Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CTI BIOPHARMA CORP | d402988d8k.htm |

1

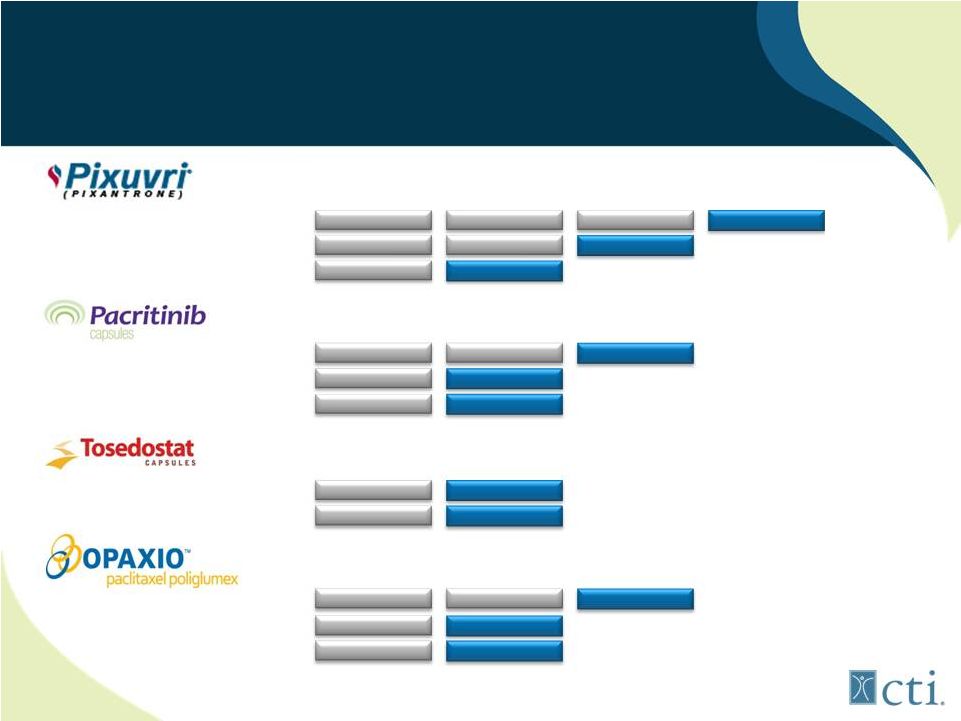

MPN

Pacritinib

Phase 3*

MDS/AML

Tosedostat

Phase 3*

NHL

Pixuvri™

Marketed (EU)

Cell Therapeutics, Inc.

Company Overview

* Phase 3 ready.

Covering a Spectrum

of Blood Related

Cancers

Exhibit 99.1 |

2

Forward Looking Statement

This presentation includes forward-looking statements that involve a number of

risks and uncertainties, the outcome of which could materially and/or

adversely affect actual future results and the market price of CTI's securities. Specifically, the risks and uncertainties that could affect

the development of Pixuvri, OPAXIO, pacritinib, tosedostat and brostallicin include

risks associated with preclinical and clinical developments in the

biopharmaceutical industry in general and with Pixuvri, OPAXIO, pacritinib, tosedostat or brostallicin in particular including, without

limitation, the potential failure of Pixuvri to prove safe and effective for the

treatment of relapsed or refractory non-Hodgkin's lymphoma and/or other

tumors as determined by the U.S. Food and Drug Administration (the “FDA”), that Pixuvri may not be available to patients in the E.U.

beginning

in

September

2012,

that

CTI

may

not

market

and

commercialize

Pixuvri

as

planned,

that

CTI

may

not

launch

Pixuvri

in

the

E.U.

this

year

as

planned

or

in

any

of

the

specific

countries

in

the

E.U.

we

are

currently

planning

to

launch,

that

CTI

may

not

be

able

to

complete

the

PIX306 clinical trial of Pixuvri-rituximab compared to

gemcitabine-rituximab in patients who have relapsed after 1 to 3 prior regimens for

aggressive B-cell NHL and who

are not eligible for autologous stem cell transplant by June 2015 or at all as required by the European

Medicines

Agency

(the

“EMA”)

or

have

the

results

of

such

trial

available

by

June

2015

or

at

all,

that

CTI

may

not

be

able

complete

a

post-

marketing study aimed at confirming the clinical benefit observed in the PIX301

trial, that the conditional marketing authorization for Pixuvri may not be

renewed, the potential failure of OPAXIO to prove safe and effective for treatment of non-small cell lung and ovarian cancers, that

the interim survival results for the phase 3 clinical trial for OPAXIO may not be

ready in 2012, the potential that phase III studies of pacritinib

might

not

begin

in

the

fourth

quarter

of

2012,

the

potential

that

pacritinib

may

fail

to

prove

safe

and

effective

for

primary

MF

and

MF

secondary

to other MPNs, the potential that phase III studies of tosedostat may not occur as

planned, the potential failure of tosedostat to prove safe and effective for

the treatment of elderly patients with newly-diagnosed AML or high-risk myelodysplastic syndrome ("MDS") (including when

administered in combination with cytarabine or decitabine) as determined by the FDA

and/or the EMA, the potential failure of combination studies of tosedostat

with hypomethylating agents in treating AML and/or MDS, that the studies of tosedostat may not achieve their primary

and/or secondary objectives, that the development of tosedostat may be delayed by

disputes with Chroma Therapeutics Ltd. (“Chroma”) under CTI’s

co-development and license agreement with Chroma, that OPAXIO, pacritinib, tosedostat and/or brostallicin may not be approved by the

FDA and/or the EMA, that CTI cannot predict or guarantee what actual sales of its

product candidates will be, that CTI cannot predict or guarantee the pace or

geography of enrollment of its clinical trials or the total number of patients enrolled, that CTI may not achieve a burn

rate of an average of $4.5 million per month through the remainder of the year,

that CTI's average net operating burn rate may increase, that CTI cannot

guarantee that it will not exceed it estimated net operating burn rate for 2013, that CTI cannot guarantee that it will not incur any

debt

or

maintain

its

current

cash

amount

of

cash

available,

that

CTI

cannot

guarantee

that

its

current

amount

of

cash

available

will

be

sufficient

to sustain CTI’s operations until January 2013, that CTI cannot predict or

guarantee when CTI will achieve profitability, if ever, or if CTI will

achieve cash flow break even in the fourth quarter of 2014, and that CTI may not be

able to continue to raise capital as needed to fund its operations

in

general,

and,

including,

without

limitation,

competitive

factors,

technological

developments,

costs

of

developing,

producing,

and

selling its product candidates, and the risk factors listed or described from time

to time in CTI's filings with the Securities and Exchange Commission

including, without limitation, CTI's most recent filings on Forms 10-K, 8-K, and 10-Q. Except as may be required by law, CTI does

not intend to update or alter its forward-looking statements whether as a

result of new information, future events, or otherwise. |

3

Company Overview

Hematology/Oncology-focused biotechnology company

1 commercial product

•

Pixuvri™

:

for

the

treatment

of

non-Hodgkin's

lymphoma

(“NHL”)

-

Conditional

Marketing

Authorization

May

2012-

E.U.

launch

September

2012

-

Attractive “niche”

market ~16,000 patients

(1)

; 10 yrs market exclusivity in E.U.

