Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - W. P. Carey Inc. | d410886d8k.htm |

Investing

for

the

Long

Run

TM

September 2012

Exhibit 99.1 |

Investing for the Long Run™

| 2

Disclosures

W.

P.

Carey

&

Co.

LLC,

W.

P.

Carey

Inc.,

and

CPA

®

:15

and

can

be

identified

by

the

use

of

words

such

as

“may,”

“will,”

“should,”

“would,”

“assume,”

“outlook,”

“seek,”

“plan,”

“believe,”

“expect,”

proposed

REIT

Conversion

and

Merger.

These

statements

are

based

on

the

current

expectations

of

the

management

of

W.

P.

Carey

&

Co.

LLC,

W.

P.

Carey

Inc.,

and

CPA

®

:15.

It

is

important

to

achievements

of

the

combined

company.

Discussions

of

some

of

these

other

important

factors

and

assumptions

are

contained

in

W.

P.

Carey

&

Co.

LLC’s,

W.

P.

Carey

Inc.’s,

and

CPA

®

:15’s

rules

and

regulations

of

the

SEC,

none

of

W.

P.

Carey,

CPA

®

:15

or

W.

P.

Carey

Inc.

undertakes

any

obligation

to

release

publicly

any

revisions

to

the

forward-looking

statements

to

reflect

events

impairments

and

stock

compensation.

Additionally,

we

exclude

merger

expenses

related

to

the

proposed

merger

with

CPA

®

:15,

which

are

considered

non-recurring,

and

gains/losses

in

real

Cautionary Statement Concerning Forward-Looking Statements:

Certain of the matters discussed in this communication constitute forward-looking statements

within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as

amended by the Private Securities Litigation Reform Act of 1995. The forward-looking statements

include, among other things, statements regarding the intent, belief or expectations of

“anticipate,” “intend,” “estimate,” “forecast” and other

comparable terms. These forward-looking statements include, but are not limited to, the “Investment Highlights” and statements regarding the

benefits of the proposed REIT Conversion and Merger, Stable Cash Flows from Long-Term Leases,

integration plans and expected synergies, the expected benefits of the proposed REIT Conversion

and Merger, anticipated future financial and operating performance and results, including estimates of growth and value creation, and the expected timing of completion of the

note that the combined company’s actual results could be materially different from those

projected in such forward-looking statements. There are a number of risks and uncertainties that could

cause actual results to differ materially from the forward-looking statements. Other unknown or

unpredictable factors could also have material adverse effects on future results, performance or

filings with the SEC and are available at the SEC’s website at http://www.sec.gov, including Item

1A. Risk Factors in the Annual Report on Form 10-K for the year ended December 31, 2011 of

W. P. Carey & Co. LLC as filed with the SEC on February 29, 2012. These risks, as well as other

risks associated with the proposed REIT Conversion and Merger, are more fully discussed in the

Joint Proxy Statement/Prospectus that is included in the Registration Statement on Form S-4 that

W. P. Carey Inc. filed with the SEC in connection with the proposed REIT Conversion and Merger

on March 23, 2012, as amended. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this communication may not occur. Readers are

cautioned not to place undue reliance on these forward-looking statements, which speak only as of

the date of this communication. Except as required under the federal securities laws and the

or circumstances after the date of this communication or to reflect the occurrence of unanticipated

events.

Non-GAAP Financial Disclosure We

believe that earnings before interest, taxes, depreciation and amortization (“EBITDA”) is a useful supplemental measure to investors and analysts for assessing the performance of our

business segments, although it does not represent net income that is computed in accordance with GAAP,

because it removes the impact of our capital structure and asset base from our operating

results and because it is helpful when comparing our operating performance to that of companies in our industry without regard to such items, which can vary substantially from

company to company. Adjusted EBITDA as disclosed represents EBITDA, as described herein,

modified to include other adjustments to GAAP net income for certain non-cash charges such as

estate, foreign exchange and derivatives which are not considered fundamental attributes of our

business plans and do not affect our overall long-term operating performance. We exclude these

items from Adjusted EBITDA as they are not the primary drivers in our decision making process.

Our assessment of our operations is focused on long-term sustainability and not on such non-

cash items, which may cause short term fluctuations in net income but have no impact on cash flows. We

believe that Adjusted EBITDA is a useful supplemental measure to investors and analysts for

assessing the performance of our business segments, although it does not represent net income that is computed in accordance with GAAP. Accordingly, EBITDA and Adjusted

