Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EAGLE ROCK ENERGY PARTNERS L P | anadarkoamendment8-k.htm |

| EX-99.1 - EXHIBIT - EAGLE ROCK ENERGY PARTNERS L P | pressrelease5.htm |

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

AMENDMENT TO BROOKELAND GAS FACILITIES

GAS GATHERING AND PROCESSING AGREEMENT

This Amendment (this “Amendment”) dated effective as of April 1, 2012 (the “Effective Date”) is between ANADARKO E&P COMPANY LP (“Anadarko”), successor to RME Petroleum Company and Union Pacific Resources Company producing division (“Producer”) and EAGLE ROCK OPERATING, L.P. (“Eagle Rock”), successor to Duke Energy Field Services, LP (“DEFS”), Duke Energy Field Services, Inc. and Union Pacific Resources Company, processing division (“Processor”).

WHEREAS, Producer and Processor, and/or their predecessors in interest are parties to that certain Brookeland Gas Facilities Gas Gathering and Processing Agreement dated as of September 1, 1993, as amended by amendments dated as of October 1, 1994, December 1, 1995, January 1, 1996, July 1, 1998, July 1, 2008, July 15, 2008, March 15, 1999, September 1, 2001, and November 1, 2005 (as amended, the “Contract”);

WHEREAS, notwithstanding that the Amendment to Gas Gathering and Processing Agreement dated as of November 1, 2005 (the “2005 Amendment”), was executed by Anadarko but was never executed by Eagle Rock, as successor in interest to DEFS, Anadarko and Eagle Rock have operated in accordance with the terms of such 2005 Amendment, attached hereto as Exhibit “B”;

WHEREAS, Anadarko and Eagle Rock desire to ratify and adopt the 2005 Amendment effective as of November 1, 2005; and

WHEREAS, Anadarko and Eagle Rock desire to further amend the Contract as provided herein.

NOW, THEREFORE, for and in consideration of the premises and of the mutual covenants contained herein, the parties agree to further amend the Contract as set forth below. Unless otherwise defined herein, capitalized terms used in this Amendment shall have the meanings ascribed to those terms in the Contract.

1. | 2005 Amendment. The 2005 Amendment is hereby ratified and adopted by the parties in accordance with its terms, effective as of November 1, 2005, being the original date of that amendment. Except as such amendment is modified hereby, the 2005 Amendment shall be effective in accordance with its terms. |

