Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InterDigital, Inc. | form8-k.htm |

InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. August 2012 INTERDIGITAL, INC. INVESTOR PRESENTATION

2 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Forward-Looking Statements All trademarks are the sole property of their respective owners This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding InterDigital, Inc.’s current beliefs, plans and expectations, as to: (i) future results, projections and trends; (ii) our strategy and business plan; (iii) the company’s 3G/4G revenue growth potential and the growth potential of its 3G/4G patent licensing program and 4G/LTE royalty rates; (iv) the development of next generation cellular technologies, including LTE and LTE-Advanced; (v) future global mobile device sales and market opportunities; (vi) selective acquisition and investment opportunities; and (vii) targeted patent sales and partnerships. Such statements are subject to the safe harbor created by those sections. Words such as “anticipate,” “believe,” “estimate,” “expect,” “project,” “intend,” “plan,” “forecast,” "will," variations of any such words or similar expressions, and graphical timelines representing future estimates or events are intended to identify such forward-looking statements. Forward-looking statements are subject to risks and uncertainties. Actual outcomes could differ materially from those expressed in or anticipated by such forward-looking statements due to a variety of factors, including, without limitation: (i) the market relevance of our technologies; (ii) changes in the needs, availability, pricing and features of competitive technologies as well as those of strategic partners or consumers; (iii) unanticipated technical or resource difficulties or delays related to further development of our technologies; (iv) our ability to enter into additional patent license agreements on expected terms, if at all; (v) our ability to enter into sales and/or licensing partnering arrangements for certain of our patent assets; (vi) our ability to enter into strategic relationships or complementary investment opportunities on acceptable terms; (vii) changes in the market share and sales performance of our primary licensees, delays in product shipments of our licensees and timely receipt and final reviews of quarterly royalty reports from our licensees and related matters; (viii) the resolution of current legal proceedings, including any awards or judgments relating to such proceedings, additional legal proceedings, changes in the schedules or costs associated with legal proceedings or adverse rulings in such legal proceedings; (ix) changes in the company’s strategy going forward; (x) the approval of the Intel transaction by antitrust authorities and the satisfaction of other closing conditions; and (xi) changes or inaccuracies in market projections, as well as other risks and uncertainties, including those detailed in our Annual Report on Form 10-K for the year ended December 31, 2011 and from time to time in our other Securities and Exchange Commission filings. We undertake no duty to update publicly any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law, regulation or other competent legal authority.

