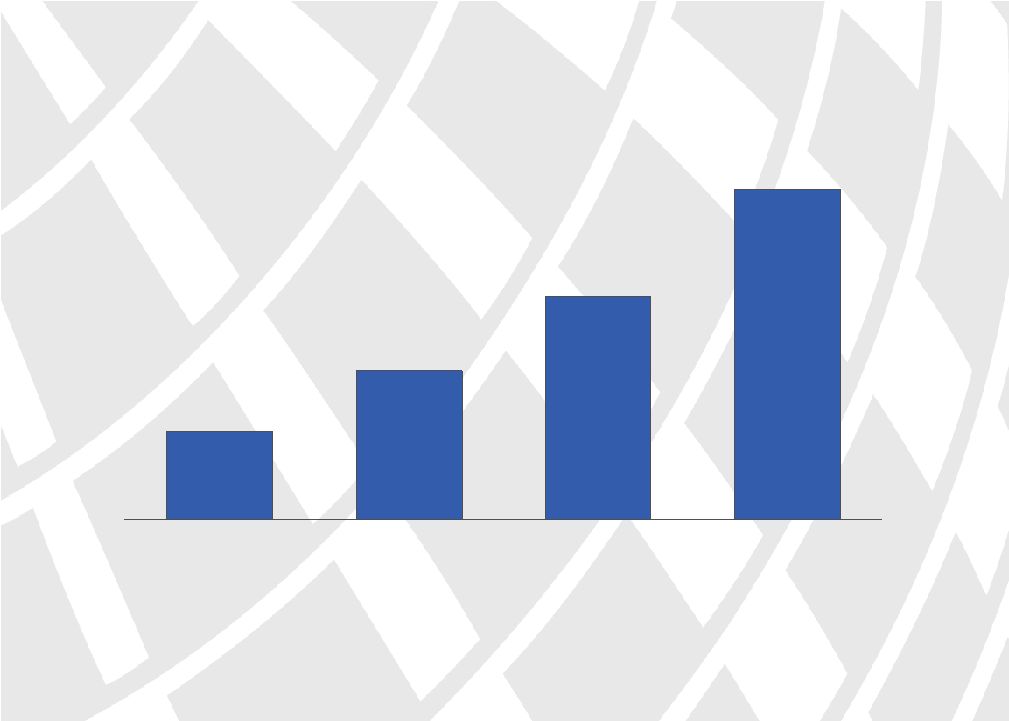

Opportunity to increase unencumbered asset base

14

$11.3

$7.7

$5.1

$3.0

2015

2014

2013

2012

Potential Unencumbered Asset Balance ($B)

Note: Cumulative total of assets generally accepted as collateral in financing

transactions and not then encumbered; Asset values derived from historical

appraisals and company estimates; 2012 amount includes currently available assets and assets expected to become

unencumbered by 2012 year-end |

Boeing 737

MAX 9

Highly efficient

Great fit for network

Unrivaled customer

experience

Boeing 787

Dreamliner

Investing in our fleet

15 |

Record low coupon in September 2012 EETC financing

16

Finances

21

aircraft

to

be

delivered

November

2012

–

July

2013

18 Boeing 737-900ER

3 Boeing 787-8 Dreamliners

1. Without the benefit of an insurance policy to support repayment of principal

LTV of 55.0%

$712M of proceeds

4% fixed-rate coupon, lowest in

A Tranche

B Tranche

LTV of 65.2%

$132M of proceeds

5 ½% fixed-rate coupon

Blended fixed-rate coupon of 4.16% lowest EETC coupon ever achieved

1

history |

Investing in our product and technology

New United

Club in

ORD T-2

Boeing

Sky

Interior

Enhanced

Agent

Interface

Global

Satellite

Wi-Fi |

Growing high margin components of our business

18

90 million members worldwide

100+ partnerships to earn

Unmatched redemption opportunities

Up to 5 more inches of space in coach

Ancillary Revenue

Economy Plus

Value-add products & services

Dynamic pricing

Improved CRM targeting

® |

19

Getting the basics right

Working Together culture

Direct, open & honest communication

Dignity & respect

We are a customer service business |

United is transforming

We are building a new airline

Broad,

business-centric

network

Capacity

discipline &

business

flexibility

Strengthening

the balance

sheet

Investing in

our people,

customers,

products &

technology

Growing

high-margin

businesses

20 |

21

Appendix A: ROIC calculation

TME 2Q12

$1,146

870

490

166

(6)

$2,666

TME 2Q12

$38,726

7,077

(19,863)

$25,940

10.3%

Source: Earnings releases and SEC filings;

1.Excludes special, one-time items. See non-GAAP reconciliation in Appendix

B 2.Interest components of NOPAT include tax effect at annualized cash tax

rate Net Operating Profit After Tax (“NOPAT”) ($M)

Adjusted Pre-Tax Income

+ Interest Expense

+ Interest Component of Capitalized Aircraft Rent

+ Net Interest on Pension

Adjusted for Cash Taxes

NOPAT

Invested Capital ($M)

Total Assets

+ Capitalized Aircraft Rent (@ 7.0x)

-

Non-Interest Bearing Liabilities

Average Invested Capital

Return on Invested Capital

2

2

2

1 |

22

Appendix B: Non-GAAP Financial Reconciliation

S-UA

S-CO

UAL

UAL

($5,427)

($695)

($6,122)

$407

3,654

181

3,835

739

($1,773)

($514)

($2,287)

$1,146

$20,194

$15,241

$35,435

$37,640

(8.8%)

(3.4%)

(6.5%)

3.0%

Note: Non-GAAP financial measures are presented because they provide management

and investors with the ability to measure and monitor UAL’s performance

using similar criteria on a consistent basis. UAL believes that adjusting for special

items is useful to investors because they are non-recurring items not indicative

of UAL’s on-going performance. Special items relate to activities

that are not central to UAL’s ongoing operations or are unusual in nature.

2008

2008

2008

TME 2Q12

Pre-tax Margin

($ millions)

Earnings / (Loss) Before Income Taxes

Add: Special Items

Adjusted Earnings / (Loss) Before Income Taxes

Total Operating Revenue

Adjusted Pre-tax Margin |