Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOLINA HEALTHCARE, INC. | d410435d8k.htm |

Investor Day

2012B September 19, 2012

New York, New York

Exhibit 99.1 |

©

2012 Molina Healthcare, Inc.

Cautionary Statement

2

Safe

Harbor

Statement

under

the

Private

Securities

Litigation

Reform

Act

of

1995:

This

slide presentation and our accompanying oral remarks contain numerous “forward looking

statements”

regarding our cost control initiatives in Texas and Wisconsin; our expansion into

the dual eligible markets in California, Texas, Michigan, and Ohio; growth in the Medicaid

membership of our health plans as a result of the Affordable Care Act and otherwise;

our planned participation in health insurance exchanges; requests for proposals in

Florida and New

Mexico;

the

rates

paid

to

our

health

plans

and

the

estimated

effect

of

those

rates

on

plan

revenues;

our

capital

needs

and

capital

planning;

and

other

various

matters.

All

of

our

forward-looking

statements

are

subject

to

numerous

risks,

uncertainties,

and

other

factors

that

could

cause

our

actual

results

to

differ

materially.

Anyone

viewing

or

listening

to

this

presentation is urged to read the risk factors and cautionary statements found under Item

1A in our annual report on Form 10-K, as well as the risk factors and cautionary

statements in our quarterly reports and in our other reports and filings with the

Securities and Exchange Commission

and

available

for

viewing

on

its

website

at

www.sec.gov.

Except

to

the

extent

otherwise required by federal securities laws, we do not undertake to address or update

forward-looking

statements

in

future

filings

or

communications

regarding

our

business

or

operating results. |

©

2012 Molina Healthcare, Inc.

Agenda

Approx. Time

Topic

Speaker

12:30pm-12:35pm

Opening Remarks

Juan José

Orellana, VP Investor Relations

12:35pm-1:10pm

Operations Review

Terry Bayer, Chief Operating Officer

1:10pm-1:45pm

Business Overview

Dr. J. Mario Molina, Chief Executive Officer

1:45pm-2:00pm

Q&A

2:00pm-2:15pm

Break

2:15pm-2:45pm

Long-Term Growth

John Molina, Chief Financial Officer

Joseph White, Chief Accounting Officer

2:45pm-3:05pm

Q&A

3:05pm-3:50pm

Funding Our Growth

John Molina, Chief Financial Officer

3:50pm-4:30pm

Q&A

4:30pm

End of Program

3 |

Operations

Review Terry Bayer

Chief Operations Officer

September 19, 2012

New York, New York |

©

2012 Molina Healthcare, Inc.

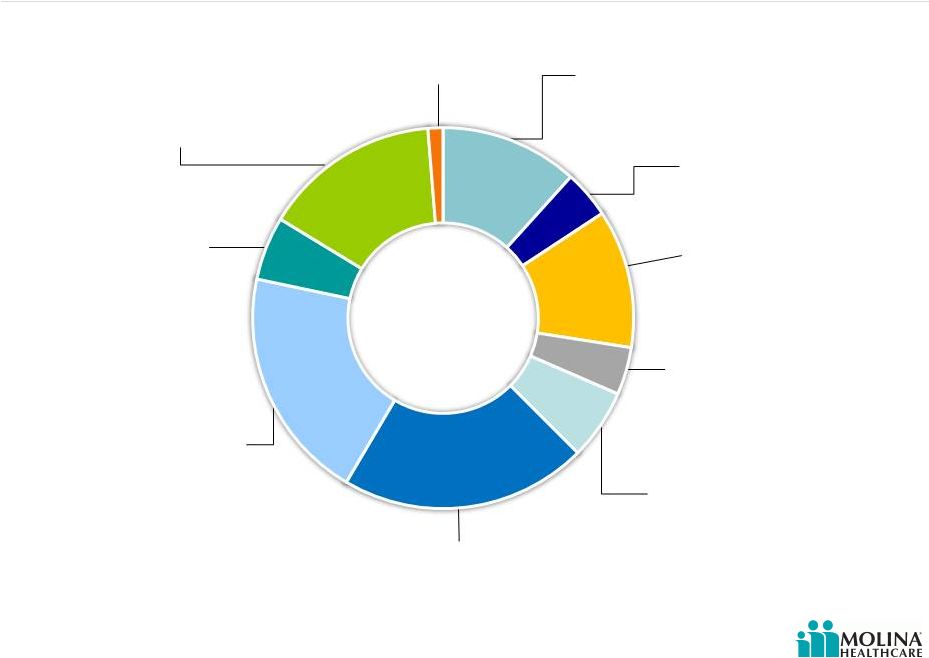

Revenue Contribution by State

5

Washington 15%

Began serving ABD

population 7/1/2012

Utah 5%

RX carve-in effective

1/2013

Texas 20%

Medical management

initiatives implemented

Ohio 21%

Dual eligible contract in 3 regions

effective 2013; statewide

expansion effective 1/2013

Missouri 4%

Contract ended June 30, 2012

Michigan 12%

CSHCS effective 10/1/2012

Florida 4%

Submitted Long-Term Care

contract RFP

California 12%

Dual eligible contract in 4

counties effective 2013

Wisconsin 1%

PDR taken 2Q 2012

Please refer to the Company’s cautionary statements.

New Mexico 6%

RFP effective 1/2014

1H 2012 |

Texas

Existing Molina

footprint

6

Molina new SDAs

effective 3/1/2012

Effective March 1, 2012, Molina added three new service

delivery areas (SDAs).

Molina New SDAs

(effective 3/1/2012)

El Paso Service Area

STAR & STAR+PLUS

El Paso and Hudspeth

Counties

Hidalgo Service Area

STAR & STAR+PLUS

Cameron, Duval, Hidalgo, Jim Hogg,

Maverick, McMullen, Starr, Webb,

Willacy, and Zapata counties

Jefferson Service Area

CHIP

Chambers, Hardin,

Jasper, Jefferson,

Liberty, Newton, Orange,

Polk, San Jacinto, Tyler

and Walker counties

Texas Health Plan Enrollment

Source: Texas Health and Human Services Commission

301K

155K

94K

40K

31K

2008

2009

2010

2011

1H

2012

©

2012 Molina Healthcare, Inc. |

©

2012 Molina Healthcare, Inc.

Texas Overview

7

Remediation activities

Blended rate increase of 4% effective 9/1

Provider contract changes

Re-contracted at lower unit costs

Implementation of state required fee schedules

New President & Management Team

Enrollment at September 1

st

was 291,000; ABD declined

8.1% from June 30th

Source: Molina Healthcare, Inc. 2Q 2012 earnings release and company data.