3 late-stage product candidates:

•

Pacritinib,

:

highly

selective

JAK2

inhibitor,

Phase

3-

expected

Q4

2012

-

Addresses unmet need in MF market post ruxolitinib approval

•

Tosedostat

: novel aminopeptidase inhibitor anticipating Phase 3 in 2013

for MDS/AML

•

Opaxio

:

protein-paclitaxel

conjugate

completing

Phase

3

trial

in

1

st

line

maintenance therapy for Ovarian Cancer

~$24mm cash and no debt

on the balance sheet

(2)

•

Estimated cash burn of an average of ~$4.5mm per month through the remainder of

2012. (1) European Cancer Observatory, Publications on NHL subgroup and

relapse rates includes 4th line. (2) Pro forma cash balance as of

August 1,2012. |

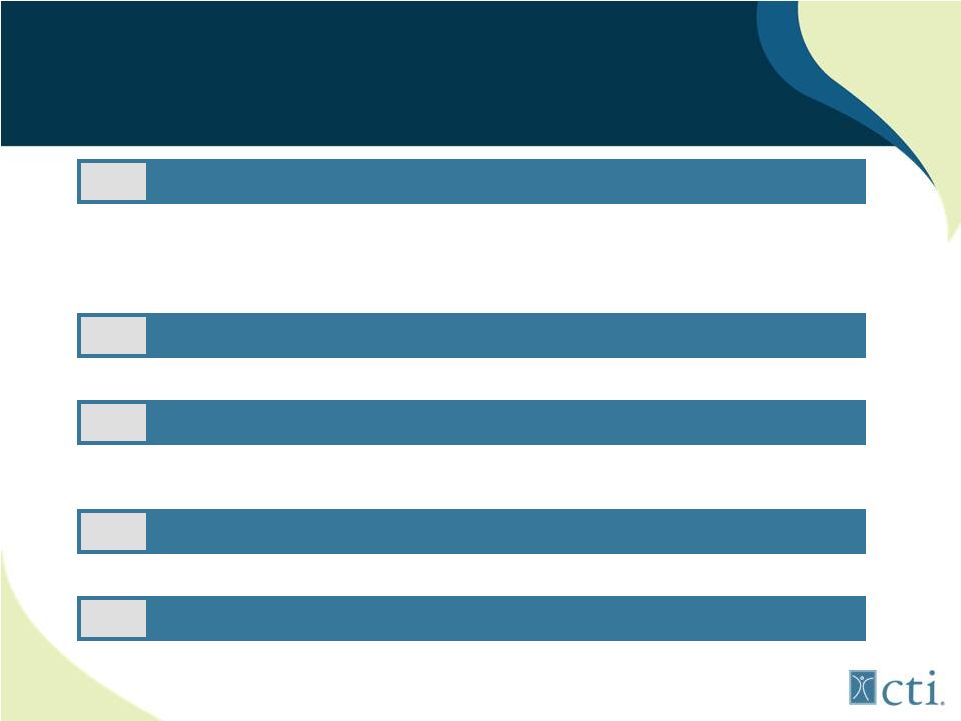

4

Current Pipeline

Third-line r/r aggressive NHL (PIX301)

Second-line r/r aggressive NHL (PIX306)

First-line aggressive NHL (PIX203)

Myelofibrosis (<100,000plts)

(1)

Primary Myelofibrosis

Relapsed Lymphoma

First-line or r/r Myelodysplastic Syndrome

Elderly high-risk r/r AML (OPAL)

Maintenance therapy for ovarian cancer

First-line GBM +XRT vs standard of care

Head and neck cancer w/ Erbitux+XRT

Phase 1

Phase 2

Phase 3

Commercial

(1)

Phase 3 study is expected to initiate in 4Q 2012. |

5

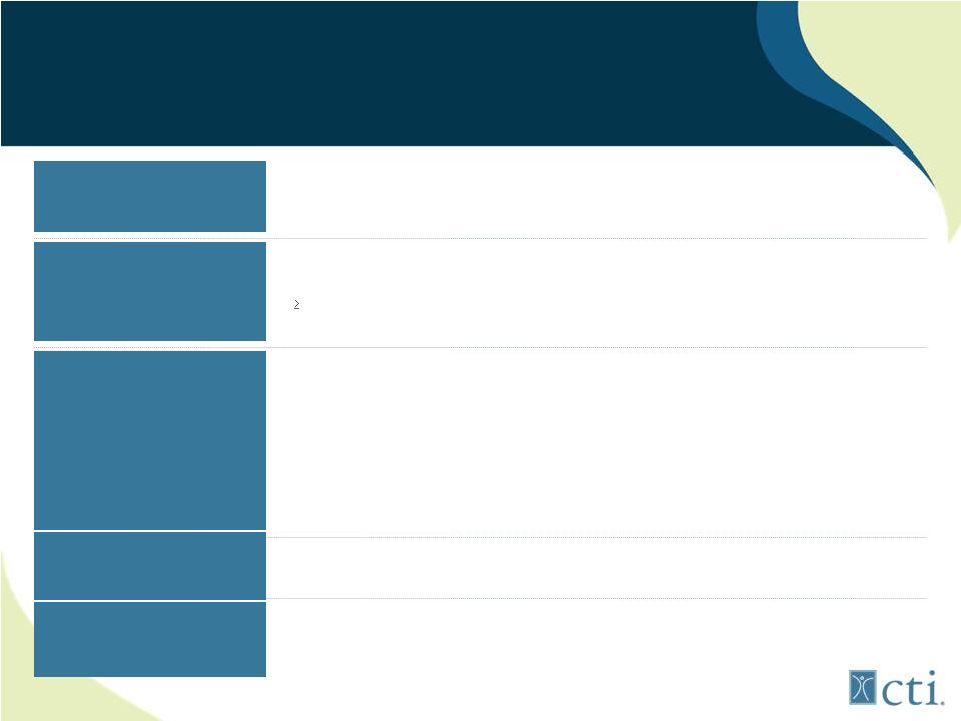

Investment Highlights

Pixuvri Approved in E.U.

Pacritinib is a Differentiated

JAK2 Inhibitor

Leading, Late-Stage

Oncology Franchise

Tosedostat has Shown

Encouraging Data in

AML/MDS

Significant Upcoming

Milestones

•

Late-stage portfolio focused on blood-related cancers

•

Deep pipeline with 1 product approved in the E.U., 1 product in Phase 3 trials, 2

products planning to initiate pivotal Phase 3 trials in 2012/2013

•

Received

E.U.

conditional

marketing

approval

in

May

2012;

launch

roll-out

September

2012

•

Engaged Quintiles to hire Pixuvri dedicated sales force and MSL’s

•

$240mm potential peak sales in E.U., pricing –reimbursement studies support

reasonable price •

Pixuvri

sales

can

help

fund

pipeline

development

and

potentially

lead

to

profitability

by

Q4-2014

•

Highly selective JAK2 inhibitor (does not affect the JAK1 pathway, unlike

competitors) •

Positioned to be the first JAK2 inhibitor for MF patients with platelet counts

below 100,000/uL, and potentially the second JAK2 inhibitor to enter the

market after Incyte’s JAKAFI (peak worldwide sales of JAKAFI in

MF are estimated at $1bn) -

Only grade 3 side effect is diarrhea

-

Potential competitive advantage over JAKAFI in patients with thrombocytopenia (27%

-33% of MF market)

•

Expected to enter pivotal Phase 3 trial in Q4 2012, target enrollment completion:

12 months •

The only aminopeptidase inhibitor in advanced clinical development

•

Demonstrating results in Phase 2 trials

•

September 2012: Pixuvri launch in E.U.

