Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HEALTHCARE REALTY TRUST INC | d406568d8k.htm |

Exhibit 99.1

|

|

Investor Presentation

September 2012

HEALTHCARE

REALTY

In addition to the historical information contained within, the matters discussed in this presentation contain forward-looking statements that involve estimates, assumptions, risks and uncertainties. These risks are discussed in filings with the Securities and Exchange Commission by Healthcare Realty Trust, including its Annual Report on Form 10-K for the year ended December 31, 2011 under the heading “Risk Factors,” and as may be updated in its Quarterly Reports on Form 10-Q filed thereafter. Forward-looking statements represent the Company’s judgment as of the date of this presentation. The Company disclaims any obligation to update forward-looking material.

Information as of June 30, 2012, unless otherwise disclosed.

|

|

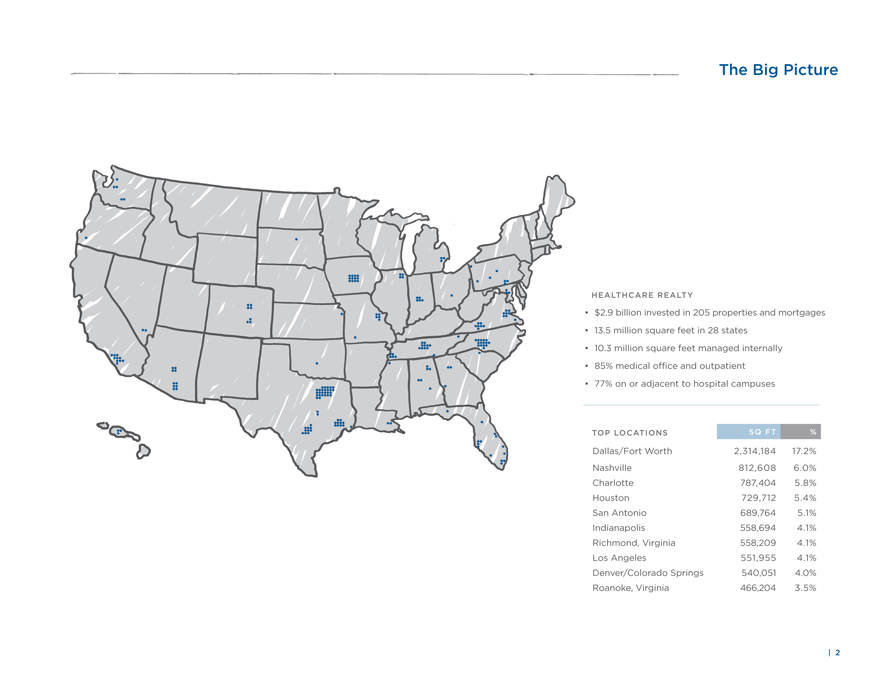

The Big Picture

HEALTHCARE REALTY

• $2.9 billion invested in 205 properties and mortgages

• 13.5 million square feet in 28 states

• 10.3 million square feet managed internally

• 85% medical office and outpatient

• 77% on or adjacent to hospital campuses

TOP LOCATIONS SQ FT %

Dallas/Fort Worth 2,314,184 17.2%

Nashville 812,608 6.0%

Charlotte 787,404 5.8%

Houston 729,712 5.4%

San Antonio 689,764 5.1%

Indianapolis 558,694 4.1%

Richmond, Virginia 558,209 4.1%

Los Angeles 551,955 4.1%

Denver/Colorado Springs 540,051 4.0%

Roanoke, Virginia 466,204 3.5%

| 2

|

|

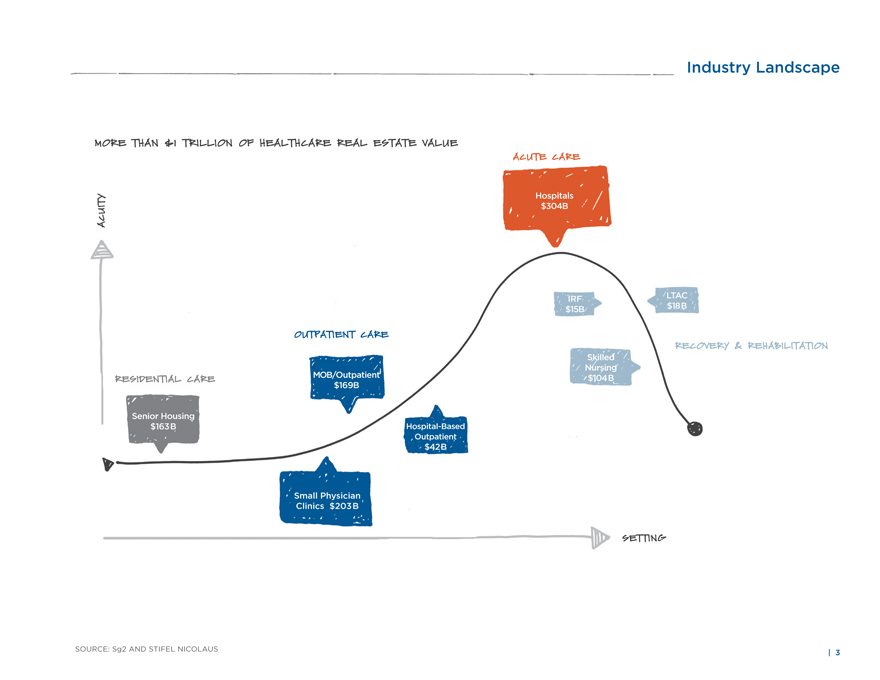

Industry Landscape

MORE THAN $1 TRILLION OF HEALTHCARE REAL ESTATE VALUE

ACUITY

RESIDENTIAL CARE

Senior Housing $163B

OUTPATIENT CARE

MOB/Outpatient $169B

Small Physician Clinics $203B

Hospital-Based

Outpatient

$42B

ACUTE CARE

Hospitals $304B

IRF $15B

Skilled Nursing $104B

LTAC $18B

RECOVERY & REHABILITATION

SETTING

SOURCE: Sg2 AND STIFEL NICOLAUS

| 3

|

|

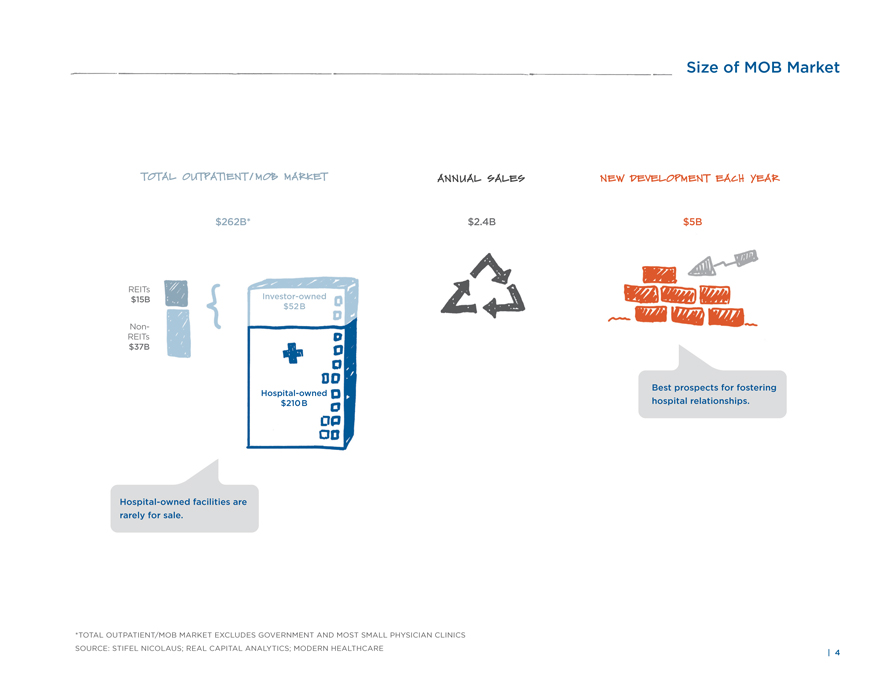

Size of MOB Market

TOTAL OUTPATIENT / MOB MARKET

ANNUAL SALES

NEW DEVELOPMENT EACH YEAR

$262B*

$2.4B

$5B

REITs $15B

Non-REITs $37B

Investor-owned $52B

Hospital-owned $210B

Hospital-owned facilities are rarely for sale.

Best prospects for fostering hospital relationships.