EBITDA should not be considered as alternatives to net income as indicators of our financial

performance. EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of

other companies. Therefore, we use EBITDA and Adjusted EBITDA as two of the measures of our operating

performance when we formulate corporate goals, evaluate the effectiveness of our strategies,

and determine executive compensation. Funds from operations (“FFO”) is a non-GAAP measure defined by the National Association

of Real Estate Investment Trusts (“NAREIT”). NAREIT defines FFO as net income or loss (as

computed in accordance with GAAP) excluding: depreciation and amortization expense from real estate

assets, impairment charges on real estate, gains or losses from sales of depreciated real

estate assets and extraordinary items; however FFO related to assets held for sale, sold or otherwise

transferred and included in the results of discontinued operations are included. These

adjustments also incorporate the pro rata share of unconsolidated subsidiaries. FFO is used by

management, investors and analysts to facilitate meaningful comparisons of operating performance

between periods and among our peers. Although NAREIT has published this definition of FFO, companies

often modify this definition as they seek to provide financial measures that meaningfully

reflect their distinctive operations. We modify the NAREIT computation of FFO to include other

adjustments to GAAP net income to adjust for certain non-cash charges such as amortization of

intangibles, deferred income tax benefits and expenses, straight-line rents, stock compensation,

gains or losses from extinguishment of debt and deconsolidation of subsidiaries and unrealized

foreign currency exchange gains and losses. We refer to our modified definition of FFO as adjusted

funds from operations (“AFFO”). We exclude these items from GAAP net income as they are

not the primary drivers in our decision making process. Our assessment of our operations is focused on

long-term sustainability and not on such non-cash items, which may cause short-term

fluctuations in net income but have no impact on cash flows, and we therefore use AFFO as one measure

of our operating performance when we formulate corporate goals, evaluate the effectiveness of

our strategies, and determine executive compensation. We believe that AFFO is a useful supplemental measure for investors to consider because it will help them to better

assess the sustainability of our operating performance without potentially distorting the impact of

these short-term fluctuations. However, there are limits on the usefulness of AFFO to investors.

For example, impairment charges and unrealized foreign currency losses that we exclude may become

actual realized losses upon the ultimate disposition of the properties in the form of lower

cash proceeds or other considerations.

|

Investing

for

the

Long

Run™|

3

•

Largest owner/manager of triple net lease assets

•

Superior credit and real estate underwriting platform leveraged

across various industries and property types

•

Stable cash flows from long-term leases to creditworthy tenants

•

Solid

stream

of

fee

income

from

$7.5

billion

of

AUM

(1)

•

Access to capital (both public and private) provides capacity for

growth

•

Well-covered, stable dividend; expectation for continued growth

(1)

Excludes

CPA

®

:15

and

includes

cash

and

distributions

payable

as

of

June

30,

2012.

Investment

Highlights |

Background :

W. P. Carey & Co. LLC

(1)

Past performance does not indicate future results.

Investing for the Long Run™

| 4

•

Founded in 1973 and publicly

listed since 1998, W. P. Carey is

a leading global real estate firm

specializing in sale-leaseback

investments of corporate-owned

real estate worldwide

•

The Company’s REIT conversion

will expand its owned real estate

asset base and provide a

platform for future growth |

Our

Post-Merger Business Model

Manages

CPA

®

REITs

and

CWI

•

Manages $7.5 billion of net-leased real

estate

•

Generates approximately 17% of its

revenue in fee income from managing the

day-to-day operations of its real estate

investments

(3)

Owns

Diversified Net Lease Portfolio

•

Owns $5 billion of net-leased real

estate

(1)

•

Generates approximately 83% of its

revenue through rental income from

its owned assets

(2)

(1)

Includes

assets

for

WPC

and

CPA

®

:15

on

a

combined

basis

plus

cash

on

hand.

(2)

Revenues from real estate ownership = pro-rata net lease revenues.

(3)

Revenues

from

investment

management

=

asset

management

revenue

+

structuring

revenue.

(4)

Including our pro rata share of revenue from equity investments.

(5)

Excludes

reimbursed

costs

from

affiliates.

Investing for the Long Run™| 5

Combined

Company

2012E

Revenues

(4),

(5) |

Investing for the Long Run™

| 6

•

Generate attractive risk-adjusted returns by

identifying growing companies with real estate

assets globally

•

Create upside through lease escalations, credit

improvements and real estate appreciation

•

Protect downside by combining credit and real

estate underwriting with sophisticated structuring

and direct origination

•

Evaluate each transaction on:

creditworthiness of tenant

strategic importance of the asset to the tenant

the underlying value of the real estate

the transaction’s structure and pricing

Investment

Strategy |

Investing for the Long Run™

| 7

•

Alternative form of financing

•

Company sells its real estate for cash and enters into long-term lease

•

Long-term leases translate into steady cash flow

Sale-Leaseback

Process |

Combined company market capitalization

of approximately $5 billion

High-quality portfolio of premium assets

Investing for the Long Run™| 8

Combined Portfolio by Property Type

(3)

Combined Portfolio by Geography

(3)

(1) Reflects square feet on a pro rata basis. Excludes 20 domestic

self-storage properties in our Carey Storage subsidiary, totaling

approximately

0.5

million

square

feet

on

a

pro

rata

basis.

(2) Based on percentage of the portfolio’s total pro rata square footage

that was subject to lease. (3) Based on Annualized Contractual Minimum

Base Rent (“ABR”). (4)

Other

includes:

Child

Care

and

Social

Services;

Education;

Hospitality;

Sports;

Theater;

and

Unoccupied

Land.

