Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IDENIX PHARMACEUTICALS INC | d413898d8k.htm |

Exhibit 99.1

| 1 Investor Presentation September 20, 2012 |

| 2 Building a Leading Antiviral Franchise Safe Harbor Statement This presentation includes forward-looking statements about Idenix and its business, including without limitation, statements regarding drug discovery, research and clinical development, regulatory approval processes and market opportunities. These forward- looking statements are subject to risks and uncertainties that may cause actual events or results to differ materially from our current expectations. These risks and uncertainties are detailed in our filings with the Securities and Exchange Commission. All forward- looking statements speak only as of the date of this presentation and, except as required by law, we undertake no obligation to update such statements. |

| 3 Building a Leading Antiviral Franchise Idenix Pharmaceuticals Highlights Focused on development of next-generation antiviral oral combination treatments for hepatitis C virus (HCV) infection IDX184, an HCV nucleotide polymerase inhibitor, in phase IIb trials Interim SVR4 and 12-week cEVR data demonstrate safety and promising antiviral activity Placed on partial clinical hold by FDA in August 2012 due to cardiac-related SAEs with BMS-094 (formerly INX-189) IDX19368, lead candidate from next-generation HCV nucleotide discovery program Filed IND in Q3 2012; no patients dosed to date Placed on clinical hold by FDA in August 2012 due to cardiac-related SAEs with BMS-094 Robust nucleotide discovery program ongoing IDX719, an HCV NS5A inhibitor, completed 3-day proof-of-concept study Favorable safety and potent pan-genotypic activity in HCV-infected patients Restructured agreement with Novartis enhances Idenix's strategic flexibility to develop an optimal DAA portfolio of both internally and externally derived assets |

| Convenient Once- or twice-daily Low dosage Fixed-dose Ease of Administration ^ 12 weeks duration Simple stopping rules All Oral PegIFN-free RBV still a question Potent >80% SVR Nulls, relapsers, cirrhotics High barrier to resistance Safe Low toxicity High tolerability Minimal AEs Pan-genotypic Can be used in any genotype The HCV Treatment Paradigm is Evolving Rapidly Idenix Strategy: Pursue the Optimal DAA Regimen to Cure HCV 4 Building a Leading Antiviral Franchise |

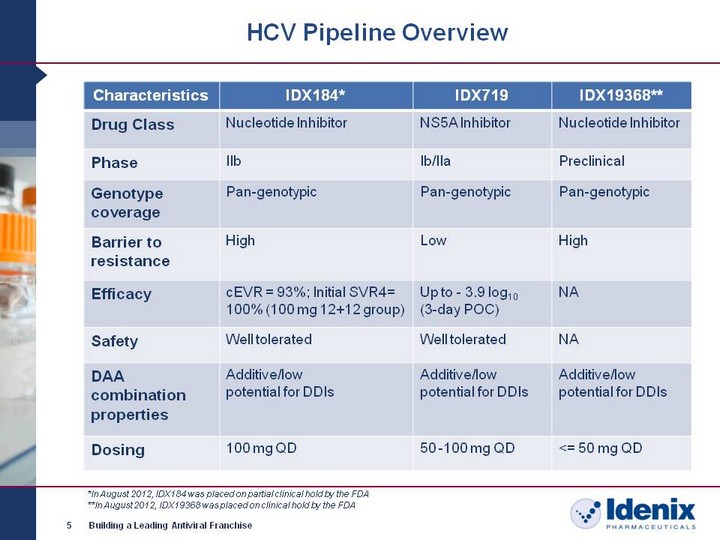

| HCV Pipeline Overview 5 Building a Leading Antiviral Franchise Characteristics IDX184* IDX719 IDX19368** Drug Class Nucleotide Inhibitor NS5A Inhibitor Nucleotide Inhibitor Phase IIb Ib/IIa Preclinical Genotype coverage Pan-genotypic Pan-genotypic Pan-genotypic Barrier to resistance High Low High Efficacy cEVR = 93%; Initial SVR4= 100% (100 mg 12+12 group) Up to - 3.9 log10 (3-day POC) NA Safety Well tolerated Well tolerated NA DAA combination properties Additive/low potential for DDIs Additive/low potential for DDIs Additive/low potential for DDIs Dosing 100 mg QD 50 -100 mg QD <= 50 mg QD *In August 2012, IDX184 was placed on partial clinical hold by the FDA **In August 2012, IDX19368 was placed on clinical hold by the FDA |