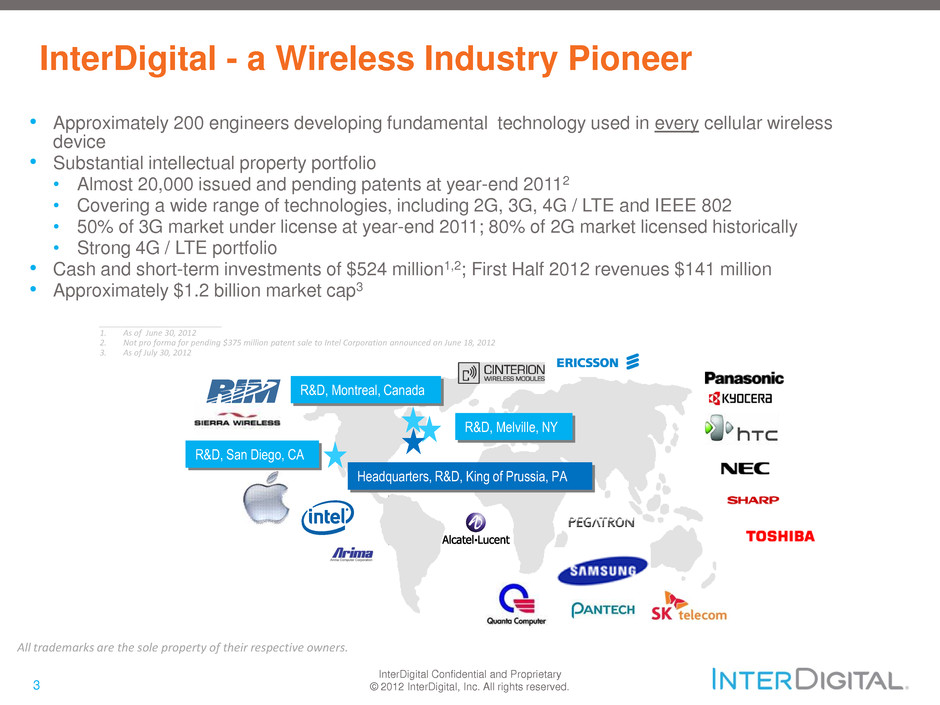

3 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. InterDigital - a Wireless Industry Pioneer • Approximately 200 engineers developing fundamental technology used in every cellular wireless device • Substantial intellectual property portfolio • Almost 20,000 issued and pending patents at year-end 20112 • Covering a wide range of technologies, including 2G, 3G, 4G / LTE and IEEE 802 • 50% of 3G market under license at year-end 2011; 80% of 2G market licensed historically • Strong 4G / LTE portfolio • Cash and short-term investments of $524 million1,2; First Half 2012 revenues $141 million • Approximately $1.2 billion market cap3 All trademarks are the sole property of their respective owners R&D, Montreal, Canada R&D, Melville, NY Headquarters, R&D, King of Prussia, PA R&D, San Diego, CA ___________________________ 1. As of June 30, 2012 2. Not pro forma for pending $375 million patent sale to Intel Corporation announced on June 18, 2012 3. As of July 30, 2012 All trademarks are the sole property of their respective owners.

