Attached files

| file | filename |

|---|---|

| EX-10.2 - SHARE PURCHASE AGREEMENT BETWEEN RAMZAN SAVJI AND MICHAEL THIESSEN DATED SEPTEMBER 7, 2012 - NORTHERN MINERALS & EXPLORATION LTD. | f8k090712ex10ii_punchline.htm |

| EX-10.3 - RELEASE FROM MICHAEL THIESSEN - NORTHERN MINERALS & EXPLORATION LTD. | f8k090712ex10iii_punchline.htm |

| EX-10.1 - MINERALS LEASE AND AGREEMENT - NORTHERN MINERALS & EXPLORATION LTD. | f8k090712ex10i_punchline.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): September 7, 2012

PUNCHLINE RESOURCES LTD.

(Exact name of registrant as specified in its Charter)

|

Nevada

|

333-146934

|

N/A

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

736 Bay Street, Suite 1205 Toronto, Ontario, Canada

|

|

(Address of Principal Executive Offices)

|

(416) 619-0611

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in conjunction with our pro forma financial statements and the related notes that will be filed herein.

In this Form 8-K, references to “we,” “our,” “us,” “our company,” “the Company,” “Punchline” or the “Registrant” refer to Punchline Resources Ltd., a Nevada corporation.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

As more fully described in Item 2.01 below, on September 7, 2012 we entered into a Mineral Lease Agreement with MinQuest, Inc. Pursuant to the terms of the Agreement, MinQuest, Inc., has agreed to lease us 100% of the exploration and mining rights to 27 unpatented mining claims in Esmeralda County, Nevada approximately 26 miles south of Goldfield in the Tokop mining district for a period of 20 years (the “Empress Property”). As consideration, we are required to provide annual payments of $20,000 and commit to the following work expenditures:

|

●

|

$150,000 spent in the first year;

|

|

●

|

$200,000 spent in the second year;

|

|

●

|

$250,000 spent in the third year;

|

|

●

|

$300,000 spent in the fourth year;

|

|

●

|

$350,000 spent in the fifth year;

|

|

●

|

$400,000 in the sixth year; and

|

|

●

|

$650,000 in the seventh year.

|

MinQuest will also retain a 3% net smelter royalty in the event that we enter mineral production on the Empress Property. If we are unable to fulfill any of the commitments set out above, the Mineral Lease Agreement will terminate and all property rights will revert back to MinQuest, Inc.

A full description of the Empress Property is available further in this Current Report, under the heading “Description of Property”. A full copy of the Mineral Lease Agreement is attached hereto as Exhibit 10.1.

Also on September 7, 2012 our sole director and officer, Ramzan Savji, acquired 30,000,000 shares of our common stock from our former sole director and officer, Michael Thiessen for total consideration of $30,000. The 30,000,000 shares of our common stock represents 60% of our currently issued and outstanding stock as of the date of this report. The funds used for the acquisition were Mr. Savji’s personal funds and we have no other change of control arrangements in place. In connection withthis sale, Mr. Thiessen provided a release from all liabilities owed to him by our company. A copy of the share purchase agreement and the release are filed as Exhibits to this Form 8-K.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

ACQUISITION OF MINERAL RIGHTS

As described in Item 1.01 above, on September 7, 2012, we entered into a Mineral Lease Agreement with MinQuest, Inc. On September 10, 2012 we made the initial $20,000 payment and acquired exploration and mining rights to the Empress Property.

1

CORPORATE HISTORY AND STRUCTURE

Our Corporate History and Background

We were incorporated on December 11, 2006 under the laws of the State of Nevada. On that date, Nikolai Malitski was appointed as President, Secretary, Treasurer, Chief Executive Officer and Director. On August 17, 2009, Nikolai Malitski resigned as our Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer, President, and Secretary and Kathryn Kozak was appointed as our President, Chief Executive Officer, Treasurer, Secretary, Principal Financial Officer, Principal Accounting Officer and Director.

On November 4, 2009, Nikolai Malitski transferred all of his 30,000,000 of outstanding common shares to Michael Thiessen in a stock purchase agreement for $30,000. On September 7, 2012 our new sole director and officer, Ramzan Savji, acquired 30,000,000 shares of our common stock from Mr. Thiessen for $30,000, triggering a change in control of our company.

We were originally started as a company involved in the placing of strength testing amusement gaming machines called Boxers in venues such as bars, pubs and night clubs in the Seattle area, in the State of Washington. As of July 31, 2011, we had acquired one Boxer that had been placed in Lynwood, Washington. The machine wasbeen de-commissioned as it needed material repairs. We were not able to secure sufficient capital for these repairs and our management decided to change our business focus to mineral exploration.

Sources of Available Land for Mining and Exploration

There are at least five sources of land available for exploration, development and mining: public lands, private fee lands, unpatented mining claims, patented mining claims, and tribal lands. The primary sources for acquisition of these lands are the United States government, through the Bureau of Land Management and the United States Forest Service, state and Canadian Provincial governments, tribal governments, and individuals or entities who currently hold title to or lease government and private lands.

There are numerous levels of government regulation associated with the activities of exploration and mining companies. Permits, which we, or the current operators of the mining properties we have an interest in, are maintaining and amending include “Notice of Intent” to explore, “Plan of Operations” to explore, “Plan of Operations” to mine, “Reclamation Permit,” “Air Quality Permit,” “Water Quality Permit,” “Industrial Artificial Pond Permit,” and several other health and safety permits. These permits are subject to amendment or renewal during our operations. Although there is no guarantee that the regulatory agencies will timely approve, if at all, the necessary permits for our current or anticipated operations, we have no reason to believe that necessary permits will not be issued in due course. The total cost and effects on our operations of the permitting and bonding process cannot be estimated at this time. The cost will vary for each project when initiated and could be material.