•

Q4 2012: Expected to Initiate pacritinib Phase 3 trial in

myelofibrosis •

Q1-2013 Expected interim survival analysis on Opaxio (GOG212) phase 3

trial |

6

Recent Strategic Initiatives

Reduced Projected Monthly Cash Burn from an average of ~$5.5mm to

~$4.5mm 1

•

Do not plan to resubmit Pixuvri US NDA in the near-term

•

Discuss options for PIX306 trial with FDA/EMA for earlier data (PFS)

•

Delaying

initiation

of

tosedostat

Phase

3

trial

until

1

st

line

phase

2

results

•

Reduced advisory, consulting, legal fees and occupancy costs

Initiation of Pacritinib Phase 3 Trial to Q4 2012

4

Pixuvri Pre-launch Activities in Support of a September 2012 Launch

3

•

Engaged Quintiles to hire CTI’s Pixuvri dedicated sales force and medical

specialists •

EU General Manager, Market Access Specialist, and VP of Medical Affairs in

place New Hires with Significant Industry and Operational Expertise

2

•

Recently hired new CMO and EVP, Corporate Development

Implemented Reverse Stock Split

5

•

Current shares outstanding ~56.6 million

•

Engaged CRO that conducted COMFORT II trial

•

Planned initiation Q4 2012 |

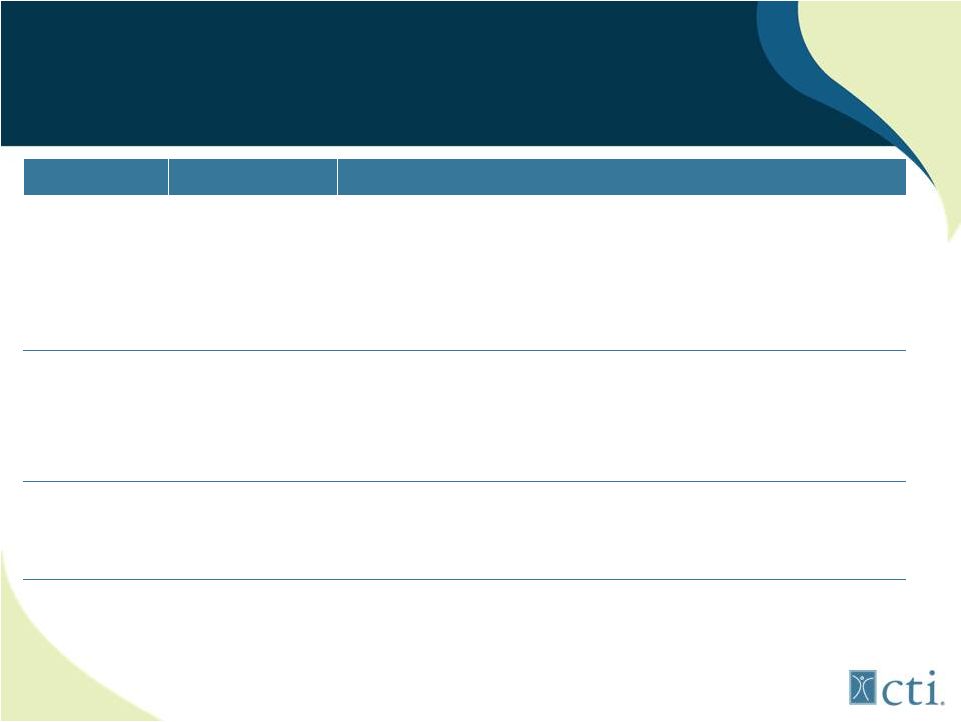

7

Executive Management Team

Officers

Position

Experience

James Bianco, MD

Principal Founder,

President & Chief

Executive Officer, and

Director

•

Chief architect of CTI’s portfolio strategy and has secured more than $1.6bn

in operating capital

•

Previously was an Assistant Member in the clinical research division of the Fred

Hutchinson Cancer Research Center and an Assistant Professor of Medicine at

the University of Washington and Director Bone Marrow Transplant Unit

SVAMC •

Received B.S. in Biology and Physics from New York University and M.D. from

Mount Sinai School of Medicine

Steven Benner,

MD, MHS

EVP, Chief Medical

Officer

•

Joined CTI as EVP and CMO in June 2012

•

Previously was SVP and CMO at OncoMed and CMO at Protein Design Labs

•

Industry experience Bristol –Myers Squibb

•

Completed his training in medical oncology at Johns Hopkins University, where he

also earned an M.H.S. in Clinical Epidemiology from the University’s

school of Public Health

Matt Plunkett. PhD

EVP, Corporate

Development

•

Former CFO California Institute Regenerative Medicine, iPierian

•

Previously Managing Director, Head West Coast Biotechnology, CIBC

•

70 transactions, $4.3bn equity linked transactions, $1bn M&A

•

Received PhD. from UC Berkeley |

8 |

9

Pixuvri™: Addresses an Unmet Need

Anthracyclines: most active class of chemotherapy

•

Cornerstone agents for NHL, AML, sarcoma, breast

•

Cumulative cardiac damage is dose limiting

Pixuvri™

•

Lacks structural motifs that lead to cardiotoxicity

-

Significant reduction in biochemical, echo-cardiographic and severe

clinical

symptoms

(CHF)

vs

doxorubicin

in

randomized

P2

clinical

trial |

10

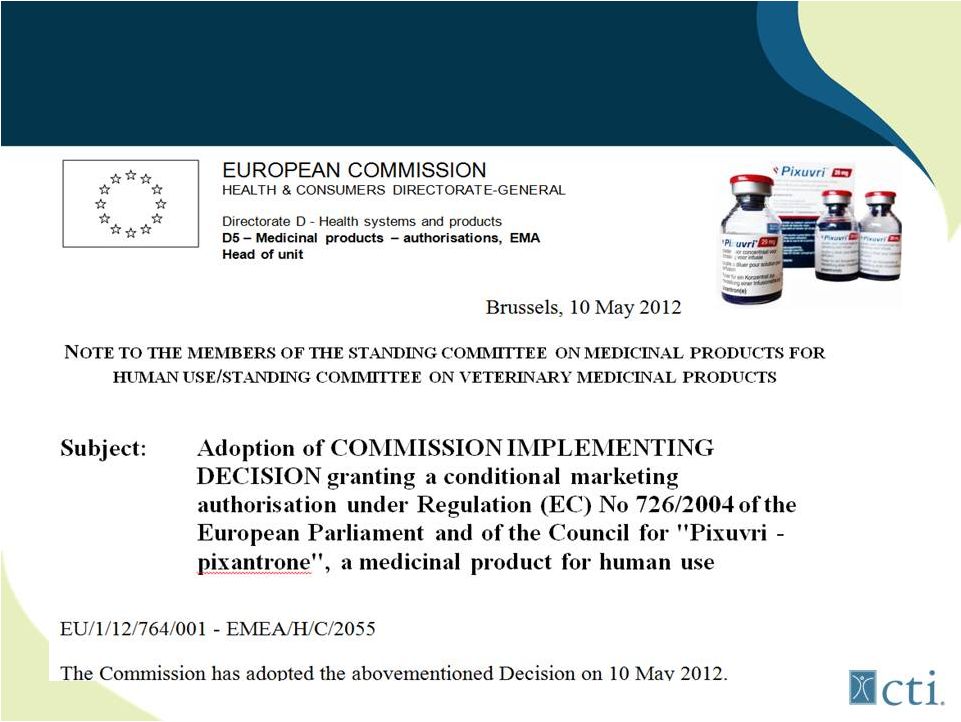

Pixuvri™:

Conditional

Marketing

Authorisation

3

rd

/4

th

line aggressive B-cell NHL |

11

Lancet Oncology: May 2012

11 |

12

Pixuvri™:

First to Market for r/r

aggressive B-cell NHL

Pixuvri

(n=70)

Comparator

(n=70)