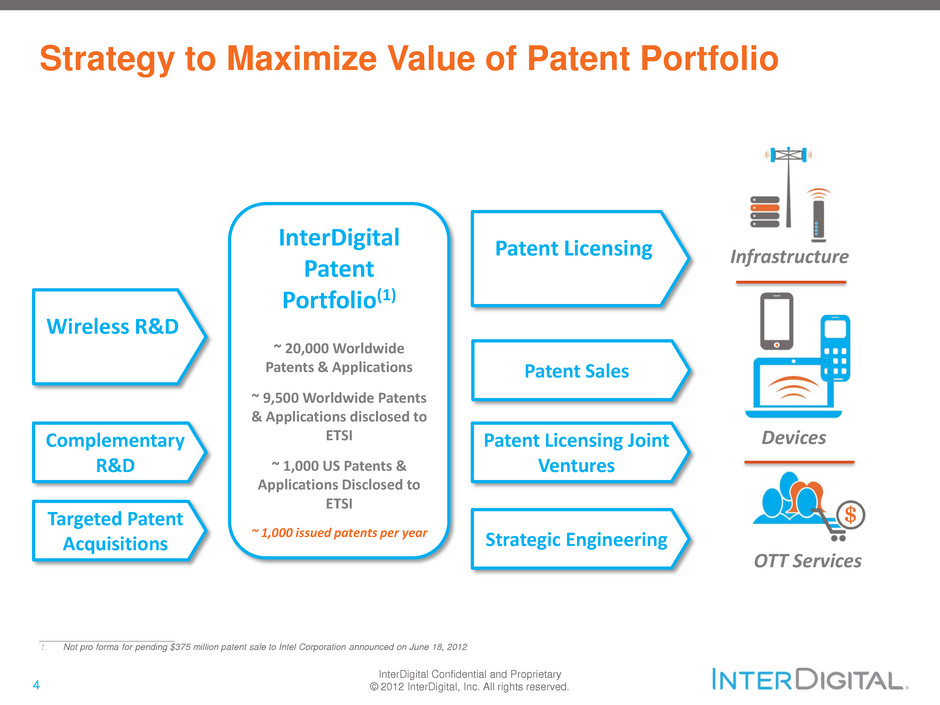

4 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Strategy to Maximize Value of Patent Portfolio InterDigital Patent Portfolio(1) ~ 20,000 Worldwide Patents & Applications ~ 9,500 Worldwide Patents & Applications disclosed to ETSI ~ 1,000 US Patents & Applications Disclosed to ETSI ~ 1,000 issued patents per year Wireless R&D Patent Licensing Complementary R&D Targeted Patent Acquisitions Infrastructure Devices OTT Services Patent Sales Patent Licensing Joint Ventures Strategic Engineering ___________________________ 1. Not pro forma for pending $375 million patent sale to Intel Corporation announced on June 18, 2012

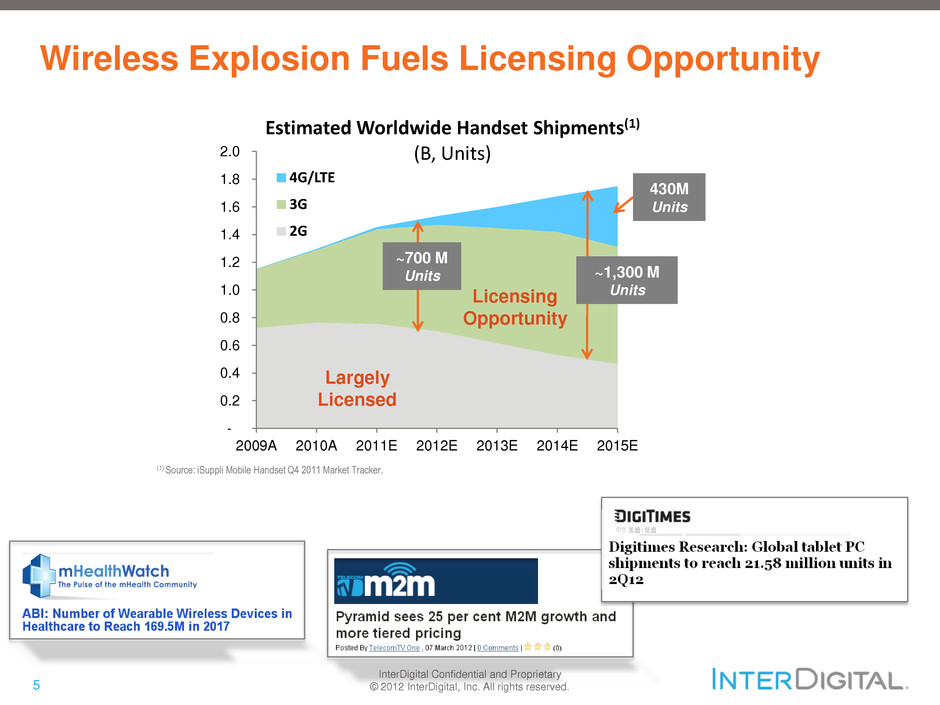

5 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Wireless Explosion Fuels Licensing Opportunity - 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2009A 2010A 2011E 2012E 2013E 2014E 2015E Estimated Worldwide Handset Shipments(1) (B, Units) 4G/LTE 3G 2G Largely Licensed Licensing Opportunity ~1,300 M Units ~700 M Units 430M Units (1) Source: iSuppli Mobile Handset Q4 2011 Market Tracker.