The Federal government owns public lands that are administered by the Bureau of Land Management or the United States Forest Service. Ownership of the subsurface mineral estate can be acquired by staking a twenty (20) acre mining claim granted under the General Mining Law of 1872, as amended (the “General Mining Law”). The Federal government still owns the surface estate even though the subsurface can be controlled with a right to extract through claim staking. Private fee lands are lands that are controlled by fee-simple title by private individuals or corporations. These lands can be controlled for mining and exploration activities by either leasing or purchasing the surface and subsurface rights from the private owner. Unpatented mining claims located on public land owned by another entity can be controlled by leasing or purchasing the claims outright from the owners. Patented mining claims are claims that were staked under the General Mining Law, and through application and approval the owners were granted full private ownership of the surface and subsurface estate by the Federal government. These lands can be acquired for exploration and mining through lease or purchase from the owners. Tribal lands are those lands that are under control by sovereign Native American tribes. Areas that show promise for exploration and mining can be leased or joint ventured with the tribe controlling the land.

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

2

Compliance with Government Regulation

he operation of mines is governed by both federal and state laws. The Empress Property is administered by the United States Department of Interior, Bureau of Land Management (“BLM”) in Nevada. In general, the federal laws that govern mining claim location and maintenance and mining operations on Federal Lands, including the Empress Property, are administered by the BLM. Additional federal laws, such as those governing the purchase, transport or storage of explosives, and those governing mine safety and health, also apply.

The State of Nevada likewise requires various permits and approvals before mining operations can begin, although the state and federal regulatory agencies usually cooperate to minimize duplication of permitting efforts. Among other things, a detailed reclamation plan must be prepared and approved, with bonding in the amount of projected reclamation costs. The bond is used to ensure that proper reclamation takes place, and the bond will not be released until that time. The Nevada Division of Environmental Protection (NDEP) is the state agency that administers the reclamation permits, mine permits and related closure plans on the project. Local jurisdictions may also impose permitting requirements, such as conditional use permits or zoning approvals.

Mining activities at the Empress Property are also subject to various environmental laws, both federal and state, including but not limited to the federal National Environmental Policy Act, CERCLA (as defined below), the Resource Recovery and Conservation Act, the Clean Water Act, the Clean Air Act and the Endangered Species Act, and certain Nevada state laws governing the discharge of pollutants and the use and discharge of water. Various permits from federal and state agencies are required under many of these laws. Local laws and ordinances may also apply to such activities as waste disposal, road use and noise levels.

We are committed to fulfilling our requirements under applicable environmental laws and regulations. These laws and regulations are continually changing and, as a general matter, are becoming more restrictive. Our policy is to conduct our business in a manner that safeguards public health and mitigates the environmental effects of our business activities. To comply with these laws and regulations, we have made, and in the future may be required to make, capital and operating expenditures.

The Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (CERCLA), imposes strict, joint, and several liability on parties associated with releases or threats of releases of hazardous substances. Liable parties include, among others, the current owners and operators of facilities at which hazardous substances were disposed or released into the environment and past owners and operators of properties who owned such properties at the time of such disposal or release. This liability could include response costs for removing or remediating the release and damages to natural resources. We are unaware of any reason why our properties would currently give rise to any potential liability under CERCLA. We cannot predict the likelihood of future liability under CERCLA with respect to our property or surrounding areas that have been affected by historic mining operations.

Under the Resource Conservation and Recovery Act (RCRA) and related state laws, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous or solid wastes associated with certain mining-related activities. RCRA costs may also include corrective action or clean up costs.

Mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, such as crushers and storage facilities, and from mobile sources such as trucks and heavy construction equipment. All of these sources are subject to review, monitoring, permitting, and/or control requirements under the federal Clean Air Act and related state air quality laws. Air quality permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the permitting conditions. Under the federal Clean Water Act and delegated state water-quality programs, point-source discharges into “Waters of the State” are regulated by the National Pollution Discharge Elimination System (NPDES) program. Section 404 of the Clean Water Act regulates the discharge of dredge and fill material into “Waters of the United States,” including wetlands. Stormwater discharges also are regulated and permitted under that statute. All of those programs may impose permitting and other requirements on our operations.

3

The National Environmental Policy Act (NEPA) requires an assessment of the environmental impacts of “major” federal actions. The “federal action” requirement can be satisfied if the project involves federal land or if the federal government provides financing or permitting approvals. NEPA does not establish any substantive standards. It merely requires the analysis of any potential impact. The scope of the assessment process depends on the size of the project. An “Environmental Assessment” (EA) may be adequate for smaller projects. An “Environmental Impact Statement” (EIS), which is much more detailed and broader in scope than an EA, is required for larger projects. NEPA compliance requirements for any of our proposed projects could result in additional costs or delays.

The Endangered Species Act (ESA) is administered by the U.S. Fish and Wildlife Service of the U.S. Department of Interior. The purpose of the ESA is to conserve and recover listed endangered and threatened species and their habitat. Under the ESA, “endangered” means that a species is in danger of extinction throughout all or a significant portion of its range. The term “threatened” under such statute means that a species is likely to become endangered within the foreseeable future. Under the ESA, it is unlawful to “take” a listed species, which can include harassing or harming members of such species or significantly modifying their habitat. We currently are unaware of any endangered species issues at our project that would have a material adverse effect on our operations. Future identification of endangered species or habitat in our project areas may delay or adversely affect our operations.

U.S. federal and state reclamation requirements often mandate concurrent reclamation and require permitting in addition to the posting of reclamation bonds, letters of credit or other financial assurance sufficient to guarantee the cost of reclamation. If reclamation obligations are not met, the designated agency could draw on these bonds or letters of credit to fund expenditures for reclamation requirements. Reclamation requirements generally include stabilizing, contouring and re-vegetating disturbed lands, controlling drainage from portals and waste rock dumps, removing roads and structures, neutralizing or removing process solutions, monitoring groundwater at the mining site, and maintaining visual aesthetics. We are committed to maintaining all of our financial assurance and reclamation obligations.

We believe that we are currently in compliance with the statutory and regulatory provisions governing our operations. We hold or will hold all necessary permits and other authorizations to the extent that our current or future claims and the associated operations require them. During the initial phases of our exploration program there will not be any significant disturbances to the land or environment and hence, no government approval is required.

However, we may do business and own properties in a number of different geographical areas and are therefore subject to the jurisdictions of a large number of different authorities at different countries. We plan to comply with all statutory and regulatory provisions governing our current and future operations. However, these regulations may increase significant costs of compliance to us, and regulatory authorities also could impose administrative, civil and criminal penalties for non-compliance. At this time, it is not possible to accurately estimate how laws or regulations would impact our future business. We also can give no assurance that we will be able to comply with future changes in the statutes and regulations.

