Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DOLE FOOD CO INC | d411289d8k.htm |

| EX-99.1 - PRESS RELEASE - DOLE FOOD CO INC | d411289dex991.htm |

Sale of Worldwide Packaged Foods

and

Asia Fresh Produce Businesses

September 18, 2012

Exhibit 99.2 |

2

2

Forward-Looking Statements

The information presented here contains "forward-looking

statements," within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve a number of risks and uncertainties.

Forward looking statements, which are based on management's

current expectations, are generally identifiable by the use of terms

such as "may," "will," "expects," "believes,"

"intends," "anticipates" and similar expressions. The

potential risks and uncertainties that could cause actual results to differ

materially from those expressed or implied herein include

weather-related phenomena; market responses to industry volume

pressures; product and raw materials supplies and pricing; energy supply and

pricing; changes in interest and currency exchange rates; economic crises

and security risks in developing countries; international conflict; and

quotas, tariffs and other governmental actions. Further information on the

factors that could affect Dole's financial results is included in its SEC

filings, including its Annual Report on Form 10-K.

|

Overview of Transaction

May 2012: announced strategic business review

As a result of this initiative, we have reached an agreement to sell our

Worldwide Packaged Food and Asia Fresh businesses (together “Dole Asia”)

to Itochu Corporation

Proceeds of $1.68 billion in cash will be used to pay down existing

indebtedness, pay deal-related expenses, for restructuring expenses

associated with the transaction and other corporate purposes

