Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PALMETTO BANCSHARES INC | d412226d8k.htm |

NASDAQ:

PLMT

KBW Bank Conference

September 14, 2012

Palmetto Bancshares, Inc.

Palmetto Bancshares, Inc.

Holding Company for

Holding Company for

1

Sam Erwin,

President and Chief Executive Officer

Office: 864-250-6083

Email:

serwin@palmettobank.com

Lee Dixon,

Chief Operating and Chief Risk Officer

Office: 864-250-6082

Email:

ldixon@palmettobank.com

Exhibit 99.1 |

NASDAQ:

PLMT

2

Non-GAAP Measures and Forward Looking Statements

This presentation contains financial information determined by methods other than in accordance with

Generally Accepted Accounting Principles (“GAAP”) such as earnings figures excluding

credit-related items such as provision for loan losses, loan workout expenses, foreclosed

real estate write downs and expenses, and losses on loans held for sale; one-time charges; and

gains on sales. Non-GAAP measures should not be considered as an alternative to any measure of

performance as promulgated under GAAP. Non-GAAP measures have limitations as analytical

tools, and investors should not consider them in isolation or as a substitute for analysis of

the Company’s results as reported under GAAP.

Certain statements in this presentation contain “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995, such as statements relating to

future plans and expectations, and are thus prospective. Such forward-looking statements

are identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,”

“targets,” and “projects,” as well as similar expressions.

Forward-looking statements are subject to risks, uncertainties, and other factors which

could cause actual results to differ materially from future results expressed or implied by such forward-looking

statements. Factors which could cause actual results to differ materially from the anticipated results

or other expectations expressed in the forward-looking statements include, but are not

limited to: (1) the strength of the United States economy in general and the strength of the

local economies in which the Company conducts its operations which could result in, among other

things, a deterioration in the credit quality or a reduced demand for credit, including the resultant effect on our loan portfolio

and allowance for loan losses and the rate of delinquencies and amounts of charge-offs, or adverse

changes in asset quality in our loan portfolio, which may result in increased credit

risk-related losses and expenses; (2) adverse conditions in the stock market, the public

debt market and other capital markets (including changes in interest rate conditions) and the impact of such

conditions on the Company, and the timing and amount of future capital raising activities by the

Company, if any; and (3) actions taken by banking regulatory agencies related to the banking

industry in general and the Company or the Bank specifically. The assumptions underlying the

forward-looking statements could prove to be inaccurate. Therefore, we can give no assurance that

the results contemplated in the forward-looking statements will be realized. The inclusion of this

forward-looking information should not be construed as a representation by our Company or

any person that the future events, plans, or expectations contemplated by our Company will be

achieved. Additional factors that could cause our results to differ materially from those

described in the forward-looking statements can be found in our reports (such as Annual Reports on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed

with the U.S. Securities and Exchange Commission (the “SEC”) and available at the

SEC’s Internet site (www.sec.gov), including the “Risk Factors” included therein. All subsequent written and

oral forward-looking statements concerning the Company or any person acting on its behalf is

expressly qualified in its entirety by the cautionary statements above. We do not undertake any

obligation to update any forward-looking statement to reflect changes in circumstances or

events that occur after the date the forward-looking statements are made.

|

NASDAQ:

PLMT

General Background on

The Palmetto Bank

3 |

NASDAQ:

PLMT

The Palmetto Bank At a Glance

Headquarters: Greenville, South Carolina

Inception: 1906 (105 years)

Team members (FTE): 322.5

Total assets: $1.181 billion

Total deposits: $1.063 billion

Tangible book value/share: $7.04

Stock price: $7.50 (and as of September 10)

Market capitalization: $95.6 million

Private equity ownership: 87%

NASDAQ Capital Markets: PLMT

Source: financial and FTE information as of June 30, 2012 per Form

10-Q 4 |

NASDAQ:

PLMT

Franchise and Leadership

History:

105

year

history

with

strong

brand

recognition

and

client

loyalty

–

$1.2 billion community bank headquartered in Greenville, South Carolina

–

Simple capital structure consisting of 100% common stock (no TARP financing)

–

Approximately 2,000 shareholders with 87% ownership through eight private equity

firms resulting from a $114 million private placement and follow-on

offering in October 2010 Franchise:

Premier

deposit-gathering

franchise

in

attractive

banking

markets

–

4 largest bank headquartered in South Carolina (6

in deposit share in the Upstate and

1 of banks headquartered in South Carolina)

–

25 branches in the attractive Upstate region of South Carolina with 325

teammates –

Excellent historical financial results as a high performing bank

–

Heritage of high touch client service provides platform for enhanced sales

culture Team:

Energized

and

experienced

executive

leadership

team

with

demonstrated

turnaround

capabilities

–

New senior leadership team starting in 2009 (7 of the 9 are new)

–

Experienced team with deep local market relationships

–

Proactive and comprehensive Strategic Project Plan implemented and producing

measurable results

Asset

quality:

Asset

quality

has

been

aggressively

addressed

–

Credit problems were identified and have been substantially resolved (with 52% of

the losses

incurred

related

to

a

specific

pool

of

55

problem

assets

–

losses

of

$98

million)

5

th

st

th |

NASDAQ:

PLMT

Established Branch Network

25 branches located in the Upstate region of South Carolina (down from a peak of 33

branches) Corporate headquarters relocated from Laurens to Greenville, South

Carolina, in March 2009 to expand in the Anderson, Greenville and

Spartanburg markets along the economically strong Interstate 85 corridor

between Atlanta, GA and Charlotte, NC

6

Georgia

North Carolina

South Carolina |

NASDAQ:

PLMT

Attractive Size and Franchise

Note: SCBT Financial Corp. financials do not reflect the acquisition of Savannah

Bancorp, Inc. announced on August 8, 2012 Source: SNL Financial LC; deposit

data as of June 30, 2011, total company assets as of most recent quarter available

Strategically well-positioned as both an acquirer or

as an entry point into South Carolina for a merger partner

7

Rank

Among SC-

Based

Banks

Company Name

City

Total Company

Assets

($000)

Total

SC Deposits

2011

($000)

SC Deposit

Market

Share 2011

(%)

1

First Citizens Bancorp. Inc.

Columbia

8,240,135

6,176,963

9.10

2

SCBT Financial Corp.

Columbia

4,373,269

2,791,628

4.11

3

First Financial Holdings Inc.

Charleston

3,304,174

2,687,814

3.96

4

Palmetto Bancshares Inc.

Greenville

1,180,960

1,076,345

1.59

5

CNB Corp.

Conway

930,166

737,775

1.09

6

Carolina Financial Corp.

Charleston

826,855

658,781

0.97

7

Security Federal Corp.

Aiken

910,112

658,354

0.97

8

Southern First Bancshares Inc.

Greenville

759,632

557,894

0.82

9

Arthur Financial Corp.

Union

565,454

531,857

0.78

10

HCSB Financial Corp.

Loris

536,744

517,598

0.76 |

NASDAQ:

PLMT

Attractive Markets in Upstate South Carolina

Branches

located

in

nine

counties

in

the

Upstate

which

represent

approximately

1/3rd

of

South

Carolina’s

population

and

deposits

Fourteen branches located in Greenville and Spartanburg counties, the largest and

fourth largest counties in South Carolina, where combined population growth

since 2000 averaged 17.8% compared to 16.7% for South Carolina and 10.4% nationwide

The Upstate Region:

Located

adjacent

to

major

transportation

corridors

and

centrally

located

between

Charlotte,

NC

and

Atlanta,

GA

Diversified and broad economic base

Highest international investment per capita in the nation with more than 250

international firms One of the fastest growing and economically attractive

regions in South Carolina and in the Southeast in recent years Academic

center with Clemson University, Furman University, Wofford College, Converse College and USC Upstate

Source: SNL Financial LC; data as of June 30, 2011

County

Market

Rank

Number

of

Branches

Company

Deposits

in Market

($000)

Average

Deposits

Per

Branch

($000)

Deposit

Market

Share

(%)

Percent of

State

Franchise

(%)

Total

Population

2011

(Actual)

Population

Change

2000-2011

(%)

Projected

Population

Change

2011-2016

(%)

Greenville

8

9

343,775

38,197

3.18

31.94

459,324

21.00

8.15

Laurens

1

3

194,050

64,683

36.86

18.03

66,287

(4.71)

(1.77)

Spartanburg

10

5

164,594

32,919

3.91

15.29

286,838

13.02

4.67

Anderson

9

2

114,075

57,038

4.91

10.60

188,659

13.83

4.77

Greenwood

4

2

113,085

56,543

13.23

10.51

69,904

5.48

1.84

Cherokee

4

1

56,311

56,311

11.89

5.23

55,798

6.21

3.00

Abbeville

5

1

30,574

30,574

12.12

2.84

25,294

(3.34)

(1.86)

Oconee

10

1

30,403

30,403

2.64

2.82

74,978

13.23

4.82

Pickens

12

1

29,478

29,478

1.89

2.74

119,793

8.16

2.93

Total

25

1,076,345

43,054

100.00

1,346,875

13.12

5.07

Weighted Average: South Carolina Franchise

10.72

4.02

Aggregate: Entire State of South Carolina

4,682,632

16.72

6.02

Aggregate: National

10.41

3.42

8 |

NASDAQ:

PLMT

9

Sam Erwin, President and Chief Executive Officer

Hired in March 2009

22 years of banking experience

CEO of Community Bankshares, Inc., Orangeburg, SC ($576 million in assets)