As we do not know the extent of the exploration program that we will be undertaking, we can not estimate the cost of the remediation and reclamation that will be required. Hence, it is impossible at this time to assess the impact of any capital expenditures on earnings or our competitive position in the event that a potentially economic deposit is discovered.

If we are successful in identifying a commercially viable ore body and we are able to enter into commercial production, due to the increased environmental impact, the cost of complying with permit and environmental laws will be greater than in the previous phases.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

4

Research and Development Expenditures

We have not incurred any research and development expenditures over the past two fiscal years.

Employees

Currently, we do not have any employees. Additionally, we have not entered into any consulting or employment agreements with our president, chief executive officer, treasurer, secretary or chief financial officer. Our directors, executive officers and certain contracted individuals play an important role in the running of our company. We do not expect any material changes in the number of employees over the next 12 month period. We do and will continue to outsource contract employment as needed.

We engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs.

Subsidiaries

We do not have any subsidiaries

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

DESCRIPTION OF PROPERTY

Headquarters and Administration Offices

Our principal executive offices are located at 736 Bay Street, Suite 1205, Toronto, Ontario, Canada. Our offices occupy approximately 200 square feet of space.

Empress Property

On September 7, 2012 we entered into a Mineral Lease Agreement with MinQuest, Inc. Pursuant to the terms of the Agreement, MinQuest, Inc., has agreed to lease us 100% of the exploration and mining rights to the Empress Property for a period of 20 years.

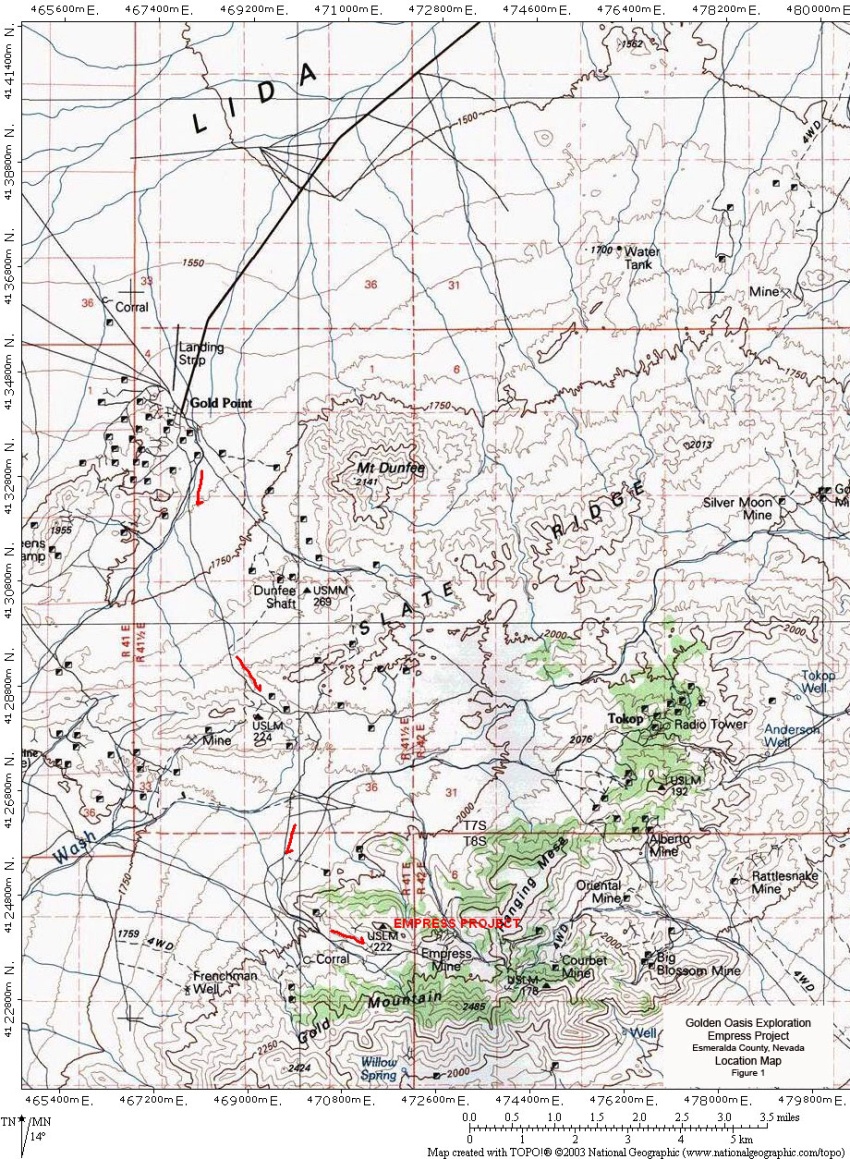

Location and Access

The Empress Property is situated in southwestern Nevada. The property is located in Esmeralda County, Nevada, approximately 26 miles south of Goldfield in the Tokop mining district. Access is via 10 miles of gravel roads from the small hamlet of Gold Point. The property is located near the eastern margin of the Montezuma Range. Branch roads, some requiring 4-wheel drive vehicles, lead to most parts of the property area. The town of Goldfield, the County seat, offers few services. Some supplies and services are available in Tonopah, 42 km north of Goldfield.

5

6

7

Ownership Interest

On September 7, 2012 we entered into a Mineral Lease Agreement with MinQuest, Inc. Pursuant to the terms of the Agreement, MinQuest, Inc., has agreed to lease us 100% of the exploration and mining rights to the Empress Property. As consideration, we are required to provide annual payments of $20,000 and commit to the following work expenditures:

|

●

|

$150,000 spent in the first year;

|

|

●

|

$200,000 spent in the second year;

|

|

●

|

$250,000 spent in the third year;

|

|

●

|

$300,000 spent in the fourth year;

|

|

●

|

$350,000 spent in the fifth year;

|

|

●

|

$400,000 in the sixth year; and

|

|

●

|

$650,000 in the seventh year.

|

MinQuest will also retain a 3% net smelter royalty in the event that we enter mineral production on the Empress Property. If we are unable to fulfill any of the commitments set out above, the Mineral Lease Agreement will terminate and all property rights will revert back to MinQuest, Inc. A full copy of the Mineral Lease Agreement is attached hereto as Exhibit 10.1.

