Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIFTH THIRD BANCORP | d409026d8k.htm |

©

Fifth Third Bank | All Rights Reserved

Exhibit 99.1

Barclays

Global Financial Services Conference

Kevin T. Kabat

President & Chief Executive Officer

September 11, 2012

Refer to earnings release dated July 19, 2012

and 10-Q dated August 8, 2012 for further information

|

2

©

Fifth Third Bank | All Rights Reserved

Well-positioned for success and leadership in new banking landscape

Key themes

Traditional

banking focus

consistent with

direction of

financial reform

Strong levels of

profitability

Broad-based

credit

improvements

Exceed fully

phased-in Basel

III capital

standards today

Well-established

franchise in key

markets

Commitment to

our customers

and our

communities

Continued

investments to

maintain and

enhance

revenue-

generation

Disciplined

expense control |

3

©

Fifth Third Bank | All Rights Reserved

Continued momentum

Strong first half 2012 results underscored by

continued loan growth, solid fee income,

expense control, and ongoing improvement

in credit metrics

Traditional banking model and moderate risk

profile contribute to above average returns

New product offerings consistent with our

mission, our customer value proposition,

and regulatory reform

Return capital from robust internal capital

generation through appropriate dividend

payout and share repurchase plans

We believe current and forecasted fully

phased-in pro-forma capital ratios would

substantially exceed new fully phased-in

well-capitalized minimums

1

2

3

4

5

$130

$175

$270

$88

$328

$373

$305

$421

$376

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

Earnings Growth

Net income available to common shareholders

($mm) |

4

©

Fifth Third Bank | All Rights Reserved

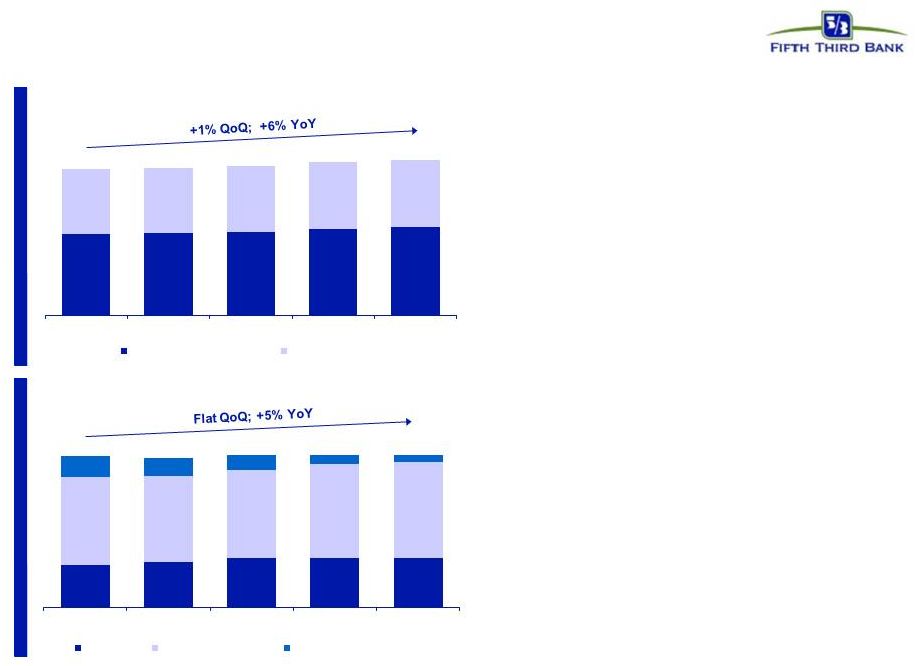

Balance sheet growth mitigates rate environment

•

Core deposit to loan ratio of 99% consistent with

2Q11

–

DDAs up 19% year-over-year

–

Consumer average transaction deposits up 6%

year-over-year

–

Commercial average transaction deposits up

12% year-over-year

Average loan growth ($B)^

Average core deposit growth ($B)

83

78

82

78

^

Excludes loans held-for-sale

Note: Numbers may not sum due to rounding

79

78

81

82

•

Sustained growth driven by C&I and residential

mortgage loans; portfolios in run-off mode of

moderate size

–

Commercial line utilization stable at 32%;