84K

106K

111K

84K

105K

102K

CHIP

TANF

ABD

Jun 30

Sep 1

(8.1%) |

©

2012 Molina Healthcare, Inc.

Wisconsin

Premium rates low in relation to benefits

United

Healthcare

exit

regions

1

Remediation activities

Terminated certain high-cost providers

Utilization Management

New leadership

8

(http//www.jsonline.com)

1. Milwaukee Wisconsin Journal Sentinel, “UnitedHealthcare ends

BadgerCare Plus contract with state” August 19, 2012.

|

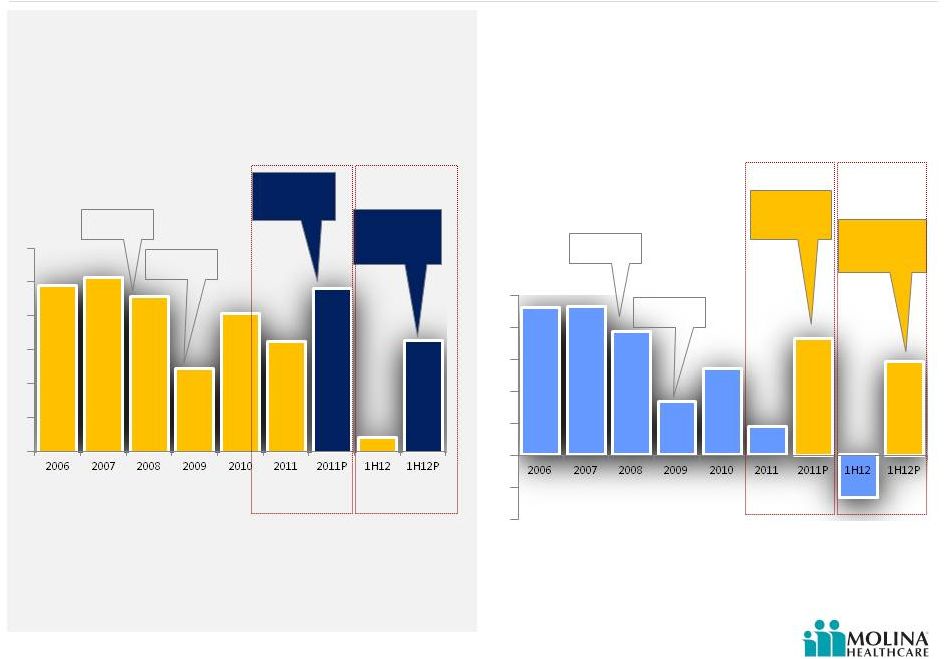

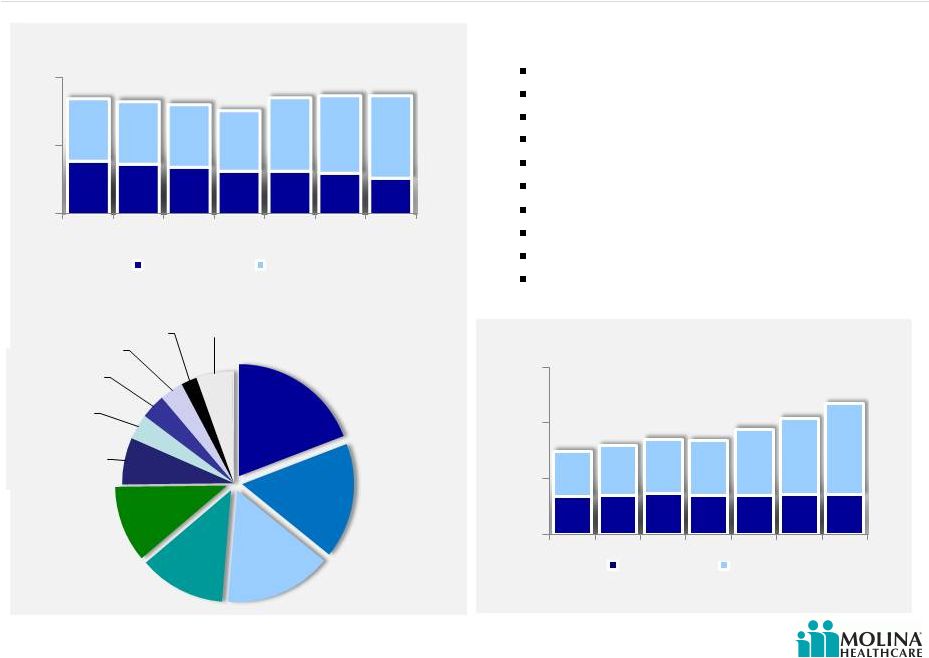

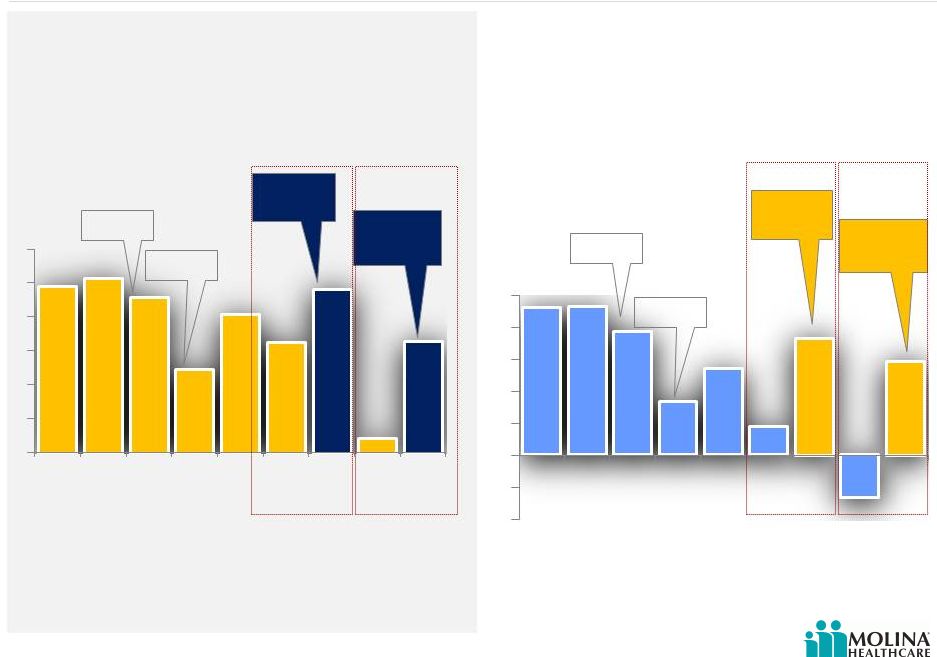

Earnings Margin

2006-1H2012 9

AFTER TAX MARGIN

Please refer to the Company’s cautionary statements.

1. P denotes results excluding Missouri write-down in 2011, and Texas and Missouri

operations in 2012 1

1

H1N1 Flu

Excluding

Texas and

Missouri

Excluding

Missouri

write-down

TX & OH

Startup

H1N1 Flu

Excluding

Texas and

Missouri

Excluding

Missouri

write-down

TX & OH

Startup

EBITDA MARGIN

1

1

©

2012 Molina Healthcare, Inc.

4.9%

5.1%

4.6%

2.5%

4.1%

3.2%

4.6%

0.4%

3.3%

2.3%

2.3%

1.9%

0.8%

1.3%

0.4%

1.7%

-

0.7%

1.5% |

©

2012 Molina Healthcare, Inc.

California’s Coordinated Care Initiative (CCI)

Health plans must have an existing Medicaid contract

The CCI will impact Molina Healthcare of California as

follows:

1.

Mandatory managed care enrollment of dual eligibles

for the Medicaid

portion of the benefit

2.

Passive Medicare enrollment with opt-out option

3.