History of Operations

Although there is little information on the early history of the area the property was likely first discovered in the 1860’s when Silver Peak, located 30 miles to the northwest, was developed. Obvious exploitation of the veins probably occurred around the turn of the century, in the 1930’s and probably intermittently thereafter. A drill program was conducted in the early 1980’s by Homestake Mining Co. Although none of the Homestake drill data is available, a brief summary from Homestake geologists confirm the presence of gold mineralization and the partial success of their drill program. At least five holes and maybe more were known to be drilled during this venture. In 2007-2008, American Consolidated drilled 6 core holes.

Below the 7 adits that make up the Empress Mine is the remnants of a mill and several stone foundations from that era. Little production is reported for the district, although the Gold Point district, immediately to the north, produced gold and silver. The Wonder Mine, located 2,000 feet southwest of Empress, was worked in the 1930’s as judged by artifacts, and probably direct shipped its ore to a mill elsewhere.

At the Wonder mine area, there is solid evidence of six existing drill holes (two holes found, one angle and one vertical, and drill chips from four others) and three probable holes (drill sites prepared for angled holes). These holes were all collared in the hanging wall of the Wonder vein irregularly spaced across some 1500’ strike.

Present Condition and Plan of Exploration

Though there is a significant amount of historical exploration on the Empress Property, none of the previous owners have established any substantial operations which will be of use to us in our exploitation of the property. We plan to conduct exploration activities on the Empress Property in three separate phases as follows:

|

PHASE 1

|

|||||

|

Nature of Work

|

Timeframe

|

Cost

|

|||

|

Compilation and interpretation of all existing geologic, geochemical and geophysial data concerning the property, verification sampling, drill target selection

|

1 Month

|

||||

|

Hire senior geologist (10 days)

|

$ | 5,000 | |||

|

Prepare topographic base maps

|

$ | 1,000 | |||

|

Collect select rock chip samples and have analyzed for gold and silver

|

$ | 5,000 | |||

|

Compare assays to historical results

|

$ | 1,000 | |||

|

Stake 10-20 buffer claims to expand land holdings

|

$ | 4,000 | |||

|

Compile plan map of identified drill targets

|

$ | 2,000 | |||

|

Compile cross sections of identified drill targets

|

$ | 2,000 | |||

|

Total

|

1 Month

|

$ | 20,000 | ||

8

If the results of Phase 1 exploration work are favorable, we will continue with Phase 2.

|

PHASE 2

|

|||||

|

Nature of Work

|

Timeframe

|

Cost

|

|||

|

Exploration Drilling Program

|

12 Months

|

||||

|

Hire Project Geologist (60 days)

|

$ | 30,000 | |||

|

Hire RC Drilling Contractor (8,000 feet)

|

$ | 240,000 | |||

|

Contract an assay lab (1,700 samples)

|

$ | 51,000 | |||

|

Contract drill hole surveying (5 surveys)

|

$ | 8,000 | |||

|

Contract dozer, backhoe (20 hours)

|

$ | 4,000 | |||

|

Travel Expenses

|

$ | 8,000 | |||

|

Field expenses

|

$ | 4,000 | |||

|

Office expenses

|

$ | 2,000 | |||

|

Contingencies

|

$ | 3,000 | |||

|

Total

|

12 Months

|

$ | 350,000 | ||

Geology

The property lies within the southern portion of the Walker Lane structural corridor. Major mines within the lower portion of the Walker Lane include Tonopah, Goldfield and Silver Peak. Mineralization in the Tokop district occurs in quartz veins hosted by granitic rocks of the Sylvania pluton. At least 3 separate east-west trending, steeply dipping quartz veins are exposed on the property. Over the years the property owner has had several geologists sample the veins. Most of this sampling is underground as the veins are poorly exposed on the surface.

Much of southern Esmeralda County is underlain by plutonic rock, dated as Jurassic, that has intruded, assimilated, and metamorphosed a section of upper Proterozioc siliciclastics and carbonates. The Sylvania Pluton is tabbed as a quartz monzonite, very likely an exposed southeasterly outlier of the Inyo portion of the Sierra Nevada Batholith.

Major east striking, concave northerly faults with traceable continuity over tens of miles cross lithologic contacts and are themselves crosscut by younger faults. Brecciated, sheared quartz veins, hosting precious metal mineralization, represent repeated fault movements, probably originating during Jurassic intrusion with Tertiary overprints.

The histiorical Empress mine area is underlain by a portion of the Sylvania Pluton, a light to medium gray, medium to coarse grained biotite, k-feldspar equigranular intrusive rock that fits the quartz monzonite classification as a field designation. The intrusive typically displays “soft”, rounded shapes with abundant decomposed material, yet outcrops are normally abundant. Fine grained, dense, light to dark aplite dikes range from 1” to 12” wide.

Assimilated blocks and roof pendants of Proterozoic siliciclastics and carbonates are altered to brown and greenish calc-silicate, with lesser hornfels, often the target of prospectors and miners. The Empress area and neighboring uplands are capped by brown to dark brown, vesicular basalt ranging from several tens of feet thick to thin scabs. Flat topped, basalt-covered hills confirm that the basalts are very young (Pliocene or Pleistocene) and little eroded. It is clear that basalt conceals faults and quartz veins.