potential source of future growth

•

CRE portfolio run-off at slowing rate, with modest

selective current origination volume

•

Managing auto volumes to ensure appropriate

returns; spread pressure due to competition

•

Branch mortgage refi product has FICO over 780,

LTV ~60% and avg. term ~17 years while yielding

above market rates due to process convenience

80

Demand

IBT/Savings/MMDA

Consumer CD/Core foreign

22

24

26

26

26

46

45

46

49

50

11

9

8

7

6

2Q11

3Q11

4Q11

1Q12

2Q12

44

44

45

46

47

34

35

35

36

36

2Q11

3Q11

4Q11

1Q12

2Q12

Commercial Loans

Consumer Loans

82

•

Short-term wholesale borrowings represent only

7% of total funding |

5

©

Fifth Third Bank | All Rights Reserved

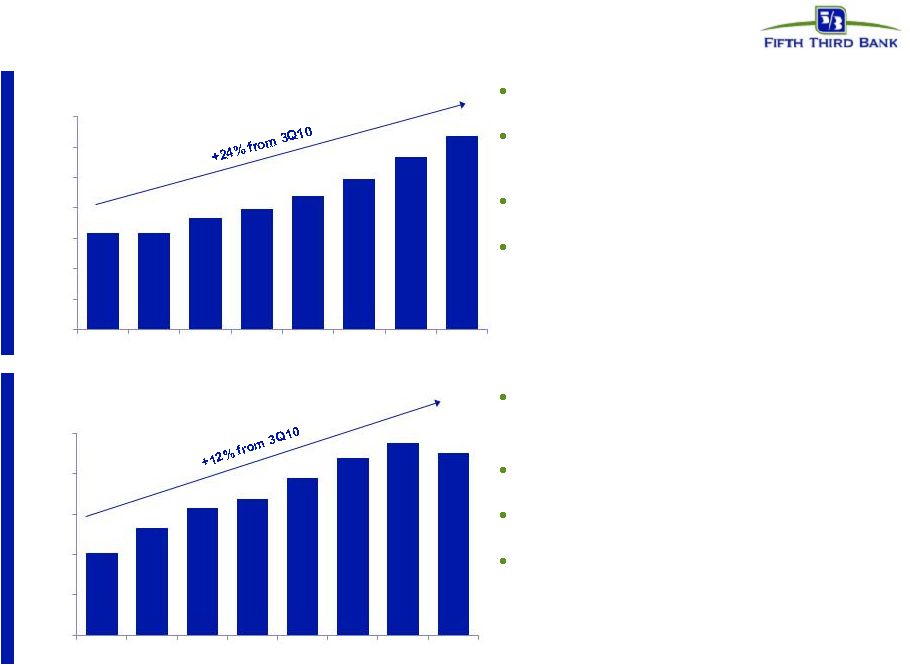

Strength in loan growth

Completed geographic expansion initiatives

–

Now in 44 states representing majority of US

auto sales

Increased competition for high quality prime

auto assets

Careful margin management to optimize

volume/return levels

Continued strong credit performance

–

Net charge-offs of 0.21% in 2Q12

–

High quality origination profile with ~770

YTD average FICO

Continued solid demand in large corporate and

mid-corporate space

Mix shift toward higher-quality loans and

portfolio effects of repricing have resulted in

reduction in portfolio yields

C&I loans as a percent of total commercial loans

was 70% at 2Q12 versus peer average of 62%

C&I production continues to be broad based

across industries and sectors

Source: SNL Financial and Company Reports. Peer average includes: BBT, CMA, HBAN,

KEY, MTB, PNC, RF, STI, USB, WFC, and ZION *ZION & BBT exclude government guaranteed loans; ZION presented as end of

period data. ^Presented on an average basis; Excluding held-for-sale loans.

26.3

26.3

27.3

27.9

28.8

29.9

31.4

32.7

$20.0

$22.0

$24.0

$26.0

$28.0

$30.0

$32.0

$34.0

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

C&I Portfolio*^ ($B)

10.5

10.8

11.1

11.2

11.4

11.7

11.9

11.8

$9.5

$10.0

$10.5

$11.0

$11.5

$12.0

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

Auto Portfolio^ ($B) |

6

©

Fifth Third Bank | All Rights Reserved

NII results reflect continued moderate NIM

pressure offset by balance sheet growth

*

^ Estimate; funding (DDAs +

Fixed / Floating Portfolio

•

Near-term NIM pressure created by low rate

environment and modest natural asset sensitivity, but

is expected to be manageable

•

$1.4bn TruPS redemptions in August will benefit 3Q12

NII ~$4MM and benefit NIM ~2 bps vs. 2Q12

•

Coupons on new originations of variable rate assets

consistent with portfolio weighted average coupons

Emphasis on variable rate C&I lending

•

Coupons on new fixed rate originations converging

with portfolio average coupons

•

Current trends provide for stable near-term net interest

income levels

Funding^

NII and NIM (FTE)

Trend: fixed rate loan origination coupons

relative to fixed portfolio weighted avg

Larger portfolio repricing effects

0.00

0.50

1.00

1.50

2.00

3.62%

3.65%

3.67%

3.61%

3.56%

$450

$550

$650

$750

$850

$950

2.0%

2.5%

3.0%

3.5%

4.0%

2Q11

3Q11

4Q11

1Q12

2Q12

Net Interest Income (right axis)

PAA*

NIM

$869

$902

$920

$903

$899

($mm)

Loans

51%

Investment

Portfolio

14%

Fixed

46%

Floating

54%

Investment

Portfolio 3%

Interest-Earning

Assets

Fixed

Floating

Floating

~40-45%

Loans

32%

Fixed

55-60%

Represents purchase accounting adjustments included in net interest income.

