Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DYCOM INDUSTRIES INC | form8k.htm |

Exhibit 99.1

D.A. Davidson

11th Annual Engineering &

Construction Conference

11th Annual Engineering &

Construction Conference

September 11, 2012

1

Forward-Looking Statements and Non-GAAP

Information

Information

Forward-Looking Statements and Non-GAAP

Information

Information

This presentation contains “forward-looking statements” which are statements relating to future events, future

financial performance, strategies, expectations, and competitive environment. All statements, other than

statements of historical facts, contained in this presentation, including statements regarding our future financial

position, future revenue, prospects, plans and objectives of management, are forward-looking statements.

Words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project,”

“looking ahead” and similar expressions, as well as statements in future tense, identify forward-looking

statements. You should not read forward looking statements as a guarantee of future performance or results.

They will not necessarily be accurate indications of whether or at what time such performance or results will be

achieved. Forward-looking statements are based on information available at the time those statements are

made and/or management’s good faith belief at that time with respect to future events. Such statements are

subject to risks and uncertainties that could cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. Important factors that could cause such

differences include, but are not limited to factors described under Item 1A, “Risk Factors” of the Company’s

Annual Report on Form 10-K for the year ended July 28, 2012, and other risks outlined in the Company’s

periodic filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in this

presentation are expressly qualified in their entirety by this cautionary statement. Except as required by law, the

Company may not update forward-looking statements even though its situation may change in the future.

financial performance, strategies, expectations, and competitive environment. All statements, other than

statements of historical facts, contained in this presentation, including statements regarding our future financial

position, future revenue, prospects, plans and objectives of management, are forward-looking statements.

Words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project,”

“looking ahead” and similar expressions, as well as statements in future tense, identify forward-looking

statements. You should not read forward looking statements as a guarantee of future performance or results.

They will not necessarily be accurate indications of whether or at what time such performance or results will be

achieved. Forward-looking statements are based on information available at the time those statements are

made and/or management’s good faith belief at that time with respect to future events. Such statements are

subject to risks and uncertainties that could cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. Important factors that could cause such

differences include, but are not limited to factors described under Item 1A, “Risk Factors” of the Company’s

Annual Report on Form 10-K for the year ended July 28, 2012, and other risks outlined in the Company’s

periodic filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in this

presentation are expressly qualified in their entirety by this cautionary statement. Except as required by law, the

Company may not update forward-looking statements even though its situation may change in the future.

This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules. We believe that the

presentation of certain Non-GAAP financial measures provides information that is useful to investors because it

allows for a more direct comparison of our performance for the period with our performance in the comparable

prior-year periods. As required by the SEC, we have provided a reconciliation of those measures to the most

directly comparable GAAP measures on the Regulation G slides included at the end of this presentation. We

caution that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our

reported GAAP results.

presentation of certain Non-GAAP financial measures provides information that is useful to investors because it

allows for a more direct comparison of our performance for the period with our performance in the comparable

prior-year periods. As required by the SEC, we have provided a reconciliation of those measures to the most

directly comparable GAAP measures on the Regulation G slides included at the end of this presentation. We

caution that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our

reported GAAP results.

2

Positioned for strong equity returns

n A leading supplier of specialty contracting services to

telecommunication providers nationwide

telecommunication providers nationwide

n Telecommunications networks fundamental to economic progress

n Firm end market opportunities

Ø Wireless backhaul

Ø Rural fiber networks

Ø Fiber deployments to businesses

Ø Wireless network upgrades

Ø FTTx deployments

n Increased market share as our customers consolidate vendor

relationships and reward scale

relationships and reward scale

n Capital allocation strategy designed to produce strong equity

returns

returns

3

Nationwide Footprint and Significant

Resources

Resources

n Headquartered in Palm Beach Gardens, Florida

n Nationwide footprint

} Operates in 48 states and in Canada

} 31 operating subsidiaries and hundreds of field offices

n Fiscal 2012 fourth quarter revenues of $318.0 million grew organically 9.0% year