9

Index of Geologic Terms

INDEX

|

TERM

|

DEFINITION

|

|

Aplite

|

a light-colored fine-grained igneous rock

|

|

Basalt

|

basalt is a dark gray to black, dense to finely grained igneous rock that is the result of lava eruptions. Basalt flows are noneruptive, voluminous, and characterized by relatively low viscosity.

|

|

Breccias

|

a coarse-grained sedimentary rock made of sharp fragments of rock and stone cemented together by finer material. Breccia is produced by volcanic activity or erosion, including frost shattering.

|

|

Biotite

|

a black, dark brown, or green silicate mineral of the mica group.

|

|

Equigranular

|

a material composed chiefly of crystals of similar orders of magnitude to one another.

|

|

Hornfels

|

a fine-grained metamorphic rock composed of silicate minerals and formed through the action of heat and pressure on shale.

|

|

Igneous

|

describes rock formed under conditions of intense heat or produced by the solidification of volcanic magma on or below the Earth's surface.

|

|

Lithologic

|

the gross physical character of a rock or rock formation

|

|

Monzonite

|

a visibly crystalline, granular igneous rock composed chiefly of equal amounts of two feldspar minerals, plagioclase and orthoclase, and small amounts of a variety of colored minerals.

|

|

Plutonic

|

a mass of intrusive igneous rock that has solidified underground by the crystallization of magma.

|

|

Quartz

|

a common, hard, usually colorless, transparent crystalline mineral with colored varieties. Use: electronics, gems.

|

|

Silica

|

silicon dioxide found naturally in various crystalline and amorphous forms, e.g. quartz, opal, sand, flint, and agate. Use: manufacture of glass, abrasives, concrete.

|

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR OVERALL BUSINESS OPERATIONS

We Have A Limited Operating History With Significant Losses And Expect Losses To Continue For The Foreseeable Future.

We have yet to establish any history of profitable operations. We have incurred net losses of $113,969 and $64,124 for the fiscal years ended July 31, 2011 and 2010, respectively. As a result, at July 31, 2011, we had an accumulated deficit of $232,662 and a total stockholders’ deficiency of $204,662. We have not generated any revenues since our inception and do not anticipate that we will generate revenues which will be sufficient to sustain our operations. We expect that our revenues will not be sufficient to sustain our operations for the foreseeable future. Our profitability will require the successful commercialization of our mining properties. We may not be able to successfully commercialize our mines or ever become profitable.

10

There Is Doubt About Our Ability To Continue As A Going Concern Due To Recurring Losses From Operations, Accumulated Deficit And Insufficient Cash Resources To Meet Our Business Objectives, All Of Which Means That We May Not Be Able To Continue Operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended July 31, 2011 and 2010, respectively, with respect to their doubt about our ability to continue as a going concern. As discussed in Note 1 to our financial statements for the year ended July 31, 2011, we have generated operating losses since inception, and our cash resources are insufficient to meet our planned business objectives, which together raises doubt about our ability to continue as a going concern.

We May Not Be Able To Secure Additional Financing To Meet Our Future Capital Needs Due To Changes In General Economic Conditions.

We anticipate needing significant capital to conduct further exploration and development needed to bring our existing mining properties into production and/or to continue to seek out appropriate joint venture partners or buyers for certain mining properties. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

Our Business And Operating Results Could Be Harmed If We Fail To Manage Our Growth Or Change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must continue to try to locate skilled geologists, mappers, drillers, engineers, technical personnel and adequate funds in a timely manner.

We May Not Have Access To The Supplies And Materials Needed For Exploration, Which Could Cause Delays Or Suspension Of Our Operations.

Competitive demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times in our exploration programs. Furthermore, fuel prices are rising. We will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower can be obtained.

Attraction And Retention Of Qualified Personnel Is Necessary To Implement And Conduct Our Mineral Exploration Programs.

Our future success will depend largely upon the continued services of our Board members, executive officers and other key personnel. Our success will also depend on our ability to continue to attract and retain qualified personnel with mining experience. Key personnel represent a significant asset for us, and the competition for qualified personnel is intense in the mineral exploration industry.

We may have particular difficulty attracting and retaining key personnel in the initial phases of our exploration programs. We do not have key-person life insurance coverage on any of our personnel. The loss of one or more of our key people or our inability to attract, retain and motivate other qualified personnel could negatively impact our ability to complete our exploration programs.

11

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail, and you could lose your entire investment.

We have not yet started exploration of our mineral claim, and thus have no way to evaluate the likelihood that we will be successful in establishing commercially exploitable reserves of gold or other valuable minerals on our mineral claim. You should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold or other minerals in any our mineral claim. In such a case, we may be unable to continue operations, and you could lose your entire investment.

If we discover commercial reserves of gold on our mineral property, we can provide no assurance that we will be able to successfully advance the mineral claim into commercial production. If we cannot commence commercial production, we may not be able to achieve revenues.

Our current mineral property does not contain any known bodies of ore. If our exploration program is successful in establishing ore of commercial tonnage and grade on our mineral claim, we will require additional funds in order to advance the mineral claim into commercial production. In such an event, we may be unable to obtain any such funds, or to obtain such funds on terms that we consider economically feasible, and we may be unable to generate revenues.

RISKS ASSOCIATED WITH OUR INDUSTRY

The Development And Operation Of Our Mining Projects Involve Numerous Uncertainties.

Mine development projects, including our planned projects, typically require a number of years and significant expenditures during the development phase before production is possible.

Development projects are subject to the completion of successful feasibility studies, issuance of necessary governmental permits and receipt of adequate financing. The economic feasibility of development projects is based on many factors such as:

|

●

|

estimation of reserves;

|

|

●

|

anticipated metallurgical recoveries;

|

|

●

|

future gold and silver prices; and

|

|

●

|

anticipated capital and operating costs of such projects.

|

Our mine development projects may have limited relevant operating history upon which to base estimates of future operating costs and capital requirements. Estimates of proven and probable reserves and operating costs determined in feasibility studies are based on geologic and engineering analyses.

Any of the following events, among others, could affect the profitability or economic feasibility of a project:

|

●

|

unanticipated changes in grade and tonnage of material to be mined and processed;

|

|

●

|

unanticipated adverse geotechnical conditions;

|

|

●

|

incorrect data on which engineering assumptions are made;

|

|

●

|

costs of constructing and operating a mine in a specific environment;

|

|

●

|

availability and cost of processing and refining facilities;

|

|

●

|

availability of economic sources of power;

|

|

●

|

adequacy of water supply;

|

|

●

|

adequate access to the site;

|

|

●

|

unanticipated transportation costs;

|

|

●

|

government regulations (including regulations relating to prices, royalties, duties, taxes, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands);

|

12

|

●

|

fluctuations in metal prices; and

|

|

●

|

accidents, labor actions and force majeure events.

|

Any of the above referenced events may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

Mineral Exploration Is Highly Speculative, Involves Substantial Expenditures, And Is Frequently Non-Productive.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. Few prospects that are explored end up being ultimately developed into producing mines. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. We cannot assure you that our mineral exploration efforts will be successful. The risks associated with mineral exploration include:

|

●

|

The identification of potential economic mineralization based on superficial analysis;

|

|

●

|

the quality of our management and our geological and technical expertise; and

|

|

●

|

the capital available for exploration and development.

|

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Because of these uncertainties, our current and future exploration programs may not result in the discovery of reserves, the expansion of our existing reserves or the further development of our mines.

