Attached files

| file | filename |

|---|---|

| EX-31.1 - SECTION 302 - National Graphite Corp | ex31-1.htm |

| EX-32.2 - SECTION 906 - National Graphite Corp | ex32-2.htm |

| EX-31.2 - SECTION 302 - National Graphite Corp | ex31-2.htm |

| EX-32.1 - SECTION 906 - National Graphite Corp | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2012

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission file number: 000-53284

National Graphite Corp.

(formerly Lucky Boy Silver Corp.)

(Exact name of registrant as specified in its charter)

| Nevada | 26-0665441 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 5466 Canvasback Rd., | |

| Blaine, Washington | 98230 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (702) 839-4029

Securities registered under Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| None | N/A |

Securities registered pursuant to Section 12(g) of the Act:

| Common Stock |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Rule 13 or Section 15(d) of the Act

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant Rule 405 of Regulation S-T (§220.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.

Yes [X] No [ ] Not applicable.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed third fiscal quarter.

74,653,215 common shares at $0.65 on February 29, 2012, which is the quotation posted on the Over-the-Counter Bulletin Board (“OTC-BB” under the symbol “NGRC”).

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date 75,669,881 common shares issued and outstanding as of August 27, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). Not applicable.

TABLE OF CONTENTS

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 3 |

| GLOSSARY OF EXPLORATION TERMS | 4 |

| PART I | 8 |

| Item 1. Business | 8 |

| Item 1A Risk Factors | 12 |

| Item 1B. Unresolved Staff Comments | 17 |

| Item 2 Properties | 17 |

| Item 3. Legal Proceedings | 31 |

| Item 4. (Removed and Reserved) | 31 |

| PART II | 31 |

| Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 31 |

| Item 6. Selected Financial Data | 32 |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 32 |

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk | 36 |

| Item 8. Financial Statements and Supplementary Data | 36 |

| Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 39 |

| Item 9A(T). Controls and Procedures | 39 |

| Item 9B. Other Information | 40 |

| PART III | 41 |

| Item 10. Directors, Executive Officers and Corporate Governance | 41 |

| Item 11. Executive Compensation | 44 |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 46 |

| Item 13. Certain Relationships and Related Transactions, and Director Independence | 47 |

| Item 14. Principal Accounting Fees and Services | 47 |

| PART IV | 48 |

| Item 15. Exhibits, Financial Statement Schedules | 48 |

| SIGNATURES | 49 |

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may”, “should”, “plan”, “predict”, “potential” or “continue” or the negative of these terms or other comparable terminology. Examples of forward-looking statements made in this annual report on Form 10-K include statements about:

| ● | Our future exploration programs and results, |

| ● | Our future capital expenditures, and |

| ● | Our future investments in and acquisitions of mineral resource properties. |

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including

| ● | risks and uncertainties relating to the interpretation of sampling results, the geology, grade and continuity of mineral deposits; |

| ● | risks and uncertainties that results of initial sampling and mapping will not be consistent with our expectations; |

| ● | mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production; |

| ● | the potential for delays in exploration activities; |

| ● | risks related to the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses; |

| ● | risks related to commodity price fluctuations; |

| ● | the uncertainty of profitability based upon our limited history; |

| ● | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration project; |

| ● | risks related to environmental regulation and liability; |

| ● | risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs; |

| ● | risks related to tax assessments; |

| ● | political and regulatory risks associated with mining development and exploration; and |

| ● | the risks in the section entitled “Risk Factors”, |

any of which may cause our company’s or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. References to common shares refer to common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our” and “Lucky Boy” mean National Graphite Corp. unless otherwise indicated.

| 3 |

GLOSSARY OF EXPLORATION TERMS

The following terms, when used in this report, have the respective meanings specified below:

Amortization - The gradual and systematic writing off of a balance in an account over an appropriate period.

Amphibolite - A gneiss or schist largely made up of amphibole and plagioclase minerals.

Anomaly - Any departure from the norm which may indicate the presence of mineralization in the underlying bedrock.

Assay - A chemical test performed on a sample of ores or minerals to determine the amount of valuable metals contained.

Assessment work - The amount of work, specified by mining law, that must be performed each year in order to retain legal control of mining claims.

Base metal - Any non-precious metal (e.g. copper, lead, zinc, nickel, etc.).

Bedding - The arrangement of sedimentary rocks in layers.

Biotite - A platy magnesium-iron mica, common in igneous rocks.

Chalcopyrite - A sulphide mineral of copper and iron; the most important ore mineral of copper.

Chip sample - A method of sampling a rock exposure whereby a regular series of small chips of rock is broken off along a line across the face.

Claim - A portion of land held either by a prospector or a mining company. In Canada, the common size is 1,320 ft. (about 400 m) square, or 40 acres (about 16 ha).

Clay - A fine-grained material composed of hydrous aluminum silicates.

Cleavage - The tendency of a mineral to split along crystallographic planes.

Contact - A geological term used to describe the line or plane along which two different rock formations meet.

Contact metamorphism - Metamorphism of country rocks adjacent to an intrusion, caused by heat from the intrusion.

Country rock - Loosely used to describe the general mass of rock adjacent to an orebody. Also known as the host rock.

Crosscut - A horizontal opening driven from a shaft and (or near) right angles to the strike of a vein or other orebody.

Development - Underground work carried out for the purpose of opening up a mineral deposit. Includes shaft sinking, crosscutting, drifting and raising.

Diorite - An intrusive igneous rock composed chiefly of sodic plagioclase, hornblende, biotite or pyroxene.

Drift - A horizontal underground opening that follows along the length of a vein or rock formation as opposed to a crosscut which crosses the rock formation.

| 4 |

Exploration - Prospecting, sampling, mapping, diamond drilling and other work involved in searching for ore.

Face - The end of a drift, crosscut or stope in which work is taking place.

Felsic - Term used to describe light-colored rocks containing feldspar, feldspathoids and silica.

Fracture - A break in the rock, the opening of which allows mineral-bearing solutions to enter. A "cross-fracture" is a minor break extending at more-or-less right angles to the direction of the principal fractures.

Geochemistry - The study of the chemical properties of rocks.

Geology - The science concerned with the study of the rocks which compose the Earth.

Gneiss - A layered or banded crystalline metamorphic rock, the grains of which are aligned or elongated into a roughly parallel arrangement.

Greenstone belt - An area underlain by metamorphosed volcanic and sedimentary rocks, usually in a continental shield.