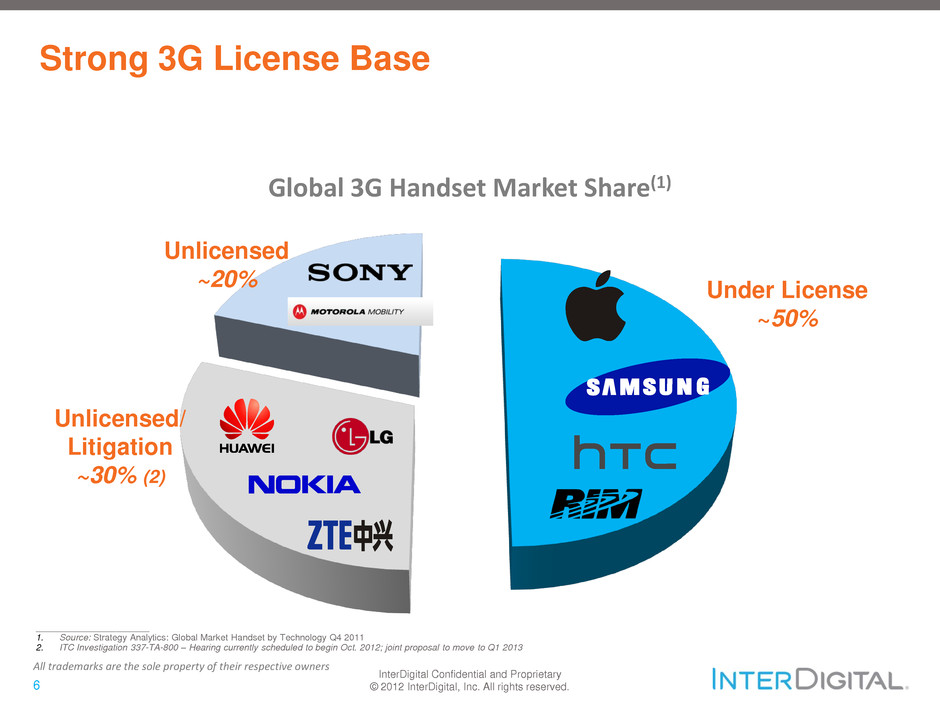

6 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Strong 3G License Base ___________________________ 1. Source: Strategy Analytics: Global Market Handset by Technology Q4 2011 2. ITC Investigation 337-TA-800 – Hearing currently scheduled to begin Oct. 2012; joint proposal to move to Q1 2013 Global 3G Handset Market Share(1) Unlicensed/ Litigation ~30% (2) Unlicensed ~20% Under License ~50% All trademarks are the sole property of their respective owners