REIT Conversion:

The Next Chapter

•

429 properties

•

39.1 million square feet

(1)

•

High-quality tenant base

•

97.6% occupancy

(2)

•

Diversified portfolio across geographies,

industries and property types

•

Average lease term of 8.9 years |

Investing for the Long Run™

| 9

Geographically

Diversified Portfolio |

Annualized

Rent ($’000)

% of

Total

Leading German Do-It-Yourself (DIY) retailer with a broad footprint across

Germany and Austria $24,813

8.2%

North America’s largest DIY moving and storage operator with nearly 16,000

locations across the U.S. and Canada; Annual revenues in excess of $2

billion 18,741

6.2%

World’s second-largest food retailer, based on sales, with over 15,000

stores across Europe, Asia and South America; Annual sales of

approximately $115 billion 15,774

5.2%

Leading European DIY retailer with more than 530 stores in central and eastern

Europe Private company owned by the Tengelmann Group

12,743

4.2%

Provides post-secondary education for professional automotive, collision

repair, motorcycle and marine technicians; Annual revenues in excess of

$100 million 10,065

3.3%

Leading

lodging

company

with

more

than

3,700

lodging

properties

in

73

countries;

Annual

revenues

in excess of $12 billion

8,406

2.8%

220

countries; Annual revenues in excess of $41 billion

7,433

2.4%

One of the largest retailer-owned hardware cooperatives with more than 4,700

stores worldwide 7,101

2.3%

Foster Wheeler is a leading international engineering, construction and project

management contractor and power equipment supplier; Annual revenues of

approximately $4.5 billion 6,510

2.1%

A leading global provider of information management and electronic commerce

systems for the financial services industry, with more than 16,000 clients

worldwide; Annual revenues in excess of $4 billion

5,342

1.8%

Top 10 Total

$116,928

38.5%

Investing for the Long Run™| 10

Note: Company financial and valuation metrics as per CapitalIQ.

Major Tenants –

Established Corporate Credits

Top 10 Tenants – Combined Company

World's #1 express transportation provider, delivering more than 8 million packages daily to |

Investing for the Long Run™

| 11

Stable Cash Flows

from Long-Term Leases

Lease Maturity Schedule (Combined Company)

•

Average lease term of 8.9 years

•

Low near-term rollover: 9.5% through 2014 |

•

99% of leases include either fixed or CPI-based rent increases or percentage

rent Investing for the Long Run™

| 12

Internal Growth from

Built-In Rent Increases

Built-In

Contractual

Rent

Increases

(Combined

Company)

(1)

(1) Based on annualized base rents and exchange rates as of June 30,

2012. |

Financial

Results |

Financial

Highlights

Investing for the Long Run™

| 14

•

Broad access to equity capital

–

Public –

REIT conversion will likely increase liquidity and access to public capital

–

Private

–

W.

P.

Carey

has

raised

$2.3

billion

via

CPA

®

:17-Global,

its

latest

non-

traded CPA

®

REIT offering

(1)

•

Conservative capital structure

–

Net Debt to Total Market Cap of 39%

–

Strategic use of non-recourse leverage

•

Well-covered dividend

–

WPC has increased quarterly dividends each of the past 45 consecutive

quarters –

Annual dividend growth has averaged 2.4% from 1998–2011

•

Matching debt financing and rental income currency to mitigate risk

(1)

As of June 30, 2012. |

Annualized Dividend per Share

Note: Annualized dividend per share reflects annualized fourth quarter

dividend per share for the respective year. Note: Past performance does not

guarantee future results. (1)

Reflects pro forma annual dividend per share following transaction close to

maintain compliance with REIT requirements. Subject to modification.

Combined Company

Supports Continued Dividend Growth

Investing for the Long Run™

| 15

Pro Forma Dividend Well Covered

•

Payout ratio of 68%, based on results through

June 30, 2012 and current dividend of $2.27 per

share

•

Pro forma dividend of $2.60 supported by a

strong payout ratio of 70%

(1)

Consistent Historical Growth

•

W. P. Carey has increased its dividend every

year since going public in 1998

•

Transaction expected to be accretive to both

AFFO and CAD per share, providing for

continuation of stable dividend growth |

Investing for the Long Run™

| 16

Note: Past performance does not guarantee future results.

(1)

Does not include special dividends.

Dividend is

Well-Covered

Payout

Ratio

63%

51%

71%

55%

56%

63%

65%

62%

46%

Funds

from

Operations

Coverage

(1) |

Investing for the Long Run™

| 17

Note: Past performance does not guarantee future results.

Source: SNL Financial LC, Charlottesville, VA, 2012, www.snl.com

Returns have outpaced major indices, including the S&P 500 and the

FTSE NAREIT Equity REIT Index

Five-Year Total

Return Comparison

Five-Year Total Return Comparison |

CPA®

Program

Performance

Investing for the long run™

| 18

Program

Program Life

Total Return as

% of Original

Investment

Average Annual

Total Return

IRR

CPA

®

:1

1979-1998

237%

7.2%

7.0%

CPA

®

:2

1980-1998

369%

14.9%

13.2%

CPA

®

:3

1981-1998

408%

18.8%

15.1%

CPA

®

:4

1983-1998

310%

13.9%

12.2%

CPA

®

:5

1984-1998

210%

7.7%

8.6%

CPA

®

:6

1985-1998

264%

12.5%

10.6%

CPA

®

:7

1987-1998

215%

10.2%

9.8%

CPA

®

:8

1988-1998

229%

13.1%

11.5%

CPA

®

:9

1989-1998

184%

9.6%

9.3%

CPA

®

:10

1990-2002

208%

8.8%

8.6%

CPA

®

:11

1992-2004

242%

11.2%

9.6%

CPA

®

:12

1994-2006

236%

10.9%

9.4%

CPA

®

:14

1998-2011

217%

9.0%

8.2%

Average

13 years

256%

11.4%

10.2%

Note: Calculated assuming investment at program inception.