Host rock - The rock surrounding an ore deposit.

Igneous rocks - Rocks formed by the solidification of molten material from far below the earth's surface.

Intrusive - A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface.

Lava - A general name for the molten rock ejected by volcanoes.

Lens - Generally used to describe a body of ore that is thick in the middle and tapers towards the ends.

Limestone - A bedded, sedimentary deposit consisting chiefly of calcium carbonate.

Lode - A mineral deposit in solid rock.

Mafic - Igneous rocks composed mostly of dark, iron- and magnesium-rich minerals.

Magma - The molten material deep in the Earth from which rocks are formed.

Magnetic survey - A geophysical survey that measures the intensity of the Earth's magnetic field.

Metamorphic rocks - Rocks which have undergone a change in texture or composition as the result of heat and/or pressure.

Metamorphism - The process by which the form or structure of rocks is changed by heat and pressure.

Mineral - A naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form.

Net smelter return - A share of the net revenues generated from the sale of metal produced by a mine.

Option - An agreement to purchase a property reached between the property vendor and some other party who wishes to explore the property further.

Ore - A mixture of ore minerals and gangue from which at least one of the metals can be extracted at a profit.

| 5 |

Orebody - A natural concentration of valuable material that can be extracted and sold at a profit.

Outcrop - An exposure of rock or mineral deposit that can be seen on surface, that is, not covered by soil or water.

Plug - A common name for a small offshoot from a large body of molten rock.

Plutonic - Refers to rocks of igneous origin that have come from great depth.

Pyrite - A yellow iron sulphide mineral, normally of little value. It is sometimes referred to as "fool's gold".

Pyrrhotite - A bronze-colored, magnetic iron sulphide mineral.

Quartz - Common rock-forming mineral consisting of silicon and oxygen.

Quartzite - A metamorphic rock formed by the transformation of a sandstone by heat and pressure.

Reclamation - The restoration of a site after mining or exploration activity is completed.

Resource - The calculated amount of material in a mineral deposit, based on limited drill information.

Rock - Any natural combination of minerals; part of the earth's crust.

Royalty - An amount of money paid at regular intervals by the lessee or operator of an exploration or mining property to the owner of the ground. Generally based on a certain amount per ton or a percentage of the total production or profits. Also, the fee paid for the right to use a patented process.

Sample - A small portion of rock or a mineral deposit taken so that the metal content can be determined by assaying.

Sampling - Selecting a fractional but representative part of a mineral deposit for analysis.

Sandstone - A sedimentary rock consisting of grains of sand cemented together.

Schist - A foliated metamorphic rock the grains of which have a roughly parallel arrangement; generally developed by shearing.

Sedimentary rocks - Secondary rocks formed from material derived from other rocks and laid down under water. Examples are limestone, shale and sandstone.

Shaft - A vertical or inclined excavation in rock for the purpose of providing access to an orebody. Usually equipped with a hoist at the top, which lowers and raises a conveyance for handling workers and materials.

Shale - Sedimentary rock formed by the consolidation of mud or silt.

Shear or shearing - The deformation of rocks by lateral movement along innumerable parallel planes, generally resulting from pressure and producing such metamorphic structures as cleavage and schistosity.

Shear zone - A zone in which shearing has occurred on a large scale.

Silica - Silicon dioxide. Quartz is a common example.

Siliceous - A rock containing an abundance of quartz.

| 6 |

Sill - An intrusive sheet of igneous rock of roughly uniform thickness that has been forced between the bedding planes of existing rock.

Silt - Muddy deposits of fine sediment usually found on the bottoms of lakes.

Spot price - Current delivery price of a commodity traded in the spot market.

Stope - An excavation in a mine from which ore is, or has been, extracted.

Strike - The direction, or bearing from true north, of a vein or rock formation measure

on a horizontal surface.

Sulphide - A compound of sulphur and some other element.

Trench - A long, narrow excavation dug through overburden, or blasted out of rock, to expose a vein or ore structure.

Tuff - Rock composed of fine volcanic ash.

Vein - A fissure, fault or crack in a rock filled by minerals that have travelled upwards from some deep source.

Volcanic rocks - Igneous rocks formed from magma that has flowed out or has been violently ejected from a volcano.

Zone - An area of distinct mineralization.

| 7 |

PART I

Item 1. Business.

Overview

We were incorporated in the State of Wyoming on October 19, 2006, as Sierra Ventures, Inc. and established a fiscal year end of May 31. Our statutory registered agent's office is located at 1620 Central Avenue, Suite 202, Cheyenne, Wyoming 82001 and our business office is located at 5466 Canvasback Rd., Blaine, Washington 98230. Our telephone number is (702) 839-4029. On February 5, 2010 we filed an Amendment to Articles with the Wyoming Secretary of State and changed our name from “Sierra Ventures Inc.” to “Lucky Boy Silver Corp.” On May 9, 2012 we changed the name of our Company to National Graphite Corp. We changed the name of our company to better reflect the direction and business of our company.

On March 22, 2011, the corporation converted from a Wyoming corporation to a Nevada corporation pursuant to Wyoming Statutes Title 17, ch. 16, Sect.(s) 820, 821 and 1114 and Nevada Revised Statutes 92A.205. This conversion did not alter the number of authorized shares, or the number of issued and outstanding shares, of the corporation. The voting and other rights of the common and preferred shares of the company’s capital stock remain substantially similar under Nevada law. The powers of the company’s officers, directors and shareholders also remain substantially the same. Our authorized capital stock continues to consist of 499,000,000 shares of common stock, par value $0.001 per share and 1,000,000 shares of preferred stock, par value $0.001 per share. Our statutory registered agent's office is located at 701 N. Green Valley Pkwy, Ste 200-238, Henderson, NV 89074. Our telephone number is (702) 839-4029.

We are a start-up, exploration-stage company engaged in the search for gold, silver, graphite and related minerals. Our mineral properties are without known reserves and our proposed program is explanatory in nature. There is no assurance that commercially viable mineral deposits exist on our mineral properties. Further exploration and/or drilling will be required before a final evaluation as to the economic and legal feasibility of our projects is determined.

Effective April 6, 2010, we conducted a 15:1 forward stock split of our common stock. The split was approved by FINRA for taking effect on the OTC-BB at the open of business on March 31, 2010. The transfer agent effected the forward split on their records as of April 6, 2010. Our statements of stockholder’s equity have been retroactively restated to reflect the split.