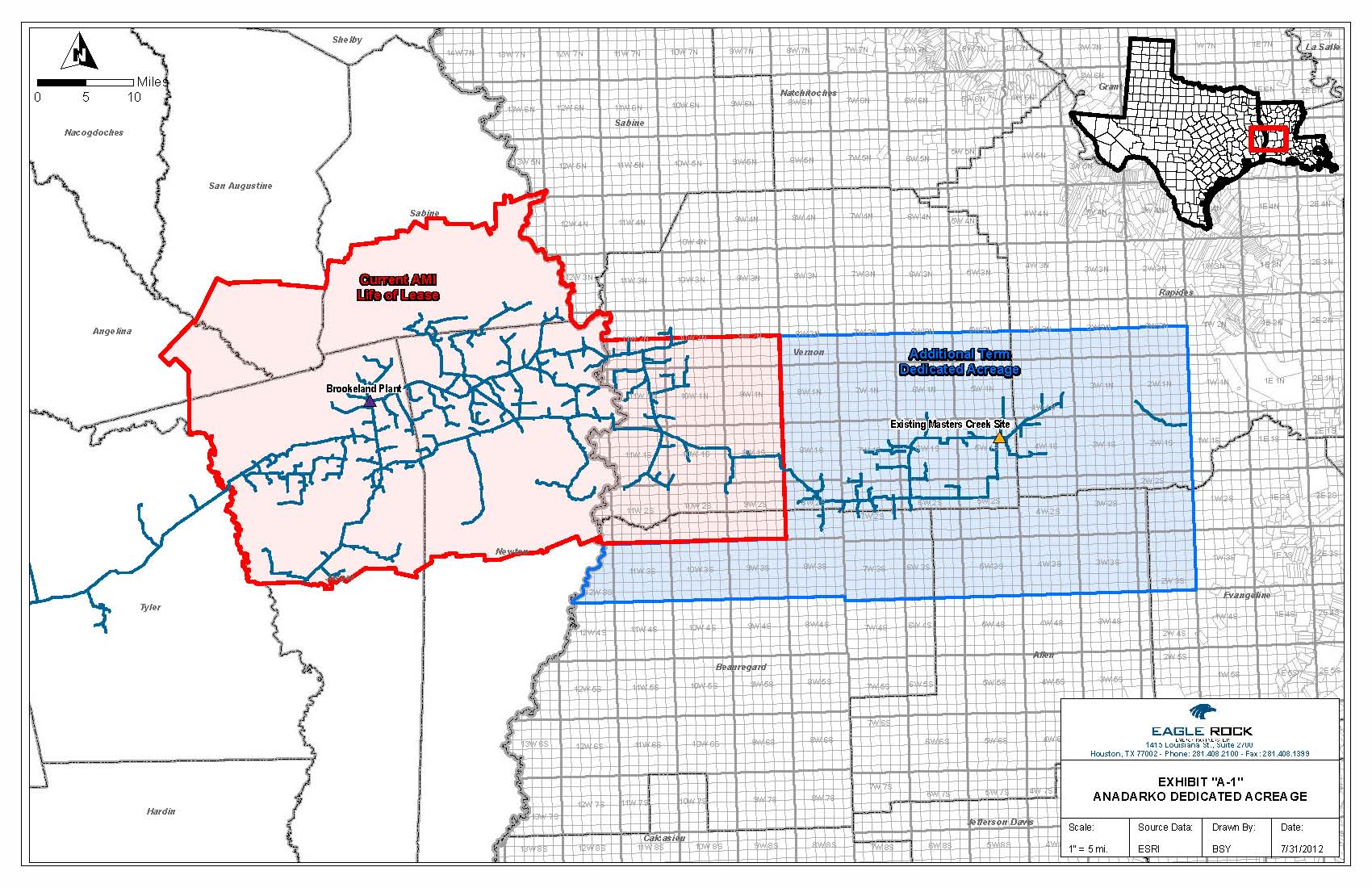

2. | Contract Area; Dedication. Effective as of the Effective Date, the Contract Area, as shown on Exhibit “A” of the Contract, is hereby modified to add those lands located in Vernon, Beauregard, Allen, Rapides and Evangeline Parishes, Louisiana described in Exhibit “A” and shaded in blue on the map set forth as Exhibit “A-1”, both attached hereto (the “Additional Term Dedicated Acreage”) to the Contract Area for a term of ten (10) years from the Effective Date; PROVIDED, HOWEVER, that upon the expiration of such ten (10) year term, such dedication shall continue from year to year thereafter unless and until terminated by Producer by giving written notice of the same to Processor not less than ninety (90) days prior to the expiration of the original ten (10) year dedication or the expiration of any one (1) year extension thereof, and PROVIDED, FURTHER, that Producer shall have the option, exercisable within ninety (90) days of the date of first flow of each well completed within the Additional Term Dedicated Acreage, to convert the dedication of all lands contained in the township in which such well is located from a term dedication under this Paragraph 2 to a life of lease dedication for the term of the Contract. |

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

3. | Expansion of Gathering System. It is understood and agreed that the cost recovery procedure set forth in this Amendment is intended to operate such that 100% of volumes delivered from wells operated by Producer shall be counted toward satisfaction of the minimum annual volume commitment, regardless of whether Producer owns all or less than all of the working interest in such well, so long as Producer delivers to Processor all of the Gas attributable to its owned or controlled volumes. Any Gas from a well operated by Producer taken in kind by a third party working interest owner and delivered to Processor shall be counted toward such volume commitment. Although Gas delivered to Processor from a well operated by a party other than Producer shall not be counted toward satisfaction of the minimum annual volume commitments under this Amendment, Producer shall be compensated for such Gas under the terms of the Contract and this Amendment, provided that such well is located within the Contract Area and was spudded after the Effective Date. |

Effective as of the Effective Date, and with respect only to wells drilled by Producer within the Contract Area (as amended hereby) or any lands pooled therewith that are spud on or after the Effective Date, Section 4.5 of the Contract is deleted in its entirety and replaced with the following (it being the intent of the parties that the existing Section 4.5 of the Contract shall continue to apply to any wells drilled by Producer within Contract Area or lands pooled therewith that are spud prior to the Effective Date):

“4.5 To expeditiously handle expansion of the Gathering system, the Processor and Producer agree to the following terms:

“a. Producer shall provide written notice to Processor of Producer's intent to drill a well or wells on lands within the Contract Area or lands pooled therewith and request that Processor initiate the construction of necessary pipelines and related facilities to connect the Delivery Point(s) for the well or wells to the existing Gathering System (hereinafter "pipeline expansion"). Processor shall provide Producer of Processor's total estimated cost of the pipeline expansion, and, if that total estimated cost exceeds $500,000, Producer shall have ten days from receipt of such estimate to make a written election (i) for Processor to proceed with the pipeline expansion or (ii) to rescind its request for the pipeline expansion. If Producer elects to proceed with the pipeline expansion, Processor may nevertheless decline to construct the pipeline expansion if Processor determines that it would not be profitable to do so. In such event, Producer may construct the expansion at its sole cost, provided, that the pipeline expansion must meet all Processor's specifications. In such event, Processor will construct and install the meter station and connection of the pipeline expansion to the Gathering System. Such meter station and connection shall be owned by Processor. Thereafter, Processor may, at its election, acquire the ownership of the pipeline expansion installed by the Producer by reimbursing Producer for the actual pipeline expansion costs with no allowance for inflation or depreciation. Producer agrees to execute all assignments or contracts deemed necessary to accomplish the transfer to Processor of title to the pipeline expansion, including rights-of-way and easements. In the event neither Processor nor Producer elect to construct the necessary pipeline expansion to connect the Delivery Point to the existing Gathering System, then this Agreement shall terminate as to the Gas from the well or wells to be connected to that Delivery Point.

“b. If Producer timely elects to proceed with pipeline expansion where the total cost is estimated to exceed $500,000 or where the estimated cost does not exceed $500,000, and Processor has agreed to construct the pipeline expansion, Processor shall cause

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

commencement of construction as soon as practicable after the later of right-of-way acquisition or commencement of drilling of the well.

“c. In order to provide a recovery mechanism for the capital expenditures incurred by Processor in connection with a pipeline expansion (including, but not limited to, the costs of right-of-way, construction, and materials), for each new Delivery Point receiving Gas from a well operated by Producer spud on or after April 1, 2012, Producer shall be subject to a minimum annual volume commitment (“Minimum Annual Volume Commitment”) for the first three (3) years from initial flow (each an “Annual Commitment Period”). Such Minimum Annual Volume Commitment shall be calculated based on the assumed volumes and capital expenditure set forth in Table 1 below.

Table 1

(assumed capital expenditure = $1,000,000)

Year | Minimum Annual Volume Commitment (Mcf) | Minimum Daily Volume Commitment (Mcf/D) | Deficiency Fee ($/Mcf) |

1 | [***] | [***] | $[***] |

2 | [***] | [***] | $[***] |

3 | [***] | [***] | $[***] |

“The Minimum Annual and Daily Volume Commitments set forth in Table 1 are provided for purposes of illustration only and are based on an assumed capital expenditure by Processor of $1,000,000. The Annual Volume Commitment shall be calculated for each Delivery Point based on Processor's actual expenditure for that Delivery Point and will vary from the volumes set forth in Table 1 in the proportion that the actual expenditures vary from the assumed expenditure. For example: If Processor spends $800,000 to connect Delivery Point A, (i.e., 80% of $1,000,000), the Minimum Annual Volume Commitment for Delivery Point A would be calculated by multiplying the Minimum Annual Volume Commitment volume shown in Table 1 for the applicable year by 80% (e.g. [***] Mcf for Year 1 x 80% = [***] Mcf or [***] Mcf/D), with similar calculations being made for Years 2 and 3. Conversely, if Processor spends $1,200,000 to connect Delivery Point B, the volumes shown in Table 1 would be multiplied by 120% to determine the actual Minimum Annual Volume Commitment for Delivery Point B.

“Producer may manage its compliance with the Minimum Annual Volume Commitments by using any volume delivered during an Annual Commitment Period to a Delivery Point receiving Gas from a well spud on or after April 1, 2012 in excess of the Minimum Annual Volume Commitment as (i) an offset against a deficiency in delivered volumes below the Minimum Annual Volume Commitment for another Delivery Point also receiving Gas from a well(s) spud on or after April 1, 2012 (“Volume Offset”), and/or (but without duplication) (ii) a credit toward compliance of the Minimum Annual Volume Commitment for the same Delivery Point for the next one-year period (“Volume Carryover”). As soon as practical after the end of the Annual Commitment Period for a Delivery Point, Processor shall determine whether the Minimum Annual Volume Commitment was satisfied for such Delivery Point and shall notify Producer in writing of the amount of the excess or deficiency applicable to that Delivery Point.