interest-bearing liabilities); liabilities attributed to fixed

or floating using terms and expected beta |

7

©

Fifth Third Bank | All Rights Reserved

Strong revenue and profit generation

Source: SNL Financial and Company Reports. Peer median includes: BBT, CMA, HBAN,

KEY, MTB, PNC, RF, STI, USB, WFC, and ZION *

Excludes

$29MM,

$3MM,

$10MM,

$46MM,

and

$56MM

positive

valuation

adjustment

on

the

Vantiv

warrant

and

put

option

in

2Q11,

3Q11,

4Q11,

1Q12,

and

2Q12,

respectively,

as

well

as

$115MM in gains from Vantiv's IPO and $34MM charge related to Vantiv's debt

refinancing in 1Q12. **

Non-GAAP measure. See Reg. G reconciliation in the Appendix to the

presentation. Revenue / Avg. Int. Earning Assets*

PPNR** / Avg. Int. Earning Assets*

Returns strong relative to peers

•

Business mix provides higher than average

diversity among spread and fee revenues

(40+% of revenue)

•

Relatively strong margin and relatively high

fee income contribution drives strong revenue

and PPNR generation profitability despite

sluggish economy

•

Income from ownership in Vantiv $26mm in

2Q12 (full year 2011 quarterly avg ~$14mm),

despite selling ~10% in 1Q12 |

8

©

Fifth Third Bank | All Rights Reserved

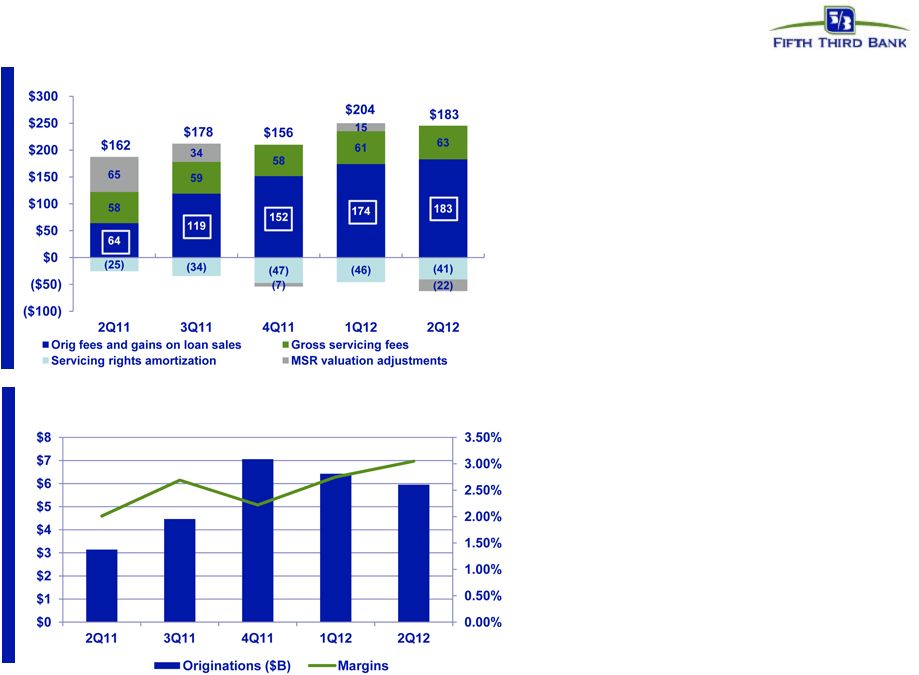

Strong mortgage banking results

•

Record origination fees and gain on

loan sales in 2Q12

•

Highest ranking among all servicers

and peer groups in Fannie Mae’s

2011 STAR

TM

Program for servicing

performance

Looking forward:

•

Continued strong originations /

deliveries in 3Q12

–

Results should remain robust

while rates remain low

•

Gain on sale margins benefitting

from:

–

Strong demand

–

Industry capacity constraints

–

Low prepayment expectations

(particularly on HARP 2.0

originations)

•

HARP 2.0 originations expected to

remain similar percentage of total

originations in 3Q12 vs 2Q12

Mortgage originations and gain-on-sale margins

Mortgage Banking Revenue ($MM) |

9

©

Fifth Third Bank | All Rights Reserved

Momentum building in corporate banking

Corporate banking revenue ($mm)

