Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF CAWLEY, GILLESPIE & ASSOCIATES - Mid-Con Energy Partners, LP | d412710dex231.htm |

| EX-23.2 - CONSENT OF GRANT THORNTON LLP - Mid-Con Energy Partners, LP | d412710dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 26, 2012

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Mid-Con Energy Partners, LP

(Exact name of registrant as specified in its charter)

| Delaware | 1311 | 45-2842469 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2501 North Harwood Street, Suite 2410

Dallas, Texas 75201

(972) 479-5980

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Nathan P. Pekar

Mid-Con Energy GP, LLC

2501 North Harwood, Suite 2410

Dallas, Texas 75201

(972) 479-5980

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Richard M. Carson Jordan B. Edwards Gable & Gotwals, A Professional Corporation 1100 ONEOK Plaza 100 W. Fifth Street Tulsa, Oklahoma 74103 (918) 595-4800 |

Brett E. Braden Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common units representing limited partner interests |

$106,214,000 | $12,172.13 | ||

|

| ||||

|

| ||||

| (1) | Includes common units issuable upon exercise of the underwriters’ option to purchase additional common units. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Subject to Completion, dated September 26, 2012

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

PROSPECTUS

Mid-Con Energy Partners, LP

4,000,000 Common Units

Representing Limited Partner Interests

We are a Delaware limited partnership formed in July 2011 to own, operate, acquire, exploit and develop producing oil and natural gas properties in North America, with a focus on the Mid-Continent region of the United States.

We are offering 1,000,000 common units and Yorktown Energy Partners VI, L.P., Yorktown Energy Partners VII, L.P. and Yorktown Energy Partners VIII, L.P. are offering an aggregate of 3,000,000 common units in this offering.

Our common units are traded on the NASDAQ Global Market under the symbol “MCEP.” On September 25, 2012, the last reported sales price of our common units on the NASDAQ Global Market was $22.84 per common unit.

We are an “emerging growth company” as defined in Section 101 of the Jumpstart Our Business Startups Act, or JOBS Act.

Investing in our common units involves risks. See “Risk Factors” beginning on page 23.

These risks include the following:

| • | We may not have sufficient cash to pay any quarterly distribution on our units following the establishment of cash reserves and payment of expenses, including payments to our general partner. |

| • | A decline in oil prices, or an increase in the differential between the NYMEX or other benchmark prices of oil and the wellhead price we receive for our production, will cause a decline in our cash flow from operations, which could cause us to reduce our distributions or cease paying distributions altogether. |

| • | Unless we replace the oil reserves we produce, our revenues and production will decline, which would adversely affect our cash flow from operations and our ability to make distributions to our unitholders. |

| • | Our general partner, who controls us, has conflicts of interest with, and owes limited fiduciary duties to, us, which may permit them to favor their own interests to the detriment of us and our unitholders. |

| • | Neither we nor our general partner have any employees, and we rely solely on an affiliate of our general partner to manage and operate our business. The individuals who manage us also provide substantially similar services to affiliates of our general partner, and thus are not solely focused on our business. |

| • | Common units held by persons who our general partner determines are not eligible holders will be subject to redemption. |

| • | Our unitholders have limited voting rights and are not entitled to elect our general partner or its board of directors. |

| • | Even if our unitholders are dissatisfied, they cannot remove our general partner without its consent. |

| • | Our tax treatment depends on our status as a partnership for federal income tax purposes. If the IRS were to treat us as a corporation, then our cash available for distribution to our unitholders would be substantially reduced. |

| • | Our unitholders will be required to pay taxes on their share of our taxable income even if they do not receive any cash distributions from us. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PRICE $ PER COMMON UNIT

| Per Common Unit |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to Mid-Con Energy Partners, LP |

$ | $ | ||||||

| Proceeds, before expenses, to Selling Unitholders |

$ | $ | ||||||

The Selling Unitholders have granted the underwriters a 30-day option to purchase up to an additional 600,000 common units on the same terms and conditions as set forth above if the underwriters sell more than 4,000,000 common units in this offering.

The underwriters expect to deliver the common units on or about , 2012.

| RBC CAPITAL MARKETS |

RAYMOND JAMES | UBS INVESTMENT BANK | WELLS FARGO SECURITIES |

| BAIRD |

OPPENHEIMER & CO. | STEPHENS INC. |

September 26, 2012

Table of Contents

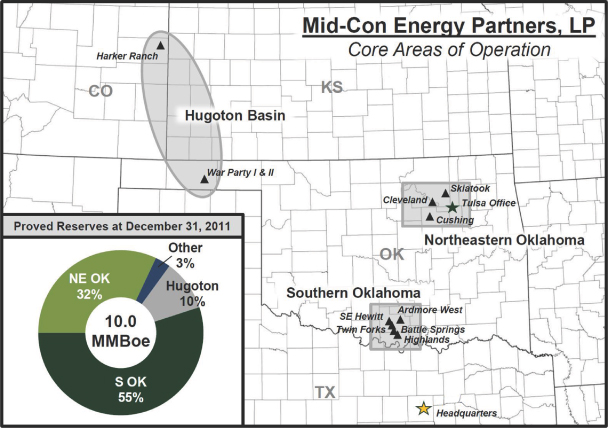

| Ÿ | As of December 31, 2011, we had total estimated proved reserves of 10.0 MMBoe, 99% of which were oil and 69% of which were proved developed, both on a Boe basis. As of December 31, 2011, Mid-Con Energy Operating operated 99% of our reserves and 96% of such reserves were being operated under waterflood, both on a Boe basis. |

| Ÿ | As of June 30, 2012, we had 320 gross producing wells (224 net wells), 149 gross injection wells (97 net wells), and 81 gross wells (67 net wells) shut-in or waiting on completion. |

Table of Contents

i

Table of Contents

ii

Table of Contents

You should rely only on the information contained in this prospectus. We have not, and the underwriters and Selling Unitholders have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters and Selling Unitholders are not, making an offer to sell these securities in any jurisdiction where such an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read “Risk Factors” and “Forward-Looking Statements.”

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications or other published independent sources. Some data is also based on our good faith estimates. Although we believe these third-party sources are reliable and that the information is accurate and complete, we have not independently verified the information.

iii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including “Risk Factors” and the historical and unaudited financial statements and the notes to those financial statements. The information presented in this prospectus assumes that the underwriters do not exercise their option to purchase up to an additional common units from the Selling Unitholders, unless otherwise indicated. As used in this prospectus, unless we indicate otherwise:

| Ÿ | “Founders” collectively refers to Charles R. Olmstead, S. Craig George and Jeffrey R. Olmstead; |

| Ÿ | “initial public offering” refers to our December 2011 initial public offering of 5,400,000 of our common units and subsequent over-allotment offering of 810,000 of our common units; |

| Ÿ | “our general partner” refers to Mid-Con Energy GP, LLC; |

| Ÿ | “Mid-Con Affiliates” collectively refers to Mid-Con Energy III, LLC and Mid-Con Energy IV, LLC, which are affiliates of Yorktown; |

| Ÿ | “Mid-Con Energy Partners,” the “partnership,” “we,” “our,” “us” or like terms when referring to periods prior to our initial public offering generally refer to our predecessor, which was merged with and into Mid-Con Energy Properties, LLC, our wholly owned subsidiary, in connection with our initial public offering. When used in reference to periods after our initial public offering or prospectively, those terms refer to Mid-Con Energy Partners, LP, a Delaware limited partnership, and its subsidiaries; |

| Ÿ | “Mid-Con Energy Operating” refers to Mid-Con Energy Operating, Inc., an entity owned by Yorktown and the Founders; |

| Ÿ | “Mid-Con Energy Properties” refers to Mid-Con Energy Properties, LLC, our wholly owned subsidiary; |

| Ÿ | “our predecessor” collectively refers to Mid-Con Energy Corporation, prior to June 30, 2009, and to Mid-Con Energy I, LLC and Mid-Con Energy II, LLC, on a combined basis, thereafter, our respective predecessors for accounting purposes; |

| Ÿ | “Selling Unitholders” refers to Yorktown Energy Partners VI, L.P., Yorktown Energy Partners VII, L.P. and Yorktown Energy Partners VIII, L.P.; and |

| Ÿ | “Yorktown” collectively refers to Yorktown Partners LLC, Yorktown Energy Partners VI, L.P., Yorktown Energy Partners VII, L.P., Yorktown Energy Partners VIII, L.P. and/or Yorktown Energy Partners IX, L.P. |

We include a glossary of some of the oil and natural gas terms used in this prospectus in Appendix A.

