Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DITECH HOLDING Corp | d406247d8k.htm |

| EX-99.2 - EX-99.2 - DITECH HOLDING Corp | d406247dex992.htm |

Exhibit 99.1

| Walter Investment Announces Acquisition of Reverse Mortgage Solutions, Inc. September 4, 2012 |

| Legal Disclaimers Disclaimer and Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements, including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning Walter Investment's plans, beliefs, objectives, expectations and intentions and other statements that are not historical or current facts. Forward-looking statements are based on Walter Investment's current expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Factors that could cause Walter Investment's results to differ materially from current expectations include, but are not limited to: Walter Investment's ability to obtain necessary approvals and close the acquisition of RMS in a timely manner and to implement our strategic initiatives, particularly as they relate to our ability to develop new reverse mortgage business and the anticipated growth in the reverse mortgage sector, which are both subject to customer demand, approval and timing; the availability of MSRs at acceptable prices, along with the availability of capital to purchase MSRs; government and industry regulation, including any new laws, regulations or policies, or changes to existing laws, regulations or policies pertaining to the reverse mortgage industry which could materially and adversely affect the participation of government and quasi- government agencies, including Ginnie Mae, in the reverse mortgage industry; increased costs, and/or decreased revenues that may result from increased scrutiny by government regulators and customers; U.S. competition; and other factors relating to our business in general as detailed in Walter Investment's 2011 Annual Report on Form 10-K and other periodic reports filed with the U.S. Securities and Exchange Commission. In addition, these statements are based on a number of assumptions that are subject to change. Accordingly, actual results may be materially higher or lower than those projected. The inclusion of such projections herein should not be regarded as a representation by Walter Investment that the projections will prove to be correct. This press release speaks only as of this date. Walter Investment disclaims any duty to update the information herein. Non-GAAP Financial Measures To supplement Walter Investment's consolidated financial statements prepared in accordance with GAAP and to better reflect period-over- period comparisons, Walter Investment uses non-GAAP financial measures of performance, financial position, or cash flows that either exclude or include amounts that are not normally excluded or included in the most directly comparable measure, calculated and presented in accordance with GAAP. Non-GAAP financial measures do not replace and are not superior to the presentation of GAAP financial results, but are provided to (i) measure the Company's financial performance excluding depreciation and amortization costs, corporate and MSR facility interest expense, transaction and merger integration-related costs, certain other non-cash adjustments, the net impact of the consolidated Non-Residual Trust VIEs and certain other items as defined by our first and second lien credit agreements, including, but not limited to pro-forma synergies, (ii) provide investors a means of evaluating our core operating performance and (iii) improve overall understanding of Walter Investment's current financial performance and its prospects for the future. The GAAP and non-GAAP financial results for RMS reflect estimated 2012 pro forma results for RMS under the fair value option methodology of accounting for HECM reverse mortgages and related HMBS debt. This is the methodology Walter Investment expects to utilize for RMS after the acquisition is completed. Specifically, Walter Investment believes the non-GAAP financial results provide useful information to both management and investors regarding certain additional financial and business trends relating to financial condition and operating results. In addition, management uses these measures for reviewing financial results and evaluating financial performance. The non-GAAP adjustments for all periods presented are based upon information and assumptions available as of the date of this presentation. 2 |