Our Current Business – Mineral Exploration

On March 22, 2007, as amended on May 15, 2009, we optioned a 25 percent interest in a gold exploration property referred to as the Zhangjiafan Mining Property located in Jiangxi Province, People’s Republic of China, 13 kilometres northwest of Dexing City which is approximately 8 hours by aircraft and ground transportation west of Shanghai by entering into an Option to Purchase and Royalty Agreement with Jiujiang Gao Feng Mining Industry Limited Company of Jiangxi City, Jiangxi Province, China (“Jiujiang”), the beneficial owner of the property, an arms-length Chinese corporation, to acquire an interest in the property by making certain expenditures and carrying out exploration work. Work commenced on the phase I exploration program on our optioned Zhangjiafan mineral property on April 27 and concluded on June 04, 2009. Our portion of the phase I geological exploration program on the property cost $30,000 (paid) (25% of the totally budgeted cost of $120,000) which was a reflection of local costs for the specified type of work. Costs for phase I were made up of wages, fees, geological and geochemical supplies, assaying, equipment, diamond drilling and costs of operation. At the completion of the field work on this property, management has determined that further expenditures or issuance of stock for this property is not in the best interest of the Company and the project has been abandoned.

On October 11, 2007, a registration statement relating to our initial public offering of common stock was filed with the SEC. A total of 2,900,000 shares of common stock were sold to the public for $0.05 per share (consisting of 2,000,000 sold by us for gross proceeds of $100,000 and 900,000 shares sold by the selling stockholders) prior to the declaration of an effective date of the registration statement under our mistaken assumption that the registration statement had become effective through the passage of time after its filing. Selling shares prior to the establishment of an effective date can result in potential violations of federal and state securities laws. As a result, these stock issuances and re-sales may have violated the Securities Act of 1933. Rescission offers for such potential violations are commonly made by companies in these situations and the filing of a registration statement is a normal part of the rescission offer process. We have previously disclosed in our regulatory filings that all of the subscribers had been informed of this situation. As a result, we were prepared to refund part or all associated monies and to cancel part or all associated common shares that could have been tendered for rescission.

| 8 |

On February 27, 2009, we filed an S-1 rescission offering registration statement which became effective on March 5, 2009, and which addressed federal and state securities laws compliance issues by allowing the holders of the shares covered by the rescission offer to rescind the underlying securities transactions and sell those securities back to us or the selling shareholders. In addition, we conducted the offering in order to be able to reduce our contingent liabilities.

The rescission offer process closed on April 24, 2009, with no shares being submitted for rescission. When the rescission offer expired, any person who did not accept the offer received freely tradable stock.

During the year ended May 31, 2010, the Company issued for cash 425,000 pre-split (6,375,000 post-split) shares of its par value $0.001 common stock for $170,000.

On January 24, 2010 the Company issued 290,000 and 150,000 (10,000 pre-split) shares of the Company’s common stock to a consultant and two board members for services provided to the Company. The shares were valued at $0.40 per share based on the recent cash sales price. The Company recorded $120,000 of expense in professional fees.

During February 2010 the Company entered into two lease agreements for mineral leases located in the Mineral County, Nevada. On February 8, 2010, we acquired 38 unpatented BLM claims including those known as the Silver Summit and Silver Strike claims and two historic, silver mine leases (“AG Properties”) known as Lucky Boy Silver Mine and the Black Butte Silver Mine. The Company issued 150,000 post-split shares of common stock for the mining claims. These shares were valued at $0.40 per share based on the recent cash sale price.

Under these agreements the Company committed $17,500 in non-refundable upfront lease payments, $10,000 in future payments to be made every nine months and $7,500 in future payments to be made annually as long as the lease is in force. In a geological report compiled by Hunsaker dated May 2010, Hunsaker opined that further work on the Lucky Boy project was not recommended while further exploration on the Black Butte project was justified. The lease for the Lucky Boy mineral property was not renewed.

On May 25, 2011 we expanded our claims in the Silver Strike area to 62 unpatented claims renaming them the LAG claims.

On April 20, 2012, the Company entered into an agreement with Habitants Minerals Ltd. (“Habitants”) granting the Company the sole and exclusive right to purchase 100% right, title and interest in and to the applications and subsequent claims to be issued by Quebec Ministry of Resources and Fauna for the following applications:

The Quebec applications cover ground referred to in reports GM19842, GM35169, GM35267, GM19844, GM20308, GM13866, reports which report historic graphite occurrences on Lot 32 and Lot 33 Range 11 in Low Township, Lot 1 Range 2 in Suffolk Township, Lot 9 and Lot 16 Range 3 and Lot 10 Range 9 all in Clarendon Township, Lot 46 Range 11 in Low Township, and ground in Lochaber Township covering historic mag anomalies.

APPLICATION 1186716 (29 claims)

APPLICATION 1187995 (14 claims)

APPLICATION 1187994 (12 claims)

APPLICATION 1187992 (10 claims)

65 claims approx., 60 hectares each = 3900 hectares

The consideration for the transaction was payment by the Company to Habitants a total of Fifty Thousand United States Dollars (US$50,000.00) consisting of Twenty Five Thousand United States Dollars ($25,000.00) on the date of execution of this Agreement and Twenty Five Thousand United States Dollars ($25,000.00) upon the issuance of the claims in the Company’s name, and the issuance of 100,000 shares of the Company’s common stock within 15 days of the date of the closing of the transaction described in the Agreement or within 15 days of any Regulatory Approvals required for the issuance of the shares.

| 9 |

On April 24, 2012, the Company entered into an agreement with GeoXplor Corporation to purchase a 100% interest in and to the Chedic Graphite Property consisting of 20 Mineral Lode Claims in Township, 15 North, Range 19 East, Sections 25 & 26 Carson City, NV mining claims compromising approximately 400 acres.