Dole Food Company (“Dole”) will remain an international company, focused

on the fresh fruit and vegetables business in North America, Latin America

and Europe

The transaction is subject to Dole stockholder approval and customary

regulatory approvals

We expect the transaction to close in late 2012

3 |

Transaction Rationale

Realizes a premium valuation for a Dole Asia

Enables significant de-leveraging and increases financial flexibility

-

Creates a transformed Dole platform that is able to pursue growth

opportunities within the sector

Retains industry-leading fresh fruit and vegetable business and

brand ownership beyond the scope of activities of Dole Asia

businesses

Continued targeted focus on the growing health/wellness trends and

leader in nutrition education in the fresh fruit and vegetable sectors

Retains significant operating asset base, as well as non-core assets,

including approximately 25,000 acres of Hawaiian land

4 |

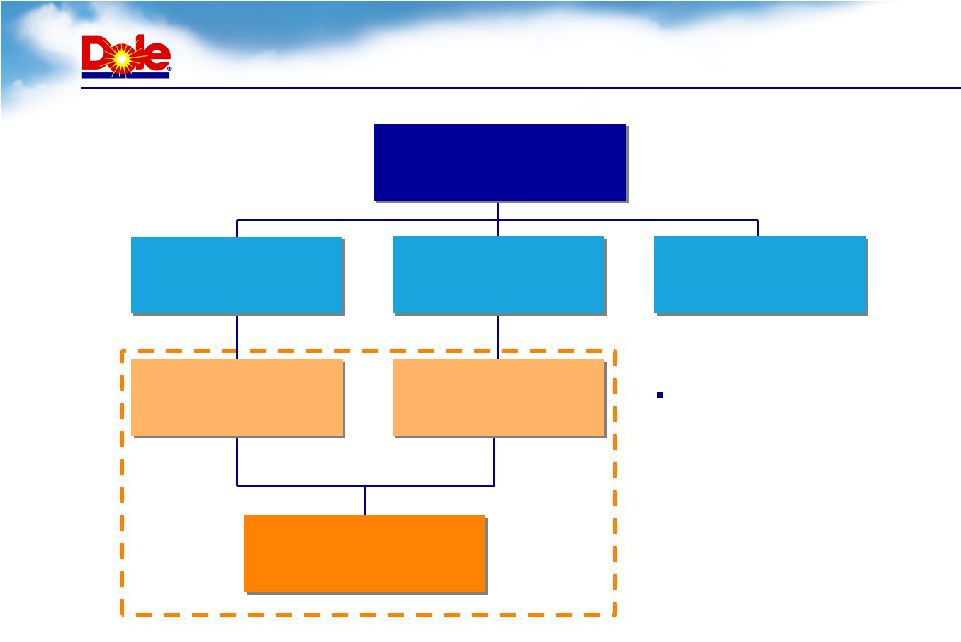

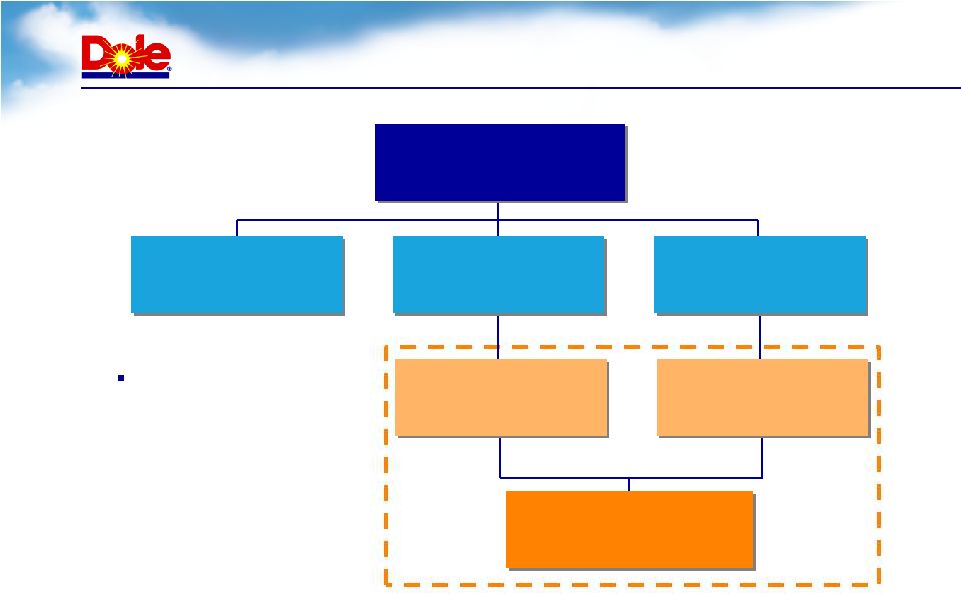

Fresh Fruit

Sales:$4.5B (67% of total)

Notes: Figures based on 2011, excludes revenues and Adjusted EBITDA from

divested European operations; Adjusted EBITDA from operations excludes

corporate overhead of $50 million Dole Asia

Transaction includes the

sale of 100% of the

Worldwide Packaged

Foods business and 29%

of Dole’s existing Fresh

Fruit business

5

Worldwide Packaged Foods

Sales: $1.2B (18% of total)

Fresh Vegetables

Sales: $1.0B (15% of total)

Asia Fresh Produce

Sales: $1.3B

Adj EBITDA: $65 million

Worldwide Packaged Foods

Sales: $1.2B

Adj EBITDA: $123 million

Dole Asia

Sales: $2.5B (37% of total)

Adj EBITDA: $188 million

(43% of total)