*TOTAL OUTPATIENT/MOB MARKET EXCLUDES GOVERNMENT AND MOST SMALL PHYSICIAN CLINICS SOURCE: STIFEL NICOLAUS; REAL CAPITAL ANALYTICS; MODERN HEALTHCARE

| 4

|

|

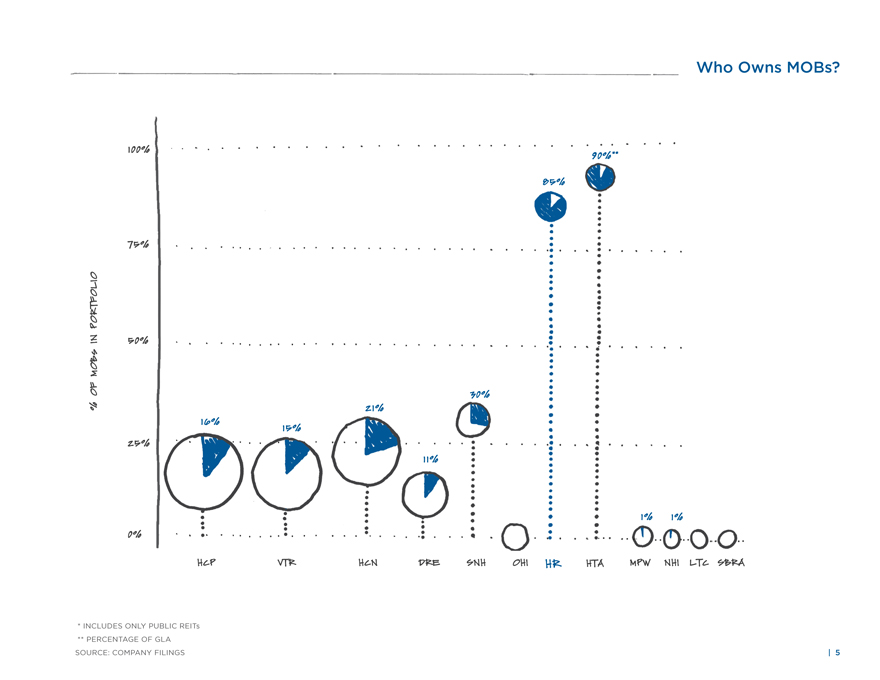

Who Owns MOBs?

% OF MOBs IN PORTFOLIO

100%

90% **

85%

75%

50%

30%

21%

16%

15%

25%

11%

1%

1%

0%

HCP

VTR

HCN

DRE

SNH

OHI

HR

HTA

MPW

NHI

LTC

SBRA

* INCLUDES ONLY PUBLIC REITs

** PERCENTAGE OF GLA

SOURCE: COMPANY FILINGS

| 5

|

|

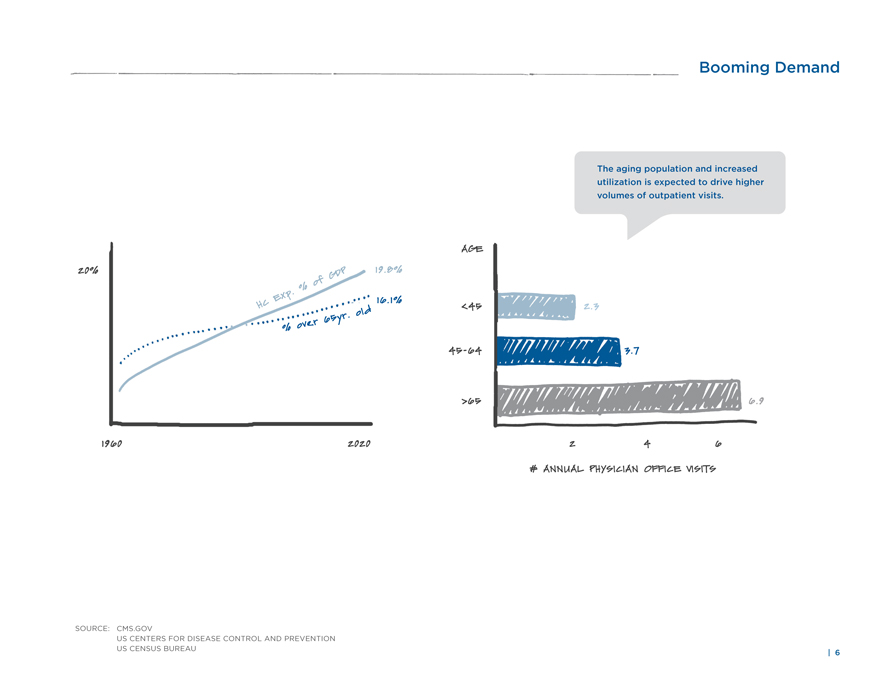

Booming Demand

The aging population and increased utilization is expected to drive higher volumes of outpatient visits.

AGE

20%

HC Exp. % of GDP

19.8%

% over 65yr. old

16.1%

<45

2.3

45-64

3.7

>65

6.9

1960

2020

2

4

6

# ANNUAL PHYSICIAN OFFICE VISITS

SOURCE: CMS.GOV

US CENTERS FOR DISEASE CONTROL AND PREVENTION US CENSUS BUREAU

| 6

|

|

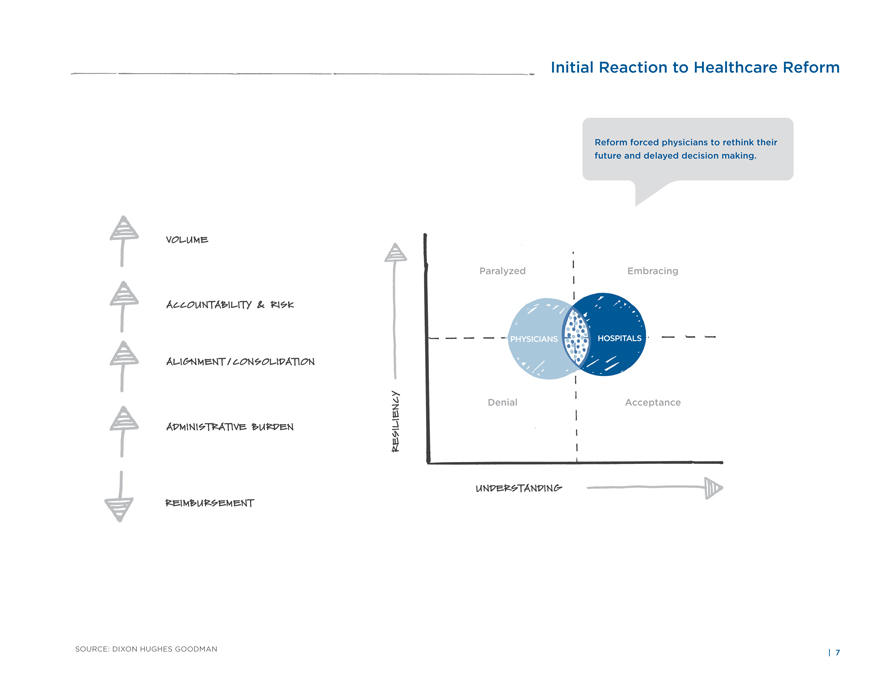

Initial Reaction to Healthcare Reform

Reform forced physicians to rethink their future and delayed decision making.

VOLUME

ACCOUNTABILITY & RISK

ALIGNMENT / CONSOLIDATION

ADMINISTRATIVE BURDEN

REIMBURSEMENT

RESILIENCY

Paralyzed

Embracing

PHYSICIANS

HOSPITALS

Denial

Acceptance

UNDERSTANDING

SOURCE: DIXON HUGHES GOODMAN | 7

|

|

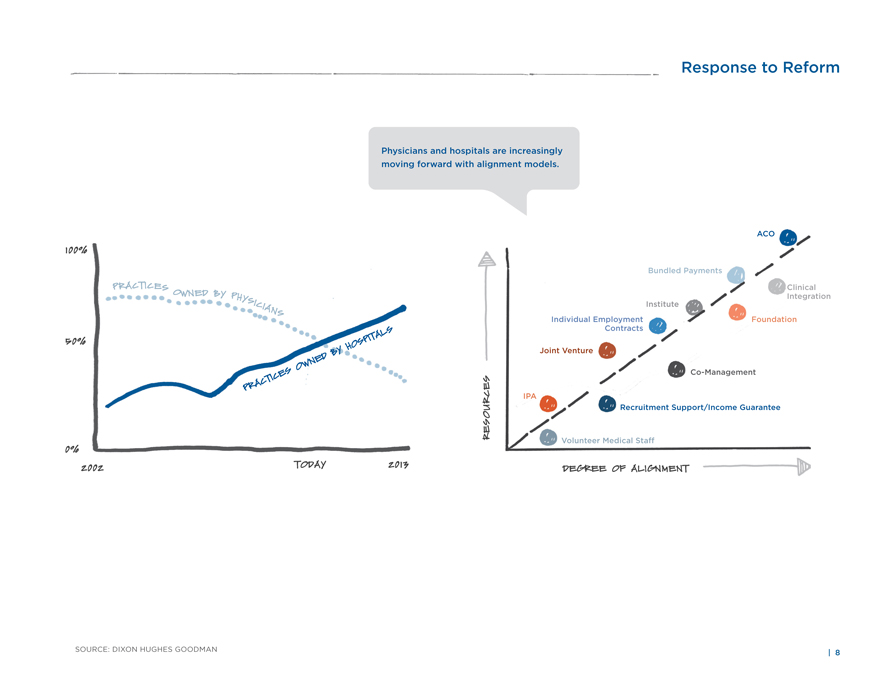

Response to Reform

Physicians and hospitals are increasingly moving forward with alignment models.