The Price Of Gold and Silver are Highly Volatile And A Decrease In The Price Of Gold or Silver Would Have A Material Adverse Effect On Our Business.

The profitability of mining operations is directly related to the market prices of metals. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations of metals from the time development of a mine is undertaken to the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop one or more of our mining properties at a time when the price of metals makes such exploration economically feasible and, subsequently, incur losses because the price of metals decreases. Adverse fluctuations of the market prices of metals may force us to curtail or cease our business operations.

Mining Risks And Insurance Could Have An Adverse Effect On Our Profitability.

Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as unusual or unexpected geological formations, environmental pollution, personal injuries, flooding, cave-ins, changes in technology or mining techniques, periodic interruptions because of inclement weather and industrial accidents. Although maintenance of insurance to ameliorate some of these risks is part of our proposed exploration program associated with those mining properties we have an interest in, such insurance may not be available at economically feasible rates or in the future be adequate to cover the risks and potential liabilities associated with exploring, owning and operating our properties. Either of these events could cause us to curtail or cease our business operations.

We Face Significant Competition In The Mineral Exploration Industry.

We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do in connection with the acquisition of exploration properties and leases on prospects and properties and in connection with the recruitment and retention of qualified personnel. Such competition may result in our being unable to acquire interests in economically viable gold and silver exploration properties or qualified personnel.

13

Our Applications For Exploration Permits May Be Delayed Or May Be Denied In The Future.

Exploration activities usually require the granting of permits from various governmental agencies. For exploration drilling on unpatented mineral claims, a drilling plan must be filed with the Bureau of Land Management or the United States Forest Service, which may then take several months or more to grant the requested permit. Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Indian grave yards, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional permits before exploration activities can commence. With all permitting processes, there is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits or the refusal to grant required permits may not be granted at all, all of which may cause delays and unanticipated costs in conducting planned exploration activities. Any such delays or unexpected costs in the permitting process could result in serious adverse consequences to the price of our stock and to the value of your investment.

RISKS RELATED TO THE MARKET FOR OUR STOCK

The market price of our common stock can become volatile, leading to the possibility of its value being depressed at a time when you may want to sell your holdings.

The market price of our common stock can become volatile. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include: our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors; changes in financial estimates by us or by any securities analysts who might cover our stock; speculation about our business in the press or the investment community; significant developments relating to our relationships with our customers or suppliers; stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in our industry; customer demand for our products; investor perceptions of our industry in general and our Company in particular; the operating and stock performance of comparable companies; general economic conditions and trends; announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures; changes in accounting standards, policies, guidance, interpretation or principles; loss of external funding sources; sales of our common stock, including sales by our directors, officers or significant stockholders; and additions or departures of key personnel. Securities class action litigation is often instituted against companies following periods of volatility in their stock price. Should this type of litigation be instituted against us, it could result in substantial costs to us and divert our management’s attention and resources.

Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to the operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our Company at a time when you want to sell your interest in us. We do not intend to pay dividends on shares of our common stock for the foreseeable future.

We have never declared or paid any cash dividends on shares of our common stock.

We intend to retain any future earnings to fund the operation and expansion of our business and, therefore, we do not anticipate paying cash dividends on shares of our common stock in the foreseeable future.

We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. If our common stock becomes a “penny stock,” we may become subject to Rule 15g-9 under the Exchange Act, or the Penny Stock Rule. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by the Penny Stock Rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

14

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

There can be no assurance that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

We are not likely to pay cash dividends in the foreseeable future.

We intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate. Should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions.

Our common stock is illiquid and subject to price volatility unrelated to our operations.

If a market for our common stock does develop, its market price could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting us or our competitors. In addition, the stock market itself is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

A large number of shares may be eligible for future sale and may depress our stock price.

We may be required, under terms of future financing arrangements, to offer a large number of common shares to the public, or to register for sale by future private investors a large number of shares sold in private sales to them.

Sales of substantial amounts of common stock, or a perception that such sales could occur, and the existence of options or warrants to purchase shares of common stock at prices that may be below the then-current market price of our common stock, could adversely affect the market price of our common stock and could impair our ability to raise capital through the sale of our equity securities, either of which would decrease the value of any earlier investment in our common stock.

FINANCIAL STATEMENTS AND EXHIBITS

Our audited dinancial statements for the years ended July 31, 2011 and 2010, are incorporated herein by reference to our amended Annual Report on Form 10-K filed on December 14, 2011. Our unaudited financial statements for the period ended April 30, 2012 are incorporated herein by reference to our Quarterly Report on Form 10-Q filed on June 14, 2012.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our consolidated financial statements and the notes thereto which appear elsewhere in this report. The results shown herein are not necessarily indicative of the results to be expected in any future periods. This discussion contains forward-looking statements based on current expectations, which involve uncertainties. In some cases, you can identify forward-looking statements by terminology such as "anticipate," "estimate," "plan," "project," "predict," "potential," "continue," "ongoing," "expect," "believe," "intend," "may," "will," "should," "could," or the negative of these terms or other comparable terminology. All forward-looking statements included in this document are based on information available to the management on the date hereof. Actual results and the timing of events could differ materially from the forward-looking statements as a result of a number of factors. Readers should also carefully review factors set forth in other reports or documents that we file from time to time with the Securities and Exchange Commission.

15

Comparison of Results for the Nine Months Ended April 30, 2012 and April 30, 2011

For the nine-month period ended April 30, 2012, we incurred a net loss of $78,210 compared with a net loss of $79,200 for the nine-month period ended April 30, 2011. As we did not generate any revenue during either the nine-month periods ended April 30, 2012 and 2011, the net losses were comprised completely of general and administrative expenses incurred related to corporate overhead, public company filing and listing costs, financial and administrative contracted services such as legal and accounting, and business development costs.