| 6 Building a Leading Antiviral Franchise In August 2012, FDA placed IDX184 on partial clinical hold and IDX19368 on clinical hold due to serious cardiac-related adverse events seen with BMS-094 (formerly INX-189) Idenix is working with FDA and BMS to resolve the clinical holds Idenix received formal FDA letter related to IDX184 Clinical: majority of requested data has been collected; external cardiology expert review planned Echocardiograms, ECGs and cardiac biomarkers, including NT pro-BNP's, CK, and ultra sensitive troponins Non-clinical: certain requested data has been performed, further testing is underway In vitro cytotoxicity studies, including human cardiomyocytes Cardiac safety assessments in ongoing IDX184 in vivo studies Risk management plan for cardiac monitoring for future clinical trials requested Idenix received formal FDA letter related to IDX19368 Additional toxicology and metabolism preclinical studies requested IDX184 and IDX19368 Update |

| 7 Building a Leading Antiviral Franchise There has been no evidence to date of cardiotoxicity in patients dosed with IDX184 with PegIFN/RBV beyond that seen with PegIFN/RBV alone No patients have been exposed to IDX19368 The three compounds share the same active metabolite (2'-methyl G) however, we believe there are significant differences between IDX184 and IDX19368 compared to BMS-094 Different prodrug approaches BMS-094 has potentially toxic metabolites that are different from those of IDX184 and IDX19368 BMS-094 distribution appears to be less liver-targeted than IDX184 In preclinical testing performed by Idenix, BMS-094 exhibited significant cytotoxicity across a wide variety of cell types, including human cardiomyocytes, in contrast to IDX184 and IDX19368 Comparison of IDX184, IDX19368 and BMS-094 |

| 8 Building a Leading Antiviral Franchise Phase IIb study status In July 2012, DSMB confirmed no safety or efficacy concerns; side effect profile remains consistent with known safety profile of PegIFN/RBV alone No patients are receiving IDX184. Patients currently on PegIFN/RBV extension IDX184 was placed on partial clinical hold by FDA in August 2012 due to serious cardiac-related adverse events seen with BMS-094 Complete SVR data in 2013 Study design 12-week, randomized, double-blind, parallel groups Treatment-naive genotype 1 HCV-infected patients; stratified by IL28B 50 mg IDX184 with PegIFN/RBV 100 mg IDX184 with PegIFN/RBV Response-guided PegIFN/RBV extension for 12 or 36 weeks Endpoints: safety and tolerability; antiviral activity 67 patients have been enrolled IDX184: Phase IIb 12-Week PegIFN/RBV Study Overview |

| Safety: Safety observed to date consistent with known safety profile of PegIFN/RBV alone IDX184* Interim Antiviral Activity and Safety Summary - First Cohort Phase IIb 12-Week PegIFN/RBV Study 9 Building a Leading Antiviral Franchise n Median Time to <25 IU/mL 50 mg IDX184 + Peg/RBV 16 22 days 100 mg IDX184 + Peg/RBV 15 15 days HCV RNA <25 IU/mL at Week 4 (RVR) 10/16 (63%) 11/15 (73%) HCV RNA <25 IU/mL at Week 12 (cEVR, ITT) 13/16 (81%) 14/15 (93%) Antiviral activity: † Interim analysis of 9 patients who achieved eRVR and were randomized to stop treatment after an additional 12 weeks of PegIFN/RBV. Majority of patients had normal ALT levels by Week 12 SVR4† (12+12) 4/5 (80%) 4/4 (100%) *In August 2012, IDX184 was placed on partial clinical hold by the FDA |

