Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNTRUST BANKS INC | bodyof8-k11.htm |

| EX-99.1 - NEWS RELEASE - SUNTRUST BANKS INC | dearborn-final.htm |

SunTrust Banks, Inc. September 6, 2012

2 Important Cautionary Statement About Forward-Looking Statements This presentation contains forward-looking statements. Statements regarding (a) our ability to sell, and the current estimates of future losses to be incurred upon the sale of, certain loan portfolios; (b) expected increases in Tier 1 common capital as a result of the sale of the Coke shares; and (c) the expected level of future incurred losses on pre-2009 loans sold to GSEs, and the related provision expense, (d) the expected impact of planned asset sales on future period financial results, and (e) future levels of collections costs and OREO costs, are forward-looking statements. Also, any statement that does not describe historical or current facts, is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook,” “pro forma,” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements include: (1) general economic conditions may prevent us from completing planned sales of asset, or may impair the prices we receive upon sale of those assets; (2) if in the future we incur additional loan losses, then we will need to record additional mortgage repurchase provision expense; (3) if in the future we receive greater levels of mortgage repurchase request than expected, then we may will need to record additional mortgage repurchase provision expense; and (4) our ability to reduce collection and OREO costs as a result of planned loan sales depends upon our assumptions regarding collection and OREO costs for the loans which we retain. Additional factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, “Item 1A. Risk Factors,” beginning at page 8 of our Annual Report on Form 10-K for the year ended December 31, 2011, and in other periodic reports that we file with the SEC.