“If an excess exists, Producer shall have thirty (30) days from receipt of such notification from Processor to elect the manner in which Producer wishes to apply the available

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

excess, and, if such excess is to be applied (either in whole or in part) as a Volume Offset for another Delivery Point, designate the Delivery Point(s) to which such Volume Offset should be applied. Should Producer fail to provide written notice of such election (and designation of Delivery Point(s) if applicable) to Processor within the prescribed thirty (30) day period, the excess shall be treated as a Volume Carryover and applied as a credit toward the Minimum Annual Volume Commitment for the same Delivery Point for the next one-year period. Excess volumes may be used as a Volume Offset for any Delivery Point that receives Gas from a well spud on or after April 1, 2012 but may be applied prospectively only. Once excess volumes have been applied as a Volume Offset or Volume Carryover, no reversals of such application shall be made. However, should application of a Volume Offset result in volumes in excess of the Minimum Annual Volume Commitment for the Delivery Point to which such Volume Offset is applied, the resulting excess may be similarly managed in accordance with this Paragraph.

“If Processor determines that the Minimum Annual Volume Commitment for a Delivery Point was not met, Processor shall apply any Volume Offsets and/or Volume Carryovers that may be available and, if a deficiency still applies, calculate and invoice Producer for an amount equal to the product obtained by multiplying (a) the difference of (x) the sum of Producer's actual total delivered volumes (in Mcf) and any excess volumes applied as an offset for such Delivery Point (in Mcf) less (y) the Minimum annual Commitment Volume by (b) the applicable Deficiency Fee shown in Table 1. The invoiced amount shall be due and payable by Producer in accordance with Article XIV of the Contract. If the application of Volume Offsets and/or Volume Carryovers for such Delivery Point as provided above results in volumes in excess of the Minimum Annual Volume Commitment, Processor shall advise Producer of the amount of such excess whereupon Producer shall elect how to manage such excess as provided above.

“Producer shall not be relieved of payment of any Deficiency Fee by the occurrence of an event of Force Majeure claimed by Producer. In the event that Processor is rendered unable to receive and/or process Gas delivered by Producer at a Delivery Point due to the occurrence of a Force Majeure claimed by Processor, the Minimum Annual Volume Commitment for the applicable Delivery Point(s) shall be suspended for the duration of the Force Majeure and the Annual Commitment Periods for such Delivery Point(s) shall be extended accordingly.”

4. | Gathering Fee. The following Paragraph 4.5.d. shall be added at the end of Section 4.5: |

“d. Gathering Fee. With respect to all Delivery Points receiving Gas from a well located within the Contract Area spud on or after April 1, 2012, Processor shall charge Producer a fee for gathering services over Processor's Gathering System (“Gathering Fee”) equal to [***] ($[***]) multiplied by the volume (in Mcf) of Gas received by Processor at each such Delivery Point. On April 1, 2014, and each April 1 thereafter, the Gathering Fee shall be adjusted upward or downward in accordance with the adjustment methodology used in Paragraph 4.2 of the Contract (as such index may be replaced and/or updated from time to time by the Bureau of Labor Statistics). Notwithstanding the above, at no time shall the Gathering Fee be adjusted to be less than the initial Gathering Fee above nor shall the Gathering Fee be adjusted by more than four percent (4%) in any one year.”

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

5. | Processing Fee and Disposition of Plant Products and Residue Gas. |

a. | Paragraph 11.2.c. of the Contract shall be deleted in its entirety and replaced with the following: |

“Whenever Producer is taking its Plant Products in kind, Processor shall have no duty to compensate Producer for the value of Plant Products recovered from Producer's Gas, and Producer shall pay to Processor a fee equal to: (i) [***] percent ([***]%) of the value of the Plant Products determined under Paragraph 11.1 above for wells spud prior to July 1, 1998, and (ii) [***] percent ([***]%) of the value of the Plant Products determined under Paragraph 11.1 above for all wells spud on or after July 1, 1998 but before April 1, 2012, and (iii) zero percent (0%) of the value of the Plant Products determined under Paragraph 11.1 above for all wells spud on or after April 1, 2012, using for purposes of clauses (i), (ii) and (iii), the values realized by Processor in sales of Plant Products recovered at the Plant other than those allocated to Producer.”

b. | Paragraph 12.1 of the Contract shall be deleted in its entirety and replaced with the following: |