The purchase price for the Property is a total of $425,000 in cash, an issuance of 2,500,000 shares of the Company’s Restricted Common Stock, and a work commitment on the Property of up to $1,000,000 over four years as follows:

a.) Cash Consideration: Purchaser will pay Seller $425,000 USD in cash consideration as follows :

| i) | USD $50,000 upon the signing of the Agreement ( the “Effective Date” ), |

| ii) | an additional USD $25,000 on or before 6 months from the Effective Date , |

| iii) | an additional USD $25,000 on or before 12 months from the Effective Date, |

| iv) | an additional USD $50,000 on or before 18 months from the Effective Date, |

| v) | an additional USD $75,000 on or before 24 Months from the Effective Date, |

| vi) | an additional USD $50,000 on or before 30 months from the Effective Date, |

| vii) | an additional USD $50,000 on or before 36 months from the Effective Date, |

| viii) | an additional USD $50,000 on or before 42 months from the Effective Date, |

| ix) | an additional USD $50,000 on or before 48 months from the Effective Date ( for a total cash consideration of $425,000 on or before 48 months from and after the Effective Date. ) |

b) Stock Consideration: (restricted common shares)

| i) | 500,000 shares upon the signing of the Agreement (the “Effective Date“), |

| ii) | 500,000 shares on or before 6 months from the Effective Date, |

| iii) | 500,000 shares on or before 18 months from the Effective Date, |

| iv) | 500,000 shares on or before 24 months from the Effective Date, |

| v) | 500,000 shares on or before 48 months from the Effective Date, |

c) Work Commitment:

Purchaser will provide funds for the conduct of a program of work to be undertaken by the Seller for the benefit of the Property of not less than USD $1,000,000 over 4 years as follows:

| i) | $100,000 on or before 12 months from the Effective Date, |

| ii) | $300,000 on or before 24 months from the Effective Date, |

| iii) | $300,000 on or before 36 months from the Effective date , |

| iv) | $300,000 on or before 48 months from the Effective Date. |

Our Proposed Exploration Program – Plan of Operation

Our business plan is to abandon exploration of the Zhangjiafan property and proceed with exploration on the Black Butte and Lucky Boy projects to determine if there are commercially exploitable deposits of gold and silver, and if we decide not to proceed, to seek other mineral exploration properties.

We do not have any ores or reserves whatsoever at this time on our optioned property or other mineral properties.

Gao Fenglin, Senior Engineer, originally recommended a two-phase exploration program for the Zhangjiafan property to properly evaluate the potential of the property. However, management has determined that further exploration on this property is not warranted.

During February 2010 the Company entered into two additional lease agreements for mineral leases located in the Mineral County, Nevada, including the Black Butte and Lucky Boy projects. Under these agreements the Company has committed $17,500 in non-refundable up-front lease payments, $10,000 in future payments to be made every nine months and $7,500 in future payments to be made annually as long as the lease is in force. Additionally, the Company has committed to spend a minimum of $100,000 over the first three years of the lease on exploration and property development. The Company also has agreed to pay a total of 3% for each lease net smelter return production royalty which can be bought out for $2,000,000/ per cent NSR ($1,000,000 per lease) with approval and consent of the lessor. If payments are in default for 30 days or the work commitment is not completed as agreed, the lessor must vacate the property immediately and settle all accounts related to the property.

| 10 |

We retained the services of the Hunsaker Inc., a geological company, to assess the results of our program. In a report compiled by Hunsaker dated February 2011, Hunsaker concluded that the Silver Strike claims warranted additional exploration whereas the Silver Summit claims did not. Our mineral properties are currently without known reserves and our proposed programs are exploratory in nature. On May 25, 2011 we expanded our claims in the Silver Strike area to 66 unpatented claims by staking the LAG claims.

Our business plan for the Black Butte and Lucky Boy projects is to proceed with the initial exploration of the gold and silver properties to determine if there are commercially exploitable deposits of gold and silver. We retained the services of the Hunsaker Inc., a geological company, to assess the results of our program.In a geological report compiled by Hunsaker dated May 2010, Hunsaker opined that further work on the Lucky Boy project is not recommended while further exploration on the Black Butte project is justified. We did not renew the Lucky Boy Silver Mine lease.

As per the purchase agreement of the Nevada graphite property, the Company is committed to anexpenditure of at least $100,000 on the property over the next twelve months.

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties.

We also compete with other mineral resource exploration companies for financing from a limited number of investors that are prepared to make investments in mineral resource exploration companies. The presence of competing mineral resource exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We also compete with other mineral resource exploration companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

Government Regulations

Any operations at the our mineral properties will be subject to various federal and state laws and regulations in the United States and laws and regulations in Canada which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We will be required to obtain those licenses, permits or other authorizations currently required to conduct exploration and other programs. There are no current orders or directions relating to us or our properties with respect to the foregoing laws and regulations. Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on any of our mineral properties. We are not presently aware of any specific material environmental constraints affecting our properties that would preclude the economic development or operation of property in the United States and in Canada.

The U.S. Forest Service requires that mining operations on lands subject to its regulation obtain an approved plan of operations subject to environmental impact evaluation under the National Environmental Policy Act. Any significant modifications to the plan of operations may require the completion of an environmental assessment or Environmental Impact Statement prior to approval. Mining companies must post a bond or other surety to guarantee the cost of post-mining reclamation. These requirements could add significant additional cost and delays to any mining project undertaken by us.

| 11 |

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Any future mining operations at our mineral properties may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures for pollution control in order to comply with the rules.

The U.S. Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended ("CERCLA"), imposes strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. Those liable groups include, among others, the current owners and operators of facilities which release hazardous substances into the environment and past owners and operators of properties who owned such properties at the time the disposal of the hazardous substances occurred. This liability could include the cost of removal or remediation of the release and damages for injury to the surrounding property. We cannot predict the potential for future CERCLA liability with respect to our mineral properties or surrounding areas.

Employees

At present, we have no employees. We currently operate with two executive officers, who devote their time as required to our business operations. Our executive officers are not presently compensated for their services and do not have an employment agreement with us.

Item 1A Risk Factors

Risks Associated with our Business

We are an exploration stage company, lack a business history and have losses that we expect to continue into the future. If the losses continue we will have to suspend operations or cease functioning.

We were incorporated in the State of Wyoming on October 19, 2006, and have only started our proposed business but have not realized any revenues. We have no business history upon which an evaluation of our future success or failure can be made. Our net loss since inception is $1,411,956.

Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

| • | our ability to find a profitable exploration property; |

| • | our ability to generate revenues; and |

| • | our ability to reduce exploration costs. |

Because of the speculative nature of exploration of mineral properties, we may never discover a commercially exploitable quantity of minerals, our business may fail and investors may lose their entire investment.

