Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OSH 1 LIQUIDATING Corp | d408182d8k.htm |

| EX-99.1 - PRESS RELEASE - OSH 1 LIQUIDATING Corp | d408182dex991.htm |

NASDAQ: OSH

September 2012

September 2012

Exhibit 99.2 |

2

September 2012

This presentation (including information incorporated or deemed incorporated by

reference herein) contains “forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-

looking statements are those involving future events and future results that are

based on current expectations, estimates, forecasts, and projects as well as

the current beliefs and assumptions of our management. Words such as

“outlook”, “believes”, expects”, “appears”, “may”, “will”, “should”, “intend”, “target”, “projects”, “estimates”,

“plans”, “forecast”, “is likely to”,

“anticipates”, or the negative thereof or comparable terminology, are intended to

identify such forward-looking statements. Any statement that is not a

historical fact, including estimates, projections, future trends and the

outcome of events that have not yet occurred, is a forward-looking statement.

Forward-looking statements are only predictions and are subject to risks,

uncertainties and assumptions that are difficult to predict. Therefore

actual results may differ materially and adversely from those expressed in any

forward-looking statements. Factors that might cause or contribute to

such differences include, but are not limited to,

those

discussed

under

the

section

entitled

“Risk

Factors”

in

our

reports

filed

with

the

Securities

and

Exchange

Commission. Many of such factors relate to events and circumstances that are

beyond our control. You should not place undue reliance on

forward-looking statements. Forward-looking statements speak only as of the date

they

are

made.

The

Company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statement, whether as a result of new information, future events, or

otherwise. Safe Harbor Statement |

Business Overview |

4

September 2012

Strong brand heritage and 80 year history

Neighborhood hardware and garden store focused on paint, repair and

the backyard

Uniquely positioned between big boxes and small independent

hardware stores

Differentiated operating model focuses on high margin categories

High performance management team in place with new vision

Store conversion and opening plans expected to drive growth

About Orchard |

5

September 2012

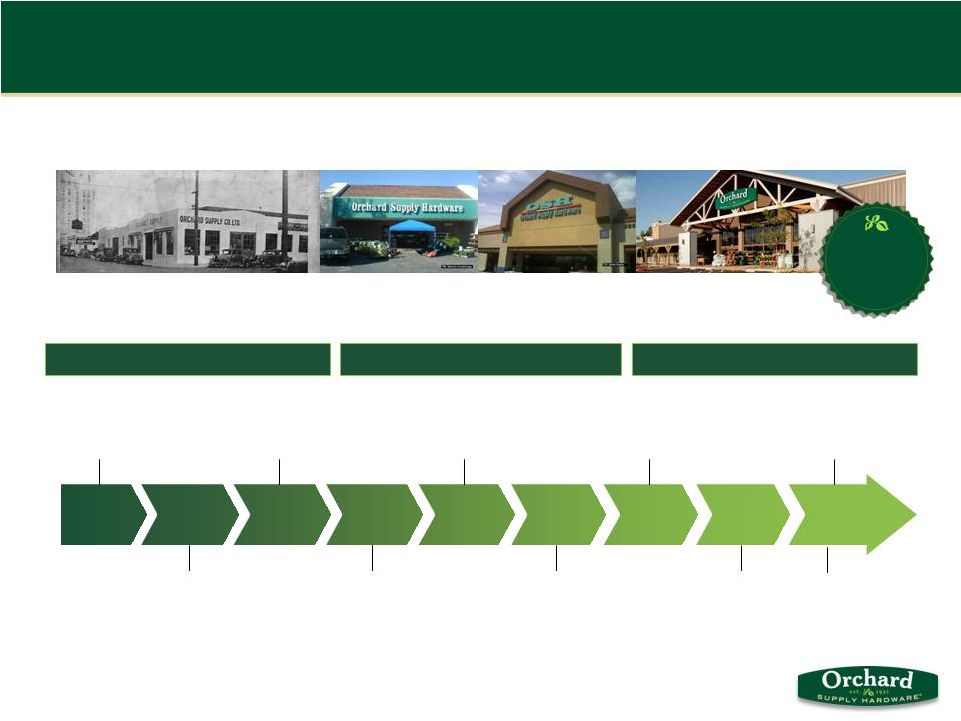

Strong Brand Heritage Over 80 Years

Early Days

Ownership Change

Today

(1931)

(1970’s)

(1990’s)

(2011)

80

YEARS

80

YEARS

Founded as a

Farmer's

Purchasing

Cooperative

W.R. Grace

acquired Orchard

Wickes acquired

Orchard from W.R.