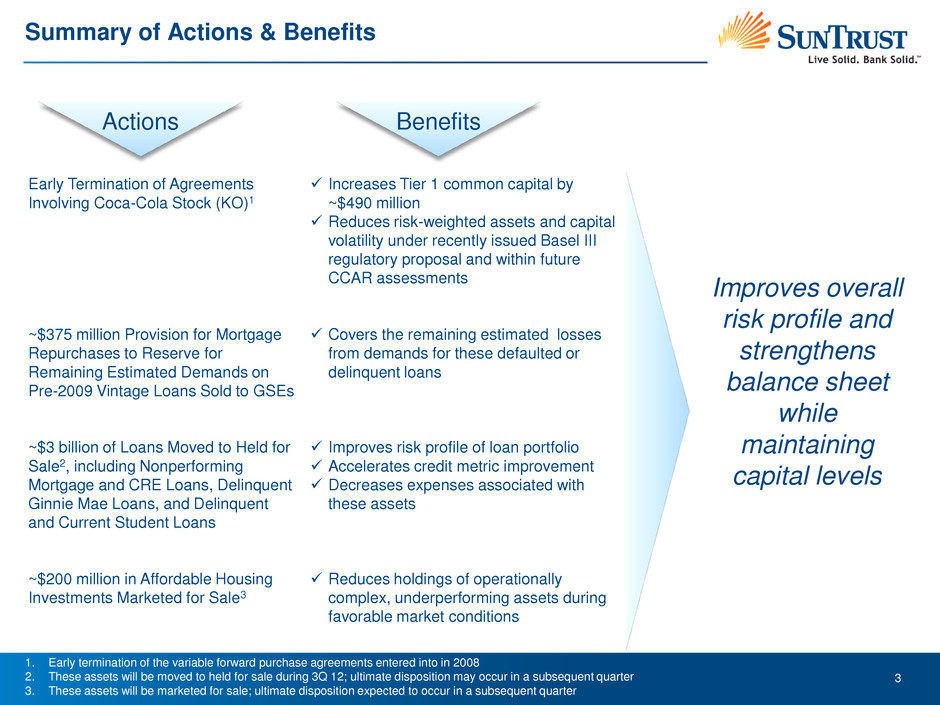

3 Summary of Actions & Benefits 1. Early termination of the variable forward purchase agreements entered into in 2008 2. These assets will be moved to held for sale during 3Q 12; ultimate disposition may occur in a subsequent quarter 3. These assets will be marketed for sale; ultimate disposition expected to occur in a subsequent quarter Improves overall risk profile and strengthens balance sheet while maintaining capital levels Actions Benefits Early Termination of Agreements Involving Coca-Cola Stock (KO)1 ~$375 million Provision for Mortgage Repurchases to Reserve for Remaining Estimated Demands on Pre-2009 Vintage Loans Sold to GSEs ~$3 billion of Loans Moved to Held for Sale2, including Nonperforming Mortgage and CRE Loans, Delinquent Ginnie Mae Loans, and Delinquent and Current Student Loans ~$200 million in Affordable Housing Investments Marketed for Sale3 Increases Tier 1 common capital by ~$490 million Reduces risk-weighted assets and capital volatility under recently issued Basel III regulatory proposal and within future CCAR assessments Covers the remaining estimated losses from demands for these defaulted or delinquent loans Improves risk profile of loan portfolio Accelerates credit metric improvement Decreases expenses associated with these assets Reduces holdings of operationally complex, underperforming assets during favorable market conditions

4 Expected Financial Impact Action Estimated 3Q 12 Financial Impact Expected 2013 Financial Impact Other Comments Early Termination of Agreements Involving Coca- Cola Stock • ~$1.9 billion increase in noninterest income from the sale of shares and termination of agreements • ~$10 million decrease in net interest income, reflective of lost KO dividends less elimination of interest expense associated with the original agreements • ~$37 million increase to noninterest expense from the charitable contribution • Net interest income will decline by ~$40 million1, reflective of lost KO dividends less elimination of interest expense associated with the original agreements • Tier 1 common increase of ~$490 million is lower than the after-tax gain, as prior to this transaction SunTrust received ~$730 million in regulatory capital credit for its KO shares2 • SunTrust contributed one million KO shares to the SunTrust Foundation Mortgage Repurchase Provision, Pre-2009 GSE Loans • ~$375 million decrease in noninterest income • Expected to eliminate future provisions on GSE loans for these vintages • Dialogue with Fannie Mae and Freddie Mac, as well as overall trends in repurchases and full file requests, resulted in an adjustment to the estimate of incurred losses ~$3 billion of Loans Moved to Held for Sale • ~$250 million in pre-tax charges (write- downs of nonperforming loans will be recorded in provision/net charge-offs, while gains/losses on student and delinquent Ginnie Mae loans will be reflected in noninterest income) • Expected to contribute to decline in credit-related costs • Decrease in net interest income due to sales of student and Ginnie Mae loans • More granular information on the sales amounts and income statement impacts by loan category is expected to be made available on the 3Q 12 earnings call ~$200 million Affordable Housing Investments Marketed for Sale • ~$100 million increase in noninterest expense to write-down properties to expected disposition value • Financial impact not expected to be material • Sale of assets is targeted for 2013 1. This reduction in income otherwise would have occurred after the 2014 and 2015 settlements of the agreements 2. Reflective of the after-tax value of the shares at the ~$19 per share variable forward purchase agreements’ floor price ($ pre-tax, except for Tier 1 common figures)

5 Appendix

6 Early Termination of Coca-Cola Company Agreements1 Background Information Today’s Announcement • SunTrust has owned shares of The Coca-Cola Company (KO) since 1919, when Trust Company Bank, a predecessor institution, participated in the underwriting of KO’s IPO and received shares in lieu of fees • SunTrust retained the KO shares, and over time, the value of the holdings appreciated substantially • After a comprehensive balance sheet review in 2007 and 2008, SunTrust: Sold a portion of its KO shares Made a charitable contribution of some of the shares Retained 60 million shares (post – split) • On the retained shares, SunTrust entered into two variable forward purchase agreements (VFPAs) with an unaffiliated counterparty Per the terms of the VFPAs, SunTrust was to deliver a variable number of the KO shares (or an equivalent amount of cash) at the 2014 and 2015 settlement dates, and the counterparty was obligated to deliver an amount of cash equivalent of no less than ~$19 / share and no more than ~$33 / share These agreements enabled the Company to continue receiving the KO dividends and allowed SunTrust to participate in the upside price appreciation of KO to the $33 ceiling price. Additionally, because the transaction demonstrated the Company’s intent to sell the KO shares, the Federal Reserve granted SunTrust ~$730 million in regulatory capital credit (reflective of the after-tax value of the shares at the $19 floor price) • SunTrust and the counterparty agreed to accelerate the settlement of the VFPAs • The reasons for the Company’s decision included: The treatment of equities under the recently issued regulatory proposal regarding Basel III is expected to result in higher risk-weighted assets and the potential for greater Other Comprehensive Income volatility The assumed value of the KO shares at the 2014 and 2015 settlement dates is likely to be adversely impacted under future CCAR assessments • The sale of the shares increases Tier 1 common capital by ~$490 million (value differential between the $19 floor price and the $33 settlement)—realizing the full value of the KO shares per the terms of the 2008 VFPAs • SunTrust will recognize a pre-tax gain of ~$1.9 billion in 3Q 12 from the sale of the shares • SunTrust is contributing one million KO shares to the SunTrust Foundation. A ~$37 million increase to noninterest expense in 3Q 12 is associated with this contribution • SunTrust’s net interest income will be reduced by ~$40 million annually². This reflects the foregone dividend income it would have received from its KO holdings, less the benefit of no longer paying interest expense associated with the 2008 VFPAs 1. The number of KO shares and the price of the stock are reflective of KO’s recent stock split 2. This reduction in income otherwise would have occurred after the 2014 and 2015 settlements of the agreements