A carve in for the long term support services (LTSS),

which will become the MCOs’

responsibility

»

Long-term nursing facility care

»

Personal care

»

Adult day care

»

Other support services

10

Three Party Agreement between

the health plans, the State, and

CMS, which will provide funding

for Medicare and Long-Term Care

services on the Medicaid side for

California’s dual eligibles. |

©

2012 Molina Healthcare, Inc.

California’s Coordinated Care Initiative (CCI)

11

Health Plan Readiness

Membership

Eligible populations

defined for duals

enrollment and

mandatory Medicaid

managed care

enrollment

Passive enrollment with

opt-out (Medicare)

Rolling enrollment

based on birth month

Unknown:

Auto-assignment

methodology

Opt-out rate

Rates

Benefits

Network

Two payments for dual

members with Medicare

and Medicaid portions

determined by CMS and

DHCS, respectively

Some level of risk

adjustment for both

Medicare and Medicaid

payments

Withholds for quality

measures

Unknown:

Specific rate

methodology

All Medicare Parts A, B,

and D

All current Medicaid

managed care benefits

Medicaid LTSS

Nursing facility long

term care

Personal care (IHSS)

Adult day health (CBAS)

Non-medical assistive

services (MSSP)

Case management

Transition management

Coordination with

Medicaid behavioral

health

Leverage current

Medicaid and Medicare

networks

Direct contracts with

LTSS providers (not

delegated and

subcapitated to groups)

Contracts with county

agencies and LTSS

providers

Counties for IHSS

CBAS providers

MSSP providers

Case management

vendors

Legislatively mandated

payment provisions for

certain providers

Expected 6/1/13

Plans begin to enroll

duals into

demonstration

Expected plan rates released

12/15/12

Deadline for

CMS/DHCS/Plan

3-way contracts

Plan readiness

review by CMS

and DHCS

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun |

©

2012 Molina Healthcare, Inc.

Utilization Decreases With Length of Enrollment

12

As length of enrollment increases for our ABD populations, utilization decreases.

Admits per K

(manageable)

by enrollment month

Days per K

(manageable)

by enrollment month

Please refer to the Company’s cautionary statements.

Month

Month

Source: Molina CA ABD Length of Enrollment

289

252

276

259

231

261

237

229

225

215

1,239

1,154

1,238

1,044

1,113

1,060

902

939

1,119

926

1

2

3

4

5

6

7

8

9

10

1

2

3

4

5

6

7

8

9

10 |

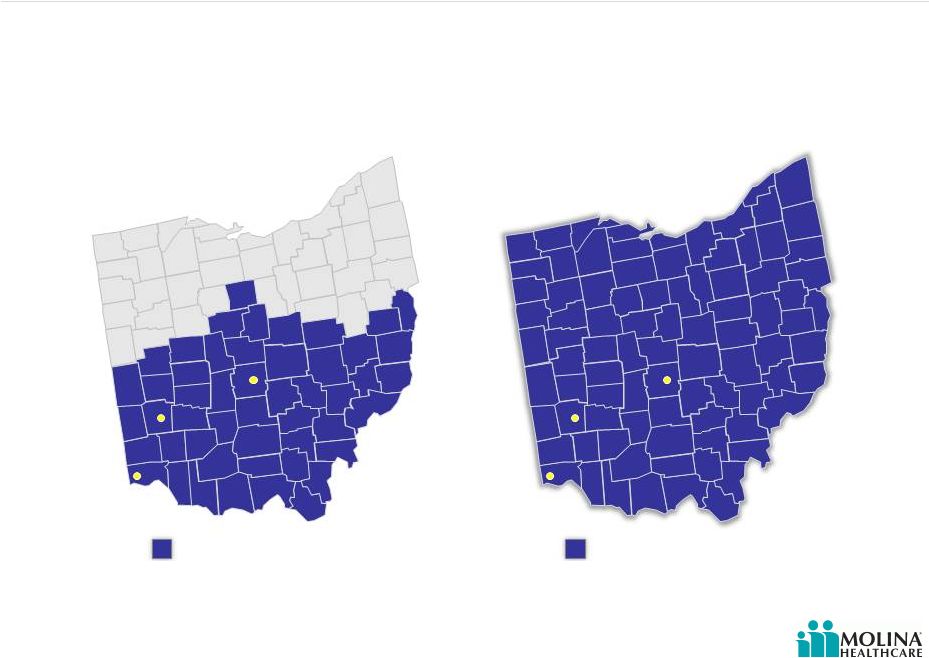

©

2012 Molina Healthcare, Inc.

Post-2012 RFA

Ohio Managed Care Regions

1.6M Eligibles

Ohio (TANF & ABD)

Source: Ohio Department of Job and Family Services

http://jfs.ohio.gov/rfp/JFSR1213078019/JFSR1213078019.stm

http://jfs.ohio.gov/ohp/bmhc/documents/reports/December2011_CFC_Penetration-Enrollment.pdf

13

Pre-2012 RFA

Current Molina Service Area

Effective June 1, 2013 Molina Healthcare will expand into 38 new

counties.

Dayton

Cincinnati

Columbus

Dayton

Cincinnati

Columbus

Current Molina service area

New Molina service area |

©

2012 Molina Healthcare, Inc.

Molina Selected To Serve Duals in Max Regions Allowed

14

The state of Ohio chose Molina to participate in the 3-year demonstration program in the

Southwest, West Central, and Central regions. Implementation expected to begin

June 1, 2013.

Current Molina Service Area

260,000 members (TANF+ABD)

Molina Integrated Care

Coordination Program Regions

45,000 dual eligibles

Dayton

Cincinnati

Columbus

Dayton

Cincinnati

Columbus

Central Region:

16,000 eligibles

South West Region:

17,000 eligibles

West Central Region:

12,000 eligibles |

©

2012 Molina Healthcare, Inc.

Washington

15

Successfully defended

Washington Medicaid

contract in 34 counties and

added one additional county,

effective 7/1/12

On September 1, enrollment was 410,000, including

19,000 ABD members

Established provider relationships

Molina was only health plan in Washington participating

in the Washington Medicaid Integration Program (WMIP)

No Long Term Care benefits for new Aged, Blind, or

Disabled (ABD) members |

©

2012 Molina Healthcare, Inc.

New Opportunities in Florida –

Long Term Care Program

Molina has bid in 8 of 11 regions (30 counties) with

90,000 beneficiaries to be shared by awarded MCOs

Molina Florida Experience

Nursing Home Diversion Program in Pinellas and

Hillsborough counties (Tampa area)

Waiver focused on intensive case management and

home and community based services vs. nursing home

placement

Timeline:

8/28/12 Bids Submitted

1/15/13 Anticipated Awards announced

8/1/13 Effective for first region awarded (Region #7);

other regions will “roll in”

each month through 3/2014

16

Florida is gradually moving toward

statewide Medicaid managed

care, Molina is competing for

contracts to provide long term

care for seniors.

The program involves nursing home, hospice, and home and

community-based services in 11 regions. The State of Florida

is expected to select 2-5 plans per region.

1. Regions: Pensacola, Tallahassee, Gainesville, Jacksonville, St.

Petersburg, Tampa, Orlando, Sarasota, Palm Beach, Ft. Lauderdale,

Miami

1 |

©

2012 Molina Healthcare, Inc.

New Opportunities in New Mexico –

Centennial Care

Overview:

Integrates medical, behavioral health, and long term care

services

680,000 beneficiaries

Plans must be statewide Special Needs Plan (SNP) or Medicare

Advantage plan

Reduces 7 MCOs to 5

Timeline:

11/20/12 Bids Due

1/7/13 Awards announced

1/1/14 Effective

17

Managed Care Organizations will

provide medical, behavioral

health, and long term care

services

which were previously

procured as separate contracts |

©

2012 Molina Healthcare, Inc.

MMS Comes of Age

18

MMS Operating Income by Quarter

Please refer to the Company’s cautionary statements.

The year over year improvement due to CMS certifications in

Idaho and Maine.