Grace

Freeman Spogli

acquired Orchard

from Wickes

Orchard IPO

Sears acquired

Orchard

Ares acquired 20%

stake

Opened new stores

and launched

e-commerce

New management

team, transition to a

public and standalone

company, new store

design

1931

1979

1986

1989

1993

1996

2005

2009/2010

2011/2012

(34 stores)

(43 stores)

(65 stores)

(85 stores)

(89 stores)

(89 stores)

Spin-off from

Sears |

6

September 2012

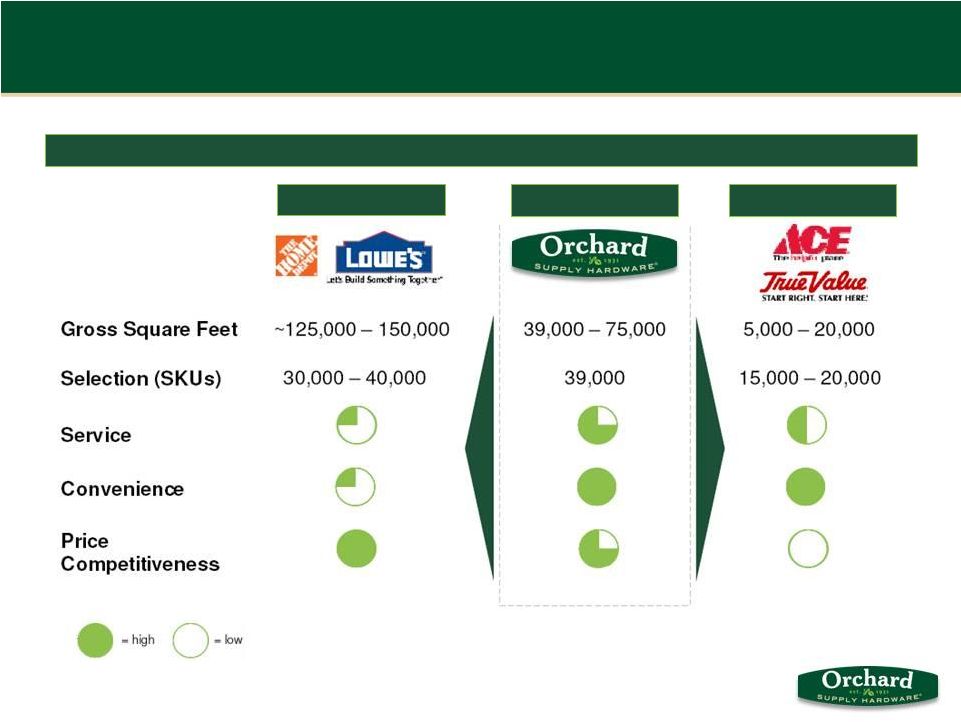

Orchard Owns the Niche Between Small Independents and Big Boxes

Attractive Competitive Positioning

Warehouse

Convenience

Local Hardware |

7

September 2012

Business Snapshot

Highly attractive niche positioning between big

box home improvement retailers and small

independent hardware stores

Neighborhood hardware and garden store

focused on paint, repair and the backyard

Efficient store footprint focuses on better quality,

higher margin products

Focus on consumers who are highly engaged

and spend on home improvement projects

High quality brands and expert, attentive

service appeal to Orchard’s customer base

Priced at parity to big box retailers on 100

high-visible products

Slight premium in pricing vs. big box retailers

on balance of assortment not as important as

overall shopping experience

New management team focused on leading

Orchard to sustained profitability and growth

Orchard Locations (as of Sept. 1, 2012)

89

locations in California

82

leased; 7

Company-owned

68

in Northern California

21

in Southern California

1

to open in Portland, Oregon

39,000 –

75,000

gross sq. ft.

39,000

SKUs

1

Distribution Center

(458,000 sq ft)

Key Statistics

FY 2011

Sales ($mm)

$660.5

Stores

87

Sales per store ($mm)