over year

over year

n Strong financial profile

} Cash and equivalents $52.6 million at July 28, 2012

} Availability on revolving credit agreement of $186.5 million at July 28, 2012

} 7.125% Senior Subordinated Notes due 2021

n Approximately 8,100 employees

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

4

Services Crucial to Customer Success

Engineering

Underground Facility Locating

Outside Plant & Equipment Installation

Premise Equipment Installation

Wireless Services

5

Intensely Focused on

Telecommunications Market

Telecommunications Market

Contract Revenue $318.0 million

Quarter Ended July 28, 2012

6

Strong Secular Trend

Sources: U.S. Telecom, The Broadband Association

Cisco Visual Networking Index

U.S. National Bureau of Economic Analysis

“When the stability of an entire economy depends on the speed, intelligence, quality

of service, robustness and security of its Internet backbone, will a just good network

be good enough?”

of service, robustness and security of its Internet backbone, will a just good network

be good enough?”

John Chambers, Chairman and CEO, Cisco, Inc.

7

“Our third key strategic initiative is investing in fiber builds to as many towers in our service area as

economically feasible. This initiative supports anticipated long-term growth in data transport, much

of which is driven by wireless data traffic. And expands our addressable customer footprint by

enabling fiber access points to other strategic locations where viable, along these routes. During

second quarter, we completed approximately 1,350 fiber builds. This is in line with expectations. And

we continue to anticipate completing 4,000 to 5,000 builds in 2012, as fiber-to-the-tower construction

continues to ramp up through the remainder of the year.

economically feasible. This initiative supports anticipated long-term growth in data transport, much

of which is driven by wireless data traffic. And expands our addressable customer footprint by

enabling fiber access points to other strategic locations where viable, along these routes. During

second quarter, we completed approximately 1,350 fiber builds. This is in line with expectations. And

we continue to anticipate completing 4,000 to 5,000 builds in 2012, as fiber-to-the-tower construction

continues to ramp up through the remainder of the year.

Glen Post III, CEO & President, CenturyLink, Inc. - August 2012

•Very attractive returns to our customers

•Telephone, cable and other companies aggressively deploying fiber to

provide wireless backhaul services

provide wireless backhaul services

•Continues to provide significant growth opportunities

Sources: FCC OBI Technical Paper 6,

Mobile Broadband: The Benefits of

Additional Spectrum

Mobile Broadband: The Benefits of

Additional Spectrum

8

Key Driver: Rural Fiber Networks

The American Recovery and Reinvestment Act

(ARRA) provided the Department of Commerce’s

National Telecommunications and Information

Administration (NTIA) and the U.S. Department of

Agriculture’s Rural Utilities Service (RUS) with

$7.2 billion to expand broadband services in the

United States.

(ARRA) provided the Department of Commerce’s

National Telecommunications and Information

Administration (NTIA) and the U.S. Department of

Agriculture’s Rural Utilities Service (RUS) with

$7.2 billion to expand broadband services in the

United States.

Cumulatively, total Federal expenditures have now exceeded $1.5 billion

and have been matched by recipient funds of more than $660 million.

and have been matched by recipient funds of more than $660 million.

NTIA BTOP Quarterly Program Status Report - June 2012

•Demand has absorbed significant industry capacity

•Dycom currently working on dozens of projects in multiple states

•Meaningfully increased exposure to rural service providers

9

$3.9 Billion

Addressable Business Services Market

$53.5 Billion

•Emerging as an industry battleground

•Multi-year cap-ex trajectory provides visible revenue opportunities

•Leverages Dycom’s existing cable engineering and construction resources

“…so give or take $700 million a year I think is the number for capital spending for business

services. [….] That $700 million is powering a business that grew 40% the last several years and is

on pace to be a couple billion dollar plus business a year from zero and we can go into the medium-

size and sell backhaul and Metro Ethernet businesses. So first answer is we would love to put more

capital at the business services if we can continue to get 30% IRRs or whatever as we've been

historically getting. It is a 50% margin business, fantastic.”

services. [….] That $700 million is powering a business that grew 40% the last several years and is

on pace to be a couple billion dollar plus business a year from zero and we can go into the medium-

size and sell backhaul and Metro Ethernet businesses. So first answer is we would love to put more

capital at the business services if we can continue to get 30% IRRs or whatever as we've been

historically getting. It is a 50% margin business, fantastic.”