We are in the very early exploration stage and cannot guarantee that our exploration work will be successful or that any minerals will be found or that any production of minerals will be realized. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that exploration on our properties will establish that commercially exploitable reserves of minerals exist on our property. Additional potential problems that may prevent us from discovering any reserves of minerals on our property include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. If we are unable to establish the presence of commercially exploitable reserves of minerals on our property our ability to fund future exploration activities will be impeded, we will not be able to operate profitably and investors may lose all of their investment in our company.

| 12 |

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claims. If this happens, our business will likely fail.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

We have no known mineral reserves and we may not find any gold, silver or graphite if we find gold, silver or graphite it may not be in economic quantities. If we fail to find any gold, silver or graphite or if we are unable to find gold, silver or graphite in economic quantities, we will have to suspend operations.

We have no known mineral reserves. Even if we find gold, silver or graphite, it may not be of sufficient quantity so as to warrant recovery. Additionally, even if we find gold, silver or graphite in sufficient quantity to warrant recovery it ultimately may not be recoverable. Finally, even if any gold, silver or graphite is recoverable, we do not know that this can be done at a profit. Failure to locate gold, silver or graphite in economically recoverable quantities will cause us to suspend operations.

The potential profitability of mineral ventures depends in part upon factors beyond the control of our company and even if we discover and exploit mineral deposits, we may never become commercially viable and we may be forced to cease operations.

The commercial feasibility of mineral properties is dependent upon many factors beyond our control, including the existence and size of mineral deposits in the properties we explore, the proximity and capacity of processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental regulation. These factors cannot be accurately predicted and any one or a combination of these factors may result in our company not receiving an adequate return on invested capital. These factors may have material and negative effects on our financial performance and our ability to continue operations.

We may be adversely affected by fluctuations in ore and precious metal prices.

The value and price of our shares of common stock, our financial results, and our exploration, development and mining activities, if any, may be significantly adversely affected by declines in the price of precious metals and ore. Mineral prices fluctuate widely and are affected by numerous factors beyond our control such as interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of mineral producing countries throughout the world.

The prices used in making resource estimates for mineral projects are disclosed, and generally use significantly lower metal prices than daily metals prices quoted in the news media. The percentage change in the price of a metal cannot be directly related to the estimated resource quantities, which are affected by a number of additional factors. For example, a 10% change in price may have little impact on the estimated resource quantities, or it may result in a significant change in the amount of resources.

| 13 |

Transportation difficulties and weather interruptions may affect and delay proposed mining operations and impact our proposed business.

Our mineral properties are accessible by road. The climate in the area is hot and dry in the summer but cold and subject to snow in the winter, which could at times hamper accessibility depending on the winter season precipitation levels. As a result, our exploration plans could be delayed for several months each year.

Supplies needed for exploration may not always be available.

Competition and unforeseen limited sources of supplies needed for our proposed exploration work could result in occasional spot shortages of supplies of certain products, equipment or materials. There is no guarantee we will be able to obtain certain products, equipment and/or materials as and when needed, without interruption, or on favorable terms. Such delays could affect our proposed business plans.

Management will devote only a limited amount of time to National Graphite’s business. Failure of our management to devote a sufficient amount of time to our business plans may adversely affect the success of our business.

Mr. Kenneth B. Liebscher will be devoting approximately 20 hours per week to National Graphite’s business. Failure of our management to devote a sufficient amount of time to our business plans may adversely affect the success of our business.

Management lacks formal training in mineral exploration.

Our officers and directors have no professional accreditation or formal training in the business of exploration. With no direct training or experience in these areas our management may not be fully aware of many of the specific requirements related to working within this industry. Decisions so made without this knowledge may not take into account standard engineering management approaches that experienced exploration corporations commonly make. Consequently, our business, earnings and ultimate financial success could suffer irreparable harm as a result of management’s lack of experience in the industry. Thus, we will retain such technical experts as are required to provide professional and technical guidance.

We require substantial funds merely to determine if mineral reserves exist on our mineral properties.

Any potential development and production of our exploration properties depends upon the results of exploration programs and/or feasibility studies and the recommendations of duly qualified engineers and geologists. Such programs require substantial additional funds. Any decision to further expand our plans on these exploration properties will involve the consideration and evaluation of several significant factors including, but not limited to:

| ● | Costs of bringing the property into production including exploration work, preparation of production feasibility studies and construction of production facilities; |

| ● | Availability and costs of financing; |

| ● | Ongoing costs of production; |

| ● | Market prices for the products to be produced; |

| ● | Environmental compliance regulations and restraints; and |

| ● | Political climate and/or governmental regulation and control. |

| 14 |

Risks Associated with our Common Stock

There is no active trading market for our common stock and if a market for our common stock does not develop, our investors will be unable to sell their shares.

Few shares of our common stock have been traded on the OTC Bulletin Board. As a result, our stockholders may find it difficult to dispose of, or to obtain accurate quotations of the price of, shares of our common stock. This severely limits the liquidity of shares of our common stock and has a material adverse effect on the market price for shares of our common stock and on our ability to raise additional capital. An active public market for shares of our common stock may not develop, or if one should develop, it may not be sustained, and as a result, investors may not be able to resell shares of our common stock that they have purchased and may lose all of their investment.

We do not intend to pay dividends on any investment in the shares of stock of our company.

We have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment of a dividend. Because we do not intend to declare dividends, any gain on an investment in our company will need to come through an increase in the stock’s price. This may never happen and investors may lose all of their investment in our company.

Because we can issue additional shares of common stock, purchasers of our common stock may incur immediate dilution and may experience further dilution.

We are authorized to issue up to 499,000,000 shares of common stock, of which 75,669,881 shares are issued and outstanding as of August 27, 2012. We have 1,000,000 preferred shares authorized of which 675,000 are issued and outstanding and held by Kenneth B. Liebscher, our President and CEO. Our board of directors has the authority to cause us to issue additional shares of common stock, and to determine the rights, preferences and privileges of such shares, without consent of any of our stockholders. Consequently, the stockholders may experience more dilution in their ownership of our stock in the future.

A decline in the price of our common stock could affect our ability to raise further working capital, it may adversely impact our ability to continue operations and we may go out of business.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because we may attempt to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, a decline in the price of our common stock could be detrimental to our liquidity and our operations because the decline may cause investors to not choose to invest in our stock. If we are unable to raise the funds we require for all our planned operations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. As a result, our business may suffer, and not be successful and we may go out of business. We also might not be able to meet our financial obligations if we cannot raise enough funds through the sale of our common stock and we may be forced to go out of business.