All expenses remained nearly identical during the two nine-month periods with the only difference being a savings in accounting expense in the nine-month period ended April 30, 2012, due to the over-accrual of our July 31, 2011 year end audit fees which we then adjusted to actual for the nine-month period ended April 30, 2012 with a reversal.

Since inception to date, we have earned revenues of $915. Our net loss from inception through April 30, 2012 was $310,872.

Liquidity and Capital Resources for the Nine Months Ended April 30, 2012

As of April 30, 2012, our total assets were $Nil, our total liabilities were $282,872, and stockholders’ deficiency was $282,872.

As of April 30, 2011, our total assets were $5,221 consisting of $5,000 in vending equipment plus $221 in prepaid rent, our total liabilities were $175,115, and stockholders’ deficiency was $169,894.

Stockholders’ deficit increased from $232,662 for fiscal year ended July 31, 2011 to a deficit of $310,872 at April 30, 2012.

Cash Flows from Operating Activities

We have not generated positive cash flows from operating activities. For the nine-month period ended April 30, 2012, net cash flows used in operating activities was $(9,869), resulting from a net loss of $51,510 and increase in accounts payable of $68,267 and prepaid expenses of $74. For the nine month period ended April 30, 2011, net cash flows used in operating activities was $(9,466), resulting from a net loss of $79,200, an increase in prepaid expense of $221 and a corresponding increase in accounts payables of $69,955.

Cash Flows from Financing Activities

We have financed our operations primarily from either advancements or the issuance of equity and debt instruments. For the nine-month period ended April 30, 2012, net cash flows provided from financing activities totaled $9,869 made up of $4,620 in the form of a temporary loan and advances from officers of $5,249. For the nine-month period ended April 30, 2011, net cash flows provided from financing activities was $9,466 as advances from officers.

We expect that working capital requirements will continue to be funded through a combination of our existing funds and further issuances of securities. Our working capital requirements are expected to increase in line with the growth of our business. We expect to earn revenues from the one machine we have already placed but there is no guaranty that this will occur.

Comparison of Results for the Years Ended July 31, 2011 and July 31, 2010

For the fiscal year ended July 31, 2011, we incurred a net loss of $113,969 compared with a net loss of $64,124 for the fiscal year ended July 31, 2010. As we did not generate any revenue during the years ended July 31, 2011 and 2010, the net losses were comprised completely of general and administrative expenses incurred related to corporate overhead, public company filing and listing costs, financial and administrative contracted services such as legal and accounting, and business development costs, and depreciation of the vending equipment. In the fiscal year ended July 31, 2011, we incurred a full twelve months of consulting expense of $8,000 per month, whereas for the fiscal year ended July 31, 2010, we began incurring consulting expense, starting March 2, 2010, so only five months of expense. For the year ended July 31, 2010, no depreciation was recognized. For the year ended July 31, 2011, full depreciation of $5,000 was expensed.

Since inception to date, we have earned revenues of $915, which were earned during the year ending July 31, 2009. Our net loss from inception through July 31, 2011 was $232,662.

16

As of July 31, 2011, our total assets were $74, our total liabilities were $204,736, and stockholders’ deficiency was $204,662.

At July 31, 2010, we had total assets of $5,000, our total liabilities were $95,693, and stockholders’ deficiency was $90,693 for the same period.

We have not attained profitable operations and are dependent upon obtaining financing to pursue the purchase of amusement games. For these reasons our auditors believe that there is substantial doubt that we will be able to continue as a going concern.

Plan of Operations:

Since we entered into the Mineral Lease Agreement, we have changed our plan of operations to focus on the exploration of the Empress Property. Our exploration plan is detailed in the “Description of Property” section of this Current Report, under the subheading “Plan of Exploration”.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the small business issuer's financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Critical Accounting Policies

Management's Discussion and Analysis of Financial Condition and Results of Operations is based upon our financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to the reported amounts of revenues and expenses, bad debt, investments, intangible assets, income taxes, and contingencies and litigation. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results could differ from these estimates under different assumptions or conditions. We consider the following accounting policies to be critical because the nature of the estimates or assumptions is material due to the levels of subjectivity and judgment necessary to account for highly uncertain matters or the susceptibility of such matters to change or because the impact of the estimates and assumptions on financial condition or operating performance is material.

Basis of Presentation

The accounting and reporting policies of the Company conform to U.S. generally accepted accounting principles (US GAAP) applicable to development stage companies.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents include cash in banks, money market funds, and certificates of term deposits with maturities of less than three months from inception, which are readily convertible to known amounts of cash and which, in the opinion of management, are subject to an insignificant risk of loss in value. The Company had $Nil in cash and cash equivalents at July 31, 2011 (July 31, 2010 - $Nil).

17

Financial Instruments and Risk Concentrations

The Company’s financial instruments comprise cash and cash equivalents, loan receivable, accounts payable and accrued liabilities, notes payable and convertible loan. Unless otherwise indicated, the fair value of financial assets and financial liabilities approximate their recorded values due to their short terms to maturity. The Company determines the fair value of its long-term financial instruments based on quoted market values or discounted cash flow analyses.

Financial instruments that may potentially subject the Company to concentrations of credit risk comprise primarily cash and cash equivalents and accounts receivable. Cash and cash equivalents comprise deposits with major commercial banks and/or checking account balances. With respect to accounts receivable, the Company performs periodic credit evaluations of the financial condition of its customers and typically does not require collateral from them. Allowances are maintained for potential credit losses consistent with the credit risk of specific customers and other information. Unless otherwise noted, it is management's opinion that the Company is not exposed to significant interest or currency risks in respect of its financial instruments.

Foreign Currency Translation

The financial statements are presented in US dollars. In accordance with Statement of Financial Accounting Standards The Company maintains its accounting records in U.S. dollars, which is the functional, and reporting currency. No significant gains or losses were recorded form inception to July 31, 2011.

Income Taxes

The Company accounts for its income taxes in accordance with ASC 740, “Income Taxes”, which requires recognition of deferred tax assets and liabilities for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in operations in the period that includes the enactment date. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that the deferred tax assets will not be realized.