P Value

CR/CRu

20%

5.7%

0.021

ORR

40%

14.3%

0.001

PFS

5.3mos

2.6mos

HR=0.60

0.005

OS

10.2mos

7.6mos

HR=0.79

0.25

Pixuvri

(n=50)

Comparator

(n=49)

P value

CR/CRu

28%

4.1%

0.002

ORR

48%

12.2%

<0.001

PFS

5.7mos

2.8mos

HR=0.50

0.002

OS

13.9mos

7.8mos

HR=0.76

0.27

Basis: PIX301 trial, only randomized controlled trial in

>3rd

line

aggressive

NHL

(n=140

patients)

Manageable toxicities (neutropenia)

Lower than expected incidence of cardiac events (7%)

Intent to Treat Results

On Label 3

rd

/4

th

line B-cell Results |

Pixuvri™: EU Commercial Opportunity

Market research supports potential peak

penetration ~8,125 patients/year*

Market access (pricing) strategy*

•

Quantitative benefit over physician choice

•

CR statistically correlative with OS

•

EU

List

Price

corridor

$29,500

-

$35,000

-

Allows for potential net ex-factory price $29,500

•

Incremental cost/QALY (ICER) favorable

Currently plan to launch in free market countries

Q4 2012

•

Nordic, Austria/Norway, Germany/UK/Netherlands

•

Balance of major market countries expected in 2013

13

*Market Access, Reimbursement and Market penetration projections provided by, UBC, and Kantar

Research respectively |

14

Pixuvri™: U.S. Regulatory Status

FDA appeal: Office New Drugs (OND) provided path for

resubmission

-

2 Independent

Radiographic

Panel

confirmed

1st

panels

results

-

Document Interim analysis was not conducted then PIX301 trial would be

considered a positive study

EU launch and pacritinib acquisition driving portfolio

dynamics and priorities

•

NDA strategy under review

•

Considering potential to use PFS from PIX306 trial to provide data for

accelerated approval while trial completes and survival data matures

•

Could

potentially

fulfill

EMA-PMC

and

serve

as

2

trial

for

US

submission

in 2014

•

Plan to seek FDA and Scientific Advice on the above in 2013

nd

nd

14 |

A

highly differentiated JAK2 inhibitor 15 |

16

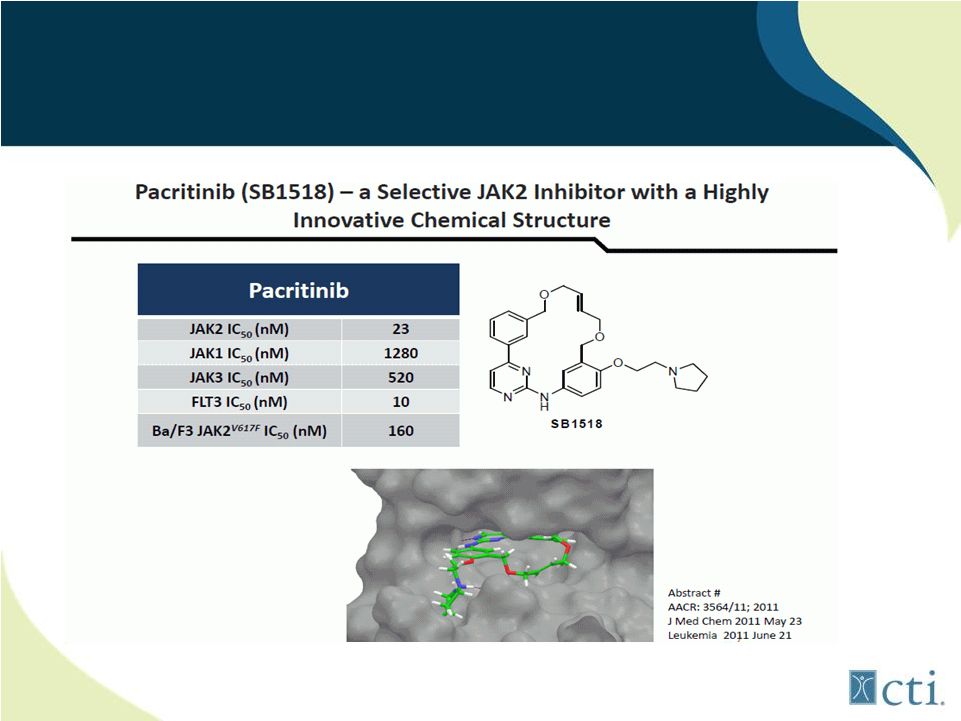

Pacritinib:

Inhibits

2

important

activating

mutations

(JAK2

+

FLT3) |

17

Initial

Target

Market:

MF

patients

with

thrombocytopenia

(platelets

<100

x10

9

)

Table 2: Maximum Restarting Doses for Jakafi After

Safety Interruption* Current Platelet Count

Maximum Dose When

Restarting Jakafi Treatment *

Greater than or equal to 125 X 109/L

20 mg twice daily

100 to less than 125 X 109/L

15 mg twice daily

75 to less than 100 X 109/L

10 mg twice daily for at least 2 weeks;

if stable, may increase to 15 mg twice

daily

50 to less than 75 X 109/L

5 mg twice daily for at least 2 weeks; if

stable, may increase to 10 mg twice

daily

Less than 50 X 109/L

Continue hold

*Maximum

doses

are

displayed.

When

restarting,

begin

with

a

dose

at

least

5

mg

twice

daily

below

the dose at interruption.

JAKAFI™

(ruxolitinib label for patients with low platelets)

|

18

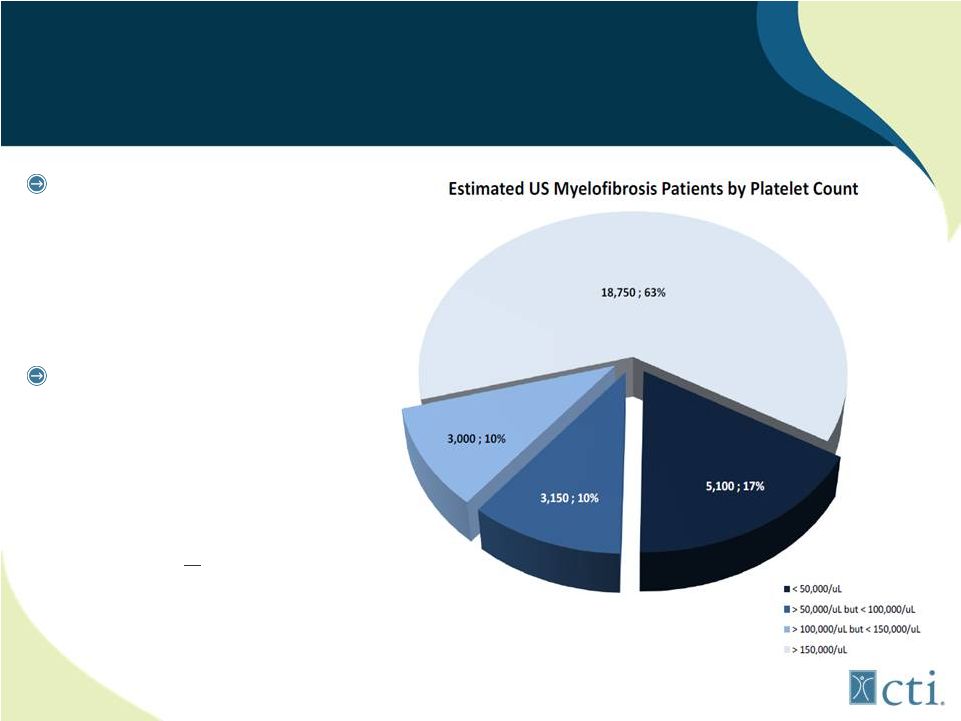

27% MF Patients Have Severe Thrombocytopenia

JAK1/JAK2 inhibitors

(ruxolitinib) associated

with treatment emergent

thrombocytopenia and

anemia

Pacritinib: selective

JAK2 inhibitor lacks

myelosupporession;

potentially first to market

for MF patients with low

platelets (<100,000/uL)

Source: MPN Research Foundation.

|

19

Pacritinib: Targets patient population

unserved by ruxolitinib

Ruxolitinib

approval

trials

excluded

patients

<100,00/uL

platelets

-

93% COMFORT II had normal platelets, median COMFORT I, 244,000/uL

-

However, MF patients with low platelet counts are higher risk population

Ruxolitinib study* (n=41) MF in patients with low platelets*

•

75% tolerated up to 10mg bid by 24 weeks, but TET* still problematic

*<100,000/uL >

50,000/uL ASCO June 2012 abstract #6630 preliminary data.