Our stock is a penny stock. Trading of our stock may be restricted by the Securities and Exchange Commission’s penny stock regulations which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

| 15 |

FINRA sales practice requirements may also limit a stockholder's ability to buy and sell our stock.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (FINRA) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Risks Related to our Financial Results and Need for Additional Financing

Our auditors’ reports contain a statement that our net loss and limited working capital raise substantial doubt about our ability to continue as a going concern.

Our independent registered public accountants have stated in their report, included in this annual report that our significant operating losses and working capital deficiency raise substantial doubt about our ability to continue as a going concern. We had net losses of $375,546 and $658,714, respectively, for the fiscal years ended May 31, 2012 and 2011. We will be required to raise substantial capital to fund our capital expenditures, working capital and other cash requirements since our current cash assets are exhausted. We are currently searching for sources of additional funding, including potential joint venture partners, while we continue the initial exploration phase on our mining claims. The successful outcome of future financing activities cannot be determined at this time and there are no assurances that, if achieved, we will have sufficient funds to execute our intended business plan or generate positive operational results.

We will need additional capital to achieve our current business strategy and our inability to obtain additional financing will inhibit our ability to expand or even maintain our research, exploration and development efforts.

In addition to our current accumulated deficit, we expect to incur additional losses in the foreseeable future. Until we are able to determine if there are mineral deposits available for extraction on our properties, we are unlikely to be profitable. Consequently, we will require substantial additional capital to continue our exploration and development activities. There is no assurance that we will not incur additional and unplanned expenses during our continuing exploration and development activities. When additional funding is required, we intend to raise funds either through private placements or public offerings of our equity securities. There is no assurance that we will be able to obtain additional financing through private placements and/or public offerings necessary to support our working capital requirements. To the extent that funds generated from any private placements and/or public offerings are insufficient, we will have to raise additional working capital through other sources, such as bank loans and/or financings. No assurance can be given that additional financing will be available, or if available, will be on acceptable terms.

If we are unable to secure adequate sources of funds, we may be forced to delay or postpone the exploration, development and research of our properties, and as a result, we might be required to diminish or suspend our business plans. These delays in development would have an adverse effect on our ability to generate revenues and could require us to possibly cease operations. In addition, such inability to obtain financing on reasonable terms could have a negative effect on our business, operating results or financial condition to such extent that we are forced to restructure, file for bankruptcy protection, sell assets or cease operations, any of which could put your investment dollars at significant risk.

| 16 |

We are incurring increased costs as a result of being a publicly-traded company.

As a public company, we incur significant legal, accounting and other expenses that we would not incur as a private company. In addition, the Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the Securities and Exchange Commission, has required changes in corporate governance practices of public companies. These new rules and regulations have increased our legal and financial compliance costs and have made some activities more time-consuming and costly. For example, as a result of becoming a public company, we have adopted policies regarding internal controls and disclosure controls and procedures. In addition, we have incurred additional costs associated with our public company reporting requirements. These new rules and regulations have made it more difficult and more expensive for us to obtain director and officer liability insurance, which we currently cannot afford to do. As a result of the new rules, it may become more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers. We cannot predict or estimate the amount of additional costs we may incur as a result of being a public company or the timing of such costs and/or whether we will be able to raise the funds necessary to meet the cash requirements for these costs.

Because we may never earn revenues from our operations, our business may fail and then investors may lose all of their investment in our company.

We have no history of revenues from operations. We have never had significant operations and have no significant assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and is in the exploration stage. The success of our company is significantly dependent on the uncertain events of the discovery and exploitation of mineral reserves on our properties or selling the rights to exploit those mineral reserves. If our business plan is not successful and we are not able to operate profitably, then our stock may become worthless and investors may lose all of their investment in our company.

Prior to completion of the exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims in the future, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will fail and investors may lose all of their investment in our company.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2 Properties.

Principal Office

Our principal office is located at 7230 Indian Creek Lane, Las Vegas, Nevada 89149. Our telephone number is (702) 849-4029. On January 1, 2012 our office rental agreement was adjusted to a $500 per month rental fee for office space in Nevada. The term of the agreement is on a month-to-month basis starting from January 1, 2012.

Our Mineral Properties

The Black Butte and Lucky Boy Projects

On February 8, 2010, we acquired 38 unpatented BLM claims including those known as Silver Summit and Candelaria and 2 historic silver mine leases ("Ag Properties") known as Lucky Boy Silver Mine and the Black Butte Silver Mine. As part of the mining lease proposal for the Lucky Boy Silver Mine, the Company agreed to pay a $10,000 non-refundable lease payment and an additional $10,000 lease payment every nine months commencing on November 17, 2010, and every nine months thereafter as long as the lease is in force. The Company deposited $50,000 in an escrow account to be drawn against invoices for work done on the property including access upgrading, exploration activities and geological expenses. Upon the recommendation of our consulting geologist, we did not renew the lease of the Lucky Boy Silver Mine.

| 17 |

On May 25, 2011 we expanded our claims in the Candelaria area to 66 unpatented claims by staking the LAG claims.

These mineral properties are without known reserves and the proposed program is explanatory in nature.

The Graphite Prospects

On April 20, 2012, Lucky Boy Silver Corp. entered into an agreement with Habitants Minerals Ltd. granting Lucky Boy the sole and exclusive right to purchase 100% right, title and interest in and to the applications and subsequent claims to be issued by Quebec Ministry of Resources and Fauna for the following applications:

The Quebec applications cover ground referred to in reports GM19842, GM35169, GM35267, GM19844, GM20308, GM13866, reports which report historic graphite occurrences on Lot 32 and Lot 33 Range 11 in Low Township, Lot 1 Range 2 in Suffolk Township, Lot 9 and Lot 16 Range 3 and Lot 10 Range 9 all in Clarendon Township, Lot 46 Range 11 in Low Township, and ground in Lochaber Township covering historic mag anomalies.

APPLICATION 1186716 (29 claims)

APPLICATION 1187995 (14 claims)

APPLICATION 1187994 (12 claims)

APPLICATION 1187992 (10 claims)

65 claims approx., 60 hectares each = 3900 hectares

On April 24, 2012, Lucky Boy Silver Corp. entered into an agreement with GeoXplor Corporation to purchase a 100% interest in and to the Chedic Graphite Property consisting of 20 Mineral Lode Claims in Township, 15 North, Range 19 East, Sections 25 & 26 Carson City, NV mining claims compromising approximately 400 acres.