Overview

We are a Delaware limited partnership formed in July 2011 to own, operate, acquire, exploit and develop producing oil and natural gas properties in North America, with a focus on the Mid-Continent region of the United States. Our management team has significant industry experience, especially with waterflood projects and, as a result, our operations focus primarily on enhancing the development of

1

Table of Contents

producing oil properties through waterflooding. Through the continued development of our existing properties and through future acquisitions, we will seek to increase our reserves and production in order to maintain and, over time, increase distributions to our unitholders. Also, in order to enhance the stability of our cash flow for the benefit of our unitholders, we generally intend to hedge a significant portion of our production volumes through various commodity derivative contracts.

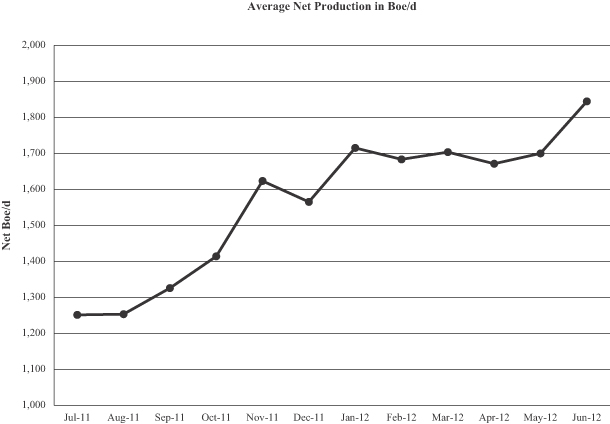

As of December 31, 2011, our total estimated proved reserves were 10.0 MMBoe, of which approximately 99% were oil and 69% were proved developed, both on a Boe basis. As of December 31, 2011, Mid-Con Energy Operating operated 99% of our properties and 96% of our properties were being produced under waterflood, in each instance on a Boe basis. Our average net production for the month ended June 30, 2012 was approximately 1,844 Boe per day and based on our December 31, 2011 audited reserves, as adjusted for average net production for the six months ended June 30, 2012, our total estimated proved reserves had a reserve-to-production ratio of approximately 15 years. As of December 31, 2011, our management team developed approximately 59% of our total reserves through new waterflood projects.

Our Properties

Our properties are located in the Mid-Continent region of the United States and primarily consist of mature, legacy onshore oil reservoirs with long-lived, relatively predictable production profiles and low production decline rates. Our core areas of operation are located in Southern Oklahoma, Northeastern Oklahoma and parts of Oklahoma and Colorado within the Hugoton Basin. As of December 31, 2011, approximately 91% of the properties associated with our estimated reserves, on a Boe basis, have been producing continuously since 1982 or earlier. Through the application of waterflooding, we believe these mature properties have attractive upside potential. Waterflooding, a form of secondary oil recovery, works by repressuring a reservoir through water injection and pushing or “sweeping” oil to producing wellbores. Based on the production estimates from our December 31, 2011 audited reserve report, the average estimated decline rate for our proved developed producing reserves is approximately 8.0% for 2012 and, on a compounded average decline basis, approximately 11% for the subsequent five years and approximately 10% thereafter.

The following table summarizes information by core area regarding our estimated oil and natural gas reserves as of December 31, 2011 and our average net production for the month ended June 30, 2012.

| Estimated Net Proved

Reserves as of December 31, 2011 |

Average Net

Production for the Month Ended June 30, 2012 |

Reserve-to- | Gross Active Wells as of June 30, 2012 |

Shut-in/ Waiting on Completion |

||||||||||||||||||||||||||||||||||||

| Oil and | ||||||||||||||||||||||||||||||||||||||||

| (MBoe) | % Operated | % Oil | % Proved Developed |

Boe/d Gross |

Boe/d Net |

Production Ratio(1) |

Natural Gas Wells |

Injection Wells |

||||||||||||||||||||||||||||||||

| Southern Oklahoma |

5,528 | 100 | % | 100 | % | 68 | % | 2,600 | 1,128 | 13 | 79 | 53 | 12 | |||||||||||||||||||||||||||

| Northeastern Oklahoma |

3,179 | 100 | % | 99 | % | 69 | % | 742 | 447 | 19 | 201 | 76 | 54 | |||||||||||||||||||||||||||

| Hugoton Basin |

1,060 | 100 | % | 99 | % | 69 | % | 340 | 219 | 13 | 29 | 15 | 13 | |||||||||||||||||||||||||||

| Other |

282 | 77 | % | 77 | % | 100 | % | 140 | 50 | 15 | 11 | 5 | 2 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total |

10,049 | 99 | % | 99 | % | 69 | % | 3,822 | 1,844 | 15 | 320 | 149 | 81 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| (1) | The reserve-to-production ratio is calculated by subtracting net production for the six months ended June 30, 2012 from estimated net proved reserves as of December 31, 2011 and dividing the result by average net production for the month ended June 30, 2012. |

2

Table of Contents

The following chart summarizes our total average net Boe production volumes on a monthly basis, and illustrates the 47% increase in our production volumes over the twelve months ended June 30, 2012. We achieved this production increase primarily through ongoing waterflood response from existing development activities and from workovers and acquisitions.

Our Hedging Strategy

Our hedging strategy is to enter into various commodity derivative contracts intended to achieve more predictable cash flows and to reduce exposure to fluctuations in the price of oil. Our hedging program’s objective is to protect our ability to make current distributions, and to allow us to be better positioned to increase our quarterly distribution over time, while retaining some ability to participate in upward movements in oil prices. We use a phased approach, looking approximately 36 months forward while targeting a higher hedged percentage in the near 12 months of the period. As of September 25, 2012, for the three months ending December 31, 2012 and the years ending December 31, 2013 and 2014, we have commodity derivative contracts covering approximately 69.9%, 69.6% and 57.0%, respectively, of our fourth quarter 2012 and calendar years 2013 and 2014 average daily oil production (as estimated from the projection of our oil production in our audited proved reserves as of December 31, 2011). All of our derivative contracts for 2012, 2013 and 2014 are either swaps with fixed settlements or collars. The weighted average minimum prices on all of our derivative contracts for 2012, 2013 and 2014 are $101.59, $99.66 and $94.30, respectively. A “collar” is a combination of a put option we purchase and a call option

3

Table of Contents

we sell. The put option portion of a collar is also referred to as a “floor.” A floor establishes a minimum average sale price for future oil production.