Diversifying profit stream

Generating cash flow

Serving 2.5M beneficiaries

($5.5M)

($0.2M)

($8M)

($6M)

($4M)

($2M)

$0M

$2M

$4M

$6M

$8M

$10M

$1.7M

$6.1M

$8.4M

$6.6M

©

2012 Molina Healthcare, Inc. |

Business

Overview J. Mario Molina, MD

Chief Executive Officer

September 19, 2012

New York, New York |

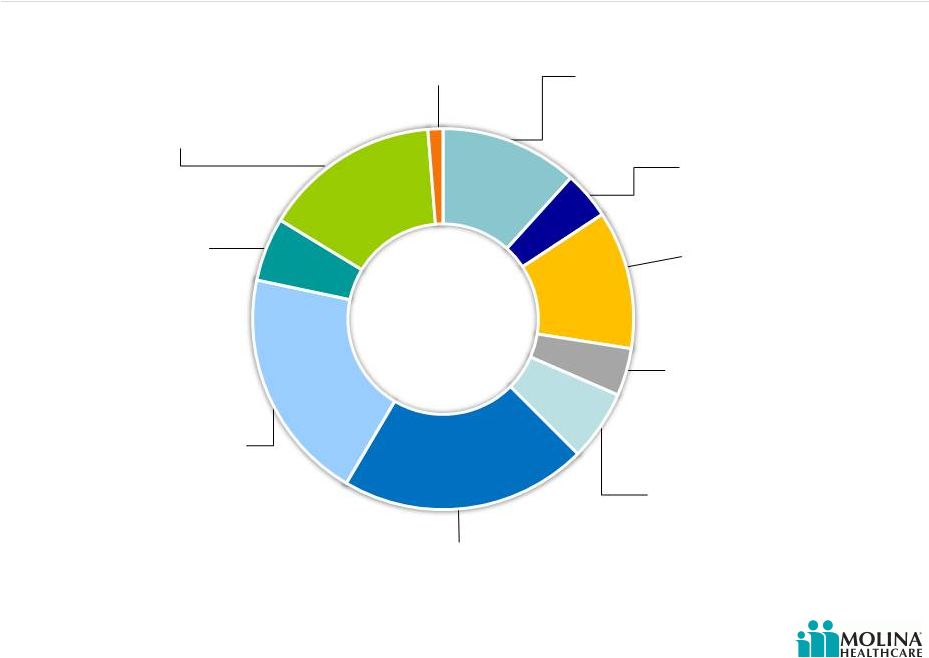

©

2012 Molina Healthcare, Inc.

Business Snapshot

Markets and members served –

2Q 2012

Washington

356,000

California

350,000

New Mexico

89,000

Utah

86,000

Texas

301,000

Michigan

220,000

Ohio

260,000

Florida

2

70,000

Health plan enrollment growth

Health plan membership profile

(in thousands)

Molina Healthcare Health Plans

Molina Medicaid Solutions

Idaho

Maine

Louisiana

West

Virginia

New

Jersey

1.

2.

3.

Virginia

1

Wisconsin

42,000

AGED,

BLIND

OR

DISABLED

MEDICARE 2%

76%

TANF

14%

CHIP

8%

20

Molina Direct Delivery

3

(1 clinic)

(17 clinics)

(2 clinics)

(1 clinic)

(3 clinics)

1,256

1,455

1,613

1,697

1,853

'08

'09

'10

'11

2Q 2012

Note: Map does not include Missouri since the contract ended June 30, 2012. However

the enrollment chart does. Virginia clinics provide Direct Delivery, operated by Molina and owned by Fairfax County. Florida has a managed

care program as well as a Pharmacy Rebate Program.

Company owned and operated primary care clinics. |

©

2012 Molina Healthcare, Inc.

Revenue Contribution by State

21

Washington 15%

Began serving ABD

population 7/1/2012

Utah 5%

RX carve-in effective

1/2013

Texas 20%

Medical management

initiatives implemented

Ohio 21%

Dual eligible contract in 3 regions

effective 2013; statewide

expansion effective 1/2013

Missouri 4%

Contract ended June 30, 2012

Michigan 12%

CSHCS effective 10/1/2012

Florida 4%

Submitted Long-Term Care

contract RFP

California 12%

Dual eligible contract in 4

counties effective 2013

Wisconsin 1%

PDR taken 2Q 2012

Please refer to the Company’s cautionary statements.

New Mexico 6%

RFP effective 1/2014

1H 2012 |

©

2012 Molina Healthcare, Inc.

Market Dynamics

State Budget Shortfalls

*Reported to Date

Source: Center on Budget and Policy Priorities.

Analysis using data from U.S. Department of Health

and Human Services, U.S. Department of Education,

Congressional Budget Office, and state budget

documents. June 2012.

Budget gaps offset by Recovery

Act and extension

Remaining budget gaps after

Recovery Act and extension

State Budget

Unemployment

ACA

Makes Medicaid

expansion optional for

states

11 million additional

Medicaid beneficiaries

Federal government

incurs 100% of the cost

of expansion for the first

3 years

2012 Elections

Budget shortfalls in billions

Unemployment

Nationwide through July 2012

22

Joblessness and slow

economic recovery

-$110

-$191

-$130

-$107

-$55*

Supreme Court Decision

2012 Elections |

©

2012 Molina Healthcare, Inc.

23

A History of Adapting to Constant Change

1980

Opened 3 Primary

Care Clinics

in

California

1997

Established

Utah

operation, the first

venture outside of

California

2006

Launched

Medicare SNP

product

2003

Completed

successful Initial

Public Offering

2010

Acquired

the

Health

Information Management

business from Unisys, now

Molina Medicaid Solutions

2013+

Medicaid

Expansion &

the dual eligible

1994

First

Medicaid

Managed Care

contract

(California)

2000

First

CHIP Managed

Care contract

(California)

C. David Molina, MD

Founder

Molina Healthcare, Founded 1980 |

©

2012 Molina Healthcare, Inc.

Long-Term Incremental Growth Drivers

24

Estimated additional revenue by 2015 as a result of duals and Medicaid expansion

4

Estimated 2015 run rate

Duals

1

Current

Health Plan

Business

ACA

2

Total

1.

Duals denote revenue potential for dual eligibles in CA, MI, OH and TX.

2.

ACA denotes revenue potential as a result of Medicaid expansion in CA, MI, OH, NM, UT, WA, WI;

and exchanges in CA, FL, MI, NM, OH, TX, UT, WA, WI. 3.

Other includes FL, MI, NM, TX, UT, WI.

4.

Figures may not add up due to rounding.

Please refer to the Company’s cautionary statements.