Location and Means and Access

We have acquired an interest in the Black Butte and Lucky Boy projects in the Mineral County, Nevada. Black Butte is in T7N/R34E sections 25 and 26.Candelaria is in T3N/R35E sections 1,2, and 3; T4N/R35E sections 25, 35, and 36.

| 18 |

Figure 1: Black Butte and Candelaria Location Map

| 19 |

Black Butte

The Black Butte Project is approximately 30 miles east of Hawthorne on the east flank of Black Dyke Mountain at the eastern end of the Garfield Hills. The project can be reached by traveling 29.5 miles east on U.S. Highway 95 to a well-graded dirt road into the project area. Further access by vehicle is limited to several steep, primitive 4-wheel drive tracks.

The land position initially consisted of the Black Butte unpatented lode mining claims (Table 1 and Figure 2). Additional lode claims (BB-1 to6) were staked on August 12, 2010 to cover the interpreted extensions of the mineralized zone.

| Owner/Claimant | Claim Name | Land Tenure | Tenure Number | |||

| G. L. Buffington | Black Butte | Unpatented Lode Mining Claim | NMC 95801 | |||

| G. L. Buffington | Black Butte #1 | Unpatented Lode Mining Claim | NMC 95802 | |||

| G. L. Buffington | Black Butte #2 | Unpatented Lode Mining Claim | NMC 95803 | |||

| G. L. Buffington | Black Butte #3 | Unpatented Lode Mining Claim | NMC 95804 | |||

| Lucky Boy Silver Corp. | BB-1 | Unpatented Lode Mining Claim | NMC 1026931 | |||

| Lucky Boy Silver Corp. | BB-2 | Unpatented Lode Mining Claim | NMC 1026932 | |||

| Lucky Boy Silver Corp. | BB-3 | Unpatented Lode Mining Claim | NMC 1026933 | |||

| Lucky Boy Silver Corp. | BB-4 | Unpatented Lode Mining Claim | NMC 1026934 | |||

| Lucky Boy Silver Corp. | BB-5 | Unpatented Lode Mining Claim | NMC 1026935 | |||

| Lucky Boy Silver Corp. | BB-6 | Unpatented Lode Mining Claim | NMC 1026936 |

Table 1: Black Butte and Lucky Boy Land Description

The claims Black Butte, Black Butte #1 to #3, BB-1 to BB-6 , and LAG 1 to 66 are valid until September 1, 2012.

| Lucky Boy Silver Corp. |

LAG 1 to LAG 38 |

Unpatented Lode Mining Claim |

NMC 1047475 to NMC 1047512 |

| Lucky Boy Silver Corp. |

LAG 39 to LAG 66 |

Unpatented Lode Mining Claim |

NMC 1051010 to NMC 1051037 |

| 20 |

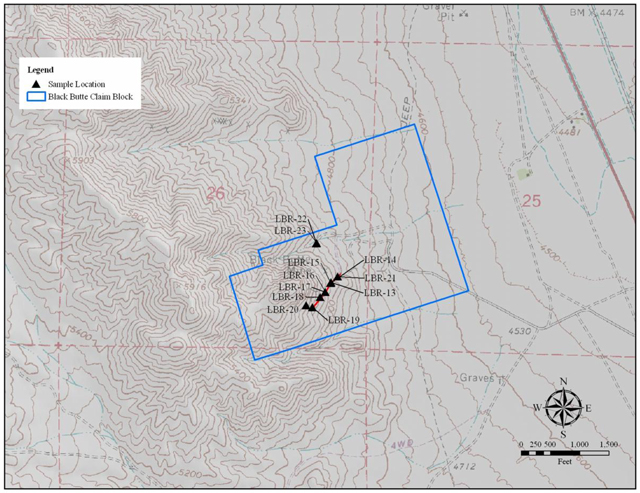

Figure 2: Black Butte Project Land Map

| 21 |

GEOLOGY

Regional Geology

The Black Butte project area is located in the Walker Lane Mineral Belt in western Nevada (Figure 1). Rocks in the region encompassing the project areas range from Triassic age sediments to recent alluvium filling the basins. The western side of the region is dominated by Cretaceous age intrusive rocks forming the Wassuk Range.

The Walker Lane is a major northwest-southeast-trending fault zone which displays right lateral movement that ranges from 30 to 40 miles in its central portion, and hosts a variety of precious metal and base metal mineral deposits (as well as geothermal activity) along its length. Late Cenozoic faults of the central Walker Lane form a complex array of variably oriented structures characterized by coeval strike-slip and dip-slip motions.

The rock formations for the project areas fit into the regional setting described for Mineral County (Figure 6, and Ross, 1961):

“About 30,000 feet of structurally complex calcareous, clastic, and volcanic rocks of Triassic and Jurassic age exposed in the central part of the county are flanked on the south by a few thousand feet of calcareous and clastic rocks of Cambrian, Ordovician, and Permian age. Intrusive into this sequence are granitic rocks, chiefly quartz monzonite, which are probably satellitic to the composite Sierra Nevada Batholith of Cretaceous age.”

Black Butte Project Geology

The Black Butte Project area lithology is mapped as Triassic Excelsior Formation which is summarized as a sequence of felsic volcanic rocks, clastic rocks, and tuffs (Figure 7). To the south of the project area the Excelsior is in fault contact with the Triassic Luning Formation described as a sequence of limestone, dolomite, and shale.

| 22 |

Figure 3: Legend for all Geological Maps

| 23 |

Figure 4: Black Butte Project Geology Map

| 24 |

Figure 5: Looking west at Black Butte Project Area

Figure 6: Looking at Black Butte Vein Zone

| 25 |

MINERALIZATION

Black Butte Project Mineralization

No historical data was found for the Black Butte Project area. There are at least four adits that collar on the vein and drive along the strike. These adits appear to be interconnected by raises and winzes. The lowermost adit (near samples LBR-14 and 21, Figure 11) has power and lights behind a locked door which services the seismograph equipment located within.

The mineralization is a quartz vein zone trending northeast-southwest and exposed at the surface for approximately 800 feet in a series of adits and prospect pits (Figure 7, Figure 8, and Figure 9). To the northeast the vein appears to go under alluvial cover. Going to the southwest along the strike of the vein the hill becomes higher and beyond the last exposed part of the vein strong, pervasive zones of iron oxidation are much more prominent as well as a zone of carbonate alteration (calcite veining). These alteration zones are typical of the uppermost extent of the alteration associated with an epithermal quartz vein system.