•

Dedicated national

healthcare team also

focused in core Midwest &

Southeast markets

•

$2.8B in outstandings; up

40% from June 2011

•

Specialized products

including RevLink

Solutions platform; 30%

increase in accounts from a

year ago

$95

$87

$82

$97

Mid-corporate opportunity

•

Target clients: businesses

that generate $200mm to

$2B in revenue

•

Hired 20+ bankers in the

past 9 months

–

Have generated over $3B

in committed credit and

more than $1.5B in

funded loans

•

Integrated receivables solutions

simplify cash handling and improve

cash flow

–

Remote Currency Manager, our

remote cash capture smart safe

solution

–

Electronic Deposit Manager, our

remote deposit capture solution

•

Commercial card solutions

streamline processes, reduce costs

and maximize convenience

Healthcare vertical

Innovative solutions

$102

31

32

30

29

33

12

9

9

11

14

7

7

6

6

8

28

28

29

31

30

16

11

7

19

17

$0

$20

$40

$60

$80

$100

$120

2Q11

3Q11

4Q11

1Q12

2Q12

Letter of Credit / FX

Institutional Sales

Interest Rate Derivatives

Business Lending Fees

Other Corporate Banking |

10

©

Fifth Third Bank | All Rights Reserved

•

View balances,

transfer money, pay

bills, view alerts,

and more

•

App available on

iPhone, Android,

and BlackBerry

•

The only

combined credit

and a debit card

•

Convenience, security,

and financial flexibility

•

New sales consistently

increasing; ~30% of new

consumer card accounts

•

Pay down mortgage faster, just for doing

everyday banking

•

Credit card earns rewards points and

automatically pays down mortgage

principal

•

Pay off mortgage up to a year early

•

Innovative, end-to-end

remote cash

management solution

•

Maximize cash flow while

boosting control over

cash handling

•

Nearly 6,400 RCM

locations; has doubled

since 2009

Mobile Experience

Homeowner Plus Value Package

DUO Card

Remote Currency Manager

Providing customers with products and services they find valuable

New products developed by listening to the voice of the customer

and a

deliberate approach to mitigate regulatory and legislative impacts

Customer oriented solutions |

11

©

Fifth Third Bank | All Rights Reserved

Simplifying deposit structure:

Aligning value to our customers with value to Fifth Third

Value to our customers

Value to Fifth Third

1

2

3

1

2

3

Accounts straightforward and easy to

use

Simplified service charges with

elimination of certain fees

Greater benefits, including competitive

rates and identity theft protection, for

total relationship value

Simplifies relationship building

for our sales force by reducing

complexity across checking and

savings products

Payment and deposit fee results

and balances expected to

contribute to revenue growth

Changes are compatible with

Fifth Third’s strategic direction

and new regulatory landscape

We are committed to providing valuable products

and services at a fair price

–

Broader and deeper banking

relationships with Fifth Third earn

better rates and lower costs

–

Elimination of daily overdraft fees

on continuing customer overdraft

positions

–

25 checking products simplified to

5 segment-focused products

–

17 savings products simplified to 3 |

12

©

Fifth Third Bank | All Rights Reserved

Credit trends continue to improve

with strong reserve coverage levels

Source: SNL Financial and Company Reports. Data as of 2Q12. HFI NPLs exclude loans

held-for-sale and also exclude covered assets for BBT, USB, and ZION

Continued

decline

in

problem

assets

and

corresponding

decline

in

charge-offs

combined

with strong reserves on an absolute and relative basis

NPLs / Loans

Peer average: 1.8%

Loan loss reserves / Loans

Peer average: 2.1%

Net charge-off ratio

Peer average: 0.8%

Reserves / NPLs

Peer average: 129% |

13

©

Fifth Third Bank | All Rights Reserved

Capital management philosophy

*

Subject to Board of Directors and regulatory approval

Organic growth opportunities

•

Support growth of core banking franchise

•

Continued loan growth despite sluggish

economy

Strategic opportunities

*

•

Prudently evaluate franchise including

increasing density in core markets via

disciplined acquisitions or selective de

novos

•

Expect future acquisition activity although

less likely in near-term

•

Attain top 3 market position in 65% of

markets or more longer term

Return to more normal dividend policy*

•

Strong levels of profitability would support

higher dividend than current level

•

Move towards levels more consistent with

Fed’s near-term payout ratio guidance of

30%

•

Potential increase of quarterly dividend in

3Q12 (to $0.10) not objected by FRB in 2Q12

CCAR; considered by BOD in September

Repurchases / Redemptions

*

•

Common share repurchases to limit and

manage growth of excess capital levels

•

Redeemed $1.4bn in TruPS in 3Q12

Ability to increase shareholder distributions with recent

Federal Reserve non-objection to capital plan

Capital Deployment

Capital Return

Manage capital in light of regulatory

environment, other alternatives,

maintenance of desired / required buffers,

stock price

$600MM of potential repurchases through

1Q13 ($350MM ASR entered into in August) |

14

©

Fifth Third Bank | All Rights Reserved

Capital position remains strong

*The pro forma Tier I common equity ratio is management’s

estimate based upon its current interpretation of the three draft Federal Register notices proposing enhancements to regulatory

capital requirements published in June 2012. The actual impact to the

Bancorp’s Tier I common equity ratio may change significantly due to further clarification of the agencies proposals or

revisions to the agencies final rules, which remain subject to public

comment. Proposed new U.S. capital standards would have manageable impact, if

adopted Primary Basel III Adjustments*

Proposed

fully

phased in

buffered

minimum

of 7.0%

Basel III Impacts

NPR Capital Impact

~50 bps +/-

NPR RWA Impact

~(125 bps) +/-

Total Tier 1 Change

Tier 1 Common Equity

~(75 bps) +/-

9.77%

~9%*

Basel I

Pro forma Basel III

•

2Q12 Tier 1 common equity ratio of

9.77% under Basel I

•

Capital impact increase primarily

from inclusion of AOCI

•

RWA increase primarily from 1-4

family senior and junior lien

residential mortgages,

commitments under one year

•

Pro forma 2Q12 Tier 1 common

equity ratio of ~9%* under Basel III

•

Does not include the effect of any

mitigating actions Fifth Third may

take

Estimated NPR Impact

Current

Pro forma Tier 1 Common Equity |

15

©

Fifth Third Bank | All Rights Reserved

Fifth Third’s balance sheet and business model

relatively advantaged under new capital standards

Fifth Third’s capital position already well in excess of any established

standards, likely standards, and most peers Unofficial CCAR supervisory

reference minimum 2Q12 Pro forma Tier 1 common / RWA

U.S. proposed Basel III*

2Q12 Tier 1 common / RWA

Basel I

Source: SNL Financial and company reports (financial data as of 2Q12).

