Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hanesbrands Inc. | d405083d8k.htm |

| EX-99.1 - PRESS RELEASE - Hanesbrands Inc. | d405083dex991.htm |

| EX-99.2 - UPDATED SUPPLEMENTAL INFORMATION REGARDING DISCOUNTINUED OPERATIONS - Hanesbrands Inc. | d405083dex992.htm |

Investor Presentation 2012

Updated September 5, 2012

Exhibit 99.3 |

2

Forward-looking Statements and Continuing Operations

These presentation slides and the related presentation include forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements include all statements that

do not relate solely to historical or current facts, and can generally be identified by the

use of words such as “may,” “believe,” “will,”

“expect,” “project,” “estimate,” “intend,”

“anticipate,” “plan,” “continue” or similar expressions. Forward-looking statements inherently

involve many risks and uncertainties that could cause actual results to differ materially from

those projected in these statements. Where, in any forward-looking statement, we

express an expectation or belief as to future results or events, such expectation or belief

is based on the current plans and expectations of our management and expressed in good faith

and believed to have a reasonable basis, but there can be no assurance that the

expectation or belief will result or be achieved or accomplished. The following include

some but not all of the factors that could cause actual results or events to differ materially

from those anticipated: •

current economic conditions, including consumer spending levels and the price elasticity of

our products; •

the impact of significant fluctuations and volatility in various input costs, such as cotton

and oil-related materials, utilities, freight and wages; •

the highly competitive and evolving nature of the industry in which we compete; •

the loss of or material reduction in sales to any of our top customers; •

our ability to successfully manage social, political, economic, legal and other conditions

affecting our domestic and foreign operations and supply-chain sources; •

our debt and debt service requirements that restrict our operating and financial flexibility

and impose interest and financing costs; and •

other risks identified from time to time in our most recent Securities and Exchange Commission

reports, including our annual report on Form 10-K, quarterly reports on Form

10-Q and current reports on Form 8-K, registration statements, press

releases and other communications. Except as required by law, we undertake no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of unanticipated events or

changes to future operating results over time. In the second quarter of 2012, the company announced exiting certain international and

domestic imagewear businesses that are all now classified as discontinued operations.

Unless otherwise noted, all financial results in this presentation are GAAP measures for

continuing operations. Information on discontinued operations and financial results for

prior-period continuing operations is available in the investors section of the

company’s corporate website, http://tiny.cc/HanesBrandsIR, and is also available in the company’s

second quarter 2012 Form 10-Q filing. |

3

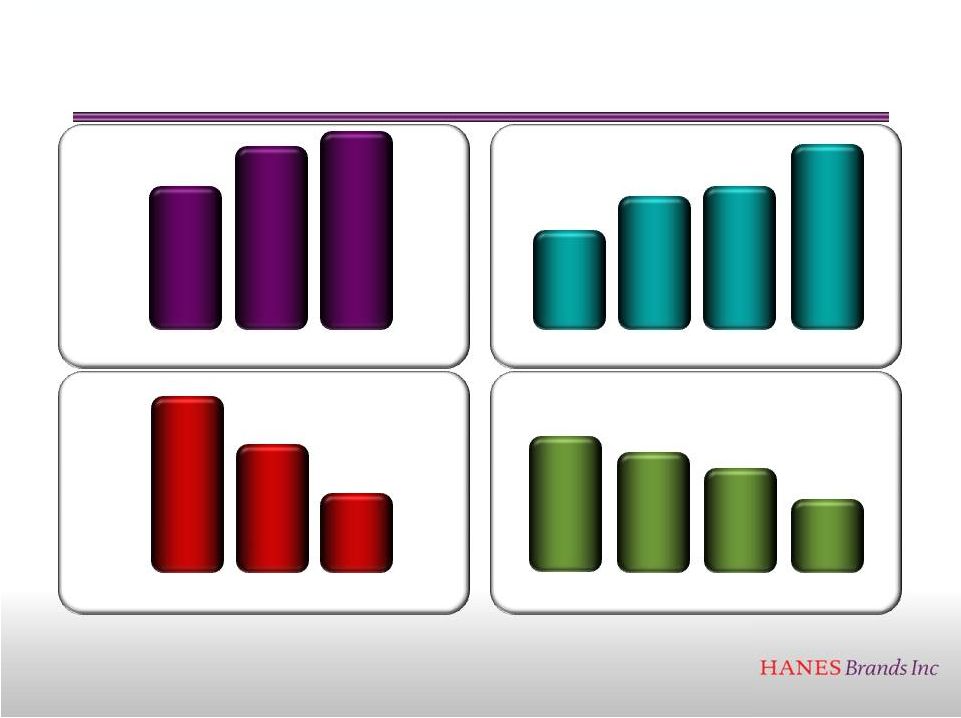

HanesBrands’