100%

PRACTICES

OWNED

BY PHYSICIANS

50%

HOSPITALS

BY

OWNED

PRACTICES

0%

2002

TODAY

2013

ACO

Bundled Payments

Clinical

Integration

Institute

Individual Employment

Foundation

Contracts

Joint Venture

Co-Management

IPA

RESOURCES

Recruitment Support/Income Guarantee

Volunteer Medical Staff

DEGREE OF ALIGNMENT

SOURCE: DIXON HUGHES GOODMAN | 8

|

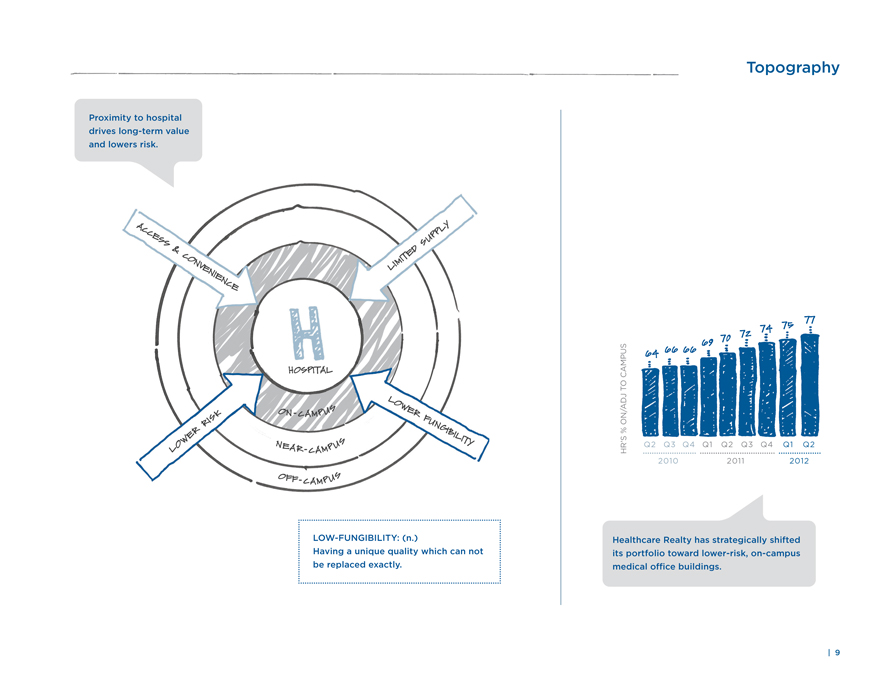

Topography

Proximity to hospital drives long-term value and lowers risk.

ACCESS & CONVENIENCE

LIMITED SUPPLY

H HOSPITAL

LOWER RISK

ON-CAMPUS

NEAR-CAMPUS

OFF-CAMPUS

LOWER FUNGIBILITY

LOW-FUNGIBILITY: (n.)

Having a unique quality which can not be replaced exactly.

HR’S% ON/ADJ TO CAMPUS

77

75

74

72

70

69

66

66

64

Q2 Q3 Q4

Q1 Q2 Q3 Q4

Q1 Q2

2010

2011

2012

Healthcare Realty has strategically shifted its portfolio toward lower-risk, on-campus medical office buildings.

| 9

|

|

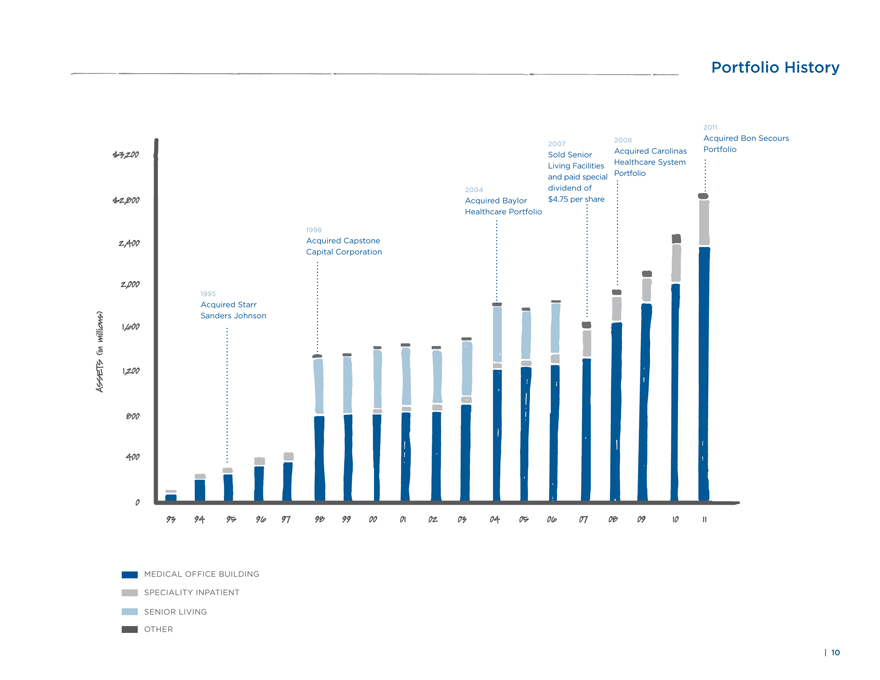

Portfolio History

ASSETS (in millions)

2011

2008

Acquired Bon Secours

2007

$3,200

Sold Senior

Acquired Carolinas

Portfolio

Living Facilities

Healthcare System

and paid special

Portfolio

2004

dividend of

$2,800

Acquired Baylor

$4.75 per share

Healthcare Portfolio

1998

2,400

Acquired Capstone

Capital Corporation

2,000

1995

Acquired Starr

Sanders Johnson

1,600

1,200

800

400

0

93

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

MEDICAL OFFICE BUILDING

SPECIALITY INPATIENT

SENIOR LIVING

OTHER

| 10

|

|

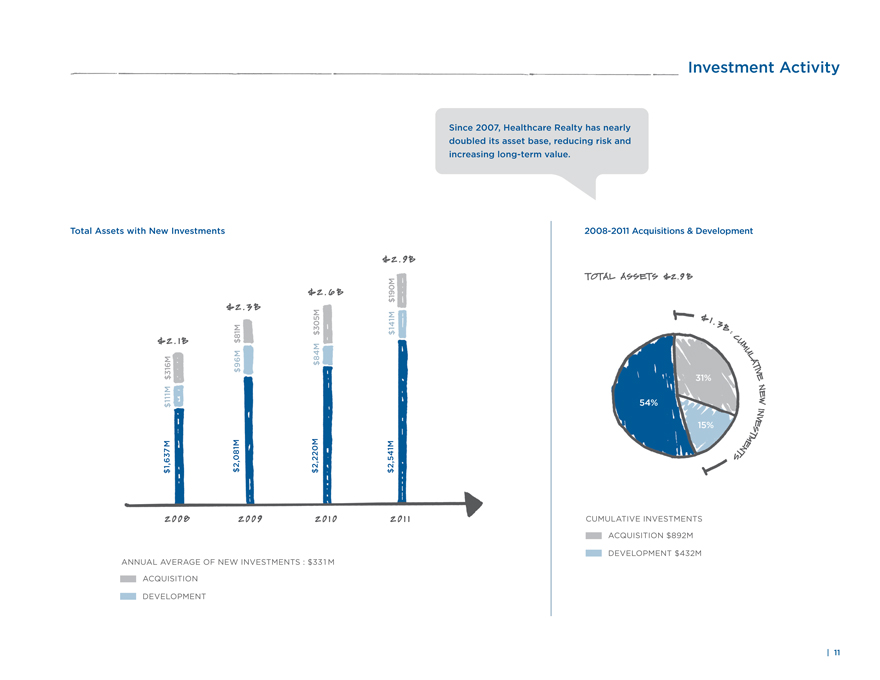

Investment Activity

Since 2007, Healthcare Realty has nearly doubled its asset base, reducing risk and increasing long-term value.