* Note: Fifth Third’s pro forma Tier I common equity ratio is

management’s estimate based upon its current interpretation of the three draft Federal Register notices proposing

enhancements to regulatory capital requirements published in June 2012. The actual

impact to the Bancorp’s Tier I common equity ratio may change significantly due to further

clarification of the agencies proposals or revisions to the agencies final rules,

which remain subject to public comment. Not adjusted for potential mitigation efforts.

2019 Basel III buffered minimum

2019 Basel III minimum

Not disclosed |

16

©

Fifth Third Bank | All Rights Reserved

FITB

“Trillionaire”

Banks

Regional

Banks

Community

Banks

Investment

Banks

Diverse businesses

Efficiencies

of scale

Local market focus

Multi-channel

delivery

Customer-centric

model

Moderate risk

profile

Strong profitability

and well-capitalized

Fifth Third: A differentiated business model

Competitively well-positioned in new landscape

|

17

©

Fifth Third Bank | All Rights Reserved

Cautionary statement

This report contains statements that we believe are “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule

3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans,

objectives, future performance or business. They usually can be identified by the use of

forward-looking language such as “will likely result,” “may,” “are

expected to,” “is anticipated,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or

phrases such as “believes,” “plans,” “trend,” “objective,”

“continue,” “remain,” or similar expressions, or future or conditional verbs

such as “will,” “would,” “should,” “could,” “might,”

“can,” or similar verbs. You should not place undue reliance on these statements, as

they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report

on Form 10-K. When considering these forward-looking statements, you should keep in mind these

risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should

treat these statements as speaking only as of the date they are made and based only on

information then actually known to us.

There are a number of important factors that could cause future results to differ materially from

historical performance and these forward-looking statements. Factors that might cause such

a difference include, but are not limited to: (1) general economic conditions and weakening in

the economy, specifically the real estate market, either nationally or in the states in which Fifth Third,

one or more acquired entities and/or the combined company do business, are less favorable than

expected; (2) deteriorating credit quality; (3) political developments, wars or other

hostilities may disrupt or increase volatility in securities markets or other economic

conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment

speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth

Third’s ability to maintain required capital levels and adequate sources of funding and

liquidity; (7) maintaining capital requirements may limit Fifth Third’s operations and potential growth; (8) changes and

trends in capital markets; (9) problems encountered by larger or similar financial institutions may

adversely affect the banking industry and/or Fifth Third; (10) competitive pressures among

depository institutions increase significantly; (11) effects of critical accounting policies

and judgments; (12) changes in accounting policies or procedures as may be required by the Financial

Accounting Standards Board (FASB) or other regulatory agencies; (13) legislative or regulatory changes

or actions, or significant litigation, adversely affect Fifth Third, one or more acquired

entities and/or the combined company or the businesses in which Fifth Third, one or more

acquired entities and/or the combined company are engaged, including the Dodd-Frank Wall Street Reform and

Consumer Protection Act; (14) ability to maintain favorable ratings from rating agencies; (15)

fluctuation of Fifth Third’s stock price; (16) ability to attract and retain key

personnel; (17) ability to receive dividends from its subsidiaries; (18) potentially dilutive effect of

future acquisitions on current shareholders’ ownership of Fifth Third; (19) effects of accounting

or financial results of one or more acquired entities; (20) difficulties from the separation of

Vantiv, LLC, formerly Fifth Third Processing Solutions from Fifth Third; (21) loss of income

from any sale or potential sale of businesses that could have an adverse effect on Fifth Third’s earnings and future

growth; (22) ability to secure confidential information through the use of computer systems and

telecommunications networks; and (23) the impact of reputational risk created by these

developments on such matters as business generation and retention, funding and

liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could cause

actual results to be significantly different from those expressed or implied by these

forward-looking statements. |

18

©

Fifth Third Bank | All Rights Reserved

Appendix |

19

©

Fifth Third Bank | All Rights Reserved

Diverse business mix

Branch Banking

Consumer Lending

Commercial Banking

Investment Advisors

•

Professionals committed to

understanding customers’

unique needs, providing

options and identifying the

right solution

•

Top 5 market share within

the non-captive prime auto

lending space

•

Top 13

mortgage

origination share

•

$1.0bn total FY11 revenue

•

Holistic approach to branch

banking combined with

mobile convenience to

improve the banking

experience and be the

trusted financial partner for

our customers

•

1,322 full-service banking

centers

•

2,409 full-service ATMs

•

$2.3bn total FY11 revenue

•

Comprehensive product and

service offering including

commercial lending,

treasury management, and

capital markets

•

Innovative products,

advancements in

technology, and exceptional

customer service

•

$2.0bn total FY11 revenue

•

Provide financial insight, a

wide array of leading-edge

products and services, and

a professional team to

help develop a strategy for

clients’

financial success

•

$486MM total FY11

revenue

•

$25bn assets under

management

•

$291bn assets under care

•

39% indirect interest in Vantiv, LLC, formerly Fifth Third Processing Solutions,

LLC |

20

©

Fifth Third Bank | All Rights Reserved

Deposit simplification:

Checking product design and offerings

All-new, redesigned Fifth Third accounts

Special Access

Just the Basics

Full Relationship Programs

Premium Relationships

eAccess

Essential

Checking

Established

Checking

Enhanced

Checking

Preferred

Checking

N/A

$11 / month

$15 / month

$20 / month

$25 / month

Online access only

$1,500

monthly avg balance in

checking and savings

$5,000

monthly avg balance in checking,

savings, and investments

$20,000

monthly avg balance in checking,

savings, and investments

$100,000

monthly avg balance in checking,

savings, and investments

For those who

never write checks

and do all their

banking online

For those who

want just the

basics

For those who keep

deposits and loans

with Fifth Third

For those who want

investment services

and strategies

For those who want

comprehensive

financial solutions with

dedicated, personalized

service

Monthly service charge

Balance requirements to avoid monthly service charges

All accounts include:

Debit Card

Savings Account(s) with monthly service charges waived

Internet Banking & Online Bill Payment

Mobile Banking & Text Alerts

Fifth Third ATM Access

Online Statements

The

information

on

this

slide

is

for

informational

purposes

only

and

is

not

intended

to

serve

as

initial

product

disclosures.

Please

visit

www.53.com/checking

for details on the benefits and features of these products including terms and

conditions. |

21

©

Fifth Third Bank | All Rights Reserved

Deposit simplification:

Savings product design and offerings

Simplified and rewarding Fifth Third accounts

Start saving a little at a time

Keep your savings separate from everyday spending

A bonus when you reach your goal

Tiered interest rates

Easy access to your money

Bonus interest every month when you have checking

Our best rates for larger balances

Check access –

write up to 6 checks per month

An even better rate when you have checking

Easy ways to earn out of monthly service charge:

1. Have checking account with us

2. $500 average savings account balance

3. Free for kids and Military Banking members

The

information

on

this

slide

is

for

informational

purposes

only

and

is

not

intended

to

serve

as

initial

product

disclosures.

Please

visit

www.53.com/checking

for details on the benefits and features of these products including terms and

conditions. Relationship Money

Market

best rates -

$25,000+

Relationship Savings

better rates

Goal Setter Savings

competitive rates |

22

©

Fifth Third Bank | All Rights Reserved

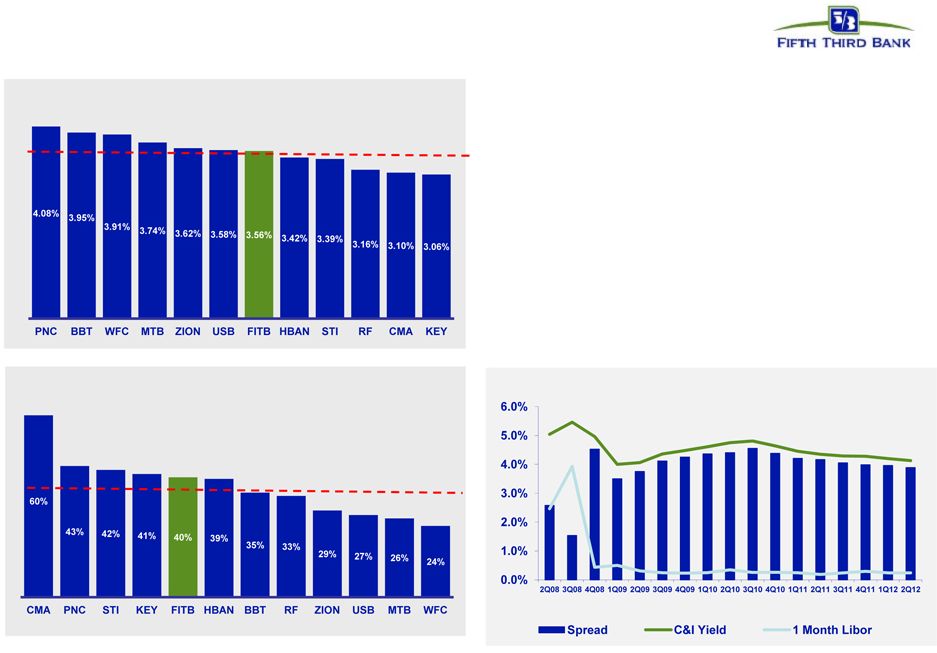

C&I/Total Loans*^

NIM

•

NIM supported by balance sheet and business

mix

–

Heavy emphasis on traditional C&I lending,

much of which is variable

•

Pricing discipline on commercial loans

–

Spreads have narrowed from post-crisis

levels but remain attractive

–

Loan origination rates have stabilized the

past several months

Relatively strong NIM results

due to balance sheet and business mix

Source: SNL Financial and Company Reports. Data as of 2Q12.