$7.6 |

8

September 2012

Deep

Product

Knowledge

and

Global

Sourcing

Capability

with

Local

Market

Delivery

and

Know

How

Knowledgeable and

experienced associates

Genuine customer

hospitality

Engaging shopping

environment

New floor zone coverage

and 2-way radios

Increased sales training

Extensive selection of

national and regional

brands

Large assortment in

recurring maintenance &

repair items

High in-stock levels

Unique assortments tailored

to customer segments and

geographic location

Prime locations in densely

populated areas

Easy in-and-out

Easy-to-shop format

Efficient checkout and

customer pick-up across all

channels

Service

Selection

Convenience

Powerful and Efficient Operating Model |

9

September 2012

Focused on Three Core Categories

Backyard

40% of revenue; 36% of margin

contribution

High repeat shopping in garden

category drives traffic

Quick in-and-out

More than 50% of Orchard stores

have direct nursery access from

the parking lot

Repair

40% of revenue; 44% of margin

contribution

Differentiated through service

Rationalized and localized

assortments

Provides solutions

Neighborhood convenience

Paint & Home

20% of revenue; 20% of margin

contribution

Key home improvement do-it-

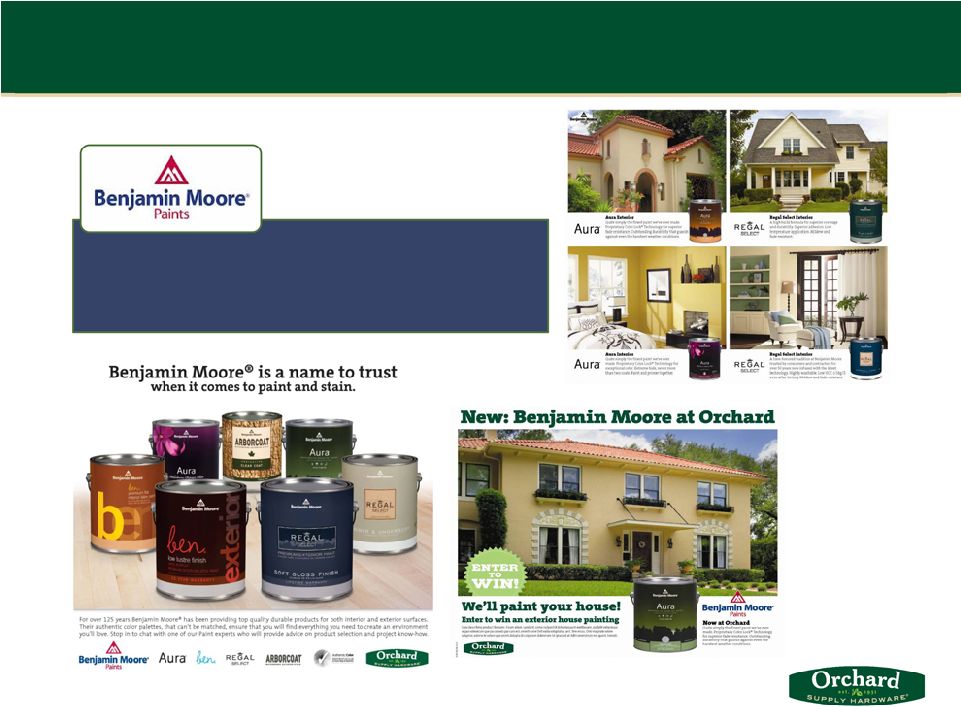

yourself category

Strategic alliance with Benjamin

Moore –

exclusive paint supplier

Orchard stores offer “how-to”