Total Assets with New Investments

$1,637M $111M $316M

$2.1B

2008

$2,081M $96M $81M

$2.3B

2009

$2,220M $84M $305M

$2.6B

2010

$2,541M $141M $190M

$2.9B

2011

ANNUAL AVERAGE OF NEW INVESTMENTS : $331 M

ACQUISITION

DEVELOPMENT

2008-2011 Acquisitions & Development

TOTAL ASSETS $2.9B

31% 54% 15%

$1.3B: CUMULATIVE NEW INVESTMENTS

CUMULATIVE INVESTMENTS

ACQUISITION $892M

DEVELOPMENT $432M

| 11

|

|

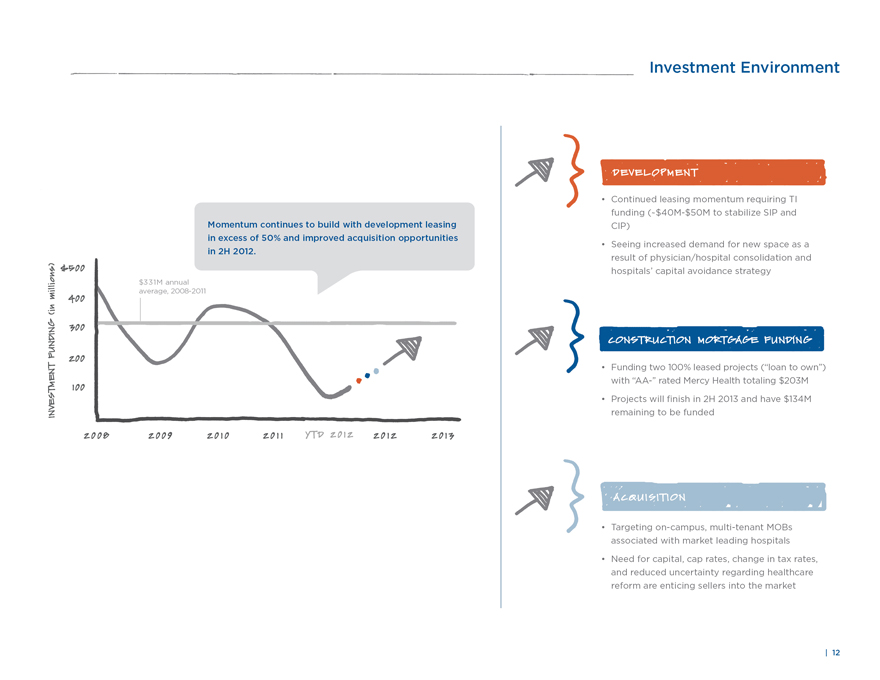

Investment Environment

With the focus on development properties, leasing now exceeds 50% with solid momentum. In addition, Healthcare Realty is seeing more attractive acquisition opportunities, with several expected to move to contract in 2H 2012.

INVESTMENT FUNDING (in millions)

$500

400

300

200

100

$331M annual average, 2008-2011

2008

2009

2010

2011

YTD 2012

2012

2013

DEVELOPMENT

• Continued leasing momentum requiring TI funding (~$40M to stabilize SIP and CIP)

• Seeing increased demand for new space as a result of physician/hospital consolidation and hospitals’ capital avoidance strategy

CONSTRUCTION MORTGAGE FUNDING

• Funding two 100% leased projects (“loan to own”) with “AA-” rated Mercy Health totaling $203M

• Projects will finish in 2H 2013 and have $134M remaining to be funded

ACQUISITION

• Targeting on-campus, multi-tenant MOBs associated with market leading hospitals

• Need for capital, cap rates, change in tax rates, and reduced uncertainty regarding healthcare reform are enticing sellers into the market

| 12

|

|

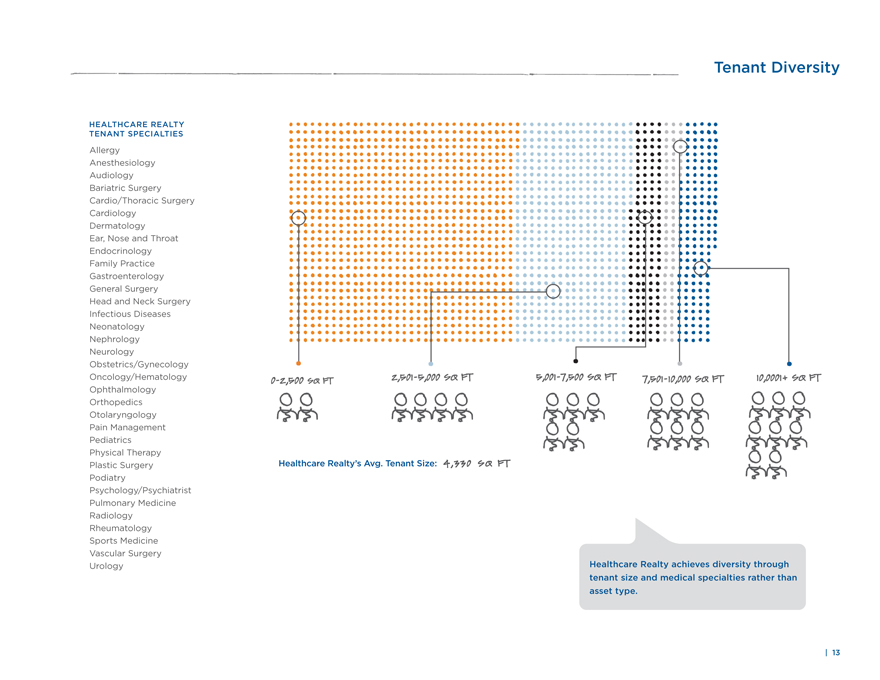

Tenant Diversity

HEALTHCARE REALTY

TENANT SPECIALTIES

Allergy

Anesthesiology

Audiology

Bariatric Surgery

Cardio/Thoracic Surgery

Cardiology

Dermatology

Ear, Nose and Throat

Endocrinology

Family Practice

Gastroenterology

General Surgery

Head and Neck Surgery

Infectious Diseases

Neonatology

Nephrology

Neurology

Obstetrics/Gynecology

Oncology/Hematology

Ophthalmology

Orthopedics

Otolaryngology

Pain Management

Pediatrics

Physical Therapy

Plastic Surgery

Podiatry

Psychology/Psychiatrist

Pulmonary Medicine

Radiology

Rheumatology

Sports Medicine

Vascular Surgery

Urology

0-2,500 SQ FT 2,501-5000 SQ FT 5,001-7,500 SQ FT 7,501-10,000 SQ FT 10,000+ SQ FT

Healthcare Realty’s Avg. Tenant Size: 4,330 SQ FT

Healthcare Realty achieves diversity through tenant size and medical specialties rather than asset type.

| 13

|

|

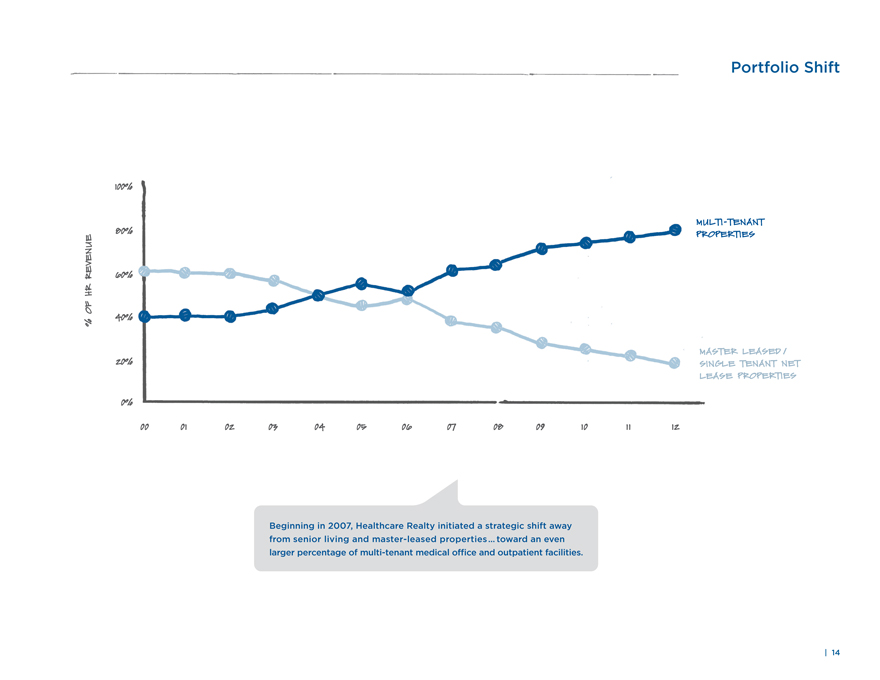

Portfolio Shift

% OF HR REVENUE

100%

80%

60%

40%

20%

0%

MULTI-TENANT

PROPERTIES

MASTER LEASED /

SINGLE TENANT NET

LEASE PROPERTIES

00

01

02

03

04

05

06

07

08

09

10

11

12

Beginning in 2007, Healthcare Realty initiated a strategic shift away from senior living and master-leased properties … toward an even larger percentage of multi-tenant medical office and outpatient facilities.