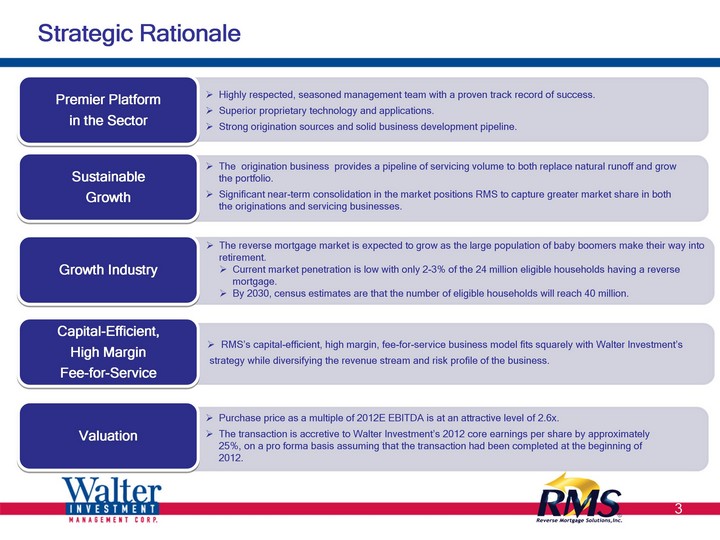

| Strategic Rationale 3 RMS's capital-efficient, high margin, fee-for-service business model fits squarely with Walter Investment's strategy while diversifying the revenue stream and risk profile of the business. Capital-Efficient, High Margin Fee-for-Service Sustainable Growth Growth Industry The origination business provides a pipeline of servicing volume to both replace natural runoff and grow the portfolio. Significant near-term consolidation in the market positions RMS to capture greater market share in both the originations and servicing businesses. The reverse mortgage market is expected to grow as the large population of baby boomers make their way into retirement. Current market penetration is low with only 2-3% of the 24 million eligible households having a reverse mortgage. By 2030, census estimates are that the number of eligible households will reach 40 million. Highly respected, seasoned management team with a proven track record of success. Superior proprietary technology and applications. Strong origination sources and solid business development pipeline. Premier Platform in the Sector Valuation Purchase price as a multiple of 2012E EBITDA is at an attractive level of 2.6x. The transaction is accretive to Walter Investment's 2012 core earnings per share by approximately 25%, on a pro forma basis assuming that the transaction had been completed at the beginning of 2012. |

| Reverse Mortgage Industry 4 Since the introduction of the HECM program in 1998, 740,000 reverse mortgages with a UPB of $166 BN have been originated. 2012 origination volumes are projected to be approximately 58,000 units with a UPB of $ 12 BN. Today, there are approximately 582,000 reverse mortgages outstanding with a UPB of $136 BN(1). Historically, a range of proprietary products (non- government insured) were available but today, the primary product being originated is the Home Equity Conversion Mortgage (HECM), which is insured by the FHA. FHA insurance guarantees that lenders will be repaid in full when the home is sold, regardless of the loan balance or value of the home. FHA also guarantees to the borrower that they will be able to access their authorized loan funds and stay in the home even if the loan balance exceeds the value of the property. Today, the secondary market is dominated by Ginnie Mae who holds 90% of the outstanding HECM product and provides liquidity for nearly all new originations for the 2,000 reverse mortgage originators in the market. *Annualized 2012 figure *Annualized 2012 figure 58* Source: Reverse Market Insight (1) UPB as measured by home value at origination. Reverse mortgages are measured by initial principal limit, which is generally the actual cash amount borrowers are authorized to receive. |

| Transaction Overview 5 Approvals Subject to customary closing conditions, including receipt of governmental approvals and third-party consents Purchase Price $120 million; stock purchase Consideration $60 million cash, $25 million of WAC stock (891,266 shares), and a $35 million, 3 year, 8% seller MSR note. Transaction Multiple Purchase price represents 2.6x 2012E EBITDA; 4.1x 2012 estimated core earnings Expected Closing Q4 2012 Employees Retention Two year retention agreements in place for key executives |

| Company Overview 6 Founded in 2007, RMS is a leading originator and servicer of reverse mortgages Leading provider of reverse mortgage technology systems Approximately 330 employees, headquartered in Spring, TX Offices in Houston, Palm Beach Gardens, FL & Hiram, GA One of 12 HUD-approved servicers and one of 3 approved HECM sub-servicers HUD and FNMA approved HECM seller / servicer "Strong" servicer rating by S&P (July 2011) is the best in the sector. Approved GNMA issuer, servicer and master servicer for reverse mortgage HMBS RMS Business Lines Origination Servicing REO Asset Management Technology Originates through a variety of retail and wholesale channels. Issuances of $1.1BN in 1H 2012 ranking it the second largest issuer in the sector. Issued more than 130 HMBS pools ($3.9BN) since 2007. $11.8BN UPB (76,442 loans) at July 2012. Fourth largest reverse mortgage servicer in the U.S. Currently manages over 6,800 units for clients, including a large national depository. 1H 2012 sales higher than sales for all of 2011. Develops software and technology solutions for reverse mortgage industry - both for internal use and third-parties. Selected by FHA to replace its existing mortgage insurance tracking system. |

| Financial Impact 7 Immediately accretive to Walter Investment stand-alone earnings Approximately 25% accretive to pro forma 2012 core earnings per share, assuming the transaction had been completed at the beginning of 2012 Strong Earnings and EBITDA generation(1) Estimated 2012 RMS stand-alone earnings of approximately $29.0 million Estimated 2012 RMS EBITDA of approximately $47.0 million $5.0 billion of loans and $5.0 billion of non-recourse obligations to be brought on balance sheet by FYE 2012 Strong earnings accretion and a solid return on invested capital well in excess of our cost of capital (1) The GAAP and non-GAAP financial results for RMS reflect estimated 2012 pro forma results for RMS under the fair value option methodology of accounting for HECM reverse mortgages and related HMBS debt. This is the methodology Walter Investment expects to utilize for RMS after the acquisition is completed. |