TET: treatment emergent thrombocytopenia |

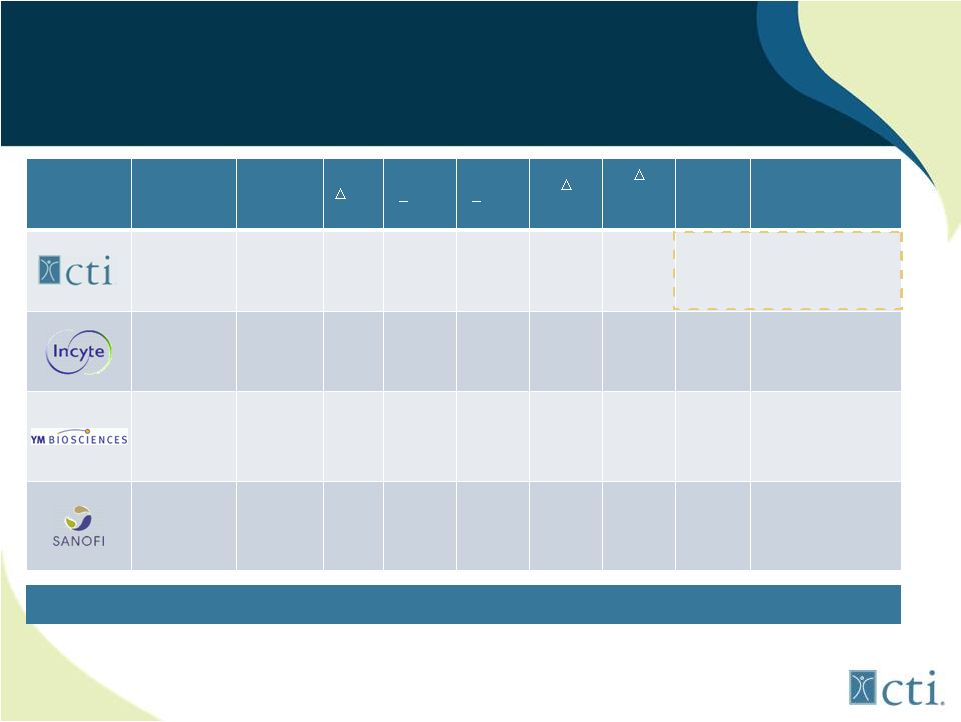

20

Summary Clinical Trial Results

JAK Inhibitors in MF

Company

Drug

Stage

SX

Spleen

>50%

PE

Spleen

>35%

MRI

RBC

JAK2

V617F*

Platelet

cutoff

Side

Effects

Pacritinib

JAK2-wt

JAK2V617F

FLT-3

Phase 3

(Phase 2

n=65)**

>50%

42%

32%

NR

>30%

NONE

Nausea/diarrhea

Ruxolitinib

JAK1

JAK2-wt

Marketed

>50%

29-42%

14%

NA

100,000

Anemia,

thrombocytopenia,

withdrawal

syndrome

CYT387

JAK1

JAK2-wt

TYK2

Phase 3

(Phase 2

n=60)

>50%

45%

50%

NA

50,000

Thrombocytopenia,

headaches, 1

st

dose

effect, neuropathy,

lipase/amylasemia

SAR302503

JAK2-wt

JAK2V617F

FLT-3

Phase 3

(Phase ½

n=59)

>50%

39%

0%

21%

50,000

Nausea/diarrhea,

anemia,

thrombocytopenia,

lipase/amylasemia

Chart taken from Terferri, Supplement to Blood ASH 2012

*Median allele burden reduction at 24 cycles.

** Data combined from two Phase 2 trials.

Pacritinib Demonstrates a Truly Differentiated Side-Effect Profile

|

21

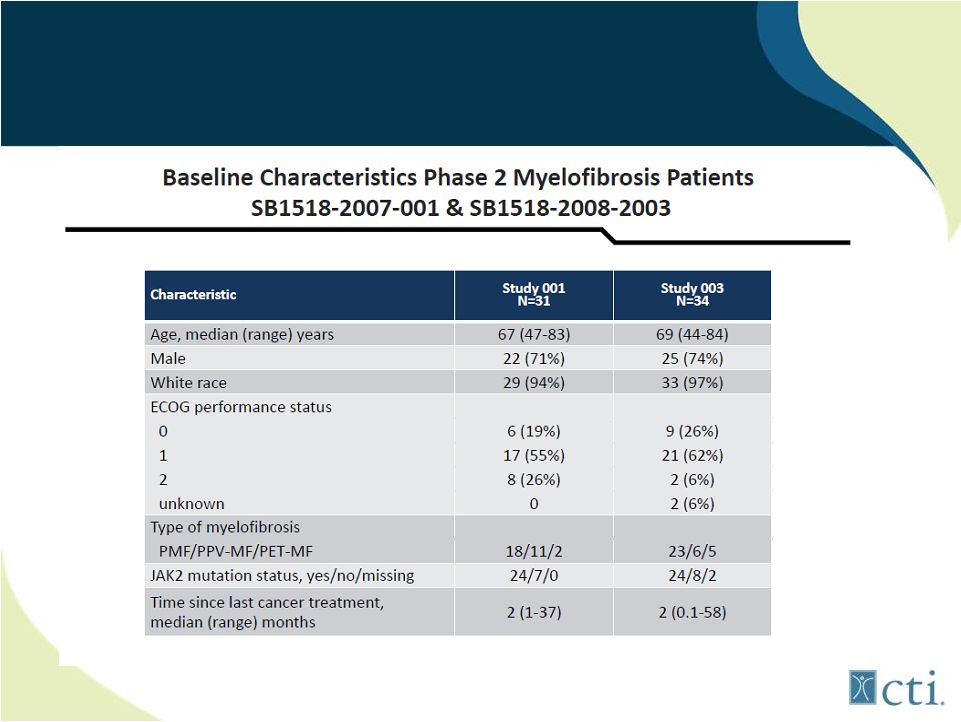

Pacritinib: Phase 2 Studies

Source: ASH 2011. |

22

Pacritinib: Phase 2 Studies (combined)