In addition to our primary hedging strategy as described above, we also intend to enter into additional commodity derivative contracts in connection with material increases in our estimated production and at times when we believe market conditions or other circumstances suggest that it is prudent to do so as opposed to entering into commodity derivative contracts at predetermined times or on prescribed terms. Additionally, we may take advantage of opportunities to modify our commodity derivative portfolio to change the percentage of our hedged production volumes or the duration of our hedge contracts when circumstances suggest that it is prudent to do so.

By removing a significant portion of price volatility associated with our estimated future oil production, we have mitigated, but not eliminated, the potential effects of changing oil prices on our cash flow from operations for those periods. For a further description of our commodity derivative contracts, please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations —Liquidity and Capital Resources — Derivative Contracts.”

Our Business Strategies

Our primary business objective is to manage our oil and natural gas properties for the purpose of generating stable cash flows, which we expect will provide stability and, over time, growth of distributions to our unitholders. In addition to our hedging strategy described above, we intend to execute the following business strategies:

| Ÿ | Continue exploitation of our existing properties to maximize production; |

| Ÿ | Pursue acquisitions of long-lived, low-risk producing properties with upside potential; |

| Ÿ | Capitalize on our relationship with the Mid-Con Affiliates for favorable acquisition opportunities; |

| Ÿ | Maintain operational control and a focus on cost-effectiveness in all our operations; |

| Ÿ | Reduce the impact of commodity price volatility on our cash flow through a disciplined commodity hedging strategy; |

| Ÿ | Maintain a balanced capital structure to allow for financial flexibility to execute our business strategies; and |

| Ÿ | Utilize compensation programs that align the interests of our management team with our unitholders. |

For a more detailed description of our business strategies, please read “Business and Properties—Our Business Strategies.”

Our Competitive Strengths

We believe that the following competitive strengths will allow us to successfully execute our business strategies and achieve our objective of generating and growing cash available for distribution:

| Ÿ | An asset portfolio largely consisting of properties with existing waterflood projects that have proved reserves which are 99% oil, that have and relatively predictable production profiles, that provide growth potential through ongoing response to waterflooding and that have modest capital requirements; |

4

Table of Contents

| Ÿ | The ability to further exploit existing mature properties by utilizing our waterflooding expertise; |

| Ÿ | Acquisition opportunities that are consistent with our criteria of predictable production profiles with upside potential that may arise as a result of our relationship with the Mid-Con Affiliates; |

| Ÿ | Access to the collective expertise of Yorktown’s employees and their extensive network of industry relationships through our relationship with Yorktown; |

| Ÿ | Mid-Con Energy Operating operates 99% of our properties, which allows them to control our operating costs and capital expenditures; |

| Ÿ | An enhanced ability to pursue acquisition opportunities arising from our competitive cost of capital and balanced capital structure; and |

| Ÿ | The range and depth of our technical and operational expertise will allow us to expand both geographically and operationally to achieve our goals. |

For a more detailed discussion of our competitive strengths, please read “Business and Properties — Our Competitive Strengths.”

Our Principal Business Relationships

Our Relationship with the Mid-Con Affiliates

In June 2011, management and Yorktown formed two limited liability companies, which we refer to collectively as the Mid-Con Affiliates, to acquire and develop oil and natural gas properties that are either undeveloped or that may require significant capital investment and development efforts before they meet our criteria for ownership. As these development projects mature, we expect to have the opportunity to acquire certain of these properties from the Mid-Con Affiliates. Through this relationship with the Mid-Con Affiliates, we will avoid much of the capital, engineering and geological risks associated with the early development of any of these properties we may acquire. However, the Mid-Con Affiliates may not be successful in identifying or consummating acquisitions or in successfully developing the new properties they acquire. Further, the Mid-Con Affiliates are not obligated to sell any properties to us and they are not prohibited from competing with us to acquire oil and natural gas properties. Please read “Certain Relationships and Related Party Transactions—Review, Approval or Ratification of Transactions with Related Persons.”

Our Relationship with Yorktown

We have a valuable relationship with Yorktown, a private investment firm founded in 1991 and focused on investments in the energy sector. Yorktown made several equity investments in our predecessor. Prior to this offering, Yorktown owned an approximate 48.5% limited partner interest in us, making it our largest unitholder. Immediately following this offering, Yorktown will own an approximate 30.1% limited partner interest in us (or an approximate 26.9% limited partner interest in us if the underwriters exercise their option to purchase additional common units in full), and will continue to be our largest unitholder. Yorktown Energy Partners IX, L.P. will continue to own a 50% interest in our affiliate Mid-Con Energy Operating. Also, Peter A. Leidel, a principal of Yorktown, serves on our board of directors.

Yorktown currently has more than $3.0 billion in assets under management, and Yorktown’s employees have extensive investment experience in the oil and natural gas industry. Yorktown’s employees review a large number of potential acquisitions and are involved in decisions relating to the acquisition and

5

Table of Contents

disposition of oil and natural gas assets by the various portfolio companies in which Yorktown owns interests. With their extensive investment experience in the oil and natural gas industry and their extensive network of industry relationships, we believe that Yorktown’s employees are well positioned to assist us in identifying and evaluating acquisition opportunities and in making strategic decisions. Yorktown is not obligated to sell any properties to us, and they are not prohibited from competing with us to acquire oil and natural gas properties. Investment funds managed by Yorktown manage numerous other portfolio companies, including the Mid-Con Affiliates, that are engaged in the oil and natural gas industry and, as a result, Yorktown may present acquisition opportunities to other Yorktown portfolio companies, including the Mid-Con Affiliates, that compete with us.

An investment in our common units involves risks. Below is a summary of certain key risk factors that you should consider in evaluating an investment in our common units. This list is not exhaustive. Please read the full discussion of these risks and other risks described under “Risk Factors.”

Risks Related to Our Business

| Ÿ | We may not have sufficient cash to pay any quarterly distribution on our units following the establishment of cash reserves and payment of expenses, including payments to our general partner. |

| Ÿ | A decline in oil prices, or an increase in the differential between the NYMEX or other benchmark prices of oil and the wellhead price we receive for our production, will cause a decline in our cash flow from operations, which could cause us to reduce our distributions or cease paying distributions altogether. |

| Ÿ | Unless we replace the oil reserves we produce, our revenues and production will decline, which would adversely affect our cash flow from operations and our ability to make distributions to our unitholders. |

| Ÿ | We may be unable to compete effectively with larger companies, which may adversely affect our ability to generate sufficient revenue to allow us to pay distributions to our unitholders. |

| Ÿ | Our business depends in part on transportation, pipelines and refining facilities owned by others. Any limitation in the availability of those facilities, or increase in their costs, could interfere with our ability to market our production and adversely affect our revenues. |

Risks Inherent in an Investment in Us

| Ÿ | Our general partner controls us, and following this offering, the Founders and Yorktown will own a 36.0% limited partner interest in us, or a 32.8% limited partner interest in us if the underwriters exercise their option to purchase additional common units in full. They have conflicts of interest with, and owe limited fiduciary duties to, us, which may permit them to favor their own interests to the detriment of us and our unitholders. |

| Ÿ | Neither we nor our general partner have any employees, and we rely solely on Mid-Con Energy Operating to manage and operate our business. The management team of Mid-Con Energy Operating, which includes the individuals who manage us, also provides substantially similar services to the Mid-Con Affiliates, and thus is not solely focused on our business. |