|

Fees Earned from

Asset Management

Investing for the long run™

| 19

1)

2)

3)

WPC

earns

contractual

fees

as

Advisor

to

the

CPA

®

REITs

and

CWI

Acquisition Fee

(1)

4.5%

Asset Management Fee

(2)

0.5% per annum

Cash flow participation

(3)

10%

Back-end participation

15% of gain

We generally earn base asset management revenue of 0.5% of average invested

assets. We

generally

receive

structuring

revenue

of

up

to

an

average

of

4.5%

of

the

total

cost

of

all

investments

made

by

each

CPA

®

:

REIT.

For

certain

types

of

non-long

term

net

lease

investments

acquired on behalf of CPA

®

:17 –

Global, structuring revenue may range from 0% to 1.75% of the equity invested plus

the related structuring revenue. For CWI, we earn structuring revenue of 2.5%

of the total investment cost of the properties acquired.

We

receive

up

to

10%

of

distributions

of

available

cash

from

the

operating

partnerships

of

CPA

®

:16

–

Global,

CPA

®

:17

–

Global,

and

CWI,

which

is

defined

as

cash

generated

from

operations,

excluding

capital proceeds, as reduced by operating expenses and debt service, excluding

prepayments and balloon payments. |

Investing for the Long Run™

| 20

1)

Based on September 12, 2012 closing prices, pro forma AFFO of $3.72 for WPC and

consensus estimates for peer group which includes NNN, O, EPR, and LXP.

Source: SNL Financial 2)

Based on September 12, 2012 closing prices, pro forma dividend of $2.60 for

WPC. 3)

O represents the proposed merger of Realty Income and American Realty Capital Trust.

Figures for the combined company O were obtained from its proposed merger

investor presentation. 4)

Book value debt was used for Debt / EV ratios

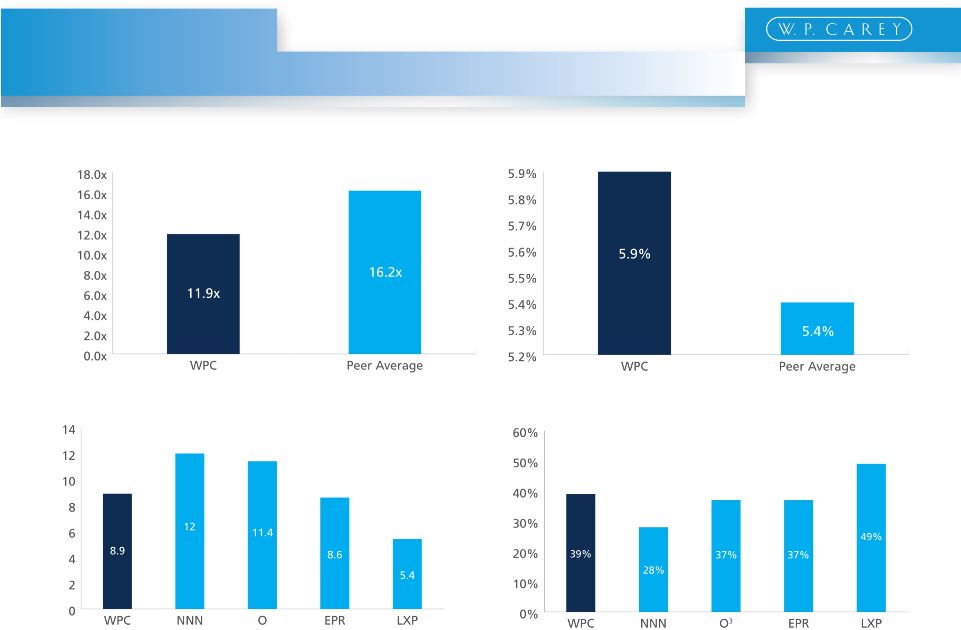

Peer Analysis

Price / AFFO

(1)

Dividend Yield

(2)

Weighted Average Lease Term (Yrs)

Leverage

(4)

3 |

Investing for the Long Run™

| 21

Strong Pro Forma

Balance Sheet

Combined Company

1)

Based on annualized YTD June 2012 results.

2)

Based on September 12, 2012 closing price of $44.33.

3)

Includes outstanding recourse debt on the unsecured line of credit.

Equity Market Capitalization

$3.1 billion

Total Debt

$1.9 billion

Total Capitalization

$5.0 billion

Selected Metrics

Total Debt / Total Market Cap.

39%

Net Debt / Total Market Cap.