7 Additional Mortgage Repurchase Information 1. Agency excludes GNMA 2. Includes estimates for delinquent loans sold servicing released 3. Reflects the Cumulative Income Statement Impact to Date divided by the Sold UPB Sold UPB Loans Ever 120 Days Past Due2 Cumulative Repurchase Requests Requests Resolved Loss Recognized Through 2Q 2012 Reserve Balance at 2Q 2012 Incremental Estimated 3Q Provision Cumulative Income Statement Impact to Date Cumulative Loss Ratio3 Agency1 2005-2008 Vintages $117.1 18.0 4.9 4.3 1.3 0.4 0.4 2.1 1.8% ($ billions, pre-tax, as of 6/30/12) Comments • Due to recent dialogue with the GSEs, as well as the patterns of full file requests and repurchase demands, SunTrust increased the estimated incurred losses on pre-2009 vintage loans sold to the GSEs • Accordingly, the reserve has been increased. Pro forma for the ~$375 million estimated provision, the 2Q 12 mortgage repurchase reserve would have been $809 million • The 2005-08 vintage GSE loans have accounted for the preponderance of all mortgage repurchase losses The ~$2.1 billion cumulative income statement impact of the 2005-2008 vintage agency loans compares to ~$0.1 billion for all other sold loans • Substantially all of the recent mortgage repurchase provision expense has been associated with the 2005- 2008 vintage agency loans. SunTrust does not currently expect to incur future provisions on existing defaulted or delinquent loans from this population. As such, it anticipates its mortgage repurchase provisions will be substantially reduced going forward

8 Additional Detail on Other Actions Loans Moved to Held For Sale • SunTrust is transferring ~$3 billion of loans to Loans Held for Sale. The loans within the transfer include : Nonperforming mortgage loans Nonperforming CRE loans Loans that are delinquent but guaranteed by GNMA Delinquent and current student loans • Corresponding pre-tax charges of ~$250 million are expected to occur in 3Q 12 to reflect market valuation adjustments: The majority of this will be NCOs/provision due to writing down the nonperforming loans Expected losses on the sales of delinquent GNMA loans and any gains/losses on the student loan sale will both be recorded in noninterest income • The disposition of these loans is expected in 3Q 12 and 4Q 12 • The 2013 financial impact will be based upon the ultimate disposition sizes of the various portfolios. Current expectations are that these sales will reduce net interest income and contribute to a decline in credit-related noninterest expenses Affordable Housing Investments • Transom Development, Inc. is a SunTrust subsidiary that owns and operates affordable housing investments • These properties provide SunTrust low income housing tax credits, development opportunities, and help meet CRA obligations • With cap rates down in the industry, SunTrust believes now is an opportune time to reduce its holdings of these operationally complex, underperforming assets • ~$200 million of SunTrust’s affordable housing investments are being marketed for sale. In the process, a ~$100 million pre-tax write-down will be reflected in 3Q 12 noninterest expense The net carrying value reflects SunTrust’s estimate of the ultimate disposition price of these assets • The sale of these assets is targeted for completion in early 2013 • The ongoing financial impact of this transaction is not expected to be material, as the elimination of the depreciation on the properties is largely offset by the loss of tax credits • SunTrust currently expects to retain its remaining ~$150 million in affordable housing investments