| 14

|

|

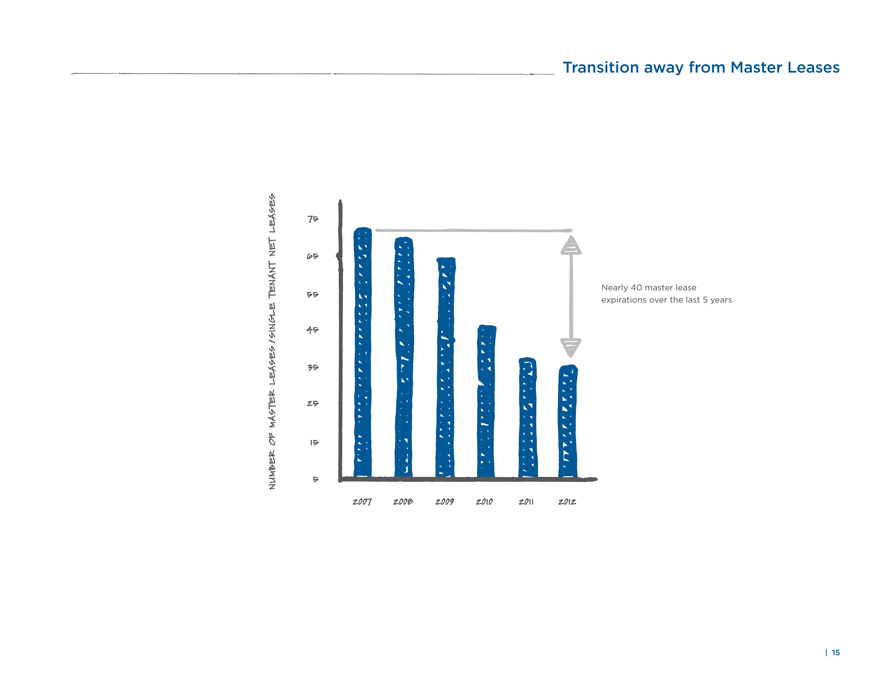

Transition away from Master Leases

NUMBER OF MASTER LEASES / SINGLE TENANT NET LEASES

75

65

55

45

35

25

15

5

2007

2008

2009

2010

2011

2012

Nearly 40 master lease expirations over the last 5 years

| 15

|

|

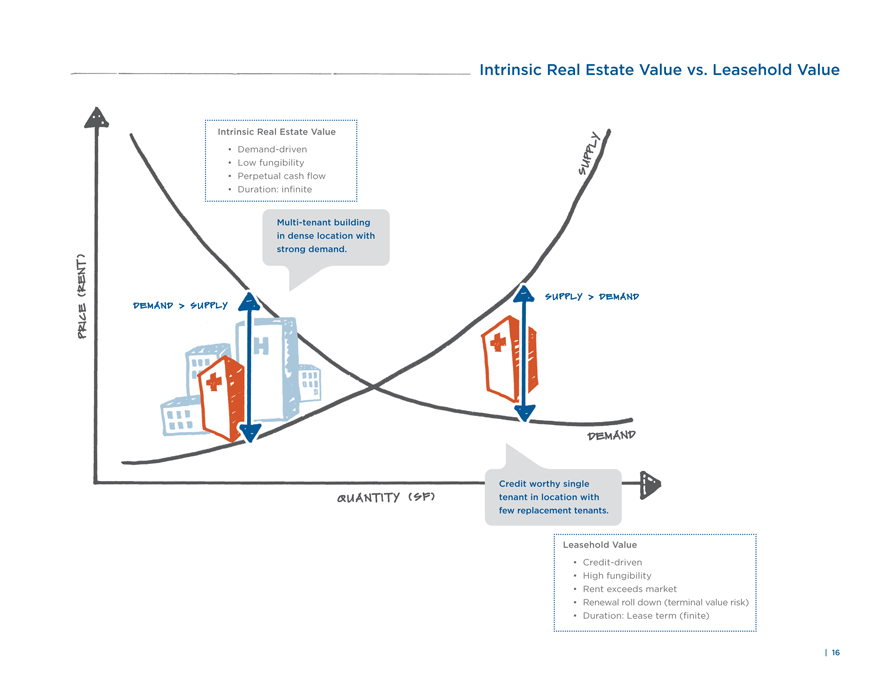

Intrinsic Real Estate Value vs. Leasehold Value

PRICE (RENT)

Intrinsic Real Estate Value

• Demand-driven

• Low fungibility

• Perpetual cash flow

• Duration: infinite

Multi-tenant building in dense location with strong demand.

DEMAND > SUPPLY

SUPPLY

SUPPLY > DEMAND

DEMAND

QUANTITY (SF)

Credit worthy single tenant in location with few replacement tenants.

Leasehold Value

• Credit-driven

• High fungibility

• Rent exceeds market

• Renewal roll down (terminal value risk)

• Duration: Lease term (finite)