–

Addressed serious asset quality and organizational issues

–

Successful resolution of asset quality issues ultimately resulted in sale of the

bank for a significant market premium in October 2008 at two times book

value despite a depressed market Lee Dixon, Chief Operating and Chief Risk

Officer Hired in May 2009

24 years of business experience including 21 years of banking experience

Partner at PricewaterhouseCoopers LLP

–

Banking clients ranged from $100 million asset community banks to the largest

national and regional banks (Bank of America, Wachovia, and BB&T)

–

Extensive

operational

experience

covering

all

aspects

of

banking

and

financial

services

–

Key player on deal teams in many mergers and acquisition engagements and

integration teams Energized and Experienced Management Team

Roy Jones, Chief Financial Officer

Hired in November 2010

22 years of banking and banking-related experience

–

Various finance and accounting leadership positions with banks ranging from

national banks (NationsBank/Bank of America) to large regional banks (The

South Financial Group/TD Bank, Barnett Bank) as well as CFO of $800 million

asset community bank –

Started career with PricewaterhouseCoopers LLP in the firm’s financial

services audit practice |

NASDAQ:

PLMT

Energized and Experienced Management Team

Coleman Kirven, Commercial Banking Executive

Started in this role in July 2011 (hired in January 2005)

19 years of business experience including 16 years of retail, commercial and

mortgage banking –

Previous bank experience includes BB&T, CapitalBank, and Carolina First Bank

(The South Financial Group) Trish Springfield, Retail Banking Executive

Hired in October 2010

24 years of retail banking and related experience

–

Key role in branch training, marketing, retail sales, branch network analysis and

incentive plan design; prior experience

includes

National

Bank

of

Commerce/SunTrust,

National

Commerce

Bank

Services,

Trustmark

National Bank, and Carolina First Bank (The South Financial Group)

Jack McElveen, Chief Credit Officer

Hired in July 2009

27 years of banking experience related mainly to lending, underwriting, credit

policy and credit review Senior credit-related roles for various banking

organizations since 2002, including at Community Bankshares with Mr.

Erwin –

Brought deep experience and capabilities and made significant improvements in

credit processes, procedures, infrastructure, reporting, staffing and loan

workout in a very short period of time 10 |

NASDAQ:

PLMT

11

Teresa Knight, Bank Administration and HR Executive

Hired in May 1981

34 years of business experience including 31 years with The Palmetto Bank

–

Range of responsibilities during tenure at the Bank, including Retail leadership,

consumer lending, marketing and, most recently, human resources

Energized and Experienced Management Team

Matt Walter, Treasurer & Chief Investment Officer

Hired in August 1990

22 years of banking experience (all with The Palmetto Bank)

–

Prior to assuming the Treasurer role in 2009 worked in both Retail and Commercial

roles. Currently engaged in oversight of the investment securities

portfolio, leading the Bank’s Asset-Liability Committee and balance sheet

management

Mark Terry, Chief Information Officer

Hired in May 2011

22 years of information technology management experience, including 20 years in

banking –

Led information technology initiatives in healthcare, insurance and financial

services industries, including a $1 billion asset community bank

–

Managed technology and operations projects for several de novo startups and

mergers & acquisition |

NASDAQ:

PLMT

The Turnaround Summary

Balance sheet (loan) “growth imperative”

resulted in rapid growth in real estate loans during 2004

to 2009 (balance sheet grew 60% from $893 million to $1.436 billion)

–

Heavy

concentration

in

acquisition,

development

and

construction

loans

with

a

higher

volume

of individually larger real estate loans including purchased participations,

brokered loans, and out-of-market loans

–

Originations continued into 2008 when both the overall economy and real estate

market were deteriorating

Chief

Executive

Officer,

Chief

Operating

and

Chief

Risk

Officer,

and

Chief

Credit

Officer

were

replaced by a new management team in March to July 2009

–

Rapid transition from a “family owned bank”

to a disciplined public company

–

Transformed Board with complete engagement and quick action (including three new

Directors in 2010 from private equity investors)

New

management

quickly

developed

and

implemented

a

comprehensive

Strategic

Project

Plan

in

2009 to address all major areas with an immediate emphasis on aggressively

resolving asset quality issues

–

Provisions of Consent Order effective June 2010 had been anticipated and included

in the Plan

–

Capital raise completed in October 2010 ($114 million private placement and

follow-on offering)

–

Nonperforming assets aggressively resolved, including through bulk sales (down 73%

from the peak in March 2010)

Management has set a new course which is now focused on a “Value Creation

Strategy” that

builds on the Company’s 105 year heritage as it returns to sustained

profitability 12 |

NASDAQ:

PLMT

Strategic Focus

13 |

NASDAQ:

PLMT

Evolution of Big Picture Strategic Focus

•

2009

–

Quantify depth of credit loss hole

–

Strategic Project Plan to survive

and thrive

–

Prepare for regulatory agreement

•

2010

–

Raise capital ($114 million in

October 2010)

–

Process improvement

–

Change management

•

2011

–

Performance culture and talent

management

–

Operating earnings

–

Client focus

14

•

2012

–

Profitability

–

Expense reductions

–

Technology

enhancements

–

Palmetto Partnership

•

2013

-

Sustained and

predictable earnings

-

Niche lending and

Treasury services

-

Value creation

-

Client experience |

NASDAQ:

PLMT

15

Strategic Priorities

2012

1.