financial performance has improved since the recession with both net sales and

diluted EPS increasing and leverage decreasing. While a

mid-cap consumer company, we have two brands with more than a billion

dollars in sales at retail with global potential to drive future growth.

For reconciliation to GAAP, please see press releases dated January 27, 2011, February

15, 2012, July 31, 2012 and our other public filings, all of which are available under the “Investor”

tab on our website at

www.hanesbrands.com

Net Sales

($

billions)

$4.1

$4.4

$4.52

o

$4.57

2010

2011

2012

Guidance

Diluted EPS

($

per share)

$1.97

$2.44

$2.50

to

$2.60

2010

2011

2012

Guidance

low

$3.00

range

2013

Prelim

t

Net

Debt/

EBITDA

2010

4.7x

3.8x

~3.0

x

2011

2012

Long

Term Debt Goals

($

billions)

$2.0

$1.5

2010

Actual

2011

Actual

$1.8

$1.0

2013

2012

Net debt defined as short and long-term debt minus cash; For 2012 ~3.0x assumes

current guidance Long-term debt goals reflect year-ending debt

levels - |

4

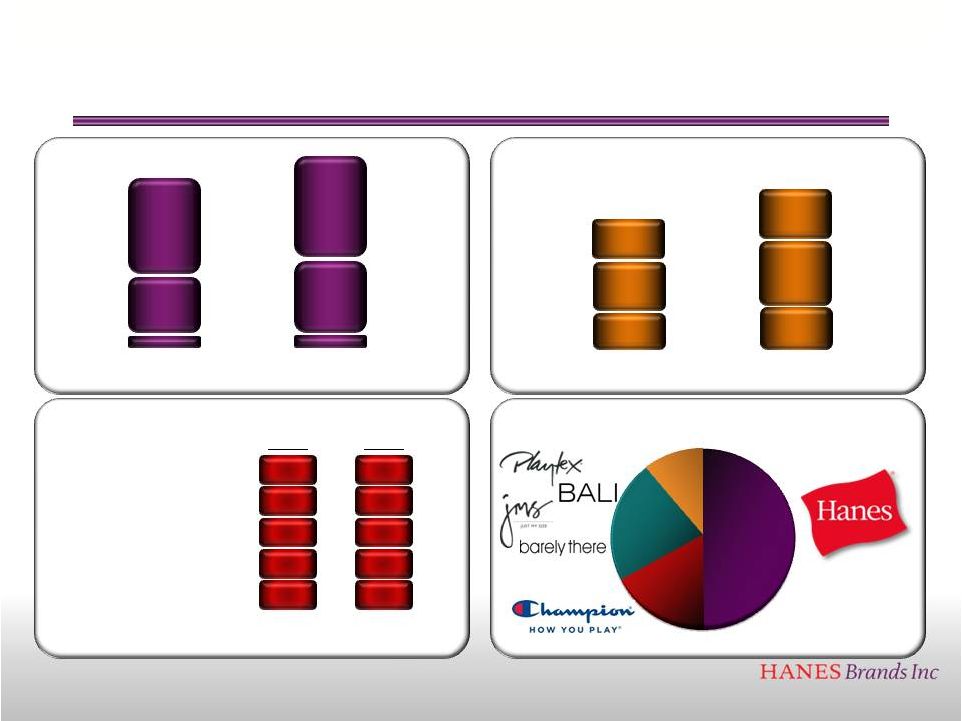

HanesBrands is growing and gaining share throughout the

Americas and Asia by leveraging its very large brands

Asia

Latin

America

Canada

+15%

Innerwear

Outerwear

DTC

+6%

Men’s Underwear

Bras

Panties

Socks

Sheer Hosiery

2005

2011

2010

2011

2010

2011

#1

#2

#2

#1

#1

#1

#1

#1

#1

#1

Brands grouped by retail $ sales; Chart shows proportions of Hanesbrands net sales