| 16

|

|

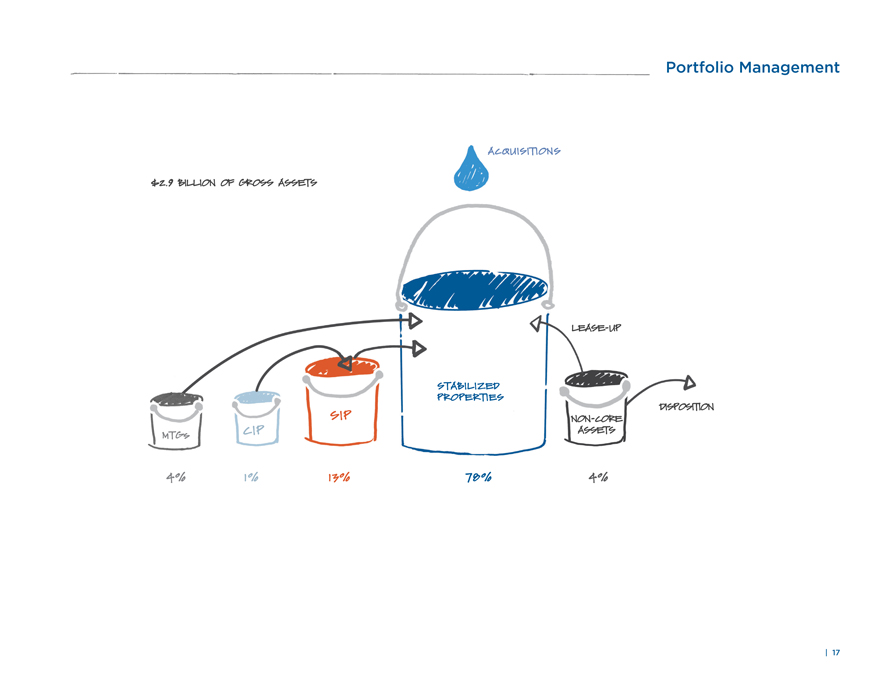

Portfolio Management

$2.9 BILLION OF GROSS ASSETS

ACQUISITIONS

LEASE-UP

STABILIZED

PROPERTIES

78%

MTGs

4%

CIP

1%

SIP

13%

NON-CORE

ASSETS

4%

DISPOSITION

| 17

|

|

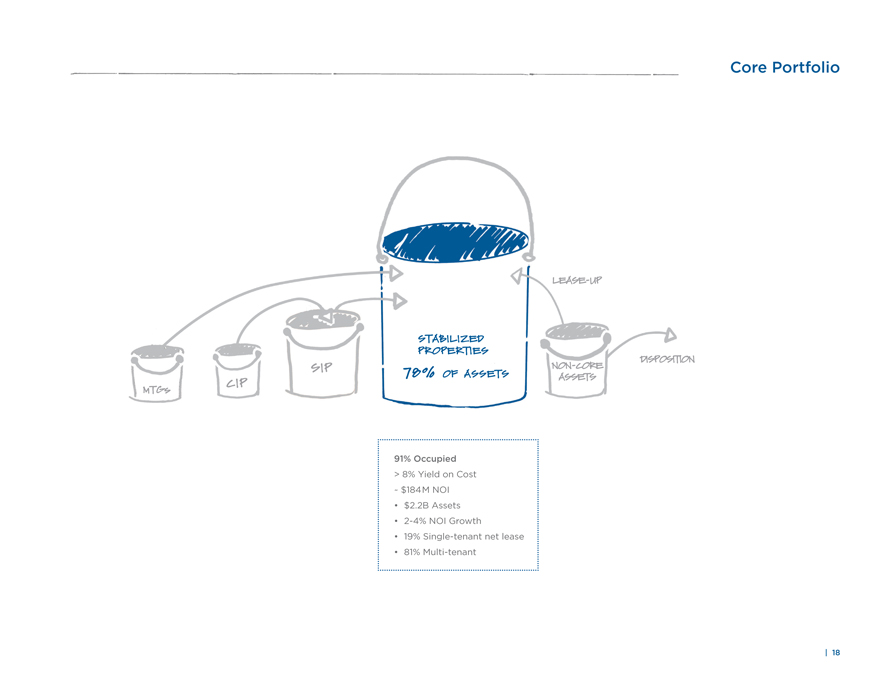

Core Portfolio

LEASE-UP

STABILIZED

PROPERTIES

CIP

MTGs

SIP

78% OF ASSETS

NON-CORE ASSETS

DISPOSITION

91% Occupied

> 8% Yield on Cost

~ $184M NOI

• $2.2B Assets

• 2-4% NOI Growth

• 19% Single-tenant net lease

• 81% Multi-tenant

| 18

|

|

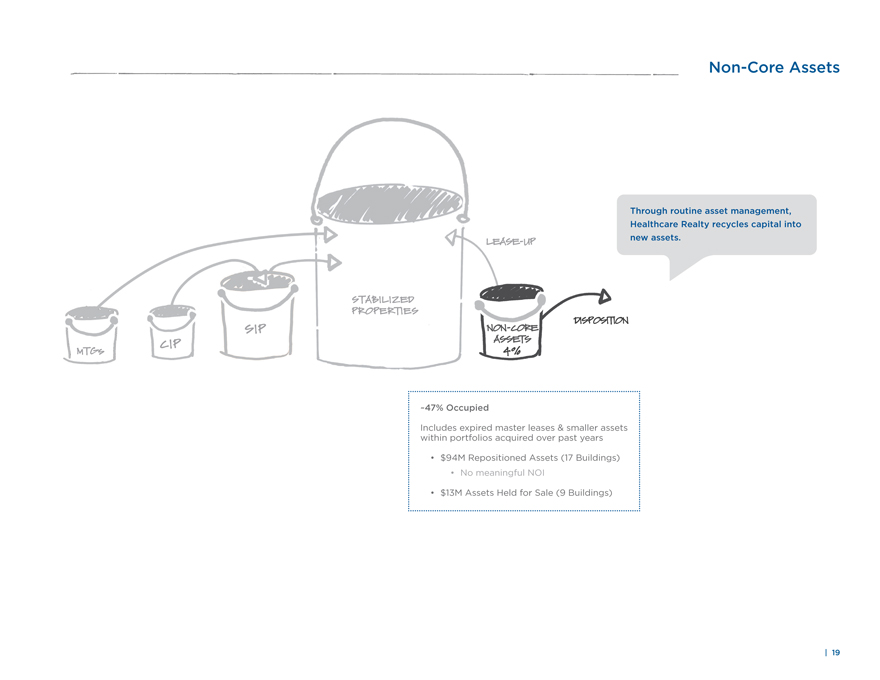

Non-Core Assets

Through routine asset management, Healthcare Realty recycles capital into new assets.

LEASE-UP

MTGs

CIP

SIP

STABILIZED

PROPERTIES

NON-CORE

ASSETS

4%

DISPOSITION

~ 47% Occupied

Includes expired master leases & smaller assets within portfolios acquired over past years

• $94M Repositioned Assets (17 Buildings)

• No meaningful NOI

• $13M Assets Held for Sale (9 Buildings)

| 19

|

|

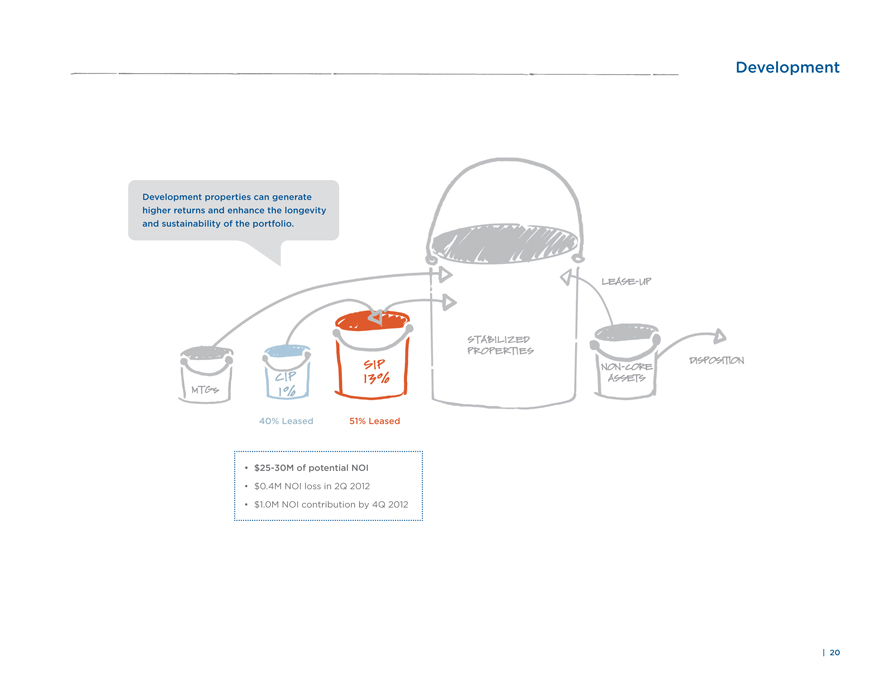

Development

Development properties can generate higher returns and enhance the longevity and sustainability of the portfolio.

LEASE-UP

MTGs

CIP 1%

SIP 13%

STABILIZED PROPERTIES

NON-CORE ASSETS

DISPOSITION

40% Leased

51% Leased

• $25-30M of potential NOI

• $0.4M NOI loss in 2Q 2012

• $1.0M NOI contribution by 4Q 2012

| 20

|

|

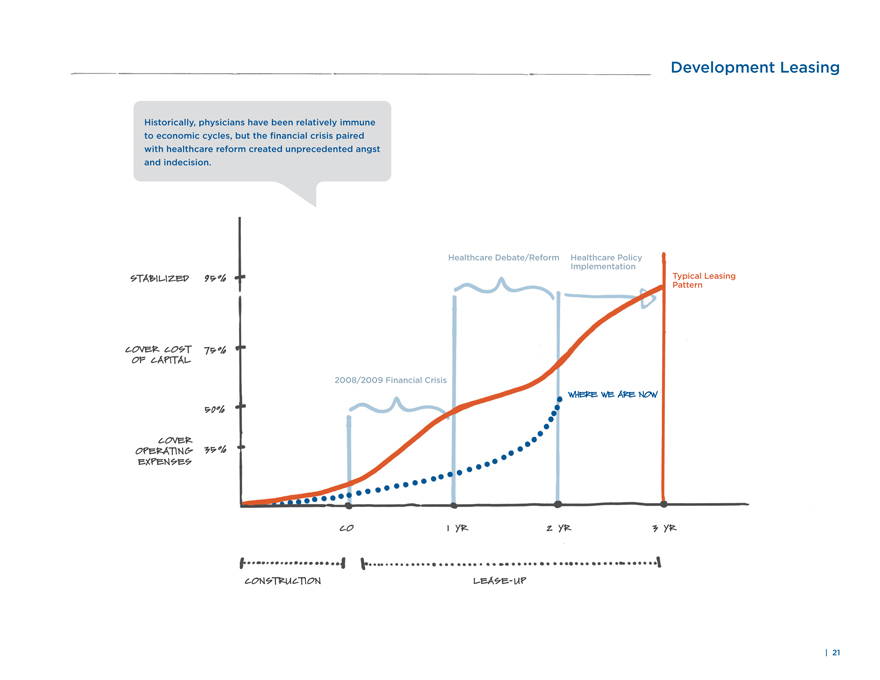

Development Leasing

Historically, physicians have been relatively immune to economic cycles, but the financial crisis paired with healthcare reform created unprecedented angst and indecision.