“In-Kind Processing Fees. Whenever Producer is not taking in-kind either its Plant Products or Residue Gas, or both, Processor shall retain, from the Plant Products and/or Residue Gas not being taken in-kind, as applicable, an in-kind fee equal to: (i) [***] percent ([***]%) of the Plant Products or Residue Gas not being taken in-kind by Producer for wells spud prior to July 1, 1998, (ii) [***] percent ([***]%) of the Plant Products or Residue Gas not being taken in-kind by Producer for wells spud on or after July 1, 1998 but prior to April 1, 2012, and (iii) [***] percent ([***]%) of the Plant Products or Residue Gas not being taken in-kind by Producer for wells spud on or after April 1, 2012. Producer will keep Processor informed of the spud dates for all committed wells, the production quantities from the respective wells, and of any Producer test sampling results, all to facilitate the correct calculation of the processing fee due under this Paragraph from time to time.”

c. | Paragraph 13.1.c. of the Contract shall be deleted in its entirety and replaced with the following: |

“Whenever Producer is taking its Residue Gas in-kind, Processor shall have no duty to compensate Producer for the value of Residue Gas recovered from Producer's Gas, and Producer shall pay to Processor a fee equal to: (i) [***] percent ([***]%) of the value of the Residue Gas determined under Paragraph 12.3 above for wells spud prior to July 1, 1998, (ii) [***] percent ([***]%) of the value of the Residue Gas determined under Paragraph 12.3 above for all wells spud on or after July 1, 1998 but before April 1, 2012, and (iii) [***] percent ([***]%) of the value of the Residue Gas determined under Paragraph 12.3 above for all wells spud on or after April 1, 2012.”

6. | Miscellaneous. The following Section 25.10 shall be added at the end of Article 25: |

“25.10 NOTWITHSTANDING ANYTHING TO THE CONTRARY IN THIS AGREEMENT, EACH PARTY EXPRESSLY WAIVES ALL RIGHTS TO CLAIM INCIDENTAL, CONSEQUENTIAL, SPECIAL, INDIRECT, PUNITIVE OR EXEMPLARY DAMAGES THAT IN ANYWAY RELATE TO A CLAIM UNDER OR A BREACH OF THIS AGREEMENT. THIS SECTION 25.10 DOES NOT APPLY TO AND DOES NOT LIMIT INDEMNIFICATION REGARDING ANY CLAIMS BY UNAFFILIATED THIRD PARTIES.”

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

7. | Except as expressly amended hereby, the Contract shall remain in full force and effect in accordance with its terms. |

8. | Headings and Titles. The headings and titles in this Amendment are for guidance and convenience of reference only and shall not be deemed to limit or otherwise affect or interpret the meaning or construction of the terms or provisions of this Amendment. |

9. | Counterparts. This Amendment may be executed in multiple counterparts, each of which shall be deemed an original but together shall constitute a single document. Facsimile or other electronic copies (such as PDF or other scanned files delivered by electronic mail) of signatures shall constitute original signatures for all purposes of this Amendment and any enforcement hereof. |

IN WITNESS WHEREOF, the parties have executed this Amendment on this 3rd day of October, 2012, to be effective as of the Effective Date, notwithstanding the actual date of execution.

ANADARKO E&P COMPANY, LP EAGLE ROCK OPERATING, L.P.

By: Eagle Rock Pipeline GP, LLC,

its general partner

By: /s/ Daniel M. Altena By: /s/ Joseph A. Mills

Name: Daniel M. Altena Name: Joseph A. Mills

Title: General Manager Title: Chairman & Chief Executive Officer

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

EXHIBIT “A”

Attached to

Amendment to Brookeland Gas Facilities

Gas Gathering and Processing Agreement

dated Effective as of April 1, 2012, between

Anadarko E&P Company LP (“Producer”)

and Eagle Rock Operating, L.P. (“Processor”)