Source: ASH 2011. |

23

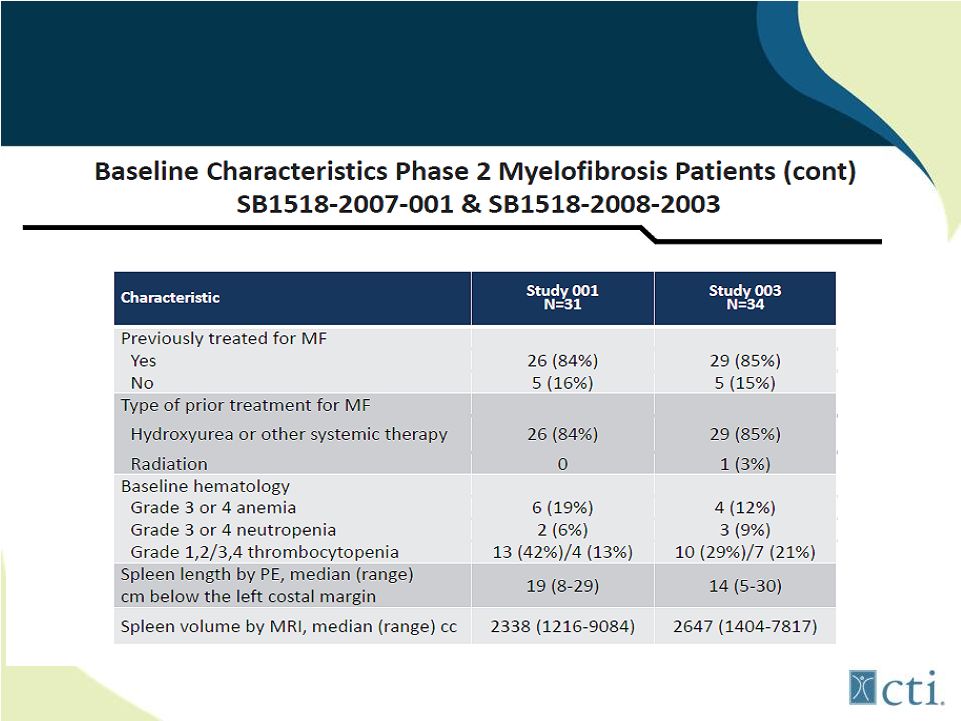

Pacritinib: Phase 2 Efficacy (combined)

27 of 65 (42%) patients had response of 50%

14 of 65 (21%) had complete response with resolution of splenomegaly

8 of 26 (32%) treated with SB1518 had 35% reduction by

MRI* Source: ASH 2011.

*Among patients who had MRI measurements (8 patients did not have baseline

MRI’s). |

24

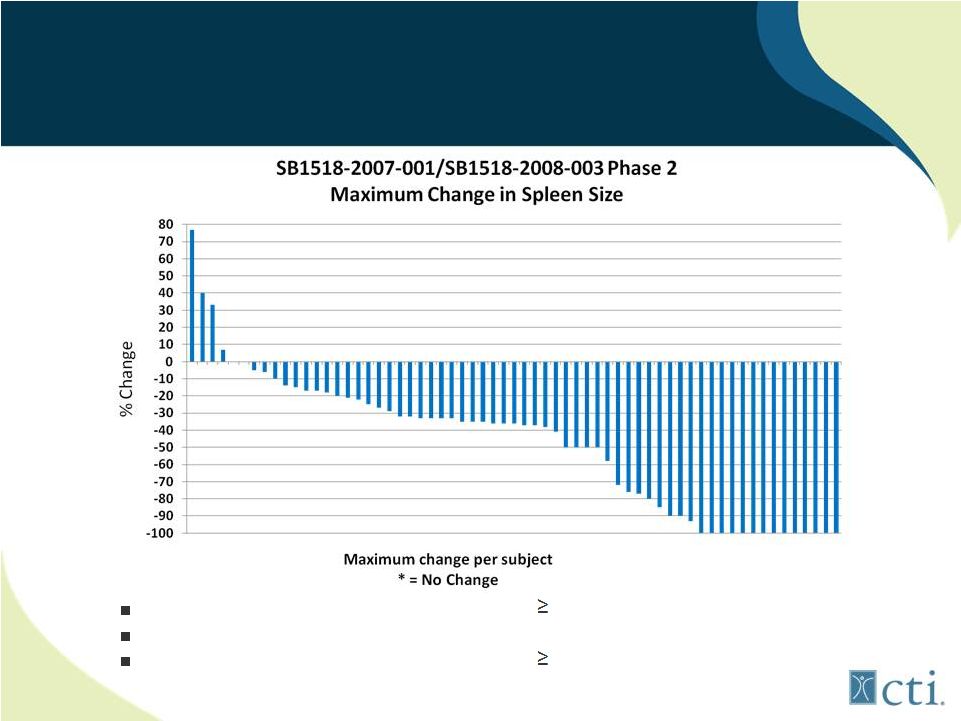

Pacritinib: Benefit Independent

of Platelet Count

Assessment

Maximum

decrease from

baseline

Patients with

baseline platelet

counts

150,000

N=36

All Evaluable

Patients

N=65

PE

50%

14 (39%)

27 (42%)

Source: ASH 2011.

*

Reduction of splenomegaly was observed with similar frequency in patients with normal or low platelet