and

project advice |

10

September 2012

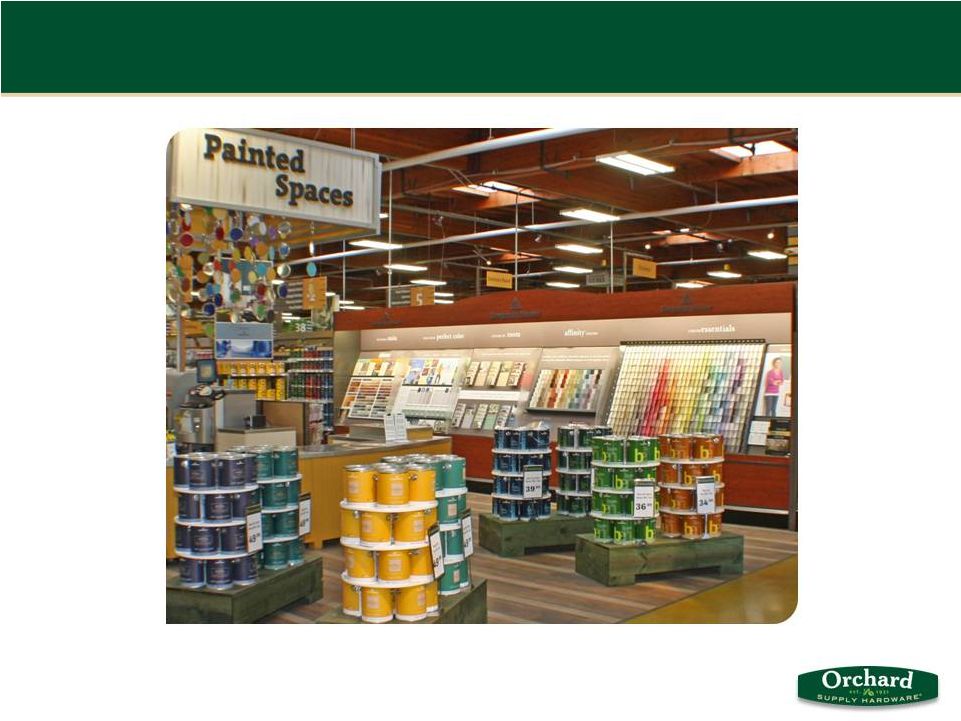

Strategic Alliance with Premier Paint Brand

Benjamin Moore

Exclusive supplier of paint

to all Orchard locations |

11

September 2012

Differentiated Product Assortment

Breadth

Depth

Value

Offers products across major categories

8,000 sq ft dedicated to an exterior nursery

750

sq

ft

highly

visible

paint

area

–

prominent

placement of high quality Benjamin Moore

paints

39,000 total SKUs

Dominant assortment in key categories

Multiple products and price points within each

product category to appeal to all shoppers

Average ticket: $26

Pricing comparable to big box retailers

Products focused on higher quality at

comparable value prices; not competing to be

low price leader |

Business Repositioning |

13

September 2012

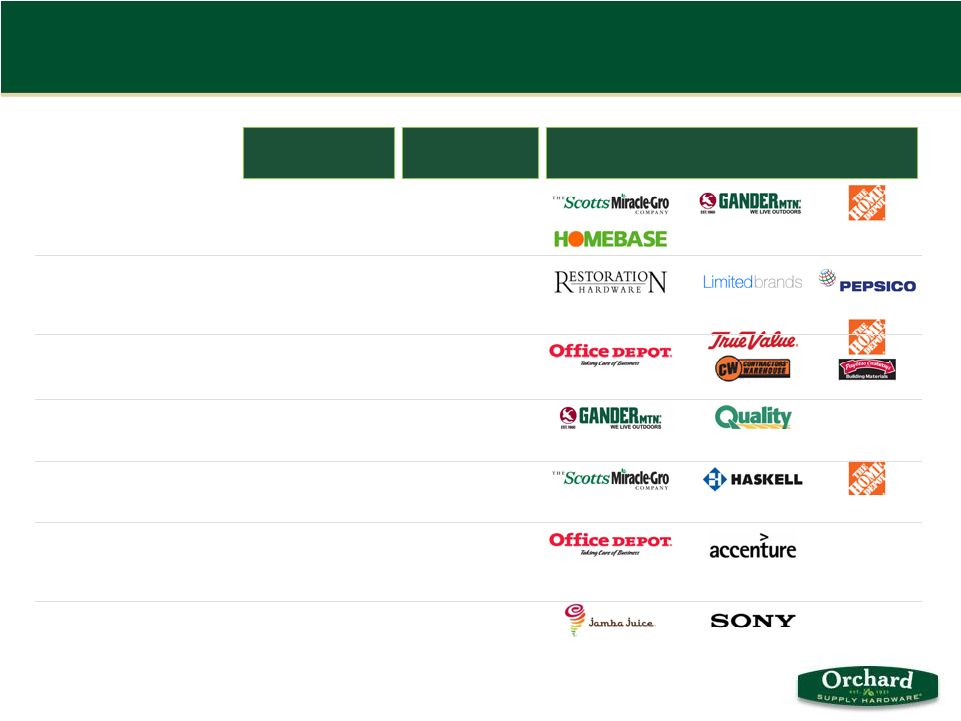

Mark R. Baker

Chief Executive Officer,

President

March 2011

31 years

Chris D. Newman

Executive Vice President,

Chief Financial Officer &

Treasurer

November 2011

13 years

Steven L. Mahurin

Executive Vice President,

Merchandising

May 2011

30 years

Mark A. Bussard

Senior Vice President,

Operations

June 2011

22 years

David I. Bogage

Senior Vice President,

Human Resources

April 2011

17 years

Steve Olsen

Senior Vice President, Supply

Chain, IT and Chief Strategy

Officer

June 2010

15 years

Michael W. Fox

Senior Vice President,

General Counsel & Secretary

October 2011

7 years

Scotty’s Home

Improvement Centers

Knox Hardware

And Lumber

Meridian Point

Properties

# Years Retail

Experience

With Orchard

Since

Prior Retail Experience

New Management Team With Deep Retail and Home

Improvement Experience |

14

September 2012

Key Accomplishments Under New Management Team

Developed new, highly productive store

format

Enhanced customer service and store

support

Upgraded store and regional

leadership

Implemented new floor zone coverage

and 2-way radios

Improved inventory in-stock levels

Increased average ticket

Heightened morale across the

organization with energized field

personnel |

15

September 2012

We’re in the Early Stages of Repositioning the

Business

Management is Focused on Five Key Priorities

1)

