Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAMCO FINANCIAL CORP | d403350d8k.htm |

Exhibit 99.1

Camco Financial Corporation Advantage Bank Executive Overview Another Step Forward

Financial Disclosure Safe Harbor Statement: Certain statements contained in this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on current expectations, estimates, forecasts and projections of future company or industry performance based on management’s judgment, beliefs, current trends and market conditions. Forward-looking statements made or to be made by or on behalf of the company may be identified by the use of words such as “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, and similar expressions. Forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict. Actual outcomes and results may differ materially from what is expressed, forecast or implied in the forward-looking statements, whether as a result of new information, future events or otherwise. For more details, please refer to Camco’s SEC filings, including its most recent Annual Report on Form 10-K and quarterly reports on Form 10-Q.

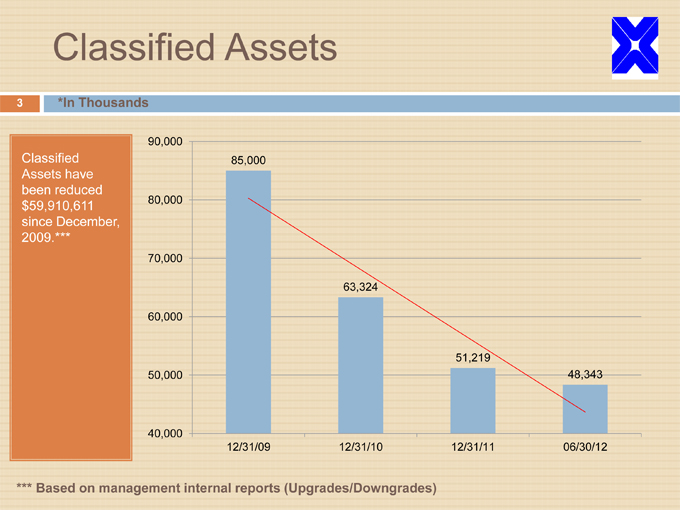

Classified Assets *In Thousands Classified Assets have been reduced $59,910,611 since December, 2009.*** *** Based on management internal reports (Upgrades/Downgrades)

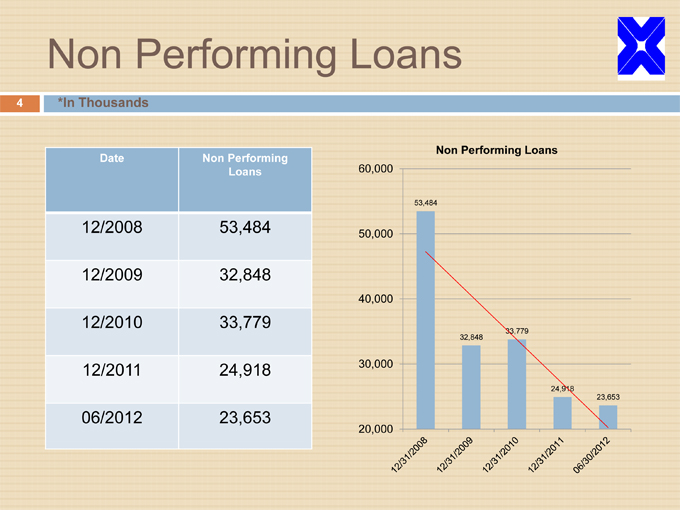

Non Performing Loans *In Thousands Date Non Performing Loans 12/2008 53,484 12/2009 32,848 12/2010 33,779 12/2011 24,918 06/2012 23,653 Non Performing Loans 60,000 53,484 50,000 40,000 33,779 32,848 30,000 24,918 23,653 20,000

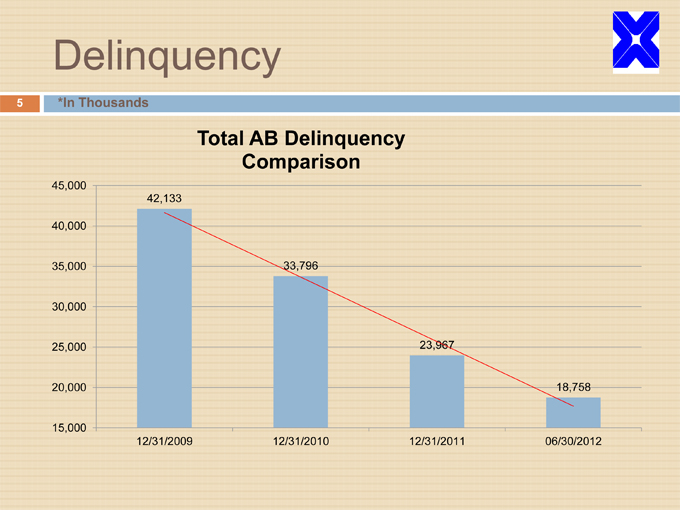

Delinquency Thousands Total AB Delinquency Comparison 45,000 42,133 40,000 35,000 33,796 30,000 25,000 23,967 20,000 18,758 15,000 12/31/2009 12/31/2010 12/31/2011 06/30/2012