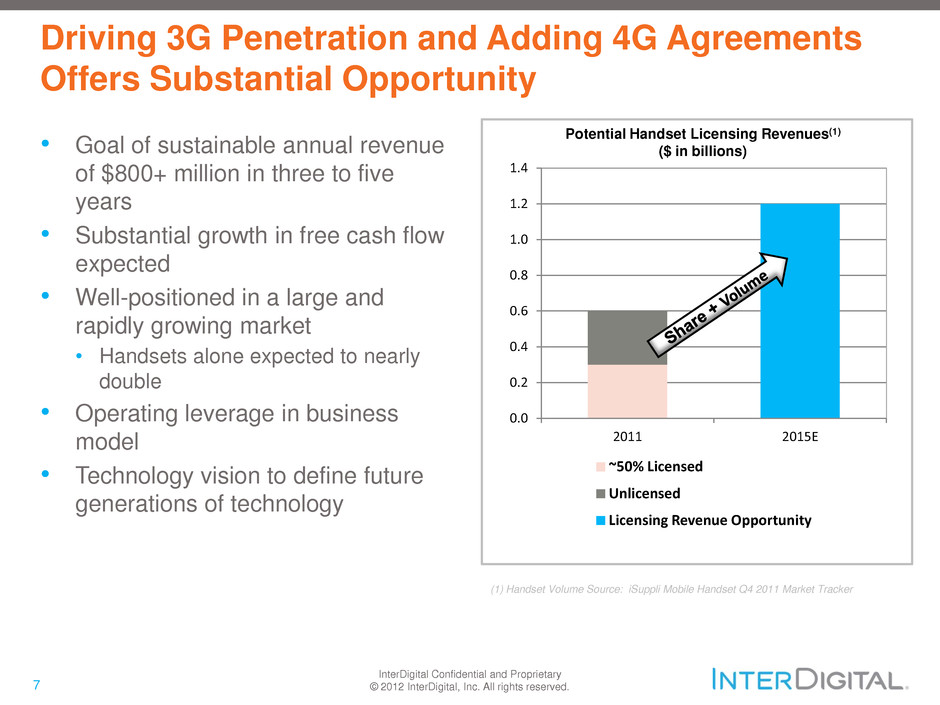

7 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Driving 3G Penetration and Adding 4G Agreements Offers Substantial Opportunity Potential Handset Licensing Revenues(1) ($ in billions) 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 2011 2015E ~50% Licensed Unlicensed Licensing Revenue Opportunity (1) Handset Volume Source: iSuppli Mobile Handset Q4 2011 Market Tracker • Goal of sustainable annual revenue of $800+ million in three to five years • Substantial growth in free cash flow expected • Well-positioned in a large and rapidly growing market • Handsets alone expected to nearly double • Operating leverage in business model • Technology vision to define future generations of technology