Dole Food Company

Sales: $6.7B

Adj EBITDA from ops: $434 million |

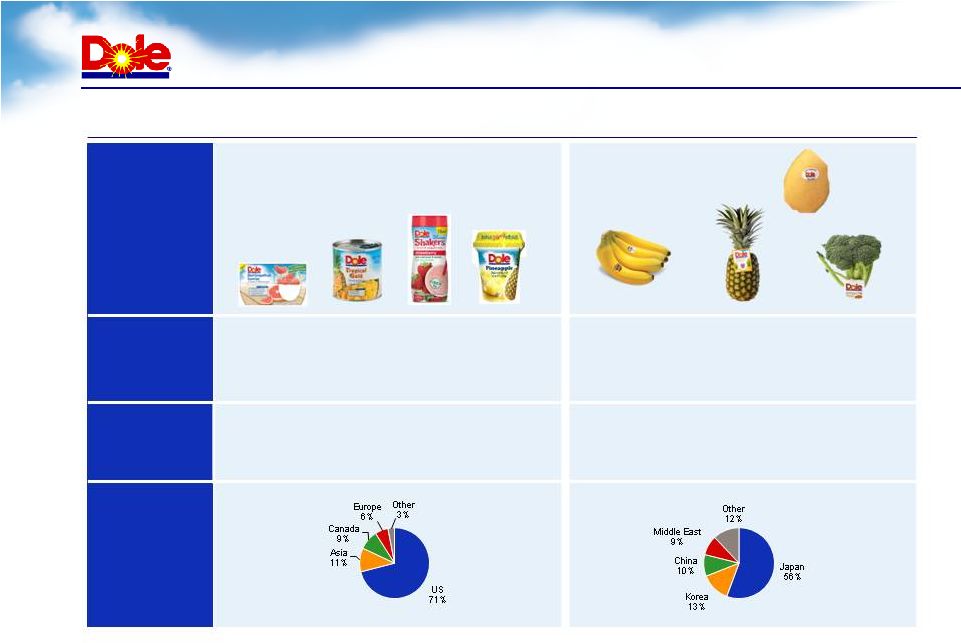

Dole Asia Business Profile

6

Core

products

Relevant market

positions

Financials

Geographic mix

(2011 revenue)

Worldwide Packaged

Asia Fresh

–

–

Canned fruit

juice

–

Fruit juice concentrate

–

Fruit in plastic cups, jars

and pouches

–

Fruit parfaits

–

Healthy snack foods

–

Frozen fruit

–

Fresh fruit

–

Fresh vegetables

–

#1 plastic fruit cups in US

–

#1 canned pineapple in US

–

#1canned pineapple juice in US

–

#1 frozen fruit in US

–

#1 bananas in Japan

–

#1 pineapples in Japan

–

#2 bananas in Korea

–

2011

revenue: $1.2B

–

2011 Adjusted EBITDA:

$123 million

–

2011 revenue: $1.3B

–

2011 Adjusted EBITDA: $65 million

Canned fruit |

Dole Food Company

Pro forma Dole business

includes 100% of the

Fresh Vegetables

business and 71% of

Dole’s existing Fresh Fruit

business

Notes: Figures based on 2011, excludes revenues and Adjusted EBITDA from

divested European operations; Adjusted EBITDA from operations excludes

corporate overhead of $50 million. 7

Worldwide Packaged Foods

Sales: $1.2B (18% of total)

Fresh Fruit

Sales:$4.5B (67% of total)

Fresh Vegetables

Sales: $1.0B (15% of total)

Dole Food Company

Sales: $6.7B

Adj EBITDA from ops: $434 million

Fresh Fruit

Sales: $3.2B

Adj EBITDA: $193 million

Fresh Vegetables

Sales: $1.0B

Adj EBITDA: $53 million

Dole Food Company

Sales: $4.2B (63% of total)