Return to profitability

2.

Improve asset quality

3.

Exit regulatory agreement

4.

Execute on client service and

support through Palmetto

Partnership

5.

Develop a high performing

culture and winning team

2013

Increase the value of

The Palmetto Bank franchise by:

1.

Improving profitability to

become a high performing

bank

2.

Enhancing the client

experience

3.

Cultivating a high performing

culture and winning team

4.

Exiting the regulatory

agreement, including

improvement in asset quality

5.

Operating with sound risk

management |

NASDAQ:

PLMT

Value Creation Strategy

and the Client Experience

1.

What actions do we need to take to increase

the Value of The Palmetto Bank franchise?

2.

Are all of our actions contributing to an

enhanced Client Experience?

16 |

NASDAQ:

PLMT

17

Big Picture Strategy –

Line of Business Delineation is Critical to

Improved Profitability and Risk Management

1.

Retail Bank: primarily manage funding cost through low cost

deposits and expanding household penetration

2.

Commercial Bank: primarily generate income through lending and

ancillary services

3.

Wealth Management: primarily generate incremental revenue and

provide “full service”

banking

4.

Support departments: enable the above with disciplined expense

management and sound risk management

By line of business, tailored go-to-market strategies, products,

services, bundled offerings, expertise, technology, infrastructure,

marketing, etc.

Out-service the big banks and

out-muscle the little banks! |

NASDAQ:

PLMT

2012 Strategic Priorities

18 |

NASDAQ:

PLMT

19

2012 Strategic Priorities

1.

Return to profitability

2.

Improve asset quality

3.

Exit regulatory agreement

4.

Execute on client service and support

through Palmetto Partnership

5.

Develop a high performing culture and

winning team

While keenly focused on the above in 2012,

we are already executing on 2013 Strategic Priorities.

|

NASDAQ:

PLMT

1. Return to Profitability

20 |

NASDAQ:

PLMT

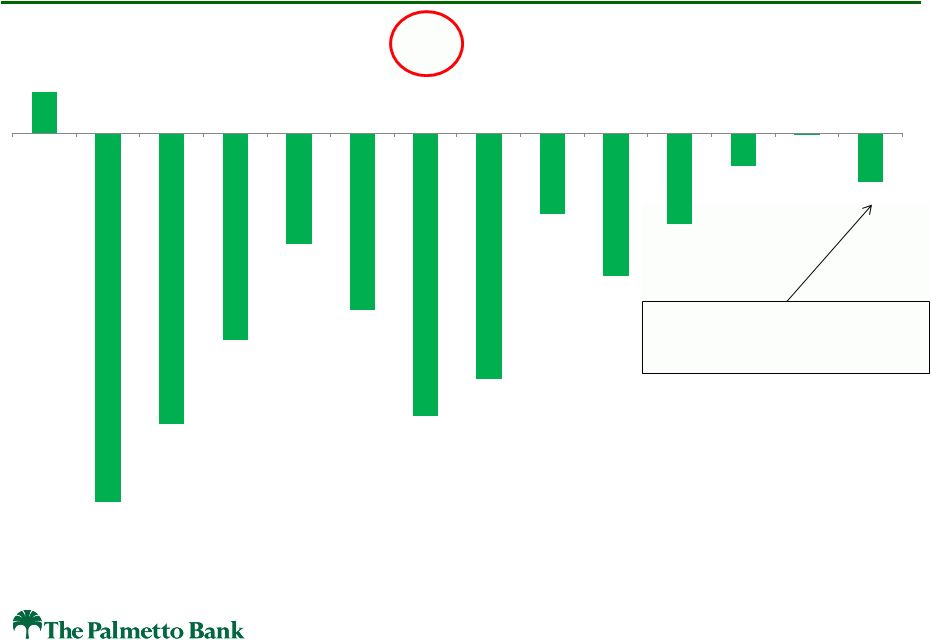

Pre-Tax Loss

21

Strategic problem asset

sales at discounted prices

$3,117

$(27,772)

$(21,939)

$(15,619)

$(8,334)

$(13,326)

$(21,359)

$(18,525)

$(6,028)

$(10,760)

$(6,824)

$(2,452)

$(70)

$(3,638)

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012 |

NASDAQ:

PLMT

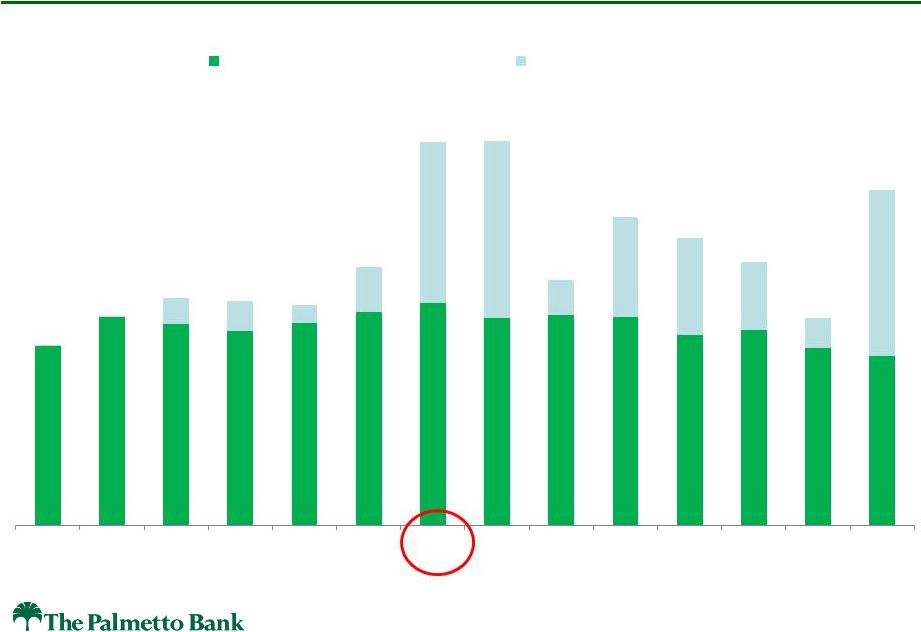

Operating Earnings

(excluding credit costs and non-recurring items)

22

$5,333

$2,294

$3,631

$3,361

$2,868

$1,996

$977

$966

$1,475

$2,338

$4,321

$3,733

$4,683

$4,496

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012 |

NASDAQ:

PLMT

The Path to Profitability

•

Making money on an operating basis in spite of:

–

Low interest rates and flat yield curve

(compressed net interest margin)

–

Higher regulatory costs and revenue

restrictions (lower service charges, higher

FDIC premiums, etc.)

–

High operating expenses from workout mode

and catch up in infrastructure and technology

The core franchise is generating operating

earnings on a day-to-day basis.

23 |

NASDAQ:

PLMT

Net Interest Income

24

3.62%

2.82%

3.15%

3.06%

3.34%

3.23%

2.91%

2.69%

3.18%

3.32%

3.53%

3.65%

3.71%

3.56%

5.21%

4.45%

4.73%

4.56%

4.63%

4.37%

4.08%

3.74%

4.06%

4.12%

4.26%

4.27%

4.20%

4.03%

1.86%

1.91%

1.80%

1.70%

1.45%

1.30%

1.32%

1.25%

1.06%

0.99%

0.91%

0.78%

0.61%

0.59%

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

Net Interest Margin

Total yield on interest earning assets

Total rate on interest-bearing liabilities |

NASDAQ:

PLMT

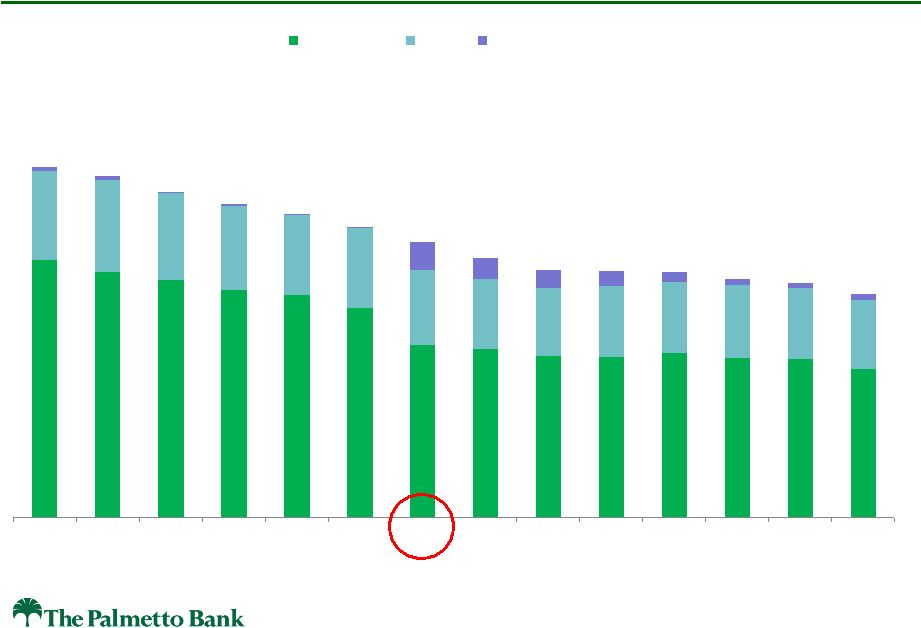

$1,167,924

$1,138,832

$1,082,313

$1,044,196

$1,011,368

$969,142

$919,844

$864,376

$824,852

$821,197

$817,691

$791,384

$779,231

$742,221

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

Commercial

Retail

Loans held for sale

Loans

25 |

NASDAQ:

PLMT

Noninterest Income

(excluding securities gains and non-recurring items)

26

$3,767

$4,496

$4,010

$4,131

$3,930

$3,728

$4,060

$3,404

$3,572

$3,702

$4,300

$3,695

$3,930

$4,104

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

1Q 2012

Service charges on deposit

acconts, net

Fees for trust, investment

management and brokerage

Mortgage-banking

Automated teller machine

Merchant services

Bankcard services

Other

2Q 2012

Service charges on deposit acconts, net

Fees for trust, investment management

and brokerage

Mortgage-banking

Automated teller machine

Merchant services

Bankcard services

Other |

NASDAQ:

PLMT

Noninterest Expense

(excluding provision for loan losses)

27

$10,336

$12,026

$13,039

$12,875

$12,639

$14,808

$22,011

$22,054

$14,061

$17,708

$16,472

$15,141

$11,931

$19,234

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

Operating noninterest expense

Credit-related expenses |

NASDAQ:

PLMT

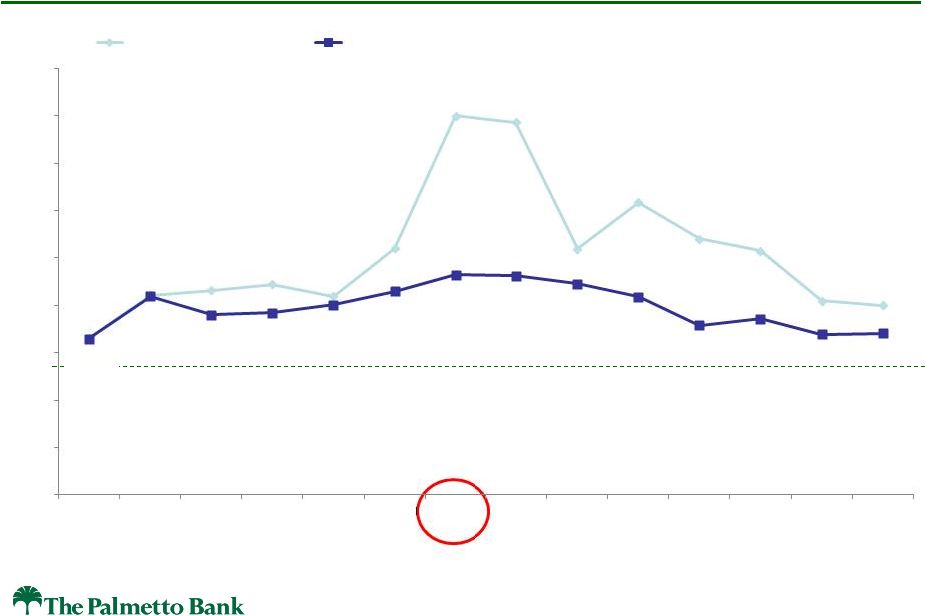

Efficiency Ratio

28

Medium Term Target = 60% (GAAP)

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

140.0%

160.0%

180.0%

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

Efficiency

Ratio

-

GAAP

Efficiency

Ratio

-

before

credit-related

and

non-recurring

items,

ex-securities

gains

66.1%

84.4%

86.4%

88.9%

84.0%

104.0%

160.1%

157.2%

103.9%

123.4%

108.0%

103.1%

81.9%

80.0%

83.9%

76.0%

76.8%

80.2%

86.0%

92.9%

92.5%

89.1%

83.6%

71.7%

74.4%

67.8%

68.3%

3Q 2010

65.9% |

NASDAQ:

PLMT

Expense Reduction through Project SAVE

$6.2 million of annual expense

Savings

through

Automation,

Vendor

management

and

Efficiency

•

Outsourcing

–

Asset-liability management and Internal Audit co-sourcing began

January 1, 2012

–

Check processing outsourcing and related deposit statements process

on April 27, 2012

•

Branch reduction (from 29 to 25)

–

Two consolidations completed on March 30, 2012

–

Two sales completed on July 1, 2012

•

Compensation and benefits

–

Headcount reduced 20% from peak of 420 at December 31, 2008 to

323 at June 30, 2012

–

Salary freeze re-instated in 2012

–

Regular 401(k) Plan employer match suspended in 2012

29 |

NASDAQ:

PLMT

Remainder of 2012

1.

Emphasis on quality loan production, including

niches (Small Business Administration,

Commercial & Industrial, Corporate Lending,

Indirect Auto and Mortgage)

2.

Margin and fee income pressure, with keen

focus on reducing funding costs

3.

Lower, more predicable credit-related expenses

4.

Clear focus on operating expense reduction

5.