Basic and Diluted Loss Per Share

The Company reports earnings (loss) per share in accordance with ASC 260, "Earnings per Share." Basic earnings (loss) per share is computed by dividing income (loss) available to common stockholders by the weighted average number of common shares available. Diluted earnings (loss) per share is computed similar to basic earnings (loss) per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive.

The Company has no potential dilutive instruments and accordingly, basic loss and diluted share loss per share are equal.

Stock-Based Compensation

The Company has adopted FASB ASC 718 (Prior authoritative literature: SFAS 123 (revised in December 2004), “Share Based Payment,” which requires measuring the cost of employee and non-employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award. That cost will be recognized over the period during which an employee or a non-employee is required to provide service in exchange for the award-the requisite service period. The Company does not recognize compensation cost for equity instruments for which employees do not render the requisite service. Grant-date fair value of employee and non-employee share options and similar instruments are estimated using option-pricing models adjusted for the unique characteristics of those instruments.

Revenue Recognition

The Company recognizes revenue at the point of passage to the customer of title and risk of loss when there is persuasive evidence of an arrangement, the sales price is determinable, and collection of the resulting receivable is reasonably assured. Service revenues are generally recognized at the time of performance. Revenues billed in advance under contracts are deferred and recognized over the corresponding service periods. Revenue will consist of services income and will be recognized only when all of the following criteria have been met:

18

|

(i)

|

Persuasive evidence for an agreement exists;

|

|

(ii)

|

Service has occurred;

|

|

(iii)

|

The fee is fixed or determinable; and

|

|

(iv)

|

Revenue is reasonably assured.

|

Recent Accounting Pronouncements

In April 2010, the FASB issued Accounting Standards Update (“ASU” or “Update”) No. 2010–17, “Revenue Recognition - Milestone Method.” The objective of this Update is to provide guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research or development transactions. The amendments in this Update are effective on a prospective basis for milestones achieved in fiscal years, and interim periods within those years, beginning on or after June 15, 2010. Early adoption is permitted. The Company does not anticipate that the adoption of this pronouncement will have a significant effect on its financial statements.

In February 2010, FASB issued ASU No. 2010-09, “Subsequent Events” (Topic 855) Amendments to Certain Recognition and Disclosure Requirements (“ASU 2010-09”). ASU 2010-09 amends disclosure requirements within Subtopic 855-10. An entity that is an SEC filer is not required to disclose the date through which subsequent events have been evaluated. This change alleviates potential conflicts between Subtopic 855-10 and the SEC’s requirements. ASU 2010-09 is effective for interim and annual periods ending after June 15, 2010. The Company does not expect the adoption of ASU 2010-09 to have a material impact on its results of operations or financial position.

In January 2010, the FASB issued ASU No. 2010-06, “Improving Disclosures about Fair Value Measurements” (ASU 2010-06) (codified within ASC 820 Fair Value Measurements and Disclosures). ASU 2010-06 improves disclosures originally required under SFAS No. 157. ASU 2010-06 is effective for interim and annual periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances and settlements in the roll forward of activity in Level 3 fair value measurements. Those disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those years. The adoption of the guidance did not have a material effect on the Company's financial position, results of operations, cash flows or related disclosures.

The Company does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position or cash flow.

As new accounting pronouncements are issued, the Company will adopt those that are applicable under the circumstances.

Reports to Security Holders

We intend to furnish our shareholders with annual reports containing financial statements audited by our independent auditors and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our common stock as of September 10, 2012 (i) by each person who is known by us to beneficially own more than 5% of our common stock; (ii) by each of our officers and directors; and (iii) by all of our officers and directors as a group. Unless otherwise specified, the address of each of the persons set forth below is in care of our company, 736 Bay Street, Suite 1205 Toronto, Ontario, Canada.

19

|

Name and Address of Beneficial Owner

|

Office, If Any

|

Title of Class

|

Amount and Nature of Beneficial

Ownership(1)

|

Percent of

Class(2)

|

||||||

|

Officers and Directors

|

||||||||||

|

Ramzan Savji

|

President, CEO, CFO, Treasurer, Secretary

|

Common stock,

$0.001 par value

|

30,000,000 | 60 | % | |||||

|

All officers and directors as a group

|

30,000,000 | 60 | % | |||||||

* Less than 1%

|

(1)

|

Beneficial Ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Each of the beneficial owners listed above has direct ownership of and sole voting power and investment power with respect to the shares of our common stock.

|

|

(2)

|

A total of 50,000,000 shares of our common stock are considered to be outstanding pursuant to SEC Rule 13d-3(d)(1) as of September 10, 2012. For each beneficial owner above, any options exercisable within 60 days have been included in the denominator.

|

Changes in Control

We do not currently have any arrangements which if consummated may result in a change of control of our company.

DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Directors and Executive Officers

The following sets forth information about our directors and executive officers as of the date of this report:

|

Name

|

Age

|

Position

|

|

Ramzan Savji

|

62

|

CEO, CFO, President, Secretary, Treasuer and Director

|

Ramzan Savji

Ramzan Savji has more than 30 years of experience in the banking and business sector. He has studied Banking and Business Administration in Germany and was employed with the Deutsche Bank A.G., Munich, Germany in their letters of credit department from June 1971 to August 1974. He then became the Area Representative for Societe Generale, the French & International Bank from May 1988 to April 1995. He covered Kenya, Uganda, Tanzania, Rwanda, Burundi and Malawi. He was responsible for building up and enhancing correspondent banking relationships between Societe Generale and the banks domiciled in the above countries. He was also responsible for lobbying and promoting business for the French companies and arranging short, medium and long term lines of credit for project financing for both, the Public Sector as well the Private Sector.

In August 2000, Mr. Savji incorporated Telecommunications Supply Line Ltd., a telecommunications installation and networking material supplier in Kenya, wherein he managed the company on a day-to-day basis for over a period of ten years.

From December 1993 to December 1996, Mr. Savji has been a Member of the Board of Governors of the Aga Khan Hospital in Nairobi, Kenya.

Since October 2011, Mr. Savji has been the vice president, secretary and a member to the board of directors of Toron, Inc., a mineral exploration company located in Montreal, Quebec, Canada. His primary duties and responsibilities include assisting the president with the day-to-day operations of the company.

We believe that Mr. Savji is qualified to sit on our board of directors due to his financial background and his ability to manage startup companies.