Adj EBITDA from ops: $246 million

(57% of total) |

Cost Savings Initiative

In connection with the announced transaction, Dole will undertake

cost savings and right-sizing initiatives

Dole will realign and streamline its global personnel structure to

conform to the specific needs of the remaining fresh produce

businesses

Cost savings initiatives and corporate restructuring are expected to

result in aggregate savings of approximately $50 million annually

Full run-rate of these savings expected to be fully implemented by

the end of fiscal 2013

8 |

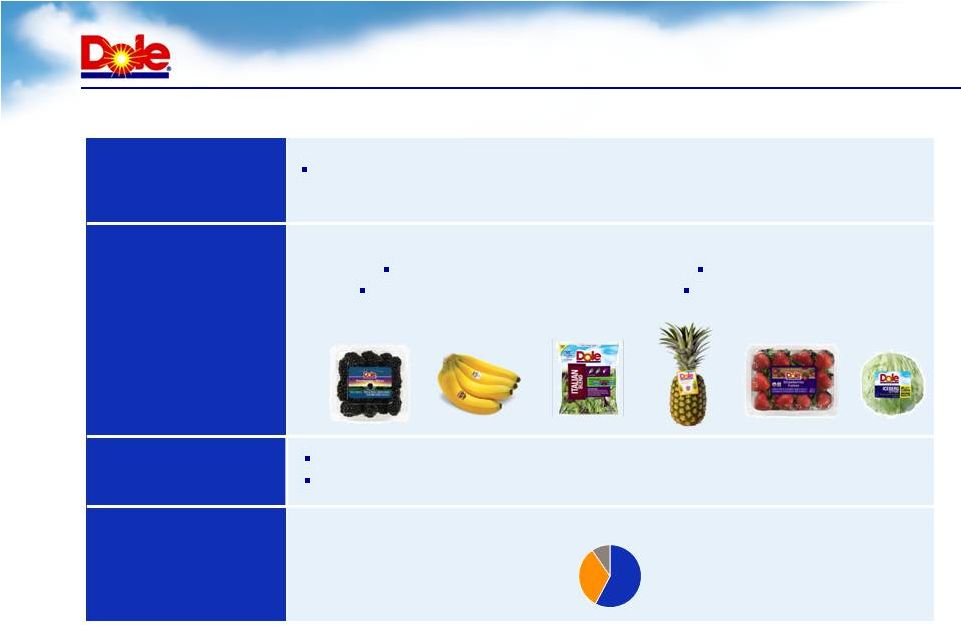

Dole Food Company Business Profile

9

North

America

58%

Europe

33%

Other

9%

Business overview

Core

products

Financials

Geographic mix

(2011 revenue)

Industry-leading fresh produce business, primarily focused on North America,

Latin America and Europe

Fresh fruit

Fresh vegetables

Fresh berries

Packaged salads

2011 revenue: $4.2B

2011 Adjusted EBITDA from ops: $246 million |

Valuable Asset Base

Dole California docked at the Port of San Diego

Asset Type

Description

Farms and other

land holdings

113,000 owned acres, including ~25,000

non-core acres in Hawaii

Processing

facilities

5 salad manufacturing plants

Ships and

containers

11 owned and 6 chartered/leased vessels

13,300 refrigerated containers; 1,300 dry

containers; 5,300 chassis and 4,000

generator sets

Other

Port facilities in each country

Offices, housing compounds, schools and

hospitals

Research facilities

Bessemer City, NC packaged salad plant

10

Founded over 150 years ago, and built on a rich

tradition of industry leadership

State-of-the-art, vertically-integrated refrigerated

supply chain

Over $500 million FMV of non-core assets (e.g.

idle land)

Ecuador banana plantation |

Strategy

Supply the finest, high

quality, healthy and nutritious

fresh fruits and vegetables

Lead the industry in nutrition

research and education

Leverage brand

strength

Expand value-added and

organic product offerings

Continue to drive supply

chain efficiencies throughout

our businesses

11 |

Financial Terms and Impact on Dole

(US$ in millions)

Pre-transaction

Adjustments

Post-transaction

2011 Revenue

$6,685

($2,485)

$4,200

2011 Adjusted EBITDA

Cost savings

$384

($188)

+$50

$246*

Debt (as of 6/16/12)

$1,656

$260**

Total debt / 2011 EBITDA

4.3x

1.0x

Net debt / 2011 EBITDA

4.0x

0.7x

2011 Capital expenditures

$74

$41

Net interest expense

$138

$16

12

Note: Excludes revenues and Adjusted EBITDA from divested European

operations *Shown pro forma net of anticipated $50 million cost savings.