Expected to return to quarterly profitability

30 |

NASDAQ:

PLMT

2. Improve Asset Quality

31 |

NASDAQ:

PLMT

Return to Profitability and

Improve Asset Quality

•

Objectives are inter-related with financial results driven primarily by

credit losses

•

Significant

reduction

in

problem

assets

and

improving

quarterly

trends -

reduced

–

Number of problem assets

–

Size of problem assets

–

Losses on problem assets

–

Inflows of problem assets

•

Strategic decision in second quarter 2012 to sell problem assets

at

discounts given

–

Ongoing cost to carry (taxes, insurance, legal fees, utilities,

repairs, etc.)

–

Regulatory and investor perspective on aggregate amount

–

Public perception of continued quarterly losses

32 |

Nonperforming Assets

33

$63,648

$113,413

$120,297

$124,950

$142,161

$118,280

$113,411

$111,492

$101,484

$87,073

$89,858

$80,852

$72,333

$38,922

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

$-

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

$160,000

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

Nonperforming assets

NPA to total assets

NASDAQ:

PLMT |

NASDAQ:

PLMT

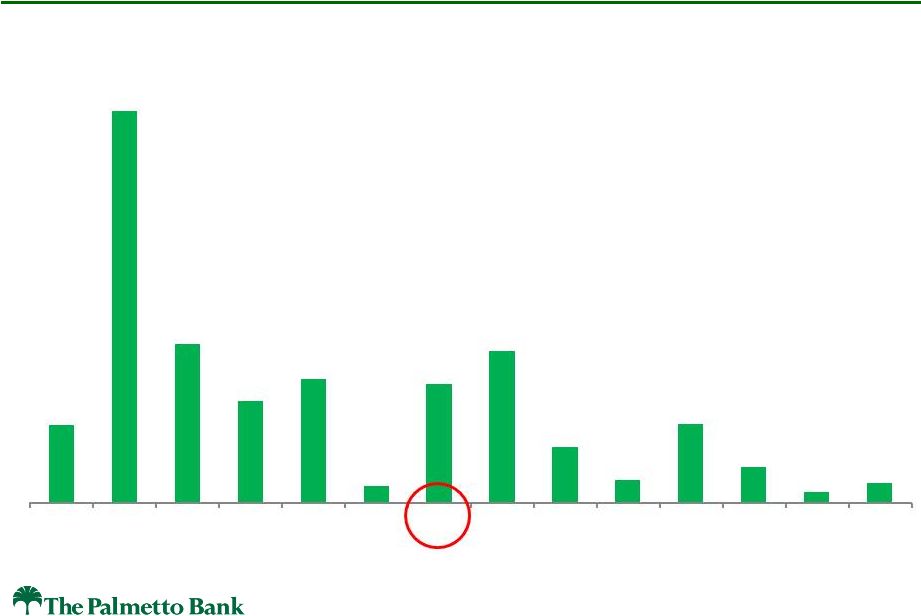

Nonaccrual Loan Inflows

34

$13,983

$71,020

$28,784

$18,419

$22,423

$2,930

$21,420

$27,449

$10,100

$4,012

$14,140

$6,417

$1,885

$3,520

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012 |

Commercial Real Estate Loans

35

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

Development CRE

Existing and Other CRE

CRE Owner Occupied and Residential

NASDAQ:

PLMT |

Commercial Real Estate as % of Tier 1 Capital

36

541.3%

596.1%

608.3%

571.2%

639.3%

701.7%

881.3%

341.6%

318.5%

326.0%

326.7%

306.1%

296.5%

288.4%

NASDAQ:

PLMT |

NASDAQ:

PLMT

Provision for Loan Losses

37

Strategic problem asset

sales at discounted prices |

NASDAQ:

PLMT

3. Exit Regulatory Agreement

38 |

NASDAQ:

PLMT

Consent Order and

Regulatory Examinations

39

•

Consent Order: in compliance with all provisions

–

Continued focus on reducing commercial real estate

concentration

–

Elevated leverage capital ratio requirement (8%)

–

Prohibitions on incentive compensation and acquisitions

•

FDIC insurance premiums are based in part on the overall

ratings from the annual Safety and Soundness

examinations

–

Starting in the second quarter 2012, our annual

premiums were reduced by $1 million based on current

deposit levels |

NASDAQ:

PLMT

4. Execute on Client Service and Support

through Palmetto Partnership

40 |

NASDAQ:

PLMT

The Path To Profitability!

Project

SAVE

The Palmetto

Partnership

Profitability

Driven by...

Executing

Clients

41 |

NASDAQ:

PLMT

Leveraging Technology

to Improve the Client Experience

42 |

NASDAQ:

PLMT

Technology Upgrades to Meet Client Expectations

Upgraded

ATM fleet and locations

DONE!

Upgraded

Telephone Automatic Voice Response Unit

DONE!

Upgraded

Remote Deposit Capture

DONE!