| Strategic Rationale 8 RMS's capital-efficient, high margin, fee-for-service business model fits squarely with Walter Investment's strategy while diversifying the revenue stream and risk profile of the business. Capital-Efficient, High Margin Fee-for-Service Sustainable Growth Growth Industry The origination business provides a pipeline of servicing volume to both replace natural runoff and grow the portfolio. Significant near-term consolidation in the market positions RMS to capture greater market share in both the originations and servicing businesses. The reverse mortgage market is expected to grow as the large population of baby boomers make their way into retirement. Current market penetration is low with only 2-3% of the 24 million eligible households having a reverse mortgage. By 2030, census estimates are that the number of eligible households will reach 40 million. Highly respected, seasoned management team with a proven track record of success. Superior proprietary technology and applications. Strong origination sources and solid business development pipeline. Premier Platform in the Sector Valuation Purchase price as a multiple of 2012E EBITDA is at an attractive level of 2.6x. The transaction is accretive to Walter Investment's 2012 core earnings per share by approximately 25%, on a pro forma basis assuming that the transaction had been completed at the beginning of 2012. |

| Transaction Overview 9 Appendix |

| Reverse Mortgage Product 10 Reverse mortgages are non-recourse loans which are secured by the borrower's primary residence and allow the borrower to convert home equity into cash. Eligibility Borrowers must be at least 62 years old, they must live in the property, and cannot carry any other debt against the property. The borrowers must also complete HUD counseling prior to being issued a reverse mortgage. Ongoing obligations Although there are no monthly payments due, the borrower must continue to pay taxes and insurance, they must keep the home in good repair according to FHA quality standards, and must maintain primary occupancy. Failure to do so, could result in foreclosure of the property. Loan Determination Because payments are not due from the borrower, the product is not underwritten according to the credit worthiness. Instead, loan proceeds are determined by the borrower's age and life expectancy as determined by census mortality tables, interest rates, and home value. Loan Balance Unlike forward mortgages, reverse mortgage balances grow over time as the borrower makes additional draws and as interest, servicing fees, MIP and advances accrue to the balance. The maximum allowable loan by FHA is currently $625,000. Payment Plans Borrowers can choose between a lump sum up front, an income stream, a line of credit or some combination of the three. In total, there are 5 payment plans. Loan Repayment Reverse mortgages do not have a fixed term but instead a pay-off is triggered by either the death of the borrower ("mortality"), borrowers moving out of the home ("mobility"), or other causes such as refinance or foreclosure. |

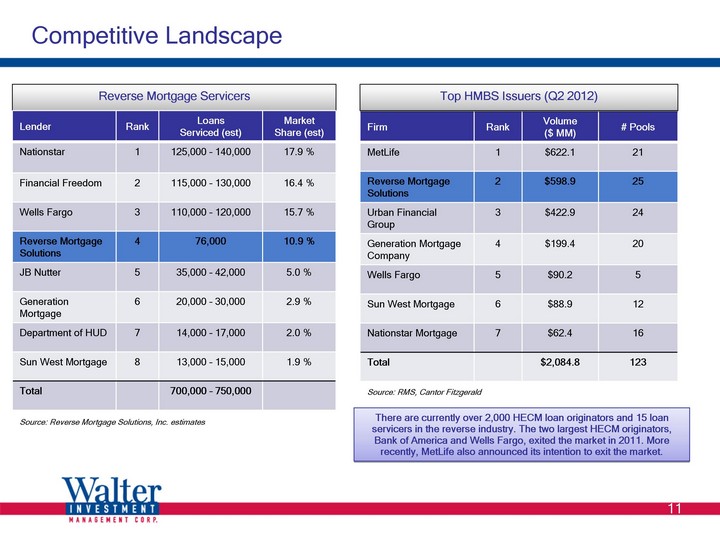

| Competitive Landscape 11 Reverse Mortgage Servicers Lender Rank Loans Serviced (est) Market Share (est) Nationstar 1 125,000 - 140,000 17.9 % Financial Freedom 2 115,000 - 130,000 16.4 % Wells Fargo 3 110,000 - 120,000 15.7 % Reverse Mortgage Solutions 4 76,000 10.9 % JB Nutter 5 35,000 - 42,000 5.0 % Generation Mortgage 6 20,000 - 30,000 2.9 % Department of HUD 7 14,000 - 17,000 2.0 % Sun West Mortgage 8 13,000 - 15,000 1.9 % Total 700,000 - 750,000 Firm Rank Volume ($ MM) # Pools MetLife 1 $622.1 21 Reverse Mortgage Solutions 2 $598.9 25 Urban Financial Group 3 $422.9 24 Generation Mortgage Company 4 $199.4 20 Wells Fargo 5 $90.2 5 Sun West Mortgage 6 $88.9 12 Nationstar Mortgage 7 $62.4 16 Total $2,084.8 123 Top HMBS Issuers (Q2 2012) There are currently over 2,000 HECM loan originators and 15 loan servicers in the reverse industry. The two largest HECM originators, Bank of America and Wells Fargo, exited the market in 2011. More recently, MetLife also announced its intention to exit the market. Source: Reverse Mortgage Solutions, Inc. estimates Source: RMS, Cantor Fitzgerald |

| RMS 2012E EBITDA 12 ($ in millions) (2) (1) Estimated results based on a conversion from "gain on sale" methodology to fair value option accounting methodology under GAAP. Excludes amortization related to purchase accounting. |