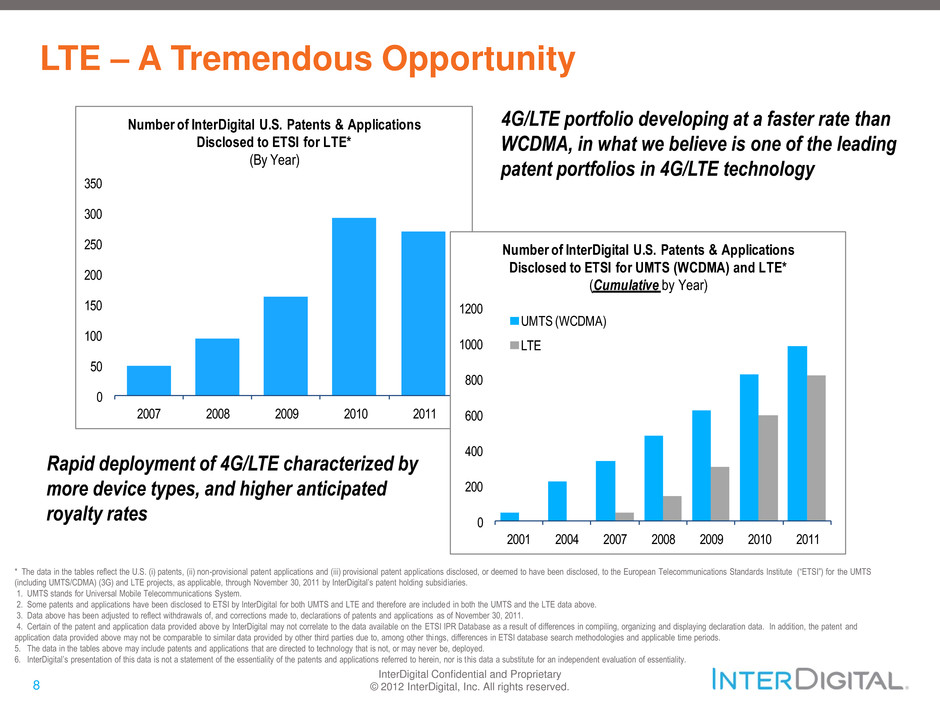

8 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. LTE – A Tremendous Opportunity 0 50 100 150 200 250 300 350 2007 2008 2009 2010 2011 Number of InterDigital U.S. Patents & Applications Disclosed to ETSI for LTE* (By Year) 0 200 400 600 800 1000 1200 2001 2004 2007 2008 2009 2010 2011 Number of InterDigital U.S. Patents & Applications Disclosed to ETSI for UMTS (WCDMA) and LTE* (Cumulative by Year) UMTS (WCDMA) LTE * The data in the tables reflect the U.S. (i) patents, (ii) non-provisional patent applications and (iii) provisional patent applications disclosed, or deemed to have been disclosed, to the European Telecommunications Standards Institute (“ETSI”) for the UMTS (including UMTS/CDMA) (3G) and LTE projects, as applicable, through November 30, 2011 by InterDigital’s patent holding subsid iaries. 1. UMTS stands for Universal Mobile Telecommunications System. 2. Some patents and applications have been disclosed to ETSI by InterDigital for both UMTS and LTE and therefore are included in both the UMTS and the LTE data above. 3. Data above has been adjusted to reflect withdrawals of, and corrections made to, declarations of patents and applications as of November 30, 2011. 4. Certain of the patent and application data provided above by InterDigital may not correlate to the data available on the ETSI IPR Database as a result of differences in compiling, organizing and displaying declaration data. In addition, the patent and application data provided above may not be comparable to similar data provided by other third parties due to, among other things, differences in ETSI database search methodologies and applicable time periods. 5. The data in the tables above may include patents and applications that are directed to technology that is not, or may never be, deployed. 6. InterDigital’s presentation of this data is not a statement of the essentiality of the patents and applications referred to herein, nor is this data a substitute for an independent evaluation of essentiality. 4G/LTE portfolio developing at a faster rate than WCDMA, in what we believe is one of the leading patent portfolios in 4G/LTE technology Rapid deployment of 4G/LTE characterized by more device types, and higher anticipated royalty rates

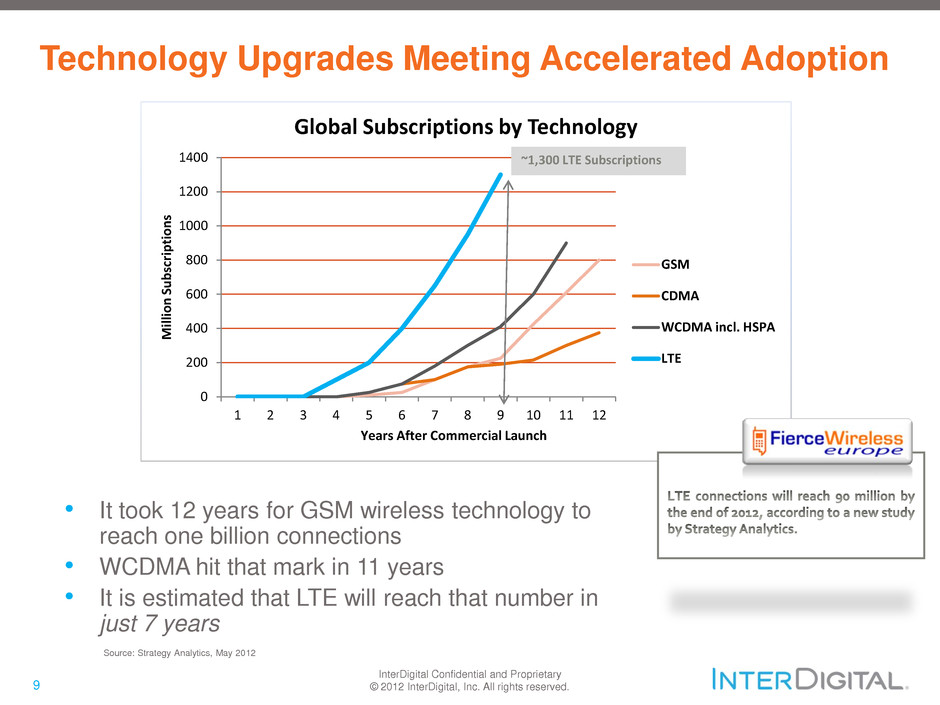

9 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Technology Upgrades Meeting Accelerated Adoption 0 200 400 600 800 1000 1200 1400 1 2 3 4 5 6 7 8 9 10 11 12 M ill io n S u b sc ri p ti o n s Years After Commercial Launch Global Subscriptions by Technology GSM CDMA WCDMA incl. HSPA LTE ~1,300 LTE Subscriptions Source: Strategy Analytics, May 2012 • It took 12 years for GSM wireless technology to reach one billion connections • WCDMA hit that mark in 11 years • It is estimated that LTE will reach that number in just 7 years