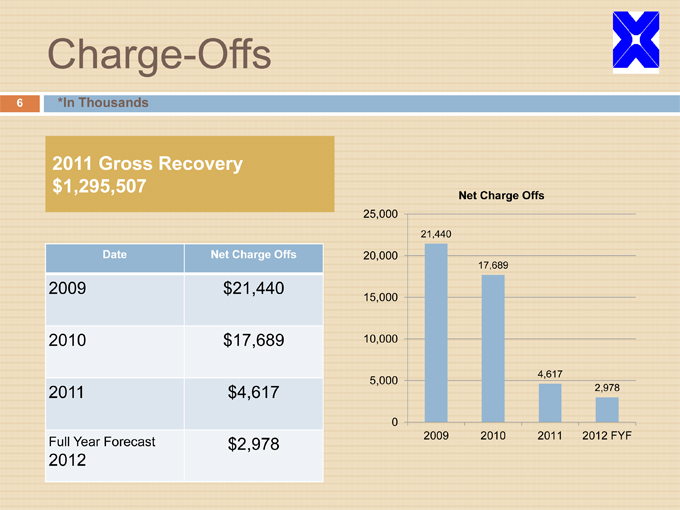

Charge-Offs 6 *In Thousands 2011 Gross Recovery $1,295,507 Net Charge Offs 25,000 21,440 Date Net Charge Offs 20,000 17,689 2009 $21,440 15,000 2010 $17,689 10,000 4,617 5,000 2011 $4,617 2,978 0 2009 2010 2011 2012 FYF Full Year Forecast $2,978 2012