34%

Pro Rata Adjusted EBITDA

(1)

$391 million

Net Debt / Pro Rata Adjusted EBITDA

Pro Forma Dividend

Pro Forma AFFO Per Share

Dividend Yield

(2)

5.9%

Dividend Payout

69.9%

% Investment Grade Tenants

30.4%

Combined Company Metrics

Debt Maturity Schedule

4.46x

$2.60

$3.72 |

The

Transaction |

Benefits of the Merger

Investing for the Long Run™

| 23

Benefits of the

Transaction

Likely increased Wall Street research

coverage

Potential inclusion in REIT indices

Shareholders’

ability to benchmark W. P.

Carey against similar triple net lease REITs

Increased float and liquidity

Enhances W. P. Carey’s access to capital

markets

Creates better currency to pursue potential

future growth opportunities

Provides simplified tax reporting for

shareholders

Creates potential long-term valuation benefits

including:

Benefits of REIT Conversion

Supports W. P. Carey’s overall strategy and

significantly grows W. P. Carey’s high-quality

real estate asset base

Substantially increases W. P. Carey’s

scale

and

liquidity

–

pro forma equity value

of approximately $3 billion

Provides platform for future growth

Expected to be accretive to AFFO and CAD

per share, further improving coverage of W.

P. Carey’s secure dividend

Increases income contribution from owned

properties while preserving asset

management platform

Enhances W. P. Carey’s world-class asset

management platform |

Key

Operational Metrics as of June 30, 2012

Investing for the long run™

| 24

AFFO/MFFO ($m)

(a)

Per share

135.8

$3.33

115.1

$0.88

Pro Rata Adjusted EBITDA ($m)

(a)

Per share

219.2

$5.37

187.0

$1.42

Annualized Contractual Minimum

Base Rent ($m)

84.7

219.4

Weighted Avg. Lease Term

6.4

9.9

Number of Properties

148

305

Square Footage (m)

11.6

27.5

Weighted Avg. Occupancy

94.4%

99.1%

Top 10 Tenant Concentration

54.8%

48.3%

% of Investment Grade Tenants

47.0%

24.0%

LLC

CPA

®

: 15

WPC

“LLC”

represents

the

actual

results

for

the

six

months

ended

June

30,

2012

or

the

current

position

as

of

June

30,

2012.

“CPA

®

”

represents

the

actual

results

for

the

six

months

ended

June

30,

2012

or

the

current

position

as

of

June

30,

2012.

“WPC”

represents the pro forma results for the six months ended June 30, 2012 or the pro

forma position as of June 30, 2012, had the All portfolio information

contained herein is based on pro rata annualized contractual minimum based rent and pro rata square footage.

Based on annualized YTD June 2012 results..

256.7

$3.72

391.4

$5.67

304.1

8.9

429

39.1

97.6%

38.5%

30.4%

Basis of Presentation

•

•

•

•

merger occurred on January 1, 2012.

15

:

a) |

APPENDIX |

Investing for the Long Run™

| 26

Blue Cross and Blue Shield of Minnesota

Facility Type

Six-building headquarters campus

and two additional properties

Purchase Price

$169 million

Location

Minneapolis, Aurora and Virginia, MN

•

Blue Cross of Minnesota was chartered in 1933 as Minnesota's first health plan

•

Blue Cross health plan is the largest health plan in Minnesota with $2.8 billion

in total revenues and 41% market share

•

The company is a conservatively run organization with strong capitalization

and no long term debt

Investment

Strategy |

Investing for the Long Run™

| 27

The New York Times Company

Facility Type

Global Headquarters

Purchase Price

$234 million

Location

New York City

•

Constructed for approximately $500 million in 2007

•

Purchased for $234 million -

40% of the appraised value of the asset

•

15-year lease, initial cap rate of 10.75%, fixed annual escalations

•

Facility houses NYT’s senior executive team and main news desk –

critical to the entire enterprise

•

Transaction closed in March 2009

Investment

Strategy |

Investing for the Long Run™

| 28

C1000 B.V.

Facility Type

Portfolio of 6 logistics properties leased

on a long-term triple net basis

Purchase Price

$208 million

Location

Netherlands

•

C1000

B.V.

is

a

leading

Dutch

supermarket

with

371

stores

across

the

Netherlands

•

Portfolio of 6 logistics properties represents the complete distribution network

of C1000, supplying all of its supermarket stores in the country

•

C1000 and its franchisee network comprise the second largest food retailer

in the Netherlands

•

Annual sales of €3.7 billion

Investment

Strategy |

Investing for the Long Run™

| 29

Metro A.G.

Facility Type

20 cash and carry stores

Purchase Price

$396 million

Location

Throughout Italy

•

Lease is guaranteed by its German parent company, Metro A.G.

•

Metro A.G. is the world’s largest cash and carry operator and third largest

retailer, with 2011 revenues totaling €66 billion

•

Facilities represent half of Metro’s Italian presence

Investment

Strategy |

Case Study –

New Lease

Investing for the long run™

| 30

Google, Inc.