6

Table of Contents

| Ÿ | Units held by persons who our general partner determines are not eligible holders will be subject to redemption. |

| Ÿ | Our unitholders have limited voting rights and are not entitled to elect our general partner or its board of directors. |

| Ÿ | Even if our unitholders are dissatisfied, they cannot remove our general partner without its consent. |

| Ÿ | Control of our general partner may be transferred to a third party without unitholder consent. |

| Ÿ | We may issue an unlimited number of additional units, including units that are senior to the common units, without unitholder approval, which would dilute unitholders’ ownership interests. |

Tax Risks to Unitholders

| Ÿ | Our tax treatment depends on our status as a partnership for federal income tax purposes. If the IRS were to treat us as a corporation, then our cash available for distribution to our unitholders would be substantially reduced. |

| Ÿ | Our unitholders are required to pay taxes on their share of our taxable income even if they do not receive any cash distributions from us. |

7

Table of Contents

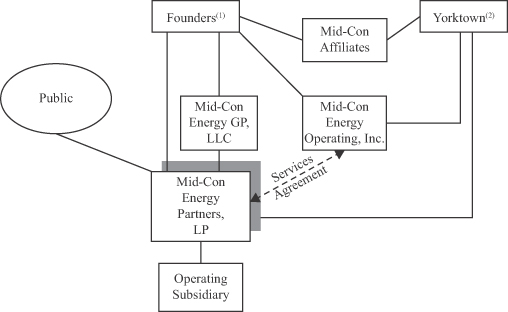

Ownership and Organizational Structure of Mid-Con Energy Partners, LP

The diagram below depicts our organization and ownership after giving effect to the offering and assumes that the underwriters do not exercise their option to purchase additional common units from the Selling Unitholders.

| Common units held by the public |

53.4% | |||

| Common units held by the Founders |

5.8% | |||

| Common units held by Yorktown |

29.5% | |||

| Common units held by our executive officers, employees and other individuals and entities, other than the Founders and Yorktown who held membership interests in our predecessor |

9.4% | |||

| General partner units |

1.9% | |||

|

|

|

|||

| Total |

100.0% |

| (1) | The Founders are S. Craig George, Charles R. Olmstead and Jeffrey R. Olmstead. |

| (2) | Yorktown Energy Partners IX, L.P. owns a 50% interest in Mid-Con Energy Operating. Yorktown IX Company LP is the sole general partner of Yorktown Energy Partners IX, L.P. Yorktown Associates LLC is the sole general partner of Yorktown IX Company LP. Yorktown Energy Partners VI, L.P., Yorktown Energy Partners VII, L.P., and Yorktown Energy Partners VIII, L.P. own common units in us. For more information on the entities that control Yorktown Energy Partners VI, L.P., Yorktown Energy Partners VII, L.P., and Yorktown Energy Partners VIII, L.P., please see “Security Ownership of Certain Beneficial Owners and Management.” |

8

Table of Contents

Management of Mid-Con Energy Partners, LP

We are managed and operated by the board of directors and executive officers of our general partner, Mid-Con Energy GP, LLC. Our unitholders are not entitled to elect our general partner or its directors or otherwise participate in our management or operation. All of the executive officers of our general partner are also officers and/or directors of the Mid-Con Affiliates. For information about the executive officers and directors of our general partner, please read “Management.”

S. Craig George, the Executive Chairman of the board of directors of our general partner, Charles R. Olmstead, the Chief Executive Officer and a director of our general partner, and Jeffrey R. Olmstead, the President and Chief Financial Officer and a director of our general partner, each own one-third of the member interests in our general partner. As the holders of all of the member interests of our general partner, the Founders control our general partner, are entitled to appoint its entire board of directors and receive all of the distributions our general partner receives in respect of its approximate 2.0% general partner interest in us. Please see “Security Ownership of Certain Beneficial Owners and Management.”

Neither we, our general partner, nor our subsidiary have any employees. We and our general partner are parties to a services agreement with Mid-Con Energy Operating, pursuant to which Mid-Con Energy Operating provides management, administrative and operational services to us. Although all of the employees that conduct our business are employed by Mid-Con Energy Operating, we sometimes refer to these individuals in this prospectus as our employees.

We have one subsidiary, Mid-Con Energy Properties, that holds title to our properties.

Principal Executive Offices and Internet Address

Our headquarters are located at 2501 North Harwood Street, Suite 2410, Dallas, Texas 75201. Our principal operating office is located at 2431 East 61st Street, Suite 850, Tulsa, Oklahoma 74136, and our telephone number is (972) 479-5980. Our website address is www.midconenergypartners.com. We make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission, which we refer to as the SEC, available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into, and does not constitute a part of, this prospectus.

9

Table of Contents

Summary of Conflicts of Interest and Fiduciary Duties

Under our partnership agreement, our general partner has a legal duty to manage us in a manner that is in, or not opposed to, the best interests of the holders of our common units. This legal duty, as modified by our partnership agreement, originates in statutes and judicial decisions and is commonly referred to as a “fiduciary duty.” However, the officers and directors of our general partner also have a fiduciary duty to manage the business of our general partner in a manner beneficial to its owners, the Founders. All of the executive officers of our general partner are also officers and/or directors of the Mid-Con Affiliates and have economic interests in the Mid-Con Affiliates. In addition, Peter A. Leidel, a principal of Yorktown, serves on our board of directors. Mr. Leidel has economic interests in Yorktown and its affiliates that manage, hold and own investments in other funds and companies that may compete with us. As a result of these relationships, conflicts of interest may arise in the future between us and our unitholders, on the one hand, and our general partner and its owners and affiliates, on the other hand. For example, our general partner is entitled to make determinations that affect our ability to generate the cash flow necessary to make cash distributions to our unitholders, including determinations related to:

| Ÿ | purchases and sales of oil and natural gas properties and other acquisitions and dispositions, including whether to pursue acquisitions that may also be suitable for the Mid-Con Affiliates, Yorktown or any Yorktown portfolio company; |

| Ÿ | the manner in which our business is operated; |

| Ÿ | the level of our borrowings; |

| Ÿ | the amount, nature and timing of our capital expenditures; and |

| Ÿ | the amount of cash reserves necessary or appropriate to satisfy our general, administrative and other expenses and debt service requirements and to otherwise provide for the proper conduct of our business. |

For a more detailed description of the conflicts of interest and fiduciary duties of our general partner, please read “Risk Factors — Risks Inherent in an Investment in Us” and “Conflicts of Interest and Fiduciary Duties.”

Generally, our partnership agreement can be amended in a manner that materially adversely affects our limited partners only with the consent of our general partner and the approval of the holders of a majority of our outstanding common units (including any common units held by affiliates of our general partner). Following this offering, our general partner will continue to be owned by the Founders, and the Founders and Yorktown collectively will own and control the voting of an aggregate of approximately 36.0% of our outstanding common units, or approximately 32.8% of our outstanding common units if the underwriters exercise their option to purchase additional common units in full. Please see “Risk Factors — Risks Inherent in an Investment in Us” and “The Partnership Agreement — Amendment of the Partnership Agreement.”

Partnership Agreement Modification of Fiduciary Duties

Our partnership agreement limits the liability of our general partner and reduces the fiduciary duties it owes to our unitholders. Our partnership agreement also restricts the remedies available to our unitholders for actions that might otherwise constitute a breach of the fiduciary duties that our general partner owes to our unitholders. By purchasing a common unit, our unitholders agree to be bound by the terms of our partnership agreement and, pursuant to the terms of our partnership agreement, are treated as having

10

Table of Contents

consented to various actions contemplated in our partnership agreement and conflicts of interest that might otherwise be considered a breach of fiduciary or other duties under Delaware law. Please read “Conflicts of Interest and Fiduciary Duties — Fiduciary Duties” for a description of the fiduciary duties imposed on our general partner by Delaware law, the material modifications of these duties contained in our partnership agreement and certain legal rights and remedies available to our unitholders.