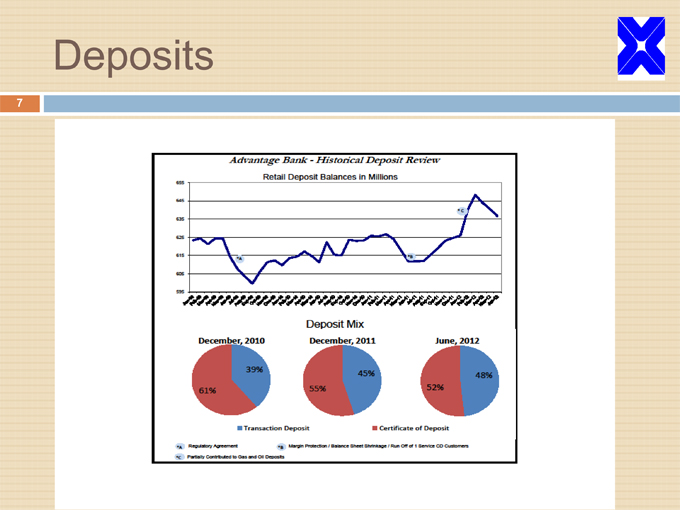

Deposits

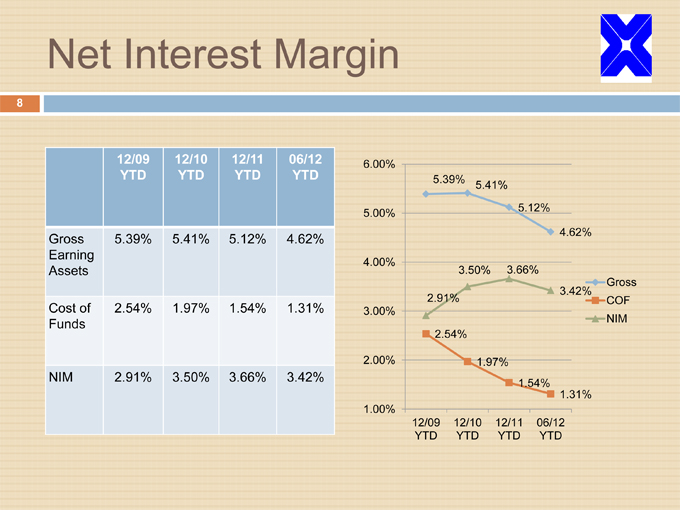

Net Interest Margin 8 12/09 12/10 12/11 06/12 6.00% YTD YTD YTD YTD 5.39% 5.41% 5.12% 5.00% 4.62% Gross 5.39% 5.41% 5.12% 4.62% Earning 4.00% Assets 3.50% 3.66% Gross 3.42% 2.91% COF Cost of 2.54% 1.97% 1.54% 1.31% 3.00% NIM Funds 2.54% 2.00% 1.97% NIM 2.91% 3.50% 3.66% 3.42% 1.54% 1.31% 1.00% 12/09 12/10 12/11 06/12 YTD YTD YTD YTD

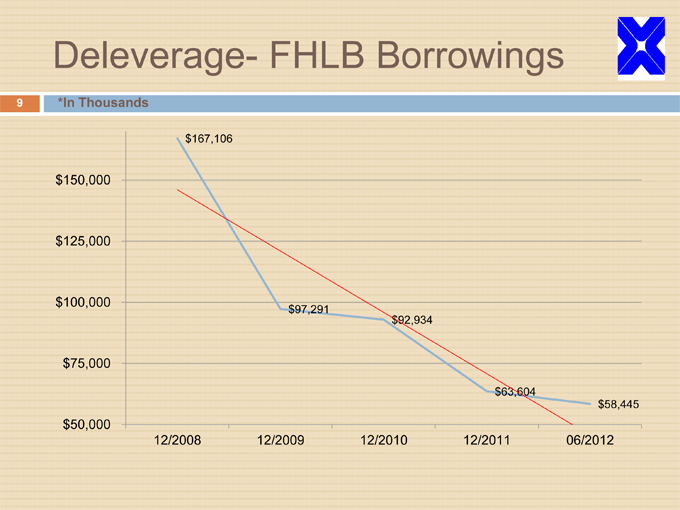

Deleverage- FHLB Borrowings 9 *In Thousands $167,106 $150,000 $125,000 $100,000 $97,291 $92,934 $75,000 $63,604 $58,445 $50,000 12/2008 12/2009 12/2010 12/2011 06/2012

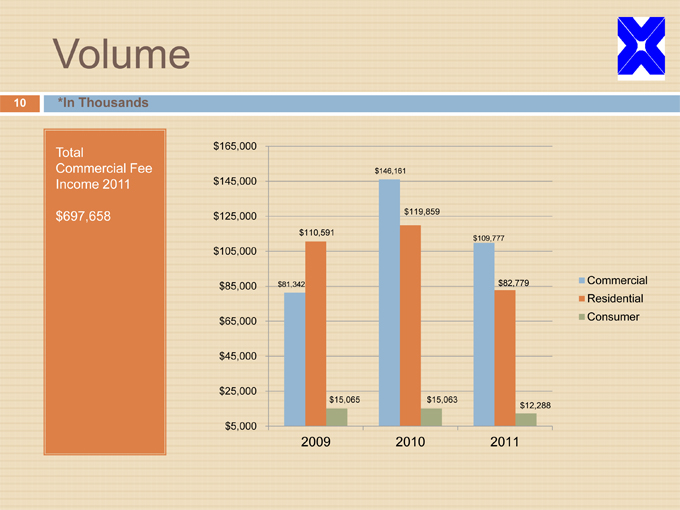

Volume 10 *In Thousands $165,000 Total Commercial Fee $146,161 Income 2011 $145,000 $697,658 $125,000 $119,859 $110,591 $109,777 $105,000 $81,342 $82,779 Commercial $85,000 Residential $65,000 Consumer $45,000 $25,000 $15,065 $15,063 $12,288 $5,000 2009 2010 2011