Venice, CA

Background

•

Acquirer:

WPC

•

Initial

Acquisition:

1994

•

Square

Feet:

67,682

•

Original

Tenant:

Omnicom

Group

•

Omnicom

Lease

Expiration:

9/2010

•

Annual

Rent:

$1.2M

($17.64

PSF)

Opportunity

•

Landmark Frank Gehry Designed

“Binoculars Building”

•

Omnicom opted not to renew

•

Communication w/Omnicom Management

provided early visibility on non-renewal

•

Enforced deferred maintenance

•

Commenced marketing with Omnicom still

on lease

•Worked With Adjacent Landlords to Create a 200,00

SF Campus, Transforming Downtown Venice

•Landlord & tenant contributed capital for gut

renovation

•15-year lease, Annual Rent ~$30 PSF •Limited Downtime: Less than 4 months of vacancy

•Placed $24M,

15-year, Non-Recourse Mortgage @ 5.15%

Outcome |

Case Study –

Opportunistic Disposition

Investing for the long run™

| 31

Best Buy Co. Inc.

National Big Box Portfolio

Background

•

Acquirer:

CPA

®

:14

(37%)

&

CPA

®

:15

(63%)

•

Initial

Acquisition:

1993

•

Acquisition

Cost:

$46M

•

Square

Feet:

452,348

(12

stores)

•

Annual

Rent:

$4.2M

($17.64

PSF)

•

Remaining

Lease

Term:

6.5

years

Opportunity

•

Partial renewal rights

•

Above-market contract rent

•

Strong avg. store sales, but wide range

•

70% of rent from large-format stores

•

BBY telegraphed shift from large format

•

Sold Portfolio on 9/1/11 for $53.3M (7.7% cap, $118 PSF)

•

Retail REIT capital imbalance: Lack of retail product

•

Challenging $23M mortgage maturity in 2012

•

Ran accelerated marketing process

•

BBY subsequently downgraded to BB+ on 8/6/12, 4 stores

already closed, 30% of rent

Outcome |

Case Study –

Opportunistic Disposition

Investing for the long run™

| 32

Médica France, S.A.

Nursing Homes in France

Background

•

Acquirer:

WPC

(46%)

&

CPA

®

:15

(54%)

•

Initial

Acquisition:

2002

•

Acquisition

Cost:

$43.5M

•

Square

Feet:

336,923

(6

nursing

homes)

•

Annual

Rent:

$6.2M

($18.40

PSF)

•

Remaining

Lease

Term:

9.5

years

Opportunity

•

Lease extended to 12 years in 2009

•

Exchange Rate €1:$1.00 at acquisition,

€1:$1.34 at time of sale

•

20-year old assets would require significant

capex if leases not renewed

•

Beneficial tax structure began to erode

•

Assumable debt

•

Sold Portfolio on 4/11/12 for $74.5M (6.2% cap, $222

PSF)

•

Off-Market sale to large French REIT with expertise in

nursing homes

•

Buyer also funded 50% of tax costs

•

Buyer assumed in-place debt, saving $4.4M in prepayment

penalties

Outcome |

Case Study –

Strategic Disposition

Investing for the long run™

| 33

Shoprite Supermarkets

Hudson Valley Area of NY

Background

•

Acquirer:

CPA

®

:14

(44%)

&

CPA

®

:15

(66%)

•

Initial

Acquisition:

1992,

1993

•

Acquisition

Cost:

$20.1M

•

Square

Feet:

196,590

(3

grocery

stores)

•

Annual

Rent:

$3.3M

($16.91

PSF)

•

Remaining

Lease

Term:

~12

years

Opportunity

•

Store Competition: Each location threatened by

pending Wal-Mart or Price Chopper

•

One strong store masked looming competition &

weak locations

•

Low renewal probability

•

$13.5M of near-term debt maturing, refi possible,

but not optimal value

•

10+ years of remaining term = liquidity

•

Sold Portfolio on 12/31/2011 for $37.1M (8.97% cap,

$228 PSF)

•

Able to market broadly as investment sale (lease term)

•

Sold at 5% premium to base case underwritten value, 20%

premium to downside case

•

Prior experience had shown potential for the degradation of

value

on

2

nd

generation

grocery,

exited

at

peak

valuation

Outcome |

Case

Study

–

Early Lease Extension

Investing for the long run™

| 34

Dr. Pepper Snapple Group

Houston & Irving, TX

Background

•

Acquirer:

WPC

•

Initial

Acquisition:

1989

•

Acquisition

Price:

$28.4M

•

Original

SF:

721,947

(2

Bottling

Plants)

•

Current

Expanded

SF:

1.27

MSF

•

Annual

Rent:

$5.0M

($3.52

PSF)

•

Remaining

Lease

Term:

2

years

Opportunity

•

Critical facilities-tenant expanded each

facility over time with own capital

•

Irving is largest Dr. Pepper plant

•

Relationship w/Dr. Pepper management

opened dialog with Dr. Pepper supply chain

team

•

$26M mortgage maturing in 2015

Extended Lease on 8/8/12 to 17 yrs in Exchange for 10%

Immediate Rent Reduction

Increases unlevered DCF value by ~$6M vs. base case

Long-Lease Term = Attractive Long Term Financing Options

Refinancing will generate ~$12M in excess proceeds w/ long

amortization at historically low rates

Outcome |

Investing for the Long Run™

| 35

W. P. Carey Inc.

Consolidated AFFO

AFFO Accretion / (Dilution) Per Share Buildup

Note: See next page for footnotes.

W. P. Carey Inc. Consolidated AFFO

30-Jun-12

W.

P.

Carey

Inc.

Shares

LLC

2012

Wtd

Avg.