Implication of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during its last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other regulatory requirements for up to five years that are otherwise applicable generally to public companies. These provisions include:

| Ÿ | a requirement to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis; |

| Ÿ | exemption from the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting; |

| Ÿ | exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| Ÿ | exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and |

| Ÿ | reduced disclosure about executive compensation arrangements. |

We will cease to be an emerging growth company if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our limited partner interests held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period.

We have elected to take advantage of the applicable JOBS Act provisions, except for the following:

| Ÿ | we have elected to present three years of audited financial statements and three years of related Management’s Discussion and Analysis rather than only two years; |

| Ÿ | we have elected to opt out of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards (this election is irrevocable); |

| Ÿ | we have elected to comply with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and |

| Ÿ | we have elected to make full disclosure about executive compensation arrangements. |

Accordingly, the information that we provide you may be different than what you may receive from other public companies in which you hold equity interests.

11

Table of Contents

| Common units offered by us |

1,000,000 common units. As described below, if the underwriters exercise their option to purchase additional common units, such units will be offered exclusively by the Selling Unitholders on a pro rata basis. |

| Common units offered by the Selling Unitholders |

3,000,000 common units, or 3,600,000 common units if the underwriters exercise in full their option to purchase additional common units, which in each case will be offered by the Selling Unitholders on a pro rata basis, in proportion to their interests in us. |

| Immediately before this offering, Yorktown owned 8,691,468 common units, representing an approximate 48.5% limited partner interest in us. Following this offering, Yorktown will own 5,691,468 common units, or 5,091,468 common units if the underwriters exercise in full their option to purchase additional common units, representing an approximate 30.1% and 26.9% limited partner interest in us, respectively. |

| Units outstanding after this offering |

18,939,549 common units. |

| Use of proceeds |

We intend to use the net proceeds of approximately $ million from this offering, after deducting underwriting discounts and estimated expenses, to repay $ million of indebtedness outstanding under our credit facility. |

| We will not receive any proceeds from the sale of common units by the Selling Unitholders, including any proceeds from the sale of common units by the Selling Unitholders if the underwriters exercise in whole or in part their option to purchase additional common units. |

| Affiliates of certain of the underwriters are lenders under our credit facility and accordingly, will receive a substantial portion of the proceeds from this offering. Please read “Underwriting.” |

| Cash distributions |

We paid a quarterly distribution of $0.475 per unit for the second quarter of 2012 on all common and general partner units ($1.90 per unit on an annualized basis) on August 14, 2012 to unitholders of record as of August 7, 2012. Distributions on our units are generally paid approximately 45 days following the end of a fiscal quarter to the extent we have sufficient cash from operations, after the establishment of cash reserves and the payment of fees and expenses. |

| There is no guarantee that unitholders will receive a quarterly distribution from us. We do not have a legal obligation to pay |

12

Table of Contents

| distributions at our current quarterly distribution rate or at any other rate except as provided in our partnership agreement. |

| Assuming our general partner maintains its approximate 2.0% general partner interest in us, our partnership agreement requires that we distribute approximately 98.0% of our available cash each quarter to the holders of our common units, pro rata, and approximately 2.0% to our general partner. |

| Unlike many publicly traded limited partnerships, our general partner is not entitled to any incentive distributions, and we do not have any subordinated units. |

| Issuance of additional units |

We can issue an unlimited number of additional units, including units that are senior to the common units in right of distributions, liquidation and voting, on terms and conditions determined by our general partner, without the approval of our unitholders. Please read “Units Eligible for Future Sale” and “The Partnership Agreement—Issuance of Additional Interests.” |

| Limited voting rights |

Our general partner manages us and operates our business. Unlike stockholders of a corporation, our unitholders have only limited voting rights on matters affecting our business. Our unitholders have no right to elect our general partner or its board of directors on an annual or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 662/3% of the outstanding units, including any units owned by our general partner and its affiliates. Following this offering, the Founders and Yorktown will own an aggregate of approximately 36.0% of our common units (or approximately 32.8% of our common units if the underwriters exercise their option to purchase additional common units in full) and, therefore, will be able to prevent the removal of our general partner. Please read “The Partnership Agreement — Limited Voting Rights.” |

| Limited call right |

If at any time our general partner and its affiliates own more than 80% of the outstanding common units, our general partner has the right, but not the obligation, to purchase all of the remaining common units at a purchase price not less than the then-current market price of the common units, as calculated pursuant to the terms of our partnership agreement. Following this offering, the Founders will own an aggregate of approximately 5.9% of our common units. Please read “The Partnership Agreement — Limited Call Right.” |

| Eligible Holders and redemption |

Units held by persons who our general partner determines are not Eligible Holders will be subject to redemption. As used herein, an Eligible Holder means any person or entity qualified to hold an interest in oil and natural gas leases on federal lands. If, following |

13

Table of Contents

| a request by our general partner, a transferee or unitholder, as the case may be, does not properly complete a recertification for any reason, we will have the right to redeem the units held by such person at the then-current market price of the units held by such person. The redemption price will be paid in cash or by delivery of a promissory note, as determined by our general partner. Please read “Description of the Common Units — Transfer Agent and Registrar — Transfer of Common Units” and “The Partnership Agreement — Non-Citizen Unitholders; Redemption.” |

| Estimated ratio of taxable income to distributions |

We estimate that if our unitholders own the common units purchased in this offering through the record date for distributions for the period ending December 31, 2014, such unitholders will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be less than 45% of the cash distributed to such unitholders with respect to that period. Please read “Material Tax Consequences — Tax Consequences of Unit Ownership — Ratio of Taxable Income to Distributions” for the basis of this estimate. |

| Material tax consequences |

For a discussion of other material federal income tax consequences that may be relevant to prospective unitholders who are individual citizens or residents of the United States, please read “Material Tax Consequences.” |

| Listing and trading symbol |

Our common units are listed on the NASDAQ Global Market under the symbol “MCEP.” |

14

Table of Contents

Summary Historical Financial Data

The following table shows summary financial data of us and our predecessor for the periods and as of the dates indicated. The summary financial data as of and for the year ended June 30, 2009 are derived from the audited consolidated financial statements of our predecessor included elsewhere in this prospectus. The summary financial data as of and for the years ended December 31, 2010 and 2011 and the six months ended December 31, 2009 are derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary financial data as of and for the six months ended June 30, 2011 and 2012 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus.

You should read the following table in conjunction with “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the audited historical consolidated financial statements of Mid-Con Energy Partners, LP and our predecessor and the unaudited consolidated financial statements of Mid-Con Energy Partners, LP and the notes thereto included elsewhere in this prospectus. Among other things, those historical consolidated financial statements and unaudited consolidated financial statements include more detailed information regarding the basis of presentation for the following information.

The following table presents a non-GAAP financial measure, Adjusted EBITDA, which we use in evaluating the financial performance and liquidity of our business. This measure is not calculated or presented in accordance with generally accepted accounting principles, or GAAP. We explain this measure below and reconcile it to the most directly comparable financial measures calculated and presented in accordance with GAAP.