Source: NPD Group/Consumer Tracking Service, R12 Dec, Unit Share

Percent change reflects international sales dollar change as reported

Percent change reflects domestic sales dollar change

$1B

Brand

$100MM -

$1B Brands

Small

Brands

$4B

Brand

4

Growing in the USA

Gaining Share

Growing in the Developing World

Building Very Large Brands |

5

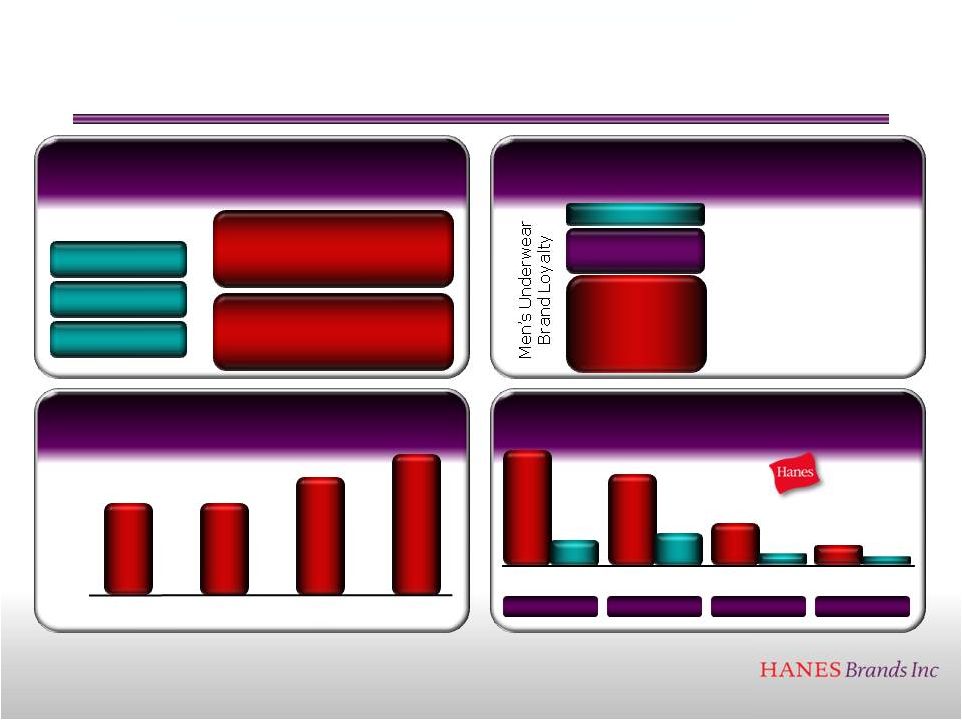

Consumers demand brands in our categories. For example, consumers value brands

much more than price in men’s underwear, and the category exhibits

characteristics similar to other highly branded categories such as

toothpaste and razors. Brands are beating private label

Brands are important to consumers

Consumers are loyal to brands

Hanes beats all other brands

#1 -

Brand

#2 -

Comfort

#3 -

Price

80% of consumers

know what brand of underwear

they are wearing

Nearly 40% admit they do not

know how much they paid

for their own underwear

Purchase

Decision Drivers

Source: Company Research

National Brands as a % of Men’s Underwear Sales

77%

77%

83%

85%

2008

2009

2010

2011

Source: NPD Panel Data R12 Dec Dollar Share

Source: NPD Accupanel

62%

10%

27%

Brand Loyalists

Bi-Branders

Brand Switchers

Consumer

Preference: vs Comp “A”