Brian Roberts, Chairman and CEO, Comcast Corporation - June 2012

Sources: Company Filings

Company Transcripts

10

Key Driver: Wireless Network Upgrades

“…We've had a volume surge that is hard to explain what's transpired. The last five years

we've had literally in the mobile Internet traffic going across our network it's been a 20,000

percent increase in traffic, and we're seeing no signs of that slowing anytime soon. In fact,

we're on a pace this year that it grows another 75 percent, and our current planning

assumption is that that just continues for the next five years after this year.”

we've had literally in the mobile Internet traffic going across our network it's been a 20,000

percent increase in traffic, and we're seeing no signs of that slowing anytime soon. In fact,

we're on a pace this year that it grows another 75 percent, and our current planning

assumption is that that just continues for the next five years after this year.”

Randall Stephenson, CEO, AT&T- July 2012

•Wireless network spending increasing faster than overall spending

•Entered wireless market via NeoCom acquisition in December 2010 and is further

expanding its wireless services to key customers

expanding its wireless services to key customers

•Strong growth opportunities as industry migrates from 3G to 4G technologies

Sources: CTIA

Collins Stewart, LLC

11

Key Driver: FTTx Deployments

“…our Prism TV service represents a very compelling entertainment alternative to

cable TV services in the eight markets where it is currently available. We remain

focused on expanding our Prism TV enabled footprint and in driving additional

subscriber growth in the months ahead.”

cable TV services in the eight markets where it is currently available. We remain

focused on expanding our Prism TV enabled footprint and in driving additional

subscriber growth in the months ahead.”

Glen Post III, CEO & President, CenturyLink, Inc. - May 2012

•A key competitive response by telephone companies to cable MSO’s

•CenturyLink just beginning scale deployments

•Dycom is leveraging prior, extensive FTTx experience with Verizon and AT&T

Sources: Company Filings

12

Subsidiaries

Dycom’s Nationwide Presence

Local Credibility, National Capability

13

Focused on High Value Profitable Growth

n Anticipating emerging technology trends which drive

capital spending

capital spending

n Deliberately targeting high quality, long-term industry

leaders which generate the vast majority of the

industry’s profitable opportunities

leaders which generate the vast majority of the

industry’s profitable opportunities

n Selectively acquiring businesses which complement

our existing footprint and enhance our customer

relationships

our existing footprint and enhance our customer

relationships

n Leveraging our scale and expertise to expand margins

through best practices

through best practices

14

Blue-chip, predominantly investment grade clients comprise the vast majority of revenue

Well Established Customers

Quarter Ended July 28, 2012

Customer Revenue Breakdown

Comcast

AT&T

CenturyLink

Verizon

Windstream

Charter

Ericcson

Other

Frontier

Cablevision

15

Durable Customer Relationships

For comparison purposes, when customers have been combined through acquisition or merger, their revenues have been combined for all periods.

16

n Master Service Agreements (MSA’s)

} Multi-year, multi-million dollar

arrangements covering thousands of

individual work orders

arrangements covering thousands of

individual work orders

n Significant majority of contracts are based on

units of delivery

units of delivery

Revenue By Contract Type

Quarter Ended July 28, 2012

Quarter Ended July 28, 2012

Anchored by Long-Term Agreements

17

Robust Cash Flow - Investing for Growth

$841 million

Cash flow from operations

Cash flow from operations

$238 million

provided by other financing and investing activities and beginning cash on hand

$347 million

Business

acquisitions

Business

acquisitions

$436 million

Capital

expenditures,

net

expenditures,

net

$296 million

Share

repurchases

Share

repurchases

Cumulative Cash Flows Fiscal 2003 - Fiscal 2012

Note: Amounts hereon represent cumulative cash flow amounts for fiscal 2003 - fiscal 2012;

See “Regulation G Disclosure” a summary of amounts.

See “Regulation G Disclosure” a summary of amounts.