15

Table of Contents

| Mid-Con Energy Corporation (consolidated) |

Mid-Con Energy Partners, LP | |||||||||||||||||||||||

| Year Ended June 30, |

Six Months Ended December 31, |

Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||||||||||

| 2009 | 2009 | 2010 | 2011 | 2011 | 2012 | |||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||

| (in thousands) |

||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||

| Oil sales |

$ | 10,246 | $ | 5,729 | $ | 16,853 | $ | 36,813 | $ | 15,609 | $ | 28,998 | ||||||||||||

| Natural gas sales |

2,172 | 743 | 1,418 | 1,218 | 658 | 353 | ||||||||||||||||||

| Realized gain (loss) on derivatives, net |

(669 | ) | (350 | ) | (90 | ) | (2,157 | ) | (715 | ) | 769 | |||||||||||||

| Unrealized gain (loss) on derivatives, net |

1,679 | (147 | ) | (707 | ) | 3,437 | 1,046 | 9,741 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenues |

13,428 | 5,975 | 17,474 | 39,311 | 16,598 | 39,861 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating costs and expenses: |

||||||||||||||||||||||||

| Lease operating expenses |

5,369 | 2,431 | 6,237 | 8,491 | 3,550 | 4,725 | ||||||||||||||||||

| Oil and gas production taxes |

631 | 269 | 822 | 1,869 | 656 | 713 | ||||||||||||||||||

| Dry holes and abandonments of unproved properties |

— | — | 1,418 | 813 | 772 | — | ||||||||||||||||||

| Geological and geophysical |

507 | — | 394 | 172 | — | — | ||||||||||||||||||

| Depreciation, depletion and amortization |

2,293 | 2,552 | 5,851 | 7,160 | 2,418 | 4,709 | ||||||||||||||||||

| Accretion of discount on asset retirement obligations |

78 | 58 | 127 | 78 | 32 | 57 | ||||||||||||||||||

| General and administrative |

1,767 | 704 | 982 | 1,924 | 534 | 4,869 | ||||||||||||||||||

| Impairment of proved oil and gas properties |

— | 9,208 | 1,886 | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating costs and expenses |

10,645 | 15,222 | 17,717 | 20,507 | 7,962 | 15,073 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from operations |

2,783 | (9,247 | ) | (243 | ) | 18,804 | 8,636 | 24,788 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other income (expenses): |

||||||||||||||||||||||||

| Interest income and other |

118 | 35 | 218 | 216 | 62 | 5 | ||||||||||||||||||

| Interest expense |

(93 | ) | (2 | ) | (98 | ) | (578 | ) | (237 | ) | (703 | ) | ||||||||||||

| Gain on sale of assets |

1 | — | 354 | 1,621 | 1,209 | — | ||||||||||||||||||

| Equity-based compensation |

— | — | — | (1,671 | ) | — | — | |||||||||||||||||

| Other revenue and expenses, net |

298 | 118 | 847 | 576 | 576 | — | ||||||||||||||||||

| Tax expense — current |

(625 | ) | — | — | — | — | — | |||||||||||||||||

| Tax (expense) benefit — deferred |

502 | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

$ | 2,984 | $ | (9,096 | ) | $ | 1,078 | $ | 18,968 | $ | 10,246 | $ | 24,090 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income per limited partner unit (basic and diluted) |

$ | (0.51 | ) | $ | 0.06 | $ | 1.05 | $ | 0.57 | $ | 1.33 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Weighted average number of limited partner units outstanding (basic and diluted) |

17,640 | 17,640 | 17,640 | 17,640 | 17,790 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| Adjusted EBITDA |

$ | 3,773 | $ | 2,836 | $ | 10,593 | $ | 23,994 | $ | 11,388 | $ | 22,503 | ||||||||||||

| Cash Flow Data: |

||||||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||||||

| Operating activities |

$ | 10,935 | $ | 965 | $ | 11,798 | $ | 24,113 | $ | 5,192 | $ | 24,384 | ||||||||||||

| Investing activities |

(12,448 | ) | (5,018 | ) | (22,726 | ) | (42,045 | ) | (13,351 | ) | (23,992 | ) | ||||||||||||

| Financing activities |

4,841 | (1,164 | ) | 10,387 | 17,938 | 8,377 | 3,344 | |||||||||||||||||

16

Table of Contents

| Mid-Con Energy Partners, LP | ||||||||||||||||||||

| As of December 31, | As of June 30, | |||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Working capital(1) |

$ | 2,420 | $ | (1,256 | ) | $ | 2,361 | $ | 4,383 | $ | 11,879 | |||||||||

| Total assets |

40,496 | 56,867 | 96,611 | 72,390 | 125,148 | |||||||||||||||

| Total debt |

337 | 5,513 | 45,000 | 13,310 | 58,000 | |||||||||||||||

| Total Equity |

36,779 | 43,072 | 43,349 | 56,098 | 60,473 | |||||||||||||||

| (1) | For 2010, excludes $5.3 million of current maturities under our predecessor’s credit facilities. The maturity date for these facilities was subsequently extended to December 2013. |

17

Table of Contents

We include in this prospectus the non-GAAP financial measure Adjusted EBITDA and provide our calculation of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income and net cash from operating activities, our most directly comparable financial measures calculated and presented in accordance with GAAP. We define Adjusted EBITDA as net income (loss):

| Ÿ | Plus: |

| Ÿ | income tax expense (benefit), if any; |

| Ÿ | interest expense; |

| Ÿ | depreciation, depletion and amortization; |

| Ÿ | accretion of discount on asset retirement obligations; |

| Ÿ | unrealized losses on commodity derivative contracts; |

| Ÿ | impairment expenses; |

| Ÿ | dry hole costs and abandonments of unproved properties; |

| Ÿ | equity-based compensation; and |

| Ÿ | loss on sale of assets; |

| Ÿ | Less: |

| Ÿ | interest income; |

| Ÿ | unrealized gains on commodity derivative contracts; and |

| Ÿ | gain on sale of assets. |

Adjusted EBITDA is used as a supplemental financial measure by our management and by external users of our financial statements, such as industry analysts, investors, lenders, rating agencies and others, to assess:

| Ÿ | the cash flow generated by our assets, without regard to financing methods, capital structure or historical cost basis; and |

| Ÿ | our ability to incur and service debt and fund capital expenditures. |

In addition, management uses Adjusted EBITDA to evaluate actual cash flow available to pay distributions to our unitholders, develop existing reserves or acquire additional oil properties.

Adjusted EBITDA should not be considered an alternative to net income, operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Our Adjusted EBITDA may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDA in the same manner. The following table presents our reconciliation of Adjusted EBITDA to Net Income. The table below further presents a reconciliation of Adjusted EBITDA to cash flow from operating activities, our most directly comparable GAAP financial measure, for each of the periods indicated.