Additional Term Dedicated Acreage

T8W-R2N Sections 19 - 36

T7W-R2N Sections 19 - 36

T6W-R2N Sections 19 - 36

T5W-R2N Sections 19 - 36

T4W-R2N Sections 19 - 36

T8W-R1N Sections 1 - 36

T7W-R1N Sections 1 - 36

T6W-R1N Sections 1 - 36

T5W-R1N Sections 1 - 36

T4W-R1N Sections 1 - 36

T8W-R1S Sections 1 - 36

T7W-R1S Sections 1 - 36

T6W-R1S Sections 1 - 36

T5W-R1S Sections 1 - 36

T4W-R1S Sections 1 - 36

T8W-R2S Sections 1 - 36

T7W-R2S Sections 1 - 36

T6W-R2S Sections 1 - 36

T5W-R2S Sections 1 - 36

T4W-R2S Sections 1 - 36

T3W-R2N Sections 19 - 36

T2W-R2N Sections 19 - 36

T3W-R1N Sections 1 - 36

T2W-R1N Sections 1 - 36

T3W-R1S Sections 1 - 36

T2W-R1S Sections 1 - 36

T3W-R2S Sections 1 - 36

T2W-R2S Sections 1 - 36

T2W-R3S | Sections 1 - 36 |

T12W-R3S | Sections 1, 11 - 15, 22 - 28, and 32 - 36 |

T11W-R3S Sections 1 - 36

T10W-R3S Sections 1 - 36

T9W-R3S Sections 1 - 36

T8W-R3S Sections 1 - 36

T7W-R3S Sections 1 - 36

T6W-R3S Sections 1 - 36

T5W-R3S Sections 1 - 36

T4W-R3S Sections 1 - 36

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

T3W-R3S Sections 1 - 36

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

EXHIBIT “A-1”

Attached to

Amendment to Brookeland Gas Facilities

Gas Gathering and Processing Agreement

dated Effective as of April 1, 2012, between

Anadarko E&P Company LP (“Producer”)

and Eagle Rock Operating, L.P. (“Processor”)

Map showing Additional Term Dedicated Acreage (blue)

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

EXHIBIT “B”

Attached to

Amendment to Brookeland Gas Facilities

Gas Gathering and Processing Agreement

dated Effective as of April 1, 2012, between

Anadarko E&P Company LP (“Producer”)

and Eagle Rock Operating, L.P. (“Processor”)

BRK-0006-00*

AMENDMENT TO GAS GATHERING

AND PROCESSING AGREEMENT

This Amendment dated as of November 1, 2005 is between ANADARKO E&P COMPANY LP, successor to RME Petroleum Company and Union Pacific Resources Company producing division ("Producer") and DUKE ENERGY FIELD SERVICES, LP, successor to Duke Energy Field Services, Inc. and Union Pacific Resources Company, processing division ("Processor").

In consideration of the premises and of the mutual covenants contained herein, the parties agree to further amend the Brookeland Gas Facilities Gas Gathering and Processing Agreement dated as of September 1, 1993, as heretofore amended, Processor's File No. BRK-0006-00* (previously Processor's File No. BR-G&P-200137, the "Contract") between the parties' predecessors covering properties in Jasper, Newton, and Sabine Counties, Texas, and Vernon Parish, Louisiana, as follows:

1. Article XI, Disposition of Producer's Portion of Plant Products, is amended to read in its entirety as follows. The former Paragraph 11.3 is deleted.

XI. FLANT PRODUCTS VALUATION

AND OPTION TO TAKE IN KIND

11.1 Plant Products Ownership and Valuation. Subject to Paragraph 11.2 below, Processor shall own and have the right to sell all Plant Products removed or extracted from the Facilities after Gas is delivered at the Delivery Points. Processor will compensate Producer for recovered Plant Products in accordance with this Paragraph and Article XII below unless Producer's option under Paragraph 11.2 below is in effect. The compensation due to Producer for Plant Products allocable to Producer's Gas will be based on Processor's actual sales prices. Processor shall sell the Plant Products at or f.o.b. the Plant Tailgate. The prices received by Processor for the Plant Products f.o.b. the Plant Tailgate will be net of costs and any losses incurred by Processor or its purchaser downstream of the Plant Tailgate for transportation, fractionation, treatment, storage, upgrade, line losses, measurement, commissions, brokerage fees, marketing fees, exchange differentials, and fractionator retainage. The Sum of all of these costs for Plant Products transported by pipeline shall not exceed $0.061/gallon for 1994, and will be subject to fluctuations thereafter based on Processor's experience. This $0.061/gallon limitation shall not apply to Plant Products transported other than by pipeline. Producer recognizes that Processor affiliates may participate in handling of Plant Products downstream from the Plant, and the actual fees incurred by Processor in all downstream transactions will apply, subject to Processor's duty to use reasonable and normal industry practices and pricing in affiliate transactions.

11.2 Producer's Option to Elect to Take Its Plant Products In Kind.

(a)Subject to the following conditions, Producer shall have an option, exercisable annually as of each January 1, to elect to take in kind 100% of the Plant Products allocated to Gas supplied by Producer and market those Plant Products at values to be negotiated between Producer and the purchaser of the Plant Products taken in kind by Producer. Any take in kind election by Producer shall be applicable to all of Producer's allocable Plant Products, and not less than all of those quantities. For periods when Producer has elected this "Take In Kind" option, Processor will deliver the Plant Products to be taken in kind by Producer to Producer or for its account at the tailgate of the Plant into the existing connected NGL pipeline, and, as between the parties hereto, Producer will be responsible for all costs incurred downstream from that point, including without limitation cost for Plant Products transportation, fractionation, treatment, storage, upgrade, line losses, measurement, commissions, brokerage fees, marketing fees, exchange differentials, and fractionator retainage.