Upgraded

Statements

DONE!

New

Automated Wire Transfer System

DONE!

Upgraded

Real Time Online Banking

DONE!

Upgraded

E-Statement System

DONE!

New

Mobile Friendly Web Site

September

New

Deposit Taking/Imaging ATMs

September

43 |

NASDAQ:

PLMT

Technology Upgrades to Meet Client Expectations

44

New ACH Fraud Control

September

New Mobile Banking and App

October

Upgraded

Web Site

October

New

Online Personal Finance System

December

New

Electronic Notices Delivered for Loans &

Deposits

TBD

New

Person to Person Payments

TBD

New

Commercial Positive Pay

TBD

New

Electronic Check Recovery

TBD

New

Lockbox System

TBD |

NASDAQ:

PLMT

Technology Upgrades to

Improve Risk Management and Profitability Analytics

New

Server Automated Monitoring

DONE!

New

Email Archiving

DONE!

Upgraded

Core Processing Hardware with Backup

September

Upgraded

General Ledger, Accounts Payable & Financial

Reporting (Prologue)

September

Upgraded

Customer Relationship Management System

(Encore)

October

New Report Writer and Automated Dashboards

(Data Warehouse)

November

45 |

NASDAQ:

PLMT

5. Develop a High Performing Culture

and Winning Team

46 |

NASDAQ:

PLMT

Critical Elements of Our Evolving Culture

1.

Continuous improvement culture (including

“possibility thinking”, automation, and expense

consciousness)

2.

Client

service

and

support

culture

Palmetto

Partnership

3.

Performance culture (personally and corporately)

4.

Winning culture!

47 |

NASDAQ:

PLMT

Strategic Outlook

48 |

NASDAQ:

PLMT

2012 Outlook

1.

General economic challenges although some have begun to

moderate in the Upstate

2.

Manage net interest income through continued reduction in time

deposit balances and rates, and reinvestment of excess cash

3.

Improving loan production but still a challenge and very competitive

4.

Focus on fee income, including Treasury Services, Mortgage, Trust

and Investments

5.

Credit losses expected to be significantly lower and more predictable

6.

Sustained focus on efficiency and continued operating expense

reductions

7.

Enhanced infrastructure, including continued technology investment

8.

Recruit high-performing lenders and lending teams

9.

Ongoing talent management

Projected to return to quarterly profitability in 2012

49 |

NASDAQ:

PLMT

Longer-Term Outlook

1.

Improving and sustained profitability

2.

Removal of Consent Order (2013?)

3.

Reduction of allowance for loan losses coverage ratio

4.

Reversal of deferred tax asset valuation allowance

5.

Improved efficiency ratio (continuation of Project SAVE)

6.

Focused loan production strategy (SBA, C&I, Corporate,

Indirect Auto and Mortgage)

7.

Net interest margin management

8.

Growth through mergers and acquisitions (including potential

niche businesses)

50 |

NASDAQ:

PLMT

Overall Summary

51 |

NASDAQ:

PLMT

Value Creation and the Client Experience

Now spending much more of our time and energy on the

future instead of the past…

1.

An experienced team, including M&A and niche expertise

(Retail, Commercial, SBA, Corporate, C&I, etc.)

2.

Product and service bundling focused on the business

and personal life cycles of our clients and prospects

3.

Structured and disciplined sales and business

development process through Palmetto Partnership

4.

Client onboarding and assimilation program to engender

loyalty and identify cross-sell opportunities

5.

Technology that is competitive with the big banks and not

offered by the smaller community banks

52 |

NASDAQ:

PLMT

Summary Thoughts on the Path Forward

1.

Significant progress on the path to profitability

2.

Asset quality has been aggressively improved

3.

Substantially completed the transition from “workout”

mode to

“value creation”

mode

4.

Clarity of the path forward -

more focused Bank, department, and

individual objectives and expectations

5.

Dedicated team and pride in our Bank

6.

High expectations to cultivate a performance culture and winning

team

7.

Sense of urgency continues and we insist on results, not activity

8.

Taking advantage of market disruption

9.

We are moving the Bank forward –

with intense focus on

profitability, value creation and the client experience

Proactive, comprehensive and focused strategic plan being executed

53 |

NASDAQ:

PLMT

54

Value of The Palmetto Bank Franchise

1.

105 year legacy with excellent reputation and strong brand

recognition

2.

Historical high performing financial results, with history of

innovation and balanced and fair pricing to our clients

3.

Premier deposit-gathering franchise in an attractive banking

market with strong deposit gathering capability

–

4

th

largest bank headquartered in South Carolina

–

6

th

in deposit share in the Upstate and

1

st

of banks headquartered in South Carolina

–

25 branches in the economically attractive Upstate market along

the Interstate 85 corridor between Atlanta and Charlotte

4.

Heritage of deep client relationships and loyalty, with high touch

client service platform to be leveraged for enhanced sales culture

|