2012

2015

~$6B

~$4B

~$12B

CA: $1.2B

OH: $0.5B

TX: $1.5B

MI: $0.9B

OH: $0.5B

WA: $0.3B

CA: $0.3B

Other: $1.0B

3

~$2B |

©

2012 Molina Healthcare, Inc.

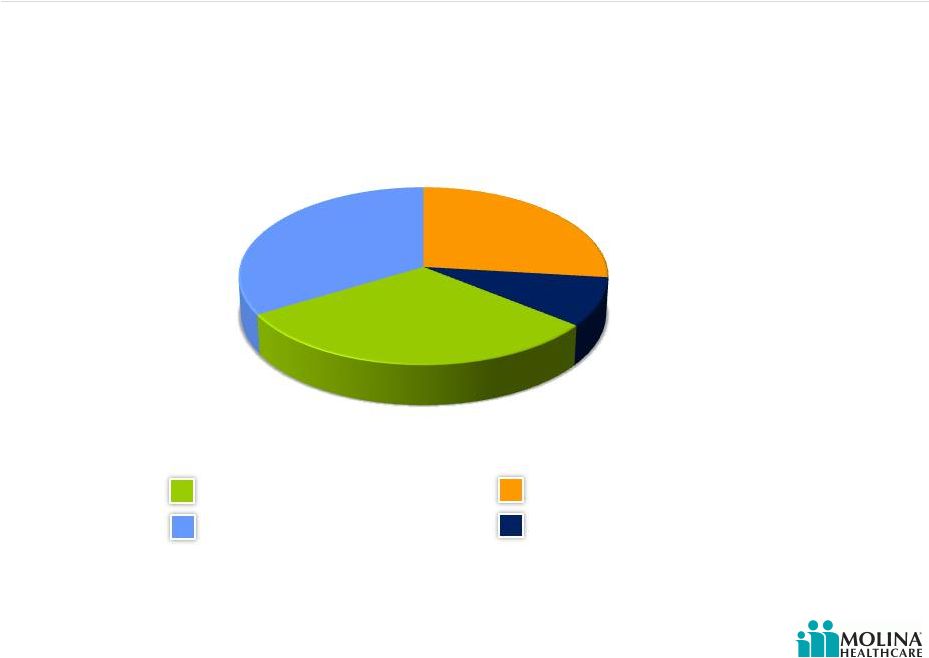

U.S. Medicaid Coverage Estimates Updated for the Supreme Court Decision

25

* Source:

Congressional

Budget

Office,

“Estimates

for

the

Insurance

Coverage

Provisions

of

the

Affordable

Care

Act

Updated

for

the

Recent

Supreme

Court

Decision.”

July

2012.

1.

The change in employment-based coverage is the net result of increases in and losses of

offers of health insurance from employers and changes in enrollment by workers and their families.

2.

Other includes Medicare; the effects of the ACA are almost entirely on nongroup coverage

. Medicaid

& CHIP

Exchanges

Employer

Nongroup

& Other

Uninsured

Estimated Changes in Insurance Coverage by 2022*

1

2

March 2012 Baseline

July 2012 Estimate Incorporating

SCOTUS Decision |

©

2012 Molina Healthcare, Inc.

Two Ends of the Continuum

26

Duals

TANF

More continuous eligibility

Chronic illnesses

Behavioral health

More likely to have greater

limitations in activities of

daily living (ADL)

Require more focused care

including home care

More likely to have a usual

source of care and less likely

to delay care due to cost

Breaks in eligibility

Episodic care

Pregnancy

Greater ethnic diversity

Larger support system at

clinic visits

Under

Age 65

38%

Over Age

65

62%

Under

Age 65

75%

Over Age

65

25%

TANF

ABDs

Duals

Demographics

Source: 1. KFF.org

TANF

Duals

1 |

©

2012 Molina Healthcare, Inc.

Most Common Diagnoses

27

TANF Diagnoses

ABD Diagnoses

Dual Eligibles Diagnoses

Inpatient Services

Delivery

Affective psychoses

Affective psychoses

Complications of delivery

Septicemia

Septicemia

Other maternal complications

Schizophrenic disorders

Care involving use of rehabilitation

procedures

Prolonged pregnancy

Chronic bronchitis

Pneumonia

Other OB

Pneumonia

Chronic bronchitis

Outpatient Services

Well Child care

Respiratory & other chest

Essential hypertension

Acute upper respiratory infection

Fever and fatigue

Respiratory and other chest

Respiratory & other chest

Diabetes mellitus

Diabetes mellitus

Fever and fatigue

Back disorders

Fever and fatigue

Ear infection

Joint disorders

Joint disorders |

©

2012 Molina Healthcare, Inc.

Specific Benefits for Duals

28

Medicaid Benefits*

Medicare Benefits

Hospital Insurance (Part A)

Blood, home health care, hospice care,

hospital inpatient stay, mental health

inpatient stay, skilled nursing facility

stay

Medical Insurance (Part B)

Blood, clinical laboratory services,

home health services, medical and

other services, outpatient mental

health services, outpatient hospital

services, other covered services

Medicare Prescription Drug

Coverage (Part D)

Copayments for Medicare services

Long Term Care

Institutional

HCBS (Home & Community Based

Services)

Personal Care

Adult Day Care

Home modifications

Meals

Paramedical/nursing services

Physical, speech, and occupational

therapies

Behavioral health

*Subject to state carve-outs

Sources: KFF.org, “Proposed Models to Integrate Medicare and Medicaid Benefits for Dual

Eligibles: A Look at the 15 State Design Contracts Funded By CMS” and Medicare.gov,

“Medicare costs at a glance” |

©

2012 Molina Healthcare, Inc.

We Currently Manage Many Dual Benefits

Benefits

California

(SPD Duals)

Washington

(WMIP)

Texas

(STAR+PLUS)

Personal Care

X

X

Nursing Home

Adult Day Care

X

X

X

Behavioral Health

X

X

Paramedical/Nursing Services

X

X

Meals

X

X

Physical, Speech, and

Occupational Therapies

X

X

X

Home Modifications

X

X

29 |

©

2012 Molina Healthcare, Inc.

CMS

Rate

Setting

Process

Guidance

30

Savings targets may differ among States with low historic

Medicare spending, low utilization of institutional long-

term care services, or a high penetration of Medicaid

managed care.

Sample Aggregate Savings Targets

Under the Demonstrations

Aggregate Savings would be applied to Medicare

A/B and Medicaid components of the rate

Both payers proportionally share in the

contribution to the capitation rate and in the

savings achieved

Savings targets not applied to the Part D

component of the rate

1

1.0%

3.0%

5.0%

Year 1

Year 2

Year 3

1. CMS Joint Rate Setting Process Under the Capitated Financial Alignment Initiative |

©

2012 Molina Healthcare, Inc.

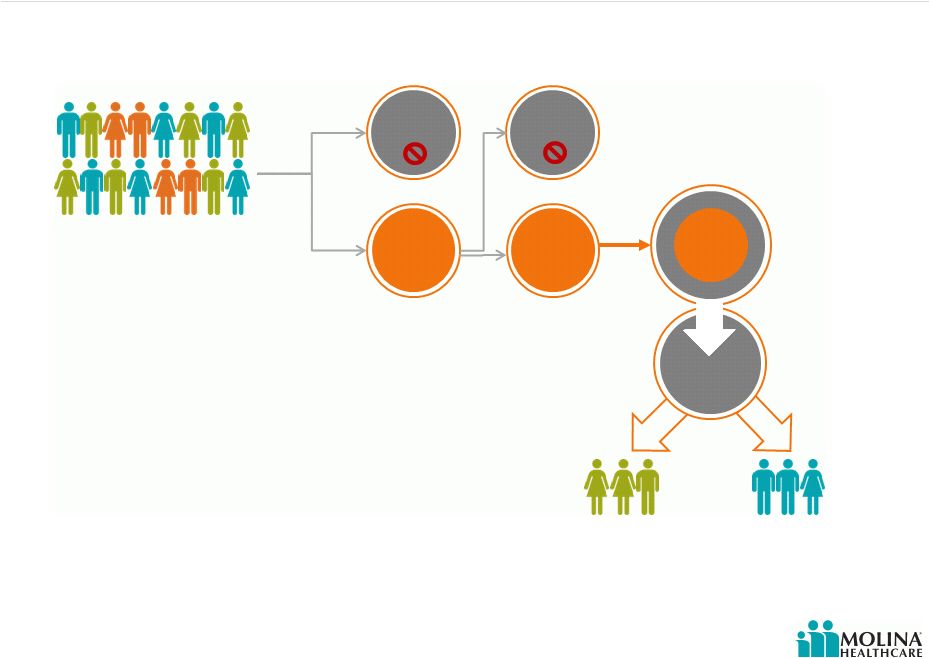

Opt Out Impact On Dual Premium

31

Auto

Assignment

Opt-Out

of Medicare

Managed

Care

?