18

Table of Contents

Reconciliation of Adjusted EBITDA to Net Income

| Mid-Con Energy Corporation (consolidated) |

Mid-Con Energy Partners, LP | |||||||||||||||||||||||

| Year Ended June 30, |

Six Months Ended December 31, |

Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||||||||||

| 2009 | 2009 | 2010 | 2011 | 2011 | 2012 | |||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Net income (loss) |

$ | 2,984 | $ | (9,096 | ) | $ | 1,078 | $ | 18,968 | $ | 10,246 | $ | 24,090 | |||||||||||

| Tax expense (benefit) — deferred |

(502 | ) | — | — | — | — | — | |||||||||||||||||

| Tax expense — current |

625 | — | — | — | — | — | ||||||||||||||||||

| Interest expense |

93 | 2 | 98 | 578 | 237 | 703 | ||||||||||||||||||

| Depreciation, depletion and amortization |

2,293 | 2,552 | 5,851 | 7,160 | 2,418 | 4,709 | ||||||||||||||||||

| Accretion of discount on asset retirement obligations |

78 | 58 | 127 | 78 | 32 | 57 | ||||||||||||||||||

| Unrealized (gain) loss on derivatives, net |

(1,679 | ) | 147 | 707 | (3,437 | ) | (1,046 | ) | (9,741 | ) | ||||||||||||||

| Impairment of proved oil and gas properties |

— | 9,208 | 1,886 | — | — | — | ||||||||||||||||||

| Dry holes and abandonments of unproved properties |

— | — | 1,418 | 813 | 772 | — | ||||||||||||||||||

| Gain on sale of assets |

(1 | ) | — | (354 | ) | (1,621 | ) | (1,209 | ) | — | ||||||||||||||

| Equity-based compensation |

— | — | — | 1,671 | — | 2,690 | ||||||||||||||||||

| Interest income |

(118 | ) | (35 | ) | (218 | ) | (216 | ) | (62 | ) | (5 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 3,773 | $ | 2,836 | $ | 10,593 | $ | 23,994 | $ | 11,388 | $ | 22,503 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Reconciliation of Adjusted EBITDA to Net Cash Provided by Operating Activities

| Mid-Con Energy Corporation (consolidated) |

Mid-Con Energy Partners, LP | |||||||||||||||||||||||

| Year Ended June 30, |

Six Months Ended December 31, |

Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||||||||||

| 2009 | 2009 | 2010 | 2011 | 2011 | 2012 | |||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Net cash provided by operating activities |

$ | 10,935 | $ | 965 | $ | 11,798 | $ | 24,113 | $ | 5,192 | $ | 24,384 | ||||||||||||

| Amortization of debt placement fees |

— | — | — | — | — | (54 | ) | |||||||||||||||||

| Change in working capital |

(7,762 | ) | 1,904 | (1,085 | ) | (481 | ) | 6,021 | (2,525 | ) | ||||||||||||||

| Tax expense — current |

625 | — | — | — | — | — | ||||||||||||||||||

| Interest expense |

93 | 2 | 98 | 578 | 237 | 703 | ||||||||||||||||||

| Interest income |

(118 | ) | (35 | ) | (218 | ) | (216 | ) | (62 | ) | (5 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 3,773 | $ | 2,836 | $ | 10,593 | $ | 23,994 | $ | 11,388 | $ | 22,503 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

19

Table of Contents

Summary Historical Reserve and Operating Data

The following table presents summary data with respect to our estimated net proved oil and natural gas reserves that we own and the standardized measure amounts associated with those estimated proved reserves as of December 31, 2010 and as of December 31, 2011, both based on reserve reports prepared by our internal reserve engineers and audited by Cawley, Gillespie & Associates, Inc., our independent reserve engineers.

These reserve estimates were prepared in accordance with the SEC’s rules regarding oil and natural gas reserve reporting that are currently in effect. From December 31, 2010 to December 31, 2011 our proved reserves increased by approximately 2.8 MMBoe, or 39%. Total proved reserves increased by approximately 0.9 MMBoe from acquisitions in the Hugoton Basin and Northeastern Oklahoma core areas; 0.8 MMBoe from waterflood expansion in the Northeastern Oklahoma core area; 0.7 MMBoe from infill drilling in the Southern Oklahoma core area; 0.7 MMBoe from drilling and workovers in the Northeastern Oklahoma core area and (0.3) MMBoe in net performance revisions for all of our properties. We spent a total of $19.3 million and $30.0 million in capital expenditures for the year ended December 31, 2010 and the year ended December 31, 2011, respectively, which contributed to the increase in our December 31, 2011 proved reserves.

From December 31, 2010 to December 31, 2011 our proved developed reserves increased by approximately 3.1 MMBoe, or 82%. Proved developed reserves increased in our Southern Oklahoma core area by 0.9 MMBoe from development drilling and 0.7 MMBoe in performance revisions; in the Hugoton Basin core area by 0.7 MMBoe from the acquisition of the War Party I and II Units; in our Northeastern Oklahoma core area by 0.2 MMBoe from acquisitions, 0.7 MMBoe from infill drilling and workovers and (0.1) MMBoe in net performance revisions for the Hugoton Basin and Northeastern Oklahoma core areas and Other Properties.

During the year ended December 31, 2011, we spent approximately $21.9 million in our Southern Oklahoma core area resulting in production increases and reclassifications of 0.9 MMBoe from proved undeveloped reserves to proved developed reserves, which contributed to the 1.6 MMBoe increase in proved developed reserves in our Southern Oklahoma core area discussed in the prior paragraph. Additionally, we spent approximately $13.2 million during the year ended December 31, 2011 to acquire new leases in the Hugoton Basin and Northeastern Oklahoma. We spent another $2.4 million on workover activities and $3.4 million on drilling during the year ended December 31, 2011 in Northeastern Oklahoma.

20

Table of Contents

For a discussion of risks associated with internal reserve estimates, please read “Risk Factors — Risks Related to Our Business — Our estimated proved reserves and future production rates are based on many assumptions that may prove to be inaccurate. Any material inaccuracies in these reserve estimates or underlying assumptions will materially affect the quantities and present value of our estimated reserves.” Please also read “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business and Properties — Oil and Natural Gas Reserves and Production — Estimated Proved Reserves,” and the summary of our reserve audits dated December 31, 2010 and December 31, 2011 in evaluating the material presented below.

| As of December 31, 2010 |

As of December 31, 2011 |

|||||||

| Reserve Data: |

||||||||

| Estimated proved reserves: |

||||||||

| Oil (MBbl) |

7,007 | 9,936 | ||||||

| Natural Gas (MMcf) |

1,346 | 676 | ||||||

|

|

|

|

|

|||||

| Total (MBoe) |

7,231 | 10,049 | ||||||

|

|

|

|

|

|||||

| Proved developed (MBoe) |

3,825 | 6,948 | ||||||

| Oil (MBbl) |

3,601 | 6,835 | ||||||

| Natural Gas (MMcf) |

1,346 | 676 | ||||||

| Proved undeveloped (MBoe) |

3,406 | 3,101 | ||||||

| Oil (MBbl) |

3,406 | 3,101 | ||||||

| Natural Gas (MMcf) |

— | — | ||||||

| Proved developed reserves as a percentage of total proved reserves |

52.9 | % | 69.1 | % | ||||

| Standardized Measure (in millions)(1) |

$ | 183.7 | $ | 328.2 | ||||

| Oil and Natural Gas Prices(2): |

||||||||

| Oil — NYMEX — WTI per Bbl |

$ | 79.43 | $ | 96.19 | ||||

| Natural gas — NYMEX — Henry Hub per MMBtu |

$ | 4.37 | $ | 4.11 | ||||

| (1) | Standardized measure is calculated in accordance with Statement of Financial Accounting Standards No. 69, Disclosures About Oil and Gas Producing Activities, as codified in ASC Topic 932, Extractive Activities — Oil and Gas. Because we were not subject to federal or state income taxes for the periods presented, we make no provision for federal or state income taxes in the calculation of our standardized measure. For a description of our commodity derivative contracts, please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Derivative Contracts.” |

| (2) | Our estimated net proved reserves and related standardized measure were determined using index prices for oil and natural gas, without giving effect to commodity derivative contracts, held constant throughout the life of the properties. The unweighted arithmetic average first-day-of-the-month prices for the prior twelve months were $79.43 per Bbl for oil and $4.37 per MMBtu for natural gas at December 31, 2010 and $96.19 per Bbl for oil and $4.11 per MMBtu for natural gas at December 31, 2011. These prices were adjusted by lease for quality, transportation fees, location differentials, marketing bonuses or deductions and other factors affecting the price received at the wellhead. For the year ended December 31, 2010, the relevant average realized prices for oil and natural gas were $73.92 |