Healthcare Debate/Reform

Healthcare Policy Implementation

Typical Leasing Pattern

STABILIZED 95%

COVER COST OF CAPITAL 75%

2008/2009 Financial Crisis

WHERE WE ARE NOW

50%

COVER OPERATING EXPENSES 35%

CO

1 YR

2 YR

3 YR

CONSTRUCTION LEASE-UP

| 21

|

|

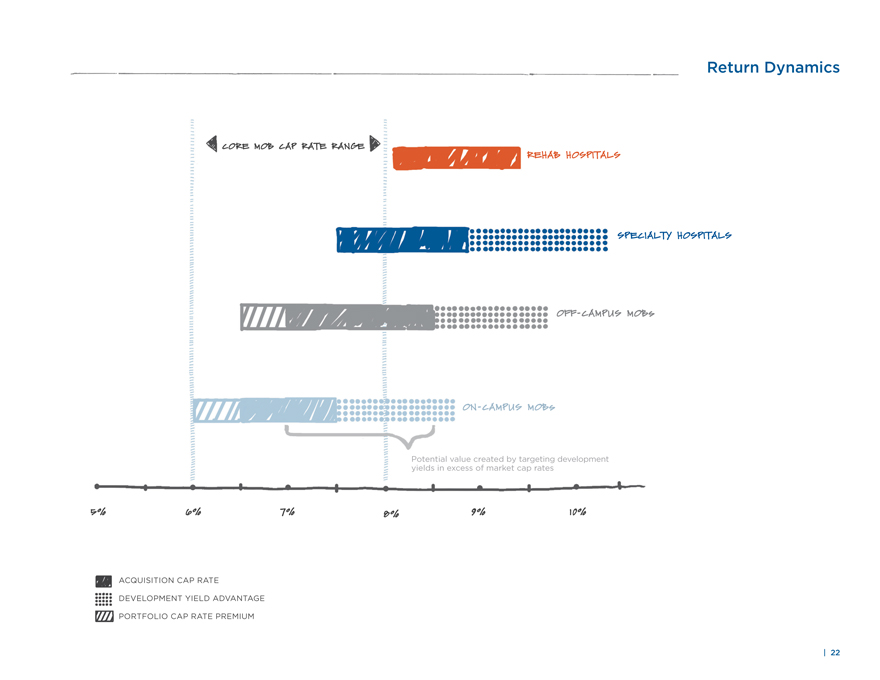

Return Dynamics

CORE MOB CAP RATE RANGE

REHAB HOSPITALS

SPECIALTY HOSPITALS

OFF-CAMPUS MOBs

ON-CAMPUS MOBs

Potential value created by targeting development yields in excess of market cap rates

5%

6%

7%

8%

9%

10%

ACQUISITION CAP RATE

DEVELOPMENT YIELD ADVANTAGE

PORTFOLIO CAP RATE PREMIUM

| 22

|

|

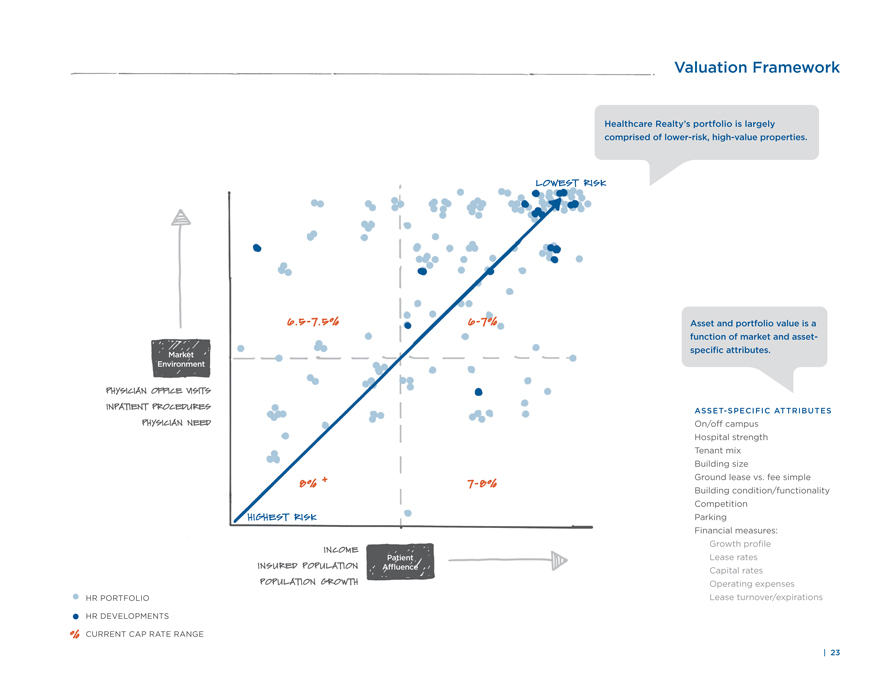

Valuation Framework

Healthcare Realty’s portfolio is largely comprised of lower-risk, high-value properties.

LOWEST RISK

6.5-7.5%

6-7%

Market Environment

PHYSICIAN OFFICE VISITS

INPATIENT PROCEDURES

PHYSICIAN NEED

8% +

7-8%

HIGHEST RISK

INCOME

INSURED POPULATION

POPULATION GROWTH

Patient Affluence

HR PORTFOLIO

HR DEVELOPMENTS

% CURRENT CAP RATE RANGE

Asset and portfolio value is a function of market and asset-specific attributes.

ASSET-SPECIFIC ATTRIBUTES

On/off campus

Hospital strength

Tenant mix

Building size

Ground lease vs. fee simple

Building condition/functionality

Competition

Parking

Financial measures:

Growth profile

Lease rates

Capital rates

Operating expenses

Lease turnover/expirations

| 23

|

|

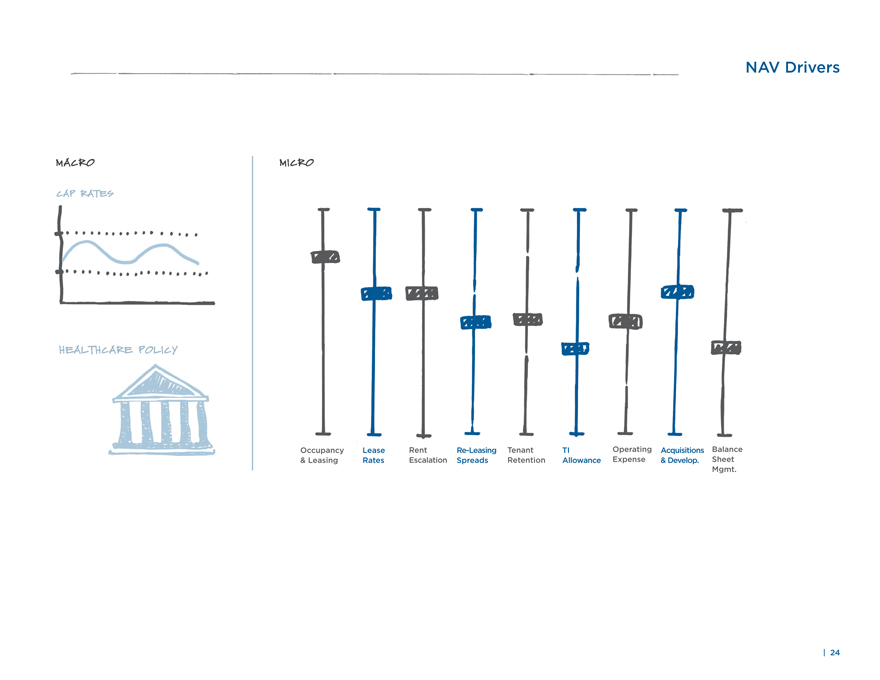

NAV Drivers

MACRO

MICRO

CAP RATES

HEALTHCARE POLICY

Occupancy & Leasing

Lease Rates

Rent Escalation

Re-Leasing Spreads

Tenant Retention

TI Allowance

Operating Expense

Acquisitions & Develop.