The vein zone is poly-phase, with multiple bands of silica that are sulfide bearing. The vein zone is from two to ten feet wide; within the wider parts of the zone there are distinct anastomosing quartz veins separated by orange and brown clay/gouge (frontispiece-note pencil for scale). Sulfides of iron, copper, lead, and silver were obvious on some of the dumps.

Gold values along the vein are anomalous (2.59, 3.4, and 6.22 ppm gold) to strongly anomalous (46.7 ppm gold) (Figure 12). The 46.7 ppm gold (1.36 opt) sample was a 10 inch channel sample across the quartz vein. Most of the higher grade gold values appear to be in the quartz; however the clay/gouge within the vein zone between the quartz does also carry some lesser gold values.

Silver values along the vein are also highly anomalous (316, 403, 630, 684 ppm silver) (Figure 13). The silver is highly correlative to the gold. Overall the system appears to be silver dominant with silver to gold ratio equal to 43:1.

Lead, copper, and zinc values are also anomalous; as might be expected in a silver dominated epithermal vein system (Figure 14 and Table 2).

| Black Butte Rock Geochemical Summary | |||||||||

| Gold ppm | Silver ppm | Lead ppm | Copper ppm | Zinc ppm | |||||

| High | 46.7 (1.36 opt) | 684 (19.94 opt) | 43,000 (4.3%) | 9,590 | 2,120 | ||||

| Low | 0.098 | 3.3 | 31 | 177 | 170 | ||||

| Average | 5.525 (0.161 opt) | 204.4 | 9,529 | 1,916 | 707 | ||||

| No. Samples | 11 | 11 | 11 | 11 | 11 | ||||

Table 2: Black Butte Geochemical Summary Table

| 26 |

Figure 7: Black Butte Rock Sample Location Map

| 27 |

Figure 8: Black Butte Gold in Rock Map

| 28 |

Figure 9: Black Butte Silver in Rock Map

| 29 |

Figure 10: Black Butte Lead in Rock

| 30 |

Item 3. Legal Proceedings.

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to National Graphite.

Item 4. (Removed and Reserved).

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our shares of common stock are quoted on the OTC Bulletin Board under the symbol “NGRC”. Our CUSIP number is 631268 104. The quotation was first posted at the opening on May 29, 2009 with an opening bid of $0.05 ($0.0033 post-split) and offer at $0.10 ($0.0067 post-split).

Holders of our Common Stock

As of the date of this report the shareholders' list of our common shares showed 22 registered shareholders. There are 75,669,881 shares outstanding.

Dividends

We have not declared any dividends since incorporation and do not anticipate that we will do so in the foreseeable future. Although there are no restrictions that limit the ability to pay dividends on our common shares, our intention is to retain future earnings for use in our operations and the expansion of our business.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans in place.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

On October 25, 2010 the Company issued 356,154 units consisting of one share of common stock and one warrant for cash at $0.63 per share. The attached warrants are exercisable for two years from issuance and have an exercise price of $0.85 per share for one year from issuance which increased to $1.05 in the second year. The Company used the Black-Scholes option pricing model to value the warrants based on the terms of the warrant, a volatility of 350%risk free rate of 0.37%, and a stock price and issuance of $0.65. Based on this calculation, the Company determined that the relative fair value of the warrants is $113,148 and allocated this amount of the additional paid-in capital to the warrants

On December 15, 2010 the Company issued 47,060 shares of its restricted common stock issued to 20 shareholders subscribed for at a price of $0.85 per share in private placements for $40,000 cash.

During the year ended May 31, 2012 the Company issued 500,000 shares of its restricted common stock issued to non-afilliated shareholders subscribed for at a price of $0.60 per share in private placements for $300,000 cash.

| 31 |

During the year ended May 31, 2012 the Company issued 500,000 shares of its restricted common stock as consideration for the purchase of certain mineral interests in Carson City, Nevada. These shares were valued at $0.60 per share, resulting in an aggregate value of $300,000.

All of these shares were issued to accredited investors under the exemption from Section 5 of the Securities Act of 1933 (the “Act”) contained in Section 4(6) of the Act.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

You should read the following discussion of our financial condition and results of operations together with the audited financial statements and the notes to audited financial statements included elsewhere in this report. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those anticipated in these forward-looking statements.

We are a start-up, exploration stage company engaged in the search for gold, silver, graphite and related minerals. Our mineral properties are without known reserves and our proposed program is explanatory in nature. There is no assurance that commercially viable mineral deposits exist on our mineral properties. Further exploration and/or drilling will be required before a final evaluation as to the economic and legal feasibility of our projects is determined.

Our business plan is to proceed with exploration of the Black Butte and our unpatented LAG claims to determine if there are commercially exploitable deposits of gold and silver, and if we decide not to proceed, to seek other mineral exploration properties. As per our purchase agreement, the Company is obligated to spend a minimum of $100,000 over the next twelve months on its Chedic graphite claims in Nevada.

The Black Butte Project – Our Proposed Exploration Program

Our business plan for the Black Butte Project is to proceed with the initial exploration of the gold and silver properties to determine if there are commercially exploitable deposits of gold and silver. We retained the services of the Hunsaker Inc., a geological company, to assess the results of our program.In a geological report compiled by Hunsaker dated May 2010, Hunsaker opined that further exploration on the Black Butte project is justified.

Over the twelve months ending May 31, 2013 we intend to use almost all available funds to commence exploration of our mineral properties in Nevada. We anticipate that phase II will not be carried out until 2013 or 2014 and will be contingent upon favorable results from phase I and specific recommendations in the resulting report. Specifics of the work to be carried out have not yet been determined and will be delineated as recommendations in the reporting of the results of phase I. The second phase may require up to six weeks work. Four months may be required for analysis and the preparation of a report and evaluation on the work accomplished.

| 32 |

Employees

We intend to continue to use the services of subcontractors for manual labor exploration work and an engineer or geologist to manage the exploration program. In regards to phase I of the planned exploration program, we have retained Buster Hunsaker as senior geological consultant.

At present, we have no employees. We currently operate with two executive officers, who devote their time as required to our business operations. Our executive officers are not presently compensated for their services and do not have an employment agreement with us.