*ZION & BBT exclude government guaranteed loans; ZION presented as end of

period data. ^Presented on an average basis; Excluding held-for-sale

loans. C&I Spread to 1-month LIBOR

Peer average: 36%

Peer average: 3.55% |

23

©

Fifth Third Bank | All Rights Reserved

Core funded balance sheet and pricing discipline

•

Strong, deposit-rich core funding mix supports

relatively low cost of funds

–

High percentage of funding base in low cost

transaction deposits and noninterest-

bearing DDA accounts

–

Low reliance on wholesale funding

SOURCE: SNL Financial and Company Reports. Data as of 2Q12

Transaction deposits defined as DDA, NOW and Savings/MMDA accounts; Cost of Funds

defined as interest incurred on interest-bearing liabilities as a percentage of average noninterest-bearing deposits and interest-

bearing liabilities; Transaction deposits/Total deposits presented on an average

basis; DDA/Total deposits presented on end-of-period basis. Transaction

Deposits / Total Deposits Peer average

83%

Cost of Funds

Peer average

0.57%

DDA/Total Deposits

Peer average

32% |

24

©

Fifth Third Bank | All Rights Reserved

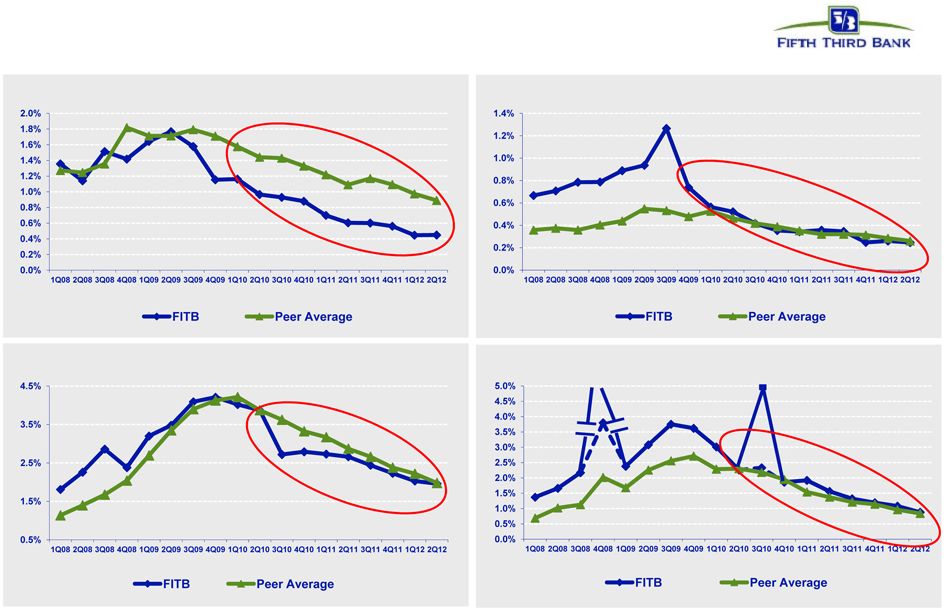

Continued improvement in credit trends

Peer average includes: BBT, CMA, HBAN, KEY, MTB, PNC, RF, STI, USB, WFC, and

ZION Source: SNL Financial and company filings. All ratios exclude loans

held-for-sale and covered assets for peers where appropriate. *

NPA ratio vs. peers

Net charge-off ratio vs. peers

Loans 90+ days delinquent % vs. peers

Loans 30-89 days delinquent % vs. peers

(7.5%)*

(HFS transfer)

3.8%

before credit

actions

5.0%*

2.3%

before credit

actions

FITB credit metrics are in line with or better than peers

4Q08 NCOs included $800mm in NCOs related to commercial loans moved to held-for-sale; 3Q10

NCOs included $510mm in NCOs related to loans sold or moved to held-for-sale |

25

©

Fifth Third Bank | All Rights Reserved

Mortgage repurchase overview

2Q12 balances of outstanding claims increased 23% from 1Q12

—

Within recent norms of quarterly increases and decreases

Virtually all sold loans and the majority of new claims relate to

agencies

—

99% of outstanding balance of loans sold

—

82% of current quarter outstanding claims

Majority of outstanding balances of the serviced for others

portfolio relates to origination activity in 2009 and later

Private claims and exposure relate to whole loan sales (no

outstanding first mortgage securitizations)

Repurchase Reserves* ($ in millions)

Outstanding Counterparty Claims ($ in millions)

2Q11

3Q11

4Q11

1Q12

2Q12

Beginning balance

$87

$80

$69

$72

$71

Net reserve additions

15

20

20

17

20

Repurchase losses

(23)

(31)

(17)

(17)

(16)