Balance

Sheet

Mgmt.

| 24

|

|

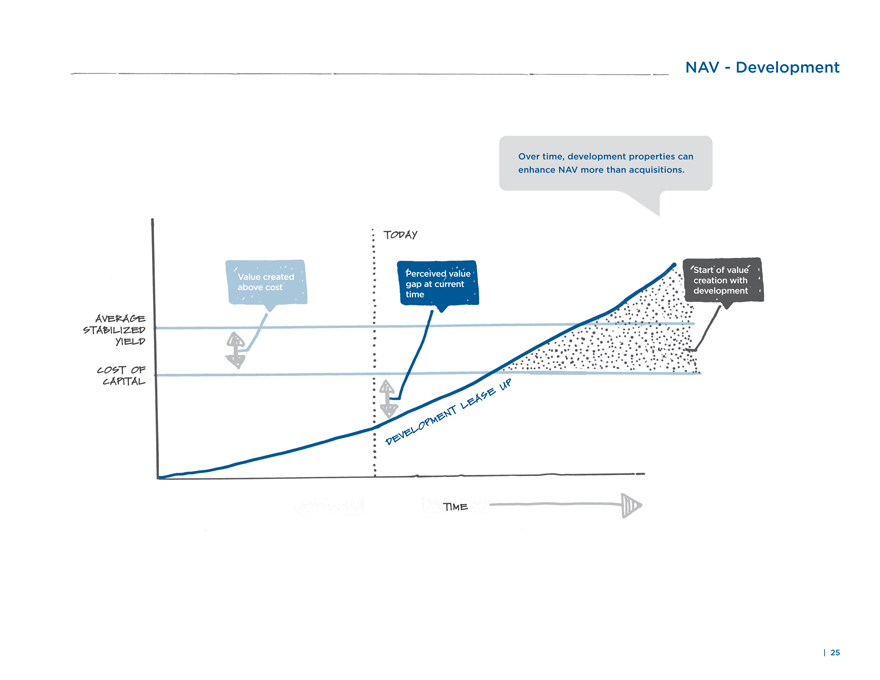

NAV - Development

Over time, development properties can enhance NAV more than acquisitions.

TODAY

Start of value creation with development

Value created above cost

Perceived value gap at current time

AVERAGE STABILIZED YIELD

COST OF CAPITAL

DEVELOPMENT LEASE UP

TIME

| 25

|

|

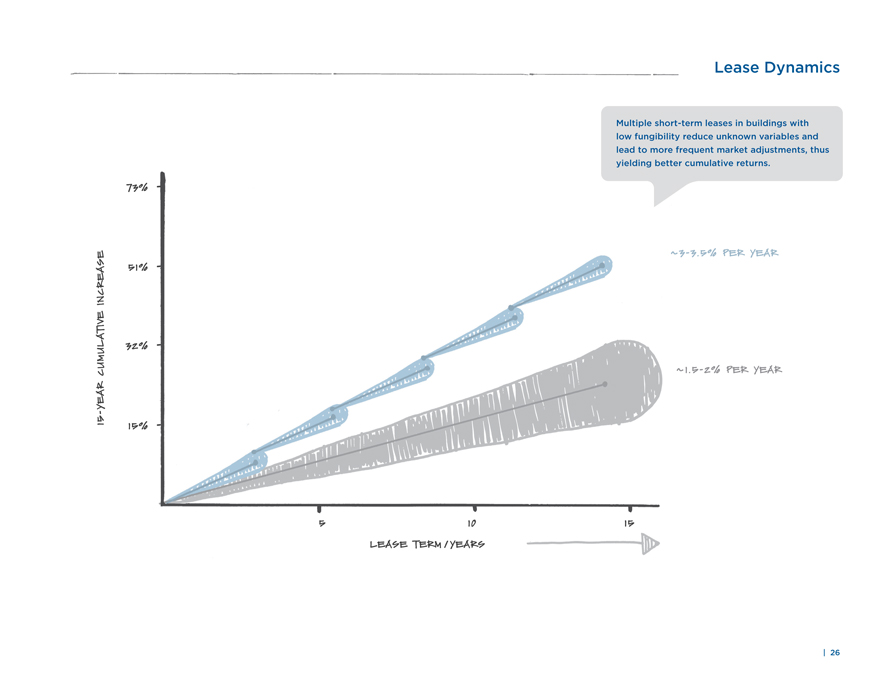

Lease Dynamics

Multiple short-term leases in buildings with low fungibility reduce unknown variables and lead to more frequent market adjustments, thus yielding better cumulative returns.

73%

51%

32%

15%

~3-3.5% PER YEAR

~1.5-2% PER YEAR

5

10

15

15-YEAR CUMULATIVE INCREASE

LEASE TERM / YEARS

| 26

|

|

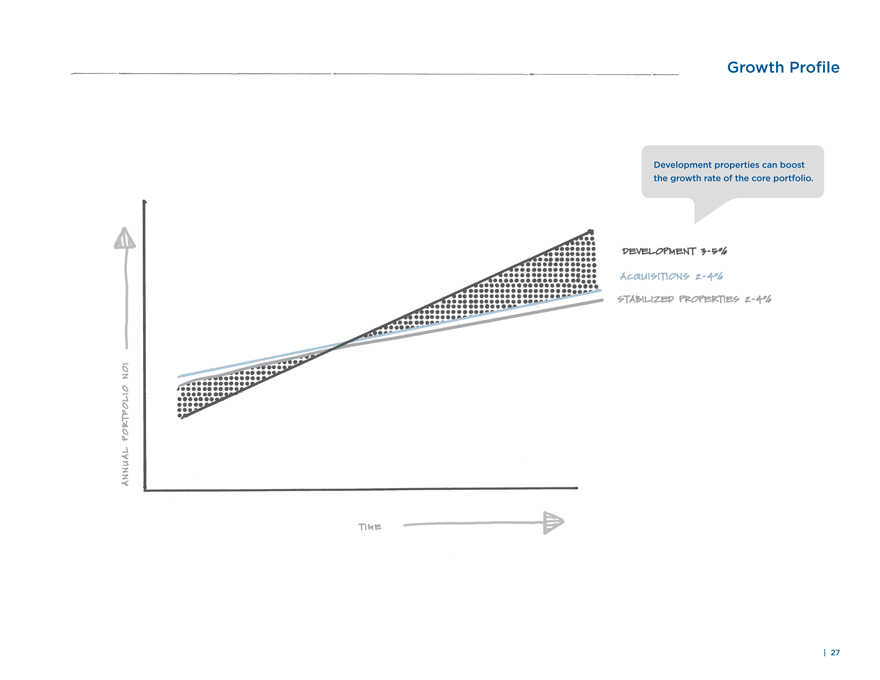

Growth Profile

Development properties can boost the growth rate of the core portfolio.

ANNUAL PORTFOLIO NOI

DEVELOPMENT 3-5%

ACQUISITIONS 2-4%

STABILIZED PROPERTIES 2-4%

TIME

| 27

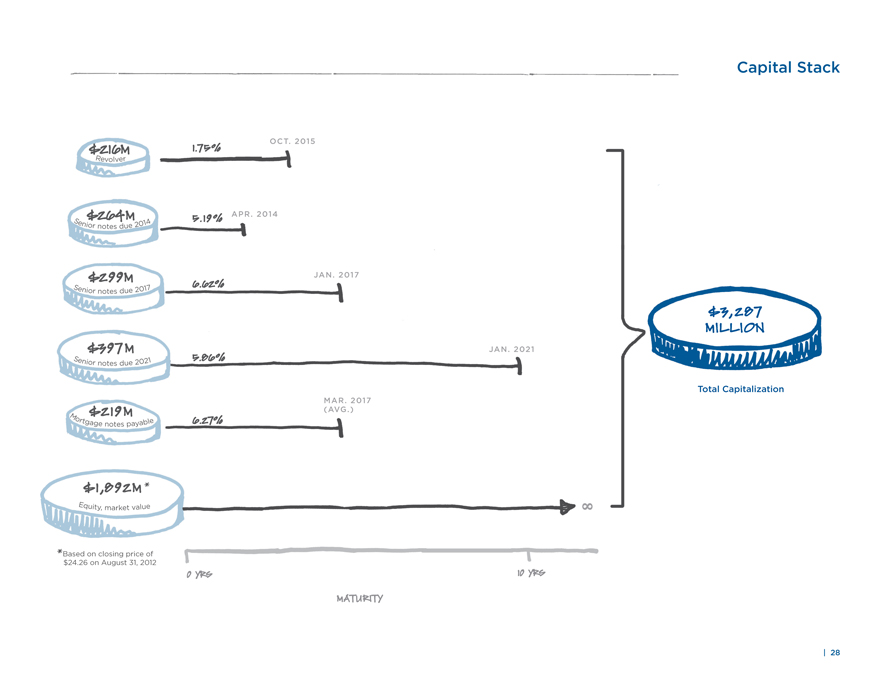

Capital Stack

$216M

1.75%

OCT. 2015

Revolver

$264M

5.19%

APR. 2014

Senior notes due 2014

$299M

Senior notes due 2017

6.62%

JAN. 2017

$3,287 MILLION

Total Capitalization

$397 M

5.86%

JAN. 2021

Senior notes due 2021

$219 M

Mortgage notes payable

6.27%

MAR. 2017 (AVG.)

$1,892M *

00

Equity, market value

*Based on closing price of $24.26 on August 31, 2012

0 YRS

10 YRS

MATURITY

| 28