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

(b)Processor acknowledges and agrees that Producer has elected to exercise this option effective as of November 1, 2005, and continuing through the calendar year 2006. For 2007 and subsequent years, the option exercise will be presumed to carryover from year to year unless Producer informs Processor for the upcoming year by written notice given no later than November 1 of the preceding year that it desires to cease exercising the Plant Products Take in Kind option, in which event Processor shall again purchase from and pay Producer for the Plant Products allocable to Producer's Gas in accordance with Paragraph 11.1 and Article XII hereof.

(c)Whenever Producer is taking its Plant Products in kind, Processor shall have no duty to compensate Producer for the value of Plant Products recovered from Producer's Gas, and Producer shall pay to Processor a fee equal to 20% of the value of the Plant Products determined under Paragraph 11.1 above for wells spudded prior to July 1, 1998 and a fee equal to 15% of the value of the Plant Products determined under Paragraph 11.1 above for wells spudded on or after July 1, 1998, using for this purpose the values realized by Processor in sales of Plant Products recovered at the Plant other than those allocated to Producer.

2. The text of Article XII, Processing Payment, is amended to read in its entirety as follows:

ARTICLE XII. PROCESSOR'S IN KIND PROCESSING FEE;

PAYMENTS TO PRODUCER FOR PLANT PRODUCTS

AND RESIDUE GAS NOT TAKEN IN KIND

12.l In Kind Processing Fees. Whenever Producer is not taking in kind either its Plant Products or Residue Gas or both, Processor shall retain in kind from the Plant Products or Residue Gas not being taken in kind, as applicable, an in kind fee of 20% of the Plant Products or Residue Gas not being taken inland for wells spudded prior to July 1, 1998 and an in kind fee of 15% of the Plant Products or Residue Gas not being taken in land for wells spudded on or after July 1, 1998. Producer will keep Processor informed of the spud dates for all committed wells, the production quantities from the respective wells, and of any Producer test sampling results, all to facilitate correct calculation of the processing fee due under this Paragraph from time to time.

12.2 Plant Products Value Payment. When Producer is not electing to take its Plant Products in kind, Processor shall pay Producer for the recovered Plant Products attributable to Producer's Gas remaining after deducting the applicable in land fee Under Paragraph 12.1 at the value for the month established under Paragraph 11.1 above.

12.3 Residue Gas Value Payment. When Producer is not electing to take its Residue Gas in kind, Processor shall take title to Residue Gas allocable to Producer's Gas and pay Producer for its Residue Gas remaining after deducting the applicable in kind fee under Paragraph 12.1 at the value published in Inside F.E.R.C.'s Gas Market Report in its first publication of tile month of deliveries for "Prices of Spot Gas Delivered to Pipelines" for Tennessee Gas Pipeline Co., Zone 0 Texas ("Index Price"). If this price quotation is discontinued or materially modified, its successor will be used, or in the absence of a successor, Producer and Processor will promptly select another publication that enables calculation of an index price closely comparable to the Index Price. If a change in the Index Price calculation becomes necessary, Processor will so inform Producer by written notice, setting forth the proposed changes and the reason for the changes. Processor will have the right to deduct from payments to Producer under Paragraphs 12.2 and 12.3 any amounts due to Processor under this Agreement. No separate payment or value calculation is to he made under this Contract for helium, sulfur, CO2, other non-hydrocarbons, or for Inferior Liquids.

3. Article Xiii, Disposition of Producer's Portion of Residue Gas, is Amended to read in its entirety as follows:

13.1 Producer's Option to Elect to Take Its Residue Gas In Kind.

(a)Subject to the following conditions, Producer shall have an option, exercisable annually as of each January 1, to elect to take in kind 100% of the Residue Gas allocated to gas supplied by Producer and market the Residue Gas at values to be negotiated between Producer and the purchaser of the Residue Gas taken in kind by Producer. Any take in kind election by Producer shall be applicable to all of Producer's allocable

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

Residue Gas quantities, and not less than all of those quantities. For periods when Producer has elected this "Take In Kind" option, Processor will deliver the Residue Gas to be taken in kind by Producer to Producer or for its account at the tailgate of the Plant into the existing connected Residue Gas pipeline(s) designated by Producer in good faith, and, as between the parties hereto, Producer will be responsible for all costs incurred downstream from that point, including without limitation costs for Residue Gas transportation, storage, line losses, measurement differences, and other expenses.