Standalone

Shares

(per

10Q)

(a)

40,828,646

CPA

®

:15

2012

Wtd

Avg.

Standalone

Shares

(per

10Q)

(b)

131,657,978

Exchange Ratio

0.2326x

Shares Issued

28,192,415

W. P. Carey Inc. Shares Outstanding

69,021,061

$'000, except per share data

YTD Jun-12

$ Amount

$ / Share

Impact

Cumulative

Acc / (Dil)

YTD Jun-12

AFFO / Share

Annualized

AFFO / Share

W. P. Carey Inc. AFFO Calculation

Standalone LLC AFFO

(c)

67,892

1.66

1.66

3.33

Primary Accretion / (Dilution) Drivers

1. Dilutive Impact of New Share Issuance

-

(0.68)

(0.68)

0.98

1.97

2. CPA

®

:15

Contribution to

New Co

AFFO

(d)

57,367

0.83

0.15

1.81

3.63

3. (+)

Provision

for

income

taxes

(e)

Tax Savings from foregone Asset Mgmt Revenues

6,354

0.09

0.24

1.91

3.81

4. (+) Deferred taxes

(e)

Lost taxes deferred on CPA

:15 mgmt fees paid in shares

2,200

0.03

0.28

1.94

3.88

5. (+)

Distributions

from

Equity

Investments

in

CPAs

(f)

Foregone AFFO proceeds from LLC's CPA

:15 investment

(4,540)

(0.07)

0.21

1.87

3.75

Adjustments for Primary Accretion / (Dilution) Drivers

61,381

0.21

0.21

1.87

3.75

Acquisition Debt Interest Expense Impact

6. (-) Interest expense

(g)

Acquisition Debt Interest Expense

(944)

(0.01)

0.20

1.86

3.72

Adjustments for Acquisition Debt Interest Expense Impact

(944)

(0.01)

0.20

1.86

3.72

Elimination

of

Asset

Management

Fees

7. (-)

Asset

Management

Revenue

(h)

LLC Fee Revenues no longer received from CPA

:15

(12,418)

(0.18)

0.02

1.68

3.36

8. (+) Property expenses

(h)

CPA 15 Mgmt Fee Expense No Longer paid to LLC

12,418

0.18

0.20

1.86

3.72

Adjustments for Elimination of Management Fees

-

-

0.20

1.86

3.72

W. P. Carey Inc. Consolidated AFFO

128,329

1.86

0.20

1.86

3.72

®

®

®

® |

a)

Per W. P. Carey’s Form 10-Q for the period ended June 30, 2012.

b)

Per CPA

®

:15’s Form 10-Q for the period ended June 30, 2012.

c)

For

a

reconciliation

of

W.

P.

Carey’s

Net

Income

for

the

six

months

ended

June

30,

2012

to

Funds

from

Operations

–

as

Adjusted

(AFFO),

see W. P. Carey ’s Form 10-Q for the period ended June 30, 2012.

d)

CPA

®

:15’s

contribution

to

W.

P.

Carey,

Inc.

AFFO

represents

MFFO

of

$57.5

million

as

filed

in

CPA

®

:15’s

Form

10-Q

for

the

period

ended

June 30, 2012, adjusted by $0.2 million related to acquisition expenses and

accretion of discounts and amortization of premiums on debt

investments.

For

a

reconciliation

of

CPA

®

:15’s

Net

Income

Attributable

to

CPA

®

:15

Stockholders

for

the

six

months

ended

June

30,

2012

to

Modified

Funds

from

Operations

(MFFO),

please

see

CPA

®

:15’s

Form

10-Q

for

the

period

ended

June

30,

2012.

e)

In

light

of

the

pending

merger

of

CPA

®

:15

and

W.

P.

Carey,

asset

management

and

other

taxable

revenues

have

been

eliminated.

The

adjustments of $6.4 million and $2.2 million for the six months ended June 30, 2012

reflect tax benefits related to the elimination of these transactions.

f)

Reflects

adjustment

to

eliminate

the

impact

on

AFFO

of

distributions

from

W.

P.

Carey’s

equity

investment

in

CPA

®

:15

as

a

result

of

the

pending merger.

g)

Reflects

an

increase

in

interest

expense

of

$0.9

million

for

the

six

months

ended

June

30,

2012

from

the

$175

million

new

line

of

credit

and

expected repayment of $113 million of the pre-existing line of credit.

h)

Reflects

adjustments

to

eliminate

activities

between

W.

P.

Carey

and

CPA

®

:15

in

the

respective

historical

financial

statements,

as

all

such

revenues, expenses and interests would have been eliminated in consolidation had

the merger occurred on January 1, 2011. Investing for the Long Run™ | 36

W. P. Carey Inc.

Consolidated AFFO: Footnotes |

Investing for the Long Run™

| 37

W. P. Carey Inc.

Consolidated EBITDA

Note: See next page for footnotes.