21

Table of Contents

| per Bbl and $7.42 per Mcf, respectively. For the year ended December 31, 2011, the relevant average realized prices for oil and natural gas were $90.45 per Bbl and $7.43 per Mcf, respectively. Realized natural gas sales price per Mcf includes the sale of natural gas liquids for both the year ended December 31, 2010 and the year ended December 31, 2011. |

| Year

Ended December 31, 2011 |

Six Months Ended June 30, 2012 |

|||||||

| Production and operating data: |

||||||||

| Net production volumes: |

||||||||

| Oil (MBbls) |

407 | 304 | ||||||

| Natural gas (MMcf) |

164 | 60 | ||||||

| Total (MBoe) |

434 | 314 | ||||||

| Average net production (Boe/d) |

1,191 | 1,725 | ||||||

| Average sales price:(1) |

||||||||

| Oil (per Bbl) |

$ | 90.45 | $ | 95.39 | ||||

| Natural gas (per Mcf)(2) |

$ | 7.43 | $ | 5.88 | ||||

| Average price per Boe |

$ | 87.63 | $ | 93.47 | ||||

| Average unit costs per Boe: |

||||||||

| Oil and natural gas production expenses |

$ | 19.56 | $ | 15.05 | ||||

| Production taxes |

$ | 4.31 | $ | 2.27 | ||||

| General and administrative and other(3) |

$ | 4.43 | $ | 15.51 | ||||

| Depreciation, depletion and amortization |

$ | 15.66 | $ | 15.00 | ||||

| (1) | Prices do not include the effects of derivative cash settlements. |

| (2) | Realized natural gas sales price per Mcf includes the sale of natural gas liquids. |

| (3) | General and administrative expenses include non-cash, equity-based compensation for the six months ended June 30, 2012. We had no non-cash, equity-based compensation expense for the year ended December 31, 2011. |

22

Table of Contents

Limited partner interests are inherently different from the capital stock of a corporation. Prospective unitholders should carefully consider the following risk factors together with all of the other information included in this prospectus in evaluating an investment in our common units.

If any of the following risks were actually to occur, our business, financial condition or results of operations could be materially adversely affected. In that case, we might not be able to pay distributions on our common units, the trading price of our common units could decline and our unitholders could lose all or part of their investment.

We may not have sufficient cash to pay any quarterly distribution on our units following the establishment of cash reserves and payment of expenses, including payments to our general partner.

We may not have sufficient available cash each quarter to pay any distributions to our unitholders. Under the terms of our partnership agreement, the amount of cash available for distribution will be reduced by our operating expenses and the amount of any cash reserves established by our general partner to provide for future operations, future capital expenditures, including development of our oil and natural gas properties, future debt service requirements and future cash distributions to our unitholders. The amount of cash that we distribute to our unitholders will depend principally on the cash we generate from operations, which will depend on, among other factors:

| Ÿ | the amount of oil and natural gas we produce; |

| Ÿ | the prices at which we sell our oil and natural gas production; |

| Ÿ | the amount and timing of settlements on our commodity derivative contracts; |

| Ÿ | the level of our capital expenditures, including scheduled and unexpected maintenance expenditures; |

| Ÿ | the level of our operating costs, including payments to our general partner; and |

| Ÿ | the level of our interest expense, which will depend on the amount of our outstanding indebtedness and the applicable interest rate. |

Further, the amount of cash we have available for distribution depends primarily on our cash flow, including cash from financial reserves and borrowings, and not solely on profitability, which will be affected by non-cash items. As a result, we may make cash distributions during periods when we record losses for financial accounting purposes and may not make cash distributions during periods when we record net income for financial accounting purposes.

A decline in oil prices, or an increase in the differential between the NYMEX or other benchmark prices of oil and the wellhead price we receive for our production, will cause a decline in our cash flow from operations, which could cause us to reduce our distributions or cease paying distributions altogether.

Lower oil prices may decrease our revenues and, therefore, our cash available for distribution to our unitholders. Historically, oil prices have been extremely volatile. For example, for the five years ended December 31, 2011, the NYMEX — WTI oil price ranged from a high of $145.29 per Bbl to a low of $33.87 per Bbl. A significant decrease in commodity prices may cause us to reduce the distributions we pay to our unitholders or to cease paying distributions altogether.

23

Table of Contents

Also, the prices that we receive for our oil production often reflect a regional discount, based on the location of the production, to the relevant benchmark prices that are used for calculating hedge positions, such as NYMEX. These discounts, if significant, could similarly reduce our cash available for distribution to our unitholders and adversely affect our financial condition.

If commodity prices decline and remain depressed for a prolonged period, production from a significant portion of our oil properties may become uneconomic and cause write downs of the value of such oil properties, which may adversely affect our financial condition and our ability to make distributions to our unitholders.

Significantly lower oil prices may render many of our development projects uneconomic and result in a downward adjustment of our reserve estimates, which would negatively impact our borrowing base and ability to borrow to fund our operations or make distributions to our unitholders. As a result, we may reduce the amount of distributions paid to our unitholders or cease paying distributions. In addition, a significant or sustained decline in oil prices could hinder our ability to effectively execute our hedging strategy. For example, during a period of declining commodity prices, we may enter into commodity derivative contracts at relatively unattractive prices in order to mitigate a potential decrease in our borrowing base upon a redetermination.

Further, deteriorating commodity prices may cause us to recognize impairments in the value of our oil properties. In addition, if our estimates of drilling costs increase, production data factors change or drilling results deteriorate, accounting rules may require us to write down, as a non-cash charge to earnings, the carrying value of our oil properties as impairments. We may incur impairment charges in the future, which could have a material adverse effect on our results of operations in the period taken.

Our hedging strategy may be ineffective in removing the impact of commodity price volatility from our cash flow, which could result in financial losses or could reduce our income, which may adversely affect our ability to pay distributions to our unitholders.

We generally intend to hedge a significant portion of our near-term estimated oil production. The prices at which we are able to enter into commodity derivative contracts covering our production in the future will be dependent upon oil prices at the time we enter into these transactions, which may be substantially higher or lower than current oil prices. Accordingly, our price hedging strategy may not protect us from significant declines in oil prices received for our future production.

Our credit facility may hinder our ability to effectively execute our hedging strategy. To the extent our credit facility limits the maximum percentage of our production that we can hedge or the duration of those hedges, we may be unable to enter into additional commodity derivative contracts during favorable market conditions and, thus, unable to lock in attractive future prices for our product sales. Conversely, while our credit facility does not currently require us to hedge a minimum percentage of our production, it may cause us to enter into commodity derivative contracts at inopportune times. For example, during a period of declining commodity prices, we may enter into commodity derivative contracts at relatively unattractive prices in order to mitigate a potential decrease in our borrowing base upon a redetermination.

Our hedging activities could result in cash losses, could reduce our cash available for distribution and may limit the prices we would otherwise realize for our production.

Many of our derivative contracts require us to make cash payments to the extent the applicable index exceeds a predetermined price, thereby limiting our ability to realize the benefit of increases in oil prices. If our actual production and sales for any period are less than our hedged production and sales for that period (including reductions in production due to operational delays), we might be forced to satisfy all or a portion

24

Table of Contents

of our hedging obligations without the benefit of the cash flow from our sale of the underlying physical commodity, which may materially impact our liquidity and our cash available for distribution to our unitholders.

Our hedging transactions expose us to counterparty credit risk.