10 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Strategic Value of Patents Drives New Sales Opportunity

11 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Depth of InterDigital Patent Portfolio Supports Sales Strategy • Two sales agreements executed to date: • Approximately 1,700 patents and patent applications to Intel for $375 million (closing expected Q3 2012) • Sale of patents and patent applications to NuFront for $9 million • InterDigital has identified over 3,000 additional patent assets to monetize while continuing to drive licensing program • Company continues to pursue additional sales and patent joint venture opportunities

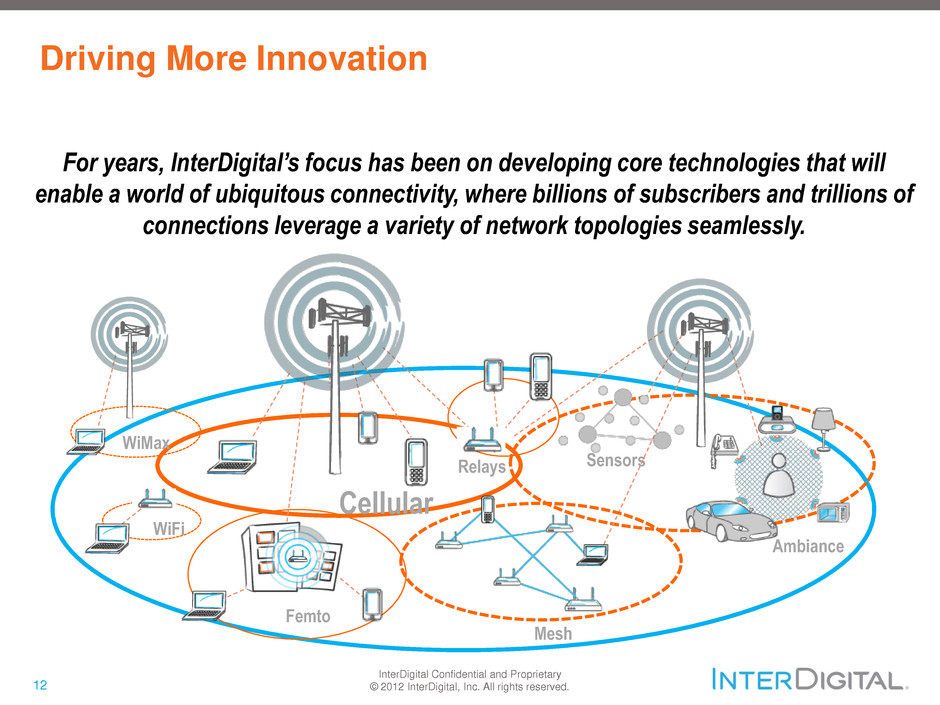

12 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Driving More Innovation For years, InterDigital’s focus has been on developing core technologies that will enable a world of ubiquitous connectivity, where billions of subscribers and trillions of connections leverage a variety of network topologies seamlessly. Sensors Cellular WiMax WiFi Mesh Ambiance Femto Relays

13 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Tech Portfolio Aligned with Market

14 InterDigital Confidential and Proprietary © 2012 InterDigital, Inc. All rights reserved. Highlights of the Business • Vendor agnostic wireless communications pure play • Creates opportunity to develop a broad range of technologies • Continuously developing fundamental wireless technology IP that is incorporated into industry standards • Robust position in 3G/4G IP providing potentially strong cash flow generation going forward • Patent portfolio validated through nearly $3.0 billion in cash generated to date primarily from 2G and 3G licenses • Large and growing addressable market • $231 billion handset market in 20111 • Secular market growth and potential for higher royalty rate from 4G / LTE • Business model provides significant operating leverage • Management team with a proven track record ___________________________ 1. Source: Gartner Mobile Devices Worldwide, 2009-2016, Q1 2012 Update