EBITDA Per Share

W. P. Carey Inc. Pro Rata Adjusted EBITDA

$'000, except per share data

YTD Jun-12

$ Amount

$ / Share

Impact

Cumulative

Acc / (Dil)

YTD Jun-12

EBITDA / Share

Annualized

EBITDA / Share

W. P. Carey Inc. Adjusted EBITDA Calculation

Standalone LLC EBITDA

(a)

72,614

1.78

1.78

3.56

Proportionate share of adjustments for joint ventures

1. Proportionate share of adjustments from equity method investments

(b)

34,496

0.84

2.62

5.25

2. Proportionate share of adjustments for noncontrolling interests

(b)

(1,359)

(0.03)

2.59

5.18

Adjustment for joint ventures

33,137

0.81

2.59

5.18

Management adjustments)

3. (+) Impairments

6,727

0.16

2.75

5.51

4. (-) Gain on sale

(1,505)

(0.04)

2.72

5.44

5. (+) Stock Compensation

9,755

0.24

2.96

5.91

6. (+) Realized and Unrealized Loss on FX and Derivatives

542

0.01

2.97

5.94

7. (+) Merger Expenses

4,719

0.12

3.09

6.17

8. (-) Proportionate share of adjustments from equity method investments

(d)

(16,386)

(0.40)

2.68

5.37

Management adjustments

3,853

0.09

2.68

5.37

CPA

®

:15 contribution to EBITDA

9. (+) CPA

®

:15 EBITDA per 10Q

(e)

118,664

1.72

1.72

4.40

8.81

10. Proportionate share of adjustments from equity method investments

(b)

11,746

0.17

1.89

4.57

9.15

11. Proportionate share of adjustments for noncontrolling interests

(b)

(15,512)

(0.22)

1.66

4.35

8.70

12. (-) Management Adjustments

(c)

(21,398)

(0.31)

1.35

4.04

8.08

CPA®:15 contribution to EBITDA

93,500

1.35

1.35

4.04

8.08

Consolidation Adjustments

13. Dilutive Impact of New Shares Issuance

-

(1.10)

0.26

2.94

5.89

14. (-) Elimination of LLC's ownership in CPA

®

:15's Prorata Adjusted EBITDA

(f)

(7,387)

(0.11)

0.15

2.84

5.67

Consolidated Adjustments

(7,387)

(1.20)

0.15

2.84

5.67

Combined Adjusted EBITDA

195,718

2.84

0.15

2.84

5.67

(c) |

a)

Per

W. P.

Carey’s

Form

8-K

disclosing

Supplemental

Unaudited

Operating

and

Financial

Data

for

the

period

ended

June

30,

2012.

b)

Incorporates the pro rata share of depreciation, amortization, interest and tax

provision adjustments for unconsolidated subsidiaries and joint

ventures.

c)

Represents adjustments to EBITDA to add impairments, stock compensation, merger

expenses, gain or losses on the sale of real estate, as well as, addback the

impact of realized and unrealized gains/losses related to foreign exchange and derivatives.

d)

Incorporates the pro rata share of management adjustments as described above for

unconsolidated subsidiaries and joint ventures. e)

Reflects

adjustments

to

eliminate

activities

between

W. P.

Carey

and

of

CPA

®

:15

in

the

respective

historical

financial

statements,

as

all

such

revenues, expenses and interests would have been eliminated in consolidation had

the merger occurred on January 1, 2012. f)

See

next

page

for

a

reconciliation

of

CPA

®

:15’s

Net

Income

for

the

six

months

ended

June

30,

2012

to

Adjusted

EBITDA.

Investing for the Long Run™

| 38

W. P. Carey Inc.

Consolidated EBITDA: Footnotes |

a)

Per CPA

®

:15’s Form 10-Q for the period ended June 30, 2012.

b)

Incorporates the pro rata share of depreciation, amortization, interest and tax

provision adjustments for unconsolidated subsidiaries and joint

ventures.

c)

Represents adjustments to EBITDA to add impairments, stock compensation, merger

expenses, gain or losses on the sale of real estate, gain/loss on

extinguishment of debt, as well as, to addback the impact of realized and unrealized gains/losses related to foreign exchange and

derivatives.

d)

Incorporates the pro rata share of management adjustments for unconsolidated

subsidiaries and joint ventures. Investing for the Long

Run™| 39 W. P. Carey Inc.

Consolidated EBITDA: Footnotes

$'000

YTD Jun-12

Prorata Adjusted EBITDA Calculation

Net

income

attributable

to

CPA

®

:15

shareholders

(a)

54,458

Adjustments:

Depreciation and amortization

25,054

Interest expense

37,093

Provision for Income Taxes

2,059

CPA

®

:15 EBITDA

118,664

Proportionate

share

of

adjustments

from

equity

method

investments

(b)

11,746

Proportionate

share

of

adjustments

for

noncontrolling

interests

(b)

(15,512)

60,440

Prorata EBITDA

114,898

Management

adjustments:

(c)

Impairments

Loss on sale

(39,156)

Gain/Loss on extinguishment of debt

(474)

Stock compensation

-

Merger expenses

1,339

Realized and unrealized loss on foreign currency (net)

1,897

Realized and unrealized gain on derivatives (net)

(67)

Proportionate

share

of

adjustments

from

equity

method

investments

(d)

(10)

Proportionate

share

of

adjustments

for

noncontrolling

interests

(d)

15,073

Total adjustments

(21,398)

Pro rata Adjusted EBITDA

93,500 |