$1.079

Billion

Billion

Available

for

Investment

for

Investment

18

Capital Allocated to Maximize

Shareholder Returns

Shareholder Returns

n Organic growth, solid free cash flow and confidence in industry

outlook promotes capital allocation strategy to further expand

shareholder returns

outlook promotes capital allocation strategy to further expand

shareholder returns

n Acquisitions of NeoCom Solutions and Communication Services in

FY 2011 supplement organic growth and contribute to equity returns

FY 2011 supplement organic growth and contribute to equity returns

n Share repurchases of approximately 15% of outstanding shares

during fiscal 2011 and fiscal 2012 creates incremental shareholder

value and reduces equity claims on future earnings

during fiscal 2011 and fiscal 2012 creates incremental shareholder

value and reduces equity claims on future earnings

Financial Update

20

n Organic revenue growth of 9.0% during Q4-2012

n Strong margins and earnings

n Stable balance sheet

n Solid cash flows and liquidity

n Capital structure designed to produce strong equity returns

Financial Overview

21

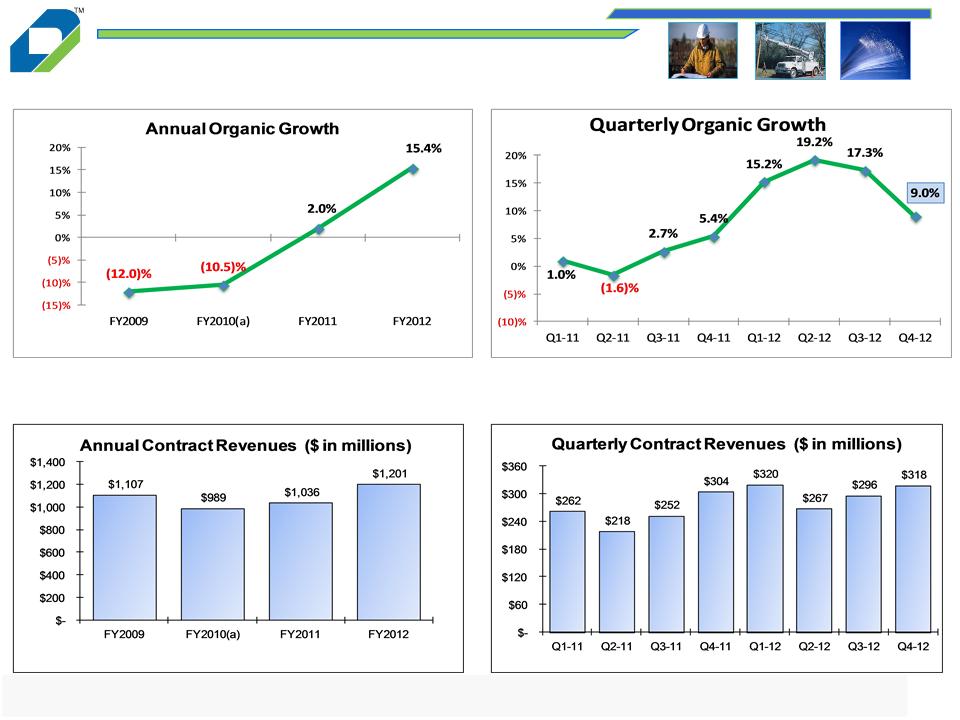

Contract Revenue Growth

Growth within existing contracts and rural

broadband projects driving revenue increases

broadband projects driving revenue increases

Quarterly results exhibit seasonal weather patterns

Organic growth trend since fiscal 2009

Six consecutive quarters of organic growth

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

(a)Fiscal 2010 includes an incremental week as the result of our 52/53 week fiscal year.

22

Margins and Earnings Expansion

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

(a)The amounts and percentages for EBITDA - Adjusted and amounts for Income from continuing operations -Non-

GAAP are Non-GAAP financial measures adjusted to exclude certain items.

GAAP are Non-GAAP financial measures adjusted to exclude certain items.

Adjusted EBITDA expanding in

recent periods as a percentage

of revenue

Earnings growth from higher

revenues and tight cost controls

revenues and tight cost controls

23

Solid Cash Flow

(a) Capital expenditures are presented net of proceeds from the sale of assets.