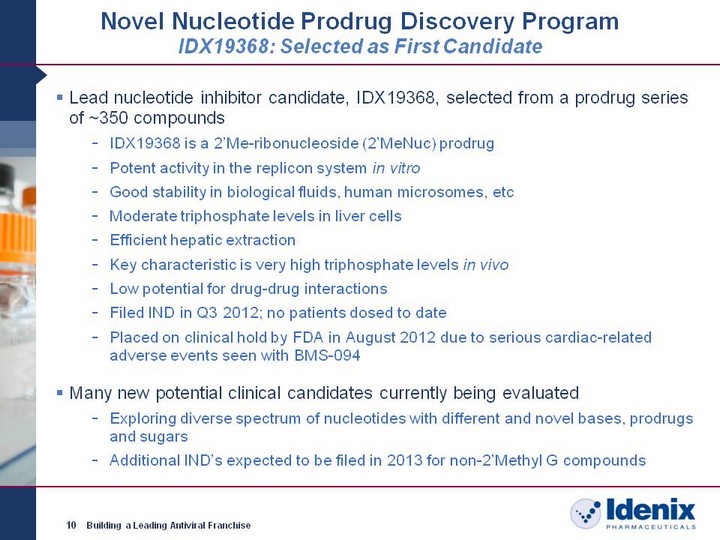

| Novel Nucleotide Prodrug Discovery Program IDX19368: Selected as First Candidate Lead nucleotide inhibitor candidate, IDX19368, selected from a prodrug series of ~350 compounds IDX19368 is a 2'Me-ribonucleoside (2'MeNuc) prodrug Potent activity in the replicon system in vitro Good stability in biological fluids, human microsomes, etc Moderate triphosphate levels in liver cells Efficient hepatic extraction Key characteristic is very high triphosphate levels in vivo Low potential for drug-drug interactions Filed IND in Q3 2012; no patients dosed to date Placed on clinical hold by FDA in August 2012 due to serious cardiac-related adverse events seen with BMS-094 Many new potential clinical candidates currently being evaluated Exploring diverse spectrum of nucleotides with different and novel bases, prodrugs and sugars Additional IND's expected to be filed in 2013 for non-2'Methyl G compounds 10 Building a Leading Antiviral Franchise |

| 11 Building a Leading Antiviral Franchise IDX719: NS5A Inhibitor Strong Preclinical Profile EC50 versus HCV replicon (pM) Potent broad genotypic activity across multiple genotypes with high selectivity indices in vitro (2-24 pM activity overall) Clean preclinical safety profile to date Low potential for drug-drug interactions |

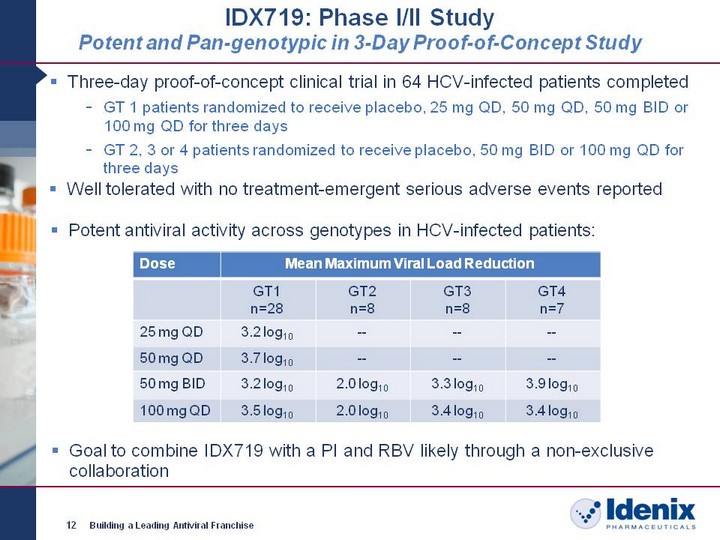

| IDX719: Phase I/II Study Potent and Pan-genotypic in 3-Day Proof-of-Concept Study 12 Building a Leading Antiviral Franchise Dose Mean Maximum Viral Load Reduction Mean Maximum Viral Load Reduction Mean Maximum Viral Load Reduction Mean Maximum Viral Load Reduction GT1 n=28 GT2 n=8 GT3 n=8 GT4 n=7 25 mg QD 3.2 log10 -- -- -- 50 mg QD 3.7 log10 -- -- -- 50 mg BID 3.2 log10 2.0 log10 3.3 log10 3.9 log10 100 mg QD 3.5 log10 2.0 log10 3.4 log10 3.4 log10 Potent antiviral activity across genotypes in HCV-infected patients: Three-day proof-of-concept clinical trial in 64 HCV-infected patients completed GT 1 patients randomized to receive placebo, 25 mg QD, 50 mg QD, 50 mg BID or 100 mg QD for three days GT 2, 3 or 4 patients randomized to receive placebo, 50 mg BID or 100 mg QD for three days Well tolerated with no treatment-emergent serious adverse events reported Goal to combine IDX719 with a PI and RBV likely through a non-exclusive collaboration |