Project a consistent and compelling brand

identity

2)

Drive sales through merchandising and

marketing initiatives

3)

Improve operational efficiencies

4)

Align resources and talent

5)

Strengthen the Company’s financial position |

16

September 2012

New Brand (logo, colors, look/feel)

Old Brand

New Brand Identity |

17

September 2012

New Paint Area |

18

September 2012

Old Paint Area |

19

September 2012

New Nursery and Garden Center |

20

September 2012

Old Nursery and Garden Center |

21

September 2012

New Tools Area |

22

September 2012

Old Tools Area |

23

September 2012

New Workbench Area |

24

September 2012

Reorganized regional leadership team

Moved from 8 districts to 4 regions

Home improvement and specialty retail experience includes Home Depot,

Whole Foods, Office Depot, Safeway, Gander Mountain and Macy’s

Emphasis placed on training

Set higher expectations for store management

New playbook of standards across the store network

Migrating from an operating focus to a sales and service focus among store

teams We are Aligning and Better Managing

Resources and Talent |

25

September 2012

5 properties in Q3/Q4 2011

•

Generated gross proceeds of $57.8 million

•

Paid down Real Estate Term Loan by $21.6 million

•

Paid down Senior Secured Term Loan by $34.4 million

•

Renegotiated

financing

arrangements

-

enhanced

operating

flexibility

and

extended

term

1 property in Q1 2012, and the sale of a parcel of land

•

Generated gross proceeds of $6.9 million

•

Paid down Real Estate Term Loan by $2.5 million

•

Paid down Senior Secured Term Loan by $1.2 million

6 properties in Q2 2012

•

Generated gross proceeds of $42.8 million

•

Paid off $25.2 million Real Estate Term Loan in its entirety

•

Paid

down

Senior

Secured

Term

Loan

by

$7.6

million

subsequent

to

quarter-end

Reduced total debt, including capital leases, from $338.2 million at year-end

2010 to $226.8 million at July 28, 2012

The Company Strengthened its Financial Position

Deleveraged Through Sale-Leaseback Transactions

|

26

September 2012

New store design opened in September 2011 at

Princeton Plaza location

Innovative store layout and design

developed by new management team

Race-track layout

Farmer’s market look and feel with

upgraded product assortment

Updated logo, colors and branding

Larger nursery and garden center with direct

parking lot access

Prominent customer service center, the

“Workbench”, concentrates all critical hardware

services into one conveniently located area

Eye-catching and distinct interior upgrades in

easy-to-shop format

Target trade area (3 miles), 100K population,

$30K per capita income, more than 1 mile to big

box competition

New Store Target Model

New Innovative ‘Neighborhood’

Store Format

Description

Store Performance:

Sales

$9.0-$15.0

4-Wall EBITDA Margin

15-25%

Store Investments:

Fixed Asset Investment

$3.2

Less: Landlord Contribution

1.0

Net Investment

$2.2

Inventory, net of Payables

0.9

Total Investment

$3.1

Payback Period:

18 -

36 months

Return on Investment (IRR):

40%+

($ in millions) |

27

September 2012

Fiscal 2012 Store Opening and Conversion Plans

New Stores

Conversions

Partial Remodels

Three new store openings planned for fiscal 2012

Fig Garden (Fresno) opened in April 2012

Torrance (South Bay) opened in September 2012

Yorba Linda expected to open in second half

Over time, the majority of stores will be converted to the new neighborhood store

format

Six Orchard locations will be remodeled in fiscal 2012

Grand

re-opening

events

scheduled

for

Q3:

Two

in

San

Jose

and

one

in

Los Angeles

Three additional remodels scheduled for Q4

High impact refresh initiatives have been executed at a number of stores

39 stores have new/updated external signage and paint (50% of the portfolio

will be completed by year-end)

46 stores have direct entry to the nursery from the parking lot (65% of the

portfolio will be completed by year-end) |