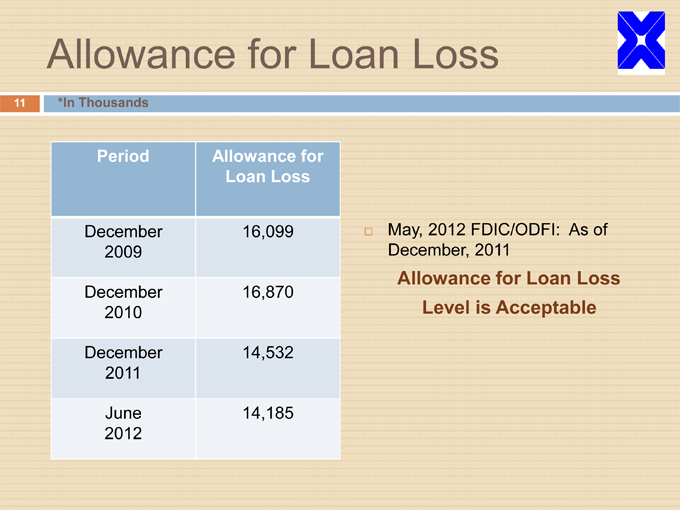

Allowance for Loan Loss 11 *In Thousands Period Allowance for Loan Loss December 16,099 ??May, 2012 FDIC/ODFI: As of 2009 December, 2011 Allowance for Loan Loss December 16,870 Level is Acceptable 2010 December 14,532 2011 June 14,185 2012

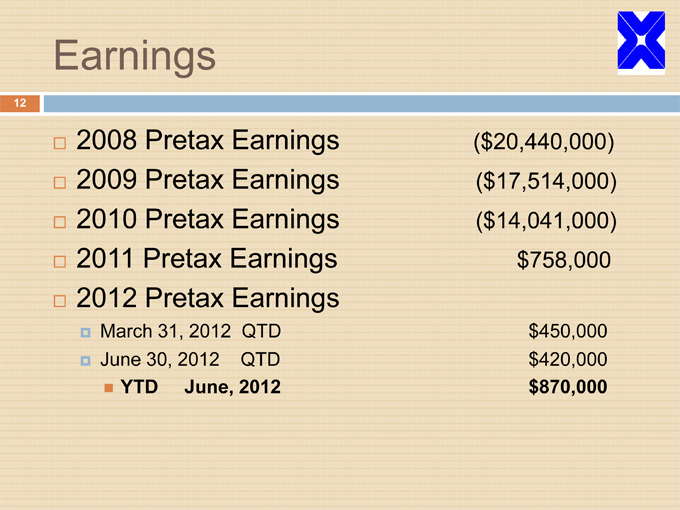

Earnings ??2008 Pretax Earnings ($20,440,000) ??2009 Pretax Earnings ($17,514,000) ??2010 Pretax Earnings ($14,041,000) ??2011 Pretax Earnings $758,000 ??2012 Pretax Earnings ??March 31, 2012 QTD $450,000 ??June 30, 2012 QTD $420,000 ?YTD June, 2012 $870,000

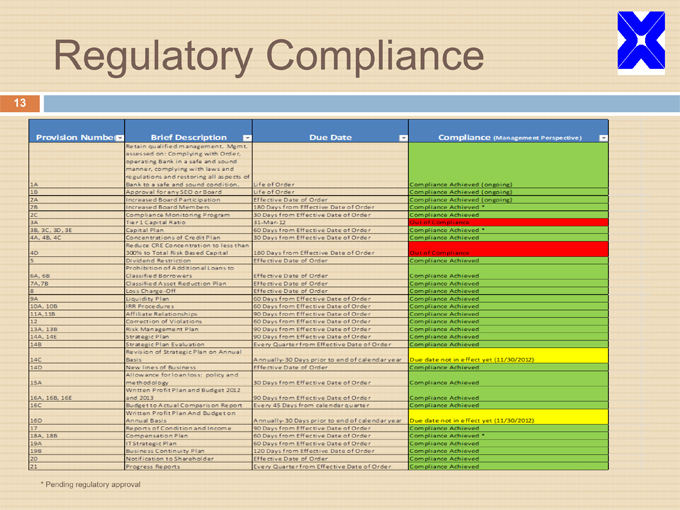

Regulatory Compliance * Pending regulatory approval

Rights Offering July 17, 2012 – Camco Financial Corporation (Nasdaq: CAFI) announced that it intends to conduct a rights offering of common shares of up to $10.0 million to existing shareholders. Under the terms of the rights offering, stock as of July 29, 2012 for the rights offering will receive, at no charge, one subscription right for each share of common stock held as of the record date. Each subscription right will entitle the holder of the right to purchase one share of Company common stock. In addition, for every two shares purchased in the offering, investors will receive one warrant to purchase Company common stock within five years at a pre-determined price. Rights holders will have the opportunity to purchase shares in excess of their basic subscription rights, subject to availability.