(b)Processor acknowledges and agrees that Producer has elected to exercise this option effective as of November 1, 2005, and continuing through the calendar year 2006. For 2007 and subsequent years, the option exercise will be presumed to carry over from year to year unless Producer informs Processor for the upcoming year by written notice given no later than November 1 of the preceding year that it desires to cease exercising the Residue Gas Take in Kind option, in which event Processor shall again purchase from and pay Producer for the Residue Gas allocable to Producer's Gas in accordance with Article XII hereof.

(c)Whenever Producer is taking its Residue Gas in kind, Processor shall have no duty to compensate Producer for' the value of Residue Gas recovered from Producer's Gas, and Producer shall pay to Processor a fee equal to 20% of the value of the Residue Gas determined under Paragraph 12.3 above for wells spudded prior to July 1, 1998 and a fee equal to 15% of the value of the Residue Gas determined under Paragraph 12.3 above for wells spudded on or after July 1, 1998.

(d)This subparagraph (d) and subparagraphs (e) through (h) apply to both Plant Products and to Residue Gas to be taken in kind by Producer. Producer or its designee shall be responsible for the disbursement of payment to all owners of all working interests, royalties, bonus payments, and the like for all proceeds received from the sale of Plant Products and Residue Gas. Producer or its designee shall establish any necessary agreements with these other parties to allow Producer or its designee to be responsible for all such payments. Producer agrees to release, defend, indemnify, and hold Processor harmless from any and all liabilities accruing from Producer's exercise of Take in Kind rights and from any claims of any third parties owning or claiming to own interests ill the production.

(e)Processor shall not be required to install any additional facilities to serve Producer in the disposition of Producer's Plant Products or Residue Gas taken in kind; however, Producer shall be entitled to use a proportionate share of Processor's existing Facilities at the plant at no cost or expense to Producer. Any additional facilities that may be required, including, but not limited to storage and measurement, shall be provided, operated, and maintained at Producer's sale cost and expense.

(f)During each effective period for which Producer has elected to take in kind its allocable Residue Gas or Plant Products or both, in lieu of receiving any payment from Processor for Residue Gas or Plant Products, as the case may be, allocated to Producer's Gas, Producer shall take in kind and market 100% of the net Residue Gas, Plant Products or both allocated to Producer. For the avoidance of doubt, no separate payment or value calculation is to be made to Producer under this Contract for Producer's allocable Plant Products or Residue Gas while an applicable Take in Kind option is in effect.

(g)Producer recognizes that Processor has no gas storage capability other than line pack in its gathering system, Processor will deliver Producer's allocable Residue Gas to the tailgate of Processor's Plant at a pressure sufficient to enter the facilities of the downstream pipeline, but in no event shall Processor be obligated to deliver residue gas at a pressure that exceeds the capabilities of Processor's existing facilities. Producer will separately contract with each downstream Plant Products and gas pipeline and each Plant Products and Residue Gas customer for the handling and sale of Producer's in kind Plant Products and Residue Gas, Producer will make timely all agreements for sale, transportation, nominations, and gas scheduling necessary or appropriate to cause timely delivery of Producer's Plant Products and Residue Gas to or for the benefit of Producer. Producer will be responsible for all gas imbalance resolutions and related costs between Producer and the downstream pipelines under their respective tariffs and policies, and Producer is entitled to all gas imbalance resolution revenue from those parties when applicable.

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

(h)The Plant Products and Residue Gas Take in Kind provisions of this Contract are exercisable only by Anadarko E&P Company LP for the gas committed under this Contract, are excepted from Article XXIV "Assignment," and may not be included with any assignment or partial assignment by Producer of this Contract.

4. Scope. The Contract is amended to the extent noted herein. In all other respects, it is confirmed and shall continue in full force and effect.

5. Counterparts. This Amendment may be executed in any number of counterparts, all of which shall be considered together as one instrument. This Amendment is binding upon all parties executing it, whether or not it is executed by all parties owning interests in the properties committed under the Contract as amended.

The parties have signed this Amendment by their duly authorized representatives as of the date set forth below, to be effective as of the date first set forth above.

DUKE ENERGY FIELD SERVICES, LP ANADARKO E&P COMPANY LP

___________________________________ ______________________________________

Richard A. Cargile Karl F. Kurz

Title: Vice President Title: SVP, Mktg & GM, US Onshore

Executed on: _________________ Executed on:_____________________

PROCESSOR PRODUCER