Medicaid

Benefit Only

Medicaid + Medicare

Integrated Benefits

Yes

State/County/Region

Dual Eligible Population

No

Partial

Dual

Full Dual

D-SNP*

Parts A, B, D

Illustrative Example for California

*Specific to California example |

©

2012 Molina Healthcare, Inc.

Strategic Priorities

32

Mission

Priorities

Quality Care

Current Portfolio

Health plan business

MMS

Direct delivery

Growth

Organic growth

Medicaid expansion

Dual eligible population

Acquisitions

RFPs

Margin Expansion

Long-Term EBITDA target: 4% -

5% EBITDA margin

1.5%-2% after tax margin

Our mission is to provide quality

health services to financially

vulnerable families and individuals

covered by government programs. |

©

2012 Molina Healthcare, Inc.

Q&A

33 |

Long-Term

Growth September 19, 2012

New York, New York

John Molina,

Chief Financial Officer

Joseph White,

Chief Accounting Officer |

©

2012 Molina Healthcare, Inc.

Long-Term Incremental Growth Drivers

35

Estimated additional revenue by 2015 as a result of duals and Medicaid expansion

4

Estimated 2015 run rate

Duals

Current

Health Plan

Business

~$6B

~$4B

ACA

~$12B

CA: $1.2B

OH: $0.5B

MI: $0.9B

Total

1.

Duals denote revenue potential for dual eligibles in CA, MI, OH and TX.

2.

ACA denotes revenue potential as a result of Medicaid expansion in CA, MI, OH, NM, UT, WA, WI;

and exchanges in CA, FL, MI, NM, OH, TX, UT, WA, WI. 3.

Other includes FL, MI, NM, TX, UT, WI.

4.

Figures may not add due to rounding.

Please refer to the Company’s cautionary statements.

OH: $0.5B

WA: $0.3B

CA: $0.3B

Other: $1.0B

~$2B

2012

2015

1

TX: $1.5B

3

2 |

©

2012 Molina Healthcare, Inc.

Estimating Dual Revenue PMPM

36

Two Molina programs could help us estimate dual eligible premiums

Please refer to the Company’s cautionary statements.

1.

2.

Program

Medicaid &

Medicare

LTC

Total

Texas SNP

$1,900

$700

$2,600

WMIP

$1,700

$700

$2,400

Our

expectation

for

Dual

Eligible

premium

(Medicare

&

Medicaid

–

No

opt-out)

$2,500 PMPM

Note:

LTC based on Florida LTC RFP Region 11 Assumes 15% of

Integrated Dual population would be institutionalized LTC

1

2 |

©

2012 Molina Healthcare, Inc.

Opt Out Impact On Dual Premiums

37

Auto

Assignment

Opt-Out

of Medicare

Managed

Care

?

Medicaid

Benefit Only

Medicaid + Medicare

Integrated Benefits

Yes

State/County/Region

Dual Eligible Population

No

Partial

Dual

Full Dual

Parts A, B, D

Illustrative Example for California

10%

90%

Substantial

Uncertainty

~50%

10%

80%

Please refer to the Company’s cautionary statements.

*Specific to California example

D-SNP* |

©

2012 Molina Healthcare, Inc.

Dual Market Opportunity

State

Estimated Number of

Participating Duals in

Molina markets

Opt-Out Rate

Potential Range

Molina’s

Estimated Dual

Enrollment

Annualized

Premium

Revenues

California

430K

20% -

80%

50K

$0.9B -

$1.4B

Michigan

160K

20% -

80%

40K

$0.7B -

$1.0B

Ohio

50K

20% -

80%

25K

$0.4B –

$0.7B

Texas

215K

20% -

80%

60K

$1.1B -

$1.6B

Total

855K

175K

$3.1B -

$4.7B

38

Source: Company estimates; figures may not add due to rounding.

Please refer to the Company’s cautionary statements. |

©

2012 Molina Healthcare, Inc.

Medicaid Expansion Opportunity

State

Expansion Eligibles

in Medicaid

Managed Care

Molina’s

Estimated

Enrollment

Estimated

Premium

1

PMPM

Annualized

Premium Revenues

California

1M

100K

$100

$120M

Florida

not included

not included

not included

not included

Michigan

500K

100K

$125

$150M

New Mexico

100K

25K

$200

$60M

Ohio

500K

125K

$250

$375M

Texas

not included

not included

not included

not included

Utah

125K

40K

$200

$95M

Washington

250K

125K

$175

$260M

Wisconsin

125K

15K

$125

$20M

Total

2.6M

530K

$ 1.1B

39

Source:

1.

Based on Molina’s current TANF premium

Company estimates, figures may not add due to rounding. |

©

2012 Molina Healthcare, Inc.

Exchange Opportunity

State

Number of Exchange

Members in Molina

Markets

Molina’s

Estimated

Exchange

Enrollment

Estimated

Premium

1

PMPM

Annualized

Premium Revenues

California

2.2M

180K

$100

$ 215M

Florida

1.0M

80K

$150

$145M

Michigan

400K

35K

$125

$50M

New Mexico

100K

10K

$200

$25M

Ohio

500K

40K

$250

$120M

Texas

1.6M

125K

$225

$340M

Utah

200K

15K

$200

$40M

Washington

300K

30K

$175

$60M

Wisconsin

300K

20K

$125

$30M

Total

6.6M

535K

$1.0B

40

1.

Source: Company estimates, figures may not add due to rounding.

Based on Molina’s current TANF premium |

©

2012 Molina Healthcare, Inc.

Premium Rate Changes

41

1. Denotes announced rate changes.

Please refer to the Company’s cautionary statements.

Health Plan

Effective Date

Revenue Change

California

10/1/2012

unknown

Florida

9/1/2012

unknown

Michigan

10/1/2012

unknown

New Mexico

7/1/2012

(1)

Ohio

1/1/2012

(1)

Texas

9/1/2012

(1)

Utah

7/1/2012

(1)

Washington

7/1/2012

(1)

Wisconsin

1/1/2012

1%

(1)

( 0.5%)

( 2%)

4%

( 2%)

( 2%) |

Leveraging

Administrative Costs Two types of administrative costs:

Activities that improve healthcare outcomes

General & administrative costs (G&A)

42

Please refer to the Company’s cautionary statements.

©

2012 Molina Healthcare, Inc. |

©

2012 Molina Healthcare, Inc.

43

As a % of Total Revenue

Per Member Per Month (PMPM)

Cost by Category –

YTD 2012

2.6%

Please refer to the Company’s cautionary statements.