counts |

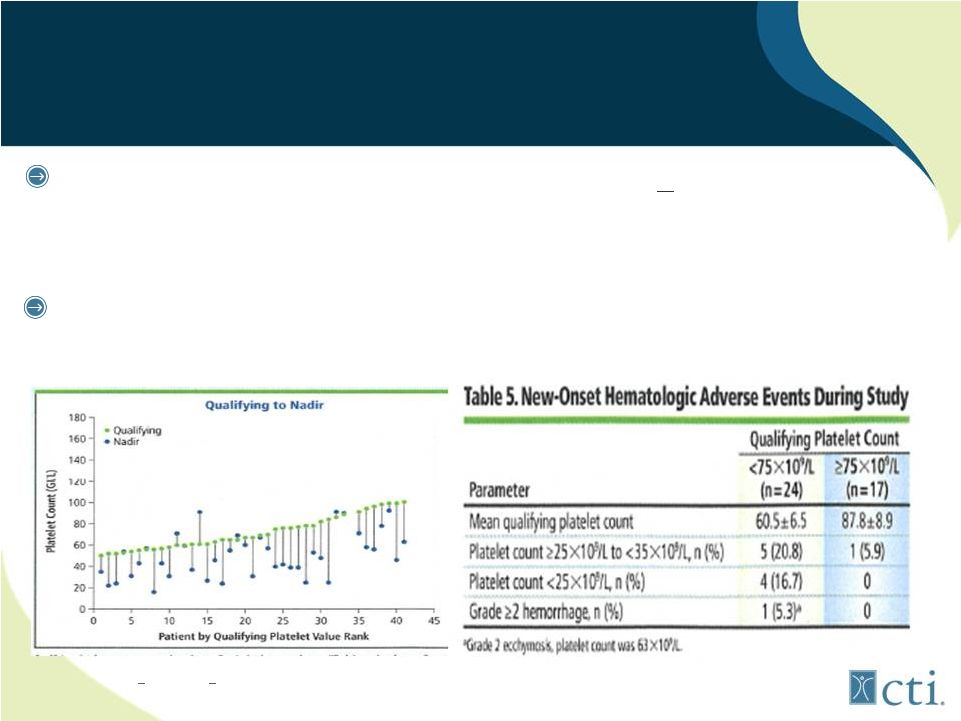

25

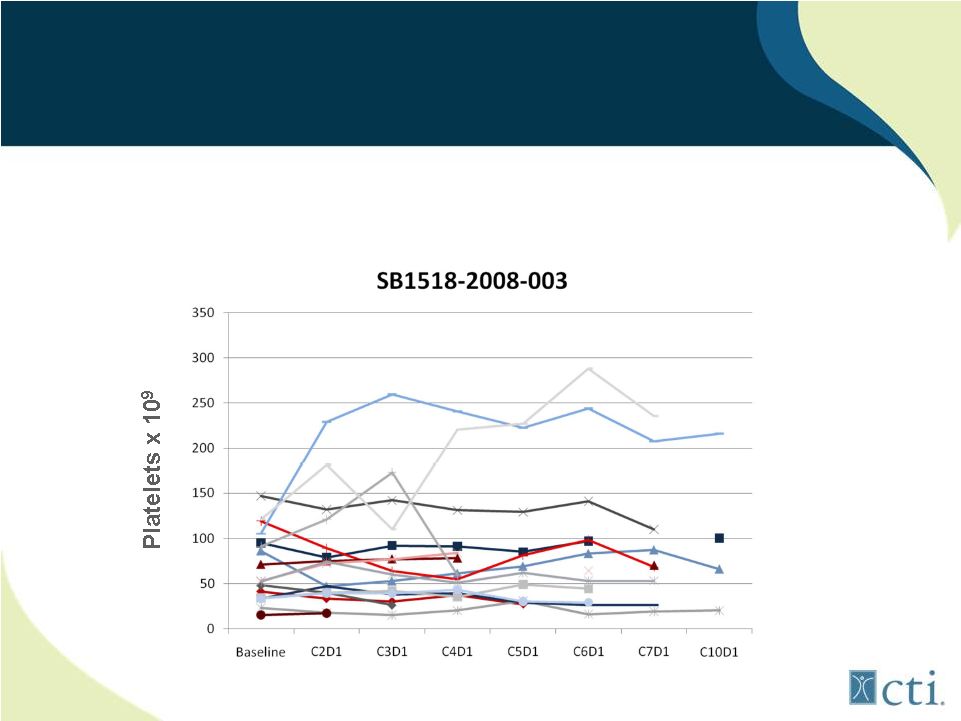

Lack of treatment emergent thrombocytopenia observed in patients

with low starting platelet counts

Pacritinib: Minimal Effect on Platelet

Counts

Source: Komrokji. R., et al |

26

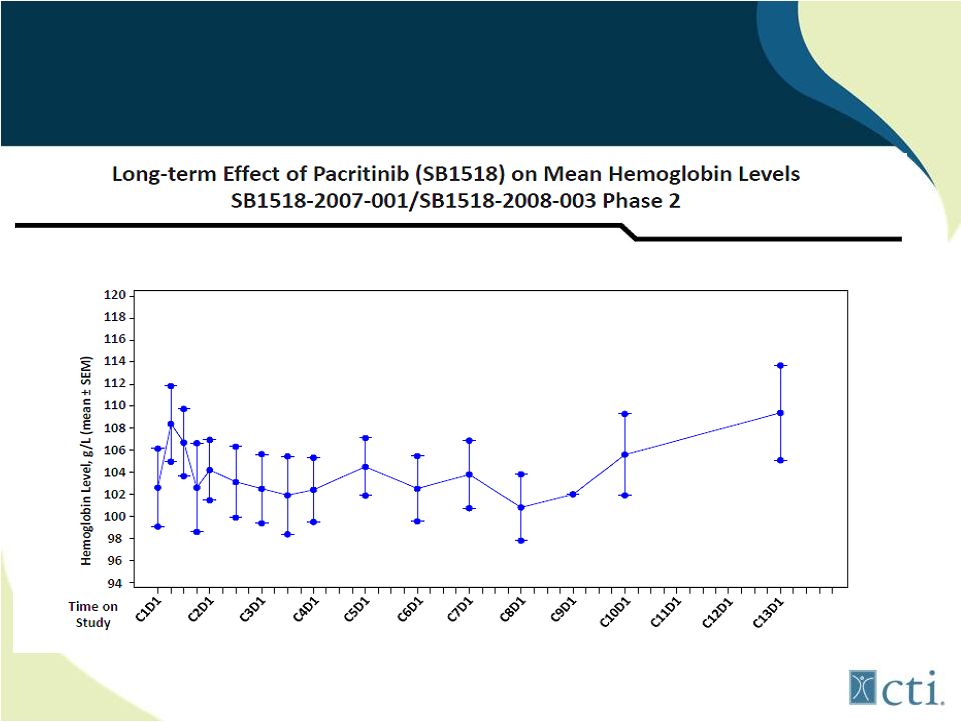

Pacritinib: Lack of treatment associated

anemia

Source: Komrokji. R., et al |

27

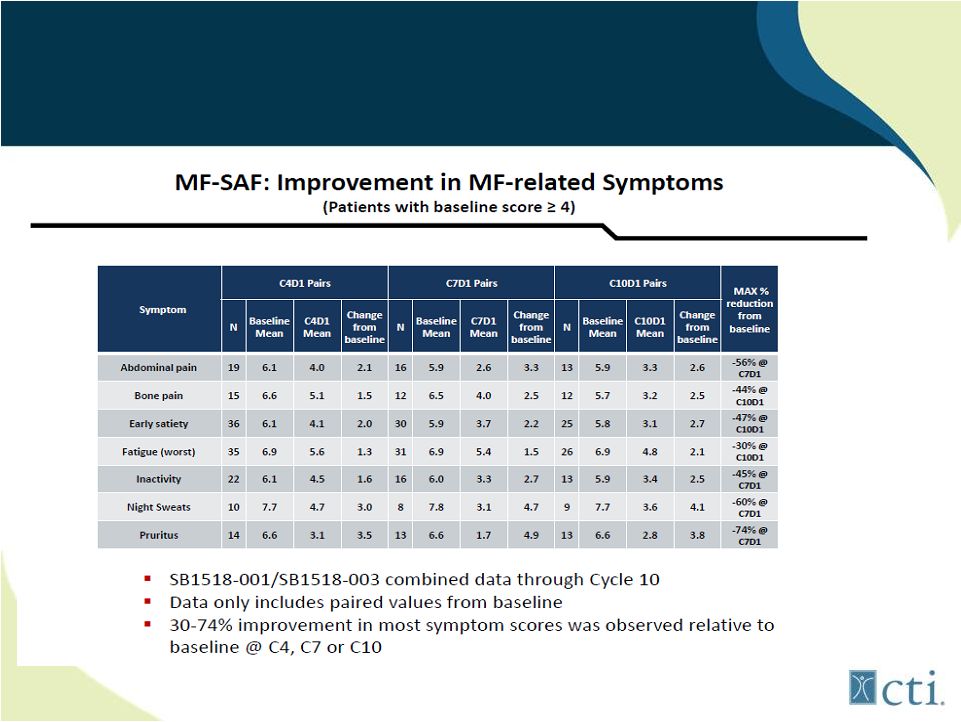

Pacritinib: Durable Improvement

in MF Related Symptoms

Source: ASH 2011. |

28

Contemplated Phase 3 Trial Designs

Target Indication:

•

Patients with PMF, PPV-MF, PET-MF with splenomegaly and

thrombocytopenia

•

Two phase 3 trials, each approximately 270 patients

-

Pacritinib Vs BAT

-

Pacritinib Vs BAT including patients on low dose ruxolitonib

(5,10mg) with treatment emergent thrombocyopenia (<100,000/uL

platelets)