Ending balance

$80

$69

$72

$71

$75

* Includes reps and warranty reserve ($57MM )and reserve for loans sold with

recourse ($19MM) Note: Numbers may not sum due to rounding

% Current

42% 49% 41% 37%

41%

Outstanding Balance of Sold Loans ($ in millions)

Fannie

Freddie

GNMA

Private

Total

2004 and Prior

$825

$3,789

$206

$323

$5,143

2005

295

1,263

55

137

1,750

2006

385

1,038

52

234

1,709

14%

2007

606

1,688

75

203

2,572

2008

792

1,370

595

-

2,575

2009

1,506

7,176

3,404

1

12,087

2010

3,257

7,290

2,847

-

13,395

2011

3,962

7,255

2,361

-

13,578

2012

2,734

4,355

1,555

-

8,644

Grand Total

$14,361

$35,225

$11,150

$899

$61,635

1.5%

2005-2008 vintages account for ~80% of total life to

date losses of $354MM from sold portfolio

—

Preponderance of private sales prior to 2006 |

26

©

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

June

March

December

September

June

2012

2012

2011

2011

2011

Income before income taxes (U.S. GAAP)

$565

$603

$418

$530

$506

Add:

Provision expense (U.S. GAAP)

71

91

55

87

113

Pre-provision net revenue (a)

636

694

473

617

619

Net income available to common shareholders (U.S. GAAP)

376

421

305

373

328

Add:

Intangible amortization, net of tax

2

3

3

3

4

Tangible net

income available to common shareholders 378

424

308

376

332

Tangible net income available to common

shareholders (annualized) (b) 1,520

1,705

1,222

1,492

1,332

Average Bancorp shareholders' equity (U.S. GAAP)

13,628

13,366

13,147

12,841

12,365

Less:

Average preferred stock

398

398

398

398

398

Average goodwill

2,417

2,417

2,417

2,417

2,417

Average intangible assets

34

38

42

47

52

Average tangible common

equity (c) 10,779

10,513

10,290

9,979

9,498

Total Bancorp shareholders' equity (U.S. GAAP)

13,773

13,560

13,201

13,029

12,572

Less:

Preferred stock

(398)

(398)

(398)

(398)

(398)

Goodwill

(2,417)

(2,417)

(2,417)

(2,417)

(2,417)

Intangible assets

(33)

(36)

(40)

(45)

(49)

Tangible common equity, including

unrealized gains / losses (d) 10,925

10,709

10,346

10,169

9,708

Less: Accumulated other comprehensive income / loss

(454)

(468)

(470)

(542)

(396)

Tangible common equity, excluding unrealized gains /

losses (e) 10,471

10,241

9,876

9,627

9,312

Total assets (U.S. GAAP)

117,543

116,747

116,967

114,905

110,805

Less:

Goodwill

(2,417)

(2,417)

(2,417)

(2,417)

(2,417)

Intangible assets

(33)

(36)

(40)

(45)

(49)

Tangible assets, including

unrealized gains / losses (f) 115,093

114,294

114,510

112,443

108,339

Less: Accumulated other comprehensive income / loss, before tax

(698)

(720)

(723)

(834)

(609)

Tangible assets, excluding unrealized gains / losses

(g) 114,395

113,574

113,787

111,609

107,730

Common shares outstanding (h)

919

920

920

920

920

Net charge-offs (i)

181

220

239

262

304

Ratios:

Return on average tangible common equity (b) / (c)

14.1%

16.2%

11.9%

15.0%

14.0%

Tangible common equity (excluding unrealized gains/losses) (e) / (g)

9.15%

9.02%

8.68%

8.63%

8.64%

Tangible common equity (including unrealized gains/losses) (d) / (f)

9.49%

9.37%

9.04%

9.04%

8.96%

Tangible book value per share (d) / (h)

11.89

11.64

11.25

11.05

10.55

Pre-provision net revenue / net charge-offs (a) / (i)

351%

315%

198%

235%

204%

For the Three Months Ended |

27

©

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

June

March

December

September

June

2012

2012

2011

2011

2011

Total Bancorp shareholders' equity (U.S. GAAP)

$13,773

$13,560

$13,201

$13,029

$12,572

Goodwill and certain other intangibles

(2,512)

(2,518)

(2,514)

(2,514)

(2,536)

Unrealized gains

(454)

(468)

(470)

(542)

(396)

Qualifying trust preferred securities

2,248

2,248

2,248

2,273

2,312

Other

38

38

38

20

20

Tier I capital

13,093

12,860

12,503

12,266

11,972

Less:

Preferred stock

(398)

(398)

(398)

(398)

(398)

Qualifying trust preferred securities

(2,248)

(2,248)

(2,248)

(2,273)

(2,312)

Qualifying noncontrolling interest in consolidated subsidiaries

(50)

(50)

(50)

(30)

(30)

Tier I common equity (a)

10,397

10,164

9,807

9,565

9,232

Risk-weighted assets, determined in accordance with

prescribed regulatory requirements (b)

106,398

105,412

104,945

102,562

100,320

Ratios:

Tier I common equity (a) / (b)

9.77%

9.64%

9.35%

9.33%

9.20%

For the Three Months Ended |