Activities That Improve Healthcare Outcomes

$5

Utilization

Management

Quality

Mgmt

Medical

Affairs

Service

Coordination

Health Education

Nurse Advice Line

Other

Utilization Management

Quality Management

Coordination of Medical Management

Coordination of Care, CM & DM

Health Education

Nurse Advice Line

Include the following services: |

Dual Eligibles

– Level of Care

Level IV

Level III

Level II

Level I

% of potential enrollees

10%

20%

30%

40%

At High Risk For

Institutionalization

Critical Event or Diagnosis Requiring

Extensive Medical Care

Medium-Risk Chronic Illness

Episodic Care –

No or Low Risk Factors

44

Please refer to the Company’s cautionary statements.

©

2012 Molina Healthcare, Inc. |

Dual Eligibles

Level of Care – Financial Impact

Greater portion of duals are categorized as care Level III

and Level IV

Require home visits

Require in-home care manager assessments and visits

Increased medical staffing especially for:

Care Managers (CM) & Nurse Practitioners (NP)

Community Connectors (CC)

Services of Medical Directors and Pharmacy Directors also

required

45

Please refer to the Company’s cautionary statements.

©

2012 Molina Healthcare, Inc. |

Not All

Activities That Improve Healthcare Outcomes Are Equal 46

Fixed Costs

Variable Costs

Please refer to the Company’s cautionary statements.

Utilization

Management

Quality

Mgmt

Medical

Affairs

Service

Coordination

Nurse Advice Line

Other

©

2012 Molina Healthcare, Inc.

Health Education |

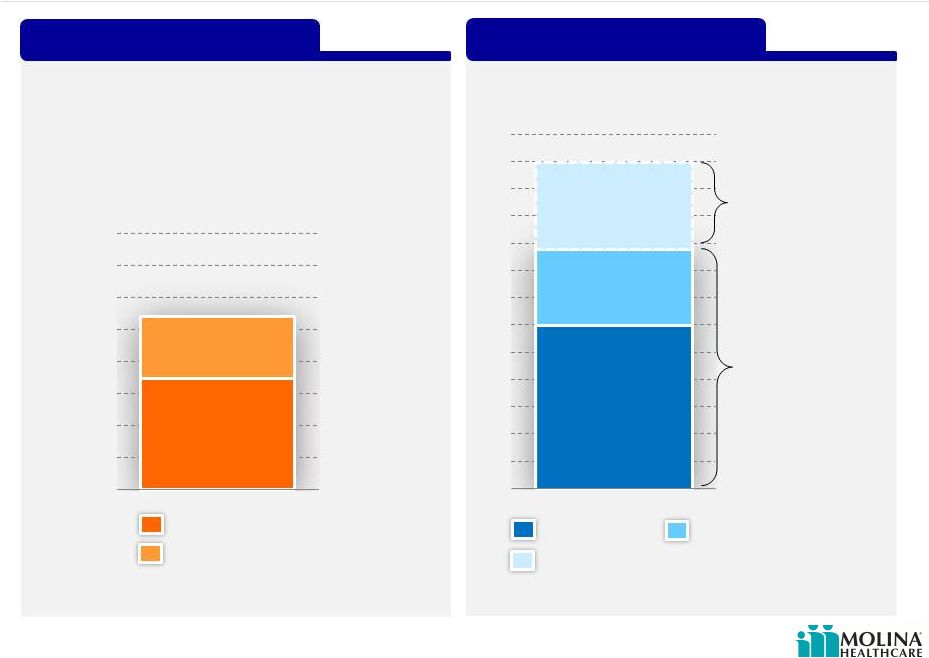

Estimated Costs

of Activities That Improve Healthcare Outcomes 47

As a % of Premium Revenue

Per Member Per Month

Current Cost

Incremental

Cost of

Dual Eligibles

(Model Care)

@ $2,500 premium

Estimated

@ $260 premium

as of June 30, 2012

Please refer to the Company’s cautionary statements.

$50

$6

2.2%

2.0%

Current

Dual Eligibles

Current

Dual Eligibles

©

2012 Molina Healthcare, Inc. |

©

2012 Molina Healthcare, Inc.

General & Administrative Costs

48

As a % of Total Revenue

Include the following:

Per Member Per Month (PMPM)

8.7%

8.6%

Cost

by

Category

–

YTD

2012

Please refer to the Company’s cautionary statements.

$16

$7

IT

Claims

Executive

Finance

Provider

Services

Legal

HR

Marketing

Sales

Other

Operations

2006

2007

2008

2009

2010

2011

Q2-

12

YTD

Health Plans

Corporate

8.4%

8.2%

8.0%

7.5%

8.5%

2006

2007

2008

2009

2010

2011

Q2-

12

YTD

Health Plans

Corporate

$14

$16

$17

$17

$19

$21

$23

Claims

Information Technology

Finance

Operations

Marketing

Provider Services

Legal

HR

Marketing

Medicare Sales |

Not All General

& Administrative Costs Are Equal 49

Please refer to the Company’s cautionary statements.