Target Initiation: Q4 2012

•

Estimated enrollment time-

12 months + 6 months follow-up

•

Potential topline results mid 2014

Contemplated Phase 3 Trial Design(s) |

29

Pacritinib: Certain Key Deal Terms

Acquired molecule from S*Bio

•

S*BIO was established as a joint venture between The Singapore Economic

Development Board Investments and Chiron Corporation as Singapore’s first

fully- integrated, drug discovery company

Upfront payment $30mm

•

$15 million cash

•

$15mm total in stock

Up to $132.5mm in potential approval and sales milestones

Sliding scale, low single digit royalty on sales |

30

A new class of cancer targeted agents

AADR inducers

30 |

31

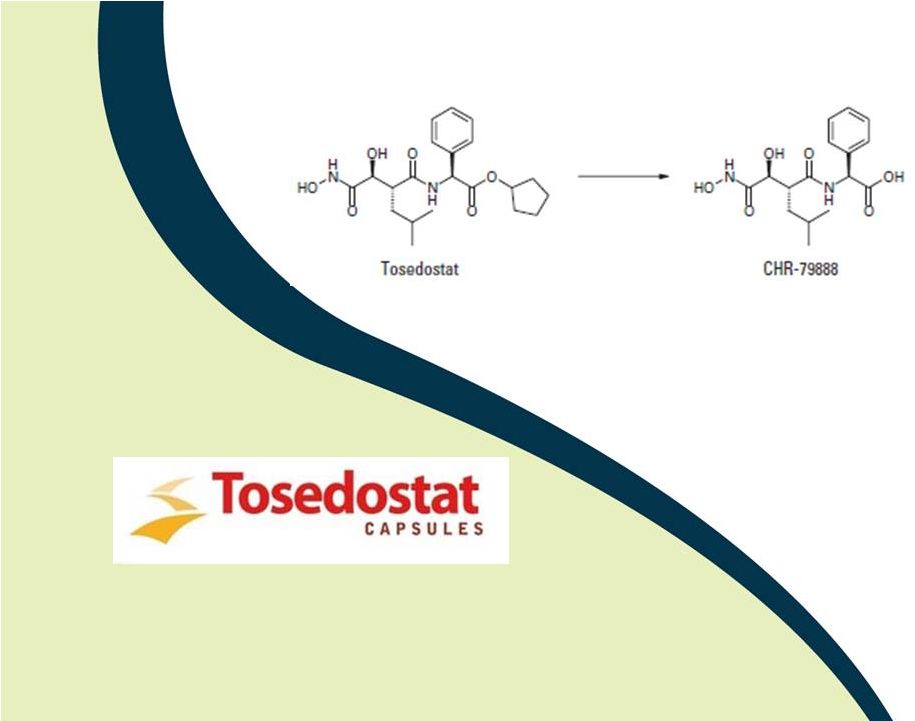

Tosedostat:

Novel Mechanism of Action AADR Inducer

Targets members of aminopeptidase family

Induces genes characteristic of Amino Acid Deprivation

Response (AADR) resulting in cell death

AADR changes only seen in transformed (tumor) cells and not

normal cells

Demonstrated clinical activity across range of solid and liquid

tumors |

32

Tosedostat: OPAL Study Results

Encouraging Phase 2 data -

r/r elderly AML (n=73)

•

Oral once-a-day dosing for 6 months

•

16 of 50 (32%) evaluable patients had bone marrow response

-

9 (12%) of which were complete bone marrow responses

•

9 of 25 (36%) patients who previously failed therapy with HMA

had a bone marrow response

Well-tolerated

•

Most common grade > 3 febrile neutropenia (29%), fatigue (21%)

|

33

Tosedostat: Phase 3 Study

Data support pivotal trial: high risk MDS/secondary AML

Phase 3 trial options:

•

Relapsed/refractory setting combination with LDAC

-

High risk heterogenous patient population

-

Several drugs currently targeting this population

•

1

st

line setting combination with HMA

-

Substantial investigator interest

-

Higher probability of success and shorter enrollment time

Ongoing phase 2 data (1

st

line HMA + tosedostat in MDS)

will drive decision in 2013 |

34

Partnership with Chroma Therapeutics

Exclusive co-development and marketing rights in the Americas

•

Chroma Therapeutics has ROW rights

Cost-sharing

•

CTI bears 75% of agreed upon direct development expenses

•

Registration trials aimed at US/EU regulatory approval

Initial Payments

•

$5mm upon execution of license

•

$5mm upon initiation of first pivotal trial

Development and sales based milestones

Royalty rate based on net sales volume |

35

Financial

Overview |

36

Financial Overview

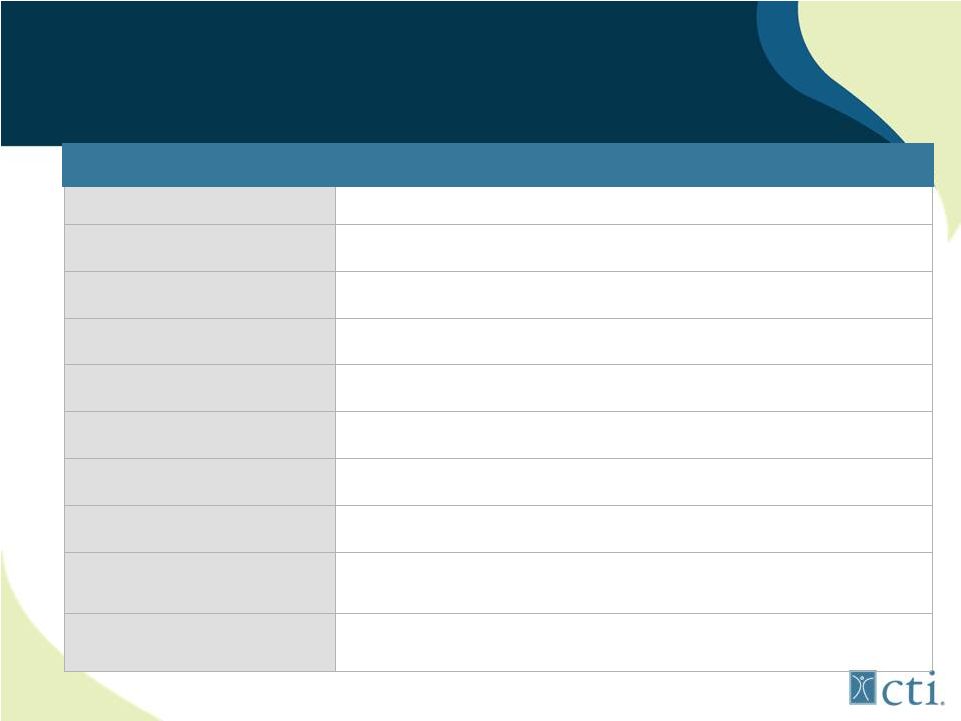

Exchanges / Tickers

•

NASDAQ: CTIC and MTA: CTIC.MI

Market Capitalization

•

~$125mm

Shares Outstanding

•

~56.6mm

Cash

•

$24mm

(1)

Debt

•

None

Projected Cash Burn

•

~$4.5mm / month

Cash Remaining

•

January 2013

Estimated

2013

Cash

Burn

(2)

•

$58mm net of Pixuvri product margin contribution

Targeted Cash Flow Break

Even

(2)

•

Q4 2014

Financing Need

•

~$75mm

of

additional

financing

is

needed

to

reach

potential

CFBE and

maintain a level of cash reserves

Capital Structure and Financial Statistics

(1)

Estimated cash balance as of August 1, 2012.

(2)

Assumes Pixuvri price reimbursement and market penetration within corridors and

percentages noted in Kantar Market Research and this presentation and also

assumes burn rate stays in line with expectations |

37

Expected News Flow

Upcoming Planned Events

•

Pixuvri launch in the EU

•

Pacritinib phase 3 trial initiation in Myelofibrosis

•

Brostallicin-

SABC triple negative breast cancer

•

OPAXIO interim survival analysis Phase 3 ovarian cancer trial

•

IQWiG innovation score assignment

Upcoming publications

•

Journal Clinical Oncology

Pacritinib in lymphoma

•

Blood

Pacritinib in AML

•

Journal Clinical Oncology

Pacritinib MF phase 2

•

Journal Immunology

SB1578 in RA |