**Post transaction debt takes into consideration ~$300 million cash costs

associated with the transaction, including taxes, debt breakage,

restructuring costs, and deal related expenses |

Appendix

13 |

14

Non-GAAP Financial Measures

Earnings before interest, taxes and discontinued operations (“EBIT before discontinued

operations”), Adjusted EBITDA and Adjusted EBITDA from operations are measures commonly

used by financial analysts in evaluating the performance of companies. EBIT before discontinued

operations is calculated from net income by adding interest expense and income tax expense, and adding the

loss or subtracting the income from discontinued operations, net of income taxes. Adjusted EBITDA is

calculated from EBIT before discontinued operations by: (1) adding depreciation and

amortization from continuing operations; (2) adding the net unrealized loss or subtracting the

net unrealized gain on foreign currency and bunker fuel hedges and the cross currency swap which do not have a

more than insignificant financing element present at contract inception; (3) adding the net loss or

subtracting the net gain on the long-term Japanese yen hedges; (4) adding the foreign

currency loss or subtracting the foreign currency gain on the vessel obligations; (5) adding

the net unrealized loss or subtracting the net unrealized gain on foreign denominated instruments; (6) adding

share-based compensation expense; (7) adding charges for restructuring and long-term

receivables; (8) adding loss on early retirement of debt; and (9) subtracting the gain on asset

sales. Due to the fact that the long-term Japanese yen hedges had more than an

insignificant financing element at inception, the liability is treated similar to a debt instrument and the associated cash flows

are classified as a financing activity. As a result, both the realized and unrealized gains and losses

related to these hedges are subtracted from or added back to EBIT before discontinued

operations when calculating Adjusted EBITDA. Adjusted EBITDA from operations is calculated from

Adjusted EBITDA by adding corporate overhead expense. These items have been adjusted because

management excludes these amounts when evaluating the performance of Dole. Net debt is calculated as

total debt less cash.

EBIT before discontinued operations, Adjusted EBITDA and Adjusted EBITDA from operations are not

calculated or presented in accordance with U.S. GAAP and are not a substitute for net income

attributable to Dole Food Company, Inc., net income, income from continuing operations, cash

flows from operating activities or any other measure prescribed by U.S. GAAP. Further, EBIT

before discontinued operations, Adjusted EBITDA and Adjusted EBITDA from operations as used herein are

not necessarily comparable to similarly titled measures of other companies. However, Dole has

included these three measures herein because management believes that they are useful

performance measures for Dole and for securities analysts, investors and others in the

evaluation of Dole.

|

Reconciliation of Net Income to EBIT before

Discontinued Operations and Adjusted EBITDA

2011

Net income (loss)

42

$

Discontinued operations, net

-

Income (loss) from continuing operations

42

Interest expense

142

Income taxes

7

EBIT before discontinued operations

191

Depreciation and amortization

104

Net unrealized (gain) loss - derivatives

7

Net loss on long-term Japanese yen hedges

21

Foreign currency (gain) loss - vessel obligations

-

Net unrealized (gain) loss - foreign instruments

3

Share-based compensation

9

Charges for restructuring and long-term receivables

30

Refinancing charges and loss on early retirement of

notes

26

Gain on asset sales

(5)

Adjusted EBITDA

386

$

Fiscal Year

($ millions)

15

Note: Includes divested European operations |

Full Year 2011 Adjusted EBITDA by Segment

($ millions)

16

Note: Includes divested European operations

Year Ended December 31, 2011

EBIT before disc. ops.

172

$

31

$

97

$

(109)

$

191

$

Net unrealized (gain) loss -

derivatives

2

-

2

3

7

Net loss on long-term Japanese yen hedges

1

-

-

20

21

Net unrealized (gain) loss -

foreign instruments

-

-

1

2

3

Share-based compensation

2

1

-

6

9

Charges for restructuring and long-term receivables

30

-

-

-

30

Refinancing charges and loss early retirement notes

-

-

-

26

26

Gain on asset sales

(5)

-

-

-

(5)

Sub total

202

32

100

(52)

282

Depreciation and amortization

58

21

23

2

104

Adjusted EBITDA

260

$

53

$

123

$

(50)

$

386

$

Fresh

Fruit

Fresh

Vegetables

Packaged

Foods

Corporate/

Other

Total |

17

|