IT

Claims

Executive

Finance

Provider

Services

Legal

HR

Marketing

Sales

Other

Operations

Fixed Costs

Variable Costs

©

2012 Molina Healthcare, Inc. |

©

2012 Molina Healthcare, Inc.

Long-Term Admin Ratio Goal Below 8%

50

$23

$17

$25

$95

Corporate

Subsidiaries

G&A Ratio

G&A PMPM

Corporate

Subsidiaries

$16

$70

$10

$17

$7

$25

$7

$8

Current

Duals

ACA

Consolidated

6.0%

3.7%

5.8%

5.2%

2.5%

1.3%

4.2%

2.3%

Current

Duals

ACA

Consolidated

8.5%

10.0%

7.5%

5.0% |

Q&A

51

©

2012 Molina Healthcare, Inc. |

Funding Our

Growth John Molina

Chief Financial Officer

September 19, 2012

New York, New York |

©

2012 Molina Healthcare, Inc.

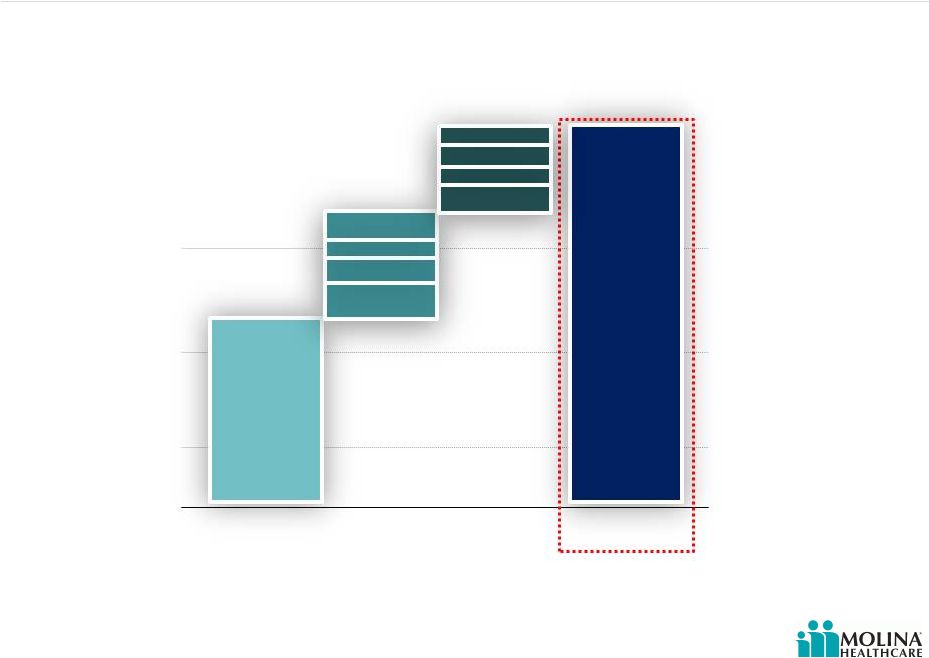

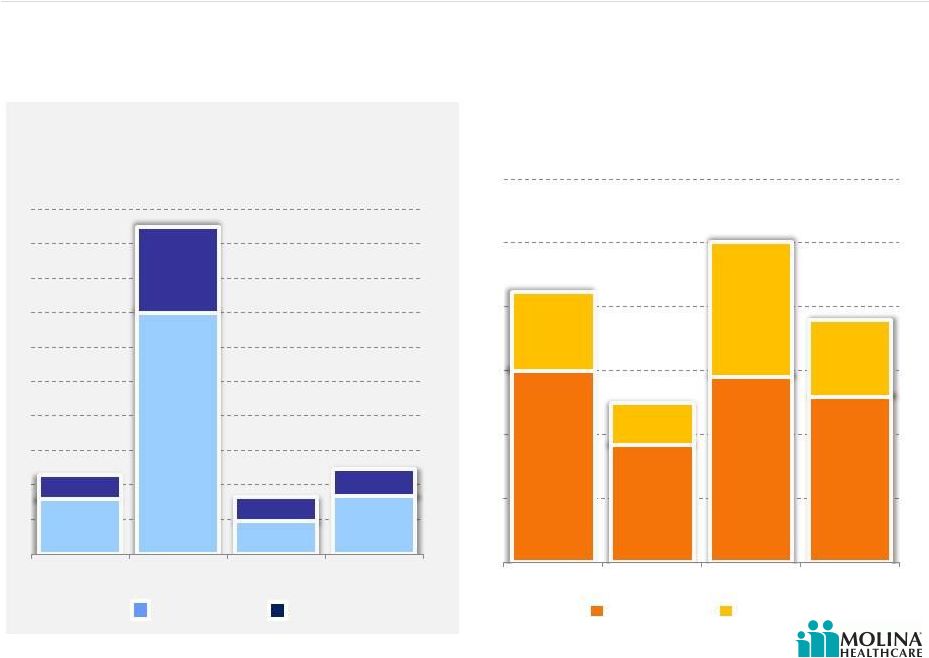

Molina Earnings Have Funded Past Growth

53

Sources of Capital

2006 through 2Q2012

Common Equity

Convertible Debt

Net Income

Source(s): SEC Filings

*CAGR calculated from 2006 to 2012E.

Please refer to the Company’s cautionary statements.

Total Premium Revenue

2006-2011

20%

46%

34%

$12B

$5B

$6B

$4B

$4B

$3B

$2B

$2B |

©

2012 Molina Healthcare, Inc.

Molina Has Invested to Grow Its Business

54

Cash Paid for Acquisitions

Contributions to Subsidiaries

Capital Expenditures

Share Repurchases

Source(s): SEC Filings and Company Data

Please refer to the Company’s cautionary statements.

Capital Deployment

2006 through 2Q2012

27%

9%

31%

33% |

©

2012 Molina Healthcare, Inc.

Earnings Margin 2006-1H2012

55

EBITDA MARGIN

AFTER TAX MARGIN

Please refer to the Company’s cautionary statements.

1. P denotes results excluding Missouri write-down in 2011, and Texas and Missouri

operations in 2012 1

1

1

1

2.3%

2.3%

1.9%

0.8%

1.3%

0.4%

1.7%

-0.7%

1.5%

Excluding

Missouri

write-down

Excluding

Missouri

write-down

Excluding

Texas and

Missouri

Excluding

Texas and

Missouri

H1N1 Flu

TX & OH

Startup

H1N1 Flu

TX & OH

Startup

4.9%

5.1%

4.6%

2.5%

4.1%

3.2%

4.6%

0.4%

3.3%

2006

2007

2008

2009

2010

2011

2011P

1H12

1H12P

2006

2007

2008

2009

2010

2011

2011P

1H12

1H12P |

©

2012 Molina Healthcare, Inc.

Estimated regulatory capital at 12/31/12

approximately $0.5B; compared to a

requirement of approximately $0.3B.

1. Denotes estimated required regulatory capital for 12.31.12

2. Excess assumes actual regulatory capital as of 6.30.2012

Regulatory Capital

Preparing for Growth

$0.3B

Surplus regulatory capital would contribute

to funding growth

Current Revenue

Growth Capacity with Existing

Growth Capacity

$0.2B

Excess

Regulatory

Capital

Required

Regulatory

Capital

$0.5B

Estimated

Revenues

Requiring

additional

Regulatory

Capital

1. Assumes estimated required regulatory capital for 12.31.12 and actual

regulatory capital as of 6.30.2012. Please refer to the Company’s cautionary

statements. $6B

$2.8B

$3.2B

Additional

regulatory capital

($0.2B); to fund up

to $12B of revenue

Existing

regulatory capital

($0.5B); funds up

to $8.8B of

revenue

$12B

56

2

1

1

1

Regulatory

Capital |

©

2012 Molina Healthcare, Inc.

57

Potential Capital Needs

Please refer to the Company’s cautionary statements.

Average 7%

Required Equity as % of Premium Revenue

2006 -

2Q2012*

*Denotes estimated required regulatory capital for 12.31.12 as a percentage of annualized

revenue for the six months ended 6.30.12. Source(s): Company Data

2Q2012*

Est. Incremental Capital Sensitivity

Low

Med

High

Base Revenue

$6B

$6B

$6B

Incremental

Revenue

$3B

$4.5B

$6B

Total Revenue

$9B

$10.5B

$12B

After Tax Margin

1.5%

1.5%

1.5%

Avg. Incremental

Cap Requirement

(%)

7.0%

7.0%

7.0%

Incremental Cap

Requirement ($)

($210M)

($315M)

($420M)

Pro-forma Net

Income @ 1.5%

$135M

$158M

$180M

Estimated 2012

Excess Capacity

$200M

$200M

$200M

Capital Need

$0M

$0M

$40M

7.9%

8.1%

6.8%

7.0%

7.0%

5.8%

6.1%

0%

2%

4%

6%

8%

10%

2011

2010

2009

2008

2007

2006 |

©

2012 Molina Healthcare, Inc.

Earnings Margin 2006-1H2012

58

EBITDA MARGIN

AFTER TAX MARGIN

Please refer to the Company’s cautionary statements.

1. P denotes results excluding Missouri write-down in 2011, and Texas and Missouri

operations in 2012 |

Why We Might Want

To Raise Capital? Acquisitions

Convertible debt repayment in 2014

Capital expenditures

Variability in profitability

Timing

New benefits

Growth above expectations

Desire for capital cushion (e.g. debt covenant and rating

agencies)

Excluded duals in WA and potential FL & TX ACA Medicaid

expansion

Regulatory capital in excess of minimum requirements

Regulatory requirements in advance of premium receipts

59

Please refer to the Company’s cautionary statements.

©

2012 Molina Healthcare, Inc. |

Investment

Highlights 60

Attractive sector growth prospects driven by

government policies and economic conditions

Proven flexible health care services portfolio (risk-

based, fee-based and direct delivery)

Diversified geographic exposure with significant

presence in high growth regions

Focus on government-sponsored health care

programs

Seasoned management team with strong track

record of delivering earnings growth

Over 30 years of experience

Please refer to the Company’s cautionary statements.

©

2012 Molina Healthcare, Inc. |

Q&A

61

©

2012 Molina Healthcare, Inc. |