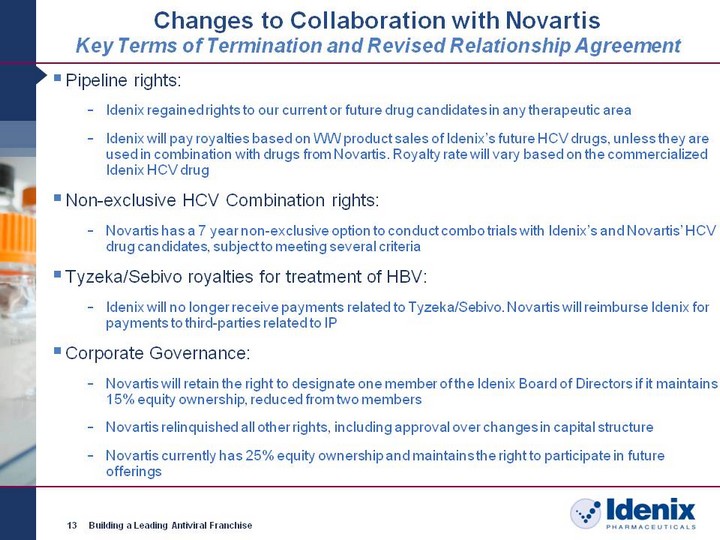

| Changes to Collaboration with Novartis Key Terms of Termination and Revised Relationship Agreement 13 Building a Leading Antiviral Franchise Pipeline rights: Idenix regained rights to our current or future drug candidates in any therapeutic area Idenix will pay royalties based on WW product sales of Idenix's future HCV drugs, unless they are used in combination with drugs from Novartis. Royalty rate will vary based on the commercialized Idenix HCV drug Non-exclusive HCV Combination rights: Novartis has a 7 year non-exclusive option to conduct combo trials with Idenix's and Novartis' HCV drug candidates, subject to meeting several criteria Tyzeka/Sebivo royalties for treatment of HBV: Idenix will no longer receive payments related to Tyzeka/Sebivo. Novartis will reimburse Idenix for payments to third-parties related to IP Corporate Governance: Novartis will retain the right to designate one member of the Idenix Board of Directors if it maintains 15% equity ownership, reduced from two members Novartis relinquished all other rights, including approval over changes in capital structure Novartis currently has 25% equity ownership and maintains the right to participate in future offerings |

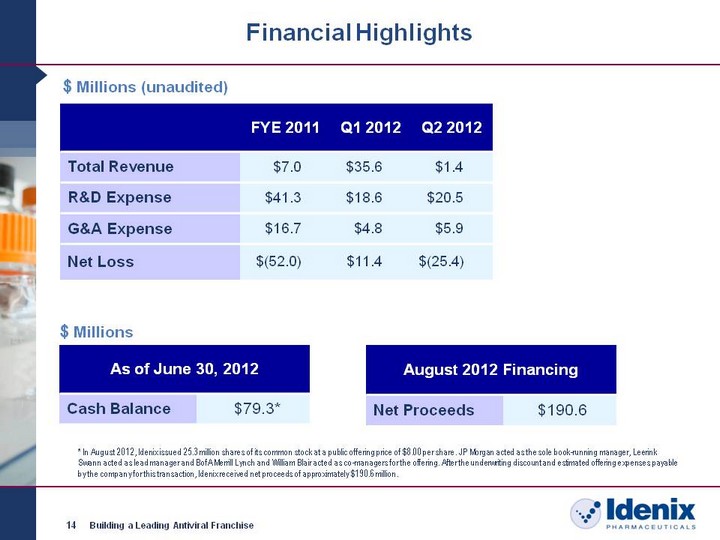

| 14 Building a Leading Antiviral Franchise Financial Highlights $ Millions (unaudited) FYE 2011 Q1 2012 Q2 2012 Total Revenue $7.0 $35.6 $1.4 R&D Expense $41.3 $18.6 $20.5 G&A Expense $16.7 $4.8 $5.9 Net Loss $(52.0) $11.4 $(25.4) As of June 30, 2012 As of June 30, 2012 Cash Balance $79.3* $ Millions August 2012 Financing August 2012 Financing Net Proceeds $190.6 * In August 2012, Idenix issued 25.3 million shares of its common stock at a public offering price of $8.00 per share. JP Morgan acted as the sole book-running manager, Leerink Swann acted as lead manager and BofA Merrill Lynch and William Blair acted as co-managers for the offering. After the underwriting discount and estimated offering expenses payable by the company for this transaction, Idenix received net proceeds of approximately $190.6 million. |