Solid cash flows support growth

in operations

Targeted capital spending

supports organic growth and

fleet efficiency

supports organic growth and

fleet efficiency

24

Strong Balance Sheet

Financial profile positioned to

address emerging industry

opportunities

address emerging industry

opportunities

n Fiscal 2021 maturity of Senior

Subordinated Notes

Subordinated Notes

n Over $239 million of liquidity from cash

on hand and availability under Senior

Credit agreement

on hand and availability under Senior

Credit agreement

n Repurchased $2.0 million of common

shares during Q4-12

shares during Q4-12

Net debt declines from solid cash

flows in fiscal 2012

flows in fiscal 2012

n Ratio of Net Debt to EBITDA-Adjusted

suitable for growth

suitable for growth

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

(a)The ratio of Net debt to EBITDA-Adjusted is a Non-GAAP financial measure adjusted to exclude certain items.

Supplemental schedules

Regulation G Disclosures

26

Regulation G Disclosure

(a) Year-over-year growth percentage is calculated as follows: (i) revenues in the current twelve month period less (ii) revenues in the comparative prior twelve month period;

divided by (ii) revenues in the comparative prior twelve month period.

divided by (ii) revenues in the comparative prior twelve month period.

(b) Non-GAAP adjustments in FY 2010 reflect adjustments in Q4-10 result from the Company’s 52/53 week fiscal year of $20.1 million. The Q4-10 Non-GAAP adjustments

reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The result, representing one week of contract revenues, is

subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for comparison purposes.

reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The result, representing one week of contract revenues, is

subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for comparison purposes.

Amounts may not foot due to rounding.

27

(a) Year-over-year growth (decline) percentage is calculated as follows: (i) revenues in the quarterly period less (ii) revenues in the comparative prior year quarter period;

divided by (ii) revenues in the comparative prior year quarter period.

divided by (ii) revenues in the comparative prior year quarter period.

(b) Q4-12 organic growth excludes storm restoration revenues of $2.3 million in Q4-12 and $14.1 million in Q4-11.

(c) For Q3-12, GAAP and Non-GAAP revenue growth percentages are the same as revenues from business acquired in 2011 were included for the full quarter in each period

and there were no other Non-GAAP adjustments in either period. For Q1-11, GAAP and Non-GAAP revenue growth percentages are the same as there were no Non-GAAP

adjustments in either period.

and there were no other Non-GAAP adjustments in either period. For Q1-11, GAAP and Non-GAAP revenue growth percentages are the same as there were no Non-GAAP

adjustments in either period.

(d) Non-GAAP adjustments in Q2-12, Q3-11 and Q2-11 reflect revenues from businesses acquired during Q2-11. Non-GAAP adjustments in Q1-12 reflect storm restoration

revenues ($3.7 million) and revenues from businesses acquired during Q2-11 ($14.5 million). Non-GAAP adjustments in Q4-11 for fiscal 2011 fourth quarter year-over-year

organic growth reflects storm restoration revenues ($14.1 million) and revenues from businesses acquired during Q2-11 ($14.1 million). Non-GAAP adjustments in Q4-10 result

from the Company’s 52/53 week fiscal year. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract

revenues by 14 weeks. The result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on

a Non-GAAP basis for comparison purposes. Non-GAAP adjustments in Q3-09, Q2-09, and Q1-09 reflect storm restoration revenues recognized during those periods.

revenues ($3.7 million) and revenues from businesses acquired during Q2-11 ($14.5 million). Non-GAAP adjustments in Q4-11 for fiscal 2011 fourth quarter year-over-year

organic growth reflects storm restoration revenues ($14.1 million) and revenues from businesses acquired during Q2-11 ($14.1 million). Non-GAAP adjustments in Q4-10 result

from the Company’s 52/53 week fiscal year. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract

revenues by 14 weeks. The result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on

a Non-GAAP basis for comparison purposes. Non-GAAP adjustments in Q3-09, Q2-09, and Q1-09 reflect storm restoration revenues recognized during those periods.

Amounts may not foot due to rounding.

28

Regulation G Disclosure

The below table presents the Non-GAAP financial measures of EBITDA and Adjusted EBITDA for the respective periods. EBITDA and Adjusted EBITDA are Non-GAAP financial measures within the meaning of Regulation G

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

29

Regulation G Disclosure

D.A. Davidson

11th Annual Engineering &

Construction Conference

11th Annual Engineering &

Construction Conference

September 11, 2012