47%

10%

37%

13%

17%

7%

Intimate

Apparel

Men’s

Apparel

Kid’s

Apparel

Women’s

Apparel

4.7x

2.8x

4.2x

2.3x

Source: Retailing Today TOP BRANDS 2010 Report

4%

3% |

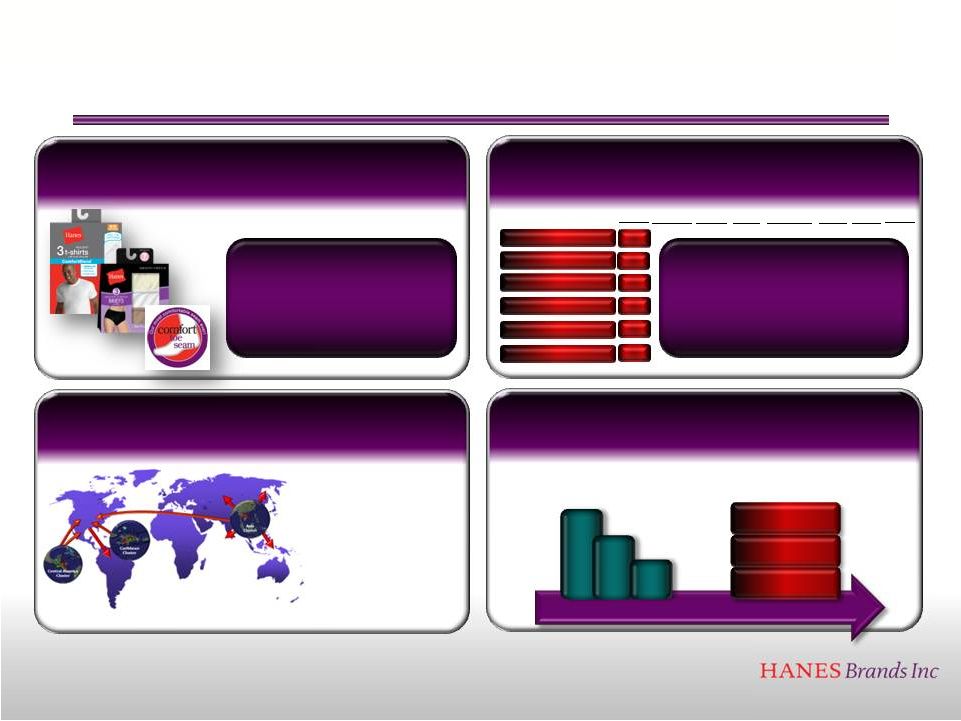

4.

Deploy our cash flow

to maximize returns to shareholders

We have four strategies to drive profitable growth

3.

Leverage our global supply chain

and overhead to improve margins

1.

Leverage brands and product

innovation to drive profitable growth

More volume

equals lower cost

Serves 90%+

of Global GDP in a

trade-advantaged

manner

After reducing debt, our flexible capital structure enables

us to make bolt-on acquisitions or return cash to shareholders

2.

Use our brand strength to fill

distribution voids in the US

Source: NPD Group/Consumer Tracking Service, R12 Dec 2011

Walmart

Target

Kohl’s

JCPenney

Kmart

Macys

Outlet

Stores

Our goal is to not only be #1

in every category in which we

compete, but to be #1 in every

sub-category, and at every account

Socks

Male Underwear

Intimate Apparel

#1

Casualwear

Activewear

#1

#1

#1

#1

#1

Hosiery

Total

Stores

2011 -

2013

2014 +

Debt

Reduction

Drive higher-priced,

higher-margin products

Address consumer needs with

continual product innovation

Selective

Acquisitions

Stock Buybacks

Dividends

6 |

7

2012 Guidance

•

Full-year net sales are expected to be $4.52 billion to $4.57 billion, approximately 2

percent to 3 percent over last year

•

Full-year diluted EPS is expected to be in the range of $2.50 to $2.60 versus last

year’s diluted EPS of $2.44

•

Free cash flow is projected to be in the range of $400 million to $500 million

•

Expected long-term bond debt for year-ending 2012 is $1.5 billion

Future

Outlook

–

as

of

September

5,

2012

Guidance

Assumptions,

GAAP

Reconciliation

and

Discontinued

Operations

Please

see

press

releases

dated

September

5,

2012,

July

31,

2012

and

April

19,

2012

and

our

other

public

filings,

all

of

which

are

available

under

the

“Investor”

tab

on

our

website

at

www.hanesbrands.com

2013 Preliminary

•

•

Full-year diluted EPS is expected to be in the low $3.00 range

Expect to prepay the $500 million of 8 percent fixed rate notes leaving long-term bond

debt for year- ending 2013 at $1 billion |